Exhibit 99.2

Eberle Medical Office Building — Elk Grove, IL

All amounts shown in this report are unaudited and in U.S. dollars unless otherwise noted.

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Table of Contents

| | | | | |

Portfolio Overview | | | | |

| | | | | |

| Triple-Net, Managed and Loan Portfolio | | | 1-2 | |

| | | | | |

| Property Type and Operator Revenue/NOI Concentration Charts | | | 3 | |

| | | | | |

| Private Pay Owned Asset Composition Trend | | | 4 | |

| | | | | |

| Revenue Rollover Schedule | | | 5 | |

| | | | | |

| Company Development Data | | | 6 | |

| | | | | |

Triple-Net Leased Portfolio | | | | |

| | | | | |

| Same-Store Cash Flow Coverage and Occupancy Comparison | | | 7 | |

| | | | | |

| Kindred Healthcare Same-Store TTM EBITDARM Coverage Ratios | | | 8 | |

| | | | | |

| Cash Flow Coverage and Occupancy Trend Charts | | | 9-11 | |

| | | | | |

Medical Office Building Portfolio | | | | |

| | | | | |

| Year-over-Year and Sequential Quarter Comparison | | | 12 | |

| | | | | |

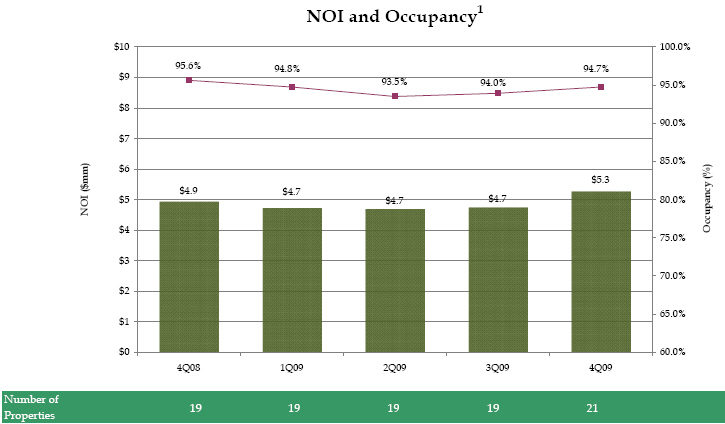

| Stabilized Portfolio Net Operating Income and Occupancy Trend Chart | | | 13 | |

| | | | | |

Seniors Housing Operating Portfolio | | | | |

| | | | | |

| Year-over-Year and Sequential Quarter Comparison | | | 14 | |

| | | | | |

| Stabilized Portfolio Net Operating Income, Occupancy and Average Daily Rate Trend Charts | | | 15 | |

| | | | | |

Consolidated Financial Information | | | | |

| | | | | |

| Historical Normalized FFO/Share | | | 16 | |

| | | | | |

| Capitalization | | | 17 | |

| | | | | |

| Debt Maturity Information | | | 18-19 | |

| | | | | |

| Debt Covenants | | | 20-21 | |

| | | | | |

| Consolidated Financial Statements | | | 22-26 | |

| | | | | |

| Funds From Operations, Normalized Funds from Operations, and Funds Available for Distribution | | | 27-28 | |

| | | | | |

| Recently Adopted Accounting Standards | | | 29 | |

| | | | | |

| Normalized FFO and FAD Guidance for the Year Ending December 31, 2010 | | | 30 | |

| | | | | |

| Net Debt to Pro Forma EBITDA | | | 31 | |

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Owned Portfolio — Overview by Type (Dollars in Millions):1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Annualized | | | | | | | | | | | Annualized | | | | |

| | | | | | | | | | | | | Number | | | | | | | | | | | | | | | Annualized | | | Operating | | | Total | | | Annualized | | | Operating | | | Total | |

| | | Number of | | | Number of | | of States/ | | | Ventas | | | Cash Flow | | | | | | | NNN | | | Property | | | Annualized | | | NNN | | | Property | | | Annualized | |

| Property Type | | Properties | | | Beds/Units/Square Feet | | Provinces | | | Investment | | | Coverage | | | Occupancy2 | | | Revenue3 | | | Revenue3 | | | Revenue3 | | | NOI3 | | | NOI3 | | | NOI3 | |

| Hospital — Stabilized Triple-Net | | | 40 | | | | 3,517 | | | Beds | | | 17 | | | $ | 345 | | | | 2.5 | x | | | 57.3 | % | | $ | 94 | | | $ | 0 | | | $ | 94 | | | $ | 94 | | | $ | 0 | | | $ | 94 | |

| Skilled Nursing — Stabilized Triple-Net | | | 187 | | | | 22,377 | | | Beds | | | 29 | | | | 809 | | | | 1.9 | x | | | 89.6 | % | | | 179 | | | | 0 | | | | 179 | | | | 179 | | | | 0 | | | | 179 | |

| Seniors Housing — Triple-Net | | | 164 | | | | 16,689 | | | Units | | | 31 | | | | 2,256 | | | | 1.3 | x | | | 87.8 | % | | | 195 | | | | 0 | | | | 195 | | | | 195 | | | | 0 | | | | 195 | |

| Seniors Housing — Operating | | | 80 | | | | 6,553 | | | Units | | | 22 | | | | 2,034 | | | | N/A | | | | 88.9 | % | | | 0 | | | | 371 | | | | 371 | | | | 0 | | | | 113 | | | | 113 | |

| Medical Office — Stabilized | | | 21 | | | | 1,281,357 | | | Square Feet | | | 9 | | | | 283 | | | | N/A | | | | 94.7 | % | | | 0 | | | | 37 | | | | 37 | | | | 0 | | | | 24 | | | | 24 | |

| Medical Office — Lease-Up | | | 5 | | | | 432,742 | | | Square Feet | | | 5 | | | | 79 | | | | N/A | | | | 74.4 | % | | | 0 | | | | 9 | | | | 9 | | | | 0 | | | | 6 | | | | 6 | |

| Other — Stabilized Triple-Net | | | 8 | | | | 122 | | | Beds | | | 1 | | | | 7 | | | | 4.7 | x | | | N/A | | | | 1 | | | | 0 | | | | 1 | | | | 1 | | | | 0 | | | | 1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | 505 | | | | | | | | | | 45 | | | $ | 5,814 | | | | 1.8 | x | | | | | | $ | 469 | | | $ | 417 | | | $ | 885 | | | $ | 469 | | | $ | 143 | | | $ | 612 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 53 | % | | | 47 | % | | | 100 | % | | | 77 | % | | | 23 | % | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loan Portfolio — Overview by Investment (Dollars in Millions):1

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Borrower/ | | Effective | | | | | | |

| | | Original | | | Outstanding | | | Secured/ | | Asset | | Interest | | | Annualized | | | |

| Borrower | | Investment | | | Principal | | | Unsecured | | Type | | Rate | | | Revenue3 | | | Balance Sheet Line |

| Manor Care | | $ | 99 | | | $ | 112 | | | Secured | | SNF/ALF | | 5.9 | % | | $ | 6 | | | Loans Receivable |

| HCA | | | 45 | | | | 50 | | | Unsecured | | Hospital | | | 9.6 | % | | | 4 | | | Other Assets |

| Emeritus Senior Living | | | 13 | | | | 15 | | | Secured | | Seniors Housing | | | 12.6 | % | | | 2 | | | Loans Receivable |

| Brookdale Senior Living | | | 9 | | | | 0 | | | Secured | | Seniors Housing | | L + 600 | bps4 | | | 0 | | | Loans Receivable |

Other — Secured5 | | | 19 | | | | 14 | | | Secured | | Seniors Housing | | | 3.7 | % | | | 1 | | | Loans Receivable |

| Other — Unsecured | | | 14 | | | | 15 | | | Unsecured | | Hospital | | | 9.4 | % | | | 1 | | | Other Assets |

| | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 198 | | | $ | 206 | | | | | | | | | | | $ | 14 | | | |

| | | | | | | | | | | | | | | | | | | | |

Owned Portfolio — Overview by State/Province:1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Totals | | | Hospital | | | Skilled Nursing | | | Seniors Housing | | | Medical Office | | | Other | |

| State/Province | | No. | | | % | | | No. | | | Beds | | | No. | | | Beds | | | No. | | | Units | | | No. | | | Sq. Feet | | | No. | | | Beds | |

| California | | | 37 | | | | 7 | % | | | 5 | | | | 455 | | | | 6 | | | | 771 | | | | 26 | | | | 3,301 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Pennsylvania | | | 34 | | | | 7 | % | | | 2 | | | | 115 | | | | 6 | | | | 797 | | | | 24 | | | | 1,597 | | | | 2 | | | | 111,671 | | | | 0 | | | | 0 | |

| Massachusetts | | | 34 | | | | 7 | % | | | 2 | | | | 109 | | | | 26 | | | | 2,694 | | | | 6 | | | | 856 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Ohio | | | 30 | | | | 6 | % | | | 0 | | | | 0 | | | | 12 | | | | 1,575 | | | | 16 | | | | 1,153 | | | | 2 | | | | 144,639 | | | | 0 | | | | 0 | |

| Kentucky | | | 29 | | | | 6 | % | | | 2 | | | | 424 | | | | 27 | | | | 3,054 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Florida | | | 26 | | | | 5 | % | | | 6 | | | | 511 | | | | 0 | | | | 0 | | | | 14 | | | | 1,454 | | | | 6 | | | | 206,533 | | | | 0 | | | | 0 | |

| Illinois | | | 24 | | | | 5 | % | | | 4 | | | | 431 | | | | 1 | | | | 82 | | | | 17 | | | | 2,634 | | | | 2 | | | | 164,279 | | | | 0 | | | | 0 | |

| Indiana | | | 23 | | | | 5 | % | | | 1 | | | | 59 | | | | 13 | | | | 1,867 | | | | 9 | | | | 1,001 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| North Carolina | | | 23 | | | | 5 | % | | | 1 | | | | 124 | | | | 16 | | | | 1,802 | | | | 6 | | | | 438 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Texas | | | 21 | | | | 4 | % | | | 7 | | | | 496 | | | | 0 | | | | 0 | | | | 3 | | | | 261 | | | | 3 | | | | 78,222 | | | | 8 | | | | 122 | |

| All Other | | | 224 | | | | 44 | % | | | 10 | | | | 793 | | | | 80 | | | | 9,735 | | | | 123 | | | | 10,547 | | | | 11 | | | | 1,008,755 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | 505 | | | | 100 | % | | | 40 | | | | 3,517 | | | | 187 | | | | 22,377 | | | | 244 | | | | 23,242 | | | | 26 | | | | 1,714,099 | | | | 8 | | | | 122 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| 1 | | Totals may not add due to rounding. |

| |

| 2 | | Occupancy shown for Seniors Housing excludes communities in lease-up. Occupancy for triple-net properties is as of 3Q09 and occupancy for operating properties is as of 4Q09. |

| |

| 3 | | Annualized fourth quarter Ventas revenue/NOI assuming all events occurred at the beginning of the period. Revenue/NOI reflects Ventas’s portion only for joint venture assets. |

| |

| 4 | | LIBOR floor of 3%. Excludes upfront fee equating to 0.67% per annum. |

| |

| 5 | | Outstanding principal is the approximate carrying value. |

1

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

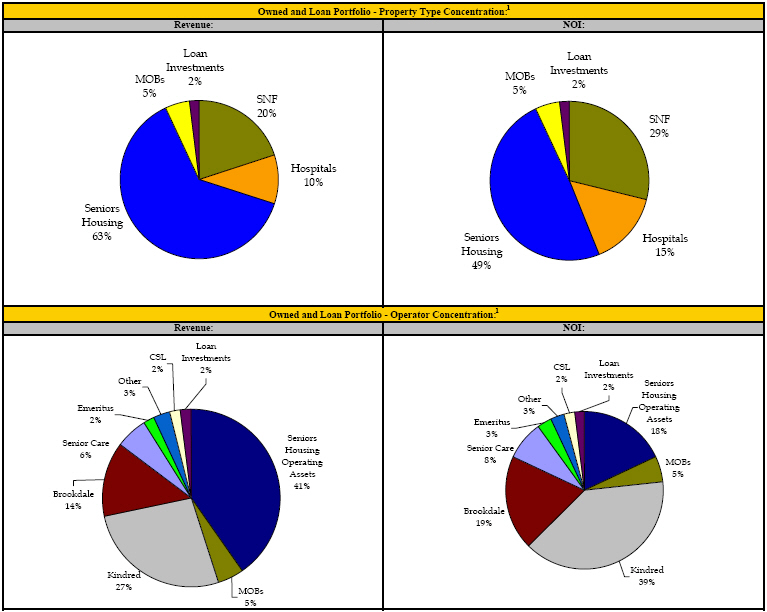

Owned and Loan Portfolio — Property Type Concentration:1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Owned | | | | | | | | | | | | | | | | | | | | | |

| | | Property | | | Ventas | | | | | | | Annualized | | | | | | | Annualized | | | | |

| Investment Type | | Count | | | Investment | | | % | | | Rent/Revenue2 | | | % | | | Rent/NOI2 | | | % | |

| Seniors Housing | | | 244 | | | $ | 4,290 | | | | 71 | % | | $ | 565 | | | | 63 | % | | $ | 308 | | | | 49 | % |

| Skilled Nursing | | | 187 | | | | 809 | | | | 13 | % | | | 179 | | | | 20 | % | | | 179 | | | | 29 | % |

| Hospital | | | 40 | | | | 345 | | | | 6 | % | | | 94 | | | | 10 | % | | | 94 | | | | 15 | % |

| Medical Office | | | 26 | | | | 362 | | | | 6 | % | | | 46 | | | | 5 | % | | | 30 | | | | 5 | % |

| Other | | | 8 | | | | 7 | | | NM | | | | 1 | | | NM | | | | 1 | | | NM | |

| Loans | | | N/A | | | | 206 | | | | 3 | % | | | 14 | | | | 2 | % | | | 14 | | | | 2 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| Total | | | 505 | | | $ | 6,020 | | | | 100 | % | | $ | 899 | | | | 100 | % | | $ | 625 | | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Owned and Loan Portfolio — Operator Concentration:1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Owned | | | | | | | | | | | | | | | | | | | | | |

| | | Property | | | Ventas | | | | | | | Annualized | | | | | | | Annualized | | | | |

| Operator/Manager | | Count | | | Investment | | | % | | | Rent/Revenue2 | | | % | | | Rent/NOI2 | | | % | |

| Sunrise Senior Living | | | 79 | | | $ | 2,033 | | | | 34 | % | | $ | 369 | | | | 41 | % | | $ | 113 | | | | 18 | % |

| Brookdale Senior Living | | | 84 | | | | 1,403 | | | | 23 | % | | | 122 | | | | 14 | % | | | 122 | | | | 19 | % |

| Kindred Healthcare | | | 197 | | | | 906 | | | | 15 | % | | | 244 | | | | 27 | % | | | 244 | | | | 39 | % |

| Senior Care | | | 65 | | | | 621 | | | | 10 | % | | | 52 | | | | 6 | % | | | 52 | | | | 8 | % |

| Emeritus Senior Living | | | 11 | | | | 168 | | | | 3 | % | | | 18 | | | | 2 | % | | | 18 | | | | 3 | % |

| Capital Senior Living | | | 11 | | | | 158 | | | | 3 | % | | | 14 | | | | 2 | % | | | 14 | | | | 2 | % |

| NexCore | | | 7 | | | | 154 | | | | 3 | % | | | 21 | | | | 2 | % | | | 13 | | | | 2 | % |

| Manor Care | | | N/A | | | | 112 | | | | 2 | % | | | 6 | | | | 1 | % | | | 6 | | | | 1 | % |

| Formation | | | 11 | | | | 89 | | | | 1 | % | | | 11 | | | | 1 | % | | | 11 | | | | 2 | % |

| HCA | | | 1 | | | | 51 | | | | 1 | % | | | 4 | | | NM | | | | 4 | | | | 1 | % |

| Assisted Living Concepts | | | 8 | | | | 50 | | | | 1 | % | | | 5 | | | | 1 | % | | | 5 | | | | 1 | % |

| Grubb and Ellis | | | 5 | | | | 42 | | | | 1 | % | | | 4 | | | NM | | | | 2 | | | NM | |

| All Other | | | 26 | | | | 233 | | | | 4 | % | | | 30 | | | | 3 | % | | | 22 | | | | 3 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| Total | | | 505 | | | $ | 6,020 | | | | 100 | % | | $ | 899 | | | | 100 | % | | $ | 625 | | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Owned Portfolio — State/Province Concentration:1

| | | | | | | | | | | | | | | | | | | | | |

| | | Owned | | | | | | | | | | | | | | |

| | | Property | | | Annualized | | | | | | | Annualized | | | | |

| State/Province | | Count | | | Rent/Revenue2 | | | % | | | Rent/NOI2 | | | % | |

| California | | | 37 | | | $ | 113 | | | | 13 | % | | $ | 78 | | | | 13 | % |

| Illinois | | | 24 | | | | 94 | | | | 11 | % | | | 69 | | | | 11 | % |

| Ontario | | | 9 | | | | 53 | | | | 6 | % | | | 14 | | | | 2 | % |

| Massachusetts | | | 34 | | | | 49 | | | | 6 | % | | | 42 | | | | 7 | % |

| Pennsylvania | | | 34 | | | | 47 | | | | 5 | % | | | 26 | | | | 4 | % |

| New Jersey | | | 10 | | | | 40 | | | | 5 | % | | | 16 | | | | 3 | % |

| Florida | | | 26 | | | | 38 | | | | 4 | % | | | 36 | | | | 6 | % |

| Colorado | | | 16 | | | | 37 | | | | 4 | % | | | 20 | | | | 3 | % |

| Georgia | | | 16 | | | | 30 | | | | 3 | % | | | 17 | | | | 3 | % |

| New York | | | 14 | | | | 30 | | | | 3 | % | | | 20 | | | | 3 | % |

| All Other | | | 285 | | | | 354 | | | | 40 | % | | | 274 | | | | 45 | % |

| | | | | | | | | | | | | | | | |

| Total | | | 505 | | | $ | 885 | | | | 100 | % | | $ | 612 | | | | 100 | % |

| | | | | | | | | | | | | | | | |

| | | |

| 1 | | Dollars in millions. Totals may not add due to rounding. NM = not material. |

| |

| 2 | | Annualized fourth quarter Ventas revenue/NOI assuming all events occurred at the beginning of the period. Operating asset revenue/NOI reflects Ventas’s portion only for joint venture assets. |

2

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

| | | |

| 1 | | Annualized fourth quarter Ventas revenue/NOI assuming all events occurred at the beginning of the period. Operating asset revenue/NOI reflects Ventas’s portion only for joint venture assets. Totals may not add due to rounding. |

3

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

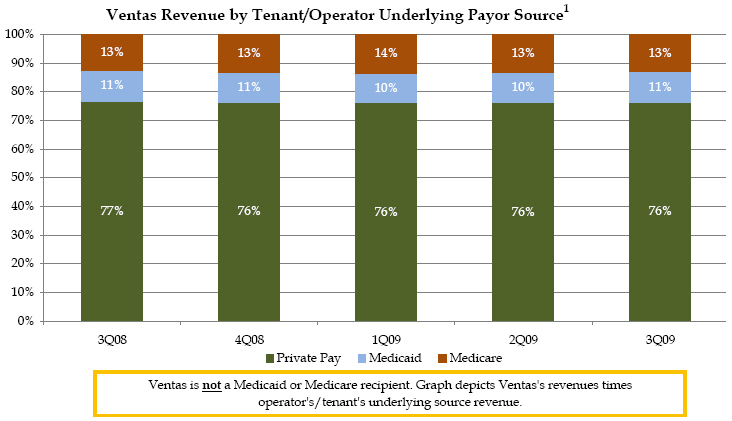

Private Pay Owned Asset Composition Trend:

| | | |

| 1 | | Payor source at asset level for Company’s tenants and operators. 3Q2009 is most recent data available. All seniors housing revenue is assumed to be private pay. Totals may not add due to rounding. |

4

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Triple-Net and Operating Portfolio Revenue Rollover Schedule Excluding Seniors Housing Operating Communities:1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Lease Rollover Year | |

| | | Totals | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | Thereafter | |

Hospital — Stabilized Triple-Net: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annualized Revenue | | $ | 94.3 | | | | — | | | | — | | | | — | | | $ | 46.9 | | | | — | | | $ | 47.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Skilled Nursing — Stabilized Triple-Net: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annualized Revenue | | | 178.8 | | | | — | | | | — | | | $ | 2.2 | | | | 70.5 | | | $ | 2.8 | | | | 103.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Seniors Housing — Stabilized Triple-Net: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annualized Revenue | | | 194.6 | | | | — | | | | — | | | | 1.7 | | | | — | | | | 0.5 | | | | 192.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Medical Office — Stabilized: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Annualized Revenue2 | | | 30.1 | | | $ | 3.2 | | | $ | 3.6 | | | | 2.9 | | | | 2.4 | | | | 4.3 | | | | 13.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Medical Office — Lease-Up: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Annualized Revenue2 | | | 8.4 | | | | 0.1 | | | | 0.7 | | | | 0.2 | | | | 0.2 | | | | 0.3 | | | | 6.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other — Stabilized Triple-Net: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annualized Revenue | | | 1.0 | | | | 1.0 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annualized Revenue | | $ | 507.2 | | | $ | 4.3 | | | $ | 4.3 | | | $ | 6.9 | | | $ | 119.9 | | | $ | 7.9 | | | $ | 363.9 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Percent of Total: | | | 100 | % | | | 1 | % | | | 1 | % | | | 1 | % | | | 24 | % | | | 2 | % | | | 72 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | | |

| 1 | | Annualized fourth quarter Ventas revenue assuming all events occurred at the beginning of the period. Dollars in millions. Totals may not add due to rounding. |

| |

| 2 | | Company’s partners’ share has not been eliminated from revenue. |

5

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Company Development Data:

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Ventas | | | | | | |

| | | | | Ventas | | | | | | | | | | Estimated/Actual | | Total | | Ventas Fixed | | Expected |

| | | | | Ownership | | | | Property | | Number of | | Actual/Projected | | Acquisition | | Development | | Purchase Price | | Stabilized |

| Status | | Property Name | | % | | MSA | | Type | | Residents or Beds/Units/Square Feet | | Opening Date | | Date | | Cost1 | | (incl. FPAC)1 | | Yield |

| In Lease-up | | Sunrise of Thorne Mills on Steeles | | 80% | | Toronto | | IL/AL/ALZ | | 256 Residents / 229 Units / 210,000 SF | | September 2007 | | December 2007 | | Cdn $62.8 | | Cdn $52.7 | | 8.0%-8.5% |

6

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Same-Store Triple-Net Portfolio Trend Data for Properties Owned for the Full 3rd Quarters of 2009 & 2008:1,2

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Sequential Quarter Comparison | | | Year-Over-Year Comparison | |

| | | | | | | 3Q09 | | | 2Q09 | | | | | | | | | | | 3Q09 | | | 3Q08 | | | | | | | |

| | | Number of | | | Cash Flow | | | Cash Flow | | | 3Q09 | | | 2Q09 | | | Cash Flow | | | Cash Flow | | | 3Q09 | | | 3Q08 | |

| Property Type | | Properties | | | Coverage | | | Coverage | | | Occupancy | | | Occupancy | | | Coverage | | | Coverage | | | Occupancy | | | Occupancy | |

| Hospital | | | 40 | | | | 2.5 | x | | | 2.5 | x | | | 57.3 | % | | | 59.2 | % | | | 2.5 | x | | | 2.5 | x | | | 57.3 | % | | | 58.0 | % |

| Skilled Nursing | | | 186 | | | | 1.9 | x | | | 1.9 | x | | | 89.6 | % | | | 89.5 | % | | | 1.9 | x | | | 2.0 | x | | | 89.6 | % | | | 89.4 | % |

| Seniors Housing | | | 164 | | | | 1.3 | x | | | 1.3 | x | | | 87.8 | % | | | 87.0 | % | | | 1.3 | x | | | 1.3 | x | | | 87.8 | % | | | 88.4 | % |

| Other | | | 8 | | | | 4.7 | x | | | 5.1 | x | | | N/A | | | | N/A | | | | 4.7 | x | | | 5.0 | x | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | 398 | | | | 1.8 | x | | | 1.8 | x | | | | | | | | | | | 1.8 | x | | | 1.8 | x | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Same-Store Triple-Net Portfolio Trend Data for Properties Owned for the Full 2nd and 3rd Quarters of 2009:1,2

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Sequential Quarter Comparison | |

| | | | | | | 3Q09 | | | 2Q09 | | | | | | | |

| | | Number of | | | Cash Flow | | | Cash Flow | | | 3Q09 | | | 2Q09 | |

| Property Type | | Properties | | | Coverage | | | Coverage | | | Occupancy | | | Occupancy | |

| Hospital | | | 40 | | | | 2.5 | x | | | 2.5 | x | | | 57.3 | % | | | 59.2 | % |

| Skilled Nursing | | | 187 | | | | 1.9 | x | | | 1.9 | x | | | 89.6 | % | | | 89.5 | % |

| Seniors Housing | | | 164 | | | | 1.3 | x | | | 1.3 | x | | | 87.8 | % | | | 87.0 | % |

| Other | | | 8 | | | | 4.7 | x | | | 5.1 | x | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | �� | |

| Total | | | 399 | | | | 1.8 | x | | | 1.8 | x | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

| 1 | | Third quarter 2009 is most recent quarter available. |

| |

| 2 | | Cash flow coverages are for trailing twelve months or annualized where the Company’s ownership is for a shorter period. |

7

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Kindred Healthcare Same-Store TTM EBITDARM Coverage Ratios:1

| | | | | | | | | | | | | | | | | | | | | |

| Ventas — Kindred | | Number of | | | Sequential Quarter Comparison | | | Year-Over-Year Comparison | |

| Master Lease | | Properties | | | 3Q09 | | | 2Q09 | | | 3Q09 | | | 3Q08 | |

| 1 | | | 81 | | | | 2.3 | x | | | 2.3 | x | | | 2.3 | x | | | 2.4 | x |

| 2 | | | 40 | | | | 2.0 | x | | | 2.0 | x | | | 2.0 | x | | | 2.0 | x |

| 3 | | | 36 | | | | 1.8 | x | | | 1.7 | x | | | 1.8 | x | | | 1.9 | x |

| 4 | | | 40 | | | | 2.3 | x | | | 2.3 | x | | | 2.3 | x | | | 2.3 | x |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 197 | | | | 2.1 | x | | | 2.1 | x | | | 2.1 | x | | | 2.2 | x |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | Number of | | | | | | | | | | | | | |

| Property Type | | Properties | | | 3Q09 | | | 2Q09 | | | 3Q09 | | | 3Q08 | |

| Hospital | | | 38 | | | | 2.5 | x | | | 2.5 | x | | | 2.5 | x | | | 2.5 | x |

| Skilled Nursing | | | 159 | | | | 1.9 | x | | | 1.9 | x | | | 1.9 | x | | | 2.0 | x |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 197 | | | | 2.1 | x | | | 2.1 | x | | | 2.1 | x | | | 2.2 | x |

| | | | | | | | | | | | | | | | | | | | |

| | | |

| 1 | | Coverage reflects the ratio of Kindred’s EBITDARM to rent. EBITDARM is defined as earnings before interest, income taxes, depreciation, amortization, rent and management fees. In the calculation of trailing twelve months EBITDARM, intercompany profit pertaining to services provided by Kindred’s PeopleFirst Rehabilitation Division has been eliminated from purchased ancillary expenses within the Ventas portfolio. Third quarter 2009 is most recent quarter available. |

8

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Triple-Net Lease Portfolio Trends:

| | | |

| 1 | | Cash flow coverages are for trailing twelve months or annualized where the Company’s ownership is for a shorter period. Third quarter 2009 is most recent quarter available. |

9

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Triple-Net Lease Portfolio Trends:

| | | |

| 1 | | Cash flow coverages are for trailing twelve months or annualized where the Company’s ownership is for a shorter period. Third quarter 2009 is most recent quarter available. |

10

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Triple-Net Lease Portfolio Trends:

| | | |

| 1 | | Cash flow coverages are for trailing twelve months or annualized where the Company’s ownership is for a shorter period. Third quarter 2009 is most recent quarter available. |

11

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Medical Office Portfolio Statistics:1

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year-Over-Year Comparison | |

| | | Stabilized | | | Same-Store Stabilized2,3 | | | Lease-Up | |

| | | 4Q09 | | | 4Q08 | | | 4Q09 | | | 4Q08 | | | 4Q09 | | | 4Q08 | |

| Number of properties: | | | 21 | | | | 19 | | | | 18 | | | | 18 | | | | 5 | | | | 2 | |

| Number of square feet: | | | 1,281,357 | | | | 1,046,828 | | | | 1,042,728 | | | | 1,042,728 | | | | 432,742 | | | | 181,952 | |

| Average occupancy: | | | 94.7 | % | | | 95.6 | % | | | 94.4 | % | | | 95.6 | % | | | 74.4 | % | | | 58.9 | % |

Average annual rate per square foot:4 | | $ | 30 | | | $ | 29 | | | $ | 29 | | | $ | 29 | | | $ | 30 | | | $ | 26 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating revenue: | | $ | 8.0 | | | $ | 7.6 | | | $ | 7.3 | | | $ | 7.5 | | | $ | 2.2 | | | $ | 0.7 | |

| Less expenses: | | | 2.7 | | | | 2.6 | | | | 2.5 | | | | 2.6 | | | | 0.8 | | | | 0.4 | |

| | | | | | | | | | | | | | | | | | | |

| Total NOI: | | | 5.3 | | | | 4.9 | | | | 4.8 | | | | 4.9 | | | | 1.4 | | | | 0.4 | |

| Less Company’s partners’ share: | | | 0.2 | | | | 0.4 | | | | 0.2 | | | | 0.4 | | | | 0.2 | | | | 0.0 | |

| | | | | | | | | | | | | | | | | | | |

| Ventas NOI: | | $ | 5.1 | | | $ | 4.5 | | | $ | 4.6 | | | $ | 4.5 | | | $ | 1.2 | | | $ | 0.4 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Sequential Quarter Comparison | |

| | | Stabilized | | | Same-Store Stabilized2,3 | | | Lease-Up | |

| | | 4Q09 | | | 3Q09 | | | 4Q09 | | | 3Q09 | | | 4Q09 | | | 3Q09 | |

| Number of properties: | | | 21 | | | | 19 | | | | 18 | | | | 18 | | | | 5 | | | | 4 | |

| Number of square feet: | | | 1,281,357 | | | | 1,046,828 | | | | 1,042,728 | | | | 1,042,728 | | | | 432,742 | | | | 355,479 | |

| Average occupancy: | | | 94.7 | % | | | 94.0 | % | | | 94.4 | % | | | 93.9 | % | | | 74.4 | % | | | 70.6 | % |

Average annual rate per square foot:4 | | $ | 30 | | | $ | 29 | | | $ | 29 | | | $ | 29 | | | $ | 30 | | | $ | 30 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating revenue: | | $ | 8.0 | | | $ | 7.3 | | | $ | 7.3 | | | $ | 7.3 | | | $ | 2.2 | | | $ | 1.8 | |

| Less expenses: | | | 2.7 | | | | 2.5 | | | | 2.5 | | | | 2.5 | | | | 0.8 | | | | 0.7 | |

| | | | | | | | | | | | | | | | | | | |

| Total NOI: | | | 5.3 | | | | 4.7 | | | | 4.8 | | | | 4.7 | | | | 1.4 | | | | 1.1 | |

| Less Company’s partners’ share: | | | 0.2 | | | | 0.2 | | | | 0.2 | | | | 0.2 | | | | 0.2 | | | | 0.1 | |

| | | | | | | | | | | | | | | | | | | |

| Ventas NOI: | | $ | 5.1 | | | $ | 4.5 | | | $ | 4.6 | | | $ | 4.5 | | | $ | 1.2 | | | $ | 1.0 | |

| | | | | | | | | | | | | | | | | | | |

| | | |

| 1 | | Dollars in millions except for rate data. Totals may not add due to rounding. |

| |

| 2 | | Includes only those MOBs owned for the full period. |

| |

| 3 | | Includes only those MOBs owned in both comparison periods. |

| |

| 4 | | Average annual rate includes CAM adjustments. |

12

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Medical Office Stabilized Portfolio Trends:

| | | |

| 1 | | Total property NOI, does not take into account Company’s partners’ share. |

13

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Seniors Housing Operating Portfolio Statistics:1

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year-Over-Year Comparison | |

| | | Stabilized | | | Same-Store Stabilized2 | | | Lease-Up | |

| | | 4Q09 | | | 4Q08 | | | 4Q09 | | | 4Q08 | | | 4Q09 | | | 4Q08 | |

| Number of properties: | | | 78 | | | | 77 | | | | 77 | | | | 77 | | | | 1 | | | | 2 | |

| Number of units: | | | 6,284 | | | | 6,220 | | | | 6,220 | | | | 6,220 | | | | 229 | | | | 293 | |

| Resident day capacity: | | | 685,124 | | | | 677,396 | | | | 677,948 | | | | 677,396 | | | | 23,552 | | | | 30,728 | |

| Average resident occupancy: | | | 88.8 | % | | | 90.7 | % | | | 88.8 | % | | | 90.7 | % | | | 77.7 | % | | | 63.7 | % |

| Average daily rate / resident fees: | | $ | 174 | | | $ | 167 | | | $ | 173 | | | $ | 167 | | | $ | 139 | | | $ | 140 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating revenue: | | $ | 105.7 | | | $ | 102.9 | | | $ | 104.4 | | | $ | 102.9 | | | $ | 2.5 | | | $ | 2.7 | |

| Less expenses: | | | 73.0 | | | | 71.6 | | | | 72.1 | | | | 71.6 | | | | 1.9 | | | | 1.9 | |

| | | | | | | | | | | | | | | | | | | |

| Total NOI: | | | 32.7 | | �� | | 31.3 | | | | 32.3 | | | | 31.3 | | | | 0.6 | | | | 0.9 | |

| Less Company’s partner’s share: | | | 4.9 | | | | 4.7 | | | | 4.8 | | | | 4.7 | | | | 0.1 | | | | 0.2 | |

| | | | | | | | | | | | | | | | | | | |

| Ventas NOI: | | $ | 27.8 | | | $ | 26.6 | | | $ | 27.5 | | | $ | 26.6 | | | $ | 0.5 | | | $ | 0.7 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Sequential Quarter Comparison | |

| | | Stabilized | | | Same-Store Stabilized2 | | | Lease-Up | |

| | | 4Q09 | | | 3Q09 | | | 4Q09 | | | 3Q09 | | | 4Q09 | | | 3Q09 | |

| Number of properties: | | | 78 | | | | 78 | | | | 78 | | | | 78 | | | | 1 | | | | 1 | |

| Number of units: | | | 6,284 | | | | 6,284 | | | | 6,284 | | | | 6,284 | | | | 229 | | | | 229 | |

| Resident day capacity: | | | 685,124 | | | | 684,752 | | | | 685,124 | | | | 684,752 | | | | 23,552 | | | | 23,552 | |

| Average resident occupancy: | | | 88.8 | % | | | 88.1 | % | | | 88.8 | % | | | 88.1 | % | | | 77.7 | % | | | 72.0 | % |

| Average daily rate / resident fees: | | $ | 174 | | | $ | 173 | | | $ | 174 | | | $ | 173 | | | $ | 139 | | | $ | 136 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating revenue: | | $ | 105.7 | | | $ | 104.2 | | | $ | 105.7 | | | $ | 104.2 | | | $ | 2.5 | | | $ | 2.3 | |

| Less expenses: | | | 73.0 | | | | 71.2 | | | | 73.0 | | | | 71.2 | | | | 1.9 | | | | 1.9 | |

| | | | | | | | | | | | | | | | | | | |

| Total NOI: | | | 32.7 | | | | 33.0 | | | | 32.7 | | | | 33.0 | | | | 0.6 | | | | 0.4 | |

| Less Company’s partner’s share: | | | 4.9 | | | | 4.9 | | | | 4.9 | | | | 4.9 | | | | 0.1 | | | | 0.1 | |

| | | | | | | | | | | | | | | | | | | |

| Ventas NOI: | | $ | 27.8 | | | $ | 28.1 | | | $ | 27.8 | | | $ | 28.1 | | | $ | 0.5 | | | $ | 0.3 | |

| | | | | | | | | | | | | | | | | | | |

| | | |

| 1 | | Dollars in millions except for rate data. Totals may not add due to rounding. |

| |

| 2 | | Includes only those communities stabilized in both comparison periods. |

14

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Seniors Housing Stabilized Operating Portfolio Trends:

| | | |

| 1 | | Total community NOI, does not take into account Company’s partner’s share. |

15

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Historical Normalized FFO/Share:1

| | | |

| 1 | | See Company’s public filings for a definition of normalized FFO. |

16

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Capitalization:

| | | | | | | | | | | | | |

| | | | | | | | | | | As of | |

| | | | | | | | | | | December 31, | |

| (In thousands, except per share amounts) | | | | | | | | | | 2009 | |

Debt1 | | | | | | | | | | | | |

| Revolving credit facilities | | | | | | | | | | $ | 8,466 | |

| Senior notes | | | | | | | | | | | 1,109,929 | |

| Mortgage debt | | | | | | | | | | | 1,551,706 | |

| | | | | | | | | | | | |

| Total debt | | | | | | | | | | $ | 2,670,101 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

Enterprise Value | | | | | | | | | | | | |

| Total debt | | | | | | | | | | $ | 2,670,101 | |

| Cash, including cash escrows pertaining to debt | | | | | | | | | | | (114,639 | ) |

| | | | | | | | | | | | |

| Net debt | | | | | | | | | | | 2,555,462 | |

| | | | | | | | | | | | | |

| | | Number of Shares | | | Closing Price | | | | | |

| Common Stock | | | 156,612 | | | $ | 43.74 | | | | 6,850,209 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

Enterprise Value2 | | | | | | | | | | $ | 9,405,671 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

Credit Statistics | | | | | | | | | | | | |

| Debt / Enterprise Value | | | | | | | | | | | 28 | % |

| Secured Debt / Enterprise Value | | | | | | | | | | | 16 | % |

Net Debt / Pro Forma EBITDA3 | | | | | | | | | | | 4.1 | x |

| | | | | | | | | | | | | |

Pro Forma EBITDA3, annualized | | | | | | | | | | $ | 625,640 | |

| | | |

| 1 | | Debt balances are net of discounts and fair market value. |

| |

| 2 | | Total debt plus total equity. |

| |

| 3 | | EBITDA excludes merger-related expenses and deal costs. |

17

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Debt Maturity Schedule:1

| | | |

| 1 | | Dollars in millions; data as of December 31, 2009 and excludes normal monthly principal amortization. The Company’s joint venture partners’ pro rata share of total maturities is approximately $143 million. |

18

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Debt Summary as of December 31, 2009

Debt Maturities and Scheduled Principal Amortization1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Credit Facilities | | | Senior/Convertible Notes | | | Mortgage Debt | | | Total Debt | |

| Period | | Amount | | | Rate2 | | | Amount | | | Rate2 | | | Amount3 | | | Rate2 | | | Amount | | | Rate2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2010 | | $ | — | | | | — | | | $ | 1,375 | | | | 6.8 | % | | $ | 201,607 | | | | 4.6 | % | | $ | 202,982 | | | | 4.6 | % |

| 2011 | | | — | | | | — | | | | 230,000 | | | | 3.9 | % | | | 97,505 | | | | 4.8 | % | | | 327,505 | | | | 4.2 | % |

| 2012 | | | 8,466 | | | | 3.0 | % | | | 82,433 | | | | 9.0 | % | | | 329,328 | | | | 6.2 | % | | | 420,227 | | | | 6.7 | % |

| 2013 | | | — | | | | — | | | | — | | | | — | | | | 168,256 | | | | 5.9 | % | | | 168,256 | | | | 5.9 | % |

| 2014 | | | — | | | | — | | | | 71,654 | | | | 6.6 | % | | | 52,567 | | | | 5.4 | % | | | 124,221 | | | | 6.1 | % |

| 2015 | | | — | | | | — | | | | 142,669 | | | | 7.1 | % | | | 78,503 | | | | 6.0 | % | | | 221,172 | | | | 6.7 | % |

| 2016 | | | — | | | | — | | | | 400,000 | | | | 6.5 | % | | | 204,818 | | | | 6.1 | % | | | 604,818 | | | | 6.4 | % |

| 2017 | | | — | | | | — | | | | 225,000 | | | | 6.8 | % | | | 47,403 | | | | 6.1 | % | | | 272,403 | | | | 6.6 | % |

| 2018 | | | — | | | | — | | | | — | | | | — | | | | 20,297 | | | | 6.5 | % | | | 20,297 | | | | 6.5 | % |

| 2019 | | | — | | | | — | | | | — | | | | — | | | | 257,126 | | | | 5.9 | % | | | 257,126 | | | | 5.9 | % |

| Thereafter | | | — | | | | — | | | | — | | | | — | | | | 82,654 | | | | 5.1 | % | | | 82,654 | | | | 5.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Subtotal | | | 8,466 | | | | 3.0 | % | | | 1,153,131 | | | | 6.3 | % | | | 1,540,064 | | | | 5.7 | % | | | 2,701,661 | | | | 5.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Discounts and Fair Market Value, net | | | — | | | | | | | | (43,202 | ) | | | | | | | 11,642 | | | | | | | | (31,560 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 8,466 | | | | | | | $ | 1,109,929 | | | | | | | $ | 1,551,706 | | | | | | | $ | 2,670,101 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted Average Maturity in Years | | | 1.7 | | | | | | | | 5.1 | | | | | | | | 5.3 | | | | | | | | 5.2 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Debt Composition1

| | | | | | | | | | | | | |

| | | December 31, 2009 | |

| | | Amount | | | Rate2 | | | % of Total | |

| Fixed Rate Debt | | | | | | | | | | | | |

| Senior/Convertible Notes | | $ | 1,153,131 | | | | 6.3 | % | | | 42.7 | % |

| Mortgage Debt | | | 1,324,094 | | | | 6.3 | % | | | 49.0 | % |

| | | | | | | | | | | |

| Total Fixed Rate Debt | | $ | 2,477,225 | | | | 6.3 | % | | | 91.7 | % |

| | | | | | | | | | | |

| | | | | | | | | | | | | |

| Variable Rate Debt | | | | | | | | | | | | |

| Credit Facilities | | $ | 8,466 | | | | 3.0 | % | | | 0.3 | % |

| Mortgage Debt | | | 215,970 | | | | 2.1 | % | | | 8.0 | % |

| | | | | | | | | | | |

| Total Variable Rate Debt | | | 224,436 | | | | 2.1 | % | | | 8.3 | % |

| | | | | | | | | | | |

| Total Debt | | $ | 2,701,661 | | | | 5.9 | % | | | 100.0 | % |

| | | | | | | | | | |

| | | |

| 1 | | Dollars in thousands. |

| |

| 2 | | Rates are based on the cash interest paid on the outstanding debt and do not include amortization of discounts, fair market value or debt costs. |

| |

| 3 | | The Company’s joint venture partners’ pro rata share of total mortgage debt is approximately $159 million. |

19

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Debt Covenants:

| | | | | | | |

| | | Credit Facilities | |

| | | Required | | 12/31/09 | |

| Total Liabilities / Gross Asset Value | | Not greater than 60% | | | 38 | % |

| Secured Debt / Gross Asset Value | | Not greater than 30% | | | 22 | % |

| Unsecured Debt / Unencumb. Gross Asset Value | | Not greater than 60% | | | 27 | % |

| Fixed Charge Coverage | | Not less than 1.75x | | | 3.2 | x |

| Unencumbered Interest Coverage | | Not less than 2.00x | | | 5.1 | x |

| | | | | | | |

| | | Bonds due 2012 | |

| | | Required | | 12/31/09 | |

| Incurrence of Debt | | Not greater than 60% | | | 31 | % |

| Incurrence of Secured Debt | | Not greater than 40% | | | 10 | % |

| Total Unencumbered Assets | | Not less than 150% | | | 369 | % |

| Consolidated Income Available for Debt Service to Debt Service | | Not less than 2.00x | | | 5.1 | x |

20

Ventas, Inc.

Fourth Quarter 2009 Supplemental Data

Debt Covenants:

21

CONSOLIDATED BALANCE SHEETS

As of December 31, 2009, September 30, 2009, June 30, 2009, March 31, 2009 and December 31, 2008

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | |

| | | December 31, | | | September 30, | | | June 30, | | | March 31, | | | December 31, | |

| | | 2009 | | | 2009 | | | 2009 | | | 2009 | | | 2008 * | |

Assets | | | | | | | | | | | | | | | | | | | | |

| Real estate investments: | | | | | | | | | | | | | | | | | | | | |

| Land | | $ | 557,276 | | | $ | 557,123 | | | $ | 552,712 | | | $ | 554,286 | | | $ | 555,015 | |

| Buildings and improvements | | | 5,722,837 | | | | 5,641,309 | | | | 5,603,042 | | | | 5,592,051 | | | | 5,593,024 | |

| Construction in progress | | | 12,508 | | | | 8,611 | | | | 18,319 | | | | 21,176 | | | | 12,591 | |

| | | | | | | | | | | | | | | | |

| | | | 6,292,621 | | | | 6,207,043 | | | | 6,174,073 | | | | 6,167,513 | | | | 6,160,630 | |

| Accumulated depreciation | | | (1,177,911 | ) | | | (1,126,516 | ) | | | (1,075,293 | ) | | | (1,036,617 | ) | | | (987,691 | ) |

| | | | | | | | | | | | | | | | |

| Net real estate property | | | 5,114,710 | | | | 5,080,527 | | | | 5,098,780 | | | | 5,130,896 | | | | 5,172,939 | |

| Loans receivable, net | | | 131,887 | | | | 125,410 | | | | 125,106 | | | | 130,076 | | | | 123,289 | |

| | | | | | | | | | | | | | | | |

| Net real estate investments | | | 5,246,597 | | | | 5,205,937 | | | | 5,223,886 | | | | 5,260,972 | | | | 5,296,228 | |

| Cash and cash equivalents | | | 107,397 | | | | 70,889 | | | | 46,523 | | | | 95,806 | | | | 176,812 | |

| Escrow deposits and restricted cash | | | 39,832 | | | | 96,477 | | | | 94,470 | | | | 38,275 | | | | 55,866 | |

| Deferred financing costs, net | | | 29,252 | | | | 27,804 | | | | 29,569 | | | | 29,935 | | | | 22,032 | |

| Other | | | 193,167 | | | | 186,203 | | | | 176,413 | | | | 168,858 | | | | 220,480 | |

| | | | | | | | | | | | | | | | |

| Total assets | | $ | 5,616,245 | | | $ | 5,587,310 | | | $ | 5,570,861 | | | $ | 5,593,846 | | | $ | 5,771,418 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Liabilities and equity | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | |

| Senior notes payable and other debt | | $ | 2,670,101 | | | $ | 2,615,142 | | | $ | 2,616,304 | | | $ | 2,942,401 | | | $ | 3,136,998 | |

| Deferred revenue | | | 4,315 | | | | 4,628 | | | | 5,305 | | | | 6,307 | | | | 7,057 | |

| Accrued interest | | | 17,974 | | | | 35,481 | | | | 16,952 | | | | 42,121 | | | | 21,931 | |

| Accounts payable and other accrued liabilities | | | 186,130 | | | | 175,125 | | | | 164,659 | | | | 161,775 | | | | 168,198 | |

| Deferred income taxes | | | 253,665 | | | | 254,622 | | | | 255,175 | | | | 255,570 | | | | 257,499 | |

| | | | | | | | | | | | | | | | |

| Total liabilities | | | 3,132,185 | | | | 3,084,998 | | | | 3,058,395 | | | | 3,408,174 | | | | 3,591,683 | |

| | | | | | | | | | | | | | | | | | | | | |

| Commitments and contingencies | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Equity: | | | | | | | | | | | | | | | | | | | | |

| Ventas stockholders’ equity: | | | | | | | | | | | | | | | | | | | | |

| Preferred stock, $1.00 par value; 10,000 shares authorized, unissued | | | — | | | | — | | | | — | | | | — | | | | — | |

| Common stock, $0.25 par value; 156,627, 156,605, 156,539, 143,453 and 143,302 shares issued at December 31, 2009, September 30, 2009, June 30, 2009, March 31, 2009 and December 31, 2008, respectively | | | 39,160 | | | | 39,155 | | | | 39,138 | | | | 35,867 | | | | 35,825 | |

| Capital in excess of par value | | | 2,573,039 | | | | 2,570,146 | | | | 2,565,933 | | | | 2,267,440 | | | | 2,264,125 | |

| Accumulated other comprehensive income (loss) | | | 19,669 | | | | 15,080 | | | | (1,411 | ) | | | (18,322 | ) | | | (21,089 | ) |

| Retained earnings (deficit) | | | (165,710 | ) | | | (139,478 | ) | | | (109,012 | ) | | | (117,124 | ) | | | (117,806 | ) |

| Treasury stock, 15, 0, 0, 2 and 15 shares at December 31, 2009, September 30, 2009, June 30, 2009, March 31, 2009 and December 31, 2008, respectively | | | (647 | ) | | | — | | | | (5 | ) | | | (53 | ) | | | (457 | ) |

| | | | | | | | | | | | | | | | |

| Total Ventas stockholders’ equity | | | 2,465,511 | | | | 2,484,903 | | | | 2,494,643 | | | | 2,167,808 | | | | 2,160,598 | |

| Noncontrolling interest | | | 18,549 | | | | 17,409 | | | | 17,823 | | | | 17,864 | | | | 19,137 | |

| | | | | | | | | | | | | | | | |

| Total equity | | | 2,484,060 | | | | 2,502,312 | | | | 2,512,466 | | | | 2,185,672 | | | | 2,179,735 | |

| | | | | | | | | | | | | | | | |

| Total liabilities and equity | | $ | 5,616,245 | | | $ | 5,587,310 | | | $ | 5,570,861 | | | $ | 5,593,846 | | | $ | 5,771,418 | |

| | | | | | | | | | | | | | | | |

| | | |

| * | | Historical financial statements have been restated to reflect the adoption of FASB guidance relating to the accounting of convertible debt instruments and FASB guidance relating to minority interests (now characterized as noncontrolling interests). |

22

CONSOLIDATED STATEMENTS OF INCOME

For the three months and year ended December 31, 2009 and 2008

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | |

| | | For the Three Months | | | For the Year | |

| | | Ended December 31, | | | Ended December 31, | |

| | | 2009 | | | 2008 * | | | 2009 | | | 2008 * | |

Revenues: | | | | | | | | | | | | | | | | |

| Rental income | | $ | 127,193 | | | $ | 122,673 | | | $ | 501,087 | | | $ | 481,368 | |

| Resident fees and services | | | 108,205 | | | | 105,609 | | | | 421,058 | | | | 429,257 | |

| Income from loans and investments | | | 3,279 | | | | 3,474 | | | | 13,107 | | | | 8,847 | |

| Interest and other income | | | 349 | | | | 697 | | | | 842 | | | | 4,226 | |

| | | | | | | | | | | | | |

| Total revenues | | | 239,026 | | | | 232,453 | | | | 936,094 | | | | 923,698 | |

| | | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | |

| Interest | | | 44,607 | | | | 50,603 | | | | 178,503 | | | | 204,450 | |

| Depreciation and amortization | | | 52,075 | | | | 53,982 | | | | 200,911 | | | | 230,881 | |

| Property-level operating expenses | | | 78,443 | | | | 76,447 | | | | 302,813 | | | | 306,944 | |

| General, administrative and professional fees (including non-cash stock-based compensation expense of $2,667 and $2,160 for the three months ended 2009 and 2008, respectively, and $11,882 and $9,976 for the year ended 2009 and 2008, respectively) | | | 8,220 | | | | 11,158 | | | | 38,830 | | | | 40,651 | |

| Foreign currency loss (gain) | | | 19 | | | | (11 | ) | | | 50 | | | | (162 | ) |

| (Gain) loss on extinguishment of debt | | | — | | | | (2,858 | ) | | | 6,080 | | | | (2,398 | ) |

| Merger-related expenses and deal costs | | | 1,565 | | | | 1,332 | | | | 13,015 | | | | 4,460 | |

| | | | | | | | | | | | | |

| Total expenses | | | 184,929 | | | | 190,653 | | | | 740,202 | | | | 784,826 | |

| | | | | | | | | | | | | |

| Income before reversal of contingent liability, income taxes, discontinued operations and noncontrolling interest | | | 54,097 | | | | 41,800 | | | | 195,892 | | | | 138,872 | |

| Reversal of contingent liability | | | — | | | | — | | | | — | | | | 23,328 | |

| Income tax benefit | | | 367 | | | | 1,720 | | | | 1,719 | | | | 15,885 | |

| | | | | | | | | | | | | |

| Income from continuing operations | | | 54,464 | | | | 43,520 | | | | 197,611 | | | | 178,085 | |

| Discontinued operations | | | 314 | | | | 14,631 | | | | 71,749 | | | | 47,202 | |

| | | | | | | | | | | | | |

| Net income | | | 54,778 | | | | 58,151 | | | | 269,360 | | | | 225,287 | |

| Net income attributable to noncontrolling interest, net of tax | | | 697 | | | | 621 | | | | 2,865 | | | | 2,684 | |

| | | | | | | | | | | | | |

| Net income attributable to common stockholders | | $ | 54,081 | | | $ | 57,530 | | | $ | 266,495 | | | $ | 222,603 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Earnings per common share: | | | | | | | | | | | | | | | | |

| Basic: | | | | | | | | | | | | | | | | |

| Income from continuing operations attributable to common stockholders | | $ | 0.35 | | | $ | 0.30 | | | $ | 1.28 | | | $ | 1.25 | |

| Discontinued operations | | | 0.00 | | | | 0.10 | | | | 0.47 | | | | 0.34 | |

| | | | | | | | | | | | | |

| Net income attributable to common stockholders | | $ | 0.35 | | | $ | 0.40 | | | $ | 1.75 | | | $ | 1.59 | |

| | | | | | | | | | | | | |

| Diluted: | | | | | | | | | | | | | | | | |

| Income from continuing operations attributable to common stockholders | | $ | 0.35 | | | $ | 0.30 | | | $ | 1.27 | | | $ | 1.25 | |

| Discontinued operations | | | 0.00 | | | | 0.10 | | | | 0.47 | | | | 0.34 | |

| | | | | | | | | | | | | |

| Net income attributable to common stockholders | | $ | 0.35 | | | $ | 0.40 | | | $ | 1.74 | | | $ | 1.59 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Weighted average shares used in computing earnings per common share: | | | | | | | | | | | | | | | | |

| Basic | | | 156,296 | | | | 142,963 | | | | 152,566 | | | | 139,572 | |

| Diluted | | | 156,692 | | | | 143,047 | | | | 152,758 | | | | 139,912 | |

| | | | | | | | | | | | | | | | | |

| Dividends declared per common share | | $ | 0.5125 | | | $ | 0.5125 | | | $ | 2.0500 | | | $ | 2.0500 | |

| | | |

| * | | Historical financial statements have been restated to reflect the adoption of FASB guidance relating to the accounting of convertible debt instruments and FASB guidance relating to minority interests (now characterized as noncontrolling interests). |

23

QUARTERLY CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Fourth | |

| | | 2009 Quarters | | | Quarter | |

| | | Fourth | | | Third | | | Second | | | First | | | 2008* | |

Revenues: | | | | | | | | | | | | | | | | | | | | |

| Rental income | | $ | 127,193 | | | $ | 125,939 | | | $ | 125,084 | | | $ | 122,871 | | | $ | 122,673 | |

| Resident fees and services | | | 108,205 | | | | 106,515 | | | | 103,399 | | | | 102,939 | | | | 105,609 | |

| Income from loans and investments | | | 3,279 | | | | 3,214 | | | | 3,333 | | | | 3,281 | | | | 3,474 | |

| Interest and other income | | | 349 | | | | 99 | | | | 108 | | | | 286 | | | | 697 | |

| | | | | | | | | | | | | | | | |

| Total revenues | | | 239,026 | | | | 235,767 | | | | 231,924 | | | | 229,377 | | | | 232,453 | |

| | | | | | | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | | | | | |

| Interest | | | 44,607 | | | | 43,646 | | | | 44,156 | | | | 46,094 | | | | 50,603 | |

| Depreciation and amortization | | | 52,075 | | | | 50,329 | | | | 48,826 | | | | 49,681 | | | | 53,982 | |

| Property-level operating expenses | | | 78,443 | | | | 76,338 | | | | 72,564 | | | | 75,468 | | | | 76,447 | |

| General, administrative and professional fees (including non-cash stock-based compensation expense of $2,667, $3,078, $3,078, $3,059, and $2,160, respectively) | | | 8,220 | | | | 9,657 | | | | 10,355 | | | | 10,598 | | | | 11,158 | |

| Foreign currency loss (gain) | | | 19 | | | | 32 | | | | 5 | | | | (6 | ) | | | (11 | ) |

| Loss (gain) on extinguishment of debt | | | — | | | | — | | | | 5,975 | | | | 105 | | | | (2,858 | ) |

| Merger-related expenses and deal costs | | | 1,565 | | | | 5,894 | | | | 3,502 | | | | 2,054 | | | | 1,332 | |

| | | | | | | | | | | | | | | | |

| Total expenses | | | 184,929 | | | | 185,896 | | | | 185,383 | | | | 183,994 | | | | 190,653 | |

| | | | | | | | | | | | | | | | |

| Income before income taxes, discontinued operations and noncontrolling interest | | | 54,097 | | | | 49,871 | | | | 46,541 | | | | 45,383 | | | | 41,800 | |

| Income tax benefit | | | 367 | | | | 410 | | | | 395 | | | | 547 | | | | 1,720 | |

| | | | | | | | | | | | | | | | |

| Income from continuing operations | | | 54,464 | | | | 50,281 | | | | 46,936 | | | | 45,930 | | | | 43,520 | |

| Discontinued operations | | | 314 | | | | 149 | | | | 42,247 | | | | 29,039 | | | | 14,631 | |

| | | | | | | | | | | | | | | | |

| Net income | | | 54,778 | | | | 50,430 | | | | 89,183 | | | | 74,969 | | | | 58,151 | |

| Net income attributable to noncontrolling interest, net of tax | | | 697 | | | | 625 | | | | 802 | | | | 741 | | | | 621 | |

| | | | | | | | | | | | | | | | |

| Net income attributable to common stockholders | | $ | 54,081 | | | $ | 49,805 | | | $ | 88,381 | | | $ | 74,228 | | | $ | 57,530 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Earnings per common share: | | | | | | | | | | | | | | | | | | | | |

| Basic: | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations attributable to common stockholders | | $ | 0.35 | | | $ | 0.32 | | | $ | 0.30 | | | $ | 0.32 | | | $ | 0.30 | |

| Discontinued operations | | | 0.00 | | | | 0.00 | | | | 0.27 | | | | 0.20 | | | | 0.10 | |

| | | | | | | | | | | | | | | | |

| Net income attributable to common stockholders | | $ | 0.35 | | | $ | 0.32 | | | $ | 0.57 | | | $ | 0.52 | | | $ | 0.40 | |

| | | | | | | | | | | | | | | | |

| Diluted: | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations attributable to common stockholders | | $ | 0.35 | | | $ | 0.32 | | | $ | 0.30 | | | $ | 0.32 | | | $ | 0.30 | |

| Discontinued operations | | | 0.00 | | | | 0.00 | | | | 0.27 | | | | 0.20 | | | | 0.10 | |

| | | | | | | | | | | | | | | | |

| Net income attributable to common stockholders | | $ | 0.35 | | | $ | 0.32 | | | $ | 0.57 | | | $ | 0.52 | | | $ | 0.40 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Weighted average shares used in computing earnings per common share: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 156,296 | | | | 156,250 | | | | 154,441 | | | | 143,091 | | | | 142,963 | |

| Diluted | | | 156,692 | | | | 156,516 | | | | 154,510 | | | | 143,145 | | | | 143,047 | |

| | | | | | | | | | | | | | | | | | | | | |

| Dividends declared per common share | | $ | 0.5125 | | | $ | 0.5125 | | | $ | 0.5125 | | | $ | 0.5125 | | | $ | 0.5125 | |

| | | |

| * | | Historical financial statements have been restated to reflect the adoption of FASB guidance relating to the accounting of convertible debt instruments and FASB guidance relating to minority interests (now characterized as noncontrolling interests). |

24

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the year ended December 31, 2009 and 2008

(In thousands)

| | | | | | | | | |

| | | 2009 | | | 2008 * | |

| Cash flows from operating activities: | | | | | | | | |

| Net income | | $ | 269,360 | | | $ | 225,287 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

| Depreciation and amortization (including amounts in discontinued operations) | | | 201,254 | | | | 235,754 | |

| Amortization of deferred revenue and lease intangibles, net | | | (6,669 | ) | | | (9,344 | ) |

| Other amortization expenses | | | 6,353 | | | | 3,994 | |

| Stock-based compensation | | | 11,882 | | | | 9,976 | |

| Straight-lining of rental income | | | (11,879 | ) | | | (14,652 | ) |

| Loss (gain) on extinguishment of debt | | | 6,080 | | | | (168 | ) |

| Net gain on sale of real estate assets (including amounts in discontinued operations) | | | (67,305 | ) | | | (39,026 | ) |

| Income tax benefit | | | (1,719 | ) | | | (15,885 | ) |

| Reversal of contingent liability | | | — | | | | (23,328 | ) |

| Provision for loan losses | | | — | | | | 5,994 | |

| Other | | | (91 | ) | | | 614 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Increase in other assets | | | (1,514 | ) | | | (3,541 | ) |

| (Decrease) increase in accrued interest | | | (3,957 | ) | | | 1,100 | |

| Increase in other liabilities | | | 20,306 | | | | 3,132 | |

| | | | | | | |

| Net cash provided by operating activities | | | 422,101 | | | | 379,907 | |

| Cash flows from investing activities: | | | | | | | | |

| Net investment in real estate property | | | (45,715 | ) | | | (53,801 | ) |

| Investment in loans receivable | | | (13,803 | ) | | | (108,826 | ) |

| Purchase of marketable debt securities | | | — | | | | (63,680 | ) |

| Proceeds from real estate disposals | | | 58,542 | | | | 104,183 | |

| Proceeds from loans receivable | | | 8,028 | | | | 135 | |

| Proceeds from sale of investments | | | 5,000 | | | | — | |

| Capital expenditures | | | (13,798 | ) | | | (16,359 | ) |

| Other | | | — | | | | 2,092 | |

| | | | | | | |

| Net cash used in investing activities | | | (1,746 | ) | | | (136,256 | ) |

| Cash flows from financing activities: | | | | | | | | |

| Net change in borrowings under revolving credit facilities | | | (292,873 | ) | | | 73,366 | |

| Proceeds from debt | | | 365,682 | | | | 140,262 | |

| Repayment of debt | | | (525,173 | ) | | | (416,896 | ) |

| Payment of deferred financing costs | | | (16,655 | ) | | | (3,857 | ) |

| Issuance of common stock, net | | | 299,201 | | | | 408,540 | |

| Cash distribution to common stockholders | | | (314,399 | ) | | | (288,849 | ) |

| Contributions from noncontrolling interest | | | 1,211 | | | | — | |

| Distributions to noncontrolling interest | | | (9,869 | ) | | | (15,732 | ) |

| Other | | | 2,695 | | | | 7,187 | |

| | | | | | | |

| Net cash used in financing activities | | | (490,180 | ) | | | (95,979 | ) |

| | | | | | | |

| Net (decrease) increase in cash and cash equivalents | | | (69,825 | ) | | | 147,672 | |

| Effect of foreign currency translation on cash and cash equivalents | | | 410 | | | | 806 | |

| Cash and cash equivalents at beginning of period | | | 176,812 | | | | 28,334 | |

| | | | | | | |

| Cash and cash equivalents at end of period | | $ | 107,397 | | | $ | 176,812 | |

| | | | | | | |

| | | | | | | | | |

| Supplemental schedule of non-cash activities: | | | | | | | | |

| Assets and liabilities assumed from acquisitions: | | | | | | | | |

| Real estate investments | | $ | 67,781 | | | $ | 33,967 | |

| Utilization of escrow funds held for an Internal Revenue Code Section 1031 exchange | | | (64,995 | ) | | | — | |

| Other assets acquired | | | — | | | | 1,684 | |

| Debt assumed | | | — | | | | 34,629 | |

| Deferred taxes | | | — | | | | — | |

| Other liabilities | | | 62 | | | | 337 | |

| Noncontrolling interest | | | 2,724 | | | | 685 | |

| | | | | | | |

| Debt transferred on the sale of assets | | | 38,759 | | | | 6,917 | |

| | | |

| * | | Historical financial statements have been restated to reflect the adoption of FASB guidance relating to the accounting of convertible debt instruments and FASB guidance relating to minority interests (now characterized as noncontrolling interests). |

25

QUARTERLY CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Fourth | |

| | | 2009 Quarters | | | Quarter | |

| | | Fourth | | | Third | | | Second | | | First | | | 2008* | |

| Cash flows from operating activities: | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 54,778 | | | $ | 50,430 | | | $ | 89,183 | | | $ | 74,969 | | | $ | 58,151 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization (including amounts in discontinued operations) | | | 52,092 | | | | 50,347 | | | | 48,907 | | | | 49,908 | | | | 54,974 | |

| Amortization of deferred revenue and lease intangibles, net | | | (1,518 | ) | | | (1,564 | ) | | | (1,729 | ) | | | (1,858 | ) | | | (2,142 | ) |

| Other amortization expenses | | | 2,058 | | | | 1,921 | | | | 1,766 | | | | 608 | | | | 376 | |

| Stock-based compensation | | | 2,667 | | | | 3,078 | | | | 3,078 | | | | 3,059 | | | | 2,160 | |

| Straight-lining of rental income | | | (2,918 | ) | | | (2,971 | ) | | | (3,052 | ) | | | (2,938 | ) | | | (3,437 | ) |

| Loss (gain) on extinguishment of debt | | | — | | | | — | | | | 5,922 | | | | 158 | | | | (105 | ) |

| Net gain on sale of real estate assets (including amounts in discontinued operations) | | | (294 | ) | | | (120 | ) | | | (39,020 | ) | | | (27,871 | ) | | | (13,157 | ) |

| Income tax benefit | | | (367 | ) | | | (410 | ) | | | (395 | ) | | | (547 | ) | | | (1,720 | ) |

| Other | | | (178 | ) | | | 99 | | | | (169 | ) | | | 157 | | | | (90 | ) |

| Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | | | | | |

| Decrease (increase) in other assets | | | 2,763 | | | | (5,703 | ) | | | (262 | ) | | | 1,688 | | | | (2,247 | ) |

| (Decrease) increase in accrued interest | | | (17,507 | ) | | | 18,529 | | | | (25,169 | ) | | | 20,190 | | | | (24,324 | ) |

| Increase (decrease) in other liabilities | | | 7,328 | | | | 14,419 | | | | 2,526 | | | | (3,967 | ) | | | 9,660 | |

| | | | | | | | | | | | | | | | |

| Net cash provided by operating activities | | | 98,904 | | | | 128,055 | | | | 81,586 | | | | 113,556 | | | | 78,099 | |

| Cash flows from investing activities: | | | | | | | | | | | | | | | | | | | | |

| Net investment in real estate property | | | (21,987 | ) | | | (4,370 | ) | | | (10,971 | ) | | | (8,387 | ) | | | (6,514 | ) |

| Investment in loans receivable | | | (6,430 | ) | | | — | | | | — | | | | (7,373 | ) | | | (10,000 | ) |

| Proceeds from real estate disposals | | | 740 | | | | 1,188 | | | | — | | | | 56,614 | | | | 45,804 | |

| Proceeds from loans receivable | | | 120 | | | | 207 | | | | 6,051 | | | | 1,650 | | | | 13 | |

| Proceeds from sale of investments | | | 5,000 | | | | — | | | | — | | | | — | | | | — | |

| Capital expenditures | | | (6,614 | ) | | | (3,156 | ) | | | (158 | ) | | | (3,870 | ) | | | (4,185 | ) |

| Other | | | — | | | | — | | | | — | | | | — | | | | 1,770 | |

| | | | | | | | | | | | | | | | |

| Net cash (used in) provided by investing activities | | | (29,171 | ) | | | (6,131 | ) | | | (5,078 | ) | | | 38,634 | | | | 26,888 | |

| Cash flows from financing activities: | | | | | | | | | | | | | | | | | | | | |

| Net change in borrowings under revolving credit facilities | | | (1,417 | ) | | | (1,528 | ) | | | (202,882 | ) | | | (87,046 | ) | | | 245,582 | |

| Proceeds from debt | | | 61,480 | | | | 3,087 | | | | 291,914 | | | | 9,201 | | | | 129,903 | |

| Repayment of debt | | | (8,642 | ) | | | (13,515 | ) | | | (428,659 | ) | | | (74,357 | ) | | | (333,750 | ) |

| Payment of deferred financing costs | | | (3,233 | ) | | | — | | | | (3,855 | ) | | | (9,567 | ) | | | (3,202 | ) |

| Issuance of common stock, net | | | — | | | | — | | | | 299,201 | | | | — | | | | — | |

| Cash distribution to common stockholders | | | (80,313 | ) | | | (80,271 | ) | | | (80,269 | ) | | | (73,546 | ) | | | (73,468 | ) |

| Contributions from noncontrolling interest | | | 576 | | | | 329 | | | | 306 | | | | — | | | | — | |

| Distributions to noncontrolling interest | | | (2,373 | ) | | | (2,472 | ) | | | (3,610 | ) | | | (1,414 | ) | | | (10,400 | ) |

| Other | | | 692 | | | | (3,454 | ) | | | 1,808 | | | | 3,649 | | | | 235 | |

| | | | | | | | | | | | | | | | |

| Net cash used in financing activities | | | (33,230 | ) | | | (97,824 | ) | | | (126,046 | ) | | | (233,080 | ) | | | (45,100 | ) |

| | | | | | | | | | | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | | 36,503 | | | | 24,100 | | | | (49,538 | ) | | | (80,890 | ) | | | 59,887 | |

| Effect of foreign currency translation on cash and cash equivalents | | | 5 | | | | 266 | | | | 255 | | | | (116 | ) | | | 1,002 | |

| Cash and cash equivalents at beginning of period | | | 70,889 | | | | 46,523 | | | | 95,806 | | | | 176,812 | | | | 115,923 | |

| | | | | | | | | | | | | | | | |

| Cash and cash equivalents at end of period | | $ | 107,397 | | | $ | 70,889 | | | $ | 46,523 | | | $ | 95,806 | | | $ | 176,812 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental schedule of non-cash activities: | | | | | | | | | | | | | | | | | | | | |

| Assets and liabilities assumed from acquisitions: | | | | | | | | | | | | | | | | | | | | |

| Real estate investments | | $ | 59,326 | | | $ | 148 | | | $ | — | | | $ | 8,307 | | | $ | (4,611 | ) |

| Utilization of escrow funds held for an Internal Revenue Code Section 1031 exchange | | | (55,700 | ) | | | — | | | | — | | | | (9,295 | ) | | | — | |

| Other assets acquired | | | — | | | | (82 | ) | | | — | | | | 82 | | | | 1,163 | |

| Debt assumed | | | — | | | | — | | | | — | | | | — | | | | — | |

| Deferred taxes | | | — | | | | — | | | | — | | | | — | | | | (650 | ) |

| Other liabilities | | | 1,948 | | | | — | | | | — | | | | (1,886 | ) | | | (3,234 | ) |

| Noncontrolling interest | | | 1,677 | | | | 67 | | | | — | | | | 980 | | | | 436 | |

| | | | | | | | | | | | | | | |

| Debt transferred on the sale of assets | | | — | | | | — | | | | — | | | | 38,759 | | | | 6,917 | |

| | | |

| * | | Historical financial statements have been restated to reflect the adoption of FASB guidance relating to the accounting of convertible debt instruments and FASB guidance relating to minority interests (now characterized as noncontrolling interests). |

26

ANNUAL FUNDS FROM OPERATIONS, NORMALIZED FFO AND FUNDS AVAILABLE FOR DISTRIBUTION

(In thousands, except per share amounts)

| | | | | | | | | |

| | | For the Year | |

| | | Ended December 31, | |

| | | 2009 | | | 2008 * | |

| |

| Net income attributable to common stockholders | | $ | 266,495 | | | $ | 222,603 | |

| Adjustments: | | | | | | | | |

| Depreciation and amortization on real estate assets | | | 200,221 | | | | 230,158 | |

| Depreciation on real estate assets related to noncontrolling interest | | | (6,349 | ) | | | (6,251 | ) |

| Discontinued operations: | | | | | | | | |

| Gain on sale of real estate assets | | | (67,305 | ) | | | (39,026 | ) |

| Depreciation and amortization on real estate assets | | | 347 | | | | 4,873 | |

| | | | | | | |

| FFO | | | 393,409 | | | | 412,357 | |

| Merger-related expenses and deal costs | | | 13,015 | | | | 4,460 | |

| Income tax benefit | | | (3,459 | ) | | | (17,616 | ) |

| Loss (gain) on extinguishment of debt | | | 6,080 | | | | (2,398 | ) |

| Reversal of contingent liability | | | — | | | | (23,328 | ) |

| Provision for loan losses | | | — | | | | 5,994 | |

| | | | | | | |

| Normalized FFO | | | 409,045 | | | | 379,469 | |

| | | | | | | | | |

| Straight-lining of rental income | | | (11,879 | ) | | | (14,652 | ) |

| Routine capital expenditures | | | (8,067 | ) | | | (8,128 | ) |

| | | | | | | |

| Normalized FAD | | $ | 389,099 | | | $ | 356,689 | |

| | | | | | | |

| | | | | | | | | |

Per diluted share(1): | | | | | | | | |

| Net income attributable to common stockholders | | $ | 1.74 | | | $ | 1.59 | |

| Adjustments: | | | | | | | | |

| Depreciation and amortization on real estate assets | | | 1.31 | | | | 1.65 | |

| Depreciation on real estate assets related to noncontrolling interest | | | (0.04 | ) | | | (0.04 | ) |

| Discontinued operations: | | | | | | | | |

| Gain on sale of real estate assets | | | (0.44 | ) | | | (0.28 | ) |

| Depreciation and amortization on real estate assets | | | 0.00 | | | | 0.03 | |

| | | | | | | |

| FFO | | | 2.58 | | | | 2.95 | |

| Merger-related expenses and deal costs | | | 0.09 | | | | 0.03 | |

| Income tax benefit | | | (0.02 | ) | | | (0.13 | ) |

| Loss (gain) on extinguishment of debt | | | 0.04 | | | | (0.02 | ) |

| Reversal of contingent liability | | | — | | | | (0.17 | ) |

| Provision for loan losses | | | — | | | | 0.04 | |

| | | | | | | |

Normalized FFO | | | 2.68 | | | | 2.71 | |

| | | | | | | | | |

| Straight-lining of rental income | | | (0.08 | ) | | | (0.10 | ) |

| Routine capital expenditures | | | (0.05 | ) | | | (0.06 | ) |

| | | | | | | |

| Normalized FAD | | $ | 2.55 | | | $ | 2.55 | |

| | | | | | | |

| | | |

| (1) | | Per share amounts may not add due to rounding. |

| |

| * | | Historical financial statements have been restated to reflect the adoption of FASB guidance relating to the accounting of convertible debt instruments and FASB guidance relating to minority interests (now characterized as noncontrolling interests). |

27

QUARTERLY FUNDS FROM OPERATIONS, NORMALIZED FFO AND FUNDS AVAILABLE FOR DISTRIBUTION

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Fourth | |

| | | 2009 Quarters | | | Quarter | |

| | | Fourth | | | Third | | | Second | | | First | | | 2008* | |

| | | | | | | | | | | | | | | | | | | | | |

| Net income attributable to common stockholders | | $ | 54,081 | | | $ | 49,805 | | | $ | 88,381 | | | $ | 74,228 | | | $ | 57,530 | |

| Adjustments: | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization on real estate assets | | | 51,891 | | | | 50,164 | | | | 48,655 | | | | 49,511 | | | | 53,809 | |

| Depreciation on real estate assets related to noncontrolling interest | | | (1,653 | ) | | | (1,580 | ) | | | (1,496 | ) | | | (1,620 | ) | | | (1,582 | ) |

| Discontinued operations: | | | | | | | | | | | | | | | | | | | | |

| Gain on sale of real estate assets | | | (294 | ) | | | (120 | ) | | | (39,020 | ) | | | (27,871 | ) | | | (13,157 | ) |

| Depreciation and amortization on real estate assets | | | 17 | | | | 20 | | | | 83 | | | | 227 | | | | 992 | |

| | | | | | | | | | | | | | | | |

| FFO | | | 104,042 | | | | 98,289 | | | | 96,603 | | | | 94,475 | | | | 97,592 | |

| Merger-related expenses and deal costs | | | 1,565 | | | | 5,894 | | | | 3,502 | | | | 2,054 | | | | 1,332 | |

| Income tax benefit | | | (789 | ) | | | (797 | ) | | | (936 | ) | | | (937 | ) | | | (2,059 | ) |

| Loss (gain) on extinguishment of debt | | | — | | | | — | | | | 5,975 | | | | 105 | | | | (2,858 | ) |

| | | | | | | | | | | | | | | | |

| Normalized FFO | | | 104,818 | | | | 103,386 | | | | 105,144 | | | | 95,697 | | | | 94,007 | |

| | | | | | | | | | | | | | | | | | | | | |

| Straight-lining of rental income | | | (2,918 | ) | | | (2,971 | ) | | | (3,052 | ) | | | (2,938 | ) | | | (3,437 | ) |

| Routine capital expenditures | | | (4,233 | ) | | | (2,058 | ) | | | (632 | ) | | | (1,144 | ) | | | (3,660 | ) |

| | | | | | | | | | | | | | | | |

| Normalized FAD | | $ | 97,667 | | | $ | 98,357 | | | $ | 101,460 | | | $ | 91,615 | | | $ | 86,910 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Per diluted share(1): | | | | | | | | | | | | | | | | | | | | |

| Net income attributable to common stockholders | | $ | 0.35 | | | $ | 0.32 | | | $ | 0.57 | | | $ | 0.52 | | | $ | 0.40 | |

| Adjustments: | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization on real estate assets | | | 0.33 | | | | 0.32 | | | | 0.31 | | | | 0.35 | | | | 0.38 | |

| Depreciation on real estate assets related to noncontrolling interest | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) |

| Discontinued operations: | | | | | | | | | | | | | | | | | | | | |

| Gain on sale of real estate assets | | | (0.00 | ) | | | (0.00 | ) | | | (0.25 | ) | | | (0.19 | ) | | | (0.09 | ) |

| Depreciation and amortization on real estate assets | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.01 | |

| | | | | | | | | | | | | | | | |

| FFO | | | 0.66 | | | | 0.63 | | | | 0.63 | | | | 0.66 | | | | 0.68 | |

| Merger-related expenses and deal costs | | | 0.01 | | | | 0.04 | | | | 0.02 | | | | 0.01 | | | | 0.01 | |

| Income tax benefit | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) |

| Loss (gain) on extinguishment of debt | | | — | | | | — | | | | 0.04 | | | | 0.00 | | | | (0.02 | ) |

| | | | | | | | | | | | | | | | |

| Normalized FFO | | | 0.67 | | | | 0.66 | | | | 0.68 | | | | 0.67 | | | | 0.66 | |

| | | | | | | | | | | | | | | | | | | | | |

| Straight-lining of rental income | | | (0.02 | ) | | | (0.02 | ) | | | (0.02 | ) | | | (0.02 | ) | | | (0.02 | ) |

| Routine capital expenditures | | | (0.03 | ) | | | (0.01 | ) | | | (0.00 | ) | | | (0.01 | ) | | | (0.03 | ) |

| | | | | | | | | | | | | | | | |

| Normalized FAD | | $ | 0.62 | | | $ | 0.63 | | | $ | 0.66 | | | $ | 0.64 | | | $ | 0.61 | |

| | | | | | | | | | | | | | | | |

| | | |

| (1) | | Per share amounts may not add due to rounding. |

| |

| * | | Historical financial statements have been restated to reflect the adoption of FASB guidance relating to the accounting of convertible debt instruments and FASB guidance relating to minority interests (now characterized as noncontrolling interests). |

Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, many industry investors have considered presentations of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. To overcome this problem, the Company considers FFO and normalized FFO and FAD appropriate measures of performance of an equity REIT. The Company uses the NAREIT definition of FFO. NAREIT defines FFO as net income, computed in accordance with GAAP, excluding gains (or losses) from sales of property, plus real estate depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect FFO on the same basis. The Company defines normalized FFO as FFO excluding certain income and expense items as listed below. Normalized FAD represents normalized FFO excluding straight-line rental adjustments and routine capital expenditures.

FFO and normalized FFO and FAD presented herein are not necessarily comparable to FFO and normalized FFO and FAD presented by other real estate companies due to the fact that not all real estate companies use the same definitions. FFO and normalized FFO and FAD should not be considered as alternatives to net income (determined in accordance with GAAP) as indicators of the Company’s financial performance or as alternatives to cash flow from operating activities (determined in accordance with GAAP) as measures of the Company’s liquidity, nor are FFO and normalized FFO and FAD necessarily indicative of sufficient cash flow to fund all of the Company’s needs. The Company believes that in order to facilitate a clear understanding of the consolidated historical operating results of the Company, FFO and normalized FFO and FAD should be examined in conjunction with net income as presented elsewhere herein.

The Company’s normalized FFO excludes (a) gains and losses on the sales of assets, (b) merger-related costs and expenses and deal costs and expenses, including expenses relating to the Company’s lawsuit against HCP, Inc., (c) the impact of any expenses related to asset impairment and valuation allowances, the write-off of unamortized deferred financing fees, or additional costs, expenses, discounts or premiums incurred as a result of early debt retirement or payment of the Company’s debt, (d) the non-cash effect of income tax benefits and (e) the reversal of contingent liabilities.

28

Recently Adopted Accounting Standards

On January 1, 2009, the Company adopted Financial Accounting Standards Board (“FASB”) guidance relating to convertible debt instruments that specifies that issuers of convertible debt instruments that may be settled in cash upon conversion (including partial cash settlement) should separately account for the liability and equity components in a manner that will reflect the entity’s nonconvertible debt borrowing rate when interest cost is recognized in subsequent periods. Additionally, on January 1, 2009, the Company adopted FASB guidance which changes the reporting for minority interests, which now must be characterized as noncontrolling interests and classified as a component of consolidated equity. The calculation of income and earnings per share continues to be based on income amounts attributable to the parent and is characterized as net income attributable to common stockholders. As required, all prior period amounts have been restated to reflect the adoption of this new guidance.

29

Normalized FFO and FAD Guidance for the Year Ending December 31, 2010

The following table illustrates the Company’s normalized FFO and FAD per diluted common share guidance for the year ending December 31, 2010:

| | | | | | | | | | | |

| | | GUIDANCE | |

| | | For the Year | |

| | | Ending | |

| | | December 31, 2010 | |

| Net income attributable to common stockholders | | 1.38 | | | – | | 1.47 | |

| Adjustments: | | | | | | | | | | |

| Depreciation and amortization on real estate assets, depreciation related to noncontrolling interest and gain/loss on sale of real estate assets, net | | 1.28 | | | – | | 1.28 | |

| | | | | | | | | |

| FFO | | | 2.66 | | | – | | | 2.75 | |

| Adjustments: | | | | | | | | | | |

| Income tax benefit/expense, gain/loss on extinguishment of debt and merger-related expenses and deal costs, net | | 0.03 | | | – | | 0.00 | |

| | | | | | | | | |

Normalized FFO | | | 2.69 | | | – | | | 2.75 | |

| Straight-lining of rental income and routine capital expenditures | | (0.14 | ) | | – | | (0.13 | ) |

| | | | | | | | | |

| Normalized FAD | | $ | 2.55 | | | – | | $ | 2.62 | |

| | | | | | | | | |

30

Net Debt to Pro Forma EBITDA