- VTR Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PREC14A Filing

Ventas (VTR) PREC14APreliminary proxy with contested solicitation

Filed: 7 Mar 22, 6:30am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12

| VENTAS, INC. |

| (Name of Registrant as Specified in Its Charter) |

LAND & BUILDINGS CAPITAL GROWTH FUND, LP LAND & BUILDINGS GP LP L&B OPPORTUNITY FUND, LLC L&B TOTAL RETURN FUND LLC L&B MEGATREND FUND LAND & BUILDINGS INVESTMENT MANAGEMENT, LLC JONATHAN LITT |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||

| ☒ | No fee required. | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

☐ | Fee paid previously with preliminary materials.

| |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

| ||

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 7, 2022

2022 ANNUAL MEETING OF STOCKHOLDERS

OF

VENTAS, INC.

_________________________

PROXY STATEMENT

OF

Land & buildings capital growth fund, lp

_________________________

PLEASE VOTE ON THE ENCLOSED WHITE PROXY CARD TODAY

Land & Buildings Capital Growth Fund, LP (“L&B Capital”), L&B Opportunity Fund, LLC (“L&B Opportunity”), Land & Buildings GP LP (“L&B GP”), L&B Total Return Fund LLC (“L&B Total Return”), L&B Megatrend Fund (“L&B Megatrend”), Land & Buildings Investment Management, LLC (“L&B Management”) and Jonathan Litt (collectively, “Land & Buildings” or “we”) are investors in Ventas, Inc., a Delaware corporation (“Ventas” or the “Company”), which beneficially own an aggregate of 872,585 shares of common stock, par value $0.25 per share (the “Common Stock”), of the Company. We believe that the right stockholder representation on the Board of Directors of the Company (the “Board”) is required to ensure that the Company is being run in a manner consistent with stockholders’ best interests. We have nominated a director candidate who has a strong, relevant background and who is committed to fully exploring all opportunities to unlock stockholder value and demanding accountability in the boardroom. We are seeking your support at the Company’s 2022 Annual Meeting of Stockholders scheduled to be held on ___________, 2022 at _______, Central Standard Time, at ________________ (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:1

| 1. | To elect Land & Buildings’ director nominee, Jonathan Litt (the “Nominee”), to serve until the 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”); |

| 2. | To approve, on an advisory basis, the compensation of the Company’s Named Executive Officers; |

| 3. | To ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for the 2022 fiscal year; and |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponements thereof. |

This Proxy Statement and the enclosed WHITE proxy card are first being mailed to stockholders on or about [____________], 2022.

1 As of the date of this Proxy Statement, the Company’s proxy statement has not yet been filed with the Securities and Exchange Commission. The proposal numbers in this Proxy Statement may not correspond to the proposal numbers that will be used in the Company’s proxy statement. Certain information in this Proxy Statement will be updated after the Company’s proxy statement is filed.

Land & Buildings believes the terms of eleven directors currently serving on the Board expire at the Annual Meeting. Through the attached Proxy Statement and enclosed WHITE proxy card, we are soliciting proxies to elect not only our Nominee, but also the candidates who have been nominated by the Company other than [_____]. Stockholders will therefore be able to vote for the total number of directors up for election at the Annual Meeting. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. Your vote to elect our Nominee will have the legal effect of replacing an incumbent director with our Nominee. If elected, our Nominee will constitute a minority on the Board – accordingly, there can be no guarantee that our Nominee will be able to implement any actions that he may believe are necessary to unlock stockholder value. However, we believe the election of our Nominee is an important step in the right direction for enhancing long-term value at the Company.

The Company has set the close of business on ___________, 2022 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). Each outstanding share of Common Stock is entitled to one vote on each matter to be voted upon at the Annual Meeting. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were ___________ shares of Common Stock outstanding and entitled to vote at the Annual Meeting. The mailing address of the principal executive offices of the Company is 353 N. Clark Street, Suite 3300, Chicago, Illinois 60654.

As of the date hereof, the members of Land & Buildings collectively own an aggregate of 872,585 shares of Common Stock (the “Land & Buildings Group Shares”). The Participants intend to vote the Land & Buildings Group Shares “FOR” the Nominee, “[FOR/AGAINST/ABSTAIN]” on the non-binding advisory resolution on the compensation of the Company’s named executive officers, and “FOR” the ratification of KPMG LLP as the Company’s independent registered public accounting firm for the 2022 fiscal year.

THIS SOLICITATION IS BEING MADE BY LAND & BUILDINGS AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH LAND & BUILDINGS IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

LAND & BUILDINGS URGES YOU TO VOTE “FOR” ITS NOMINEE VIA THE INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED WHITE PROXY CARD TODAY. IF YOU DO NOT HAVE ACCESS TO THE INTERNET OR A TOUCH-TONE TELEPHONE, PLEASE SIGN, DATE AND RETURN THE WHITE PROXY CARD VOTING “FOR” THE ELECTION OF THE NOMINEE.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT VIA THE INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED WHITE PROXY CARD, OR IF YOU DO NOT HAVE ACCESS TO THE INTERNET OR A TOUCH-TONE TELEPHONE, BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT WILL BE COUNTED. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

2

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—

This Proxy Statement and our WHITE proxy card are available at

_______________________.com

3

IMPORTANT

Your vote is important, no matter how many or few shares of Common Stock you own. Land & Buildings urges you to vote FOR the Nominee and in accordance with Land & Buildings’ recommendations on the other proposals on the agenda for the Annual Meeting via the Internet or telephone by following the instructions on the enclosed WHITE proxy card today. If you do not have access to the Internet or a touch-tone telephone, please sign, date and return the enclosed WHITE proxy card today.

| • | If your shares of Common Stock are registered in your own name, please follow the instructions on the enclosed WHITE proxy card to vote via the Internet or telephone today. If you do not have access to the Internet or a touch-tone telephone, please sign and date the enclosed WHITE proxy card and return it to Land & Buildings, c/o Saratoga Proxy Consulting LLC (“Saratoga”), in the enclosed postage-paid envelope today. |

| • | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a WHITE voting instruction form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| • | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed proxy card or voting instruction form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Due to ongoing delays in the postal system, we are encouraging stockholders to submit their proxies electronically (by Internet or by telephone) if possible.

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our Nominee only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

4

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Land and Buildings’ proxy materials, please contact Saratoga at the phone numbers listed below.

520 8TH Avenue, 14th Floor New York, NY 10018 (212) 257-1311

Stockholders call toll free at (888) 368-0379

|

5

Background to the Solicitation

The following is a chronology of material events leading up to this proxy solicitation.

| · | During November of 2021, Jonathan Litt of Land & Buildings reached out to Debra Cafaro, Chairman and Chief Executive Officer of Ventas, in order to set up a call to discuss the Company. |

| · | On December 1, 2021, Mr. Litt and Ms. Cafaro had a telephone call to discuss the Company, during which Mr. Litt attempted to express his concerns regarding the Company, including, among others, Ventas’ material underperformance compared to peers, poor stockholder communications, poor capital allocation decisions and oversized Board comprised of 11 directors. |

| · | On December 3, 2021, Mr. Litt sent an email to Ms. Cafaro expressing his disappointment that they were unable to have a substantive discussion on ways to address the concerns outlined by Mr. Litt during their December 1st call. Despite Mr. Litt’s disappointment, in the spirit of collaboration, Mr. Litt responded to Ms. Cafaro’s request to outline Land & Buildings’ concerns regarding the Company. In addition to reiterating Land & Buildings’ concerns, Mr. Litt expressed the importance of having a stockholder perspective in the boardroom to instill accountability, and to that end, notified Ms. Cafaro of Land & Buildings’ intention to nominate Mr. Litt for election to the Board at the Annual Meeting. Mr. Litt reiterated his desire to reach a constructive resolution with the Company. |

| · | Following the December 3, 2021 call, counsel for Land & Buildings and counsel for Ventas engaged in a series of communications and telephone calls in an attempt to negotiate a constructive resolution between Land & Buildings and Ventas. |

| · | On December 10, 2021, in order to preserve its right to nominate director candidates pursuant to the Company’s Fifth Amended and Restated By-laws, as amended (the “Bylaws”), Land & Buildings privately delivered a letter to Ventas nominating individuals for election as directors at the Annual Meeting. |

| · | Following Land & Buildings’ nomination, counsel for Land & Buildings and counsel for Ventas continued to engage in settlement discussions. During these discussions, both parties relayed their desire to reach an agreement around Board composition, among other things. After various proposals were discussed between respective counsels, Land & Buildings agreed to permit the Company’s requested interviews of Mr. Litt under the assumption that the settlement framework could include the appointment of Mr. Litt to the Board. |

| · | On January 6, 2022 and January 10, 2022, various members of the Board interviewed Mr. Litt in furtherance of the negotiated framework around Board composition. Given the many years of familiarity between Mr. Litt and a number of the individuals involved, and the assurances that had already been provided that a settlement was being offered, Land & Buildings’ interpretation was that these “interviews” were somewhat pro forma. |

| · | On January 11, 2022, Mr. Litt had a telephone call with Ventas director Matthew Lustig and Alan Hartman of Centerview, during which Mr. Lustig informed Mr. Litt that the Board had determined to proceed down a different pathway that did not include the appointment of Mr. Litt to the Board. |

| · | On January 19, 2022, Mr. Litt sent an email to Mr. Lustig expressing his disappointment that the Board determined not to work constructively with Land & Buildings to appoint the right direct stockholder representative despite Land & Buildings’ repeated attempts and the Company’s purported willingness to consider the appointment of Mr. Litt to the Board as part of a negotiated settlement. Later that day, Mr. Lustig responded to Mr. Litt reiterating the Board’s prior proposal, which purportedly welcomed Land & Buildings’ input on Board refreshment and related matters but did not provide for the appointment of Mr. Litt to the Board. |

6

| · | On January 20, 2022, Mr. Litt and Mr. Lustig exchanged additional emails regarding their prior conversations around Board composition. |

| · | On February 24, 2022, Mr. Litt and Ms. Cafaro had a telephone call to discuss the Company, Land & Buildings’ nomination and the prior settlement discussions between Ventas and Land & Buildings. |

| · | On March 7, 2022, Land & Buildings filed this preliminary proxy statement in connection with the Annual Meeting. |

7

REASONS FOR THE SOLICITATION

Land & Buildings has conducted extensive due diligence on the Company, having monitored Ventas for years. In doing so, we have carefully analyzed the Company’s operating and financial performance as well as the competitive landscape in the real estate investment trust (“REIT”) industry in which it operates. For the past several months, we have attempted to maintain an ongoing dialogue with the Company’s Board and management team to discuss our concerns and the opportunities that we believe are available to create value for the benefit of all Ventas stockholders.

Specifically, we believe Ventas has significantly underperformed and has failed to create meaningful value for long-term stockholders. We believe this underperformance is largely the result of poor investor communications, capital allocation issues, and insufficient Board oversight. Despite our sincere efforts to engage constructively with the Company regarding our concerns and opportunities for improvement, we have been continuously disappointed by the Board’s apparent failure to recognize the importance of having the right stockholder representative in the boardroom.

As a result, we do not have confidence that the Board, as currently composed, will take the necessary steps to ensure effective oversight of the Company and maximize opportunities for value creation. We believe the stockholders, as the true owners of the Company, need to have a strong voice at the Board level. We are therefore soliciting your support to elect our Nominee at the Annual Meeting, who we believe will bring an unbiased owner’s mentality into the boardroom, relevant industry experience, and sorely needed stockholder alignment to help instill accountability and drive improved performance.

We are Concerned with Ventas’ Significant Underperformance

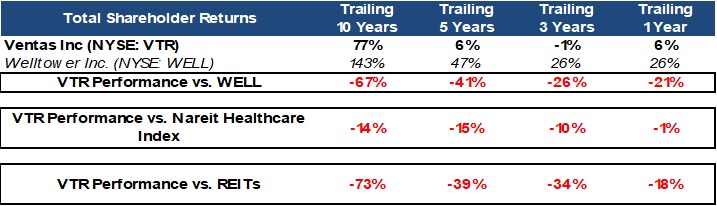

When looking at the past 10, 5, 3 and 1-year periods, Ventas’ performance has meaningfully fallen behind its closest peer, Welltower Inc. (NYSE: WELL) (“Welltower”) which trades at a 19% higher multiple, and both the broader REIT and Healthcare REIT universes.2

Source: Bloomberg, Company Filings

The comparison of Ventas versus Welltower is particularly instructive. The two companies are of similar size, have assets of comparable mix and quality, and have historically had similar valuations, often at times trading in line with one another. However, in recent years – to the chagrin of Ventas stockholders – this last point has ceased to be true.

2 Data through February 28, 2022; Nareit Healthcare Index defined as FTSE Nareit Equity Health Care Index or FNHEATR Index; REITs defined as MSCI U.S. REIT Index or RMSG Index.

8

Welltower’s earnings growth has outpaced Ventas by double-digits in the past five (5) years, and by even more (7%) when looking at the pre-COVID comparison of 2022 versus 2019.

Source: Bloomberg, Company Fillings

We believe this slowing of earnings growth has largely been the result of underwhelming capital allocation decisions on the part of Ventas, which has subsequently driven the poor TSR underperformance that has frustrated investors for far too long. Lagging SHOP (Senior Housing Operating Portfolio) NOI growth has heightened these disappointments.

We Are Concerned with the Board’s Poor Investor Communications and Capital Allocation Decisions

We believe the Board’s poor investor communications and undisciplined approach to capital allocation demonstrates its inability or unwillingness to be an effective steward of stockholder capital. With a company of Ventas’ pedigree, investors tend to trust what the Company says and expect that it will follow through on its promises. This faith in Ventas’ ability to communicate has proven to be misplaced on multiple occasions.

At its June 2019 investor day, Ventas championed a new “Pivot to growth,” promising that earnings for the entire company would grow in 2020 and compound over the next five years, and that as a result, the Company would see a “well-deserved multiple expansion” which would boost total stockholder return. Just a month later, on the Company’s second quarter 2019 earnings call, issues were beginning to emerge.

However, these issues truly came to light in October 2019 on the Company’s third quarter earnings call – particularly regarding the Company’s SHOP segment. Ventas ultimately backtracked its growth pivot, lowering its SHOP guidance and stating that as a result, “enterprise growth will be deferred until after 2020.” The market’s reaction was swift, with the stock price declining nearly 9% that day and by 24% in the ensuing two months. This caused not only a massive loss of credibility with the investment community, but the beginning of a sharper divergence between the Company’s performance and its closest peer, Welltower’s performance.

As one sell-side analyst noted at the time:

“While we have deep respect for management and their longer term success, the recent guidance and forecasting stumbles have broken our confidence in their ability to forecast, especially given an uncertain and more challenging senior housing operating environment than previously expected… Going forward, we see…a diminishment of credibility following the Investor Day, subsequent investor meetings and conferences, and the 3Q earnings call.”3

We believe the next major misstep that hit the Company could also have been avoided. Like many other senior housing focused REITS, Ventas had to navigate challenging waters that afflicted the sector during the COVID-19 pandemic. Unfortunately, what this period made clear to us was that the Company had apparently mismanaged its balance sheet heading into the crisis. As a result, just as daylight was visible with the emergence of the vaccine at the end of 2020, Ventas was effectively forced to raise cash by selling a 45% interest in its promising life sciences development pipeline. This $930 million deal was done at cost (7% yield). In addition, the Company raised equity at nearly $45 per share – roughly 35% below the shares’ pre-COVID high.

3 “Citi: Ventas Inc. – Everybody Hurts – Downgrade to Neutral,” October 28, 2019.

9

We believe Ventas effectively backed itself into a corner and had to forfeit significant upside from this gem of an asset for cash. The detrimental impact of this deal was even worse than initially anticipated given the continued strength of life science and subsequent recovery in the equity markets.

The latest example of Ventas’ poor investment decision-making has its origin in January of 2018, when the Company created Eclipse Senior Living (“ESL”), a whole new senior housing operator of which Ventas owned 34%, in order to manage 76 underperforming assets. These assets had previously been triple net assets and were converted to SHOP (RIDEA) assets.

ESL poorly underperformed in subsequent years and in our view, was a principal driver of the missed “Pivot to growth.” In October of 2021, Ventas finally acknowledged defeat on this project, shuttering ESL and handing over the operations of 90 assets to eight local sharp shooters. This transition caused further deterioration in NOI, and the lack of a sale or joint venture around these assets – which had previously been messaged to the investment community on multiple occasions – caused analysts to materially reduce 2022 earnings given this portfolio is not contributing positively to earnings today.

We Believe Our Nominee Would Bring Much-Needed Alignment and Accountability to the Board

Our engagement with the Company, together with Ventas’ long-term underperformance and poor capital allocation decisions, has proven to us that the right stockholder-aligned representative is needed on the Board to drive improved performance and instill accountability. We are therefore seeking your support to elect Land & Buildings’ Founder and CIO, Jonathan Litt, to the Board at the Annual Meeting. In addition to bringing stockholder-alignment to the Board, Mr. Litt has extensive experience as a public company director and a lengthy history in the real estate investment industry, which we believe makes him well-qualified to serve as a director of the Company.

10

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of eleven directors, each with a term expiring at the 2022 Annual Meeting. Your vote to elect our Nominee will have the legal effect of replacing an incumbent director with the Nominee. If elected, our Nominee will constitute a minority on the Board and there can be no guarantee that our Nominee will be able to implement any actions that he may believe are necessary to unlock stockholder value at Ventas. There is no assurance that any incumbent director will serve as a director if our Nominee is elected to the Board. You should refer to the Company's proxy statement for the names, background, qualifications and other information concerning the Company's nominees.

This Proxy Statement is soliciting proxies to elect not only our Nominee, but also the candidates who have been nominated by the Company other than [____]. This gives stockholders who wish to vote for our Nominee the ability to vote for a full slate of eleven nominees in total. The names, background and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement.

our NOMINEE

Set forth below is the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of the Nominee. This information has been furnished to us by the Nominee. The nomination was made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominee should serve as a director of the Company is set forth below.

Jonathan Litt, age 57, is the Founder and Chief Investment Officer of Land & Buildings Investment Management, LLC, a registered investment advisor specializing in publicly traded real estate and real estate related securities, which he founded in 2008. Prior to founding L&B Management, Mr. Litt was Managing Director and Senior Global Real Estate Analyst at Citigroup, where he was responsible for Global Property Investment Strategy, coordinating a 44-person team of research analysts located across 16 countries. Mr. Litt previously served on the Board of Directors of Taubman Centers, Inc. (formerly NYSE: TCO), a former S&P MidCap 400 Real Estate Investment Trust engaged in the ownership, management and/or leasing of regional, super-regional and outlet shopping centers in the U.S. and Asia, from May 2018 to May 2019. He has served as a director of the Land & Buildings Offshore Fund, Ltd. since 2008. Mr. Litt previously served as a director of Mack-Cali Realty Corporation (NYSE: CLI), a leading owner, manager, and developer of office and class A residential real estate throughout the Northeast, from March 2014 to August 2016, and as a director of the Children with Dyslexia Scholarship Fund. Mr. Litt holds a Bachelor of Arts degree in Economics from Columbia University and a Master of Finance degree from New York University's Stern School of Business.

Land & Buildings believes that Mr. Litt is well-qualified to serve as a director of the Company given his extensive experience as a public company director, his lengthy history in the real estate investment industry, and his expertise gained as Founder and Chief Investment Officer of L&B Management.

Mr. Litt is a citizen of the United States of America.

The principal business address of Mr. Litt is c/o Land & Buildings Investment Management, LLC, 1 Landmark Square, 17th Floor, Stamford, Connecticut 06901.

11

As of the date hereof, Mr. Litt does not directly own any securities of the Company and has not entered into any transactions in securities of the Company during the past two years. Mr. Litt, as the Managing Principal of L&B Management, which is the investment manager of each of L&B Capital, L&B Opportunity, L&B Total Return and L&B Megatrend and is the investment advisor of a certain account managed by L&B Management (the “Managed Account”), may be deemed to beneficially own the (i) 186,059 shares of Common Stock beneficially owned directly by L&B Capital, (ii) 44,175 shares of Common Stock beneficially owned directly by L&B Opportunity, (iii) 108,190 shares of Common Stock beneficially owned directly by L&B Total Return, (iv) 4,660 shares of Common Stock beneficially owned directly by L&B Megatrend, and (v) 529,501 shares of Common Stock held in the Managed Account. For information regarding transactions in securities of the Company during the past two years by certain of the Participants (as defined below), please see Schedule I.

Land & Buildings believes that the Nominee presently is, and if elected as a director of the Company, the Nominee would qualify as, an “independent director” within the meaning of (i) applicable New York Stock Exchange (“NYSE”) listing standards applicable to board composition, including NYSE Listed Company Manual Section 303.A, and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, Land & Buildings acknowledges that no director of a NYSE listed company qualifies as “independent” under the NYSE listing standards unless the board of directors affirmatively determines that such director is independent under such standards. Accordingly, Land & Buildings acknowledges that if the Nominee is elected, the determination of the Nominee’s independence under the NYSE listing standards ultimately rests with the judgment and discretion of the Board.

Other than as stated herein, and except for compensation received by Mr. Litt as an employee of Land & Buildings, there are no arrangements or understandings between members of Land & Buildings and the Nominee or any other person or persons pursuant to which the nomination of the Nominee described herein is to be made, other than the consent by the Nominee to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. The Nominee is not a party adverse to the Company or any of its subsidiaries nor does the Nominee have a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

We do not expect that the Nominee will be unable to stand for election, but, in the event the Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by the enclosed WHITE proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying the Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we would identify and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of Common Stock represented by the enclosed WHITE proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of Land & Buildings that any attempt to increase the size of the current Board or to classify the Board, constitutes an unlawful manipulation of the Company’s corporate machinery.

WE STRONGLY URGE YOU TO VOTE “FOR” THE NOMINEE USING THE ENCLOSED WHITE PROXY CARD.

12

PROPOSAL NO. 2

ADVISORY VOTE to approve the compensation of the company’s named executive officers

As discussed in further detail in the Company’s proxy statement, the Company is providing stockholders with the opportunity to approve, on an advisory basis, the compensation of the Company’s Named Executive Officers. Accordingly, the Board recommends that stockholders vote in favor of the following resolution:

“RESOLVED, that the stockholders approve, on an advisory basis, the compensation of the Company’s Named Executive Officers as disclosed in the Company’s proxy statement, including the Compensation Discussion and Analysis, compensation tables and the related narrative disclosure.”

As discussed in the Company’s proxy statement, the results of this advisory vote are non-binding, but the Compensation Committee will consider the outcome of the vote when making future executive compensation decisions.

[WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES [“FOR”/”AGAINST”/“ASBSTAIN” ON] THIS PROPOSAL.]

13

PROPOSAL NO. 3

RATIFICATION OF fiscal 2022 auditor selection

As discussed in further detail in the Company’s proxy statement, the Company has proposed that the stockholders ratify the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022. Additional information regarding this proposal is contained in the Company’s proxy statement.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

14

VOTING AND PROXY PROCEDURES

Stockholders are entitled to one vote for each share of Common Stock held of record on the Record Date with respect to each matter to be acted on at the Annual Meeting. Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information, Land & Buildings believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the Common Stock.

Shares of Common Stock represented by properly executed WHITE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the Nominee, [FOR/AGAINST/ABSTAIN] on the approval of the non-binding advisory resolution on the compensation of the Company’s named executive officers, and FOR the ratification of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022, and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting, as described herein.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate eleven candidates for election at the Annual Meeting. This Proxy Statement is soliciting proxies to elect the Nominee as a director in opposition to an incumbent director. Stockholders who vote on the enclosed WHITE proxy card will also have the opportunity to vote for the candidates who have been nominated by the Company other than [_____]. Stockholders will therefore be able to vote for the total number of directors up for election at the Annual Meeting. Under applicable proxy rules we are required either to solicit proxies only for our Nominee, which could result in limiting the ability of stockholders to fully exercise their voting rights with respect to the Company’s nominees, or to solicit for our Nominee while also allowing stockholders to vote for fewer than all of the Company’s nominees, which enables a stockholder who desires to vote for the Nominee to also vote for certain of the Company’s nominees. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. In the event that the Nominee is elected, there can be no assurance that the Company nominees who get the most votes and are elected to the Board will choose to serve as on the Board with the Nominee if elected.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting under the Company’s Bylaws and Delaware Law. A majority of the voting power of all outstanding shares of Common Stock entitled to vote in the election of directors, properly represented in person or by proxy, is required for a quorum at the Annual Meeting.

Abstentions, withhold votes and “broker non-votes” are counted as shares present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under applicable rules, your broker will not have discretionary authority to vote your shares at the Annual Meeting on any of the proposals.

15

If you are a stockholder of record, you must deliver your vote by mail, the Internet, by telephone or attend the Annual Meeting in order to be counted in the determination of a quorum.

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ The Company has adopted a plurality vote standard for contested director elections. The eleven directors receiving the highest number of affirmative votes will be elected as directors of the Company. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose, and will have no effect on the election of the Nominee.

Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers ─ According to the Company’s proxy statement, the affirmative vote of a majority of shares present (in person or by proxy) and entitled to vote will be required to approve the advisory resolution on executive compensation. Abstentions will have the same impact as a vote against this proposal. Broker non-votes will have no impact on the outcome of this vote.

Ratification of Fiscal 2022 Auditor Selection ─ According to the Company’s proxy statement, the affirmative vote of a majority of shares present (in person or by proxy) and entitled to vote will be required to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022. Abstentions will have the same impact as a vote against this proposal. Broker non-votes will have no impact on the outcome of this vote.

Under applicable Delaware law, none of the holders of Common Stock is entitled to appraisal rights in connection with any matter to be acted on at the Annual Meeting. If you sign and submit your WHITE proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with Land & Buildings’ recommendations specified herein and in accordance with the discretion of the persons named on the WHITE proxy card with respect to any other matters that may be voted upon at the Annual Meeting.

REVOCATION OF PROXIES

You may change your vote or revoke your proxy at any time prior to its exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy), by voting again by telephone or through the Internet, by delivering a written notice of revocation, or by signing and delivering a subsequently dated proxy which is properly completed. A written notice of revocation may be delivered either to Land & Buildings in care of Saratoga at the address set forth on the back cover of this Proxy Statement or to the Company at 353 N. Clark Street, Suite 3300, Chicago, Illinois 60654 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to Land & Buildings in care of Saratoga at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares of Common Stock. Additionally, Saratoga may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominee.

16

IF YOU WISH TO VOTE FOR THE NOMINEE, PLEASE FOLLOW THE INSTRUCTIONS TO VOTE BY INTERNET OR BY TELEPHONE ON THE ENCLOSED WHITE PROXY CARD. ALTERNATIVELY, IF YOU DO NOT HAVE ACCESS TO THE INTERNET OR A TOUCH-TONE TELEPHONE, PLEASE SIGN, DATE AND RETURN THE ENCLOSED WHITE PROXY CARD TODAY IN THE POSTAGE-PAID ENVELOPE PROVIDED.

17

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by Land & Buildings. Proxies may be solicited by mail, facsimile, telephone, telegraph, electronic mail, in person and by advertisements. Solicitations may also be made by certain of the respective directors, officers, members and employees of Land & Buildings, none of whom will, except as described elsewhere in this Proxy Statement, receive additional compensation for such solicitation. The Nominee may make solicitations of proxies but, except as described herein, will not receive compensation for acting as a director nominee.

Members of Land & Buildings have entered into an agreement with Saratoga for solicitation and advisory services in connection with this solicitation, for which Saratoga will receive a fee not to exceed $[_______], together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Saratoga will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Land & Buildings has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. Land & Buildings will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that Saratoga will employ approximately [___] persons to solicit stockholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by Land & Buildings. Land & Buildings estimates that through the date hereof its expenses in furtherance of, or in connection with, this solicitation are approximately $[_____]. Costs of this solicitation of proxies are currently estimated to be up to $[_______] (including, but not limited to, fees for attorneys, solicitors and other advisors, and other costs incidental to the solicitation). The actual amount could be higher or lower depending on the facts and circumstances arising in connection with the solicitation. Land & Buildings intends to seek reimbursement from the Company of all expenses it incurs in connection with this solicitation. Land & Buildings does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

The participants in the solicitation are anticipated to be L&B Capital, a Delaware limited partnership, L&B Opportunity, a Delaware limited liability company, L&B GP, a Delaware limited partnership, L&B Management, a Delaware limited liability company, L&B Total Return, a Delaware limited liability company, L&B Megatrend Fund (“L&B Megatrend”), a Cayman Islands company, and the Nominee (each, a “Participant” and collectively, the “Participants”).

The address of the principal office of each of the Participants is 1 Landmark Square, 17th Floor, Stamford, Connecticut 06901.

The principal business of each of L&B Capital, L&B Opportunity, L&B Total Return and L&B Megatrend is serving as a private investment fund. The principal business of L&B GP is serving as the general partner of L&B Capital. The principal business of L&B Management is serving as the investment manager of each of L&B Capital, L&B Opportunity, L&B Total Return and L&B Megatrend and as the investment advisor of the Managed Account.

18

As of the date hereof, L&B Capital directly owns 186,059 shares of Common Stock. As of the date hereof, L&B Opportunity directly owns 44,175 shares of Common Stock. As of the date hereof, 529,501 shares of Common Stock were held in the Managed Account. L&B GP, as the general partner of L&B Capital, may be deemed the beneficial owner of the 186,059 shares of Common Stock owned by L&B Capital. As of the date hereof, L&B Total Return directly owns 108,190 shares of Common Stock. As of the date hereof, L&B Megatrend directly owns 4,660 shares of Common Stock. L&B Management, as the investment manager of each of L&B Capital, L&B Opportunity, L&B Total Return and L&B Megatrend and as the investment advisor of the Managed Account, may be deemed the beneficial owner of an aggregate of 872,585 shares of Common Stock owned by L&B Capital, L&B Opportunity, L&B Total Return and L&B Megatrend and held in the Managed Account. Mr. Litt, as the managing principal of L&B Management, which is the investment manager of each of L&B Capital, L&B Opportunity, L&B Total Return and L&B Megatrend and the investment advisor of the Managed Account, may be deemed the beneficial owner of an aggregate of 872,585 shares of Common Stock owned by L&B Capital, L&B Opportunity, L&B Total Return and L&B Megatrend and held in the Managed Account.

The shares of Common Stock owned directly L&B Capital, L&B Opportunity, L&B Total Return and L&B Megatrend and held in the Managed Account were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business).

For information regarding purchases and sales of securities of the Company during the past two years by certain of the Participants, see Schedule I.

L&B Management, as the investment manager of L&B Capital, L&B Opportunity, L&B Total Return and L&B Megatrend and the investment advisor of the Managed Account, is entitled to receive certain management fees and performance-related fees with respect to the shares of Common Stock owned by each of L&B Capital, L&B Opportunity, L&B Total Return and L&B Megatrend and held in the Managed Account. Mr. Litt, as the Managing Principal of L&B Management, is entitled to receive certain management fees and performance-related fees paid to L&B Management with respect to the shares of Common Stock owned by each of L&B Capital, L&B Opportunity, L&B Total Return and L&B Megatrend and held in the Managed Account.

Except as otherwise set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no Participant has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no Participant directly or indirectly beneficially owns any securities of the Company; (iii) no Participant owns any securities of the Company which are owned of record but not beneficially; (iv) no Participant has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any Participant is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no Participant is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any Participant owns beneficially, directly or indirectly, any securities of the Company; (viii) no Participant owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no Participant or any of his, her or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no Participant or any of his, her or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; (xi) no Participant has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting; (xii) no Participant holds any positions or offices with the Company; (xiii) no Participant has a family relationship with any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer; and (xiv) no companies or organizations, with which any of the Participants has been employed in the past five years, is a parent, subsidiary or other affiliate of the Company. There are no material proceedings to which any Participant or any of his, her or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the Participants, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past 10 years.

19

CERTAIN OTHER MATTERS

Land & Buildings is unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which Land & Buildings is not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed WHITE proxy card will vote on such matters in their discretion.

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of this Proxy Statement may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of the document to you if you contact our proxy solicitor, Saratoga, at the following address or phone number: 520 8th Avenue, 14th Floor, New York, New York 10018 or call toll free at (888) 368-0379. If you want to receive separate copies of our proxy materials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee record holder, or you may contact our proxy solicitor at the above address or phone number.

The information concerning the Company and the proposals in the Company’s proxy statement contained in this Proxy Statement has been taken from, or is based upon, publicly available documents on file with the SEC and other publicly available information. Although we have no knowledge that would indicate that statements relating to the Company contained in this Proxy Statement, in reliance upon publicly available information, are inaccurate or incomplete, to date we have not had access to the books and records of the Company, were not involved in the preparation of such information and statements and are not in a position to verify such information and statements. All information relating to any person other than the Participants is given only to the knowledge of Land & Buildings.

This Proxy Statement is dated [___________], 2022. You should not assume that the information contained in this Proxy Statement is accurate as of any date other than such date, and the mailing of this Proxy Statement to stockholders shall not create any implication to the contrary.

StockHOLDER PROPOSALS

According to the Company’s proxy statement, any stockholder who wishes to submit a proposal for inclusion in the Company’s proxy materials for the 2023 Annual Meeting may do so by following the procedures set out in Rule 14a-8 under the Exchange Act. To be eligible for inclusion, the proposal must be received by the Corporate Secretary at the Company’s principal executive offices at 353 North Clark Street, Suite 3300, Chicago, Illinois 60654 not later than [_________].

According to the Company’s proxy statement, under the Bylaws, stockholders must follow certain procedures to nominate a person for election as a director or introduce an item of business at an annual meeting, even if that item will not be included in the Company’s proxy statement. To be properly brought before the 2023 Annual Meeting, the Corporate Secretary must receive any such nomination or proposal at the address provided above no earlier than [_______] and no later than [________]. As required by the Bylaws, a notice of a proposed nomination must include information about the stockholder and the nominee, as well as a written consent of the proposed nominee to serve if elected. A notice of a proposed item of business must include a description of and the reasons for bringing the proposed business to the meeting, any material interest of the stockholder in the business and certain other information about the stockholder.

20

The information set forth above regarding the procedures for submitting stockholder proposals for consideration at the 2023 Annual Meeting is based on information contained in the Company’s proxy statement. The incorporation of this information in this proxy statement should not be construed as an admission by Land & Buildings that such procedures are legal, valid or binding.

ADDITIONAL INFORMATION

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING TO THE ANNUAL MEETING BASED ON RELIANCE ON RULE 14A-5(C). THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE OF THE COMPANY’S DIRECTORS, RELATED PERSON TRANSACTIONS AND GENERAL INFORMATION CONCERNING THE COMPANY’S ADMINISTRATION AND INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. SEE SCHEDULE II FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

LAND & BUILDINGS CAPITAL GROWTH FUND, LP

Dated: ___________, 2022

21

SCHEDULE I

TRANSACTIONS IN SECURITIES OF the Company

DURING THE PAST TWO YEARS

| Nature of the Transaction | Amount of Securities Purchased/(Sold) | Date of Purchase/Sale |

LAND & BUILDINGS CAPITAL GROWTH FUND, LP

| Sale of Common Stock1 | (21,700) | 06/19/2020 |

| Sale of Common Stock1 | (5,056) | 06/23/2020 |

| Sale of Common Stock1 | (5,309) | 06/24/2020 |

| Sale of Common Stock1 | (5,309) | 06/25/2020 |

| Sale of Common Stock1 | (5,255) | 06/26/2020 |

| Sale of Common Stock1 | (5,318) | 06/29/2020 |

| Purchase of Common Stock2 | 21,800 | 07/01/2020 |

| Purchase of Common Stock2 | 26,147 | 07/23/2020 |

| Purchase Of Common Stock | 39,700 | 08/10/2020 |

| Purchase Of Common Stock | 260 | 09/01/2020 |

| Purchase Of Common Stock | 20,500 | 09/02/2020 |

| Purchase Of Common Stock | 38,500 | 09/10/2020 |

| Purchase Of Common Stock | 9,165 | 10/07/2020 |

| Purchase Of Common Stock | 10,335 | 10/08/2020 |

| Purchase Of Common Stock | 13,527 | 10/27/2020 |

| Purchase Of Common Stock | 2,273 | 10/28/2020 |

| Sale Of Common Stock | (19,500) | 11/04/2020 |

| Purchase Of Common Stock | 17,700 | 11/11/2020 |

| Sale Of Common Stock | (17,400) | 11/19/2020 |

| Purchase Of Common Stock | 13,929 | 12/04/2020 |

| Purchase Of Common Stock | 3,371 | 12/07/2020 |

| Sale Of Common Stock | (10,649) | 12/21/2020 |

| Sale Of Common Stock | (6,160) | 12/31/2020 |

| Sale Of Common Stock | (17,200) | 01/11/2021 |

| Sale Of Common Stock | (25,000) | 01/19/2021 |

| Sale Of Common Stock | (73,351) | 01/20/2021 |

| Purchase Of Common Stock | 42,200 | 02/16/2021 |

| Purchase Of Common Stock | 8,100 | 03/01/2021 |

| Purchase Of Common Stock | 15,700 | 03/18/2021 |

| Purchase Of Common Stock | 24,800 | 04/01/2021 |

| Purchase Of Common Stock | 4,068 | 04/05/2021 |

| Purchase Of Common Stock | 4,066 | 04/06/2021 |

| Purchase Of Common Stock | 8,400 | 05/04/2021 |

| Purchase Of Common Stock | 19,000 | 05/07/2021 |

I-1

| Purchase Of Common Stock | 1,000 | 07/30/2021 |

| Purchase Of Common Stock | 9,200 | 08/24/2021 |

| Purchase Of Common Stock | 17,900 | 09/17/2021 |

| Sale Of Common Stock | (19,100) | 10/25/2021 |

| Sale Of Common Stock | (1,728) | 11/09/2021 |

| Sale Of Common Stock | (2,296) | 11/10/2021 |

| Sale Of Common Stock | (1,566) | 11/11/2021 |

| Sale Of Common Stock | (1,226) | 11/12/2021 |

| Sale Of Common Stock | (1,315) | 11/15/2021 |

| Sale Of Common Stock | (1,006) | 11/16/2021 |

| Sale Of Common Stock | (863) | 11/17/2021 |

| Sale Of Common Stock | (31,300) | 11/18/2021 |

| Sale Of Common Stock | (10,195) | 11/30/2021 |

| Purchase Of Common Stock | 43,000 | 12/07/2021 |

| Purchase Of Common Stock | 43,000 | 12/08/2021 |

| Purchase Of Common Stock | 83,739 | 12/08/2021 |

| Sale Of Common Stock | (83,739) | 12/08/2021 |

| Sale Of Common Stock | (83,739) | 12/08/2021 |

| Purchase of Common Stock | 83,739 | 12/08/2021 |

| Sale of Common Stock1 | (10,870) | 12/31/2021 |

| Sale of Common Stock | (10,870) | 12/31/2021 |

| Purchase of Common Stock2 | 10,870 | 12/31/2021 |

| Purchase of Common Stock | 20,100 | 01/03/2022 |

| Purchase of Common Stock | 4,800 | 01/28/2022 |

| Purchase of Common Stock | 2,190 | 02/28/2022 |

LAND & BUILDINGS INVESTMENT MANAGEMENT, LLC

(Through the Managed Account)

| Sale of Common Stock1 | (22,360) | 06/19/2020 |

| Sale of Common Stock1 | (33,540) | 06/19/2020 |

| Sale of Common Stock1 | (5,203) | 06/23/2020 |

| Sale of Common Stock1 | (7,805) | 06/23/2020 |

| Sale of Common Stock1 | (5,463) | 06/24/2020 |

| Sale of Common Stock1 | (8,195) | 06/24/2020 |

| Sale of Common Stock1 | (8,195) | 06/25/2020 |

| Sale of Common Stock1 | (5,463) | 06/25/2020 |

| Sale of Common Stock1 | (5,409) | 06/26/2020 |

| Sale of Common Stock1 | (8,113) | 06/26/2020 |

| Sale of Common Stock1 | (8,209) | 06/29/2020 |

| Sale of Common Stock1 | (5,473) | 06/29/2020 |

| Sale of Common Stock1 | (972) | 07/01/2020 |

| Sale of Common Stock1 | (648) | 07/01/2020 |

I-2

| Purchase of Common Stock2 | 22,400 | 07/01/2020 |

| Purchase of Common Stock2 | 33,700 | 07/01/2020 |

| Purchase of Common Stock2 | 41,329 | 07/23/2020 |

| Purchase of Common Stock2 | 27,619 | 07/23/2020 |

| Purchase Of Common Stock | 62,100 | 08/10/2020 |

| Purchase Of Common Stock | 41,400 | 08/10/2020 |

| Purchase Of Common Stock | 31,800 | 09/02/2020 |

| Purchase Of Common Stock | 21,200 | 09/02/2020 |

| Purchase Of Common Stock | 59,800 | 09/10/2020 |

| Purchase Of Common Stock | 39,900 | 09/10/2020 |

| Purchase Of Common Stock | 14,241 | 10/07/2020 |

| Purchase Of Common Stock | 9,494 | 10/07/2020 |

| Purchase Of Common Stock | 10,706 | 10/08/2020 |

| Purchase Of Common Stock | 16,059 | 10/08/2020 |

| Purchase Of Common Stock | 20,976 | 10/27/2020 |

| Purchase Of Common Stock | 13,955 | 10/27/2020 |

| Purchase Of Common Stock | 3,524 | 10/28/2020 |

| Purchase Of Common Stock | 2,345 | 10/28/2020 |

| Sale Of Common Stock | (30,200) | 11/04/2020 |

| Sale Of Common Stock | (20,100) | 11/04/2020 |

| Purchase Of Common Stock | 27,300 | 11/11/2020 |

| Purchase Of Common Stock | 18,200 | 11/11/2020 |

| Sale Of Common Stock | (18,000) | 11/19/2020 |

| Sale Of Common Stock | (27,100) | 11/19/2020 |

| Purchase Of Common Stock | 21,497 | 12/04/2020 |

| Purchase Of Common Stock | 14,332 | 12/04/2020 |

| Purchase Of Common Stock | 5,203 | 12/07/2020 |

| Purchase Of Common Stock | 3,468 | 12/07/2020 |

| Sale Of Common Stock | (11,021) | 12/21/2020 |

| Sale Of Common Stock | (16,469) | 12/21/2020 |

| Sale Of Common Stock | (28,200) | 01/11/2021 |

| Sale Of Common Stock | (18,800) | 01/11/2021 |

| Sale Of Common Stock | (27,200) | 01/19/2021 |

| Sale Of Common Stock | (40,800) | 01/19/2021 |

| Sale Of Common Stock | (79,879) | 01/20/2021 |

| Sale Of Common Stock | (119,731) | 01/20/2021 |

| Purchase Of Common Stock | 68,700 | 02/16/2021 |

| Purchase Of Common Stock | 45,800 | 02/16/2021 |

| Purchase Of Common Stock | 13,200 | 03/01/2021 |

| Purchase Of Common Stock | 8,800 | 03/01/2021 |

| Purchase Of Common Stock | 25,600 | 03/18/2021 |

| Purchase Of Common Stock | 17,100 | 03/18/2021 |

| Purchase Of Common Stock | 27,000 | 04/01/2021 |

I-3

| Purchase Of Common Stock | 40,500 | 04/01/2021 |

| Purchase Of Common Stock | 4,434 | 04/05/2021 |

| Purchase Of Common Stock | 6,668 | 04/05/2021 |

| Purchase Of Common Stock | 4,433 | 04/06/2021 |

| Purchase Of Common Stock | 6,666 | 04/06/2021 |

| Purchase Of Common Stock | 9,200 | 05/04/2021 |

| Purchase Of Common Stock | 13,700 | 05/04/2021 |

| Purchase Of Common Stock | 20,700 | 05/07/2021 |

| Purchase Of Common Stock | 31,000 | 05/07/2021 |

| Purchase Of Common Stock | 15,000 | 08/24/2021 |

| Purchase Of Common Stock | 10,000 | 08/24/2021 |

| Purchase Of Common Stock | 19,300 | 09/17/2021 |

| Purchase Of Common Stock | 29,000 | 09/17/2021 |

| Sale Of Common Stock | (30,900) | 10/25/2021 |

| Sale Of Common Stock | (20,600) | 10/25/2021 |

| Sale Of Common Stock | (1,849) | 11/09/2021 |

| Sale Of Common Stock | (2,782) | 11/09/2021 |

| Sale Of Common Stock | (3,696) | 11/10/2021 |

| Sale Of Common Stock | (2,456) | 11/10/2021 |

| Sale Of Common Stock | (1,675) | 11/11/2021 |

| Sale Of Common Stock | (2,521) | 11/11/2021 |

| Sale Of Common Stock | (1,974) | 11/12/2021 |

| Sale Of Common Stock | (1,312) | 11/12/2021 |

| Sale Of Common Stock | (1,408) | 11/15/2021 |

| Sale Of Common Stock | (2,118) | 11/15/2021 |

| Sale Of Common Stock | (1,619) | 11/16/2021 |

| Sale Of Common Stock | (1,076) | 11/16/2021 |

| Sale Of Common Stock | (1,390) | 11/17/2021 |

| Sale Of Common Stock | (924) | 11/17/2021 |

| Sale Of Common Stock | (50,800) | 11/18/2021 |

| Sale Of Common Stock | (33,900) | 11/18/2021 |

| Sale Of Common Stock | (16,550) | 11/30/2021 |

| Sale Of Common Stock | (11,050) | 11/30/2021 |

| Purchase Of Common Stock | 46,300 | 12/07/2021 |

| Purchase Of Common Stock | 69,450 | 12/07/2021 |

| Purchase Of Common Stock | 69,450 | 12/08/2021 |

| Purchase Of Common Stock | 46,300 | 12/08/2021 |

| Purchase Of Common Stock | 34,700 | 01/03/2022 |

| Purchase Of Common Stock | 23,100 | 01/03/2022 |

| Purchase Of Common Stock | 5,600 | 01/28/2022 |

| Purchase Of Common Stock | 8,400 | 01/28/2022 |

I-4

L&B OPPORTUNITY FUND, LLC

| Purchase Of Common Stock | 2,510 | 08/10/2020 |

| Sale Of Common Stock | (1,030) | 08/19/2020 |

| Purchase Of Common Stock | 1,450 | 08/31/2020 |

| Purchase Of Common Stock | 3,240 | 09/02/2020 |

| Purchase Of Common Stock | 280 | 09/10/2020 |

| Sale Of Common Stock | (2,800) | 09/17/2020 |

| Purchase Of Common Stock | 7,030 | 09/25/2020 |

| Purchase Of Common Stock | 131 | 10/07/2020 |

| Purchase Of Common Stock | 149 | 10/08/2020 |

| Purchase Of Common Stock | 3,870 | 10/27/2020 |

| Purchase Of Common Stock | 650 | 10/28/2020 |

| Purchase Of Common Stock | 2,020 | 11/02/2020 |

| Sale Of Common Stock | (2,820) | 11/04/2020 |

| Sale Of Common Stock | (2,670) | 11/19/2020 |

| Purchase Of Common Stock | 2,158 | 12/04/2020 |

| Purchase Of Common Stock | 522 | 12/07/2020 |

| Sale Of Common Stock | (1,622) | 12/21/2020 |

| Purchase Of Common Stock | 730 | 12/31/2020 |

| Sale Of Common Stock | (1,610) | 01/04/2021 |

| Sale Of Common Stock | (3,050) | 01/11/2021 |

| Sale Of Common Stock | (4,420) | 01/19/2021 |

| Sale Of Common Stock | (4,718) | 01/20/2021 |

| Purchase Of Common Stock | 4,610 | 02/16/2021 |

| Purchase Of Common Stock | 1,460 | 03/01/2021 |

| Purchase Of Common Stock | 2,610 | 03/18/2021 |

| Purchase Of Common Stock | 220 | 03/31/2021 |

| Purchase Of Common Stock | 4,150 | 04/01/2021 |

| Purchase Of Common Stock | 1,110 | 04/05/2021 |

| Purchase Of Common Stock | 1,110 | 04/06/2021 |

| Sale Of Common Stock | (1,250) | 04/30/2021 |

| Purchase Of Common Stock | 2,950 | 05/04/2021 |

| Purchase Of Common Stock | 1,340 | 05/07/2021 |

| Purchase Of Common Stock | 1,390 | 05/12/2021 |

| Purchase Of Common Stock | 2,470 | 06/07/2021 |

| Purchase Of Common Stock | 1,830 | 08/24/2021 |

| Purchase Of Common Stock | 350 | 09/17/2021 |

| Sale Of Common Stock | (3,320) | 10/15/2021 |

| Sale Of Common Stock | (3,320) | 10/25/2021 |

| Sale Of Common Stock | (341) | 11/09/2021 |

| Sale Of Common Stock | (452) | 11/10/2021 |

| Sale Of Common Stock | (308) | 11/11/2021 |

I-5

| Sale Of Common Stock | (241) | 11/12/2021 |

| Sale Of Common Stock | (259) | 11/15/2021 |

| Sale Of Common Stock | (199) | 11/16/2021 |

| Sale Of Common Stock | (170) | 11/17/2021 |

| Sale Of Common Stock | (3,940) | 11/18/2021 |

| Sale Of Common Stock | (1,285) | 11/30/2021 |

| Purchase Of Common Stock | 7,665 | 12/07/2021 |

| Purchase Of Common Stock | 7,665 | 12/08/2021 |

| Sale Of Common Stock | (2,600) | 12/31/2021 |

| Purchase Of Common Stock | 3,850 | 01/03/2022 |

| Purchase Of Common Stock | 15,510 | 01/28/2022 |

| Purchase Of Common Stock | 1,570 | 02/18/2022 |

L&B MEGATREND FUND

| Purchase Of Common Stock | 1,240 | 01/07/2022 |

| Purchase Of Common Stock | 1,240 | 01/10/2022 |

| Purchase Of Common Stock | 1,320 | 01/11/2022 |

| Purchase Of Common Stock | 190 | 01/12/2022 |

| Purchase Of Common Stock | 90 | 01/21/2022 |

| Purchase Of Common Stock | 580 | 02/25/2022 |

L&B TOTAL RETURN FUND LLC

| Purchase Of Common Stock | 52,630 | 01/27/2022 |

| Purchase Of Common Stock | 52,150 | 01/28/2022 |

| Purchase Of Common Stock | 3,410 | 02/28/2022 |

_______________________________

1 Represents a short sale.

2 Represents a purchase to cover a short position.

I-6

SCHEDULE II

The following table is reprinted from the Company’s proxy statement filed with

the Securities and Exchange Commission on _________, 2022.

II-1

IMPORTANT

Tell your Board what you think! Your vote is important. No matter how many shares of Common Stock you own, please give Land & Buildings your proxy “FOR” the Nominee and in accordance with Land & Buildings’ recommendations on the other proposals on the agenda for the Annual Meeting by using one of the following methods to vote:

| ● | Voting via the INTERNET by following the easy instructions included on the enclosed WHITE proxy card; |

| ● | Voting by TELEPHONE by following the easy instructions included on the enclosed WHITE proxy card; or |

| ● | SIGNING, DATING AND MAILING the enclosed WHITE proxy card TODAY in the envelope provided (no postage is required if mailed in the United States). |

Due to ongoing delays in the postal system, we are encouraging stockholders to submit their proxies electronically (by Internet or by telephone) if possible.

If any of your shares of Common Stock are held in the name of a brokerage firm, bank, bank nominee or other institution, only it can vote such shares of Common Stock and only upon receipt of your specific instructions. Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed WHITE voting instruction form.

If you have any questions or require any additional information concerning this Proxy Statement, please contact Saratoga at the address or phone number set forth below.

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Land and Buildings’ proxy materials, please contact Saratoga at the phone numbers listed below.

520 8TH Avenue, 14th Floor New York, NY 10018 (212) 257-1311

Stockholders call toll free at (888) 368-0379

|

WHITE PROXY CARD

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 7, 2022

VENTAS, INC.

2022 ANNUAL MEETING OF stockholders

THIS PROXY IS SOLICITED ON BEHALF OF land & buildings capital growth fund, lp, and the other participants in its solicitation

THE BOARD OF DIRECTORS OF VENTAS, INC.

IS NOT SOLICITING THIS PROXY

P R O X Y

The undersigned appoints Jonathan Litt, Craig Melcher and John Ferguson, and each of them, attorneys and agents with full power of substitution to vote all shares of common stock, par value $0.25 (the “Common Stock”), of Ventas, Inc. (the “Company”), which the undersigned would be entitled to vote if personally present at the 2022 Annual Meeting of Stockholders of the Company scheduled to be held on _________ at ________, Central Standard Time, at ________________ (including any adjournments or postponements thereof and any meeting called in lieu thereof, the “Annual Meeting”).

The undersigned hereby revokes any other proxy or proxies heretofore given to vote or act with respect to the shares of Common Stock held by the undersigned, and hereby ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may lawfully take by virtue hereof. If properly executed, this Proxy will be voted as directed on the reverse and in the discretion of the herein named attorneys and proxies or their substitutes with respect to any other matters as may properly come before the Annual Meeting that are unknown to Land & Buildings Capital Growth Fund, LP (“Land & Buildings”), a reasonable time before this solicitation.

IF NO DIRECTION IS INDICATED WITH RESPECT TO THE PROPOSALS ON THE REVERSE, THIS PROXY WILL BE VOTED “FOR” THE NOMINEE IN PROPOSAL 1, [“FOR”/”AGAINST”/”ASBSTAIN” ON] PROPOSAL 2, AND “FOR” PROPOSAL 3.

This Proxy will be valid until the completion of the Annual Meeting. This Proxy will only be valid in connection with Land & Buildings’ solicitation of proxies for the Annual Meeting.

IMPORTANT: PLEASE VOTE VIA THE INTERNET, TELEPHONE OR BY SIGNING, DATING AND MAILING THIS PROXY CARD PROMPTLY!

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

WHITE PROXY CARD

☒ Please mark vote as in this example

LAND & BUILDINGS STRONGLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE NOMINEE IN PROPOSAL 1. LAND & BUILDINGS [MAKES NO RECOMMENDATION] WITH RESPECT TO PROPOSAL 2 AND PROPOSAL 3.

| 1. | To elect Land & Buildings’ director nominee, Jonathan Litt (the “Nominee”), and the candidates who have been nominated by the Company other than [____], to serve as directors of the Company until the 2023 Annual Meeting of Stockholders. |

| FOR ALL | WITHHOLD ALL | FOR ALL EXCEPT |

| ☐ | ☐ | ☐ |

Land & Buildings does not expect that the Nominee will be unable to stand for election, but, in the event the Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by this proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Bylaws and applicable law. In addition, Land & Buildings has reserved the right to nominate substitute person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying the Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we would identify and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of Common Stock represented by this proxy card will be voted for such substitute nominee(s).

Land & Buildings intends to use this proxy to vote “FOR ALL” nominees, including the Nominee and the candidates who have been nominated by the Company other than [______], for whom Land & Buildings is not seeking authority to vote for and will not exercise any such authority. The names, backgrounds and qualifications of the candidates who have been nominated by the Company, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the candidates who have been nominated by the Company will serve as directors if our Nominee is elected.

NOTE: If you do not wish for your shares to be voted “FOR” a particular nominee, mark the “FOR ALL EXCEPT” box above and write the name(s) of the nominee(s) you do not support on the line below. Your shares of Common Stock will be voted for the remaining nominee(s).

| 2. | To approve, on an advisory basis, the compensation of the Company’s named executive officers. |

| ☐ FOR | ☐ AGAINST | ☐ ABSTAIN |

| 3. | To ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for the 2022 fiscal year. |

| ☐ FOR | ☐ AGAINST | ☐ ABSTAIN |

WHITE PROXY CARD

DATED: _____________________________

____________________________________

(Signature)

____________________________________

(Signature, if held jointly)

____________________________________

(Title)

Please sign exactly as your name(s) appear(s) on stock certificates or on the label affixed hereto. When signing as attorney, executor, administrator or other fiduciary, please give full title as such. Joint owners must each sign personally. ALL HOLDERS MUST SIGN. If a corporation or partnership, please sign in full corporate or partnership name by an authorized officer and give full title as such.