- VTR Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ventas (VTR) DEF 14ADefinitive proxy

Filed: 5 Apr 23, 8:30am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Ventas, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

2023

Proxy Statement for

Annual Meeting of

Stockholders

| Letter to Ventas Stockholders |  |

Dear Fellow Stockholder,

On behalf of our Board of Directors, I am pleased to present the 2023 Ventas Proxy Statement and invite you to join our Annual Meeting of Stockholders on May 16, 2023.

Over the past year, Ventas has continued to deliver value to our stakeholders with strong financial performance and by taking decisive actions to position our business for the future. We leveraged our deep expertise and strong relationships to drive operational excellence and create opportunities, and we launched our powerful data analytics platform, Ventas Operational Insights (OI)TM, to accelerate the performance of our assets. We have maintained our focus on curating and growing our diverse portfolio and our commitment to the organizational strength, culture and values that power our long-term strategic priorities.

Delivering Strong Financial Performance

In 2022, Ventas performed among the top REITs in the S&P 500 and delivered total shareholder return that outperformed all major REIT benchmarks for the year. With strong contributions across our businesses, we enjoyed the benefits of our diversified portfolio of assets, unified in catering to the needs of the large and growing aging demographic. Our notable performance accomplishments include:

| Delivering total shareholder return that outperformed the Nareit Health Care Index by more than 13% and the MSCI US REIT Index by approximately 16% |

| Delivering total company year-over-year same-store cash net operating income growth of 6.1%, led by the strong performance of our SHOP portfolio with 13.4% growth powered by Ventas OI™ |

| Achieving record Medical Office Building (“MOB”) performance, complemented by strong contributions from our Life Science, Research & Innovation (“R&I”) portfolio |

| Enhancing our financial strength and flexibility through opportunistically extending the Company’s debt duration |

| Maintaining our BBB+ credit rating and receiving positive actions by all three rating agencies |

Curating and Growing our Diverse Portfolio

We completed or announced $1.2 billion in total investments in 2022, principally in senior housing, MOB and Life Science, R&I, with a continued focus on capitalizing on favorable demographically led demand trends.

We have taken decisive actions in our SHOP portfolio to position Ventas to recapture NOI amid the multiyear growth and recovery cycle underway in senior housing. In the past two years, we have converted more than 50 triple-net communities to SHOP and completed more than 130 transitions to new operators to ensure we have the right partners in the right markets operating our assets. In that time, we also acquired more than 100 new communities and executed 30 dispositions and eight new developments. Ventas OI™ continues to be a powerful tool in the capital allocation process, as we leverage our vast and growing data advantage to generate industry and market-specific insights that inform decisions around revenue-generating projects to maximize performance.

In January, J. Justin Hutchens, Executive Vice President, Senior Housing, was appointed to the additional role of Chief Investment Officer to oversee Ventas’s capital allocation strategy and execution across the enterprise. By combining the Chief Investment Officer and EVP, Senior Housing roles, we streamlined our executive management structure and enhanced the connection between our investment activity and business operations to continue our long history of value creation.

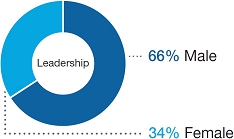

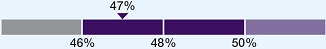

Maintaining our Commitment to Organizational Strength, Culture and Values

We know that diversity of thought, experiences, perspectives and backgrounds drives better outcomes, and we continue our ongoing and rigorous focus on diversity. Today, 50% of our Board members identify as diverse by gender or ethnicity, and as our Board has become more diverse, it has also become more excellent. Since 2019, we have added four new Board members, including Sumit Roy, who we welcomed in October. A highly accomplished REIT executive, Sumit brings deep industry knowledge and capital allocation expertise and a complementary skillset that aligns with Ventas’s strategic vision. We also continued our board committee refreshment and the regular rotation of committee chairmanships with the appointment of Melody Barnes as Chair of the Nominating, Governance and Corporate Responsibility Committee.

We continue to lead at the forefront of business efforts to address climate change and believe our sustainability leadership raises our returns. In 2022 we elevated our sustainability targets, announcing a commitment to achieve carbon neutral operations by 2040, with a 30% decrease of absolute carbon emissions by 2030.

| 2023 Proxy Statement | i |

Accelerating our Strong Momentum

We have begun 2023 with strong momentum. We are well positioned to capitalize on the exciting demographically driven demand for our assets and to continue driving sustainable value creation for our stockholders and broader stakeholders. Our experienced team is energized by the unprecedented opportunity to capture organic growth over a multiyear time horizon, led by SHOP and supported by favorable supply-demand fundamentals, actions we have taken in the portfolio and our post-pandemic rebound. We expect strong revenue growth in SHOP driven by pricing improvements and a significant occupancy ramp throughout the year. We also expect to continue to benefit from our diverse portfolio as we focus on operational excellence across our businesses. We look forward to continuing the dialogue with our stockholders and are grateful for all the perspectives shared with us to date. Thank you for your investment in our company and the trust you place in our team. Sincerely,

Debra A. Cafaro Chairman and Chief Executive Officer |  |

| ii |  |

| Notice of 2023 Annual Meeting of Stockholders |  |

|  |  |  | |||

| Date & Time | Location | Record Date | Outstanding Shares | |||

| Tuesday, May 16, 2023 8:00 a.m. Central Time | The 2023 Annual Meeting will be conducted as a virtual meeting at www.virtualshareholdermeeting.com/VTR2023. There is no physical location for the 2023 Annual Meeting. | March 24, 2023 | On the record date, there were approximately 400,053,497 shares of common stock issued and outstanding and entitled to vote at the meeting. |

Agenda

| Board Recommendation | ||||

| Proposal 1: | To elect the 11 director nominees named in the Proxy Statement to serve until the 2024 Annual Meeting of Stockholders |  FOR each director nominee FOR each director nominee | ||

| Proposal 2: | To approve, on an advisory basis, the compensation of our Named Executive Officers |  FOR FOR | ||

| Proposal 3: | To approve, on an advisory basis, the frequency of advisory votes on the compensation of our Named Executive Officers (every one, two or three years) |  Every ONE Year Every ONE Year | ||

| Proposal 4: | To ratify the selection of KPMG LLP as our independent registered public accounting firm for the 2023 fiscal year |  FOR FOR |

To transact such other business as may properly come before the meeting or any adjournment or postponements thereof.

Casting Your Vote

Your vote is very important. Please carefully review the proxy materials for the 2023 Annual Meeting of Stockholders and follow the instructions below to cast your vote promptly on all voting matters.

We urge you to vote by proxy as soon as possible to ensure that your shares are represented at the 2023 Annual Meeting whether or not you currently plan to attend. You do not need to attend the meeting to vote if you vote your shares before the meeting.

PLEASE NOTE: We encourage all stockholders to vote electronically – by Internet or telephone – whenever possible.

By Telephone | Call the number shown on the enclosed proxy card or voting instruction form. |  By Mail | Request, complete and return the enclosed proxy card or voting instruction form in the postage-paid envelope provided. | |||

Via the Internet | Visit the website shown on the enclosed proxy card or voting instruction form. |  During the Meeting | Attend the virtual meeting via live webcast at www.virtualshareholdermeeting.com/VTR2023 and vote by ballot online. |

| 2023 Proxy Statement | iii |

Participating in the Meeting

Attendance at the 2023 Annual Meeting or any adjournment or postponement thereof will be limited to stockholders of the Company as of the close of business on March 24, 2023, the record date, and guests of the Company. The meeting will be held virtually at www.virtualshareholdermeeting.com/VTR2023. You will not be able to attend the 2023 Annual Meeting in person at a physical location. To attend and participate in the meeting, stockholders will need the 16-digit control number included in the Notice of Meeting, on their proxy card or on the voting instruction form or other instructions.

Stockholders as of the close of business on the record date who attend and participate in the 2023 Annual Meeting will have an opportunity to submit questions live via the Internet during the 2023 Annual Meeting. Please review “Information About Our 2023 Annual Meeting” beginning on page 94 of this Proxy Statement for information about attending and voting at the 2023 Annual Meeting.

By Order of the Board of Directors,

Carey S. Roberts

Executive Vice President, General Counsel,

Corporate Secretary and Ethics & Compliance Officer

April 5, 2023

Chicago, Illinois

Important Notice Regarding Internet Availability of Proxy Materials for May 16, 2023, Annual Meeting

We are sending this Proxy Statement and making this Proxy Statement first available on or about April 5, 2023. This Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, are available via the internet at www.proxyvote.com.

| iv |  |

| Table of Contents |

| 2023 Proxy Statement |

| About Ventas |

Our Company

Ventas Inc., an S&P 500 company, operates at the intersection of two large and dynamic industries—healthcare and real estate. Fueled by powerful demographic demand from growth in the aging population, Ventas owns a diversified portfolio of over 1,200 properties in the United States, Canada and the United Kingdom. Ventas uses the power of its capital to unlock the value of healthcare real estate.

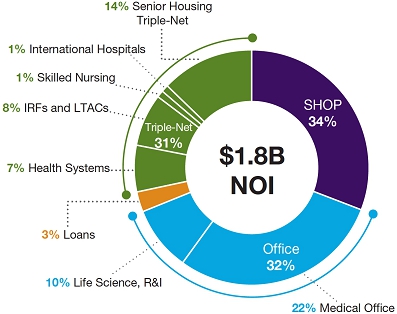

We hold a highly diversified portfolio through three reportable business segments – triple-net leased properties (“NNN”), senior housing operating properties (“SHOP”) and office properties (“Office”).

Portfolio percentage based on Annualized Adjusted NOI as of December 31, 2022. Annualized Adjusted NOI is a means of presenting Ventas’s portfolio composition and is not used to monitor financial performance.

For more than 20 years, Ventas has pursued what we believe is a successful, enduring strategy built on diversification of property types, capital sources and partners, financial strength and flexibility and strong environmental, social and governance (“ESG”) initiatives. Working with industry-leading tenants, operators and partners, our collaborative and experienced team is focused on leveraging our portfolio of properties to produce consistent, growing cash flows and superior returns on a strong balance sheet for the benefit of our stockholders. In 2022, we delivered Nareit Funds From Operations (“FFO”) of $2.82 per share* and Normalized FFO of $2.99 per share.

| 2 |  |

ABOUT VENTAS

A SNAPSHOT OF SUCCESS(1)

| 20+ Years of Operation | 18% Compound Annual Total Stockholder Return CAGR since 1999(2) | $30B Enterprise Value | BBB+ Credit Rating(3) |

| >1,200 Properties | 24M Square Foot Office Portfolio(4) | $5.5B Assets Under Management in the Ventas Investment Management Platform | ~100 Industry-Leading Relationships |

| (1) | Information as of December 31, 2022. |

| (2) | Bloomberg, for the period beginning December 31, 1999, and ending December 31, 2022. Ventas stock price adjusted historically for spin-off of Care Capital Properties, Inc. on August 17, 2015. |

| (3) | BBB+ rating from Fitch and Standard & Poor’s; Baa1 from Moody’s. |

| (4) | Inclusive of Life Science, R&I developments underway and exclusive of non-consolidated properties. |

| * | Some of the financial measures discussed are non-GAAP measures. Please see Appendix A for additional information and a reconciliation to the most directly comparable GAAP measures. |

2022 Performance

We believe our diverse portfolio, financial strength, experienced team and committed operating partners enabled the Company to remain strong and stable in 2022.

We delivered strong results and continued to advance our strategy through, among other things:

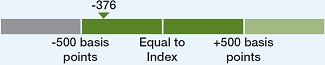

| Delivering relative Total Shareholder Return (“TSR”) that outperformed all major benchmarks for the year. Notably for 2022 by: |

| Outperforming the Nareit Health Care Index by more than 13% | |

| Outperforming the MSCI US REIT Index by approximately 16% | |

| Performing among the top 5 REITs in the S&P 500 for 2022 | |

| Delivering three-year compound annual TSR that outperformed the Nareit Health Care Index by 2.74% |

| Achieving strong year-over-year financial performance, including: |

| Normalized FFO* per share growth of 3.1% to $2.99 per share | |

| Total Company same-store cash NOI* growth of 6.1% | |

| SHOP same-store cash NOI* growth of 13.4%, including fourth quarter same-store cash NOI* growth of 19.1% | |

| Office and NNN same-store cash NOI* growth of 3.8% and 2.4%, respectively |

| Launching Ventas OI™, our proprietary, industry-leading platform to drive performance in our SHOP portfolio. Ventas OI™ blends our operational expertise with advanced data analytics to engage operators and influence performance. Among other things, we conducted more than 70 Ventas OI™ sessions with operators and launched a web-based platform that visualizes over 200,000 new daily operating and sales data points impacting our business. |

| Opportunistically extending our debt duration and committed capital at more attractive pricing by refinancing our existing $200 million term loan maturing in 2023 with a new $500 million term loan facility that matures in 2027. |

| Receiving positive credit rating actions from three credit rating agencies, who attributed their actions to the sustained SHOP recovery that is underway, the durable cashflows from our diversified portfolio and our commitment to maintaining a strong financial position. |

| Ending the year with robust liquidity of $2.4 billion. |

| Improving Net Debt to EBITDA by 0.2x over 2021. |

| Maintaining limited exposure to floating rate debt in a rising interest rate environment, with 88% of outstanding consolidated debt at fixed rates. |

| Accelerating growth of our VIM platform, which ended 2022 with $5.5 billion in assets under management, and earning our first promote revenue as general partner of the Ventas Life Science & Healthcare Real Estate Fund during the fourth quarter of 2022. |

| 2023 Proxy Statement | 3 |

ABOUT VENTAS

| Completing or announcing over $1.2 billion of investment activity that included: |

| Expanding our life science, R&I footprint, as evidenced by $0.7 billion in closed or committed projects in 2022. The 643k square foot, $425 million Atrium Health/Wake Forest University School of Medicine development in Charlotte announced in 2022 exemplifies our ability to leverage strong relationships with leaders in research, medicine and higher education to execute on high-quality, large-scale transactions. | |

| Growing our senior housing portfolio by closing on approximately $0.2 billion in investments including the acquisition of Mangrove Bay, a Class A community with strong occupancy located in the Jupiter, Florida market. We also continued our track record of development with our partner Le Groupe Maurice and broke ground on a new 362-unit senior housing development project in the Montreal, Quebec market. | |

| Selectively expanding our Medical Office Building (“MOB”) business with $0.3 billion in completed acquisitions, highlighted by the 18-property, 732k square foot MOB portfolio 100% leased to Ardent Health Services for a twelve-year term. |

| Earning notable recognition in Environmental, Social and Governance matters, including: |

| Receiving Nareit Leader in the Light Award for the sixth consecutive year and seventh time overall. | |

| Being named the 2022 GRESB Global Listed Sector Leader for Healthcare and earning a 4-Star Rating for the tenth consecutive year. | |

| Scoring in the 98th percentile of real estate companies in the 2022 S&P Global Corporate Sustainability Assessment (CSA) and being included in the World and North America Dow Jones Sustainability Indices (DJSI). |

| Appointing J. Justin Hutchens in January 2023 to the additional role of Chief Investment Officer. In his expanded role, Hutchens is responsible for our capital allocation strategy and execution across the enterprise in addition to his responsibility for our senior housing portfolio. By combining the CIO and EVP, Senior Housing roles, we are streamlining our executive management structure and enhancing the connection between investment activity and business operations. |

| * | Some of the financial measures discussed are non-GAAP financial measures. Please see Appendix A for additional information and a reconciliation to the most directly comparable GAAP measures. |

| 4 |  |

ABOUT VENTAS

2022 Environmental, Social and Governance Highlights

We believe good environmental, social and governance practices are essential to the long-term success of our business. Our industry-leading ESG program is designed to drive long-term value creation through intentional actions and collective effort.

We have developed an ESG strategy based on three key pillars—People, Performance, Planet—that we believe are important to our company, stockholders and other stakeholders and that have been validated through a GRI-aligned ESG materiality assessment. These pillars are supported by our foundational values of health and safety and strong corporate governance. To hold ourselves accountable for progress, we set ambitious goals for each of these key priority areas and provide updates about our performance through annual sustainability reporting.

HEALTH & SAFETY Prioritizing Healthy Communities: We are committed to ensuring the safety and well-being of our employees and the residents, tenants, caregivers and patients who live in and frequent our buildings. | GOVERNANCE A Company Built on Ethics & Integrity: We seek to adhere to best-in-class governance practices. Integrity, transparency and accountability are embedded in our culture, embraced by our Board of Directors, our leaders and our employees and reflected in our business conduct. |

Core to our business, we have incorporated a comprehensive ESG assessment into our due diligence process for acquisitions, dispositions, developments and major redevelopments, and selection of new operators and partners. Considering these areas for evaluating business opportunities helps ensure that our business decisions reflect our ESG priorities, consider ESG-related risks and align with our value-creation strategy.

Reflecting our ongoing commitment to best-in-class governance practices, in 2022, we expanded the role of the Nominating and Corporate Governance Committee to include oversight and monitoring of the Company’s ESG strategies, goals and initiatives including those relating to diversity, equity and inclusion (“DE&I”). At the same time, we changed the name of the Committee to the Nominating, Governance and Corporate Responsibility Committee, emphasizing the importance of the Committee’s role in the Board’s longstanding oversight and monitoring of the Company’s DE&I and ESG strategies, goals and initiatives.

Recognizing the importance of DE&I and influenced by our engagement with stockholders, we began publishing our Equal Employment Opportunity (EEO-1) data on our website this year.

| 2023 Proxy Statement | 5 |

ABOUT VENTAS

Achievements and Goals(1)

People

Our team drives our success and creates unmatched value. Ensuring our employees’ overall well-being and embracing their diverse perspectives is critical to delivering sustainable results.

Talent Attraction and Retention

|

|

|

61st percentile Employee engagement in top half of | $17/hour 99.6% of full-time employees earned | 58% of mid-level managers in |

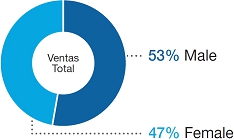

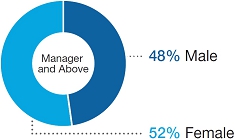

| Diversity, Equity and Inclusion | ||

EMPLOYEE GENDER BALANCE Achieved +/-5% gender balance goal | 52% WOMEN MANAGERS | 34% WOMEN LEADERSHIP Exceeding our 2023 goal |

|  |  |

| Performance | ||

| Smart business growth is synonymous with our Company’s long history of outperformance. Our strategic investments and partnerships are structured to create a positive impact for our stockholders and communities and to strengthen our portfolio. | ||

| TENANT, RESIDENT AND OPERATOR SATISFACTION | RESPONSIBLE INVESTMENT | |

Tenant satisfaction For medical office building |

33% green Energy Star, LEED or other green

|

100% LEED Silver For our life science, |

(1) As of December 31, 2022 unless otherwise noted

| 6 |  |

ABOUT VENTAS

Planet

Protecting the planet and minimizing our impact is a business and moral imperative. Our ambitious environmental goals provide a clear roadmap toward advancing our sustainability objectives.

CLIMATE CHANGE

|  |  |

Net zero by 2040 In 2022, announced a three-pronged | -16% carbon Absolute reduction in Scope 1 and | TCFD climate Enhanced disclosure on our climate |

| ENVIRONMENT | ||

|  |  |

$74M Investment in accretive energy | -21% energy Reduction in energy intensity | -3% water Reduction in water intensity |

| Recognition and Awards | ||

|  |  |

| Achieved Elite member status in the Certification Nation recognition program with 154 Energy Star certifications in 2022 | #1 Listed Healthcare REIT in Global Real Estate Sustainability Benchmark Assessment since 2017 | Awarded Bronze in Nareit’s 2022 Diversity, Equity & Inclusion Recognition Awards |

For more information, please see our latest Corporate Sustainability Report available at www.ventasreit.com.

Note About Website and Corporate Sustainability Report

The reports mentioned above, or any other information from our website, are not part of or incorporated by reference into this Proxy Statement. Some of the statements and reports contain cautionary statements regarding forward-looking information that should be carefully considered. Our statements and reports about our objectives may include statistics or metrics that are estimates, which may make assumptions based on developments or standards that may change and provide aspirational goals that are not intended to be promises or guarantees. The statements and reports also may change at any time, and we undertake no obligation to update them, except as required by law.

| 2023 Proxy Statement | 7 |

| Proxy Summary |

At our 2023 Annual Meeting, you will be asked to vote on four proposals. This proxy summary provides limited information regarding each proposal. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

2023 Annual Meeting Proposals

The proposals that stockholders will be asked to vote on at this meeting are as follows:

| Board Recommendation | Page Reference | ||||||

| Proposal 1: | To elect the 11 director nominees named in the Proxy Statement to serve until the 2024 Annual Meeting of Stockholders |  | FOR each Director Nominee listed on the proxy card | 10 | |||

| Proposal 2: | To approve, on an advisory basis, the compensation of our Named Executive Officers |  | FOR | 47 | |||

| Proposal 3: | To recommend, on an advisory basis, the frequency with which we should hold future advisory votes regarding the compensation of our Named Executive Officers |  | Every ONE Year | 88 | |||

| Proposal 4: | To ratify the selection of KPMG LLP as our independent registered public accounting firm for the 2023 fiscal year |  | FOR | 89 | |||

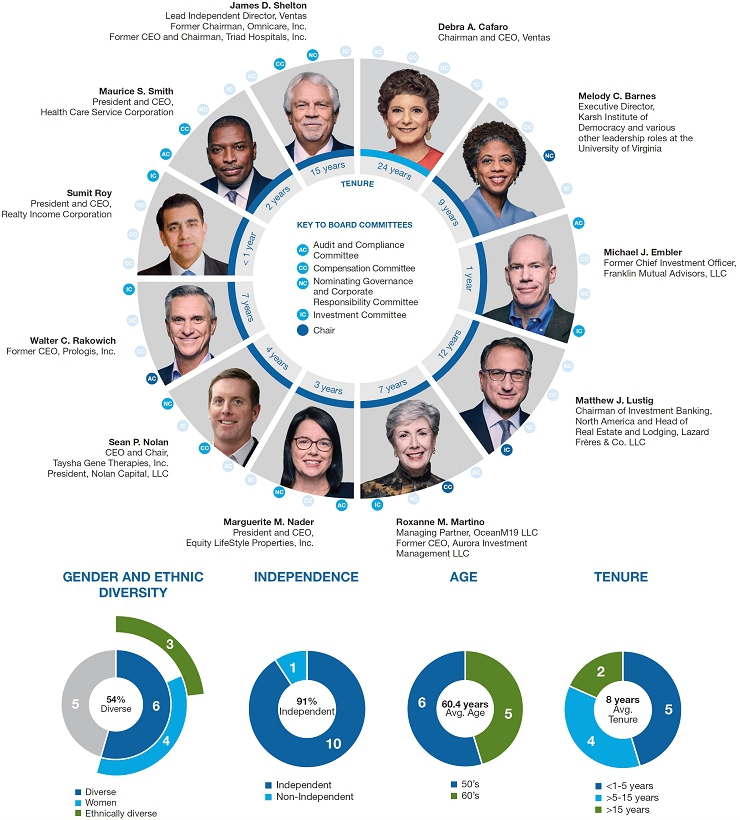

Director Nominees

Our Board has nominated 11 individuals for election as directors at the Company’s 2023 Annual Meeting. All of our director nominees are currently members of our Board of Directors. Each brings valuable skills and opinions, informed by their background and experience, to our deliberations and is an important contributor to our Board and advisor to our management team.

Additional information concerning the composition of our Board and our director nominees can be found under Proposal 1: Election of Directors.

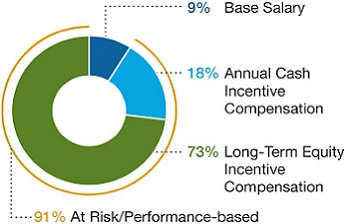

Executive Compensation

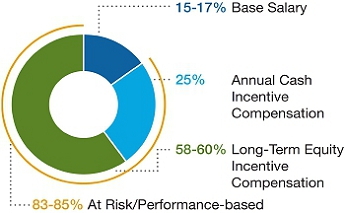

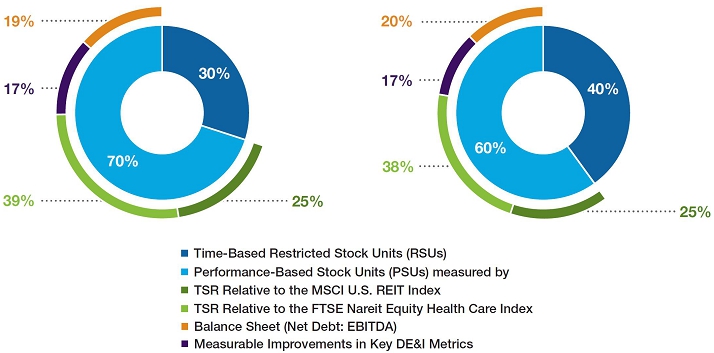

The second item on the agenda is an advisory vote on our executive compensation program. Our executive compensation program reflects our philosophy that compensation should be linked to performance, align with stockholder experience and attract, retain and motivate talented employees. We benchmark our executive compensation against that of our peers to ensure that our executives’ pay is appropriate based on their roles, responsibilities and years of experience. A significant proportion of executive compensation—more than 80% of the 2022 compensation of our Named Executive Officers—is in the form of equity and cash incentive awards tied to pre-identified performance measures such that an executive’s realized pay is closely tied to the Company’s performance.

Our 2022 executive compensation program reflects several changes implemented in response to stockholder perspectives shared with us at the end of 2021, including, among other things, the reduction in the value of the 2022 target compensation opportunity for our CEO by 14% and for our CFO and former CIO by 8%. The Board and the Compensation Committee made additional changes to our executive compensation program for 2023 in response to the 2022 say-on-pay vote and further engagement with our stockholders.

Additional information regarding our executive compensation program, including the changes discussed above, can be found in the section titled Proposal 2: Advisory Vote to Approve the Compensation of Our Named Executive Officers.

| 8 |  |

PROXY SUMMARY

Frequency of Say-On-Pay Votes

The third item on the agenda is an advisory vote regarding the frequency with which we should hold future advisory votes on the compensation of our Named Executive Officers. Regulations of the Securities and Exchange Commission (“SEC”) require us to hold an advisory vote on the compensation of our Named Executive Officers every one, two or three years, and require us to hold an advisory vote regarding the frequency of such votes every six years. We currently hold an advisory vote on the compensation of our Named Executive Officers every year and our Board is recommending that we continue this practice.

Additional information regarding this proposal can be found under Proposal 3: Advisory Vote to Recommend the Frequency with Which We Should Hold Future Advisory Votes regarding the compensation of our Named Executive Officers.

Auditors

The fourth item on the agenda for the 2023 Annual Meeting is approval of the selection of KPMG as our auditors for 2023. KPMG was first engaged to serve as our independent registered public accounting firm in July 2014. We believe that the continued retention of KPMG to serve in this role for this fiscal year is in the best interests of the Company and its stockholders.

Additional information regarding this proposal can be found under Proposal 4: Ratification of Fiscal 2023 Auditor Selection.

| 2023 Proxy Statement | 9 |

| Corporate Governance and Board Matters |

| Proposal 1: Election of Directors | |

At the 2023 Annual Meeting, stockholders will vote on the election of the 11 director nominees listed on the following page, each of whom is currently a director of the Company, for a one-year term of office. The Board has nominated the director nominees, on the recommendation of the Nominating, Governance and Corporate Responsibility Committee, to serve until the 2024 Annual Meeting or until their successor has been duly elected and qualified or their earlier resignation, death or removal. Each director nominee has indicated that he or she will serve if elected. We do not anticipate that any of the director nominees will be unable or unwilling to stand for election but, if that happens, your proxy may be voted for another person nominated by the Board, or the Board may reduce its size, in each case, on the recommendation of the Nominating, Governance and Corporate Responsibility Committee. In nominating the following director nominees for election at the Company’s 2023 Annual Meeting, the Board has evaluated each director nominee by reference to the criteria described under the heading “Director Recruitment, Nomination and Succession Planning.” In addition, the Board evaluates each individual director in the context of the Board as a whole, with the objective of recommending a group that can best support the success of our businesses and represent stockholder interests. The following section contains information provided by the director nominees about their principal occupations, business experience and other matters, as well as a description of how each individual’s experience qualifies him or her to serve as a director of the Company. The information reflects their respective ages and tenure as of the 2023 Annual Meeting and their current committee and chair assignments.  Our Board recommends that you vote FOR the election of each of the 11 director nominees to the Board of Directors listed on the enclosed proxy card or voting instruction form. | |

| 10 |  |

CORPORATE GOVERNANCE AND BOARD MATTERS

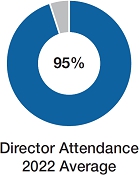

Board Snapshot

2023 Director Nominees

Below is a snapshot of our director nominees, including current committee assignments. Diversity, age and tenure statistics are provided as of the date of our 2023 Annual Meeting for all nominees.

| 2023 Proxy Statement | 11 |

CORPORATE GOVERNANCE AND BOARD MATTERS

Board Nominees

Director Nominee Skills, Experience, Qualifications and Attributes Matrix

In recommending director nominees, our Nominating, Governance and Corporate Responsibility Committee considers the particular experience, qualifications and skills of the current Board members and prospective candidates to ensure a variety of experience, skills and qualifications are represented on the Board.

| Skills and Attributes |  |  |  |  |  |  |  |  |  |  |  | |

| Executive Experience (CEO): Supports our management team through relevant advice and leadership | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Financial/Accounting Experience: Critical to the oversight of the Company’s financial statements, financial reporting and internal controls | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| REITS/Real Estate: Contributes to a deeper understanding of the Company’s challenges and opportunities in the REIT and real estate industries | ● | ● | ● | ● | ● | ● | |||||

| Healthcare, Senior Housing & Health Systems: Contributes to a deeper understanding of the challenges and opportunities in the healthcare, senior housing and for-profit/not-for-profit health systems industries | ● | ● | ● | ● | ● | ● | ● | ● | |||

| Life Sciences, Research & Innovation: Provides valuable insight regarding the unique considerations relevant to the life sciences, research & innovation space as the Company seeks to grow this line of business | ● | ● | |||||||||

| Investment & Capital Allocation: Valuable in overseeing the Company’s investment and capital allocation strategies, capital structure and financing activities | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Capital Intensive Industry: Contributes to a deeper understanding of the Company’s operations and key performance indicators | ● | ● | ● | ● | ● | ● | ● | ||||

| Public Company Executive Compensation: Contributes to the Board’s ability to attract, motivate and retain executive talent and align executive compensation with long-term stockholder value | ● | ● | ● | ● | ● | ● | ● | ||||

| Public Policy & Regulation: Contributes to the Board’s understanding of complex public policy issues and legal, regulatory and compliance risks | ● | ● | ● | ● | ● | ● | ● | ||||

| Technology/Cybersecurity: Contributes to the Board’s understanding of information technology and cybersecurity risks | ● | ● | ● | ● | |||||||

| Education, Communication & Brand: Valuable in managing communications with stakeholders and protecting the Company’s brand and reputation | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Sales & Marketing: Valuable in promoting and selling our services and delivering excellent customer service | ● | ● | ● | ● | |||||||

| Strategic Planning: Essential to guiding the Company’s long-term business strategy | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Investor Experience & Perspective: Provides valuable insight regarding the considerations relevant to institutional investors | ● | ● | ● | ● | ● | ● | ● | ● | |||

| Risk Management: Contributes to the identification, assessment and prioritization of risks facing the Company | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Independent | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Gender | F | F | M | M | F | F | M | M | M | M | M | |

| Race/Ethnicity | ||||||||||||

| Black/African American | ● | ● | ||||||||||

| Asian | ● | |||||||||||

| Caucasian/White | ● | ● | ● | ● | ● | ● | ● | ● | ||||

| 12 |  |

CORPORATE GOVERNANCE AND BOARD MATTERS

Director Nominee Biographies

| Melody C. Barnes, Independent Director | ||

Committees: Nominating, Governance and Corporate Responsibility (Chair) | Other Public Company Directorships: Booz Allen Hamilton Inc. (NYSE: BAH) | Director Since: 2014

Age: 59 | |

| Key Experience and Qualifications | |||

| Public Policy & Regulation | Ms. Barnes brings to our Board extensive experience as a governance and public policy expert. In her multiple roles at the University of Virginia and as co-founder and principal of MB2 Solutions, Ms. Barnes is a thought leader on domestic policy, governance, leadership and strategy. As the director of President Barack Obama’s Domestic Policy Counsel, she provided policy and strategic advice to the President and coordinated the domestic policy-making process in the White House, including with respect to healthcare matters such as the Health Care and Education Reconciliation Act. | |

| Healthcare, Senior Housing & Health Systems | ||

| Strategic Planning | ||

| Education, Communication & Brand |

| Professional Experience |

| The University of Virginia |

| Executive Director of the Karsh Institute of Democracy (2021 to present) | |

| W.L. Lyons Brown Family Director for Public Policy and Public Engagement, College and Graduate School of Arts and Sciences Democracy Initiative (2018 to present) | |

| J. Wilson Newman Professor of Governance, Miller Center of Public Affairs (2021 to present) | |

| Distinguished Fellow, The University of Virginia School of Law (2018 to present) | |

| Co-Founder and Principal of MB2 Solutions, LLC, a public policy and domestic strategy firm (2014 to present) |

| Director of the Domestic Policy Council in the White House (2009 to 2012), providing policy and strategic advice to then-President Obama and coordinating the domestic policy-making process for his administration |

| Senior Domestic Policy Advisor for then-Senator Obama’s 2008 presidential campaign (2008) |

| Executive Vice President for Policy (2005 to 2008) and a Senior Fellow (2003 to 2005) at the Center for American Progress, an independent nonpartisan policy institute |

| Chief Counsel to Senator Edward M. Kennedy on the Senate Judiciary Committee (1998 to 2003) and General Counsel for Senator Kennedy (1995 to 1998) |

| Private Boards and Community Service |

| Member of the Board of Trustees, former Chair and Vice-Chair at The Thomas Jefferson Foundation, Inc. |

| Member of the Advisory Board of the Institute for Contemporary Art at Virginia Commonwealth University |

| Chair of the Aspen Institute for Community Solutions and Opportunity Youth Forum |

| Member of the Board of Directors of the William & Flora Hewlett Foundation |

| 2023 Proxy Statement | 13 |

CORPORATE GOVERNANCE AND BOARD MATTERS

| Debra a. Cafaro, Chairman and CEO | ||

Committees: None | Other Public Company Directorships: PNC Financial Services Group Inc. | Director Since: 1999

Age: 65 | |

| Key Experience and Qualifications |

| Executive Experience (CEO) | Ms. Cafaro brings to our Board substantial executive experience and leadership ability and a proven record of accomplishment. A recognized industry leader, Ms. Cafaro led the transformation of the Company into one of the world’s foremost REITs by setting and overseeing the execution of a long-term strategy that drove the Company’s market capitalization from $0.3 billion since her leadership began in 1999 to $20 billion. Under Ms. Cafaro’s leadership, the Company’s compound annual total shareholder return (TSR) exceeded 18% percent for the 23 years ended December 31, 2022. | |

| Investment & Capital Allocation | ||

| REITS/Real Estate | ||

| Strategic Planning |

| Professional Experience |

| Chief Executive Officer and director (1999 to present), Chairman of the Board (2003 to present) and President (1999 to 2010) of Ventas, Inc. |

| Private Boards and Community Service |

| Member of the American Academy of Arts & Sciences |

| Immediate past Chair of the Real Estate Roundtable |

| Past Chair of the Board of Directors of The Economic Club of Chicago |

| Member of the Board of Trustees of the University of Chicago |

| Member of the Board of Trustees of the Chicago Symphony Orchestra |

| Advisory Board Member of the Harvard Kennedy School Taubman Center for State and Local Government |

| 14 |  |

CORPORATE GOVERNANCE AND BOARD MATTERS

| Michael J. Embler, Independent Director | ||

Committees: Audit and Compliance Investment | Other Public Company Directorships: American Airlines Group Inc. (NYSE: AAL) (2013 to Present) | Director Since: 2022

Age: 59

| |

| Key Experience and Qualifications | |||

| �� | |||

| Investor Experience & Perspective | Mr. Embler brings to our Board deep investment, finance and healthcare expertise. He is widely recognized for his success and insights as an institutional investor and seasoned board member, with deep experience across a broad range of industries, including healthcare, capital intensive industries and finance. As the Chief Investment Officer of Franklin Mutual Advisers, he oversaw over $85 billion in assets under management and 25 investment professionals. He is also an experienced director, with over 20 years of public board experience, including in the healthcare space. | |

| Investment & Capital Allocation | ||

| Healthcare, Senior Housing & Health Systems | ||

| Capital Intensive Industry |

| Professional Experience |

| Chief Investment Officer of Franklin Mutual Advisers, LLC (2005 to 2009) |

| Head of Franklin Mutual Advisers’ Distressed Investment Group (2001 to 2005) |

| Various roles culminating in Managing Director of Nomura Securities (1992 to 2001) |

| Other relevant Experience |

| Certificate in Cybersecurity Oversight, National Association of Corporate Directors |

| Member of Risk Advisory Council – New York Chapter |

| Certificate in Environmental Conservation and Sustainability, Earth Institute Center for Environmental Sustainability - Columbia University |

| 2023 Proxy Statement | 15 |

CORPORATE GOVERNANCE AND BOARD MATTERS

| Matthew J. Lustig, Independent Director | ||

Committees: Investment (Chair) | Other Public Company Directorships: Boston Properties, Inc. (NYSE: BXP) (2011 to present) | Director Since: 2011

Age: 62

| |

| Key Experience and Qualifications | |||

| Investment & Capital Allocation | Mr. Lustig brings to our Board over 35 years of experience in the real estate industry. He has extensive experience providing strategic and financial advice and transaction execution to clients, including leading real estate companies, and investing in real estate companies and assets as a principal. In recent years, Mr. Lustig has played an active role in more than $400 billion of advisory assignments and transactions involving real estate companies. In his prior roles at Lazard, he oversaw multiple funds, including Lazard Senior Housing Partners, with over $2.5 billion of equity capital invested in REITs and real estate operating companies. | |

| REITS/Real Estate | ||

| Healthcare, Senior Housing & Health Systems | ||

| Financial/Accounting Experience |

| Professional Experience |

| Chairman of Investment Banking, North America (2019 to present), Head of Investment Banking, North America (2012 to 2019), Head of Real Estate & Lodging (1989 to present) and former Chief Executive Officer of the private equity real estate investment business at Lazard Frères & Co. LLC, a financial advisory and asset management firm |

| Private Boards and Community Service |

| Member (former Chair of Executive Committee) at The Samuel Zell and Robert Lurie Real Estate Center at The Wharton School, University of Pennsylvania |

| Member of the Board of Advisors at the Edmund A. Walsh School of Foreign Service, Georgetown University |

| Member of the MBA Real Estate Program Advisory Board at the Paul Milstein Center for Real Estate at Columbia Business School, Columbia University |

| Member of the Council on Foreign Relations, the Pension Real Estate Association, the Real Estate Roundtable and the Urban Land Institute |

| Chairman of the Board of Directors of Atria Senior Living, Inc., a for-profit senior housing company (2004 to 2011) |

| 16 |  |

CORPORATE GOVERNANCE AND BOARD MATTERS

| Roxanne M. Martino, Independent Director | ||

Committees: Compensation (Chair) | Other Public Company Directorships: None | Director Since: 2016

Age: 66 | |

| Key Experience and Qualifications | |||

| Investor Experience & Perspective | Ms. Martino brings to our Board extensive experience as an institutional investor, chief executive and industry leader. She managed over $14 billion in assets in her roles as Investment Committee Chair and CEO of Aurora Investment Management. Widely recognized as a leader in finance, Ms. Martino was inducted into the InvestHedge Hall of Fame and recognized as one of the 50 Leading Women in Hedge Funds by the Hedge Fund Journal. | |

| Investment & Capital Allocation | ||

| Financial/Accounting Experience | ||

| Strategic Planning |

| Professional Experience |

| Managing Partner of OceanM19 (2016 to present) |

| Chief Executive Officer, Partner and Chair of the Investment Committee, Aurora Investment Management L.L.C., a hedge fund and investment firm, and its predecessor companies (1990 to 2016) |

| General Partner of Grosvenor Capital Management, L.P., an asset management firm (now GCM Grosvenor, NASDAQ: GCMG) (1984 to 1990) |

| Private Boards and Community Service |

| Chairperson of Board of Directors of the Ann & Robert H. Lurie Children’s Hospital of Chicago |

| Member of the Board of Directors of The Havi Group |

| Member of the Board of the Chicago Network |

| Director and former Chairman of Thresholds, a not-for-profit psychiatric rehabilitation organization |

| 2023 Proxy Statement | 17 |

CORPORATE GOVERNANCE AND BOARD MATTERS

| Marguerite M. Nader, Independent Director | ||

Committees: Audit and Compliance | Other Public Company Directorships: Equity LifeStyle Properties, Inc. (NYSE: ELS) | Director Since: 2020

Age: 54

| |

| Key Experience and Qualifications | |||

| REITS/Real Estate | Ms. Nader brings to our Board substantial real estate, investor, and financial experience and a proven record of accomplishment as a REIT executive. In her role as President and CEO of Equity LifeStyle Properties, she has successfully overseen a portfolio of over 400 high quality resort communities across the United States and Canada. She previously served as the company’s Chief Financial Officer and brings to our Board significant financial and accounting expertise. | |

| Financial/Accounting Experience | ||

| Investor Experience & Perspective | ||

| Executive Experience (CEO) |

| Professional Experience |

| President and Chief Executive Officer (2013 to present), President and Chief Financial Officer (2012 to 2013), Executive Vice President and Chief Financial Officer (2011 to 2012) and other roles in asset management, business development and sales and marketing (1993 to 2011) of Equity LifeStyle Properties, Inc. (NYSE: ELS), a resort community real estate investment trust |

| Member of the Management Committee and Board of Directors for Equity LifeStyle Properties, Inc. |

| Private Boards and Community Service |

| Member of the Executive Board, former Chair and Vice-Chair and former Member of the Advisory Board of Governors of the National Association of Real Estate Investment Trusts (Nareit) |

| 18 |  |

CORPORATE GOVERNANCE AND BOARD MATTERS

| Sean P. Nolan, Independent Director | ||

Committees: Compensation | Other Public Company Directorships: Taysha Gene Therapies, Inc., Chairman of the Board (NASDAQ: | Director Since: 2019

Age: 55 | |

| Key Experience and Qualifications | |||

| Life Sciences, Research & Innovation | Mr. Nolan brings to our Board nearly 30 years of experience in the life sciences industry as a public company executive, operator and serial entrepreneur. His diverse functional expertise includes commercial operations, global marketing, and corporate and business development. Mr. Nolan previously served as CEO of AveXis (NYSE: AVXS), which he grew from four employees to a fully integrated global public company with research, clinical, regulatory, manufacturing and commercial operations that was ultimately sold to Novartis for $8.7 billion. | |

| Sales & Marketing | ||

| Financial/Accounting Experience | ||

| Investor Experience & Perspective |

| Professional Experience |

| Chief Executive Officer (December 2022 to present) and Chair of the Board (2020 to present) of Taysha Gene Therapies, Inc. (NASDAQ: TSHA) |

| President of Nolan Capital, LLC, an investment fund (2019 to present) |

| President and Chief Executive Officer of AveXis, Inc. (formerly NASDAQ: AVXS), a gene therapy company (2015 to 2018) |

| Chief Business Officer for InterMune, Inc. (formerly NASDAQ: ITMN), a biopharmaceutical company (2013 to 2015) |

| Chief Commercial Officer of Reata Pharmaceuticals, Inc. (NASDAQ: RETA), a pharmaceuticals company (2011 to 2012) |

| Chief Commercial Officer and President of Lundbeck, Inc., a U.S. affiliate of H. Lundbeck A/S, a Danish pharmaceuticals company (2009 to 2010) |

| Private Boards and Community Service |

| Chairman of the Board of Jaguar Gene Therapy, LLC |

| Chairman of the Board of Affinia Therapeutics Inc. |

| Chairman of the Board of Encoded Therapeutics, Inc. |

| Chairman of the Board of Istari Oncology, Inc. |

| Member of the Board of John Carroll University |

| (1) | Social Capital Suvretta Holdings Corp. II has announced that Mr. Nolan intends to resign as a director of the company upon the earlier of the appointment of his successor and July 31, 2023. Please see “—Director Recruitment, Nomination and Succession Planning” for additional disclosure regarding Mr. Nolan’s service on this Board. |

| 2023 Proxy Statement | 19 |

CORPORATE GOVERNANCE AND BOARD MATTERS

| Walter C. Rakowich, Independent Director | ||

Committees: Audit and Compliance | Other Public Company Directorships: Host Hotels & Resorts, Inc. (NYSE: HST) | Director Since:

Age: 65 | |

| Key Experience and Qualifications | |||

| REITS/Real Estate | Mr. Rakowich brings to our Board extensive experience as a seasoned and accomplished REIT executive and finance professional. He brings valuable experience to the Board with respect to risk assessment and leadership development. In his prior role as CEO of Prologis, Inc. he led a dramatic turnaround of the company and the $17 billion merger of Prologis with AMB Property Corporation and had extensive involvement in the creation and oversight of Prologis’ ESG initiatives. He is also an experienced director, with over 17 years of public board experience. | |

| Financial/Accounting Experience | ||

| Investment & Capital Allocation | ||

| Strategic Planning |

| Professional Experience |

| Chief Executive Officer of Prologis, Inc., an industrial real estate company (NYSE: PLD) (2008 to 2011), Co-Chief Executive Officer following its merger with AMB Property Corporation (2011 to 2012), member of the Board of Directors (2005 to 2012). Served in a number of other senior and executive positions, including as President, Chief Financial Officer and Chief Operating Officer (1994 to 2008) |

| Partner and Principal with Trammell Crow Company, a real estate provider (1985 to 1993) |

| Private Boards and Community Service |

| Member of the Advisory Council of Gender Fair |

| Chairman of the Board of Colorado UpLift |

| Board Member of the Alliance for School Choice in Education |

| Member of the Board of Trustees of Pennsylvania State University |

| Member of the Advisory Board of the Institute for Real Estate Studies in the Smeal College of Business, Pennsylvania State University |

| 20 |  |

CORPORATE GOVERNANCE AND BOARD MATTERS

| Sumit Roy, Independent Director | ||

Committees: Investment | Other Public Company Directorships: Realty Income Corporation (NYSE: O) (2018 to present) | Director Since: 2022

Age: 53

| |

| Key Experience and Qualifications | |||

| REITS/Real Estate | Mr. Roy brings to our Board substantial executive, investor, real estate and technology experience. As President and Chief Executive Officer of Realty Income Corporation, he has successfully overseen the rapid growth of the company, which, as of December 31, 2022, holds a portfolio of over 12,237 freestanding commercial properties across the United States, Puerto Rico, the United Kingdom and Spain. Prior to Realty Income, Mr. Roy was an Executive Director at UBS Investment Bank, where he was responsible for more than $57 billion in real estate capital markets and advisory transactions. Drawing from his early career in technology, in each of his roles, Mr. Roy has leveraged technology to create value for stakeholders and investors. | |

| Investment & Capital Allocation | ||

| Technology/Cybersecurity | ||

| Executive Experience (CEO) | ||

| Professional Experience |

| Chief Executive Officer and Director (2018-present), President (2015-present), Chief Operating Officer (2014 – 2018), Chief Investment Officer (2013 – 2014), Senior Vice President, Acquisitions (2011 – 2013) of Realty Income Corporation (NYSE: O), a diversified real estate investment trust |

| Executive Director, UBS Investment Bank (2004 – 2011) |

| Manager, Corporate Finance, MeadWestvaco (2003 – 2004) |

| Associate, Technology Investment Banking, Merrill Lynch (2001 – 2003) |

| Principal, Cap Gemini (1994 – 1999) |

| Private Boards and Community Service |

| Member of the Executive Board and Governance Committee of the National Association of Real Estate Investment Trusts (Nareit) |

| 2023 Proxy Statement | 21 |

CORPORATE GOVERNANCE AND BOARD MATTERS

| James D. Shelton, Lead Independent Director | ||

Committees: Compensation | Other Public Company Directorships: Envision Healthcare Corp. (2015 to 2018) | Director Since: 2008

Age: 69 | |

| Key Experience and Qualifications | |||

| Healthcare, Senior Housing & Health Systems | Mr. Shelton brings to our Board extensive healthcare, executive and strategic planning experience. As Chairman and CEO of Triad Hospitals, a healthcare enterprise with over 40,000 employees, Mr. Shelton led the Company through its 1999 spin-off from HCA, through its acquisition of Quorum Health Group in 2000 until its 2007 sale, which at the time represented the largest publicly traded U.S. hospital system transaction in history. During his tenure at Triad, Mr. Shelton delivered a total shareholder return of 321%. As non-executive Chairman of Omnicare, Mr. Shelton took decisive steps to optimize performance (including management changes) delivering total shareholder return of 305% during his tenure. | |

| Strategic Planning | ||

| Public Company Executive Compensation | ||

| Capital Intensive Industry | ||

| Professional Experience |

| Non-executive Chairman of the Board of Omnicare, Inc. (formerly NYSE: OCR), a pharmaceutical care provider (2010 to 2015), and interim Chief Executive Officer of Omnicare (2010 to 2011) |

| Chief Executive Officer and Chairman of the Board of Triad Hospitals, Inc. (formerly NYSE: TRI), an owner and manager of hospitals and ambulatory surgery centers (1999 to 2007) |

| President of the Pacific Group (1998 to 1999) and President of the Central Group (1994 to 1998) of Columbia/HCA Healthcare Corporation, a hospital operator (now known as HCA Inc. (NYSE: HCA)) |

| Executive Vice President of National Medical Enterprises (now known as Tenet Healthcare Corporation (NYSE: THC)), a healthcare services company (1991 to 1994) |

| Other relevant Experience |

| Former Member of the Board of Directors and the Executive Committee of the American Hospital Association (2004 to 2006) |

| Former Chairman and member of the Board of Directors of the Federation of American Hospitals (1991 to 2001) |

| 22 |  |

CORPORATE GOVERNANCE AND BOARD MATTERS

| Maurice S. Smith, Independent Director | ||

Committees: Audit and Compliance | Other Public Company Directorships: Halliburton Company (NYSE: HAL) (2023-present) | Director Since: 2021

Age: 51 | |

| Key Experience and Qualifications | |||

| Health Care, Senior Housing & Health Systems | Mr. Smith brings over 25 years of experience in fiscal, strategic and operations leadership in the health insurance industry. Mr. Smith serves as President and CEO of Health Care Service Corp., the fifth largest health insurer in the United States, with annual revenues in excess of $45 billion, more than 24,000 employees and covering over 16 million individuals across its Blue Cross and Blue Shield plans in five states, including Illinois and Texas. | |

| Strategic Planning | ||

| Executive Experience | ||

| Public Policy & Regulation |

| Professional Experience |

| President and Chief Executive Officer and Member of the Board of Directors, Health Care Service Corporation, a leading health insurer (2020 to present), President (2019 to 2020), Senior Vice President, Business Development and Subsidiary Management (2015), Divisional Vice President, Business Development and Subsidiary Management (2012 to 2014), Vice President, Corporate Transactions and Business Analysis (2011 to 2012) and numerous other roles of progressive responsibility (1993 to 2011) |

| President, Blue Cross Blue Shield of Illinois, a division of Health Care Service Corporation (2015 to 2019) |

| Private Boards and Community Service |

| Member of the Board of Trustees of the Civic Federation |

| Chair of the Board of Trustees of Roosevelt University |

| Member of the Board of Directors of The Economic Club of Chicago |

| Member of the Board of Directors of AHIP |

| Member of the Board of Trustees of the Art Institute of Chicago |

| Member of the Board of Directors of Blue Cross and Blue Shield Association |

| Chair of the Board of Prime Therapeutics LLC |

| Director of the Federal Reserve Bank of Chicago |

| 2023 Proxy Statement | 23 |

CORPORATE GOVERNANCE AND BOARD MATTERS

| Effective as of our 2023 Annual Meeting, Robert B. Reed will retire from our Board. We extend our sincere gratitude to Mr. Reed for his service as a director for the past fifteen years. |

| 24 |  |

CORPORATE GOVERNANCE AND BOARD MATTERS

Director Recruitment, Nomination and Succession Planning

In accordance with our Guidelines on Governance (our “Guidelines”), the Nominating, Governance and Corporate Responsibility Committee annually considers and recommends to the Board a slate of director nominees for election at the next annual meeting of stockholders.

In making its recommendations, the Nominating, Governance and Corporate Responsibility Committee considers:

| high-performing, independent incumbent directors who have indicated a willingness to continue serving on our Board; |

| candidates, if any, nominated by our stockholders in accordance with the Company’s organizational documents and applicable laws, including Rule 14a-8 of the Securities Exchange Act of 1934 (the “Exchange Act”); and |

| other candidates identified by the Nominating, Governance and Corporate Responsibility Committee. |

The Nominating, Governance and Corporate Responsibility Committee also regularly reviews the size and composition of the Board on a holistic basis, utilizing the matrix of identified skills, experience and qualifications disclosed above, and considers potential candidates during the course of the year on an ongoing basis as part of our Board refreshment process.

In recruiting and evaluating candidates, the Nominating, Governance and Corporate Responsibility Committee considers different perspectives, skill sets, education, ages, genders, racial and ethnic demographics and other diversity factors, independence, conflicts of interest, outside commitments and business experience. In general, the Nominating, Governance and Corporate Responsibility Committee seeks to include on our Board a complementary mix of individuals with diverse backgrounds, knowledge and viewpoints responsive to the broad set of challenges that the Company confronts.

Our Guidelines provide that, in general, director nominees should have one or more of the following qualifications:

| have demonstrated management or technical ability at high levels in successful organizations; |

| are currently or have been employed in positions of significant responsibility and decision-making; |

| have experience relevant to our operations, such as real estate, REITs, healthcare, finance or general management; |

| be well-respected in their business and home communities; |

| have time to devote to Board duties; and |

| be independent from us and not related to our other directors or employees. |

Our Nominating, Governance and Corporate Responsibility Committee looks for certain characteristics common to all Board members, including:

| integrity; |

| independence; |

| leadership ability, and a proven record of accomplishment; |

| personal commitment of time and effort; |

| expertise in business, professional, academic, political or community affairs; |

| willingness to evaluate, challenge and stimulate; and |

| candor. |

Our directors are expected to be active participants in governing our enterprise. The Nominating, Governance and Corporate Responsibility Committee seeks to recommend candidates who have adequate time to devote to Board activities, recognizing that public company boards of directors command a significant portion of directors’ time. Accordingly, the Company maintains an overboarding policy that prohibits anyone who serves as a Chief Executive Officer of a public company from simultaneously serving on more than two public company boards in addition to the Company’s Board and prohibits all other directors from simultaneously serving on more than four public company boards in addition to the Company’s Board. The Company also prohibits Audit and Compliance Committee members from simultaneously serving on more than two additional public company audit committees.

Mr. Nolan, who is a current director and nominee, serves on two public company boards in addition to the Company’s Board. He is the Chief Executive Officer of one of those companies, and the other company is Social Capital Suvretta Holdings Corp. II, a special purpose acquisition company (“SPAC”) where he serves as a non-executive director. The SPAC does not have significant operations and its initial term is set to expire on July 2, 2023, subject to the right of its stockholders to elect to extend the term. The SPAC has publicly announced, and Mr. Nolan has confirmed, that Mr. Nolan intends to resign as a director of the SPAC upon the earlier of the appointment of his successor and July 31, 2023.

| 2023 Proxy Statement | 25 |

CORPORATE GOVERNANCE AND BOARD MATTERS

The Nominating, Governance and Corporate Responsibility Committee has carefully reviewed Mr. Nolan’s current time commitments, as it does for all director nominees, and assessed whether he will have adequate time to carry out his responsibilities on the Board. The Committee determined that Mr. Nolan brings valuable experience, qualifications and skills to our Board, has consistently demonstrated strong engagement and integrity and is widely respected by fellow Board members for his informed and meaningful insights during Board discussions. In light of Mr. Nolan’s experience, qualifications, skills, and his contributions and active engagement on the Board, the limited operating nature of the SPAC, Mr. Nolan’s intent to resign as a director of the SPAC in the coming months and our assessment of his continued commitment and availability to the Company, the Committee recommended that Mr. Nolan be reelected as a member of the Board.

No single factor or group of factors is necessarily dispositive of whether a candidate will be recommended by our Nominating, Governance and Corporate Responsibility Committee. The Committee will consider candidates recommended by stockholders and applies these same standards in evaluating individuals in that context. Candidates recommended by stockholders must meet the criteria and qualifications described above. Stockholders may submit recommendations to our Corporate Secretary at our principal executive offices at 353 North Clark Street, Suite 3300, Chicago, Illinois 60654.

Director nominations by our stockholders must follow the procedures described in the “Additional Information—Submission of Stockholder Proposals and Other Items for 2024 Annual Meeting” section of this Proxy Statement.

Refreshment and Succession Planning

The Board is committed to effective succession planning and a rigorous, ongoing refreshment program. The average tenure of our independent director nominees is approximately six years as of the date of the 2023 Annual Meeting. Including our CEO, the average tenure is less than eight years as of the date of the 2023 Annual Meeting. Our Nominating, Governance and Corporate Responsibility Committee monitors the average tenure of our directors and seeks to achieve a variety of director tenures in order to benefit from long-tenured directors’ institutional knowledge and newly elected directors’ fresh perspectives. Since 2015, we have appointed seven new directors to the Board of Directors. Robert B. Reed, a valued director who has served on the Board since 2008, will not be standing for re-election at the 2023 Annual Meeting.

In September 2022, we continued the ongoing refreshment of the Board with the appointment of Sumit Roy as a director. Mr. Roy was identified as a candidate by a third-party search firm and a non-management director. The search firm assisted the Nominating, Governance and Corporate Responsibility Committee by identifying a pool of potential director candidates based on specifications provided by the Committee. The firm reviewed potential candidates with the Nominating, Governance and Corporate Responsibility Committee, reached out to candidates selected from the pool to assess interest and availability and arranged candidate interviews with members of the Nominating, Governance and Corporate Responsibility Committee and other members of the Board. The search firm also conducted reference checks and a background check on the candidate before a final recommendation was made to the Board.

In its annual review of the Board’s composition, the Nominating, Governance and Corporate Responsibility Committee considers succession planning in light of factors such as skills, experience and qualifications needed, the Company’s strategy, director feedback from the annual Board self-evaluation, stockholder perspectives shared during our annual engagement process and upcoming retirements and other potential departures. The Nominating, Governance and Corporate Responsibility Committee conducts an enhanced evaluation of any director with more than fifteen (15) years of service on the Board and provides the Board with a detailed explanation as to the determinative factors for nominating such director for another term if the Committee recommends that such candidate be nominated for election.

| 26 |  |

CORPORATE GOVERNANCE AND BOARD MATTERS

Director Recruitment

Our Nominating, Governance and Corporate Responsibility Committee has the authority to identify, consider and recommend candidates to the Board. An overview of the Board’s director recruitment process is provided below:

| Evaluate Board Composition | The Nominating, Governance and Corporate Responsibility Committee periodically reviews Board composition and the skills, experience and qualifications held by existing directors and those sought in candidates, considering the needs of the Board in light of the Company’s strategy, director feedback (including from the annual Board self-evaluation), stockholder perspectives and upcoming retirements and other potential departures. | |

| ||

| Identify Candidates | Based on its assessment of Board composition, the Nominating, Governance and Corporate Responsibility Committee identifies a candidate profile to guide the Committee’s search and may retain a third-party search firm to assist in identifying and evaluating candidates. Candidates may also be recommended by our stockholders, existing directors, advisors and other sources. | |

| ||

| Assess Candidates | Candidates are assessed against the criteria outlined in “—Director Recruitment, Nomination and Succession Planning” and the skills, experience and qualifications shown in “Board Nominees— Director Nominees Skills, Experience, Qualifications and Attributes Matrix,” as well as the future needs of the Board, including succession planning. The Committee, with the assistance of the Corporate Secretary, reviews candidates for independence and potential conflicts. | |

| ||

| Interview Candidates | Qualified top candidates are interviewed by members of the Nominating, Governance and Corporate Responsibility Committee and other Board members, as appropriate. | |

| ||

| Recommend Candidates | The Nominating, Governance and Corporate Responsibility Committee recommends candidates to the Board for appointment or nomination for election. | |

| ||

| Stockholder Vote | Stockholders vote on director nominees at the annual meeting of stockholders. |

| 7 New Directors Added Since 2015 | ||

Ethnic and gender diversity Ethnic and gender diversity |  Current and former CEOs Current and former CEOs |  All independent All independent |

Expertise in investments, finance, accounting, investor perspectives/institutional investing, life sciences, technology, research and innovation, healthcare and REITs Expertise in investments, finance, accounting, investor perspectives/institutional investing, life sciences, technology, research and innovation, healthcare and REITs | ||

Independence

Our Guidelines require that at least a majority of the members of our Board meet the criteria for independence under the rules and regulations of the New York Stock Exchange (“NYSE”). For a director to be considered independent under the NYSE’s listing standards, the director must satisfy certain tests, and the Board must affirmatively determine that the director has no direct or indirect material relationship (other than as a director) with us. Not less than annually, our Board evaluates the independence of each non-management director on a case-by-case basis by considering any matters that could affect their ability to exercise independent judgment in carrying out the responsibilities of a director, including all transactions and relationships between that director, members of their family and organizations with which that director or their family members have an affiliation, on the one hand, and us, our subsidiaries and our management, on the other hand.

The Board has affirmatively determined that all of the Company’s current directors and directors who served during 2022, with the exception of Ms. Cafaro, are independent under the NYSE’s listing standards based on its most recent review upon application of the standards described above. Under the NYSE listing standards, Ms. Cafaro is not considered independent due to her employment as our CEO.

| 2023 Proxy Statement | 27 |

CORPORATE GOVERNANCE AND BOARD MATTERS

The Board has also determined that:

| all of the members of the Audit and Compliance Committee are independent under the applicable rules of the NYSE the Securities and Exchange Commission (“SEC”) respectively; and |

| all of the members of the Compensation Committee are independent, non-employee directors, under the applicable rules of the NYSE and the SEC respectively. |

In determining that Mr. Lustig is independent, the Board considered that he is employed by Lazard, a large multi-national financial institution that, with its affiliates, has provided financial advisory and investment banking services in the ordinary course of business to the Company and its subsidiaries, for which Lazard has received customary compensation, fees and expense reimbursement. The Board did not believe that the Company’s relationship with Lazard impacted the independence of Mr. Lustig for the following reasons:

| Lazard is a large multi-national financial institution and the Company had a relationship with Lazard for many years prior to Mr. Lustig’s appointment to the Board; and |

| amounts paid by the Company to Lazard for the services described above represent an immaterial percentage of Lazard’s and its affiliates’ gross revenues, are well below the amounts that would preclude a finding of independence under the NYSE listing standards and are immaterial to Mr. Lustig. |

Director Resignation Policy

In accordance with our Director Resignation Policy, our Board will nominate an incumbent director for election only if the director agrees that, in the event the director fails to receive a majority of votes cast in an uncontested election at our annual meeting, they will tender an irrevocable resignation that will be effective upon acceptance by the Board. If an incumbent director fails to receive a majority of votes cast in an uncontested election at our annual meeting, our Nominating, Governance and Corporate Responsibility Committee will act on an expedited basis to determine whether to recommend acceptance or rejection of the director’s resignation and submit its recommendation for prompt consideration by the Board. Our Board will act on the Nominating, Governance and Corporate Responsibility Committee’s recommendation and publicly disclose its decision regarding the tendered resignation by filing a Current Report on Form 8-K with the SEC no later than 90 days following certification of the election results.

Director Retirement Policy

Under our Guidelines, a non-management director is required to retire at the first annual meeting of stockholders following their 75th birthday. On the recommendation of our Nominating, Governance and Corporate Responsibility Committee, our Board may waive this requirement if it deems a waiver to be in our best interests and the best interests of our stockholders.

Annual Board Self-Evaluation

The Board recognizes that a robust and constructive evaluation process is an essential component of good corporate governance and Board effectiveness. The Board and each of its committees conduct self-evaluations through completion of written questionnaires related to their performance on an annual basis. Through this process, directors provide feedback and assess Board, committee and director performance, including areas where the Board believes it is functioning effectively and areas where the Board believes it can improve.

The Nominating, Governance and Corporate Responsibility Committee supervises the annual self-evaluations and uses various processes to solicit feedback, including periodic interviews conducted by the Chair of the Nominating, Governance and Corporate Responsibility Committee with each of the other directors. The Board and each committee review and discuss the evaluation results and take this information into account when assessing the qualifications of the Board and further enhancing the effectiveness of the Board and its committees.

Director Orientation and Continuing Education

New directors typically participate in an orientation coordinated by the Nominating, Governance and Corporate Responsibility Committee and management. New directors engage with senior management to review the Company’s strategic plans, significant financial, accounting and risk management matters, compliance programs, corporate governance practices, key policies, principal officers, internal and independent auditors and other key service providers. We provide new directors with written materials to supplement the management meetings to permit them to further understand our business and industry. Informally, our directors also meet individually with new directors as part of the new director onboarding.

We expect our directors to be well informed about the Company’s business, the competitive landscape in which the Company operates and issues currently affecting the Company, the healthcare and life science, research and innovation industries, the real estate investment trust industry, matters of corporate governance and the broader economy. Because our Board believes that ongoing director education is vital to the development of best practices and helps directors fulfill their fiduciary duties to the Company’s stockholders, directors are encouraged to participate in continuing education programs. The Company covers the fees, costs and expenses associated with attendance at one director education program per year for each director.

| 28 |  |

CORPORATE GOVERNANCE AND BOARD MATTERS

Our Corporate Governance Framework

Commitment to Strong Governance Practices

Accountability to Stockholders

| Director Commitment

| ||||

Board Independence

| |||||

Director Diversity, Refreshment & Tenure

| |||||

Alignment with Stockholder Interests

| Board Performance

| ||||

Robust Stockholder Engagement

| |||||

| 2023 Proxy Statement | 29 |

CORPORATE GOVERNANCE AND BOARD MATTERS

Corporate Governance Guidelines

Our Guidelines reflect the fundamental corporate governance principles by which our Board and its committees operate. They set forth general practices the Board and its committees follow with respect to structure, function, organization, composition and conduct. These Guidelines are reviewed at least annually by the Nominating, Governance and Corporate Responsibility Committee and are updated periodically in response to changing regulatory requirements, evolving corporate governance practices, input from our stockholders and otherwise as circumstances warrant. In 2022, the Board approved, on the recommendation of the Nominating, Governance and Corporate Responsibility Committee, several enhancements to the Guidelines, including among other things, to clarify and more clearly articulate the responsibilities of the Company’s Lead Independent Director (which position was previously referred to as the Presiding Director).

Independent Compensation Advisor