UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2014

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from _____ to _____

___________________________

Commission File Number 001-12622

OIL-DRI CORPORATION OF AMERICA

| Delaware | 36-2048898 |

| (State or other jurisdiction of | (IRS. Employer Identification No.) |

| incorporation or organization) | |

410 North Michigan Avenue, Suite 400, Chicago, Illinois 60611-4213

(312) 321-1515

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.10 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act:

Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act:

Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | o | Accelerated filer | ý | |

| Non-accelerated filer | o | Smaller reporting company | o | |

| (Do not check if a smaller reporting company) | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes o No ý

The aggregate market value of Oil-Dri’s Common Stock owned by non-affiliates as of January 31, 2014 was $167,618,000.

Number of shares of each class of Oil-Dri’s capital stock outstanding as of September 30, 2014:

Common Stock – 5,001,742 shares

Class B Stock – 2,069,994 shares

Class A Common Stock – 0 shares

DOCUMENTS INCORPORATED BY REFERENCE

The following documents are incorporated by reference: Oil-Dri’s Proxy Statement for its 2014 Annual Meeting of Stockholders (“Proxy Statement”), which will be filed with the Securities and Exchange Commission (“SEC”) not later than November 28, 2014 (120 days after the end of Oil-Dri’s fiscal year ended July 31, 2014), is incorporated into Part III of this Annual Report on Form 10-K, as indicated herein.

CONTENTS

| Item | Page | |||

| 1 | ||||

| 1A. | ||||

| 1B. | ||||

| 2 | ||||

| 3 | ||||

| 4 | Mine Safety Disclosure | |||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 7A. | ||||

| 8 | ||||

| 9 | ||||

| 9A. | ||||

| 9B. | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

3

CONTENTS (CONTINUED)

FORWARD-LOOKING STATEMENTS

Certain statements in this report, including those under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and those statements elsewhere in this report and other documents we file with the SEC, contain forward-looking statements that are based on current expectations, estimates, forecasts and projections about our future performance, our business, our beliefs and our management’s assumptions. In addition, we, or others on our behalf, may make forward-looking statements in press releases or written statements, or in our communications and discussions with investors and analysts in the normal course of business through meetings, webcasts, phone calls and conference calls. Words such as “expect,” “outlook,” “forecast,” “would,” “could,” “should,” “project,” “intend,” “plan,” “continue,” “believe,” “seek,” “estimate,” “anticipate,” “may,” “assume,” variations of such words and similar expressions are intended to identify such forward-looking statements, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Such statements are subject to certain risks, uncertainties and assumptions that could cause actual results to differ materially, including those described in Item 1A “Risk Factors” below and other documents we file with the SEC. Should one or more of these or other risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, intended, expected, believed, estimated, projected or planned. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except to the extent required by law, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this report, whether as a result of new information, future events, changes in assumptions or otherwise.

TRADEMARK NOTICE

Agsorb, Amlan, Calibrin, Cat’s Pride, ConditionAde, Flo-Fre, Fresh & Light, Jonny Cat, KatKit, Oil-Dri, Pel-Unite, Perform, Pro Mound, Pure-Flo, Rapid Dry, Select, Terra-Green, Ultra-Clear and Verge are all registered trademarks of Oil-Dri Corporation of America or of its subsidiaries. MD-09, Pro’s Choice and Saular are trademarks of Oil-Dri Corporation of America. Fresh Step is a registered trademark of The Clorox Company (“Clorox”).

4

PART I

ITEM 1 – BUSINESS

In 1969, Oil-Dri Corporation of America was incorporated in Delaware as the successor to an Illinois corporation incorporated in 1946; the Illinois corporation was the successor to a partnership that commenced business in 1941. Except as otherwise indicated herein or as the context otherwise requires, references to “Oil-Dri,” the “Company,” “we,” “us” or “our” refer to Oil-Dri Corporation of America and its subsidiaries.

GENERAL BUSINESS DEVELOPMENTS

During fiscal 2014 we made substantial business investments in both of our operating segments, including the acquisition of certain assets of MFM Industries Inc. (“MFM”), which expanded our private label cat litter business, and the opening of our subsidiary in Shenzhen, China, which extended the presence of our animal health and nutrition products in China through a direct sales force. See Note 3 of the Notes to the Consolidated Financial Statements for further information about the MFM acquisition. In addition, we increased spending for trade promotions and advertising of our cat litter products and invested significantly in capital at our plant facilities for equipment and capacity expansion. We also experienced cost increases to mine, manufacture and transport our products during fiscal 2014. Rising costs for natural gas, freight and packaging, as well as increased mining costs to extract clay deeper in the ground all impacted our annual results.

We believe our balance sheet remains strong at the end of fiscal 2014, even though cash, cash equivalents and short-term investments declined. Major uses of cash included capital expenditures, the MFM acquisition, advertising, dividend payments and debt repayments. We believe cash requirements for capital expenditures in fiscal 2015 will be comparable to fiscal 2014 due to projects at our manufacturing facilities. Advertising and promotions spending is also anticipated to be a significant use of cash in fiscal 2015, which we believe will be at levels similar to fiscal 2014. Our capital requirements are subject to change as business conditions warrant and opportunities arise.

PRINCIPAL PRODUCTS

We are a leader in developing, manufacturing and/or marketing sorbent products. Our sorbent products are principally produced from clay minerals, primarily consisting of montmorillonite and attapulgite and, to a lesser extent, other clay-like sorbent materials, such as Antelope shale, which we refer to collectively as our “clay” or our “minerals.” Our sorbent technologies include absorbent and adsorbent products. Absorbents, like sponges, draw liquids up into their many pores. Examples of our absorbent clay products are Cat’s Pride and Jonny Cat branded premium cat litter, as well as other private label cat litters. We also produce Oil-Dri branded floor absorbents, Agsorb and Verge agricultural chemical carriers and ConditionAde and Calibrin enterosorbents used in animal feed. Adsorbent products attract impurities in liquids, such as metals and surfactants, and form low-level chemical bonds. Examples of our adsorbent products are Oil-Dri synthetic sorbents, which are used for industrial cleanup, and Pure-Flo, Perform and Select bleaching clay products, which act as a filtration media for edible oils, fats and tallows. Also, our Ultra-Clear product serves as a purification aid for petroleum-based oils and by-products. Our absorbent and adsorbent products are described in more detail below.

Agricultural and Horticultural Products

We produce a wide range of granular and powdered mineral absorbent products that are used for crop protection chemical carriers, drying agents, bulk processing aids, growing media components and seed enhancement media. Our brands include: Agsorb, an agricultural chemical carrier and drying agent; Verge, an engineered granule agricultural chemical carrier; Flo-Fre, a highly absorbent microgranule flowability aid; Terra-Green, a growing media supplement; and Pel-Unite, an animal feed binder.

Agsorb and Verge carriers are used as an alternative to agricultural sprays. The clay granules absorb active ingredients and are then delivered directly into, or on top of, the ground providing a more precise application than chemical sprays. Verge carriers are spherical, uniform-sized granules with very low dust. Agsorb drying agent is blended into fertilizer-pesticide blends applied by farmers to absorb moisture and improve flowability. Agsorb also acts as a flowability aid for fertilizers and chemicals used in the lawn and garden market. Flo-Fre microgranules are used by grain processors and other large handlers of bulk products to soak up excess moisture preventing caking. We employ technical sales people to market these products in the United States.

5

Animal Health and Nutrition Products

We produce, or use contract processors to produce, several products used in the livestock feed industry. Many of these products are sold under the Amlan trademark. Calibrin and ConditionAde enterosorbent products are used in animal feed to absorb naturally-occurring mycotoxins. These products work to improve animal health and productivity. Our MD-09 moisture manager product is a feed additive for the reduction of wet droppings in poultry. Pel-Unite and Pel-Unite Plus products are specialized animal feed pellet binders. These products are sold through a network of feed products distributors in the United States and through distribution agreements with animal health and nutrition products distributors in Latin America, Africa, the Middle East and Asia. Beginning in fiscal 2014, these products were also sold by sales people employed by our new subsidiary located in China, as further described in Foreign Operations below.

Bleaching Clay and Purification Aid Products

We produce an array of bleaching, purification and filtration applications used by edible oil, jet fuel and other petroleum-based product processors around the world. Bleaching clays are used by edible oil processors to adsorb soluble contaminants that create oxidation problems. Our Pure-Flo and Perform bleaching clays remove impurities, such as trace metals, chlorophyll and color bodies, in various types of edible oils. Perform products provide increased activity for hard-to-bleach oils. Our Select adsorbents are used to remove contaminants in vegetable oil processing and can be used to prepare oil prior to the creation of biodiesel fuel. Our Ultra-Clear product is used as a filtration and purification medium for jet fuel and other petroleum-based products. These products are marketed in the United States and in international markets. The products are supported by our team of technical sales employees as well as by agent representatives and the services of our research and development group.

Cat Litter Products

Branded products. We produce two types of mineral-based cat litter products, traditional coarse and scoopable, both of which have absorbent and odor controlling characteristics. Scoopable litters have the additional characteristic of clumping when exposed to moisture, allowing the consumer to selectively dispose of the used portion of the litter. Our coarse and scoopable products are sold under our Cat’s Pride and Jonny Cat brand names. In 2011, under our Cat's Pride Fresh & Light product line, we introduced a scoopable lightweight litter to the industry that offers superior performance with the added convenience of being lighter to carry and pour. We subsequently expanded our Cat's Pride Fresh & Light offerings to include a flushable, paper-based cat litter. In addition, we offer our coarse litter in a pre-packaged, disposable tray under the Cat’s Pride KatKit and Jonny Cat brands. Moreover, we offer litter box liners under the Cat's Pride and Jonny Cat product lines.

Private label products. We also produce private label cat litters for other customers that are sold through both independent food brokers and our sales force to major grocery, drug, dollar store, mass-merchandiser and pet outlets.

Co-packaged products. We have two long-term supply arrangements (one of which is material to our business) under which we manufacture branded traditional litters for other marketers. Under these co-manufacturing relationships, the marketer controls all aspects of sales, marketing, and distribution, as well as the odor control formula, and we are responsible for manufacturing. The long-term supply agreement that is material to our business is with Clorox, under which we have the exclusive right to supply Clorox’s requirements for Fresh Step coarse cat litter up to certain levels.

Industrial and Automotive Products

We manufacture and/or sell products made from clay, polypropylene and recycled cotton materials that absorb oil, grease, water and other types of spills. These products are used in industrial, home and automotive environments. Our clay-based sorbent products, such as Oil-Dri branded floor absorbent, are used for floor maintenance in industrial applications to provide a non-slip and non-flammable surface for workers. These floor absorbents are also used in automotive repair facilities, car dealerships and other industrial applications, as well as for home use in garages and driveways. Our Oil-Dri branded polypropylene-based and cotton-based products are sold in various forms, such as pads, rolls, socks, booms and spill kits.

Industrial and automotive sorbent products are sold through a distribution network that includes industrial, auto parts, safety, sanitary supply, chemical and paper distributors. These products are also sold through environmental service companies, mass merchandisers, catalogs and the Internet.

Sports Products

Pro’s Choice sports field products are used on baseball, softball, football and soccer fields. Pro’s Choice soil conditioners are used in field construction or as top dressing to absorb moisture, suppress dust and improve field performance. Pro Mound

6

packing clay is used to construct pitcher’s mounds and batter’s boxes. Rapid Dry drying agent is used to dry up puddles and slick spots after rain. Sports products are used at all levels of play, including professional, college and high school and on municipal fields. These products are sold through a network of distributors specializing in sports turf products.

BUSINESS SEGMENTS

We have two reportable operating segments for financial reporting derived from the different characteristics of our two major customer groups: Retail and Wholesale Products Group and Business to Business Products Group. The Retail and Wholesale Products Group customers include mass merchandisers, wholesale clubs, drugstore chains, pet specialty retail outlets, dollar stores, retail grocery stores, distributors of industrial cleanup and automotive products, environmental service companies and sports field product users. The Business to Business Products Group customers include: processors and refiners of edible oils, petroleum-based oils and biodiesel fuel; manufacturers of animal feed and agricultural chemicals; distributors of animal health and nutrition products; and marketers of consumer products. Certain financial information on both segments is contained in Note 4 of the Notes to the Consolidated Financial Statements and is incorporated herein by reference.

We do not manage our business, allocate resources or generate revenue data by product line. Any of our products may be sold in one or both of our operating segments. Information concerning total revenue of classes of similar products accounting for more than 10% of consolidated revenues in any of the last three fiscal years is not separately provided because it would be impracticable to do so.

FOREIGN OPERATIONS

Our wholly-owned subsidiary, Amlan Trading (Shenzhen) Company, Ltd., located in Shenzhen, China, is dedicated to animal health and provides natural disease management solutions for livestock. This subsidiary sells animal health and nutrition products under our Amlan brand name.

Our wholly-owned subsidiary, Oil-Dri Canada ULC, is a manufacturer and marketer of branded and private label cat litter in the Canadian marketplace. Among its leading brands are Saular, Cat’s Pride and Jonny Cat. Our Canadian business also manufactures or purchases and sells industrial granule floor absorbents, synthetic polypropylene sorbent materials and agricultural chemical carriers.

Our wholly-owned subsidiary, Oil-Dri (U.K.) Limited, is a manufacturer and marketer of industrial floor absorbents, bleaching earth and cat litter. These products are marketed in the United Kingdom and Western Europe. Oil-Dri (U.K.) Limited also sells synthetic polypropylene sorbent materials, filtration units and plastic containment products.

Our wholly-owned subsidiary, Oil-Dri SARL, is a Swiss company that performs various management, customer service and administrative functions for the international business of our domestic operations.

Our foreign operations are subject to the normal risks of doing business overseas, such as currency fluctuations, restrictions on the transfer of funds and import/export duties. We were not materially impacted by these foreign currency fluctuations in any of our last three fiscal years. See Item 7A “Quantitative and Qualitative Disclosures About Market Risk” for further information about our foreign markets risks. Certain financial information about our foreign operations is contained in Note 4 of the Notes to the Consolidated Financial Statements and is incorporated herein by reference.

CUSTOMERS

Sales to Wal-Mart Stores, Inc. (“Walmart”) and its affiliates accounted for approximately 19%, 20% and 22% of our total net sales for the fiscal years ended July 31, 2014, 2013 and 2012, respectively. Walmart is a customer in our Retail and Wholesale Products Group segment. There are no customers in the Business to Business Products Group with sales equal to or greater than 10% of our total sales; however, sales to Clorox (a customer in our Business to Business Products Group) and its affiliates accounted for approximately 6% of total net sales for the fiscal year ended July 31, 2014 and 7% of total net sales for each of the fiscal years ended July 31, 2013 and 2012. The degree of margin contribution of our significant customers in the Business to Business Products Group varies, with certain customers having a greater effect on our operating results. The loss of any customer other than those described in this paragraph would not be expected to have a material adverse effect on our business.

COMPETITION

Price, customer service, marketing, technical support, product quality and distribution resources are the principal methods of competition in our markets and competition historically has been very vigorous. Some of our competitors, particularly in the

7

sale of cat litter (the largest product in our Retail and Wholesale Products Group), have substantially greater financial resources or market presence than we do and have established brands.

In our Retail and Wholesale Products Group, we have five principal competitors, including one which is also our customer. The overall cat litter market has been stable in recent years as household cat ownership has remained relatively constant. Scoopable products have a majority of the cat litter market share followed by traditional coarse products. The overwhelming majority of all cat litter is mineral based; however, cat litters based on alternative strata such as paper, various agricultural waste products and silica gels have niche positions. There is significant competition to attract consumers of cat litter across multi-outlet channels, including grocery, mass-merchandisers, dollar, pet and drug stores. These retailers desire product innovation and demand the best value from their suppliers, thus they enjoy substantial negotiating leverage over their suppliers, including us. We differentiate ourselves through our operations via nation-wide distribution, strong customer service and world class sales, marketing and research and development teams, which gives us a potential advantage over smaller and regional manufacturers.

In the Business to Business Products Group, we have 14 principal competitors. Our agricultural chemical carrier products have experienced competition from new engineered granular technologies in the agricultural and horticultural markets. Our bleaching clay and fluids purification products are sold in a highly cost competitive global marketplace. Performance is a primary competitive factor for these products. The animal health portion of this segment also operates in a global marketplace with price and performance competition from multi-national and local competitors.

PATENTS

We have obtained or applied for patents for certain of our processes and products sold to customers in both the Retail and Wholesale Products Group and the Business to Business Products Group. These patents expire at various times, including fiscal 2015. We expect no material impact on our business from the expiration of patents in the upcoming year.

BACKLOG; SEASONALITY

As of July 31, 2014, 2013 and 2012, our backlog of orders were valued at approximately $7,401,000, $8,503,000 and $4,741,000, respectively. The value of backlog orders was determined by the number of tons on backlog order and the net selling prices. All backlog orders are expected to be filled within the next 12 months. We consider our business, taken as a whole, to be moderately seasonal; however, business activities of certain customers (such as agricultural chemical manufacturers) are subject to such seasonal factors as crop acreage planted, product formulation cycles and weather conditions.

EFFECTS OF INFLATION

Inflation generally affects us by increasing the cost of employee wages and benefits, transportation, processing equipment, purchased raw materials and packaging, energy and borrowings under our credit facility. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 7A “Quantitative and Qualitative Disclosures About Market Risk” below.

RESERVES

We mine our clay on leased or owned land near our manufacturing facilities in Mississippi, Georgia, Illinois and California; we also have reserves in Nevada, Oregon and Tennessee. We estimate that our proven mineral reserves as of July 31, 2014 are approximately 148,578,000 tons in aggregate and our probable reserves are approximately 135,371,000 tons in aggregate, for a total of 283,949,000 tons of mineral reserves. Based on our rate of consumption during fiscal year 2014, and without regard to any of our reserves in Nevada, Oregon and Tennessee, we consider our proven reserves adequate to supply our needs for over 40 years. Although we consider these reserves to be extremely valuable to our business, only a small portion of the reserves, those which were acquired in acquisitions, was reflected at cost on our balance sheet.

It is our policy to attempt to add to reserves in most years, but not necessarily in every year, an amount at least equal to the amount of reserves consumed in that year. We have a program of exploration for additional reserves and, although reserves have been acquired, we cannot assure that additional reserves will continue to become available. Our use of these reserves, and our ability to explore for additional reserves, are subject to compliance with existing and future federal and state statutes and regulations regarding mining and environmental compliance. During the fiscal year ended July 31, 2014, we utilized these reserves to produce a majority of the sorbent products that we sold.

Proven reserves are those reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from results of detailed sampling, and (b) the sites for inspection,

8

sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well established. Probable reserves are computed from information similar to that used for proven reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. We employ geologists and mineral specialists who estimate and evaluate existing and potential reserves in terms of quality, quantity and availability.

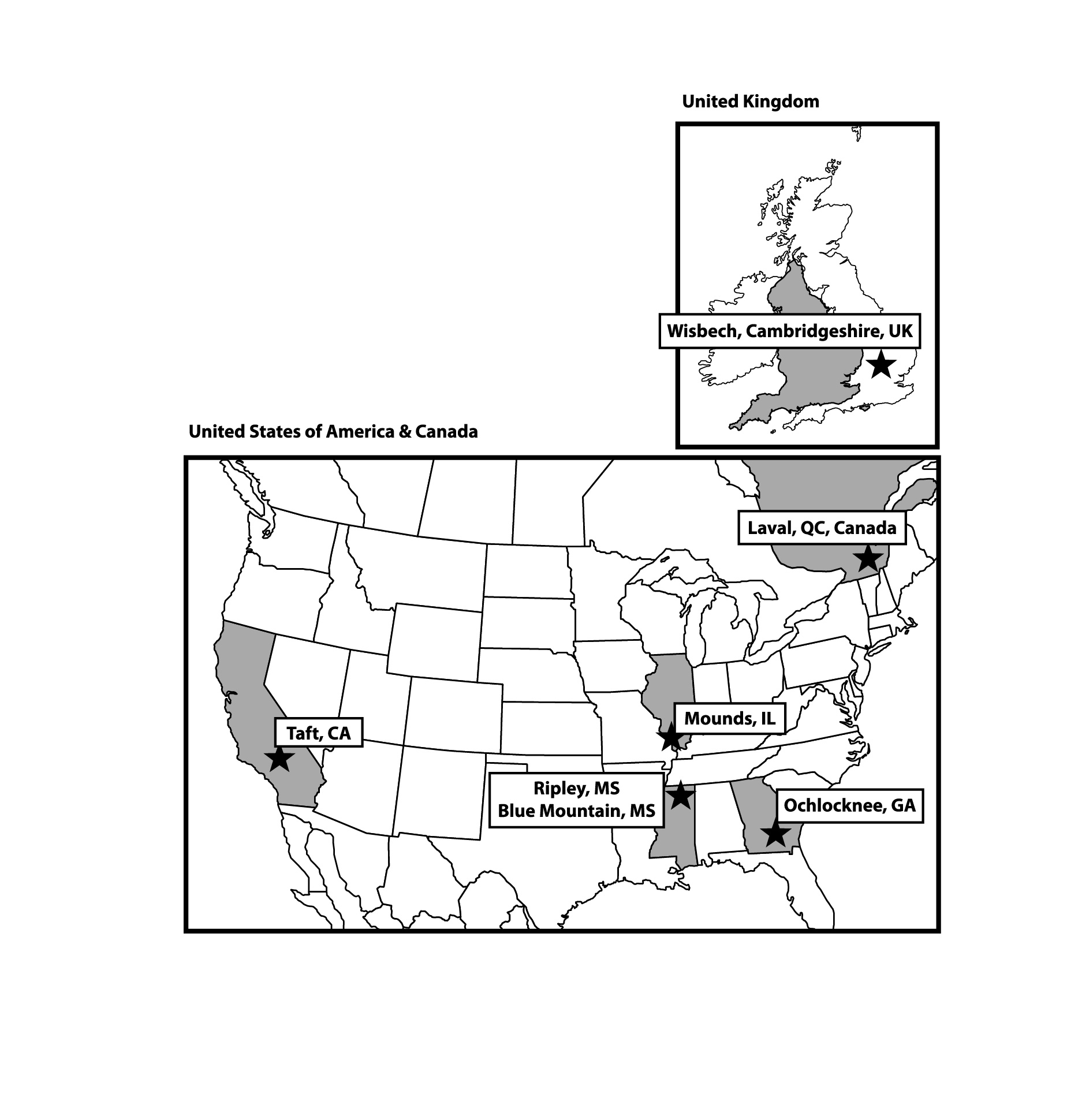

MINING OPERATIONS

We have conducted mining operations in Ripley, Mississippi since 1963, in Ochlocknee, Georgia since 1968, in Blue Mountain, Mississippi since 1989, in Mounds, Illinois since 1998 and in Taft, California since 2002. Our clay is surface mined on a year-round basis, generally using large earth moving scrapers, bulldozers, or excavators and off-road trucks to remove overburden (non-usable material), and then loaded into dump trucks with backhoes or front end loaders for movement to the processing facilities. The mining and hauling of our clay is performed by us and by independent contractors. Our current operating mines range in distance from immediately adjacent to approximately 13 miles from the related processing plants. Processing facilities are generally accessed from the mining areas by private roads and in some instances by public highways. Each of our processing facilities maintains inventories of unprocessed clay of approximately one week of production requirements. See Item 2 “Properties” below for additional information regarding our mining properties and operations.

The following schedule summarizes the net book value of land and other plant and equipment for each of our manufacturing facilities:

| Land & Mineral Rights | Plant and Equipment | |||||||

| (in thousands) | ||||||||

| Ochlocknee, Georgia | $ | 8,646 | $ | 29,059 | ||||

| Ripley, Mississippi | $ | 1,770 | $ | 10,212 | ||||

| Mounds, Illinois | $ | 1,545 | $ | 1,506 | ||||

| Blue Mountain, Mississippi | $ | 878 | $ | 10,538 | ||||

| Taft, California | $ | 1,506 | $ | 3,203 | ||||

EMPLOYEES

As of July 31, 2014, we employed 793 persons, 47 of whom were employed by our foreign subsidiaries. We believe our corporate offices, research and development center and manufacturing facilities are adequately staffed and no material labor shortages are anticipated. Approximately 45 of our employees in the U.S. and approximately 22 of our employees in Canada are represented by labor unions, with whom we have entered into separate collective bargaining agreements. We consider our employee relations to be satisfactory.

ENVIRONMENTAL COMPLIANCE

Our mining and manufacturing operations and facilities in Georgia, Mississippi, California and Illinois are required to comply with state surface mining and environmental protection statues. These domestic locations and our Canadian operations are subject to various federal, state and local statutes, regulations and ordinances which govern the discharge of materials, water and waste into the environment or otherwise regulate our operations. In recent years, environmental regulation has grown increasingly stringent, a trend that we expect will continue. We endeavor to be in compliance at all times and in all material respects with all applicable environmental controls and regulations. As a result, expenditures relating to environmental compliance have increased over the years; however, these expenditures have not been material. As part of our ongoing environmental compliance activities, we incur expenses in connection with reclaiming mining sites. Historically, reclamation expenses have not had a material effect on our cost of sales.

In addition to the environmental requirements relating to our mining and manufacturing operations and facilities, there is increasing federal and state regulation with respect to the content, labeling, use, and disposal after use of various products that we sell. We endeavor to be in compliance at all times and in all material respects with those regulations and to assist our customers in that compliance.

9

We cannot assure that, despite all commercially reasonable efforts, we will always be in compliance in all material respects with all applicable environmental regulations or with requirements regarding the content, labeling, use, and disposal after use of our products; nor can we assure that from time to time enforcement of such requirements will not have a material adverse effect on our business. See Item 1A “Risk Factors” below for a discussion of these and other risks to our business.

ENERGY

We primarily used natural gas in the processing of our clay products during fiscal 2014. We have the ability to switch among various energy sources, including natural gas, recycled oil and coal as permitted. See Item 7A “Quantitative and Qualitative Disclosures About Market Risk” below for more information about commodity risk with respect to our energy use.

RESEARCH AND DEVELOPMENT

At our research and development facility in Vernon Hills, Illinois, we develop new products and applications and improve existing products. The facility’s staff (and various consultants they engage from time to time) may consist of geologists, mineralogists and chemists. In the past several years, our research efforts have resulted in a number of new sorbent products and processes. The facility produces prototype samples and tests new products for customer trial and evaluation. No significant research and development was customer sponsored, and all research and development costs are expensed in the period in which incurred. See Note 1 of the Notes to the Consolidated Financial Statements for further information about research and development expenses.

AVAILABLE INFORMATION

This Annual Report on Form 10-K, as well as our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to all of the foregoing reports, are made available free of charge on or through the “Investor Information” section of our website at www.oildri.com as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC.

Information related to corporate governance at Oil-Dri, including its Code of Ethics and Business Conduct, information concerning executive officers, directors and Board committees, and transactions in Oil-Dri securities by directors and executive officers, is available free of charge on or through the “Investor Information” section of our website at www.oildri.com. The information on our website in not included as a part of, nor incorporated by reference into, this Annual Report on Form 10-K.

10

ITEM 1A – RISK FACTORS

We seek to identify, manage and mitigate risks to our business, but risk and uncertainty cannot be eliminated or necessarily predicted. You should consider the following factors carefully, in addition to other information contained in this Annual Report on Form 10-K, before making an investment decision with respect to our securities.

Risks Related to our Business

Our future growth and financial performance depend in large part on successful new product introductions.

A significant portion of our net sales comes from the sale of products in mature categories, some of which have had little or no volume growth or have had volume declines in recent fiscal years. Our future growth and financial performance will require that we successfully introduce new products or extend existing product offerings to meet emerging customer needs, technological trends and product market opportunities. We cannot be certain that we will achieve these goals. The development and introduction of new products generally require substantial and effective research, development and marketing expenditures, some or all of which may be unrecoverable if the new products do not gain market acceptance. New product development itself is inherently risky, as research failures, competitive barriers arising out of the intellectual property rights of others, launch and production difficulties, customer rejection and unexpectedly short product life cycles may occur even after substantial effort and expense on our part. Even in the case of a successful launch of a new product, the ultimate benefit we realize may be uncertain if the new product “cannibalizes” sales of our existing products beyond expected levels.

We face intense competition in our markets.

Our markets are highly competitive and we expect that both direct and indirect competition will increase in the future. Our overall competitive position depends on a number of factors including price, customer service, marketing, technical support, product quality and delivery. Some of our competitors, particularly in the sale of cat litter (the largest product in our Retail and Wholesale Products Group), have substantially greater financial resources or market presence and have established brands. The competition in the future may, in some cases, result in price reductions, reduced margins or loss of market share or product distribution, any of which could materially and adversely affect our business, operating results and financial condition. If we fail to compete successfully based on these or other factors, our business, financial condition and future financial results could be materially and adversely affected.

Our periodic results may be volatile.

Our operating results have varied on a quarterly basis during our operating history and are likely to fluctuate significantly in the future. Our expense levels are based, in part, on our expectations regarding future net sales, and many of our expenses are fixed, particularly in the short term. We may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Any significant shortfall of net sales in relation to our expectations could negatively affect our quarterly operating results. Our operating results may be below the expectations of our investors as a result of a variety of factors, many of which are outside our control. Factors that may affect our quarterly operating results include:

| • | fluctuating demand for our products and services; |

| • | size and timing of sales of our products and services; |

| • | the mix of products with varying profitability sold in a given quarter; |

| • | changes in our operating costs including raw materials, energy, transportation, packaging, overburden removal, trade spending and marketing, wages and other employee-related expenses such as health care costs, and other costs; |

| • | our ability to anticipate and adapt to rapidly changing conditions; |

| • | introduction of new products and services by us or our competitors; |

| • | our ability to successfully implement price increases and surcharges, as well as other changes in our pricing policies or those of our competitors; |

| • | variations in purchasing patterns by our customers, including due to weather conditions; |

| • | the ability of major customers and other debtors to meet their obligations to us as they come due; |

| • | our ability to successfully manage regulatory, intellectual property, tax and legal matters; |

| • | the incurrence of restructuring, impairment or other charges; and |

| • | general economic conditions and specific economic conditions in our industry and the industries of our customers. |

Accordingly, we believe that quarter-to-quarter comparisons of our operating results are not necessarily meaningful. Investors should not rely on the results of one quarter as an indication of our future performance.

11

Acquisitions involve a number of risks, any of which could cause us not to realize the anticipated benefits.

We intend from time to time to strategically explore potential opportunities to expand our operations and reserves through acquisitions. Identification of good acquisition candidates is difficult and highly competitive. If we are unable to identify attractive acquisition candidates, complete acquisitions, and successfully integrate the companies, businesses or properties that we acquire, our profitability may decline and we could experience a material adverse effect on our business, financial condition, or operating results. Acquisitions involve a number of inherent risks, including:

| • | uncertainties in assessing the value, strengths, and potential profitability of acquisition candidates, and in identifying the extent of all weaknesses, risks, contingent and other liabilities (including environmental, legacy product or mining safety liabilities) of those candidates; |

| • | the potential loss of key customers, management and employees of an acquired business; |

| • | the ability to achieve identified operating and financial synergies anticipated to result from an acquisition; |

| • | problems that could arise from the integration of the acquired business; and |

| • | unanticipated changes in business, industry or general economic conditions that affect the assumptions underlying our rationale for pursuing the acquisition. |

Any one or more of these factors could cause us not to realize the benefits we anticipate to result from an acquisition. Moreover, acquisition opportunities we pursue could materially affect our liquidity and capital resources and may require us to incur indebtedness, seek equity capital or both. In addition, future acquisitions could result in our assuming more long-term liabilities relative to the value of the acquired assets than we have assumed in our previous acquisitions.

We depend on a limited number of customers for a large portion of our net sales.

A limited number of customers account for a large percentage of our net sales, as described in Item 1 “Business” above. The loss of, or a substantial decrease in the volume of, purchases by Walmart, Clorox or any of our other top customers would harm our sales and profitability. In addition, an adverse change in the terms of our dealings with, or in the financial wherewithal or viability of, one or more of our significant customers could harm our business, financial condition and results of operations.

We expect that a significant portion of our net sales will continue to be derived from a small number of customers and that the percentage of net sales represented by these customers may increase. As a result, changes in the strategies of our largest customers may reduce our net sales. These strategic changes may include a reduction in the number of brands or variety of products they carry or a shift of shelf space to private label products or increased use of global or centralized procurement initiatives. In addition, our business is based primarily upon individual sales orders placed by customers rather than contracts with a fixed duration. Accordingly, most of our customers could reduce their purchasing levels or cease buying products from us on relatively short notice. While we do have long-term contracts with certain of our customers, including Clorox, even these agreements are subject to termination in certain circumstances. In addition, the degree of profit margin contribution of our significant customers varies. If a significant customer with a more favorable profit margin was to terminate its relationship with us or shift its mix of product purchases to lower-margin products, it would have a disproportionately adverse impact on our results of operations.

Price or trade concessions, or the failure to make them to retain customers, could adversely affect our sales and profitability.

The products we sell are subject to significant price competition. From time to time, we may need to reduce the prices for some of our products to respond to competitive and customer pressures and to maintain market share. These pressures are often exacerbated during an economic downturn. Any reduction in prices to respond to these pressures would reduce our profit margins. In addition, if our sales volumes fail to grow sufficiently to offset any reduction in margins, our results of operations would suffer. Because of the competitive environment facing many of our customers, particularly our high-volume mass merchandiser customers, these customers have increasingly sought to obtain price reductions, specialized packaging or other concessions from product suppliers. These business demands may relate to inventory practices, logistics or other aspects of the customer-supplier relationship. To the extent we provide these concessions, our profit margins are reduced. Further, if we are unable to maintain terms that are acceptable to our customers, these customers could reduce purchases of our products and increase purchases of products from our competitors, which would harm our sales and profitability.

12

Increases in energy and other commodity prices would increase our operating costs, and we may be unable to pass all these increases on to our customers in the form of higher prices and surcharges.

If our energy costs increase disproportionately to our net sales, our earnings could be significantly reduced. Increases in our operating costs may reduce our profitability if we are unable to pass all the increases in energy and other commodity prices on to our customers through price increases or surcharges. Sustained price increases or surcharges in turn may lead to declines in volume, and while we seek to project tradeoffs between price increases and surcharges, on the one hand, and volume, on the other, there can be no assurance that our projections will prove to be accurate.

We are subject to volatility in the price and availability of natural gas, as well as other sources of energy. In the past, we have endeavored to reallocate a portion of our energy needs among different sources of energy due to seasonal supply limitations and the higher cost of one particular fuel relative to other fuels; however, there can be no assurance that we will be able to effectively reallocate among different fuels in the future. From time to time, we may use forward purchase contracts or financial instruments to hedge the volatility of a portion of our energy costs. The success or failure of any such hedging transactions depends on a number of factors, including our ability to anticipate and manage volatility in energy prices, the general demand for fuel by the manufacturing sector, seasonality and the weather patterns throughout the United States and the world.

The prices of other commodities such as paper, plastic resins, synthetic rubber, raw materials and steel significantly influence the costs of packaging, replacement parts and equipment we use in the manufacture of our products and the maintenance of our facilities. As a result, increases in the prices of these commodities generally increase the costs of the related materials we use. These increased materials costs present the same types of risks as described above with respect to increased energy costs.

Our business could be negatively affected by supply, capacity, information technology and logistics disruptions.

Supply, capacity, information technology and logistics disruptions could adversely affect our ability to manufacture, package or transport our products. Some of our products require raw materials that are provided by a limited number of suppliers, or are demanded by other industries or are simply not available at times. Also, some of our products are manufactured on equipment at or near its capacity thus limiting our ability to sell additional volumes of such products until more capacity is obtained. Moreover, disruptions or failures in our information technology or phone systems could adversely affect our communications and business operations. In addition, an increase in truck or ocean freight costs may reduce our profitability if we are unable to pass such increases on to our customers through price increases or surcharges, and a decrease in transportation availability may affect our ability to deliver our products to our customers and consequently decrease customer satisfaction and future orders.

Reductions in inventory by our customers could adversely affect our sales and increase our inventory risk.

From time to time, customers in both our Retail and Wholesale Products Group and our Business to Business Products Group have reduced inventory levels as part of managing their working capital requirements. Any reduction in inventory levels by our customers would harm our operating results for the financial periods affected by the reductions. In particular, continued consolidation within the retail industry could potentially reduce inventory levels maintained by our retail customers, which could adversely affect our results of operations for the financial periods affected by the reductions.

The value of our inventory may decline as a result of surplus inventory, packaging changes driven by regulatory requirements or market refreshment, price reductions or obsolescence. We must identify the right product mix and maintain sufficient inventory on hand to meet customer orders. Failure to do so could adversely affect our revenue and operating results. If circumstances change (for example, an unexpected shift in market demand, pricing or customer defaults) there could be a material impact on the net realizable value of our inventory. We maintain an inventory valuation reserve account against diminution in the value or saleability of our inventory; however, there is no guaranty that these arrangements will be sufficient to avoid write-offs in excess of our reserves.

Environmental, health and safety matters create potential compliance and other liability risks.

We are subject to a variety of federal, state, local and foreign laws and regulatory requirements relating to the environment and to health and safety matters. For example, our mining operations are subject to extensive governmental regulation on matters such as permitting and licensing requirements, workplace safety, plant and wildlife protection, wetlands and other environmental protection, reclamation and restoration of mining properties after mining is completed, the discharge of materials into the environment, and the effects that mining has on groundwater quality and availability. We believe we have obtained all material permits and licenses required to conduct our present operations. We will, however, need additional permits and renewals of permits in the future.

13

The expense, liabilities and requirements associated with environmental, health and safety laws and regulations are costly and time-consuming and may delay commencement or continuation of exploration, mining or manufacturing operations. We have incurred, and will continue to incur, significant capital and operating expenditures and other costs in complying with environmental, health and safety laws and regulations. In recent years, regulation of environmental, health and safety matters has grown increasingly stringent, a trend that we expect will continue. Substantial penalties may be imposed if we violate certain of these laws and regulations even if the violation was inadvertent or unintentional. Failure to maintain or achieve compliance with these laws and regulations or with the permits required for our operations could result in substantial operating costs and capital expenditures, in addition to fines and administrative, civil or criminal sanctions, third-party claims for property damage or personal injury, cleanup and site restoration costs and liens, the issuance of injunctions to limit or cease operations, the suspension or revocation of permits and other enforcement measures that could have the effect of limiting our operations. Under the “joint and several” liability principle of certain environmental laws, we may be held liable for all remediation costs at a particular site and the amount of that liability could be material. In addition, future environmental laws and regulations could restrict our ability to expand our facilities or extract our existing reserves or could require us to acquire costly equipment or to incur other significant expenses in connection with our business. There can be no assurance that future events, including changes in any environmental requirements and the costs associated with complying with such requirements, will not have a material adverse effect on us.

Government regulation imposes significant costs on us, and future regulatory changes (or related customer responses to regulatory changes) could increase those costs or limit our ability to produce and sell our products.

In addition to the regulatory matters described above, our operations are subject to various federal, state, local and foreign laws and regulations relating to the manufacture, packaging, labeling, content, storage, distribution and advertising of our products and the conduct of our business operations. For example, in the United States, some of our products are regulated by the Food and Drug Administration, the Consumer Product Safety Commission and the Environmental Protection Agency and our product claims and advertising are regulated by the Federal Trade Commission. Most states have agencies that regulate in parallel to these federal agencies. In addition, our international sales and operations are subject to regulation in each of the foreign jurisdictions in which we manufacture, distribute or sell our products. There is increasing federal and state regulation with respect to the content, labeling, use, and disposal after use of various products we sell. Throughout the world, but particularly in the United States and Europe, there is also increasing government scrutiny and regulation of the food chain and products entering or affecting the food chain.

If we are found to be out of compliance with applicable laws and regulations in these or other areas, we could be subject to loss of customers and to civil remedies, including fines, injunctions, recalls or asset seizures, as well as potential criminal sanctions, any of which could have a material adverse effect on our business. Loss of or failure to obtain necessary permits and registrations could delay or prevent us from meeting product demand, introducing new products, building new facilities or acquiring new businesses and could adversely affect operating results. If these laws or regulations are changed or interpreted differently in the future, it may become more difficult or expensive for us to comply. In addition, investigations or evaluations of our products by government agencies may require us to adopt additional labeling, safety measures or other precautions, or may effectively limit or eliminate our ability to market and sell these products. Accordingly, there can be no assurance that current or future governmental regulation will not have a material adverse effect on our business or that we will be able to obtain or renew required governmental permits and registrations in the future.

We are also experiencing increasing customer scrutiny of the content and manufacturing of our products, particularly our products entering or affecting the food chain, in parallel with the increasing government regulation discussed above. Our customers may impose product specifications or other requirements that are different from, and more onerous than, applicable laws and regulations. As a result, the failure of our products to meet these additional requirements may result in loss of customers and decreased sales of our products even in the absence of any actual failure to comply with applicable laws and regulations. There can be no assurance that future customer requirements concerning the content or manufacturing of our products will not have a material adverse effect on our business.

We depend on our mining operations for a majority of our supply of sorbent minerals.

Most of our principal raw materials are sorbent minerals mined by us or independent contractors on land that we own or lease. While our mining operations are conducted in surface mines, which do not present many of the risks associated with deep underground mining, our mining operations are nevertheless subject to many conditions beyond our control. Our mining operations are affected by weather and natural disasters, such as heavy rains and flooding, equipment failures and other unexpected maintenance problems, variations in the amount of rock and soil overlying our reserves, variations in geological conditions, fires and other accidents, fluctuations in the price or availability of supplies and other matters. Any of these risks could result in significant damage to our mining properties or processing facilities, personal injury to our employees, environmental damage, delays in mining or

14

processing, losses or possible legal liability. We cannot predict whether or the extent to which we will suffer the impact of these and other conditions in the future.

We may not be successful in acquiring adequate additional reserves in the future.

We have an ongoing program of exploration for additional reserves on existing properties as well as through the potential acquisition of new owned or leased properties; however, there can be no assurance that our attempts to acquire additional reserves in the future will be successful. Our ability to acquire additional reserves in the future could be limited by competition from other companies for attractive properties, the lack of suitable properties that can be acquired on terms acceptable to us or restrictions under our existing or future debt facilities. We may not be able to negotiate new leases or obtain mining contracts for properties containing additional reserves or renew our leasehold interests in properties on which operations are not commenced during the term of the lease. Also, requirements for environmental compliance may restrict exploration or use of lands that might otherwise be utilized as a source of reserves.

The loss of any key member of our senior management team may impede the implementation of our business plans in a timely manner.

The execution of our business plans depends in part upon the continued service of our senior management team, who possess unique and extensive industry knowledge and experience. The loss or other unavailability of one or more of the key members of our senior management team could adversely impact our ability to manage our operations effectively and/or pursue our business strategy. No company-owned life insurance coverage has been obtained on these team members.

We face risks as a result of our international sales and business operations.

We derived approximately 21% of our net sales from sales outside of the United States in the fiscal year ended July 31, 2014. Our ability to sell our products and conduct our operations outside of the United States is subject to a number of risks. Local economic, political and labor conditions in each country could adversely affect demand for our products or disrupt our operations in these markets, particularly when local political and economic conditions are unstable. In addition, international sales and operations are subject to currency exchange fluctuations, fund transfer and trade restrictions and import/export duties, and international operations are subject to foreign regulatory requirements and issues, including with respect to environmental matters. Any of these matters could result in sudden, and potentially prolonged, changes in demand for our products. Also, we may have difficulty enforcing agreements and collecting accounts receivable through a foreign country’s legal system.

We may incur adverse safety events or product liability claims that may be costly, create adverse publicity and may add further governmental regulation.

If any of the products that we sell cause, or appear to cause, harm to any of our customers or to consumers, we could be exposed to product liability lawsuits, heightened regulatory scrutiny, requirements for additional labeling, withdrawal of products from the market, imposition of fines or criminal penalties or other governmental actions. Any of these actions could result in material write-offs of inventory, material impairments of intangible assets, goodwill and fixed assets, material restructuring charges and other adverse impacts on our business operations. We cannot predict with certainty the eventual outcome of any pending or future litigation, and we could be required to pay substantial judgments or settlements against us or change our product formulations in response to governmental action. Further, lawsuits can be expensive to defend, whether or not they have merit, and the defense of these actions may divert the attention of our management and other resources that would otherwise be engaged in managing our business and our reputation could suffer, any of which could harm our business.

Failure to maintain effective internal control over financial reporting could have a material adverse effect on our business, operating results and stock price.

Section 404 of the Sarbanes-Oxley Act and related SEC rules require that we perform an annual management assessment of the design and effectiveness of our internal control over financial reporting and obtain an opinion from our independent registered public accounting firm on our internal control over financial reporting. Our assessment concluded that our internal control over financial reporting was effective as of July 31, 2014 and we obtained from our independent registered public accounting firm an unqualified opinion on our internal control over financial reporting; however, there can be no assurance that we will be able to maintain the adequacy of our internal control over financial reporting, as such standards are modified, supplemented or amended from time to time in future periods. Accordingly, we cannot assure that we will be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal control is necessary for us to produce reliable financial reports and is important to help prevent financial fraud.

15

If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our Common Stock could drop significantly.

Risks Related to Our Common Stock

Our principal stockholders have the ability to control matters requiring a stockholder vote and could delay, deter or prevent a change in control of our company.

Under our Certificate of Incorporation, the holders of our Common Stock are entitled to one vote per share and the holders of our Class B Stock are entitled to ten votes per share; the two classes generally vote together without regard to class (except that any amendment to our Certificate of Incorporation changing the number of authorized shares or adversely affecting the rights of Common Stock or Class B Stock requires the separate approval of the class so affected as well as the approval of both classes voting together). As a result, the holders of our Class B Stock exert control over us and thus limit the ability of other stockholders to influence corporate matters. Beneficial ownership of Common Stock and Class B Stock by Jaffee Investment Partnership, L.P. and its affiliates (including Richard M. Jaffee, our Chairman, and Daniel S. Jaffee, his son and our President and Chief Executive Officer) provides them with the ability to control the election of our Board of Directors and the outcome of most matters requiring the approval of our stockholders, including the amendment of certain provisions of our Certificate of Incorporation and By-Laws, the approval of any equity-based employee compensation plans and the approval of fundamental corporate transactions, including mergers and substantial asset sales. Through their concentration of voting power, our principal stockholders may be able to delay, deter or prevent a change in control of our company or other business combinations that might otherwise be beneficial to our other stockholders.

We are a “controlled company” within the meaning of the New York Stock Exchange (“NYSE”) rules and, as a result, qualify for, and intend to rely on, exemptions from certain corporate governance requirements.

We are a “controlled company” under the New York Stock Exchange Corporate Governance Standards. As a controlled company, we may rely on exemptions from certain NYSE corporate governance requirements that otherwise would be applicable, including the requirements:

| • | that a majority of the board of directors consists of independent directors; |

| • | that we have a nominating and governance committee comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| • | that we have a compensation committee comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| • | that we include in our proxy statements certain information regarding compensation consultants and related conflicts of interest; and |

| • | that we conduct an annual performance evaluation of the nominating and corporate governance and compensation committees. |

We have previously relied on these exemptions, and we intend to continue to rely on them in the future. As a result, you may not have the same benefits and information available to stockholders of NYSE-listed companies that are subject to all of the NYSE corporate governance requirements.

The market price for our Common Stock may be volatile.

In recent periods, there has been volatility in the market price for our Common Stock. Furthermore, the market price of our Common Stock could fluctuate substantially in the future in response to a number of factors, including the following:

| • | fluctuations in our quarterly operating results or the operating results of our competitors; |

| • | changes in general conditions in the economy, the financial markets, or the industries in which we operate; |

| • | announcements of significant acquisitions, strategic alliances or joint ventures by us, our customers or our competitors; |

| • | introduction of new products or services; |

| • | increases in the price of energy sources and other raw materials; and |

| • | other developments affecting us, our industries, customers or competitors. |

In addition, in recent years the stock market has experienced extreme price and volume fluctuations. This volatility has had a significant effect on the market prices of securities issued by many companies for reasons unrelated to their operating performance. These broad market fluctuations may materially adversely affect our Common Stock price, regardless of our operating results. Given its relatively small public float, number of shareholders and average daily trading volume, our Common Stock may be

16

relatively more susceptible to volatility arising from any of these factors. There can be no assurance that the price of our Common Stock will increase in the future or be maintained at its recent levels.

Future sales of our Common Stock could depress its market price.

Future sales of shares of our Common Stock could adversely affect its prevailing market price. If our officers, directors or significant stockholders sell a large number of shares, or if we issue a large number of shares, the market price of our Common Stock could significantly decline. Moreover, the perception in the public market that stockholders might sell shares of Common Stock could depress the market for our Common Stock. Our Common Stock’s relatively small public float and average daily trading volume may make it relatively more susceptible to these risks.

ITEM 1B – UNRESOLVED STAFF COMMENTS

None.

17

ITEM 2 – PROPERTIES

Real Property Holdings and Mineral Reserves

Land Owned | Land Leased | Land Unpatented Claims | Total | Estimated Proven Reserves | Estimated Probable Reserves | Total | |||||||||||||||

| (acres) | (thousands of tons) | ||||||||||||||||||||

| California | 795 | — | 1,030 | 1,825 | 4,367 | 11,226 | 15,593 | ||||||||||||||

| Georgia | 3,707 | 1,840 | — | 5,547 | 35,423 | 24,891 | 60,314 | ||||||||||||||

| Illinois | 82 | 598 | — | 680 | 3,468 | — | 3,468 | ||||||||||||||

| Mississippi | 2,156 | 999 | — | 3,155 | 79,004 | 93,253 | 172,257 | ||||||||||||||

| Nevada | 535 | — | — | 535 | 23,316 | 2,976 | 26,292 | ||||||||||||||

| Oregon | 340 | — | — | 340 | — | 25 | 25 | ||||||||||||||

| Tennessee | 178 | — | — | 178 | 3,000 | 3,000 | 6,000 | ||||||||||||||

| 7,793 | 3,437 | 1,030 | 12,260 | 148,578 | 135,371 | 283,949 | |||||||||||||||

The Mississippi, Georgia, Tennessee, Nevada, California and Illinois properties are primarily mineral in nature, except our research and development facility which is included in the Illinois owned land. We mine sorbent minerals primarily consisting of montmorillonite and attapulgite and, to a lesser extent, other clay-like sorbent materials, such as Antelope shale. We employ geologists and mineral specialists who prepared the estimated reserves of these minerals in the table above. See also Item 1 “Business” above for further information about our reserves. The locations in the table above collectively produced approximately 857,000 tons of finished product in fiscal 2014, 794,000 tons in fiscal 2013 and 824,000 tons in fiscal 2012. Parcels of such land are also sites of manufacturing facilities operated by us. We own approximately one acre of land in Laval, Quebec, Canada, which is the site of the processing and packaging facility for our Canadian subsidiary.

MINING PROPERTIES

Our mining operations are conducted on land that we own or lease. The Georgia, Illinois and Mississippi mining leases generally require that we pay a minimum monthly rent to continue the lease term. The rental payments are generally applied against a stated royalty related to the number of unprocessed, or in some cases processed, tons of minerals extracted from the leased property. Many of our mining leases have no stated expiration dates. Some of our leases, however, do have expiration dates ranging from 2023 to 2097. We would not experience a material adverse effect from the expiration or termination of any of these leases. We have a variety of access arrangements, some of which are styled as leases, for manufacturing at facilities that are not contiguous with the related mines. We would not experience a material adverse effect from the expiration or termination of any of these arrangements. See also Item 1 “Business” above for further information on our reserves.

Certain of our land holdings in California are represented by unpatented mining claims we lease from the Bureau of Land Management. These leases generally give us the contractual right to conduct mining or processing activities on the land covered by the claims. The validity of title to unpatented claims, however, is dependent upon numerous factual matters. We believe the unpatented claims we lease are in compliance with all applicable federal, state and local mining laws, rules and regulations. Future amendments to existing federal mining laws, however, could have a prospective effect on mining operations on federal lands and include, among other changes, the imposition of royalty fees on the mining of unpatented claims, the elimination or restructuring of the patent system and an increase in fees for the maintenance of unpatented claims. To the extent that future proposals may result in the imposition of royalty fees on unpatented lands, the mining of our unpatented claims may become economically unfavorable. We cannot predict the form that any such amendments might take or whether or when such amendments might be adopted. In addition, the construction and operation of processing facilities on these sites would require the approval of federal, state and local regulatory authorities. See Item 1A “Risk Factors” above for a discussion of other risks to our business related to our mining properties.

18

MINING AND MANUFACTURING METHODS

Mining and Hauling

We mine clay in open-pit mines in Georgia, Mississippi, Illinois and California. The mining and hauling operations are similar throughout the Oil-Dri locations, with the exception of California. The land to be mined is first stripped. The stripping process involves removing the overburden and preparing the site to allow the excavators to reach the desired clay. When stripping is completed, the excavators dig out and load the clay onto dump trucks. The trucks haul the clay directly to our processing plants where it is dumped in a clay yard and segregated by clay type if necessary. Generally, the mine sites are in close proximity to the processing plants; however, the maximum distance the clay is currently hauled to a plant is approximately 13 miles.

At our California mines the clay is excavated and hauled to a hopper. An initial crushing and screening operation is performed at the mine site before the trucks are loaded for delivery to the processing plant.

Processing

The processing of our clay varies depending on the level of moisture desired in the clay after the drying process. The moisture level is referred to as regular volatile moisture (“RVM”) or low volatile moisture (“LVM”).

RVM Clay: A front end loader is used to load the clay from the clay yard into the primary crusher. The primary crusher reduces the clay chunks to 2.0 inches in diameter or smaller. From the crusher, the clay is transported via a belt conveyor into the clay shed. A clay shed loader feeds the clay into a disintegrator which reduces the clay to particles 0.5 inches in diameter or smaller. The clay then feeds directly into the RVM kiln. The RVM kiln reduces the clay’s moisture content. From the RVM kiln, the clay moves through a series of mills and screens which further size and separate the clay into the desired particle sizes. The sized clay is then conveyed into storage tanks. The RVM processed clay can then be packaged or processed into LVM material.

LVM Clay: RVM clay is fed from storage tanks into the LVM kiln where the moisture content is further reduced. The clay then proceeds into a rotary cooler, then on to a screening circuit which separates the clay into the desired particle sizes.

In addition, certain other products may go through further processing or the application of fragrances and additives. For example, certain fluid purification and animal health products are processed into a powder form. We also use a proprietary process for our engineered granules to create spherical, uniform-sized granules.

Packaging

Once the clay has been dried to the desired level it will be sized and packaged. Our products have package sizes ranging from bags, boxes and jugs of cat litter to railcars of agricultural products. We also package some of our products into bulk (approximately one ton) bags or into bulk trucks. The size and delivery configuration of our finished products is determined by customer requirements.

19

FACILITIES

We operate clay manufacturing and non-clay production facilities on property owned or leased by us as shown on the map below:

Oil-Dri Corporation of America Plant Site Locations

| Location | Owned/Leased | Function |

| Alpharetta, Georgia | Leased | Non-clay manufacturing and packaging, sales, customer service |

| Bentonville, Arkansas | Leased | Sales office |

| Blue Mountain, Mississippi | Owned | Manufacturing and packaging |

| Chicago, Illinois | Leased | Principal executive office |

| Coppet, Switzerland | Leased | Customer service office |

| Laval, Quebec, Canada | Owned | Non-clay manufacturing and clay and non-clay packaging, sales |

| Mounds, Illinois | Owned | Manufacturing and packaging |

| Ochlocknee, Georgia | Owned | Manufacturing and packaging |

| Ripley, Mississippi | Owned | Manufacturing and packaging |

| Shenzhen, China | Leased | Sales office, customer service |

| Taft, California | Owned | Manufacturing and packaging |

| Vernon Hills, Illinois | Owned | Research and development |

| Wisbech, United Kingdom | Leased | Non-clay production and clay and non-clay packaging, sales, customer service |

We have no mortgages on the real property we own. The lease for the Shenzhen, China office expires in 2015 and the Bentonville, Arkansas office lease expires in 2016. The leases for the Alpharetta, Georgia facility and the Chicago, Illinois corporate office space expire in 2018. The Wisbech, United Kingdom facility lease expires in 2032. The lease for the Coppet, Switzerland office is on a year-to-year basis. We consider that our properties are generally in good condition, well maintained and suitable and adequate to carry on our business.

20

ITEM 3 – LEGAL PROCEEDINGS

We are party to various legal actions from time to time that are ordinary in nature and incidental to the operation of our business. While it is not possible at this time to determine with certainty the ultimate outcome of these lawsuits, we believe that none of the pending proceedings will have a material adverse effect on our business or financial condition.

ITEM 4 – MINE SAFETY DISCLOSURE

Our mining operations are subject to regulation by the Mine Safety and Health Administration under authority of the Federal Mine Safety and Health Act of 1977, as amended. Information concerning mine safety violations or other regulatory matters required by section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 104 of Regulation S-K is included in Exhibit 95 to this Annual Report on Form 10-K.

21

PART II

ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our Common Stock is traded on the NYSE under the symbol ODC. There is no established trading market for our Class B Stock. There are no shares of Class A Common Stock currently outstanding. See Note 8 of the Notes to the Consolidated Financial Statements for a description of our Common Stock, Class B Stock and Class A Common Stock. The number of holders of record of Common Stock and Class B Stock on September 30, 2014 were 642 and 29, respectively, as reported by our transfer agent. In the last three years, we have not sold any securities which were not registered under the Securities Act of 1933.

The following table sets forth, for the periods indicated, the high and low sales price for our Common Stock listed on the NYSE and dividends per share declared on our Common Stock and Class B Stock.

Common Stock Price Range | Cash Dividends Per Share | |||||||||||||||

| Low | High | Common Stock | Class B Stock | |||||||||||||

| Fiscal 2014: | ||||||||||||||||

| First Quarter | $ | 30.35 | $ | 36.80 | $ | 0.1900 | $ | 0.1425 | ||||||||

| Second Quarter | $ | 32.90 | $ | 41.74 | 0.1900 | 0.1425 | ||||||||||

| Third Quarter | $ | 31.24 | $ | 36.27 | 0.1900 | 0.1425 | ||||||||||

| Fourth Quarter | $ | 28.71 | $ | 34.90 | 0.2000 | 0.1500 | ||||||||||

| Total | $ | 0.7700 | $ | 0.5775 | ||||||||||||

| Fiscal 2013: | ||||||||||||||||

| First Quarter | $ | 21.26 | $ | 23.77 | $ | 0.1800 | $ | 0.1350 | ||||||||

| Second Quarter | $ | 20.82 | $ | 30.34 | 0.3600 | 0.2700 | ||||||||||

| Third Quarter | $ | 23.92 | $ | 28.52 | — | — | ||||||||||

| Fourth Quarter | $ | 25.30 | $ | 32.40 | 0.1900 | 0.1425 | ||||||||||

| Total | $ | 0.7300 | $ | 0.5475 | ||||||||||||