The investment securities purchased with borrowed funds had a higher overall yield than the Bank’s existing securities portfolio. This is the primary reason that the yield on the Bank’s taxable securities portfolio increased by 20 basis points when comparing 2008 to 2007.

Although net interest spread increased by 28 basis points in 2008, net interest margin declined by 11 basis points. The decline in net interest margin occurred largely because the margin on the borrowing and investing strategy is less than the margin on the balance of the Bank’s interest-earning assets and interest-bearing liabilities. In addition, the return on noninterest-bearing checking balances and capital decreased due to the lower yield on interest-earning assets. Excluding the borrowing and investing strategy, net interest margin for 2008 would have increased versus 2007 and the increase in net interest spread would have been greater.

Competition for deposits in the Bank’s market area could continue to exert downward pressure on net interest margin and net interest spread. Furthermore, new branch openings should cause the Bank’s overall cost of deposits to trend upward because new branches will have a competitively priced deposit base rather than a base consisting of a mix of historically and competitively priced deposits as found in the Bank’s established branches. The “Market Risk” section of this discussion and analysis of financial condition and results of operations includes a more complete discussion of the impact of interest rate movements on the Bank’s net interest income.

Net interest income on a tax-equivalent basis increased by $744,000, or from $39,292,000 in 2006 to $40,036,000 in 2007. The most significant reason for the growth in net interest income was that management used proceeds from the maturity and paydown of taxable securities to fund loan growth and thereby moved money from a lower to a higher yielding asset category. In 2007, average total loan balances grew by $61.4 million, or 14.7%, and represented 50.8% of average interest earning assets compared to 45.3% in 2006.

In 2007, the yield on interest-earning assets increased by 31 basis points. Important reasons for the increase were the shift from securities to loans, the purchase of securities at yields better than those currently in portfolio, and the better yields realized on securities purchased as part of the portfolio restructuring conducted late in 2006. The higher overall yield on interest-earning assets resulted in an increase in net interest income on those interest-earning assets funded by checking deposits and capital, since checking deposits and capital have no associated interest cost. Although checking balances decreased by approximately $3.2 million when comparing year-end 2007 to year-end 2006, on an average balance basis checking deposits were up by $6.2 million, or 1.9%, in 2007 versus 2006. Although competition in the Bank’s market area and higher interest rates have caused the rate of growth in checking deposits to trend down in recent years, a significant portion of the Bank’s interest-earning assets continues to be funded by such deposits.

As a partial offset to the increase in net interest income realized on interest-earning assets funded by checking deposits and capital, the Bank’s net interest spread declined by 21 basis points in 2007 thus causing a decrease in net interest income on those interest-earning assets funded by interest-bearing liabilities. Net interest spread declined in the presence of a yield curve characterized by short-term interest rates that were approximately the same or higher than intermediate and longer-term interest rates. This negatively impacted the Bank’s net interest spread because short-term interest rates are a key driver of the Bank’s deposit rates and intermediate and longer-term interest rates are key drivers of the yields that can be earned by the Bank on loans and securities. Net interest spread was also negatively impacted by increased competition for loans and deposits in the Bank’s market area which put upward pressure on deposit pricing, downward pressure on loan pricing and made core deposit growth challenging. With upward pressure on deposit pricing, funds migrated from the Bank’s lower yielding savings and money market products to its higher priced savings and money market products and competitively priced time deposits. This accounts for the downward trend in savings and money market balances and upward trend in time deposits experienced in recent years.

Noninterest income includes service charges on deposit accounts, Investment Management Division income, gains or losses on sales of securities, and all other items of income, other than interest, resulting from the business activities of the Corporation. Noninterest income increased by $699,000, or 12.5%, from $5,582,000 in 2007 to $6,281,000 in 2008. The increase is principally due to a $482,000 increase in net gains on sales of available-for-sale securities, a $198,000 increase in other noninterest income and a $102,000 increase in service charge income. The increase in other noninterest income is primarily attributable to small increases in miscellaneous consumer fees. Service charge income increased as a result of an increase in maintenance and activity charges.

Excluding net losses on sales of securities, noninterest income decreased by $117,000, or 2.0%, from $5,933,000 in 2006 to $5,816,000 in 2007. The decrease is primarily due to a decrease in service charge income of $179,000 largely caused by reductions in maintenance and activity and returned check charges.

Noninterest expense is comprised of salaries, employee benefits, occupancy and equipment expense and other operating expenses incurred in supporting the various business activities of the Corporation. Noninterest expense was $29,689,000 and $27,384,000 in 2008 and 2007, respectively, representing increases over prior year amounts of $2,305,000, or 8.4%, and $717,000, or 2.7%.

The increase in noninterest expense for 2008 is comprised of increases in other operating expenses of $730,000, or 13.7%, employee benefits expense of $608,000, or 15.2%, occupancy and equipment expense of $567,000, or 12.8%, and salaries of $400,000, or 2.9%. The increase in other operating expenses is largely attributable to a $458,000 increase in FDIC deposit insurance expense. Based on the FDIC’s base assessment rates for 2009 and a recently adopted emergency special assessment of 20 basis points on deposits as of June 30, 2009, the Bank currently estimates that its FDIC insurance expense will increase by approximately $2,800,000 in 2009. The increase in employee benefits expense is largely the result of an increase in retirement plan expense. Based primarily on the poor performance of the equity markets in 2008, pension expense will increase by approximately $1,025,000 in 2009. Occupancy and equipment expense increased primarily due to branch openings and branch expansion. The increase in salaries expense is due to normal annual salary adjustments, additions to staff related to branch expansion, and severance payments, as largely offset by staff reductions accomplished through attrition.

The increase in noninterest expense for 2007 is largely comprised of an increase in salaries of $1,074,000, or 8.5%, and an increase in occupancy and equipment expense of $379,000, or 9.4%, as partially offset by a decrease in employee benefits of $695,000, or 14.8%. In addition to normal salary adjustments, the increase in salaries expense principally resulted from an increase in lending and business development staff, staffing for new branches, and an increase in stock-based compensation expense. A significant reason for the increase in stock-based compensation expense is additional equity awards in 2007 as well as the timing and terms of such equity awards. The increase in occupancy and equipment expense is largely attributable to the opening of the Smithtown branch in the fourth quarter of 2006 and investments in new technology. Significant reasons for the decrease in employee benefits expense are the discontinuation of profit sharing contributions beginning in 2007 and a reduction in the number of SERP plan participants in 2007.

Income tax expense as a percentage of book income (“effective tax rate”) was 26.3% in 2008, 20.1% in 2007 and 19.9% in 2006. Despite state income taxes, the benefit of tax-exempt income causes the effective tax rate to be considerably lower than the statutory Federal income tax rate of 34%. The increase in the effective tax rate in 2008 is the result of the Corporation losing the tax benefit derived from its REIT entity and tax-exempt income now representing a smaller percentage of income before income taxes. The loss of the REIT tax benefit resulted from a change in New York State tax law effective January 1, 2008. In December 2008, the ownership of the REIT entity within the consolidated group was changed to once again obtain favorable tax treatment. This change, combined with the implementation of other tax planning strategies, should reduce 2009 taxes by approximately $800,000.

Application of Critical Accounting Policies

In preparing the consolidated financial statements, management is required to make estimates and assumptions that affect the reported asset and liability balances and revenue and expense amounts. Our determination of the allowance for loan losses is a critical accounting estimate because it is based on our subjective evaluation of a variety of factors at a specific point in time and involves difficult and complex judgments about matters that are inherently uncertain. In the event that management’s estimate needs to be adjusted based on, among other things, additional information that comes to light after the estimate is made or changes in circumstances, such adjustment could result in the need for a significantly different allowance for loan losses and thereby materially impact, either positively or negatively, the Bank’s results of operations.

The Bank’s Reserve Committee, which is chaired by the Senior Lending Officer, meets on a quarterly basis and is responsible for determining the allowance for loan losses after considering, among other things, the results of credit reviews performed by the Bank’s loan review officers. In addition, and in consultation with the Bank’s Chief Financial Officer, the Reserve Committee is responsible for implementing and maintaining policies and procedures surrounding the calculation of the required allowance. The Bank’s allowance for loan losses is subject to periodic examination by the Office of the Comptroller of the Currency, the Bank’s primary federal banking regulator, whose safety and soundness examination includes a determination as to its adequacy to absorb probable incurred losses.

The first step in determining the allowance for loan losses is to identify loans in the Bank’s portfolio that are individually deemed to be impaired. In doing so, subjective judgments need to be made regarding whether or not it is

35

probable that a borrower will be unable to pay all principal and interest due according to contractual terms. Once a loan is identified as being impaired, management uses the fair value of the underlying collateral and/or the discounted value of expected future cash flows to determine the amount of the impairment loss, if any, that needs to be included in the overall allowance for loan losses. In estimating the fair value of real estate collateral, management utilizes appraisals and also makes qualitative judgments based on, among other things, its knowledge of the local real estate market and analyses of current economic conditions. Estimating the fair value of collateral other than real estate is also subjective in nature and sometimes requires difficult and complex judgments. Determining expected future cash flows can be more subjective than determining fair values. Expected future cash flows could differ significantly, both in timing and amount, from the cash flows actually received over the loan’s remaining life.

In addition to estimating losses for loans individually deemed to be impaired, management also estimates collective impairment losses for pools of loans that are not specifically reviewed. Statistical information regarding the Bank’s historical loss experience over a period of time is the starting point in making such estimates. However, future losses could vary significantly from those experienced in the past and accordingly management periodically adjusts its historical loss experience to reflect current conditions. In doing so, management considers a variety of general qualitative factors and then subjectively determines the weight to assign to each in estimating losses. The factors include, among others, national and local economic conditions, environmental risks, trends in volume and terms of loans, concentrations of credit, changes in lending policies and procedures, and experience, ability, and depth of the Bank’s lending staff. Because of the nature of the factors and the difficulty in assessing their impact, management’s resulting estimate of losses may not accurately reflect actual losses in the portfolio.

Although the allowance for loan losses has two separate components, one for impairment losses on individual loans and one for collective impairment losses on pools of loans, the entire allowance for loan losses is available to absorb realized losses as they occur whether they relate to individual loans or pools of loans.

Asset Quality

The Corporation has identified certain assets as risk elements. These assets include nonaccruing loans, foreclosed real estate, loans that are contractually past due 90 days or more as to principal or interest payments and still accruing and troubled debt restructurings. These assets present more than the normal risk that the Corporation will be unable to eventually collect or realize their full carrying value. Information about the Corporation’s risk elements is as follows:

| | | | | | | | | | | | | | | | |

| | December 31, | |

| |

| |

| | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| |

| |

| |

| |

| |

| |

| | (dollars in thousands) | |

Nonaccrual loans | | $ | 112 | | $ | 257 | | $ | 135 | | $ | 151 | | $ | — | |

Loans past due 90 days or more and still accruing | | | 42 | | | 95 | | | 50 | | | — | | | 18 | |

Foreclosed real estate | | | — | | | — | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total nonperforming assets | | | 154 | | | 352 | | | 185 | | | 151 | | | 18 | |

Troubled debt restructurings | | | — | | | — | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total risk elements | | $ | 154 | | $ | 352 | | $ | 185 | | $ | 151 | | $ | 18 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Nonaccrual loans as a percentage of total loans | | | .02 | % | | .05 | % | | .03 | % | | .04 | % | | .00 | % |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Nonperforming assets as a percentage of total loans and foreclosed real estate | | | .02 | % | | .07 | % | | .04 | % | | .04 | % | | .01 | % |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Risk elements as a percentage of total loans and foreclosed real estate | | | .02 | % | | .07 | % | | .04 | % | | .04 | % | | .01 | % |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

| | Year Ended December 31, | |

| |

| |

| | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| |

| |

| |

| |

| |

| |

| | (in thousands) | |

Gross interest income on nonaccrual loans: | | | | | | | | | | | | | | | | |

Amount that would have been recorded during the year under original terms | | $ | 10 | | $ | 13 | | $ | 12 | | $ | 9 | | $ | — | |

| | | | | | | | | | | | | | | | |

Actual amount recorded during the year | | | — | | | 10 | | | — | | | 4 | | | — | |

| | | | | | | | | | | | | | | | |

Commitments for additional funds - - Nonaccrual, restructured, past due loans | | | None | | | None | | | None | | | None | | | None | |

36

Allowance and Provision for Loan Losses

The allowance for loan losses grew by $1,623,000 during 2008, amounting to $6,076,000, or .92% of total loans, at December 31, 2008 as compared to $4,453,000, or .85% of total loans, at December 31, 2007. During 2008, the Bank had loan chargeoffs and recoveries of $325,000 and $3,000, respectively, and recorded a $1,945,000 provision for loan losses. The provision for loan losses increased by $1,370,000 in 2008 primarily because of more loan growth in 2008, a $275,000 chargeoff on one commercial loan, the establishment of a $200,000 impairment reserve on another commercial loan, and a deterioration in local economic conditions. The chargeoff and establishment of the impairment reserve occurred in the fourth quarter.

The allowance for loan losses is an amount that management currently believes will be adequate to absorb probable incurred losses in the Bank’s loan portfolio. In determining the allowance for loan losses, there is not an exact amount but rather a range for what constitutes an appropriate allowance. As more fully discussed in the “Application of Critical Accounting Policies” section of this discussion and analysis of financial condition and results of operations, the process for estimating credit losses and determining the allowance for loan losses as of any balance sheet date is subjective in nature and requires material estimates. Actual results could differ significantly from those estimates.

The following table sets forth changes in the Bank’s allowance for loan losses.

| | | | | | | | | | | | | | | | |

| | Year ended December 31, | |

| |

| |

| | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| |

| |

| |

| |

| |

| |

| | (dollars in thousands) | |

| | | |

Balance, beginning of year | | $ | 4,453 | | $ | 3,891 | | $ | 3,282 | | $ | 2,808 | | $ | 2,452 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Loans charged off: | | | | | | | | | | | | | | | | |

Commercial and industrial | | | 275 | | | — | | | 65 | | | — | | | 12 | |

Other | | | 50 | | | 14 | | | 11 | | | 25 | | | 33 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | 325 | | | 14 | | | 76 | | | 25 | | | 45 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Recoveries of loans charged off: | | | | | | | | | | | | | | | | |

Commercial and industrial | | | — | | | — | | | — | | | — | | | 7 | |

Other | | | 3 | | | 1 | | | 15 | | | 29 | | | 38 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | 3 | | | 1 | | | 15 | | | 29 | | | 45 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net (chargeoffs) recoveries | | | (322 | ) | | (13 | ) | | (61 | ) | | 4 | | | — | |

Provision for loan losses | | | 1,945 | | | 575 | | | 670 | | | 470 | | | 356 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Balance, end of year | | $ | 6,076 | | $ | 4,453 | | $ | 3,891 | | $ | 3,282 | | $ | 2,808 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Ratio of net chargeoffs or recoveries to average loans outstanding | | | .06 | % | | .00 | % | | .01 | % | | .00 | % | | .00 | % |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

The following table sets forth the allocation of the Bank’s total allowance for loan losses by loan type.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, | |

| |

| |

| | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| |

| |

| |

| |

| |

| |

| | Amount | | % of

Loans

To Total

Loans | | Amount | | % of

Loans

To Total

Loans | | Amount | | % of

Loans

To Total

Loans | | Amount | | % of

Loans

To Total

Loans | | Amount | | % of

Loans

To Total

Loans | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | (dollars in thousands) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Commercial and industrial | | $ | 933 | | 8.1 | % | | $ | 874 | | 11.7 | % | | $ | 833 | | 12.3 | % | | $ | 827 | | 12.4 | % | | $ | 789 | | 15.1 | % | |

Commercial mortgages | | | 3,011 | | 41.5 | | | | 1,785 | | 32.3 | | | | 1,464 | | 30.7 | | | | 1,095 | | 28.3 | | | | 865 | | 25.9 | | |

Residential mortgages | | | 1,227 | | 32.9 | | | | 1,026 | | 37.1 | | | | 914 | | 38.7 | | | | 843 | | 42.0 | | | | 790 | | 44.0 | | |

Home equity loans | | | 706 | | 15.5 | | | | 551 | | 15.8 | | | | 497 | | 14.9 | | | | 348 | | 14.0 | | | | 226 | | 12.0 | | |

Construction loans | | | 100 | | 1.4 | | | | 116 | | 2.2 | | | | 89 | | 2.2 | | | | 71 | | 1.9 | | | | 45 | | 1.4 | | |

Other | | | 99 | | .6 | | | | 101 | | .9 | | | | 94 | | 1.2 | | | | 98 | | 1.4 | | | | 93 | | 1.6 | | |

| |

|

| |

| | |

|

| |

| | |

|

| |

| | |

|

| |

| | |

|

| |

| | |

| | $ | 6,076 | | 100.0 | % | | $ | 4,453 | | 100.0 | % | | $ | 3,891 | | 100.0 | % | | $ | 3,282 | | 100.0 | % | | $ | 2,808 | | 100.0 | % | |

| |

|

| |

| | |

|

| |

| | |

|

| |

| | |

|

| |

| | |

|

| |

| | |

The amount of future chargeoffs and provisions for loan losses will be affected by, among other things, economic conditions on Long Island and in New York City. Such conditions could affect the financial strength of the Bank’s borrowers and will affect the value of real estate collateral securing the Bank’s mortgage loans. Loans secured by real estate represent approximately 91% of the Bank’s total loans outstanding at December 31, 2008. Most of these loans were made to borrowers domiciled on Long Island and in New York City. Although local economic conditions had been good

37

and real estate values had grown considerably over a number of years, over the last year or so residential real estate values on Long Island declined and economic conditions deteriorated. The decline and deterioration could continue, and commercial real estate values could also decline. This could cause some of the Bank’s borrowers to be unable to make the required contractual payments on their loans and the Bank to be unable to realize the full carrying value of such loans through foreclosure. However, management believes that the Bank’s underwriting policies are relatively conservative and, as a result, the Bank should be less affected than the overall market.

Future provisions and chargeoffs could also be affected by environmental impairment of properties securing the Bank’s mortgage loans. At the present time, management is not aware of any environmental pollution originating on or near properties securing the Bank’s loans that would materially affect the carrying value of such loans.

Off-Balance Sheet Arrangements and Contractual Obligations

The Corporation’s off-balance sheet arrangements and contractual obligations at December 31, 2008 are summarized in the table that follows. The amounts shown for commitments to extend credit and letters of credit are contingent obligations, some of which are expected to expire without being drawn upon. As a result, the amounts shown for these items do not necessarily represent future cash requirements. The amounts shown for securities sold under repurchase agreements are based on the contractual maturities of such agreements and include scheduled principal and interest payments. The interest payments do not reflect any offset that the Bank could get from interest rate caps embedded in the agreements. Some of these repurchase agreements can be terminated by the purchaser prior to contractual maturity (see Note F to the Corporation’s 2008 consolidated financial statements for more detailed disclosures regarding repurchase agreements). The Corporation believes that its current sources of liquidity are more than sufficient to fulfill the obligations it has at December 31, 2008 pursuant to off-balance sheet arrangements and contractual obligations.

| | | | | | | | | | | | | | | | |

| | | | | Amount of Commitment Expiration Per Period | |

| | | | |

| |

| | Total

Amounts

Committed | | One

Year

or Less | | Over

One Year

Through

Three Years | | Over

Three Years

Through

Five Years | | Over

Five

Years | |

| |

| |

| |

| |

| |

| |

| | (in thousands) | |

| | | |

Commitments to extend credit | | $ | 116,653 | | $ | 48,291 | | $ | 14,392 | | $ | 8,890 | | $ | 45,080 | |

Standby letters of credit | | | 3,641 | | | 3,641 | | | — | | | — | | | — | |

Commercial letters of credit | | | — | | | — | | | — | | | — | | | — | |

Securities sold under repurchase agreements - Long-term | | | 157,970 | | | 5,478 | | | 22,682 | | | 67,592 | | | 62,218 | |

Operating lease obligations | | | 8,974 | | | 1,181 | | | 2,245 | | | 1,794 | | | 3,754 | |

Purchase obligations | | | 1,687 | | | 348 | | | 697 | | | 642 | | | — | |

Time Deposits | | | 192,152 | | | 167,834 | | | 10,513 | | | 13,600 | | | 205 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | $ | 481,077 | | $ | 226,773 | | $ | 50,529 | | $ | 92,518 | | $ | 111,257 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Commitments to extend credit and letters of credit arise in the normal course of the Bank’s business of meeting the financing needs of its customers and involve, to varying degrees, elements of credit risk in excess of the amount recognized in the consolidated balance sheets.

The Bank’s exposure to credit loss in the event of nonperformance by the other party to financial instruments for commitments to extend credit, standby letters of credit, and commercial letters of credit is represented by the contractual notional amount of these instruments. The Bank uses the same credit policies in making commitments to extend credit and generally uses the same credit policies for letters of credit as it does for on-balance-sheet instruments.

Commitments to extend credit are legally binding agreements to lend to a customer as long as there is no violation of any condition established in the contract. Unused home equity lines, which comprise a substantial portion of these commitments, generally expire ten years from their date of origination. Other real estate loan commitments generally expire within 60 days and commercial loan commitments generally expire within one year. The amount of collateral obtained, if any, by the Bank upon extension of credit is based on management’s credit evaluation of the borrower. Collateral held varies but may include mortgages on commercial and residential real estate, security interests in business assets, deposit accounts with the Bank or other financial institutions, and securities.

Standby letters of credit are conditional commitments issued by the Bank to assure the performance or financial obligations of a customer to a third party. The credit risk involved in issuing standby letters of credit is essentially the same as that involved in extending loans to customers. The Bank generally holds collateral and/or obtains personal

38

guarantees supporting these commitments. Commercial letters of credit are conditional commitments issued by the Bank to assure the payment by a customer to a supplier. The Bank generally obtains personal guarantees supporting these commitments.

The purchase obligations shown in the preceding table are pursuant to contracts that the Bank has with providers of data processing services. Required pension plan contributions for years beyond 2009 are not presently known and are therefore not included in the table. For the Plan year ending September 30, 2009, the Bank has a minimum required pension contribution of $1,119,000 and a maximum tax deductible contribution of $8,765,000. The Bank expects to make a contribution within that range by September 30, 2009, but the amount of such contribution has not yet been determined.

Capital

The Corporation’s capital management policy is designed to build and maintain capital levels that exceed regulatory standards. Under current regulatory capital standards, banks are classified as well capitalized, adequately capitalized or undercapitalized. Under such standards, a well-capitalized bank is one that has a total risk-based capital ratio equal to or greater than 10%, a Tier 1 risk-based capital ratio equal to or greater than 6%, and a Tier 1 leverage capital ratio equal to or greater than 5%. The Bank’s total risk-based capital, Tier 1 risk-based capital and Tier 1 leverage capital ratios of 17.27%, 16.29% and 8.03%, respectively, at December 31, 2008 substantially exceed the requirements for a well-capitalized bank. The Corporation (on a consolidated basis) is subject to minimum risk-based and leverage capital requirements, which the Corporation substantially exceeds as of December 31, 2008.

Total stockholders’ equity increased slightly from $102,384,000 at December 31, 2007 to $102,532,000 at December 31, 2008. The positive impact on stockholders’ equity of net income, unrealized gains on available-for-sale securities, and stock-based compensation transactions was almost entirely offset by stock repurchases, cash dividends declared, and a decrease in the funded status of the Bank’s pension plan.

Stock Repurchase Program and Market Liquidity. Since 1988, the Corporation has had a stock repurchase program under which it has purchased from time to time shares of its own common stock in market or private transactions. Under plans approved by the Board of Directors in 2007 and 2008, the Corporation purchased 296,479 shares in 2008 and can purchase 114,011 shares in the future. The details of the Corporation’s purchases under the stock repurchase program during the fourth quarter of 2008 are set forth in the table that follows.

| | | | | | | | | | | | | | |

Period | | Total

Number of

Shares

Purchased | | Average

Price Paid

Per Share | | Total Number of

Shares Purchased as

Part of Publicly

Announced Plans

or Programs(1) | | Maximum Number of

of Shares that May Yet

Be Purchased Under the

Plans or Programs(1) | |

| |

| |

| |

| |

| |

October 1, 2008 to October 31, 2008 | | — | | | | — | | | — | | | | 116,711 | |

November 1, 2008 to November 30, 2008 | | 2,500 | | | $ | 21.40 | | | 2,500 | | | | 114,211 | |

December 1, 2008 to December 31, 2008 | | 200 | | | $ | 22.08 | | | 200 | | | | 114,011 | |

| |

(1) | All shares purchased by the Corporation under its stock repurchase program in the fourth quarter of 2008 were purchased under a 200,000 share plan approved by the Corporation’s Board of Directors on February 21, 2008 and publicly announced on February 22, 2008. The Corporation’s share repurchase plans do not have fixed expiration dates. |

The stock repurchase program has historically enhanced earnings per share and return on average stockholders’ equity. The program is estimated to have contributed four cents more to earnings per share in 2008 than 2007. The larger contribution to earnings per share this year is attributable to the full-year impact of the shares purchased in 2007 plus the pro rata impact of the shares purchased throughout 2008, taking into account the volume of shares purchased, the price paid per share, and current interest rates.

The Corporation periodically reevaluates whether it wants to continue purchasing shares of its own common stock in open market transactions under the safe harbor provisions of Rule 10b-18 or otherwise. Because the trading volume in the Corporation’s common stock is limited, the Corporation believes that a reduction or discontinuance of its share repurchase program could adversely impact market liquidity for its common stock, the price of its common stock, or both. The publicly reported trading volume in the Corporation’s common stock in 2008 and 2007 was 979,245 and 615,795 shares, respectively. Open market purchases by the Corporation under its share repurchase program accounted for 14.6% of the trading volume in 2008 and 12.2% in 2007.

39

Russell Microcap Index.Frank Russell Company (“Russell”) maintains a family of U.S. equity indices. The indices are reconstituted in June of each year based on market capitalization and do not reflect subjective opinions. All indices are subsets of the Russell 3000E Index, which represents most of the investable U. S. equity market.

The Corporation’s common stock is included in the Russell Microcap Index. When reconstituted in June 2008, the average market capitalization of companies in the Russell Microcap Index was $310 million, the median market capitalization was $169 million, the capitalization of the largest company in the index was $617 million, and the capitalization of the smallest company in the index was $37 million. The Corporation’s market capitalization as of December 31, 2008 was approximately $171 million.

The strong performance of the Corporation’s stock over the last year relative to the overall market should result in its stock being included in the Russell 3000 and 2000 Indexes when they are reconstituted in June 2009. The Corporation believes that migration of its stock from the Russell Microcap to the Russell 3000 and 2000 Indexes could improve the stock’s price, trading volume and liquidity. Conversely, if the Corporation’s market capitalization falls below the minimum necessary to be included in the Russell 3000 and 2000 Indexes or the Russell Microcap Index at any future reconstitution date, the opposite could occur.

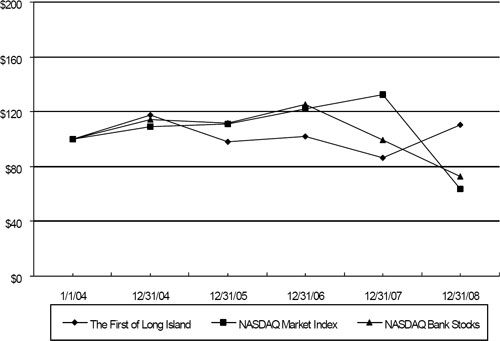

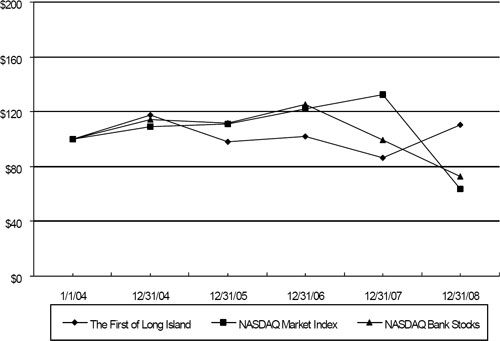

Performance Graph. The following graph compares the Corporation’s total stockholder return over a 5-year measurement period with the NASDAQ Market Index and the NASDAQ Bank Stocks Index.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN

THE FIRST OF LONG ISLAND CORPORATION,

NASDAQ BANK STOCKS INDEX AND NASDAQ MARKET INDEX

Assumes $100 Invested on January 1, 2004

Assumes Dividends Reinvested

Fiscal Year Ended December 31, 2008

Cash Flows and Liquidity

Cash Flows.The Corporation’s primary sources of cash are deposit growth, maturities and amortization of loans and investment securities, operations, and borrowing. The Corporation uses cash from these and other sources to fund loan growth, purchase investment securities, pay cash dividends, and repurchase common stock under the Corporation’s share repurchase program. During 2008, the cash needed to grow loans significantly exceeded the cash provided by deposit growth and operations. This is the main reason for the increase in Federal Home Loan Bank advances. Savings and money market products increased during the year, driven partially by new branch openings and the migration of funds

40

from time deposit accounts. As further discussed below, the increase in securities sold under repurchase agreements is primarily a result of the Corporation’s borrowing and investing strategy.

In 2008, the Bank continued to use maturities and paydowns from its investment securities portfolio to fund loan growth. Despite this, the securities portfolio grew by almost $82 million from year-end 2007 to year-end 2008. The growth occurred because the Bank continued with the leveraging program that began in the latter part of 2007, whereby it borrowed an additional $47 million under repurchase agreements and used the resulting proceeds to purchase securities. The leveraging program was undertaken to increase current earnings and also protect the Bank’s future earnings in the event of an increase in interest rates. $75 million of the borrowings have embedded interest rate caps. The purpose of borrowing with embedded interest rate caps is to potentially reduce the negative impact on the Bank’s net interest income that could occur with an increase in interest rates. Additional information regarding the Bank’s sensitivity to changes in interest rates can be found under the caption “Market Risk” in this discussion and analysis of financial condition and results of operations. Additional information regarding the borrowings under repurchase agreements and embedded interest rate caps can be found in Note F to the Corporation’s consolidated financial statements.

The Corporation paid $4,575,000 in cash dividends in 2008, which is $767,000 less than the $5,342,000 paid in 2007. The decrease is primarily due to the change from a semi-annual to a quarterly dividend in 2007 and the resulting payment in 2007 of one semi-annual and three quarterly dividends.

Liquidity. The Bank has both internal and external sources of liquidity that can be used to fund loan growth and accommodate deposit outflows. The Bank’s primary internal sources of liquidity are its overnight investments, investment securities designated as available-for-sale, and maturities and monthly payments on its investment securities and loan portfolios. At December 31, 2008, the Bank had approximately $93 million in unencumbered available-for-sale securities.

The Bank is a member of the Federal Home Loan Bank of New York (“FHLB”) and has repurchase agreements in place with a number of brokerage firms and commercial banks. In addition to customer deposits, the Bank’s primary external sources of liquidity are secured borrowings in the form of FHLB advances and repurchase agreements. However, neither the Bank’s FHLB membership nor repurchase agreements represent legal commitments on the part of the FHLB or repurchase agreement counterparties to extend credit to the Bank. The amount that the Bank can potentially borrow from these parties is currently dependent on, among other things, the amount of unencumbered eligible securities that the Bank can use as collateral. At December 31, 2008, the Bank had unencumbered securities of approximately $183 million that are eligible collateral for borrowing under repurchase agreements. Of these securities, $35 million are eligible collateral for FHLB borrowings. In addition, the Bank is currently working towards increasing its liquidity by obtaining FHLB approval to pledge its residential and commercial mortgages as collateral for borrowings.

The Bank can also purchase overnight federal funds on an unsecured basis under lines with two other commercial banks. These lines in the aggregate amount of $25 million do not represent legal commitments to extend credit on the part of the other banks.

As a backup to borrowing from the FHLB, brokerage firms and other commercial banks, the Bank is eligible to borrow on a secured basis at the Federal Reserve Bank (“FRB”) discount window under the primary credit program. Primary credit, which is normally extended on a very short-term basis, typically overnight, at a rate which is currently between 25 and 50 basis points above the federal funds target rate, is viewed by the FRB as a backup source of short-term funds for sound depository institutions like the Bank. The amount that the Bank can borrow under the primary credit program depends on, among other things, the amount of available eligible collateral.

Market Risk

The Bank invests in interest-earning assets which are funded by interest-bearing deposits and borrowings, noninterest-bearing deposits, and capital. The Bank’s results of operations are subject to risk resulting from interest rate fluctuations generally and having assets and liabilities that have different maturity, repricing, and prepayment/withdrawal characteristics. The Bank defines interest rate risk as the risk that the Bank’s earnings and/or net portfolio value (present value of expected future cash flows from assets less the present value of expected future cash flows from liabilities) will change when interest rates change. The principal objective of the Bank’s asset/liability management activities is to maximize net interest income while at the same time maintain acceptable levels of interest rate and liquidity risk and facilitate the funding needs of the Bank.

Because the Bank’s loans and investment securities generally reprice slower than its interest-bearing liabilities, an immediate increase in interest rates uniformly across the yield curve should initially have a negative effect on net interest income. However, if the Bank does not increase the rates paid on its deposit accounts as quickly or in the same amount as

41

increases in market interest rates and/or owns interest rate caps that are in-the-money at the time of the interest rate increase or become in-the-money as a result of the increase, the magnitude of the negative impact will decline and the impact could even be positive. Over a longer period of time, and assuming that interest rates remain stable after the initial rate increase and the Bank purchases securities and originates loans at yields higher than those maturing and reprices loans at higher yields, the impact of an increase in interest rates should be positive. This occurs primarily because with the passage of time more loans and investment securities will reprice at the higher rates and there will be no offsetting increase in interest expense for those loans and investment securities funded by noninterest-bearing checking deposits and capital.

Conversely, a decrease in interest rates uniformly across the yield curve should initially have a positive impact on the Bank’s net interest income. Furthermore, if the Bank owns interest rate floors that are in-the-money at the time of the interest rate decrease or become in-the-money as a result of the decrease, the magnitude of the positive impact should increase. However, if the Bank does not or cannot decrease the rates paid on its deposit accounts as quickly or in the same amount as decreases in market interest rates, regardless of whether or not it owns interest rate floors, the magnitude of the positive impact will decline and could even be negative.

If interest rates decline, or have declined, and are sustained at the lower levels and, as a result, the Bank purchases securities at lower yields and loans are originated or repriced at lower yields, the impact on net interest income should be negative because a significant portion of the Bank’s average interest-earning assets are funded by noninterest-bearing checking deposits and capital.

The Bank monitors and controls interest rate risk through a variety of techniques including the use of interest rate sensitivity models and traditional repricing gap analysis. Through use of the models, the Bank projects future net interest income and then estimates the effect on projected net interest income of various changes in interest rates and balance sheet growth rates. The Bank also uses the models to calculate the change in net portfolio value over a range of interest rate change scenarios.

Traditional gap analysis involves arranging the Bank’s interest-earning assets and interest-bearing liabilities by repricing periods and then computing the difference, or gap, between the assets and liabilities which are estimated to reprice during each time period and cumulatively through the end of each time period.

Both interest rate sensitivity modeling and gap analysis involve a variety of significant estimates and assumptions and are done at a specific point in time. Interest rate sensitivity modeling requires, among other things, estimates of: (1) how much and when yields and costs on individual categories of interest-earning assets and interest-bearing liabilities will change because of projected changes in market interest rates; (2) future cash flows; (3) discount rates; and (4) decay or runoff rates for nonmaturity deposits such as checking, savings, and money market accounts.

Gap analysis requires estimates as to when individual categories of interest-sensitive assets and liabilities will reprice and assumes that assets and liabilities assigned to the same repricing period will reprice at the same time and in the same amount. Like sensitivity modeling, gap analysis does not fully take into account the fact that the repricing of some assets and liabilities is discretionary and subject to competitive and other pressures.

Changes in the estimates and assumptions made for interest rate sensitivity modeling and gap analysis could have a significant impact on projected results and conclusions. Therefore, these techniques may not accurately reflect the actual impact of changes in the interest rate environment on the Bank’s net interest income or net portfolio value.

The table that follows summarizes the Corporation’s cumulative interest repricing gap at December 31, 2008 based upon significant estimates and assumptions that the Corporation believes to be reasonable. The table arranges interest-earning assets and interest-bearing liabilities according to the period in which they contractually mature or, if earlier, are estimated to repay or reprice. Repayment and repricing estimates are based on internal data and management’s assumptions about factors that are inherently uncertain. These factors include, among others, prepayment speeds, changes in market interest rates and the Bank’s response thereto, early withdrawal of deposits, and competition. The balances of non-maturity deposit products have been included in categories beyond three months in the table because management believes, based on past experience and its knowledge of current competitive pressures, that the repricing of these products will lag market changes in interest rates to varying degrees. The table does not reflect any protection against interest rate changes that the Corporation may have as a result of its ownership of derivative instruments such as interest rate caps or floors. The only such instruments that the Corporation owns at December 31, 2008 are the interest rate caps disclosed in Note F to the Corporation’s December 31, 2008 consolidated financial statements.

42

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Repricing Period | |

| |

| |

| | Three

Months

or Less | | Over

Three

Months

Through

Six Months | | Over

Six

Months

Through

One Year | | Total

Within

One Year | | Over

One Year

Through

Five

Years | | Over

Five

Years | | Non-

interest-

Sensitive | | Total | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | (in thousands) | |

Assets: | | | | | | | | | | | | | | | | | | | | | | | | | |

Federal funds sold & overnight investments | | $ | 514 | | $ | — | | $ | — | | $ | 514 | | $ | — | | $ | — | | $ | — | | $ | 514 | |

Investment securities | | | 30,014 | | | 33,884 | | | 77,036 | | | 140,934 | | | 258,835 | | | 143,057 | | | 5,427 | | | 548,253 | |

Loans | | | 172,449 | | | 29,941 | | | 59,881 | | | 262,271 | | | 313,899 | | | 81,088 | | | (5,200 | ) | | 652,058 | |

Other assets | | | — | | | — | | | — | | | — | | | — | | | — | | | 60,784 | | | 60,784 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | 202,977 | | | 63,825 | | | 136,917 | | | 403,719 | | | 572,734 | | | 224,145 | | | 61,011 | | | 1,261,609 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Liabilities & Stockholders’ Equity: | | | | | | | | | | | | | | | | | | | | | | | | | |

Checking deposits | | | — | | | — | | | — | | | — | | | — | | | — | | | 324,138 | | | 324,138 | |

Savings & money market deposits | | | 287,772 | | | 8,069 | | | 16,137 | | | 311,978 | | | 72,069 | | | — | | | — | | | 384,047 | |

Time deposits, $100,000 and over | | | 110,706 | | | 7,717 | | | 5,330 | | | 123,753 | | | 10,197 | | | 100 | | | — | | | 134,050 | |

Time deposits, other | | | 28,105 | | | 11,593 | | | 4,382 | | | 44,080 | | | 13,917 | | | 105 | | | — | | | 58,102 | |

Borrowed funds | | | 124,122 | | | — | | | — | | | 124,122 | | | 72,000 | | | 55,000 | | | — | | | 251,122 | |

Other liabilities | | | — | | | — | | | — | | | — | | | — | | | — | | | 7,618 | | | 7,618 | |

Stockholders’ equity | | | — | | | — | | | — | | | — | | | — | | | — | | | 102,532 | | | 102,532 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | 550,705 | | | 27,379 | | | 25,849 | | | 603,933 | | | 168,183 | | | 55,205 | | | 434,288 | | | 1,261,609 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Interest-rate sensitivity gap | | $ | (347,728 | ) | $ | 36,446 | | $ | 111,068 | | $ | (200,214 | ) | $ | 404,551 | | $ | 168,940 | | $ | (373,277 | ) | $ | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Cumulative interest-rate sensitivity gap | | $ | (347,728 | ) | $ | (311,282 | ) | $ | (200,214 | ) | $ | (200,214 | ) | $ | 204,337 | | $ | 373,277 | | $ | — | | $ | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

As shown in the preceding table, the Bank has a significant volume of deposit accounts and borrowings that are subject to repricing as short-term interest rates change. Since the amount of these liabilities outweighs the assets held by the Bank whose pricing is tied to short-term interest rates, an increase in short-term interest rates should negatively impact the Bank’s net interest income in the near term. The interest rate caps owned by the Bank at December 31, 2008 may help to reduce the negative impact. In addition, the Bank can reduce the magnitude of the negative impact by not increasing the rates paid on its deposit accounts as quickly or in the same amount as market increases in the overnight funds rate, the prime lending rate, or other short-term rates. Conversely, a decrease in short-term interest rates should positively impact the Bank’s net interest income in the near term. However, if short-term rates decline and the Bank cannot, due to competitive pressures and/or the absolute level of rates, decrease its deposit rates in the same amount as market decreases in the federal funds target rate, the prime lending rate, and other short-term rates, the magnitude of the positive impact will decline and the impact could even be negative.

The table that follows is provided pursuant to the market risk disclosure rules set forth in Item 305 of Regulation S-K of the Securities and Exchange Commission. The information provided in the following table is based on significant estimates and assumptions and constitutes, like certain other statements included herein, a forward-looking statement. The base case information in the table shows (1) an estimate of the Corporation’s net portfolio value at December 31, 2008 arrived at by discounting estimated future cash flows at current market rates and (2) an estimate of net interest income on a tax-equivalent basis for the year ending December 31, 2009 assuming that maturing assets or liabilities are replaced with new balances of the same type, in the same amount, and at current rate levels and repricing balances are adjusted to current rate levels. For purposes of the base case, nonmaturity deposits are included in the calculation of net portfolio value at their carrying amount. The rate change information in the table shows estimates of net portfolio value at December 31, 2008 and net interest income on a tax-equivalent basis for the year ending December 31, 2009 assuming rate changes of plus 100 and 200 basis points and minus 100 and 200 basis points. The changes in net portfolio value from the base case have not been tax affected. In addition, cash flows for nonmaturity deposits are based on a decay or runoff rate of eight years. Also, rate changes are assumed to be shock or immediate changes and occur uniformly across the yield curve regardless of the duration to maturity or repricing of specific assets and liabilities. In projecting future net interest income under the indicated rate change scenarios, activity is simulated by replacing maturing balances with new balances of the same type, in the same amount, but at the assumed rate level and adjusting repricing balances to the assumed rate level.

43

Based on the foregoing assumptions and as depicted in the table that follows, an immediate increase in interest rates of 100 or 200 basis points would have a negative effect on net interest income over a one-year time period. This is principally because the Bank’s interest-bearing deposit accounts are assumed to reprice faster than its loans and investment securities. However, if the Bank does not increase the rates paid on its deposit accounts as quickly or in the same amount as increases in market interest rates, the magnitude of the negative impact will decline. If the Bank does not increase its deposit rates at all, the impact should be positive. Over a longer period of time, and assuming that interest rates remain stable after the initial rate increase and the Bank purchases securities and originates loans at yields higher than those maturing and reprices loans at higher yields, the impact of an increase in interest rates should be positive. This occurs primarily because with the passage of time more loans and investment securities will reprice at the higher rates and there will be no offsetting increase in interest expense for those loans and investment securities funded by noninterest-bearing checking deposits and capital. Generally, the reverse should be true of an immediate decrease in interest rates of 100 or 200 basis points. However, the positive impact of a decrease in interest rates of 100 or 200 basis points is currently reduced by the fact that some of the Bank’s deposit products have yields below 1% while others have yields below 2%.

| | | | | | | | | | | | | |

| | Net Portfolio Value at

December 31, 2008 | | Net Interest Income

for 2009 | |

| |

| |

| |

Rate Change Scenario | | Amount | | Percent

Change

From

Base Case | | Amount | | Percent

Change

From

Base Case | |

| |

| |

| |

| |

| |

| | (dollars in thousands) | |

+ 200 basis point rate shock | | $ | 83,957 | | (9.2 | )% | | $ | 44,493 | | (14.9 | )% | |

+ 100 basis point rate shock | | | 88,054 | | (4.7 | ) | | | 48,365 | | (7.5 | ) | |

Base case (no rate change) | | | 92,426 | | — | | | | 52,310 | | — | | |

- 100 basis point rate shock | | | 97,111 | | 5.1 | | | | 56,037 | | 7.1 | | |

- 200 basis point rate shock | | | 104,289 | | 12.8 | | | | 57,163 | | 9.3 | | |

Legislation and Regulatory Matters

Enacted Legislation. In the latter part of 2008, two major pieces of legislation (the “Legislation”) impacting the financial services industry were enacted; the Housing and Economic Recovery Act of 2008 and the Emergency Economic Stabilization Act of 2008. This Legislation was enacted to address the subprime mortgage crisis and in response to capital adequacy, asset quality, management, liquidity, earnings and sensitivity to market risk problems being experienced by a large number of financial institutions. It contains broad changes that impact, either directly or indirectly, the Bank’s business operations. The significant changes brought about by this Legislation include, among others, the following:

| | |

| • | The placing of Fannie Mae and Freddie Mac into conservatorship by their primary regulator, the Federal Housing Finance Agency; |

| | |

| • | A temporary increase through December 31, 2009 in FDIC insurance coverage from $100,000 to $250,000; |

| | |

| • | A temporary guarantee by the FDIC through December 31, 2009 of all transaction account balances, without limitation, which is in addition to and separate from the $250,000 insurance limit under the FDIC’s general deposit insurance regulations. Transaction accounts include traditional checking accounts and funds swept from such accounts to another noninterest-bearing deposit account, NOW accounts paying less than .5% interest, and Interest on Lawyer Accounts; |

| | |

| • | A guarantee by the FDIC of the senior unsecured debt of financial institutions issued through June 30, 2009. The guarantee expires upon maturity of the debt or June 30, 2012, whichever is earlier; |

| | |

| • | A provision that allows the Federal Reserve Bank to pay interest to banks on sterile reserves beginning October 1, 2008, three years earlier than previously permitted; |

| | |

| • | The creation of the $700 billion Troubled Asset Relief Program (“TARP”) within the U.S. Treasury Department to purchase troubled assets from any financial institution through December 31, 2009; |

| | |

| • | As part of the TARP, the $250 billion Capital Purchase Program that enables financial institutions to raise capital by selling senior preferred shares to the federal government. |

44

Financial institutions may opt out of the FDIC’s unlimited guarantee of transaction account balances and the FDIC’s guarantee of senior unsecured debt. In addition, raising capital by selling senior preferred shares to the federal government is voluntary on the part of banks. The Bank did not opt out of the FDIC’s transaction account and senior unsecured debt guarantees and, based on the Bank’s strong capital position, chose not to participate in the Capital Purchase Program. In addition, the Bank has no assets in its loan or securities portfolios that it would consider selling to the Treasury Department under the TARP.

In February 2009, the American Recovery and Reinvestment Act of 2009 (the “Act”) became law. Otherwise known as the Stimulus Plan, the Act is a $787 billion package of spending, tax cuts and tax credits that’s designed to help pull the nation out of the significant current downturn. The provisions of the Act are intended to have significant positive impact on the economy and could significantly impact the Bank’s business on a near and longer-term basis. Also in February 2009, the FDIC took two actions designed to allow the Deposit Insurance Fund to withstand the existing problems in the banking industry. The first was the imposition of an emergency special assessment of 20 basis points on deposits of insured banks and savings associations as of June 30, 2009. The second was adoption of previously proposed changes to its risk-based assessment system. These changes considered, the Bank currently estimates that its FDIC insurance cost will increase by approximately $2,800,000 in 2009.

Pending Legislation. Commercial checking deposits currently account for approximately 27% of the Bank’s total deposits. Congress has been considering legislation that would allow corporate customers to cover checks by sweeping funds from interest-bearing deposit accounts each business day and repeal the prohibition of the payment of interest on corporate checking deposits. Either could have a material adverse impact on the Bank’s future results of operations.

Examination.The Bank was examined by the Office of the Comptroller of the Currency as of September 30, 2008. The examination was a regularly scheduled safety and soundness examination. Management is not aware, nor has it been apprised, of any recommendations by regulatory authorities that would have a material adverse impact on the Corporation’s liquidity, capital resources, or operations.

Impact of Not Yet Effective Authoritative Accounting Pronouncements

In December 2007, the FASB issued SFAS No. 141 (revised 2007) “Business Combinations” (“SFAS No. 141(R)”), which establishes principles and requirements for how an acquirer recognizes and measures in its financial statements the identifiable assets acquired, liabilities assumed, and any noncontrolling interest in an acquiree, including the recognition and measurement of goodwill acquired in a business combination. SFAS No. 141(R) is effective for fiscal years beginning on or after December 15, 2008. Earlier adoption is prohibited. The adoption of this standard is not expected to materially affect the Corporation’s results of operations or financial position.

In December 2007, the FASB issued SFAS No. 160 “Noncontrolling Interest in Consolidated Financial Statements, an amendment of ARB No. 51” (“SFAS No. 160”), which will change the accounting and reporting for minority interests. Under SFAS No. 160, minority interests will be recharacterized as noncontrolling interests and classified as a component of equity within the consolidated balance sheets. SFAS No. 160 is effective as of the beginning of the first fiscal year beginning on or after December 15, 2008. Earlier adoption is prohibited. The adoption of this standard is not expected to materially affect the Corporation’s results of operations or financial position.

In March 2008, the FASB issued SFAS No. 161 “Disclosures about Derivative Instruments and Hedging Activities – an amendment of SFAS No. 133” (“SFAS No. 161”). SFAS No. 161 requires enhanced disclosures about an entity’s derivative and hedging activities and thereby improves the transparency of financial reporting. SFAS No. 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The adoption of this standard is not expected to materially affect the Corporation’s results of operations or financial position.

In May 2008, the FASB issued SFAS No. 162 “The Hierarchy of Generally Accepted Accounting Principles” (“SFAS No. 162”). This Statement identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles (“GAAP”) in the United States. This Statement will be effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board amendments to AU Section 411. The adoption of SFAS No. 162 is not expected to impact the Corporation’s consolidated financial statements.

45

On February 20, 2008, the FASB issued FSP FAS 140-3 “Accounting for Transfers of Financial Assets and Repurchase Financing Transactions” (“FSP 140-3”) to resolve questions about the accounting for repurchase financings. This FSP is effective for repurchase financings in which the initial transfer is entered into in fiscal years beginning after November 15, 2008. The adoption of FSP 140-3 on January 1, 2009 had no impact on the Corporation’s consolidated financial statements.

On April 25, 2008, the FASB issued FSP FAS 142-3 “Determination of the Useful Life of Intangible Assets” (“FSP 142-3”), which amends the list of factors an entity should consider in developing renewal or extension assumptions used in determining the useful life of recognized intangible assets under SFAS No. 142 “Goodwill and Other Intangible Assets.” FSP 142-3 is effective for financial statements issued for fiscal years and interim periods beginning after December 15, 2008. The adoption of FSP 142-3 on January 1, 2009 did not impact the Corporation’s consolidated financial statements.

On May 9, 2008, the FASB issued FSP APB 14-1 “Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement)” (“FSP 14-1”). FSP 14-1 is effective for financial statements issued for fiscal years and interim periods beginning after December 15, 2008. The adoption of FSP 14-1 on January 1, 2009 had no impact on the Corporation’s consolidated financial statements.

On June 16, 2008, the FASB issued FSP EITF 03-6-1 “Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities” (“FSP 03-6-1”). The FSP addresses whether instruments granted in share-based payment transactions are participating securities prior to vesting and, therefore, need to be included in the earnings allocation in computing earnings per share under the two-class method described in paragraphs 60 and 61 of SFAS No. 128, Earnings per Share. FSP 03-6-1 is effective for financial statements issued for fiscal years and interim periods beginning after December 15, 2008. The adoption of FSP 03-6-1 on January 1, 2009 had no impact on the Corporation’s consolidated financial statements.

Forward Looking Statements

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” contains various forward-looking statements with respect to financial performance and business matters. Such statements are generally contained in sentences including the words “may” or “expect” or “could” or “should” or “would” or “believe”. The Corporation cautions that these forward-looking statements are subject to numerous assumptions, risks and uncertainties, and therefore actual results could differ materially from those contemplated by the forward-looking statements. In addition, the Corporation assumes no duty to update forward-looking statements.

46

CONSOLIDATED BALANCE SHEETS

| | | | | | | |

| | December 31, | |

| |

| |

| | 2008 | | 2007 | |

| |

| |

| |

Assets: | | | | | | | |

Cash and due from banks | | $ | 20,924,000 | | $ | 25,729,000 | |

Federal funds sold and overnight investments | | | 514,000 | | | 21,768,000 | |

| |

|

| |

|

| |

Cash and cash equivalents | | | 21,438,000 | | | 47,497,000 | |

| |

|

| |

|

| |

| | | | | | | |

Investment securities: | | | | | | | |

Held-to-maturity, at amortized cost (fair value of $172,640,000 and $193,890,000) | | | 169,480,000 | | | 193,234,000 | |

Available-for-sale, at fair value (amortized cost of $373,346,000 and $270,325,000) | | | 378,773,000 | | | 273,080,000 | |

| |

|

| |

|

| |

| | | 548,253,000 | | | 466,314,000 | |

| |

|

| |

|

| |

Loans: | | | | | | | |

Commercial and industrial | | | 53,555,000 | | | 61,317,000 | |

Secured by real estate: | | | | | | | |

Commercial mortgages | | | 273,097,000 | | | 169,621,000 | |

Residential mortgages | | | 216,654,000 | | | 194,926,000 | |

Home equity loans | | | 99,953,000 | | | 81,846,000 | |

Construction loans | | | 9,175,000 | | | 11,751,000 | |

Other | | | 3,761,000 | | | 4,893,000 | |

| |

|

| |

|

| |

| | | 656,195,000 | | | 524,354,000 | |

Net deferred loan origination costs | | | 1,939,000 | | | 1,185,000 | |

| |

|

| |

|

| |

| | | 658,134,000 | | | 525,539,000 | |

Allowance for loan losses | | | (6,076,000 | ) | | (4,453,000 | ) |

| |

|

| |

|

| |

| | | 652,058,000 | | | 521,086,000 | |

| |

|

| |

|

| |

| | | | | | | |

Federal Home Loan Bank stock, at cost | | | 6,199,000 | | | 1,184,000 | |

Bank premises and equipment, net | | | 12,593,000 | | | 10,922,000 | |

Deferred income tax benefits | | | 1,638,000 | | | — | |

Bank-owned life insurance | | | 11,650,000 | | | 11,158,000 | |

Other assets | | | 7,780,000 | | | 10,858,000 | |

| |

|

| |

|

| |

| | $ | 1,261,609,000 | | $ | 1,069,019,000 | |

| |

|

| |

|

| |

Liabilities: | | | | | | | |

Deposits: | | | | | | | |

Checking | | $ | 324,138,000 | | $ | 318,322,000 | |

Savings and money market | | | 384,047,000 | | | 302,158,000 | |

Time, $100,000 and over | | | 134,050,000 | | | 197,554,000 | |

Time, other | | | 58,102,000 | | | 51,004,000 | |

| |

|

| |

|

| |

| | | 900,337,000 | | | 869,038,000 | |

Short-term borrowings | | | 124,122,000 | | | 12,110,000 | |

Long-term debt | | | 127,000,000 | | | 80,000,000 | |

Accrued expenses and other liabilities | | | 7,543,000 | | | 4,686,000 | |

Current income taxes payable | | | 75,000 | | | 37,000 | |

Deferred income taxes payable | | | — | | | 764,000 | |

| |

|

| |

|

| |

| | | 1,159,077,000 | | | 966,635,000 | |

| |

|

| |

|

| |

Commitments and Contingent Liabilities (Note M) | | | | | | | |

| | | | | | | |

Stockholders’ Equity: | | | | | | | |

Common stock, par value $.10 per share: | | | | | | | |

Authorized, 20,000,000 shares; Issued and outstanding, 7,194,747 and 7,454,385 shares | | | 719,000 | | | 745,000 | |

Surplus | | | 1,354,000 | | | 96,000 | |

Retained earnings | | | 102,061,000 | | | 99,844,000 | |

| |

|

| |

|

| |

| | | 104,134,000 | | | 100,685,000 | |

Accumulated other comprehensive income (loss) net of tax | | | (1,602,000 | ) | | 1,699,000 | |

| |

|

| |

|

| |

| | | 102,532,000 | | | 102,384,000 | |

| |

|

| |

|

| |

| | $ | 1,261,609,000 | | $ | 1,069,019,000 | |

| |

|

| |

|

| |

See notes to consolidated financial statements

47

CONSOLIDATED STATEMENTS OF INCOME

| | | | | | | | | | |

| | Year Ended December 31, | |

| |

| |

| | 2008 | | 2007 | | 2006 | |

| |

| |

| |

| |

Interest and dividend income: | | | | | | | | | | |

Loans | | $ | 34,163,000 | | $ | 31,627,000 | | $ | 27,299,000 | |

Investment securities: | | | | | | | | | | |

Taxable | | | 18,857,000 | | | 13,529,000 | | | 14,536,000 | |

Nontaxable | | | 6,186,000 | | | 6,362,000 | | | 6,283,000 | |

Federal funds sold and overnight investments | | | 480,000 | | | 1,505,000 | | | 882,000 | |

| |

|

| |

|

| |

|

| |

| | | 59,686,000 | | | 53,023,000 | | | 49,000,000 | |

| |

|

| |

|

| |

|

| |

Interest expense: | | | | | | | | | | |

Savings and money market deposits | | | 4,576,000 | | | 4,768,000 | | | 4,629,000 | |

Time deposits | | | 6,782,000 | | | 10,081,000 | | | 6,575,000 | |

Short-term borrowings | | | 746,000 | | | 896,000 | | | 1,745,000 | |

Long-term debt | | | 4,639,000 | | | 524,000 | | | — | |

| |

|

| |

|

| |

|

| |

| | | 16,743,000 | | | 16,269,000 | | | 12,949,000 | |

| |

|

| |

|

| |

|

| |

Net interest income | | | 42,943,000 | | | 36,754,000 | | | 36,051,000 | |

|

Provision for loan losses | | | 1,945,000 | | | 575,000 | | | 670,000 | |

| |

|

| |

|

| |

|

| |

Net interest income after provision for loan losses | | | 40,998,000 | | | 36,179,000 | | | 35,381,000 | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

Noninterest income: | | | | | | | | | | |

Investment Management Division income | | | 1,703,000 | | | 1,786,000 | | | 1,728,000 | |

Service charges on deposit accounts | | | 2,985,000 | | | 2,883,000 | | | 3,062,000 | |

Net gains (losses) on sales of available-for-sale securities | | | 248,000 | | | (234,000 | ) | | (635,000 | ) |

Other | | | 1,345,000 | | | 1,147,000 | | | 1,143,000 | |

| |

|

| |

|

| |

|

| |

| | | 6,281,000 | | | 5,582,000 | | | 5,298,000 | |

| |

|

| |

|

| |

|

| |

Noninterest expense: | | | | | | | | | | |

Salaries | | | 14,037,000 | | | 13,637,000 | | | 12,563,000 | |

Employee benefits | | | 4,599,000 | | | 3,991,000 | | | 4,686,000 | |

Occupancy and equipment expense | | | 4,987,000 | | | 4,420,000 | | | 4,041,000 | |

Other operating expenses | | | 6,066,000 | | | 5,336,000 | | | 5,377,000 | |

| |

|

| |

|

| |

|

| |

| | | 29,689,000 | | | 27,384,000 | | | 26,667,000 | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

Income before income taxes | | | 17,590,000 | | | 14,377,000 | | | 14,012,000 | |

Income tax expense | | | 4,628,000 | | | 2,895,000 | | | 2,785,000 | |

| |

|

| |

|

| |

|

| |

Net Income | | $ | 12,962,000 | | $ | 11,482,000 | | $ | 11,227,000 | |

| |

|

| |

|

| |

|

| |

Weighted average: | | | | | | | | | | |

Common shares | | | 7,225,530 | | | 7,553,495 | | | 7,641,424 | |

Dilutive stock options and restricted stock units | | | 69,012 | | | 73,740 | | | 92,244 | |

| |

|

| |

|

| |

|

| |

| | | 7,294,542 | | | 7,627,235 | | | 7,733,668 | |

| |

|

| |

|

| |

|

| |

Earnings per share: | | | | | | | | | | |

Basic | | | $1.79 | | | $1.52 | | | $1.47 | |

| |

|

| |

|

| |

|

| |

Diluted | | | $1.78 | | | $1.51 | | | $1.45 | |

| |

|

| |

|

| |

|

| |

| | | | | | | | | | |

Cash dividends declared per share | | | $.66 | | | $.58 | | | $.50 | |

| |

|

| |

|

| |

|

| |

See notes to consolidated financial statements

48

CONSOLIDATED STATEMENT OF CHANGES

IN STOCKHOLDERS’ EQUITY

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | Accumulated

Other

Compre-

hensive

Income (Loss) | | | | |

| | | | | | | | | | | | | | | | |

| | Common Stock | | Surplus | | Compre-

hensive

Income | | Retained

Earnings | | | | | |

| |

| | | | | | | | |

| | Shares | | Amount | | | | | | Total | |

| |

| |

| |

| |

| |

| |

| |

| |

Balance, January 1, 2006 | | | 3,846,716 | | $ | 385,000 | | $ | 817,000 | | | | | $ | 89,701,000 | | $ | (205,000 | ) | $ | 90,698,000 | |

Net Income | | | | | | | | | | | $ | 11,227,000 | | | 11,227,000 | | | | | | 11,227,000 | |

Repurchase of common stock | | | (67,814 | ) | | (7,000 | ) | | (2,920,000 | ) | | | | | | | | | | | (2,927,000 | ) |

Common stock issued under stock compensation plans, including tax benefit | | | 14,673 | | | 1,000 | | | 418,000 | | | | | | | | | | | | 419,000 | |

Unrealized gains on available-for-sale-securities, net of reclassification adjustment and taxes | | | | | | | | | | | | 447,000 | | | | | | 447,000 | | | 447,000 | |

| | | | | | | | | | |

|

| | | | | | | | | | |

Comprehensive income | | | | | | | | | | | $ | 11,674,000 | | | | | | | | | | |

| | | | | | | | | | |

|

| | | | | | | | | | |

Adjustment to initially apply SFAS No. 158, net of taxes | | | | | | | | | | | | | | | | | | (707,000 | ) | | (707,000 | ) |

Cash dividends declared | | | | | | | | | | | | | | | (3,806,000 | ) | | | | | (3,806,000 | ) |

Stock-based compensation | | | | | | | | | 210,000 | | | | | | | | | | | | 210,000 | |

Transfer from retained earnings to surplus | | | | | | | | | 2,000,000 | | | | | | (2,000,000 | ) | | | | | | |

| |

|

| |

|

| |

|

| | | | |

|

| |

|

| |

|

| |

Balance, December 31, 2006 | | | 3,793,575 | | | 379,000 | | | 525,000 | | | | | | 95,122,000 | | | (465,000 | ) | | 95,561,000 | |

Net Income | | | | | | | | | | | $ | 11,482,000 | | | 11,482,000 | | | | | | 11,482,000 | |

Repurchase of common stock | | | (183,015 | ) | | (18,000 | ) | | (3,701,000 | ) | | | | | | | | | | | (3,719,000 | ) |

Common stock issued under stock compensation plans, including tax benefit | | | 39,202 | | | 4,000 | | | 766,000 | | | | | | | | | | | | 770,000 | |

2-for-1 stock split | | | 3,804,623 | | | 380,000 | | | | | | | | | (380,000 | ) | | | | | | |

Unrealized gains on available-for-sale-securities, net of reclassification adjustment and taxes | | | | | | | | | | | | 1,419,000 | | | | | | 1,419,000 | | | 1,419,000 | |

Change in funded status of pension plan, net of taxes | | | | | | | | | | | | 745,000 | | | | | | 745,000 | | | 745,000 | |

| | | | | | | | | | |

|

| | | | | | | | | | |

Comprehensive income | | | | | | | | | | | $ | 13,646,000 | | | | | | | | | | |

| | | | | | | | | | |

|

| | | | | | | | | | |

Cash dividends declared | | | | | | | | | | | | | | | (4,380,000 | ) | | | | | (4,380,000 | ) |

Stock-based compensation | | | | | | | | | 506,000 | | | | | | | | | | | | 506,000 | |

Transfer from retained earnings to surplus | | | | | | | | | 2,000,000 | | | | | | (2,000,000 | ) | | | | | | |

| |

|

| |

|

| |

|

| | | | |

|

| |

|

| |

|

| |

Balance, December 31, 2007 | | | 7,454,385 | | | 745,000 | | | 96,000 | | | | | | 99,844,000 | | | 1,699,000 | | | 102,384,000 | |

Net Income | | | | | | | | | | | $ | 12,962,000 | | | 12,962,000 | | | | | | 12,962,000 | |