Shareholders

Meeting

April 25, 2007

Forward-looking statements should not be read as a guarantee of future performance or results,

and will not necessarily be accurate indications of the times at, or by which, such performance

or results will be achieved. Forward-looking information is based on information available at the

time and/or management’s good faith belief with respect to future events, and is subject to risks

and uncertainties that could cause actual performance or results to differ materially from those

expressed in the statements.

Forward-looking statements speak only as of the date the statements are made. Bucyrus

International, Inc. (“Bucyrus” or the “Company”) assumes no obligation to update forward-

looking statements to reflect actual results, changes in assumptions or changes in other factors

affecting forward-looking information except to the extent required by applicable securities laws.

If the Company does update one or more forward-looking statements, no inference should be

drawn that the Company will make additional updates with respect thereto or with respect to

other forward-looking statements.

Forward Looking Statements

Forward Looking Statements

The factors that could cause actual results to differ materially from those anticipated in such forward-looking statements and could

adversely affect our actual results of operations and financial condition include, without limitation:

· disruption of our plant operations due to equipment failures, natural disasters or other reasons;

· our ability to attract and retain skilled labor;

· our production capacity;

· our ability to purchase component parts or raw materials from key suppliers at acceptable prices and/or on

the required time schedule;

· the cyclical nature of the sale of new machines due to fluctuations in market prices for copper, coal, oil, iron ore and other

minerals, changes in general economic conditions, interest rates, customers’ replacement or repair cycles, consolidation in

the mining industry and competitive pressures;

· the loss of key customers or key members of management;

· the risks and uncertainties of doing business in foreign countries, including emerging markets, and foreign currency risks;

· our ability to continue to offer products containing innovative technology that meets the needs of our customers;

· costs and risks associated with regulatory compliance and changing regulations affecting the mining industry

and/or electric utilities;

· product liability, environmental and other potential litigation;

· work stoppages at our company, our customers, suppliers or providers of transportation;

· our ability to satisfy under-funded pension obligations;

· our ability to effectively and efficiently integrate the operations of DBT and to realize expected levels of sales,

profit and adjusted EBITDA from this acquisition;

· potential risks and liabilities of DBT unknown to us; and

· our increased levels of debt service obligations.

The foregoing factors do not constitute an exhaustive list of factors that could cause actual results to differ materially from those

anticipated in forward-looking statements, and should be read in conjunction with the other cautionary statements and risk factors

included in our 2006 Annual Report to Stockholders and Annual Report on Form 10-K filed with the Securities and Exchange

Commission on March 1, 2007 and other cautionary statements described in our subsequent reports filed with the Securities and

Exchange Commission.

Agenda

1. Call to Order Theodore C. Rogers,

Chairman

2. Introductions Theodore C. Rogers,

Chairman

3. Meeting Procedure Craig R. Mackus,

Secretary

4. Report of the Inspectors of Election on Attendance Craig R. Mackus,

Secretary

5. Business of the Meeting Theodore C. Rogers,

a. Election of Directors Chairman

b. Ratification of appointment of Independent Accountants

c. Approval of amendment and restatement of 2004 Equity Incentive Plan

6. Management Presentation Timothy W. Sullivan,

President & CEO

7. Shareholder Questions Timothy W. Sullivan,

President & CEO

8. Adjournment Theodore C. Rogers,

Chairman

Business of the Meeting

Election of Directors

Ratification of appointment of

Independent Accountants

Approval of amendment and restatement of

2004 Equity Incentive Plan

Business of the Meeting

Election of Directors

Ratification of appointment of

Independent Accountants

Approval of amendment and restatement

of 2004 Equity Incentive Plan

Business of the Meeting

Election of Directors

Ratification of appointment of

Independent Accountants

Approval of amendment and restatement

of 2004 Equity Incentive Plan

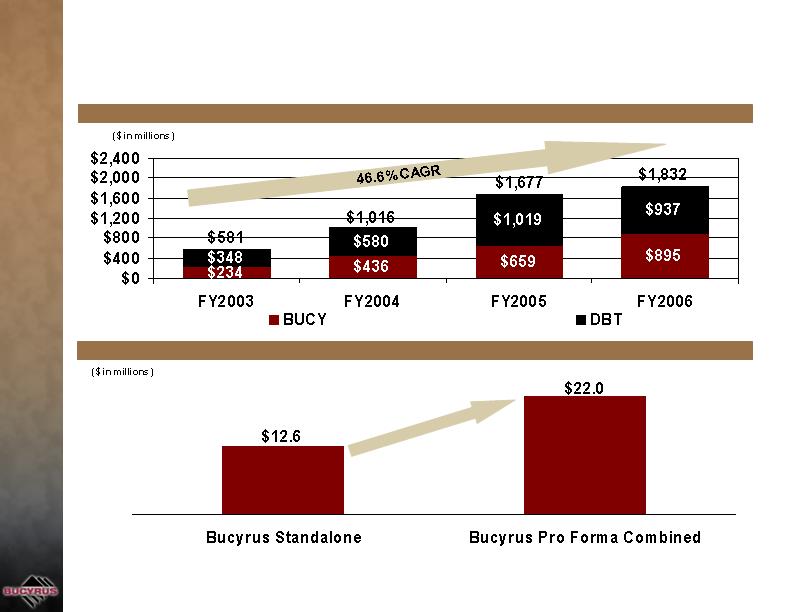

DBT Transaction Summary

Management Presentation

DBT Transaction Summary

On December 17, 2006 Bucyrus International signed a

definitive agreement to acquire DBT GmbH

Financing - $1,290 million Senior Credit Facilities

$400 million 5-year Revolving Facility

€50 million 5-year German Revolving Facility

$825 million 7-year Senior Term Loan Facility

$731 million ($710 million of cash, $21 million of Bucyrus stock)

Purchase Price

Financing

DBT Acquisition & Company Overview

Management Presentation

Strategic Rationale

Increases size and scale for Bucyrus, creating a leading platform in both above

and below ground mining equipment

Pro forma 61% of 2006 revenue from underground mining and 39% from

surface mining

Increases installed base by approximately $9 billion to approximately $22 billion

Increases product and geographic diversification

Provides opportunity to improve surface and underground penetration in high

growth Chinese market

Opportunity to leverage Bucyrus’ aftermarket sales strategy to increase

aftermarket share at DBT

Attractive coal market fundamentals

The DBT acquisition is highly strategic for Bucyrus

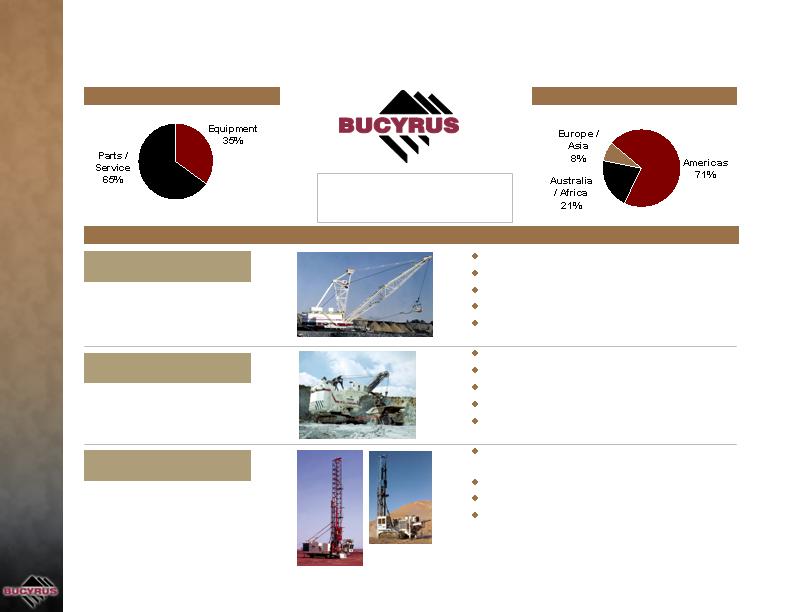

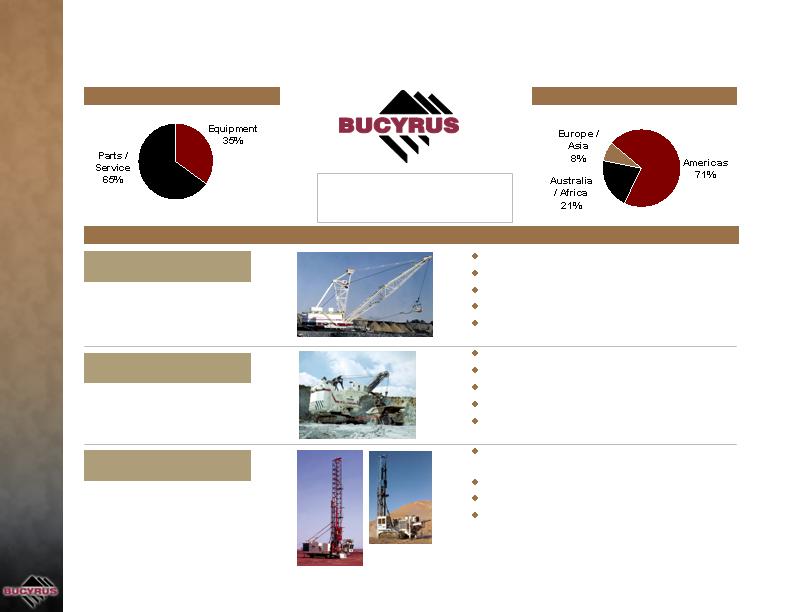

Overview of Bucyrus

2006 Sales by Segment

2006 Sales by Geography

2006 Net Sales: $738 Million

2006 Adj. EBITDA(1) : $122 Million

% Margin: 16.5%

Drill holes for explosives used to break rock prior to

excavation

Most popular model price: ~$4.0 million

Average life: 15 years

Market share: 64%

Load materials into haul trucks

Price range: $2 to $20 million

Most popular model: ~$17 million

Average life: 15 years

Market share: 35%

Remove overburden

Provide lowest material removal cost per ton

Price range: $20 to $100 million

Average life: 40 years

Market share: 88%

Product Overview

Electric Mining Shovels

Draglines

Rotary Blasthole Drills

___________________________

1. Adjusted EBITDA excludes non-cash stock compensation expense, severance charges, restructuring charges and net losses from sale of fixed assets.

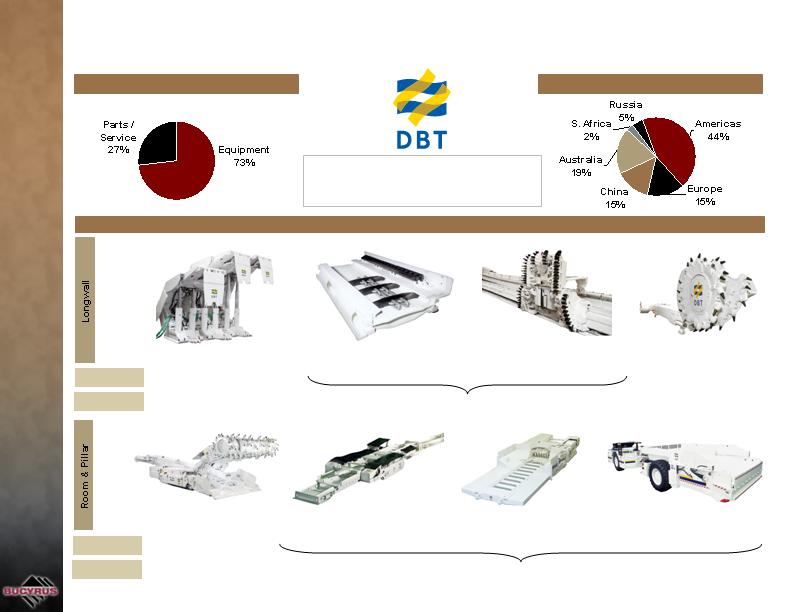

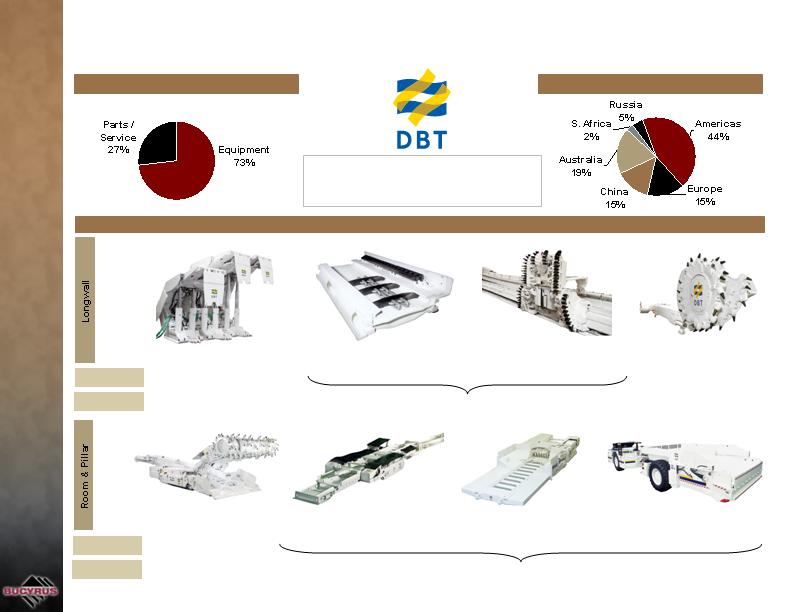

Overview of DBT

Product Overview

2006 Sales by Product Category

Estimated Sales by Region

2006 Net Sales: $1,175 Million

2006 Adj. EBITDA(1) : $141 Million

% Margin: 12.0%

___________________________

1. Adjusted EBITDA excludes one-time product liability payment, net gains on sale of fixed assets and profit from disposal of DBT Mineral Processing.

Roof Support Shields

#1

31%

Armored Face Conveyor

#1

Automated Plow System

#1

Longwall Shearer

#3

2%

Underground Vehicles

#1 / #2

Feeder Breaker

#2

Continuous Haulage System

#1

Continuous Miner

#2

4%

19%

14%

Market Position

% of Sales

Market Position

% of Sales

Key Investment Highlights

Management Presentation

Key Investment Highlights

Experienced and

Dedicated Senior

Management

Diversified, Blue

Chip Client Base

Leading

Comprehensive

Platform

Predictable and

Recurring Revenue

Strong Market

Positions

Strong End Market

Fundamentals

Large, Diverse

Geographic Footprint

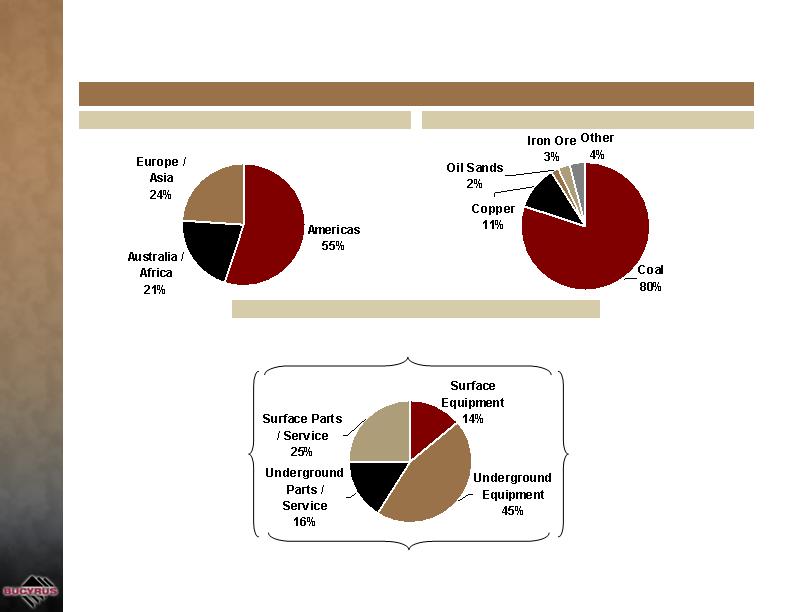

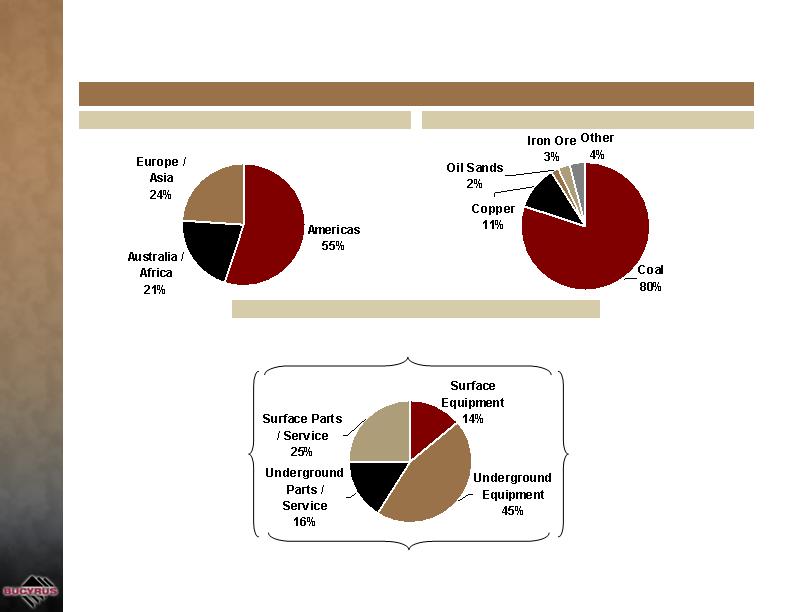

Leading Comprehensive Platform

Estimated Sales by Region

2006 Sales by Product Category

Bucyrus Pro Forma Revenue Breakdown

Parts /

Services

Total

42%

Equipment

Total

58%

Estimated Sales by Commodity

___________________________

Source: Bucyrus filings, Bucyrus management and DBT management.

Underground Total

61%

Surface Total

39%

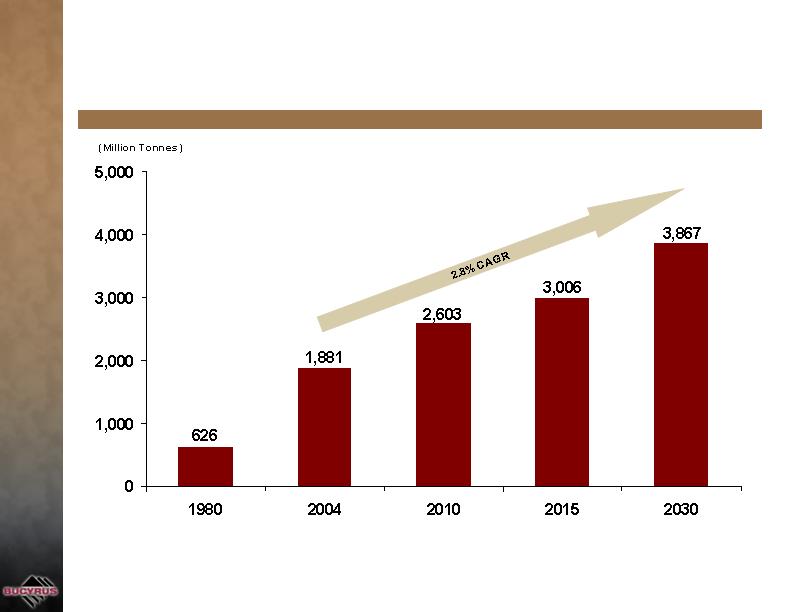

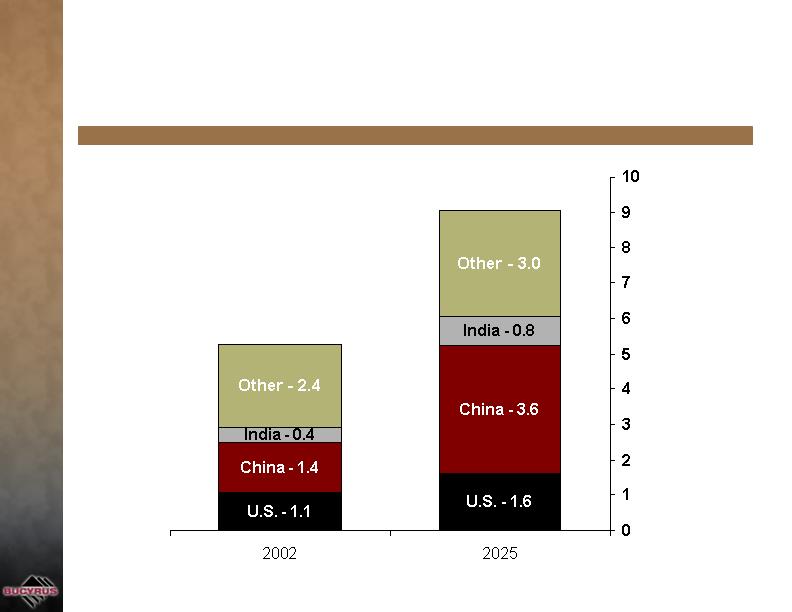

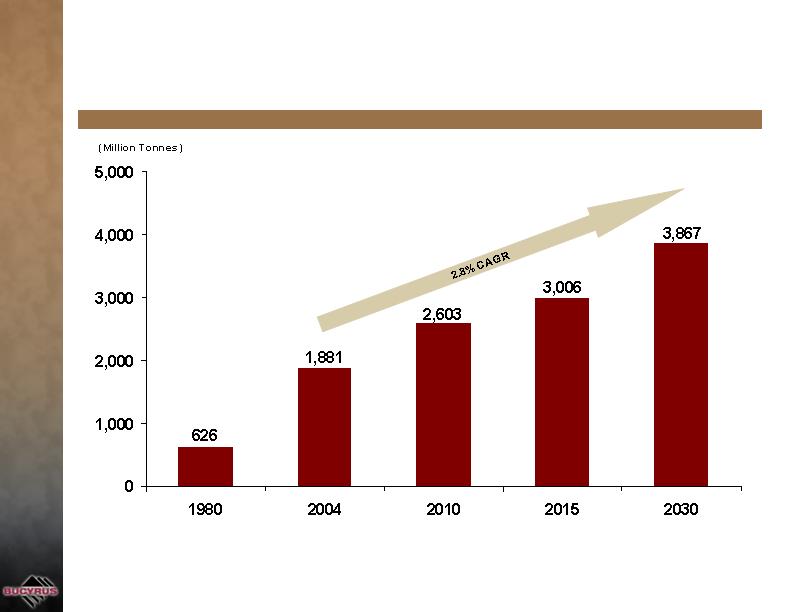

Coal Fundamentals Remain Very Strong

Over 1 trillion tons of coal reserves spread throughout the world

Reserves will last nearly 200 years at today’s production levels

Chinese coal demand is expected to grow by 5.6% annually from 2004 to 2010

Leading input to global electricity generation; 40% of global generation

More than double the second largest input, natural gas

Most cost effective power generation input; cheaper than oil and gas

New clean coal technologies mitigate environmental and regulatory concerns

Large amounts of coal reserves and massive coal infrastructure makes moves away from

coal impractical

Gasification and liquefaction create opportunity for future growth

TXU recently announced it has begun planning for two integrated gasification

combined-cycle, or IGCC, power plants that will burn coal and sequester the resulting

carbon dioxide

Pro forma for the acquisition, approximately 80% of the

Company’s revenues will come from the coal end market

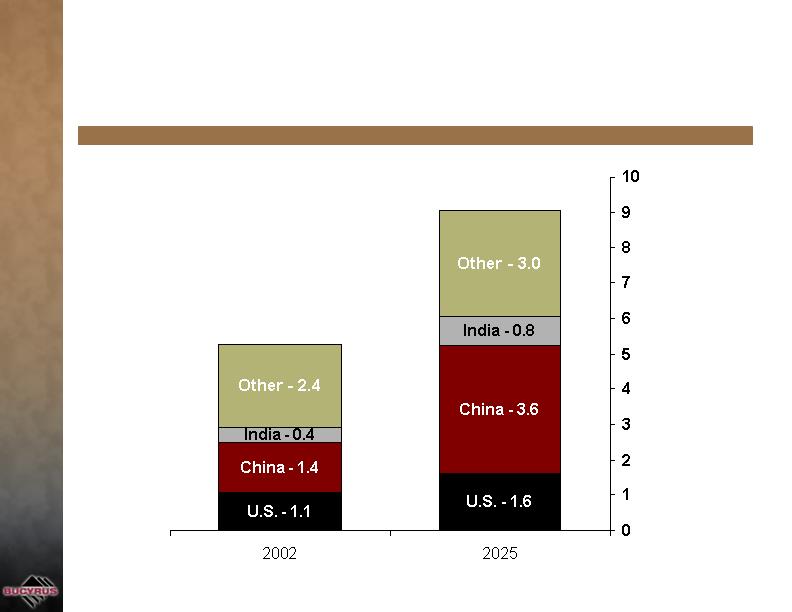

5.3

9.1

(in billions of short tons)

Global Demand to Grow Dramatically in Coming Decades

Global Coal Demand Growth

___________________________

Source: EIA International Energy Outlook 2005.

Annual Coal Use

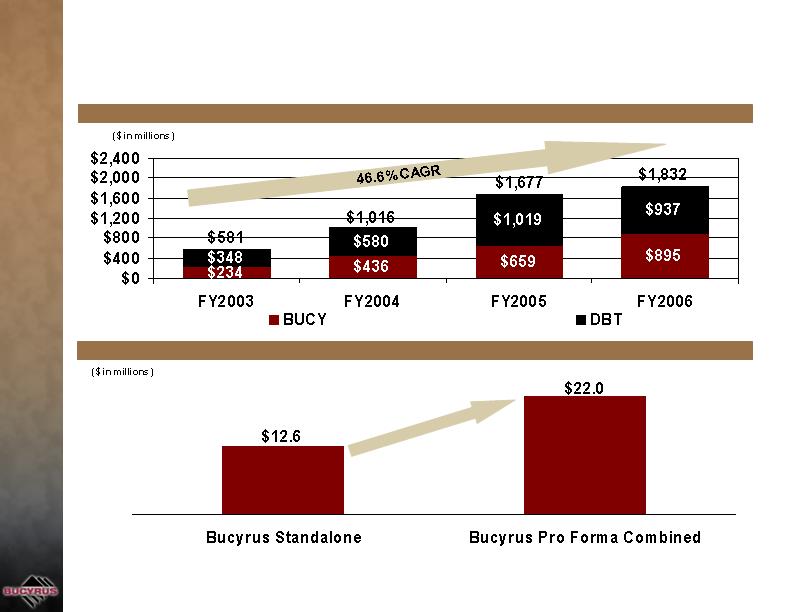

Predictable and Recurring Revenue

Combined Company Historical Backlog(1)

Bucyrus Installed Base

___________________________

1. DBT backlog data not pro forma for change in accounting from completed contract to percentage of completion.

Customer Trends

Large multinationals

Record earnings

Significantly increased capital spending

Diversified, Blue Chip Client Base

Representative Customers

(China Shenhua Energy Company)

Large, Diverse Geographic Footprint

___________________________

1.

Source: DBT management.

2.

Source: Bucyrus filings and website.

DBT(1)

Service / Sales Center

Bucyrus(2)

Service / Sales Center

Manufacturing Plant

Manufacturing Plant

Location# of Facilities

Australia 3

Canada 3

China 4

Europe 5

India 4

Inner Mongolia 1

Mexico 1

Russia 1

South Africa 4

South America 7

U.S. 19

Houston

(Pittsburgh)

Washington

Pulaski

Hillsville

Daphne

Monclova

Huntington

Carrier Mills

Pearisburg

Germiston

Beresfield

Mackay

Calcutta

Beijing

Langfang

Tangshan

Kuzbas

Moscow

Lünen/Wuppertal

Myslowice

Milwaukee

Gillette

Ft. Meade

Kilgore

Tyler

Gilbert

Phoenix

Lakeland

Mt. Sterling

Edmonton

Vespasiano

Lincoln

Lima

Ft. McMurray

Labrador City

Carajás

Huaraz

Antofagasta

Iquique

Benoni

Middelburg

Vereeniging

Bangalore

Sidhi

Kolkata

Memphis

Ilkeston

Experienced and Dedicated Management

Bucyrus is led by a team of executives with substantial experience with the

industry and the Company

Bucyrus is retaining key management currently at DBT including William Tate

(CEO), Luis de Leon (CFO) and Hermann Oecking (CHRO)

Bucyrus’ core senior management team was formed in 2000

DBT

8

President & CEO

William Tate

10

Chief Financial Officer

Luis de Leon

22

Treasurer

John Bosbous

4

1

30

29

Years of

Service

Chief Operating Officer

Ken Krueger

Chief Human Resources Officer

Hermann Oecking

Chief Financial Officer

Craig Mackus

President & CEO

Tim Sullivan

Bucyrus

Position

Name

Strategic Business Initiatives

Management Presentation

Bucyrus Strategic Business Initiatives

Continue to increase aftermarket market share

Operating enhancements at DBT

Major manufacturing expansion in final stages

Dragline replacement opportunity

Strategically address the growing China market opportunity

Bucyrus has several strategic initiatives planned for the

short-, medium- and long-term

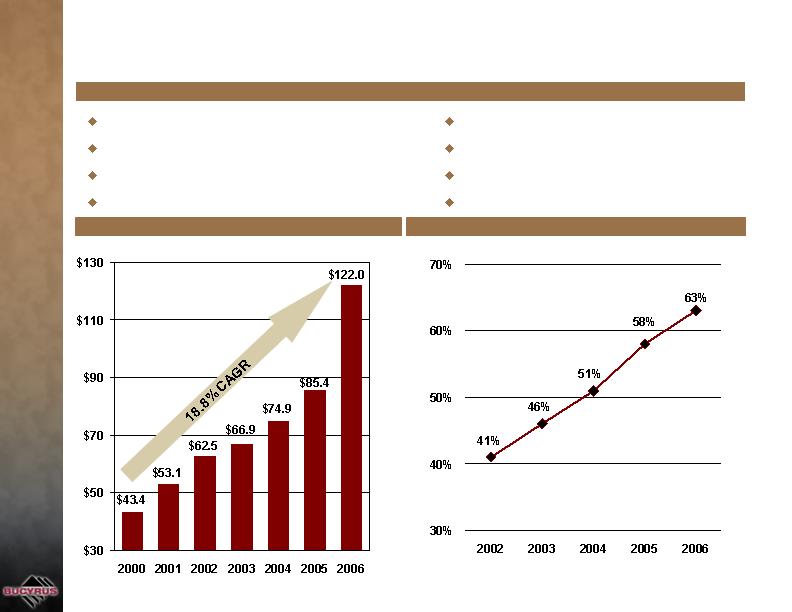

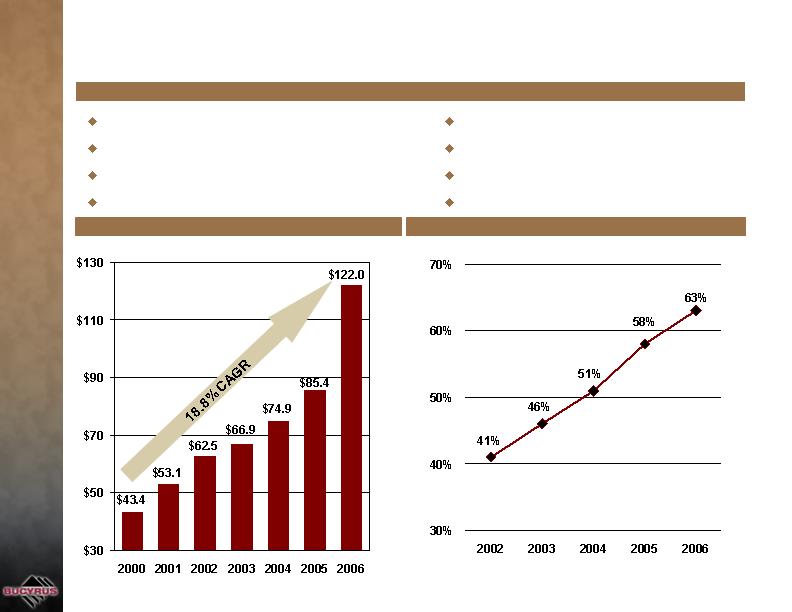

Bucyrus Aftermarket Parts & Services

Aftermarket Business

Replacement Parts

Service and Maintenance

Machine Moves & Erections

Electrical & Mechanical Upgrades

Turnkey Repair

Component Rebuilds

OEM-Certified Machine Rebuilds

Consulting & Troubleshooting

Estimated Spare Parts Market Share

Historical Service Sales

($ in millions)

Operating Enhancements

Bucyrus has an opportunity to leverage its operating

strengths to improve the profitability of DBT

Focus on DBT Aftermarket Business

SG&A Savings

Leverage Existing Manufacturing Footprint

Introduce Best Practices for DBT Working Capital

Procurement

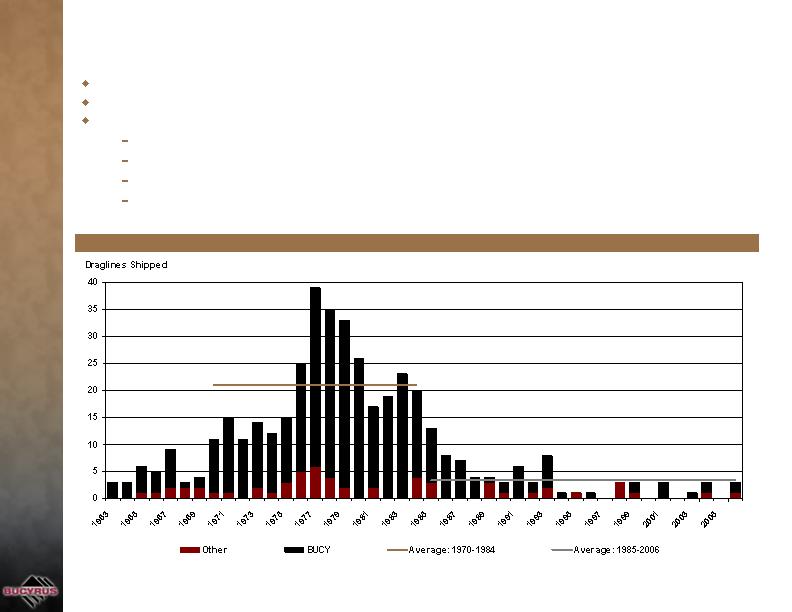

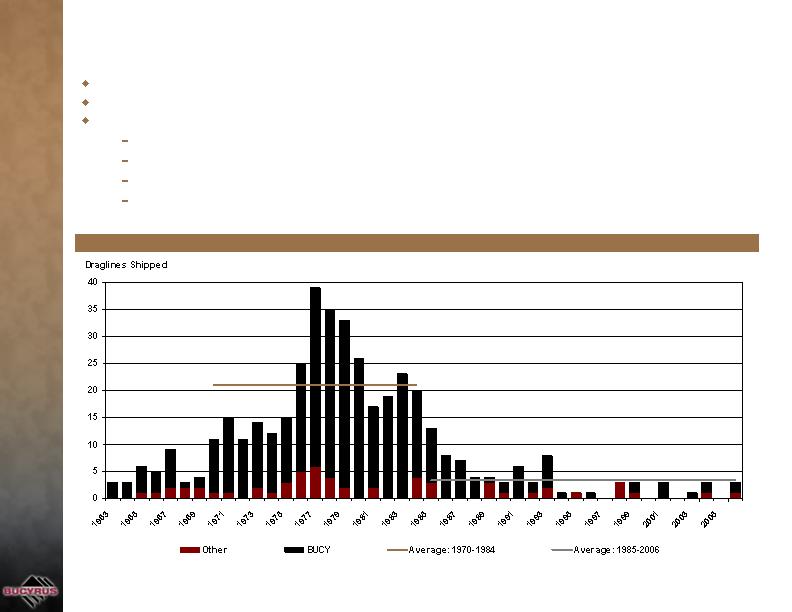

Dragline Replacement Opportunity

Average order-to-ship time period of 2 years; draglines have an average life of 40 years

23 draglines have been recommissioned over the last 5 years

Age of current fleet

0-10 years: 13 machines

11-20 years: 76 machines

21-30 years: 244 machines

31-40 years: 81 machines

Historical Dragline Shipments

Robust Coal Demand Growth in China

Chinese Coal Demand

___________________________

Source: IEA.

Stockholder Question & Answer Period

Please raise your hand

if you have a question to

bring before the meeting.

Shareholders

Meeting

April 25, 2007