The information in this prospectus supplement is not complete and may be changed. This prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any state where this offer or sale is not permitted.

Filed Pursuant to 424(b)(5)

Registration No. 333-135555

Subject to Completion, dated May 4, 2007

PROSPECTUS SUPPLEMENT

(To Prospectus dated June 30, 2006) |

4,614,000 Shares

Bucyrus International, Inc.

Class A Common Stock

We are offering 4,614,000 shares of our common stock. Our common stock trades on The NASDAQ Global Select Market under the symbol “BUCY.” The last reported sale price of our common stock on May 3, 2007 was $65.03 per share.

We intend to use the net proceeds from this offering to repay a portion of our new term loan facility. Affiliates of Lehman Brothers Inc. and J.P. Morgan Securities Inc. are lenders under our new term loan facility and, as such, will receive substantially all of the proceeds from this offering. See “Underwriting—Relationships.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page S-17 of this prospectus supplement.

| | | | | | |

| | | Per Share | | Total |

| | |

Price to the public | | $ | | | $ | |

| | |

Underwriting discounts and commissions | | $ | | | $ | |

| | |

Proceeds to us (before expenses) | | $ | | | $ | |

We have granted the underwriters a 30-day option to purchase up to an additional 692,100 shares from us on the same terms and conditions as set forth above if the underwriters sell more than 4,614,000 shares of common stock in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Lehman Brothers, on behalf of the underwriters, expects to deliver the shares on or about , 2007.

Sole Book-Running Manager

LEHMAN BROTHERS

, 2007

TABLE OF CONTENTS

You should rely only on the information included or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not, and the underwriters have not, authorized anyone to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. We are not, and the underwriters are not, offering to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus is accurate only as of the date of this prospectus supplement or the accompanying prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any sales of our common stock. Our business, financial condition, results of operations and prospects may have changed since those dates.

The underwriters are offering shares of our common stock subject to various conditions and may reject all or any part of any order. The shares of our common stock should be ready for delivery on or about May , 2007 against payment of immediately available funds.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring to both parts combined.

If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement. This prospectus supplement, the accompanying prospectus and the documents incorporated into each by reference include important information about us, the shares being offered and other information you should know before investing in our common stock.

All references to the “Company,” “us,” “we” and “our” in this prospectus supplement and the accompanying prospectus mean, unless the context indicates otherwise, Bucyrus International, Inc. together with its consolidated subsidiaries, including DBT GmbH, or DBT. All references to “common stock” in this prospectus supplement mean our Class A common stock, par value $.01 per share. All references to “Bucyrus” in this prospectus supplement are to our surface mining segment and all references to “DBT” are to our underground mining segment.

All references in this prospectus supplement to our consolidated financial statements include, unless the context indicates otherwise, the related notes.

In certain places in this prospectus supplement we have presented financial information of DBT in U.S. dollars, which, for the balance sheet and backlog data, is based on a translation at a representative rate of exchange of Euro 1.00 = U.S. Dollar 1.3203 as of December 29, 2006 and, for the statement of earnings and other financial data, is based on a translation at a representative average 2006 rate of exchange of Euro 1.00 = U.S. Dollar 1.25622. We have presented the DBT order intake information in this prospectus supplement using the following representative rates of exchange: for the first quarter ended March 31, 2007, Euro 1.00 = U.S. Dollar 1.31044, for the fourth quarter ended December 31, 2006, Euro 1.00 = U.S. Dollar 1.28958, for the third quarter ended September 30, 2006, Euro 1.00 = U.S. Dollar 1.27512 and for the first quarter ended March 31, 2006, Euro 1.00 = U.S. Dollar 1.20256. All historical DBT numbers presented in this prospectus supplement in dollars are unaudited.

DBT’s historical consolidated financial statements appearing elsewhere in this prospectus supplement have been prepared in accordance with International Financial Reporting Standards, or IFRS, which differ in certain material respects from United States generally accepted accounting principles, or U.S. GAAP. For a discussion of certain significant differences between IFRS and U.S. GAAP, see note 30 to DBT’s audited consolidated financial statements included elsewhere in this prospectus supplement, which reconciles DBT’s net profits and shareholders’ equity as reported under IFRS to U.S. GAAP. Bucyrus is in the process of reviewing DBT’s accounting policies and financial statement classifications. As a result of this review, it may become necessary to make additional reclassifications to the consolidated financial information of DBT and its subsidiaries on a prospective basis. See “Unaudited Pro Forma Combined Condensed Financial Information.”

This document includes market share and industry data and forecasts that we have obtained from internal company surveys, market research, consultant surveys, publicly available information and industry publications and surveys. Information regarding our surface mining operations, including historical original equipment sales, industry surveys of original equipment installation and industry aftermarket purchasing and sales information are derived primarily from databases maintained by the Parker Bay Company, which specializes in providing market research for the mining and earthmoving equipment industries. Third-party surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but we cannot assure you as to the accuracy and completeness of such information. We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal company surveys and reports, industry forecasts and market research, which we believe to be reliable based upon our knowledge of the industry, have not been verified by any independent sources. In addition, we do not know what assumptions regarding general worldwide or country specific economic growth were used in preparing the third-party forecasts cited in this document.

We have registered the following trademarks that are used in this prospectus supplement: Bucyrus, Bucyrus (design mark), DBT and DBT (design mark).

S-ii

FORWARD-LOOKING STATEMENTS AND CAUTIONARY FACTORS

This prospectus supplement contains statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by the use of predictive, future tense or forward-looking terminology, such as “believes,” “anticipates,” “expects,” “estimates,” “intends,” “may,” “will” or similar terms. The 2007 guidance provided under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Current 2007 Outlook” constitutes forward-looking statements. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those contained in the forward-looking statements as a result of various factors, some of which are unknown. The factors that could cause actual results to differ materially from those anticipated in such forward-looking statements and could adversely affect our actual results of operations and financial condition include, without limitation:

| | • | | disruption of our plant operations due to equipment failures, natural disasters or other reasons; |

| | • | | our ability to attract and retain skilled labor; |

| | • | | our production capacity; |

| | • | | our ability to purchase component parts or raw materials from key suppliers at acceptable prices and/or on the required time schedule; |

| | • | | the cyclical nature of the sale of original equipment due to fluctuations in market prices for coal, copper, iron ore and other minerals, changes in general economic conditions, interest rates, customers’ replacement or repair cycles, consolidation in the mining industry and competitive pressures; |

| | • | | the loss of key customers or key members of management; |

| | • | | the risks and uncertainties of doing business in foreign countries, including emerging markets, and foreign currency risks; |

| | • | | the highly competitive nature of our industry; |

| | • | | our ability to continue to offer products containing innovative technology that meets the needs of our customers; |

| | • | | costs and risks associated with regulatory compliance and changing regulations affecting the mining industry and/or electric utilities; |

| | • | | product liability, environmental and other potential litigation; |

| | • | | work stoppages at our company, our customers, suppliers or providers of transportation; |

| | • | | our ability to satisfy underfunded pension obligations; |

| | • | | our ability to effectively and efficiently integrate the operations of DBT and realize expected levels of sales and profit from our acquisition of DBT; |

| | • | | potential risks, material weaknesses in financial reporting and liabilities of DBT unknown to us; |

| | • | | our dependence on the commodity price of coal and other conditions in the coal market; |

| | • | | our reliance on significant customers; |

| | • | | our experience in the underground mining business, which is less than some of our competitors; and |

| | • | | our increased levels of debt and debt service obligations relating to our acquisition of DBT. |

The foregoing factors do not constitute an exhaustive list of factors that could cause actual results to differ materially from those anticipated in forward-looking statements, and should be read in conjunction with the other

S-iii

cautionary statements and risk factors, including those described under the caption “Risk Factors” and elsewhere in this prospectus supplement and under the caption “Forward-Looking Statements and Cautionary Factors” and elsewhere in the accompanying prospectus or those contained in the documents incorporated by reference into this prospectus supplement.

We urge you to consider these factors and to review carefully the “Risk Factors” section in this prospectus supplement for a more complete discussion of the risks of an investment in our common stock. The forward-looking statements included in this prospectus supplement or incorporated by reference into this prospectus supplement are made only as of the date of this prospectus supplement or the date of the incorporated document, and we undertake no obligation to publicly update these statements to reflect subsequent events or circumstances.

S-iv

SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement and the accompanying prospectus. This summary may not contain all of the information that may be important to you. You should read the entire prospectus supplement and the accompanying prospectus carefully before making an investment decision.

Overview

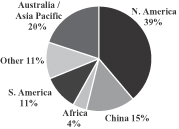

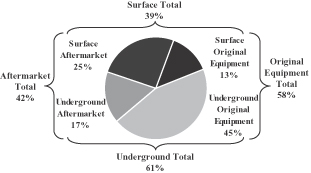

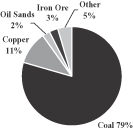

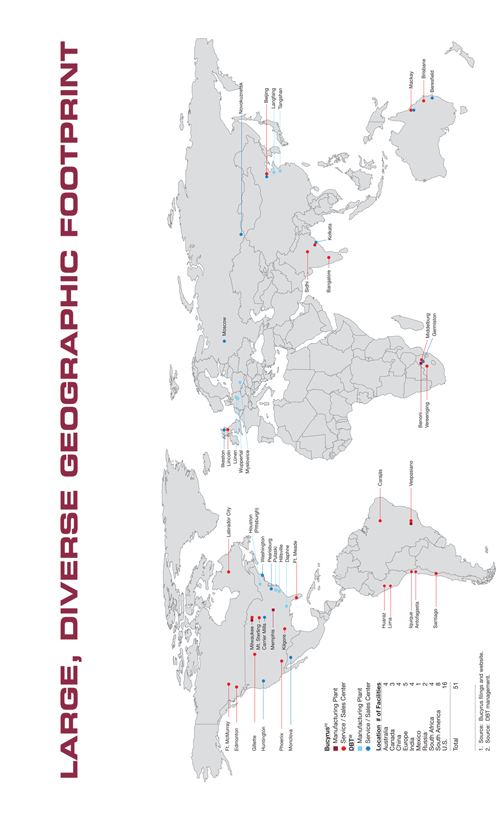

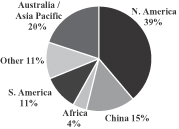

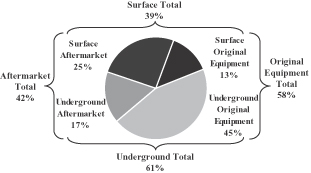

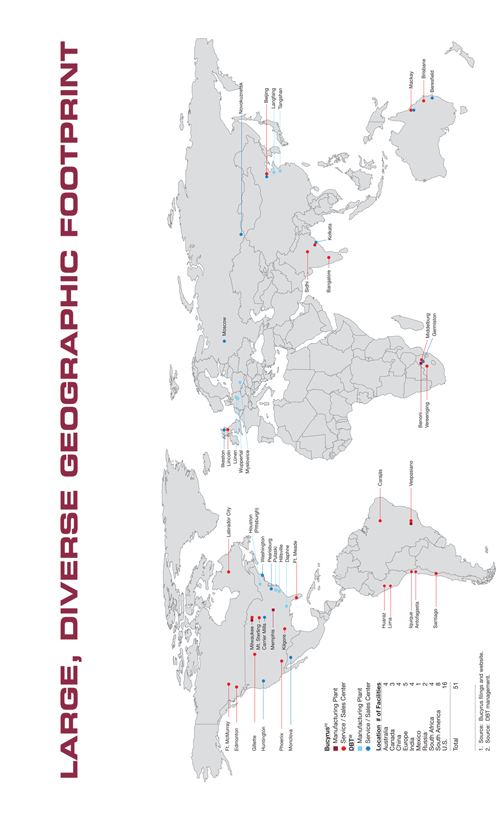

We are a leading designer and manufacturer of high productivity mining equipment for the extraction of coal, copper, iron ore, oil sands and other minerals in major mining centers throughout the world. In addition to the manufacture of original equipment, an important part of our business consists of aftermarket sales, such as supplying parts, maintenance and repair services, and technical advice, as well as refurbishing and relocating older, installed original equipment. On May 4, 2007, we consummated the acquisition of DBT, a subsidiary of RAG Coal International AG, or RAG Coal, for $731.0 million in cash and stock, subject to certain closing adjustments. We paid to RAG Coal $710.0 million in cash, subject to certain closing adjustments, and issued 471,476 shares of our common stock with a market value of $21.0 million at the time of announcement of the acquisition of DBT, or the DBT Acquisition. As a result of the DBT Acquisition, we now operate in two business segments: surface mining (Bucyrus) and underground mining (DBT). We now have manufacturing facilities in Australia, China, Germany, Poland and the United States and service and sales centers in Australia, Brazil, Canada, Chile, China, England, Germany, India, Mexico, Peru, Russia, South Africa and the United States. After giving pro forma effect to the DBT Acquisition as if it had been consummated on January 1, 2006, we had combined sales for 2006 of $1.9 billion, comprised of $1.1 billion (58%) of original equipment sales and $799.1 million (42%) of aftermarket sales. Our pro forma combined backlog was $1.4 billion as of December 31, 2006.

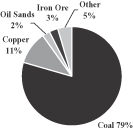

The following charts provide a breakdown of our 2006 pro forma combined sales by geographic region, product/service category and end-market commodity:

2006 Pro Forma Combined Sales Breakdown

| | | | |

Geography | | Product/Service | | End-Market |

| | |

| |

| |  |

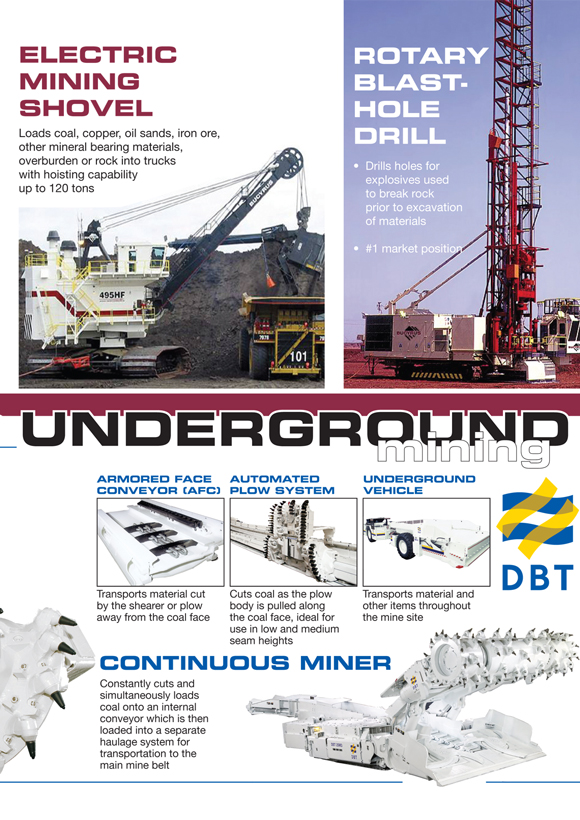

Bucyrus—Surface Mining Equipment and Aftermarket Sales (39% of 2006 Pro Forma Combined Sales)

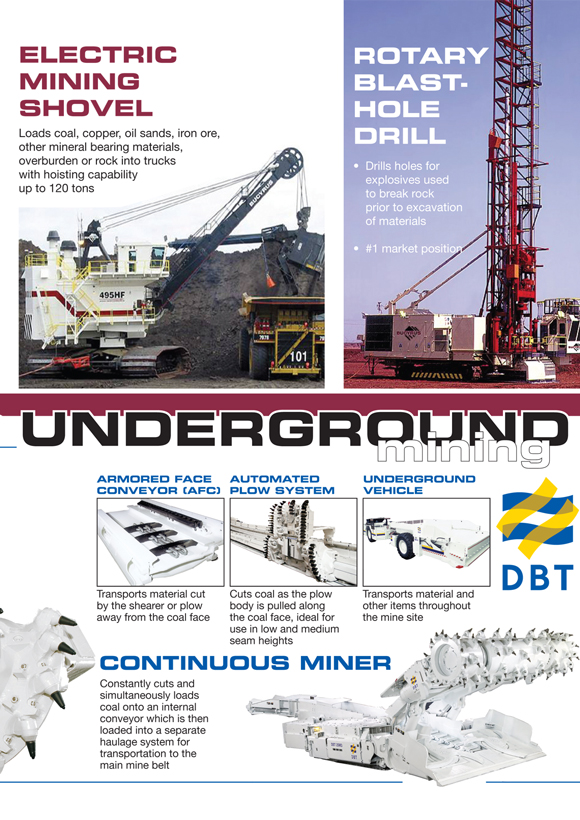

Bucyrus designs, manufactures and markets draglines, electric mining shovels and rotary blasthole drills, which are used for the surface mining of coal, copper, oil sands, iron ore and other minerals throughout the world. Bucyrus also provides the aftermarket replacement parts and service for this original equipment. Bucyrus’ sales for 2006 were $738.0 million, comprised of $255.7 million (35%) of original equipment sales and $482.3 million (65%) of aftermarket sales. Bucyrus’ backlog was $894.7 million as of December 31, 2006.

S-1

The table below describes Bucyrus’ surface mining equipment:

| | | | | | | | |

Original Equipment | | Primary Use | | Price Range Per Unit | | Average Life | | Installed Base

Market Position(1) |

Draglines | | Remove overburden | | $30 - 120 million | | 40 years | | #1 |

Electric Mining Shovels | | Load materials into trucks | | $5 - 23 million | | 15 years | | #2 |

Rotary Blasthole Drills | | Drill holes for explosives | | $1 - 4.5 million | | 15 years | | #1 |

(1) | Installed base market positions are based on information from Parker Bay Company. |

DBT—Underground Mining Equipment and Aftermarket Sales (61% of 2006 Pro Forma Combined Sales)

DBT designs, manufactures and markets high technology system solutions for underground coal mining throughout the world. DBT also provides the aftermarket parts and services for these systems. Principal original equipment products include roof support systems, armored face conveyors, automated plow systems, longwall shearers, continuous miners, transportation vehicles, idlers and belt drives. DBT’s sales for 2006 were $1.2 billion, comprised of $856.9 million (73%) of original equipment sales and $316.8 million (27%) of aftermarket sales. DBT’s backlog was $514.3 million as of December 31, 2006.

The table below describes DBT’s underground mining equipment:

| | | | | | | | |

Original Equipment | | Primary Use | | Price Range Per Unit | | Average Life | | Installed Base

Market Position(1) |

Roof Support Systems | | Support mine roof | | $25 - 35 million | | 8 - 10 years | | #1 |

Automated Plow Systems | | Longwall seam cutting | | $9 - 10 million | | 8 - 10 years | | #1 |

Longwall Shearers | | Longwall seam cutting | | $2.5 - 3.5 million | | 8 - 10 years | | #3 |

Armored Face Conveyors | | Transport cut material | | $5.5 - 9 million | | 8 - 10 years | | #1 |

Continuous Miners | | Room and pillar cutting | | $1.2 - 3 million | | 10 - 15 years | | #2 |

Continuous Haulage Systems | | Transport cut material | | $1 - 2 million | | 10 - 15 years | | #1 |

Feeder Breakers | | Crush mined material | | $0.3 - 0.5 million | | 10 - 15 years | | #2 |

Underground Vehicles | | Transport cut material and other items | | $0.3 - 0.6 million | | 10 - 15 years | | #2 |

(1) | Installed base market positions are for high productivity Western-style mining equipment and are based on management’s estimates. |

Aftermarket Sales

Our combined aftermarket parts and service business is sourced primarily from our large installed original equipment base. We estimate that, on a pro forma basis, the replacement value of our combined installed original equipment base as of December 31, 2006 was approximately $22.0 billion. We believe that our installed base provides the foundation for our aftermarket sales. Customer purchases of aftermarket parts and services over the life of certain of our original equipment can exceed the initial purchase price of that equipment. Additionally, we generally realize higher gross margins on sales of our aftermarket parts than on sales of our original equipment. Because our original equipment tends to operate continuously in all market conditions and has predictable parts and maintenance needs, our aftermarket sales have historically been more stable and more predictable than original equipment sales.

S-2

DBT Acquisition Strategic Rationale

Expanded Product Portfolio. The DBT Acquisition expands our product portfolio to include underground mining equipment and aftermarket support and enhances our capability to serve a larger segment of the global mining equipment market. According to the World Coal Institute, longwall mining equipment is utilized in approximately 60% of global underground coal mining production worldwide, and longwall mining is the predominant method in many of the high growth mining regions. DBT has the leading market position in longwall mining equipment systems and is an internationally recognized brand in the underground mining and equipment services market. Additionally, DBT has continued to increase its presence in the room and pillar equipment market, and we believe that it has significant opportunity for additional growth in this market.

Increased Installed Original Equipment Base. The DBT Acquisition increases the replacement value of our pro forma combined worldwide installed original equipment base as of December 31, 2006 from approximately $12.6 billion to approximately $22.0 billion. We believe that this increased installed base provides us with significantly greater opportunities to market our aftermarket parts and services. Parts typically earn a higher margin than our original equipment sales. Additionally, DBT’s aftermarket business has lower market share than that of Bucyrus, which we believe presents an opportunity for growth.

Expanded Presence in Potentially High Growth Markets. The DBT Acquisition provides us with an increased strategic presence in markets that we expect will experience substantial mining growth over the next several years, such as China and Russia. Additionally, we anticipate building upon Bucyrus’ presence in India, another market that we believe has high growth potential, to increase DBT’s share of the underground mining equipment market in that country. According to the International Energy Agency’s World Energy Outlook, coal production is expected to grow annually at 4.2%, 1.5% and 3.2% in China, Russia and India, respectively, through 2015.

Advanced Engineering and Innovative Technology. DBT’s products utilize advanced engineering and technology, and we believe that DBT is now a technology leader in the underground mining equipment industry. Specifically, DBT has made significant investments over the last three years to develop its line of longwall shearers and automated plow systems that we believe are technologically advanced products. DBT has made similar investments to develop its line of continuous miners.

For more information regarding the structure of the DBT Acquisition, see “Business—DBT Acquisition.”

Our Industry

The surface and underground mining equipment that we manufacture and service is used primarily in coal, copper, oil sands, iron ore and other mineral mines worldwide. Increased demand for these commodities is generally a function of population growth and continuing improvements in standards of living in many areas of the world. The market for equipment tends to be somewhat cyclical in nature due to market fluctuations for these commodities; however, the aftermarket for parts and services is generally more stable because this expensive, complex equipment is typically kept in continuous operation for eight to 40 years and requires regular maintenance and repair throughout its productive life. According to The Freedonia Group, the global annual market for mining equipment sales was estimated at $17.7 billion in 2004 and is expected to reach $27.5 billion in 2009.

The two primary suppliers of surface mining equipment are Bucyrus and Joy Global Inc.’s P&H Mining Equipment division, or P&H. Similarly, the two primary suppliers of underground mining equipment are DBT and Joy Global’s Joy Mining Machinery division, or Joy Mining. In addition, several niche players compete with limited product lines. We believe that recent consolidation within the mining industry has resulted in higher capitalized companies being better positioned to withstand commodity cycles and adhere to increased supply-side price discipline.

S-3

Business Strengths

Stable and Profitable Aftermarket Business Driven by an Installed Base of Approximately $22.0 Billion. Aftermarket sales accounted for 42% of our total 2006 pro forma combined sales. On a stand-alone basis, Bucyrus’ aftermarket sales accounted for 65% of its total 2006 sales, and DBT’s aftermarket sales accounted for 27% of its total 2006 sales. Bucyrus’ aftermarket sales have grown at a 10.5% compound annual growth rate over the past 10 years, increasing every year over that period except for one year (1999) in which aftermarket sales declined by approximately 2%. Bucyrus has increased its market share in the supply of aftermarket parts and service for Bucyrus’ existing installed base from approximately 40% in 2002 to approximately 60% in 2006.

Advanced Engineering and Innovative Technology. We believe that innovative technologies enable mines to achieve increased efficiency and increased production levels. As a result, we have focused on developing advanced technologies for our products. For example, by teaming with Siemens Energy & Automation, or Siemens, Bucyrus recently developed a new dragline technology called Direct Drive for Draglines, or D3. D3 is a gearless drive system that enables mines to increase productivity and reduce downtime, maintenance costs and energy consumption. Additionally, in 2006 Bucyrus introduced the innovative 495 Series High-Performance shovels. The improvements to this series enhance shovel operation through increased efficiency and lower maintenance costs. DBT offers an upgraded line of continuous miners, which combine high cutting power with matching conveying and tramming capacity. Independent drive functions help to ensure high reliability and ease of maintenance, while the modular design allows roof bolter equipment to be added to the continuous miner.

Strong Global Fundamentals in Our Major End Markets. Our products are used primarily by large multinational companies and other customers that mine coal, copper, oil sands, iron ore and other minerals. As a result, our continued growth is directly linked to each of these underlying commodity markets. The majority of our major end markets have recently experienced strong market conditions, and prospects for continued growth currently remain positive over the longer term. We believe that large amounts of coal reserves and significant coal infrastructure make transitions from coal to other energy sources more difficult. Additionally, we believe that new clean coal technologies help to mitigate environmental and regulatory concerns, and new technologies, such as gasification and liquefaction, create opportunities for future growth in the use of coal.

Strong Backlog. We believe that our backlog level allows us to more accurately forecast our upcoming sales and plan our production accordingly. We expect our pro forma combined backlog of firm orders of $1.4 billion as of December 31, 2006 to generate relatively predictable 2007 levels of sales and cash flows from original equipment orders and related service and maintenance revenue. Additionally, we continue to experience strong market demand for our original equipment based on preliminary letters of intent to purchase, and indications for potential orders for, our original equipment for delivery through 2009.

Experienced Management Team. We are led by a group of executives with substantial experience at Bucyrus and in the mining industry. Our president and chief executive officer, Timothy W. Sullivan, and our chief financial officer, Craig R. Mackus, have 29 and 30 years of experience with us, respectively. Since our current management team was constituted in 2000, we have increased both sales and operating margins, even during the 2000-2003 period of prolonged weakness in commodity prices and original equipment sales, and have also operated efficiently in the current environment of constrained capacity and strong demand for our products. DBT is led by management with substantial experience in the underground mining industry, including William S. Tate, DBT’s current president and chief executive officer, who has over 30 years of energy experience as an operator and equipment manufacturer and has been with DBT for over eight years, and Luis de Leon, DBT’s current chief financial officer, who has 15 years of international experience in machinery and the systems manufacturing industry and has been with DBT for over 10 years.

S-4

Business Strategy

Grow Our Aftermarket Business. We continue to increase our focus on the important aftermarket business associated with our installed base of original equipment because of its attractive profit margins and its greater stability and predictability compared to sales of original equipment. We will seek to increase DBT’s market share of aftermarket parts and services by implementing a strategy similar to Bucyrus’ successful aftermarket strategy. In addition, by enhancing aftermarket support, which is critical to maintaining equipment longevity and productivity, we hope to enhance our ability to secure more original equipment orders in the future.

Improve Operating Efficiencies at DBT. We have identified several long-term growth and cost-saving opportunities at DBT that we expect to implement. We expect to focus on additional initiatives in an attempt to realize increased operating efficiencies at DBT, including consolidating some of DBT’s international sales offices with Bucyrus’ sales offices and reducing DBT’s selling, general and administrative expenses and research and development expenses.

Expand Capacity and Productivity Initiatives. We are in the process of completing the third phase of our capacity expansion of Bucyrus’ manufacturing facilities in South Milwaukee, Wisconsin. Assuming that we are able to attract and retain the necessary skilled labor, the expansion is expected to enable us to increase our annual shovel production capacity from 10 machines in 2006 to 16 machines in 2007 and ultimately to 24 machines in 2008, as well as approximately double our manufactured parts capacity. Our expansion also will help provide us with added flexibility to increase dragline production should demand for shovels decline or demand for draglines increase. In addition, we expect that our expansion will provide for improved efficiency and improved workflow through the implementation of an improved production system and lean manufacturing initiatives. We expect our capacity expansion to be substantially completed by the end of the first quarter of 2008.

Focus on Strategic Markets. We believe that certain markets, including China, Russia and India, present significant growth opportunities in both underground and surface mining, and that these countries will be key strategic markets for our business. China has a fast-growing economy with limited domestic energy sources other than coal. According to the World Coal Institute, coal is currently the dominant natural resource used for power generation in China (approximately 77%). China has the third largest coal reserves in the world, and coal-fired power is expected to fuel most of its growth. According to the Methane to Markets Partnership, 90% of coal production in China was mined underground in 2006. To be in a position to compete more effectively in the underground mining market in China, we plan to expand our manufacturing capacity in China, although this expansion process will likely take at least 12 to 18 months to complete, and we expect that it likely will take at least several quarters after completion until we can begin realizing its anticipated benefits. Furthermore, DBT’s presence in Russia and Bucyrus’ presence in India provide additional opportunities for growth. We also intend to continue focusing on the North American and South African coal markets as areas of potential growth for DBT’s room and pillar mining products and services.

S-5

The Offering

Common stock offered | 4,614,000 shares. |

Approximate number of shares of common stock outstanding after the offering | 36,696,665 shares. |

Listing | The NASDAQ Global Select Market. |

Use of proceeds | We estimate that the net proceeds from this offering will be approximately $286.4 million. We intend to use the net proceeds from this offering to repay a portion of our new $825.0 million term loan facility used to partially finance the DBT Acquisition. See “Use of Proceeds.” |

| | Affiliates of Lehman Brothers Inc. and J.P. Morgan Securities Inc. are lenders under our new term loan facility and, as such, will receive substantially all of the proceeds from this offering. See “Underwriting—Relationships.” |

Risk factors | See “Risk Factors” and other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

The number of shares of our common stock outstanding after this offering is based on our shares outstanding as of March 31, 2007, together with the 471,476 shares of our common stock issued to consummate the DBT Acquisition on May 4, 2007.

The number of shares of our common stock outstanding after this offering assumes that the offering closed on March 31, 2007 and the underwriters’ option to purchase additional shares is not exercised and excludes:

| | • | | 9,600 shares of our common stock issuable upon exercise of fully vested stock options at a weighted average exercise price of $8.33 per share as of March 31, 2007; |

| | • | | 81,774 shares of our common stock issuable upon exercise of 470,150 outstanding stock appreciation rights as of March 31, 2007. Of the 81,774 shares, 8,177 pertain to fully vested and exercisable outstanding stock appreciation rights as of March 31, 2007; and |

| | • | | 2,466,251 shares of our common stock available for future grants under our equity incentive plans as of March 31, 2007 (including under our Omnibus Incentive Plan 2007 approved at our 2007 annual stockholders meeting). |

If the underwriters exercise their option to purchase additional shares in full, we will issue and sell an additional 692,100 shares and will receive additional proceeds, after underwriting discounts and commissions but before expenses, of $43.1 million, which we expect to use to further reduce our term loan facility. See “Underwriting.”

Our principal executive offices are located at 1100 Milwaukee Avenue, South Milwaukee, Wisconsin 53172. Our phone number is (414) 768-4000.

S-6

Summary First Quarter 2007 Results

Bucyrus First Quarter 2007 Compared to First Quarter 2006

While Bucyrus’ unaudited financial statements are not yet complete and Bucyrus has not yet filed its quarterly report on Form 10-Q for its first quarter ended March 31, 2007, Bucyrus currently expects to report the following results of operations and balance sheet information for the quarter ended March 31, 2007. The data reported in the following table for the quarter ended March 31, 2006 has been derived from Bucyrus’ unaudited consolidated condensed financial statements, which include all adjustments, consisting only of normal adjustments that management considers necessary for the fair presentation of the consolidated financial position and results of operations for that interim period. You should not consider the results presented in the table below for the first quarter ended March 31, 2007 to be indicative of results for the year ending December 31, 2007, particularly as a result of the DBT Acquisition. This table should be read together with our other financial information, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” appearing elsewhere in this prospectus supplement.

| | | | | | | |

| | | Three months ended March 31, |

| | | 2007 | | | 2006 |

| | | (Dollars in thousands) |

Statement of Earnings Data: | | | | | | | |

| | |

Sales | | $ | 190,361 | | | $ | 165,653 |

Cost of products sold | | | 138,283 | | | | 124,780 |

| | | | | | | |

Gross profit | | | 52,078 | | | | 40,873 |

Selling, general and administrative expenses | | | 21,194 | | | | 15,460 |

Research and development expenses | | | 2,548 | | | | 1,922 |

Amortization of intangible assets | | | 446 | | | | 452 |

| | | | | | | |

Operating earnings | | | 27,890 | | | | 23,039 |

| | |

Interest expense | | | 1,449 | | | | 645 |

Other (income) expense, net | | | (23 | ) | | | 122 |

| | | | | | | |

Earnings before income taxes | | | 26,464 | | | | 22,272 |

Income tax expense | | | 8,601 | | | | 7,750 |

| | | | | | | |

Net earnings | | $ | 17,863 | | | $ | 14,522 |

| | | | | | | |

Balance Sheet Data: | | | | | | | |

| | |

Cash and cash equivalents | | $ | 13,285 | | | $ | 9,575 |

Total assets | | | 627,751 | | | | 600,712 |

Total debt | | | 94,180 | | | | 82,597 |

Stockholders’ investment | | | 314,084 | | | | 295,996 |

| | | | | | | |

Other Financial Data: | | | | | | | |

| | |

EBITDA(1) | | $ | 32,160 | | | $ | 26,616 |

Certain charges deducted in calculating EBITDA(2) | | | 2,260 | | | | 892 |

(1) | EBITDA is defined as net earnings before interest income, interest expense, income tax expense, depreciation and amortization. EBITDA is presented because (a) we use EBITDA to measure our liquidity and financial performance and (b) we believe EBITDA is frequently used by securities analysts, investors and other interested parties in evaluating the performance and enterprise value of companies in general, and in evaluating the liquidity of companies with significant debt service obligations and their ability to service their indebtedness. Our EBITDA calculation is not an alternative to operating earnings under U.S. GAAP as an indicator of operating performance or of cash flows as a measure of liquidity. Additionally, EBITDA is |

S-7

| | not intended to be a measure of free cash flow for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. Because not all companies use identical calculations, this presentation of EBITDA may not be comparable to other similarly titled measures of other companies. The following table reconciles net earnings as shown in Bucyrus’ Unaudited Consolidated Statements of Earnings to EBITDA and reconciles EBITDA to net cash provided by operating activities as shown in Bucyrus’ Unaudited Consolidated Statements of Cash Flows: |

| | | | | | | | |

| | | Three months ended March 31, | |

| | | 2007 | | | 2006 | |

| | | (Dollars in thousands) | |

Net earnings | | $ | 17,863 | | | $ | 14,522 | |

Interest income | | | (212 | ) | | | (114 | ) |

Interest expense | | | 1,449 | | | | 645 | |

Income tax expense | | | 8,601 | | | | 7,750 | |

Depreciation | | | 3,748 | | | | 3,107 | |

Amortization(3) | | | 711 | | | | 706 | |

| | | | | | | | |

EBITDA | | | 32,160 | | | | 26,616 | |

| | |

Changes in assets and liabilities | | | (15,057 | ) | | | 23,822 | |

Non-cash stock compensation expense | | | 1,692 | | | | 578 | |

Loss on sales of fixed assets | | | 95 | | | | 42 | |

Interest income | | | 212 | | | | 114 | |

Interest expense | | | (1,449 | ) | | | (645 | ) |

Income tax expense | | | (8,601 | ) | | | (7,750 | ) |

| | | | | | | | |

Net cash provided by operating activities | | $ | 9,052 | | | $ | 42,777 | |

| | | | | | | | |

(2) | The following table shows certain charges that were deducted in calculating EBITDA for each of the periods presented. These items include (a) non-cash stock compensation expense related to Bucyrus’ equity incentive plans, (b) severance expenses for personnel changes in the ordinary course and (c) loss on sales of fixed assets in the ordinary course. We believe this table, when reviewed in connection with our presentation of EBITDA, provides additional information that is useful to our management and investors for measuring comparative operating performance between time periods and among companies. In addition to EBITDA, our management assesses the charges presented in this table when preparing our annual operating budget and financial projections. Specifically, we believe that this table allows our management and investors to assess our operating performance during the periods these charges were incurred on a consistent basis with the periods during which these charges were not incurred. |

| | | | | | |

| | | Three months ended March 31, |

| | | 2007 | | 2006 |

| | | (Dollars in thousands) |

Non-cash stock compensation expense | | $ | 1,692 | | $ | 578 |

Severance expenses | | | 473 | | | 272 |

Loss on sales of fixed assets | | | 95 | | | 42 |

| | | | | | |

| | $ | 2,260 | | $ | 892 |

| | | | | | |

(3) | Includes amortization of intangible assets and debt issuance costs. |

S-8

DBT First Quarter 2007

DBT has not been a United States reporting company and has not historically prepared quarterly financial statements on a basis consistent with the audited financial statements of DBT included elsewhere in this prospectus supplement. As a result, DBT has not prepared financial statements for the first quarters of 2007 or 2006 on a basis that is directly comparable to the DBT audited financial information. Although DBT’s quarterly results are not necessarily indicative of the results to be expected for the remainder of 2007, we expect that DBT’s sales for 2007 will return to more normalized levels than were recognized in the first half of 2006. For the first quarter of 2007, DBT’s order intake, which we define as firm purchase orders booked during the period, was approximately $250 million, a decrease of 18.4% compared to order intake of approximately $296 million for the first quarter of 2006, but an increase of 81.2% and 41.2% compared to DBT’s order intake of approximately $138 million and $177 million for the third and fourth quarters of 2006, respectively. We believe this decrease reflects the fact that the first half of DBT’s 2006 results of operations benefited significantly from an influx of original equipment orders from underground mining customers that had deferred their original equipment purchases during the prolonged prior period of weaker coal commodity prices. We further base our expected decrease in DBT’s 2007 sales on the combination of the recent softening of U.S. coal commodity prices and our projected decreased demand for DBT’s original equipment from the unusually high levels of demand in the last half of 2005 and the first half of 2006. We anticipated and took into account these expected normalized levels of results when we valued and entered into the agreement to acquire DBT and have incorporated these expectations into our estimated range of full year 2007 pro forma combined sales and EBITDA. See “Management’s Discussion and Analysis of Results of Operations and Financial Condition—Current 2007 Outlook.”

S-9

Summary Financial and Other Data

The following summary historical consolidated financial and other data of Bucyrus for the past three years is derived from Bucyrus’ audited consolidated financial statements. The following summary historical consolidated financial and other data of DBT for the past three years is derived from DBT’s audited consolidated financial statements (except for amounts presented in U.S. dollars, which have not been audited). You should read these tables in conjunction with “Use of Proceeds,” “Selected Historical Consolidated Financial Information of Bucyrus,” “Selected Financial Information of DBT,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the historical financial statements, including the related notes thereto, included elsewhere in this prospectus supplement.

The summary historical financial information of DBT is presented in thousands of Euros. We also present summary historical financial information of DBT for 2006 in thousands of U.S. dollars, which, for the balance sheet and backlog data, is based on a translation at a representative rate of exchange of Euro 1.00 = U.S. Dollar 1.3203 as of December 29, 2006 and, for the statement of earnings and other financial data, is based on a translation at a representative average 2006 rate of exchange of Euro = U.S. Dollar 1.25622.

DBT’s historical consolidated financial statements appearing elsewhere in this prospectus supplement have been prepared in accordance with IFRS, which differ in certain material respects from U.S. GAAP. For a discussion of certain significant differences between IFRS and U.S. GAAP, see note 30 to DBT’s audited consolidated financial statements included elsewhere in this prospectus supplement, which reconciles DBT’s net profits and shareholders’ equity as reported under IFRS to U.S. GAAP. See “Unaudited Pro Forma Combined Condensed Financial Information.”

The pro forma statement of earnings gives pro forma effect to the DBT Acquisition and the related financing transactions, including this offering, as if those transactions had occurred on January 1, 2006. For more information, see “Unaudited Pro Forma Combined Condensed Financial Information.” The pro forma balance sheet gives pro forma effect to the same transactions as if they had occurred on December 31, 2006.

The pro forma condensed combined financial information is presented for illustrative purposes only and is not necessarily indicative of what the actual combined financial condition or results of operations would have been had the DBT Acquisition been completed on January 1, 2006 or December 31, 2006. The DBT Acquisition will be accounted for as a purchase. The adjustments reflected in the pro forma condensed combined financial information are based on preliminary purchase price allocations and assumptions that we believe are reasonable. These adjustments may change when additional information becomes available. Differences between the preliminary and final purchase price allocations could have a material impact on the pro forma financial information presented. The pro forma condensed combined financial information does not reflect costs we may incur to integrate DBT, and these costs may be material. Accordingly, the pro forma condensed consolidated financial information does not purport to be indicative of the financial condition or results of operations as of the effective date of the DBT Acquisition, as of the date of this prospectus supplement, or as of any other future date or period. This pro forma information is only a summary and should be read together with “Unaudited Pro Forma Condensed Combined Financial Information” and the historical financial statements, the related notes and other financial information of Bucyrus and DBT included or incorporated by reference into this prospectus supplement.

S-10

Summary Bucyrus Historical Financial Information

| | | | | | | | | |

| | | Years ended December 31, |

| | | 2006 | | 2005 | | 2004 |

| | | (Dollars in thousands) |

Statement of Earnings Data: | | | | | | | | | |

| | | |

Sales | | $ | 738,050 | | $ | 575,042 | | $ | 454,186 |

Cost of products sold | | | 551,275 | | | 437,611 | | | 357,819 |

Selling, general and administrative expenses | | | 73,138 | | | 54,354 | | | 53,050 |

Research and development expenses | | | 10,661 | | | 7,225 | | | 5,619 |

Amortization of intangible assets | | | 1,792 | | | 1,801 | | | 1,817 |

| | | | | | | | | |

Operating earnings | | | 101,184 | | | 74,051 | | | 35,881 |

| | | |

Interest expense | | | 3,693 | | | 4,865 | | | 11,547 |

Other expense, net | | | 217 | | | 269 | | | 1,658 |

Loss on extinguishment of debt | | | — | | | — | | | 7,316 |

| | | | | | | | | |

Earnings before income taxes | | | 97,274 | | | 68,917 | | | 15,360 |

Income tax expense | | | 26,930 | | | 15,358 | | | 9,276 |

| | | | | | | | | |

Net earnings | | $ | 70,344 | | $ | 53,559 | | $ | 6,084 |

| | | | | | | | | |

Balance Sheet Data: | | | | | | | | | |

| | | |

Cash and cash equivalents | | $ | 9,575 | | $ | 12,451 | | $ | 20,617 |

Total assets | | | 600,712 | | | 491,967 | | | 392,809 |

Total debt | | | 82,597 | | | 68,314 | | | 103,252 |

Common stockholders’ investment | | | 295,996 | | | 220,900 | | | 167,068 |

| | | |

Other Financial Data: | | | | | | | | | |

| | | |

Capital expenditures | | $ | 71,306 | | $ | 22,164 | | $ | 6,285 |

EBITDA(1) | | | 116,023 | | | 87,582 | | | 40,846 |

Certain charges deducted in calculating EBITDA(2) | | | 5,867 | | | 974 | | | 19,833 |

Total backlog | | | 894,749 | | | 658,612 | | | 436,317 |

(1) | Please see page S-7 for a comprehensive discussion of EBITDA and why we believe this non-GAAP measure is useful to measure our liquidity and financial performance. |

S-11

The following table reconciles net earnings as shown in Bucyrus’ Consolidated Statements of Earnings to EBITDA and reconciles EBITDA to net cash provided by operating activities as shown in Bucyrus’ Consolidated Statements of Cash Flows:

| | | | | | | | | | | | |

| | | Years ended December 31, | |

| | | 2006 | | | 2005 | | | 2004 | |

| | | (Dollars in thousands) | |

Net earnings | | $ | 70,344 | | | $ | 53,559 | | | $ | 6,084 | |

Interest income | | | (663 | ) | | | (669 | ) | | | (316 | ) |

Interest expense | | | 3,693 | | | | 4,865 | | | | 11,547 | |

Income tax expense | | | 26,930 | | | | 15,358 | | | | 9,276 | |

Depreciation | | | 12,892 | | | | 11,681 | | | | 11,061 | |

Amortization(3) | | | 2,827 | | | | 2,788 | | | | 3,194 | |

| | | | | | | | | | | | |

EBITDA(2) | | | 116,023 | | | | 87,582 | | | | 40,846 | |

Changes in assets and liabilities | | | (39,557 | ) | | | (18,123 | ) | | | (22,957 | ) |

Non-cash stock compensation expense | | | 4,284 | | | | 180 | | | | 10,076 | |

Loss on sales of fixed assets | | | 140 | | | | 273 | | | | 287 | |

Interest income | | | 663 | | | | 669 | | | | 316 | |

Interest expense | | | (3,693 | ) | | | (4,865 | ) | | | (11,547 | ) |

Income tax expense | | | (26,930 | ) | | | (15,358 | ) | | | (9,276 | ) |

Loss on extinguishment of debt | | | — | | | | — | | | | 7,316 | |

Secondary offering expenses | | | — | | | | — | | | | 602 | |

| | | | | | | | | | | | |

Net cash provided by operating activities | | $ | 50,930 | | | $ | 50,358 | | | $ | 15,663 | |

| | | | | | | | | | | | |

Net cash used in investing activities | | $ | (70,603 | ) | | $ | (22,109 | ) | | $ | (6,706 | ) |

| | | | | | | | | | | | |

Net cash provided by (used in) financing activities | | $ | 15,134 | | | $ | (36,299 | ) | | $ | 5,188 | |

| | | | | | | | | | | | |

(2) | The following table shows certain charges that were deducted in calculating EBITDA for each of the periods presented. These items include (a) expenses pursuant to a management services agreement with American Industrial Partners, or AIP, our former controlling stockholder, as well as fees paid to AIP or its affiliates and advisors for financial and management services performed for us outside the scope of the management services agreement, which was terminated in July 2004, (b) severance expenses for personnel changes in the ordinary course, (c) non-cash stock compensation expense related to Bucyrus’ equity incentive plans, (d) loss on sales of fixed assets in the ordinary course, (e) loss on extinguishment of debt and (f) secondary offering expenses. We believe this table, when reviewed in connection with our presentation of EBITDA, provides additional information that is useful to our management and investors for measuring comparative operating performance between time periods and among companies. In addition to EBITDA, our management assesses the charges presented in this table when preparing our annual operating budget and financial projections. Specifically, we believe that this table allows our management and investors to assess our operating performance during the periods these charges were incurred on a consistent basis with the periods during which these charges were not incurred. |

S-12

| | | | | | | | | |

| | | Years ended December 31, |

| | | 2006 | | 2005 | | 2004 |

| | | (Dollars in thousands) |

AIP management services expenses | | $ | — | | $ | — | | $ | 1,182 |

Severance expenses | | | 1,443 | | | 521 | | | 370 |

Non-cash stock compensation expense | | | 4,284 | | | 180 | | | 10,076 |

Loss on sales of fixed assets | | | 140 | | | 273 | | | 287 |

Loss on extinguishment of debt | | | — | | | — | | | 7,316 |

Secondary offering expenses | | | — | | | — | | | 602 |

| | | | | | | | | |

| | $ | 5,867 | | $ | 974 | | $ | 19,833 |

| | | | | | | | | |

(3) | Includes amortization of intangible assets and debt issuance costs. |

Summary DBT Historical Financial Information

The following summary historical consolidated financial and other data of DBT for the past three years is derived from DBT’s historical consolidated financial statements that have been prepared in accordance with IFRS, which differ in certain material respects from U.S. GAAP. For a discussion of certain significant differences between IFRS and U.S. GAAP, see note 30 to DBT’s audited consolidated financial statements included elsewhere in this prospectus supplement, which reconciles DBT’s net profits and shareholders’ equity as reported under IFRS to U.S. GAAP.

| | | | | | | | | | | |

| | | Years ended December 31, | |

| | | 2006(1) | | 2006 | | 2005 | | | 2004 | |

| | | (Dollars in thousands) | | (Euros in thousands) | |

Statement of Income Data: | | | | | | | | | | | |

| | | | |

| Sales | | $ | 1,173,680 | | €934,295 | | €752,453 | | | €621,108 | |

| Cost of sales | | | 917,729 | | 730,548 | | 596,025 | | | 506,019 | |

| Other operating income | | | 23,839 | | 18,977 | | 25,629 | | | 25,831 | |

| Selling expenses | | | 60,667 | | 48,293 | | 52,384 | | | 49,617 | |

| General and administrative expenses | | | 93,379 | | 74,333 | | 60,449 | | | 50,510 | |

| Other expenses | | | 13,473 | | 10,726 | | 9,617 | | | 10,252 | |

| | | | | | | | | | | |

| | | 112,271 | | 89,372 | | 59,607 | | | 30,541 | |

| Other interest and similar income | | | 4,993 | | 3,975 | | 3,065 | | | 3,650 | |

| Interest and similar expenses | | | 10,756 | | 8,562 | | 9,398 | | | 8,450 | |

| | | | | | | | | | | |

| Profit before tax | | | 106,508 | | 84,785 | | 53,274 | | | 25,741 | |

| Income tax | | | 26,505 | | 21,099 | | 15,323 | | | 7,979 | |

| | | | | | | | | | | |

| Profit of the year from continuing operations | | $ | 80,003 | | € 63,686 | | € 37,951 | | | € 17,762 | |

| | | | | | | | | | | |

Balance Sheet Data: | | | | | | | | | | | |

| | | | |

Cash and cash equivalents | | $ | 22,536 | | € 17,069 | | € 25,311 | | | N/A | |

Total assets | | | 789,889 | | 598,265 | | 607,223 | | | N/A | |

Other financial liabilities | | | 85,955 | | 65,103 | | 82,908 | | | N/A | |

Total shareholders’ equity | | | 223,548 | | 169,316 | | 122,002 | | | N/A | |

| | | | |

Other Financial Data: | | | | | | | | | | | |

| | | | |

Capital expenditures | | $ | 58,748 | | € 46,766 | | € 14,982 | | | € 23,999 | |

EBITDA(2) | | | 128,821 | | 102,546 | | 73,673 | | | 45,273 | |

Certain charges (credits) included in calculating EBITDA(3) | | | 16,762 | | 13,344 | | (2,389 | ) | | (3,893 | ) |

Total backlog | | | 514,320 | | 389,548 | | N/A | | | N/A | |

S-13

(1) | For convenience, financial information in this column is unaudited and has been converted into U.S. dollars from the comparable information presented in Euros using the representative exchange rates described elsewhere in this prospectus supplement. Total amounts in this column may not correspond to the summation of individual line items due to rounding related to the conversion. |

(2) | Please see page S-7 for a comprehensive discussion of EBITDA and why we believe this non-GAAP measure is useful to measure our liquidity and financial performance. The following table reconciles net earnings as shown in DBT’s Consolidated Statements of Earnings to EBITDA: |

| | | | | | | | | | | | | |

| | | Years ended December 31, | |

| | | 2006(1) | | | 2006 | | | 2005 | | | 2004 | |

| | | (Dollars in

thousands) | | | (Euros in thousands) | |

Profit of the year from continuing operations | | $ | 80,003 | | | € 63,686 | | | €37,951 | | | €17,762 | |

Other interest and similar income | | | (4,993 | ) | | (3,975 | ) | | (3,065 | ) | | (3,650 | ) |

Interest and similar expenses | | | 10,756 | | | 8,562 | | | 9,398 | | | 8,450 | |

Income tax | | | 26,505 | | | 21,099 | | | 15,323 | | | 7,979 | |

Depreciation | | | 15,261 | | | 12,148 | | | 12,987 | | | 13,301 | |

Amortization(4) | | | 1,289 | | | 1,026 | | | 1,079 | | | 1,431 | |

| | | | | | | | | | | | | |

EBITDA(3) | | $ | 128,821 | | | €102,546 | | | €73,673 | | | €45,273 | |

| | | | | | | | | | | | | |

(3) | The following table shows certain charges (credits) that were included in calculating EBITDA for each of the periods presented. These items include (a) a customer accommodation settlement related to temporary technological deficiencies for a newly introduced, high-technology prototype longwall system, which deficiencies have been subsequently rectified, (b) net gains on sales of fixed assets and (c) profit from DBT’s disposition of its DBT Mineral Processing subsidiary. We believe this table, when reviewed in connection with our presentation of EBITDA, provides additional information that is useful to our management and investors for measuring comparative operating performance between time periods and among companies. In addition to EBITDA, our management assesses the charges presented in this table when preparing our annual operating budget and financial projections. We believe that this table allows our management and investors to assess our operating performance during the periods these charges were incurred on a consistent basis with the periods during which these charges were not incurred. |

| | | | | | | | | | | | | |

| | | Years ended December 31, | |

| | | 2006(1) | | | 2006 | | | 2005 | | | 2004 | |

| | | (Dollars in

thousands) | | | (Euros in thousands) | |

Customer accommodation settlement | | $ | 22,844 | | | €18,185 | | | € — | | | € — | |

Net gains on sales of fixed assets | | | (3,318 | ) | | (2,641 | ) | | (2,389 | ) | | (3,893 | ) |

Profit from disposal of DBT Mineral Processing | | | (2,764 | ) | | (2,200 | ) | | — | | | — | |

| | | | | | | | | | | | | |

| | $ | 16,762 | | | €13,344 | | | €(2,389 | ) | | €(3,893 | ) |

| | | | | | | | | | | | | |

(4) | Includes amortization of intangible assets. |

S-14

Summary Pro Forma Financial Information

The pro forma condensed combined financial information is presented for illustrative purposes only and is not necessarily indicative of what the actual combined financial position or results of operations would have been had the DBT Acquisition been completed on January 1, 2006 for the statement of earnings or December 31, 2006 for the balance sheet. This pro forma information is only a summary and should be read together with “Unaudited Pro Forma Combined Condensed Financial Information” and the historical financial statements, the related notes and other financial information of Bucyrus and DBT included elsewhere in this prospectus supplement.

| | | |

| | | Year ended

December 31,

2006 |

| | | (Dollars in

thousands) |

Statement of Earnings Data: | | | |

| |

Sales | | $ | 1,911,730 |

Cost of products sold | | | 1,420,239 |

Selling, general and administrative expenses | | | 251,646 |

Research and development expenses | | | 19,881 |

Amortization of intangible assets | | | 10,192 |

| | | |

Operating earnings | | | 209,772 |

Interest expense | | | 39,534 |

Other income, net | | | 6,904 |

| | | |

Earnings before income taxes | | | 177,142 |

Income tax expense | | | 57,386 |

| | | |

| |

Net earnings | | $ | 119,756 |

| | | |

| |

Balance Sheet Data: | | | |

| |

Cash and cash equivalents | | $ | 17,386 |

Total assets | | | 1,977,542 |

Long-term debt, less current maturities | | | 542,077 |

Common stockholders’ investment | | | 604,178 |

| |

Other Financial Data: | | | |

| |

EBITDA(1) | | $ | 252,851 |

Certain charges deducted in calculating EBITDA(2) | | | 22,629 |

Total backlog | | | 1,409,609 |

S-15

(1) | Please see page S-7 for a comprehensive discussion of EBITDA and why we believe this non-GAAP financial measure is useful to measure our liquidity and financial performance. Pro forma EBITDA presented below includes adjustments necessary to conform DBT’s financial statements, which are prepared in accordance with IFRS, to U.S. GAAP and to the Company’s accounting policies. These adjustments will cause the component of pro forma EBITDA that is attributable to DBT’s results of operations to differ from the presentation of DBT’s EBITDA in “—Summary DBT Historical Financial Information.” The following table reconciles net earnings as shown in the Unaudited Pro Forma Combined Condensed Statements of Earnings to EBITDA: |

| | | | |

| | | Year ended December 31,

2006 | |

| | | (Dollars in

thousands) | |

Net earnings | | $ | 119,756 | |

Interest income | | | (5,656 | ) |

Interest expense | | | 39,534 | |

Income tax expense | | | 57,386 | |

Depreciation | | | 28,404 | |

Amortization(3) | | | 13,427 | |

| | | | |

EBITDA(2) | | $ | 252,851 | |

| | | | |

(2) | The following table shows certain charges (credits) that were included in calculating EBITDA for the period presented. These items include (a) severance expenses for personnel changes in the ordinary course, (b) non-cash stock compensation expense related to Bucyrus’ equity compensation plans, (c) gain on sales of fixed assets, net, (d) a customer accommodation settlement described in footnote 3 to the “Summary DBT Historical Financial Information” table and (e) profit from DBT’s disposition of its DBT Mineral Processing subsidiary. We believe this table, when reviewed in connection with our presentation of EBITDA, provides additional information that is useful to our management and investors for measuring comparative operating performance between time periods and among companies. In addition to EBITDA, our management assesses the charges presented in this table when preparing our annual operating budget and financial projections. Specifically, we believe that this table allows our management and investors to assess our operating performance during the periods these charges were incurred on a consistent basis with the periods during which these charges were not incurred. |

| | | | |

| | | Year ended

December 31,

2006 | |

| | | (Dollars in

thousands) | |

Severance expenses | | $ | 1,443 | |

Non-cash stock compensation expense | | | 4,284 | |

Gain on sales of fixed assets, net | | | (3,178 | ) |

Customer accommodation settlement | | | 22,844 | |

Profit from disposal of DBT Mineral Processing | | | (2,764 | ) |

| | | | |

| | $ | 22,629 | |

| | | | |

(3) | Includes amortization of intangible assets and debt issuance costs. |

S-16

RISK FACTORS

Before making a decision to invest in our common stock, you should carefully consider the risk factors set forth below and all other information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference and the matters discussed under “Forward-Looking Statements and Cautionary Factors” in this prospectus supplement and in the accompanying prospectus. If any of the events contemplated by the following risks actually occur, our business, financial condition and/or results of operations could be materially adversely affected. As a result of these and other factors, the value of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

A material disruption to our manufacturing plants could adversely affect our ability to generate revenue.

Bucyrus produces most of its surface mining equipment and aftermarket parts at its manufacturing plants in South Milwaukee and Milwaukee, Wisconsin, while DBT produces most of its underground mining equipment and aftermarket parts at its manufacturing plants in Germany, Pennsylvania and Virginia and, to a lesser extent, in Poland, China, Australia and Alabama. If operations at any of these facilities were to be disrupted as a result of equipment failures, natural disasters, work stoppages, power outages or other reasons, our business, financial condition and/or results of operations could be materially adversely affected. Any of these significant events could require us to make large unanticipated capital expenditures. Interruptions in production could increase our costs and delay our delivery of original equipment and parts in production. Production capacity limits could cause us to reduce or delay sales efforts until production capacity is available. All of our facilities are also subject to the risk of catastrophic loss due to fires, explosions or adverse weather conditions. Lost sales or increased costs that we may experience during the disruption of operations may not be recoverable under our insurance policies, and longer-term business disruptions could result in a loss of customers. If this were to occur, our future sales levels, and therefore our future profitability and cash flow, could be materially adversely affected.

We must attract and retain skilled labor in order to maintain and increase our business.

Our ability to operate profitably and expand our operations, including the realization of the desired benefits of our current production capacity expansion program, depends in part on our ability to attract and retain skilled manufacturing workers, equipment operators, engineers and other technical personnel. Demand for these workers is currently high and the supply is limited, particularly in the case of skilled and experienced machinists, welders and engineers. Also, DBT will face the retirement of a large number of skilled employees over the next five to ten years. As a result, our growth may be limited by the scarcity of skilled labor. Additionally, a significant increase in the wages paid by competing employers could result in a reduction in our skilled labor force, increases in the rates of wages we must pay or both. Further, we may be faced with increased training costs and reduced productivity as we train new employees. If our compensation costs increase or we cannot attract and retain skilled labor, including engineers, machinists and welders, our earnings could be reduced, and production capacity and growth potential could be impaired.

Bucyrus’ production capacity may not be sufficient to meet customer demand.

Bucyrus is currently operating at very high capacity utilization levels. In addition, its backlog of firm orders for surface mining equipment was $894.7 million as of December 31, 2006, compared to $658.6 million as of December 31, 2005. Our current expectations for 2007 assume continued strong global mining growth, as well as continued growth of Bucyrus’ sales. Bucyrus is in the midst of completing the third phase of its expansion program at its South Milwaukee facility that we believe will substantially increase its surface mining equipment production capacity, assuming we can employ sufficient skilled labor. However, production capacity may not be expanded soon enough, or to a sufficient extent, to satisfy customer demand for our surface mining products. If Bucyrus is unable to commit to producing products for its customers within the timeframes they require, then these customers may seek to procure equipment from other sources to meet their project deadlines, which could adversely affect our future sales levels, profitability and cash flow.

S-17

If we are unable to purchase component parts or raw materials from key suppliers, the prices of component parts or raw materials rise materially, or the costs of shipping products rise materially, our business and results of operations may be materially adversely affected.

Bucyrus purchases all of its alternating current, or AC, drives relating to surface mining equipment and certain other electrical parts pursuant to a 10-year agreement with Siemens. Delays, disruptions or other difficulties procuring parts from Siemens, or our inability to obtain parts from Siemens altogether could have a material adverse effect on our business and results of operations. DBT purchases components of its roof supports from three primary suppliers pursuant to written agreements. The loss of any of these three primary suppliers, or delays, disruptions or other difficulties procuring parts from these suppliers, could have a material adverse effect on DBT’s ability to timely produce its roof supports and other underground mining original equipment and, ultimately, could have a material adverse effect on our business and results of operations. Bucyrus also purchases track links, castings and forgings from suppliers with whom we have longstanding relationships. Although these are not sole source suppliers, the loss of these suppliers could affect our ability to maintain or lower costs.

If we are required to procure alternative sources of supply, our ability to supply parts to our customers when needed could be impaired, we could lose business and our margins and cash flow could be reduced. Also, because we maintain limited production input inventories, even brief unanticipated delays in delivery by suppliers, including those due to capacity constraints, labor disputes, impaired financial condition of suppliers, weather emergencies or other natural disasters, may impair our ability to satisfy our customers and could adversely affect our operations.

In addition, we use substantial quantities of steel in our production processes. If the price of steel or other raw materials increases further and we are unable to recover those price increases, or if availability of certain types of steel decreases and we are not able to acquire sufficient quantities of this steel, we will experience reduced margins. Any significant future delays in obtaining production inputs and other supplies could result in our delay in delivering or producing products for our customers, which could subject us to contractual damage claims or otherwise harm our business and results of operations. In addition, there recently has been consolidation within the steelmaking industry, which could impede our ability to rely on competitive balance and longstanding business relationships to procure steel on favorable terms and in a timely manner.

Bucyrus also purchases component parts and raw materials on terms extended to us by our suppliers based on our overall credit rating. We significantly increased our debt levels to fund the DBT Acquisition. If our credit rating were to change adversely, our suppliers may not be willing or able to continue to extend favorable terms to us, which could negatively impact our cash flow or cause us to incur increased indebtedness under our revolving credit facility.

Some of our contracts require us to bear all costs of shipping and handling to the customer’s site. Because of the size and weight of our goods, these costs can be a significant portion of the total costs of a given contract. If transportation costs rise materially due to fuel prices or other factors, our margins could be reduced.

The industries we serve and our business are subject to significant cyclical fluctuations.

The sale of mining equipment is cyclical in nature and sensitive to a variety of factors, including fluctuations in market prices for coal, copper, oil, iron ore and other minerals, as well as alternatives to these minerals, changes in general economic conditions, interest rates, our customers’ replacement or repair cycles, consolidation in the mining industry and competitive pressures. Many factors affect the supply and demand for coal, minerals and oil and thus may affect the sale of our products and services, including:

| | • | | commodities prices and changes in those prices; |

| | • | | the levels of commodity production; |

| | • | | the levels of mineral inventories; |

S-18

| | • | | the expected cost of developing new reserves; |

| | • | | the cost of conducting mining operations; |

| | • | | the level of mining activity; |

| | • | | worldwide economic activity; |

| | • | | substitution of new or competing inputs and mining methods; |

| | • | | national government political requirements; |

| | • | | environmental regulation; and |

If demand for mining services or mining equipment utilization rates decrease significantly, then demand for our products and services (particularly demand for original equipment, which tends to be closely correlated with the strength of commodity markets and, as a result, tends to be more cyclical than aftermarket sales), will likely decrease. Future decreased demand for original equipment may impact our results of operations to a greater extent than decreased demand in prior periods since we expect the total percentage of our sales derived from the sale of original equipment versus aftermarket parts and services to increase as a result of the DBT Acquisition. As a result of this cyclicality, we have experienced, and in the future could experience, extended periods of reduced sales and margins.

Because our customers’ purchasing patterns are affected by a variety of factors beyond our control, our sales and operating results may fluctuate significantly from period to period. Given the large sales prices of our equipment, one or a limited number of machines may account for a substantial portion of our sales in any particular quarter or other period. Although we recognize sales on a percentage-of-completion basis for most of our original equipment, the timing of one or a small number of contracts in any particular period may nevertheless affect our operating results. In addition, our sales and gross profit may fluctuate depending upon the sizes and the requirements of the particular contracts we enter into in that period.

As a result of the DBT Acquisition, we anticipate that our consolidated sales to coal mining customers will increase substantially, which will make our results of operations more dependent on the commodity price of coal and other conditions in the coal markets.

We anticipate that our consolidated sales to coal mining customers will increase substantially, primarily as a result of the DBT Acquisition. Approximately 96% of DBT’s sales in 2006 were derived from sales to coal mining customers compared to approximately 53% of Bucyrus’ sales for the same period. On a pro forma combined basis, our 2006 sales to coal mining customers accounted for approximately 79% of our total sales. Many of these customers supply coal as fuel for the production of electricity in the United States and other countries. Government regulation of electric utilities may adversely impact the demand for coal to the extent that such regulations cause or require such utilities to select alternative energy sources or technologies as a source of electric power. If a more economical form of electricity generation is discovered, developed or mandated, or if a current alternative source of energy such as nuclear power becomes more widely accepted or cost effective, the demand for our mining equipment could be adversely affected.

In any given year, we rely on significant customers for a large percentage of our sales.

Our business is dependent on securing and maintaining customers by promptly delivering reliable and high-performance products. We do not believe we are dependent upon any single customer; however, on an annual basis a single customer may account for a large percentage of our sales, particularly original equipment sales. In 2006, 2005 and 2004, BHP Billiton, Bucyrus’ single largest customer, accounted for approximately 13%, 14% and 12%, respectively, of its sales. DBT’s largest customer, the Shenhua Group, accounted for approximately 14% of its sales in 2006. The products that Bucyrus or DBT may sell to any particular customer depend on the

S-19

size of that customer’s capital expenditure budget devoted to mining plans in a particular year and on the results of competitive bids for major projects. Additionally, Bucyrus’ top five customers in each of 2006, 2005 and 2004 collectively accounted for approximately 40%, 38% and 36%, respectively, of its sales. This trend reflects the recent consolidation within the mining industry. In addition, key sectors of the mining industry are dominated by a few enterprises, most of which are our customers. The loss of one or more of our significant customers or significantly reduced sales orders from significant customers could have a material adverse effect on our results of operations.

The loss of key members of our management team could adversely affect our business.

Our success substantially depends upon our ability to attract and retain qualified employees and upon the ability of senior management and other key employees to implement our business strategy and maintain and enhance our customer and supplier relationships. We believe there are only a limited number of available qualified chief executives in our industry. We rely substantially upon the services of our executive officers, and the loss of their services or the services of other members of our management team or our inability to attract or retain other talented personnel could impede the further implementation of our business strategy, which could have a material adverse effect on our business.

We are subject to risks of conducting business in foreign countries, including emerging markets.

We derive the majority of our sales from foreign markets where we have substantial operations. During 2006, Bucyrus generated $556.4 million, or approximately 75%, of its sales outside the United States, and DBT generated a significant percentage of its sales outside the United States. Various political, regulatory or economic factors, or changes in those factors, have the potential to adversely affect our international operations and our financial results. These factors principally include:

| | • | | tariffs and price controls; |