UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3970

Smith Barney California Municipals Fund Inc.

(Exact name of registrant as specified in charter)

125 Broad Street, New York, NY 10004

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Smith Barney Fund Management LLC

300 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: February 28

Date of reporting period: August 31, 2004

| ITEM 1. | REPORT TO STOCKHOLDERS. |

| | The Semi-Annual Report to Stockholders is filed herewith. |

SMITH BARNEY

CALIFORNIA MUNICIPALS

FUND INC.

CLASSIC SERIES | SEMI-ANNUAL REPORT | AUGUST 31, 2004

Your Serious Money. Professionally Managed.® is a registered service mark of Citigroup Global Markets Inc.

NOT FDIC INSURED • NOT BANK GUARANTEED • MAY LOSE VALUE

| | |

| Classic Series |

Semi-Annual Report • August 31, 2004

SMITH BARNEY CALIFORNIA

MUNICIPALS FUND INC.

JOSEPH P. DEANE DAVID T. FARE

PORTFOLIO MANAGER PORTFOLIO MANAGER

JOSEPH P. DEANE

Joseph P. Deane has more than 34 years of securities business experience and has managed the fund since its inception.

Education: BA in History from Iona College.

DAVID T. FARE

David T. Fare has more than 17 years of securities business experience.

Education: BA from St. John’s University

FUND OBJECTIVE

The fund seeks to provide California investors with as high a level of current income exempt from federal income taxes and California state personal income taxes as is consistent with prudent investment management and the preservation of capital.* The fund invests at least 80% of its assets in California municipal securities. California municipal securities include securities issued by the state of California and certain other municipal issuers, political subdivisions, agencies and public authorities that pay interest that is exempt from California personal income taxes.

FUND FACTS

FUND INCEPTION |

|

April 19, 1984 |

MANAGER INVESTMENT

INDUSTRY EXPERIENCE

|

|

34 Years (Joseph P. Deane)

17 Years (David T. Fare) |

| * | Certain investors may be subject to the federal Alternative Minimum Tax, and state and local taxes may apply. Capital gains, if any, are fully taxable. Please consult your personal tax advisor. |

What’s Inside

R. JAYGERKEN, CFA

Chairman, President and

Chief Executive Officer

Dear Shareholder,

After an extended period of monetary easing, the Federal Reserve’s (“Fed”) monetary policymaking committee raised its federal funds ratei target from a four-decade low of 1% to 1.25% at its June meeting, representing the Fed’s first interest rate hike in four years. It raised the rate again by an additional 25 basis points to 1.50% at its August meeting and once again to 1.75% at its September meeting, after the end of the fund’s reporting period. These increases marked a significant reversal from the Fed’s monetary policy position from June 2003, when it last slashed its rate target following a long series of accommodative rate cuts. While lower interest rates can help to stimulate the economy, higher rates can put the brakes on economic growth and help to maintain a balance between that growth and the inflation that can generally accompany it.

This past spring, the rate hikes were widely anticipated due to comments previously made by the Fed regarding the momentum behind the economy and the fact that it was prepared to push rates higher from near-historic lows. As a result, bond prices declined sharply and yields rose virtually across the board in advance of the Fed’s action in April and May, before prices stabilized somewhat over the summer before rising significantly in August. Although the municipal bond market dropped sharply this past April in accordance with the broader bond market, it rebounded over the latter half of the six-month period ending August 31, 2004.ii

PERFORMANCE SNAPSHOT

AS OF AUGUST 31, 2004

(excluding sales charges)

|

| | 6 Months |

|

| Class A Shares — California Municipals Fund | -0.20% |

|

| Lehman Brothers Municipal Bond Index | 0.55% |

|

| Lipper California Municipal Debt Funds Category Average | 0.13% |

|

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarneymutualfunds.com.

Class A share returns assume the reinvestment of income dividends and capital gains distributions at net asset value and the deduction of all fund expenses. Returns have not been adjusted to include sales charges that may apply when shares are purchased or the deduction of taxes that a shareholder would pay on fund distributions. Excluding sales charges, Class B shares returned -0.46% and Class C shares returned -0.48% over the six months ended August 31, 2004.

1 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

Performance Review

Within this environment, the fund performed as follows: For the six months ended August 31, 2004, Class A shares of the Smith Barney California Municipals Fund Inc., excluding sales charges, returned -0.20%. These shares underperformed the fund’s unmanaged benchmark, the Lehman Brothers Municipal Bond Index,iii which returned 0.55% for the same period. The fund’s Lipper California municipal debt funds category average was 0.13%.1

Certain investors may be subject to the federal Alternative Minimum Tax, and state and local taxes may apply. Capital gains, if any, are fully taxable. Please consult your personal tax or legal adviser.

Special Shareholder Notice

On February 2, 2004, initial sales charges on Class L shares were eliminated. Effective April 29, 2004, Class L shares were renamed Class C shares.

Effective April 29, 2004, the Board appointed David Fare Co-Portfolio Manager of the fund, joining Joe Deane in managing the fund. Mr. Fare is Vice President and Investment Officer of the fund. Mr. Fare is an investment officer of the fund’s advisor, Smith Barney Fund Management LLC. Mr. Fare is a Director of Citigroup Global Markets Inc. and Portfolio Manager of Citigroup Asset Management. He has been with CGM or its predecessor firms since 1989. Mr. Fare holds a B.A. from St. John’s University.

Information About Your Fund

In recent months several issues in the mutual fund industry have come under the scrutiny of federal and state regulators. The fund’s Adviser and some of its affiliates have received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the fund’s response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The fund has been informed that the Adviser and its affiliates are responding to those information requests, but are not in a position to predict the outcome of these requests and investigations.

In November 2003, Citigroup Asset Management (“CAM”) disclosed an investigation by the Securities and Exchange Commission (“SEC”) and the U.S. Attorney relating to CAM’s entry into the transfer agency business during 1997-1999. Citigroup has disclosed that the Staff of the SEC is considering recommending a civil injunctive action and/or an administrative proceeding against certain advisory and transfer agent entities affiliated with Citigroup, the former CEO of CAM, a former employee and a current employee of CAM, relating to the creation, operation and fees of its internal transfer agent unit that serves various CAM-managed funds. Citigroup is cooperating with the SEC and will seek to resolve this matter in discussion with the SEC Staff. Although there can be no assurance, Citigroup does not believe that this matter will have a material adverse effect on the fund.

| 1 | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the six-month period ended August 31, 2004, calculated among the 128 funds in the fund’s Lipper category, including the reinvestment of dividends and capital gains, if any, and excluding sales charges. |

2 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you continue to meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

September 22, 2004

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS: The fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on fund performance. Certain investors may be subject to the federal Alterative Minimum Tax, and state and local taxes apply. Capital gains, if any, are fully taxable. Please consult your personal tax advisor. As interest rates rise, bond prices fall, reducing the value of the fund’s share price. Lower-rated, higher yielding bonds known as “junk bonds” are subject to greater credit risk of default, than higher-rated obligations. The fund’s investments are subject to interest rate and credit risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

| i | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| ii | Source: Based upon the performance of the Lehman Brothers Municipal Bond Index over the 6-month period ending August 31, 2004. |

| iii | The Lehman Brothers Municipal Bond Index is a broad measure of the municipal bond market with maturities of at least one year. |

3 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

Smith Barney California Municipals Fund Inc. at a Glance (unaudited)

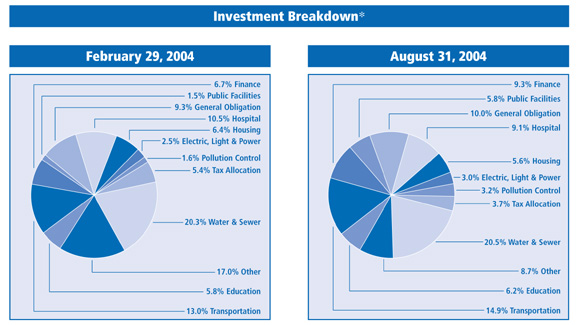

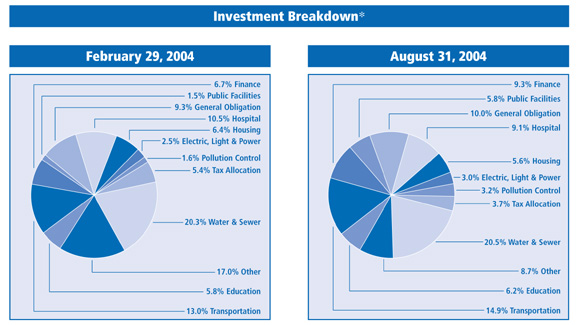

* As a percentage ot total investments. Please note that Fund holdings are subject to change.

4 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested on March 1, 2004 and held for the six months ended August 31, 2004.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Based on Actual Total Return(1)

| | | Actual

Total Return

Without

Sales Charges(2) | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense Ratio | | Expenses

Paid During

the Period(3) |

|---|

|

| Class A | | (0.20)% | | $1,000.00 | | $998.00 | | 0.68% | | $3.42 | |

|

| Class B | | (0.46)% | | 1,000.00 | | 995.40 | | 1.20 | | 6.04 | |

|

| Class C | | (0.48)% | | 1,000.00 | | 995.20 | | 1.24 | | 6.24 | |

|

| (1) | For the six months ended August 31, 2004. |

| (2) | Assumes reinvestment of all dividends and capital gain distributions, if any, at net asset value and does not reflect the deduction of the applicable sales charges with respect to Class A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class B and C shares. |

| (3) | Expenses (net of voluntary waiver) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

5 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Based on Hypothetical Total Return(1)

| | | Hypothetical

Total Return | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense Ratio | | Expenses

Paid During

the Period(2) |

|---|

|

| Class A | | 5.00% | | $1,000.00 | | $1,021.78 | | 0.68% | | $3.47 | |

|

| Class B | | 5.00% | | 1,000.00 | | 1,019.16 | | 1.20 | | 6.11 | |

|

| Class C | | 5.00% | | 1,000.00 | | 1,018.95 | | 1.24 | | 6.31 | |

|

| (1) | For the six months ended August 31, 2004. |

| (2) | Expenses (net of voluntary waiver) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

6 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

FACE

AMOUNT | RATING(a) SECURITY | VALUE |

|---|

|

| | | | | | | | |

| Education — 6.1% | | | |

| | | | California Educational Facilities Authority Revenue: | | | |

| $ 2,980,000 | | Aa3* | | Claremont University Center, Series B, 5.000% due 3/1/24 | | $ 3,071,784 | |

| | | | Pepperdine University, Series A: | | | |

| 1,775,000 | | A1* | | 5.000% due 11/1/18 | | 1,868,010 | |

| 1,500,000 | | A1* | | 5.000% due 11/1/29 | | 1,507,065 | |

| 6,125,000 | | Ba1* | | Pooled College & University Project, Series A, (Call 7/1/08 @ 101), 5.500% due 7/1/15 (b) | | 5,789,901 | |

| 1,000,000 | | A1* | | Scripps College, 5.250% due 8/1/26 | | 1,032,690 | |

| | | | Southwestern University Project, (Call 11/1/04 @ 102): | | | |

| 2,635,000 | | A3* | | 6.600% due 11/1/14 (b) | | 2,711,046 | |

| 6,505,000 | | A3* | | 6.700% due 11/1/24 (b) | | 6,693,775 | |

| 15,000,000 | | AAA | | Stanford University, Series Q, 5.250% due 12/1/32 (c) | | 15,628,050 | |

| 315,000 | | A- | | California State Public Works Board, High Technology Facilities, Lease Revenue, San Jose Facilities, Series A, 7.750% due 8/1/06 | | 339,803 | |

| 2,000,000 | | AAA | | California State University Foundation Revenue, Monterey Bay, MBIA-Insured, 5.350% due 6/1/31 | | 2,093,060 | |

| 1,100,000 | | VMIG 1* | | California Statewide Communities Development Authority Revenue, (Concordia University Irvine Project),

Series A, 1.380% due 10/1/31 (d) | | 1,100,000 | |

| 5,000,000 | | AAA | | Corona-Norco Unified School District, Special Tax, Community Facilities District No. 98-1, MBIA-Insured, 5.500% due 9/1/33 | | 5,309,500 | |

| 1,000,000 | | AAA | | Fullerton University Foundation, Auxiliary Organization Revenue, Series A, MBIA-Insured,5.750% due 7/1/30 | | 1,088,250 | |

| 200,000 | | VMIG 1* | | Irvine Unified School District, Special Tax, Community Facilities District No. 01-1, 1.330% due 9/1/38 (d) | | 200,000 | |

| 1,250,000 | | AAA | | San Diego Community College District, Lease Revenue, MBIA-Insured, (Call 12/1/06 @ 102), 6.125% due 12/1/16 (b) | | 1,396,813 | |

| 2,600,000 | | AAA | | Victor Valley Unified High School District, COP, MBIA-Insured, 5.750% due 11/1/17 | | 2,780,284 | |

|

| 52,610,031 | |

|

| Electric, Light & Power — 2.9% | | | | | | | |

| | | | California State Department of Water Resources, Power Supply Revenue: | | | |

| 1,000,000 | | A-1+ | | Series B-2, 1.400% due 5/1/22 (d) | | 1,000,000 | |

| 4,100,000 | | A-1+ | | Series B-6, 1.330% due 5/1/22 (d) | | 4,100,000 | |

| 1,100,000 | | A-1+ | | Los Angeles Water & Power Revenue, Sub-Series B-3, 1.350% due 7/1/34 (d) | | 1,100,000 | |

| 3,000,000 | | A-1+ | | M-S-R Public Power Agency, (San Juan Project Revenue), Series F, MBIA-Insured, 1.330% due 7/1/22 (d) | | 3,000,000 | |

| | | | Northern California Power Agency, Public Power Revenue, (Geothermal Project No. 3), Series A: | | | |

| 360,000 | | BBB+ | | 5.000% due 7/1/09 | | 364,478 | |

| 750,000 | | BBB+ | | Pre-Refunded — Escrowed with state and local government securities to 7/1/08 Call @ 100, 5.000% due 7/1/09 | | 825,503 | |

| 2,000,000 | | AAA | | Redding Electric System Revenue COP, Regular Linked SAVRS & RIBS, MBIA-Insured, (Partially escrowed to maturity with U.S.

Treasury Obligations), 6.368% due 7/1/22 | | 2,444,100 | |

| 6,000,000 | | AAA | | Sacramento Municipal Utility District Electric Revenue, MBIA-Insured, Series N, 5.000% due 8/15/28 | | 6,123,000 | |

| | | | Sacramento Power Authority, Cogeneration Project Revenue: | | | |

| 1,800,000 | | BBB | | 6.500% due 7/1/07 | | 1,958,094 | |

| 1,800,000 | | BBB | | 6.500% due 7/1/08 | | 1,953,684 | |

| 2,200,000 | | BBB | | 6.500% due 7/1/09 | | 2,377,518 | |

|

| 25,246,377 | |

|

See Notes to Financial Statements.

7 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

|

| Schedule of Investments (unaudited) | August 31, 2004 |

|

FACE

AMOUNT | RATING(a) SECURITY | VALUE |

|---|

|

| | | | | | | | |

| Finance — 9.1% | | |

| $10,000,000 | | AA | | Beverly Hills PFA Lease Revenue, (Capital Improvements Project), Series A, 5.250% due 6/1/28 | | $10,322,300 | |

| 1,300,000 | | BBB+ | | Fresno Joint Powers Financing Authority Local Agency Revenue, Series A, 6.550% due 9/2/12 (c) | | 1,331,083 | |

| 3,000,000 | | AAA | | Long Beach Bond Finance Authority Lease Revenue, (Rainbow Harbor Refinancing Project), AMBAC-Insured, 5.250% due 5/1/24 | | 3,138,450 | |

| 6,500,000 | | AA | | Los Angeles County Public Works Financing Authority Revenue, 5.000% due 10/1/19 | | 6,776,445 | |

| 2,000,000 | | AAA | | Monrovia Financing Authority Lease Revenue, AMBAC-Insured, 5.125% due 12/1/31 | | 2,066,700 | |

| 5,550,000 | | AAA | | Pomona PFA Revenue, (Merged Redevelopment Project), Tax Allocation, Series AD, MBIA-Insured, 5.000% due 2/1/21 | | 5,759,180 | |

| | | | Sacramento City Financing Authority Revenue, Capital Improvement: | | | |

| 2,000,000 | | AA- | | 5.625% due 6/1/30 | | 2,132,300 | |

| | | | AMBAC-Insured: | | | |

| | | | Series A: | | | |

| 5,070,000 | | AAA | | 5.500% due 12/1/20 | | 5,635,559 | |

| 6,300,000 | | AAA | | 5.500% due 12/1/21 | | 6,963,075 | |

| 1,600,000 | | AAA | | Solid Waste and Redevelopment Project, 5.875% due 12/1/29 | | 1,768,960 | |

| 2,800,000 | | AAA | | Salida Area Public Facilities Financing Agency Community Facilities District Special Tax Revenue No. 1988-1,

FSA-Insured, 5.250% due 9/1/18 | | 3,001,908 | |

| 3,205,000 | | AAA | | San Luis Obispo County Financing Authority Revenue, (Lopez Dam Improvement Project), Series A, MBIA-Insured, 5.375% due 8/1/30 | | 3,343,937 | |

| 2,875,000 | | AAA | | Santa Ana Financing Authority Lease Revenue, (Police Administration & Holding Facilities), Series A, MBIA-Insured, 6.250% due 7/1/24 | | 3,449,856 | |

| 2,000,000 | | AAA | | South Orange County PFA Special Tax Revenue, Series A, MBIA-Insured, 7.000% due 9/1/10 (e) | | 2,427,360 | |

| | | | Stockton PFA Lease Revenue, (Parking & Capital Projects), FGIC-Insured: | | | |

| 2,000,000 | | AAA | | 5.125% due 9/1/30 | | 2,065,720 | |

| 1,900,000 | | AAA | | 5.250% due 9/1/34 | | 1,990,307 | |

| | | | Virgin Islands Public Finance Authority Revenue, Series A: | | | |

| 10,000,000 | | BBB- | | 5.500% due 10/1/18 (c) | | 10,474,600 | |

| 5,000,000 | | BBB | | 6.500% due 10/1/24 | | 5,609,850 | |

|

| 78,257,590 | |

|

| General Obligation — 9.8% | | |

| 2,000,000 | | AAA | | Adelanto School District, Capital Appreciation, Series B, FGIC-Insured, zero coupon due 9/1/18 | | 1,045,380 | |

| | | | California State: | | | |

| 2,425,000 | | A-1+ | | Series A-2, 1.340% due 5/1/33 (d) | | 2,425,000 | |

| | | | Veterans Bonds: | | | |

| 1,000,000 | | A | | Series AT, 9.500% due 2/1/10 | | 1,304,310 | |

| 2,000,000 | | A | | Series AU, 8.400% due 10/1/06 | | 2,256,120 | |

| | | | Los Angeles Unified School District: | | | |

| 20,000,000 | | AAA | | Series A, FSA-Insured, 5.000% due 7/1/24 (c) | | 20,809,400 | |

| 14,230,000 | | AAA | | Series E, MBIA-Insured, 5.125% due 7/1/22 (c) | | 15,080,100 | |

| 4,000,000 | | AAA | | Moreno Valley, Special Tax, Unified School District, Series A, FSA-Insured, 5.000% due 8/1/25 | | 4,138,920 | |

| 4,720,000 | | AAA | | Pasadena Unified School District, Series A, FGIC-Insured, 5.000% due 5/1/20 | | 4,949,486 | |

| 3,000,000 | | AAA | | Placentia-Yorba Linda Unified School District, Series B, FGIC-Insured, 5.500% due 8/1/27 | | 3,230,160 | |

| 1,000,000 | | AA- | | San Diego Public Safety Communication Project, 6.650% due 7/15/11 | | 1,199,520 | |

| | | | Santa Margarita/Dana Point Authority Revenue: | | | |

| 20,000,000 | | AAA | | Series A, AMBAC-Insured, 5.125% due 8/1/18 (c) | | 21,218,600 | |

| 1,500,000 | | AAA | | Water Improvement Districts 3, 3A, 4 & 4A, Series B, MBIA-Insured, 7.250% due 8/1/14 (e) | | 1,932,615 | |

| 4,000,000 | | AAA | | Tahoe Truckee Unified School District, Improvement District No.1, Series A, FGIC-Insured, (Pre-Refunded — Escrowed with

state and local government securities to 8/1/09 Call @ 101), 5.750% due 8/1/20 | | 4,632,600 | |

|

| 84,222,211 | |

|

See Notes to Financial Statements.

8 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

|

| Schedule of Investments (unaudited) | August 31, 2004 |

|

FACE

AMOUNT | RATING(a) SECURITY | VALUE |

|---|

|

| | | | | | | | |

| Hospitals — 8.9% | | |

| | | | California Health Facilities Financing Authority Revenue: | | | |

| $ 705,000 | | A | | Casa De Las Campanas, 5.500% due 8/1/12 | | $ 761,449 | |

| | | | Catholic West, Series A, MBIA-Insured: | | | |

| 2,185,000 | | AAA | | 5.125% due 7/1/24 | | 2,261,650 | |

| 815,000 | | AAA | | Call 7/1/07 @ 102, 5.125% due 7/1/24 (b) | | 903,419 | |

| 12,000,000 | | A3* | | Cedars-Sinai Medical Center, Series A, 6.125% due 12/1/30 (c) | | 12,885,480 | |

| 1,930,000 | | NR | | Daniel Freeman Hospital, Series A, (Call 5/1/05 @ 102), 6.500% due 5/1/20 (b) | | 2,034,741 | |

| 2,500,000 | | AAA | | De Las Companas, Series A, AMBAC-Insured, 5.750% due 7/1/15 | | 2,634,050 | |

| | | | Kaiser Permanente: | | | |

| 3,500,000 | | AAA | | Series A, FSA-Insured, 5.000% due 6/1/18 (f) | | 3,747,870 | |

| 1,750,000 | | AAA | | Series B, 5.250% due 10/1/14 (f) | | 1,900,062 | |

| 2,500,000 | | A | | Marshall Hospital, Series A, 5.250% due 11/1/18 | | 2,605,625 | |

| 5,145,000 | | AAA | | Stanford Health Care, Series A, FSA-Insured, 5.000% due 11/15/18 | | 5,438,574 | |

| | | | Sutter Health, Series A: | | | |

| | | | FSA-Insured: | | | |

| 1,470,000 | | AAA | | 5.125% due 8/15/17 | | 1,564,198 | |

| 1,500,000 | | AAA | | 5.250% due 8/15/27 | | 1,537,350 | |

| 2,000,000 | | AAA | | MBIA-Insured, 5.000% due 8/15/19 | | 2,105,860 | |

| | | | California Statewide Communities Development Authority Revenue COP: | | | |

| 4,515,000 | | AAA | | Industrial Health Facilities, Unihealth America, Series A, AMBAC-Insured, 5.500% due 10/1/07 (f) | | 5,004,336 | |

| 19,000,000 | | AAA | | Kaiser Permanente, 5.300% due 12/1/15 (c)(f) | | 20,403,150 | |

| 1,100,000 | | A | | Solheim Lutheran Home, 6.500% due 11/1/17 | | 1,130,690 | |

| 4,000,000 | | AA- | | St. Joseph's Health System, 5.250% due 7/1/21 | | 4,092,040 | |

| 500,000 | | AAA | | Sutter Health Obligated Group, MBIA-Insured, 6.000% due 8/15/25 | | 527,560 | |

| 1,000,000 | | AAA | | Modesto Health Facilities Revenue, Memorial Hospital Association, Series B, MBIA-Insured, 5.125% due 6/1/17 | | 1,065,200 | |

| 2,000,000 | | AAA | | San Bernardino County COP, (Capital Facility Project), Series B, 6.875% due 8/1/24 (f) | | 2,580,920 | |

| 590,000 | | AAA | | Santa Rosa Hospital Revenue, (Santa Rosa Hospital Memorial Project), 10.300% due 3/1/11 (f) | | 751,607 | |

| 1,250,000 | | BBB | | Sequoia Hospital District, 5.375% due 8/15/23 (f) | | 1,258,413 | |

|

| 77,194,244 | |

|

| Housing: Multi-Family — 2.1% | | |

| 1,250,000 | | AAA | | ABAG Finance Authority for Nonprofit Corp., MFH Revenue, (Edgewood Apartments Project), Series A, FNMA-Collateralized,

5.700% due 11/1/26 (g) | | 1,280,337 | |

| 6,000,000 | | NR | | California Statewide Communities Development Authority, Multi-Family Revenue, Series E, FNMA-Collateralized,

6.400% due 6/1/28 (e)(g) | | 6,218,280 | |

| 1,740,000 | | AAA | | Riverside County Housing Authority, MFH Revenue, Brandon Place Apartments, Series B, FNMA-Collateralized, 5.625% due 7/1/29 (g) | | 1,864,132 | |

| 660,000 | | AAA | | San Francisco City & County Redevelopment Agency, Multi-Family Revenue, 1045 Mission Apartments, Series C, GNMA-Collateralized,

5.200% due 12/20/17 (g) | | 679,576 | |

| 1,500,000 | | Aaa* | | San Jose MFH Revenue, Timberwood Apartments, Series A, 7.500% due 2/1/20 | | 1,509,210 | |

| 3,320,000 | | AA- | | Santa Rosa Mortgage Revenue, (Village Square Apartments Projects), Series A, FHA-Insured, 6.875% due 9/1/27 | | 3,395,995 | |

| 2,755,000 | | AAA | | Victorville MFH Revenue, Wimbledon Apartments, Series A, GNMA-Collateralized, 6.300% due 4/20/31 | | 2,862,362 | |

|

| 17,809,892 | |

|

See Notes to Financial Statements.

9 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

|

| Schedule of Investments (unaudited) | August 31, 2004 |

|

FACE

AMOUNT | RATING(a) SECURITY | VALUE |

|---|

|

| | | | | | | | |

| Housing: Single-Family — 3.4% | |

| | | | California HFA Revenue, Home Mortgage: | | | |

| | | | Capital Appreciation: | | | |

| $ 350,000 | | AA- | | Series 1983-B, FHA-Insured, zero coupon due 8/1/15 | | $ 140,154 | |

| 310,000 | | AA- | | Series 1984-B, zero coupon due 8/1/16 | | 81,654 | |

| 10,000 | | AA- | | MGIC-Insured, 10.250% due 2/1/14 | | 10,452 | |

| | | | Single-Family Mortgage: | | | |

| 835,000 | | AAA | | Issue A-2, FHA-Insured, 6.350% due 8/1/15 (e)(g) | | 857,094 | |

| 1,845,000 | | AAA | | Series B-3, Class II, MBIA-Insured, 5.375% due 8/1/21 (g) | | 1,887,011 | |

| 1,170,000 | | AAA | | California Rural Home Mortgage Financing Authority, Single-Family Mortgage Revenue, Mortgage Backed Securities, Series D,

GNMA/FNMA-Collateralized, 6.000% due 12/1/31 (g) | | 1,233,508 | |

| 10,000,000 | | AAA | | California State Department of Veterans Affairs, Home Purchase Revenue, Series A, AMBAC-Insured, 5.350% due 12/1/27 (c) | | 10,326,200 | |

| 270,000 | | AAA | | Contra Costa County Home Mortgage Revenue, Mortgage-Backed Securities Program, GNMA-Collateralized, 7.750% due 5/1/22 (f)(g) | | 361,454 | |

| 35,000 | | Aaa* | | Los Angeles Home Mortgage Revenue, Mortgage Security Program, GNMA-Collateralized, 8.100% due 5/1/17 | | 36,128 | |

| 115,000 | | AAA | | Martinez Home Mortgage Revenue, (Escrowed to maturity with cash), 10.750% due 2/1/16 | | 166,312 | |

| 3,325,000 | | AAA | | Perris Single-Family Mortgage Revenue, Series A, Mortgage-Backed Securities Program, GNMA-Collateralized, 8.300% due 12/1/13 (f)(g) | | 4,171,146 | |

| 6,000,000 | | AAA | | Pleasanton-Suisun City HFA, Home Mortgage Revenue, Series A, MBIA-Insured, zero coupon due 10/1/16 (f) | | 3,636,180 | |

| | | | Riverside County Single-Family Revenue, Mortgage-Backed Securities Program, GNMA-Collateralized: | | | |

| 2,620,000 | | AAA | | 8.300% due 11/1/12 (f)(g) | | 3,483,893 | |

| 1,000,000 | | AAA | | Series A, 7.800% due 5/1/21 (f)(g) | | 1,392,580 | |

| 1,500,000 | | AAA | | Sacramento County Single-Family Mortgage Revenue, Issue A, GNMA-Collateralized, 8.000% due 7/1/16 (f)(g) | | 1,916,490 | |

|

| 29,700,256 | |

|

| Miscellaneous — 8.5% | | | |

| 2,000,000 | | AAA | | Anaheim COP, Regular Fixed Option Bonds, MBIA-Insured, 6.200% due 7/16/23 | | 2,217,360 | |

| | | | California County Tobacco Securitization Agency, Asset-Backed Revenue Alameda County: | | | |

| 5,250,000 | | Baa3* | | 5.750% due 6/1/29 | | 4,504,553 | |

| 4,000,000 | | Baa3* | | 6.000% due 6/1/42 | | 3,347,880 | |

| 4,000,000 | | AAA | | California Infrastructure & Economic Development Bank Insured Revenue, AMBAC-Insured, (Rand Corp. Project),

Series A, 5.500% due 4/1/32 | | 4,241,120 | |

| 2,500,000 | | AAA | | California State Public Works Board Lease Revenue, Department of Corrections, Series B, MBIA-Insured, 5.000% due 9/1/21 | | 2,604,325 | |

| 3,000,000 | | AAA | | Contra Costa County COP, Capital Projects Program, AMBAC-Insured, 5.250% due 2/1/21 | | 3,159,720 | |

| 3,680,000 | | AAA | | Fontana COP, AMBAC-Insured, 5.000% due 9/1/21 | | 3,857,155 | |

| 20,000,000 | | BBB | | Golden State Tobacco Securitization Corp., Tobacco Settlement Revenue, Series 2003-A-1, 6.750% due 6/1/39 (c) | | 18,686,200 | |

| 3,250,000 | | AAA | | Los Angeles County Community Facilities, District No. 3, Special Tax, Series A, FSA-Insured, 5.500% due 9/1/14 | | 3,600,935 | |

| | | | Orange County: | | | |

| 1,675,000 | | AAA | | 1996 Recovery COP, Series A, MBIA-Insured, 6.000% due 7/1/26 | | 1,821,177 | |

| 2,700,000 | | VMIG 1* | | Improvement Board Act of 1915, Assessment District No. 01-1, Series A, 1.330% due 9/2/33 (d) | | 2,700,000 | |

| | | | San Francisco City & County COP, San Bruno Jail No. 3, AMBAC-Insured: | | | |

| 14,000,000 | | AAA | | 5.250% due 10/1/26 (c) | | 14,597,800 | |

| 5,000,000 | | AAA | | 5.250% due 10/1/33 | | 5,183,850 | |

| 2,795,000 | | AAA | | Solano County COP, Capital Improvement Program, AMBAC-Insured, 5.000% due 11/15/19 | | 2,970,666 | |

|

| 73,492,741 | |

|

See Notes to Financial Statements.

10 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

|

| Schedule of Investments (unaudited) | August 31, 2004 |

|

FACE

AMOUNT | RATING(a) SECURITY | VALUE |

|---|

|

| | | | | | | | |

| Pollution Control — 3.2% | | |

| | | | California Financing Authority PCR: | | | |

| $ 1,500,000 | | A+ | | San Diego Gas & Electric Co., Series A, 6.800% due 6/1/15 (g) | | $ 1,824,165 | |

| 9,900,000 | | BBB | | Southern California Edison Co., Series B, 6.400% due 12/1/24 (g) | | 10,025,532 | |

| 2,770,000 | | AAA | | Fresno County Financing Authority, Solid Waste Revenue, (American Avenue Landfill Project), MBIA-Insured, 5.750% due 5/15/14 | | 2,905,619 | |

| | | | Inland Empire Solid Waste Financing Authority Revenue, (Landfill Improvement Financing Project), Series B, FSA-Insured: | | | |

| 5,000,000 | | AAA | | 6.250% due 8/1/11 (f)(g) | | 5,654,900 | |

| 2,500,000 | | AAA | | Call 8/1/06 @ 102, 6.000% due 8/1/16 (b)(g) | | 2,739,650 | |

| 2,345,000 | | BBB | | Kings County Waste Management Authority Solid Waste Revenue, (Call 10/1/04 @ 102), 7.200% due 10/1/14 (b)(g) | | 2,402,617 | |

| 1,770,000 | | A-1+ | | Orange County, Sanitation Districts COP, Series B, 1.330% due 8/1/30 (d) | | 1,770,000 | |

|

| 27,322,483 | |

|

| Public Facilities — 5.7% | | |

| 5,000,000 | | AAA | | California State Public Works Board Lease Revenue, Department of Health Services, Series A, MBIA-Insured, 5.750% due 11/1/24 | | 5,405,950 | |

| 450,000 | | AAA | | Los Angeles Convention & Exhibition Center Authority, COP, (Call 12/1/05 @ 100), 9.000% due 12/1/20 (b) | | 491,436 | |

| 4,500,000 | | AAA | | Palm Springs Financing Authority Lease Revenue, (Convention Center Project), Series A, MBIA-Insured, 5.500% due 11/1/29 | | 4,908,825 | |

| | | | Riverside County COP, (Historic Courthouse Project), Series A: | | | |

| 2,320,000 | | A+ | | 5.000% due 11/1/23 | | 2,367,722 | |

| 2,705,000 | | A+ | | 5.000% due 11/1/28 | | 2,686,065 | |

| 4,600,000 | | AAA | | Sacramento County COP, (Public Facilities Project), Solid Waste Facilities, MBIA-Insured, 5.250% due 12/1/16 | | 4,959,168 | |

| 25,000,000 | | AAA | | San Francisco, California State Building Authority Lease Revenue, San Francisco Civic Center, Complex-A, AMBAC-Insured,

5.250% due 12/1/21 (c) | | 26,414,500 | |

| 4,310,000 | | Aaa* | | San Marcos Public Facilities Authority, Public Facilities Revenue, zero coupon due 1/1/19 (f) | | 2,196,635 | |

|

| 49,430,301 | |

|

| Tax Allocation — 3.6% | | |

| 2,000,000 | | AAA | | Anaheim Public Finance Authority, Tax Allocation Revenue, Regular Fixed Option Bonds, MBIA-Insured, 6.450% due 12/28/18 | | 2,285,520 | |

| 1,000,000 | | AAA | | El Centro Redevelopment Agency, Tax Allocation, (El Centro Redevelopment Project), MBIA-Insured, 6.375% due 11/1/17 | | 1,113,020 | |

| 2,160,000 | | AAA | | Fontana Public Finance Authority, Tax Allocation Revenue, Series A, MBIA-Insured, 5.000% due 9/1/20 | | 2,222,856 | |

| | | | Hawthorne Community Redevelopment Agency, Tax Allocation, (Redevelopment Project Area 2), (Call 9/1/04 @ 102): | | | |

| 670,000 | | Baa2* | | 6.625% due 9/1/14 (b)(c) | | 686,549 | |

| 705,000 | | Baa2* | | 6.700% due 9/1/20 (b)(c) | | 722,449 | |

| 6,485,000 | | AAA | | Healdsburg Community Redevelopment Agency, Tax Allocation, (Sotoyome Community Development Project),

Series A, MBIA-Insured, 5.125% due 8/1/31 | | 6,660,743 | |

| 6,500,000 | | AAA | | La Quinta Redevelopment Agency, Tax Allocation, (Redevelopment Project Area No. 1), AMBAC-Insured, 5.125% due 9/1/32 | | 6,707,805 | |

| 2,670,000 | | AAA | | Ontario Redevelopment Financing Authority, Tax Allocation, (Redevelopment Project No. 1), MBIA-Insured, 5.800% due 8/1/23 (f) | | 2,703,856 | |

See Notes to Financial Statements.

11 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

|

| Schedule of Investments (unaudited) | August 31, 2004 |

|

FACE

AMOUNT | RATING(a) SECURITY | VALUE |

|---|

|

| | | | | | | | |

| Tax Allocation — 3.6% (continued) | | |

| | | | Rancho Cucamonga Redevelopment Agency, Tax Allocation, (Rancho Redevelopment Project): | | | |

| $ 2,500,000 | | AAA | | FSA-Insured, 5.250% due 9/1/20 | | $ 2,687,750 | |

| | | | MBIA-Insured: | | | |

| 2,445,000 | | AAA | | 5.250% due 9/1/16 | | 2,623,045 | |

| 1,000,000 | | AAA | | 5.250% due 9/1/26 | | 1,029,350 | |

| 2,000,000 | | AAA | | Vista Community Development Commission, Tax Allocation Revenue, (Vista Redevelopment Project), MBIA-Insured, 5.250% due 9/1/15 | | 2,070,520 | |

|

| 31,513,463 | |

|

| Transportation — 14.6% | |

| 15,000,000 | | AAA | | California Infrastructure & Economic Development Bank Insured Revenue, Bay Area Toll Bridges 1st Lien, Series A,

FGIC-Insured, 5.000% due 7/1/29 (c) | | 15,299,400 | |

| 2,000,000 | | AAA | | Foothill Eastern Corridor Agency, California Toll Revenue, Sr. Lien, Series A, (Call 1/1/07 @ 100), 6.000% due 1/1/34 (b)(e) | | 2,193,000 | |

| 1,250,000 | | AAA | | Fresno Airport Revenue, Series A, FSA-Insured, 5.500% due 7/1/30 | | 1,324,200 | |

| 9,000,000 | | AAA | | Sacramento County Airport System Revenue, Series A, MBIA-Insured, 5.900% due 7/1/24 (g) | | 9,674,550 | |

| 130,000 | | AAA | | San Francisco Airport Improvement Corp. Lease Revenue, (United Airlines Inc.), 8.000% due 7/1/13 (f) | | 161,153 | |

| 15,270,000 | | AAA | | San Francisco Bay Area Rapid Transportation District Sales Tax Revenue, AMBAC-Insured, 5.000% due 7/1/28 (c) | | 15,617,393 | |

| | | | San Joaquin Hills, California Transportation Corridor Agency, Toll Road Revenue Sr. Lien, Escrowed to maturity with state and

local government securities: | | | |

| 5,000,000 | | AAA | | Zero coupon due 1/1/14 | | 3,474,650 | |

| 60,000,000 | | AAA | | Zero coupon due 1/1/16 (c) | | 37,219,800 | |

| 17,500,000 | | AAA | | Zero coupon due 1/1/17 | | 10,283,000 | |

| 25,000,000 | | AAA | | Zero coupon due 1/1/18 (c) | | 13,887,500 | |

| 20,000,000 | | AAA | | Zero coupon due 1/1/19 (c) | | 10,482,600 | |

| 20,000,000 | | AAA | | Zero coupon due 1/1/26 | | 6,789,800 | |

|

| 126,407,046 | |

|

| Water & Sewer — 20.1% | |

| 1,240,000 | | AAA | | Anaheim PFA Revenue, Water Utility, (Lenain Filtration Project), FGIC-Insured, (Pre-Refunded —Escrowed with state and local

government securities to 4/1/06 Call @ 100), 5.250% due 10/1/19 | | 1,313,420 | |

| | | | California State Department of Water Resources, Central Valley Project Revenue, Water System: | | | |

| 1,000,000 | | AA | | Series O, 5.000% due 12/1/22 | | 1,015,830 | |

| 5,000,000 | | AA | | Series S, 5.000% due 12/1/19 | | 5,252,100 | |

| 11,000,000 | | AA | | Series U, 5.000% due 12/1/29 (c) | | 11,191,950 | |

| | | | Castaic Lake Water Agency Revenue COP, (Water System Improvement Project), AMBAC-Insured: | | | |

| 7,270,000 | | AAA | | 5.250% due 8/1/19 | | 7,822,084 | |

| 7,615,000 | | AAA | | 5.125% due 8/1/30 | | 7,839,414 | |

| 4,350,000 | | AAA | | City of Vallejo California, Vallejo Parity Revenue, (Water Improvement Project), Series A, FSA-Insured, 5.250% due 5/1/29 | | 4,530,612 | |

| 6,000,000 | | AAA | | Clovis Sewer Revenue, MBIA-Insured, 5.200% due 8/1/28 | | 6,263,100 | |

| 4,000,000 | | AAA | | Cucamonga County Water District COP, FGIC-Insured, 5.125% due 9/1/31 | | 4,122,960 | |

| 11,440,000 | | AAA | | East Bay Municipal Utility District Wastewater Treatment Systems Revenue, FGIC-Insured, 5.000% due 6/1/26 (c) | | 11,658,046 | |

| | | | East Bay Municipal Utility District Water Systems Revenue: | | | |

| 8,400,000 | | AAA | | FGIC-Insured, 5.000% due 6/1/26 | | 8,545,572 | |

| 8,400,000 | | AAA | | MBIA-Insured, 5.000% due 6/1/26 | | 8,597,232 | |

See Notes to Financial Statements.

12 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

|

| Schedule of Investments (unaudited) | August 31, 2004 |

|

FACE

AMOUNT | RATING(a) SECURITY | VALUE |

|---|

|

| | | | | | | | |

| Water & Sewer — 20.1% (continued) | | |

| | | | Eastern Municipal Water District COP, Water & Sewer Revenue: | | | |

| $ 1,000,000 | | AAA | | FGIC-Insured, 6.750% due 7/1/12 | | $ 1,228,480 | |

| 17,750,000 | | AAA | | Series A, MBIA-Insured, 5.250% due 7/1/23 (c) | | 18,437,280 | |

| 1,900,000 | | AAA | | El Centro Financing Authority, Water & Wastewater Revenue, Series A, AMBAC-Insured, 5.125% due 10/1/27 | | 1,961,997 | |

| 1,720,000 | | AAA | | Lodi Wastewater System Revenue COP, Series A, MBIA-Insured, 5.000% due 10/1/23 | | 1,800,358 | |

| 1,100,000 | | A-1+ | | Los Angeles Department Water & Power Waterworks Revenue, Sub-Series B-2, 1.330% due 7/1/35 (d) | | 1,100,000 | |

| | | | Metropolitan Water District, Southern California Waterworks Revenue: | | | |

| | | | Series A: | | | |

| 1,000,000 | | AA | | 5.000% due 7/1/18 | | 1,046,270 | |

| 12,900,000 | | AA | | 4.750% due 7/1/22 (c) | | 13,162,386 | |

| 2,825,000 | | AA | | 5.000% due 7/1/26 | | 2,892,433 | |

| 4,785,000 | | AAA | | Call 1/1/08 @ 101, 5.000% due 7/1/26 (b) | | 5,274,888 | |

| 5,540,000 | | AAA | | Pre-Refunded — Escrowed with state and local government securities to 1/1/08 Call @ 101, 5.000% due 7/1/26 | | 6,107,185 | |

| 2,200,000 | | A-1+ | | Series B-1, 1.330% due 7/1/35 (d) | | 2,200,000 | |

| 10,000,000 | | AAA | | Series B-2, FGIC-Insured, 5.000% due 10/1/26 | | 10,301,200 | |

| 4,500,000 | | AAA | | Series C, (Call 1/1/07 @ 102), 5.250% due 7/1/16 (b) | | 4,944,015 | |

| 1,925,000 | | AAA | | Morgan Hill COP, (Water Systems Improvement Projects), FSA-Insured, 5.125% due 6/1/21 | | 2,046,082 | |

| 6,575,000 | | AAA | | Placer County Water Agency Revenue COP, (Capital Improvement Projects), AMBAC-Insured, 5.500% due 7/1/29 | | 7,052,016 | |

| | | | Pomona Public Financing Authority Revenue: | | | |

| 2,855,000 | | AAA | | Series Q, MBIA-Insured, (Call 12/1/05 @ 102), 5.750% due 12/1/15 (b) | | 3,059,646 | |

| 2,500,000 | | AAA | | Water Facilities Project, Series AA, FSA-Insured, 5.000% due 5/1/29 | | 2,553,775 | |

| 6,875,000 | | AAA | | San Diego PFA, Sewer Revenue, FGIC-Insured, 5.000% due 5/15/20 | | 7,009,063 | |

| 2,820,000 | | AAA | | Sunnyvale Financing Authority, Water & Wastewater Revenue, AMBAC-Insured, 5.000% due 10/1/22 | | 2,930,544 | |

|

| 173,259,938 | |

|

| | | | TOTAL INVESTMENTS — 98.0% (Cost — $761,745,944**) | | 846,466,573 | |

| | | | Other Assets in Excess of Liabilities — 2.0% | | 17,570,458 | |

|

| | | | NET ASSETS — 100.0% | | $864,037,031 | |

|

| (a) | All ratings are by Standard & Poor’s Ratings Service, except for those which are identified by an asterisk (*) are rated by Moody’s Investors Service. |

| (b) | Pre-Refunded bonds are escrowed with U.S. government securities and are considered by the manager to be triple-A rated even if issuer has not applied for new ratings. |

| (c) | All or a portion of this security is segregated for open futures contracts. |

| (d) | Variable rate obligation payable at par on demand at any time on no more than seven days notice. |

| (e) | All or a portion of this security is held as collateral for open futures contracts. |

| (f) | Bonds are escrowed to maturity with U.S. government securities and are considered by the manager to be triple-A rated even if issuer has not applied for new ratings. |

| (g) | Income from this issue is considered a preference item for purposes of calculating the alternative minimum tax. |

| ** | Aggregate cost for Federal income tax purposes is substantially the same. |

See pages 14 and 15 for definitions of ratings and certain abbreviations.

See Notes to Financial Statements.

13 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

Bond Ratings (unaudited)

The definitions of the applicable rating symbols are set forth below:

Standard & Poor’s Ratings Service (“Standard & Poor’s”) — Ratings from “AA” to “CCC” may be modified by the addition of a plus (+) or minus (–) sign to show relative standings within the major rating categories.

| | |

| AAA | — | Bonds rated “AAA” have the highest rating assigned by Standard & Poor’s. Capacity to pay interest and repay principal is extremely strong.

|

| AA | — | Bonds rated “AA”have a very strong capacity to pay interest and repay principal and differ from the highest rated issues only in a small degree.

|

| A | — | Bonds rated “A”have a strong capacity to pay interest and repay principal although they are somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than bonds in higher rated categories.

|

| BBB | — | Bonds rated “BBB” are regarded as having an adequate capacity to pay interest and repay principal. Whereas they normally exhibit adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal for debts in this category than in higher rated categories.

|

BB, B,

CCC

and CC | — | Bonds rated "BB", "B", "CCC" and "CC" are regarded, on balance, as predominantly speculative with respect to capacity to pay interest and repay principal in accordance with the terms of the obligation. “BB” represents a lower degree of speculation than “B”, “CCC” and “CC”, the highest degree of speculation. While such bonds will likely have some quality and protective characteristics, these are outweighed by large uncertainities or major risk exposures to adverse conditions.

|

Moody’s Investors Service (“Moody’s”) — Numerical modifiers 1, 2 and 3 may be applied to each generic rating from “Aa” to “Caa”, where 1 is the highest and 3 the lowest rating within its generic category.

| | |

| Aaa | — | Bonds rated “Aaa” are judged to be of the best quality. They carry the smallest degree of investment risk and are generally referred to as “gilt edge.” Interest payments are protected by a large or by an exceptionally stable margin, and principal is secure. While the various protective elements are likely to change, such changes as can be visualized are most unlikely to impair the fundamentally strong position of these bonds.

|

| Aa | — | Bonds rated “Aa”are judged to be of high quality by all standards. Together with the “Aaa” group they comprise what are generally known as high grade bonds. They are rated lower than the best bonds because margins of protection may not be as large as in “Aaa”securities or fluctuation of protective elements may be of greater amplitude, or there may be other elements present that make the long-term risks appear somewhat larger than in “Aaa” securities.

|

| A | — | Bonds rated “A”possess many favorable investment attributes and are to be considered as upper medium grade obligations. Factors giving security to principal and interest are considered adequate, but elements may be present that suggest a susceptibility to impairment some time in the future.

|

| Baa | — | Bonds rated “Baa” are considered to be medium grade obligations, i.e., they are neither highly protected nor poorly secured. Interest payment and principal security appear adequate for the present but certain protective elements may be lacking or may be characteristically unreliable over any great length of time. Such bonds lack outstanding investment characteristics and in fact have speculative characteristics as well.

|

| Ba | — | Bonds rated “Ba”are judged to have speculative elements; their future cannot be considered as well assured. Often the protection of interest and principal payments may be very moderate, and thereby not well safeguarded during both good and bad times over the future. Uncertainty of position characterizes bonds in this class.

|

| B | — | Bonds rated “B” generally lack characteristics of desirable investments. Assurance of interest and principal payment or of maintenance of other terms of the contract over any long period of time may be small.

|

| Caa | — | Bonds rated “Caa” are of poor standing. These issues may be in default, or present elements of danger may exist with respect to principal or interest.

|

| NR | — | Indicates that the bond is not rated by Standard & Poor’s or Moody’s.

|

14 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

Short-Term Security Ratings (unaudited)

| | |

| SP-1 | — | Standard &Poor’s highest rating indicating very strong or strong capacity to pay principal and interest; those issues determined to possess overwhelming safety characteristics are denoted with a plus (+) sign.

|

| A-1 | — | Standard & Poor’s highest commercial paper and variable-rate demand obligation (“VRDO”) rating indicating that the degree of safety regarding timely payment is either overwhelming or very strong; those issues determined to possess overwhelming safety characteristics are denoted with a plus (+) sign.

|

| VMIG 1 | — | Moody’s highest rating for issues having a demand feature — VRDO.

|

| P-1 | — | Moody’s highest rating for commercial paper and for VRDO prior to the advent of the VMIG 1 rating.

|

Abbreviations* (unaudited)

| |

|---|

| ABAG | — Association of Bay Area Governments |

| AIG | — American International Guaranty |

| AMBAC | — Ambac Assurance Corporation |

| BAN | — Bond Anticipation Notes |

| BIG | — Bond Investors Guaranty |

| CGIC | — Capital Guaranty Insurance Company |

| CHFCLI | — California Health Facility Construction Loan Insurance |

CONNIE

LEE | — College Construction Loan Insurance Association |

| COP | — Certificate of Participation |

| EDA | — Economic Development Authority |

| ETM | — Escrowed To Maturity |

| FAIRS | — Floating Adjustable Interest Rate Securities |

| FGIC | — Financial Guaranty Insurance Company |

| FHA | — Federal Housing Administration |

| FHLMC | — Federal Home Loan Mortgage Corporation |

| FNMA | — Federal National Mortgage Association |

| FRTC | — Floating Rate Trust Certificates |

| FSA | — Financial Security Assurance |

| GIC | — Guaranteed Investment Contract |

| GNMA | — Government National Mortgage Association |

| GO | — General Obligation |

| HDC | — Housing Development Corporation |

| HFA | — Housing Finance Agency |

| IDA | — Industrial Development Agency |

| IDB | — Industrial Development Board |

| IDR | — Industrial Development Revenue |

| INFLOS | — Inverse Floaters |

| ISD | — Independent School District |

| LOC | — Letter of Credit |

| MBIA | — Municipal Bond Investors Assurance Corporation |

| MFH | — Multi-Family Housing |

| MGIC | — MGIC Investment Corporation |

| MVRICS | — Municipal Variable Rate Inverse Coupon Security |

| PCR | — Pollution Control Revenue |

| PFA | — Public Financing Authority |

| PSFG | — Permanent School Fund Guaranty |

| RAN | — Revenue Anticipation Notes |

| RIBS | — Residual Interest Bonds |

| SAVRS | — Select Auction Variable Rate Securities |

| SYCC | — Structured Yield Curve Certificate |

| TAN | — Tax Anticipation Notes |

| TECP | — Tax Exempt Commercial Paper |

| TOB | — Tender Option Bonds |

| TRAN | — Tax and Revenue Anticipation Notes |

| VA | — Veterans Administration |

| VRDD | — Variable Rate Daily Demand |

| VRWE | — Variable Rate Wednesday Demand |

* Abbreviations may or may not appear in the Schedule of Investments.

15 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

| |

|---|

| ASSETS: | | | |

| Investments, at value (Cost — $761,745,944) | | $ 846,466,573 | |

| Cash | | 37,410 | |

| Interest receivable | | 9,886,887 | |

| Receivable for securities sold | | 10,003,450 | |

| Receivable for Fund shares sold | | 663,615 | |

| Prepaid expenses | | 21,306 | |

|

| Total Assets | | 867,079,241 | |

|

| LIABILITIES: | |

| Payable to broker — variation margin | | 2,090,946 | |

| Payable for Fund shares reacquired | | 496,377 | |

| Investment advisory fee payable | | 168,925 | |

| Administration fee payable | | 136,675 | |

| Distribution plan fees payable | | 71,896 | |

| Accrued expenses | | 77,391 | |

|

| Total Liabilities | | 3,042,210 | |

|

| Total Net Assets | | $864,037,031 | |

|

| NET ASSETS: | |

| Par value of capital shares | | $ 52,309 | |

| Capital paid in excess of par value | | 818,099,954 | |

| Undistributed net investment income | | 2,487,473 | |

| Accumulated net realized loss from investment transactions and futures contracts | | (33,885,695 | ) |

| Net unrealized appreciation of investments and futures contracts | | 77,282,990 | |

|

| Total Net Assets | | $864,037,031 | |

|

| Shares Outstanding: | |

| Class A | | 41,928,950 | |

|

| Class B | | 6,840,157 | |

|

| Class C | | 3,539,866 | |

|

| Net Asset Value: | |

| Class A (and redemption price) | | $16.52 | |

|

| Class B * | | $16.50 | |

|

| Class C * | | $16.48 | |

|

| Maximum Public Offering Price Per Share: | |

| Class A (based on maximum sales charge of 4.00%) | | $17.21 | |

|

| * | Redemption price is NAV of Class B and C shares reduced by a 4.50% and 1.00% contingent deferred sales charge, respectively, if shares are redeemed within one year from purchase payment (See Note 2). |

See Notes to Financial Statements.

16 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

| |

|---|

| INVESTMENT INCOME: | | | | | |

| Interest | | | $ | 22,627,281 | |

|

| EXPENSES: | | |

| Investment advisory fee (Note 2) | | | | 1,335,668 | |

| Distribution plan fees (Note 5) | | | | 1,138,272 | |

| Administration fee (Note 2) | | | | 851,812 | |

| Transfer agency services (Note 5) | | | | 101,178 | |

| Custody | | | | 35,247 | |

| Audit and legal | | | | 33,503 | |

| Shareholder communications (Note 5) | | | | 25,207 | |

| Registration fees | | | | 16,789 | |

| Directors' fees | | | | 13,702 | |

| Other | | | | 5,211 | |

|

| Total Expenses | | | | 3,556,589 | |

| Less: Investment advisory fee waiver (Notes 2 and 8) | | | | (56,220 | ) |

|

| Net Expenses | | | | 3,500,369 | |

|

| Net Investment Income | | | | 19,126,912 | |

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS

AND FUTURES CONTRACTS (NOTES 1 AND 3): | | |

| Realized Gain (Loss) From: | | |

| Investment transactions | | | | 3,111,167 | |

| Futures contracts | | | | (16,055,007 | ) |

|

| Net Realized Loss | | | | (12,943,840 | ) |

|

| Net Decrease in Unrealized Appreciation of Investments and Futures Contracts | | | | (8,688,743 | ) |

|

| Net Loss on Investments and Futures Contracts | | | | (21,632,583 | ) |

|

| Decrease in Net Assets From Operations | | | $ | (2,505,671 | ) |

|

See Notes to Financial Statements.

17 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

For the Six Months Ended August 31, 2004 (unaudited)

and the Year Ended February 29, 2004

| | |

|---|

| | | | | August 31 | | | February 29 | |

|

| OPERATIONS: | | |

| Net investment income | | | $ | 19,126,912 | | $ | 40,013,927 | |

| Net realized gain (loss) | | | | (12,943,840 | ) | | 1,790,657 | |

| Increase (decrease) in net unrealized appreciation | | | | (8,688,743 | ) | | 6,002,667 | |

|

| Increase (Decrease) in Net Assets From Operations | | | | (2,505,671 | ) | | 47,807,251 | |

|

| DISTRIBUTIONS TO SHAREHOLDERS FROM (NOTES 1 AND 6): | | |

| Net investment income | | | | (18,804,644 | ) | | (39,311,037 | ) |

|

| Decrease in Net Assets From Distributions to Shareholders | | | | (18,804,644 | ) | | (39,311,037 | ) |

|

| FUND SHARE TRANSACTIONS (NOTE 7): | | |

| Net proceeds from sale of shares | | | | 40,961,239 | | | 99,960,664 | |

| Net asset value of shares issued for reinvestment of dividends | | | | 9,826,546 | | | 20,894,978 | |

| Cost of shares reacquired | | | | (78,991,748 | ) | | (168,727,858 | ) |

|

| Decrease in Net Assets From Fund Share Transactions | | | | (28,203,963 | ) | | (47,872,216 | ) |

|

| Decrease in Net Assets | | | | (49,514,278 | ) | | (39,376,002 | ) |

NET ASSETS: | | |

| Beginning of period | | | | 913,551,309 | | | 952,927,311 | |

|

| End of period* | | | $ | 864,037,031 | | $ | 913,551,309 | |

|

| * Includes undistributed net investment income of: | | | $ | 2,487,473 | | $ | 2,165,205 | |

|

See Notes to Financial Statements.

18 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

Financial Highlights

For a share of each class of capital stock outstanding throughout each year ended February 28, unless otherwise noted:

| | | | | | |

|---|

| Class A Shares | | | | 2004(1)(2) | | | 2004(2)(3) | | | 2003(2) | | | 2002(2) | | | 2001(2) | | | 2000(2)(4) | |

|

| Net Asset Value, Beginning of Period | | | $ | 16.92 | | $ | 16.76 | | $ | 16.93 | | $ | 16.70 | | $ | 15.28 | | $ | 16.93 | |

|

| Income (Loss) From Operations: | | |

| Net investment income(5) | | | | 0.37 | | | 0.75 | | | 0.77 | | | 0.79 | | | 0.79 | | | 0.78 | |

| Net realized and unrealized gain (loss)(5) | | | | (0.41 | ) | | 0.15 | | | (0.17 | ) | | 0.22 | | | 1.41 | | | (1.67 | ) |

|

| Total Income (Loss) From Operations | | | | (0.04 | ) | | 0.90 | | | 0.60 | | | 1.01 | | | 2.20 | | | (0.89 | ) |

|

| Less Distributions From: | | |

| Net investment income | | | | (0.36 | ) | | (0.74 | ) | | (0.77 | ) | | (0.78 | ) | | (0.78 | ) | | (0.76 | ) |

|

| Total Distributions | | | | (0.36 | ) | | (0.74 | ) | | (0.77 | ) | | (0.78 | ) | | (0.78 | ) | | (0.76 | ) |

|

| Net Asset Value, End of Period | | | $ | 16.52 | | $ | 16.92 | | $ | 16.76 | | $ | 16.93 | | $ | 16.70 | | $ | 15.28 | |

|

| Total Return | | | | (0.20 | )%‡ | | 5.48 | % | | 3.59 | % | | 6.20 | % | | 14.70 | % | | (5.36 | )% |

|

| Net Assets, End of Period (millions) | | | | $693 | | | $720 | | | $734 | | | $747 | | | $698 | | | $628 | |

|

| Ratios to Average Net Assets: | | |

| Expenses(6) | | | | 0.68 | %† | | 0.68 | % | | 0.70 | % | | 0.68 | % | | 0.68 | % | | 0.70 | % |

| Net investment income(5) | | | | 4.41 | † | | 4.46 | | | 4.58 | | | 4.68 | | | 4.91 | | | 4.99 | |

|

| Portfolio Turnover Rate | | | | 2 | % | | 14 | % | | 12 | % | | 21 | % | | 29 | % | | 29 | % |

|

| (1) | For the six months ended August 31, 2004 (unaudited). |

| (2) | Per share amounts have been calculated using the monthly average shares method. |

| (3) | For the year ended February 29, 2004. |

| (4) | For the year ended February 29, 2000. |

| (5) | Effective March 1, 2001, the Fund adopted a change in the accounting method that requires the Fund to amortize premiums and accrete all discounts. Without the adoption of this change, for the year ended February 28, 2002, those amounts would have been $0.77, $0.24 and 4.61% for net investment income, net realized and unrealized gain and the ratio of net investment income to average net assets, respectively. Per share information, ratios and supplemental data for the periods prior to March 1, 2001 have not been restated to reflect this change in presentation. |

| (6) | The investment manager waived a portion of its investment advisory fee for the six months ended August 31, 2004. If such fees were not waived, the actual expense ratio would have been 0.69% (annualized) for the six months ended August 31, 2004. |

| ‡ | Total return is not annualized, as it may not be representative of the total return for the year. |

See Notes to Financial Statements.

19 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

Financial Highlights (continued)

For a share of each class of capital stock outstanding throughout each year ended February 28, unless otherwise noted:

| | | | | | |

|---|

| Class B Shares | | | | 2004(1)(2) | | | 2004(2)(3) | | | 2003(2) | | | 2002(2) | | | 2001(2) | | | 2000(2)(4) | |

|

| Net Asset Value, Beginning of Period | | | $ | 16.90 | | $ | 16.74 | | $ | 16.92 | | $ | 16.69 | | $ | 15.28 | | $ | 16.93 | |

|

| Income (Loss) From Operations: | | |

| Net investment income(5) | | | | 0.32 | | | 0.66 | | | 0.68 | | | 0.69 | | | 0.70 | | | 0.70 | |

| Net realized and unrealized gain (loss)(5) | | | | (0.40 | ) | | 0.15 | | | (0.18 | ) | | 0.24 | | | 1.41 | | | (1.68 | ) |

|

| Total Income (Loss) From Operations | | | | (0.08 | ) | | 0.81 | | | 0.50 | | | 0.93 | | | 2.11 | | | (0.98 | ) |

|

| Less Distributions From: | | |

| Net investment income | | | | (0.32 | ) | | (0.65 | ) | | (0.68 | ) | | (0.70 | ) | | (0.70 | ) | | (0.67 | ) |

|

| Total Distributions | | | | (0.32 | ) | | (0.65 | ) | | (0.68 | ) | | (0.70 | ) | | (0.70 | ) | | (0.67 | ) |

|

| Net Asset Value, End of Period | | | $ | 16.50 | | $ | 16.90 | | $ | 16.74 | | $ | 16.92 | | $ | 16.69 | | $ | 15.28 | |

|

| Total Return | | | | (0.46 | )%‡ | | 4.94 | % | | 3.02 | % | | 5.69 | % | | 14.06 | % | | (5.87 | )% |

|

| Net Assets, End of Period (millions) | | | | $113 | | | $134 | | | $157 | | | $170 | | | $183 | | | $196 | |

|

| Ratios to Average Net Assets: | | |

| Expenses(6) | | | | 1.20 | %† | | 1.20 | % | | 1.22 | % | | 1.20 | % | | 1.19 | % | | 1.22 | % |

| Net investment income(5) | | | | 3.87 | † | | 3.94 | | | 4.06 | | | 4.14 | | | 4.39 | | | 4.47 | |

|

| Portfolio Turnover Rate | | | | 2 | % | | 14 | % | | 12 | % | | 21 | % | | 29 | % | | 29 | % |

|

| (1) | For the six months ended August 31, 2004 (unaudited). |

| (2) | Per share amounts have been calculated using the monthly average shares method. |

| (3) | For the year ended February 29, 2004. |

| (4) | For the year ended February 29, 2000. |

| (5) | Effective March 1, 2001, the Fund adopted a change in the accounting method that requires the Fund to amortize premiums and accrete all discounts. Without the adoption of this change, for the year ended February 28, 2002, those amounts would have been $0.68, $0.25 and 4.07% for net investment income, net realized and unrealized g ain and the ratio of net investment income to average net assets, respectively. Per share information, ratios and supplemental data for the periods prior to March 1, 2001 have not been restated to reflect this change in presentation. |

| (6) | The investment manager waived a portion of its investment advisory fee for the six months ended August 31, 2004. If such fees were not waived, the actual expense ratio would have been 1.21% (annualized) for the six months ended August 31, 2004. |

| ‡ | Total return is not annualized, as it may not be representative of the total return for the year. |

See Notes to Financial Statements.

20 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

Financial Highlights (continued)

For a share of each class of capital stock outstanding throughout each year ended February 28, unless otherwise noted:

| | | | | | |

|---|

| Class C Shares(1) | | | | 2004(2)(3) | | | 2004(3)(4) | | | 2003(3) | | | 2002(3) | | | 2001(3) | | | 2000(3)(5) | |

|

| Net Asset Value, Beginning of Period | | | $ | 16.88 | | $ | 16.72 | | $ | 16.90 | | $ | 16.68 | | $ | 15.26 | | $ | 16.91 | |

|

| Income (Loss) From Operations: | | |

| Net investment income(6) | | | | 0.32 | | | 0.65 | | | 0.68 | | | 0.69 | | | 0.69 | | | 0.69 | |

| Net realized and unrealized gain (loss)(6) | | | | (0.40 | ) | | 0.15 | | | (0.19 | ) | | 0.22 | | | 1.42 | | | (1.68 | ) |

|

| Total Income (Loss) From Operations | | | | (0.08 | ) | | 0.80 | | | 0.49 | | | 0.91 | | | 2.11 | | | (0.99 | ) |

|

| Less Distributions From: | | |

| Net investment income | | | | (0.32 | ) | | (0.64 | ) | | (0.67 | ) | | (0.69 | ) | | (0.69 | ) | | (0.66 | ) |

|

| Total Distributions | | | | (0.32 | ) | | (0.64 | ) | | (0.67 | ) | | (0.69 | ) | | (0.69 | ) | | (0.66 | ) |

|

| Net Asset Value, End of Period | | | $ | 16.48 | | $ | 16.88 | | $ | 16.72 | | $ | 16.90 | | $ | 16.68 | | $ | 15.26 | |

|

| Total Return | | | | (0.48 | )%‡ | | 4.91 | % | | 2.99 | % | | 5.59 | % | | 14.09 | % | | (5.92 | )% |

|

| Net Assets, End of Period (millions) | | | | $58 | | | $60 | | | $62 | | | $60 | | | $51 | | | $38 | |

|

| Ratios to Average Net Assets: | | |

| Expenses(7) | | | | 1.24 | %† | | 1.24 | % | | 1.26 | % | | 1.25 | % | | 1.24 | % | | 1.28 | % |

| Net investment income(6) | | | | 3.84 | † | | 3.90 | | | 4.01 | | | 4.12 | | | 4.34 | | | 4.41 | |

|

| Portfolio Turnover Rate | | | | 2 | % | | 14 | % | | 12 | % | | 21 | % | | 29 | % | | 29 | % |

|

| (1) | On April 29, 2004, Class L shares were renamed as Class C shares. |

| (2) | For the six months ended August 31, 2004 (unaudited). |

| (3) | Per share amounts have been calculated using the monthly average shares method. |

| (4) | For the year ended February 29, 2004. |

| (5) | For the year ended February 29, 2000. |

| (6) | Effective March 1, 2001, the Fund adopted a change in the accounting method that requires the Fund to amortize premiums and accrete all discounts. Without the adoption of this change, for the year ended February 28, 2002, those amounts would have been $0.68, $0.23 and 4.05% for net investment income, net realized and unrealized gain and the ratio of net investment income to average net assets, respectively. Per share information, ratios and supplemental data for the periods prior to March 1, 2001 have not been restated to reflect this change in presentation. |

| (7) | The investment manager waived a portion of its investment advisory fee for the six months ended August 31, 2004. If such fees were not waived, the actual expense ratio would have been 1.25% (annualized) for the six months ended August 31, 2004. |

| ‡ | Total return is not annualized, as it may not be representative of the total return for the year. |

See Notes to Financial Statements.

21 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

1. Organization and Significant Accounting Policies

The Smith Barney California Municipals Fund Inc. (“Fund”), a Maryland corporation, is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment Valuation. Securities are valued at the mean between the bid and asked prices provided by an independent pricing service that are based on transactions in municipal obligations, quotations from municipal bond dealers, market transactions in comparable securities and various relationship between securities. When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the fund’s Board of Directors. Short-term obligations with maturities of 60 days or less are valued at cost plus accreted discount, or minus amortized premium, which approximates value.

(b) Futures Contracts. Securities or cash equal to the initial margin amount are either deposited with the broker or segregated by the custodian upon entering into the futures contract. Additional securities are also segregated up to the current market value of the futures contract. During the period the futures contract is open, changes in the value of the contract are recognized as unrealized gains or losses by “marking-to-market” on a daily basis to reflect the market value of the contract at the end of each day’s trading.Variation margin payments are received or made and recognized as assets due from or liabilities due to broker, depending upon whether unrealized gains or losses are incurred. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the proceeds from (or cost of ) the closing transactions and the Fund’s basis in the contract. The Fund enters into such contracts typically to hedge a portion of its portfolio. The Fund bears the market risk that arises from changes in the value of the financial instruments and securities indices.

(c) Investment Transactions and Investment Income. Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on an accrual basis. Gains or losses on the sale of securities are calculated by using the specific identification method.

(d) Class Accounting. Class specific expenses are charged to each class; investment advisory fees and general fund expenses, income, gains and/or losses are allocated on the basis of relative net assets of each class or on another reasonable basis.

(e) Federal Income Taxes. The Fund intends to comply with the applicable provisions of the Internal Revenue Code of 1986, as amended, pertaining to regulated investment companies and to make distributions of taxable income and capital gains sufficient to relieve it from substantially all Federal income and excise taxes. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

22 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

Notes to Financial Statements (unaudited) (continued)

(f) Exempt-Interest Dividends and Other Distributions. The Fund intends to satisfy conditions that will enable interest from municipal securities, which is exempt from Federal income tax and from designated state income taxes, to retain such tax-exempt status when distributed to the shareholders of the Fund.

It is the Fund’s policy to distribute dividends monthly. Capital gains distributions, if any, are taxable to shareholders, and are declared and paid at least annually.

2. Investment Advisory Agreement, Administration Agreement and Other Transactions

Smith Barney Fund Management LLC (“SBFM”), an indirect wholly-owned subsidiary of Citigroup Inc. (“Citigroup”), acts as investment adviser to the Fund. The Fund pays SBFM an advisory fee calculated at an annual rate of 0.30% of the Fund’s average daily net assets. This fee is calculated daily and paid monthly.

During the six months ended August 31, 2004, SBFM waived a portion of its investment advisory fee of $56,220.

SBFM also acts as the Fund’s administrator for which the Fund pays a fee calculated at an annual rate of 0.20% of the Fund’s average daily net assets up to $500 million and 0.18% of the Fund’s average daily net assets in excess of $500 million. This fee is calculated daily and paid monthly.

Citicorp Trust Bank, fsb. (“CTB”), another subsidiary of Citigroup, acts as the Fund’s transfer agent. PFPC Inc. (“PFPC”) and Primerica Shareholder Services (“PSS”), another subsidiary of Citigroup, act as the Fund’s sub-transfer agents. CTB receives account fees and asset-based fees that vary according to the size and type of account. PFPC and PSS are responsible for shareholder recordkeeping and financial processing for all shareholder accounts and are paid by CTB. For the six months ended August 31, 2004, the Fund paid transfer agent fees of $78,693 to CTB.

Citigroup Global Markets Inc. (“CGM”) and PFS Distributors, Inc., both of which are subsidiaries of Citigroup, act as the Fund’s distributors.

On February 2, 2004, initial sales charges on Class L shares were eliminated. Effective April 29, 2004, the Fund’s Class L shares were renamed as Class C shares.

There is a maximum initial sales charge of 4.00% for Class A shares. There is a contingent deferred sales charge (“CDSC”) of 4.50% on Class B shares, which applies if redemption occurs within one year from purchase payment. This CDSC declines by 0.50% the first year after purchase payment and thereafter by 1.00% per year until no CDSC is incurred. Class C shares also have a 1.00% CDSC, which applies if redemption occurs within one year from purchase payment. In addition, Class A shares also have a 1.00% CDSC, which applies if redemption occurs within one year from purchase payment. This CDSC only applies to those purchases of Class A shares, which, when combined with current holdings of Class A shares, equal or exceed $500,000 in the aggregate. These purchases do not incur an initial sales charge.

For the six months ended August 31, 2004, CGM and its affiliates received sales charges of approximately $291,000 and $1,000 on sales of the Fund’s Class A and C shares, respectively. In addition, for the six months ended August 31, 2004, CDSCs paid to CGM and its affiliates were approximately:

| | | |

|---|

| | Class A | | Class B | | Class C | |

|

| CDSCs | | $13,000 | | $115,000 | | $2,000 | |

|

All officers and one Director of the Fund are employees of Citigroup or its affiliates.

23 Smith Barney California Municipals Fund Inc. | 2004 Semi-Annual Report

Notes to Financial Statements (unaudited) (continued)

3. Investments

During the six months ended August 31, 2004, the aggregate cost of purchases and proceeds from sales of investments (including maturities of long-term investments, but excluding short-term investments) were as follows:

| |

|---|

|

| Purchases | | $17,253,706 | |

|

| Sales | | 47,591,050 | |

|

At August 31, 2004, the aggregate gross unrealized appreciation and depreciation of investments for Federal income tax purposes were substantially as follows:

| |

|---|

|

| Gross unrealized appreciation | | $ 88,265,846 | |

| Gross unrealized depreciation | | (3,545,217 | ) |

|

| Net unrealized appreciation | | $ 84,720,629 | |

|

At August 31, 2004, the Fund had the following open futures contracts:

| | | | | |

|---|

| | | | | | | | | | | | |

| | | Number of

Contracts | | Expiration

Date | | Basis

Value | | Market

Value | | Unrealized

Loss | |

|

| Contracts to Sell: | |

| U.S. Treasury Bonds | | 620 | | 9/04 | | $ 64,717,946 | | $ 69,769,375 | | $(5,051,429) | |

| U.S. Treasury Bonds | | 2,290 | | 12/04 | | 252,519,415 | | 254,905,625 | | (2,386,210) | |

|

| Net Unrealized Loss | | | | | | | | | | $(7,437,639) | |

|

4. Fund Concentration

The Fund primarily invests in debt obligations issued by the State of California and local governments in the State of California, its political subdivisions, agencies and public authorities to obtain funds for various public purposes. The Fund is more susceptible to factors adversely affecting issuers of California municipal securities than is a municipal bond fund that is not concentrated in these issuers to the same extent.

5. Class Specific Expenses

Pursuant to a Rule 12b-1 Distribution Plan, the Fund pays a service fee with respect to its Class A, B and C shares calculated at the annual rate of 0.15% of the average daily net assets of each respective class. The Fund also pays a distribution fee with respect to its Class B and C shares calculated at the annual rate of 0.50% and 0.55% of the average daily net assets for each class, respectively. For the six months ended August 31, 2004, total Rule 12b-1 Distribution Plan fees, which are accrued daily and paid monthly, were as follows:

| | | |

|---|

| | | Class A | | Class B | | Class C | |

|

| Rule 12b-1 Distribution Plan Fees | | $531,158 | | $399,239 | | $207,875 | |

|

For the six months ended August 31, 2004, total Transfer Agency Service expenses were as follows:

| | | |

|---|

| | Class A | | Class B | | Class C | |