File No. 333-[______]

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JULY 6, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

Pre-Effective Amendment No. [ ]

Post-Effective Amendment No. [ ]

FIRST INVESTORS INCOME FUNDS

(Exact Name of Registrant as Specified in Charter)

40 Wall Street

New York, New York 10005

(Address of Principal Executive Offices)

(212) 858-8000

(Registrant’s Area Code and Telephone Number)

Frank Genna, Esq.

40 Wall Street

New York, New York 10005

(Name and Address of Agent for Service)

With copies to:

Kathy Kresch Ingber, Esq. K&L Gates LLP 1601 K Street, N.W. Washington, DC 20006-1600 |

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this Registration Statement will become effective on the 30th day after filing pursuant to Rule 488 under the Securities Act of 1933, as amended.

Title of securities being registered: Class A, Advisor Class and Institutional Class shares of beneficial interest in the series of the Registrant designated as the First Investors Limited Duration Bond Fund.

No filing fee is required because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of shares (File Nos. 002-89287 and 811-03967).

FIRST INVESTORS INCOME FUNDS

CONTENTS OF REGISTRATION STATEMENT

This Registration Statement contains the following papers and documents:

Cover Sheet

Contents of Registration Statement

Letter to Shareholders

Questions and Answers

Part A - Information Statement and Prospectus

Part B - Statement of Additional Information

Part C - Other Information

Signature Page

Exhibit Index

FIRST INVESTORS INCOME FUNDS

40 Wall Street

New York, New York 10005

[ ], 2018

Dear First Investors Government Fund shareholder:

At First Investors, we continually review our lineup of mutual funds to ensure that each fund continues to serve the best interests of our shareholders. After careful consideration, we proposed, and your fund’s Board of Trustees agreed, that shareholders would benefit from the merger of your fund, the First Investors Government Fund, into the First Investors Limited Duration Bond Fund, each a series of First Investors Income Funds. No shareholder vote is required for the reorganization. You do not need to take any action regarding your account.

Benefits of the Proposed Reorganization:

Continuity of Management. Foresters Investment Management Company, Inc. serves as investment adviser of each fund. The reorganization will allow shareholders of the First Investors Government Fund to continue to pursue their investment objective through another fixed income fund managed by the same investment adviser;

Lower Fees and Expenses. Shareholders of the First Investors Government Fund will benefit from lower fees and expenses after the reorganization. Taking into account the contractual expense cap limitations currently in place for the First Investors Limited Duration Bond Fund through at least January 31, 2020 and without taking into account the voluntary fee waiver in place for the First Investors Government Fund which can be terminated by the investment adviser at anytime, shareholders will immediately realize reductions in annual fund operating expenses in the amounts of 0.44% for Class A shares, 1.35% for Class B shares (as compared to the First Investors Limited Duration Bond Fund’s Class A shares), 0.45% for Advisor Class shares, and 0.44% for Institutional Class shares;

Potential Economies of Scale. The reorganization may provide shareholders the opportunity to benefit from the increased assets resulting from combining the funds, which may contribute to further lowering annual fund operating expenses of the combined fund over time; and

More Efficient Use of Management Resources. Merging the funds would allow the investment adviser to concentrate its management resources on a single combined fund which could benefit the combined fund and lead to greater operational efficiencies.

The reorganization is expected to take effect on or about September 21, 2018. At that time, the Class A shares, Class B shares, Advisor Class shares and Institutional Class shares you currently own of the First Investors Government Fund would, in effect, be exchanged for the class of shares of the First Investors Limited Duration Bond Fund with an aggregate value equal to the aggregate value of the class of shares of the First Investors Government Fund, as set forth below:

| First Investors Government Fund | | First Investors Limited Duration Bond Fund |

| Class A shares | à | Class A shares |

| Class B shares | à | Class A shares |

| Advisor Class shares | à | Advisor Class shares |

| Institutional Class shares | à | Institutional Class shares |

No sales loads, commissions or other transactional fees will be imposed on shareholders in connection with the exchange of their shares. The reorganization is expected to be tax-free for federal income tax purposes. As such, no gain or loss will be recognized by the First Investors Government Fund or its shareholders for federal income tax purposes as a direct result of the reorganization.

The attached Combined Information Statement and Prospectus contains further information regarding the reorganization and the First Investors Limited Duration Bond Fund. If you have any questions regarding the reorganization please contact First Investors toll-free at 1 (800) 423-4026.

Thank you for your continued investment in the First Investors Family of Funds.

Sincerely,

/s/ E. Blake Moore Jr.

E. Blake Moore Jr.

President of First Investors Family of Funds

Questions and Answers

Q. What is this document and why did you send it to me?

A. The attached Combined Information Statement and Prospectus (“Information Statement”) is an information statement for the First Investors Government Fund (“Target Fund”), and a prospectus for the First Investors Limited Duration Bond Fund (“Acquiring Fund”), each a series of First Investors Income Funds (“Trust”). The Acquiring Fund and Target Fund are referred to individually as a “Fund” and collectively as the “Funds.”

The Board of Trustees (“Board”) of the Trust has approved the reorganization of the Target Fund into the Acquiring Fund (“Reorganization”). You are receiving this document because, as of July 10, 2018, you were a shareholder of the Target Fund. Pursuant to a Plan of Reorganization and Termination adopted by the Board (“Reorganization Plan”), upon the closing of the Reorganization, your shares of the Target Fund will automatically convert to shares of the Acquiring Fund with an aggregate value equal to the aggregate value of your Target Fund shares as of the close of business on the day the Reorganization is closed. No shareholder vote is required for the Reorganization. You do not need to take any action regarding your account.

This Information Statement contains information that shareholders of the Target Fund may wish to know about the Reorganization and the Acquiring Fund. You should retain this document for future reference.

Q. What is the purpose of the Reorganization?

A. Foresters Investment Management Company, Inc. (“FIMCO”), the investment adviser to the Funds, has proposed reorganizing the Target Fund into the Acquiring Fund. The Board has determined that the Reorganization is in the best interests of the Target Fund and would benefit the Target Fund and its shareholders for several reasons, including:

| 1. | The Reorganization will allow shareholders of the Target Fund to continue to pursue their investment objective through the Acquiring Fund, another fixed income fund managed by the same investment adviser; |

| 2. | Shareholders of the Target Fund will benefit from lower fees and expenses after the reorganization. Taking into account the expense cap limitations currently in place for the Acquiring Fund through at least January 31, 2020 and without taking into account the voluntary fee waiver in place for the Target Fund which can be terminated by the investment adviser at anytime, Target Fund shareholders will immediately realize reductions in annual fund operating expenses in the amounts of 0.44% for Class A shares, 1.35% for Class B shares (as compared to the Acquiring Fund’s Class A shares), 0.45% for Advisor Class shares, and 0.44% for Institutional Class shares; |

| 3. | The Reorganization may provide Target Fund shareholders the opportunity to benefit from the increased assets resulting from combining the Funds, which may contribute to further lowering annual fund operating expenses of the Acquiring Fund over time; and |

| 4. | The Reorganization would allow FIMCO to concentrate its management resources on a single combined Fund which could benefit the combined Fund and lead to greater operational efficiencies. |

Q. When will the Reorganization occur? How will the Reorganization work?

A. The Reorganization is currently scheduled to take place on or about September 21, 2018 (“Closing Date”). As of the close of business on the Closing Date, the Target Fund will transfer all of its assets to the Acquiring Fund in exchange solely for shares of beneficial interest in the Acquiring Fund having an aggregate value equal to the Target Fund’s net assets and the Acquiring Fund’s assumption of all of the Target Fund’s liabilities. The shares of the Acquiring Fund received by the Target Fund will be distributed pro rata to the Target Fund’s shareholders of record as of the Closing Date, and the Target Fund will be terminated. After the close of business on the Closing Date, shareholders of the Target Fund will receive the class of shares of the Acquiring Fund with an aggregate value

equal to the aggregate value of the Target Fund shares held by the shareholder immediately prior to the Reorganization, as set forth below:

| Target Fund | | Acquiring Fund |

| Class A shares | à | Class A shares |

| Class B shares | à | Class A shares |

| Advisor Class shares | à | Advisor Class shares |

| Institutional Class shares | à | Institutional Class shares |

Please refer to the Information Statement for a detailed explanation of the Reorganization Plan.

Q. How will this affect me as a Target Fund shareholder?

A. After the Closing Date, you will no longer be a shareholder of the Target Fund, but rather will be a shareholder of the Acquiring Fund. The shares of the Acquiring Fund that you receive in the Reorganization will be of the same class as the shares you hold in the Target Fund, except that Class B shareholders of the Target Fund will receive Class A shares of the Acquiring Fund, and will have an aggregate value equal to the aggregate value of the shares you hold in the Target Fund as of the Closing Date. No sales loads, commissions or other transactional fees will be imposed on Target Fund shareholders in connection with the Reorganization.

Q. Will the Reorganization affect the value of my investment? After the Reorganization, will I own the same number of shares?

A. The Reorganization will not affect the value of your investment at the time of the Reorganization. The Acquiring Fund shares that you receive will have an aggregate value equal to the aggregate value of the Target Fund shares you held as of the Closing Date. It is likely, however, that the number of Acquiring Fund shares you own will differ because your Target Fund shares will be exchanged at the net asset values per share of the classes of the Acquiring Fund, which are likely to be different from the net asset values per share of the corresponding classes of the Target Fund on the Closing Date.

Q. How is the Target Fund different from the Acquiring Fund?

A. The Target Fund and the Acquiring Fund pursue similar investment objectives but different investment strategies. The Target Fund seeks a significant level of current income which is consistent with security and liquidity of principal, while the Acquiring Fund seeks current income consistent with low volatility of principal. Under normal circumstances, the Target Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in securities issued or guaranteed as to payment of principal and interest by the U.S. government, its agencies or instrumentalities (“U.S. Government Securities”), whereas the Acquiring Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in investment grade bonds, which may include other investment grade debt securities. The primary difference between the Funds’ investment strategies is that the Target Fund invests principally in U.S. Government Securities and, to a lesser extent, may invest in municipal securities and non-government investment grade debt securities, while the Acquiring Fund invests in a variety of investment grade debt securities, including corporate bonds, U.S. Government Securities, securities issued by U.S. government-sponsored enterprises, and mortgage-backed and other asset-backed securities. In addition, to a lesser extent, the Acquiring Fund also invests in below investment grade corporate bonds, also known as “high yield” or “junk bonds,” whereas the Target Fund does not. In pursuing its investment strategy, the Acquiring Fund also may invest in exchange-traded funds that invest in high yield securities and, from time to time, may hold significant investments in a specific market sector. The Target Fund may engage in short-term trading, which is not a principal investment strategy of the Acquiring Fund. Both Funds may invest in U.S. Treasury futures and options on U.S. Treasury futures to hedge against changes in interest rates.

The difference in investment strategies results in different risk profiles for the Funds. The Acquiring Fund has greater exposure to credit risk than the Target Fund. The Acquiring Fund also has exposure to exchange-traded funds risk, high yield securities risk and sector risk as principal risks, which are not principal risks of the Target Fund, while the Target Fund has exposure to call risk, high portfolio turnover risk and liquidity risk as principal risks, which are not principal risks of the Acquiring Fund. The Acquiring Fund will continue to pursue its current investment objective and investment strategy after the Reorganization.

Q. Will the service providers to the Target Fund change following the Reorganization?

A. The Target Fund and the Acquiring Fund use the same investment adviser, principal underwriter, transfer agent and custodian. The Acquiring Fund uses an investment subadviser while the Target Fund does not. FIMCO is the investment adviser to each Fund, while Muzinich & Co., Inc. (“Muzinich”) is the investment subadviser for the portion of the Acquiring Fund’s portfolio invested in high-yield debt securities. Foresters Financial Services, Inc. (“FFS”) serves as the principal underwriter, Foresters Investor Services, Inc., an affiliate of FIMCO and FFS, serves as the transfer agent, and the Bank of New York Mellon Corp. serves as the custodian of each Fund. The Acquiring Fund will continue to retain its current service providers after the Reorganization.

Q. Do the portfolio managers who manage the Target Fund also manage the Acquiring Fund?

A. The portfolio manager at FIMCO who manages the Target Fund also manages the Acquiring Fund. After the Reorganization, the same portfolio manager will continue to serve as the portfolio manager of the Acquiring Fund. Since January 2018, Muzinich has served as the investment subadviser of a portion of the Acquiring Fund and the same portfolio managers at Muzinich who manage the portion of the Acquiring Fund allocated to Muzinich will continue to do so after the Reorganization.

Q. Will there be any changes to my fees and expenses as a result of the Reorganization?

A. Shareholders of the Target Fund will benefit from lower fees and expenses after the Reorganization. As reflected below and in the tables setting forth information regarding comparative expense ratios under “Comparative Fee and Expense Tables” in the Information Statement, the total annual fund operating expense ratios for each class of shares of the Acquiring Fund are lower than the total annual fund operating expenses of each corresponding class of shares of the Target Fund, and the total annual fund operating expense ratio for Class A shares of the Acquiring Fund is lower than the total annual fund operating expenses of the Class B shares of the Target Fund. Also, the annual fund operating expenses of the Acquiring Fund are subject to contractual expense cap limitations through at least January 31, 2020 which further reduce these expense ratios, while the Target Fund is not subject to contractual expense cap limitations. FIMCO voluntarily waives advisory fees payable by the Target Fund, but these fee waivers can be terminated by FIMCO at any time in its discretion. After giving effect to the contractual expense cap limitations in place for the Acquiring Fund, and without taking into account any voluntary fee waivers by FIMCO of the Target Fund’s advisory fee, the difference in the net annual fund operating expense ratios for the classes of shares of the Acquiring Fund compared to those of the Target Fund are as follows:

| · | Acquiring Fund’s Class A shares expense ratio is 0.44% and 1.35% lower than the Target Fund’s Class A and Class B shares expense ratios, respectively; |

| · | Acquiring Fund’s Advisor Class shares expense ratio is 0.45% lower than the Target Fund’s Advisor Class shares expense ratio; and |

| · | Acquiring Fund’s Institutional Class shares expense ratio is 0.44% lower than the Target Fund’s Institutional Class shares expense ratio. |

After giving effect to the Reorganization, the pro forma net annual fund operating expense ratios of the Acquiring Fund are not expected to change for any share class, though the total annual fund operating expense ratios are expected to be lower for each share class.

Class (a) | Target Fund | Acquiring Fund

| Acquiring Fund

(Pro Forma) |

| | Total Annual Fund Operating Expenses | Net Annual Fund Operating Expenses (after fee waiver and/or expense reimbursement)(b) | Total Annual Fund Operating Expenses | Net Annual Fund Operating Expenses (after fee waiver and/or expense reimbursement) | Total Annual Fund Operating Expenses | Net Annual Fund Operating Expenses (after fee waiver and/or expense reimbursement) |

| | | | | | | |

| Class A | 1.23% | 1.23% | 0.97% | 0.79% | 0.95% | 0.79% |

| | | | | | | |

| Class B | 2.14% | 2.14% | N/A | N/A | N/A | N/A |

| | | | | | | |

| Advisor Class | 0.96% | 0.96% | 0.77% | 0.51% | 0.73% | 0.51% |

| | | | | | | |

| Institutional Class | 0.80% | 0.80% | 0.57% | 0.36% | 0.52% | 0.36% |

________________________________________________________________ (a) See “Comparative Fee and Expense Tables” in the Information Statement for more information on the operating expenses of each class of shares.

(b) FIMCO voluntarily waives advisory fees payable by the Target Fund, but these fee waivers are not reflected in the table and can be terminated by FIMCO at any time in its discretion. Taking into account the voluntary fee waiver, net annual fund operating expenses for the Target Fund are 1.07% for Class A shares, 1.98% for Class B shares, 0.80% for Advisor Class shares and 0.64% for Institutional Class shares. |

The contractual advisory fee rates for the Acquiring Fund are lower than the contractual advisory fee rates for the Target Fund at the same asset levels. As of March 31, 2018, the effective advisory fee rate for the Acquiring Fund was 0.41% per annum, whereas as of the same date, the effective advisory fee rate for the Target Fund was 0.66% per annum.

The initial sales charge for Class A shares of the Target Fund is 4.00%. The initial sales charge for Class A shares of the Acquiring Fund is 2.50%. While the initial sales charge will not apply to Class A shares you receive in connection with the Reorganization, whether you are a Class A or Class B shareholder of the Target Fund, any purchases you make of Class A shares of the Acquiring Fund after consummation of the Reorganization will be subject to the Acquiring Fund’s initial sales charge. Both Funds charge a contingent deferred sales charge (“CDSC”) of 1% on certain redemptions of Class A shares purchased without a sales charge. If your Class A shares of the Target Fund are subject to a CDSC, the CDSC will apply to your redemption of the Class A shares of the Acquiring Fund you receive in the Reorganization. For purposes of determining the CDSC, if any, applicable to a redemption of the Class A shares of the Acquiring Fund you acquire in the Reorganization, those Class A shares of the Acquiring Fund will be treated as continuing to age from the date you purchased the Target Fund Class A shares that were converted in the Reorganization. Class A shares of both Funds are subject to Rule 12b-1 fees of 0.30% per annum and the Class B shares of the Target Fund are subject to Rule 12b-1 fees of 1.00% per annum. Advisor Class and Institutional Class shares of both the Target Fund and the Acquiring Fund do not have a front-end sales charge, CDSC, or Rule 12b-1 fees.

Q. Will the Reorganization result in any federal income tax liability for the Target Fund or its shareholders?

A. The Reorganization is expected to be a tax-free transaction for federal income tax purposes. The Trust expects that neither the Target Fund nor its shareholders will recognize any gain or loss for federal income tax purposes as a direct result of the Reorganization, and the Trust expects to receive a tax opinion from K&L Gates LLP, counsel to the Trust, substantially to that effect. Shareholders should consult their own tax advisers about possible state and local tax consequences of the Reorganization, if any, because the information about tax consequences in this document relates only to the federal income tax consequences of the Reorganization.

To better align the Target Fund portfolio with the principal investment strategies of the Acquiring Fund, FIMCO anticipates disposing of approximately two-thirds of the holdings of the Target Fund close to the date for the

Reorganization. The degree to which the Target Fund’s holdings are sold will depend upon market conditions near the time of the Reorganization. The Target Fund’s disposition of assets before the Reorganization could result in its selling securities at a disadvantageous time and, possibly, realizing net capital gains or losses that otherwise would not have been realized. The anticipated sale of the Target Fund’s holdings prior to the Reorganization is not expected to result in the distribution of net capital gains to shareholders of the Target Fund. The proceeds from sale of the Target Fund’s holdings in preparation for the Reorganization will be held in cash or cash equivalents. During periods when the Target Fund holds large cash positions, it will not be pursuing, and will not achieve, its investment objective.

Q. Will I need to open an account in the Acquiring Fund prior to the Reorganization?

A. No. An account will be set up in your name and your shares of the Target Fund automatically will be converted to the corresponding class(es) of shares of the Acquiring Fund. You will receive confirmation of this transaction following the Reorganization.

Q. Can I still purchase and redeem shares of the Target Fund until the Reorganization?

A. You may continue to purchase and redeem shares of the Target Fund until the Closing Date. Purchase or redemption requests received by the transfer agent after the Closing Date will be treated as requests received for the purchase or redemption of shares of the Acquiring Fund received by the shareholder in connection with the Reorganization.

Q. What if I want to exchange my shares into another First Investors Fund prior to the Reorganization?

A. You may exchange your shares into another fund in the First Investors Family of Funds until the Closing Date in accordance with your existing exchange privileges. If you choose to exchange your shares of the Target Fund for another fund in the First Investors Family of Funds, including the Acquiring Fund, your request will be treated as a normal exchange of shares and will be a taxable transaction unless your shares are held in a tax-advantaged account, such as a 401(k) plan or individual retirement account. Exchanges may be subject to minimum investment requirements, sales loads, and CDSCs.

Q. Who is paying the costs of the Reorganization?

A. The costs of the Reorganization, including the costs associated with the preparation of the Reorganization Plan and Information Statement, printing and distribution costs, and legal and accounting fees and disbursements in connection with the Reorganization, will be borne by the Target Fund. The costs of the Reorganization are estimated to be approximately $75,100. This figure does not include estimated portfolio transaction costs of approximately $187,500 expected to be incurred as a result of the alignment of the Target Fund portfolio with the investment strategies of the Acquiring Fund prior to the Reorganization. These transaction costs will also be borne by the Target Fund.

Q. Who do I contact if I have questions about the Reorganization?

A. If you have any questions about the Reorganization, please call FIMCO toll-free at 1 (800) 423-4026.

The information in this combined information statement and prospectus is not complete and may be changed. We

may not sell these securities until the registration statement filed with the Securities and Exchange Commission is

effective. This combined information statement and prospectus is not an offer to sell these securities and is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

COMBINED INFORMATION STATEMENT AND PROSPECTUS

For the Reorganization of

First Investors Government Fund,

a series of First Investors Income Funds

40 Wall Street

New York, New York 10005

(212) 858-8000

Into

First Investors Limited Duration Bond Fund,

a series of First Investors Income Funds

40 Wall Street

New York, New York 10005

(212) 858-8000

[ ], 2018

INFORMATION STATEMENT

for

FIRST INVESTORS GOVERNMENT FUND,

a series of First Investors Income Funds

and

PROSPECTUS

for

FIRST INVESTORS LIMITED DURATION BOND FUND,

a series of First Investors Income Funds

Dated [ ], 2018

40 Wall Street

New York, New York 10005

(212) 858-8000

This Combined Information Statement and Prospectus (“Information Statement”) is an information statement for the First Investors Government Fund and a prospectus for the First Investors Limited Duration Bond Fund, each a series of First Investors Income Funds. The Information Statement contains information you may wish to know about the reorganization of the First Investors Government Fund into the First Investors Limited Duration Bond Fund (“Reorganization”) and the Class A shares, Advisor Class shares and Institutional Class shares of the First Investors Limited Duration Bond Fund. The First Investors Government Fund is referred to herein as the “Target Fund” and the First Investors Limited Duration Bond Fund is referred to herein as the “Acquiring Fund.” The Target Fund and the Acquiring Fund each may be referred to herein as a “Fund” and collectively as the “Funds.” The First Investors Income Funds is referred to herein as the “Trust.”

You are receiving this document because, as of July 10, 2018, you were a shareholder of the Target Fund. Upon consummation of the Reorganization, shareholders of the Target Fund will become shareholders of the Acquiring Fund. Target Fund shareholders will receive shares of the corresponding class of the Acquiring Fund with an aggregate value equal to the aggregate value of the class of Target Fund shares that they hold as of the close of business on the day the Reorganization is consummated, with the exception of Target Fund shareholders holding Class B shares, who will receive Class A shares of the Acquiring Fund with an aggregate value equal to the aggregate value of the Class B shares that they hold in the Target Fund as of the close of business on the day the Reorganization is consummated. Following the Reorganization the Target Fund will be terminated.

We are not asking you for a proxy or written consent, and you are requested not to send us a proxy or written consent.

This Information Statement sets forth important information that you may wish to know regarding the Reorganization and the Acquiring Fund. You should read and retain this Information Statement for future reference. Additional information relating to the Acquiring Fund and this Information Statement is set forth in the Statement of Additional Information (“SAI”) relating to this Information Statement.

The following documents have been filed with the Securities and Exchange Commission (“SEC”) and are incorporated by reference into this Information Statement, which means they are part of this Information Statement for legal purposes:

| 1. | The SAI dated [ ], 2018, relating to this Information Statement (File No. 333-[ ]); |

| 2. | The Prospectus and SAI for the Target Fund and the Acquiring Fund (File Nos. 002-89287 and 811-03967), each dated January 31, 2018, as supplemented; and |

| 3. | The Annual Report to shareholders of the Target Fund and the Acquiring Fund for the fiscal year ended September 30, 2017 and the Semi-Annual Report to shareholders of the Target Fund and the Acquiring Fund for the six months ended March 31, 2018. |

The Annual and Semi-Annual Reports to shareholders of the Target Fund and the Acquiring Fund containing audited and unaudited financial statements, respectively, have previously been mailed to Target Fund shareholders. For a free copy of these reports or any of the documents listed above, you may call toll-free 1 (800) 423-4026, visit www.foresters.com or write to:

Foresters Investor Services, Inc.

P.O. Box 7837

Edison, NJ 08818-7837

The Trust is subject to the informational requirements of the Securities Exchange Act of 1934, as amended. Accordingly, the Trust must file certain reports and other information with the SEC. You also may obtain many of these documents by accessing the internet site for the Funds at www.foresters.com. Text-only versions of all of the Funds’ documents can be viewed online or downloaded from the EDGAR database on the SEC’s internet site at www.sec.gov. You can review and copy information regarding the Funds by visiting the SEC’s Public Reference Room, Room 1580, 100 F Street NE, Washington, D.C. 20549, and at the following regional offices of the SEC: Atlanta – 3475 Lenox Road, NE., Suite 1000, Atlanta, GA 30326; Boston – 33 Arch Street, 23rd Floor, Boston, MA 02110; Chicago – 175 West Jackson Blvd., Suite 900, Chicago, IL 60604; Denver – 1801 California Street, Suite 1500, Denver, CO 80202; Fort Worth – Burnett Plaza, Suite 1900, 801 Cherry Street, Unit #18, Fort Worth, TX 76102; Los Angeles – 5670 Wilshire Boulevard, 11th Floor, Los Angeles, CA 90036; Miami – 801 Brickell Ave., Suite 1800, Miami, FL 33131; New York – 3 World Financial Center, Suite 400, New York, NY 10281; Philadelphia – 701 Market Street, Suite 2000, Philadelphia, PA 19106; Salt Lake City – 15 W. South Temple Street, Suite 1800, Salt Lake City, UT 84101; and San Francisco – 44 Montgomery Street, Suite 2800, San Francisco, CA 94104. You can obtain copies, upon payment of a duplicating fee at prescribed rates, by sending an e-mail request to publicinfo@sec.gov or by writing the Public Reference Room at the address above. Information on the operations of the Public Reference Room may be obtained by calling 1-202-551-5850.

The SEC has not approved or disapproved these securities or determined if this Information Statement is truthful or complete. Any representation to the contrary is a criminal offense. Shares of the Funds are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal. No person has been authorized to give any information or to make any representation other than those in this Information Statement, and, if given or made, such other information or representation must not be relied upon as having been authorized by either the Funds or the Trust. |

TABLE OF CONTENTS

| SUMMARY OF THE REORGANIZATION | 1 |

| REORGANIZATION: REORGANIZATION OF THE FIRST INVESTORS GOVERNMENT FUND INTO THE FIRST INVESTORS LIMITED DURATION BOND FUND, EACH A SERIES OF FIRST INVESTORS INCOME FUNDS | 2 |

| Considerations Regarding the Reorganization | 2 |

| Comparative Fee and Expense Tables | 4 |

| Example of Fund Expenses | 7 |

| Portfolio Turnover | 7 |

| Comparison of Investment Objectives, Policies, Strategies, Advisers and Portfolio Managers | 7 |

| Comparison of Principal Risks | 11 |

| Comparison of Investment Policies | 14 |

| Comparative Performance Information | 17 |

| Capitalization | 20 |

| ADDITIONAL INFORMATION ABOUT THE REORGANIZATION | 20 |

| Plan of Reorganization and Termination | 20 |

| Description of Acquiring Fund Shares | 22 |

| Board Considerations | 22 |

| Federal Income Tax Consequences of the Reorganization | 24 |

| Shareholder Rights | 26 |

| ADDITIONAL INFORMATION ABOUT THE ACQUIRING FUND | 27 |

| Service Providers | 27 |

| Adviser | 27 |

| Subadviser | 29 |

| Principal Underwriter, Transfer Agent, and Custodian | 30 |

| Independent Registered Public Accounting Firm | 31 |

| Rule 12b-1 Distribution Plan | 31 |

| Payments to Financial Intermediaries | 31 |

| Additional Information | 32 |

| FINANCIAL HIGHLIGHTS | 32 |

| Appendix A | A-1 |

| Appendix B | B-1 |

Appendix C | C-1 |

SUMMARY OF THE REORGANIZATION

The following is a summary of certain information relating to the Reorganization and is qualified in its entirety by reference to the more complete information contained elsewhere in this Information Statement and the attached appendices. For additional information about the Reorganization, you should consult the Plan of Reorganization and Termination (“Reorganization Plan”), the form of which is attached hereto as Appendix A.

Foresters Investment Management Company, Inc. (“FIMCO” or “Adviser”), the investment adviser for the Funds, has proposed reorganizing the Target Fund into the Acquiring Fund because doing so would allow FIMCO to concentrate its management resources on a single combined Fund which could benefit the combined Fund and lead to greater operational efficiencies. At a meeting held on April 18-19, 2018, after careful consideration of a number of factors, the Board of Trustees of the Trust (“Board” or “Board of Trustees”) voted to approve the Reorganization as being in the best interests of the Target Fund. See “Board Considerations” below for further information.

The Reorganization Plan provides for:

| · | the Target Fund’s transfer of all of its assets to the Acquiring Fund in exchange solely for Acquiring Fund shares having an aggregate value equal to the Target Fund’s net assets and the Acquiring Fund’s assumption of all the liabilities of the Target Fund; |

| · | the distribution of those Acquiring Fund shares pro rata to the Target Fund’s shareholders; and |

| · | the complete liquidation of the Target Fund (for federal tax purposes) and its termination as a series of the Trust and dissolution under Delaware law. |

The Reorganization will take effect on or about September 21, 2018 (“Closing Date”). No shareholder vote is required for the Reorganization. You do not need to take any action regarding your account.

The Target Fund offers Class A, Class B, Advisor Class and Institutional Class shares. The Acquiring Fund offers Class A, Advisor Class and Institutional Class shares. Each class of shares of the Target Fund (other than Class B shares) has the same purchase, exchange and redemption procedures as the corresponding class of shares of the Acquiring Fund. After the close of business on the Closing Date, each Target Fund shareholder will receive shares of the corresponding class of the Acquiring Fund with the same aggregate value as the shares that the shareholder holds in the Target Fund immediately prior to the Reorganization, except that Target Fund shareholders holding Class B shares will receive Class A shares of the Acquiring Fund with the same aggregate value as the Class B shares that the shareholder holds in the Target Fund immediately prior to the Reorganization, as set forth below:

| Target Fund | | Acquiring Fund |

| Class A shares | à | Class A shares |

| Class B shares | à | Class A shares |

| Advisor Class shares | à | Advisor Class shares |

| Institutional Class shares | à | Institutional Class shares |

You will not incur any sales loads, commissions or other transactional fees as a result of the Reorganization.

The Reorganization is expected to be a tax-free transaction for federal income tax purposes. The Trust expects that neither the Funds nor their shareholders will recognize any gain or loss for federal income tax purposes as a direct result of the Reorganization, and the Trust expects to receive a tax opinion from K&L Gates LLP, counsel to the Trust, substantially to that effect. See “Federal Income Tax Consequences of the Reorganization” below for further information. Shareholders should consult their own tax advisers about possible state and local tax consequences of the Reorganization, if any, because the information about tax consequences in this document relates only to the federal income tax consequences of the Reorganization.

| REORGANIZATION: | REORGANIZATION OF THE FIRST INVESTORS GOVERNMENT FUND INTO THE FIRST INVESTORS LIMITED DURATION BOND FUND, EACH A SERIES OF FIRST INVESTORS INCOME FUNDS |

Considerations Regarding the Reorganization

Please note the following information relevant to the Reorganization:

| · | The Target Fund and the Acquiring Fund have similar investment objectives. The Target Fund seeks a significant level of current income which is consistent with security and liquidity of principal, while the Acquiring Fund seeks current income consistent with low volatility of principal. |

| · | The Target Fund and the Acquiring Fund have different investment strategies. Under normal circumstances, the Target Fund invests least 80% of its net assets (plus any borrowings for investment purposes) in securities issued or guaranteed as to payment of principal and interest by the U.S. government, its agencies or instrumentalities (“U.S. Government Securities”), whereas the Acquiring Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in investment grade bonds, which may include other investment grade debt securities. The primary difference between the Funds’ investment strategies is that the Target Fund invests principally in U.S. Government Securities and, to a lesser extent, may invest in municipal securities and non-government investment grade debt securities, while the Acquiring Fund invests in a variety of investment grade debt securities, including corporate bonds, U.S. Government Securities, securities issued by U.S. government-sponsored enterprises, and mortgage-backed and other asset-backed securities. In addition, to a lesser extent, the Acquiring Fund also invests in high yield, below investment grade corporate bonds, also known as “high yield” or “junk bonds,” whereas the Target Fund does not. In pursuing its investment strategy, the Acquiring Fund also may investment in exchange-traded funds (“ETFs”) that invest in high yield securities and, from time to time, may hold significant investments in a specific market sector. The Target Fund may engage in short-term trading, which is not a principal investment strategy of the Acquiring Fund. Both Funds may invest in U.S. Treasury futures and options on U.S. Treasury futures to hedge against changes in interest rates. |

| · | The difference in investment strategies results in different risk profiles for the Fund. The Acquiring Fund has greater exposure to credit risk than the Target Fund. The Acquiring Fund also has exposure to ETFs risk, high yield securities risk and sector risk as principal risks, which are not principal risks of the Target Fund, while the Target Fund has exposure to call risk, high portfolio turnover risk and liquidity risk as principal risks, which are not principal risks of the Acquiring Fund. The Target Fund’s and the Acquiring Fund’s fundamental investment restrictions are virtually identical. The Acquiring Fund will continue to pursue its current investment objective and investment strategy after the Reorganization. See “Comparison of Investment Objectives, Policies, Strategies, Advisers and Portfolio Managers,” “Comparison of Principal Risks” and “Comparison of Investment Policies” below for further information. |

| · | FIMCO is each Fund’s investment adviser. The Target Fund does not have an investment subadviser. Muzinich & Co., Inc. (“Muzinich”) serves as the investment subadviser for the portion of the Acquiring Fund’s portfolio invested in high-yield debt securities. After the Reorganization, the same portfolio manager at FIMCO that manages the Target Fund and the Acquiring Fund will continue to manage the Acquiring Fund, and the same portfolio managers at Muzinich who manage the portion of the Acquiring Fund allocated to Muzinich will continue to manage that portion of the Acquiring Fund. See “Comparison of Investment Objectives, Policies, |

| | Strategies, Advisers and Portfolio Managers” and “Additional Information about the Acquiring Fund—Service Providers” below for further information. |

| · | The Target Fund and the Acquiring Fund use the same principal underwriter, transfer agent, and custodian. The Acquiring Fund will continue to retain its current service providers after the Reorganization. See “Additional Information about the Acquiring Fund—Service Providers” below for further information. |

| · | The Class A shares of the Acquiring Fund outperformed the Class B shares of the Target Fund for the one-year and three-year periods ended December 31, 2017. The Class A, Advisor Class and Institutional Class shares of the Acquiring Fund underperformed the Class A, Advisor Class and Institutional Class shares, respectively, of the Target Fund for the one-year period ended December 31, 2017 and outperformed the Class A, Advisor Class and Institutional Class shares, respectively, of the Target Fund for the three-year period ended December 31, 2017. No assurances may be given that the combined Fund will achieve any level of performance after the Reorganization. |

| · | The contractual advisory fee rates for the Acquiring Fund are lower than the contractual advisory fee rates for the Target Fund at the same asset levels. As of March 31, 2018, the effective advisory fee rate for the Acquiring Fund was 0.41% per annum, whereas the effective advisory fee rate for the Target Fund was 0.66% per annum. |

| · | The total annual fund operating expense ratios for each class of shares of the Acquiring Fund are lower than the total annual fund operating expense ratios of each corresponding class of shares of the Target Fund (and in the case of the Target Fund’s Class B shares, the Acquiring Fund’s Class A shares). |

| · | The annual fund operating expenses of the Acquiring Fund are subject to expense cap limitations through at least January 31, 2020, which further reduce these expense ratios. FIMCO and the transfer agent have contractually agreed to limit fees and/or reimburse expenses of the Acquiring Fund until at least January 31, 2020, to the extent that total annual fund operating expenses, exclusive of certain items, exceed 0.79% for Class A shares, 0.51% for Advisor Class shares and 0.36% for Institutional Class shares. FIMCO and the transfer agent can be reimbursed by the Acquiring Fund within three years after the date the fee limitation and/or expense reimbursement has been made by FIMCO or the transfer agent, respectively, provided that such repayment does not cause the expenses of the Acquiring Fund’s Class A, Advisor Class or Institutional Class shares to exceed the applicable expense ratio in place at the time the expenses are waived or assumed or the current limits established under the expense limitation agreement. FIMCO voluntarily waives advisory fees payable by the Target Fund, but these fee waivers are not reflected in “Comparative Fee and Expense Tables” and can be terminated by FIMCO at any time in its discretion. After giving effect to the expense cap limitations in place for the Acquiring Fund, and without taking into account any voluntary fee waivers by FIMCO of the Target Fund’s advisory fee, the difference in the net annual fund operating expense ratios of the classes of shares of the Acquiring Fund compared to those of the Target Fund are as follows: |

| § | Acquiring Fund’s Class A shares expense ratio is 0.44% and 1.35% lower than the Target Fund’s Class A and Class B shares expense ratios, respectively, |

| § | Acquiring Fund’s Advisor Class shares expense ratio is 0.45% lower than the Target Fund’s Advisor Class shares expense ratio; and |

| § | Acquiring Fund’s Institutional Class shares expense ratio is 0.44% lower than the Target Fund’s Institutional Class shares expense ratio. |

After giving effect to the Reorganization, the pro forma net annual fund operating expense ratios of the Acquiring Fund are not expected to change for any share class, though the total annual fund operating expense ratios are expected to be lower for each share class.

| · | The initial sales charge for Class A shares of the Target Fund is 4.00%. The initial sales charge for Class A shares of the Acquiring Fund is 2.50%. While the initial sales charge will not apply to Class A shares you receive in connection with the Reorganization, whether you are a Class A or Class B shareholder of the Target Fund, any purchases you make of Class A shares of the Acquiring Fund after consummation of the Reorganization will be subject to the Acquiring Fund’s initial sales charge. |

| · | Both Funds charge a contingent deferred sales charge of 1% on certain redemptions of Class A shares purchased without a sales charge. Class A shares of both Funds are subject to Rule 12b-1 fees of 0.30% per annum and the Class B shares of the Target Fund are subject to Rule 12b-1 fees of 1.00% per annum. Advisor Class and Institutional Class shares of both the Target Fund and the Acquiring Fund do not have a front-end sales charge, CDSC, or Rule 12b-1 fees. |

| · | The interests of the Funds’ shareholders would not be diluted as a result of the Reorganization. |

| · | The Reorganization is expected to be a tax-free reorganization for federal income tax purposes. The Trust expects that neither the Target Fund nor its shareholders will recognize any gain or loss for federal income tax purposes as a direct result of the Reorganization. |

| · | To better align the Target Fund portfolio with the principal investment strategies of the Acquiring Fund, FIMCO anticipates disposing of approximately two-thirds of the holdings of the Target Fund close to the date for the Reorganization. The degree to which the Target Fund’s holdings are sold will depend upon market conditions near the time of the Reorganization. The Target Fund’s disposition of assets before the Reorganization could result in its selling securities at a disadvantageous time and, possibly, realizing net capital gains or losses that otherwise would not have been realized. The anticipated sale of the Target Fund’s holdings prior to the Reorganization is not expected to result in the distribution of net capital gains to shareholders of the Target Fund. The proceeds from sale of the Target Fund’s holdings in preparation for the Reorganization will be held in cash or cash equivalents. During periods when the Target Fund holds large cash positions, it will not be pursuing, and will not achieve, its investment objective. |

| · | The costs of the Reorganization, including the costs associated with the preparation of the Reorganization Plan and Information Statement, printing and distribution costs, and legal and accounting fees and disbursements in connection with the Reorganization, will be borne by the Target Fund. The costs of the Reorganization are estimated to be approximately $75,100. This figure does not include estimated portfolio transaction costs of approximately $187,500 expected to be incurred as a result of the alignment of the Target Fund portfolio with the investment strategies of the Acquiring Fund prior to the Reorganization. These transaction costs will also be borne by the Target Fund. |

| · | FIMCO believes that the only viable alternative to the Reorganization is the liquidation of the Target Fund, which could result in adverse tax consequences to Target Fund shareholders. |

Comparative Fee and Expense Tables

The following tables show the fees and expenses of each class of shares of the Target Fund and the Acquiring Fund and the pro forma fees and expenses of each class of shares of the Acquiring Fund after giving effect to the Reorganization. You may qualify for sales charge discounts if you invest, or agree to invest in the future, at least $50,000 in certain classes of shares of certain First Investors Funds. More information about these and other discounts is available from your financial representative and in “Are sales charge discounts and waivers available” in Appendix B of this Information Statement and in the SAI. You may be required to pay a commission to your

financial intermediary for Institutional Class shares purchased through them. Such commissions are not reflected in the tables or the “Example of Fund Expenses” below. Expenses for the Target Fund and the Acquiring Fund are based on their respective operating expenses for the period ended March 31, 2018 and are annualized. The pro forma fees and expenses for the Class A, Advisor Class and Institutional Class shares of the Acquiring Fund assume that the Reorganization had been in effect for the period ended March 31, 2018.

| Fees and Expenses | Target Fund Class A | Acquiring Fund Class A | Acquiring Fund Class A (pro forma) |

| |

Shareholder Fees (fees paid directly from your investment) | | | |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 4.00% | 2.50% | 2.50% |

| Maximum deferred sales charge (load) (as a percentage of the lower of purchase price or redemption price) | 1.00% (1) | 1.00% (1) | 1.00% (1) |

| |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | |

| Management Fees | 0.66% | 0.41% | 0.41% |

| Distribution and Service (12b-1) Fees | 0.30% | 0.30% | 0.30% |

| Other Expenses | 0.27% | 0.26% | 0.24% |

| Total Annual Fund Operating Expenses | 1.23% | 0.97% | 0.95% |

Fee Waiver and/or Expense Reimbursement (2) | 0.00% | 0.18% | 0.16% |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 1.23% | 0.79% | 0.79% |

(1) A contingent deferred sales charge of 1% will be assessed on certain redemptions of Class A shares that are purchased without a sales charge.

(2) FIMCO and the transfer agent have contractually agreed to limit fees and/or reimburse expenses of the Acquiring Fund until at least January 31, 2020, to the extent that Total Annual Fund Operating Expenses (exclusive of interest expenses, taxes, brokerage commissions, acquired fund fees and expenses, dividend costs related to short sales, and extraordinary expenses, such as litigation expenses, if any) exceed 0.79% for Class A shares. FIMCO and the transfer agent can be reimbursed by the Acquiring Fund within three years after the date the fee limitation and/or expense reimbursement has been made by FIMCO or the transfer agent, respectively, provided that such repayment does not cause the expenses of the Acquiring Fund’s Class A shares to exceed the applicable expense ratio in place at the time the expenses are waived or assumed or the current limits established under the expense limitation agreement. The fee limitation and/or expense reimbursement may be terminated or amended prior to January 31, 2020, only with the approval of the Acquiring Fund’s Board of Trustees.

| Fees and Expenses | Target Fund Class B | Acquiring Fund Class A | Acquiring Fund Class A (pro forma) |

| |

Shareholder Fees (fees paid directly from your investment) | | | |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | 2.50% | 2.50% |

| Maximum deferred sales charge (load) (as a percentage of the lower of purchase price or redemption price) | 4.00% | 1.00% (1) | 1.00% (1) |

| |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | |

| Management Fees | 0.66% | 0.41% | 0.41% |

| Distribution and Service (12b-1) Fees | 1.00% | 0.30% | 0.30% |

| Other Expenses | 0.48% | 0.26% | 0.24% |

| Total Annual Fund Operating Expenses | 2.14% | 0.97% | 0.95% |

Fee Waiver and/or Expense Reimbursement (2) | 0.00% | 0.18% | 0.16% |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 2.14% | 0.79% | 0.79% |

(1) A contingent deferred sales charge of 1% will be assessed on certain redemptions of Class A shares that are purchased without a sales charge.

(2) FIMCO and the transfer agent have contractually agreed to limit fees and/or reimburse expenses of the Acquiring Fund until at least January 31, 2020, to the extent that Total Annual Fund Operating Expenses (exclusive of interest expenses, taxes, brokerage commissions, acquired fund fees and expenses, dividend costs related to short sales, and extraordinary expenses, such as litigation expenses, if any) exceed 0.79% for Class A

shares. FIMCO and the transfer agent can be reimbursed by the Acquiring Fund within three years after the date the fee limitation and/or expense reimbursement has been made by FIMCO or the transfer agent, respectively, provided that such repayment does not cause the expenses of the Acquiring Fund’s Class A shares to exceed the applicable expense ratio in place at the time the expenses are waived or assumed or the current limits established under the expense limitation agreement. The fee limitation and/or expense reimbursement may be terminated or amended prior to January 31, 2020, only with the approval of the Acquiring Fund’s Board of Trustees.

| Fees and Expenses | Target Fund Advisor Class | Acquiring Fund Advisor Class | Acquiring Fund Advisor Class (pro forma) |

| |

Shareholder Fees (fees paid directly from your investment) | | | |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None | None |

| Maximum deferred sales charge (load) (as a percentage of the lower of purchase price or redemption price) | None | None | None |

| |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | |

| Management Fees | 0.66% | 0.41% | 0.41% |

| Distribution and Service (12b-1) Fees | None | None | None |

| Other Expenses | 0.30% | 0.36% | 0.32% |

| Total Annual Fund Operating Expenses | 0.96% | 0.77% | 0.73% |

Fee Waiver and/or Expense Reimbursement (1) | 0.00% | 0.26% | 0.22% |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 0.96% | 0.51% | 0.51% |

(1) FIMCO and the transfer agent have contractually agreed to limit fees and/or reimburse expenses of the Acquiring Fund until at least January 31, 2020, to the extent that Total Annual Fund Operating Expenses (exclusive of interest expenses, taxes, brokerage commissions, acquired fund fees and expenses, dividend costs related to short sales, and extraordinary expenses, such as litigation expenses, if any) exceed 0.51% for Advisor Class shares. FIMCO and the transfer agent can be reimbursed by the Acquiring Fund within three years after the date the fee limitation and/or expense reimbursement has been made by FIMCO or the transfer agent, respectively, provided that such repayment does not cause the expenses of the Acquiring Fund’s Advisor Class shares to exceed the applicable expense ratio in place at the time the expenses are waived or assumed or the current limits established under the expense limitation agreement. The fee limitation and/or expense reimbursement may be terminated or amended prior to January 31, 2020, only with the approval of the Acquiring Fund’s Board of Trustees.

| Fees and Expenses | Target Fund Institutional Class | Acquiring Fund Institutional Class | Acquiring Fund Institutional Class (pro forma) |

| |

Shareholder Fees (fees paid directly from your investment) | | | |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | None | None | None |

| Maximum deferred sales charge (load) (as a percentage of the lower of purchase price or redemption price) | None | None | None |

| |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | |

| Management Fees | 0.66% | 0.41% | 0.41% |

| Distribution and Service (12b-1) Fees | None | None | None |

| Other Expenses | 0.14% | 0.16% | 0.11% |

| Total Annual Fund Operating Expenses | 0.80% | 0.57% | 0.52% |

Fee Waiver and/or Expense Reimbursement (1) | 0.00% | 0.21% | 0.16% |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 0.80% | 0.36% | 0.36% |

(1) FIMCO and the transfer agent have contractually agreed to limit fees and/or reimburse expenses of the Acquiring Fund until at least January 31, 2020, to the extent that Total Annual Fund Operating Expenses (exclusive of interest expenses, taxes, brokerage commissions, acquired fund fees and expenses, dividend costs related to short sales, and extraordinary expenses, such as litigation expenses, if any) exceed 0.36% for Institutional Class shares. FIMCO and the transfer agent can be reimbursed by the Acquiring Fund within three years after the date the fee limitation and/or expense reimbursement has been made by FIMCO or the transfer agent, respectively, provided that such repayment does not cause the expenses of the Acquiring Fund’s Institutional Class shares to exceed the applicable expense ratio in place at the time the expenses are waived or assumed or the current limits established under the expense limitation agreement. The fee limitation and/or expense reimbursement may be terminated or amended prior to January 31, 2020, only with the approval of the Acquiring Fund’s Board of Trustees.

Example of Fund Expenses

This example is intended to help you compare costs between the Target Fund and the Acquiring Fund and the pro forma costs for the Acquiring Fund after giving effect to the Reorganization. The Example assumes that you invest $10,000 in the Target Fund for the time periods indicated and then redeem all of your shares at the end of those periods and reflects conversion of Class B to Class A after eight years. The Example assumes that you invest $10,000 in the Acquiring Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Funds’ operating expenses remain the same (except that the Example incorporates the fee limitation/expense reimbursement arrangement through January 31, 2020 for the Acquiring Fund). Although your actual costs may be higher or lower, based on these assumptions, whether you do or do not redeem your shares of a Fund, your costs would be:

| | Year 1 | Year 3 | Year 5 | Year 10 |

| Target Fund |

| | Class A shares | $520 | $775 | $1,049 | $1,829 |

| | Class B shares | $617 | $970 | $1,349 | $2,241 |

| | Advisor Class shares | $98 | $306 | $531 | $1,178 |

| | Institutional Class shares | $82 | $255 | $444 | $990 |

| | Class B shares (if you did not redeem your shares) | $217 | $670 | $1,149 | $2,241 |

| Acquiring Fund |

| | Class A shares | $329 | $534 | $756 | $1,394 |

| | Advisor Class shares | $52 | $220 | $402 | $930 |

| | Institutional Class shares | $37 | $161 | $297 | $694 |

Pro forma Acquiring Fund (After Reorganization) |

| | Class A shares | $329 | $530 | $747 | $1,373 |

| | Advisor Class shares | $52 | $211 | $334 | $886 |

| | Institutional Class shares | $37 | $151 | $275 | $637 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Fund’s performance. During the most recent fiscal year, the Target Fund’s portfolio turnover rate was 61% of the average value of its portfolio. During the most recent fiscal year, the Acquiring Fund’s portfolio turnover rate was 60% of the average value of its portfolio.

Comparison of Investment Objectives, Policies, Strategies, Advisers and Portfolio Managers

The Target Fund and the Acquiring Fund have similar investment objectives but different investment strategies. The Target Fund seeks a significant level of current income which is consistent with security and liquidity of principal, while the Acquiring Fund seeks current income consistent with low volatility of principal. Under normal circumstances, the Target Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in U.S. Government Securities, whereas the Acquiring Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in investment grade bonds, which may include other investment grade debt securities. The primary difference between the Funds’ investment strategies is that the Target Fund invests principally in U.S. Government Securities and, to a lesser extent, may invest in municipal securities and non-government investment grade debt securities, while the Acquiring Fund invests in a variety of investment grade debt securities, including corporate bonds, U.S. Government Securities, securities issued by U.S. government-sponsored enterprises (some of which are not backed by the full faith and credit of the U.S. government), and mortgage-backed and other asset-backed securities. In addition, to a lesser extent, the Acquiring Fund also invests in high yield, below investment grade corporate bonds, also known as “high yield” or “junk bonds,” whereas the Target Fund does not. In pursuing its investment strategy, the Acquiring Fund also may invest in ETFs that invest in high yield securities and, from time to time, may hold significant investments in a specific market sector. The Target Fund may engage in short-term trading, which is not a principal investment strategy of the Acquiring Fund. Both Funds may invest in U.S. Treasury futures and options on U.S. Treasury futures to hedge against changes in interest rates. The difference in investment strategies results in different risk profiles for the Funds. The Acquiring Fund has greater exposure to credit risk than the Target Fund. The Acquiring Fund also has exposure to ETFs risk, high yield

securities risk and sector risk as principal risks, which are not principal risks of the Target Fund, while the Target Fund has exposure to call risk, high portfolio turnover risk and liquidity risk as principal risks, which are not principal risks of the Acquiring Fund. The Acquiring Fund will continue to pursue its current investment objective and investment strategy after the Reorganization.

Additional information regarding the investment objective and principal investment strategies of each Fund is set forth below:

| Government Fund | Limited Duration Bond Fund |

| Investment Objective |

| The Fund seeks to achieve a significant level of current income which is consistent with security and liquidity of principal. | The Fund seeks current income consistent with low volatility of principal. |

| The Fund’s investment objective is non-fundamental, which means that the Board of Trustees may change the investment objective of the Fund without shareholder approval. The Board may take such action upon the recommendation of the Funds’ investment adviser when the adviser believes that a change in the objective is necessary or appropriate in light of market circumstances or other events. | Same. |

| Principal Investment Strategies |

| Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in securities issued or guaranteed as to payment of principal and interest by the U.S. Government, its agencies or instrumentalities (“U.S. Government Securities”). | Under normal circumstances, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in investment grade bonds. For purposes of the 80% policy, investment grade bonds also include other investment grade fixed-income securities. The Fund defines investment grade debt securities as those that are rated within the four highest ratings categories by Moody’s Investors Service, Inc. (“Moody’s”) or Standard & Poor’s Ratings Services (“S&P”) or that are unrated but determined by the Fund’s Adviser to be of equivalent quality. |

| The 80% policy is non-fundamental and may be changed without shareholder approval, but the Fund will notify shareholders at least 60 days before making any change to this 80% policy. | The 80% policy is non-fundamental and may be changed without shareholder approval, but the Fund will provide shareholders with at least 60 days notice before changing this 80% policy. |

| The Fund may invest in all types of U.S. Government Securities, which may include (a) U.S. Treasury obligations, (b) securities issued or guaranteed by U.S. Government agencies or instrumentalities that are backed by the full faith and credit of the U.S. Government, and (c) securities issued or guaranteed by agencies or instrumentalities that are sponsored or chartered by the U.S. Government but whose securities are backed solely by the credit of the issuing agency or instrumentality or the right of the issuer to borrow from the U.S. Treasury. U.S. Government Securities may | The Fund may invest in a variety of different types of investment grade securities, including corporate bonds, securities issued or guaranteed by the U.S. Government or U.S. Government-sponsored enterprises (some of which are not backed by the full faith and credit of the U.S. Government), and mortgage-backed and other asset-backed securities. |

| Government Fund | Limited Duration Bond Fund |

include mortgage-backed securities that are guaranteed by the Government National Mortgage Association (“GNMA”), commonly known as Ginnie Maes, which are backed by the full faith and credit of the U.S. Government and mortgage-backed securities issued or guaranteed by U.S. Government-sponsored enterprises, such as the Federal National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation (“Freddie Mac”), which are not backed by the full faith and credit of the U.S. Government. | |

| The Fund uses a “top-down” approach in making investment decisions based on its assessment of interest rates, economic and market conditions, and the relative values of different types of U.S. Government Securities. In selecting investments, the Fund considers, among other factors, maturity, yield, relative value and, in the case of mortgage-backed securities, coupon and weighted average maturity. | The Adviser attempts to stay broadly diversified, but it may emphasize certain industries based on the outlook for interest rates, economic forecasts and market conditions. In selecting investments, the Adviser considers, among other things, the issuer’s earnings and cash flow generating capabilities, asset quality, debt levels, industry characteristics and management strength. The Adviser also considers ratings assigned by ratings services in addition to its own research and investment analysis. |

| The Fund will usually sell an investment when there are changes in the interest rate environment that are adverse to the investment. The Fund may engage in short-term trading, which may result in high portfolio turnover. | The Adviser will not necessarily sell an investment if its rating is reduced. The Adviser usually will sell a security when it shows deteriorating fundamentals, it falls short of the portfolio manager’s expectations, or a more attractive investment is available. |

| To a lesser extent, the Fund may invest in municipal securities and non-government investment grade securities that are rated AA or above by Standard and Poor’s Rating Services or Aa2 or above by Moody’s Investor Service, Inc. | To a lesser extent the Fund also invests in high yield, below investment grade corporate bonds (commonly known as “high yield” or “junk bonds”). The Adviser has retained Muzinich as a subadviser to manage this portion of the Fund. High yield bonds include both bonds that are rated below Baa3 by Moody’s or below BBB- by S&P as well as unrated bonds that are determined by the Adviser to be of equivalent quality. The Fund may also be exposed to high yield securities through the Adviser’s investments in ETFs. High yield bonds generally provide higher income than investment grade bonds to compensate investors for their higher risk of default (i.e., failure to make required interest or principal payments). High yield securities may be backed by receivables or other assets. Muzinich attempts to invest in bonds that have stable to improving credit quality and potential for capital appreciation because of a credit rating upgrade or an improvement in the outlook for a particular company, industry or the economy as a whole. Although Muzinich will consider ratings assigned by ratings agencies in selecting high yield bonds, it relies principally on its own research and |

| Government Fund | Limited Duration Bond Fund |

| | investment analysis. Muzinich may sell a bond when it shows deteriorating fundamentals or it falls short of the portfolio manager’s expectations. It may also decide to continue to hold a bond (or related securities, such as stocks or warrants) after its issuer defaults or is subject to a bankruptcy. Additionally, from time to time, in pursuing its investment strategies, the Fund may hold significant investments in a specific market sector. |

| The Fund may also invest in U.S. Treasury futures and options on U.S. Treasury futures to hedge against changes in interest rates. | The Fund may invest in U.S. Treasury futures and options on U.S. Treasury futures to hedge against changes in interest rates. |

| | The Fund seeks to maintain an average weighted duration of between one and six years. Duration is a measure of a bond’s or fixed income portfolio’s sensitivity to changes in interest rates. For every 1% change in interest rates, a bond’s price generally changes approximately 1% in the opposite direction for every year of duration. For example, if a portfolio of fixed income securities has an average weighted duration of six years, its value can be expected to fall about 6% if interest rates rise by 1%. Conversely, the portfolio’s value can be expected to rise approximately 6% if interest rates fall by 1%. As a result, prices of securities with longer durations tend to be more sensitive to interest rate changes than prices of securities with shorter durations. Unlike maturity, which considers only the date on which the final repayment of principal will be made, duration takes account of interim payments made during the life of the security. Duration is typically not equal to maturity. The Adviser may adjust the average weighted duration based on its interest rate outlook. If it believes that interest rates are likely to fall, it may attempt to buy securities with longer maturities. By contrast, if it believes interest rates are likely to rise, it may attempt to buy securities with shorter maturities or sell securities with longer maturities. |

| Information on the Fund’s holdings can be found in the most recent annual report, and information concerning the Fund’s policies and procedures with respect to disclosure of the Fund’s portfolio holdings is available in the Fund’s Statement of Additional Information (see back cover). | Information on the Fund’s holdings can be found in the most recent annual report, and information concerning the Fund’s policies and procedures with respect to disclosure of the Fund’s portfolio holdings is available in the Fund’s Statement of Additional Information (see back cover). |

| The Statement of Additional Information also describes non-principal investment strategies that the Fund may use, including investing in other types of investments that are not described in this prospectus. | The Statement of Additional Information also describes non-principal investment strategies that the Fund may use, including investing in other types of investments that are not described in this prospectus. |

| Temporary Defensive Strategy |

| Government Fund | Limited Duration Bond Fund |

| The Fund reserves the right to take temporary defensive positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse market, economic, political or other conditions. If it does so, it may not achieve its investment objective. The Fund may also choose not to take defensive positions. | |

| Investment Adviser |

| Foresters Investment Management Company, Inc. | Same. |

| Investment Subadviser |

| N/A | Muzinich & Co, Inc. |

| Portfolio Managers |

Rodwell Chadehumbe serves as Portfolio Manager of the Fund and has served as Portfolio Manager or Co-Portfolio Manager of the Fund since December 2012.

| The Acquiring Fund assets managed by FIMCO are managed by Rodwell Chadehumbe, who has served as Portfolio Manager of the Fund since its inception in 2014. |

Prior to joining FIMCO in 2012, Mr. Chadehumbe served as Portfolio Manager at Fifth Third Asset Management, Inc. (2008-2012) and at Fifth Third Private Bank (2006-2008). Mr. Chadehumbe also serves as Portfolio Manager of other First Investors Funds. | Same. |

| | The portion of the Acquiring Fund managed by Muzinich is managed primarily by Clinton Comeaux and Bryan Petermann, Portfolio Managers of the Fund since 2018. Mr. Petermann joined Muzinich in 2010 and prior thereto served as Managing Director, Head of High Yield, at Pinebridge Investments (f/k/a AIG Investments), for the last 5 years of his tenure (2000-2010). Mr. Comeaux joined Muzinich in 2006. |

Comparison of Principal Risks

The principal risks of investing in the Target Fund and Acquiring Fund are discussed below. The Funds are subject to many of the same principal risks, but the Acquiring Fund is subject to greater Credit Risk than the Target Fund and is also subject to exchange-traded funds risk, high yield securities risk and sector risk as principal risks, which are not principal risks of the Target Fund. The Target Fund, on the other hand, is subject to call risk, high portfolio turnover risk and liquidity risk as principal risks, which are not principal risks of the Acquiring Fund. You can lose money by investing in the Funds. Any investment carries with it some level of risk. There is no guarantee that a Fund will meet its investment objective. An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Here are the principal risks of investing in the Funds:

| Call Risk | During periods of falling interest rates, an issuer of a callable bond held by the Fund may “call” or repay the security before its stated maturity. The Fund would then lose |

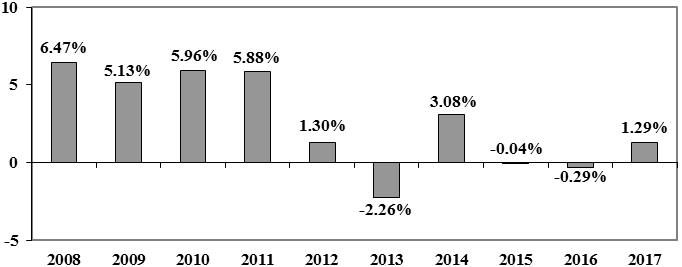

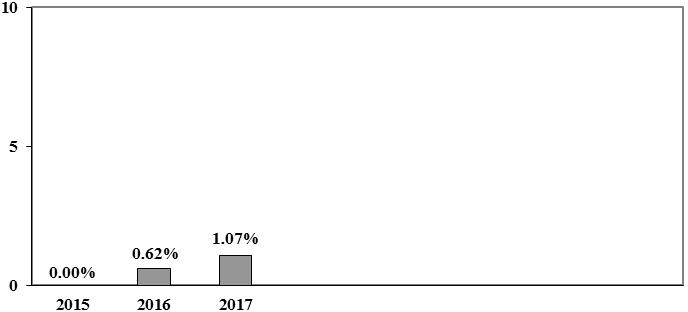

| (Target Fund only) | any price appreciation above the bond’s call price and the Fund may have to reinvest the proceeds at lower interest rates, resulting in a decline in the Fund’s income. |