| | OMB APPROVAL |

| | OMB Number: | 3235-0570 |

| | Expires: | November 30, 2005 |

| UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . . . .5.0 |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| | | | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-03980 |

|

Morgan Stanley Institutional Fund Trust |

(Exact name of registrant as specified in charter) |

|

1221 AVENUE OF THE AMERICAS 5TH FLOOR NEW YORK, NY | | 10020 |

(Address of principal executive offices) | | (Zip code) |

|

RONALD E. ROBISON

1221 AVENUE OF THE AMERICAS 5TH FLOOR NEW YORK, NY 10020 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-221-6726 | |

|

Date of fiscal year end: | 9/30 | |

|

Date of reporting period: | 3/31/07 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Item 1. Reports to Shareholders.

The Fund’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Morgan Stanley Investment Management

| Morgan Stanley |

| Institutional Fund Trust |

| |

| Balanced Portfolio | |

| Balanced | |

| | |

| Equity Portfolios | |

| Equities Plus | U.S. Small Cap Value |

| Mid Cap Growth | Value |

| U.S. Mid Cap Value | |

| | |

| Fixed Income Portfolios | |

| Core Fixed Income | Investment Grade Fixed Income |

| Core Plus Fixed Income | Limited Duration |

| High Yield | Long Duration Fixed Income |

| Intermediate Duration | Municipal |

| International Fixed Income | |

| | |

| | March 31, 2007 | |

| | | |

| Semi-Annual Report |

2007 Semi-Annual Report |

| |

March 31, 2007 |

Table of Contents

Shareholders’ Letter | 2 |

Expense Examples | 3 |

Portfolios of Investments | |

Balanced Portfolio: | |

Balanced | 7 |

Equity Portfolios: | |

Equities Plus | 18 |

Mid Cap Growth | 21 |

U.S. Mid Cap Value | 23 |

U.S. Small Cap Value | 25 |

Value | 27 |

Fixed Income Portfolios: | |

Core Fixed Income | 29 |

Core Plus Fixed Income | 36 |

High Yield | 44 |

Intermediate Duration | 50 |

International Fixed Income | 56 |

Investment Grade Fixed Income | 59 |

Limited Duration | 66 |

Long Duration Fixed Income | 73 |

Municipal | 75 |

Statements of Assets & Liabilities | 83 |

Statements of Operations | 91 |

Statements of Changes in Net Assets | 94 |

Statements of Cash Flows | 103 |

Financial Highlights | 105 |

Notes to Financial Statements | 126 |

Trustee and Officer Information | 143 |

This report is authorized for distribution only when preceded or accompanied by prospectuses of the Morgan Stanley Institutional Fund Trust. To receive a prospectus and/or SAI, which contains more complete information such as investment objectives, charges, expenses, policies for voting proxies, risk considerations, and describes in detail each of the Portfolio’s investment policies to the prospective investor, please call 1 (800) 354-8185. Please read the prospectus carefully before you invest or send money. Additionally, you can access portfolio information including performance, characteristics, and investment team commentary through Morgan Stanley Investment Management’s website: www.morganstanley.com/im.

1

2007 Semi-Annual Report |

|

March 31, 2007 (unaudited) |

Shareholders’ Letter

Dear Shareholders:

We are pleased to present to you the Morgan Stanley Institutional Fund Trust’s (the “Fund”) Semi-Annual Report for the six months ended March 31, 2007. Our Fund currently consists of 18 portfolios. The Fund’s portfolios, together with the portfolios of the Morgan Stanley Institutional Fund, Inc., provide investors with a means to help them meet specific investment needs and to allocate their investments among equities (e.g., value and growth; small, medium, and large capitalization), and fixed income (e.g., short, medium, and long duration; investment grade and high yield).

Sincerely,

Ronald E. Robison

President and Principal Executive Officer

April 2007

2

2007 Semi-Annual Report |

| |

March 31, 2007 (unaudited) |

Expense Examples

Expense Examples

As a shareholder of a Portfolio, you may incur two types of costs: (1) transactional costs, including redemption fees; and (2) ongoing costs, including management fees, shareholder servicing fees (in the case of Investment Class), distribution (12b-1) fees (in the case of Adviser Class); and other Portfolio expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in each Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the six-month period ended March 31, 2007 and held for the entire six-month period.

Actual Expenses

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Please note that “Expenses Paid During Period” are grossed up to reflect Portfolio expenses prior to the effect of Expense Offset (See Note E in the Notes to Financial Statements). Therefore, the annualized net expense ratios may differ from the ratio of expenses to average net assets shown in the Financial Highlights.

Hypothetical Example for Comparison Purposes

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account Value | | Ending Account Value | | Expenses Paid During Period* | |

| | October 1, 2006 | | March 31, 2007 | | October 1, 2006 — March 31, 2007 | |

Balanced Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,073.80 | | $ | 3.21 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.84 | | 3.13 | |

Investment Class | | | | | | | |

Actual | | 1,000.00 | | 1,073.20 | | 3.98 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.09 | | 3.88 | |

Adviser Class | | | | | | | |

Actual | | 1,000.00 | | 1,071.80 | | 4.49 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,020.59 | | 4.38 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’, Investment Class’ and Adviser Class’ annualized net expense ratios of 0.62%, 0.77% and 0.87%, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

Equities Plus Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,076.30 | | $ | 3.11 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.94 | | 3.02 | |

Adviser Class | | | | | | | |

Actual | | 1,000.00 | | 1,076.10 | | 4.40 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,020.69 | | 4.28 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’ and Adviser Class’ annualized net expense ratios of 0.60% and 0.85%, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

3

2007 Semi-Annual Report |

|

March 31, 2007 (unaudited) |

Expense Examples (cont’d)

| | Beginning Account Value | | Ending Account Value | | Expenses Paid During Period* | |

| | October 1, 2006 | | March 31, 2007 | | October 1, 2006 — March 31, 2007 | |

Mid Cap Growth Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,119.20 | | $ | 3.43 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.69 | | 3.28 | |

Adviser Class | | | | | | | |

Actual | | 1,000.00 | | 1,117.60 | | 4.75 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,020.44 | | 4.53 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’ and Adviser Class’ annualized net expense ratios of 0.65% and 0.90%, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

U.S. Mid Cap Value Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,149.10 | | $ | 4.88 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,020.39 | | 4.58 | |

Investment Class | | | | | | | |

Actual | | 1,000.00 | | 1,148.20 | | 5.68 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,019.65 | | 5.34 | |

Adviser Class | | | | | | | |

Actual | | 1,000.00 | | 1,147.60 | | 6.21 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,019.15 | | 5.84 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’, Investment Class’ and Adviser Class’ annualized net expense ratios of 0.91%, 1.06% and 1.16%, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

U.S. Small Cap Value Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,163.50 | | $ | 6.10 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,019.30 | | 5.69 | |

Adviser Class | | | | | | | |

Actual | | 1,000.00 | | 1,162.10 | | 4.69 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,020.59 | | 4.38 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’ and Adviser Class’ annualized net expense ratios of 0.87% and 1.13%, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

Value Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,074.40 | | $ | 3.36 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.69 | | 3.28 | |

Investment Class | | | | | | | |

Actual | | 1,000.00 | | 1,074.10 | | 4.14 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,020.94 | | 4.03 | |

Adviser Class | | | | | | | |

Actual | | 1,000.00 | | 1,073.10 | | 4.65 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,020.44 | | 4.53 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’, Investment Class’ and Adviser Class’ annualized net expense ratios of 0.65%, 0.80% and 0.90%, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

Core Fixed Income Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,025.10 | | $ | 2.52 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.44 | | 2.52 | |

Adviser Class | | | | | | | |

Actual | | 1,000.00 | | 1,023.10 | | 3.78 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.19 | | 3.78 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’ and Adviser Class’ annualized net expense ratios of 0.50% and 0.75%, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

4

2007 Semi-Annual Report |

| |

March 31, 2007 (unaudited) |

Expense Examples (cont’d)

| | Beginning Account Value | | Ending Account Value | | Expenses Paid During Period* | |

| | October 1, 2006 | | March 31, 2007 | | October 1, 2006 — March 31, 2007 | |

Core Plus Fixed Income Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,028.30 | | $ | 2.28 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.69 | | 2.27 | |

Investment Class | | | | | | | |

Actual | | 1,000.00 | | 1,027.60 | | 3.03 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.94 | | 3.02 | |

Adviser Class | | | | | | | |

Actual | | 1,000.00 | | 1,026.20 | | 3.54 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.44 | | 3.53 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’, Investment Class’ and Adviser Class’ annualized net expense ratios of 0.45%, 0.60% and 0.70%, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

High Yield Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,057.60 | | $ | 3.64 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.39 | | 3.58 | |

Adviser Class | | | | | | | |

Actual | | 1,000.00 | | 1,057.90 | | 4.93 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,020.14 | | 4.84 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’ and Adviser Class’ annualized net expense ratios of 0.71% and 0.96%, respectively multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

Intermediate Duration Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,025.00 | | $ | 2.83 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.14 | | 2.82 | |

Investment Class | | | | | | | |

Actual | | 1,000.00 | | 1,024.40 | | 3.58 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.39 | | 3.58 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’ and Investment Class’ annualized net expense ratios of 0.56% and 0.71%, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

International Fixed Income Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,032.10 | | $ | 3.19 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.79 | | 3.18 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’ annualized net expense ratio of 0.63% multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

Investment Grade Fixed Income Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,025.50 | | $ | 2.58 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.39 | | 2.57 | |

Adviser Class | | | | | | | |

Actual | | 1,000.00 | | 1,023.80 | | 3.33 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.64 | | 3.33 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’ and Adviser Class’ annualized net expense ratios of 0.51% and 0.66%, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

Limited Duration Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,025.40 | | $ | 2.32 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.64 | | 2.32 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’ annualized net expense ratio of 0.46% multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

5

2007 Semi-Annual Report |

|

March 31, 2007 (unaudited) |

Expense Examples (cont’d)

| | Beginning Account Value | | Ending Account Value | | Expenses Paid During Period* | |

| | October 1, 2006 | | March 31, 2007 | | October 1, 2006 — March 31, 2007 | |

Long Duration Fixed Income Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,014.40 | | $ | 2.56 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.39 | | 2.57 | |

Adviser Class | | | | | | | |

Actual | | 1,000.00 | | 1,012.30 | | 3.81 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.14 | | 3.83 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’ and Adviser Class’ annualized net expense ratios of 0.51% and 0.76%, respectively multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

Municipal Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,021.40 | | $ | 2.47 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.49 | | 2.47 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’ annualized net expense ratio of 0.49% multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

6

2007 Semi-Annual Report |

| |

March 31, 2007 (unaudited) |

Portfolio of Investments

Balanced Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Fixed Income Securities (25.2%) | | | | | |

Agency Adjustable Rate Mortgages (1.1%) | | | | | |

Federal National Mortgage Association, | | | | | |

Conventional Pools: | | | | | |

5.10%, 11/1/35 | | $ | 329 | | $ | 327 | |

7.46%, 5/1/36 | | 719 | | 739 | |

7.49%, 7/1/36 - 8/1/36 | | 857 | | 882 | |

Government National Mortgage Association, | | | | | |

Adjustable Rate Mortgages: | | | | | |

5.38%, 2/20/25 - 1/20/28 | | 521 | | 528 | |

5.64%, 1/1/37 | | 322 | | 325 | |

5.76%, 1/1/37 | | 550 | | 554 | |

6.13%, 11/20/25 - 12/20/27 | | 127 | | 129 | |

| | | | 3,484 | |

Agency Fixed Rate Mortgages (3.4%) | | | | | |

Federal Home Loan Mortgage Corp., | | | | | |

Conventional Pools: | | | | | |

10.00%, 9/1/17 | | 25 | | 27 | |

10.50%, 8/1/19 - 12/1/19 | | 76 | | 85 | |

11.00%, 5/1/20 - 9/1/20 | | 36 | | 40 | |

12.00%, 3/1/15 | | 31 | | 35 | |

Gold Pools: | | | | | |

7.50%, 8/1/20 - 11/1/32 | | 478 | | 500 | |

8.00%, 2/1/21 - 8/1/31 | | 400 | | 421 | |

9.50%, 12/1/22 | | 34 | | 37 | |

10.00%, 12/1/19 | | 33 | | 36 | |

Federal National Mortgage Association, | | | | | |

Conventional Pools: | | | | | |

6.50%, 4/1/32 - 7/1/32 | | 347 | | 357 | |

7.00%, 3/1/18 - 10/1/34 | | 1,350 | | 1,405 | |

7.50%, 11/1/29 - 9/1/35 | | 964 | | 1,009 | |

8.00%, 2/1/30 - 5/1/32 | | 430 | | 454 | |

8.50%, 6/1/30 - 12/1/30 | | 260 | | 280 | |

9.50%, 11/1/20 - 4/1/30 | | 283 | | 310 | |

10.00%, 1/1/10 - 1/1/20 | | 38 | | 42 | |

10.50%, 12/1/16 - 4/1/22 | | 178 | | 195 | |

11.50%, 11/1/19 | | 3 | | 3 | |

12.50%, 9/1/15 | | 14 | | 16 | |

April TBA | | | | | |

7.00%, 4/25/37 | | (i)1,025 | | 1,057 | |

May TBA | | | | | |

7.00%, 5/25/37 | | (i)3,125 | | 3,221 | |

Government National Mortgage Association, | | | | | |

Various Pools: | | | | | |

9.50%, 10/15/18 - 11/15/21 | | 99 | | 108 | |

10.00%, 11/15/09 - 12/15/21 | | 286 | | 318 | |

10.50%, 2/15/20 - 12/15/20 | | 56 | | 63 | |

11.00%, 1/15/19 | | 59 | | 65 | |

| | | | 10,084 | |

Asset Backed Corporates (4.0%) | | | | | |

ACE Securities Corp. | | | | | |

5.64%, 5/25/34 | | | (h)78 | | | 78 | |

Aegis Asset Backed Securities Trust | | | | | |

5.43%, 10/25/35 | | (h)8 | | 8 | |

American Express Credit Account Master Trust | | | | | |

5.32%, 10/15/12 | | (h)325 | | 325 | |

5.43%, 12/15/09 | | (h)550 | | 550 | |

Argent Securities, Inc. | | | | | |

5.37%, 10/25/36 | | (h)402 | | 402 | |

Bear Stearns Asset Backed Securities, Inc. | | | | | |

5.44%, 8/25/35 | | (h)58 | | 58 | |

5.52%, 9/25/34 | | (h)61 | | 61 | |

5.54%, 3/25/35 | | (h)114 | | 115 | |

Capital Auto Receivables Asset Trust | | | | | |

3.35%, 2/15/08 | | 55 | | 55 | |

5.38%, 5/15/11 | | (h)575 | | 575 | |

5.40%, 1/15/08 | | (h)30 | | 30 | |

Carrington Mortgage Loan Trust | | | | | |

5.40%, 3/25/47 | | (h)375 | | 375 | |

5.44%, 10/25/35 | | (h)9 | | 9 | |

5.47%, 9/25/35 | | (h)61 | | 61 | |

Citibank Credit Card Issuance Trust | | | | | |

5.34%, 3/22/12 | | (c)(h)400 | | 400 | |

Countrywide Asset Backed Certificates | | | | | |

5.47%, 7/25/25 | | (h)245 | | 246 | |

First Franklin Mortgage Loan Asset Backed Certificates | | | | | |

5.36%, 3/25/37 | | (h)362 | | 362 | |

5.37%, 7/25/36 | | (h)310 | | 310 | |

5.39%, 2/25/36 | | (h)234 | | 234 | |

5.42%, 7/25/35 | | (h)83 | | 83 | |

5.44%, 10/25/35 | | (h)229 | | 229 | |

Fremont Home Loan Owner Trust | | | | | |

5.37%, 10/25/36 | | (h)409 | | 409 | |

GE Capital Credit Card Master Note Trust | | | | | |

5.36%, 9/15/10 | | (h)350 | | 350 | |

GE Dealer Floorplan Master Note Trust | | | | | |

5.40%, 7/20/09 | | (h)450 | | 450 | |

GSAMP Trust | | | | | |

5.39%, 1/25/37 | | (h)343 | | 343 | |

5.40%, 4/25/47 | | 450 | | 450 | |

Lehman Brothers Commercial Mortgage Trust | | | | | |

5.44%, 9/15/21 | | (h)335 | | 335 | |

MBNA Credit Card Master Note Trust | | | | | |

5.46%, 2/15/10 | | (h)500 | | 501 | |

MBNA Master Credit Card Trust | | | | | |

7.80%, 10/15/12 | | 900 | | 976 | |

RAAC Series | | | | | |

5.42%, 9/25/45 | | (h)153 | | 153 | |

Residential Asset Mortgage Products, Inc. | | | | | |

5.39%, 6/25/29 | | (h)396 | | 397 | |

Residential Asset Securities Corp. | | | | | |

5.43%, 2/25/30 | | (h)350 | | 350 | |

The accompanying notes are an integral part of the financial statements.

7

2007 Semi-Annual Report |

|

March 31, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Balanced Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Asset Backed Corporates (cont’d) | | | | | |

Securitized Asset Backed Receivables LLC Trust | | | | | |

5.39%, 12/25/35 | | $ | (h)130 | | $ | 130 | |

SLM Student Loan Trust | | | | | |

5.32%, 10/25/14 | | (h)675 | | 675 | |

Soundview Home Equity Loan Trust | | | | | |

5.40%, 1/25/37 | | (h)321 | | 322 | |

5.43%, 2/25/37 | | (h)375 | | 375 | |

Structured Asset Securities Corp. | | | | | |

5.41%, 4/25/37 | | (h)350 | | 350 | |

5.44%, 1/25/37 | | (e)(h)321 | | 321 | |

5.52%, 6/25/35 | | (h)131 | | 131 | |

Terwin Mortgage Trust | | | | | |

5.44%, 7/25/35 | | (e)@— | | @— | |

TXU Electric Delivery Transition Bond Co. | | | | | |

4.81%, 11/17/14 | | 100 | | 100 | |

Wachovia Bank Commercial Mortgage Trust | | | | | |

5.44%, 9/15/21 | | (e)(h)350 | | 350 | |

| | | | 12,034 | |

Collateralized Mortgage Obligations — Agency Collateral Series (0.1%) | | | | | |

Federal Home Loan Mortgage Corp. | | | | | |

Inv FI IO | | | | | |

3.23%, 10/15/29 | | 49 | | 1 | |

20.38%, 11/15/07 | | 2 | | @— | |

Inv FI IO PAC | | | | | |

4.22%, 3/15/08 | | 16 | | @— | |

4.86%, 2/15/08 | | 31 | | @— | |

IO | | | | | |

5.00%, 6/15/17 | | 274 | | 26 | |

6.50%, 3/15/33 | | 164 | | 35 | |

7.50%, 12/1/29 | | 110 | | 30 | |

8.00%, 1/1/28 - 6/1/31 | | 34 | | 7 | |

Federal National Mortgage Association | | | | | |

Inv FI IO | | | | | |

2.23%, 2/17/31 | | 423 | | 22 | |

3.28%, 3/18/30 | | 20 | | @— | |

3.86%, 10/25/07 | | 37 | | @— | |

IO | | | | | |

1.93%, 3/25/36 | | 2,289 | | 49 | |

5.00%, 2/25/15 | | 193 | | 4 | |

5.50%, 6/25/26 | | 60 | | @— | |

6.00%, 8/25/32 - 7/25/33 | | 152 | | 29 | |

6.50%, 6/1/31 - 6/25/33 | | 322 | | 72 | |

7.00%, 4/25/33 | | 107 | | 25 | |

8.00%, 4/1/24 - 12/1/31 | | 405 | | 96 | |

9.00%, 11/1/26 | | 44 | | 11 | |

IO PAC | | | | | |

8.00%, 8/18/27 | | 92 | | 20 | |

Government National Mortgage Association | | | | | |

Inv FI IO | | | | | |

2.68%, 4/16/29 | | 236 | | 13 | |

3.28%, 8/16/29 | | 136 | | 7 | |

| | | | 447 | |

Collateralized Mortgage Obligations — Non Agency Collateral Series (1.0%) | | | | | |

Bear Stearns Structured Products, Inc. | | | | | |

1.00%, 3/27/36 | | | (e)13,517 | | | 538 | |

1.91%, 7/27/36 | | (e)6,234 | | 247 | |

6.00%, 4/25/37 | | (e)7,200 | | 281 | |

Countrywide Alternative Loan Trust | | | | | |

Zero Coupon, 4/25/47 | | 2,225 | | 114 | |

1.83%, 2/25/47 | | 4,580 | | 250 | |

IO | | | | | |

1.54%, 2/25/37 | | 2,050 | | 108 | |

1.70%, 12/20/46 | | 3,801 | | 189 | |

1.73%, 12/20/35 | | (h)2,355 | | 64 | |

1.78%, 3/20/46 | | 1,937 | | 89 | |

1.95%, 3/20/47 | | 3,561 | | 198 | |

2.71%, 12/20/35 | | (h)2,604 | | 125 | |

Countrywide Home Loan Mortgage Pass Through Trust | | | | | |

IO | | | | | |

0.76%, 2/25/35 | | 1,940 | | 42 | |

Greenpoint Mortgage Funding Trust | | | | | |

IO | | | | | |

1.91%, 10/25/45 | | 1,488 | | 45 | |

1.10%, 8/25/45 | | 1,142 | | 35 | |

Harborview Mortgage Loan Trust | | | | | |

IO | | | | | |

0.97%, 6/19/35 | | (h)1,583 | | 36 | |

1.26%, 5/19/35 | | (h)2,298 | | 55 | |

1.63%, 3/19/37 | | (h)1,896 | | 84 | |

PO | | | | | |

3/19/37 | | 1 | | 1 | |

Harborview NIM Corp. | | | | | |

Zero Coupon, 10/20/45 | | (e)(h)328 | | 210 | |

Indymac Index Mortgage Loan Trust | | | | | |

IO | | | | | |

0.91%, 7/25/35 | | (h)1,362 | | 43 | |

Residential Accredit Loans, Inc. | | | | | |

Zero Coupon, 4/25/47 | | (e)2,300 | | 132 | |

| | | | 2,886 | |

Finance (1.6%) | | | | | |

AIG SunAmerica Global Financing VI | | | | | |

6.30%, 5/10/11 | | (e)265 | | 277 | |

American General Finance Corp. | | | | | |

4.63%, 5/15/09 | | 65 | | 64 | |

4.63%, 9/1/10 | | 15 | | 15 | |

AXA Financial, Inc. | | | | | |

6.50%, 4/1/08 | | 60 | | 61 | |

Catlin Insurance Co. Ltd. | | | | | |

7.25% | | (e)(h)(o)100 | | 99 | |

CIT Group, Inc. | | | | | |

3.65%, 11/23/07 | | 80 | | 79 | |

Countrywide Home Loans, Inc. | | | | | |

3.25%, 5/21/08 | | 165 | | 161 | |

Farmers Insurance Exchange | | | | | |

8.63%, 5/1/24 | | (e)290 | | 346 | |

The accompanying notes are an integral part of the financial statements.

8

2007 Semi-Annual Report |

| |

March 31, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Balanced Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Finance (cont’d) | | | | | |

General Electric Capital Corp. | | | | | |

4.25%, 12/1/10 | | $ | (c)80 | | $ | 78 | |

HSBC Finance Corp. | | | | | |

5.88%, 2/1/09 | | 345 | | 349 | |

JPMorgan Chase & Co. | | | | | |

7.00%, 11/15/09 | | 255 | | 267 | |

M&I Marshall & Ilsley Bank | | | | | |

3.80%, 2/8/08 | | 190 | | 188 | |

Mantis Reef Ltd. | | | | | |

4.69%, 11/14/08 | | (e)200 | | 198 | |

MBNA Corp. | | | | | |

5.79%, 5/5/08 | | (h)140 | | 141 | |

Nationwide Building Society | | | | | |

4.25%, 2/1/10 | | (e)155 | | 151 | |

Platinum Underwriters Finance, Inc. | | | | | |

7.50%, 6/1/17 | | 100 | | 106 | |

Platinum Underwriters Holdings Ltd. | | | | | |

6.37%, 11/16/07 | | 90 | | 90 | |

Residential Capital Corp. | | | | | |

6.38%, 6/30/10 | | 230 | | 230 | |

SLM Corp. | | | | | |

4.00%, 1/15/10 | | 120 | | 117 | |

St. Paul Travelers Cos., Inc. (The) | | | | | |

5.01%, 8/16/07 | | 125 | | 125 | |

Two-Rock Pass Through Trust | | | | | |

6.30% | | (e)(h)(o)100 | | 99 | |

Unicredit Luxembourg Finance S.A. | | | | | |

5.41%, 10/24/08 | | (e)(h)230 | | 230 | |

USB Capital IX | | | | | |

6.19% | | (h)(o)195 | | 200 | |

Wachovia Capital Trust III | | | | | |

5.80% | | (h)(o)360 | | 365 | |

Washington Mutual, Inc. | | | | | |

8.25%, 4/1/10 | | 175 | | 189 | |

Washington Mutual Preferred Funding II | | | | | |

6.67% | | (e)(h)(o)100 | | 98 | |

World Financial Properties | | | | | |

6.91%, 9/1/13 | | (e)253 | | 265 | |

Xlliac Global Funding | | | | | |

4.80%, 8/10/10 | | (e)155 | | 153 | |

| | | | 4,741 | |

Industrials (1.7%) | | | | | |

ArvinMeritor, Inc. | | | | | |

8.75%, 3/1/12 | | (c)100 | | 104 | |

AT&T Corp. | | | | | |

8.00%, 11/15/31 | | 160 | | 198 | |

Brookfield Asset Management, Inc. | | | | | |

7.13%, 6/15/12 | | 125 | | 134 | |

Caterpillar Financial Services Corp. | | | | | |

3.63%, 11/15/07 | | (h)30 | | 30 | |

5.43%, 8/20/07 | | (h)150 | | 150 | |

Clorox Co. | | | | | |

5.48%, 12/14/07 | | (h)140 | | 140 | |

Comcast Cable Communications, Inc. | | | | | |

6.75%, 1/30/11 | | | 40 | | | 42 | |

ConAgra Foods, Inc. | | | | | |

7.00%, 10/1/28 | �� | 45 | | 48 | |

8.25%, 9/15/30 | | 55 | | 67 | |

Consumers Energy Co. | | | | | |

4.00%, 5/15/10 | | 30 | | 29 | |

4.80%, 2/17/09 | | 80 | | 79 | |

Cooper Industries, Inc. | | | | | |

5.25%, 11/15/12 | | 105 | | 105 | |

CVS/Caremark Corp. | | | | | |

5.75%, 8/15/11 | | 35 | | 36 | |

6.04%, 12/10/28 | | (e)174 | | 177 | |

DaimlerChrysler N.A. Holding Corp. | | | | | |

8.50%, 1/18/31 | | (c)65 | | 81 | |

Delhaize America, Inc. | | | | | |

9.00%, 4/15/31 | | 85 | | 103 | |

Echostar DBS Corp. | | | | | |

6.38%, 10/1/11 | | 145 | | 146 | |

6.63%, 10/1/14 | | 35 | | 35 | |

FBG Finance Ltd. | | | | | |

5.13%, 6/15/15 | | (c)(e)115 | | 111 | |

FedEx Corp. | | | | | |

2.65%, 4/1/07 | | 75 | | 75 | |

Ford Motor Credit Co. | | | | | |

7.25%, 10/25/11 | | 110 | | 107 | |

France Telecom S.A. | | | | | |

8.50%, 3/1/31 | | 120 | | 156 | |

General Motors Acceptance Corp. | | | | | |

6.88%, 9/15/11 | | 365 | | 366 | |

Hewlett-Packard Co. | | | | | |

5.49%, 5/22/09 | | (h)110 | | 110 | |

Home Depot, Inc. | | | | | |

5.48%, 12/16/09 | | (h)55 | | 55 | |

Hospira, Inc. | | | | | |

5.83%, 3/30/10 | | (h)150 | | 150 | |

Hyatt Equities LLC | | | | | |

6.88%, 6/15/07 | | (e)125 | | 125 | |

ICI Wilmington, Inc. | | | | | |

4.38%, 12/1/08 | | 65 | | 64 | |

Interpublic Group of Companies, Inc. | | | | | |

6.25%, 11/15/14 | | 70 | | 66 | |

Lenfest Communications, Inc. | | | | | |

7.63%, 2/15/08 | | 180 | | 183 | |

LG Electronics, Inc. | | | | | |

5.00%, 6/17/10 | | (e)80 | | 79 | |

May Department Stores Co. (The) | | | | | |

6.70%, 7/15/34 | | 105 | | 104 | |

Miller Brewing Co. | | | | | |

4.25%, 8/15/08 | | (e)110 | | 108 | |

Mohawk Industries, Inc. | | | | | |

7.20%, 4/15/12 | | 65 | | 69 | |

Norfolk Southern Corp. | | | | | |

7.35%, 5/15/07 | | 75 | | 75 | |

The accompanying notes are an integral part of the financial statements.

9

2007 Semi-Annual Report |

|

March 31, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Balanced Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Industrials (cont’d) | | | | | |

Pilgrim’s Pride Corp. | | | | | |

7.63%, 5/1/15 | | $ | (c)80 | | $ | 80 | |

9.63%, 9/15/11 | | 30 | | 31 | |

Sara Lee Corp. | | | | | |

6.13%, 11/1/32 | | 115 | | 107 | |

SBC Communications Inc. | | | | | |

6.15%, 9/15/34 | | 70 | | 69 | |

Sprint Capital Corp. | | | | | |

8.75%, 3/15/32 | | 15 | | 18 | |

Systems 2001 Asset Trust LLC | | | | | |

6.66%, 9/15/13 | | (e)158 | | 167 | |

Telecom Italia Capital S.A. | | | | | |

4.00%, 1/15/10 | | 155 | | 150 | |

Telefonica Europe BV | | | | | |

8.25%, 9/15/30 | | 125 | | 150 | |

Time Warner, Inc. | | | | | |

5.59%, 11/13/09 | | (h)210 | | 211 | |

Union Pacific Corp. | | | | | |

6.63%, 2/1/08 | | 45 | | 46 | |

6.79%, 11/9/07 | | 35 | | 35 | |

Viacom, Inc. | | | | | |

6.88%, 4/30/36 | | 110 | | 111 | |

WellPoint, Inc. | | | | | |

3.75%, 12/14/07 | | 30 | | 30 | |

Yum! Brands, Inc. | | | | | |

8.88%, 4/15/11 | | 70 | | 79 | |

| | | | 4,991 | |

Mortgages — Other (7.1%) | | | | | |

American Home Mortgage Assets | | | | | |

5.45%, 3/25/47 | | (h)475 | | 474 | |

5.51%, 10/25/46 | | (h)594 | | 595 | |

5.55%, 9/25/46 | | (h)491 | | 493 | |

American Home Mortgage Investment Trust | | | | | |

5.51%, 4/25/37 | | (h)350 | | 350 | |

Banc of America Funding Corp. | | | | | |

5.67%, 9/20/35 | | (h)182 | | 183 | |

Bear Stearns Mortgage Funding Trust | | | | | |

5.57%, 7/25/36 | | (h)387 | | 387 | |

Countrywide Alternative Loan Trust | | | | | |

5.25%, 7/25/46 | | (e)(h)126 | | 126 | |

5.48%, 2/25/47 | | (e)(h)332 | | 331 | |

5.51%, 10/25/46 - 11/25/46 | | (h)676 | | 676 | |

5.58%, 11/20/35 | | (h)187 | | 187 | |

5.59%, 7/25/46 | | (h)297 | | 298 | |

5.63%, 3/20/46 | | 287 | | 288 | |

6.50%, 10/25/46 | | (e)177 | | 176 | |

Countrywide Home Loan Mortgage Pass Through Trust | | | | | |

5.62%, 3/25/35 | | (h)61 | | 61 | |

Deutsche ALT-A Securities, Inc. Alternate Loan Trust | | | | | |

5.47%, 2/25/47 | | (e)585 | | 585 | |

Deutsche ALT-A Securities, Inc., NIM Trust | | | | | |

6.75%, 2/25/47 | | 169 | | 168 | |

Downey Savings & Loan Association Mortgage Loan Trust | | | | | |

5.52%, 10/19/36 | | | (h)476 | | | 478 | |

5.92%, 4/19/46 | | (h)446 | | 446 | |

Federal Home Loan Mortgage Corp. | | | | | |

5.89%, 10/1/36 | | 415 | | 419 | |

Federal National Mortgage Association | | | | | |

5.38%, 12/25/36 | | 289 | | 289 | |

PAC | | | | | |

8.50%, 9/25/20 | | 16 | | 17 | |

Greenpoint Mortgage Funding Trust | | | | | |

5.50%, 1/25/37 | | (h)373 | | 372 | |

5.52%, 3/25/47 | | (h)550 | | 550 | |

5.61%, 2/25/36 | | (h)346 | | 347 | |

5.64%, 3/25/36 | | (h)393 | | 394 | |

Harborview Mortgage Loan Trust | | | | | |

5.41%, 1/19/38 | | (h)176 | | 176 | |

5.47%, 3/19/38 | | (h)371 | | 371 | |

5.50%, 11/19/36 | | (h)484 | | 482 | |

5.51%, 12/19/37 | | (h)549 | | 550 | |

5.52%, 7/21/36 - 3/19/38 | | 676 | | 676 | |

5.53%, 11/19/36 | | (h)489 | | 491 | |

5.55%, 7/19/46 | | (h)338 | | 338 | |

5.57%, 10/19/37 | | (h)385 | | 386 | |

5.61%, 7/19/45 | | (h)125 | | 125 | |

5.70%, 11/19/35 | | (h)214 | | 215 | |

Harborview NIM Corp. | | | | | |

6.41%, 7/22/36 - 3/19/38 | | (e)453 | | 452 | |

Impac CMB Trust | | | | | |

5.57%, 6/25/34 | | (h)128 | | 128 | |

Indymac Index Mortgage Loan Trust | | | | | |

5.42%, 2/25/37 | | (h)391 | | 392 | |

5.44%, 7/25/46 | | (h)525 | | 527 | |

5.57%, 6/25/46 | | (h)466 | | 468 | |

Luminent Mortgage Capital, Inc. | | | | | |

5.56%, 4/25/36 | | (h)292 | | 293 | |

5.57%, 5/25/36 | | (h)270 | | 271 | |

Merrill Lynch Mortgage Investors, Inc. | | | | | |

5.44%, 8/25/35 | | (h)110 | | 110 | |

Mortgage Equity Conversion Asset Trust | | | | | |

5.46%, 2/25/42 | | (h)350 | | 350 | |

Residential Accredit Loans, Inc. | | | | | |

5.48%, 2/25/37 - 3/25/47 | | (h)1,171 | | 1,171 | |

5.51%, 12/25/36 | | (h)418 | | 420 | |

5.55%, 5/25/46 | | (h)207 | | 207 | |

5.58%, 2/25/46 | | (h)136 | | 136 | |

5.59%, 2/25/46 | | (h)149 | | 149 | |

Ryland Acceptance Corp. IV | | | | | |

6.65%, 7/1/11 | | 5 | | 5 | |

Structured Asset Mortgage Investments, Inc. | | | | | |

5.51%, 2/25/36 | | (h)145 | | 145 | |

5.52%, 10/25/36 | | (h)334 | | 335 | |

5.55%, 7/25/36 - 8/25/36 | | (h)922 | | 925 | |

5.59%, 4/25/36 | | (h)517 | | 520 | |

Wamu Alternative Mortgage Pass Through Certificates | | | | | |

5.42%, 5/25/46 | | (h)147 | | 147 | |

The accompanying notes are an integral part of the financial statements.

10

2007 Semi-Annual Report |

| |

March 31, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Balanced Portfolio

| | | | Face | | | |

| | | | Amount | | Value | |

| | | | (000) | | (000) | |

Mortgages — Other (cont’d) | | | | | | | |

5.51%, 7/25/46 | | | | $ | (h)198 | | $ | 198 | |

5.92%, 4/25/46 | | | | (h)343 | | 344 | |

Washington Mutual, Inc. | | | | | | | |

5.57%, 11/25/45 - 12/25/45 | | | | (h)395 | | 396 | |

5.58%, 7/25/44 - 10/25/45 | | | | 158 | | 158 | |

5.59%, 4/25/45 | | | | (h)209 | | 209 | |

5.61%, 8/25/45 | | | | (h)77 | | 77 | |

Zuni Mortgage Loan Trust | | | | | | | |

5.45%, 8/25/36 | | | | (h)319 | | 318 | |

| | | | | | 21,351 | |

Sovereign (0.4%) | | | | | | | |

Citigroup, Inc. | | | | | | | |

Zero Coupon, 7/17/08 | | | | 70 | | 83 | |

Government of Argentina | | | | | | | |

5.83%, 12/31/33 | | | | 280 | | 134 | |

Government of Japan | | | | | | | |

0.30%, 3/20/08 | | JPY | | 85,000 | | 719 | |

United Mexican States | | | | | | | |

9.50%, 12/18/14 | | MXN | | 2,090 | | 211 | |

| | | | | | 1,147 | |

U.S. Treasury Securities (4.4%) | | | | | | | |

U.S. Treasury Bonds | | | | | | | |

6.13%, 8/15/29 | | | | (c)25 | | 29 | |

6.25%, 5/15/30 | | | | (c)4,140 | | 4,906 | |

8.13%, 8/15/19 | | | | (c)2,100 | | 2,743 | |

U.S. Treasury Note | | | | | | | |

3.88%, 2/15/13 | | | | (c)1,170 | | 1,131 | |

U.S. Treasury Strip | | | | | | | |

IO | | | | | | | |

5.06%, 5/15/21 | | | | (c)9,245 | | 4,591 | |

| | | | | | 13,400 | |

Utilities (0.4%) | | | | | | | |

Arizona Public Service Co. | | | | | | | |

5.80%, 6/30/14 | | | | 110 | | 111 | |

CenterPoint Energy Resources Corp. | | | | | | | |

6.25%, 2/1/37 | | | | 35 | | 35 | |

Consolidated Natural Gas Co. | | | | | | | |

6.25%, 11/1/11 | | | | 45 | | 47 | |

Detroit Edison Co. | | | | | | | |

6.13%, 10/1/10 | | | | 60 | | 62 | |

Entergy Gulf States, Inc. | | | | | | | |

3.60%, 6/1/08 | | | | 45 | | 44 | |

5.76%, 12/1/09 | | | | (h)75 | | 75 | |

6.09%, 12/8/08 | | | | (e)(h)105 | | 105 | |

Kinder Morgan Finance Co. | | | | | | | |

5.70%, 1/5/16 | | | | 125 | | 117 | |

NiSource Finance Corp. | | | | | | | |

5.93%, 11/23/09 | | | | (h)85 | | 85 | |

Ohio Power Corp. | | | | | | | |

6.00%, 6/1/16 | | | | 110 | | 114 | |

Plains All American Pipeline LP | | | | | | | |

6.70%, 5/15/36 | | | | 110 | | 113 | |

PSEG Energy Holdings LLC | | | | | | | |

8.63%, 2/15/08 | | | | (c)65 | | 67 | |

Sempra Energy | | | | | | | |

4.62%, 5/17/07 | | | | 75 | | 75 | |

Texas Eastern Transmission LP | | | | | | | |

7.00%, 7/15/32 | | | | 70 | | 78 | |

TXU Energy Co. LLC | | | | | | | |

7.00%, 3/15/13 | | | | 70 | | 73 | |

Wisconsin Electric Power Co. | | | | | | | |

3.50%, 12/1/07 | | | | 30 | | 30 | |

| | | | | | 1,231 | |

Total Fixed Income Securities (Cost $76,994) | | | | | | 75,796 | |

| | | | | | | | | |

| | Shares | | | |

Common Stocks (58.9%) | | | | | |

Aerospace & Defense (1.4%) | | | | | |

Boeing Co. | | 9,450 | | 840 | |

General Dynamics Corp. | | 3,800 | | 290 | |

Honeywell International, Inc. | | 10,200 | | 470 | |

Lockheed Martin Corp. | | 4,450 | | 432 | |

Northrop Grumman Corp. | | 7,110 | | 528 | |

Raytheon Co. | | 16,200 | | 850 | |

Rockwell Collins, Inc. | | 1,200 | | 80 | |

United Technologies Corp. | | 11,800 | | 767 | |

| | | | 4,257 | |

Air Freight & Logistics (0.7%) | | | | | |

C.H. Robinson Worldwide, Inc. | | 17,546 | | 838 | |

Expeditors International Washington, Inc. | | 15,600 | | 644 | |

FedEx Corp. | | 1,850 | | 199 | |

United Parcel Service, Inc. | | 7,000 | | 491 | |

| | | | 2,172 | |

Airlines (0.0%) | | | | | |

Southwest Airlines Co. | | 6,150 | | 90 | |

Automobiles (0.2%) | | | | | |

Ford Motor Co. | | 28,700 | | 227 | |

Honda Motor Co. Ltd. ADR | | 9,410 | | 328 | |

| | | | 555 | |

Beverages (1.1%) | | | | | |

Anheuser-Busch Cos., Inc. | | 5,538 | | 279 | |

Brown-Forman Corp., Class B | | 600 | | 39 | |

Coca-Cola Co. (The) | | 44,684 | | 2,145 | |

Coca-Cola Enterprises, Inc. | | 2,803 | | 57 | |

Pepsi Bottling Group, Inc. | | 1,440 | | 46 | |

PepsiCo., Inc. | | 11,625 | | 739 | |

| | | | 3,305 | |

Biotechnology (0.6%) | | | | | |

Amgen, Inc. | | (a)11,960 | | 668 | |

Applera Corp. - Applied Biosystems Group | | 8,010 | | 237 | |

Biogen Idec, Inc. | | (a)3,336 | | 148 | |

Genentech, Inc. | | (a)6,440 | | 529 | |

Genzyme Corp. | | (a)1,600 | | 96 | |

Gilead Sciences, Inc. | | (a)2,600 | | 199 | |

The accompanying notes are an integral part of the financial statements.

11

2007 Semi-Annual Report |

|

March 31, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Balanced Portfolio

| | | | Value | |

| | Shares | | (000) | |

Biotechnology (cont’d) | | | | | |

Medimmune, Inc. | | (a)1,270 | | $ | 46 | |

| | | | 1,923 | |

Building Products (0.1%) | | | | | |

American Standard Cos., Inc. | | 3,350 | | 178 | |

Masco Corp. | | 8,150 | | 223 | |

| | | | 401 | |

Capital Markets (1.6%) | | | | | |

Bank of New York Co., Inc. (The) | | 2,990 | | 121 | |

Bear Stearns Cos., Inc. (The) | | 1,500 | | 226 | |

Charles Schwab Corp. (The) | | 47,191 | | 863 | |

Franklin Resources, Inc. | | 4,780 | | 578 | |

Goldman Sachs Group, Inc. | | 4,540 | | 938 | |

Lehman Brothers Holdings, Inc. | | 5,874 | | 412 | |

Mellon Financial Corp. | | 1,740 | | 75 | |

Merrill Lynch & Co., Inc. | | 17,760 | | 1,450 | |

Northern Trust Corp. | | 570 | | 34 | |

State Street Corp. | | 2,480 | | 161 | |

| | | | 4,858 | |

Chemicals (0.7%) | | | | | |

Bayer AG ADR | | 23,010 | | 1,472 | |

E.I. du Pont de Nemours & Co. | | 10,390 | | 513 | |

Tronox, Inc. | | 207 | | 3 | |

| | | | 1,988 | |

Commercial Banks (2.4%) | | | | | |

Akbank T.A.S. | | 91,102 | | 609 | |

Ameriprise Financial, Inc. | | 1,760 | | 101 | |

Bank of America Corp. | | 37,670 | | 1,922 | |

Bank Pekao S.A. | | 5,906 | | 525 | |

BB&T Corp. | | 750 | | 31 | |

Comerica, Inc. | | 440 | | 26 | |

Fifth Third Bancorp. | | 11,630 | | 450 | |

KeyCorp. | | 340 | | 13 | |

Komercni Banka A.S. | | 2,718 | | 473 | |

Marshall & Ilsley Corp. | | 670 | | 31 | |

National City Corp. | | 1,220 | | 45 | |

PNC Financial Services Group, Inc. | | 6,820 | | 491 | |

Powszechna Kasa | | 30,873 | | 514 | |

Regions Financial Corp. | | 1,954 | | 69 | |

SunTrust Banks, Inc. | | 510 | | 42 | |

Synovus Financial Corp. | | 1,120 | | 36 | |

Turkiye Garanti Bankasi A.S. | | 94,238 | | 743 | |

Turkiye Is Bankasi | | 124,706 | | 600 | |

U.S. Bancorp | | 3,690 | | 129 | |

Wachovia Corp. | | 3,746 | | 206 | |

Wells Fargo & Co. | | 6,440 | | 222 | |

| | | | 7,278 | |

Commercial Services & Supplies (0.7%) | | | | | |

ACCO Brands Corp. | | (a)376 | | 9 | |

Corporate Executive Board Co. | | 12,195 | | 926 | |

Iron Mountain, Inc. | | (a)21,325 | | 557 | |

Monster Worldwide, Inc. | | (a)12,953 | | 614 | |

| | | | 2,106 | |

Communications Equipment (1.4%) | | | | | |

Alcatel-Lucent ADR | | 30,400 | | | 359 | |

Avaya, Inc. | | (a)3,956 | | 47 | |

Cisco Systems, Inc. | | (a)76,374 | | 1,950 | |

Comverse Technology, Inc. | | (a)2,000 | | 43 | |

Corning, Inc. | | (a)15,125 | | 344 | |

JDS Uniphase Corp. | | (a)1,795 | | 27 | |

Motorola, Inc. | | 27,012 | | 477 | |

QLogic Corp. | | (a)2,114 | | 36 | |

QUALCOMM, Inc. | | 18,424 | | 786 | |

Tellabs, Inc. | | (a)4,500 | | 45 | |

| | | | 4,114 | |

Computers & Peripherals (2.2%) | | | | | |

Apple, Inc. | | (a)17,900 | | 1,663 | |

Dell, Inc. | | (a)28,869 | | 670 | |

EMC Corp. | | (a)27,550 | | 382 | |

Hewlett-Packard Co. | | 38,752 | | 1,555 | |

International Business Machines Corp. | | 19,015 | | 1,792 | |

Lexmark International, Inc., Class A | | (a)1,215 | | 71 | |

Network Appliance, Inc. | | (a)3,629 | | 133 | |

Sun Microsystems, Inc. | | (a)46,134 | | 277 | |

| | | | 6,543 | |

Construction Materials (0.2%) | | | | | |

Cemex SAB de C.V. ADR | | 17,076 | | 559 | |

Consumer Finance (0.6%) | | | | | |

American Express Co. | | 31,487 | | 1,776 | |

Capital One Financial Corp. | | 1,773 | | 134 | |

SLM Corp. | | 300 | | 12 | |

| | | | 1,922 | |

Distributors (0.2%) | | | | | |

Li & Fung Ltd. | | 158,000 | | 496 | |

Diversified Consumer Services (0.0%) | | | | | |

H&R Block, Inc. | | 3,100 | | 65 | |

Diversified Financial Services (3.2%) | | | | | |

Brookfield Asset Management, Inc. | | 43,950 | | 2,297 | |

Chicago Mercantile Exchange Holdings, Inc. | | 1,047 | | 558 | |

Citigroup, Inc. | | 58,725 | | 3,015 | |

Fortress Investment Group LLC | | 1,726 | | 49 | |

JPMorgan Chase & Co. | | 53,946 | | 2,610 | |

Moody’s Corp. | | 18,682 | | 1,159 | |

| | | | 9,688 | |

Diversified Telecommunication Services (0.6%) | | | | | |

AT&T, Inc. | | 420 | | 17 | |

Embarq Corp. | | 4,725 | | 266 | |

France Telecom S.A. ADR | | 13,070 | | 345 | |

Qwest Communications International, Inc. | | (a)100 | | 1 | |

Verizon Communications, Inc. | | 29,634 | | 1,124 | |

| | | | 1,753 | |

Electric Utilities (1.4%) | | | | | |

AES Corp. (The) | | (a)4,400 | | 95 | |

American Electric Power Co., Inc. | | 13,150 | | 641 | |

CEZ 2 | | 10,955 | | 492 | |

Consolidated Edison, Inc. | | 1,300 | | 66 | |

The accompanying notes are an integral part of the financial statements.

12

2007 Semi-Annual Report |

| |

March 31, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Balanced Portfolio

| | | | Value | |

| | Shares | | (000) | |

Electric Utilities (cont’d) | | | | | |

Edison International | | 1,800 | | $ | 89 | |

Entergy Corp. | | 10,345 | | 1,085 | |

Exelon Corp. | | 4,400 | | 302 | |

FirstEnergy Corp. | | 9,350 | | 619 | |

FPL Group, Inc. | | 3,200 | | 196 | |

PPL Corp. | | 2,600 | | 106 | |

Progress Energy, Inc. | | 1,300 | | 66 | |

Southern Co. (The) | | 5,100 | | 187 | |

TXU Corp. | | 3,700 | | 237 | |

| | | | 4,181 | |

Electrical Equipment (0.2%) | | | | | |

Cooper Industries Ltd., Class A | | 1,100 | | 49 | |

Emerson Electric Co. | | 9,100 | | 392 | |

Rockwell Automation, Inc. | | 1,000 | | 60 | |

| | | | 501 | |

Electronic Equipment & Instruments (0.1%) | | | | | |

Agilent Technologies, Inc. | | (a)5,918 | | 199 | |

Jabil Circuit, Inc. | | 3,052 | | 65 | |

Molex, Inc. | | 1,550 | | 44 | |

Sanmina-SCI Corp. | | (a)5,348 | | 19 | |

Solectron Corp. | | (a)12,249 | | 39 | |

| | | | 366 | |

Energy Equipment & Services (0.8%) | | | | | |

Baker Hughes, Inc. | | 3,860 | | 255 | |

BJ Services Co. | | 3,080 | | 86 | |

Halliburton Co. | | 9,968 | | 317 | |

Nabors Industries Ltd. | | (a)2,900 | | 86 | |

Schlumberger Ltd. | | 20,130 | | 1,391 | |

Transocean, Inc. | | (a)2,990 | | 244 | |

| | | | 2,379 | |

Food & Staples Retailing (1.4%) | | | | | |

Costco Wholesale Corp. | | 24,624 | | 1,326 | |

CVS/Caremark Corp. | | 3,840 | | 131 | |

Kroger Co. (The) | | 12,958 | | 366 | |

Rite Aid Corp. | | (a)13,700 | | 79 | |

Safeway, Inc. | | 2,002 | | 73 | |

SUPERVALU, Inc. | | 3,589 | | 140 | |

Sysco Corp. | | 3,090 | | 105 | |

Wal-Mart Stores, Inc. | | 35,364 | | 1,660 | |

Walgreen Co. | | 4,889 | | 225 | |

| | | | 4,105 | |

Food Products (1.1%) | | | | | |

Archer-Daniels-Midland Co. | | 4,402 | | 162 | |

Cadbury Schweppes plc ADR | | 12,740 | | 654 | |

Campbell Soup Co. | | 2,520 | | 98 | |

ConAgra Foods, Inc. | | 10,511 | | 262 | |

General Mills, Inc. | | 2,467 | | 144 | |

Heinz (H.J.) Co. | | 2,559 | | 121 | |

Hershey Co. (The) | | 1,828 | | 100 | |

Kellogg Co. | | 2,593 | | 133 | |

Kraft Foods, Inc., Class A | | 9,750 | | 309 | |

Nestle S.A. (Registered) ADR | | 6,670 | | 646 | |

Sara Lee Corp. | | 5,478 | | | 93 | |

Unilever N.V. (NY Shares) | | 21,470 | | 627 | |

W.M. Wrigley Jr. Co. | | 1,471 | | 75 | |

| | | | 3,424 | |

Gas Utilities (0.0%) | | | | | |

Sempra Energy | | 1,300 | | 79 | |

Health Care Equipment & Supplies (1.5%) | | | | | |

Bard (C.R.), Inc. | | 2,100 | | 167 | |

Bausch & Lomb, Inc. | | 700 | | 36 | |

Baxter International, Inc. | | 9,250 | | 487 | |

Becton Dickinson & Co. | | 3,970 | | 305 | |

Biomet, Inc. | | 3,890 | | 165 | |

Boston Scientific Corp. | | (a)37,985 | | 552 | |

Dade Behring Holdings, Inc. | | 13,023 | | 571 | |

Hospira, Inc. | | (a)1,177 | | 48 | |

Medtronic, Inc. | | 19,020 | | 933 | |

Millipore Corp. | | (a)400 | | 29 | |

St. Jude Medical, Inc. | | (a)6,520 | | 245 | |

Stryker Corp. | | 6,520 | | 433 | |

Thermo Fisher Scientific, Inc. | | (a)1,762 | | 83 | |

Waters Corp. | | (a)640 | | 37 | |

Zimmer Holdings, Inc. | | (a)3,880 | | 332 | |

| | | | 4,423 | |

Health Care Providers & Services (1.8%) | | | | | |

Aetna, Inc. | | 9,840 | | 431 | |

AmerisourceBergen Corp. | | 3,980 | | 210 | |

Cardinal Health, Inc. | | 6,660 | | 486 | |

CIGNA Corp. | | 4,990 | | 712 | |

Express Scripts, Inc. | | (a)2,500 | | 202 | |

Health Management Associates, Inc., Class A | | 4,200 | | 46 | |

Humana, Inc. | | (a)2,500 | | 145 | |

IMS Health, Inc. | | 4,400 | | 130 | |

Manor Care, Inc. | | 1,000 | | 54 | |

McKesson Corp. | | 4,510 | | 264 | |

Medco Health Solutions, Inc. | | (a)3,917 | | 284 | |

Quest Diagnostics, Inc. | | 3,200 | | 160 | |

Tenet Healthcare Corp. | | (a)7,000 | | 45 | |

UnitedHealth Group, Inc. | | 30,610 | | 1,621 | |

WellPoint, Inc. | | (a)8,800 | | 714 | |

| | | | 5,504 | |

Hotels Restaurants & Leisure (1.4%) | | | | | |

Carnival Corp. | | 1,800 | | 84 | |

Harrah’s Entertainment, Inc. | | 650 | | 55 | |

Marriott International, Inc., Class A | | 28,473 | | 1,394 | |

McDonald’s Corp. | | 28,413 | | 1,280 | |

Starbucks Corp. | | (a)2,700 | | 85 | |

Starwood Hotels & Resorts Worldwide, Inc. | | 900 | | 59 | |

Wynn Resorts Ltd. | | 12,280 | | 1,165 | |

Yum! Brands, Inc. | | 1,200 | | 69 | |

| | | | 4,191 | |

Household Products (1.4%) | | | | | |

Clorox Co. | | 2,517 | | 160 | |

Colgate Palmolive Co. | | 6,092 | | 407 | |

Kimberly-Clark Corp. | | 9,040 | | 619 | |

The accompanying notes are an integral part of the financial statements.

13

2007 Semi-Annual Report |

|

March 31, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Balanced Portfolio

| | | | Value | |

| | Shares | | (000) | |

Household Products (cont’d) | | | | | |

Procter & Gamble Co. | | 48,270 | | $ | 3,049 | |

| | | | 4,235 | |

Independent Power Producers & Energy Traders (0.0%) | | | | | |

Constellation Energy Group, Inc. | | 1,300 | | 113 | |

Industrial Conglomerates (2.8%) | | | | | |

3M Co. | | 7,800 | | 596 | |

General Electric Co. | | 143,850 | | 5,087 | |

Siemens AG ADR | | 8,640 | | 926 | |

Textron, Inc. | | 1,250 | | 112 | |

Tyco International Ltd. | | 49,000 | | 1,546 | |

| | | | 8,267 | |

Insurance (2.9%) | | | | | |

ACE Ltd. | | 1,730 | | 99 | |

Aegon N.V. (NY Shares) | | 11,730 | | 234 | |

Aflac, Inc. | | 3,660 | | 172 | |

Allstate Corp. (The) | | 5,040 | | 303 | |

AMBAC Financial Group, Inc. | | 450 | | 39 | |

American International Group, Inc. | | 16,330 | | 1,098 | |

AON Corp. | | 1,300 | | 49 | |

Berkshire Hathaway, Inc., Class B | | (a)333 | | 1,212 | |

Chubb Corp. | | 15,090 | | 780 | |

Cincinnati Financial Corp. | | 425 | | 18 | |

Hartford Financial Services Group, Inc. | | 8,160 | | 780 | |

Lincoln National Corp. | | 2,159 | | 146 | |

Loews Corp. | | 2,860 | | 130 | |

Marsh & McLennan Cos., Inc. | | 39,100 | | 1,145 | |

MBIA, Inc. | | 1,560 | | 102 | |

Metlife, Inc. | | 5,290 | | 334 | |

Principal Financial Group | | 2,670 | | 160 | |

Progressive Corp. (The) | | 6,540 | | 143 | |

Prudential Financial, Inc. | | 3,500 | | 316 | |

St. Paul Travelers Cos., Inc. (The) | | 19,436 | | 1,006 | |

XL Capital Ltd., Class A | | 6,740 | | 471 | |

| | | | 8,737 | |

Internet & Catalog Retail (1.3%) | | | | | |

Amazon.com, Inc. | | (a)38,556 | | 1,534 | |

eBay, Inc. | | (a)68,510 | | 2,271 | |

| | | | 3,805 | |

Internet Software & Services (1.5%) | | | | | |

Google, Inc., Class A | | (a)5,503 | | 2,521 | |

Yahoo!, Inc. | | (a)60,250 | | 1,885 | |

| | | | 4,406 | |

IT Services (0.2%) | | | | | |

Automatic Data Processing, Inc. | | 2,100 | | 102 | |

Electronic Data Systems Corp. | | 2,100 | | 58 | |

First Data Corp. | | 2,100 | | 56 | |

Paychex, Inc. | | 1,300 | | 49 | |

Western Union Co. (The) | | 20,028 | | 440 | |

| | | | 705 | |

Machinery (0.8%) | | | | | |

Caterpillar, Inc. | | 8,100 | | 543 | |

Danaher Corp. | | 3,200 | | 229 | |

Deere & Co. | | 2,250 | | 244 | |

Dover Corp. | | 3,250 | | 159 | |

Eaton Corp. | | 1,900 | | 159 | |

Illinois Tool Works, Inc. | | 7,400 | | 382 | |

Ingersoll-Rand Co. Ltd., Class A | | 6,770 | | 294 | |

ITT Industries, Inc. | | 2,100 | | 127 | |

Paccar, Inc. | | 3,237 | | 237 | |

Parker Hannifin Corp. | | 1,500 | | 129 | |

| | | | 2,503 | |

Media (1.9%) | | | | | |

CBS Corp., Class B | | 75 | | 2 | |

Central European T.V. | | (a)6,600 | | 584 | |

Clear Channel Communications, Inc. | | 5,119 | | 179 | |

Comcast Corp., Class A | | (a)12,315 | | 320 | |

Grupo Televisa S.A. ADR | | 47,736 | | 1,422 | |

Idearc, Inc. | | 135 | | 5 | |

Interpublic Group of Cos., Inc. | | (a)50 | | 1 | |

Live Nation, Inc. | | (a)263 | | 6 | |

McClatchy Co. | | 25 | | 1 | |

McGraw-Hill Cos., Inc. (The) | | 10,049 | | 632 | |

New York Times Co., Class A | | 50 | | 1 | |

Omnicom Group, Inc. | | 50 | | 5 | |

Time Warner, Inc. | | 62,403 | | 1,231 | |

TVN S.A. | | (a)54,982 | | 500 | |

Viacom, Inc. | | (a)20,940 | | 861 | |

Walt Disney Co. | | 150 | | 5 | |

| | | | 5,755 | |

Metals & Mining (0.2%) | | | | | |

Newmont Mining Corp. | | 12,063 | | 507 | |

Multi-Utilities (0.4%) | | | | | |

Ameren Corp. | | 1,300 | | 65 | |

Dominion Resources, Inc./VA | | 1,900 | | 169 | |

DTE Energy Co. | | 1,400 | | 67 | |

Duke Energy Corp. | | 7,828 | | 159 | |

KeySpan Corp. | | 1,400 | | 58 | |

PG&E Corp. | | 3,200 | | 154 | |

Public Service Enterprise Group, Inc. | | 1,300 | | 108 | |

Williams Cos., Inc. | | 13,420 | | 382 | |

| | | | 1,162 | |

Multiline Retail (0.7%) | | | | | |

Sears Holdings Corp. | | (a)11,506 | | 2,073 | |

Office Electronic (0.1%) | | | | | |

Xerox Corp. | | (a)8,454 | | 143 | |

Oil, Gas & Consumable Fuels (6.2%) | | | | | |

Anadarko Petroleum Corp. | | 5,240 | | 225 | |

Apache Corp. | | 3,486 | | 246 | |

Chevron Corp. | | 24,057 | | 1,779 | |

ConocoPhillips | | 27,549 | | 1,883 | |

Devon Energy Corp. | | 4,900 | | 339 | |

EOG Resources, Inc. | | 2,200 | | 157 | |

Exxon Mobil Corp. | | 70,441 | | 5,315 | |

| | | | | | |

The accompanying notes are an integral part of the financial statements.

14

2007 Semi-Annual Report |

| |

March 31, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Balanced Portfolio

| | | | Value | |

| | Shares | | (000) | |

Oil, Gas & Consumable Fuels (cont’d) | | | | | |

Hess Corp. | | 2,710 | | $ | 150 | |

Hugoton Royalty Trust | | 131 | | 3 | |

Kinder Morgan, Inc. | | 1,100 | | 117 | |

LUKOIL ADR | | 10,414 | | 901 | |

Marathon Oil Corp. | | 3,620 | | 358 | |

Monsanto Co. | | 39,940 | | 2,195 | |

OAO Gazprom (Registered) ADR | | 19,276 | | 807 | |

Occidental Petroleum Corp. | | 10,768 | | 531 | |

Royal Dutch Shell plc ADR | | 11,140 | | 739 | |

Spectra Energy Corp. | | 4,114 | | 108 | |

Tupras Turkiye Petrol Rafine | | 30,796 | | 686 | |

Ultra Petroleum Corp. | | (a)29,220 | | 1,552 | |

Valero Energy Corp. | | 5,300 | | 342 | |

XTO Energy, Inc. | | 2,200 | | 121 | |

| | | | 18,554 | |

Personal Products (0.1%) | | | | | |

Avon Products, Inc. | | 5,490 | | 205 | |

Pharmaceuticals (4.4%) | | | | | |

Abbott Laboratories | | 33,806 | | 1,886 | |

Allergan, Inc. | | 1,060 | | 117 | |

Bristol-Myers Squibb Co. | | 51,331 | | 1,425 | |

Eli Lilly & Co. | | 27,050 | | 1,453 | |

Forest Laboratories, Inc. | | (a)2,510 | | 129 | |

GlaxoSmithKline plc ADR | | 5,700 | | 315 | |

Johnson & Johnson | | 23,160 | | 1,396 | |

King Pharmaceuticals, Inc. | | (a)1,030 | | 20 | |

Merck & Co., Inc. | | 15,700 | | 694 | |

Pfizer, Inc. | | 76,941 | | 1,944 | |

Roche Holding AG ADR | | 8,930 | | 786 | |

Sanofi-Aventis ADR | | 4,000 | | 174 | |

Schering-Plough Corp. | | 64,060 | | 1,634 | |

Wyeth | | 25,477 | | 1,275 | |

| | | | 13,248 | |

Road & Rail (0.2%) | | | | | |

Burlington Northern and Santa Fe Railway Co. | | 2,100 | | 169 | |

CSX Corp. | | 3,800 | | 152 | |

Norfolk Southern Corp. | | 2,350 | | 119 | |

Union Pacific Corp. | | 1,550 | | 157 | |

| | | | 597 | |

Semiconductors & Semiconductor Equipment (1.2%) | | | | | |

Advanced Micro Devices, Inc. | | (a)4,022 | | 52 | |

Altera Corp. | | (a)4,329 | | 87 | |

Analog Devices, Inc. | | 3,392 | | 117 | |

Applied Materials, Inc. | | 15,963 | | 292 | |

Broadcom Corp., Class A | | (a)4,730 | | 152 | |

Intel Corp. | | 74,066 | | 1,417 | |

KLA-Tencor Corp. | | 2,010 | | 107 | |

Linear Technology Corp. | | 2,658 | | 84 | |

LSI Logic Corp. | | (a)460 | | 5 | |

Maxim Integrated Products, Inc. | | 3,114 | | 92 | |

Micron Technology, Inc. | | (a)31,856 | | 385 | |

National Semiconductor Corp. | | 4,106 | | 99 | |

Novellus Systems, Inc. | | (a)1,828 | | 59 | |

NVIDIA Corp. | | (a)3,800 | | | 109 | |

Teradyne, Inc. | | (a)1,455 | | 24 | |

Texas Instruments, Inc. | | 15,978 | | 481 | |

Xilinx, Inc. | | 3,160 | | 81 | |

| | | | 3,643 | |

Software (0.5%) | | | | | |

Accelr8 Technology Corp. | | (a)233 | | 1 | |

Adobe Systems, Inc. | | (a)1,400 | | 58 | |

Electronic Arts, Inc. | | (a)900 | | 45 | |

Microsoft Corp. | | 19,800 | | 552 | |

NCR Corp. | | (a)1,008 | | 48 | |

Oracle Corp. | | (a)9,800 | | 178 | |

Symantec Corp. | | (a)40,130 | | 694 | |

| | | | 1,576 | |

Specialty Retail (0.9%) | | | | | |

Abercrombie & Fitch Co., Class A | | 10,753 | | 814 | |

AutoZone, Inc. | | (a)4,774 | | 611 | |

Home Depot, Inc. | | 28,390 | | 1,043 | |

Office Depot, Inc. | | (a)4,720 | | 166 | |

| | | | 2,634 | |

Steel (0.3%) | | | | | |

Nucor Corp. | | 12,473 | | 812 | |

Textiles, Apparel & Luxury Goods (0.2%) | | | | | |

Nike, Inc., Class B | | 6,077 | | 646 | |

Thrifts & Mortgage Finance (0.4%) | | | | | |

Countrywide Financial Corp. | | 1,230 | | 41 | |

Fannie Mae | | 1,700 | | 93 | |

Freddie Mac | | 17,560 | | 1,045 | |

MGIC Investment Corp. | | 225 | | 13 | |

Washington Mutual, Inc. | | 2,010 | | 81 | |

| | | | 1,273 | |

Tobacco (0.7%) | | | | | |

Altria Group, Inc. | | 23,020 | | 2,021 | |

Reynolds American, Inc. | | 1,500 | | 94 | |

UST, Inc. | | 1,012 | | 59 | |

| | | | 2,174 | |

Trading Companies & Distributors (0.0%) | | | | | |

W.W. Grainger, Inc. | | 550 | | 42 | |

Wireless Telecommunication Services (2.0%) | | | | | |

America Movil S.A. de C.V., Series L ADR | | 25,867 | | 1,236 | |

China Mobile Ltd. ADR | | 8,400 | | 377 | |

Crown Castle International Corp. | | (a)15,146 | | 487 | |

Mobile Telesystems OJSC ADR | | 24,400 | | 1,365 | |

Sprint Nextel Corp. | | 33,897 | | 643 | |

Turkcell Iletisim Hizmet A.S. | | 94,238 | | 481 | |

Vimpel-Communications | | 15,800 | | 1,498 | |

| | | | 6,087 | |

Total Common Stocks (Cost $141,920) | | | | 177,128 | |

The accompanying notes are an integral part of the financial statements.

15

2007 Semi-Annual Report |

|

March 31, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Balanced Portfolio

| | | | Value | |

| | Shares | | (000) | |

Investment Companies (7.2%) | | | | | |

iShares MSCI Emerging Markets Index Fund | | 65,694 | | $ | 7,640 | |

iShares MSCI EMU Index Fund | | 100 | | 11 | |

iShares MSCI Hong Kong Index Fund | | 93,300 | | 1,501 | |

iShares MSCI Japan Index Fund | | 18,500 | | 270 | |

iShares MSCI Mexico Index Fund | | 113,233 | | 6,151 | |

iShares MSCI United Kingdom Index Fund | | 99,100 | | 2,385 | |

StreetTRACKS Gold Trust | | 56,700 | | 3,729 | |

Total Investment Companies (Cost $16,616) | | | | 21,687 | |

| | | | | | |

| | No. of | | | |

| | Contracts | | | |

Put Options Purchased (0.0%) | | | | | |

90 Day EuroDollar | | | | | |

6/07 @ $94.25 | | 190 | | 1 | |

6/07 @ $94.50 | | 24 | | @— | |

9/07 @ $94.75 | | 178 | | 27 | |

12/07 @ $94.75 | | 375 | | 61 | |

12/07 @ $94.50 | | 19 | | 1 | |

Total Put Options Purchased (Cost $195) | | | | 90 | |

| | Shares | | | |

Preferred Stock (0.0%) | | | | | |

Mortgages — Other (0.0%) | | | | | |

Home Ownership Funding Corp. | | | | | |

13.33% (Cost $92) | | (a)(e)500 | | 74 | |

| | Face | | | |

| | Amount | | | |

| | (000) | | | |

Short-Term Investments (11.5%) | | | | | |

Short-Term Debt Securities held as Collateral on Loaned Securities (2.6%) | | | | | |

AIG Match Funding Corp., 5.30%, 4/17/07 | | $ | (h)172 | | 172 | |

Alliance & Leicester plc, 5.33%, 4/10/07 | | (h)123 | | 123 | |

Anglo Irish Bank Corp., plc, 5.35%, 7/9/07 | | 60 | | 60 | |

Bancaja, 5.36%, 4/19/07 | | (h)61 | | 61 | |

Bank of America Corp., 5.32%, 4/2/07 | | (h)196 | | 196 | |

Bank of New York Co., Inc., 5.32%, 4/10/07 | | (h)61 | | 61 | |

Bear Stearns & Co., Inc., 5.36%, 4/16/07 | | (h)123 | | 123 | |

BNP Paribas plc, 5.33%, 5/21/07 | | (h)123 | | 123 | |

CAM US Finance S.A. Unipersonal, | | | | | |

5.36%, 7/3/07 | | (h)245 | | 245 | |

CIC, New York, | | | | | |

5.30%, 4/3/07 | | (h)86 | | 86 | |

5.34%, 4/2/07 | | (h)123 | | 123 | |

CIT Group Holdings, 5.37%, 7/18/07 | | (h)221 | | 221 | |

Credit Suisse First Boston, New York, | | | | | |

5.29%, 5/15/07 | | 74 | | 74 | |

5.32%, 4/2/07 | | (h)123 | | 123 | |

Deutsche Bank Securities, Inc., | | | | | |

5.40%, 4/2/07 | | 491 | | 491 | |

5.46%, 4/2/07 | | 1,178 | | 1,178 | |

Dexia Bank, New York, 5.32%, 4/2/07 | | (h)123 | | 123 | |

First Tennessee Bank, 5.33%, 4/17/07 | | (h)61 | | 61 | |

Gemini Securitization Corp., 5.41%, 4/2/07 | | 176 | | 176 | |

Goldman Sachs Group, Inc., | | | | | |

5.37%, 4/16/07 | | | (h)61 | | | 61 | |

5.55%, 4/2/07 | | (h)115 | | 115 | |

HSBC Finance Corp., 5.33%, 4/10/07 | | (h)61 | | 61 | |

Mane Funding Corp., 5.29%, 4/10/07 | | 88 | | 88 | |

Manufacturers & Traders, 5.30%, 4/16/07 | | (h)74 | | 74 | |

Marshall & Ilsley Bank, 5.37%, 12/17/07 | | 123 | | 123 | |

Merrill Lynch & Co., 5.33%, 4/26/07 | | (h)64 | | 64 | |

Metropolitan Life Global Funding, | | | | | |

5.31%, 4/23/07 | | (h)184 | | 184 | |

Natexis Banques Populaires, New York, | | | | | |

5.33%, 4/2/07 | | (h)123 | | 123 | |

5.34%, 4/2/07 | | (h)123 | | 123 | |

National Australia Bank Ltd., 5.31%, 4/10/07 | | (h)93 | | 93 | |

National City Bank Cleveland, 5.32%, 4/2/07 | | (h)61 | | 61 | |

National Rural Utilities Cooperative Finance Corp., | | | | | |

5.31%, 4/2/07 | | (h)245 | | 245 | |

Nationwide Building Society, 5.43%, 6/28/07 | | (h)142 | | 142 | |

Nordea Bank, New York, 5.31%, 4/2/07 | | (h)184 | | 184 | |

Raiffeisen Zentralbank Oesterreich, | | | | | |

5.31%, 6/19/07 | | 73 | | 73 | |

Rheingold Securitization, 5.32%, 5/15/07 | | 109 | | 109 | |

Sedna Finance, Inc., 5.32%, 5/15/07 | | 31 | | 31 | |

Skandi, New York, 5.32%, 4/10/07 | | (h)123 | | 123 | |

Toronto Dominion, New York, 5.32%, 5/29/07 | | (h)123 | | 123 | |

Tulip Funding Corp., 5.36%, 4/30/07 | | 244 | | 244 | |

UBS Securities LLC, 5.40%, 4/2/07 | | 1,206 | | 1,206 | |

Unicredito Delaware, Inc., 5.32%, 4/16/07 | | (h)135 | | 135 | |

Unicredito Italiano Bank (Ireland) plc, | | | | | |

5.34%, 4/10/07 | | (h)86 | | 86 | |

| | | | 7,691 | |

Repurchase Agreement (8.8%) | | | | | |

J.P. Morgan Securities, Inc. 5.28%, dated 3/30/07, due 4/2/07, repurchase price $26,618 | | (f)26,606 | | 26,606 | |

U.S. Treasury Security (0.1%) | | | | | |

U.S. Treasury Bill | | | | | |

4.97%, 7/12/07 | | (j)150 | | 148 | |

Total Short-Term Investments (Cost$34,445) | | | | 34,445 | |

Total Investments (102.8%) (Cost $270,262) — Including $13,213 of Securities Loaned | | | | 309,220 | |

Liabilities in Excess of Other Assets (-2.8%) | | | | (8,431 | ) |

Net Assets (100%) | | | | 300,789 | |

| | | | | | | |

(a) Non-income producing security.

(c) All or a portion of security on loan at March 31, 2007.

(e) 144A security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

The accompanying notes are an integral part of the financial statements.

16

2007 Semi-Annual Report |

| |

March 31, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Balanced Portfolio

(f) | Represents the Portfolio’s undivided interest in a joint repurchase agreement which has a total value of $1,580,364,000. The repurchase agreement was fully collateralized by U.S. government agency securities at the date of this Portfolio of Investments as follows: Federal Farm Credit Bank, 0.00% to 7.43%, due 5/7/07 to 3/2/21; Federal Home Loan Bank, 0.00% to 6.42%, due 4/2/07 to 3/9/26; Federal Home Loan Mortgage Corp., 0.00% to 7.00%, due 4/2/07 to 3/15/31; Federal National Mortgage Association, 0.00% to 7.13%, due 4/5/07 to 3/17/31; Tennessee Valley Authority, 4.88%, due 12/15/16, which had a total value of $1,611,974,119. The investment in the repurchase agreement is through participation in a joint account with affiliated parties pursuant to exemptive relief received by the Portfolio from the SEC. |

(h) | Variable/Floating Rate Security — Interest rate changes on these instruments are based on changes in a designated base rate. The rates shown are those in effect on March 31, 2007. |

(i) | Security is subject to delayed delivery. |

(j) | All or a portion of the security was pledged to cover margin requirements for futures contracts. |

(o) | Perpetual — Security does not have a predetermined maturity date. Rates for these securities are fixed for a period of time then revert to a floating rate. The interest rate shown is the rate in effect at March 31, 2007. |

@ | Face Amount/Value is less than $500. |

ADR | American Depositary Receipt |

Inv Fl | Inverse Floating Rate — Interest rate fluctuates with an inverse relationship to an associated interest rate. Indicated rate is the effective rate at March 31, 2007. |

IO | Interest Only |

JPY | Japanese Yen |

MXN | Mexican Peso |

PO | Principal Only |

PAC | Planned Amortization Class |

TBA | To Be Announced |

Foreign Currency Exchange Contract Information:

The Portfolio had the following foreign currency exchange contract(s) open at period end:

| | | | | | | | | | Net | |

Currency | | | | | | In | | | | Unrealized | |

to | | | | | | Exchange | | | | Appreciation | |

Deliver | | Value | | Settlement | | For | | Value | | (Depreciation) | |

(000) | | (000) | | Date | | (000) | | (000) | | (000) | |

EUR | 551 | | $ | 738 | | 5/14/07 | | USD | 719 | | $ | 719 | | $ | (19 | ) |

USD | 22,689 | | 22,689 | | 7/16/07 | | CNY | 173,255 | | 22,786 | | 97 | |

| | $ | 23,427 | | | | | | $ | 23,505 | | $ | 78 | |

CNY — Chinese RenMinBi

EUR — Euro

USD — United States Dollar

Futures Contracts:

The Portfolio had the following futures contract(s) open at period end:

| | | | | | | | Net | |

| | | | | | | | Unrealized | |

| | Number | | | | | | Appreciation | |

| | of | | Value | | Expiration | | (Depreciation) | |

| | Contracts | | (000) | | Date | | (000) | |

Long: | | | | | | | | | |

Australian Dollar

10 yr. Bond | | 39 | | $ | 22,870 | | Jun-07 | | $ | (52 | ) |

British Pound

Long Gilt | | 22 | | 4,667 | | Jun-07 | | (48 | ) |

MSCI

Singapore | | 14 | | 733 | | Jun-07 | | 14 | |

Nasdaq 100

(Equity Index) | | 9 | | 1,612 | | Jun-07 | | 20 | |

Tokyo Price Index

(Japanese Yen) | | 19 | | 2,768 | | Jun-07 | | 89 | |

S&P 500 Emini

(U.S. Dollar) | | 9 | | 644 | | Jun-07 | | @— | |

S&P 500 Index

(U.S. Dollar) | | 3 | | 1,073 | | Jun-07 | | 9 | |

U.S. Treasury

10 yr. Note | | 142 | | 15,354 | | Jun-07 | | (8 | ) |

U.S. Treasury

5 yr. Note | | 158 | | 16,716 | | Jun-07 | | (16 | ) |

U.S. Treasury

2 yr. Note | | 80 | | 16,391 | | Jun-07 | | (31 | ) |

U.S. Treasury

Long Bond | | 52 | | 5,785 | | Jun-07 | | (47 | ) |

Short: | | | | | | | | | |

U.S. Treasury

Short Bond | | 9 | | 1,001 | | Jun-07 | | 1 | |

| | | | | | | | $ | (69 | ) |

| | | | | | | | | | | |

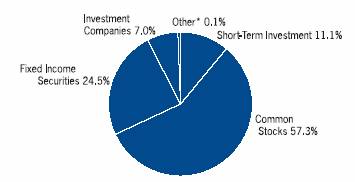

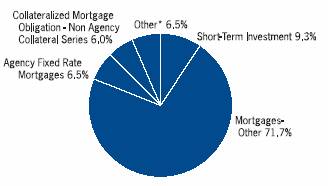

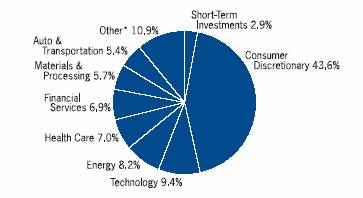

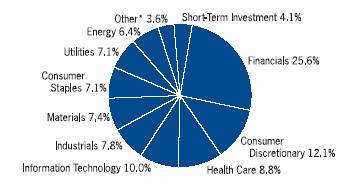

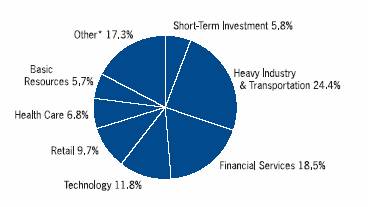

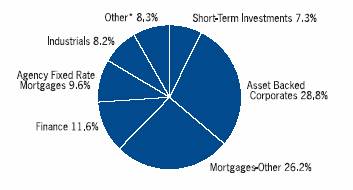

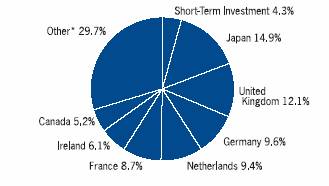

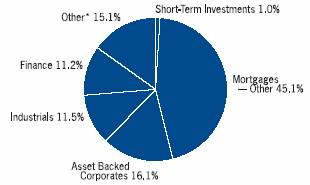

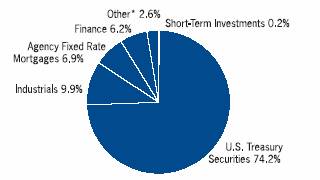

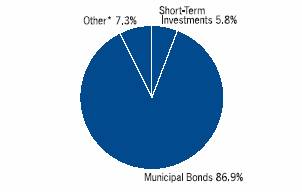

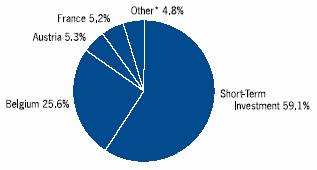

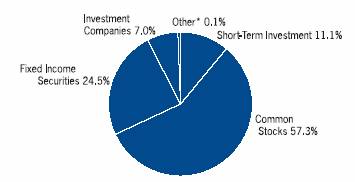

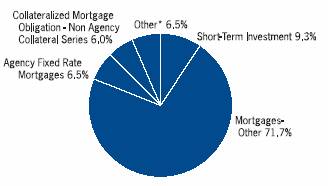

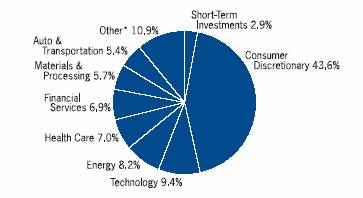

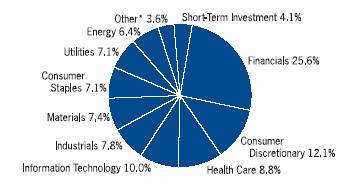

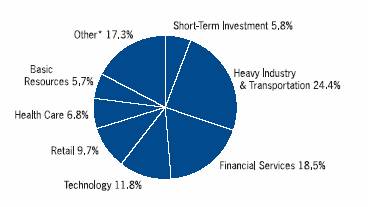

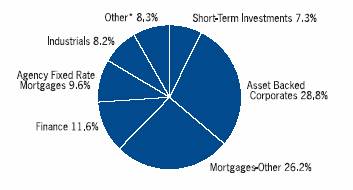

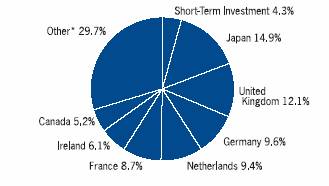

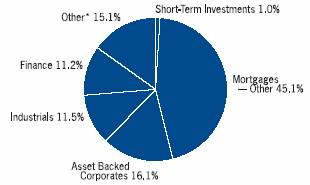

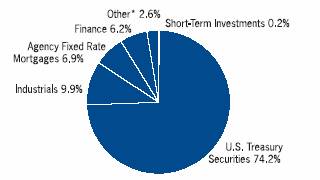

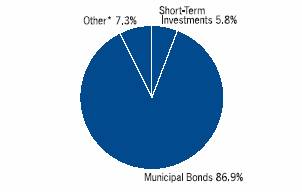

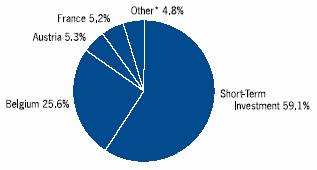

Graphic Presentation of Portfolio Holdings

The following graph depicts the Portfolio’s holdings by investment type, as a percentage of total investments.

* Investment types which do not appear in the above graph, as well as those which represent less than 5% of total investments, if applicable, are included in the category labeled “Other”.

The accompanying notes are an integral part of the financial statements.

17

2007 Semi-Annual Report |

|

March 31, 2007 (unaudited) |

Portfolio of Investments

Equities Plus Portfolio

| | | | Face | | | |

| | | | Amount | | Value | |

| | | | (000) | | (000) | |

Fixed Income Securities (90.0%) | | | | | | | |

Agency Fixed Rate Mortgages (6.5%) | | | | | | | |

Federal National Mortgage Association, | | | | | | | |

Adjustable Rate Mortgages: | | | | | | | |

6.97%, 3/1/36 | | | | $ | (n)984 | | $ | 1,013 | |

7.01%, 7/1/35 | | | | (n)757 | | 784 | |

| | | | | | 1,797 | |

Asset Backed Corporates (0.2%) | | | | | | | |

Countrywide Asset-Backed NIM Certificates | | | | | | | |

4.50%, 8/25/36 | | | | (e)61 | | 59 | |

Collateralized Mortgage Obligations — Agency Collateral Series (4.5%) | | | | | | | |

Bear Stearns Structured Products, Inc. | | | | | | | |

1.00%, 3/27/36 | | | | (e)5,227 | | 209 | |

1.91%, 7/27/36 | | | | (e)2,375 | | 94 | |

Countrywide Alternative Loan Trust | | | | | | | |

IO | | | | | | | |

1.95%, 3/20/47 | | | | 9,892 | | 549 | |

Residential Accredit Loans, Inc. | | | | | | | |

Zero Coupon, 4/25/47 | | | | (e)850 | | 49 | |

Wamu Alternative Mortgage Pass-Through Certificates | | | | | | | |

IO | | | | | | | |

1.25%, 6/25/46 | | | | 3,148 | | 75 | |

Washington Mutual, Inc. | | | | | | | |

IO | | | | | | | |

0.34%, 9/25/46 | | | | 4,558 | | 46 | |

0.38%, 7/25/46 | | | | 11,212 | | 116 | |

0.52%, 1/25/45 | | | | 6,605 | | 99 | |

| | | | | | 1,237 | |

Collateralized Mortgage Obligation — Non Agency Collateral Series (5.9%) | | | | | | | |

Countrywide Alternative Loan Trust | | | | | | | |

IO | | | | | | | |

1.08%, 9/25/35 | | | | 4,685 | | 103 | |

1.70%, 12/20/46 | | | | 6,995 | | 348 | |

1.85%, 8/25/46 | | | | (h)2,008 | | 80 | |

1.88%, 10/25/35 | | | | 3,632 | | 93 | |

2.25%, 10/25/46 | | | | 12,892 | | 645 | |

3.70%, 7/20/46 | | | | 1,442 | | 56 | |

Countrywide Home Loan Mortgage | | | | | | | |

IO | | | | | | | |

0.68%, 2/25/35 | | | | 1,847 | | 40 | |

1.39%, 2/25/35 | | | | (h)1,998 | | 37 | |

1.67%, 9/25/34 | | | | (h)1,969 | | 44 | |

Harborview Mortgage Loan Trust | | | | | | | |

IO | | | | | | | |

1.69%, 7/19/46 | | | | (h)1,171 | | 42 | |

PO | | | | | | | |

7/19/47 | | | | @— | | @— | |

Harborview NIM Corp. | | | | | | | |

Zero Coupon, 10/20/45 | | | | (e)234 | | 150 | |

| | | | | | 1,638 | |

Finance (0.9%) | | | | | | | |

Popular North America, Inc. | | | | | | | |

5.65%, 4/15/09 | | | | $ | 55 | | $ | 55 | |

USB Capital IX | | | | | | | |

6.19% | | | | (h)(o)60 | | 62 | |

Wachovia Capital Trust III | | | | | | | |

5.80% | | | | (h)(o)130 | | 132 | |

| | | | | | 249 | |

Industrials (0.5%) | | | | | | | |