UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

| I.R.S. Employer | State of | |||||

| Commission File | Registrant, Address of Principal Executive Offices and Telephone | Identification No. | Incorporation | |||

| 1-08788 | NV ENERGY, INC. | 88-0198358 | Nevada | |||

| 6226 West Sahara Avenue | ||||||

| Las Vegas, Nevada 89146 | ||||||

| (702) 402-5000 | ||||||

| 2-28348 | NEVADA POWER COMPANY d/b/a NV ENERGY | 88-0420104 | Nevada | |||

| 6226 West Sahara Avenue | ||||||

| Las Vegas, Nevada 89146 | ||||||

| (702) 402-5000 | ||||||

| 0-00508 | SIERRA PACIFIC POWER COMPANY d/b/a NV ENERGY | 88-0044418 | Nevada | |||

| P.O. Box 10100 (6100 Neil Road) | ||||||

| Reno, Nevada 89520-0024 (89511) | ||||||

| (775) 834-4011 | ||||||

| (Title of each class) | (Name of exchange on which registered) | |

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Securities of NV Energy, Inc.: | ||

| Common Stock, $1.00 par value | New York Stock Exchange | |

| Securities registered pursuant to Section 12(g) of the Act: | ||

| Securities of Nevada Power Company: | ||

| Common Stock, $1.00 stated value | ||

| Securities of Sierra Pacific Power Company: | ||

| Common Stock, $3.75 par value |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act:

NV Energy, Inc. Yesþ Noo Nevada Power Company Yeso Noþ Sierra Pacific Power Company Yeso Noþ

Indicate by check mark if each of the registrants is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yeso Noþ

Indicate by check mark whether each of the registrants (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o (Response applicable to all registrants).

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether any registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (See definitions of “large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act).

NV Energy, Inc.: Large accelerated filer þ Accelerated filer o Non-accelerated filer o Smaller reporting company o

Nevada Power Company: Large accelerated filer o Accelerated filer o Non-accelerated filer þ Smaller reporting company o

Sierra Pacific Power Company: Large accelerated filer o Accelerated filer o Non-accelerated filer þ Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yeso Noþ (Response applicable to all registrants)

State the aggregate market value of NV Energy, Inc.'s common stock held by non-affiliates. As of June 30, 2011: $3,622,247,595

Indicate the number of shares outstanding of each of the issuer’s classes of Common Stock, as of the latest practicable date.

Common Stock, $1.00 par value, of NV Energy, Inc. outstanding at February 21, 2012: 235,999,750 Shares

NV Energy, Inc. is the sole holder of the 1,000 shares of outstanding Common Stock, $1.00 stated value, of Nevada Power Company.

NV Energy, Inc. is the sole holder of the 1,000 shares of outstanding Common Stock, $3.75 par value, of Sierra Pacific Power Company.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of NV Energy, Inc.'s definitive proxy statement to be filed in connection with the annual meeting of shareholders, to be held May 10, 2012, are incorporated by reference into Part III hereof.

This combined Annual Report on Form 10-K is separately filed by NV Energy, Inc., Nevada Power Company and Sierra Pacific Power Company. Information contained in this document relating to Nevada Power Company is filed by NV Energy, Inc. and separately by Nevada Power Company on its own behalf. Nevada Power Company makes no representation as to information relating to NV Energy, Inc. or its subsidiaries, except as it may relate to Nevada Power Company.

Information contained in this document relating to Sierra Pacific Power Company is filed by NV Energy, Inc. and separately by Sierra Pacific Power Company on its own behalf. Sierra Pacific Power Company makes no representation as to information relating to NV Energy, Inc. or its subsidiaries, except as it may relate to Sierra Pacific Power Company.

NV ENERGY, INC.

NEVADA POWER COMPANY

SIERRA PACIFIC POWER COMPANY

2011 ANNUAL REPORT ON FORM 10-K

| Page | |||||

| 4 | |||||

| PART I | |||||

| ITEM 1. | 6 | ||||

| ITEM 1A. | 28 | ||||

| ITEM 1B. | 33 | ||||

| ITEM 2. | 34 | ||||

| ITEM 3. | 35 | ||||

| ITEM 4. | 35 | ||||

| PART II | |||||

| ITEM 5. | 36 | ||||

| ITEM 6. | 38 | ||||

| ITEM 7. | 40 | ||||

| 43 | |||||

| NV Energy, Inc. | |||||

| 53 | |||||

| 53 | |||||

| 54 | |||||

| Nevada Power Company | |||||

| 59 | |||||

| 65 | |||||

| 66 | |||||

| Sierra Pacific Power Company | |||||

| 71 | |||||

| 77 | |||||

| 78 | |||||

| ITEM 7A. | 83 | ||||

| ITEM 8. | 85 | ||||

| 86 | |||||

| NV Energy, Inc. | |||||

| 89 | |||||

| 90 | |||||

| 92 | |||||

| 93 | |||||

| Nevada Power Company | |||||

| 94 | |||||

| 95 | |||||

| 97 | |||||

| 98 | |||||

| Sierra Pacific Power Company | |||||

| 99 | |||||

| 100 | |||||

| 102 | |||||

| 103 | |||||

| Notes to Financial Statements | |||||

| 104 | |||||

| 110 | |||||

| 112 | |||||

| 121 | |||||

| 121 | |||||

| 123 | |||||

| 127 | |||||

| 127 | |||||

| 129 | |||||

| 131 | |||||

| 135 | |||||

| 141 | |||||

| 145 | |||||

| 149 | |||||

| 150 | |||||

| 150 | |||||

| 151 | |||||

| 152 | |||||

| ITEM 9. | 153 | ||||

| ITEM 9A. | 154 | ||||

| ITEM 9B. | 156 | ||||

| PART III | |||||

| ITEM 10. | 156 | ||||

| ITEM 11. | 157 | ||||

| ITEM 12. | 157 | ||||

| ITEM 13. | 157 | ||||

| ITEM 14. | 157 | ||||

| PART IV | |||||

| ITEM 15. | 158 | ||||

| 159 | |||||

| (The following common acronyms and terms are found in multiple locations within the document) | ||

| Acronym/Term | Meaning | |

| 2011 Form 10-K | NVE’s, NPC’s and SPPC’s Annual Report on Form 10-K for the year ended December 31, 2011 | |

| 2012 Proxy Statement | NVE’s, NPC’s and SPPC’s Proxy Statement for 2012 | |

| AFUDC-debt | Allowance for borrowed funds used during construction | |

| AFUDC-equity | Allowance for equity funds used during construction | |

| BCP | Nevada Bureau of Consumer Protection | |

| BOD | Board of Directors | |

| BTER | Base Tariff Energy Rate | |

| BTGR | Base Tariff General Rate | |

| CAISO | California Independent System Operator Corporation | |

| California Assets | SPPC’s California electric distribution and generation assets | |

| CalPeco | California Pacific Electric Company | |

| CALPX | California Power Exchange | |

| CDWR | California Department of Water Resources | |

| CEO | Chief Executive Officer of NV Energy, Inc. | |

| CIAC | Contributions in Aid of Construction | |

| Clark Generating Station | 550 MW nominally rated William Clark Generating Station | |

| Clark Peaking Units | 600 MW nominally rated peaking units at the William Clark Generating Station | |

| CPA | Certified Public Accountant | |

| CPUC | California Public Utilities Commission | |

| CSIP | Common Stock Investment Plan | |

| CWIP | Construction Work-In-Progress | |

| d/b/a | Doing business as | |

| DEAA | Deferred Energy Accounting Adjustment | |

| DOE | Department of Energy | |

| DOS | Distribution Only Service | |

| DSM | Demand Side Management | |

| Dth | Decatherm | |

| EEC | Ely Energy Center | |

| EEIR | Energy Efficiency Implementation Rate | |

| EEPR | Energy Efficiency Program Rate | |

| EPA | United States Environmental Protection Agency | |

| EPS | Earnings Per Share | |

| EROC | Enterprise Risk Oversight Committee | |

| ESP | Energy Supply Plan | |

| ESPP | Employee Stock Purchase Plan | |

| EWAM | Enterprise, Work & Asset Management | |

| FASB | Financial Accounting Standards Board | |

| FASC | FASB Accounting Standards Codification | |

| FERC | Federal Energy Regulatory Commission | |

| Fitch | Fitch Ratings, Ltd. | |

| Ft. Churchill Generating Station | 226 megawatt nominally rated Fort Churchill Generating Station | |

| GAAP | Accounting Principles Generally Accepted in the United States | |

| GBT | Great Basin Transmission, LLC | |

| GBT South | Great Basin Transmission South, LLC, a wholly owned subsidiary of GBT | |

| Goodsprings | 7.5 MW nominally rated Goodsprings Recovered Energy Generating Station | |

| GPSF-B | Global Project & Structured Finance Corporation | |

| GRC | General Rate Case | |

| Harry Allen Generating Station | 142 MW nominally rated Harry Allen Generating Station, expanded in 2011 to 642 total MWs | |

| Higgins Generating Station | 598 MW nominally rated Walter M. Higgins, III Generating Station | |

| IBEW | International Brotherhood of Electrical Workers | |

| Independence Lake | 2,325 acres of forestland in the Sierra Nevada Mountains purchased from NV Energy, Inc. by The Nature Conservancy | |

| IRP | Integrated Resource Plan | |

| IRS | Internal Revenue Service | |

| kV | Kilovolt | |

| kWh | Kilowatt Hour | |

| LDC | Local Distributing Company | |

| Legislature | Nevada State Legislature | |

| Lenzie Generating Station | 1,102 MW nominally rated Chuck Lenzie Generating Station | |

| LIBOR | London Interbank Offered Rate | |

| LTIP | Long-Term Incentive Plan | |

| MMBtu | Million British Thermal Units | |

| Mohave Generating Station | 1,580 MW nominally rated Mohave Generating Station | |

| Moody’s | Moody’s Investors Services, Inc. | |

| MW | Megawatt | |

| MWh | Megawatt hour | |

| NAAQS | National Ambient Air Quality Standards | |

| Navajo Generating Station | 255 MW nominally rated Navajo Generating Station | |

| NDEP | Nevada Division of Environmental Protection | |

| NEDSP | Non-Employee Director Stock Plan | |

| NEICO | Nevada Electrical Investment Company | |

| NERC | North American Electric Reliability Corporation | |

| Ninth Circuit | United States Court of Appeals for the Ninth Circuit | |

| NOL | Net Operating Loss | |

| NPC | Nevada Power Company d/b/a NV Energy | |

| NPC Credit Agreement | $600 million Revolving Credit Facility entered into in April 2010 between NPC and Wells Fargo, N.A., as administrative agent for the lenders a party thereto | |

| NPC’s Indenture | NPC’s General and Refunding Mortgage Indenture dated as of May 1, 2001, between NPC and The Bank of New York Mellon Trust Company N.A., as Trustee | |

| NRSRO | Nationally Recognized Statistical Rating Organization | |

| NVE | NV Energy, Inc. | |

| NV Energize | NVE project which includes Advanced Meter Infrastructure, Smart Grid Technology and Meter Data Management. | |

| NWPP | Northwest Power Pool | |

| OATT | Open Access Transmission Tariff | |

| ON Line | 250 mile 500 kV transmission line connecting NVE’s northern and southern service territories | |

| Peabody | Peabody Western Coal Company | |

| PEC | Portfolio Energy Credit | |

| Piñon Pine | Piñon Pine Coal Gasification Demonstration Project | |

| Portfolio Standard | Nevada Renewable Energy Portfolio Standard | |

| PPC | Piñon Pine Corporation | |

| PPIC | Piñon Pine Investment Company | |

| PUCN | Public Utilities Commission of Nevada | |

| Reid Gardner Generating Station | 325 MW nominally rated Reid Gardner Generating Station | |

| REPR | Renewable Energy Program Rate | |

| RFP | Request for Proposal | |

| ROE | Return on Equity | |

| ROR | Rate of Return | |

| S&P | Standard & Poor’s | |

| Salt River | Salt River Project | |

| SEC | United States Securities and Exchange Commission | |

| Silverhawk Generating Station | 395 MW nominally rated Silverhawk Generating Station | |

| Smart Meters | Advanced service delivery meters installed as part of the NV Energize project. | |

| SNWA | Southern Nevada Water Authority | |

| SPC | Sierra Pacific Communications | |

| SPPC | Sierra Pacific Power Company d/b/a NV Energy | |

| SPPC Credit Agreement | $250 million Revolving Credit Facility entered into in April 2010 between SPPC and Bank of America, N.A., as administrative agent for the lenders a party thereto | |

| SPPC’s Indenture | SPPC’s General and Refunding Mortgage Indenture, dated as of May 1, 2001, between SPPC and The Bank of New York Mellon Trust Company N.A., as Trustee | |

| SPR | Sierra Pacific Resources | |

| SRSG | Southwest Reserve Sharing Group | |

| TMWA | Truckee Meadows Water Authority | |

| Tracy Generating Station | 541 MW nominally rated Frank A. Tracy Generating Station | |

| TRED | Temporary Renewable Energy Development | |

| TSR | Total Shareholder Return | |

| TUA | Transmission Use Agreement | |

| U.S. | United States of America | |

| Utilities | Nevada Power Company and Sierra Pacific Power Company | |

| Valmy Generating Station | 261 MW nominally rated Valmy Generating Station | |

| VIE | Variable Interest Entity | |

| WECA | Western Energy Crisis Adjustment | |

| WSPP | Western Systems Power Pool |

FORWARD LOOKING STATEMENTS

The discussion of forward looking statements in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, is incorporated herein by reference.

ITEM 1. BUSINESS

NV Energy, Inc. is an investor-owned holding company that was incorporated under Nevada law on December 12, 1983. The company’s stock is traded on the New York Stock Exchange under the symbol “NVE”. NVE’s mailing address is P.O. Box 98910 (6226 West Sahara Avenue), Las Vegas, Nevada 89151.

NVE has four primary, wholly-owned subsidiaries: Nevada Power Company d/b/a NV Energy, Sierra Pacific Power Company d/b/a NV Energy, NVE Insurance Company, Inc. and Lands of Sierra. References to NVE refer to the consolidated entity, except where the context provides otherwise. NPC and SPPC are referred to collectively in this report as the “Utilities”.

The Utilities operate three business segments, as defined by the Segment Reporting Topic of the FASC: NPC electric; SPPC electric; and SPPC natural gas. Electric service is provided by NPC to Las Vegas and surrounding Clark County, and by SPPC to northern Nevada. Natural gas service is provided by SPPC in the Reno-Sparks area of Nevada. The Utilities are the major contributors to NVE’s financial position and results of operations. Other subsidiaries either do not meet the definition of a segment or are below the quantitative threshold for separate segment disclosure and are combined under “all other” in the following pages. Parenthetical references are included after each major section title to identify the specific entity or entities addressed in the section. See Note 2, Segment Information, of the Notes to Financial Statements, for further discussion.

NPC is a Nevada corporation organized in 1929 and, by itself and through a predecessor corporation, has been providing electric services to southern Nevada since 1906. NPC became a subsidiary of NVE in July 1999. Its mailing address is P.O. Box 98910 (6226 West Sahara Avenue), Las Vegas, Nevada 89151.

NEICO is a wholly-owned subsidiary of NPC. NEICO is a 25% member of Northwind Aladdin, LLC, the other 75% of Northwind Aladdin, LLC is owned by Macquarie Infrastructure Company Trust.

A Nevada corporation since 1965, SPPC was originally incorporated in Maine in 1912. SPPC became a subsidiary of NVE in 1984. Its mailing address is P. O. Box 10100 (6100 Neil Road), Reno, Nevada 89520-0024.

SPPC has three primary, wholly-owned subsidiaries: GPSF-B, PPC and PPIC. GPSF-B, PPC and PPIC, collectively, own Piñon Pine Company, LLC, which was formed to utilize federal income tax credits available under Section 20 of the Internal Revenue Code associated with the alternative fuel (syngas) produced by the coal gasifier located at the Piñon Pine facility.

Periodic reports for NVE, NPC and SPPC on Form 10-K and Form 10-Q and current reports on Form 8-K are made available to the public, free of charge, on NVE’s website (www.nvenergy.com) through links on this website to the SEC’s website at www.sec.gov, as soon as reasonably practicable after they have been filed with the SEC. The contents of the above referenced website address are not part of this Form 10-K. The public may also read any copy of materials filed with the SEC by NVE, NPC or SPPC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-(800) SEC-0030. Reports, proxy and information statements, and other information regarding NVE, NPC and SPPC may also be obtained directly from the SEC’s website. Available on the nvenergy.com website are the code of ethics for the chief executive officer, chief financial officer and controller, charters for the Audit, Compensation, Finance, and Nominating and Governance Committees of NVE’s BOD and our corporate governance and standards of conduct guidelines. Printed copies of these documents may be obtained free of charge by writing to NVE’s Corporate Secretary at NV Energy, Inc., 6226 West Sahara Avenue, Las Vegas, Nevada 89146.

The statistical data used throughout this 2011 Form 10-K, other than data relating specifically solely to NVE and its subsidiaries, are based upon independent industry publications, government publications, reports by market research firms or other published independent sources. We did not commission any of these publications or reports. These publications generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy or completeness of such information. While we believe that each of these studies and publications is reliable, we have not independently verified such data and make no representation as to the accuracy of such information.

Overview

NPC and SPPC are public utilities that generate, transmit and distribute electric energy in Nevada and, in the case of SPPC, also delivers natural gas service. At year-end 2011, NVE served approximately 1.2 million electric customers, of which 840,000 electric customers primarily in Las Vegas, North Las Vegas, Henderson and adjoining areas were served by NPC, and approximately 323,000 electric customers in an approximate 50,000 square mile area of western, central and northeastern Nevada, including the cities of Reno, Sparks, Carson City, and Elko were served by SPPC. Additionally, SPPC provided natural gas service to approximately 152,000 customers in an area of about 800 square miles in Nevada’s Reno/Sparks area.

Major industries served by the Utilities include gaming/recreation, mining, warehousing/manufacturing and governmental entities. The Utilities’ revenues and operating income are subject to fluctuations during the year due to the impacts that seasonal weather, rate changes and customer usage patterns have on demand for electric energy and services. NPC is a summer peaking utility, experiencing its highest retail energy sales in response to the demand for air conditioning. SPPC’s electric system peak also occurs in the summer, with a slightly lower peak demand in the winter. SPPC’s gas business typically peaks in the winter months due to heating demands.

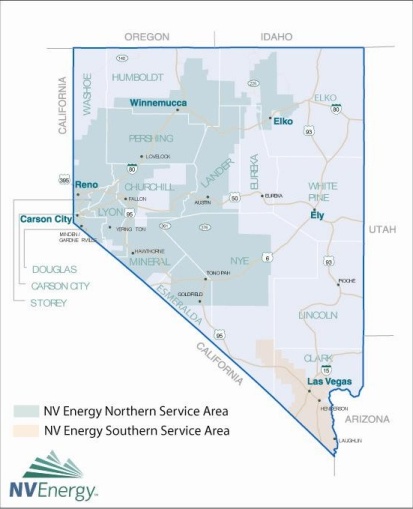

NPC and SPPC service territories are as follows:

Beginning in 2006, the Utilities embarked on a three part energy strategy to manage resources against their load by encouraging energy efficiency and conservation programs, the purchase and development of renewable energy projects, construction of generating facilities and expanding transmission capability in an effort to reduce their reliance on purchased power. This strategy was initiated at a time when the Utilities were experiencing high growth which required significant capital investment in order to meet customer demands and also to establish self sufficiency and energy independence by building our own generating stations. As customer growth and demand have stabilized, the Utilities are transitioning from an emphasis on capital investment to an emphasis on optimizing our assets and resources. A key element in the evolution of our energy strategy will be our ability to control both operating and maintenance expense as well as capital spending.

Executing the evolution of the energy strategy

The completion of the Harry Allen Generating Station marked a notable transition in the evolution of our strategy. Outlined below is the evolution of our energy strategy:

Three Part Energy Strategy------------------------------------------------------------------------------------------------àEvolution of Energy Strategy | |

| Increase energy efficiency, conservation | Empower customers through more focused energy efficiency programs |

| Expand renewable energy initiatives and investments | Pursue cost-effective renewable energy initiatives |

| Add new generation and transmission | Optimize generation efficiency and transmission |

| Engage employees to improve processes, reduce costs and enhance performance | |

Empower customers through focused energy efficiency programs

The Utilities will continue with the implementation of NV Energize which not only provides metering and customer service operating savings, but will also provide customers with better opportunities to become more energy efficient. NVE’s traditional conservation and energy efficiency programs, which have focused on behavioral change and technology replacement, will be enhanced by the new features enabled by NV Energize. Customers will have access to better information to help them manage their usage and select from enhanced energy efficiency options, including demand response and pricing programs. In 2011, NVE installed approximately 695,000 smart meters in southern Nevada and expects to have 1.4 million installed statewide by the end of 2012. The NV Energize capabilities will allow NVE to help customers implement the most cost-effective mix of energy efficiency and conservation options that will also qualify toward fulfillment of the Portfolio Standard.

Pursue cost-effective renewable energy initiatives

NVE must strive to effectively balance the need to meet the Portfolio Standard, with the changes in load forecast and the uncertainty of renewable energy project development, either for financial or resource related reasons. While NVE is better positioned to meet this challenge based on recent renewable successes, NVE remains committed to incorporating clean, cost-effective renewable energy into its portfolio. As part of this continued commitment, NVE will continue to seek the best and most cost effective opportunities that will benefit our state, customers and environment. Depending on its needs and continuous analysis of the existing portfolio, NVE has a number of tools available to seek renewable energy values for our customers. These tools may include issuing requests for proposals for new renewable energy contracts, exploring opportunities to either jointly construct or develop projects using wind, geothermal and solar, undertaking additional short-term purchases from existing renewable facilities and restructuring existing renewable relationships for the benefit of our customers.

The Portfolio Standard requires a specific percentage of an electric service provider’s total retail energy sales to be obtained from renewable energy resources. Renewable resources include biomass, geothermal, solar, waterpower, wind and qualified recovered energy generation projects. In addition, the Portfolio Standard allows energy efficiency measures from qualified conservation programs to meet up to 25% of the portfolio percentage. In 2012, the Utilities are required to obtain an amount of PECs equivalent to 15% of their total retail energy from renewables. Currently, the Portfolio Standard increases to 18% for 2013 and 2014, to 20% in 2015, after which it increases to 22% for the years 2020 through 2024, and to 25% for 2025 and beyond. Moreover, not less than 5% of the total Portfolio Standard must be satisfied from solar resources until 2016 when a minimum of 6% must be solar.

The Utilities acquire PECs through competitively-priced purchase power contracts, investments in renewable generating facilities and DSM programs. NVE seeks to meet the standard using the most cost-effective means for our customers and to pursue the best-value options that are available to the Utilities. In addition to the foregoing, this may also include economical short-term purchases of PECs (usually from outside of Nevada) to fulfill projected shortfalls due to the attrition or timing of development of renewable energy projects, weather variability or other supplier issues.

Optimize generation efficiency and transmission facilities

Since 2006, when NVE began its energy independence initiative, we have added over 3,800 MWs (nominally rated) of internal generation and, with the completion of Harry Allen Generating Station, NVE may obtain approximately 80% of its energy from internal generation. In 2012, NVE’s management will continue to strive to optimize the Utilities’ energy portfolio in order to meet load obligations in a cost effective and reliable manner. In addition, to the extent the Utilities have the economical opportunity to sell excess capacity or energy, they may enter into such transactions to reduce overall energy costs. NVE anticipates it will have sufficient resources to meet its forecasted load requirements for 2012. However, resource adequacy could be affected by a number of factors, including the unplanned retirement of generating stations, plant outages, the timing of commercial operation of renewable energy projects and associated purchase power agreements, customer behavior with respect to energy efficiency and conservation programs, and environmental regulations which may limit our ability to operate certain generating units.

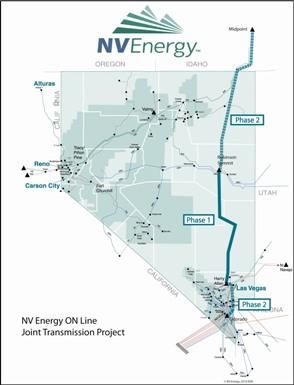

NVE will continue with the construction of the ON Line which will enable us to optimize our transmission capabilities. Upon completion, the ON Line will connect NVE’s southern and northern service territories and, pending certain state and federal regulatory approvals, will provide the ability to jointly dispatch energy throughout the state and provide access to renewable energy resources in parts of northern and eastern Nevada, which will enhance NVE’s ability to manage its Portfolio Standard, discussed above, and optimize its generating facilities.

ON Line is Phase 1 of a Joint Project between the Utilities and GBT-South. The Joint Project consists of two phases. In Phase 1 of the Joint Project, the parties would complete construction of a 500 kV interconnection between the Robinson Summit substation on the SPPC system and the Harry Allen substation on the NPC system. The Utilities own a 25% interest in ON Line and have entered into a TUA with GBT-South for its 75% interest in ON Line. The Utilities’ 25% interest in ON Line, which approximates $127 million, will be allocated 95% and 5% to NPC and SPPC, respectively. The Utilities will have rights to 100% of the capacity of ON Line, which is estimated to be approximately 600 MW. If GBT elects to construct Phase 2, it would construct two additional transmission segments at either end of ON Line: one extending from Robinson Summit north to Midpoint, Idaho, and the other commencing at the Harry Allen substation and interconnecting south to the Eldorado substation. GBT would pay for and own 100% of Phase 2 facilities. However, NPC and SPPC would have rights to additional transmission capacity from Midpoint to Eldorado (for a total of approximately 760 MW based on a rating of 2,000 MW for the complete path).

In February 2012, NVE announced ON Line will be delayed by at least three months. ON Line was previously expected to be in service by December 31, 2012. The delay is attributed to addressing recent wind-related damage sustained by some of the tower structures. As a result of the damage and as a precautionary measure, the ON Line owners have directed construction crews to lay down certain existing tower structures and cease erection of further tower structures until the owners have completed an assessment of the situation. Other construction activities that are focused on safety and are unrelated to the wind-damage are continuing while the owners work to resolve and repair the wind-related damage, ascertain the root causes of the damage, and otherwise determine what project modifications will be necessary to ensure project safety and reliability. As a result, NVE is also delaying the merger application of the Utilities.

Engage employees to improve processes, reduce costs and enhance performance

The Utilities will continue to control operating and maintenance and capital costs through diligent review and process improvement initiatives by providing appropriate tools to our employees to find ways to reduce costs, improve processes, and enhance performance. This is particularly important at a time when customer growth is low. Going forward this will continue to be an over-arching theme of the evolution of our energy strategy. Our goal is to maintain, reduce, or eliminate upward pressure on our customers’ prices while always delivering safe and reliable energy and assure compliance with all laws and regulations.

Business and Competitive Environment

Operations

NPC and SPPC Electric

The Utilities are charged with meeting the energy needs of Nevada. Revenues are impacted by rate changes, cost of fuel and purchased power, seasonal or atypical weather and customer use. The Utilities’ electric peak demand occurs in the summer. Therefore, the Utilities’ revenues and associated expenses are not incurred or generated evenly throughout the year.

To serve their customer base, the Utilities generate electricity and purchase power in accordance with an ESP, as discussed in more detail later in this section, under Energy Supply.

SPPC Gas

The Gas LDC is responsible for providing natural gas to residential, commercial and industrial customers. SPPC is well connected with several major gas producing regions and gas transportation systems into northern Nevada. SPPC’s gas distribution system receives gas supplies from two interstate natural gas pipelines, the Paiute Pipeline Company and the Tuscarora Gas Transmission Company. In addition, SPPC has contracted for natural gas storage services to supplement firm and spot market purchases.

Regulatory Environment

The FERC and PUCN regulate portions of the Utilities’ accounting practices and electricity and natural gas rates. The FERC has jurisdiction under the Federal Power Act with respect to wholesale rates, service, interconnection, accounting, and other matters in connection with the Utilities sale of electricity for resale and interstate transmission. The FERC also has jurisdiction over the natural gas pipeline companies from which the Utilities buy transportation for natural gas. The PUCN has authority over rates charged to retail customers, the issuance of securities by the Utilities and transactions with affiliated parties.

Nevada state regulations require the Utilities to file electric GRCs every three years with the PUCN to adjust rates, based primarily on cost of service and return on investment. Nevada state regulations also require the Utilities to file annual DEAA applications to either recover or refund electric balances that have been deferred and that represent the difference between fuel and purchased power costs actually incurred and the amounts collected in current retail rates. Additionally, the Utilities may file to reset BTERs quarterly, based on the last 12 months fuel and purchased power costs. Moreover, in 2010, the PUCN adopted regulations authorizing an electric utility to recover an amount from its customers that is attributable to the measurable and verifiable effects associated with the Utilities’ implementation of energy efficiency and conservation programs approved by the PUCN. In addition, the regulation approved the transition of the recovery of energy efficiency program costs from general rates (filed every three years to recover through independent annual rate filings). The Utilities filed their first rate case with respect to this new regulation, referred to by the Utilities as the EEIR and EEPR, in October 2010 and will continue to file rate cases annually in March, thereafter. In 2011, the Legislature passed Assembly Bill 215 which allows an electric or gas utility that adjusts its BTER on a quarterly basis to request PUCN approval to make quarterly changes to its DEAA rate if the request is in the public interest. The Utilities will still be required to file an annual DEAA case to review costs for prudency and reasonableness, and if any costs are disallowed on such grounds, the disallowance will be incorporated into the next subsequent quarterly rate change. The PUCN approved the Utilities filings to implement quarterly changes to their DEAA rates. See Note 3, Regulatory Actions, of the Notes to Financial Statements, for further discussion on the various rate cases.

The PUCN regulations also require a Gas Supply Report as well as a Gas Informational Report to be filed annually. SPPC may also file gas GRCs to adjust gas division rates including cost of service and return on investment. Rate cases are discussed in more detail in Note 3, Regulatory Actions, of the Notes to Financial Statements.

Competition

NPC and SPPC Electric

The Utilities operate under certificates of public convenience and necessity as regulated by the PUCN, as well as franchise agreements with local governments in their respective operating areas. Under Nevada state law, commercial customers with an average annual load of 1 MW or more may file a letter of intent and application with the PUCN to acquire electric energy, capacity, and ancillary services from another provider. The law requires customers wishing to choose a new supplier to receive the approval of the PUCN and meet public interest standards. In particular, departing customers must secure new energy resources that are not under contract to NPC or SPPC, the departure must not burden the Utilities with increased costs or cause any remaining customers to pay increased costs, and the departing customers must pay their portion of any deferred energy balances. The PUCN adopted regulations prescribing the criteria that will be used to determine if there will be negative impacts to remaining customers or to the Utilities. Customers wishing to choose a new supplier must provide 180-day notice to NPC or SPPC. The Utilities would continue to provide transmission, distribution, metering, and billing services to such customers.

Currently, there are no material applications pending with the PUCN to exit the system in NPC’s or SPPC’s service territory. In the event a customer were to exit the system, we do not expect the departure to have a material impact on the Utilities net income.

SPPC Gas

SPPC’s natural gas LDC business is subject to competition from other suppliers and other forms of energy available to its customers. Large gas customers using 12,000 therms per month with fuel switching capability are allowed to participate in the Incentive Natural Gas Rate tariff. Once a service agreement has been executed, a customer can compare natural gas prices under this tariff to alternative energy sources and choose their source of fuel. Additionally, customers using greater than 1,000 therms per day have the ability to secure their own gas supplies under the Transportation Tariff. As of January 1, 2012, there were 17 large customers securing their own supplies. These customers have a combined firm distribution load of approximately 5,982 Dth per day. Transportation customers continue to pay firm and interruptible distribution charges. These customers are responsible for procuring and paying for their own gas supply, which reduces SPPC’s purchases, but does not have an impact on net income.

Sales

In 2011, NPC’s and SPPC’s electric revenues were approximately $2.1 billion and $716.4 million, respectively. SPPC’s natural gas business accounted for approximately $172.5 million in 2011 operating revenues or 19.4% of SPPC’s total revenues. NPC’s peak electric load decreased at an average annual growth rate of 0.3% over the past five years, while SPPC’s decreased by 2.3%. In 2011, NPC’s and SPPC’s electric system peaks were 5,539 MW and 1,513 MW, respectively, compared to 5,604 MW and 1,611 MW, respectively, in 2010. NPC’s total retail electric MWh sales have decreased at an average annual growth rate of 0.3% over the past five years; and total retail electric MWh sales declined slightly in 2011 compared to 2010 as discussed below. SPPC’s total retail electric MWh sales have decreased at an average annual growth rate of 2.6% over the past five years primarily due to a decrease in mining customers discussed below.

NPC’s electric customers by class contributed the following MWh sales:

| MWh Sales | ||||||||||||||||||||||||

| 2011 | 2010 | 2009 | ||||||||||||||||||||||

| MWh | % of Total | MWh | % of Total | MWh | % of Total | |||||||||||||||||||

| Retail: | ||||||||||||||||||||||||

| Residential | 8,523,321 | 41.1 | % | 8,684,386 | 41.6 | % | 8,893,542 | 41.8 | % | |||||||||||||||

| Commercial & Industrial: | ||||||||||||||||||||||||

| Gaming/Recreation/Restaurants | 3,171,853 | 15.3 | % | 3,215,710 | 15.4 | % | 3,392,658 | 16.0 | % | |||||||||||||||

| All Other Retail | 8,834,305 | 42.5 | % | 8,742,166 | 41.9 | % | 8,670,931 | 40.8 | % | |||||||||||||||

| Total Retail | 20,529,479 | 98.9 | % | 20,642,262 | 98.9 | % | 20,957,131 | 98.6 | % | |||||||||||||||

| Wholesale | - | - | 1,262 | - | 69,915 | 0.3 | % | |||||||||||||||||

| Sales to Public Authorities | 225,518 | 1.1 | % | 231,072 | 1.1 | % | 240,302 | 1.1 | % | |||||||||||||||

| Total | 20,754,997 | 100 | % | 20,874,596 | 100 | % | 21,267,348 | 100 | % | |||||||||||||||

Total retail MWh sales decreased approximately 0.5% in 2011 from 2010, primarily due to a decrease in customer usage due to milder summer weather in 2011 and conservation programs, partially offset by a slight increase in customers. NPC’s average residential and commercial customers increased by 1.1% and 0.4%, respectively, while average industrial customers decreased by 1.9%.

Although the unemployment rate remains above the national average in Las Vegas, the unemployment rate has improved significantly over the past year. Additionally, the economy in Southern Nevada has begun to see another sign of improvement, as visitor volumes begin to return to levels seen in 2007 before the recession. However, population growth is likely to be moderate until the economy strengthens both locally and nationally.

| SPPC’s electric customers by class contributed the following MWh sales: |

| MWh Sales | ||||||||||||||||||||||||

| 2011 | 2010 | 2009 | ||||||||||||||||||||||

| MWh | % of Total | MWh | % of Total | MWh | % of Total | |||||||||||||||||||

| Retail: | ||||||||||||||||||||||||

| Residential | 2,231,107 | 26.9 | % | 2,465,049 | 30.4 | % | 2,502,537 | 30.5 | % | |||||||||||||||

| Commercial & Industrial: | ||||||||||||||||||||||||

| Mining | 1,578,195 | 19.0 | % | 1,506,866 | 18.6 | % | 1,405,087 | 17.2 | % | |||||||||||||||

| All Other Retail | 3,838,649 | 46.3 | % | 4,108,834 | 50.6 | % | 4,254,749 | 51.9 | % | |||||||||||||||

| Total Retail | 7,647,951 | 92.2 | % | 8,080,749 | 99.6 | % | 8,162,373 | 99.6 | % | |||||||||||||||

| Wholesale | 631,569 | 7.6 | % | 13,797 | 0.2 | % | 14,993 | 0.2 | % | |||||||||||||||

| Sales to Public Authorities | 16,061 | 0.2 | % | 16,459 | 0.2 | % | 16,535 | 0.2 | % | |||||||||||||||

| Total | 8,295,581 | 100 | % | 8,111,005 | 100 | % | 8,193,901 | 100 | % | |||||||||||||||

Total retail MWh sales decreased approximately 5.4% in 2011 from 2010, primarily due to the sale of California Assets on January 1, 2011. Excluding California, retail sales increased 1.5% in 2011, which are now reported in wholesale MWh sales. Contributing to the increase in MWhs was a 2.0% increase in residential usage primarily due to colder weather, and a 4.8% increase in

11

mining usage in 2011. Excluding California, SPPC’s average number of residential and commercial customers increased by 0.4% and 0.9%, respectively, while industrial customers decreased by 1.8%.

Mining is a leading industry in northern Nevada and comprises one of SPPC’s largest classes of customers. In 2009, SPPC saw a decline in usage of mining customers as they switched to DOS service; however, in 2010 and 2011, mining customer usage increased as a result of a mining customer who restored operations in October 2009 and an increase in mining activity due to the elevated price of gold.

Similar to southern Nevada, northern Nevada is seeing modest improvement in economic indicators and the economic recovery in the North is expected to be slow and dependent on the economy of neighboring states in addition to the national economy.

SPPC has long-term electric service agreements with eight of its largest commercial and industrial customers, with yearly revenues under these agreements totaling approximately $61 million. For 2011, this represented approximately 8.5% of SPPC’s electric operating revenues of approximately $716.4 million. Such agreements include requirements for customers to maintain minimum demand and load factor levels. In addition, they include provisions to recover all investments for customer-specific facilities that have been made by SPPC on their behalf.

Commercial customers who receive approval from the PUCN to acquire electric energy, capacity, and ancillary services from another provider, and who may have previously received service from SPPC under terms of a long-term service agreement, will migrate to being served under the provisions of a DOS agreement. Under a DOS agreement, customer-specific facilities charges will continue to be collected along with a flat distribution charge per meter.

Heating Degree Days (HDD) and Cooling Degree Days (CDD)

MWh usage may be affected by the change in heating degree or cooling degree days in a given year. A Degree Day indicates how far that day's average temperature departed from 65° F. HDDs measure heating energy demand and indicates how far the average temperature fell below 65° F. CDDs measure cooling energy demand and indicates how far the temperature averaged above 65° F. For example, if a location had a mean temperature of 60° F on day 1 and 80° F on day 2, there would be 5 HDDs (65 minus 60) and 0 CDDs for day 1. In contrast, there would be 0 HDDs and 15 CDDs (80 minus 65) for day 2.

The following table shows the heating degree days and cooling degree days within NPC’s and SPPC’s service territories for each of the last three years:

| 2011 | 2010 | 2009 | ||||||||||

| Change From | Change From | |||||||||||

| Amount | Prior Year | Amount | Prior Year | Amount | ||||||||

| NPC | ||||||||||||

| HDD | 2,040 | 7.7% | 1,895 | 0.3% | 1,889 | |||||||

| CDD | 3,540 | (3.0)% | 3,648 | (3.7)% | 3,790 | |||||||

| SPPC | ||||||||||||

| HDD | 5,112 | 5.0% | 4,868 | (2.7)% | 5,004 | |||||||

| CDD | 964 | 4.6% | 922 | (13.8)% | 1,069 | |||||||

| Data Source: National Weather Service | ||||||||||||

Demand

Load and Resources Forecast

NPC’s peak electric demand decreased in 2011 to 5,539 MWs from 5,604 MWs in 2010. SPPC’s peak electric demand decreased in 2011 to 1,513 MWs from 1,611 MWs in 2010. Variations in energy usage occur as a result of varying weather conditions, economic conditions, and other energy usage behaviors, such as conservation efforts by our customers. These variations necessitate a continual balancing of loads and resources, and requires both purchases and sales of energy under short and long-term contracts and the prudent management and optimization of available resources.

The Utilities plan to meet their customers’ needs through a combination of company-owned-generation and purchased power. See the Generation section and Purchased Power section below for details of the Utilities’ generation and contracts for purchased power. Remaining needs will be met through power purchases through RFPs or short-term purchases. As shown in the tables below, the Utilities have sufficient resources to meet anticipated customer requirements. However, resource adequacy may be affected by a variety of factors including, but not limited to, the unplanned retirement of generating stations, the timing or

12

achievement of commercial operation with respect to renewable energy power projects not yet commercially operable, as well as the intermittent reliability of renewable energy resources, customer behavior with respect to energy efficiency and conservation programs and environmental regulations which may limit our ability to operate certain generating units. Resource adequacy provides the Utilities the ability to maintain a reliable supply of energy; however as discussed under Resource Optimization, to the extent the resources are not needed, the Utilities will attempt to sell their additional availability in an effort to reduce costs.

Below are tables as of December 31, 2011, summarizing the forecasted summer electric capacity requirement and resource needs of the Utilities after consideration of energy conservation programs (assuming no curtailment of supply or load, and normal weather conditions) and the completion of ON Line, as discussed in the Transmission section later, subject to change:

| Forecasted Electric Capacity Requirements and Resources (MW) | ||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||||||||

| NPC | ||||||||||||||||||||

Total requirements(1) | 6,257 | 6,089 | 6,115 | 6,191 | 6,285 | |||||||||||||||

| Resources: | ||||||||||||||||||||

Company-owned generation(2) | 4,575 | 4,570 | 4,570 | 4,570 | 4,792 | |||||||||||||||

| Contracts for power purchases | 1,706 | 1,640 | 1,417 | 1,417 | 1,195 | |||||||||||||||

| Contracts for renewable energy power purchases, not | ||||||||||||||||||||

yet commercially operable(3) | 32 | 76 | 167 | 180 | 180 | |||||||||||||||

| Total resources | 6,313 | 6,286 | 6,154 | 6,167 | 6,167 | |||||||||||||||

Total additional required (additional resources)(4) | (56 | ) | (197 | ) | (39 | ) | 24 | 118 | ||||||||||||

| (1) | Includes projected system peak load plus 12% planning reserves. The decrease in total requirements from 2012 to 2013 is primarily due to an expected decrease in demand as a result of energy efficiency and conservation programs. |

| (2) | Includes 232 MWs of peaking capacity at Reid Gardner Generating Station Unit No. 4, which is co-owned with CDWR, see Item 2, Properties. |

| (3) | Includes long term purchase power agreements for renewable energy that are not yet commercially operable and/or may not materialize due to project delays, under performance or cancelations. |

| (4) | Total additional required is the difference between the total requirements and total resources. Total additional required represents the amount needed to achieve the total requirement; conversely, additional resources represents resources in excess of the total requirement. |

| Forecasted Electric Capacity Requirements and Resources (MW) | ||||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||||||||

| SPPC | ||||||||||||||||||||

Total requirements(1) | 1,853 | 1,863 | 1,863 | 1,884 | 1,812 | |||||||||||||||

| Resources: | ||||||||||||||||||||

| Company-owned existing generation | 1,519 | 1,519 | 1,466 | 1,466 | 1,383 | |||||||||||||||

| Contracts for power purchases | 407 | 303 | 303 | 303 | 303 | |||||||||||||||

| Total resources | 1,926 | 1,822 | 1,769 | 1,769 | 1,686 | |||||||||||||||

Total additional required (additional resources)(2) | (73 | ) | 41 | 94 | 115 | 126 | ||||||||||||||

| (1) | Includes projected system peak load plus 15% planning reserves. |

| (2) | Total additional required represents the difference between the total requirements and total resources. Total additional required represents the amount needed to achieve the total requirement; conversely, additional resources represents resources in excess of the total requirement. |

Resource Optimization

Resource optimization entails the prudent purchase and sale of electric power, fuel and financial energy products by the Utilities. The Utilities optimize their portfolios continuously in order to meet load obligations in a cost effective and reliable manner within transmission constraints. The Utilities continuously monitor the resources available to meet load obligations, recognizing the uncertainty not only in system conditions, such as planned and unplanned outages of generating or transmission facilities, but also in regional energy markets organized across different commodities, locations, demand and trading timeframes. As conditions change and new information becomes available, the Utilities optimize their portfolios as appropriate to account for changes in load, cost, volatility, reliability and other commercial or technical factors.

Energy Supply

Total System

NPC and SPPC Electric

The Utilities manage a portfolio of energy supply options. The availability of alternate resources allows the Utilities to dispatch its electric generation system in a more cost-effective manner under varying operating and fuel market conditions while maintaining system integrity. During 2011, NPC generated 69.6% of its total system requirements, purchasing the remaining 30.4% as shown below and SPPC generated 50.5% of its total electric energy requirements, purchasing the remaining 49.5% as shown below.

| 2011 | 2010 | 2009 | ||||||||||||||||||||||

| MWh | % of Total | MWh | % of Total | MWh | % of Total | |||||||||||||||||||

| NPC | ||||||||||||||||||||||||

| Gas Generation | 11,687,714 | 54.1 | % | 11,666,152 | 53.6 | % | 12,793,249 | 57.8 | % | |||||||||||||||

| Coal Generation | 3,346,506 | 15.5 | % | 3,739,339 | 17.2 | % | 3,632,385 | 16.4 | % | |||||||||||||||

| Total Generated | 15,034,220 | 69.6 | % | 15,405,491 | 70.8 | % | 16,425,634 | 74.2 | % | |||||||||||||||

| Total Purchased | 6,577,339 | 30.4 | % | 6,350,795 | 29.2 | % | 5,696,555 | 25.8 | % | |||||||||||||||

Total System(1) | 21,611,559 | 100.0 | % | 21,756,286 | 100.0 | % | 22,122,189 | 100.0 | % | |||||||||||||||

| 2011 | 2010 | 2009 | ||||||||||||||||||||||

| MWh | % of Total | MWh | % of Total | MWh | % of Total | |||||||||||||||||||

| SPPC | ||||||||||||||||||||||||

| Gas Generation | 3,254,453 | 36.9 | % | 3,707,666 | 43.0 | % | 3,852,662 | 43.4 | % | |||||||||||||||

| Coal Generation | 1,199,121 | 13.6 | % | 1,412,875 | 16.3 | % | 1,729,466 | 19.5 | % | |||||||||||||||

| Total Generated | 4,453,574 | 50.5 | % | 5,120,541 | 59.3 | % | 5,582,128 | 62.9 | % | |||||||||||||||

| Total Purchased | 4,368,036 | 49.5 | % | 3,509,767 | 40.7 | % | 3,296,482 | 37.1 | % | |||||||||||||||

Total System(1) | 8,821,610 | 100.0 | % | 8,630,308 | 100.0 | % | 8,878,610 | 100.0 | % | |||||||||||||||

(1) Included in Total System is expected energy waste resulting from the transmission of electrical energy across power lines.

As a supplement to their own generation, the Utilities purchase spot, short-term firm, intermediate-term firm, long-term firm, and non-firm energy to meet its customer demand requirements. The Utilities decision to purchase this energy is based on economics, mitigation of availability risk, and transmission availability. Firm block purchases are transacted to ensure that needed firm capacity is available over peak load periods. Spot market energy is purchased based on the economics of purchasing “as-available” energy when it is less expensive than the Utilities own generation, again, subject to transmission availability.

NPC’s total system decreased 0.7% in 2011 compared to 2010. In 2011, NPC’s total generated decreased 2.4% from 2010 while purchased power MWhs increased 3.6% compared to 2010. SPPC’s total system increased 2.2% in 2011 compared to 2010. In 2011, SPPC’s purchased power total MWhs increased 24.5% compared to 2010, while generation decreased 13%. See Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional information regarding the Utilities’ total system. Also see Energy Supply, later, for discussion of the Utilities purchasing strategies.

Generation

In 2011, NPC completed construction of a 484 MW (summer peak) combined cycle natural gas generating station at the existing Harry Allen Generating Station. Sunrise Station Units 1 & 2 (summer peak 150 MW) were retired with PUCN approval on December 31, 2011.

NPC’s generation capacity consists of a combination of 44 gas and coal generating units with a combined summer capacity of 4,343 MWs as described in Item 2, Properties. In 2011, NPC generated 69.6% of its total system requirements.

SPPC’s generation capacity consists of a combination of 19 gas, oil and coal generating units with a combined summer capacity of 1,519 MWs as described in Item 2, Properties. In 2011, SPPC generated 50.5% of its total system requirements.

Fuel Sources

The Utilities’ 2011 fuel sources for electric generation were primarily provided by natural gas and coal. The average costs of gas and coal, including hedging costs, for energy generation per MMBtu for the years 2007 through 2011, along with the percentage contribution to the Utilities’ total fuel sources were as follows:

| NPC Electric | Average Consumption Cost & Percentage Contribution to Total Fuel | |||||||||

| Gas | Coal | |||||||||

| $/MMBtu | Percent | $/MMBtu | Percent | |||||||

| 2011 | 4.66 | 71.3% | 2.32 | 28.7% | ||||||

| 2010 | 5.73 | 68.5% | 2.21 | 31.5% | ||||||

| 2009 | 5.09 | 71.8% | 2.23 | 28.2% | ||||||

| 2008 | 7.79 | 66.5% | 2.17 | 33.5% | ||||||

| 2007 | 6.32 | 64.4% | 1.89 | 35.6% | ||||||

For a discussion of the change in fuel costs, see Results of Operations in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

In 2011, NPC transitioned from a three season ahead physical gas laddering strategy to a four season ahead physical gas laddering strategy to cover the time period beginning with summer season 2012. NPC employs two seasonal competitive bidding processes each year. The physical gas is procured at an appropriate industry index during the month of current delivery. No fixed price transactions were executed during 2011. All natural gas is delivered to NPC through the use of firm gas transport contracts. Monthly and daily gas supply adjustments are made based on the current energy marketplace and operational considerations.

NPC utilizes a laddered strategy with respect to coal supply and has two long term coal contracts with Arch Coal Sales Company and one with Andalex Resources, Inc. These contracts represent 90% of projected coal requirements for 2012, 68% for 2013 and 12% for 2014.

As of December 31, 2011, NPC’s Reid Gardner Generating Station coal inventory level was 237,970 tons, or approximately 70 days of consumption at 100% capacity.

A take or pay transportation services contract with the Union Pacific Railroad Company provides for deliveries from the Provo, Utah interchange, as well as various mines in Utah, Colorado and Wyoming, to the Reid Gardner Generating Station in Moapa, Nevada extends through 2014.

Coal for the Navajo Generating Station, which is jointly owned by six entities and operated by Salt River Project, is obtained under a Coal Sales Agreement with Peabody Coal Company that extends through 2019. Coal is supplied from surface mining operations conducted on Navajo Nation and Hopi Tribe reservation lands on the Black Mesa in Arizona.

To secure gas supplies for the generating stations that NPC either owns or has under long-term contract (tolling arrangements), NPC contracted for firm winter, summer, and annual gas supplies with numerous domestic suppliers. In 2011, for generating stations located in NPC’s control area, seasonal and monthly gas supply net purchases averaged approximately 268,428 Dth per day, with the winter period contracts averaging approximately 219,492 Dth per day, and the summer period contracts averaging approximately 302,958 Dth per day.

Listed below is NPC’s transportation portfolio as of December 31, 2011:

| Firm Transportation Capacity | Dth per day firm | Term | |||||

| Kern River | 50,000 | Summer | |||||

| Kern River | 374,925 | Annual | |||||

| Kern River (Backhaul) | 134,000 | Annual | |||||

| Southwest Gas | 5,200 | Summer | |||||

| Southwest Gas | 45,000 | Annual | |||||

| Southwest Gas | 288,000 | Annual | |||||

Domestic gas supplies are accessed utilizing gas transport service from Kern River directly to Lenzie, Silverhawk, Higgins, Harry Allen, and Reid Gardner (for start-up only) Generating Stations or from Kern River to SWG and then to LV Cogen 1, LV Cogen 2, Clark, and Sunpeak Generating Stations.

| SPPC Electric | Average Consumption Cost & Percentage Contribution to Total Fuel | |||||||||

| Gas | Coal | |||||||||

| $/MMBtu | Percent | $/MMBtu | Percent | |||||||

| 2011 | 5.60 | 66.5% | 2.73 | 33.5% | ||||||

| 2010 | 6.54 | 66.4% | 2.32 | 33.6% | ||||||

| 2009 | 7.98 | 63.5% | 2.12 | 36.5% | ||||||

| 2008 | 8.95 | 57.6% | 2.09 | 42.4% | ||||||

| 2007 | 8.34 | 58.0% | 1.93 | 42.0% | ||||||

For a discussion of the change in fuel costs, see Results of Operations in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Similar to NPC discussed above, in 2011, SPPC transitioned to a four season ahead laddering strategy to procure gas. No fixed price transactions were executed during 2011. Therefore, the physical gas prices are set at an appropriate industry index during the month of current delivery. All natural gas is delivered to SPPC through the use of firm gas transport contracts. Monthly and daily gas supply adjustments are made based on the current energy marketplace and operational considerations.

SPPC utilizes a laddered strategy with respect to coal supply and has long-term coal contracts with Black Butte Coal Company and Arch Coal Sales Company. These contracts represent 100% of the Valmy Generating Station’s projected coal requirements in 2012, 65% for 2013, 50% for 2014, and 40% for 2015.

A Transportation Services Contract with Union Pacific Railroad Company that provides for deliveries from the Provo, Utah interchange, as well as various mines in Utah, Colorado and Wyoming, to the Valmy Generating Station in Valmy, Nevada extends through 2014.

As of December 31, 2011, the coal inventory level at Valmy Generating Station was 359,066 tons or approximately 132 days of consumption at 100% capacity.

SPPC Gas

SPPC plans its gas transportation and supply to serve a demand that would occur if the average of the high and low temperatures for a given day drops to negative five degrees Fahrenheit, which is estimated to be 190,735 Dth per day for the winter of 2011/2012.

To secure gas supplies for the generating stations and the LDC, SPPC contracted for firm winter, summer, and annual gas supplies with numerous Canadian and domestic suppliers using a four season ahead laddering strategy discussed above. In 2011, seasonal and monthly gas supply net purchases averaged approximately 114,617 Dth per day with the winter period contracts averaging approximately 136,169 Dth per day, and the summer period contracts averaging approximately 99,409 Dth per day.

SPPC’s firm natural gas supply is supplemented with natural gas storage services and supplies from Northwest’s facility located at Jackson Prairie in southern Washington. The Jackson Prairie facility can contribute up to a total of 12,687 Dth per day of peaking supplies. In an effort to optimize the value of SPPC’s assets, from November 2010 through October 2011 and November 2011 through October 2012, SPPC entered into one year agreements whereby the respective counterparty acquired the rights to the Jackson Prairie storage facility and some of SPPC’s gas transport assets during the term of the agreement with SPPC retaining the ability to call on the resources, subject to limitations.

SPPC also has storage on the Paiute Pipeline system. This liquefied gas storage facility provides for an incremental supply of 23,000 Dth per day and is available at any time during the winter with two hours notice. Therefore, this storage project supports increases in short term gas supply needs due to unforeseen events such as extreme weather patterns and pipeline interruptions.

Listed below are the current gas transportation and storage service agreements:

| Firm Transportation Capacity | Dth per day firm | Term | ||||

| Northwest | 68,696 | Annual | ||||

| Paiute | 68,696 | Winter | ||||

| Paiute | 61,044 | Summer | ||||

| Paiute | 23,000 | Winter (Storage related) | ||||

| AB Nova (Canadian Pipeline) | 130,319 | Annual | ||||

| BC System (Canadian Pipeline) | 128,932 | Annual | ||||

| GTN | 140,169 | Winter | ||||

| GTN | 79,899 | Summer | ||||

| Tuscarora | 172,823 | Annual | ||||

| Storage Capacity | ||||||

| Northwest | 281,242 | Storage Capacity (Jackson Prairie) | ||||

| 12,687 | Daily Withdrawal Capacity | |||||

| Paiute | 303,604 | Storage Capacity | ||||

| 23,000 | Daily Withdrawal Capacity |

Canadian gas supplies are accessed utilizing gas transport service on AB Nova to BC System to GTN to Tuscarora and then directly to Tracy Generating Station. Domestic gas supplies are also accessed utilizing gas transport on Northwest to Paiute and then directly to Ft. Churchill and Tracy Generating Stations. The LDC is dual sourced from the pipelines listed above.

Total LDC supply requirements in 2011 and 2010 were 16.7 million Dth and 14.7 million Dth, respectively. Electric generating fuel requirements for 2011 and 2010 were 25.9 million Dth and 29.0 million Dth, respectively.

Water Supply

NPC and SPPC

Assured supplies of water are important for the Utilities’ generating plants, and at the present time, the Utilities have adequate water to meet their generation needs. Reliable water supply is critical to the entire desert southwest region, including the State of Nevada. The newer generation facilities in the Utilities’ fleet have been designed to minimize water usage and employ innovative conservation based technologies such as dry cooling and recycled water. Although there are current drought conditions in the Las Vegas area, water resources for most of these facilities rely on regional aquifers and recycled water that are not closely connected to transient drought conditions.

Purchased Power

Under the guidelines set forth in the respective ESPs, NPC and SPPC continue to manage a diverse portfolio of contracted and spot market supplies, as well as its own generation resources, with the objective of minimizing its net average system operating costs. During 2011, NPC and SPPC purchased approximately 30.4% and 49.5%, respectively, of their total electric energy requirements.

NPC Electric

NPC purchases both forward firm energy and spot market energy based on economics, regulatory requirements, operating reserve margins, and unit availability. NPC seeks to manage its loads efficiently by utilizing its generation resources and long-term purchase power contracts in conjunction with buying and selling opportunities in the market.

NPC has entered into long-term purchase power contracts (3 or more years) with suppliers that generate electricity utilizing gas and renewable resource facilities with a total nameplate capacity of approximately 2,481 MW and contract termination dates ranging from 2013 to 2038. Included in these contracts are approximately 886 MW of nameplate capacity of renewable energy of which approximately 649 MW of nameplate capacity are under development or construction and not currently available. The PECs from renewable resource facilities are used towards compliance with the Portfolio Standard. Energy from some of these contracts is delivered and sold to SPPC through intercompany related purchase power contracts due to the resource location and transmission constraints; however, NPC retains the PECs associated with such contracts. The completion of ON Line will give NPC the ability to take delivery of the energy from these contracts.

NPC is a member of the SRSG and the WSPP. NPC’s membership in the SRSG has allowed it to network with other utilities in an effort to use its resources more efficiently in the sharing of responsibilities for reserves.

NPC’s credit standing may affect the terms under which NPC is able to purchase fuel and electricity in the western energy markets; however, as a result of NPC’s investment grade credit rating over the last several years, this was not a significant factor in 2011.

SPPC Electric

SPPC purchases both forward firm energy and spot market energy based on economics, regulatory requirements, operating reserve margins, and unit availability. SPPC seeks to manage its loads efficiently by utilizing its generation resources and long-term purchase power contracts in conjunction with buying and selling opportunities in the market.

SPPC has entered into long-term purchase power contracts (3 or more years) with suppliers that generate electricity utilizing coal and renewable resource facilities, with a total nameplate capacity of approximately 400 MW and contract termination dates ranging from 2016 to 2039. Included in these contracts are approximately 210 MW of nameplate capacity of renewable energy of which approximately 20 MW of nameplate capacity are under construction and not currently available. The PECs from renewable resource facilities are used towards compliance with the Portfolio Standard. Energy from one of these contracts is delivered and sold to NPC through an intercompany related purchase power contract due to the resource location and transmission constraints; however, SPPC retains the PECs associated with this contract. The completion of ON Line will give SPPC the ability to take delivery of the energy from these contracts.

SPPC is a member of the NWPP and WSPP. These pools have provided SPPC further access to reserves and spot market power, respectively, in the Pacific Northwest and Southwest. In turn, SPPC’s generation resources provide a backup source for other pool members who rely heavily on hydroelectric systems.

SPPC’s credit standing may affect the terms under which SPPC is able to purchase fuel and electricity in the western energy markets; however, as a result of SPPC’s investment grade credit rating over the last several years, this was not a significant factor in 2011.

Transmission

Electric transmission systems deliver energy from electric generators to distribution systems for final delivery to customers. Transmission systems are designed to move electricity over long distances because generators can be located anywhere from a few miles to hundreds of miles from customers.

The Utilities’ electric transmission systems are part of the Western Interconnection, the regional grid in the west. The Western Interconnection includes the interconnected transmission systems of fourteen western states, two Canadian provinces and the parts of Mexico that make up the Western Electricity Coordinating Council (WECC). WECC is one of eight regional councils of the NERC, the entity responsible for the reliability, adequacy and security of North America’s bulk electric system.

NPC’s transmission system links generating units within and outside of the NPC Balancing Authority Area for delivery to the NPC distribution system and provides interconnections with the balancing authority areas of Western Area Power Administration, Los Angeles Department of Water and Power, Southern California Edison, and PacifiCorp.

SPPC’s transmission system links generating units within the SPPC balancing authority area for delivery to the SPPC distribution system and provides interconnections with the balancing authority areas of Idaho Power, Los Angeles Department of Water and Power, Southern California Edison, PacifiCorp, Bonneville Power Administration, Pacific Gas & Electric and Plumas-Sierra Rural Electric Cooperative.

The service territories of NPC and SPPC are not directly interconnected at present; however, in February 2011, NVE and the Utilities entered into an agreement with Great Basin Transmission (GBT) to construct ON Line, which will interconnect the systems for the first time.

Under the NERC guidelines, the Utilities are Balancing Authorities, Transmission Operators, and Transmission Owners among other roles. As defined by NERC, the Balancing Authority integrates resource plans ahead of time, maintains load-interchange-generation balance within a Balancing Authority Area, and supports Interconnection frequency in real time (i.e., the Balancing Authority is responsible for assuring that the demands on the system are matched by an equivalent amount of resources, whether from generators within its area or from energy imports). The Transmission Operator is responsible for the reliability of its local transmission system, and operates or directs the operations of the transmission facilities. The Transmission Owner owns and

18

maintains transmission facilities. The Utilities also schedule power deliveries over their transmission systems and maintain reliability through their operations and maintenance practices and by verifying that customers are matching loads with resources.

NPC and SPPC plan, build, and operate transmission systems that delivered 21,611,559 MWh and 8,821,610 MWh of electricity to customers, respectively, in their Balancing Authority Areas in 2011. The NPC system handled a system peak load of 5,539 MW in 2011 through approximately 1,724 miles of transmission lines and other transmission facilities ranging from 60 kV to 500 kV. The SPPC system handled a system peak load of 1,513 MW in 2011 through 1,987 miles of transmission lines and other facilities ranging from 60 kV to 345 kV. The Utilities process generation and transmission interconnection requests and requests for transmission service from a variety of customers. These requests usually involve new planning studies and the negotiation of contracts with new and existing customers.

Transmission Regulatory Environment

Transmission for the Utilities’ bundled retail customers is subject to the jurisdiction of the PUCN for rate making purposes. The Utilities provide cost based wholesale and retail access transmission services under the terms of a FERC approved OATT. In accordance with the OATT, the Utilities offer several transmission services to wholesale customers:

| • | Long-term and short-term firm point-to-point transmission service (“highest quality” service with fixed delivery and receipt points), |

| • | Non-firm point-to-point service (“as available” service with fixed delivery and receipt points), and |

| • | Network transmission service (equivalent to the service NVE provides for NVE’s bundled retail customers). |

These services are all offered on a nondiscriminatory basis in that all potential customers, including the Utilities, have an equal opportunity to access the transmission system. The Utilities’ transmission business is managed and operated independently from the energy marketing business in accordance with FERC’s Standards of Conduct.

The One Nevada Transmission Line (“ON Line”)

As discussed earlier, the Utilities are currently constructing ON Line which would provide a 500 kV interconnection between a new Robinson Summit substation on the SPPC system and the Harry Allen substation on the NPC system. ON Line would further provide an interconnection between NPC and SPPC’s system and enhance our ability to optimize the use of our generation and transmission facilities in alignment with the evolution of our energy strategy.

Regional Planning

The Utilities are members of WestConnect and the WestConnect Subregional Transmission Planning Committee. WestConnect is a group of southwest transmission-providing utilities that have agreed to work collaboratively to assess stakeholder and market needs and to investigate, analyze and recommend to its Steering Committee implementation of cost-effective enhancements to the western wholesale electricity market. The Subregional Transmission Planning Committee was established to provide coordinated transmission planning across the WestConnect footprint, including the Southwest Area Transmission Group, in which NPC participates, and the Sierra Subregional Planning Group, in which SPPC participates.

FERC issued Order 1000 on July 21, 2011. Order 1000 establishes basic requirements for transmission planning on a regional and interregional basis. The Utilities are currently evaluating Order 1000 and participating in various regional processes in order to comply with the order.

Integrated Resource Plan

The Utilities are required to file IRPs every three years, and as necessary, may file amendments to their IRPs. The IRPs are prepared in compliance with Nevada laws and regulations and cover a 20-year period. The IRPs develop a comprehensive, integrated plan that considers customer energy requirements and propose the resources to meet those requirements in a manner that is consistent with prevailing market fundamentals. The ultimate goal of the IRPs is to balance the objectives of minimizing costs and reducing volatility while reliably meeting the electric needs of NPC’s and SPPC’s customers. The ESP, discussed in detail later, operates in conjunction with the IRP. It serves as a guide for near-term execution and fulfillment of energy needs.

NPC Electric

In July 2010, the PUCN issued its order on NPC’s 2009 IRP, which included the following significant items:

| • | Approval to jointly develop ON Line with GBT, an affiliate of LS Power, discussed earlier in the Transmission section. The PUCN also approved NPC’s self-build option for ON Line if the companies and GBT were unable to reach agreement. However, in February 2011, the Utilities and GBT finalized the agreement to jointly construct ON Line. |

| • | Granted NPC’s request for critical facility designation for its incremental operating and maintenance costs for ON Line. |

| • | Approval of NV Energize of approximately $95 million and $69 million (excluding AFUDC) for NPC and SPPC, respectively, which was contingent on successfully obtaining a grant of $138 million in federal funds from the DOE to co-fund the project. A total grant of $139 million was obtained from the DOE in September 2010. |

| • | Approval to establish a regulatory asset for stranded non-advanced metering infrastructure electric meter costs related to NV Energize. |

| • | Approval of various DSM programs to increase energy efficiency and conservation programs totaling approximately $209.9 million over the three year action plan. |

| • | Accepted NPC’s proposal to postpone the EEC indefinitely, but ordered NPC to resubmit the request as a part of its next triennial IRP filing in July 2012. In February 2011, NVE and the Utilities canceled plans to construct the EEC. |

| • | Approval of the long-term load forecast and the three-year forecast. |

SPPC Electric

In July 2010, as required by Nevada law, SPPC filed its 2010 triennial IRP with the PUCN. In December 2010, the PUCN issued its order on SPPC’s IRP, which included the following significant items:

| • | Approval of the long-term load forecast and the three-year forecast. |

| • | A finding that the sale of the California Assets to CalPeco is in the public interest of Nevada, authorizing and accepting the accounting adjustments and ratemaking treatment proposed by SPPC and authorizing entry into and performing transactions necessary to accomplish the sale of the California Assets to CalPeco. The sale of the California Assets was completed in January 2011. See Note 16, Assets Held for Sale, in the Notes to Financial Statements. |

| • | Authority to modify retirement dates for eleven remote generation facilities and retire and decommission ten remote generation facilities and to accumulate the costs of decommissioning and remediating the remote generation sites in separate regulatory assets subaccounts for recovery in a future GRC proceeding. |