SCHEDULE 14A INFORMATION

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential,for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

x Definitive Proxy Statement |

|

¨ Definitive Additional Materials |

|

¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

SIERRA PACIFIC RESOURCES

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | ¨ | | Fee paid previously with preliminary materials. |

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Walter M. Higgins Chairman, President and Chief Executive Officer | | April 11, 2003 |

To Our Stockholders:

On behalf of the Board of Directors, I am pleased to invite you to attend the 2003 Annual Meeting of the Stockholders of Sierra Pacific Resources, which will be held at 10:00 a.m., Pacific Daylight time, on Monday, May 12, 2003, at the Orleans Hotel and Casino, 4500 West Tropicana Avenue, Las Vegas, Nevada. The formal notice of the Annual Meeting is set forth on the next page.

The matters to be acted upon at the meeting are described in the attached Proxy Statement. During the meeting, you and other stockholders will have the opportunity to ask questions and comment on the Company’s operations. Directors, officers, and other employees of the Company will be made available to visit with you before and after the formal meeting to answer whatever questions you may have. In addition to the matters set forth herein, we will also discuss 2002 financial results and the steps we have taken to deal with the several financial and regulatory challenges we have faced during the past year. Refreshments will be provided before and after the meeting.

Your views and opinions are very important to the Company. Whether or not you are able to be present at the Annual Meeting, we would appreciate it if you would please review the enclosed Annual Report and Proxy Statement. Regardless of the number of shares you own, please execute your proxy card and promptly return it to us in the postpaid envelope.

We greatly appreciate the interest expressed by our stockholders, and we are pleased that in the past so many of you have voted your shares either in person or by proxy. We hope that you will continue to do so and urge you to return your proxy card as soon as possible.

Sincerely,

SIERRA PACIFIC RESOURCES

6100 Neil Road

Reno, Nevada 89511

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 12, 2003

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Sierra Pacific Resources will be held at the Orleans Hotel and Casino, 4500 West Tropicana Avenue, Las Vegas, Nevada, on Monday, May 12, 2003, at 10:00 a.m., Pacific Daylight Time, for the following purposes:

| | 1. | | To elect three (3) members of the Board of Directors to serve until the Annual Meeting in 2006, and until their successors are elected and qualified; |

| | 2. | | To consider approving the 2003 Non-Employee Director Stock Plan; and |

| | 3. | | To transact such other business as may properly come before the meeting, and any or all adjournments thereof; |

all as set forth in the Proxy Solicitation Statement accompanying this notice.

Only holders of record of Common Stock at the close of business on March 14, 2003, will be entitled to vote at the meeting, and any or all adjournments thereof. The transfer books will not be closed.

Your continued interest as a stockholder in the affairs of your Company, its growth, and development is greatly appreciated by the Directors, officers, and employees who serve you.

By Order of the Board of Directors

C. STANLEY HUNTERTON, Secretary

DATED: April 11, 2003

IF YOU ARE A HOLDER OF COMMON STOCK OF THE COMPANY AND DO NOT EXPECT TO ATTEND THE ANNUAL MEETING OF STOCKHOLDERS, IT WILL BE HELPFUL TO US IF YOU WILL READ THE ACCOMPANYING PROXY STATEMENT, THEN MARK, SIGN, DATE, AND RETURN THE ENCLOSED PROXY IN THE ENVELOPE PROVIDED, AS EARLY AS POSSIBLE.

We thank you for your cooperation.

Mailing Address: | | P.O. Box 30150 Reno, Nevada 89520-3150 |

SIERRA PACIFIC RESOURCES

6100 Neil Road

Reno, Nevada 89511

PROXY STATEMENT

General

This proxy statement is furnished to the holders of Common Stock of Sierra Pacific Resources (hereinafter referred to as the “Company”) in connection with the solicitation of proxies to be voted at the Annual Meeting of Stockholders to be held on Monday, May 12, 2003. The enclosed proxy is solicited on behalf of the Board of Directors of the Company. Every properly signed proxy will be voted.

A person giving the enclosed proxy has the power to revoke it at any time before it is exercised at the meeting, by giving written notice to the Secretary of the Company, by sending a later-dated proxy, or by revoking it in person at the meeting.

The Company will bear the cost of solicitation of proxies by management, including charges and expenses of brokerage firms and others for forwarding solicitation material to beneficial owners of Common Stock. In addition to the use of mail, proxies may be solicited by personal interview, by telephone, by facsimile or electronic medium, or by certain employees without compensation. Georgeson Shareholder will assist in the solicitation of proxies at an estimated cost of $5,500. The proxy statement and the enclosed proxy will first be sent to Stockholders on or about April 11, 2003.

STOCK OUTSTANDING AND VOTING RIGHTS

Only holders of Common Stock of record on the stock transfer books of the Company at the close of business on March 14, 2003 (the “record date”) will be entitled to vote at the meeting. There were 102,177,409 shares of Common Stock outstanding on the record date. Each share of Common Stock is entitled to one vote and a fraction of a share is entitled to the appropriate fraction of a share vote. Under the Company’s By-Laws, a majority of the shares issued and outstanding and entitled to vote will constitute a quorum, and a majority of the voting power of shares represented at the meeting will be sufficient to elect Directors and to approve the Non-Employee Director Stock Plan. Abstentions and broker non-votes will be counted for purposes of determining a quorum and the number of shares which will constitute a majority of the voting power represented at the meeting.

PROPOSAL NUMBER ONE

ELECTION OF DIRECTORS

All Directors elected at the meeting will serve a three-year term ending at the Annual Meeting in 2006, and until their successors are elected and qualified. The shares represented by the enclosed proxy will be voted to elect the three Nominees unless such authority has been withheld. If any Nominee becomes unavailable for any reason, which is not anticipated, the shares represented by the enclosed proxy may be voted for such other persons as may be selected by the Board of Directors of the Company. The affirmative vote of a majority of the voting power represented at the Annual Meeting will be necessary to elect each Nominee. Abstentions and broker non-votes will have the practical effect of withholding authority with respect to a Nominee.

The following information is furnished with respect to each Nominee for election as a Director and for each Director whose term of office will continue after the meeting.

1

Name of Director And Nominee | | Age | | Principal Occupation During Last 5 Years | | Director Since |

|

|

NOMINEES FOR ELECTION FOR A TERM OF THREE YEARS EXPIRING IN 2006 |

|

Mary Lee Coleman | | 65 | | President, Coleman Enterprises. She also serves on the Board of First Dental Health Inc. | | 1980 |

|

T.J. Day | | 53 | | Senior Partner, Hale Day Gallagher, a real estate brokerage and investment company. He is also a Director of the W.M. Keck Foundation. | | 1987 |

|

Jerry E. Herbst | | 64 | | Chief Executive Officer of Terrible Herbst, Inc. He is a Director of Coast Resorts, Inc. | | 1990 |

|

Name of Director | | Age | | Principal Occupation During Last 5 Years | | Director Since |

|

|

DIRECTORS WHOSE TERM EXPIRES IN 2004 |

|

James R. Donnelley | | 67 | | Director and past Chairman, PMP, Inc., a publishing/distribution company. Partner, Stet & Query, Ltd., a family-owned investment company. Director and retired Vice Chairman of the Board of R.R. Donnelley & Sons Company. He is also Chairman of the Board of National Merit Scholarship Corporation. | | 1987 |

|

Walter M. Higgins | | 58 | | Chairman, President and Chief Executive Officer of the Company since August 8, 2000. Chairman, President and Chief Executive Officer of AGL Resources, Inc., from January 1998 to August 2000. Chairman, President and Chief Executive Officer of the Company from January 4, 1994, to January 14, 1998. He is also a Director of Aegis Insurance Services, Inc., the National Environmental Educational Training Foundation, Western Energy Institute, as well as several community service/ educational organizations. | | 2000 |

|

John F. O’Reilly | | 57 | | Chairman and Chief Executive Officer of the law firm of O’Reilly & Ferrario, a full service law firm. Chairman and Chief Executive Officer of Business Resource Group, and Chairman and Chief Executive Officer of the O’Reilly Gaming Group, a corporation consisting of various gaming and entertainment related businesses. He is also a member of the Wells Fargo Nevada Community Board and the Board of Trustees of Loyola Marymount University. | | 1995 |

2

Name of Director | | Age | | Principal Occupation During Last 5 Years | | Director Since |

|

|

DIRECTORS WHOSE TERM EXPIRES IN 2005 |

|

Krestine M. Corbin | | 65 | | President and Chief Executive Officer of Sierra Machinery Incorporated since 1984 and a Director of that company since 1980. | | 1989 |

|

Clyde T. Turner | | 65 | | Chairman and CEO of Turner Investments, Ltd., a general-purpose investment company and several special-purpose real estate development companies known as Spectrum Companies in Las Vegas, Nevada. Chairman and CEO of Mandalay Bay Group from 1994-1998. He is also a Director of St. Rose Dominican Hospital, CapCure, and Coast Resorts, Inc. | | 2001 |

|

Dennis E. Wheeler | | 60 | | Chairman, President and Chief Executive Officer of Coeur d’Alene Mines Corporation since 1986. | | 1990 |

All Directors of Sierra Pacific Resources are Directors of its wholly owned subsidiaries, Sierra Pacific Power Company and Nevada Power Company.

PROPOSAL NUMBER TWO

APPROVAL OF

2003 NON-EMPLOYEE DIRECTOR STOCK PLAN

The Board of Directors has approved and recommends that the Stockholders approve the 2003 Non-Employee Director Stock Plan (the “2003 Director Stock Plan”) to provide for the issuance of up to 700,000 shares of Common Stock over a ten-year period to members of the Company’s Board of Directors who are not employees of the Company (“Non-Employee Directors”) in lieu of a portion of the annual retainer paid to those individuals for their service on the Company’s Board of Directors. The 2003 Director Stock Plan is intended to replace a similar plan that was approved by the shareholders in 1999 and expired on December 31, 2001. The 2003 Director Stock Plan is attached as Annex A.

On March 12, 2003, the Board of Directors adopted a resolution approving the 2003 Director Stock Plan, subject to Stockholder approval, and reserved 700,000 shares of Common Stock for issuance under the plan. If the plan is approved, there will be a total of 700,000 shares available for issuance to the Company’s Non-Employee Directors over the 10-year period during which the plan will be in effect.

Assuming an annual retainer for Non-Employee Directors of $30,000, under the terms of the 2003 Director Stock Plan, if approved, a minimum of $20,000 of the annual retainer would be paid in Common Stock, with the remainder paid in cash. The Board believes that the 2003 Director Stock Plan will assist the Company in retaining the services of qualified individuals as independent Directors and will secure for the Company the benefits that flow from increased Director ownership of Company stock.

The affirmative vote of the holders of a majority of the issued and outstanding shares of the Company’s Common Stock represented at the Annual Meeting is required to approve the 2003 Director Stock Plan. The Board of Directors recommends that the Stockholders vote FOR the approval of the 2003 Director Stock Plan.

3

Summary of Material Provisions of the 2003 Director Stock Plan

The following is a summary of the material provisions of the 2003 Director Stock Plan, which is qualified in its entirety by reference to the 2003 Director Stock Plan.

Purpose. The purpose of the 2003 Director Stock Plan is to provide ownership of the Company’s Common Stock to non-employee members of the Board of Directors in order to improve the Company’s ability to attract and retain highly qualified individuals to serve as Directors of the Company, to provide competitive compensation for service on the Board of Directors, and to strengthen the commonality of interest between Directors and Stockholders.

Shares. The 2003 Director Stock Plan authorizes the issuance of up to 700,000 shares of Common Stock. The Common Stock issued under the 2003 Director Stock Plan will consist either of authorized unissued shares or shares purchased on the open market.

Administration. A Committee of three or more persons who are not eligible to participate in the 2003 Director Stock Plan will administer the 2003 Director Stock Plan. The Committee has full power and authority to determine all questions of fact that may arise under the 2003 Director Stock Plan, to interpret the 2003 Director Stock Plan and to make all other determinations necessary or advisable for the administration of the 2003 Director Stock Plan, and to prescribe, amend, and rescind rules and regulations relating to the 2003 Director Stock Plan. All interpretations, determinations and actions by the Committee will be final, conclusive and binding upon all parties.

Participation. All Non-Employee Directors must participate in the 2003 Director Stock Plan. If any Non-Employee Director owns shares of Common Stock representing more than five percent of the total combined voting power of all classes of stock of the Company, he or she will be ineligible to receive a Stock Payment. As of April 1, 2003, there are eight Non-Employee Directors eligible to participate in the 2003 Director Stock Plan.

Determination of Annual Retainers and Stock Payments. The Board of Directors determines the Annual Retainer for all Non-Employee Directors. Immediately following the date of the Annual Meeting of Stockholders, each Non-Employee Director will receive a Stock Payment as a portion of the Annual Retainer. The number of shares to be issued to each Non-Employee Director as a Stock Payment will be determined by dividing the applicable Market Price into the amount of the Annual Retainer in excess of $10,000. The cash portion of the Annual Retainer will be paid to Non-Employee Directors at such times and in such manner as determined by the Board of Directors.

Election to Increase Amount of Stock Payment. In lieu of receiving the cash portion of his or her Annual Retainer, a Non-Employee Director may make an election to reduce such Annual Retainer by a specified dollar amount and have such amount applied to purchase additional shares of Common Stock.

Election to Defer Receipt of Stock Payment. In lieu of receiving the Stock Payment, a Non-Employee Director may make an election to defer such receipt until he or she ceases to be a Non-Employee Director. With respect to such deferred shares, the Non-Employee Director is not a shareholder, has no vote and will not receive cash dividends. However, the Non-Employee Director will receive, as additional compensation and not as a dividend, the amount of any cash dividends that would have been paid to such Non-Employee Director had he or she then been the owner of the shares of Common Stock that have been deferred.

Adjustments for Changes in Capitalization. The maximum number of shares/or kind of shares that may be issued under the 2003 Director Stock Plan may be appropriately adjusted by the Committee in the event of a merger, consolidation, sale of all or substantially all of the property of the Company, reorganization or recapitalization, reclassification, stock dividend, stock split, reverse stock split, rights offering or distribution with respect of such share of the Company’s securities, or other change in the Company’s capitalization.

4

Amendment and Termination. The Board of Directors will have the power to amend, suspend or terminate the 2003 Director Stock Plan at any time. However, no amendment to the 2003 Director Stock Plan may, without the approval of the Stockholders, change the class of persons eligible to receive a Stock Payment under the 2003 Director Stock Plan, materially increase the benefits accruing to Non-Employee Directors under the 2003 Director Stock Plan, or increase the number of shares of Common Stock which may be issued under the 2003 Director Stock Plan.

Federal Income Tax Consequences. The following brief description of the tax consequences of awards under the 2003 Director Stock Plan is based upon present Federal tax laws and does not purport to be a complete description of the Federal tax consequences of the 2003 Director Stock Plan. This description does not address state, municipal or Foreign tax laws, and does not address the circumstances of special classes or individual circumstances of participants, including, without limitation, foreign persons.

A Non-Employee Director who receives shares of Common Stock will recognize ordinary compensation income in the amount of the fair market value of such shares as of the date of receipt and any cash received in lieu of fractional shares. In addition, the Company will be entitled to a deduction for the amount included in the income of a Non-Employee Director.

5

DIRECTOR’S COMPENSATION

Each Non-Employee Director is paid an annual retainer of $30,000. In keeping with the Board’s policy to tie management and Director compensation to overall Company performance and to increase Director share ownership, the 1992 Non-Employee Director Stock Plan (“Plan”) required that a minimum of $20,000 of the annual retainer be paid in Common Stock of the Company. Although the 1992 Director Stock Plan expired at the end of 2001, the practice of paying out two-thirds of the annual retainer in shares of Common Stock was maintained in 2002, and several Non-Employee Directors elected to receive an even greater percentage in stock. The reason for instituting a minimum amount of annual retainer that Directors must take in Company Stock is to insure that all Directors will have a minimum of $100,000 worth of Company Stock after five years of service. The 2003 Director Stock Plan, if approved by the Stockholders, would continue the practice of requiring that at least $20,000 of annual retainer be paid in shares of Company Stock rather than cash.

In addition to the annual retainer, Non-Employee Directors of the Company, its subsidiaries, and members of Board committees are paid $1,200 for each Board or Committee meeting attended, not to exceed two meeting fees per day regardless of the number of meetings attended. Members of the Audit Committee are paid $1,500 per meeting of the Audit Committee. Directors also receive a full meeting fee or partial meeting fee (depending on distance) for travel to attend meetings away from the Director’s home. In consideration for their additional responsibility and time commitments, Non-Employee Directors serving as Committee Chairpersons are also paid an additional $1,000 quarterly, except for the Audit Committee Chair, who receives $2,500 quarterly.

The Company’s Retirement Plan for Outside Directors, adopted March 6, 1987, was terminated on June 25, 1996. The actuarial value of the vested benefit as of May 20, 1996, for each Director was converted into “phantom stock” of the Company at its fair market value on May 20, 1996. The “phantom stock” is held in an account to be paid at the time of the Director’s departure from the Board. All “phantom stock” earns dividends at the same rate as listed stock from the date of conversion and is deemed reinvested in additional shares of such stock at the price of the stock on the day of the dividend payment date.

BOARD AND COMMITTEE MEETINGS

The Board of Directors maintains the following standing committees: Audit, Corporate and Civic Responsibility, Human Resources, and Planning and Finance. The Board also establishes ad hoc committees for specific projects when required.

The Audit Committee was established in July 1992 to review and confer with the Company’s independent auditors and to review the Company’s internal auditing program and procedures and its financial statements to ensure that its operations and financial reporting are in compliance with applicable laws, regulations and Company policies. The Directors presently serving on the Audit Committee, all of whom are “independent,” are Mr. Wheeler (Chair), Messrs. Bliss, Herbst, O’Reilly, and Turner. The Audit Committee met four times in 2002. Mr. Bliss will retire from the Board on May 12, 2003.

The Corporate and Civic Responsibility Committee was formed in July 1999 and, among other things, assumed the duties of the previous Environmental Committee, which was established in 1992. Among its other duties, this Committee oversees the Company’s environmental policy and performance and provides guidance to executive management on environmental issues as well as overseeing all other aspects of corporate compliance with applicable law, corporate giving, and legislative and governmental affairs. The Directors presently serving on the Corporate and Civic Responsibility Committee are Mr. Herbst (Chair), Ms. Coleman, and Messrs. Day and Higgins. The Corporate and Civic Responsibility Committee met two times in 2002.

6

The Human Resources Committee was formed in July 1999 and assumed the duties of the former Compensation and Organization Committee, which was formed in 1991. This Committee, which has always consisted only of “independent” Directors, considers nominations to the Board of Directors as recommended by Stockholders or others. To be considered, nominations must be submitted in writing to the Committee in care of the Secretary of the Company within the time frame fixed by the Company’s Bylaws. This Committee also reviews Director and executive performance, recommends appointments to Board Committees and reviews and recommends to the Board any changes in Directors’ fees or compensation for all officers and executives of the Company. The Committee also oversees the Company’s pension and 401K benefit programs and oversees the appointment and discharge and monitors plan money managers. It also reviews and discharges the fiduciary duties delegated to the Committee under the Company’s benefit plans. The Directors presently serving on the Human Resources Committee are Mr. Donnelley (Chair), Mses. Coleman and Corbin, and Mr. Day. The Human Resources Committee met four times in 2002.

The Planning and Finance Committee was formed in July 1999. This Committee reviews and recommends to the Board the long-range goals of the parent and subsidiary companies, and the type and amount of financing necessary to meet these goals. The Directors presently serving on the Planning and Finance Committee are Mr. O’Reilly (Chair), Ms. Corbin, and Messrs. Bliss, Donnelley, Higgins, Turner, and Wheeler. The Planning and Finance Committee met 10 times in 2002.

There were four regularly scheduled and twenty-three special meetings of the Board of Directors held during 2002. The aggregate meeting attendance of all members of the Board was 95% for Board and Committee meetings.

7

SUMMARY COMPENSATION TABLE

The following table sets forth information about the compensation of the Chief Executive Officer that served in that position during 2002, and each of the four most highly compensated officers for services in all capacities to SPR and its subsidiaries. Also included are two individuals who, although not officers at the end of 2002, warranted inclusion due to compensation levels.

| | | | | | | | | | | Long-Term Compensation

| | |

| | | | | Annual Compensation

| | Awards

| | Payouts

| | |

Name and Principal Position (a) | | Year (b) | | Salary ($) (c) | | Bonus ($) (d) | | Other Annual Compen- sation ($) (e) (3) | | Restricted Stock Awards ($) (f) (4) | | Securities Under- Lying Options/ SARS (#) (g) | | LTIP Payouts ($) (h) (5) | | All Other Compen- sation ($) (i) (6) |

|

Walter M. Higgins | | 2002 | | $ | 590,000 | | $ | — | | $ | 98,254 | | $ | — | | 123,900 | | $ | — | | $ | 188,218 |

Chairman of the Board, President, | | 2001 | | $ | 590,000 | | $ | — | | $ | 70,970 | | $ | — | | 110,130 | | $ | — | | $ | 614,129 |

and Chief Executive Officer | | 2000 | | $ | 215,151 | | $ | — | | $ | 33,690 | | $ | 256,000 | | 400,000 | | $ | — | | $ | 411,758 |

|

Mark A. Ruelle (1) | | 2002 | | $ | 588,462 | | $ | — | | $ | — | | $ | — | | 45,000 | | $ | — | | $ | 56,274 |

President, Nevada Power Company | | 2001 | | $ | 280,962 | | $ | — | | $ | 28,108 | | $ | 62,080 | | 66,520 | | $ | — | | $ | 109,437 |

| | | 2000 | | $ | 250,255 | | $ | — | | $ | 15,967 | | $ | — | | — | | $ | 59,357 | | $ | 19,160 |

|

Steven C. Oldham (2) | | 2002 | | $ | 384,933 | | $ | — | | $ | — | | $ | — | | 27,000 | | $ | — | | $ | 90,967 |

Senior Vice President, Energy Supply | | 2001 | | $ | 219,039 | | $ | — | | $ | — | | $ | — | | 20,800 | | $ | — | | $ | 19,775 |

| | | 2000 | | $ | 186,584 | | $ | — | | $ | 13,750 | | $ | — | | — | | $ | 36,527 | | $ | 19,678 |

|

Victor H. Peña | | 2002 | | $ | 230,000 | | $ | — | | $ | — | | $ | — | | 25,880 | | $ | — | | $ | 20,402 |

Senior Vice President, Chief Administrative Officer | | 2001 | | $ | 136,231 | | $ | — | | $ | 5,600 | | $ | 69,187 | | 27,000 | | $ | — | | $ | 57,696 |

|

Jeffrey L. Ceccarelli | | 2002 | | $ | 230,000 | | $ | — | | $ | 35,417 | | $ | — | | 34,500 | | $ | — | | $ | 21,999 |

President, Sierra Pacific Power | | 2001 | | $ | 221,539 | | $ | — | | $ | 13,712 | | $ | — | | 22,510 | | $ | — | | $ | 19,429 |

Company | | 2000 | | $ | 191,539 | | $ | — | | $ | 19,320 | | $ | — | | — | | $ | 36,527 | | $ | 16,781 |

|

Matt H. Davis | | 2002 | | $ | 180,000 | | $ | — | | $ | 18,367 | | $ | — | | 12,150 | | $ | — | | $ | 20,404 |

Vice President, Distribution Services, | | 2001 | | $ | 171,539 | | $ | — | | $ | 17,551 | | $ | — | | 10,200 | | $ | — | | $ | 18,872 |

Nevada Power Company | | 2000 | | $ | 159,425 | | $ | — | | $ | 21,017 | | $ | — | | — | | $ | 16,410 | | $ | 16,562 |

|

Michael R. Smart | | 2002 | | $ | 180,000 | | | | | $ | 26,376 | | $ | — | | 12,150 | | $ | — | | $ | 137,676 |

Vice President, Distribution | | 2001 | | $ | 171,116 | | $ | — | | $ | 10,911 | | $ | — | | 9,540 | | $ | — | | $ | 97,178 |

Services, Sierra | | 2000 | | $ | 139,877 | | $ | 41,144 | | $ | 8,239 | | $ | — | | — | | $ | — | | $ | 16,520 |

Pacific Power Company | | | | | | | | | | | | | | | | | | | | | | |

| | • | | Mr. Ruelle was President of Nevada Power Company until May 2002; Donald L. Shalmy was appointed to that position in July 2002. |

| | • | | Included in column (c) is a severance payment of $450,000, which represents 1.5 times his annual salary. |

| | • | | Mr. Oldham was Senior Vice President of Energy Supply until his retirement in May 2002. John F. Young was appointed to that position in July 2002. |

| | • | | Included in column (c) is a severance payment of $245,000, which represents one year’s annual salary. |

Description | | Walter M. Higgins | | Jeffrey L. Ceccarelli | | Matt H. Davis | | Michael R. Smart |

|

PTO* Cash | | $ | 50,831 | | $ | 20,417 | | $ | 8,252 | | $ | 17,576 |

*Paid Time Off | | | | | | | | | | | | |

Tax Preparation, Memberships, Auto, Misc. | | $ | 30,000 | | $ | 15,000 | | $ | 10,088 | | $ | 8,800 |

8

| 3. | | The table below shows those executive perquisites that exceed 25% of the total perquisites listed in column (e) for each named executive. |

| 4. | | Restricted Stock Grants: |

| | • | | As the result of a promotion in 2001, Mr. Ruelle was awarded a restricted grant of 4,000 shares with dividend equivalents. After Mr. Ruelle’s separation from SPR, this grant was forfeited, and had no value at December 31, 2002. |

| | • | | Upon his hire in 2001, Mr. Peña was awarded a grant of 4,300 restricted shares with dividend equivalents. At December 31, 2002, the value of the grant was $20,963 at $6.50 per share. The grant will vest over a four year period at 25% per year. In 2002, 1,075 shares from this grant were issued to Mr. Peña, in accordance with the vesting schedule; the year-end value is calculated for the remaining 3,225 shares. |

| | • | | In 2000, Mr. Higgins was awarded a restricted stock grant of 16,000 shares with dividend equivalents. At December 31, 2002, the value of the grant was $78,000 at $6.50 per share. The grant will vest over a four year period in the following manner: |

September 2002 | | 4,000 shares |

September 2003 | | 4,000 shares |

September 2004 | | 8,000 shares |

In 2002, 4,000 shares from this grant were issued to Mr. Higgins, in accordance with the vesting schedule; the year-end value is calculated for the remaining 12,000 shares.

| 5. | | The Long-term incentive payouts for the three-year periods ended December 31, 2001 and 2002, were not approved for payment by the SPR Board of Directors. |

| 6. | | Amounts for All Other Compensation include the following for 2002: |

9

|

Description | | Walter M. Higgins | | Mark A. Ruelle | | Steven C. Oldham | | Victor H. Pena | | Jeffrey L. Ceccarelli | | Matt H. Davis | | Michael R. Smart |

|

|

Company contributions to the 401k deferred compensation plan | | $ | 12,000 | | $ | 9,278 | | $ | 9,263 | | $ | 12,000 | | $ | 12,000 | | $ | 11,295 | | $ | 11,000 |

|

Company paid portion of Medical/Dental/Vision Benefits | | $ | 8,088 | | $ | 3,707 | | $ | 3,370 | | $ | 6,120 | | $ | 8,088 | | $ | 8,088 | | $ | 8,088 |

|

Imputed income on group term life insurance premiums paid by SPR | | $ | 3,612 | | $ | 200 | | $ | 366 | | $ | 814 | | $ | 531 | | $ | 396 | | $ | 396 |

|

Insurance premiums paid for executive term life policies | | $ | 19,777 | | $ | 731 | | $ | 559 | | $ | 1,468 | | $ | 1,380 | | $ | 625 | | $ | 1,105 |

|

Moving Expense Reimbursement | | $ | 36,997 | | | | | | | | | | | | | | | | | $ | 76,869 |

|

Taxable Interest/Refund of Deferred Contributions | | $ | 26,908 | | $ | 42,358 | | $ | 47,309 | | | | | | | | | | | $ | 40,218 |

|

Salary bridge to retirement | | | | | | | | $ | 30,100 | | | | | | | | | | | | |

|

Housing Allowance in SPPC area | | $ | 80,836 | | | | | | | | | | | | | | | | | | |

|

Total | | $ | 188,218 | | $ | 56,274 | | $ | 90,967 | | $ | 20,402 | | $ | 21,999 | | $ | 20,404 | | $ | 137,676 |

10

OWNERSHIP OF STOCK BY DIRECTORS, NOMINEES

FOR DIRECTORS, EXECUTIVE OFFICERS AND

CERTAIN BENEFICIAL OWNERS

Voting Stock

The following table indicates the shares owned by Putnam Investments, the only investor known to Sierra Pacific Resources to be owners of more than 5 percent of any class of its voting stock as of March 11, 2003:

Title of Class

| | Name and Address Of Beneficial Owner

| | Shares Beneficially Owned

| | Percent of Class

|

Common Stock | | Putnam Investments One Post Office Square Boston, MA 02109 | | 10,379,669 | | 8.86% |

The table below sets forth the shares of Sierra Pacific Resources Common Stock beneficially owned by each Director, nominee for Director, the Chief Executive Officer, and the four other most highly compensated executive officers. No Director, nominee for Director or executive officer owns, nor do the Directors and executive officers as a group own, in excess of one percent of the outstanding Common Stock of the Company. Unless otherwise indicated, all persons named in the table have sole voting and investment power with respect to the shares shown.

Name of Director or Nominee

| | Shares Beneficially Owned as of March 4, 2003

| | Percent of Total Shares Outstanding as of March 4, 2003

|

Edward P. Bliss | | 33,281 | | |

Mary L. Coleman | | 153,061 | | |

Krestine M. Corbin | | 26,015 | | |

Theodore J. Day | | 38,725 | | |

James R. Donnelley | | 41,336 | | No Director or nominee |

Jerry E. Herbst | | 17,888 | | for Director owns in excess |

Walter M. Higgins | | 290,981 | | of one percent |

John F. O’Reilly | | 18,544 | | |

Clyde T. Turner | | 0 | | |

Dennis E. Wheeler | | 23,644 | | |

| | |

| | |

| | | 643,475 | | |

| | |

| | |

11

Executive Officers

| | Shares Beneficially Owned as of March 4, 2003

| | Percent of Total Shares Outstanding as of March 4, 2003

|

Walter M. Higgins | | 290,981 | | |

Mark A. Ruelle | | 0 | | |

Steven C. Oldham | | 89,087 | | |

Victor H. Peña | | 29,124 | | No executive officer owns |

Jeffrey L. Ceccarelli | | 98,149 | | In excess of one percent |

Matt H. Davis | | 50,178 | | |

Michael R. Smart | | 28,908 | | |

| | |

| | |

| | | 586,427 | | |

| | |

| | |

All Directors and executive officers as a group (a) (b) (c) | | 1,159,406 | | |

| | |

| | |

| (a) | | Includes shares/units acquired through participation in the Employee Stock Purchase Plan and/or 401(k) Plan. |

| (b) | | The number of shares beneficially owned includes: shares the Executive Officers currently have the right to acquire pursuant to stock options granted. Shares beneficially owned pursuant to stock options granted to Messrs. Higgins, Ruelle, Oldham, Peña, Ceccarelli, Davis, Smart, and Directors and executive officers as a group are 234,030, 0, 89,087, 25,880, 83,150, 40,750, 21,690, and 677,865, respectively. |

| (c) | | Included in the shares beneficially owned by the Directors are 81,464 shares of “phantom stock” representing the actuarial value of the Directors’ vested benefits in the terminated Retirement Plan for Outside Directors. The “phantom stock” is held in an account to be paid at the time of the Director’s departure from the Board. |

12

OPTIONS/SAR GRANTS IN LAST FISCAL YEAR

The following table shows all grants of options to the named executive officers of SPR in 2002. Pursuant to Securities and Exchange Commission (SEC) rules, the table also shows the present value of the grant at the date of grant.

Name (a)

| | Number of Securities Underlying Options/SAR’s Granted (b)(1) | | Percent of Total Options/ SAR’s Granted to Employees in Fiscal Year (c)(2) | | | Exercise of Base Price ($/share) (d) | | Expiration Date (e) | | Grant Date Present Value (f)(3) |

|

Walter M. Higgins 01/01/2002 Grant date | | 123,900 | | 24.66 | % | | $15.58 | | 01/01/2012 | | $1,079,840 |

|

Mark A. Ruelle (4) 01/01/2002 Grant date | | 45,000 | | 8.96 | % | | $15.58 | | 01/01/2012 | | $392,194 |

|

Steven C. Oldham 01/01/2002 Grant date | | 27,000 | | 5.37 | % | | $15.58 | | 01/01/2012 | | $235,316 |

|

Victor H. Peña 01/01/2002 Grant date | | 25,880 | | 5.15 | % | | $15.58 | | 01/01/2012 | | $225,555 |

|

Jeffrey L. Ceccarelli 01/01/2002 Grant date | | 34,500 | | 6.87 | % | | $15.58 | | 01/01/2012 | | $300,682 |

|

Matt H. Davis 01/01/2002 Grant date | | 12,150 | | 2.42 | % | | $15.58 | | 01/01/2012 | | $105,892 |

|

Michael R. Smart 01/01/2002 Grant date | | 12,150 | | 2.42 | % | | $15.58 | | 01/01/2012 | | $105,892 |

| 1. | | Under the SPR executive long-term incentive plan, the 2002 grants of nonqualifying stock options were made on January 1, 2002. One-third of these grants vest annually commencing one year after the date of the grant. |

| 2. | | The total number of nonqualifying stock options granted to all employees in 2002 was 502,380. |

| 3. | | Although at the present stock price (less than $5 per share) the options have no present value, the hypothetical grant-date present values are calculated under the Black-Scholes Model. The Black-Scholes Model is a mathematical formula used to value options traded on stock exchanges. The assumptions used in determining the option grant date present values listed above include the stock’s expected volatility (37.78%), risk free rate of return (5.52%), projected dividend yield (0.00%), the stock option term (10 years), and an adjustment for risk of forfeiture during the vesting period (4 years at 3%). No adjustment was made for non-transferability. |

| 4. | | Mr. Ruelle left the Company on May 31, 2002. His options expired on August 31, 2002, and are presently forfeit. |

13

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION/SAR VALUES

The following table provides information as to the value of the options held by the named executive officers at year-end measured in terms of the closing price of Sierra Pacific Resources common stock on December 31, 2002:

|

Name | | Shares Acquired on Exercise

| | Value Realized

| | Number of Securities Underlying Unexercised Options/SARS At Fiscal Year-End

| | Value of Unexercised in-the-money Options/SARS at Fiscal Year-End

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

(a) | | (b) | | (c) | | (d) | | (e) |

|

Walter M. Higgins | | — | | — | | 236,706 | | 397,324 | | $ — | | $ — |

Mark A. Ruelle | | — | | — | | — | | — | | $ — | | $ — |

Steven C. Oldham | | | | | | 44,787 | | 44,300 | | $ — | | $ — |

Victor H. Peña | | — | | — | | 6,750 | | 46,130 | | $ — | | $ — |

Jeffrey L. Ceccarelli | | — | | — | | 30,210 | | 52,940 | | $ — | | $ — |

Matt H. Davis | | — | | — | | 18,187 | | 22,383 | | $ — | | $ — |

Michael R. Smart | | — | | — | | 3,180 | | 18,510 | | $ — | | $ — |

| (e) | | Pre-tax gain. Value of in-the-money options based on December 31, 2002, closing trading price of $6.50, less the option exercise price. |

14

LONG-TERM INCENTIVE PLANS—AWARDS IN LAST FIVE YEARS

The executive long-term incentive plan (LTIP) provides for the granting of stock options (both nonqualified and qualified), stock appreciation rights (SARs), restricted stock performance units, performance shares and bonus stock to participating employees as an incentive for outstanding performance. Incentive compensation is based on the achievement of pre-established financial goals for SPR. Goals are established for total shareholder return (TSR) compared against the Dow Jones Utility Index and annual growth in earnings per share (EPS).

The following table provides information as to the performance shares granted to the named executive officers of Sierra Pacific Resources in 2002. Nonqualifying stock options granted to the named executives as part of the LTIP are shown in the table “Option/SAR Grants in Last Fiscal Year.”

| | | | | | | Estimated Future Payouts Under Non-Stock Price-Based Plans |

| | | | | |

|

Name (a) | | Number of Shares, Units, or Other Rights (b) | | Performance or Other Period Until Maturation or Payout (c) | | Threshold (d)(1) | | Threshold (e)(2) | | Threshold (f)(3) |

|

Walter M. Higgins | | 23,650 | | 3 years | | 11,825 | | 23.650 | | 41,388 |

Mark A. Ruelle (4) | | 8,590 | | 3 years | | 4.295 | | 8,590 | | 15,033 |

Steven C. Oldham | | 5,150 | | 3 years | | 2,575 | | 5.150 | | 9,013 |

Victor H. Peña | | 4,940 | | 3 years | | 2,470 | | 4,940 | | 8,645 |

Jeffrey L. Ceccarelli | | 6,590 | | 3 years | | 3,295 | | 6,590 | | 11,533 |

Matt H. Davis | | 2,320 | | 3 years | | 1,160 | | 2,320 | | 4,060 |

Michael R. Smart | | 2,320 | | 3 years | | 1,160 | | 2,320 | | 4,060 |

All levels of awards are made with reference to the number of shares at the time of the grant, the percentages show below, and the price of each performance share at the time of the grant was $15.58.

| 1. | | The threshold represents the level of TSR and EPS achieved during the cycle, which represents minimum acceptable performance and which, if attained, results in payment of 50% of the target award. Performance below the minimum acceptable level results in no award earned. |

| 2. | | The target represents the level of TSR and EPS achieved during the cycle, which indicates outstanding performance and which, if attained, results in payment of 100% of the target award. |

| 3. | | The maximum represents the maximum payout possible under the plan and a level of TSR and EPS indicative of exceptional performance which, if attained, results in a payment of 175% of the target award. |

| 4. | | Mr. Ruelle left the Company on May 31, 2002, and his performance shares are presently forfeit. |

15

PENSION PLANS

The following table shows annual benefits payable on retirement at normal retirement age 65 to elected officers under SPR’s qualified and non-qualified defined benefit plans based on various levels of remuneration and years of service which may exist at the time of retirement. The amounts below are based upon a maximum benefit of 60% of final average earnings used under the Supplemental Executive Retirement Plan. This maximum is reduced to 50% for any Officer who became a participant after November 1, 1999.

| | | Annual Benefits for Years of Service Indicated

|

Highest Average Five-Years Remuneration

| | 15 Years

| | 20 Years

| | 25 Years

| | 30 Years

| | 35 Years

|

$60,000 | | $27,000 | | $31,500 | | $36,000 | | $36,000 | | $36,000 |

$120,000 | | $54,000 | | $63,000 | | $72,000 | | $72,000 | | $72,000 |

$180,000 | | $81,000 | | $94,500 | | $108,000 | | $108,000 | | $108,000 |

$240,000 | | $108,000 | | $126,000 | | $144,000 | | $144,000 | | $144,000 |

$300,000 | | $135,000 | | $157,500 | | $180,000 | | $180,000 | | $180,000 |

$360,000 | | $162,000 | | $189,000 | | $216,000 | | $216,000 | | $216,000 |

$420,000 | | $189,000 | | $220,500 | | $252,000 | | $252,000 | | $252,000 |

$480,000 | | $216,000 | | $252,000 | | $288,000 | | $288,000 | | $288,000 |

$540,000 | | $243,000 | | $283,500 | | $324,000 | | $324,000 | | $324,000 |

$600,000 | | $270,000 | | $315,000 | | $360,000 | | $360,000 | | $360,000 |

$660,000 | | $297,000 | | $346,500 | | $396,000 | | $396,000 | | $396,000 |

$720,000 | | $324,000 | | $378,000 | | $432,000 | | $432,000 | | $432,000 |

SPR’s noncontributory qualified retirement plan provides retirement benefits to eligible employees upon retirement at a specified age (age 55 early retirement subject to reduction in benefits; age 62 normal retirement). Annual benefits payable are determined by a formula based on years of service and final average earnings consisting of base salary and incentive compensation. Remuneration for the named executives is based on the amount shown in columns (c) and (d) of the Summary Compensation Table. Pension costs of the retirement plan, to which SPR contributes 100% of the funding, are not and cannot be readily allocated to individual employees and are not subject to Social Security or other offsets.

The years of credited service under the qualified retirement plan for the named executives are as follows: Mr. Higgins 6.5, Mr. Ruelle 5.8, Mr. Oldham 25.6, Mr. Peña 5.8, Mr. Ceccarelli 28.3 (maximum vesting is 25 years), Mr. Davis 24.5, and Mr. Smart 23.8.

A supplemental executive retirement plan (SERP) and a restoration plan are also offered to a few of the named executive officers. The SERP is intended to ensure the payment of a competitive level of retirement income to attract, retain and motivate selected executives. The Restoration Plan is intended to provide benefits to executive officers whose benefits cannot be paid under the qualified plan because of salary deferrals to the Non-Qualified Deferred Compensation Plan, IRS limitations on compensation that can be recognized by a qualified plan, and IRS limitations on benefits payable from a qualified plan.

The years of credited service under the non-qualified SERP are as follows: Mr. Higgins 9.1, Mr. Ruelle 5.8, Mr. Oldham 25.6, Mr. Peña 5.8, Mr. Ceccarelli 28.3 (maximum vesting is 25 years), Mr. Davis 24.5, and Mr. Smart 0.0.

16

PERFORMANCE GRAPH

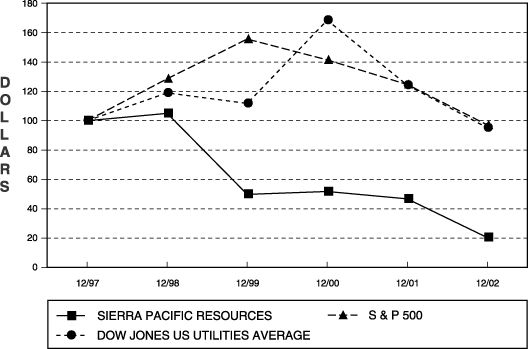

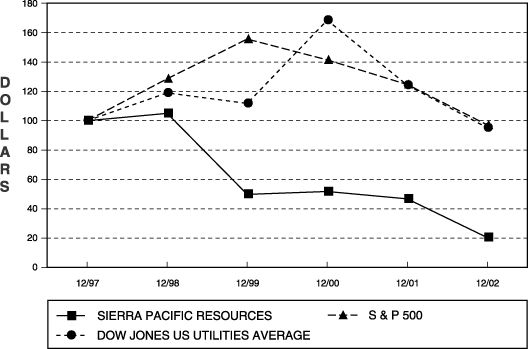

The line graph below compares the yearly percentage change in the cumulative total Stockholder return on the Company’s Common Stock against the cumulative total return of the Standard & Poor’s (S&P) Composite-500 Index and the Dow Jones Utilities Index for a five-year period commencing December 31, 1997, and ending December 31, 2002.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN*

AMONG SIERRA PACIFIC RESOURCES, THE S&P 500 INDEX

AND THE DOW JONES UTILITIES INDEX

| | | 12/31/97 | | 12/31/98 | | 12/31/99 | | 12/31/00 | | 12/31/01 | | 12/31/02 |

|

SIERRA PACIFIC RESOURCES | | $ | 100 | | 104.96 | | 49.90 | | 51.67 | | 46.69 | | 20.43 |

|

STANDARD & POORS 500 | | $ | 100 | | 128.58 | | 155.64 | | 141.46 | | 124.65 | | 97.10 |

|

DOW JONES UTILITIES | | $ | 100 | | 118.88 | | 111.72 | | 168.43 | | 124.18 | | 95.14 |

|

|

*$100invested on 12/31/97 in stock or index, including reinvestment of dividends. Fiscal year ending December 31. |

17

REPORT OF THE AUDIT COMMITTEE

The Audit Committee, described in the section “Board and Committee Meetings,” has adopted and maintains a written charter which was approved by the full Board of Directors. The Committee reviews and reassesses the adequacy of its charter on an annual basis. The charter was updated, revised and amended by the Board in 2002, and it is expected that the Board may make further revisions in 2003. In addition, the Board has adopted a written code of ethics applicable to the Company’s Chief Executive Officer and its senior financial officers. In accordance with its written charter, the Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing, and financial reporting practices of the Company. The Committee Chair, as representative of the Committee, discusses the interim financial information contained in each quarterly earnings announcement with the CFO, Controller, and independent auditors prior to public release, and the entire Committee reviews and discusses the Annual Report on Form 10-K before recommending its adoption and filing by the Company with the Securities and Exchange Commission.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtains from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” discussed with the auditors any relationships that may impact their objectivity and independence, including whether the provision of non-audit services by the auditors is compatible with maintaining auditor independence, and satisfies itself as to the auditors’ independence. A statement of audit fees and all other fees charged by the auditors is set forth immediately following this report.

The Committee also discusses with management, the internal auditors, and the independent auditors the quality and adequacy of the Company’s internal controls and the internal audit function’s organization, responsibilities, budget and staffing. The Committee reviews with both the independent and the internal auditors their audit plans, audit scope, and identification of audit risks.

The Committee discusses and reviews with the independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees.” The Committee also discusses and reviews the process used by management in formulating particularly sensitive accounting estimates and the basis for the conclusions of its independent auditors regarding the reasonableness of those estimates; and, with and without management present, discusses and reviews the results of the independent auditors’ examination of the financial statements. The Committee also discusses the results of the internal audit examinations.

The Committee reviewed the audited financial statements of the Company as of and for the fiscal year ended December 31, 2002, with management and the independent auditors, which included a discussion of the quality and effect of accounting principles, the reasonableness of significant judgments, and the clarity of disclosure in the financial statements. Management has the responsibility for the preparation of the Company’s financial statements and the independent auditors have the responsibility for the examination of those statements.

Based on the above-mentioned review and discussions with management and the independent auditors, the Committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2002, for filing with the Securities and Exchange Commission.

All members of the Audit Committee are independent as defined in Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange Standards. No member of the Committee has any

18

relationship with the Company that might interfere with the exercise of independence from management of the Company. Each member is financially knowledgeable and the Chairman is the Chief Executive Officer of a New York Stock Exchange company, with considerable knowledge of financial accounting, reporting, and management, and has been a long-time member of the Audit Committee. In addition, Mr. Turner, a member of the Audit Committee, was a former partner of Khafoury, Armstrong & Turner, a professional accounting firm, and is a CPA.

Respectfully submitted,

|

THE AUDIT COMMITTEE: | | |

Edward P. Bliss (retiring effective May 12, 2003) |

Jerry E. Herbst | | Clyde T. Turner |

John F. O’Reilly | | Dennis E. Wheeler (Chair) |

Audit Fees

Audit Fees: The aggregate fees for professional services rendered by Deloitte & Touche in connection with its audit of our consolidated financial statements and reviews of the consolidated financial statements included in our Quarterly Reports on Form 10-Q for the 2002 fiscal year was approximately $625,000.

Financial Information Systems Design and Implementation Fees: There were no professional services rendered by Deloitte & Touche in the 2002 fiscal year relating to financial information systems design and implementation.

All Other Fees: The aggregate fees for all other services rendered by Deloitte & Touche in the 2002 fiscal year was as follows:

Attestation Fees: The aggregate fees for attestation services rendered by Deloitte & Touche for matters such as comfort letters and consents related to SEC and other registration statements, agreed-upon procedures and regulatory reporting was approximately $113,000.

Other Fees: The aggregate fees for all other services, such as consultation related to tax planning and compliance, and assistance with regulatory matters, rendered by Deloitte & Touche in the 2002 fiscal year was approximately $4,054,000, of which $3,483,000 were paid to Deloitte & Touche as a contingent fee for certain tax benefits achieved during the fiscal year.

19

REPORT OF THE HUMAN RESOURCES COMMITTEE

ON EXECUTIVE COMPENSATION

Sierra Pacific Resources has in place an executive compensation plan designed to tie executive pay to the Company’s overall performance as well as to the executive’s individual achievements . A part of this Plan, embodied in the Executive Long-Term Incentive Plan, was approved by Stockholders in 1992.

| | • | | To encourage executive involvement in creating long-term Stockholder value by emphasizing the executive’s ownership of Company Stock. |

| | • | | To tie cash awards to specific goals set for the Company, the executive’s business unit, and the individual. |

| | • | | To make improved customer satisfaction, as measured by outside surveys, a specific element of the performance program. |

| | • | | To tie compensation to both annual and long-term strategic plans. |

| | • | | To be able to attract and retain executives of the high caliber vital to long-term Company success. |

| | • | | To relate base pay to industry standards but to require superior performance in order to receive payouts above those standards. |

The plan sets base salaries for executives at median levels for comparably sized companies in the utility industry, with additional “at risk” compensation, which is awarded on condition that goals designed to increase Stockholder value are satisfied or exceeded. The at-risk portion is based on competitive data for comparable positions which is assembled and evaluated by independent consultants and is set at the 50th percentile of general industry companies with annual revenues of $1-$3 billion. The expectation is that total cash compensation will exceed the competitive market for utility companies in good performance years and fall below market if performance targets have not been met. Due to the Company’s financial condition and performance during 2002, no long-term incentive awards were earned by the executive group or paid by the Company for fiscal year 2002, nor were any short-term incentive program awards made.

For the past several years, including 2002, the Board of Directors commissioned Towers Perrin to review the Company’s executive compensation strategy and levels of compensation. For 2002, the Committee determined not to increase base salary position rates for the officer group as a whole, except for a few officers promoted to new positions or who were substantially below median market compensation.

The annual cash incentive plan (called the Short-Term Incentive Program, or “STIP”) contemplates a payment in cash or stock based on achieving pre-established goals based on earnings, cost management, customer satisfaction, and other pertinent business measures. Due to the financial performance of the Company and its financial condition as a whole, as stated above, no annual incentive payments and no STIP payments were made to the executive group as a whole for the year 2002.

20

CHIEF EXECUTIVE OFFICER COMPENSATION

Under the Company’s compensation plan, CEO compensation is based on the same guiding principles established for the executive group as a whole.

On August 4, 2000, the Company elected Walter M. Higgins as President, Chief Executive Officer and Chairman of the Board under terms and conditions of an employment offer. The terms and conditions of that agreement essentially replicated Mr. Higgins’ compensation and benefits package provided by his previous employer, AGL Resources, and made him whole for benefits and compensation lost, forgone, or otherwise forfeited as a result of his accepting employment with the Company.

The Board of Directors engaged Towers Perrin to evaluate Mr. Higgins’ offer prior to consummating it in order to assure that it was consistent with Company policy to compensate its senior executives, including the Chief Executive Officer, at or near the midpoint of the competitive market for base salary and incentive compensation opportunities for executives of comparably sized companies in general industry.

The employment agreement with Mr. Higgins provides for an annual base salary of $590,000, participation in the Company’s short-term incentive program at 65% of base pay, and participation in the Company’s long-term incentive program approved by Stockholders at 140% of base salary. For the reasons expressed above in connection with the officer group as a whole, Mr. Higgins received no annual incentive or long-term payments for 2002. As part of his employment agreement, Mr. Higgins also received a one-time restricted stock grant of 16,000 shares with dividend equivalents, grossed-up for taxes, which will vest over a four-year period. Mr. Higgins is required to accumulate and maintain, over five years, five times annual compensation in Company Stock, and was also granted 400,000 non-qualified stock options at a strike price based on the closing stock price on the day he accepted employment with the Company, which will vest 25% per year or sooner if certain price threshold levels are met. Mr. Higgins is also eligible to participate in the Company’s Supplemental Executive Retirement Plan and was provided credit for all previous years of service with the Company, plus all years served at AGL Resources. Mr. Higgins is also provided $2,000,000 of life insurance coverage at Company expense and is otherwise eligible to participate in all employer-sponsored health, pension, benefit, and welfare plans. In the event Mr. Higgins is terminated by the Company for any reason other than cause (as defined in the agreement), he will receive one year’s base salary and annual incentive payment, subject to execution of an appropriate release and non-compete covenants and full vesting in the Company’s SERP calculated as though he were age 62 (retirement age). In the event of a termination resulting from a change in control, within 24 months following a change in control of the Company (as defined in the agreement either (a) by the Company for reasons other than cause (as defined in the agreement), (b) death or disability, or (c) by Mr. Higgins for good reason as defined in the agreement, including a diminution of responsibilities, compensation, or benefits (unless, with respect to reduction in salary or benefits, such reduction is applicable to all senior executives of the Company and the acquirer)), he will receive certain payments and benefits. This severance payment and benefit include (i) a lump sum payment equal to three times the sum of his base salary and target bonus, (ii) a lump sum payment equal to the present value of the benefits he would have received had he continued to participate in the Company’s retirement plans for an additional three years (or, in the case of the Company’s Supplemental Executive Retirement Plan only, the greater of three years or the period from the date of termination until the executive’s early retirement date, as defined in such plan), and (iii) continuation of life, disability, accident and health insurance benefits for a period of 36 months immediately following termination of employment.

Under the employment agreement, Sierra Pacific will pay any additional amounts sufficient to hold Mr. Higgins harmless for any excise tax that might be imposed as a result of being subject to the

21

federal excise tax on “excess parachute payments” or similar taxes imposed by state or local law in connection with receiving any compensation or benefits that are considered contingent on a change in control.

A change in control for purposes of the Employment Agreement occurs (i) if the Company merges or consolidates, or sells all or substantially all of its assets, and less than 65% of the voting power of the surviving corporation is owned by those Stockholders who were Stockholders of the Company immediately prior to such merger or sale; (ii) any person acquires 20% or more of the Company’s voting stock; (iii) the Company enters into an agreement or the Company or any person announces an intent to take action, the consummation of which would otherwise result in a change in control, or the Board of Directors of the Company adopts a resolution to the effect that a change in control has occurred; (iv) within a two-year period, a majority of the Directors of the Company at the beginning of such period cease to be Directors; (v) the Stockholders of the Company approve a complete liquidation or dissolution of the Company; or (vi) there is consummated a sale of a majority of the stock, or sale of substantially all assets, or complete liquidation or dissolution of either SPPC or NPC.

In addition, in connection with SPR’s family relocation policy, SPR made a cash equity advance of $800,000 to Mr. Higgins in 2002 to facilitate the permanent location of Mr. Higgins and relocation of his family in Las Vegas while his principal residence was being sold. Mr. Higgins repaid the equity advance in its entirety in 2002 when his prior residence was sold.

Respectfully submitted,

|

THE HUMAN RESOURCES COMMITTEE: | | |

Mary Lee Coleman | | Theodore J. Day |

Krestine M. Corbin | | James R. Donnelley, Chair |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transactions with Management

Mr. William E. Peterson became Senior Vice President and General Counsel for Sierra Pacific Resources in 1993 and retired from SPR in September 2002. Following his retirement, Mr. Peterson became associated with Woodburn and Wedge, a law firm in Reno, Nevada, in which Mr. Peterson had been a partner until 1993 and at which he performed legal work for SPR and SPPC for 18 years prior to his employment by SPR. Woodburn and Wedge has performed legal services for SPPC since 1920, for NPC since 1999, and for SPR and all of its other subsidiaries from their inception, and continues to perform legal work for SPR. Mr. Peterson’s wife, an equity partner in the firm since 1982, has performed work for SPR since 1976 and continues to do so from time to time. In order to facilitate Mr. Hunterton’s transition to Mr. Peterson’s position and to protect SPR’s legal interests during the transition, Mr. Peterson agreed to perform legal work on an as-needed basis from the date of his early retirement until the end of the year. Mr. Peterson also agreed to perform a minimum number of hours of legal services for SPR during each of the next three years at his customary hourly rates, subject to satisfactory and timely performance by him within accepted standards of professional practice.

In May 2002, SPR entered into severance and release agreement with four executive officers, including Steve C. Oldham, Senior Vice President, Energy Supply, Douglas R. Ponn, Vice President, Public Policy, and Paul Heagen, Vice President, Marketing and Communications, for SPPC and NPC, and Mark A. Ruelle, President of NPC. Under the terms of these agreements, each executive officer

22

received approximately 12 months pay, except in the case of Mr. Ruelle, who received 1.5 times his annual salary, all payable in installments over one year. In addition, each executive officer received continued medical and health coverage under SPR plans at SPR’s expense until each became reemployed and obtained comparable coverage, and in the case of Mr. Oldham, an additional payment of normal retirement pay until he attains his early retirement age (age 55). SPR also retained Mr. Ponn, formerly head of SPR’s legislative effort, to assist SPR through the January to June 2003 legislative session.

Section 16(a) of the Securities Exchange Act of 1934. as amended (the “Exchange Act”), requires our Directors and executive officers to file reports of holdings and transactions of securities of the Company with the SEC. Based on our records and other information, we believe that all SEC filing requirements applicable to our Directors and executive officers with respect to the fiscal year ended December 31, 2002, were met.

Change in Control Agreements

SPR has entered into change in control severance agreements with its executive staff, including Walter M. Higgins, Jeffrey L. Ceccarelli, Victor H. Peña, Mary O. Simmons, Susan Brennan, Carol Marin, Richard K. Atkinson, John Brown, Michael R. Smart, Matt H. Davis, Donald L. Shalmy, Julian C. Leone, Michael Yackira, Richard J. Coyle, Bob Werner, and Jane Crane. These agreements expire on December 31, 2004, and provide that, upon termination of the executive’s employment during the term of the Agreement (subject to an extension in the event a Potential Change in Control, as defined in the agreement, occurs during the term) following a change in control of SPR (as defined in the agreement) either (a) by SPR for reasons other than cause (as defined in the agreements), (b) death or disability, or by the executive for good reason (as defined in the agreement), including a diminution of responsibilities, compensation, or benefits (unless, with respect to reduction in salary or benefits, such reduction is applicable to all senior executives of SPR), the executive will receive certain payments and benefits. These severance payments and benefits include (i) a lump sum payment equal to two or, with respect to certain senior officers, three times the sum of the executive’s base salary and target bonus, (ii) a lump sum payment equal to the present value of the benefits the executive would have received had he continued to participate in SPR’s retirement plans for an additional two or in a few cases three years (or, in the case of SPR’s Supplemental Executive Retirement Plan only, the greater of three years or the period from the date of termination until the executive’s early retirement date, as defined in such plan), and (iii) continuation of life, disability, accident and health insurance benefits for a period of 24 or 36 months immediately following termination of employment, except with respect to Mr. Higgins, whose agreement is described in the section titled Chief Executive Officer Compensation above. The agreements also provide that if any compensation paid, or benefit provided, to the executive, whether or not pursuant to the change in control agreements, would be subject to the federal excise tax on “excess parachute payments,” payments and benefits provided pursuant to the agreement will be cut back to the largest amount that would not be subject to such excise tax, if such cutback results in a higher after-tax payment to the executive, except with respect to Mr. Higgins, who agreement is described in the section titled Chief Executive Officer Compensation above. The Board of Directors entered into these agreements in order to attract and retain management and to encourage and reinforce continued attention to the executives’ assigned duties without distraction under circumstances arising from the possibility of a change in control of SPR. In entering into these agreements, the Board was advised by Towers Perrin, the national compensation and benefits consulting firm described above, and Skadden, Arps, Slate, Meagher & Flom, an independent outside law firm, to insure that the agreements entered into were in line with existing industry standards, and provided benefits to management consistent with those standards.

23

INDEPENDENT PUBLIC ACCOUNTANTS

Deloitte & Touche LLP, the Company’s independent public accountants, has been selected to conduct an audit and to report on the Company’s financial statements for the years 2002 and 2003.

The Company’s financial statements, and the financial statements of subsidiary companies, for the year ended December 31, 2002, were audited by Deloitte & Touche LLP. A representative of Deloitte & Touche will be present at the Annual Meeting to answer questions from Stockholders and will have an opportunity to make a statement if desired. The auditors fees for year 2002 and the Audit Committee’s review of auditor independence are set forth in the Report of the Audit Committee above.

DISCRETIONARY AUTHORITY

The Company has no knowledge of any matters to be presented for action by the Stockholders at the meeting other than as set forth herein. However, the enclosed proxy gives discretionary authority to the persons named therein to act in accordance with their best judgment in the event that any additional matters should be presented.

DEADLINE FOR STOCKHOLDERS PROPOSALS

Proposals of Stockholders intended to be presented at the 2004 Annual Meeting of Stockholders must be received on or before December 9, 2003, for inclusion in the proxy materials relating to that meeting. Any such proposals should be sent to C. Stanley Hunterton, Secretary, Sierra Pacific Resources, P.O. Box 30150, Reno, NV 89520-3150.

ANNUAL REPORT

In order to exercise prudent judgment, Stockholders are invited to examine the financial statements contained in the Company’s Annual Report for 2002, a copy of which has been mailed to all Stockholders of record through the close of business on March 14, 2003.

To the extent that this Proxy Statement has been or will be specifically incorporated by reference into any filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act, the sections of the Proxy Statement entitled “Report of the Human Resources Committee on Executive Compensation,” “Performance Graph,” and “Report of the Audit Committee” shall not be deemed to be so incorporated, unless specifically otherwise provided in any such filing.

24

Annex A

Sierra Pacific Resources

2003 Non-Employee Director Stock Plan

1. Purpose of the Plan

The purpose of the 2003 Non-Employee Director Stock Plan is to provide ownership of the Company’s Stock to non-employee members of the Board of Directors in order to improve the Company’s ability to attract and retain highly-qualified individuals to serve as Directors of the Company; to provide competitive compensation for Board service and to strengthen the commonality of interest between Directors and shareholders.

2. Definitions

When used herein, the following terms shall have the respective meanings set forth below:

(a) “Annual Retainer” means the annual retainer payable to all Non-Employee Directors (exclusive of any per meeting fees or expenses reimbursements).

(b) “Annual Meeting of Stockholders” means the annual meeting of Stockholders of the Company or any Participating Company at which Directors of the Company or the Participating Company, as the case may be, are elected.

(c) “Board” means the Board of Directors of the Company.

(d) “Committee” means a committee whose members meet the requirements of Section 4(a) hereof, appointed from time to time by the Board to administer the Plan.

(e) “Common Stock” means the common stock, $1.00 par value, of the Company.

(f) “Company” means Sierra Pacific Resources, a Nevada corporation, and any successor corporation.

(g) “Employees” means any officer or employee of the Company or of any Subsidiary (whether or not such Subsidiary participates in the Plan).

(h) “Non-Employee Director” or “Participant” means any person who is elected or appointed to the Board of Directors of any Participating Company and who is not an Employee.

(i) “Participating Company” means the Company and any Subsidiary of the Company whose participation in the Plan has been approved by both the Company’s and such subsidiary’s board of Directors.

(j) “Plan” means the Company’s 2003 Non-Employee Director Stock Plan as set forth herein, as it may be amended from time to time.

(k) “Plan Year” means the period commencing on the effective date of the Plan and ending the next following December 31 and thereafter the calendar year.

(l) “Stock Payment” means the fixed portion of the Annual Retainer to be paid to Non-Employee Directors in shares of Common Stock rather than cash for services rendered as a Director of a Participating Company as provided in Section 6 hereof including that portion of the Stock Payment resulting from the election specified in Section 7 hereof.

25

(m) “Subsidiary” means any corporation that is a “subsidiary corporation” of the Company, as that term is defined in Section 424(f) of the Internal Revenue Code of 1986.

3. Shares of Common Stock Subject to the Plan

Subject to adjustment as provided in Section 10 below, the maximum aggregate number of shares of Common Stock that may be issued under the Plan is 700,000 shares. The Common Stock to be issued under the Plan will be made available (a) from authorized but unissued shares of Common Stock, and the Company shall set aside and reserve for issuance under the Plan said number of shares, or (b) through purchases made on the open market.

4. Administration of the Plan

(a) The Plan will be administered by the Committee, which will consist of three or more persons who are not eligible to participate in the Plan. Members of the Committee need not be members of the Board. The Company shall pay all costs of administration of the Plan.

(b) Subject to the express provisions of the Plan, the Committee has and may exercise such powers and authority of the Board as may be necessary or appropriate for the Committee to carry out its functions under the Plan. Without limiting the generality of the foregoing, the Committee shall have full power and authority (i) to determine all questions of fact that may arise under the Plan, (ii) to interpret the Plan and to make all other determinations necessary or advisable for the administration of the Plan, and (iii) to prescribe, amend, and rescind rules and regulations relating to the Plan, including, without limitation, any rules which the Committee determines are necessary or appropriate to ensure that the Company, each Participating Company and the Plan will be able to comply with all applicable provisions of any federal, state or local law, including securities laws. All interpretations, determinations, and actions by the Committee will be final, conclusive, and binding upon all parties. Any action of the Committee with respect to the administration of the Plan shall be taken pursuant to a majority vote at a meeting of the Committee (at which members may participate by telephone) or by the unanimous written consent of its members.

(c) Neither the Company, nor any other Participating Company, nor any representatives, employees or agents of any Participating Company, nor any member of the Board or the Committee will be liable for any damages resulting from any action or determination made by the Board or the Committee with respect to the Plan or any transaction arising under the Plan or any omission in connection with the Plan in the absence of willful misconduct or gross negligence.

5. Participation in the Plan

(a) All Non-Employee Directors shall participate in the Plan, subject to the conditions and limitations of the Plan, so long as they remain eligible to participate in the Plan.

(b) No Non-Employee Director shall be eligible for a Stock Payment if, at the time said Stock Payment would otherwise be made, such Non-Employee Director owns (or is deemed to own) directly or indirectly, shares of Common Stock representing more than five percent of the total combined voting power of all classes of stock of the Company. The compensation, if any, of such Directors shall be determined by the Board.

6. Determination of Annual Retainers and Stock Payments

(a) The Board shall determine the Annual Retainer for all Non-Employee Directors of the Company and all Participating Companies.

26

(b) Each Director of one or more Participating Companies who is a Non-Employee Director immediately following the date of the Annual Meeting of Stockholders of one or more Participating Companies shall receive a Stock Payment as a portion of the Annual Retainer payable to such Director as provided in the Plan for serving in such capacities. The number of shares to be issued to each Participant as a Stock Payment shall be determined by dividing the applicable Market Price into the amount of the Annual Retainer payable to such Participant in excess of $10,000; provided, however, that no fractional shares shall be issued (cash shall be paid in lieu thereof). The “Market Price” of Common Stock issued by the Company under the Plan shall be the average daily high and low sale prices of the Common Stock on the composite tape for stocks listed on the New York Stock Exchange for all trading days during the calendar month preceding the date of the applicable Annual Meeting of Stockholders of the Company. Such Market Price shall be used to determine the number of shares of Common Stock to be issued to Non-Employee Directors of all Participating Companies for the current year. Certificates evidencing the shares of Common Stock constituting Stock Payments shall be registered in the respective names of the Participants and shall be issued, together with a cash payment for any fractional share, to each Participant as soon as practicable following the respective Annual Meeting of Stockholders. The cash portion of the Annual Retainer shall be paid to Non-Employee Directors at such times and in such manner as may be determined by the Board.