EXPERIENCE AND SOLUTIONS A Century of Experience and 21st Century Banking Solutions

Certain statements in this presentation may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, predictions, expectations or beliefs about future events or results or otherwise and are not statements of historical fact. Such statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate” or other statements concerning opinions or judgments of American National and its management about future events. The forward-looking statements herein are based on certain assumptions and analyses by American National and are factors it believes are appropriate under the circumstances. Actual results could differ materially from those contained in or implied by such statements for a variety of reasons including, but not limited to: changes in interest rates; changes in accounting principles, policies or guidelines; significant changes in the economic scenario; significant changes in regulatory requirements; significant changes in securities markets; and changes regarding acquisitions and dispositions. Consequently, all forward-looking statements made herein are qualified by these cautionary statements. American National does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. FORWARD-LOOKING STATEMENTS 3

1. Introduction to American National Bankshares Inc. 2. Recent quarter performance and accomplishments 3. Financial performance 4. Capital management 5. Why invest in American National? AGENDA 4

INTRODUCTION TO AMERICAN NATIONAL 5

VISION We will be the best provider of relationship- based financial services in the communities we serve, resulting in enhanced shareholder value, customer loyalty and employee satisfaction GUIDING PRINCIPLES 1. Operate a sound, efficient, growing and highly profitable company. 2. Identify and respond to our internal and external customers’ needs and expectations in an ever-changing financial environment. 3. Provide our customers 21st century financial solutions that are designed to meet their current and future needs. 4. Provide an attractive return for our shareholders. 5. Furnish positive leadership for the well-being of all the communities we serve. 6. Continuously develop a challenging and rewarding work environment for our employees that focuses on working as a team. 7. Conduct our work with integrity and professionalism.

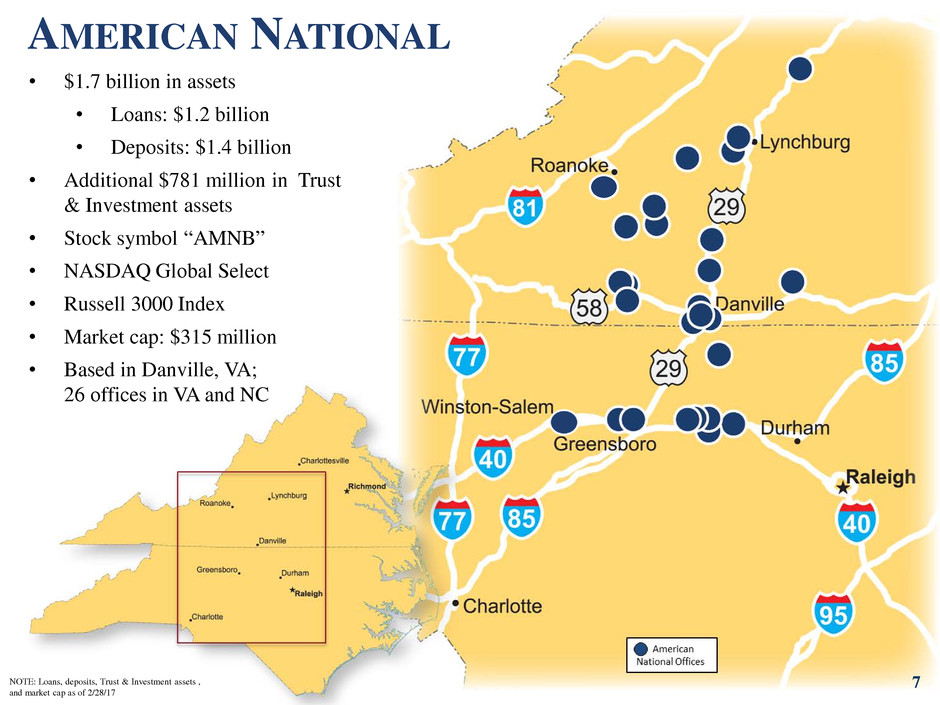

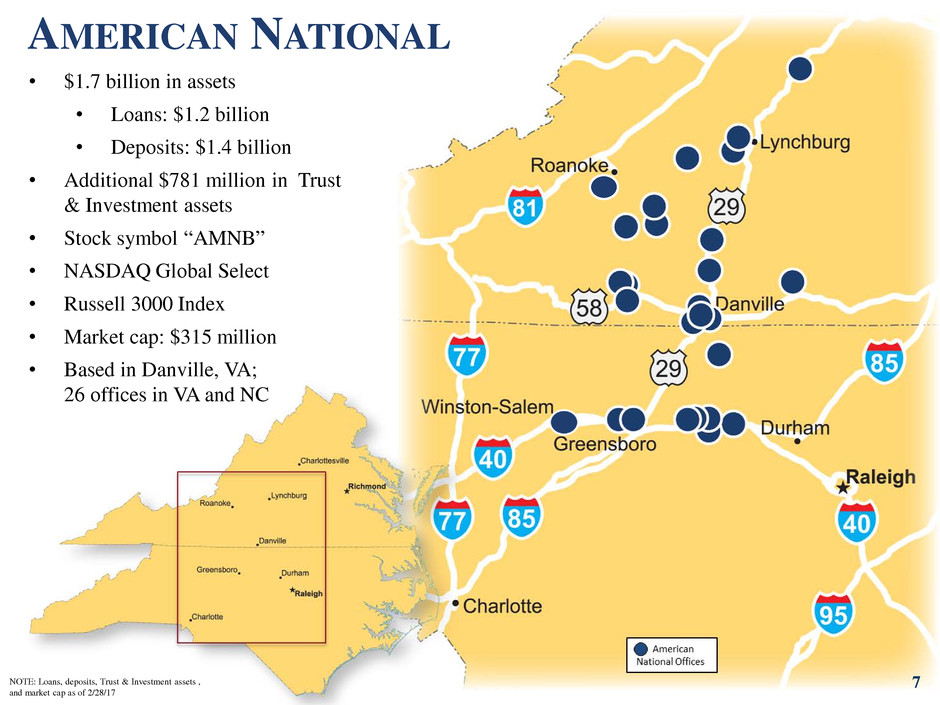

AMERICAN NATIONAL 7 • $1.7 billion in assets • Loans: $1.2 billion • Deposits: $1.4 billion • Additional $781 million in Trust & Investment assets • Stock symbol “AMNB” • NASDAQ Global Select • Russell 3000 Index • Market cap: $315 million • Based in Danville, VA; 26 offices in VA and NC NOTE: Loans, deposits, Trust & Investment assets , and market cap as of 2/28/17

• Growing – Greensboro/Winston Salem – Roanoke • Consistent – 108 years of tradition – Deep management team – Strong, experienced board of directors – Ability to execute • Conservative – Stringent underwriting – Strong capital • Shareholder focused – Exceptional dividend – Prudent growth – Good stewards of capital WE ARE… 8

• Fortress-like balance sheet – Exceptional asset quality – Low-risk investment portfolio – High liquidity – Capital strength • Disciplined growth – Organic – External • Strong earnings stream • Imagination OUR PRIORITIES 9

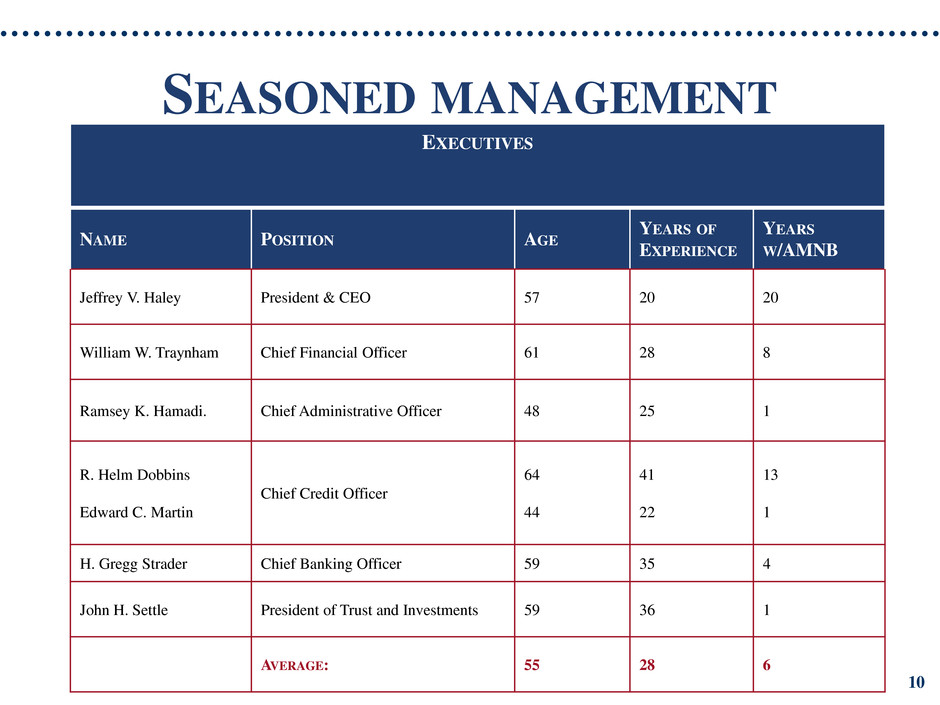

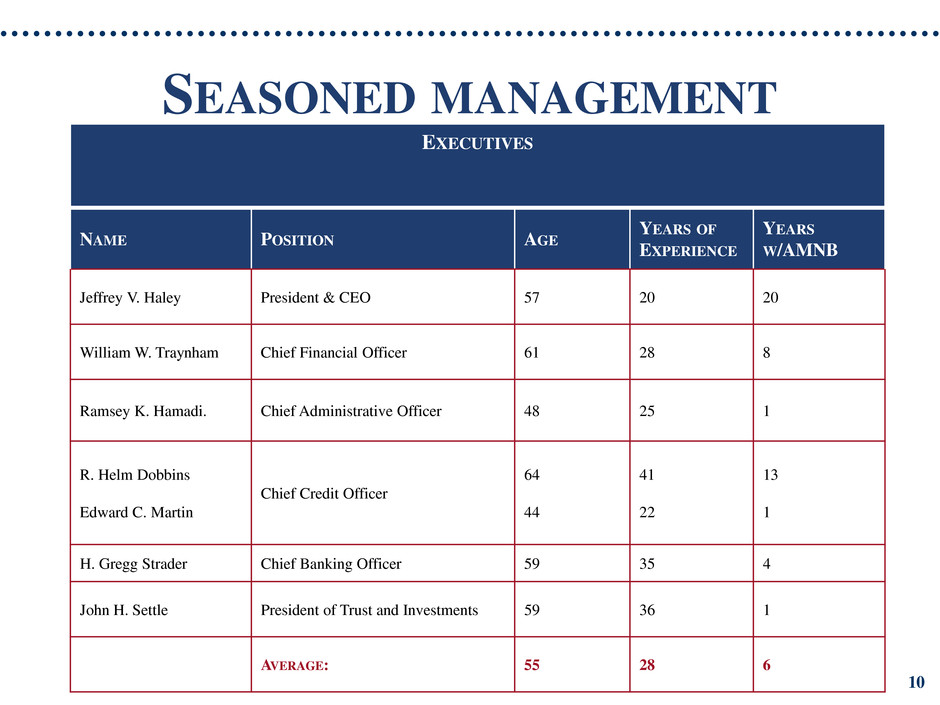

SEASONED MANAGEMENT 10 EXECUTIVES NAME POSITION AGE YEARS OF EXPERIENCE YEARS W/AMNB Jeffrey V. Haley President & CEO 57 20 20 William W. Traynham Chief Financial Officer 61 28 8 Ramsey K. Hamadi. Chief Administrative Officer 48 25 1 R. Helm Dobbins Edward C. Martin Chief Credit Officer 64 44 41 22 13 1 H. Gregg Strader Chief Banking Officer 59 35 4 John H. Settle President of Trust and Investments 59 36 1 AVERAGE: 55 28 6

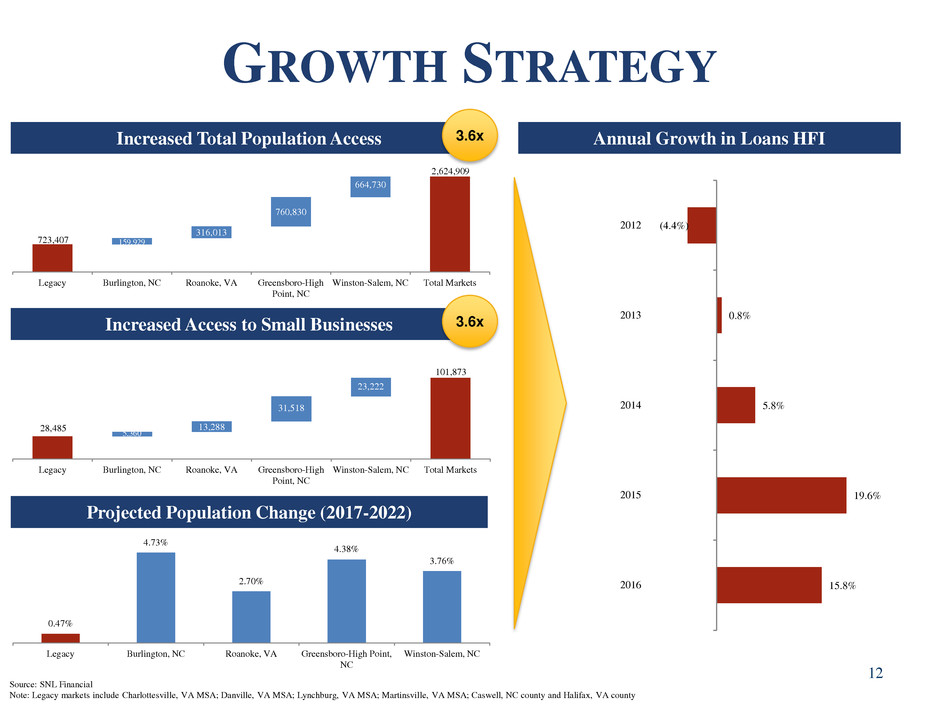

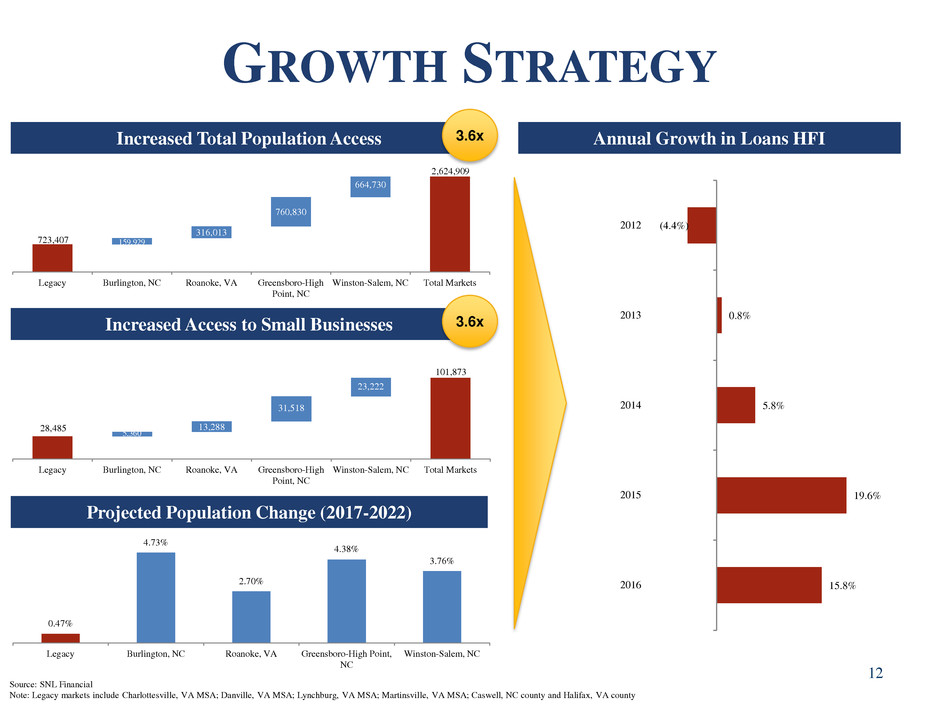

11 GROWTH STRATEGY • Organic growth 2016 – 16% • Leverage core market position in Danville • 31% deposit market share • North Carolina CAGR since 2012 • All markets – 15% • Greensboro – 30% • Team lift outs Winston-Salem, NC & Roanoke, VA • Succession for Chief Credit Officer • 7 commercial bankers • 2 small business bankers • Mortgage Originator • 4 retail bankers • 5 support/credit staff • Grow into adjacent markets • Charlottesville, VA • Richmond, VA • Blacksburg, VA • Durham-Chapel Hill, NC

12 Source: SNL Financial Note: Legacy markets include Charlottesville, VA MSA; Danville, VA MSA; Lynchburg, VA MSA; Martinsville, VA MSA; Caswell, NC county and Halifax, VA county 723,407 2,624,909 159,929 316,013 760,830 664,730 Legacy Burlington, NC Roanoke, VA Greensboro-High Point, NC Winston-Salem, NC Total Markets 28,485 101,873 5,360 13,288 31,518 23,222 Legacy Burlington, NC Roanoke, VA Greensboro-High Point, NC Winston-Salem, NC Total Markets 0.47% 4.73% 2.70% 4.38% 3.76% Legacy Burlington, NC Roanoke, VA Greensboro-High Point, NC Winston-Salem, NC Increased Total Population Access 3.6x Increased Access to Small Businesses 3.6x Projected Population Change (2017-2022) (4.4%) 0.8% 5.8% 19.6% 15.8% 2012 2013 2014 2015 2016 Annual Growth in Loans HFI GROWTH STRATEGY

13 DIVERSE REVENUE STREAM Noninterest Income • Trust & Investment Services • Brokerage • Secondary Mortgage • Title Insurance • Bankers Insurance Trust and Investment Services • Organized in 1927 • Offices in Danville, Martinsville, Lynchburg • Assets: $781 million • Customers: individuals, businesses, foundations and non-profits • Serve clients locally and abroad • Priorities: – Trust administration – Investment management – Estate settlement – Retail brokerage • Excellent equity performance Trust Assets ($ in millions) $417 $531 $541 $628 $661 $749 $781 2010 2011 2012 2013 2014 2015 2016

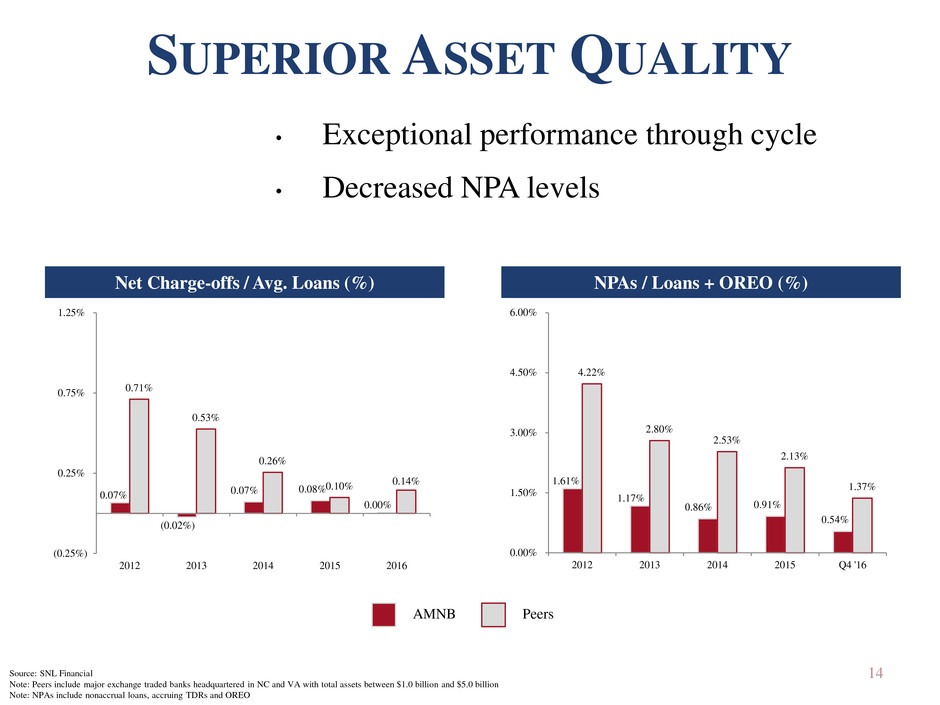

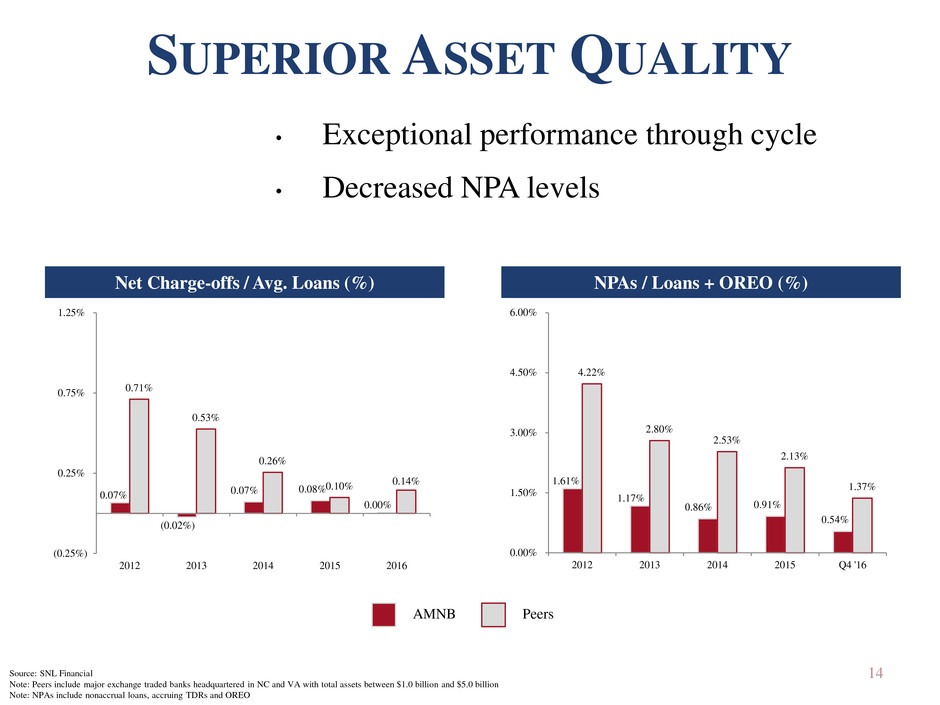

14 SUPERIOR ASSET QUALITY Net Charge-offs / Avg. Loans (%) NPAs / Loans + OREO (%) Source: SNL Financial Note: Peers include major exchange traded banks headquartered in NC and VA with total assets between $1.0 billion and $5.0 billion Note: NPAs include nonaccrual loans, accruing TDRs and OREO AMNB Peers • Exceptional performance through cycle • Decreased NPA levels 0.07% (0.02%) 0.07% 0.08% 0.00% 0.71% 0.53% 0.26% 0.10% 0.14% (0.25%) 0.25% 0.75% 1.25% 2012 2013 2014 2015 2016 1.61% 1.17% 0.86% 0.91% 0.54% 4.22% 2.80% 2.53% 2.13% 1.37% 0.00% 1.50% 3.00% 4.50% 6.00% 2012 2013 2014 2015 Q4 '16

LOAN PORTFOLIO • Granular portfolio • Highly diversified • Top 10 relationships combine for $156 million or 13% of total loans December 31, 2016 – $1.2 billion Source: SNL Financial and Company filings December 31, 2016 – CRE • Average commercial credit size of $250,428 • The sweet spot: $500,000 - $1 million Commercial R.E. 44% Construction 10% Consumer & Other 10% Commercial & Industrial 18% Residential R.E. 18% 15

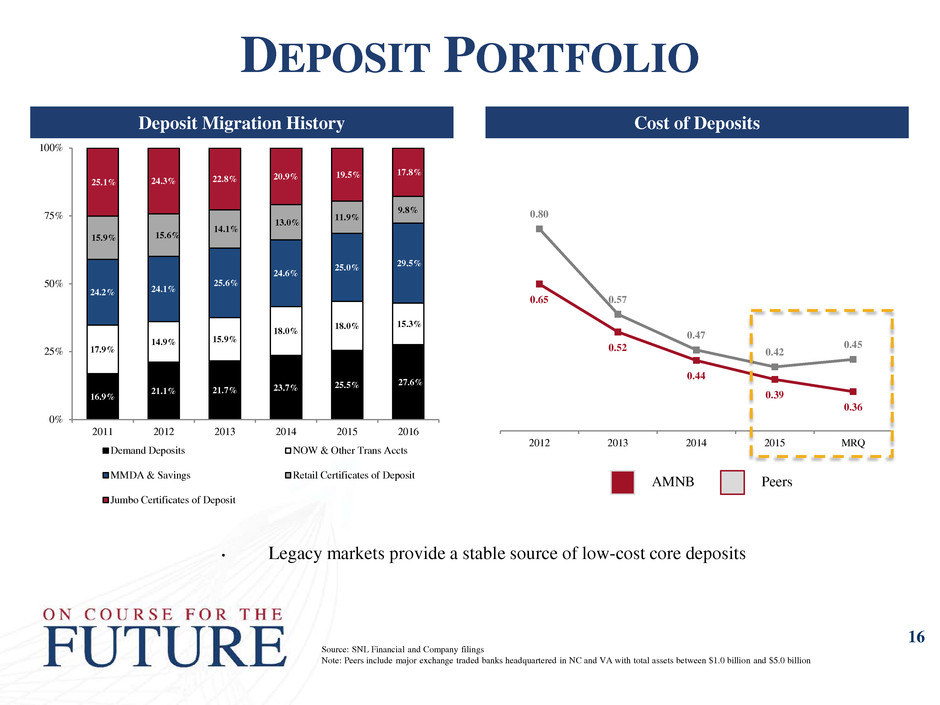

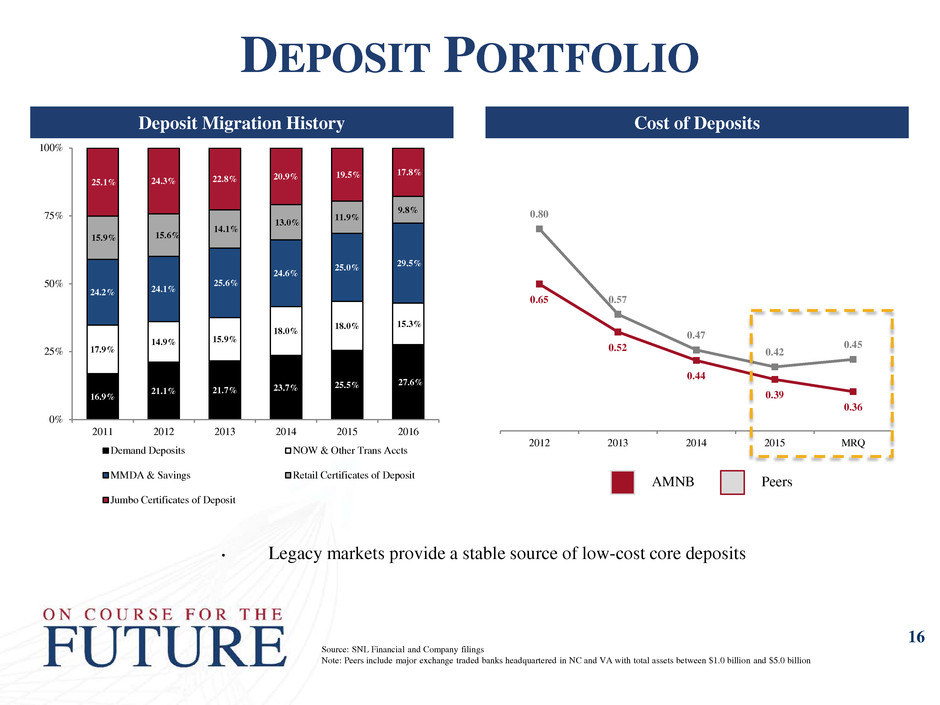

16.9% 21.1% 21.7% 23.7% 25.5% 27.6% 17.9% 14.9% 15.9% 18.0% 18.0% 15.3% 24.2% 24.1% 25.6% 24.6% 25.0% 29.5% 15.9% 15.6% 14.1% 13.0% 11.9% 9.8% 25.1% 24.3% 22.8% 20.9% 19.5% 17.8% 0% 25% 50% 75% 100% 2011 2012 2013 2014 2015 2016 Demand Deposits NOW & Other Trans Accts MMDA & Savings Retail Certificates of Deposit Jumbo Certificates of Deposit DEPOSIT PORTFOLIO Deposit Migration History Cost of Deposits Source: SNL Financial and Company filings Note: Peers include major exchange traded banks headquartered in NC and VA with total assets between $1.0 billion and $5.0 billion • Legacy markets provide a stable source of low-cost core deposits AMNB Peers 16 0.65 0.52 0.44 0.39 0.36 0.80 0.57 0.47 0.42 0.45 2012 2013 2014 2015 MRQ

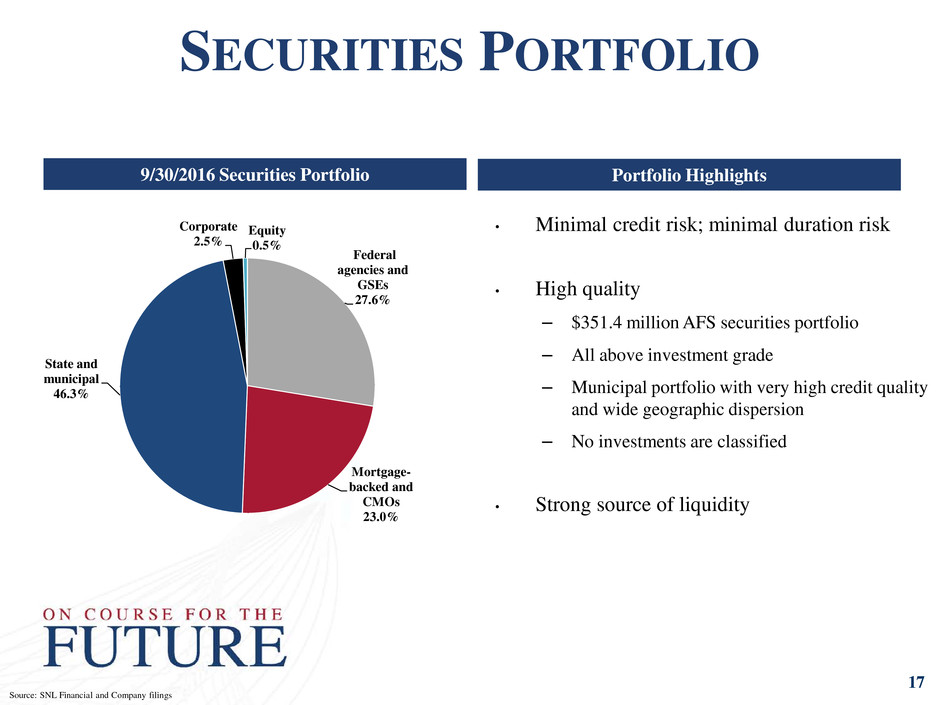

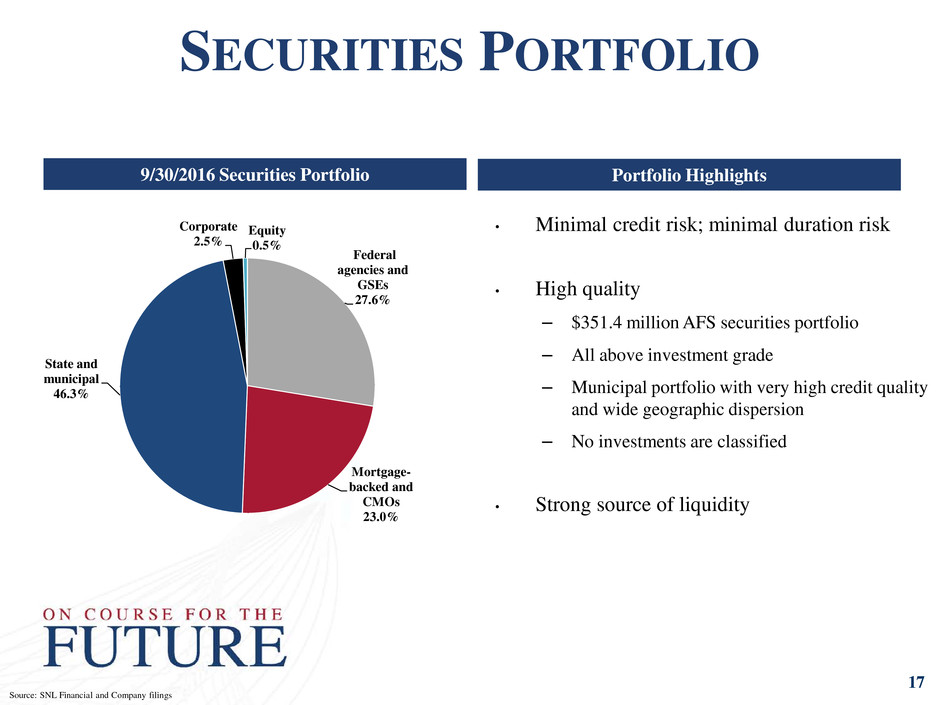

SECURITIES PORTFOLIO Source: SNL Financial and Company filings • Minimal credit risk; minimal duration risk • High quality – $351.4 million AFS securities portfolio – All above investment grade – Municipal portfolio with very high credit quality and wide geographic dispersion – No investments are classified • Strong source of liquidity Portfolio Highlights9/30/2016 Securities Portfolio Federal agencies and GSEs 27.6% Mortgage- backed and CMOs 23.0% State and municipal 46.3% Corporate 2.5% Equity 0.5% 17

Q4 PERFORMANCE & RECENT ACCOMPLISHMENTS 18

Q4 2016 HIGHLIGHTS 19 • Diluted EPS: $0.48 (FY2016 $1.89) • NPAs to Total Assets: 0.38% vs. 0.42% in Q3 2016 • Annualized net charge-offs: 0.00% • Dividend: $0.24 paid in Q4 – Paid $0.96 full year for 2016

FINANCIAL PERFORMANCE AND PEER COMPARISON 20

TOTAL RETURN AMNB Return Relative to the NASDAQ Bank Index and Peers Source: Factset Research Systems; Market data as of 2/28/2017 Note: AMNB total return assumes reinvestment of dividends Note: Peers include major exchange traded banks headquartered in NC and VA with total assets between $1.0 billion and $5.0 billion AMNB NASDAQ Bank Peer Median 170.9% 33.2% 45.8% 27.4% 108.8% 27.2% 0.0% 50.0% 100.0% 150.0% 200.0% Since 2008 Since Election 21

3 Year CAGR (%) 5 Year CAGR (%) Source: SNL Financial (1) Includes major exchange traded banks nationwide with total assets between $1 billion and $3 billion, excluding merger targets and MHCs (2) Includes all major exchange traded banks nationwide, excluding merger targets and MHCs 8.7% 9.7% 9.4% 0.0% 4.0% 8.0% 12.0% 16.0% AMNB Nationwide Peers - $1bn to $3bn in Assets Nationwide Banks (1) (2) 5.2% 9.0% 8.3% 0.0% 4.0% 8.0% 12.0% 16.0% AMNB Nationwide Peers - $1bn to $3bn in Assets Nationwide Banks (1) (2) 10 Year CAGR (%) 8.0% 7.6% 7.4% 0.0% 4.0% 8.0% 12.0% 16.0% AMNB Nationwide Peers - $1bn to $3bn in Assets Nationwide Banks (1) (2) OPPORTUNISTIC ASSET GROWTH 22

Price / TBV (x) Price / LTM EPS (x) Source: SNL Financial; Market data as of 2/28/2017 (1) Includes major exchange traded banks nationwide with total assets between $1 billion and $3 billion, excluding merger targets and MHCs (2) Includes all major exchange traded banks nationwide, excluding merger targets and MHCs 2.02x 1.69x 1.83x 1.20x 1.40x 1.60x 1.80x 2.00x 2.20x AMNB Nationwide Peers - $1bn to $3bn in Assets Nationwide Banks (1) (2) 19.3x 18.3x 19.2x 10.0x 12.0x 14.0x 16.0x 18.0x 20.0x AMNB Nationwide Peers - $1bn to $3bn in Assets Nationwide Banks (1) (2) Price / 2017 Est. EPS (x) Price / 2018 Est. EPS (x) 18.8x 17.6x 17.9x 10.0x 12.0x 14.0x 16.0x 18.0x 20.0x AMNB Nationwide Peers - $1bn to $3bn in Assets Nationwide Banks (1) (2) 15.8x 15.2x 15.5x 10.0x 12.0x 14.0x 16.0x 18.0x 20.0x AMNB Nationwide Peers - $1bn to $3bn in Assets Nationwide Banks (1) (2) TRADING MULTIPLES ANALYSIS 23

0.00% 0.40% 0.80% 1.20% 1.60% 2009 2010 2011 2012 2013 2014 2015 2016 HISTORICAL PEER COMPARISON ROAA (%) Source: SNL Financial Note: Peers include major exchange traded banks headquartered in NC and VA with total assets between $1.0 billion and $5.0 billion Efficiency Ratio (%) Net Interest Margin (%) 1.02% 0.95% 35.0% 45.0% 55.0% 65.0% 75.0% 2009 2010 2011 2012 2013 2014 2015 2016 3.00% 3.50% 4.00% 4.50% 5.00% 2009 2010 2011 2012 2013 2014 2015 2016 59.8% 65.2 % 3.52% 3.54% AMNB Peers 24

ROAA (%) NIM (%) Efficiency Ratio (%) NPAs/ Loans + OREO (%) NCOs/Avg. Loans (%) TCE/TA (%) Total Capital (%) Div Yield (%) NATIONWIDE MRQ COMPARISON Source: SNL Financial; Market data as of 2/28/2017 Note: Peers include major exchange traded banks headquartered in NC and VA with total assets between $1.0 billion and $5.0 billion 75th Percentile 50th Percentile 25th Percentile Nationwide Public Banks and Thrifts AMNB (3.45%) AMNB (0.54%) AMNB (14.8%) AMNB (2.6%) Peers (3.54%) Peers (1.37%) Peers (9.5%) Peers (14.0%) Peers (1.0%) Performance Asset Quality Capital Returns AMNB (0.00%) Peers (0.14%) 25 AMNB (0.98%) Peers (0.93%) AMNB (61.1%) Peers (63.8%) AMNB (9.5%)

CAPITAL MANAGEMENT 26

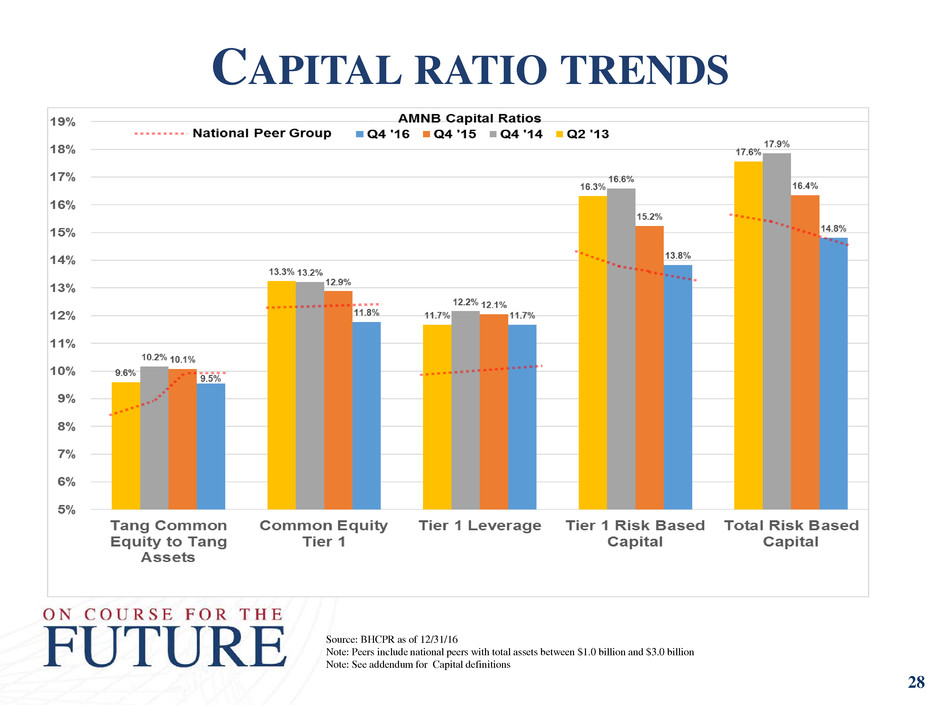

• Past: − Historically strong capital levels funded 2 transactions in past 6 years during economic crisis • Future: • Maintain more capital than most to: − Satisfy changing regulatory requirements − Flexibility to support opportunistic M&A transactions − Shareholder expectations • Appropriate balance to fund: − Organic growth − Acceptable deals − Pay strong dividend − Stock repurchase program CAPITAL MANAGEMENT 27

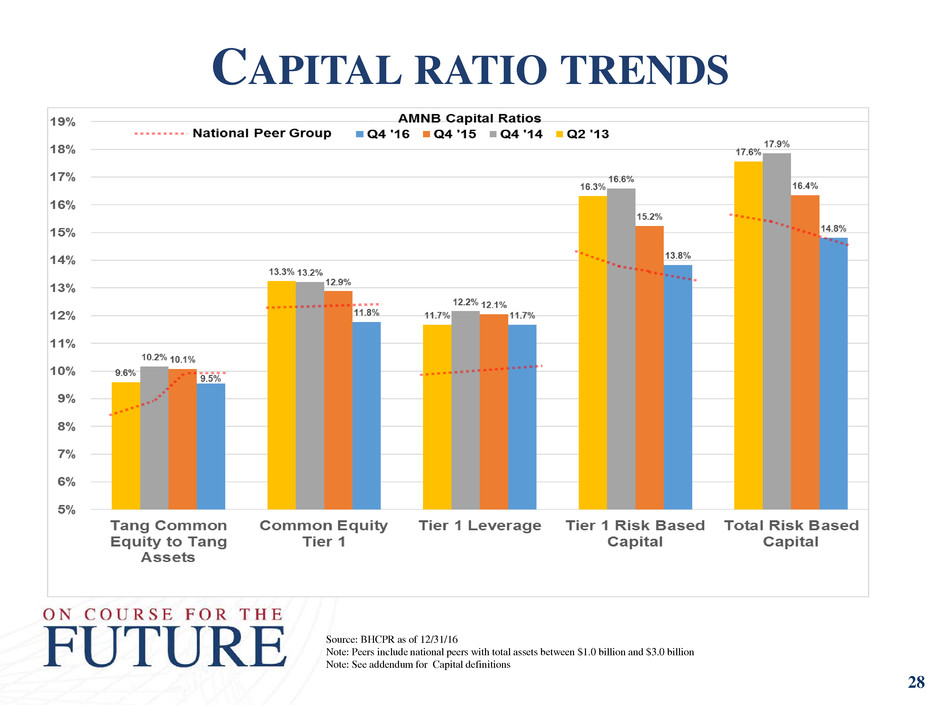

28 CAPITAL RATIO TRENDS Source: BHCPR as of 12/31/16 Note: Peers include national peers with total assets between $1.0 billion and $3.0 billion Note: See addendum for Capital definitions

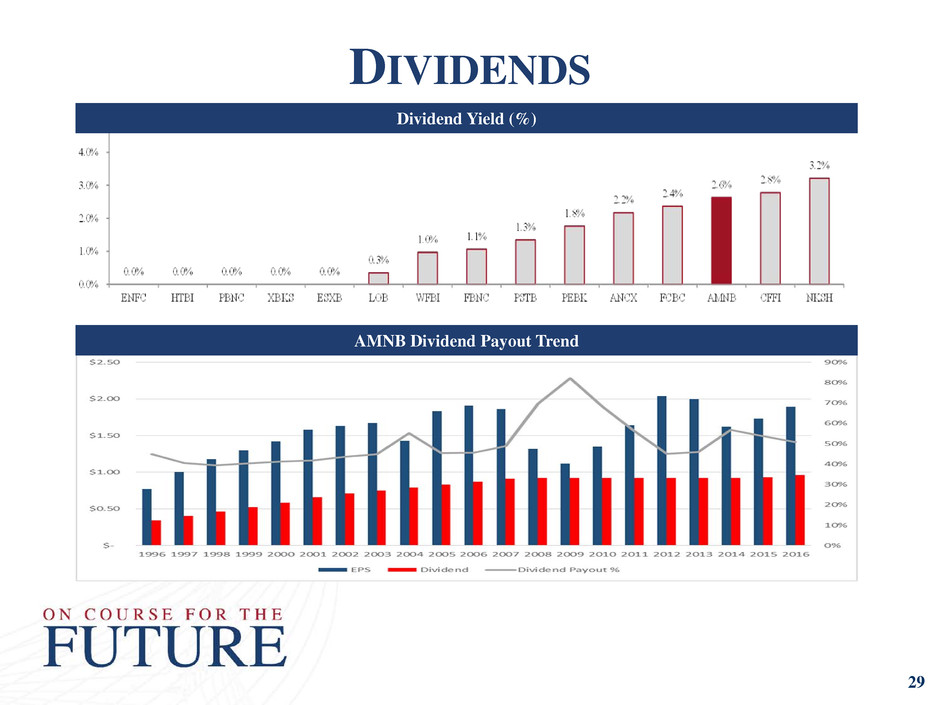

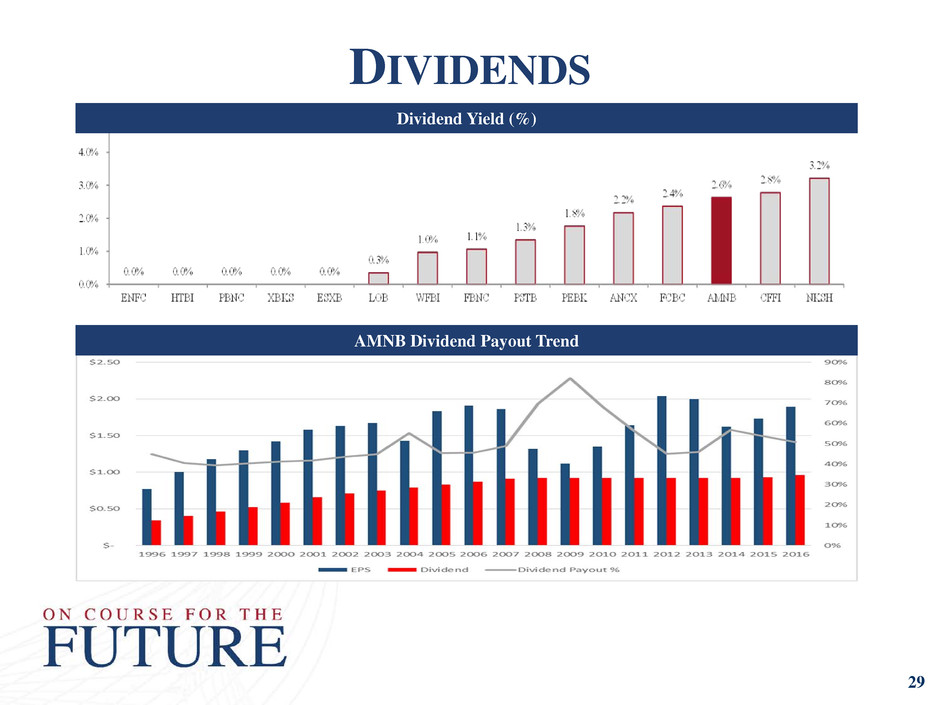

29 DIVIDENDS Dividend Yield (%) AMNB Dividend Payout Trend

OPPORTUNISTIC ACQUISITION STRATEGY • Fair value accounting changed the game • Capital is necessary to be a player • Focused on growth markets in NC and VA • Characteristics of targets: – $250 million-$750 million size – Practical assimilation – Manageable credit issues – Compatible cultures – EPS accretion – Maintenance of strong capital levels – Identifiable synergies for savings • Our credit culture will be maintained 30

We are a community bank known for… WHY INVEST IN AMERICAN NATIONAL? 31 Strong earnings Attractive dividend Consistently outperforming peers Opportunistic, disciplined growth Balance sheet positioned for rising rate environment Capital to support growth Strong board and management

INDUSTRIES IN AMNB MARKETS 32

COLLEGES AND UNIVERSITIES IN AMNB MARKETS 33

34 QUESTIONS?

Total Risk Based Capital Total Risk Based Capital (total equity less AOCI less goodwill and CDI plus TPS and Allowance)/Total Risk- Weighted Assets Tier I Risk Based Capital Tier I Capital (total equity less AOCI less goodwill and CDI plus TPS)/Total Risk-Weighted Assets Common Equity Tier I Capital Common Equity Tier I Capital (total equity less AOCI less goodwill and CDI)/Total Risk-Weighted Assets Tier I Leverage Tier I Capital (total equity less AOCI less goodwill and CDI plus TPS)/Average Assets less goodwill and CDI Tangible Common Equity Tangible Common Equity (total equity less goodwill and CDI)/Tangible Assets (total assets less goodwill and CDI) ADDENDUM 35