Progressive Growth. Regional Strength. Bright Future. July 2019

Experience and Solutions A Century of Experience and 21st Century Banking Solutions July 2019

Forward-Looking Statements Certain statements in this presentation may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, predictions, expectations or beliefs about future events or results or otherwise and are not statements of historical fact. Such statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate” or other statements concerning opinions or judgments of American National and its management about future events. The forward-looking statements herein are based on certain assumptions and analyses by American National and are factors it believes are appropriate under the circumstances. Actual results could differ materially from those contained in or implied by such statements for a variety of reasons including, but not limited to: changes in interest rates; changes in accounting principles, policies or guidelines; significant changes in the economic scenario; significant changes in regulatory requirements; significant changes in securities markets; and changes regarding acquisitions and dispositions. Consequently, all forward-looking statements made herein are qualified by these cautionary statements. American National does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. Confidential 3

Agenda ● Introduction to American National Bankshares Inc. ● First Quarter 2019 - Performance and Accomplishments — Successful Acquisition of HomeTown Bankshares ● Financial Performance ● Capital Management ● Why Invest in American National? 4

Introduction to American National

VISION GUIDING We will be the best provider of relationship-based financial services in PRINCIPLES the communities we serve, resulting in enhanced shareholder value, customer 1. Operate a sound, efficient, growing and highly loyalty and employee satisfaction. profitable company. 2. Identify and respond to our internal and external customers’ needs and expectations in an ever- changing financial environment. 3. Provide our customers 21st century financial solutions that are designed to meet their current and future needs. 4. Provide an attractive return for our shareholders. 5. Furnish positive leadership for the well-being of all the communities we serve. 6. Continuously develop a challenging and rewarding work environment for our employees that focuses on working as a team. 7. Conduct our work with integrity and professionalism. 6

FRANCHISE REVIEW Key Highlights • Progressive regional community bank • Disciplined loan growth with top tier asset quality • Noninterest bearing deposit funding in excess of peer levels • Effectively leveraging capital with ability to further support future growth • Seasoned opportunistic acquirer, as demonstrated through successful acquisition of HomeTown Bankshares Corp. • Strong, consistent profitability • Proven track record of shareholder returns • Attractive valuation 7

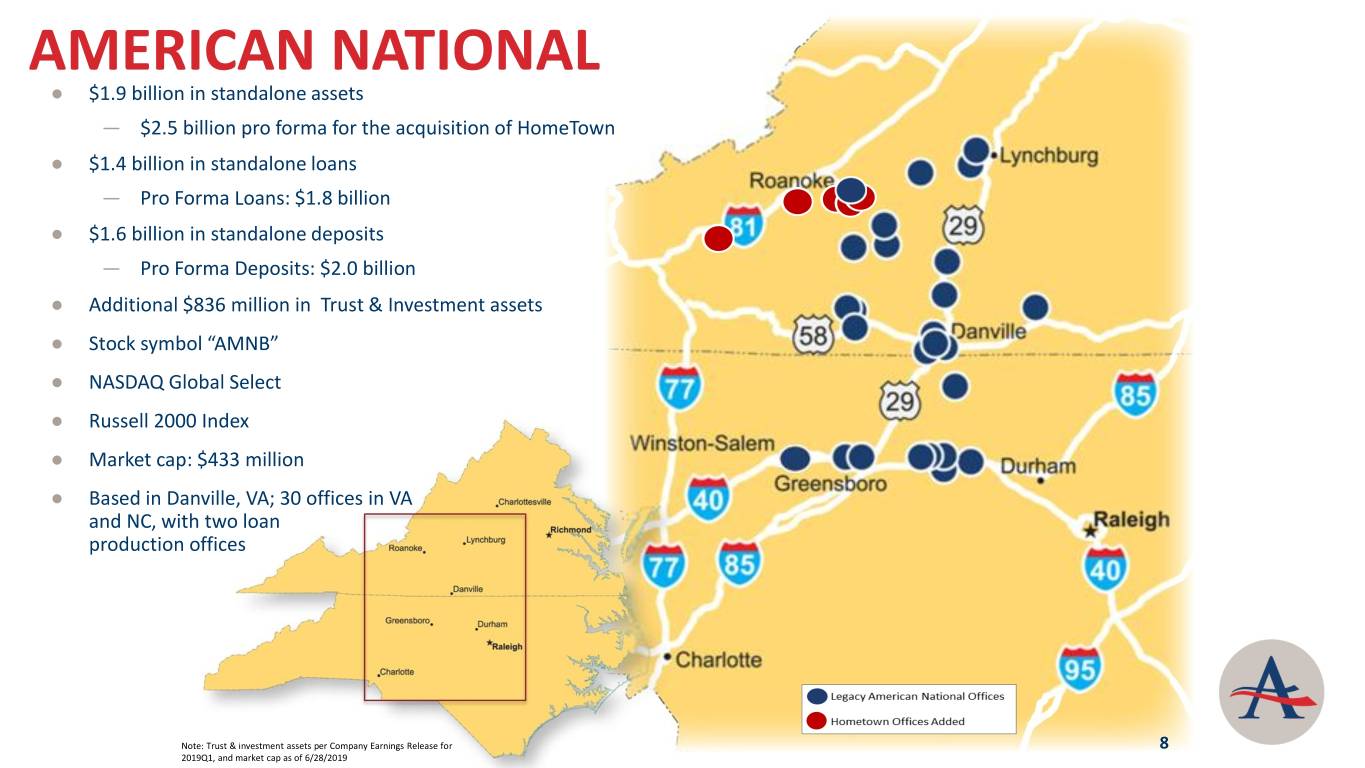

AMERICAN NATIONAL ● $1.9 billion in standalone assets — $2.5 billion pro forma for the acquisition of HomeTown ● $1.4 billion in standalone loans — Pro Forma Loans: $1.8 billion ● $1.6 billion in standalone deposits — Pro Forma Deposits: $2.0 billion ● Additional $836 million in Trust & Investment assets ● Stock symbol “AMNB” ● NASDAQ Global Select ● Russell 2000 Index ● Market cap: $433 million ● Based in Danville, VA; 30 offices in VA and NC, with two loan production offices Note: Trust & investment assets per Company Earnings Release for 8 2019Q1, and market cap as of 6/28/2019

WE ARE… ● Growing ● Conservative — Greensboro/Winston — Stringent underwriting Salem — Strong capital — Roanoke ● Shareholder focused ● Consistent — Exceptional dividend — 110 years of tradition — Prudent growth — Deep management team — Good stewards — Strong, experienced of capital board of directors — Ability to execute 9

OUR PRIORITIES • Fortress-like balance sheet • Disciplined growth — Exceptional asset quality — Organic — Low-risk investment portfolio — External — High liquidity • Strong earnings stream — Capital strength • Imagination 10

SEASONED MANAGEMENT EXECUTIVES YEARS OF YEARS W/ NAME POSITION AGE EXPERIENCE AMNB Jeffrey V. Haley President & CEO 59 22 22 William W. Traynham Chief Financial Officer 64 30 10 Jeffrey W. Farrar Chief Operating Officer 59 22 0* Cathy W. Liles Chief Accounting Officer 54 20 3 Edward C. Martin Chief Credit Officer 46 23 3 President of Trust and John H. Settle 61 38 2.5 Investment Services H. Gregg Strader Chief Banking Officer 61 37 5 AVERAGE: 58 27 7 11 Note: Jeffrey W. Farrar will assume the position of Chief Operating Officer for American National Bankshares Inc. and American National Bank and Trust Company, effective August 1, 2019

GROWTH STRATEGY • Acquired attractive core deposit base of • Recent team lift outs Winston-Salem, NC HomeTown Bankshares Corporation & Roanoke, VA headquartered in Roanoke, VA • Grow into adjacent markets — Transaction Completed on April 1 — New River Valley, VA • $38.8 million increase in total loans year- — Charlottesville, VA over-year — Richmond, VA • Leverage core market position in Danville — Durham-Chapel Hill, NC — 33% deposit market share • 3-year North Carolina CAGR — All NC markets – 16% — Greensboro – 15% 12

GROWTH STRATEGY Increased Total Population Access 5.3x Annual Growth in Loans HFI 674,337 2,594,440 769,635 183,967 2014 5.8% 315,278 486,549 164,674 Legacy Burlington, NC Roanoke, VA Greensboro- Blacksburg- Winston-Salem, Total Markets High Point, NC Christiansburg, NC 2015 VA 19.6% Increased Access to Small Businesses 5.5x 23,222 97,289 6,059 2016 15.8% 31,518 13,288 17,842 5,360 2017 14.7% Legacy Burlington, NC Roanoke, VA Greensboro- Blacksburg- Winston-Salem, Total Markets High Point, NC Christiansburg, NC VA Projected Population Change (2019-2024) 5.33% 2018 1.6% 4.42% 4.08% 2.62% 2.24% (1) 2019 0.8% (0.25%) Legacy Burlington, NC Roanoke, VA Greensboro- Blacksburg- Winston-Salem, High Point, NC Christiansburg, VA NC Source: S&P Global Market Intelligence Note: Legacy markets include Danville, VA MSA; Lynchburg, VA MSA; Martinsville, VA MSA; Caswell, NC county and Halifax, VA county 13 (1) 2019Q1 loan growth annualized

BALANCE SHEET GROWTH VS. PEERS Total Loan Growth (%) Total Deposit Growth (%) AMNB YOY NON-INT. 20.0% CAGR Pro Forma 20.0% for HomeTown BEARING DEP. GROWTH 37.9% 6.3% 20.8% 15.0% 18.4% 15.0% 28.3% 12.9% 13.0% 15.7% 11.6% 13.7% 10.9% 10.2% 9.6% 10.0% 10.0% 9.2% 9.4% 10.0% 8.9% 8.2% 7.2% 7.7% 6.5% 5.9% 5.2% 5.0% 5.0% 2.9% 0.0% 0.0% 0.0% 5-yr CAGR 3-yr CAGR YoY Growth 5-yr CAGR 3-yr CAGR YoY Growth AMNB Regional Peer Median Nationwide Peer Median AMNB Regional Peer Median Nationwide Peer Median Loans / Deposits (%) NIBs / Deposits (%) 100.0% 30.0% 27.3% 95.0% 25.0% 92.4% 91.2% 20.9% 90.0% 20.0% 20.0% 87.2% 85.0% 15.0% 80.0% 10.0% 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 AMNB Regional Peer Median Nationwide Peer Median AMNB Regional Peer Median Nationwide Peer Median Source: S&P Global Market Intelligence; Data as of quarter end 3/31/2019 Note: National Peers include major exchange traded banks nationwide with total assets between $1.0 billion and $5.0 billion, excluding merger targets 14 Note: Regional Peers include major exchange traded banks headquartered in North Carolina or Virginia with total assets between $1.0 billion and $5.0 billion, excluding merger targets

DIVERSE REVENUE STREAM Noninterest Income Trust and Investment Services ● Trust & Investment Services ● Organized in 1927 ● Brokerage ● Offices in Danville, Martinsville, Lynchburg ● Secondary Mortgage ● Assets: $836 million ● Title Insurance ● Customers: individuals, businesses, foundations and non-profits ● Bankers Insurance ● Serve clients locally and abroad ● Priorities: Trust Assets ($ in millions) — Trust administration $839 $836 — $781 Investment management $749 $769 — Estate settlement $661 $628 — Retail brokerage $541 $531 ● Excellent equity performance 2011 2012 2013 2014 2015 2016 2017 2018 2019Q1 15 Source: Company Earnings Release for 2019Q1

SUPERIOR ASSET QUALITY ● Exceptional performance through cycle ● Decreased NPA levels Net Charge-offs / Avg. Loans (%) NPAs / Loans + OREO (%) 0.30% 3.00% 2.43% 2.00% 0.20% 0.19% 0.19% 2.00% 1.70% 0.12% 0.12% 1.25% 0.12% 1.13% 1.12% 1.00% 0.91% 0.10% 0.08% 0.86% 0.07% 0.07% 0.05% 0.54% 0.33% 0.02% 0.21% 0.19% 0.00% 0.00% 0.00% 0.00% 2014 2015 2016 2017 2018 2019Q1 2014 2015 2016 2017 2018 2019Q1 AMNB Regional Peer Median Source: S&P Global Market Intelligence; Data as of quarter end 3/31/2019 Note: Regional Peers include major exchange traded banks headquartered in North Carolina or Virginia with total assets between $1.0 billion and $5.0 billion, excluding merger targets 16 Note: NPAs include nonaccrual loans, accruing TDRs and OREO

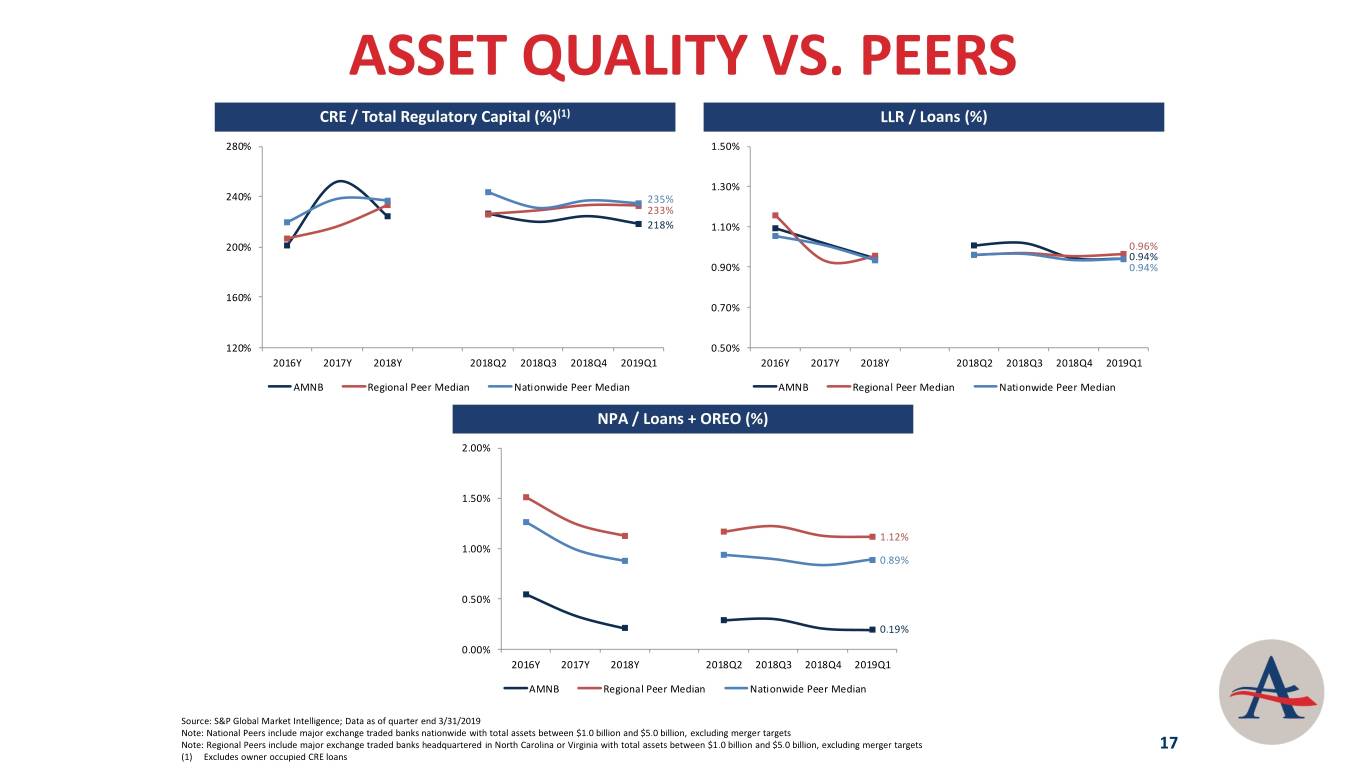

ASSET QUALITY VS. PEERS CRE / Total Regulatory Capital (%)(1) LLR / Loans (%) 280% 1.50% 1.30% 240% 235% 233% 218% 1.10% 200% 0.96% 0.94% 0.90% 0.94% 160% 0.70% 120% 0.50% 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 AMNB Regional Peer Median Nationwide Peer Median AMNB Regional Peer Median Nationwide Peer Median NPA / Loans + OREO (%) 2.00% 1.50% 1.12% 1.00% 0.89% 0.50% 0.19% 0.00% 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 AMNB Regional Peer Median Nationwide Peer Median Source: S&P Global Market Intelligence; Data as of quarter end 3/31/2019 Note: National Peers include major exchange traded banks nationwide with total assets between $1.0 billion and $5.0 billion, excluding merger targets Note: Regional Peers include major exchange traded banks headquartered in North Carolina or Virginia with total assets between $1.0 billion and $5.0 billion, excluding merger targets 17 (1) Excludes owner occupied CRE loans

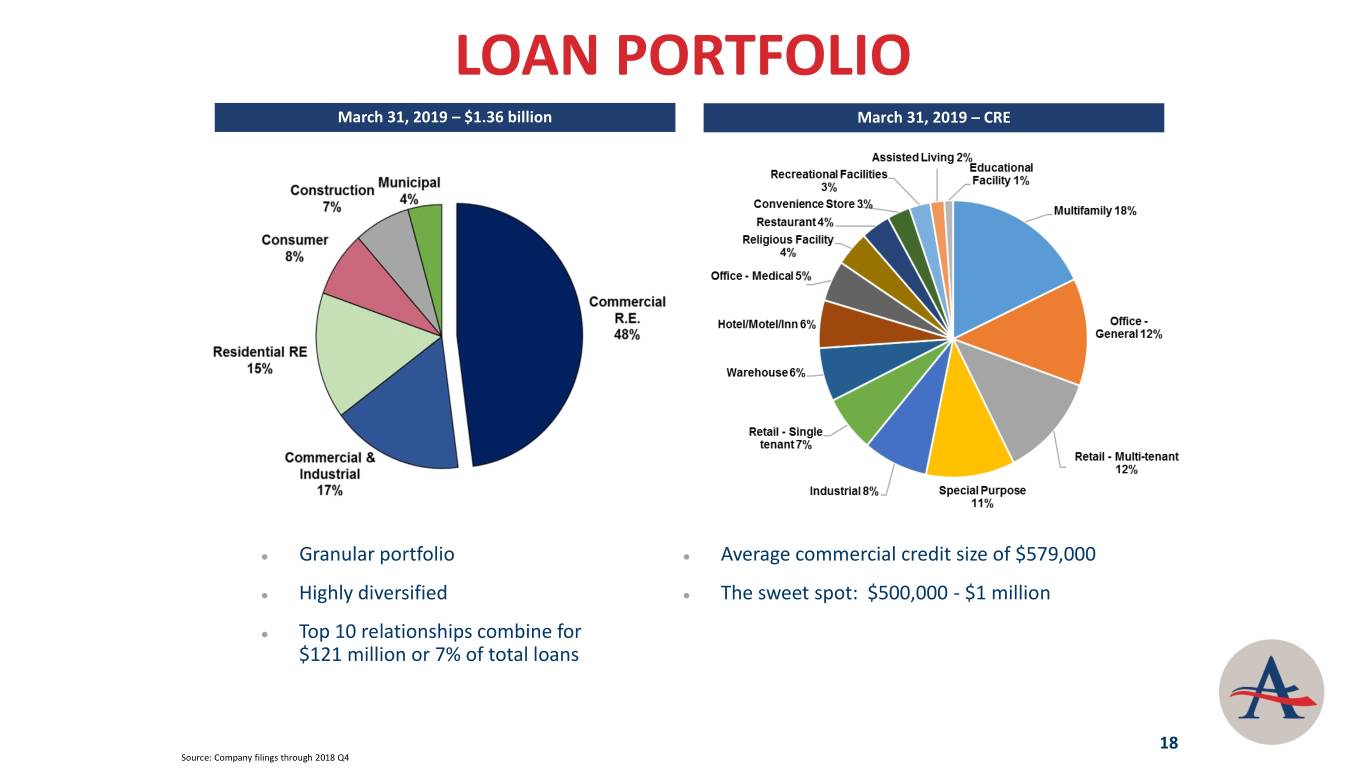

LOAN PORTFOLIO March 31, 2019 – $1.36 billion March 31, 2019 – CRE ● Granular portfolio ● Average commercial credit size of $579,000 ● Highly diversified ● The sweet spot: $500,000 - $1 million ● Top 10 relationships combine for $121 million or 7% of total loans 18 Source: Company filings through 2018 Q4

DEPOSIT PORTFOLIO Deposit Migration History Cost of Deposits (%) 100% 17.8% 17.2% 16.3% 17.4% 22.8% 20.9% 19.5% 0.89% 7.8% 6.8% 6.7% 75% 9.8% 13.0% 11.9% 0.77% 14.1% 34.1% 29.5% 34.5% 33.0% 0.67% 24.6% 25.0% 0.64% 50% 25.6% 0.58% 0.64% 15.3% 15.0% 15.6% 18.0% 18.0% 14.8% 0.49% 15.9% 0.46% 25% 0.52% 0.52% 27.6% 27.8% 27.3% 0.44% 21.7% 23.7% 25.5% 25.7% 0.39% 0.39% 0.40% 0% 2013 2014 2015 2016 2017 2018 2019Q1 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Q1 Demand Deposits NOW & Other Trans Accts MMDA & Savings Retail Certificates of Deposit AMNB Regional Peer Median Jumbo Certificates of Deposit ● Legacy markets provide a stable source of low-cost core deposits Source: S&P Global Market Intelligence; Data as of quarter end 3/31/2019 19 Note: Regional Peers include major exchange traded banks headquartered in North Carolina or Virginia with total assets between $1.0 billion and $5.0 billion, excluding merger targets

SECURITIES PORTFOLIO 3/31/2019 Securities Portfolio(1) Portfolio Highlights State and ● Minimal credit risk; minimal duration risk municipal 24.0% Other (Corporate and Equity) ● High quality 2.1% — $324.3 million AFS securities portfolio — All above investment grade — Municipal portfolio with very high credit quality and wide geographic dispersion — No investments are classified Mortgage- backed and CMOs Federal ● Strong source of liquidity 33.5% agencies and GSEs 40.4% Source: Company Documents 20 (1) Period end balance for the 3 months ended March 31, 2019

Q1 – 2019 Performance And Recent Accomplishments

Q1 – 2019 HIGHLIGHTS • Expanded presence in Roanoke and added new presence in the New River Valley, through the acquisition of HomeTown Bankshares Corp. – Transaction completed on April 1, 2019 • Net Income of $6.0 million in Q1 2019 (vs. $5.8 million in Q1 2018, or a 3.3% increase) • Diluted EPS: $0.69 in Q1 2019 (vs. $0.67 in Q1 2018) • Net interest income: $15.1 in Q1 2019 (vs. $14.5 million in Q1 2018, or a 3.6% increase) – Net Interest Margin: 3.50% (vs. 3.46% in Q1 2018) • Total loans as of Q1 2019 were up $38.8 million vs. Q1 2018 (2.9% growth) • Noninterest bearing deposits were up $25.3 million vs. Q1 2018 (6.3% growth) • Nonperforming Assets / Total Assets: 0.10% in Q1 2019 vs. 0.20% in Q1 2018 • Dividend: $0.25 paid 22

Successful Acquisition of HomeTown Bankshares Completed on April 1, 2019

Highlights of the HomeTown Acquisition Unique and Strategic Opportunity to Gain Scale in a Premier Virginia Market ● Now operating at $2.4 billion in total assets following completion ● Solidified presence in Roanoke, with the market serving as American National’s new Virginia Banking Headquarters — Approximately $600 million in pro forma deposits in the Roanoke MSA ● #1 Community Bank in the Roanoke MSA by deposit market share — #3 overall rank ● Partnered with experienced lenders from a similar banking culture ● Leveraging HomeTown’s personal touch in the Roanoke and New River Valley markets with American National’s expanded resources 24 Note: Community bank defined as less than $20 billion in assets

HomeTown Integration Update Management and Board Alignment ● Former HomeTown CEO, Susan Still, currently serving as Virginia Banking President until retirement in December 2019 ● 3 former HomeTown directors, including Susan Still, have been added to the American National Board of Directors — Transition Board, consisting of HomeTown’s remaining directors, has been formed ● Fully assimilated and streamlined lending team — Added 6 talented HomeTown lenders with experience in core markets ● Systems conversion has been completed (April) 25

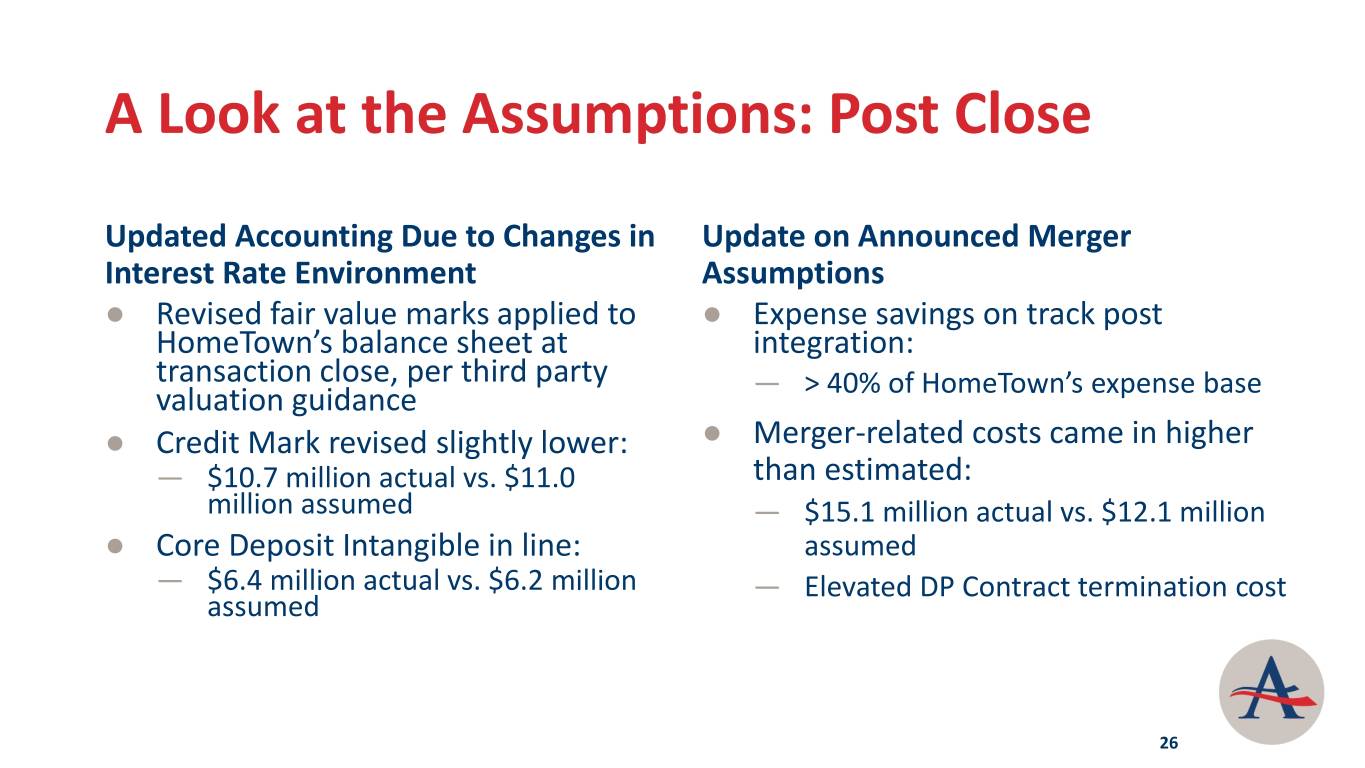

A Look at the Assumptions: Post Close Updated Accounting Due to Changes in Update on Announced Merger Interest Rate Environment Assumptions ● Revised fair value marks applied to ● Expense savings on track post HomeTown’s balance sheet at integration: transaction close, per third party valuation guidance — > 40% of HomeTown’s expense base ● Credit Mark revised slightly lower: ● Merger-related costs came in higher — $10.7 million actual vs. $11.0 than estimated: million assumed — $15.1 million actual vs. $12.1 million ● Core Deposit Intangible in line: assumed — $6.4 million actual vs. $6.2 million — Elevated DP Contract termination cost assumed 26

Impacts of the Transaction: Post Close ● Earn back period is in line with announcement forecast ● Higher near-term EPS accretion (mid-teens) — Including meaningful second quarter margin expansion ● Modeled long-term EPS accretion (core double digit) ● Higher TBV dilution (~10%) — Driven by higher DP termination costs and accounting marks ● TBV earn back of approximately 3.5 years 27

Financial Performance and Peer Comparison

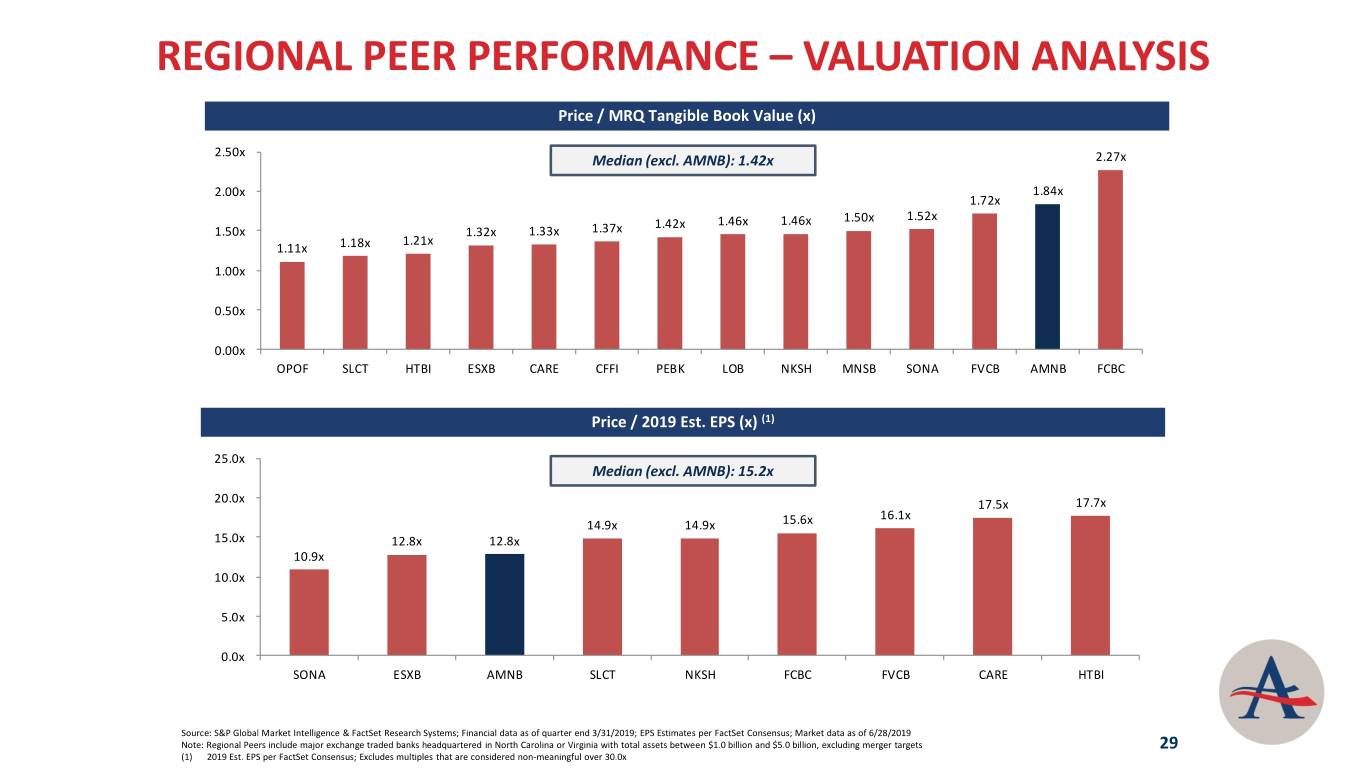

REGIONAL PEER PERFORMANCE – VALUATION ANALYSIS Price / MRQ Tangible Book Value (x) 2.50x Median (excl. AMNB): 1.42x 2.27x 2.00x 1.84x 1.72x 1.52x 1.42x 1.46x 1.46x 1.50x 1.50x 1.32x 1.33x 1.37x 1.21x 1.11x 1.18x 1.00x 0.50x 0.00x OPOF SLCT HTBI ESXB CARE CFFI PEBK LOB NKSH MNSB SONA FVCB AMNB FCBC Price / 2019 Est. EPS (x) (1) 25.0x Median (excl. AMNB): 15.2x 20.0x 17.5x 17.7x 16.1x 14.9x 14.9x 15.6x 15.0x 12.8x 12.8x 10.9x 10.0x 5.0x 0.0x SONA ESXB AMNB SLCT NKSH FCBC FVCB CARE HTBI Source: S&P Global Market Intelligence & FactSet Research Systems; Financial data as of quarter end 3/31/2019; EPS Estimates per FactSet Consensus; Market data as of 6/28/2019 Note: Regional Peers include major exchange traded banks headquartered in North Carolina or Virginia with total assets between $1.0 billion and $5.0 billion, excluding merger targets 29 (1) 2019 Est. EPS per FactSet Consensus; Excludes multiples that are considered non-meaningful over 30.0x

PROFITABILITY VS. PEERS Core ROAA (%) Core ROATCE (%) 1.60% 16.0% 1.40% 14.0% 13.7% 1.32% 1.20% 12.0% 1.14% 11.6% 1.12% 1.00% 10.0% 10.0% 0.80% 8.0% 0.60% 6.0% 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 AMNB Regional Peer Median Nationwide Peer Median AMNB Regional Peer Median Regional Peer Median Net Interest Margin (%) Efficiency Ratio (%) 4.50% 70.0% 4.00% 65.0% 65.3% 3.64% 61.5% 3.60% 3.50% 3.50% 60.0% 56.9% 3.00% 55.0% 2.50% 50.0% 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 AMNB Regional Peer Median Nationwide Peer Median AMNB Regional Peer Median Nationwide Peer Median Source: S&P Global Market Intelligence; Data as of quarter end 3/31/2019 Note: Core income excludes extraordinary items, non-recurring items, gains/losses on sale of securities, and amortization of intangibles; 2017Y core income adjusted for revaluation of DTA/DTL due to corporate tax reform Note: National Peers include major exchange traded banks nationwide with total assets between $1.0 billion and $5.0 billion, excluding merger targets 30 Note: Regional Peers include major exchange traded banks headquartered in North Carolina or Virginia with total assets between $1.0 billion and $5.0 billion, excluding merger targets

TOTAL RETURN AMNB Return Relative to the NASDAQ Bank Index and Peers 250.0% 207.0% 200.0% 146.8% 150.0% 100.0% 51.0% 50.0% 38.9% 38.1% 34.1% 20.7% 12.3% 10.3% 0.0% Since 2008 Since 2016 Election 2019 YTD AMNB NASDAQ Bank Regional Peer Median Source: FactSet Research Systems; Market data as of 6/28/2019 Note: AMNB total return assumes reinvestment of dividends 31 Note: Regional Peers include major exchange traded banks headquartered in NC and VA with total assets between $1.0 billion and $5.0 billion

OPPORTUNISTIC ASSET GROWTH 3-Year CAGR (%) 5-Year CAGR (%) 15.0% 15.0% CAGR Pro Forma for HomeTown 13.1% 14.9% 10.1% 9.9% 9.9% 10.0% 9.4% 10.0% 7.5% 5.7% 5.0% 5.0% 0.0% 0.0% AMNB Nationwide Peers - $1bn Nationwide Banks (2) AMNB Nationwide Peers - $1bn Nationwide Banks (2) to $3bn in Assets (1) to $3bn in Assets(1) 10-Year CAGR (%) 15.0% 11.2% 10.0% 8.5% 6.9% 7.0% 5.0% 0.0% AMNB Nationwide Peers - $1bn Nationwide Banks (2) to $3bn in Assets (1) Source: S&P Global Market Intelligence; Data as of quarter end 3/31/2019 (1) Includes major exchange traded banks nationwide with total assets between $1 billion and $3 billion, excluding merger targets and MHCs 32 (2) Includes all major exchange traded banks nationwide, excluding merger targets and MHCs

TRADING MULTIPLES ANALYSIS Price / TBV (x) Price / LTM EPS (x) 2.00x 16.0x 1.84x 14.8x 1.75x 14.0x 13.1x 13.1x 1.52x 1.50x 12.0x 1.42x 1.25x 10.0x 1.00x 8.0x (2) (2) AMNB Nationwide Peers - $1bn Nationwide Banks AMNB Nationwide Peers - $1bn Nationwide Banks to $3bn in Assets (1) to $3bn in Assets (1) Price / 2019 Est. EPS (x) Price / 2020 Est. EPS (x) 13.0x 12.8x 13.0x 12.3x 12.1x 12.0x 12.0x 12.0x 11.4x 11.3x 11.0x 11.0x 10.0x 10.0x 9.0x 9.0x 8.0x 8.0x (2) (2) AMNB Nationwide Peers - $1bn Nationwide Banks AMNB Nationwide Peers - $1bn Nationwide Banks to $3bn in Assets (1) to $3bn in Assets (1) Source: S&P Global Market Intelligence; Financial data as of quarter end 3/31/2019; EPS Estimates per FactSet Consensus; Market data as of 6/28/2019 (1) Includes major exchange traded banks nationwide with total assets between $1 billion and $3 billion, excluding merger targets and MHCs 33 (2) Includes all major exchange traded banks nationwide, excluding merger targets and MHCs

HISTORICAL PEER COMPARISON Core ROAA (%) 1.60% 1.32 % 1.20% 1.12 % 0.80% 0.40% 0.00% 2011 2012 2013 2014 2015 2016 2017 2018 2019Q1 AMNB Regional Peer Median Efficiency Ratio (%) Net Interest Margin (%) 75.0% 5.00% 65.0% 65.3 % 4.50% 56.9 % 55.0% 4.00% 3.60 % 45.0% 3.50% 3.50 % 35.0% 3.00% 2011 2012 2013 2014 2015 2016 2017 2018 2019Q1 2011 2012 2013 2014 2015 2016 2017 2018 2019Q1 AMNB Regional Peer Median AMNB Regional Peer Median Source: S&P Global Market Intelligence; Data as of quarter end 3/31/2019 Note: Regional Peers include major exchange traded banks headquartered in NC and VA with total assets between $1.0 billion and $5.0 billion 34 Note: Core income excludes extraordinary items, non-recurring items, gains/losses on sale of securities, and amortization of intangibles; 2017Y core income adjusted for revaluation of DTA/DTL due to Corporate Tax Reform

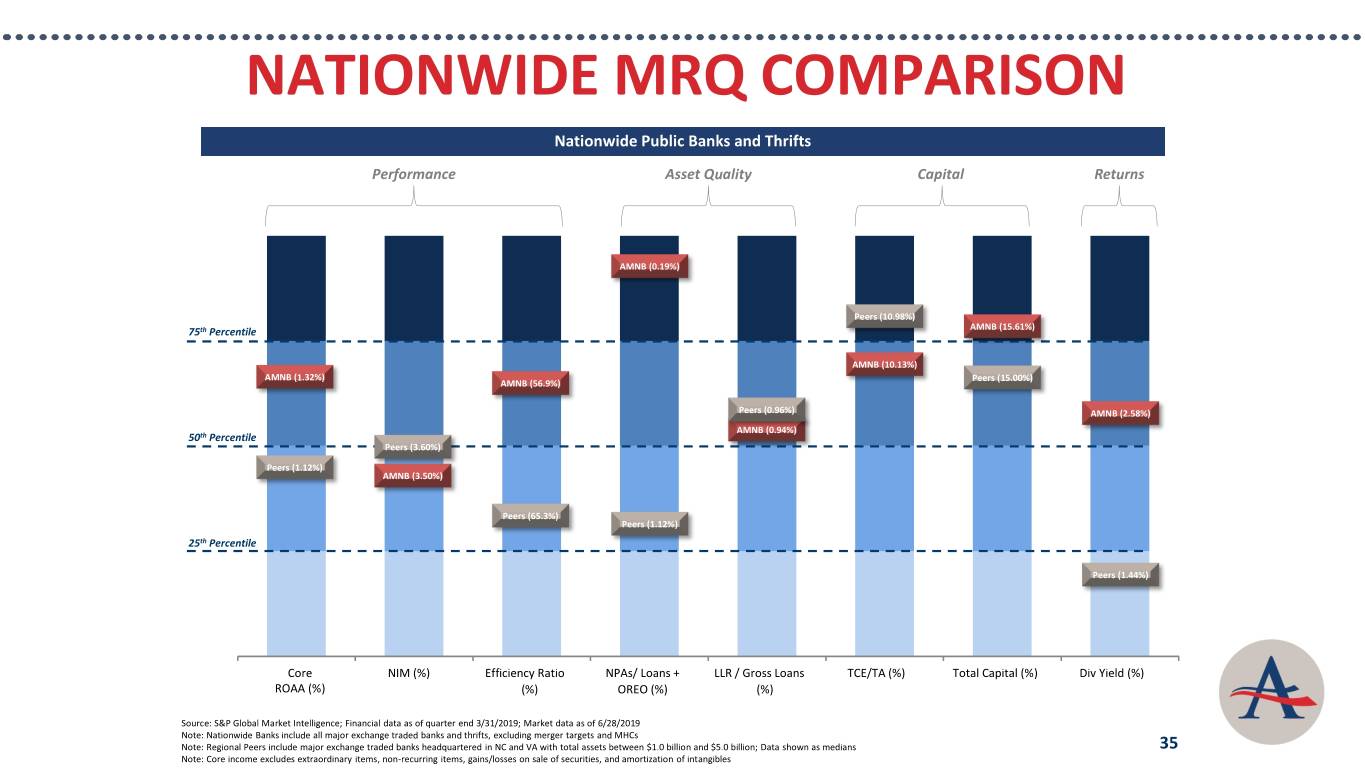

NATIONWIDE MRQ COMPARISON Nationwide Public Banks and Thrifts Performance Asset Quality Capital Returns AMNB (0.19%) Peers (10.98%) 75th Percentile AMNB (15.61%) AMNB (10.13%) AMNB (1.32%) Peers (15.00%) AMNB (56.9%) Peers (0.96%) AMNB (2.58%) AMNB (0.94%) 50th Percentile Peers (3.60%) Peers (1.12%) AMNB (3.50%) Peers (65.3%) Peers (1.12%) 25th Percentile Peers (1.44%) Core NIM (%) Efficiency Ratio NPAs/ Loans + LLR / Gross Loans TCE/TA (%) Total Capital (%) Div Yield (%) ROAA (%) (%) OREO (%) (%) Source: S&P Global Market Intelligence; Financial data as of quarter end 3/31/2019; Market data as of 6/28/2019 Note: Nationwide Banks include all major exchange traded banks and thrifts, excluding merger targets and MHCs Note: Regional Peers include major exchange traded banks headquartered in NC and VA with total assets between $1.0 billion and $5.0 billion; Data shown as medians 35 Note: Core income excludes extraordinary items, non-recurring items, gains/losses on sale of securities, and amortization of intangibles

Capital Management

CAPITAL MANAGEMENT ● Past: ● Historically strong capital levels funded 2 transactions during the economic crisis and years immediately following ● Future: ● Maintain more capital than most to: — Satisfy changing regulatory requirements — Flexibility to support opportunistic M&A transactions — Highlighted by recently completed acquisition of HomeTown Bankshares — Shareholder expectations ● Appropriate balance to fund: ● Organic growth ● Acceptable deals ● Pay strong dividend ● Stock repurchase program 37

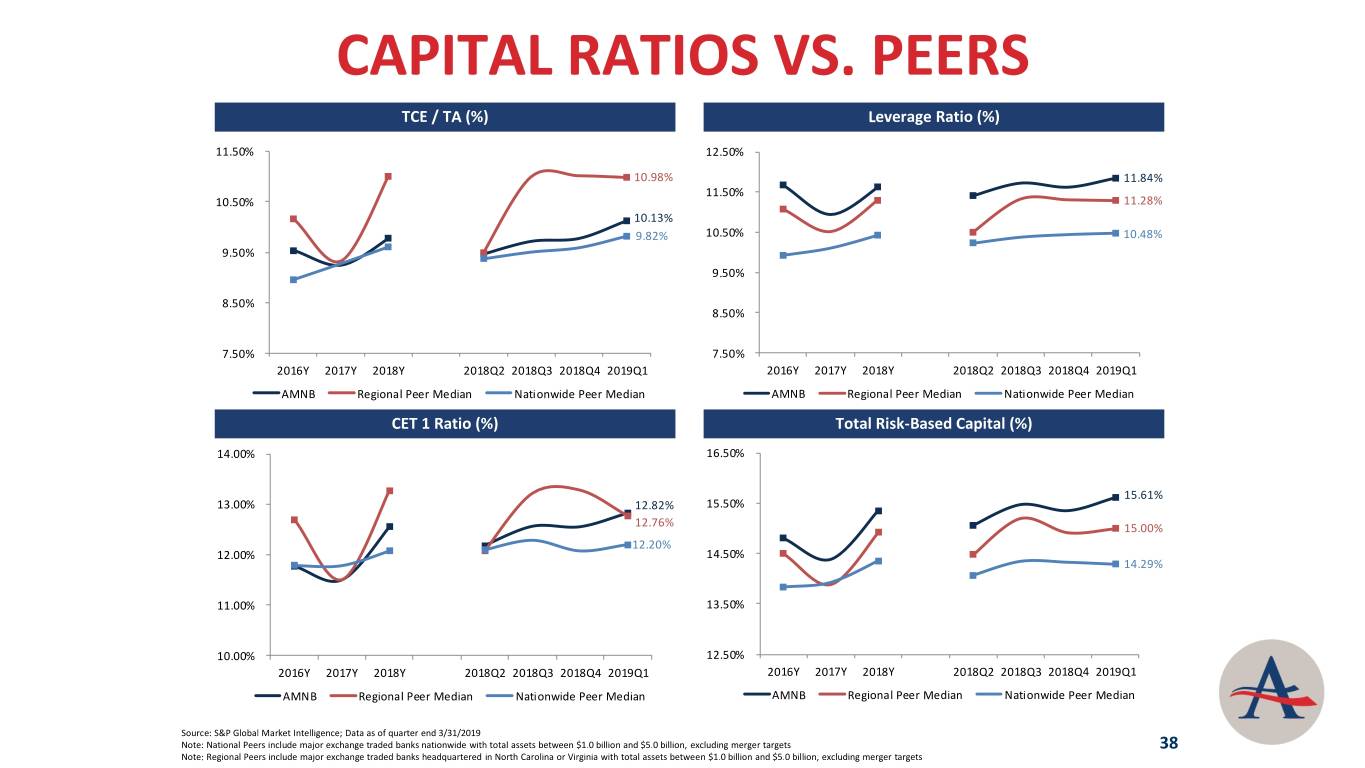

CAPITAL RATIOS VS. PEERS TCE / TA (%) Leverage Ratio (%) 11.50% 12.50% 10.98% 11.84% 11.50% 10.50% 11.28% 10.13% 9.82% 10.50% 10.48% 9.50% 9.50% 8.50% 8.50% 7.50% 7.50% 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 AMNB Regional Peer Median Nationwide Peer Median AMNB Regional Peer Median Nationwide Peer Median CET 1 Ratio (%) Total Risk-Based Capital (%) 14.00% 16.50% 15.61% 13.00% 12.82% 15.50% 12.76% 15.00% 12.20% 12.00% 14.50% 14.29% 11.00% 13.50% 10.00% 12.50% 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 2016Y 2017Y 2018Y 2018Q2 2018Q3 2018Q4 2019Q1 AMNB Regional Peer Median Nationwide Peer Median AMNB Regional Peer Median Nationwide Peer Median Source: S&P Global Market Intelligence; Data as of quarter end 3/31/2019 Note: National Peers include major exchange traded banks nationwide with total assets between $1.0 billion and $5.0 billion, excluding merger targets 38 Note: Regional Peers include major exchange traded banks headquartered in North Carolina or Virginia with total assets between $1.0 billion and $5.0 billion, excluding merger targets

CAPITAL RATIO TRENDS Source: S&P Global Market Intelligence; Data as of quarter end 3/31/2019 Note: Peers include nationwide banks with total assets between $1.0 billion and $3.0 billion 39 Note: See addendum for Capital definitions

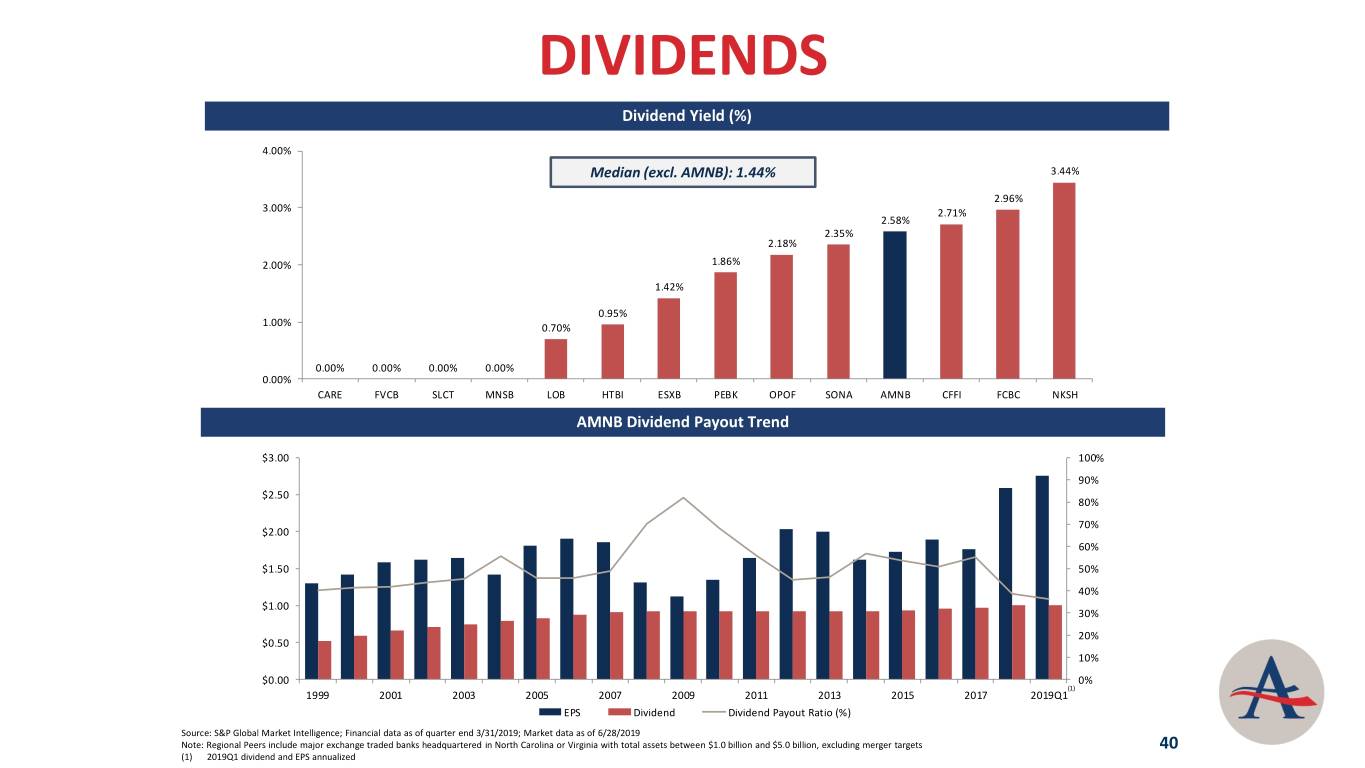

DIVIDENDS Dividend Yield (%) 4.00% Median (excl. AMNB): 1.44% 3.44% 2.96% 3.00% 2.71% 2.58% 2.35% 2.18% 2.00% 1.86% 1.42% 0.95% 1.00% 0.70% 0.00% 0.00% 0.00% 0.00% 0.00% CARE FVCB SLCT MNSB LOB HTBI ESXB PEBK OPOF SONA AMNB CFFI FCBC NKSH AMNB Dividend Payout Trend $3.00 100% 90% $2.50 80% 70% $2.00 60% $1.50 50% 40% $1.00 30% 20% $0.50 10% $0.00 0% (1) 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019Q1 EPS Dividend Dividend Payout Ratio (%) Source: S&P Global Market Intelligence; Financial data as of quarter end 3/31/2019; Market data as of 6/28/2019 Note: Regional Peers include major exchange traded banks headquartered in North Carolina or Virginia with total assets between $1.0 billion and $5.0 billion, excluding merger targets 40 (1) 2019Q1 dividend and EPS annualized

OPPORTUNISTIC ACQUISITION STRATEGY ● Fair value accounting changed the game ● Capital is necessary to be a player ● Focused on growth markets in NC and VA ● Characteristics of targets: — $250 million-$750 million size — Practical assimilation — Manageable credit issues — Compatible cultures — EPS accretion — Maintenance of strong capital levels — Identifiable synergies for savings ● Our credit culture will be maintained 41

WHY INVEST IN AMERICAN NATIONAL? We are a community bank known for… Strong earnings Strong board and Attractive management dividend Capital to Consistently support outperforming growth peers Balance sheet positioned Opportunistic, for rising rate disciplined environment growth 42

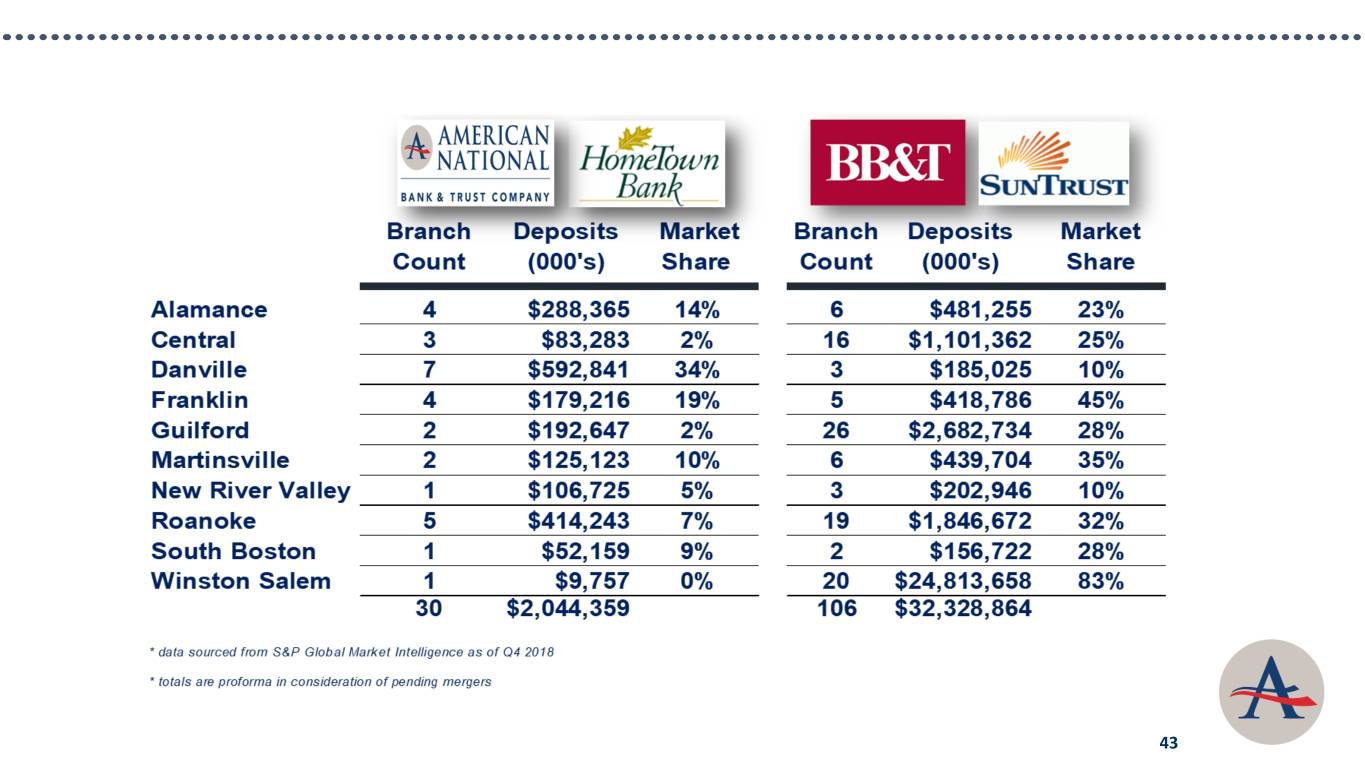

43

INDUSTRIES IN AMNB MARKETS 44

COLLEGES AND UNIVERSITIES IN AMNB MARKETS 45

Questions 46

ADDENDUM Total Risk Based Capital Total Risk Based Capital (total equity less AOCI less goodwill and CDI plus TPS and Allowance)/Total Risk-Weighted Assets Tier I Risk Based Capital Tier I Capital (total equity less AOCI less goodwill and CDI plus TPS)/Total Risk-Weighted Assets Common Equity Tier I Capital Common Equity Tier I Capital (total equity less AOCI less goodwill and CDI)/Total Risk-Weighted Assets Tier I Leverage Tier I Capital (total equity less AOCI less goodwill and CDI plus TPS)/Average Assets less goodwill and CDI Tangible Common Equity Tangible Common Equity (total equity less goodwill and CDI)/Tangible Assets (total assets less goodwill and CDI) 47