UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, For Use of the Commission Only (As permitted by Rule 14a-6(e)(2))

[x] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Section 240.14a-12

______HOOPER HOLMES, INC.________

(Name of Registrant as Specified in its Charter)

_____________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[x] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

_____________________________________________________________

2) Aggregate number of securities to which transaction applies:

____________________________________________________________

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

_____________________________________________________________

4) Proposed maximum aggregate value of transaction:

_____________________________________________________________

5) Total fee paid:

_____________________________________________________________

[ ] Fee previously paid with preliminary materials.

| |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

_____________________________________________________________

2) Form, Schedule or Registration Statement No.:

_____________________________________________________________

3) Filing Party:

_____________________________________________________________

4) Date Filed:

_____________________________________________________________

HOOPER HOLMES, INC.

560 N. Rogers Road

Olathe, Kansas 66062

NOTICE OF THE ANNUAL MEETING OF SHAREHOLDERS

June 11, 2014

_______________________________

The annual meeting of shareholders of Hooper Holmes, Inc. will be held at 10:00 a.m. (Central Time) on Wednesday, June 11, 2014 at the Hilton Garden Inn, 12080 South Strang Line Road, Olathe, Kansas 66062, for the following purposes:

1.To elect 5 directors to serve 1-year terms;

| |

| 2. | To approve an amendment and restatement of the Hooper Holmes, Inc. 2011 Omnibus Employee Incentive Plan; |

| |

| 3. | To consider an advisory vote on the approval of the compensation of our named executive officers; and |

| |

| 4. | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014. |

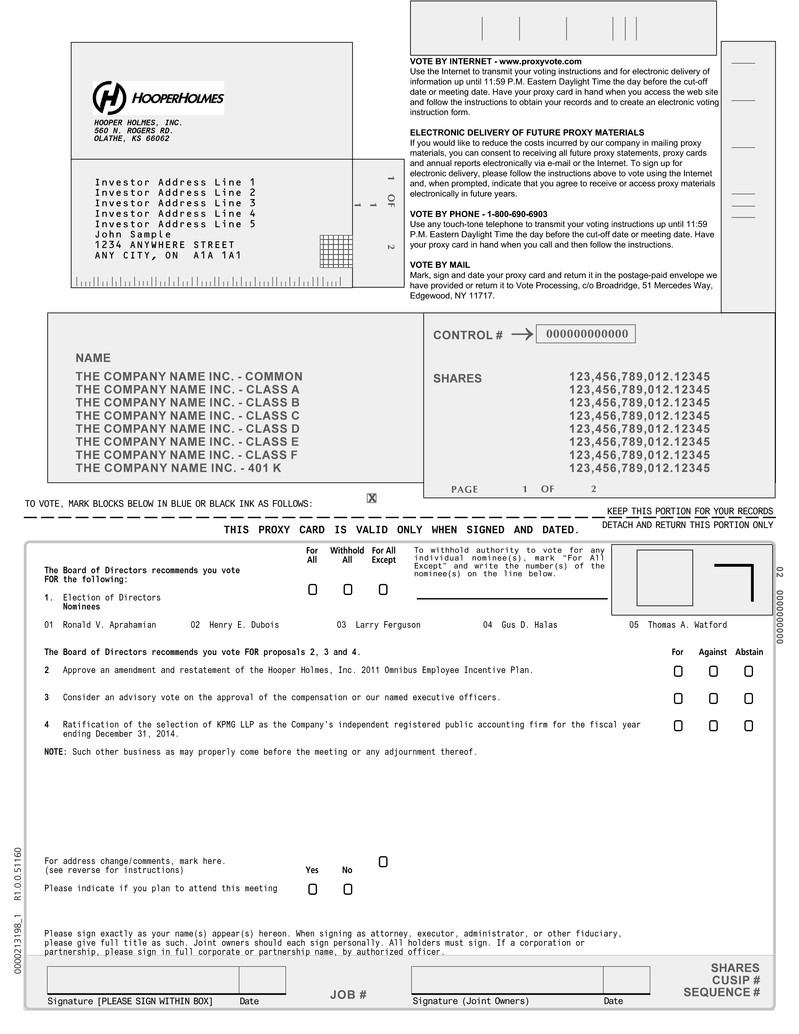

Shareholders of record at the close of business on April 15, 2014 may vote at the annual meeting and at any adjournment or postponement of the meeting. In connection with our solicitation of proxies for the annual meeting, we are making available this proxy statement, proxy card and our 2013 Annual Report to shareholders on or about April 29, 2014. Please vote in one of the following ways:

| |

| • | Use the toll-free number shown on your proxy card or Notice and Access card; |

| |

| • | Vote via the Internet, as indicated on your Notice and Access card; |

| |

| • | Complete, sign, date and return your proxy card in the enclosed postage-paid envelope, if you received a full set of proxy materials; or |

| |

| • | Vote in person at the meeting. |

Your vote is very important. Please use one of the methods above to ensure that your vote will be counted. Your proxy may be revoked at any time before the vote at the annual meeting by following the procedures outlined in the proxy statement.

By Order of the Board of Directors

Tracy D. Mackey

General Counsel and Corporate Secretary

April 29, 2014

PER HOLMES, INC.

PROXY STATEMENT

FOR 2014 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD WEDNESDAY, JUNE 11, 2014

COMMON QUESTIONS ABOUT OUR ANNUAL MEETING AND PROXY STATEMENT

| |

| Q: | Why did I receive these proxy materials? |

| |

| A: | Our Board of Directors is soliciting your proxy so that, as a shareholder of Hooper Holmes, Inc. (the “Company”), you will have the opportunity to vote on matters that will be presented at our 2014 annual meeting of shareholders. This proxy statement provides you with information about us and these proposals to assist you in voting your shares. |

| |

| Q: | What proposals will be voted on at the meeting? |

A: At the annual meeting, our shareholders will be asked to:

| |

| • | Elect 5 directors to serve for a 1-year term (Proposal 1); |

| |

| • | Approve the amendment and restatement of the Hooper Holmes, Inc. 2011 Omnibus Employee Incentive Plan (Proposal 2); |

| |

| • | Conduct a non-binding advisory vote on the approval of the compensation of our named executive officers (Proposal 3); |

| |

| • | Ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the 2014 fiscal year (Proposal 4); and |

| |

| • | Take action on any other business that properly comes before the meeting and any adjournments or postponements of the meeting. |

Q: What shares owned by me can be voted?

| |

| A: | All shares of the Company’s common stock, $0.04 par value per share, owned by you as of the close of business on April 15, 2014, the record date for the determination of shareholders entitled to notice of, and the right to vote at, the meeting, may be voted by you. These shares include those held directly in your name as the shareholder of record and held for you in “street name” as the beneficial owner through a stockbroker, bank or other nominee. |

Each holder of record of shares of our common stock outstanding on the record date will be entitled to one vote for each share held on all matters to be voted on at the annual meeting.

| |

| Q: | What is the difference between holding shares as a shareholder of record and as a “street name” holder? |

| |

| A: | These terms describe how you hold your shares. If your shares are registered directly in your name with the Company’s transfer agent, Registrar and Transfer Company, you are considered the shareholder of record. |

If your shares are held in a stock brokerage account or by a bank or other nominee, your shares are held in “street name”. If you hold your shares in street name, you have the right to direct your broker or nominee on how to vote.

| |

| Q: | How can I vote my shares? |

A: You can vote either in person at the meeting or by proxy without attending the meeting.

This proxy statement, the accompanying proxy card and the Company’s 2013 annual report to shareholders are being made available on the Internet at www.proxyvote.com, as indicated in the Notice and Access card being mailed separately.

To vote by proxy, you must do one of the following:

| |

| • | Vote over the Internet (instructions are in the Notice and Access card); or |

| |

| • | Vote by telephone (toll-free number is indicated on your proxy card or Notice and Access card); or |

| |

| • | If you received a paper copy of your proxy materials, fill out the enclosed proxy card, date and sign it, and return it in the enclosed postage-paid envelope. |

Shares held directly in your name as the shareholder of record may be voted in person at the annual meeting. To do so, please bring the enclosed proxy card and proof of identification. If you hold your shares in street name and wish to vote in person at the meeting, you must request a legal proxy from your broker or nominee to present at the meeting.

| |

| Q: | How does the Board recommend I vote on the proposals? |

| |

| A: | The Board recommends a vote “FOR” each of the director nominees for the Board, “FOR” the amendment and restatement of the Hooper Holmes, Inc. 2011 Omnibus Employee Incentive Plan, “FOR” the approval of the Company’s executive compensation programs, and “FOR” the ratification of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014. |

| |

| Q: | What vote is required to approve each proposal? |

A: Proposal 1 – Election of Directors

A plurality of the votes cast is required to elect the nominees as directors. You may not cumulate your votes in the election of directors. The five nominees receiving the highest number of affirmative votes will be elected to the Board. You may withhold authority to vote for any or all nominees for directors. Votes “WITHHELD” will not have effect on the outcome of the vote. Votes cannot be voted for a greater number of persons than the number of nominees named.

Proposal 2 – Amendment and Restatement of the Hooper Holmes, Inc. 2011 Omnibus Employee Incentive Plan

The affirmative vote of the holders of a majority of the shares of our common stock present or represented by proxy at the meeting will be required to approve the proposal.

Proposal 3 – Non-Binding Advisory Vote on Executive Compensation

The affirmative vote of the holders of a majority of the shares of our common stock present or represented by proxy at the meeting will be required to approve the proposal.

Proposal 4 – Ratification of Appointment of KPMG LLP as Independent Registered Public Accounting Firm

The affirmative vote of the holders of a majority of the shares of our common stock present or represented by proxy at the meeting will be required to approve the proposal.

Under New York law, “votes cast” at a meeting of shareholders by the holders of shares entitled to vote are determinative of the outcome of the matter subject to a vote. Although abstentions and broker non-votes are considered in determining the presence of a quorum, they will not be considered “votes cast” and will have no effect on the outcome of the vote on the proposals.

| |

| Q: | What happens if I hold my shares in “street name” and don’t provide my broker voting instructions? |

| |

| A: | In certain circumstances, if you do not provide instructions to your broker on how you wish to vote, your broker will be allowed to vote for you on routine proposals, but your broker is prohibited from voting on other proposals. The proposals on which the broker is prohibited from voting for you result in “broker non-votes”. The election of directors (Proposal 1), the approval of the amendment and restatement of the Hooper Holmes, Inc. 2011 Omnibus Employee Incentive Plan (Proposal 2) and the advisory vote on the compensation of our named executive officers (Proposal 3) are each considered non-routine matters; the proposal to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the 2014 fiscal year (Proposal 4) is considered a routine matter. Please be sure to give specific voting instructions to your broker so that your shares can be represented. |

| |

| Q: | What is the quorum for the meeting? |

| |

| A: | The presence in person or by proxy of a majority of the shares of our common stock issued and outstanding and entitled to vote on the record date will constitute a quorum at the annual meeting. On our record date, April 15, 2014, there were 70,419,649 shares of our common stock issued and outstanding and entitled to vote at our annual meeting. All shares that are voted “FOR” or “AGAINST” any matter, votes that are “WITHHELD” for Board nominees, abstentions and broker non-votes are counted as present for purposes of determining the presence of a quorum. |

If we do not have a quorum at the meeting, a vote for adjournment will be taken among the shareholders present or represented by proxy. If a majority of the shareholders present or represented by proxy vote for adjournment, it is our intention to adjourn the meeting until a later date and to vote proxies received at such adjourned meeting.

| |

| Q: | How may I vote on the proposals to be voted on at the meeting? |

| |

| A: | In the election of directors (Proposal 1), you may vote “FOR” all of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees. |

For the proposals regarding the approval of the amendment and restatement of the Hooper Holmes, Inc. 2011 Omnibus Employee Incentive Plan (Proposal 2), the advisory vote on the compensation of our named executive officers (Proposal 3) and the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the 2014 fiscal year (Proposal 4), you may vote “FOR” or “AGAINST” or “ABSTAIN.”

| |

| Q: | What if I return a proxy but do not make specific choices with respect to some or all of the matters listed on my proxy card? |

| |

| A: | If you return a signed and dated proxy card without marking your voting selections, your shares will be voted “FOR” the election of each of the five nominees for director, “FOR” the approval of the amendment and restatement of the Hooper Holmes, Inc. 2011 Omnibus Employee Incentive Plan, “FOR” the approval of the |

compensation of our named executive officers, and “FOR” the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the 2014 fiscal year.

| |

| A: | You may change your proxy instructions at any time prior to the vote at the meeting. For shares held directly in your name, you may accomplish this by: |

| |

| • | voting again over the Internet or by telephone prior to 11:59 p.m. EDT on June 10, 2014; |

| |

| • | signing another proxy card with a later date and returning it to us prior to the meeting; |

| |

| • | sending a properly signed written notice that you are revoking your proxy to Hooper Holmes, Inc., 560 N. Rogers Road, Olathe, Kansas 66062, Attention: Corporate Secretary; or |

| |

| • | attending the meeting and notifying the election officials at the meeting that you wish to revoke your proxy and vote in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request. |

If you have instructed a broker, trustee or other nominee to vote your shares, you should follow the directions received from your broker, trustee or other nominee to change those instructions.

| |

| Q: | What does it mean if I receive more than one proxy or voting instruction card? |

| |

| A: | It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive. |

| |

| Q: | Who is paying for this solicitation? |

| |

| A: | We are paying for the solicitation of proxies, including the cost of preparing, printing and mailing the Notice and Access card, the proxy statement, the proxy card and any additional related information. |

We will reimburse brokers, banks and other financial institutions and nominees for their reasonable out-of-pocket expenses in forwarding proxy materials to their customers who hold shares in street name.

The solicitation of proxies through this proxy statement may be supplemented by mail, telephone, fax, personal solicitation or other communication methods by directors, officers or other of our employees without additional compensation to them.

| |

| Q: | What do I need to do to attend the meeting? |

| |

| A: | You may attend the meeting if you are listed as a shareholder of record as of the record date and bring proof of identification. If you hold your shares through a broker or other nominee, you will need to provide proof of ownership by bringing either a copy of a brokerage statement showing your share ownership as of the record date or a legal proxy if you wish to vote your shares in person at the meeting. In addition to the items above, you should bring proof of identification. |

| |

| Q: | How can I access the Company’s proxy materials and annual report electronically? |

| |

| A: | This proxy statement, the accompanying proxy card and the Company’s 2013 annual report to shareholders are being made available on the Internet at www.proxyvote.com, through the notice and access process available to the Company’s shareholders, as indicated in the Notice and Access card being mailed separately. Most shareholders can elect to view future proxy statements and annual reports over the Internet instead of receiving paper copies in the mail. |

If you own Hooper Holmes stock in your name, you can choose this option and save us the cost of producing and mailing these documents by checking the box for electronic delivery on your proxy card, or by following the instructions provided when you vote over the Internet. If you hold your Hooper Holmes stock through a bank, broker or other holder of record, please refer to the information provided by that entity for instructions on how to elect to view future proxy statements and annual reports over the Internet.

Q: Who counts the votes?

| |

| A: | We have retained Broadridge Financial Solutions, Inc. as the Inspector of Election for the annual meeting. Representatives of Broadridge will tabulate the votes represented by proxies, cast by ballot and the Internet. |

Q: Is my vote confidential?

| |

| A: | Proxy cards, ballots and voting tabulations that identify individual shareholders are handled in a manner intended to protect your voting privacy. Your vote will not be disclosed except as needed to permit the Company to tabulate and certify the vote, as required by law, or in limited circumstances such as a contested election. All comments written on the proxy card or elsewhere will be forwarded to management. |

Q: Can I vote on other matters?

| |

| A: | Our bylaws limit the matters presented at the annual meeting to those in the notice of the meeting and those otherwise properly brought before the meeting. If any other matters are presented at the meeting, your signed proxy gives the individuals named as proxies authority to vote your shares on such matters at their discretion. |

Q: Where can I find the voting results of the meeting?

| |

| A: | We will announce preliminary voting results at the meeting, if those results are then available, and we will publish final results in a Current Report on Form 8-K filed with the Securities and Exchange Commission within four business days following the meeting. |

Annual Report to Shareholders

A copy of our annual report to shareholders, which includes our annual report on Form 10-K for the 2013 fiscal year, accompanies this proxy statement. Shareholders may also obtain, free of charge, a copy of the 2013 annual report on Form 10-K, without exhibits, by writing to Hooper Holmes, Inc., 560 N. Rogers Road, Olathe, Kansas 66062, Attention: Corporate Secretary. The 2013 annual report on Form 10-K is also available through the Company’s website at www.hooperholmes.com. The 2013 annual report on Form 10-K does not constitute proxy soliciting materials.

Householding

Under applicable rules, we are permitted to mail a single proxy statement and annual report or Notice and Access card, as applicable, to households at which two or more shareholders reside. Accordingly, shareholders sharing an address who have been previously notified by their broker or its intermediary will receive only one copy of the proxy statement and annual report or Notice and Access card, unless the shareholder has provided contrary instructions. Individual proxy cards or voting instruction forms (or electronic voting facilities) will, however, continue to be provided for each shareholder account. If you prefer to receive separate copies of the proxy statement or annual report or Notice and Access card, either now or in the future, please notify us by mail at 560 N. Rogers Road, Olathe, Kansas 66062, attention: Corporate Secretary, or by telephone at (913) 764-1045. If you are currently a shareholder sharing an address with another shareholder and wish to have only one proxy statement and annual report or Notice and Access card delivered to the household in the future, please contact us at the same address or telephone number.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board of Directors has nominated the five persons listed below to serve as directors. If elected, each of our director nominees will serve until the 2015 annual meeting or until a successor has been elected and qualified. If any of the five nominees becomes unavailable for election, the persons named on the proxy card as proxies may vote for other nominees selected by the Board or the named proxies.

Each of our director nominees is currently a member of our Board.

Dr. Elaine L. Rigolosi, whose term as director expires as of this year’s annual meeting, is retiring from our Board and will not be seeking re-election. Upon Dr. Rigolosi’s retirement, the size of the Board will be reduced from six to five persons.

Our Board recommends that shareholders vote “FOR” the election of the five director nominees in this Proposal 1. Proxies will be voted for this proposal unless you otherwise specify in the proxy.

Director Nominees

Ronald V. Aprahamian

| |

| age 67, director since 2009 | Mr. Aprahamian has been our Chair of the Board since 2012. Mr. Aprahamian was elected to the Board in 2009 as a shareholder nominee. He has served as a director of Sunrise Senior Living, Inc. from 1995 until November 2008. He served as Chairman of the Board of Superior Consultant Holdings Corp. from October 2000 to October 2003, and as a director from 2003 to 2005. He also served as a director of First Consulting Group, Inc. from April 2005 to January 2007. |

Mr. Aprahamian is qualified to serve on our Board as he has been engaged in a broad range of business development activities as an investor, consultant, board member, and chief executive officer in companies engaged in the healthcare, computer software, banking, aviation engineering products, fiber optics, and telecommunications industries.

Henry E. Dubois

| |

| age 52, director since 2013 | Mr. Dubois became our President and Chief Executive Officer of the Company and was appointed to the Board in April 2013. From January to April 2013, Mr. Dubois served as financial and strategic consultant to the Executive Committee of the Board pursuant to an Interim Services Agreement between the Company and Randstad Professionals US, LP, d/b/a Tatum. Mr. Dubois was employed by Tatum from January 2011 until September 2013. From February 2005 through December 2012, he was engaged by GeoEye, Inc., a global supplier of high resolution satellite and aerial imagery, as Executive Vice President and as Chief Financial Officer from January 2006 through December 2008 and as a management and financial consultant during the balance of the engagement. Previously, he served as President, Chief Operating Officer and Chief Financial Officer of DigitalGlobe, Inc. and held senior executive positions including chief executive officer and chief financial officer of two companies in the Asia Pacific region. |

Mr. Dubois’ qualifications to serve on our Board include his demonstrated expertise and experience in financial management, operations and strategic planning.

Larry Ferguson

| |

| age 64, director since 2009 | Mr. Ferguson has served as CEO of several publicly traded and privately held companies, including First Consulting Group, Inc., a publicly held company serving the healthcare industry, from 2006 to 2008. Since 1995, he has served as CEO of |

The Ferguson Group, a private equity consulting and investment firm focused on healthcare and life sciences information technology companies. He also serves as a director of Accelrys, Inc., a publicly traded company. He previously held executive positions with American Express and First Data Corporation.

Mr. Ferguson’s qualifications to serve on our Board include his extensive experience in the healthcare and life sciences information technology industry. Mr. Ferguson was elected to the Board in 2009 as a shareholder nominee and served as the Chairman of the Board until January 2012. He serves as the Chair of the Governance and Nominating Committee and is a member of our Audit and Compensation Committee.

Gus D. Halas

| |

| age 63, director since 2013 | Mr. Halas was appointed to the Board in April 2013. Mr. Halas serves on the Audit Committee and Compensation Committee. Mr. Halas has served as CEO of several companies. He has been Chief Executive Officer and President of the Central Operating Companies at Central Garden & Pet Company since April 2011. Mr. Halas was President and Chief Executive Officer of T-3 Energy Services, Inc. from May 2003 to March 2009 and also served as Chairman of the Board of Directors from March 2004 to March 2009. From August 2001 to April 2003, Mr. Halas served as President and Chief Executive Officer of Clore Automotive, Inc. He also serves as a director for Triangle Petroleum Corp. |

Mr. Halas is qualified to serve on our Board because of his experience and expertise as an executive and a director with companies implementing “turnaround” strategies. Mr. Halas serves as the Chair of the Compensation Committee and is a member of the Audit Committee.

Thomas A. Watford

| |

| age 53, director since 2010 | As President and Chief Operating Officer of Santa Rosa Consulting, Mr. Watford leads a company that offers an extensive portfolio of solutions that allow healthcare organizations to meet their operational and strategic objectives. Prior to joining Santa Rosa in 2008, Mr. Watford served as Chief Financial Officer and Chief Operating Officer of First Consulting Group, Inc., a $300 million NASDAQ listed company serving the healthcare industry. As Chief Operating Officer of First Consulting from 2006 to 2008, Mr. Watford was responsible for service delivery, infrastructure, and development operations in India and Vietnam. As Chief Financial Officer of First Consulting from 2005 to 2008, he led the financial turnaround of the company and, with the CEO, led the process that resulted in the sale of the firm. |

Mr. Watford’s qualifications to serve on our Board include his more than 25 years’ experience in the healthcare industry, where he has delivered professional and IT services to healthcare providers, health plans and life sciences companies. He serves as the Chair of the Audit Committee, and is a member of the Governance and Nominating Committees.

CORPORATE GOVERNANCE

Governance Structure

The Board has adopted Corporate Governance Guidelines for the Company which provide, among other things, that the Board generally favors separating the roles of Chairman and Chief Executive Officer. The Board believes it is generally appropriate for the CEO to maintain a primary focus on the Company’s strategic and operational

plans, and for the Chairman to provide an independent focus on serving shareholder interests. The Board has had an independent Chairman since 2009. The Corporate Governance Guidelines provide that no individual who has attained the age of 72 years will be appointed to the Board or be nominated for election or reelection as a director.

Director Independence

Our common stock is listed on the NYSE MKT stock exchange, which is referred to in this proxy statement as the NYSE MKT. The NYSE MKT Company Guide requires that at least a majority of the members of our Board be “independent directors” within the meaning of the listing standards of the NYSE MKT.

The Board has affirmatively determined that each of the members of the Board other than Henry E. Dubois, the Company’s President and Chief Executive Officer, is, as of the date of this proxy statement, an “independent director” within the meaning of the listing standards of the NYSE MKT.

Director Attendance at Annual Meetings of Our Shareholders

We encourage, but do not require, our directors to attend annual meetings of our shareholders. All of our continuing directors at the time of our 2013 annual meeting of our shareholders attended that meeting.

Board and Board Committee Meetings

During 2013, our Board held a total of 28 meetings, in addition to taking other actions by unanimous written consent in lieu of a meeting. All of our Board members attended at least 75% of the meetings of our Board and of the committees on which he or she served that were held during the period for which he or she was a director or committee member during 2013.

Risk Oversight

The Board oversees our functions to assure that our assets are properly safeguarded, that appropriate financial and other controls are maintained, and that business is conducted prudently and in compliance with applicable laws, regulations and ethical standards. Although the Board as a whole carries out this oversight function, much of the work is delegated to various Board Committees which meet regularly and report back to the full Board.

In particular, the Audit Committee is responsible for reviewing and overseeing our financial statements, including the integrity of our financial and disclosure controls, legal compliance programs and procedures, and procedures for identifying, evaluating and controlling material financial, legal and operational risk. The Audit Committee, whose members are all “independent” directors, receives regular reports about these matters from, and meets separately with, our outside auditors, and receives regular reports from our management.

While the Board and its Committees are responsible for risk oversight, our management is responsible for managing risk. We have robust internal processes and a strong internal control environment to identify and manage risks and to communicate with the Board. The Board and the Audit Committee monitor and evaluate the effectiveness of the internal controls and the risk management program at least annually. Management communicates routinely with the Board, Board Committees and individual Directors on the significant risks identified and how they are being managed. Directors are free to, and often do, communicate directly with senior management.

Board Committees

As of the date of this proxy statement, the Board of Directors has the following standing committees:

| |

| • | Governance and Nominating Committee |

Each of these committees has a written charter approved by the Board. These charters are posted on our website at www.hooperholmes.com. In addition, the Board from time to time may establish additional committees for particular purposes. The Executive Committee was formed in late 2012 and was discontinued as of September 30, 2013.

The current membership of each of the Board’s committees is set forth below:

|

| | | | | |

| Director | Audit

Committee | Compensation

Committee | Governance

and Nominating

Committee | | |

| Ronald V. Aprahamian | | | | | |

| Henry E. Dubois | | | | | |

| Larry Ferguson | X | X | Chair | | |

Gus D. Halas(1) | X | Chair | | | |

| Dr. Elaine L. Rigolosi | | X | X | | |

| Thomas A. Watford | Chair | | X | | |

(1) Appointed to Audit Committee and Compensation Committee on April 15, 2013.

Audit Committee

As specified in the Audit Committee’s charter, the Audit Committee was established to assist the Board in fulfilling its oversight responsibilities, primarily through:

| |

| • | overseeing management’s conduct of the Company’s financial reporting process and systems of internal accounting and financial controls; |

| |

| • | monitoring the independence and performance of the Company’s independent registered public accounting firm; and |

| |

| • | providing an avenue of communication among the independent registered public accounting firm, management and the Board. |

The Audit Committee is currently comprised of three members, each of whom satisfies the independence standards specified in Section 803B(2) of the NYSE MKT Company Guide and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our Board has determined that Thomas A. Watford, the committee’s chair, qualifies as an “audit committee financial expert” as defined by SEC rules.

The Audit Committee charter provides that the committee’s responsibilities and duties are:

| |

| • | oversight of our internal controls, which encompasses: the annual review of the budget of the internal audit function, its staffing, audit plan, and material findings of internal audit reviews and management’s response; assessment of the effectiveness of or weaknesses in our internal control over financial reporting, which may also entail obtaining from the independent registered public accounting firm its report, if required, regarding the effectiveness of our internal control over financial reporting; and review of the appointment and performance of the senior internal auditor, and the activities, organizational structure and qualifications of the persons responsible for the internal audit function; |

| |

| • | the evaluation of the performance and independence of the independent registered public accounting firm, which encompasses: review of the scope, plan and procedures to be used on the annual audit; review of the results of the annual audit and interim financial reviews performed by the independent registered public accounting firm; inquiring into accounting adjustments that were noted or proposed by the independent registered public accounting firm but were passed as immaterial or otherwise; the review, at least annually, of a report by the independent registered public accounting firm as to the independent registered public accounting firm’s internal quality control procedures; and pre-approval |

of the fees for all audit and non-audit services performed by the independent registered public accounting firm;

| |

| • | the review of our annual and interim consolidated financial statements, which encompasses: the review of significant estimates and judgments underlying such financial statements, all critical accounting policies, major changes to our accounting principles and practices and material questions of choice with respect to such principles and practices; review of earnings press releases; and review of related party transactions and other matters relating to our financial affairs and its accounts; and |

| |

| • | the review of our compliance with laws, regulations and policies. |

The Audit Committee met five times in 2013.

Compensation Committee

The Compensation Committee currently consists of three members, each of whom is an “independent director” as defined by applicable NYSE MKT listing standards.

In accordance with the Compensation Committee’s charter, the committee, among other matters, annually reviews and recommends to the Board the compensation of our Chief Executive Officer and, based in part upon our Chief Executive Officer’s recommendation, approves the compensation of the other members of our senior management. The Compensation Committee also administers the Hooper Holmes, Inc. 2011 Omnibus Employee Incentive Plan and the Hooper Holmes, Inc. 2008 Omnibus Employee Incentive Plan and determines the nature and terms of the awards granted under those plans. The Compensation Committee also administers the Hooper Holmes, Inc. 2007 Non-Employee Director Restricted Stock Plan and the Stock Purchase Plan (2004) of Hooper Holmes, Inc. In overseeing these plans, the Compensation Committee has the sole authority for day-to-day administration and interpretation of the plans. The Compensation Committee has the authority to engage outside advisors to assist it in the performance of its duties; the Compensation Committee may not delegate this authority to others. The Compensation Committee may, however, form and delegate some or all of its authority to subcommittees when it deems appropriate.

The Compensation Committee periodically reviews and recommends to the Board the compensation for the Company’s non-employee directors. Information regarding director compensation amounts paid in 2013 can be found in the Director Compensation Table located in the discussion below under the caption “Compensation of Directors.” The Compensation Committee and our Board believe that (i) non-employee director compensation should fairly compensate directors for work required in a company of our size and scope, (ii) such compensation should align such directors’ interests with the long-term interests of our shareholders, and (iii) the structure of director compensation should be simple, transparent and easy for shareholders to understand.

Hooper Holmes’ compensation programs are designed to attract, retain, and motivate executive officers and to provide a framework that delivers outstanding financial results over the long term. Our compensation programs for executive officers reflect the competitive environment in which we operate and incorporate performance-based criteria. To that end, the Compensation Committee monitors the executive compensation and compensation plans of other companies. In addition, our compensation programs are designed to establish compensation packages that balance cash and equity in a manner designed to align executive compensation with shareholder interests and also take into account the Company’s cash position.

We are required to seek non-binding advisory votes from shareholders to approve the compensation as disclosed in the discussion under the caption “Compensation of Executive Officers” and to approve how often such a advsisory vote should occur. In 2013, a majority of shareholders voted to support an annual advisory vote on the compensation of executive officers. Shareholder Proposal 3 below represents such advisory votes.

While the advisory vote on compensation is non-binding, the Compensation Committee and the Board value the opinions of our shareholders as expressed through their votes and other communications. Accordingly, the Compensation Committee and the Board will carefully consider the outcome of the advisory vote on executive

compensation and shareholder opinions received from other communications when making future compensation decisions.

The Compensation Committee met nine times in 2013.

Governance and Nominating Committee

The Governance and Nominating Committee’s principal purposes are to:

| |

| • | recommend to the Board principles for governance; |

| |

| • | oversee the evaluation of the Board and management; |

| |

| • | recommend to the Board persons to be nominated for election as directors; and |

| |

| • | assign Board members to Board committees. |

The charter of the Governance and Nominating Committee provides that the committee is to have such number of directors as determined by the Board. Except as otherwise permitted, each of the committee members is to be an “independent director” as defined by applicable NYSE MKT listing standards. The Governance and Nominating Committee has three members, each of whom is independent under the NYSE MKT listing standards.

Under applicable NYSE MKT listing requirements, at least a majority of the members of the Board must meet the definition of “independent director” set forth in such listing requirements. The Governance and Nominating Committee believes that it is preferable for at least one member of the Board to meet the criteria for an “audit committee financial expert” as defined by SEC rules.

The Governance and Nominating Committee’s goal is to assemble a Board that brings to the Company a diversity of experience. Directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of our shareholders. They should have an inquisitive and objective perspective and mature judgment. Taken as a whole, the Board should include members with a record of experience and achievement in fields relevant to the Company’s current and planned future business activities, and members with knowledge or experience that can be a source of strategic guidance to Company management. Director candidates must have sufficient time available, in the judgment of the Governance and Nominating Committee, to perform all Board and committee responsibilities. They must have experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are affiliated. Members of the Board are expected to rigorously prepare for, attend and participate in all Board and applicable committee meetings. Other than the foregoing, there are no stated minimum criteria for director nominees, although the Governance and Nominating Committee may also consider such other factors as it may deem, from time to time, in the best interests of the Company and its shareholders.

Candidates for director nominees are evaluated by the Governance and Nominating Committee in the context of the current composition of the Board, the Company’s operating requirements and the long-term interests of the Company’s shareholders. The Governance and Nominating Committee uses its network of contacts to compile a list of potential candidates and may also engage, if it deems appropriate, a professional search firm and, in such case, pay that firm a fee for its assistance in identifying or evaluating director candidates. In the case of new director candidates, the Governance and Nominating Committee will seek to determine whether the nominee is independent under applicable NYSE MKT listing standards, SEC rules and regulations and with the advice of counsel, if necessary. The Governance and Nominating Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the functions and needs of the Board. In the case of incumbent directors whose terms of office are set to expire, the Governance and Nominating Committee reviews such directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance, and whether there are any relationships and transactions that might impair such directors’ independence.

The Governance and Nominating Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee or nominees for recommendation to the Board by majority vote.

The Governance and Nominating Committee does not have a specific diversity policy, but considers diversity of race, ethnicity, gender, age, cultural background and professional experiences in evaluating candidates for Board membership. The Board believes that a variety of points of view represented on the Board contributes to a more effective decision-making process.

As set forth in the Governance and Nominating Committee’s charter, the Governance and Nominating Committee will evaluate any candidates recommended by shareholders in accordance with the same criteria applicable to the evaluation of candidates proposed by directors or management. A shareholder who wishes to recommend a person for election as a director at the 2014 annual meeting of shareholders, without including such nominee in the Company’s proxy materials, must notify the Company of such nominee in writing by March 13, 2015, but not before February 11, 2015. The notice containing such nominee must also include certain information specified in our bylaws. Shareholders should submit their recommendations to the attention of our Corporate Secretary, 560 N. Rogers Road, Olathe, Kansas 66062, by certified mail - return receipt requested.

If a shareholder wishes to have a nominee for director included in the Company’s proxy materials for the 2015 annual meeting of shareholders, the shareholder must be considered an “eligible shareholder” under the Company’s bylaws, and the nomination must be received by the Company by March 13, 2015. The notice containing such nominee must also include certain information specified in our bylaws. Shareholders should submit their notices to the attention of the Company’s Corporate Secretary, 560 N. Rogers Road, Olathe, Kansas 66062, by certified mail – return receipt requested. To be considered an “eligible shareholder,” such shareholder, together with his or her affiliates, must have continuously held (for at least one year preceding March 13, 2015) beneficial ownership of not less than 5% of the voting power of our outstanding voting securities entitled to vote in the election of directors and must comply with all applicable provisions of our bylaws.

The Governance and Nominating Committee did not have any formal separate meetings during 2013. All business of the Governance and Nominating Committee was conducted as part of meetings of the full Board of Directors in 2013.

Executive Committee

In 2013, the principal purpose of the Executive Committee was to work at the discretion of the Board on certain high level and sensitive matters, including evaluating the strategic direction of the Company. In 2013, the Executive Committee formally met four times and much more frequently on an informal basis to consider matters related to our financing arrangements, Mr. Dubois’s retention as a consultant and subsequent appointment to the Board and management, and transaction-related matters. The Executive Committee was comprised of three independent directors. The Board discontinued the Executive Committee effective September 30, 2013.

Code of Conduct and Ethics

We are committed to sound principles of corporate governance that promote honest, responsible and ethical business practices. Our corporate governance policies and practices are actively reviewed and evaluated by our Board and the Governance and Nominating Committee.

We have adopted a Code of Conduct and Ethics to provide standards for ethical conduct in dealing with agents, customers, suppliers, political entities and others. Our Code of Conduct and Ethics applies to all of our directors, officers and employees (and those of our subsidiaries), including our Chief Executive Officer, Chief Financial Officer and Controller. Our Code of Conduct and Ethics is posted on our website at www.hooperholmes.com. A printed copy of our Code of Conduct and Ethics is also available to shareholders, without charge, upon written request directed to our Corporate Secretary at the following address: Hooper Holmes, Inc., 560 N. Rogers Road, Olathe, Kansas 66062.

Communications with Our Board

Shareholders and other interested persons may communicate in writing with our Board, any of its committees, or a particular director by sending written communications to our Corporate Secretary at 560 N. Rogers Road, Olathe, Kansas 66062. The mailing envelope should contain a clear notation indicating that the enclosed letter is a “Shareholder-Board Communication” or “Shareholder-Director Communication.” All such letters should clearly state whether the intended recipients are all of the members of the Board or certain specified individual directors. You must include your name and address in the written communication and indicate whether you are a shareholder. The Corporate Secretary will review any communications received from shareholders and all material communications from shareholders will be forwarded to the appropriate director or directors or Committee of the Board based on the subject matter.

Policies on Reporting Certain Concerns Regarding Accounting and Other Matters

We have adopted policies on the reporting of concerns to our Audit Committee regarding any suspected misconduct, illegal activities or fraud, including any questionable accounting, internal accounting controls or auditing matters, or misconduct. Any person who has a concern regarding possible misconduct by any of our employees, including any executive officer, or any of our agents, may submit that concern to: Hooper Holmes, Inc., Attention: Corporate Secretary, 560 N. Rogers Road, Olathe, Kansas 66062. Employees may communicate all concerns regarding any misconduct to our General Counsel and/or the Audit Committee on a confidential and anonymous basis through our “whistleblower” hotline at 1-866-384-6616. Any communication received through the toll-free number is promptly reported to our General Counsel, as well as other appropriate management members.

COMPENSATION OF DIRECTORS

The table below sets forth the fees and other compensation that we paid our non-employee directors for services performed in 2013. In addition to these fees and other compensation, all directors are reimbursed for their out-of-pocket expenses incurred in attending Board and Board committee meetings.

|

| | |

| Nature of Director Compensation | Amount | |

Annual Board Retainers:(1) | | |

| Non-Executive Chair of the Board | $40,000 | |

| Additional Retainer for Non-Executive Chair of the Board | $35,000 | |

| Other Non-Employee Directors | $20,000 | |

Annual Board Committee Retainers:(1) | | |

| Audit Committee Chair | $12,000 | |

| Executive Committee Chair | $12,000 | |

| Other Committee Chairs | $8,000 | |

| Audit Committee Members | $8,000 | |

| Executive Committee Members | $12,000 | |

| Other Committee Members | $6,000 | |

| Fees for Board Meetings/Teleconferences Attended: | | |

| Regular or Special Meetings | $2,500 per meeting | |

| Teleconferences | $1,500 per teleconference | |

Fees for Board Committee Meetings Attended: (2) | | |

| Regular or Special Meetings | $1,500 per meeting | |

| Teleconferences | $750 per teleconference | |

| Annual Restricted Stock Grant: | | |

Non-Executive Chair of the Board(3) | 10,000 shares | |

Other Non-Employee Directors(3) | 5,000 shares | |

| |

(1) | The annual Board and Board committee retainers are paid in installments on a quarterly basis. If a director is a member of the Board or a Board committee for less than the full year, he or she receives quarterly installments of the annual Board and Board committee retainers only for the quarterly periods in which he or she serves on the Board or the applicable Board committee(s). |

| |

(2) | The Chair and members of the Executive Committee do not receive fees for meetings or teleconferences of the Executive Committee. |

| |

(3) | The 2007 Plan provides for the automatic grant, on an annual basis, of 5,000 shares of restricted stock to each non-employee member of the Board (other than the non-executive chair of the Board or the lead director, if there is no non-executive chair). The non-executive chair of the Board (or the lead director, if there is no non-executive chair) receives 10,000 shares. |

Director Compensation Table

The following table shows total compensation awarded or paid to each non-employee director during 2013.

|

| | | |

Name | Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

Total ($) |

| | | | |

| Ronald V. Aprahamian | 136,700 | 4,200 | 140,900 |

| Larry Ferguson | 112,100 | 2,100 | 114,200 |

| Gus D. Halas | 75,850 | 2,100 | 77,950 |

| Dr. Elaine L. Rigolosi | 92,350 | 2,100 | 94,450 |

| Kenneth Rossano | 42,750 | – | 42,750 |

| Thomas A. Watford | 96,100 | 2,100 | 98,200 |

| |

(1) | The stock awards reflected in this column were granted under the 2007 Plan. Stock awards under the plan are normally made in June of each year. The amounts shown represent the fair value of the stock awards on the date of grant. |

Board Governance and Compensation – 2014 Changes

The Board of Directors has approved certain governance and compensation changes to become effective upon the conclusion of the 2014 annual meeting of shareholders.

Due to the decrease in the size of the Board following the 2014 annual meeting of shareholders, the Board has determined that, following such meeting, each independent director would serve on each of the Audit, Compensation and Governance and Nominating Committees.

In connection with such Board governance realignment, the Board also determined to adopt a new compensation structure for the directors, to become effective following the 2014 annual meeting of shareholders. The new director compensation program is designed to align the directors’ interests more directly with the shareholders by providing a greater percentage of overall compensation in the form of stock grants. The new program is summarized as follows:

Annual Board retainers will be paid in a combination of cash and stock. All Non-employee directors will be paid an annual retainer of $60,000. The Non-Executive Chair will be paid an additional retainer of $20,000. These retainers are intended to provide compensation for four in-person Board meetings and four Committee meetings of each Committee on which they serve per year. Compensation for Board or Committee meetings in excess of four will be $750 per meeting, whether in person or telephonic. Committee chairs will receive an additional annual cash retainer as

follows: Audit ($10,000), Compensation ($7,500) and Governance and Nominating ($5,000). In addition to the cash compensation, subject to approval of the Amended and Restated 2011 Omnibus Employee Incentive Plan (Proposal 2), each director will receive a grant of 100,000 shares of restricted stock, with immediate vesting, issued as of the date of the annual meeting to be issued under such plan. If the shareholders fail to approve the 2011 Amended and Restated Omnibus Employee Incentive Plan, the Board will consider alternative structures for the Board compensation program.

Director and Officer Indemnification

The Company has agreed to indemnify each of its directors and executive officers for all expenses actually and reasonably incurred in defending or settling an action to which such person is a party or threatened to be made a party or is otherwise involved because of his or her status as a director or officer of the Company. If the action is brought by or in the right of the Company, the indemnification must be made only if such person acted in good faith, for a purpose reasonably believed to be in the best interest of the Company (or, in the case of service to another entity, not opposed to the interest of the Company).

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The table below sets forth information available to us as of April 15, 2014, regarding the beneficial ownership of our common stock by (i) each person, or group of affiliated persons, known by us to beneficially own more than five percent (5%) of the outstanding shares of our common stock, (ii) each of our directors and director nominees, (iii) each of our named executive officers listed in the Summary Compensation Table located elsewhere in this proxy statement, and (iv) all of our directors and executive officers as a group.

The information in the table has been presented in accordance with SEC rules and is not necessarily indicative of beneficial ownership for any other purpose. Under the SEC’s rules, a person is deemed to own beneficially all securities as to which that person owns or shares voting or dispositive power, as well as all securities which such person may acquire within 60 days through the exercise of currently available conversion rights or options. If two or more persons share voting or dispositive power with respect to specific securities, all of such persons may be deemed to be the beneficial owner of such securities. Information with respect to persons other than the holders listed in the table below that share beneficial ownership with respect to the securities shown is set forth in certain of the footnotes to the table.

Except as otherwise noted, the number of shares owned and percentage ownership in the following table is based on 70,410,649 shares of common stock outstanding on April 15, 2014.

|

| | |

Name and Address of Beneficial Owner | Number of Shares Beneficially Owned | Percent of Common Stock Outstanding |

| | | |

5% Shareholders:

| | |

Heartland Advisors, Inc. and William J. Nasgovitz 789 North Water Street Milwaukee, WI 53202

| 12,209,238 (1) | 17.34% |

J. Carlo Cannell 1315 South Highway 89, Suite 203 P.O. Box 3459 Jackson, WV 83001

| 10,681,538 (2) | 15.17% |

Named Executive Officers, Directors and Nominees for Director:

| | |

Ronald V. Aprahamian(3) | 3,391,400 | 4.82% |

Henry E. Dubois(4) | 705,532 | 1.00% |

| Larry Ferguson | 207,500 | * |

| Gus D. Halas | 105,000 | * |

Dr. Elaine L. Rigolosi(5) | 218,400 | * |

| Thomas Watford | 15,000 | * |

Tom Collins(6) | 128,100 | * |

Ransom J. Parker(7) | 50,000 | * |

Michael J. Shea(8) | 130,506 | * |

Joseph A. Marone, Jr.(9) | 429,203 | * |

| Burt R. Wolder | 189,047 | * |

All Directors and Executive Officers as a Group (12 persons) |

5,569,668 (10) | 7.91% |

| |

| * | Represents less than one percent of the outstanding shares of our common stock. |

| |

(1) | Heartland Advisors, Inc. and William J. Nasgovitz, who is identified as the president and control person of Heartland Advisors, Inc., filed an amended Schedule 13G on February 6, 2014, disclosing that they have shared voting power with respect to 11,450,231 shares of our common stock and shared dispositive power with respect to 12,209,238 shares. The amended Schedule 13G indicates that Mr. Nasgovitz disclaims beneficial ownership of these shares. |

| |

(2) | J. Carlo Cannell filed an amended Schedule 13D on December 13, 2013, disclosing that he has sole voting power and sole dispositive power with respect to all 10,681,538 shares. |

| |

(3) | Includes 60,000 shares held by Mr. Aprahamian as trustee for his late mother’s trust. |

| |

(4) | Includes 500,000 shares that Mr. Dubois has the right to acquire within 60 days of April 15, 2014, upon the exercise of outstanding options. |

| |

(5) | Includes 3,600 shares held in the name of Dr. Rigolosi’s husband. |

| |

(6) | Includes 122,100 shares that Mr. Collins has the right to acquire within 60 days of April 15, 2014, upon the exercise of outstanding options. |

| |

(7) | Information known to us on April 8, 2013, Mr. Parker’s last day of employment. |

| |

(8) | Information known to us on September 25, 2013, Mr. Shea’s last day of employment. |

| |

(9) | Information known to us on April 2, 2014, Mr. Marone’s last day of employment. Includes 345,350 shares that Mr. Marone has the right to acquire within 60 days of April 15, 2014, upon the exercise of outstanding options. |

| |

(10) | Includes shares which certain of the individuals included in the table have the right to acquire within 60 days of April 15, 2014 upon exercise of outstanding options. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors and executive officers, and the beneficial owners of more than 10% of our common stock, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities of the Company. Directors, executive officers and such beneficial owners are required by SEC regulations to furnish us with copies of all reports they file under Section 16(a). The Company has historically undertaken to make such filings on behalf of its directors and executive officers.

To our knowledge, based solely on our review of the copies of such reports (and amendments to such reports) furnished to us, we are not aware of any required Section 16(a) reports that were not filed on a timely basis with respect to the fiscal year ended December 31, 2013.

REPORT OF THE AUDIT COMMITTEE

In accordance with its written charter, the Audit Committee assists the Board in fulfilling its responsibilities for the oversight of the quality and integrity of our consolidated financial statements, our compliance with legal and regulatory requirements, the performance of the internal audit function and independent audit, and the independence and qualifications of our independent registered public accounting firm, which reports directly to the Audit Committee. The Audit Committee operates under a charter approved by the Board. The full text of the Audit Committee charter is available on our website at www.hooperholmes.com. As of the date of this proxy statement, the Audit Committee is comprised of three directors, each of whom the Board has determined to be independent within the meaning of rules adopted by the SEC and the listing standards of the NYSE MKT.

Our management has responsibility for preparing our consolidated financial statements, maintaining effective internal control over financial reporting and assessing the effectiveness of the internal control over financial reporting. Our independent registered public accounting firm, KPMG LLP, is responsible for performing an audit of our consolidated financial statements in accordance with the standards established by the Public Company Accounting Oversight Board, and for issuing their report on the results of their audit.

In this context, the Audit Committee hereby reports as follows:

1. The Audit Committee has met with management and KPMG LLP and has reviewed and discussed with them the Company’s audited consolidated financial statements as of and for the fiscal year ended December 31, 2013.

2. The Audit Committee has discussed and reviewed with KPMG LLP the matters required by Public Company Accounting Oversight Board, Auditing Standard No. 16, Communication with Audit Committees, and, with and without management present, discussed and reviewed the results of KPMG LLP’s audit of the consolidated financial statements.

3. The Audit Committee has obtained from KPMG LLP the written disclosure and the letter required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” as adopted by the Public Company Accounting Oversight Board in Rule 3200T, and has discussed with KPMG LLP any relationships that may impact their objectivity and independence as provided in Public Company Accounting Oversight Board Rule 3526, and has satisfied itself as to their independence. The Audit Committee reviewed, with KPMG LLP and management, the audit plan, audit scope and identification of audit risks.

4. Based upon the review and discussions described in the preceding paragraphs 1 through 3 above, and the Audit Committee’s review of the representations of management, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in our annual report on Form 10-K for the fiscal year ended December 31, 2013, for filing with the SEC.

Date: April 28, 2014

/s/ Thomas A. Watford

Committee Chair

/s/ Larry Ferguson

Committee Member

/s/ Gus D. Halas

Committee Member

The foregoing report does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent the Company specifically incorporates this report by reference therein.

PROPOSAL NO. 2

APPROVAL OF THE AMENDMENT AND RESTATEMENT OF THE HOOPER HOLMES, INC.

2011 OMNIBUS EMPLOYEE INCENTIVE PLAN

Upon the recommendation of the Compensation Committee, the Board has adopted an amendment and restatement of the Hooper Holmes, Inc. 2011 Omnibus Employee Incentive Plan (the “Amended and Restated Omnibus Plan”) and is submitting the Amended and Restated Omnibus Plan to our shareholders for approval.

The Amended and Restated Omnibus Plan currently provides for grants to our senior management and other employees of stock options and shares of restricted stock. The Amended and Restated Omnibus Plan is being amended and restated to include as eligible participants non-employee directors and consultants who perform bona fide services to us under the Amended and Restated Omnibus Plan. The Amended and Restated Omnibus Plan is also being amended and restated to change the name of the plan to the “Hooper Holmes, Inc. 2011 Omnibus Incentive Plan.”

The receipt, exercise and/or payout of any and all awards granted under the Amended and Restated Omnibus Plan may be made subject to the satisfaction of performance conditions. Our Board intends to use such awards to enhance our ability to attract and retain highly qualified officers, key employees and other personnel, as well as non-employee directors and consultants and to motivate such persons to expend maximum effort to improve our business results and earnings. The Board believes that, by providing an opportunity to our employees to acquire or increase their equity interests in the company, their interests are better aligned with those of our shareholders.

The Amended and Restated Omnibus Plan is to remain in effect until the earlier of (i) the 10th anniversary of its original effective date (May 24, 2011), or (ii) the date all shares of stock available for issuance under the Amended and Restated Omnibus Plan have been issued.

If approved by our shareholders, the Amended and Restated Omnibus Plan will become effective as of June 11, 2014. No awards have been nor will be made under the Amended and Restated Omnibus Plan that were not otherwise permitted by the original plan, unless and until the Amended and Restated Omnibus Plan is approved by our shareholders. Shareholder approval of the Amended and Restated Omnibus Plan is desired, among other reasons, to meet the listing requirements of the NYSE MKT stock exchange.

The material features of the Amended and Restated Omnibus Plan are summarized below. The summary is qualified in its entirety by reference to the specific provisions of the Amended and Restated Omnibus Plan, the full text of which is set forth as Annex A to this proxy statement.

Eligibility to Receive Awards under the Amended and Restated Omnibus Plan

Any of our employees or any employee of our subsidiaries or other affiliate will be eligible to receive awards under the Amended and Restated Omnibus Plan. Non-employee directors and consultants who provide bona fide services to us may also be granted awards under the Amended and Restated Omnibus Plan.

Name

To reflect the addition of non-employee directors and consultants as eligible participants under the Amended and Restated Plan, the Amended and Restated Omnibus Plan will be known as the “Hooper Holmes, Inc. 2011 Omnibus Incentive Plan.”

Administration

The Amended and Restated Omnibus Plan will be administered by the Compensation Committee. The Compensation Committee will select the employees to whom awards will be granted and set the terms and conditions of such awards, including any performance goals applicable to certain awards.

Shares Reserved for Awards

The number of shares of our common stock available for issuance under the Amended and Restated Omnibus Plan is 3,500,000 shares. The number (and kind) of shares authorized for awards is subject to proportional adjustment for changes in our capitalization, a reorganization, stock split, reverse stock split, combination of shares, exchange of shares, stock dividend or other distribution payable in capital stock, or other increase or decrease in our shares, effected without receipt of consideration.

Shares of our common stock to be issued under the Amended and Restated Omnibus Plan shall be authorized but unissued shares, shares purchased in the open market or otherwise, treasury shares or any combination of such shares, as the Compensation Committee or, if appropriate, the Board may determine.

The Amended and Restated Omnibus Plan includes provisions specifying the number of shares of our common stock that will count against the share limit under the plan. The shares subject to an option will count against the limit on a one-for-one basis.

Any shares that are not used because (i) the terms and conditions of the applicable award are not met, (ii) the award terminates, expires, or is exchanged or forfeited, or (iii) the award is settled in cash in lieu of shares may again be used for an award under the Amended and Restated Omnibus Plan.

Types of Awards

Awards under the Amended and Restated Omnibus Plan may include:

| |

| • | stock options (provided that all options granted under the Amended and Restated Omnibus Plan will be non-qualified stock options; that is, options that do not qualify as incentive stock options) (“NQSOs”); and |

| |

| • | shares of restricted stock (restricted in the sense that such shares may be subject to, among other things, restrictions based on the achievement of corporate and/or individual performance goals, time-based restrictions on vesting, holding requirements, and transfer/sale restrictions). |

The actual number and types of awards that will be granted under the Amended and Restated Omnibus Plan are not determinable at this time. The Compensation Committee will make these determinations in its sole discretion.

Options. The Compensation Committee may grant to participants in the Amended and Restated Omnibus Plan options to purchase shares of our common stock. The Compensation Committee will determine the terms and conditions of each option award, including the number of shares of stock for which the option may be exercised, the option exercise price, vesting schedule, any conditions upon which the option shall become vested and exercisable, the term of the option, the consequence of a grantee’s ceasing to be an employee, and the form of payment upon exercise of the option.

The exercise price of an option awarded under the Amended and Restated Omnibus Plan may not be less than 100% of the fair market value of a share of our common stock on the date the Compensation Committee grants the option award.

Unless the award agreement memorializing the terms of an option award specifies otherwise, an option awarded under the Amended and Restated Omnibus Plan will vest and become exercisable in four equal annual installments (i.e., 25% on each of the second through fifth anniversaries of the grant date). The Amended and Restated Omnibus Plan includes provisions that may alter the vesting schedule or the ability to exercise an option in the event of a grantee’s ceasing to be an employee or the occurrence of a change of control of the Company. An option granted under the Amended and Restated Omnibus Plan will expire no later than the 10th anniversary of its grant date.

The Amended and Restated Omnibus Plan provides a number of alternative methods to pay the exercise price of an option, including:

| |

| • | by tendering previously acquired shares of our common stock having an aggregate fair market value at the time of exercise of the option equal to the exercise price for the shares for which the option is being exercised; |

| |

| • | by a net exercise of the option (that is, using a portion of the shares of stock subject to the option, valued at the fair market value of a share of our common stock on the date of exercise of the option, to pay the option price for the shares for which the option is being exercised); and |

| |

| • | through a “cashless” exercise (in which the shares of stock underlying the option are sold by a licensed securities broker, with the proceeds used to pay the option price). |

Restricted Stock. The Compensation Committee may grant to participants in the Amended and Restated Omnibus Plan awards of shares of restricted stock - that is, shares subject to specified restrictions (for example, the achievement of corporate and/or individual performance goals, time-based restrictions on vesting, holding requirements, and transfer/sale restrictions).

Unless the award agreement memorializing the terms of an award of shares of restricted stock specifies otherwise, such an award will vest and become exercisable in four equal annual installments (i.e., 25%) on each of the second through fifth anniversaries of the grant date. Unless the Compensation Committee otherwise provides in an award agreement, upon a grantee’s ceasing to be an employee for any reason other than his death or disability, any award of shares of restricted stock held by the grantee that have not vested, or with respect to which all applicable restrictions and conditions have not been satisfied or lapsed, shall be deemed forfeited. However, the Compensation Committee may, in its discretion, in any individual case, provide for a waiver of restrictions or forfeiture conditions related to the shares of restricted stock.

Unless the Compensation Committee provides otherwise in the applicable award agreement, a grantee holding an award of shares of restricted stock granted under the Amended and Restated Omnibus Plan will have right to vote such shares and will be credited with dividends paid with respect to those shares.

General Terms of Awards

Prohibition on Repricing. The Amended and Restated Omnibus Plan provides that, without shareholder approval, no amendment or modification may be made to an outstanding option (for example, by reducing the exercise price or replacing the option with cash or another award type) that would be treated as a repricing under the rules of the principal stock exchange on which our common stock is then listed.

Restrictions on Transferability of Awards. An award granted under the Amended and Restated Omnibus Plan is not generally transferable by the grantee except in the event of the grantee’s death or unless otherwise required by law. An award agreement with respect to an award of an option may provide that a grantee may transfer to a “family member” (as defined in the plan) all or part of an award in a “not for value” transaction - for example, by a gift or a transfer under a domestic relations order in settlement of marital property rights.

Effect of Cessation of Employee Status. Unless specifically stated otherwise in the applicable award agreement, upon the date on which a grantee ceases to be employed by us, all rights to exercise the grantee’s unvested options shall terminate immediately. Vested options shall be exercisable after the grantee ceases to be an employee only during the applicable time periods described below and thereafter shall terminate.

| |

| • | If a grantee dies while an employee, the grantee’s vested options may be exercised by his or her beneficiary not later than the expiration date specified in the applicable award agreement or twelve months after the grantee’s death, whichever is earlier. |

| |

| • | If a grantee ceases to be an employee due to disability (as defined in the plan), the grantee may exercise his or her vested options not later than the expiration date specified in the applicable award agreement or twelve months after ceasing to be an employee, whichever is earlier. |

| |

| • | If a grantee ceases to be an employee by reason of retirement (as defined in the plan), all rights to exercise his or her vested options shall terminate no later than the expiration date specified in the applicable award agreement or twelve months after the grantee ceases to be an employee, whichever is earlier. |

| |

| • | If a grantee ceases to be an employee for any reason other than death, disability or retirement, all rights to exercise his or her vested options shall terminate no later than the expiration date specified in the applicable award agreement or thirty days after the date the grantee ceases to be an employee, whichever is earlier, unless the Compensation Committee decides that such options shall terminate on the date the grantee ceases to be an employee. |

Forfeiture Provisions. The Amended and Restated Omnibus Plan provides that we may retain the right in an award agreement to cause a forfeiture of the gain realized by a grantee in connection with an award(s) on account of actions taken by the grantee in violation of or in conflict with any (i) employment agreement, (ii) non-competition agreement, (iii) agreement prohibiting solicitation of our employees or clients, or (iv) any confidentiality obligation. In addition, we may annul an award if the grantee ceases to be an employee as a result of a termination for cause (as defined in the plan).

The Amended and Restated Omnibus Plan also provides that, if we are required to prepare an accounting restatement due to our material noncompliance, as a result of misconduct, with any financial reporting requirement under applicable securities laws, the individuals subject to automatic forfeiture under the Sarbanes-Oxley Act of 2002 and any grantee who knowingly engaged in or failed to prevent the misconduct, or was grossly negligent in engaging or failing to prevent the misconduct, shall reimburse us the amount of any payment in settlement of an award earned or accrued during the 12-month period following the first public issuance or filing of the financial document(s) embodying the financial reporting requirement.

Amendment, Suspension and Termination of the Amended and Restated Omnibus Plan