NobleCon14 Fort Lauderdale, FL January 29 & 30, 2018 (OTCQX: HPHW) Hooper Holmes, Inc. dba

2 Special Note Regarding Forward-Looking Statements This presentation contains forward-looking statements, as such term is defined in the Private Securities Litigation Reform Act of 1995, concerning the Company’s plans, objectives, goals, strategies, future events or performances, which are not statements of historical fact and can be identified by words such as: “expect,” “continue,” “should,” “may,” “will,” “project,” “anticipate,” “believe,” “plan,” “goal,” and similar references to future periods. The forward-looking statements contained in this presentation reflect our current beliefs and expectations. Actual results or performance may differ materially from what is expressed in the forward looking statements. Among the important factors that could cause actual results to differ materially from those expressed in, or implied by, the forward- looking statements contained in this presentation are our ability to realize the expected synergies and other benefits from the merger with Provant Health Solutions; our ability to successfully implement our business strategy and integrate Provant Health Solutions’ business with ours; our ability to retain and grow our customer base; our ability to recognize operational efficiencies and reduce costs; uncertainty as to our working capital requirements over the next 12 to 24 months; our ability to maintain compliance with the financial covenants contained in our credit facilities; the rate of growth in the Health and Wellness market and such other factors as discussed in Part I, Item 1A, Risk Factors, and Part II, Item 7, Management’s Discussion and Analysis of Financial Conditions and Results of Operations of our Annual Report on Form 10-K for the year ended December 31, 2016. The Company undertakes no obligation to update or release any revisions to these forward-looking statements to reflect events or circumstances, or to reflect the occurrence of unanticipated events, after the date of this presentation, except as required by law. This presentation contains information from third- party sources, including data from studies conducted by others and market data and industry forecasts obtained from industry publications. Although the Company believes that such information is reliable, the Company has not independently verified any of this information and the Company does not guarantee the accuracy or completeness of this information. Any references to documents not included in the presentation itself are qualified by the full text and content of those documents. During our prepared comments or responses to your questions, we may offer incremental metrics to provide greater insight into the dynamics of our business or our quarterly results, such as references to EBITDA and adjusted EBITDA, and other measures of financial performance. Please be advised that this additional detail may be one-time in nature and we may or may not provide an update in the future. These and other financial measures may also have been prepared on a non-GAAP basis. Safe Harbor

Rebranding 3 Rebranding the Company – Provant Health › The merger of Hooper Holmes and Provant resulted in the company becoming the largest publicly- traded pure-play, well-being provider in the industry. › To reflect this new position in the marketplace, we assumed a refreshed brand identity. › Rebranding the company Provant Health speaks to our current comprehensive, life-changing services for employee well-being, and positions us to take advantage of the rapidly evolving changes taking place in the healthcare industry. - Hooper Holmes, Inc. d/b/a Provant Health › Moving forward, we are building on our combined strengths, to ensure that Provant Health is the distinctive well-being provider of choice.

Value to Customers 4 We improve the health, productivity, and performance of individuals while helping employers make healthcare affordable. › Full spectrum of expertise, combining high-touch interventions, high-value technology, and comprehensive clinical services. › Greater personalization, enhanced member experiences, increased engagement, and improved outcomes. › Faster innovation. › Advanced technology driven member platform. › Extensive nationwide health professional network. Strategic - Experienced - Flexible

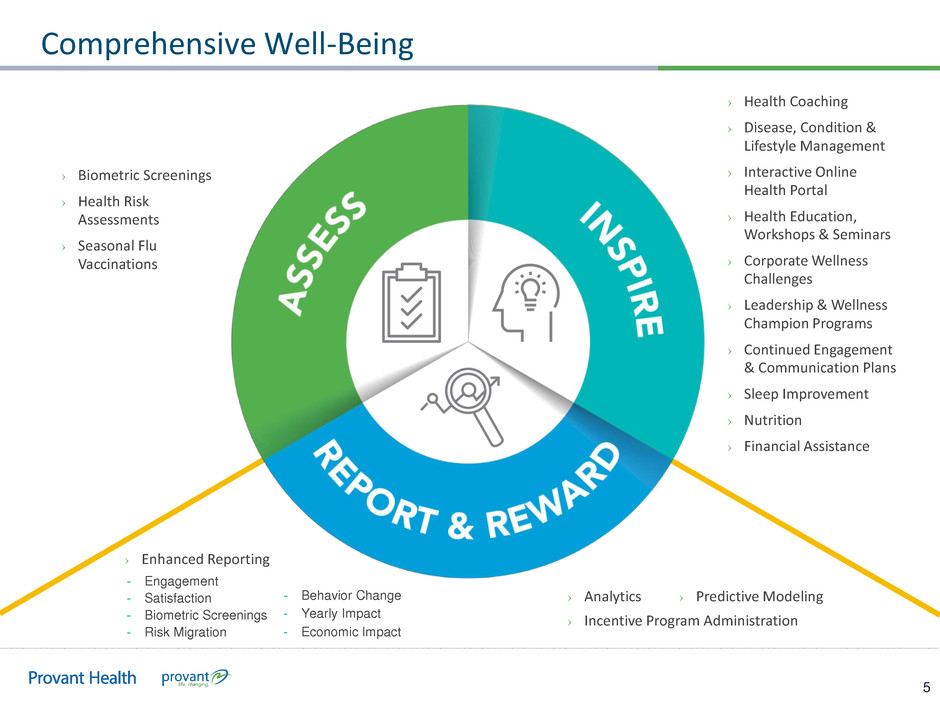

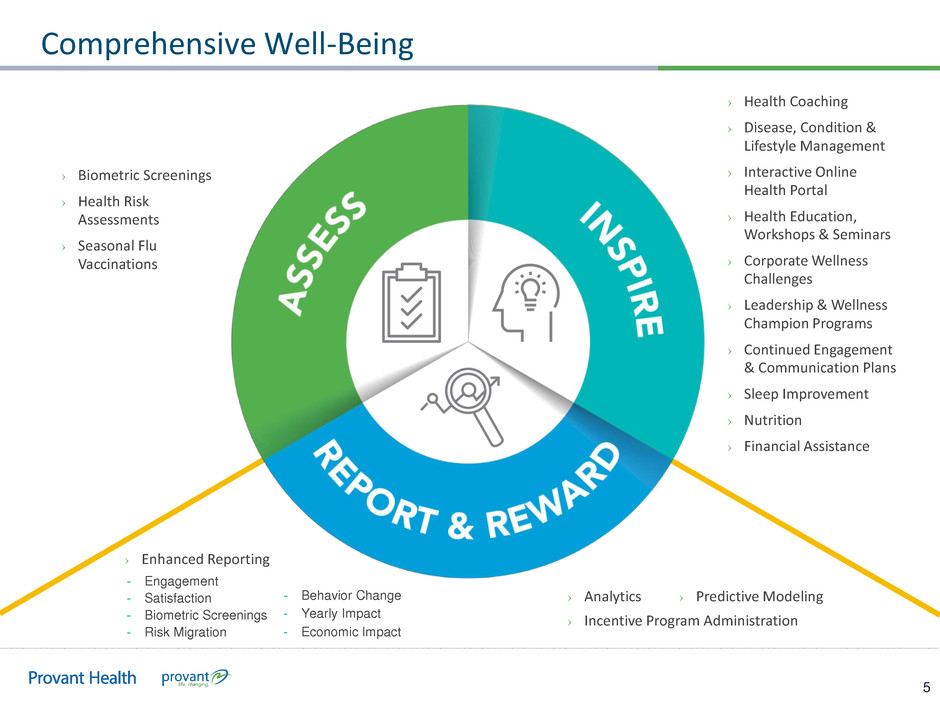

Comprehensive Well-Being 5 › Biometric Screenings › Health Risk Assessments › Seasonal Flu Vaccinations › Health Coaching › Disease, Condition & Lifestyle Management › Interactive Online Health Portal › Health Education, Workshops & Seminars › Corporate Wellness Challenges › Leadership & Wellness Champion Programs › Continued Engagement & Communication Plans › Sleep Improvement › Nutrition › Financial Assistance › Enhanced Reporting - Engagement - Satisfaction - Biometric Screenings - Risk Migration › Analytics › Incentive Program Administration › Predictive Modeling - Behavior Change - Yearly Impact - Economic Impact

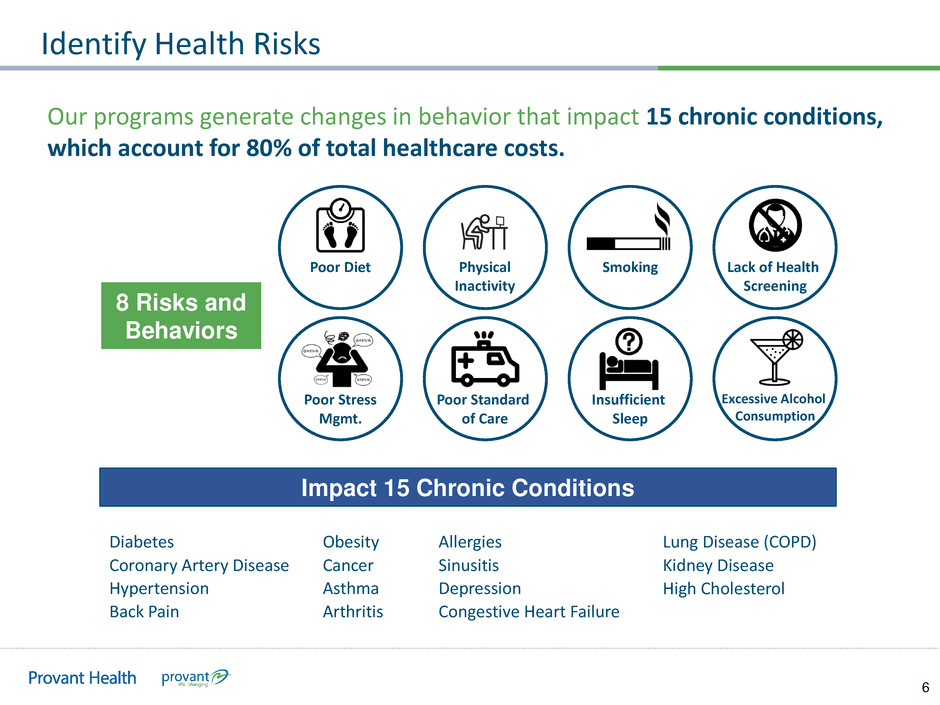

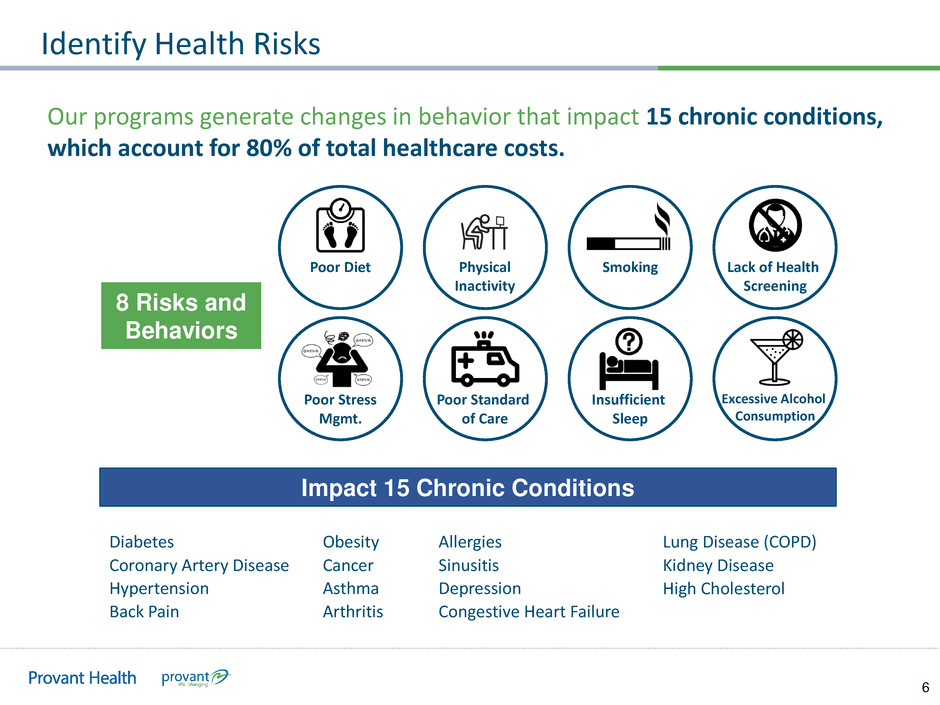

6 Our programs generate changes in behavior that impact 15 chronic conditions, which account for 80% of total healthcare costs. 8 Risks and Behaviors Poor Diet Physical Inactivity Smoking Lack of Health Screening Poor Stress Mgmt. Poor Standard of Care Insufficient Sleep Excessive Alcohol Consumption Diabetes Coronary Artery Disease Hypertension Back Pain Impact 15 Chronic Conditions Obesity Cancer Asthma Arthritis Lung Disease (COPD) Kidney Disease High Cholesterol Allergies Sinusitis Depression Congestive Heart Failure Identify Health Risks

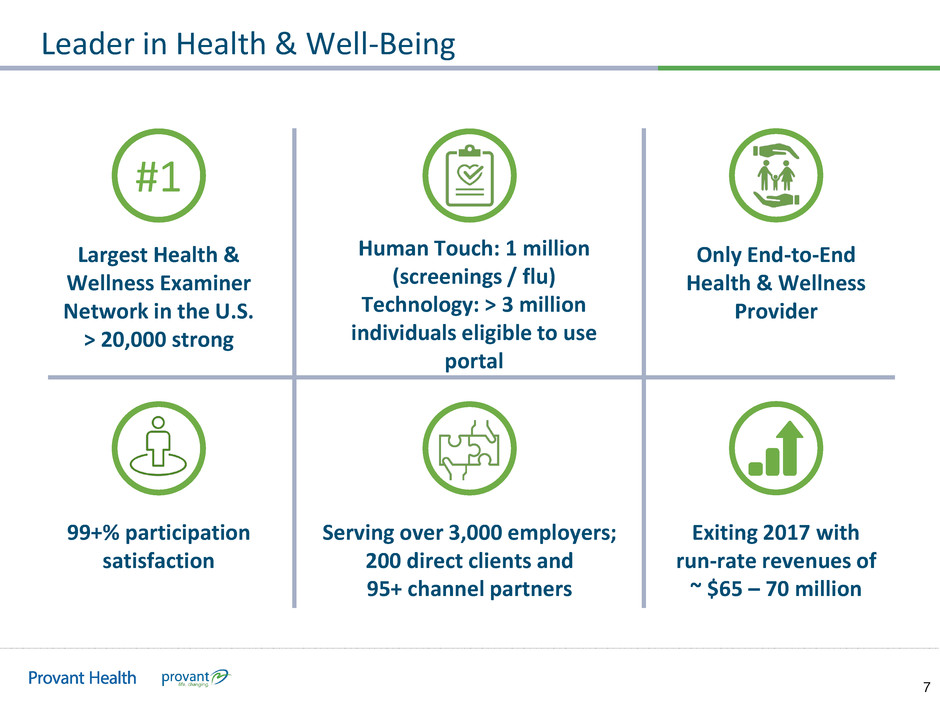

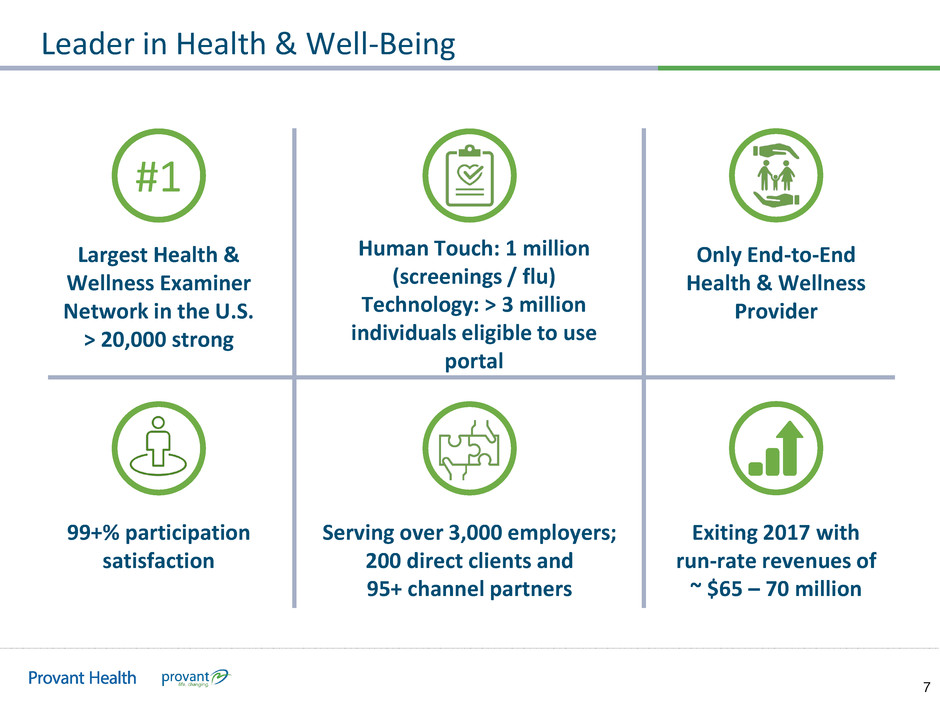

#1 Largest Health & Wellness Examiner Network in the U.S. > 20,000 strong 99+% participation satisfaction Human Touch: 1 million (screenings / flu) Technology: > 3 million individuals eligible to use portal Serving over 3,000 employers; 200 direct clients and 95+ channel partners Only End-to-End Health & Wellness Provider Exiting 2017 with run-rate revenues of ~ $65 – 70 million 7 Leader in Health & Well-Being

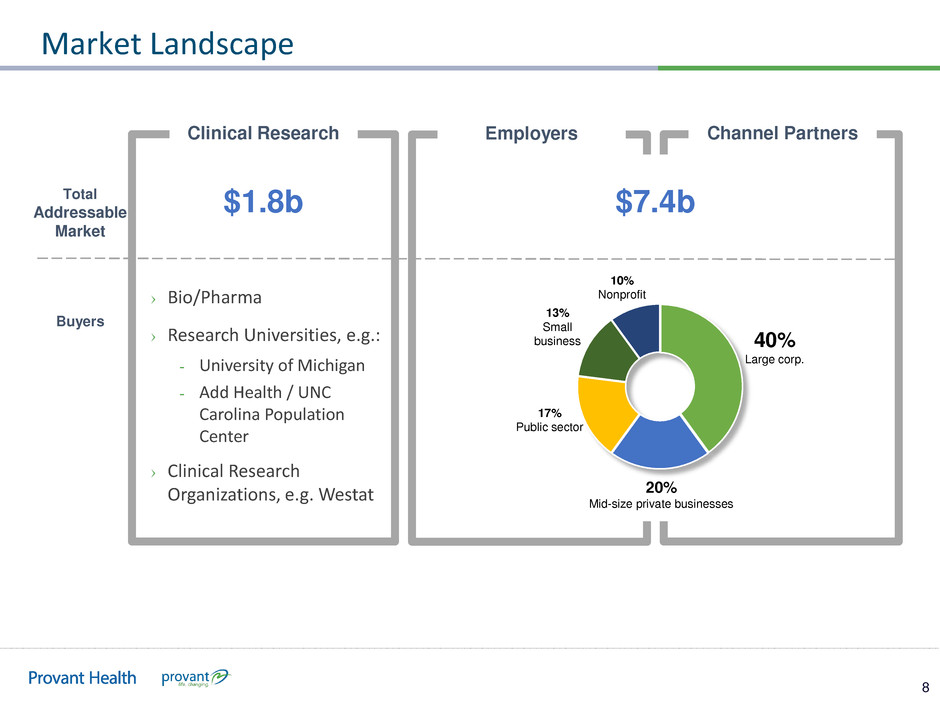

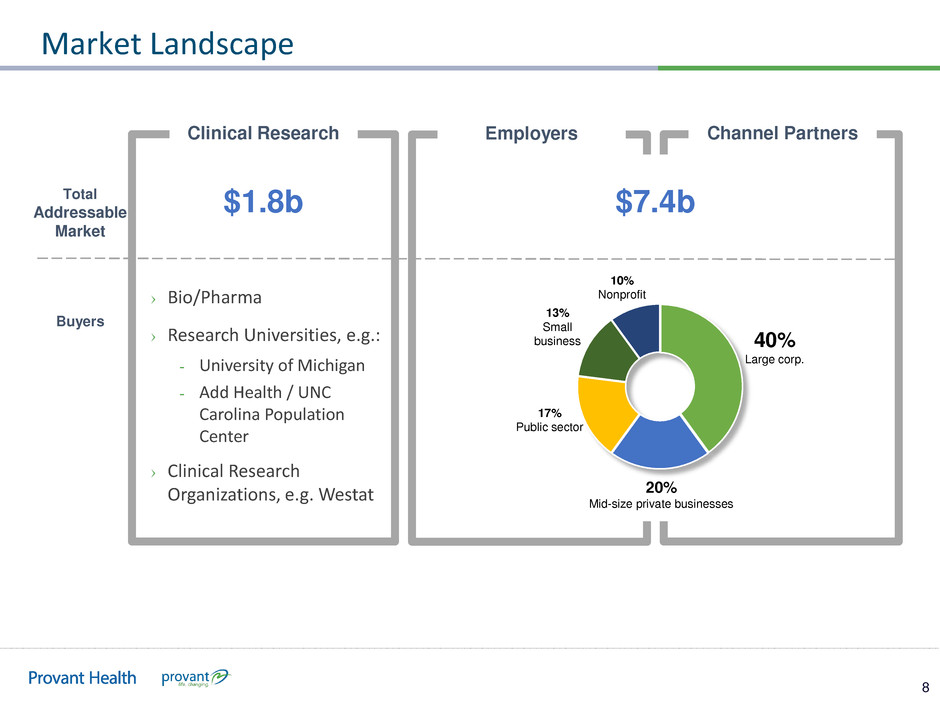

8 Employers Channel Partners $1.8b $7.4b Total Addressable Market Buyers 20% Mid-size private businesses 40% Large corp. Clinical Research 17% Public sector 13% Small business 10% Nonprofit › Bio/Pharma › Research Universities, e.g.: - University of Michigan - Add Health / UNC Carolina Population Center › Clinical Research Organizations, e.g. Westat Market Landscape

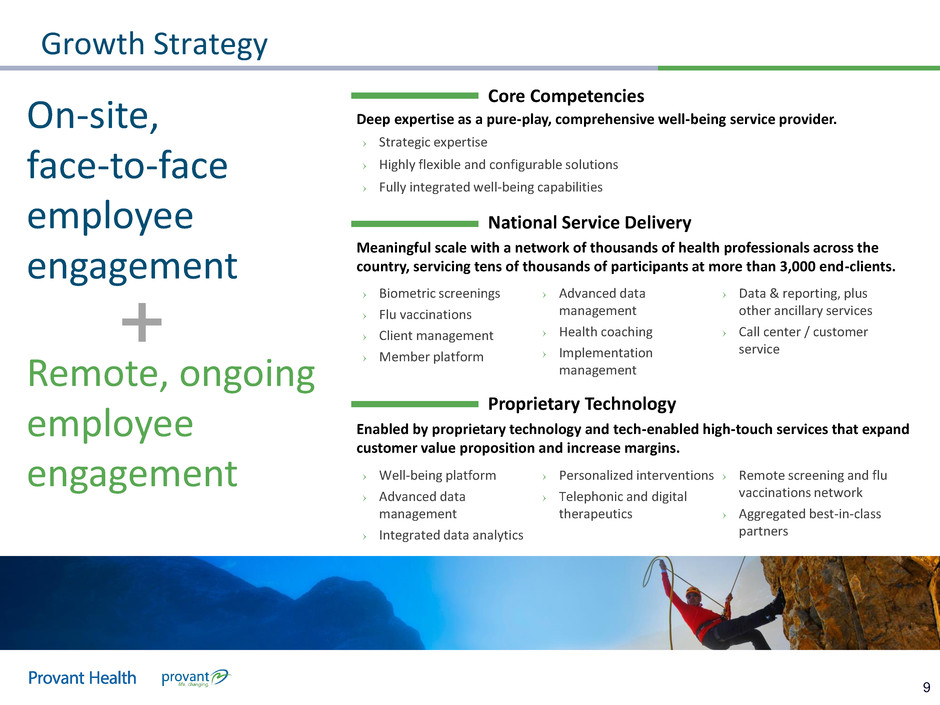

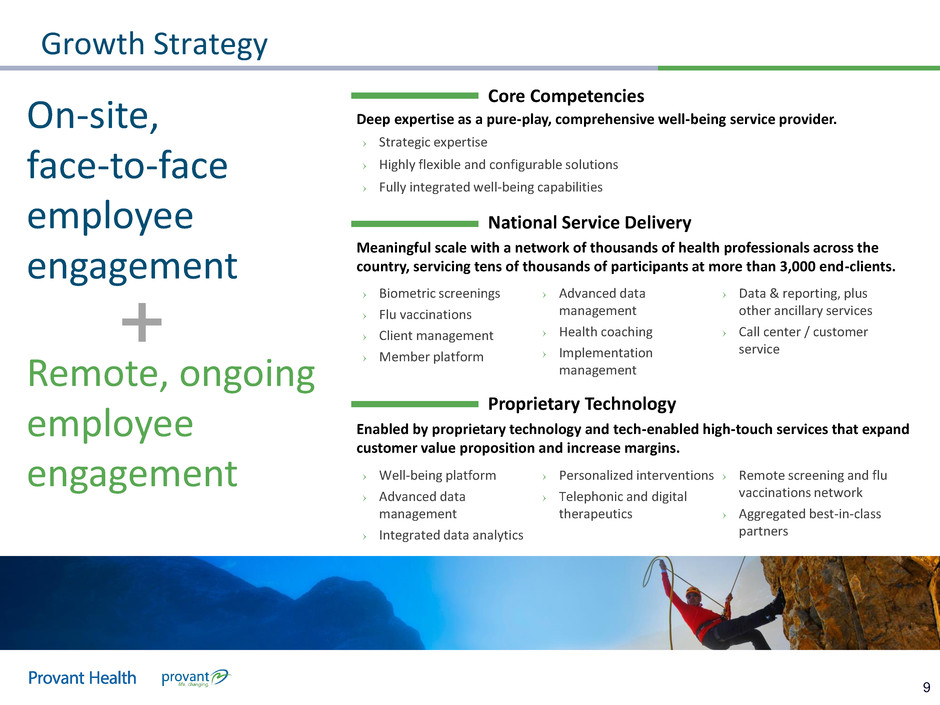

› Biometric screenings › Flu vaccinations › Client management › Member platform › Advanced data management › Health coaching › Implementation management › Data & reporting, plus other ancillary services › Call center / customer service Growth Strategy 9 On-site, face-to-face employee engagement Remote, ongoing employee engagement Deep expertise as a pure-play, comprehensive well-being service provider. › Strategic expertise › Highly flexible and configurable solutions › Fully integrated well-being capabilities Meaningful scale with a network of thousands of health professionals across the country, servicing tens of thousands of participants at more than 3,000 end-clients. Enabled by proprietary technology and tech-enabled high-touch services that expand customer value proposition and increase margins. › Well-being platform › Advanced data management › Integrated data analytics › Personalized interventions › Telephonic and digital therapeutics › Remote screening and flu vaccinations network › Aggregated best-in-class partners National Service Delivery Core Competencies Proprietary Technology

Customer Markets 10 Over 200 direct clients serving over 3,000 employers with over 3,000,000 eligibles Includes channel partners, direct customers, and clinical research organizations. Overview: Provide white label support services Services: Screenings, flu shots, and data management Customers: Health plans and wellness providers Channel Partners Overview: Comprehensive well-being programs Services: Screenings, coaching, technology, and data Customers: Fortune 100, including three Fortune 50 Direct Customers Clinical Research Organizations Overview: Sample and data collection Customers: University of Michigan & NIH PATH Services: Screenings, sample, and data collection Industries served Manufacturing Transportation Healthcare Retail Distribution Energy Utilities Financial services Education

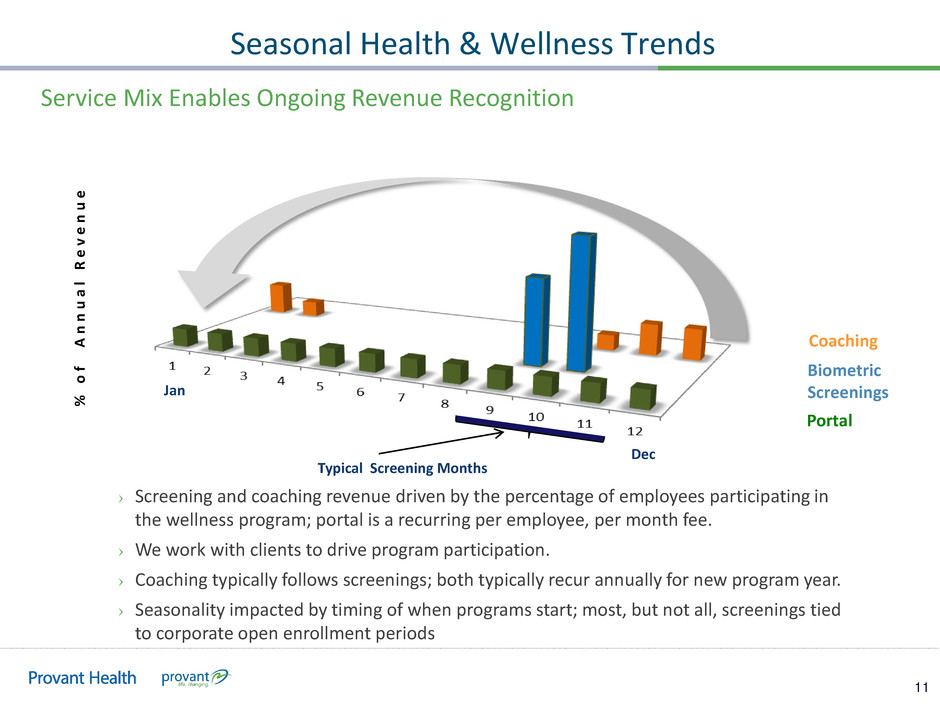

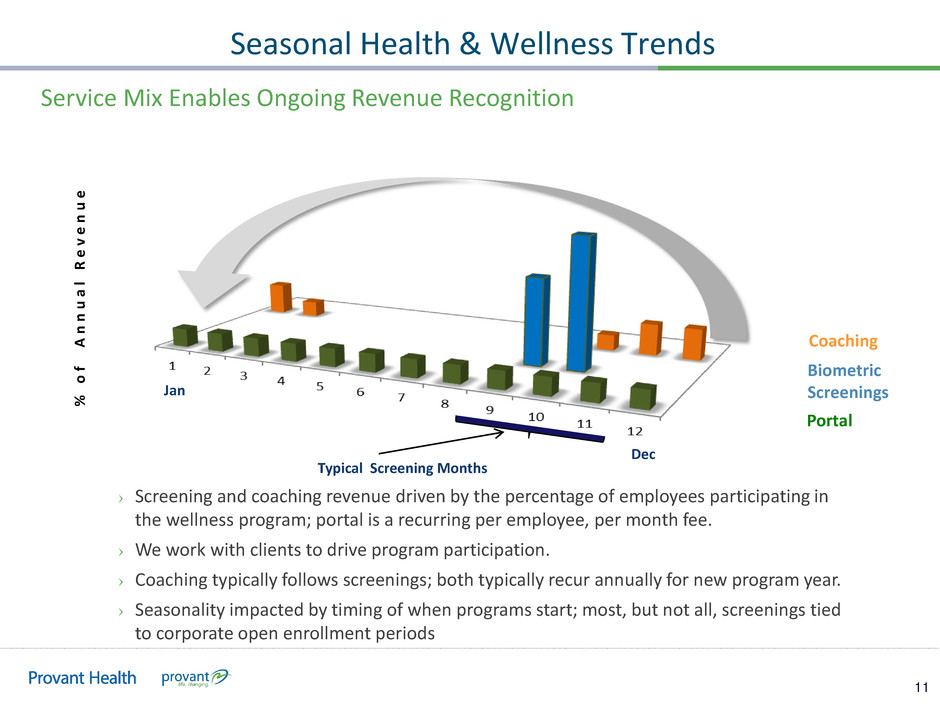

11 Service Mix Enables Ongoing Revenue Recognition › Screening and coaching revenue driven by the percentage of employees participating in the wellness program; portal is a recurring per employee, per month fee. › We work with clients to drive program participation. › Coaching typically follows screenings; both typically recur annually for new program year. › Seasonality impacted by timing of when programs start; most, but not all, screenings tied to corporate open enrollment periods % o f A n n u a l R e v e n u e Portal Coaching Biometric Screenings Typical Screening Months Dec Jan Seasonal Health & Wellness Trends

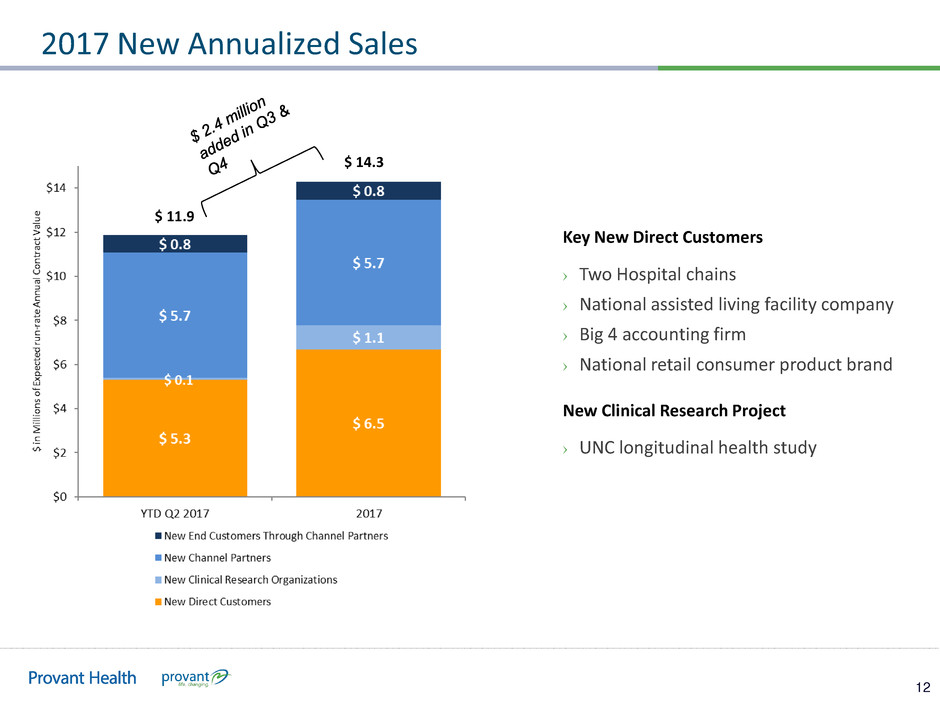

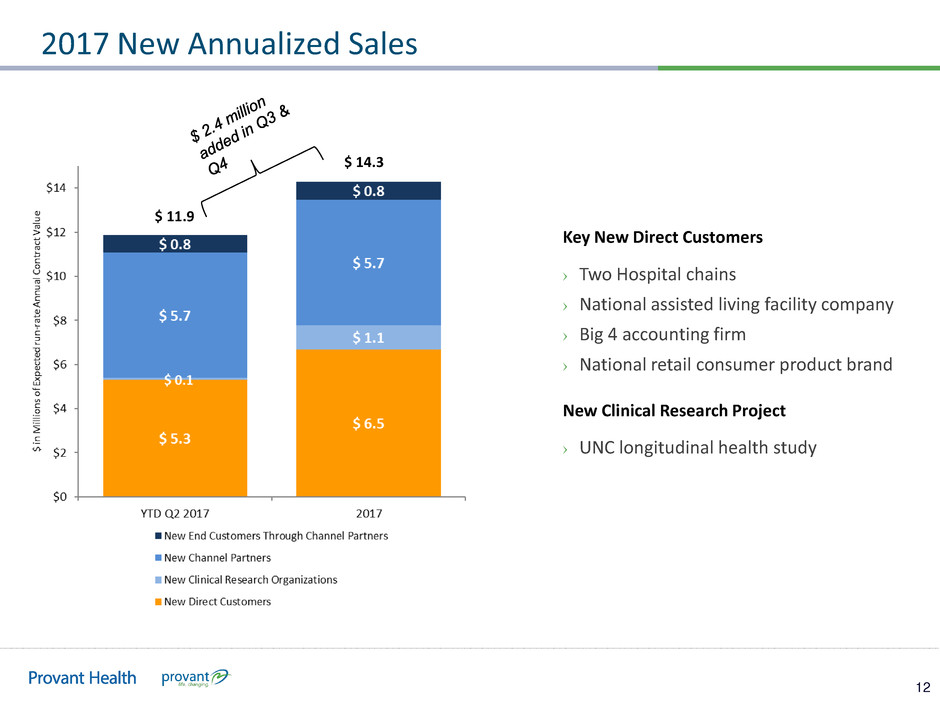

12 Key New Direct Customers › Two Hospital chains › National assisted living facility company › Big 4 accounting firm › National retail consumer product brand New Clinical Research Project › UNC longitudinal health study 2017 New Annualized Sales $ 14.3 $ 11.9

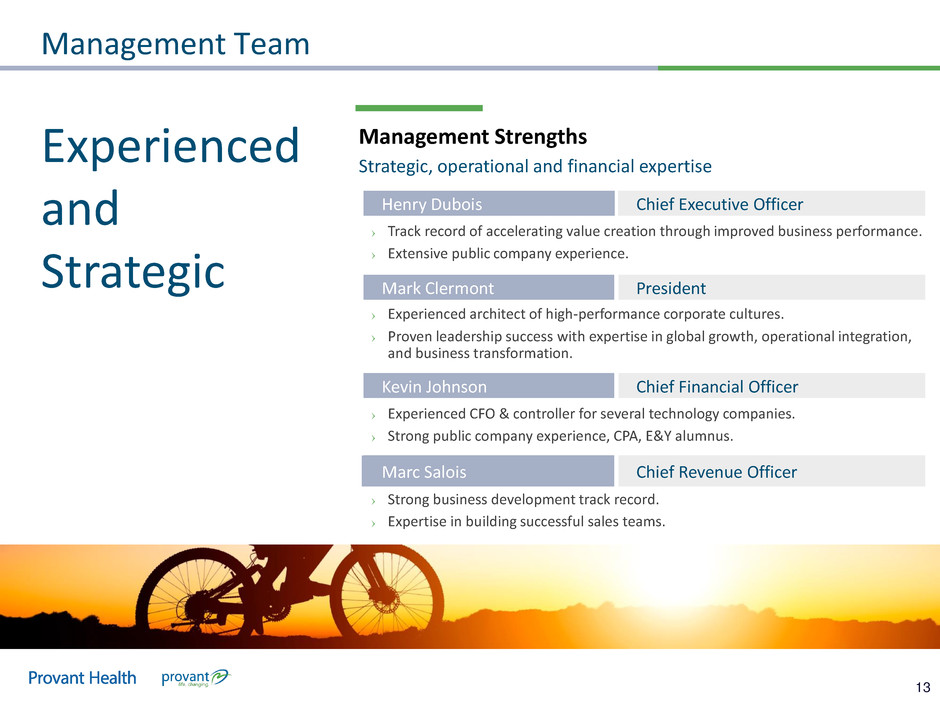

Management Team 13 Henry Dubois Chief Executive Officer › Track record of accelerating value creation through improved business performance. › Extensive public company experience. Mark Clermont President › Experienced architect of high-performance corporate cultures. › Proven leadership success with expertise in global growth, operational integration, and business transformation. Kevin Johnson Chief Financial Officer › Experienced CFO & controller for several technology companies. › Strong public company experience, CPA, E&Y alumnus. Marc Salois Chief Revenue Officer › Strong business development track record. › Expertise in building successful sales teams. Experienced and Strategic Management Strengths Strategic, operational and financial expertise

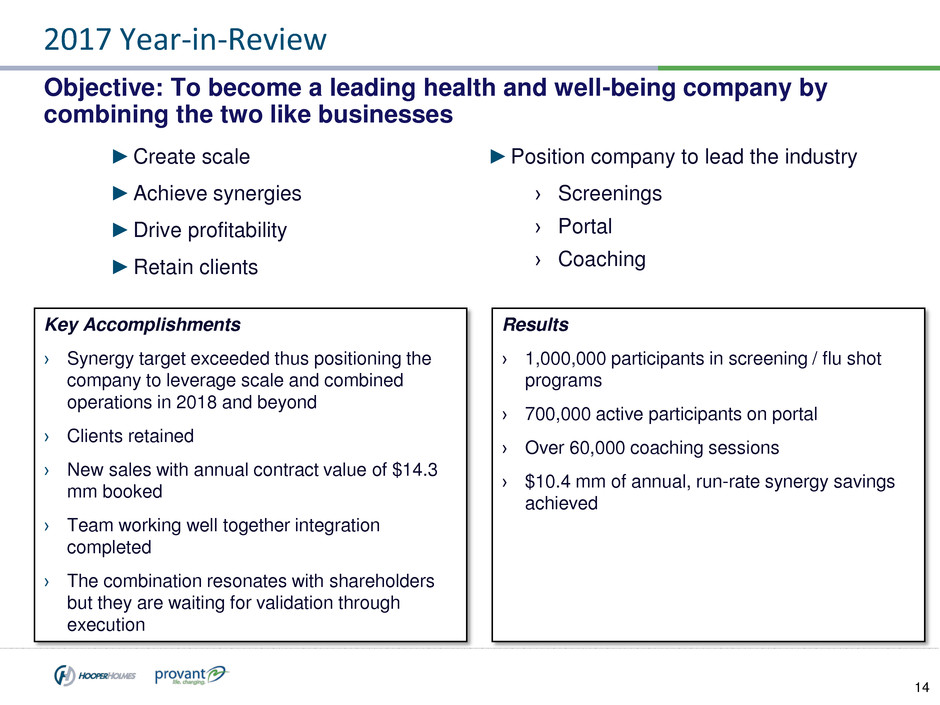

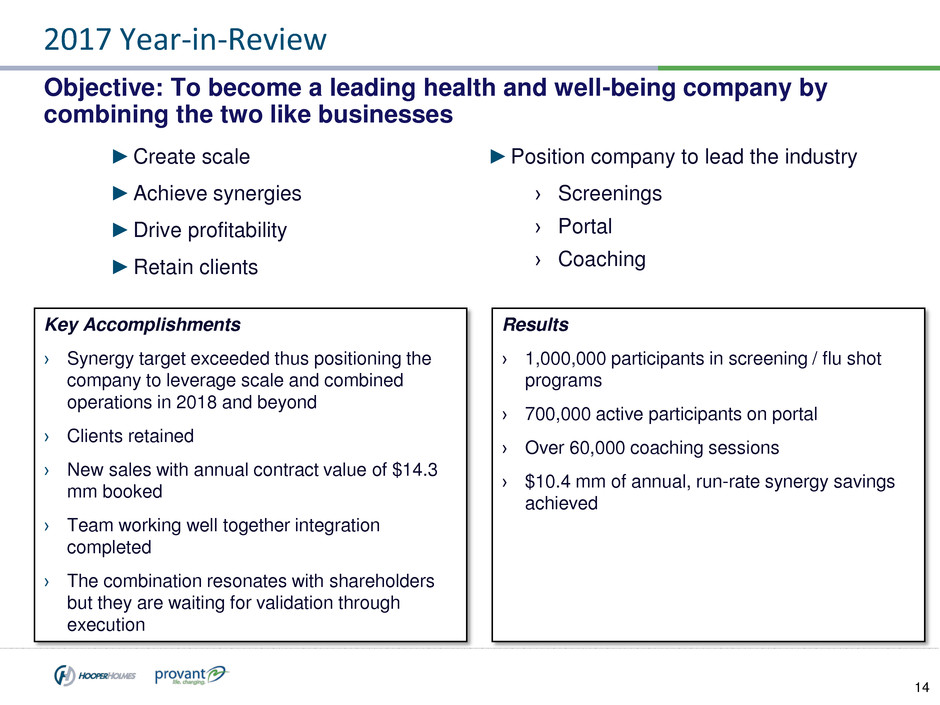

2017 Year-in-Review ►Create scale ►Achieve synergies ►Drive profitability ►Retain clients ►Position company to lead the industry › Screenings › Portal › Coaching Results › 1,000,000 participants in screening / flu shot programs › 700,000 active participants on portal › Over 60,000 coaching sessions › $10.4 mm of annual, run-rate synergy savings achieved 14 Objective: To become a leading health and well-being company by combining the two like businesses Key Accomplishments › Synergy target exceeded thus positioning the company to leverage scale and combined operations in 2018 and beyond › Clients retained › New sales with annual contract value of $14.3 mm booked › Team working well together integration completed › The combination resonates with shareholders but they are waiting for validation through execution

15 Implementation of Synergies › Synergy projects ahead of schedule. › Targeted: $ 7.0 million in annualized synergies. - $ 10.4 million already achieved. - Potential for additional savings based on initiatives in progress. Integration Synergies $ 10.4 Million Annualized Synergy Savings Already Achieved $10.4 mm $7.0 mm 1.0$ 2 0$ 3.0$ 4.0$ 5.0$ 6.0$ 7.0$ 8.0$ 9.0$ 10.0$ 11.0$ Annual run rate Synergies Implemented Progress towards Synergies Annual Run - rate Target

16 2018 Enhanced Sales Focus Introduce New Product Capabilities Integration Complete Outlook Road Map to Success Solid customer base and revenue growth Increase operating capabilities Leverage cost structure