UDR, Inc. (NYSE: UDR), has a demonstrated history of successfully managing, buying, selling, developing and redeveloping attractive real estate properties in primary U.S. markets • S&P 400 Company • $13 Billion Enterprise • 2014 Annualized Dividend of $1.04, ~3.5% Yield CFO: Tom Herzog 720.283.6139 Investor Relations: Chris Van Ens 720.348.7762 Investor Presentation September 2014 The Residences at Bella Terra – Huntington Beach, CA Development, Completed: Q4 2013 Exhibit 99.1

TABLE OF CONTENTS Cirque – Dallas, TX UDR/MetLife II Joint Venture UDR, Inc. TABLE OF CONTENTS PAGE About UDR, Inc. 3 Recent Highlights 4 3-Year Outlook / Strategic Priorities 5 Capital Allocation 6 Development Pipeline 7 Development Value Creation 8 Development Progress 9 Future Development /Funding Development 10 Where We Develop and Why 11 Joint Ventures 12 Operations 13 Operational Excellence 14 Cash Flow, Dividend and NAV Growth 15 Creating Value Over Time 16 Balance Sheet 17 Balance Sheet Management 18 APPENDIX 2014 Guidance 20 Operating Trends Update 21 2014 Market Growth Expectations 22 Apartment Fundamentals 23 Definitions and Reconciliations 27 2

ABOUT UDR, INC. 3 (1) As of June 30, 2014. Source: Company documents. UDR STATS(1) • 22 Markets • 181 Communities • 51,923 Homes • Same-Store Revenue per Occupied Home: $1,586 • Total Portfolio Revenue per Occupied Home: $1,733 • Average Age of Communities: 16 years • Approximately 45% / 55% A / B Property Quality and 35% / 65% Urban / Suburban Locations • $1.1 Billion Development Pipeline; 86% in Coastal Markets Cirque – Dallas, TX Austin n BaltimoreMetro Washington, DC Richmond Norfolk, VA Boston New York Dallas Nashville Monterey Peninsula Los Angeles O.C. Orlando Tampa San Francisco San Diego Seattle Inland Empire Portland Denver Philadelphia West Coast: % of SS NOI: 40% % of Total NOI: 40% Development: $517M Southwest: % of SS NOI: 7% % of Total NOI: 8% Development: $157M Southeast: % of SS NOI: 16% % of Total NOI: 12% Mid-Atlantic % of SS NOI: 25% % of Total NOI: 21% Development: $195M Northeast % of SS NOI: 13% % of Total NOI: 19% Development: $218M UDR’S MARKET COMPOSITION AND PORTFOLIO

RECENT HIGHLIGHTS 4 GENERATED STRONG 2Q14 SAME-STORE RESULTS AND RAISED FY GUIDANCE • SS Revenue Growth: 4.4% versus 3.7% multifamily peer REIT average • Raised full-year 2014 guidance 12.5 bps at the midpoint • SS NOI Growth: 5.5% versus 4.2% multifamily peer REIT average • Raised full-year 2014 guidance 62.5 bps at the midpoint 1 2 3 5 717 Olympic – Los Angeles, CA Pier 4 – Boston, MA Development – Scheduled Completion: 2Q 2015 (1) July 1 through August 31, 2014. Source: Company documents. COMPLETED THREE VALUE ACCRETIVE DEVELOPMENTS IN 1H14 • Completed $295M of accretive projects at an average estimated spread of ~215 bps over cap rates in San Francisco, CA, College Park, MD and Mission Viejo, CA SOLD $225M OF NON-CORE COMMUNITIES YTD • Sold 6 non-core communities at a 6.1% blended cash flow cap rate that were 25 years old on average and located in Norfolk, North San Diego County, Orlando and Tampa 4 POSITIONING THE PORTFOLIO FOR A SOLID 2015 • UDR’s historically high occupancy (~97%) is allowing for more aggressive rent increases in the second half of 2014; locking in better rent growth in 2015 RECENT OPERATING TRENDS • Move-outs to home purchase at 13.9% in 2Q versus UDR’s LT average of 15% • Rent-to-income was 19.0% in 2Q • See pages 21 and 22 for market-level detail SS GROWTH NEW LEASE RENEWAL OCCUPANCY Quarter-to-Date(1) 4.5% 5.1% 96.9% 2Q 2014 3.6% 5.5% 96.8%

Will Drive Value Creation and Total Shareholder Return (TSR) 1 2 4 3-YEAR OUTLOOK / STRATEGIC PRIORITIES WE REMAIN HIGHLY FOCUSED ON THE CONTINUED EXECUTION OF THE STRATEGIC PRIORITIES IN OUR 3-YEAR PLAN ALLOCATE CAPITAL TO ACCRETIVE GROWTH PROSPECTS THAT STRENGTHEN OUR MARKET MIX, PORTFOLIO QUALITY AND GROWTH RATE DRIVE ORGANIC GROWTH AND IMPROVE RESIDENT / ASSOCIATE SATISFACTION THROUGH OUR BEST-IN-CLASS OPERATING PLATFORM MAINTAIN A STRONG AND FLEXIBLE BALANCE SHEET WHILE SEEKING TO FURTHER IMPROVE OUR METRICS OVER TIME 3 GENERATE HIGH-QUALITY CASH FLOW GROWTH TO DRIVE DIVIDEND AND NAV PER SHARE GROWTH 5

CAPITAL ALLOCATION ALLOCATE CAPITAL TO ACCRETIVE GROWTH PROSPECTS THAT STRENGTHEN OUR MARKET MIX, PORTFOLIO QUALITY AND GROWTH RATE DEVELOPMENT CURRENTLY OFFERS THE BEST OPPORTUNITY 6 Columbus Square – NYC, NY UDR/MetLife II Joint Venture

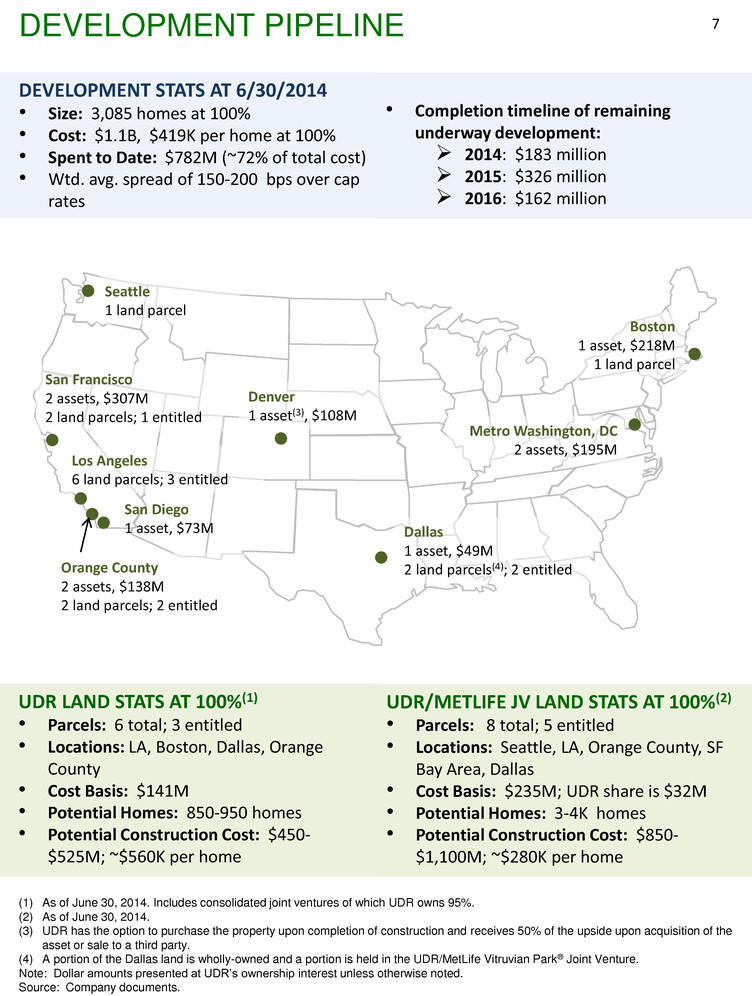

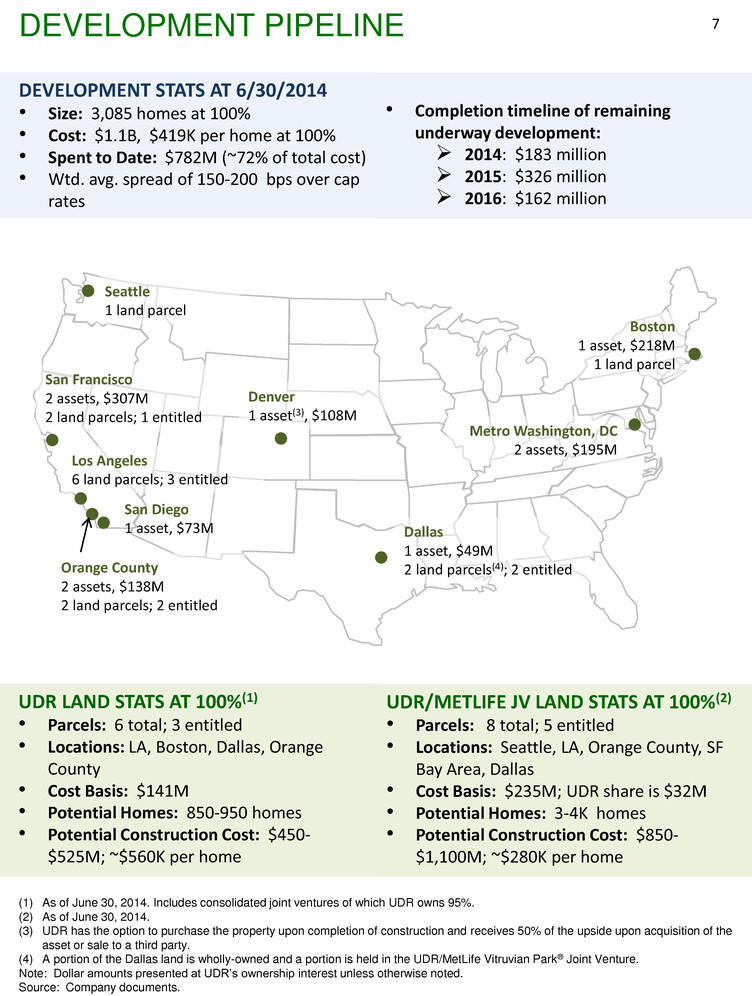

(1) As of June 30, 2014. Includes consolidated joint ventures of which UDR owns 95%. (2) As of June 30, 2014. (3) UDR has the option to purchase the property upon completion of construction and receives 50% of the upside upon acquisition of the asset or sale to a third party. (4) A portion of the Dallas land is wholly-owned and a portion is held in the UDR/MetLife Vitruvian Park® Joint Venture. Note: Dollar amounts presented at UDR’s ownership interest unless otherwise noted. Source: Company documents. 7DEVELOPMENT PIPELINE Metro Washington, DC 2 assets, $195M Boston 1 asset, $218M 1 land parcel Dallas 1 asset, $49M 2 land parcels(4); 2 entitled Denver 1 asset(3), $108M Los Angeles 6 land parcels; 3 entitled Orange County 2 assets, $138M 2 land parcels; 2 entitled San Francisco 2 assets, $307M 2 land parcels; 1 entitled San Diego 1 asset, $73M Seattle 1 land parcel DEVELOPMENT STATS AT 6/30/2014 • Size: 3,085 homes at 100% • Cost: $1.1B, $419K per home at 100% • Spent to Date: $782M (~72% of total cost) • Wtd. avg. spread of 150-200 bps over cap rates • Completion timeline of remaining underway development: 2014: $183 million 2015: $326 million 2016: $162 million UDR LAND STATS AT 100%(1) • Parcels: 6 total; 3 entitled • Locations: LA, Boston, Dallas, Orange County • Cost Basis: $141M • Potential Homes: 850-950 homes • Potential Construction Cost: $450- $525M; ~$560K per home UDR/METLIFE JV LAND STATS AT 100%(2) • Parcels: 8 total; 5 entitled • Locations: Seattle, LA, Orange County, SF Bay Area, Dallas • Cost Basis: $235M; UDR share is $32M • Potential Homes: 3-4K homes • Potential Construction Cost: $850- $1,100M; ~$280K per home

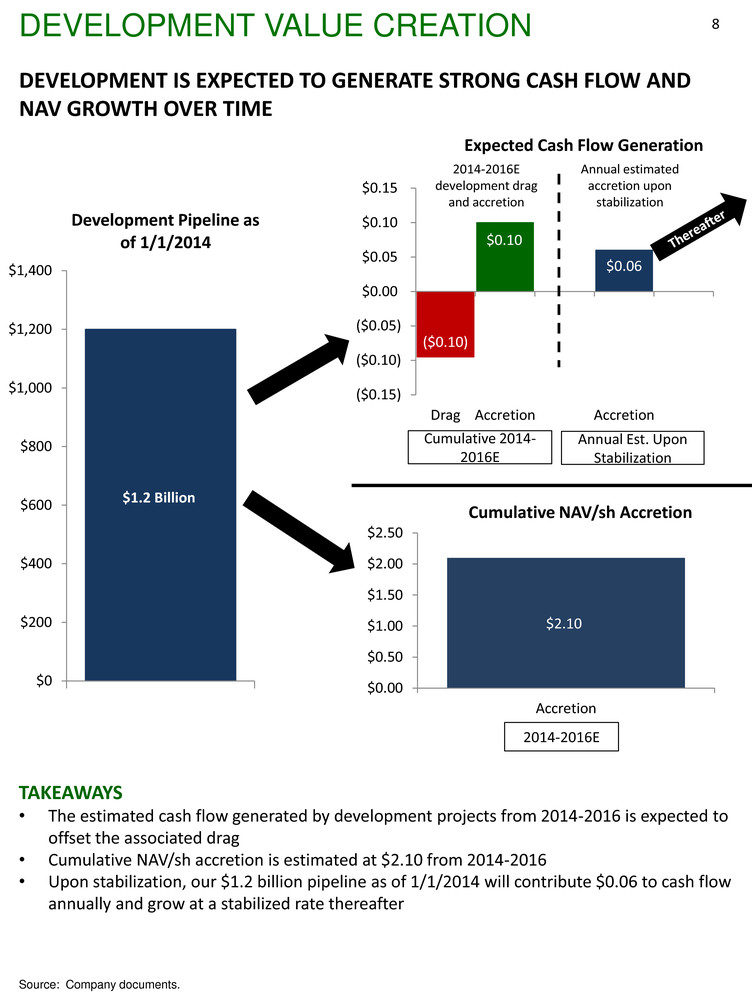

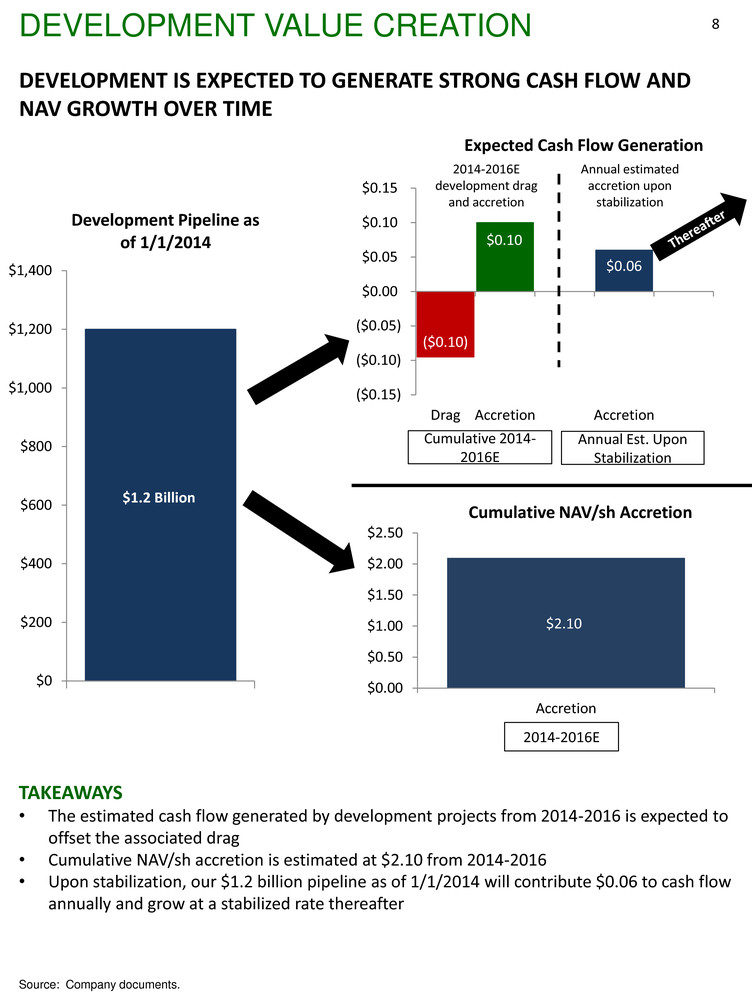

8DEVELOPMENT VALUE CREATION DEVELOPMENT IS EXPECTED TO GENERATE STRONG CASH FLOW AND NAV GROWTH OVER TIME TAKEAWAYS • The estimated cash flow generated by development projects from 2014-2016 is expected to offset the associated drag • Cumulative NAV/sh accretion is estimated at $2.10 from 2014-2016 • Upon stabilization, our $1.2 billion pipeline as of 1/1/2014 will contribute $0.06 to cash flow annually and grow at a stabilized rate thereafter Source: Company documents. $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 Accretion Cumulative NAV/sh Accretion $2.10 2014-2016E ($0.10) $0.10 $0.06 ($0.15) ($0.10) ($0.05) $0.00 $0.05 $0.10 $0.15 Drag Accretion Accretion Expected Cash Flow Generation Cumulative 2014- 2016E Annual Est. Upon Stabilization 2014-2016E development drag and accretion $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 Development Pipeline as of 1/1/2014 $1.2 Billion Annual estimated accretion upon stabilization

Development Projects(1) Performance versus Project Plans Below In-Line Above Below Above In-Line Domain College Park, $63M Los Alisos, $87M Channel, $145M 13th & Market, $73M Bella Terra, $150M Wtd. Avg. Fiori, $49M DEVELOPMENT PROGRESS 9 PROGRESS OF DEVELOPMENT PROJECTS • Some of our development projects are outperforming versus expectations, some are in-line and some are slightly underperforming • The weighted average spread between construction yields and current market cap rates for our $1.1 billion development pipeline is ~180 bps; inside of our 150-200 bp targeted range • In aggregate, our pipeline will be well accretive to both cash flow and NAV from 2014-2016 (1) Channel @ Mission Bay – San Francisco, CA; Pier 4 – Boston, MA; 399 Fremont – San Francisco, CA; 13th & Market – San Diego, CA; Beach & Ocean - Huntington Beach, CA; Fiori – Dallas, TX; Los Alisos – Mission Viejo, CA; Domain College Park – University of Maryland; DelRay Tower –Wash., DC. Table excludes Steele Creek – Denver, CO. Size of dot indicates $ size of development project. Source: Company documents. Achieved Effective Rental Rates To-Date versus Underwritten Effective Rates Le a se d Ho m e s ver su s Un der w ritt en O cc upan cy Spread - Trended Construction Yield versus Market Cap Rate Projects(1) Budgeted Cost ABOVE RANGE: > 200 BPS Channel @ Mission Bay, Pier 4, 399 Fremont $525M IN RANGE: 150-200 BPS 13th & Market, Beach & Ocean $123M BELOW RANGE: < 150 BPS Fiori, Los Alisos, Domain College Park, DelRay Tower $331M In Lease-Up Recently Stabilized The weighted averaged spread for the $671 million of development projects that have not yet delivered completed homes is ~170 bps, indicating continued strong profitability and returns

FUTURE DEVELOPMENT 10 WE HAVE $305 MILLION LEFT TO FUND ON OUR CURRENT $1.1 BILLION PIPELINE Source: Company documents. $0 $200 $400 $600 $800 $1,000 $1,200 Remaining to Fund: $305M; 28% of Pipeline FUNDING DEVELOPMENT • Sales from our $1.4 billion portfolio of non-core and capital warehouse properties will fund current and future pipeline spend FUNDING DEVELOPMENT APPROXIMATELY 90% OF OUR EXPECTED 2014/2015 DEVELOPMENT STARTS AND EXPECTED 2014/2015 DEVELOPMENT COMPLETIONS ARE LOCATED IN CORE, COASTAL MARKETS PROJECTS HOMES VALUE AT 100% VALUE AT UDR’S OWN. INTEREST 2014E Starts 4-5 1,200-1,400 $650-$800M $375-$500M Completions 5 1,396 $477M $477M Spend ($M) – incl. Land Purchase $425-$475M 2015E Starts 5-6 1,400-1,800 $650-$800M $550-$650M Completions 2 587 $326M $326M ** Locations include San Francisco, Orange County, Los Angeles, Boston, Seattle, Washington, DC, Denver and Dallas Total Pipeline: $1.1B

37% 35% 31% 31% 30% 19% 18% 16% 14% 12% 48.6% 42.8% 48.6% 42.0% 47.6% 35.3% 37.9% 32.1% 32.7% 38.3% 0% 10% 20% 30% 40% 50% 60% Orange County San Fran. Bay Area L.A. San Diego New York Boston Seattle Metro DC National Dallas Home Affordability and Propensity to Rent Avg. Mortgage Payment to Income Propensity to Rent Source: U.S. Census Bureau, Axiometrics, National Association of Realtors, Freddie Mac, Federal Financial Institutions Examination Council and Company documents. WHERE WE DEVELOP AND WHY 11 CURRENT DEMAND / SUPPLY AND LONG-TIME REVENUE GROWTH TRENDS ARE STRONG IN THE PRIMARILY COASTAL MARKETS WHERE WE DEVELOP 2014-2016E ANNUAL AVG. EXPECTATIONS LAST 15-YEAR CUMULATIVE Market Job Growth Supply Growth Demand > Supply Rev Growth > U.S. Avg. (27%) Seattle 2.7% 2.3% 33% San Fran Area 2.8% 1.6% 33% Los Angeles 1.8% 0.8% 50% Orange Cnty 2.3% 0.9% 47% San Diego 2.2% 0.9% 52% Dallas 3.4% 2.1% 11% Metro DC 1.6% 2.1% 54% New York 1.6% 0.8% 37% Boston 1.9% 1.3% 35% MANY OF THESE MARKETS ALSO HAVE ABOVE NATIONAL AVERAGE PROPENSITIES TO RENT AND RELATIVELY UNAFFORDABLE SINGLE-FAMILY HOMES.

6.0% 8.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% ROIC ROE 2Q 2014 Joint Venture ROIC and ROE (1) As of June 30, 2014. (2) Measured at gross book value at 100%. Source: Company documents. Columbus Square – New York, NY UNCONSOLIDATED JV SIZE ($M)(1,2) OWN. INTEREST TYPE MetLife $2,764 47% Long-term partnership in high-quality, core assets Operating $2,337 50% Long-term partnership in high-quality, core operating assets Development $192 50% 399 Fremont in San Francisco, CA; Fiori in Dallas, TX Land $235 14% 13 land sites in long-term development partnership Kuwait Finance House $283 30% Medium-term partnership focused on Washington, DC Texas $327 20% Short/Medium-term partnership UDR HAS THREE PRIMARY OPERATING JV RELATIONSHIPS THAT COMPRISE $3.4 BILLION(1,2) OF APARTMENT COMMUNITIES. THESE RELATIONSHIPS: • Provide a stable source of favorably priced, long-term capital • Reduce effective cost of capital while enhancing returns via promotes and fee income JOINT VENTURES 12 Current – San Diego, CA UDR/MetLife II Joint Venture 4.4% 3.9% 6.3% 4.7% 4.4% 0.0% 2.0% 4.0% 6.0% 8.0% UDR/ML UDR/KFH Texas Wt. Avg. UDR SS 2Q 2014 YOY JV SS Rev. Growth(1) Migration of all UDR/MetLife I JV operating assets to UDR/MetLife II JV is complete. Computed IRR in the high-teens on the 16 operating assets we increased our ownership interest to 50% in since late 2010

OPERATIONS DRIVE ORGANIC GROWTH AND IMPROVE RESIDENT / ASSOCIATE SATISFACTION THROUGH OUR BEST-IN- CLASS OPERATING PLATFORM 13 Garrison Square – Boston, MA Wholly-Owned

OPERATIONAL EXCELLENCE (1) Excludes historical BRE and CLP results. Source: Company documents and forecasts and peer documents. 3.8% 3.0% 3.5% 4.0% 4.5% UDR Multifamily Peer Median 2014 Same-Store Revenue Growth Guidance …AND EXPECTATIONS ARE FOR CONTINUED STRENGTH IN 2014 43% 29% 20% 30% 40% 50% UDR Multifamily Average % of Times to Place in the Top 1/3 of the Peer Group for Quarterly SS Revenue Performance Since 2001(1) 3.75%-4.25% 14 BEST-IN-CLASS OPERATING PLATFORM THAT HAS OUTPERFORMED VERSUS PEERS OVER THE LONG-TERM BETTER TOP-LINE RESULTS… MORE MARKETS WON… 38% 16% 0% 10% 20% 30% 40% UDR Multifamily Average % of UDR’s Markets Won Since 2007 on a Quarterly SS Revenue Basis(1)

CASH FLOW, DIVIDEND AND NAV GROWTH GENERATE HIGH-QUALITY CASH FLOW GROWTH TO DRIVE DIVIDEND AND NAV PER SHARE GROWTH 15 Capitol View on 14th – Washington, DC Wholly-Owned

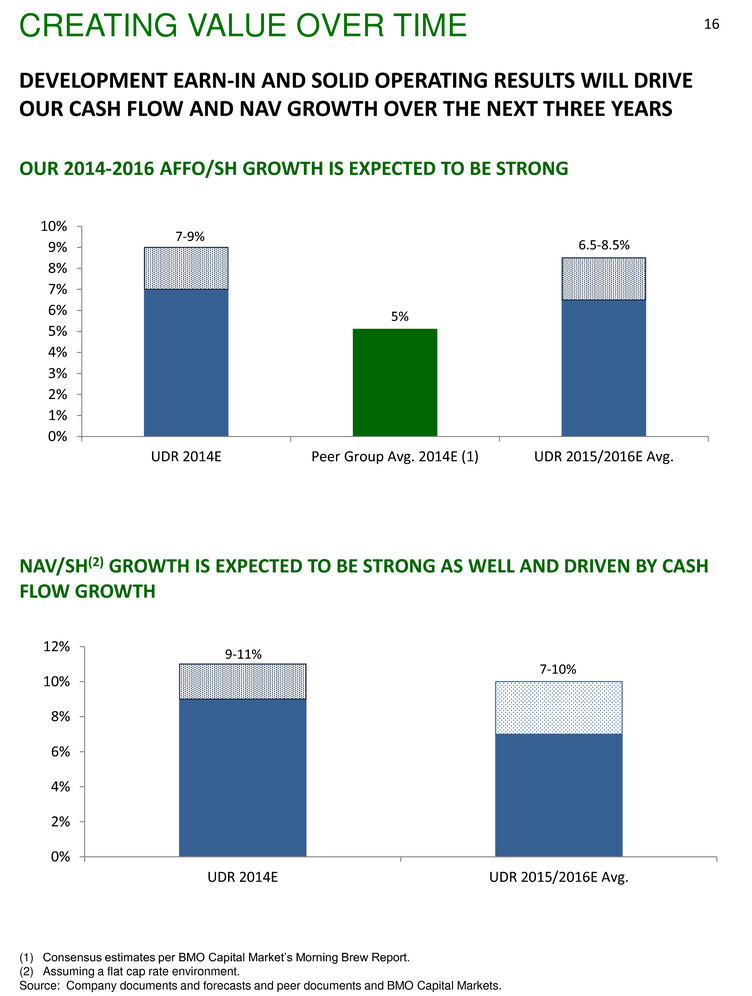

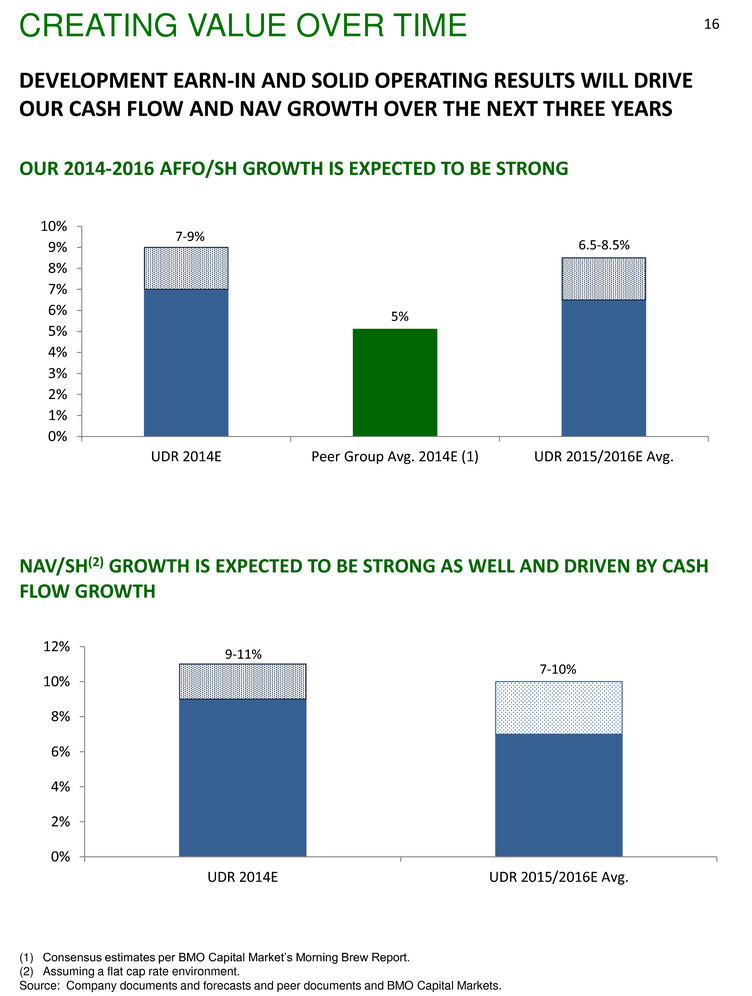

CREATING VALUE OVER TIME (1) Consensus estimates per BMO Capital Market’s Morning Brew Report. (2) Assuming a flat cap rate environment. Source: Company documents and forecasts and peer documents and BMO Capital Markets. 16 DEVELOPMENT EARN-IN AND SOLID OPERATING RESULTS WILL DRIVE OUR CASH FLOW AND NAV GROWTH OVER THE NEXT THREE YEARS OUR 2014-2016 AFFO/SH GROWTH IS EXPECTED TO BE STRONG NAV/SH(2) GROWTH IS EXPECTED TO BE STRONG AS WELL AND DRIVEN BY CASH FLOW GROWTH 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% UDR 2014E Peer Group Avg. 2014E (1) UDR 2015/2016E Avg. 7-9% 6.5-8.5% 5% 0% 2% 4% 6% 8% 10% 12% UDR 2014E UDR 2015/2016E Avg. 9-11% 7-10%

BALANCE SHEET MAINTAIN A STRONG AND FLEXIBLE BALANCE SHEET WHILE SEEKING TO FURTHER IMPROVE OUR METRICS OVER TIME 17 Edgewater – San Francisco, CA Wholly-Owned

METRIC YE 2009A YE 2013A YE 2014E YE 2016E YE 2016E – NO NEW EQUITY Debt-to-assets 53% 39% 38% to 40% 35% to 38% 38% to 40% Net debt-to-EBITDA 10.0x 7.0x 6.3x to 6.7x 5.6x to 6.2x 6.0x to 6.6x Fixed Charge Coverage 2.0x 3.1x 3.4x to 3.6x 3.6x to 3.8x 3.3x to 3.5x BALANCE SHEET MANAGEMENT 18 1 2 FOCUS ON THREE PRIMARY BALANCE SHEET METRICS • Leverage or debt to undepreciated asset value • Net debt-to-EBITDA • Fixed charge coverage MANAGE TO 35% - 40% LEVERAGE AND 5.5x - 6.0x NET DEBT-TO-EBITDA • Target the lower end of these ranges over time • Driven by development earn-in and strong operational growth 3 INVESTMENT GRADE RATINGS• S&P: BBB, stable outlook • Moody’s: Baa2, positive outlook SOLID IMPROVEMENT EVEN IF WE ISSUE NO EQUITY FOR THE NEXT THREE YEARS $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 After Debt Maturity Schedule with Extensions ($M), 6/30/2014 Secured Unsecured Line of Credit Total Debt: $3.7B Unsecured Debt: 63% of total Wtd. Avg. Rate: 3.9% Wtd. Avg. Term: 4.7 years 15% 4% 9% 31% 9% 10% 3% 9% Source: Company documents. N/A 11% N/A 5.5% 4.5% 4.5% 2.7% 4.4% 3.8% N/A 4.7% 2.1% 3.8% 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 After Wtd. Avg. Interest Rates N/A

UDR, Inc. Appendix PAGE 2014 Guidance 20 Operating Trends Update 21 2014 Market Growth Expectations 22 Apartment Fundamentals 23 Definitions and Reconciliations 27 19 Elements Too – Seattle, WA Wholly-Owned

2014 GUIDANCE 20 FFO and AFFO per Share Guidance 3Q 2014E Full-Year 2014E FFO per common share $0.39 to $0.41 $1.52 to $1.56 FFO as Adjusted per common share $0.36 to $0.38 $1.49 to $1.53 Adjusted Funds from Operations (“AFFO”) $0.31 to $0.33 $1.32 to $1.36 Weighted average diluted shares/units (M) 264.5 264.5 Same-Store Guidance Full-Year 2014E Revenue growth 3.75% to 4.25% Expense growth 1.75% to 2.25% NOI growth 4.50% to 5.50% Physical occupancy 96.5% Transactional Activity ($ in millions) Full-Year 2014E Acquisitions $100 to $150 Dispositions $350 to $450 Cap Rate Spread 100 to 150 bps Development and Redevelopment spend $425 to $475 Capital Markets Activity ($ in millions) Full-Year 2014E Debt maturities $348 New debt issuance $300 Equity issuance $0 to $150 Source: Company documents. Domus – Philadelphia, PA

(1) As of August 31, 2014. Source: Company documents. OPERATING TRENDS UPDATE(1) 21 % Total NOI % SS NOI Effective YOY SS New Lease Rate Growth Effective YOY SS Renewal Lease Rate Growth Annualized SS Turnover as of August 31 Same-Store (SS) Market 2Q 2014 2Q 2014 QTD 2014(1) 2Q 2014 QTD 2014(1) 2Q 2014 YTD 2014 YTD 2013 New York 12.3% 8.5% 4.6% 3.3% 4.4% 6.2% 46.2% 45.5% Metro Wash., DC 12.9% 13.6% (2.5%) (1.7%) 3.5% 3.4% 44.1% 46.0% Orange County 12.3% 10.2% 3.9% (0.5%) 4.6% 4.2% 62.9% 65.1% San Francisco Bay Area 11.1% 13.0% 10.3% 9.9% 8.5% 8.1% 56.1% 57.9% Seattle 6.3% 6.1% 10.0% 8.0% 6.1% 5.9% 55.1% 60.3% Dallas 5.4% 4.8% 2.6% 2.6% 4.8% 5.3% 55.7% 58.1% Boston 5.5% 4.8% 7.0% 8.1% 6.7% 6.9% 46.0% 45.9% Tampa 3.8% 5.0% 3.2% 1.4% 4.4% 4.6% 55.1% 53.7% Baltimore 4.9% 6.0% 0.9% 0.3% 4.6% 4.3% 53.5% 54.6% Orlando 3.7% 4.9% 6.0% 4.0% 6.5% 6.5% 55.8% 55.4% Los Angeles 4.2% 3.0% 5.7% 3.2% 4.5% 5.3% 54.3% 61.1% Nashville 3.1% 4.2% 6.1% 6.8% 4.1% 4.3% 56.4% 57.4% Austin 2.3% 2.4% 1.9% 3.8% 4.5% 5.9% 54.0% 53.4% Monterey Peninsula 2.5% 3.3% 8.8% 7.5% 5.3% 4.7% 47.3% 49.3% Richmond 2.3% 3.1% 1.6% 3.0% 3.0% 4.3% 58.6% 58.6% Other S. CA 2.6% 2.4% 6.4% 4.2% 5.4% 5.5% 58.9% 65.6% Norfolk 1.1% 1.5% 0.2% (0.1%) 4.0% 3.5% 54.8% 59.7% Portland 1.1% 1.5% 10.1% 6.1% 6.5% 7.0% 56.6% 56.4% Total / SS Wtd. Avg. 97.4% 98.3% 4.5% 3.6% 5.1% 5.5% 53.9% 55.5%

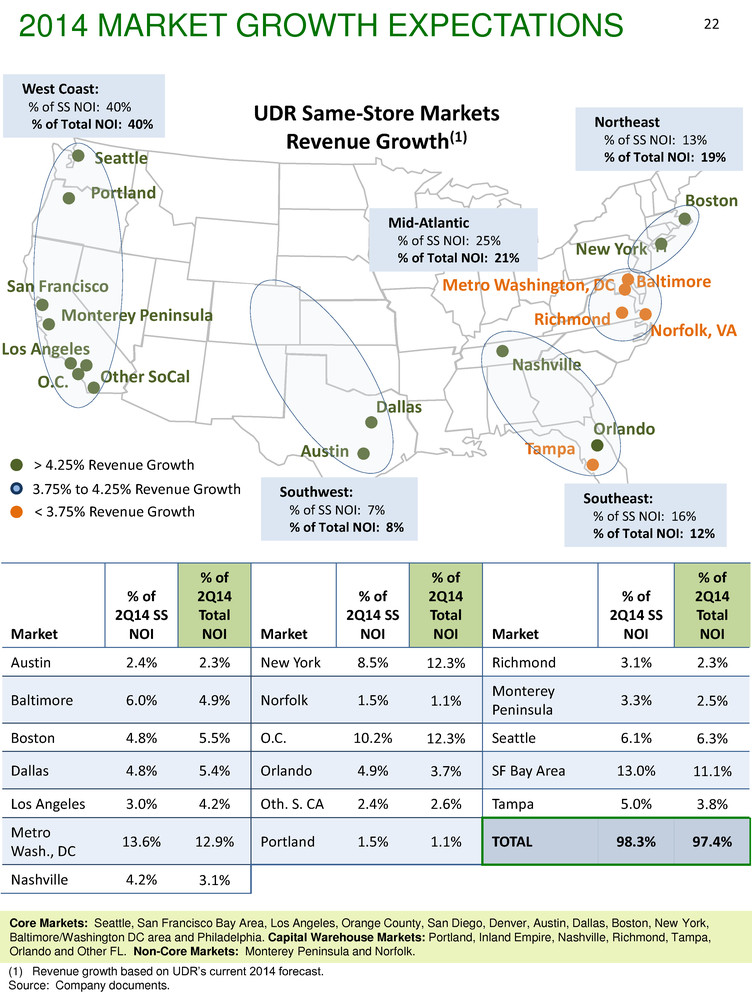

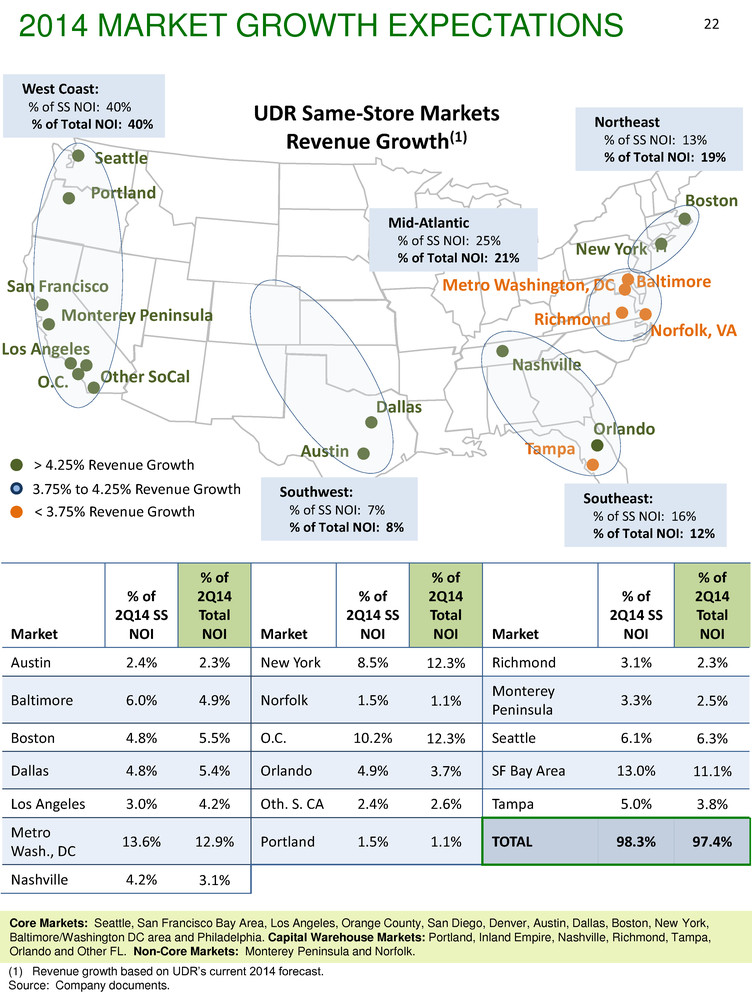

(1) Revenue growth based on UDR’s current 2014 forecast. Source: Company documents. Core Markets: Seattle, San Francisco Bay Area, Los Angeles, Orange County, San Diego, Denver, Austin, Dallas, Boston, New York, Baltimore/Washington DC area and Philadelphia. Capital Warehouse Markets: Portland, Inland Empire, Nashville, Richmond, Tampa, Orlando and Other FL. Non-Core Markets: Monterey Peninsula and Norfolk. 2014 MARKET GROWTH EXPECTATIONS 22 Austin n BaltimoreMetro Washington, DC Richmond Norfolk, VA Boston New York Dallas Nashville Monterey Peninsula Los Angeles O.C. Orlando Tampa San Francisco Other SoCal Seattle > 4.25% Revenue Growth 3.75% to 4.25% Revenue Growth < 3.75% Revenue Growth UDR Same-Store Markets Revenue Growth(1) West Coast: % of SS NOI: 40% % of Total NOI: 40% Southwest: % of SS NOI: 7% % of Total NOI: 8% Northeast % of SS NOI: 13% % of Total NOI: 19% Mid-Atlantic % of SS NOI: 25% % of Total NOI: 21% Southeast: % of SS NOI: 16% % of Total NOI: 12% Portland Market % of 2Q14 SS NOI % of 2Q14 Total NOI Market % of 2Q14 SS NOI % of 2Q14 Total NOI Market % of 2Q14 SS NOI % of 2Q14 Total NOI Austin 2.4% 2.3% New York 8.5% 12.3% Richmond 3.1% 2.3% Baltimore 6.0% 4.9% Norfolk 1.5% 1.1% Monterey Peninsula 3.3% 2.5% Boston 4.8% 5.5% O.C. 10.2% 12.3% Seattle 6.1% 6.3% Dallas 4.8% 5.4% Orlando 4.9% 3.7% SF Bay Area 13.0% 11.1% Los Angeles 3.0% 4.2% Oth. S. CA 2.4% 2.6% Tampa 5.0% 3.8% Metro Wash., DC 13.6% 12.9% Portland 1.5% 1.1% TOTAL 98.3% 97.4% Nashville 4.2% 3.1%

13th and Market – San Diego, CA Development Lease-up 23 APARTMENT FUNDAMENTALS

(100%) (50%) 0.% 50.% 100.% 150.% 200.% 20 25 30 35 40 45 1971 1975 1979 1983 1987 1991 1995 1999 2003 2007 2011 2015E Renter Households (M, left-axis) Renter Capture Rate (%, right-axis) APARTMENT FUNDAMENTALS (DEMAND) -6.0% -5.0% -4.0% -3.0% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 2002 2004 2006 2008 2010 2012 2014E 2016E U.S. Employment Growth Source: Green Street Advisors, U.S. Census Bureau, Axiometrics, Moody’s and Bureau of Labor Statistics. 24 22-35 year olds comprise the primary renter cohort with a 60%+ propensity to rent. This cohort is forecast to grow through 2025 In addition to population growth, jobs are a primary multifamily demand driver. Job growth is forecast to improve in 2014 and 2015 Demographic drivers and continued employment growth are expected to create approximately 2.2 million renter households from 2014-2016, ~45% of which should end up in apartments 55 58 61 64 67 '10 '13 '15E '20E '25E '30E 22-35 Year Old Population (M) DEMOGRAPHIC TRENDS SIGNAL CONTINUED AND SUSTAINABLE DEMAND FOR RENTAL HOUSING +2.2M Renter Households Absolute Owner Households Declining Absolute Renter Households Declining

When comparing expected job growth to new supply in our major markets from 2014 through 2016, our portfolio is well positioned APARTMENT FUNDAMENTALS (MF SUPPLY) 25 Washington, DC New York Orange County San Francisco Seattle Boston Dallas Baltimore Los Angeles Austin Other S. CA National 2% 4% 6% 8% 10% 12% 14% 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 ’14 E- ’16 E C u mu la tiv e M ark et R en t G row th p er Axiom et ric s Demand/Supply Ratio ’14E-’16E More than enough jobs to absorb expected new supply(1)Not enough jobs to absorb expected new supply(1) New multifamily supply is expected to be consistent with or below its long-term historical average over the coming years 264 285 324 317 301 301 313 315 340 355 351 322 267 107 108 159 224 335 302 249 0.0% 0.5% 1.0% 1.5% 2.0% 100 150 200 250 300 350 400 National Multifamily Completions (000s) Completions (lt. axis) 1997-2008 Avg. (lt. axis) 2013-2016E Avg. (lt. axis) Completions as % of Stock (rt. axis) 1997-2008 Avg.: 316K 2013-2016E Avg.: 277K To average the number of completions from 1997-2008, 620K additional multifamily homes were needed from 2009-2012 (1) Size of dots represents UDR’s total NOI concentration in a market. Includes joint venture homes at UDR’s pro-rata ownership interest. Excludes core markets that contribute less than 1% of NOI. Source: Axiometrics and Bureau of Labor Statistics.

(1) Most current actual data as of August 4, 2014. Source: U.S. Census Bureau, Axiometrics, National Association of Realtors and Freddie Mac. Demand for single-family homes continues to slowly improve although recent data points call into question the vitality of the recovery. At the same time, increasing home prices have curtailed affordability. This is positive for coastally focused owners/operators where home affordability is lower APARTMENT FUNDAMENTALS (SF HOUSING) 26 69.0% 64.7% 62% 64% 66% 68% 70% '90 '92 '94 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14 U.S. Homeownership Rate Mortgage payments increased in the majority of our primary markets more so than rent payments over the past year due primarily to increasing home prices The homeownership rate continues to decline. Every 1% drop in the homeownership rate results in approximately 1.1M new renters 14% 13% 11% 8% 6% 6% 5% 4% 2% 0% -4% 3% 4% 7% 3% 2% 4% 6% 5% 0% -1% 2% -5% 0% 5% 10% 15% YOY Mortgage Payment Increase(1) YOY Rent Increase(1)

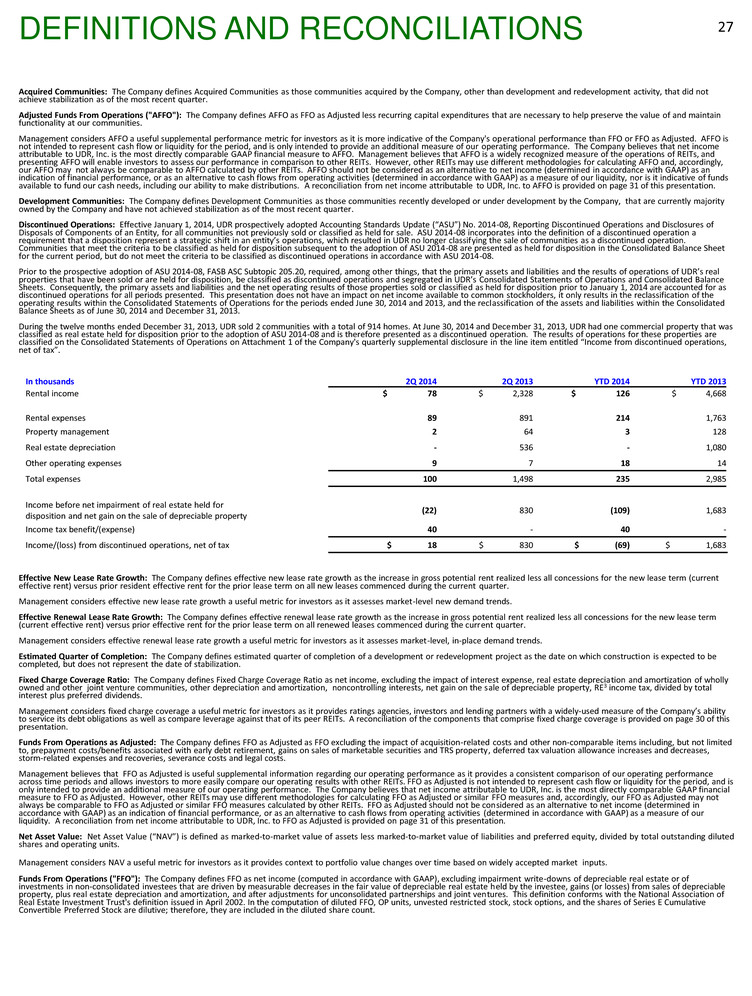

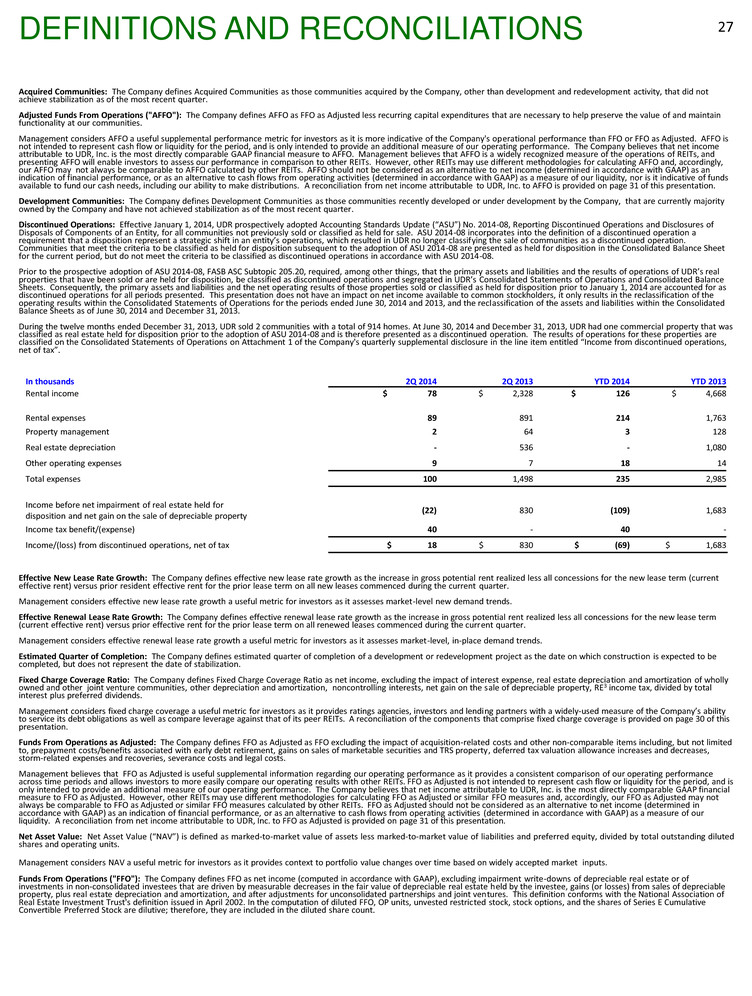

DEFINITIONS AND RECONCILIATIONS Acquired Communities: The Company defines Acquired Communities as those communities acquired by the Company, other than development and redevelopment activity, that did not achieve stabilization as of the most recent quarter. Adjusted Funds From Operations ("AFFO"): The Company defines AFFO as FFO as Adjusted less recurring capital expenditures that are necessary to help preserve the value of and maintain functionality at our communities. Management considers AFFO a useful supplemental performance metric for investors as it is more indicative of the Company's operational performance than FFO or FFO as Adjusted. AFFO is not intended to represent cash flow or liquidity for the period, and is only intended to provide an additional measure of our operating performance. The Company believes that net income attributable to UDR, Inc. is the most directly comparable GAAP financial measure to AFFO. Management believes that AFFO is a widely recognized measure of the operations of REITs, and presenting AFFO will enable investors to assess our performance in comparison to other REITs. However, other REITs may use different methodologies for calculating AFFO and, accordingly, our AFFO may not always be comparable to AFFO calculated by other REITs. AFFO should not be considered as an alternative to net income (determined in accordance with GAAP) as an indication of financial performance, or as an alternative to cash flows from operating activities (determined in accordance with GAAP) as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to make distributions. A reconciliation from net income attributable to UDR, Inc. to AFFO is provided on page 31 of this presentation. Development Communities: The Company defines Development Communities as those communities recently developed or under development by the Company, that are currently majority owned by the Company and have not achieved stabilization as of the most recent quarter. Discontinued Operations: Effective January 1, 2014, UDR prospectively adopted Accounting Standards Update (“ASU”) No. 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity, for all communities not previously sold or classified as held for sale. ASU 2014-08 incorporates into the definition of a discontinued operation a requirement that a disposition represent a strategic shift in an entity’s operations, which resulted in UDR no longer classifying the sale of communities as a discontinued operation. Communities that meet the criteria to be classified as held for disposition subsequent to the adoption of ASU 2014-08 are presented as held for disposition in the Consolidated Balance Sheet for the current period, but do not meet the criteria to be classified as discontinued operations in accordance with ASU 2014-08. Prior to the prospective adoption of ASU 2014-08, FASB ASC Subtopic 205.20, required, among other things, that the primary assets and liabilities and the results of operations of UDR’s real properties that have been sold or are held for disposition, be classified as discontinued operations and segregated in UDR’s Consolidated Statements of Operations and Consolidated Balance Sheets. Consequently, the primary assets and liabilities and the net operating results of those properties sold or classified as held for disposition prior to January 1, 2014 are accounted for as discontinued operations for all periods presented. This presentation does not have an impact on net income available to common stockholders, it only results in the reclassification of the operating results within the Consolidated Statements of Operations for the periods ended June 30, 2014 and 2013, and the reclassification of the assets and liabilities within the Consolidated Balance Sheets as of June 30, 2014 and December 31, 2013. During the twelve months ended December 31, 2013, UDR sold 2 communities with a total of 914 homes. At June 30, 2014 and December 31, 2013, UDR had one commercial property that was classified as real estate held for disposition prior to the adoption of ASU 2014-08 and is therefore presented as a discontinued operation. The results of operations for these properties are classified on the Consolidated Statements of Operations on Attachment 1 of the Company's quarterly supplemental disclosure in the line item entitled “Income from discontinued operations, net of tax”. In thousands 2Q 2014 2Q 2013 YTD 2014 YTD 2013 Rental income $ 78 $ 2,328 $ 126 $ 4,668 Rental expenses 89 891 214 1,763 Property management 2 64 3 128 Real estate depreciation - 536 - 1,080 Other operating expenses 9 7 18 14 Total expenses 100 1,498 235 2,985 Income before net impairment of real estate held for disposition and net gain on the sale of depreciable property (22) 830 (109) 1,683 Income tax benefit/(expense) 40 - 40 - Income/(loss) from discontinued operations, net of tax $ 18 $ 830 $ (69) $ 1,683 Effective New Lease Rate Growth: The Company defines effective new lease rate growth as the increase in gross potential rent realized less all concessions for the new lease term (current effective rent) versus prior resident effective rent for the prior lease term on all new leases commenced during the current quarter. Management considers effective new lease rate growth a useful metric for investors as it assesses market-level new demand trends. Effective Renewal Lease Rate Growth: The Company defines effective renewal lease rate growth as the increase in gross potential rent realized less all concessions for the new lease term (current effective rent) versus prior effective rent for the prior lease term on all renewed leases commenced during the current quarter. Management considers effective renewal lease rate growth a useful metric for investors as it assesses market-level, in-place demand trends. Estimated Quarter of Completion: The Company defines estimated quarter of completion of a development or redevelopment project as the date on which construction is expected to be completed, but does not represent the date of stabilization. Fixed Charge Coverage Ratio: The Company defines Fixed Charge Coverage Ratio as net income, excluding the impact of interest expense, real estate depreciation and amortization of wholly owned and other joint venture communities, other depreciation and amortization, noncontrolling interests, net gain on the sale of depreciable property, RE3 income tax, divided by total interest plus preferred dividends. Management considers fixed charge coverage a useful metric for investors as it provides ratings agencies, investors and lending partners with a widely-used measure of the Company’s ability to service its debt obligations as well as compare leverage against that of its peer REITs. A reconciliation of the components that comprise fixed charge coverage is provided on page 30 of this presentation. Funds From Operations as Adjusted: The Company defines FFO as Adjusted as FFO excluding the impact of acquisition-related costs and other non-comparable items including, but not limited to, prepayment costs/benefits associated with early debt retirement, gains on sales of marketable securities and TRS property, deferred tax valuation allowance increases and decreases, storm-related expenses and recoveries, severance costs and legal costs. Management believes that FFO as Adjusted is useful supplemental information regarding our operating performance as it provides a consistent comparison of our operating performance across time periods and allows investors to more easily compare our operating results with other REITs. FFO as Adjusted is not intended to represent cash flow or liquidity for the period, and is only intended to provide an additional measure of our operating performance. The Company believes that net income attributable to UDR, Inc. is the most directly comparable GAAP financial measure to FFO as Adjusted. However, other REITs may use different methodologies for calculating FFO as Adjusted or similar FFO measures and, accordingly, our FFO as Adjusted may not always be comparable to FFO as Adjusted or similar FFO measures calculated by other REITs. FFO as Adjusted should not be considered as an alternative to net income (determined in accordance with GAAP) as an indication of financial performance, or as an alternative to cash flows from operating activities (determined in accordance with GAAP) as a measure of our liquidity. A reconciliation from net income attributable to UDR, Inc. to FFO as Adjusted is provided on page 31 of this presentation. Net Asset Value: Net Asset Value (“NAV”) is defined as marked-to-market value of assets less marked-to-market value of liabilities and preferred equity, divided by total outstanding diluted shares and operating units. Management considers NAV a useful metric for investors as it provides context to portfolio value changes over time based on widely accepted market inputs. Funds From Operations ("FFO"): The Company defines FFO as net income (computed in accordance with GAAP), excluding impairment write-downs of depreciable real estate or of investments in non-consolidated investees that are driven by measurable decreases in the fair value of depreciable real estate held by the investee, gains (or losses) from sales of depreciable property, plus real estate depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. This definition conforms with the National Association of Real Estate Investment Trust's definition issued in April 2002. In the computation of diluted FFO, OP units, unvested restricted stock, stock options, and the shares of Series E Cumulative Convertible Preferred Stock are dilutive; therefore, they are included in the diluted share count. 27

DEFINITIONS AND RECONCILIATIONS Activities of our taxable REIT subsidiary (TRS), RE3, include development and land entitlement. From time to time, we develop and subsequently sell a TRS property which results in a short- term use of funds that produces a profit that differs from the traditional long-term investment in real estate for REITs. We believe that the inclusion of these TRS gains in FFO is consistent with the standards established by NAREIT as the short-term investment is incidental to our main business. TRS gains on sales, net of taxes, are defined as net sales proceeds less a tax provision and the gross investment basis of the asset before accumulated depreciation. Management considers FFO a useful metric for investors as the Company uses FFO in evaluating property acquisitions and its operating performance and believes that FFO should be considered along with, but not as an alternative to, net income and cash flow as a measure of the Company's activities in accordance with GAAP. FFO does not represent cash generated from operating activities in accordance with GAAP and is not necessarily indicative of funds available to fund our cash needs. A reconciliation from net income attributable to UDR, Inc. to FFO is provided on page 31 of this presentation. Held For Disposition Communities: The Company defines Held for Disposition Communities as those communities that were held for sale as of the end of the most recent quarter. Interest Coverage Ratio: The Company defines Interest Coverage Ratio as net income, excluding the impact of interest expense, real estate depreciation and amortization of wholly owned and joint venture communities, other depreciation and amortization, noncontrolling interests, net gain on the sale of depreciable property, RE3 income tax, divided by total interest. Management considers interest coverage ratio a useful metric for investors as it provides ratings agencies, investors and lending partners with a widely-used measure of the Company’s ability to service its debt obligations as well as compare leverage against that of its peer REITs. A reconciliation of the components that comprise interest coverage ratio is provided on page 30 of this presentation. Joint Venture Reconciliation at UDR's Weighted Average Pro-Rata Ownership Interest JV Return on Equity ("ROE"): The Company defines JV ROE as the pro rata share of property NOI plus property and asset management fee revenue less interest expense, divided by the average of beginning and ending equity capital for the quarter. Management considers ROE a useful metric for investors as it provides a widely used measure of how well the Company is investing its capital on a leveraged basis. JV Return on Invested Capital ("ROIC"): The Company defines JV ROIC as the pro rata share of property NOI plus property and asset management fee revenue divided by the average of beginning and ending invested capital for the quarter. Management considers ROIC a useful metric for investors as it provides a widely used measure of how well the Company is investing its capital on an unleveraged basis. Net Operating Income (“NOI”): The Company defines NOI as rental income less direct property rental expenses. Rental income represents gross market rent less adjustments for concessions, vacancy loss and bad debt. Rental expenses include real estate taxes, insurance, personnel, utilities, repairs and maintenance, administrative and marketing. Excluded from NOI is property management expense which is calculated as 2.75% of property revenue to cover the regional supervision and accounting costs related to consolidated property operations, and land rent. Management considers NOI a useful metric for investors as it is a more meaningful representation of a community’s continuing operating performance than net income as it is prior to corporate-level expense allocations, general and administrative costs, capital structure and depreciation and amortization and is a widely used input, along with capitalization rates, in the determination of real estate valuations. A reconciliation from net income attributable to UDR, Inc. to NOI is provided below. Non-Mature: The Company defines Non-Mature Communities as those communities that have not met the criteria to be included in Same-Store Communities. Non-Residential / Other: The Company defines Non-Residential / Other as non-apartment components of mixed-use properties, land held, properties being prepared for redevelopment and properties where a material change in home count has occurred. Physical Occupancy: The Company defines physical occupancy as the number of occupied homes divided by the total homes available at a community. In thousands 2Q 2014 1Q 2014 4Q 2013 3Q 2013 2Q 2013 Net income/(loss) attributable to UDR, Inc. $ 30,007 $ 18,361 $ 36,700 $ 3,188 $ 5,192 Property management 5,527 5,345 5,233 5,168 5,123 Other operating expenses 2,162 1,926 1,925 1,776 1,800 Real estate depreciation and amortization 88,876 88,533 88,301 83,738 84,595 Interest expense 31,691 32,884 33,360 30,939 30,803 Casualty-related (recoveries)/charges, net - 500 - (6,460) (2,772) General and administrative 12,530 11,994 11,532 11,364 9,866 Tax provision/(benefit), net (includes valuation adjustment) (2,190) (3,329) 15 (2,658) (2,683) Income/(loss) from unconsolidated entities 428 3,565 (5,666) 3,794 (515) Interest and other income, net (1,426) (1,415) (1,328) (829) (1,446) Joint venture management and other fees (2,747) (3,687) (3,095) (3,207) (3,217) Other depreciation and amortization 1,193 1,080 3,281 1,176 1,138 (Income)/loss from discontinued operations, net of tax (18) (24,294) - - (830) (Gain)/loss on sale of real estate owned, net of tax (26,709) 87 (41,376) (884) - Net income/(loss) attributable to noncontrolling interests 1,079 651 1,302 47 162 Total consolidated NOI $ 140,403 $ 132,201 $ 130,184 $ 127,152 $ 127,216 28 In thousands 2Q 2014 YTD 2014 Income/(loss) from unconsolidated entities $ (428) $ (3,993) Management fee 963 1,834 Interest expense 7,822 14,803 Depreciation 8,861 19,528 General and administrative 204 286 Other income/expense (349) (747) Total Joint Venture NOI at UDR's Pro-Rata Ownership Interest $ 17,073 $ 31,711

DEFINITIONS AND RECONCILIATIONS QTD Same-Store ("SS") Communities: The Company defines QTD SS Communities as those communities stabilized for five full consecutive quarters. These communities were owned and had stabilized occupancy and operating expenses as of the beginning of the quarter in the prior year, there is no plan to conduct substantial redevelopment activities, and the community is not held for disposition within the current year. RE3: RE3 is the Company's taxable REIT subsidiary ("TRS") that focuses on development, land entitlement and short-term hold investments. TRS gains on sales, net of taxes, is defined as net sales proceeds less a tax provision and the gross investment basis of the asset before accumulated depreciation. Recurring Capital Expenditures: The Company defines recurring capital expenditures as expenditures that are necessary to help preserve the value of and maintain functionality at its communities. Redevelopment Communities: The Company generally defines Redevelopment Communities as those communities where greater than 10% of the available apartment homes are off-line for major renovation and those that did not achieve stabilization as of the most recent quarter. Redevelopment Projected Weighted Average Return on Incremental Capital Invested: The projected weighted average return on incremental capital invested for redevelopment projects is NOI as set forth in the Stabilization Period for Redevelopment Yield definition, less Recurring Capital Expenditures, minus the project’s annualized operating NOI prior to commencing the redevelopment, less Recurring Capital Expenditures, divided by total cost of the project. Return on Equity ("ROE"): The Company defines ROE as a referenced quarter's NOI less interest expense, annualized, divided by the average of beginning and ending equity capital for the quarter. Management considers ROE a useful metric for investors as it provides a widely used measure of how well the Company is investing its capital on a leveraged basis. Return on Invested Capital ("ROIC"): The Company defines ROIC as a referenced quarter's NOI, annualized, divided by the average of beginning and ending invested capital for the quarter. Management considers ROIC a useful metric for investors as it provides a widely used measure of how well the Company is investing its capital on an unleveraged basis. Revenue Enhancing Capital Expenditures: The Company defines revenue-enhancing capital expenditures as expenditures that result in increased income generation over time. Management considers revenue enhancing capital expenditures a useful metric for investors as it quantifies the amount of capital expenditures that are expected to grow, not just maintain, revenues. Sold Communities: The Company defines Sold Communities as those communities that previously met the criteria for discontinued operations and were disposed of prior to the end of the most recent quarter. Stabilization for Same Store Classification: The Company generally defines stabilization as when a community’s occupancy reaches 90% or above for at least three consecutive months. Stabilized, Non-Mature Communities: The Company defines Stabilized, Non-Mature Communities as those communities that are stabilized but not yet in the Company's Same-Store portfolio. Stabilization Period for Development Yield: The Company defines the stabilization period for development property yield as the forward twelve month NOI, excluding any remaining lease-up concessions outstanding, commencing one year following the delivery of the final home of the project. Stabilization Period for Redevelopment Yield: The Company defines the stabilization period for a redevelopment property yield for purposes of computing the Projected Weighted Average Return on Incremental Capital Invested, as the forward twelve month NOI, excluding any remaining lease-up concessions outstanding, commencing one year following the delivery of the final home of a project. Stabilized Yield on Developments: Expected stabilized yields on development are calculated as follows, projected stabilized NOI less management fees divided by budgeted construction cost on a project-specific basis. Projected stabilized NOI for development projects, calculated in accordance with the NOI reconciliation provided on page 28 of this presentation, is set forth in the definition of Stabilization Period for Development Yield. Given the differing completion dates and years for which NOI is being projected for these communities as well as the complexities associated with estimating other expenses upon completion such as corporate overhead allocation, general and administrative costs and capital structure, a reconciliation to GAAP measures is not meaningful. Projected NOI for these projects is neither provided, nor is representative of Management’s expectations for the Company’s overall financial performance or cash flow growth and there can be no assurances that forecast NOI growth implied in the estimated construction yield of any project will be achieved. Management considers estimated stabilized yield on development as a useful metric for investors as it helps provide context to the expected effects that development projects will have on the Company’s future performance once stabilized. Total Revenue per Occupied Home: The Company defines total revenue per occupied home as rental and other revenues, calculated in accordance with GAAP, divided by the product of occupancy and the number of apartment homes. Management considers total revenue per occupied home a useful metric for investors as it serves as a proxy for portfolio quality, both geographic and physical. Value Creation: Value creation is defined as the difference between the Company’s best estimate of the current or expected market value of a community and its original purchase price or cost basis. Underlying valuation estimates and model inputs are provided by the Company. Estimated value creation is not representative of the Company’s expectations for its overall financial performance or cash flow growth and there can be no assurances that the value creation implied for any of the Company’s communities will be achieved. Management considers value creation a useful metric for investors as it quantifies how successful the Company’s past investments have been and current investments are expected to be. YTD Same-Store ("SS") Communities: The Company defines YTD SS Communities as those communities stabilized for two full consecutive calendar years. These communities were owned and had stabilized occupancy and operating expenses as of the beginning of the prior year, there is no plan to conduct substantial redevelopment activities, and the community is not held for disposition within the current year. All guidance is based on current expectations of future economic conditions and the judgment of the Company's management team. The following reconciles from GAAP net income/(loss) per share for full year 2014 and third quarter of 2014 to forecasted FFO, FFO as Adjusted and AFFO per share: Full Year 2014 Low High Forecasted earnings per diluted share $ 0.26 $ 0.30 Conversion from GAAP share count (0.08) (0.08) Net (gain)/loss on the sale of depreciable property, excluding TRS (0.19) (0.19) Depreciation 1.51 1.51 Noncontrolling Interests 0.01 0.01 Preferred Dividends 0.01 0.01 Forecasted FFO per diluted share $ 1.52 $ 1.56 TRS gains from asset sales (0.01) (0.01) Net gain on prepayment of note receivable (0.03) (0.03) Acquisition, debt extinguishment, casualty and other costs 0.01 0.01 Forecasted FFO as Adjusted per diluted share $ 1.49 $ 1.53 Recurring capital expenditures (0.17) (0.17) Forecasted AFFO per diluted share $ 1.32 $ 1.36 3Q 2014 Low High Forecasted earnings per diluted share $ 0.03 $ 0.05 Conversion from GAAP share count (0.02) (0.02) Net (gain)/loss on the sale of depreciable property, excluding TRS - - Depreciation 0.38 0.38 Noncontrolling Interests - - Preferred Dividends - - Forecasted FFO per diluted share $ 0.39 $ 0.41 TRS gains from asset sales - - Net gain on prepayment of note receivable (0.03) (0.03) Acquisition, debt extinguishment, casualty and other costs - - Forecasted FFO as Adjusted per diluted share $ 0.36 $ 0.38 Recurring capital expenditures (0.05) (0.05) Forecasted AFFO per diluted share $ 0.31 $ 0.33 29

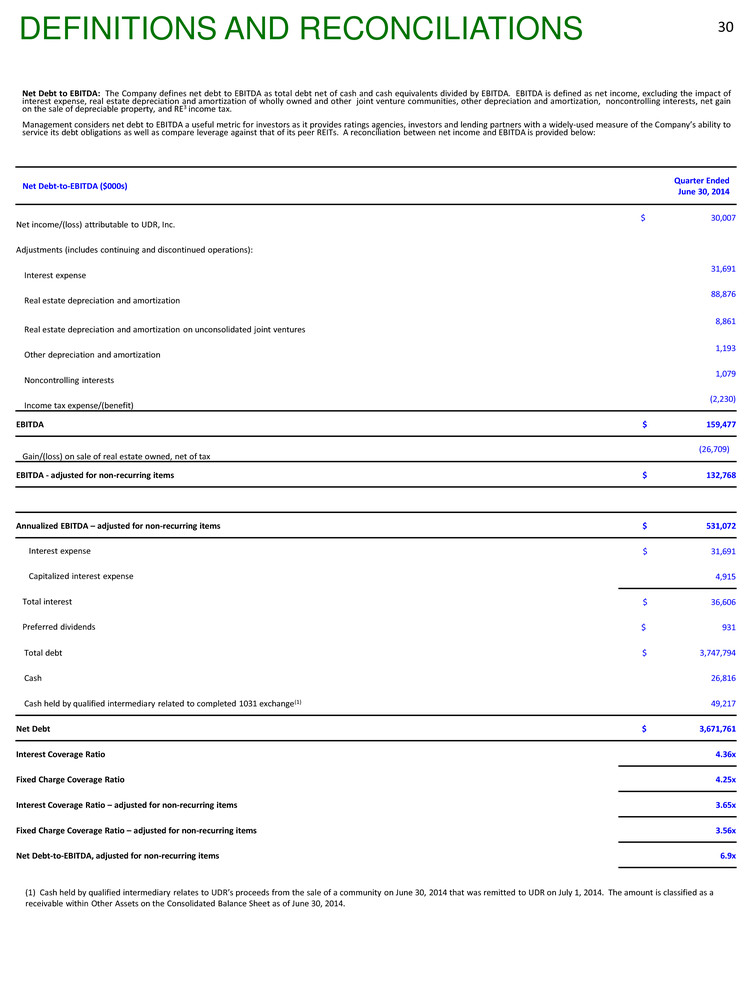

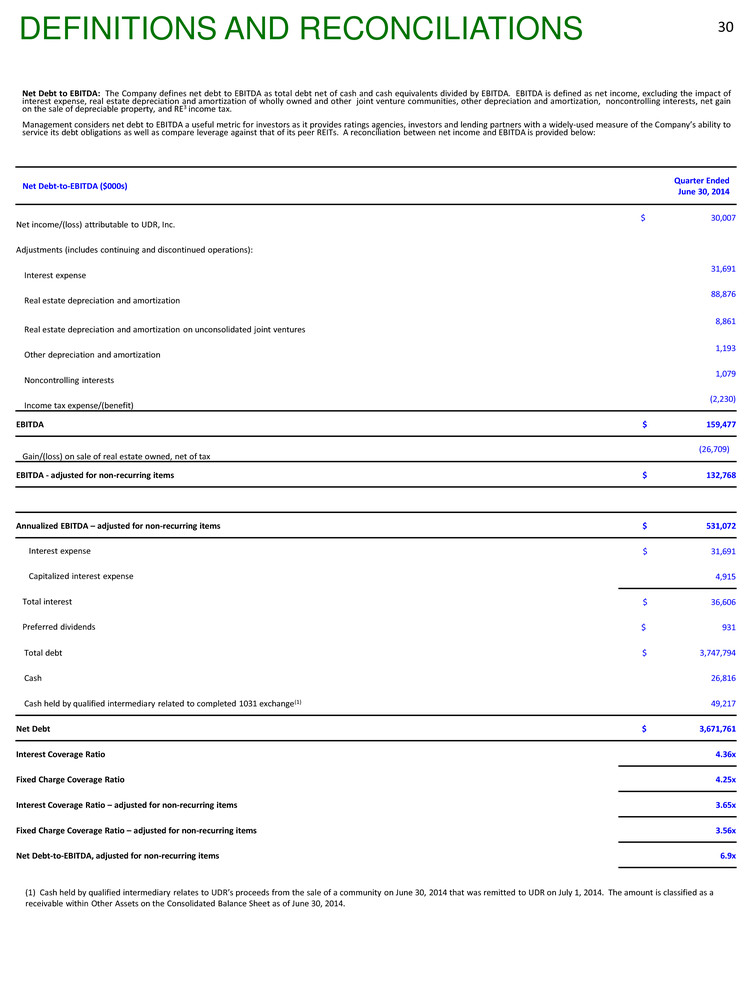

Net Debt to EBITDA: The Company defines net debt to EBITDA as total debt net of cash and cash equivalents divided by EBITDA. EBITDA is defined as net income, excluding the impact of interest expense, real estate depreciation and amortization of wholly owned and other joint venture communities, other depreciation and amortization, noncontrolling interests, net gain on the sale of depreciable property, and RE3 income tax. Management considers net debt to EBITDA a useful metric for investors as it provides ratings agencies, investors and lending partners with a widely-used measure of the Company’s ability to service its debt obligations as well as compare leverage against that of its peer REITs. A reconciliation between net income and EBITDA is provided below: DEFINITIONS AND RECONCILIATIONS Net Debt-to-EBITDA ($000s) Quarter Ended June 30, 2014 Net income/(loss) attributable to UDR, Inc. $ 30,007 Adjustments (includes continuing and discontinued operations): Interest expense 31,691 Real estate depreciation and amortization 88,876 Real estate depreciation and amortization on unconsolidated joint ventures 8,861 Other depreciation and amortization 1,193 Noncontrolling interests 1,079 Income tax expense/(benefit) (2,230) EBITDA $ 159,477 Gain/(loss) on sale of real estate owned, net of tax (26,709) EBITDA - adjusted for non-recurring items $ 132,768 Annualized EBITDA – adjusted for non-recurring items $ 531,072 Interest expense $ 31,691 Capitalized interest expense 4,915 Total interest $ 36,606 Preferred dividends $ 931 Total debt $ 3,747,794 Cash 26,816 Cash held by qualified intermediary related to completed 1031 exchange(1) 49,217 Net Debt $ 3,671,761 Interest Coverage Ratio 4.36x Fixed Charge Coverage Ratio 4.25x Interest Coverage Ratio – adjusted for non-recurring items 3.65x Fixed Charge Coverage Ratio – adjusted for non-recurring items 3.56x Net Debt-to-EBITDA, adjusted for non-recurring items 6.9x 30 (1) Cash held by qualified intermediary relates to UDR’s proceeds from the sale of a community on June 30, 2014 that was remitted to UDR on July 1, 2014. The amount is classified as a receivable within Other Assets on the Consolidated Balance Sheet as of June 30, 2014.

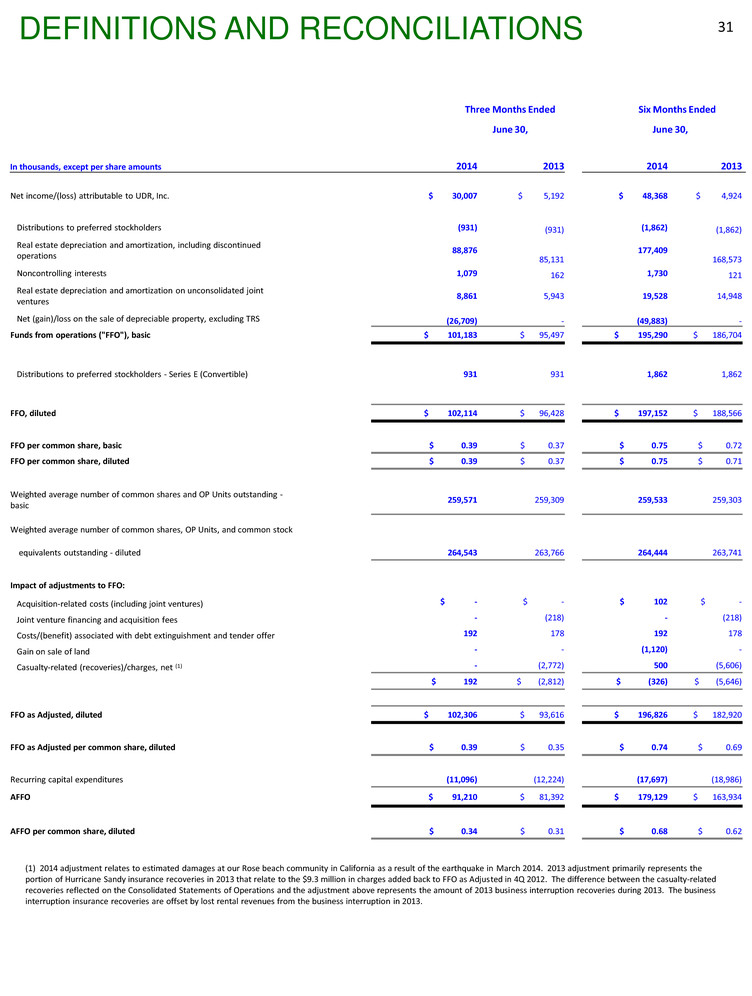

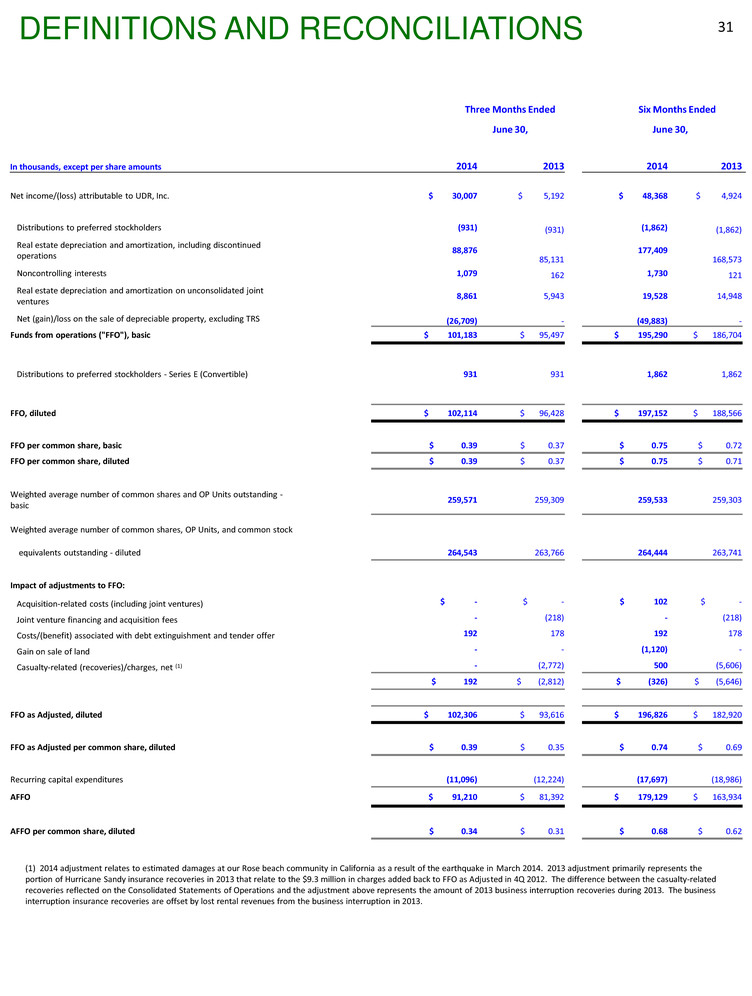

(1) 2014 adjustment relates to estimated damages at our Rose beach community in California as a result of the earthquake in March 2014. 2013 adjustment primarily represents the portion of Hurricane Sandy insurance recoveries in 2013 that relate to the $9.3 million in charges added back to FFO as Adjusted in 4Q 2012. The difference between the casualty-related recoveries reflected on the Consolidated Statements of Operations and the adjustment above represents the amount of 2013 business interruption recoveries during 2013. The business interruption insurance recoveries are offset by lost rental revenues from the business interruption in 2013. DEFINITIONS AND RECONCILIATIONS Three Months Ended Six Months Ended June 30, June 30, In thousands, except per share amounts 2014 2013 2014 2013 Net income/(loss) attributable to UDR, Inc. $ 30,007 $ 5,192 $ 48,368 $ 4,924 Distributions to preferred stockholders (931) (931) (1,862) (1,862) Real estate depreciation and amortization, including discontinued operations 88,876 85,131 177,409 168,573 Noncontrolling interests 1,079 162 1,730 121 Real estate depreciation and amortization on unconsolidated joint ventures 8,861 5,943 19,528 14,948 Net (gain)/loss on the sale of depreciable property, excluding TRS (26,709) - (49,883) - Funds from operations ("FFO"), basic $ 101,183 $ 95,497 $ 195,290 $ 186,704 Distributions to preferred stockholders - Series E (Convertible) 931 931 1,862 1,862 FFO, diluted $ 102,114 $ 96,428 $ 197,152 $ 188,566 FFO per common share, basic $ 0.39 $ 0.37 $ 0.75 $ 0.72 FFO per common share, diluted $ 0.39 $ 0.37 $ 0.75 $ 0.71 Weighted average number of common shares and OP Units outstanding - basic 259,571 259,309 259,533 259,303 Weighted average number of common shares, OP Units, and common stock equivalents outstanding - diluted 264,543 263,766 264,444 263,741 Impact of adjustments to FFO: Acquisition-related costs (including joint ventures) $ - $ - $ 102 $ - Joint venture financing and acquisition fees - (218) - (218) Costs/(benefit) associated with debt extinguishment and tender offer 192 178 192 178 Gain on sale of land - - (1,120) - Casualty-related (recoveries)/charges, net (1) - (2,772) 500 (5,606) $ 192 $ (2,812) $ (326) $ (5,646) FFO as Adjusted, diluted $ 102,306 $ 93,616 $ 196,826 $ 182,920 FFO as Adjusted per common share, diluted $ 0.39 $ 0.35 $ 0.74 $ 0.69 Recurring capital expenditures (11,096) (12,224) (17,697) (18,986) AFFO $ 91,210 $ 81,392 $ 179,129 $ 163,934 AFFO per common share, diluted $ 0.34 $ 0.31 $ 0.68 $ 0.62 31

Forward Looking Statements Certain statements made in this presentation may constitute “forward-looking statements.” Words such as “expects,” “intends,” “believes,” “anticipates,” “plans,” “likely,” “will,” “seeks,” “estimates” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements, by their nature, involve estimates, projections, goals, forecasts and assumptions and are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed in a forward-looking statement, due to a number of factors, which include, but are not limited to, unfavorable changes in the apartment market, changing economic conditions, the impact of inflation/deflation on rental rates and property operating expenses, expectations concerning availability of capital and the stabilization of the capital markets, the impact of competition and competitive pricing, acquisitions, developments and redevelopments not achieving anticipated results, delays in completing developments, redevelopments and lease-ups on schedule, expectations on job growth, home affordability and demand/supply ratio for multifamily housing, expectations concerning development and redevelopment activities, expectations on occupancy levels, expectations concerning the joint ventures with third parties, expectations that automation will help grow net operating income, expectations on annualized net operating income and other risk factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time, including the Company's Annual Report on Form 10-K and the Company's Quarterly Reports on Form 10-Q. Actual results may differ materially from those described in the forward-looking statements. These forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this presentation, and the Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in the Company's expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required under the U.S. securities laws. This presentation and these forward-looking statements include UDR’s analysis and conclusions and reflect UDR’s judgment as of the date of these materials. UDR assumes no obligation to revise or update to reflect future events or circumstances. FORWARD LOOKING STATEMENTS 32

NOTES 33

NOTES 34

NOTES 35

Investor Relations Contact: Chris Van Ens cvanens@udr.com 720.348.7762