- UDR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

UDR (UDR) DEF 14ADefinitive proxy

Filed: 8 Apr 21, 4:19pm

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

SCHEDULE 14A |

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| ☐ Filed by a Party other than the Registrant | |

Check the appropriate box: | ||

☐ | Preliminary Proxy Statement | |

☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

| Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to §240.14a-12 | |

UDR, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | |

| No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies: | |

(2) Aggregate number of securities to which transaction applies: | |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) Proposed maximum aggregate value of transaction: | |

(5) Total fee paid: | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid: | |

(2) Form, Schedule or Registration Statement No.: | |

(3) Filing Party: | |

(4) Date Filed: | |

1745 SHEA CENTER DRIVE, SUITE 200

HIGHLANDS RANCH, CO 80129

__________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 27, 2021

__________________

You are cordially invited to attend the 2021 Annual Meeting of Shareholders (the “Meeting”) of UDR, INC. (“UDR” or the “Company”) to be held on Thursday, May 27, 2021, at 10:00 a.m. local time at Hotel Crescent Court, 400 Crescent Court, Dallas, Texas 75201, for the following purposes:

| 1. | To elect nine directors, for a term of one year each, until the next Annual Meeting of Shareholders and until their successors are elected and qualified; |

| 2. | To ratify the appointment of Ernst & Young LLP, to serve as independent registered public accounting firm for the Company for the fiscal year ending December 31, 2021; |

| 3. | To conduct an advisory vote on executive compensation; |

| 4. | To approve the Amended and Restated 1999 Long-Term Incentive Plan; and |

| 5. | To transact such other business as may properly come before the Meeting or any adjournment(s) thereof. |

Only shareholders of record at the close of business on March 29, 2021, will be entitled to notice of, and to vote at, the Meeting or any adjournment(s) thereof. Each share of common stock is entitled to one vote for each director position and one vote for each of the other proposals.

On or about April 8, 2021, we intend to mail to our shareholders of record a notice containing instructions on how to access our 2021 proxy statement (“Proxy Statement”) and our Annual Report on Form 10-K for the year ended December 31, 2020, and how to vote online. The notice also provides instructions on how you can request a paper copy of these documents if you desire, and how you can enroll in e-delivery. If you received your annual meeting materials via email, the email contains voting instructions and links to our annual report and proxy statement on the Internet. If you would like to reduce the costs incurred by UDR in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions on the Proxy Card to vote using the Internet and, when prompted, indicate that you agree to receive or access shareholder communications electronically in future years. We want to thank you for helping make UDR an environmentally friendly company and for your continued support of UDR.

We intend to hold our annual meeting in person; however, we are actively monitoring the coronavirus (COVID-19). We are sensitive to the public health and travel concerns that our shareholders may have and the protocols that federal, state, and local governments have imposed or may impose. In the event it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting by means of remote communication. Please monitor our annual meeting website at https://www.udr.com/2021annualmeeting for updated information. If you are planning to attend our meeting, please check the website one week prior to the meeting date. To the extent we hold our annual meeting virtually, our shareholders who register to attend will have the opportunity to participate through the virtual meeting portal both prior to and during the meeting. Appropriate questions will be read and answered during the meeting.

WHETHER OR NOT YOU EXPECT TO BE AT THE MEETING, PLEASE VOTE AS SOON AS POSSIBLE TO ENSURE THAT YOUR SHARES ARE REPRESENTED.

| |

| By Order of the Board of Directors |

|

|

| WARREN L. TROUPE |

| Corporate Secretary |

April 8, 2021

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS

How To Vote In Advance | |

Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote your shares electronically through the Internet, by telephone or, if you have requested and received a paper copy of the proxy statement, by completing, signing and returning the paper proxy card enclosed with the proxy statement. | |

| |

| By Telephone: You can submit your vote by proxy over the telephone by following the instructions provided on the separate proxy card if you received a printed set of the proxy materials. |

| |

| By Internet: You can go to www.proxyvote.com and vote through the Internet. |

| |

| By Mail: If you have requested and received a paper copy of the proxy statement, you can mark, sign, date and return the paper proxy card enclosed with the proxy statement in the postage-paid envelope that we have provided to you. Please note that if you vote through the Internet or by telephone, you do not need to return your proxy card. |

| |

| |

Important Notice Regarding the Availability of Proxy Materials for UDR, Inc.’s Annual Meeting of Shareholders to be held on May 27, 2021. This Notice of Annual Meeting and Proxy Statement and UDR, Inc.’s Annual Report/Form 10-K for the year ended December 31, 2020 are available on the Internet at the following website: www.proxyvote.com. | |

| |

Forward-Looking Statements

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements include, without limitation, statements concerning property acquisitions and dispositions, development activity and capital expenditures, capital raising activities, rent growth, occupancy, rental expense growth and expected or potential impacts of the novel coronavirus disease (“COVID-19”) pandemic. Words such as “expects,” “anticipates,�� “intends,” “plans,” “likely,” “will,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. Such factors include, among other things, the impact of the COVID-19 pandemic and measures intended to prevent its spread or address its effects, unfavorable changes in the apartment market, changing economic conditions, the impact of inflation/deflation on rental rates and property operating expenses, expectations concerning the availability of capital and the stability of the capital markets, the impact of competition and competitive pricing, acquisitions, developments and redevelopments not achieving anticipated results, delays in completing developments and redevelopments, delays in completing lease-ups on schedule or at expected rent and occupancy levels, expectations on job growth, home affordability and demand/supply ratio for multifamily housing, expectations concerning development and redevelopment activities, expectations on occupancy levels and rental rates, expectations concerning joint ventures and partnerships with third parties, expectations that automation will help grow net operating income, and expectations on annualized net operating income.

The following factors, among others, could cause our future results to differ materially from those expressed in the forward-looking statements:

| ● | the impact of the COVID-19 pandemic and measures intended to prevent its spread or address its effects; |

| ● | general economic conditions; |

| ● | unfavorable changes in apartment market and economic conditions that could adversely affect occupancy levels and rental rates, including as a result of COVID-19; |

| ● | the failure of acquisitions to achieve anticipated results; |

| ● | possible difficulty in selling apartment communities; |

| ● | competitive factors that may limit our ability to lease apartment homes or increase or maintain rents; |

| ● | insufficient cash flow that could affect our debt financing and create refinancing risk; |

| ● | failure to generate sufficient revenue, which could impair our debt service payments and distributions to stockholders; |

| ● | development and construction risks that may impact our profitability; |

| ● | potential damage from natural disasters, including hurricanes and other weather-related events, which could result in substantial costs to us; |

| ● | risks from climate change that impacts our properties or operations; |

| ● | risks from extraordinary losses for which we may not have insurance or adequate reserves; |

| ● | risks from cybersecurity breaches of our information technology systems and the information technology systems of our third party vendors and other third parties; |

| ● | uninsured losses due to insurance deductibles, self-insurance retention, uninsured claims or casualties, or losses in excess of applicable coverage; |

| ● | delays in completing developments and lease-ups on schedule; |

| ● | our failure to succeed in new markets; |

| ● | risks that third parties who have an interest in or are otherwise involved in projects in which we have an interest, including mezzanine borrowers, joint venture partners or other investors, do not perform as expected; |

| ● | changing interest rates, which could increase interest costs and affect the market price of our securities; |

| ● | potential liability for environmental contamination, which could result in substantial costs to us; |

| ● | the imposition of federal taxes if we fail to qualify as a REIT under the Code in any taxable year; |

| ● | our internal control over financial reporting may not be considered effective which could result in a loss of investor confidence in our financial reports, and in turn have an adverse effect on our stock price; and |

| ● | changes in real estate laws, tax laws, rent control or stabilization laws or other laws affecting our business. |

A discussion of these and other factors affecting our business and prospects is set forth in Part I, Item 1A. Risk Factors of our Annual Report/Form 10-K for the year ended December 31, 2020. We encourage investors to review these risk factors.

Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore such statements included in this Proxy Statement may not prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved.

Forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this Proxy Statement, and we expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by law.

TABLE OF CONTENTS | |

| PAGE |

| |

2021 PROXY STATEMENT HIGHLIGHTS | |

TOP OF MIND ISSUES | |

PROXY SUMMARY | |

PROPOSAL NO. 1 ELECTION OF DIRECTORS | |

Vote Required and Board of Directors’ Recommendation | |

CORPORATE GOVERNANCE MATTERS | |

Corporate Governance Overview | |

Majority Voting Standard for Uncontested Elections | |

Our Commitment to Shareholder Engagement | |

Identification and Selection of Nominees for Director | |

Proxy Access | |

Shareholder Bylaws Amendments | |

Director Rotation and Retirement | |

Director Independence | |

Succession Planning | |

Director Responsibilities and Obligations | |

Board Leadership Structure and Committees | |

Role of Compensation Committee and Compensation Consultants | |

Board of Directors and Committee Meetings | |

The Role of the Board in Risk Oversight | |

Board Evaluation | |

Communicating with the Board | |

COMPENSATION OF DIRECTORS | |

Director Compensation Table | |

Director Compensation Table Discussion | |

2020 Director Compensation Program | |

2021 Director Compensation Program | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

HUMAN CAPITAL MANAGEMENT | |

SUSTAINABILITY | |

EXECUTIVE OFFICERS | |

EXECUTIVE COMPENSATION | 48 |

Compensation Discussion and Analysis | |

Compensation Committee Report | |

Compensation of Executive Officers | |

Employment and Other Agreements | |

Post-Employment Compensation - Severance, Change of Control and Other Arrangements | |

CEO Pay Ratio | |

Compensation Risks | |

Transactions with Related Persons | |

Equity Compensation Plan Information | |

AUDIT COMMITTEE REPORT | |

AUDIT MATTERS | |

Audit Fees | |

Pre-Approval Policies and Procedures | |

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS | |

Vote Required and Board of Directors’ Recommendation | 89 |

PROPOSAL NO. 3 ADVISORY VOTE ON EXECUTIVE COMPENSATION | |

Vote Required and Board of Directors’ Recommendation | |

PROPOSAL NO. 4 APPROVAL OF AMENDED AND RESTATED 1999 LONG-TERM INCENTIVE PLAN | |

Purpose of the Plan | |

Background of the Plan | |

Questions and Answers About the Plan and the Proposal | |

New Plan Benefits | |

Stock Option Awards and Other Awards Under the Plan | |

Vote Required and Board of Directors’ Recommendation | |

FREQUENTLY ASKED QUESTIONS ABOUT THE ANNUAL MEETING | |

Why did you provide this proxy statement to me? | |

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? | |

i | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

What constitutes a quorum in order to hold and transact business at the meeting? | |

How do I vote? | |

How will my proxy be voted? | |

Will other matters be voted on at the annual meeting? | |

Can I revoke my proxy and change my vote? | |

What vote is required for the proposals if a quorum is present? | |

What is an abstention, and how will it affect the vote on a proposal? | |

What are broker non-votes, and how will they affect the vote on a proposal? | |

Who will tabulate the votes? | |

Who is soliciting the proxy, and who will pay for the proxy solicitation? | |

Where do I find the voting results of the meeting? | |

OTHER MATTERS | |

Delivery of Voting Materials | |

Annual Report | |

Shareholder Proposals for the 2022 Annual Meeting of Shareholders | |

Advance Notice Procedures for the 2022 Annual Meeting of Shareholders | |

Proxy Access Procedures for the 2022 Annual Meeting of Shareholders | |

DEFINITIONS | |

APPENDIX A | |

|

ii | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

2021 PROXY STATEMENT HIGHLIGHTS

| | | | |

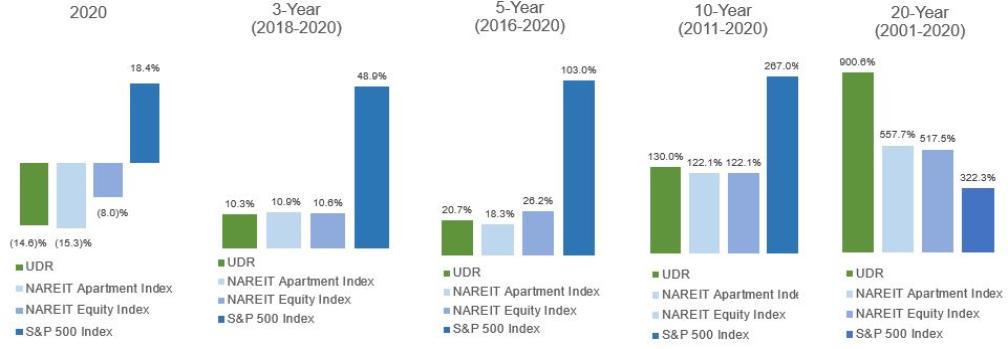

2020 Performance Highlights | ||||

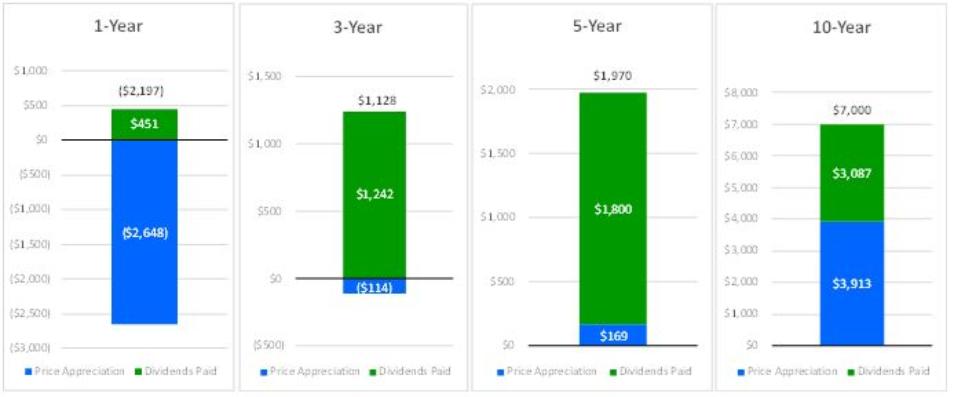

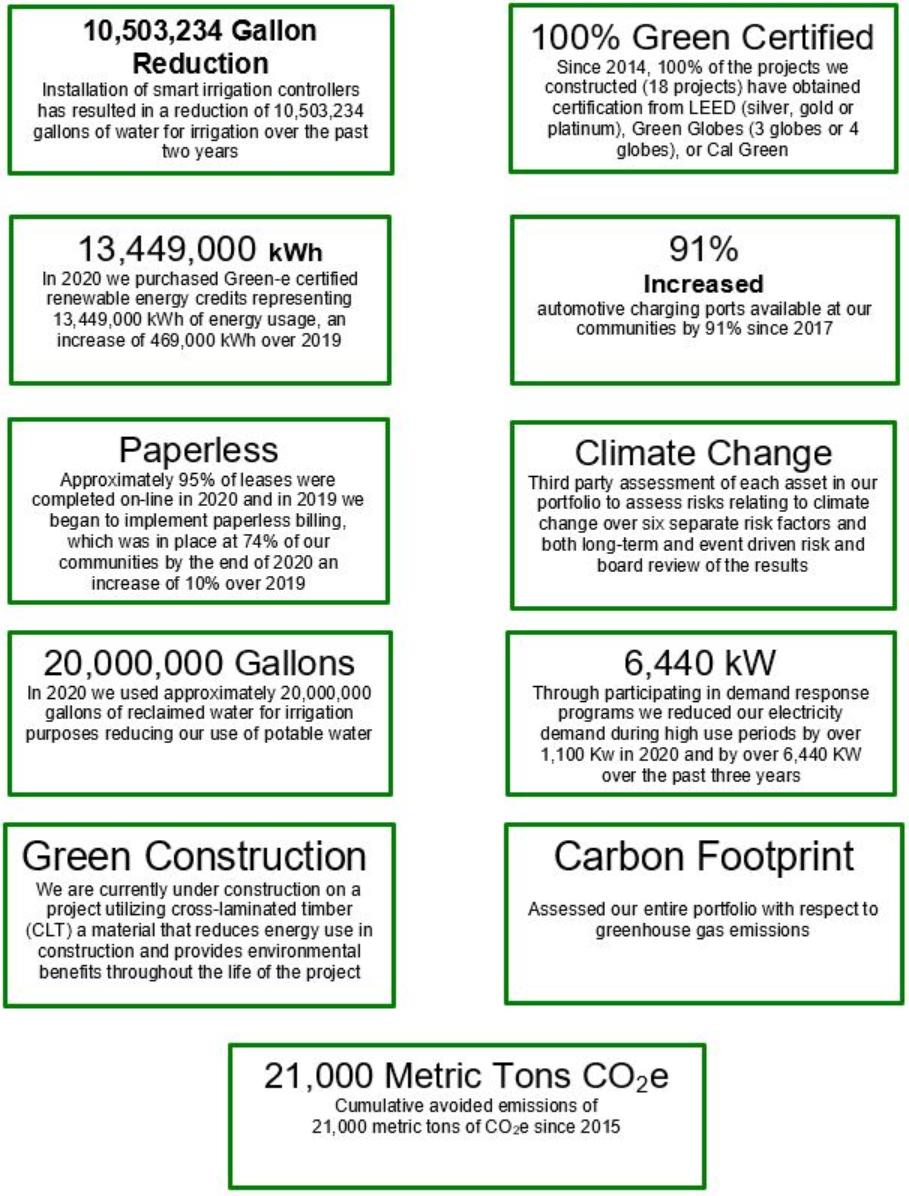

1, 3, 5, 10 and 20-Year Total Shareholder Return as of December 31, 2020

1-Year | 3-Year | 5-Year | 10-Year | 20-Year | |

UDR | (14.6)% | 10.3% | 20.7% | 130.0% | 900.6% |

| | | | | |

NAREIT Apartment Index | (15.3)% | 10.9% | 18.3% | 122.1% | 557.7% |

NAREIT Equity Index | (8.0)% | 10.6% | 26.2% | 122.1% | 517.5% |

S&P 500 Index | 18.4% | 48.9% | 103.0% | 267.0% | 322.3% |

UDR’s Absolute Return in Dollars ($ millions)

193rd Consecutive Dividend Paid

Our January 2021 dividend represented our 193rd consecutive quarterly dividend paid. We are committed to returning value to our shareholders, and for 2020 we increased our dividend by 5.1%, and we have increased our dividend 5.1% annually over the past 3 years, 5.3% annually over the past 5 years and 7.2% annually over the past 10 years. Our dividend has increased in each of the last 11 years.

| ||||

| 1-Year | 3-Year Average | 5-Year Average | 10-Year Average |

Dividend per share growth | 5.1% | 5.1% | 5.3% | 7.2% |

FFOA per | -1.9% | 2.9% | 4.2% | 6.5% |

(a) We present reconciliations of these non-GAAP financial measures to their most directly comparable GAAP measures, as well as additional information, in “Definitions” on page 109).

1 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

| | | | |

| ||||

Our Five Strategic Objectives

| ● | Our 2020 results consisted of improvement across all five of our strategic objectives, which are: 1) operating excellence, |

2) balance sheet strength,

3) portfolio composition,

4) accretive capital allocation, and

5) a strong, innovative culture with a focus on sustainability, leading to an investment for all cycles.

Below is a summary of our results categorized by objective:

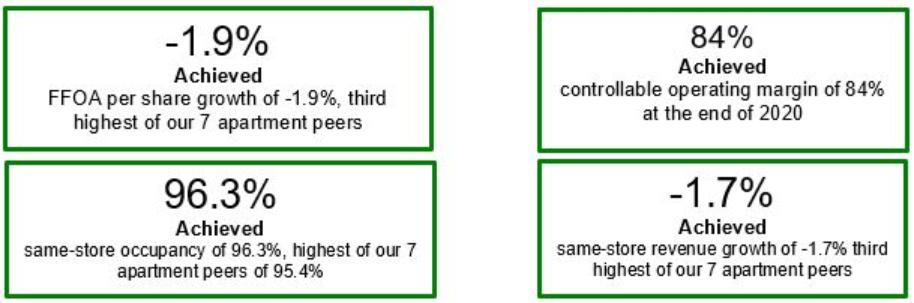

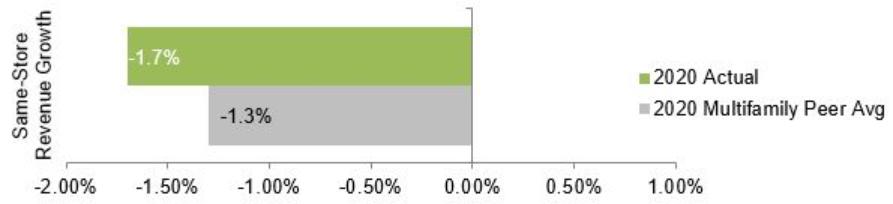

| 1. | Operating Excellence |

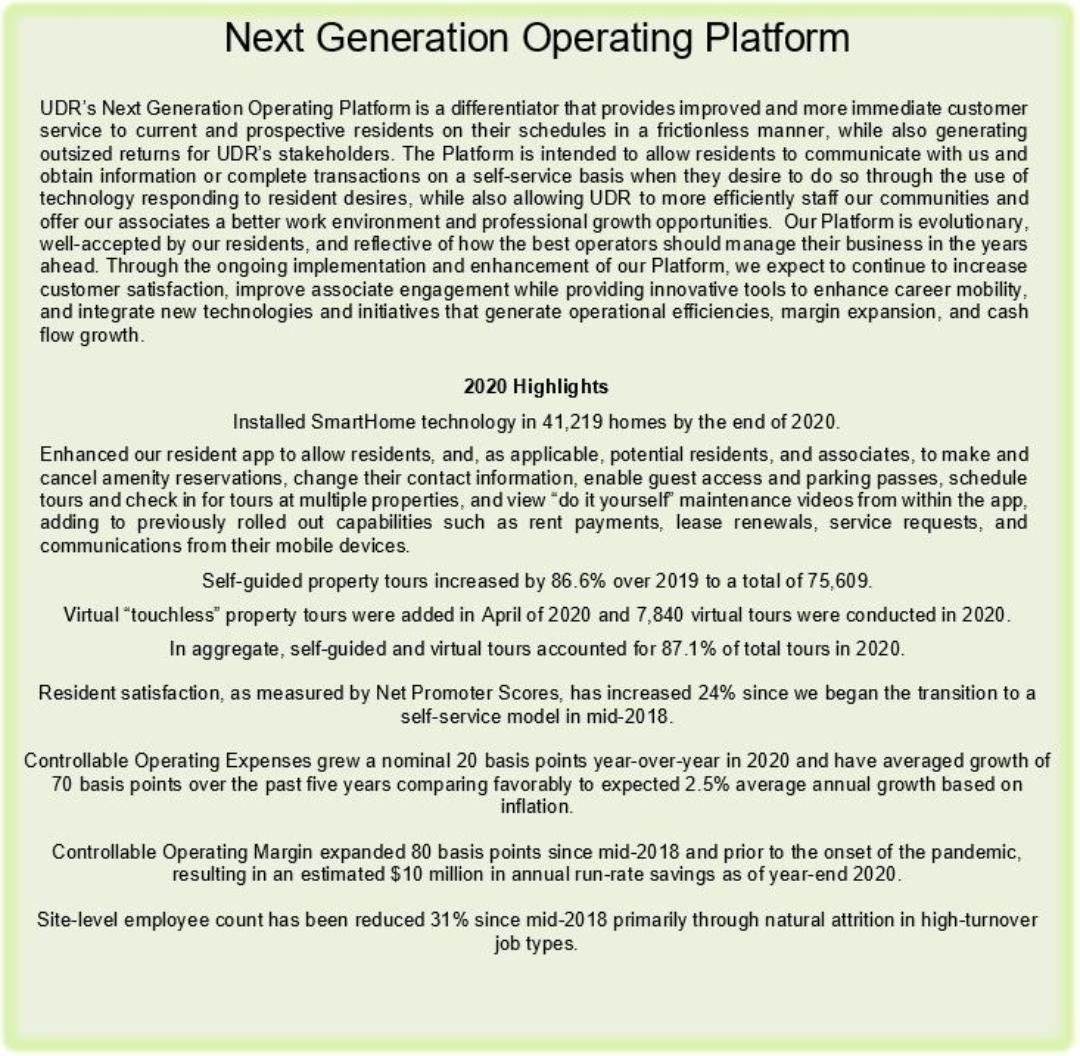

A best-in-class operating platform that couples strong blocking and tackling with continued innovation is expected to drive operating margin expansion. Initiatives that better monetize our real estate, pricing our apartment homes more efficiently, and nurturing an operating culture that embraces accretive evolution are all repeatable competitive advantages that result in superior NOI growth over a full cycle.

| 2. | Balance Sheet Strength |

Our balance sheet is safe, liquid, flexible, and capable of funding both internal and external growth opportunities. An investment-grade rating, well-laddered maturity profile, and access to liquidity from a wide variety of capital sources affords UDR efficient pricing of external capital, which serves as a competitive advantage.

*We present reconciliations of certain non-GAAP financial measures to their most directly comparable US generally accepted accounting principles (GAAP) measures in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Apartment Community Operations” in our 2020 Annual Report, including reconciliations of net income/loss reported under GAAP to NOI, FFO, FFO as Adjusted and FFOA, as well as additional information about non-GAAP measures.

(a) We present reconciliations of these non-GAAP financial measures to their most directly comparable GAAP measures, as well as additional information, in “Definitions” on page 109.

2 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

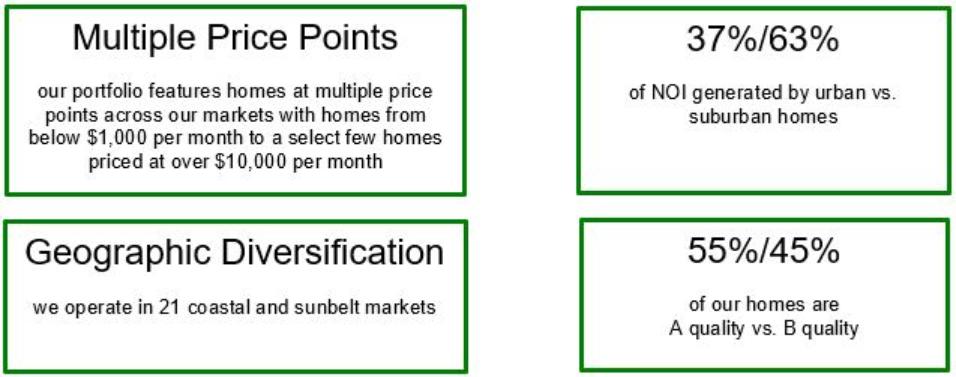

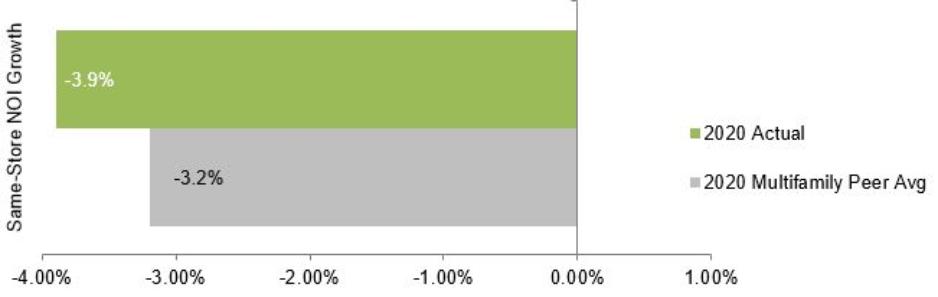

| 3. | Portfolio Composition |

Our diversified portfolio across markets, price points, and product types is a differentiating factor, appeals to a wide renter and investor audience, provides for more markets to invest in and overlay our operating platform onto, and lessens volatility in long-term same-store growth, cash flow growth, and total shareholder return to deliver a full-cycle investment that generates both growth and stability.

| 4. | Accretive Capital Allocation |

UDR’s history of disciplined capital allocation has created significant value for stakeholders over time and is a function of our ability to consider cost of capital signals and leverage our well-rounded suite of available investment options. Our diversified portfolio allows us to seek returns where others cannot, and our willingness and ability to pivot toward the investment opportunity that generates the highest risk-adjusted IRR and the greatest earnings accretion is central to UDR’s capital allocation strategy.

3 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

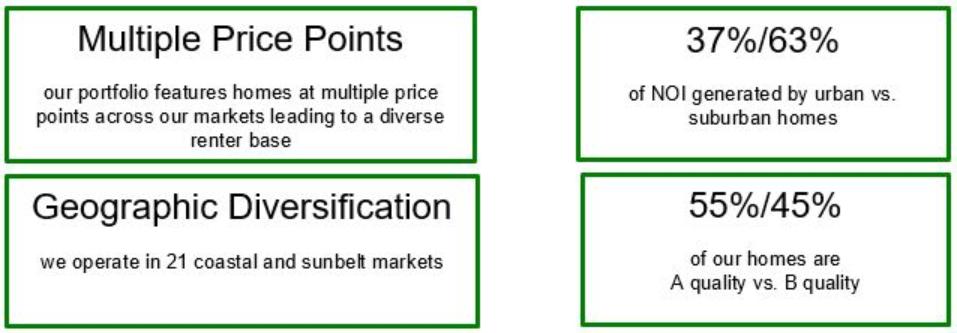

| 5. | A Strong, Diverse, Innovative Culture |

Our culture is achievement-based, goal-oriented, forward-thinking, and driven by innovation and technology. These principles support an empowered, merit-based structure that rewards strong financial results while also mandating accountability and respect for all. Our diversity, equity and inclusion initiative is designed to help assure continued high levels of associate engagement in the future. High associate engagement levels are one of the reasons it is possible for UDR to consistently deliver financial results, which in turn allow us to provide the tools our associates need to take advantage of career mobility, which helps generate long-term cash flow growth and total return to our shareholders, and deliver superior customer service to our residents. These accomplishments are achieved in concert with UDR being a responsible steward of the environment, a socially conscious corporate citizen, and a promoter of sound corporate governance.

Environmental

Social and Community Engagement

Governance

4 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

As described further within this proxy statement we regularly interact with our shareholders and other stakeholders, having had 517 total interactions with shareholders (representing 84.1% of our outstanding common stock), including 50 representatives of the stewardship or governance functions of 29 of our shareholders (representing 44.3% of our outstanding common stock), in 2020 and early 2021. Set forth below are issues that are most commonly topics of discussion in such engagements and brief descriptions of what we have done to address them.

COVID-19

As with other businesses across the globe, the COVID-19 pandemic negatively impacted our business as well as our residents, associates, and communities in a wide variety of ways during 2020. Addressing these impacts required targeted responses including measured and intentional actions to assist our residents and our associates with a focus on protecting, to the extent we could, the health and well-being of our residents and our associates.

With respect to our residents, we enhanced our cleaning protocols and improved air quality protocols. To help address our residents’ mental wellness and foster personal engagement amidst social distancing requirements, we coordinated virtual social and entertainment opportunities such as trivia contests and cooking classes. In addition, to assist with financial impacts we offered payment plans, as well as payment options such as payment by credit card or installment payments, while waiving associated fees. We also created processes to assist residents in applying for applicable rent assistance programs. Our Next Generation Operating Platform allowed us to expand the number of activities residents and prospective residents could accomplish in a self-service, no-contact manner at the time of their choosing, including the ability to make amenity reservations and log maintenance requests, among others. We substantially increased the availability of self-guided tours and added the capability for virtual community tours, allowing a UDR leasing associate to virtually “walk” prospective residents around a community through on-line interaction.

With respect to our associates, we sourced and provided personal protective equipment and provided additional cleaning supplies. In addition, we offered additional paid time off for COVID-19 reasons, one-time financial bonuses, flexible work schedules, work-from-home optionality, vacation time buy-out programs, mental wellness programs, and other benefits that assisted our associates and their families in addressing COVID-19 challenges. Senior management also communicated frequently with our associates (initially weekly and then less frequently) through Company-wide telephonic calls and virtual meetings and webinars. The goal was to ensure that our associates understood how the Company was addressing the challenges presented by the pandemic, and to provide an open forum where they could express concerns to or ask questions directly of leadership. We did not furlough or layoff any of our associates due to COVID-19.

Interaction between management and the board also increased. Additional board meetings were held virtually during 2020 so that board members had a full understanding regarding what the Company was doing to address the impact of COVID-19 and could efficiently exercise their oversight responsibilities. See page 45.

Environmental, Social, and Governance (“ESG”)

ESG remains a cornerstone of how we operate our business and invest our capital, not only because strong corporate citizenry is important to our stakeholders, but because focusing on it makes solid economic and business sense.

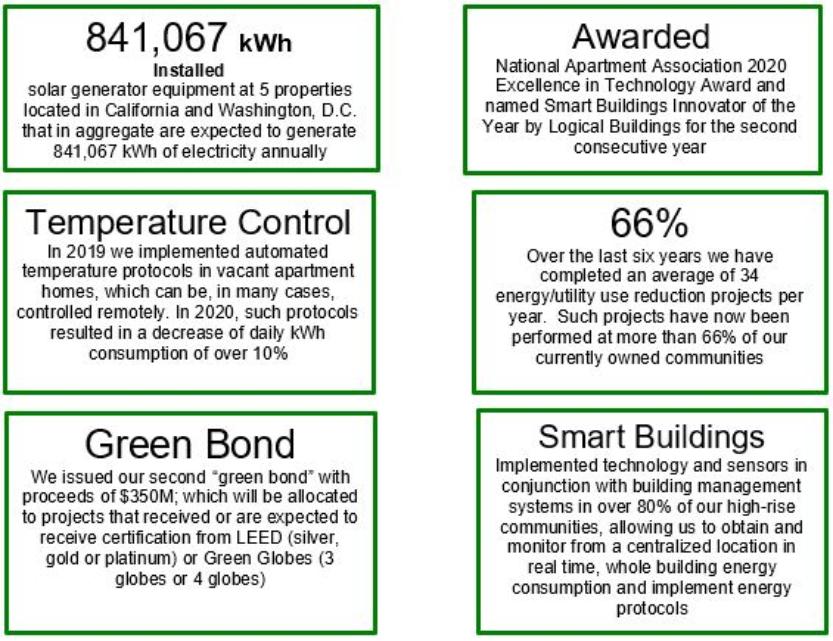

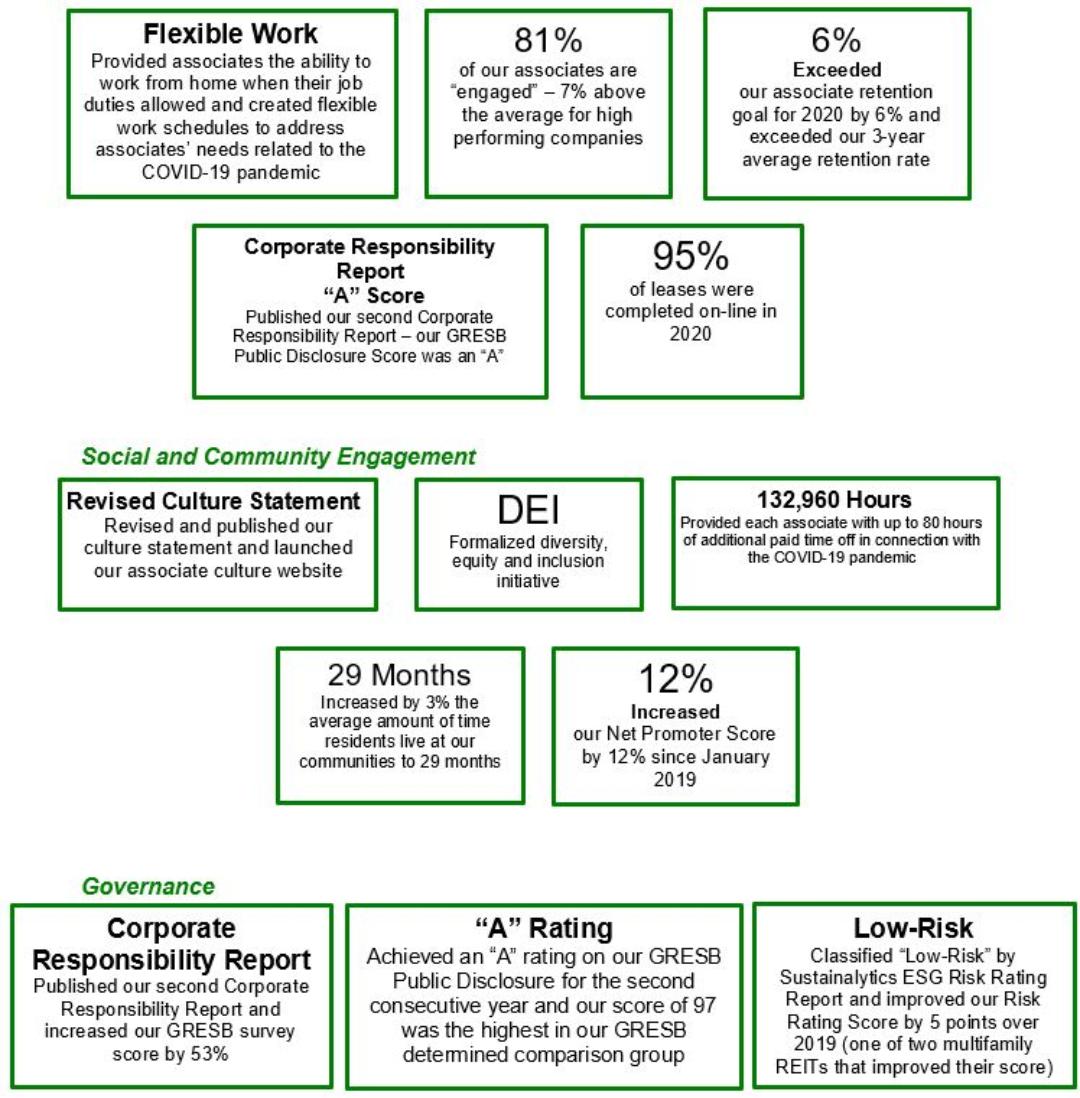

Environmental - Sustainability/Climate Change

Sustainability issues and climate change directly impact the long-term viability of our assets and the markets in which they are located. However, in our view “sustainable” does not end with widely utilized metrics such as resource conservation (e.g., electricity, water, and renewable energy usage, emissions, recycling efforts, etc.) and their associated cost savings, but also encompasses topics such as how our buildings impact our residents and the communities in which they are located. For example, we account for the “walk,” “public transit,” and “bike” scores of a community when making investment decisions, both on new developments and when acquiring operating assets to better assess these impacts. While we have measured and considered various sustainability metrics for many years, in 2019 we began an effort to explicitly disclose our sustainability metrics, goals, efforts, and accomplishments. We also undertook the task of more formally reporting and disclosing these items to our stakeholders to provide them with a deeper understanding of our efforts. In 2020 we released our second Corporate Responsibility Report, available on our website under “Corporate Social Responsibility/Corporate Responsibility Report”, which included enhanced disclosure including (1) Sustainability Accounting Standards Board (“SASB”) real estate specific disclosures with respect to energy management, water management, management of tenant sustainability and climate change adaption, and (2) Task Force for Climate-related Financial Disclosure (“TCFD”) focal points such as climate-related management, along with the Global Reporting Initiative (“GRI”) disclosures included in our inaugural report. Our efforts resulted in UDR receiving a GRESB Public Disclosure rating of “A”, a disclosure score of 97, which was the highest within our GRESB determined comparison group, and an overall survey score of 83, which resulted in a “4 Star” designation from GRESB and our being named a top ESG performer among global real estate firms.

We believe climate change related risks are growing in importance and in recognition thereof, in 2020 we engaged two third-party consultants to provide climate change risk data for each of our assets and all the markets in which we operate.

5 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

In our property-level and market analyses, we assessed both long-term and event-driven climate change risk through variables such as heat stress, water stress, sea level rise, flooding risk, hurricane risk and earthquake risk. We used these findings to segment our portfolio by relative “riskiness” to better focus our efforts on high-risk markets and communities that require further analysis. Lastly, these risks are considered by our board as part of their oversight of enterprise risk management.

The assessment results are also considered as we make decisions with respect to capital investments in our owned assets (for example, whether to “harden” an asset against sea level rise or xeriscape a property to conserve water) as well as market-level investment and divestment decisions (for example, markets or sub-markets in which to invest and markets that we may exit) within our portfolio strategy process. We presented the results of such assessments, together with our strategy and plan surrounding climate change, to our board and engaged in extensive dialogue on the topic at board meetings throughout 2020. We intend to provide regular climate change risk updates to the board in the years ahead, so that they are fully informed of the risks we may face and can actively oversee such risks. In 2020, the Company also engaged a third-party expert to present thoughts regarding climate change risks to management and the board.

Greenhouse gas emissions and carbon-footprint are important globally and are areas that we believe may be focal points for increased future regulation. Accordingly, in 2020 we measured the Scope 1 and 2 greenhouse gas emissions at each asset in our portfolio. Our aggregate Scope 1 and Scope 2 emissions are reported in our Corporate Responsibility Report. These assessments, in addition to the planned incorporation of estimated Scope 3 emissions in 2021, will be updated annually to (1) enable evaluation of usage patterns over time, (2) allow us to monitor year-over-year emission reductions due to capital investments we have previously made, (3) allows us to measure progress against our GHG reduction goal set forth in the Corporate Responsibility Report, and (4) provide insight into how and where we can further lower our carbon footprint through additional energy conservation investments. When evaluating existing properties for acquisition we also perform, as part of our due diligence process, site assessments and property condition assessments, the results of which, in part, are used to assess opportunities to improve building energy usage. See pages 46 through 47.

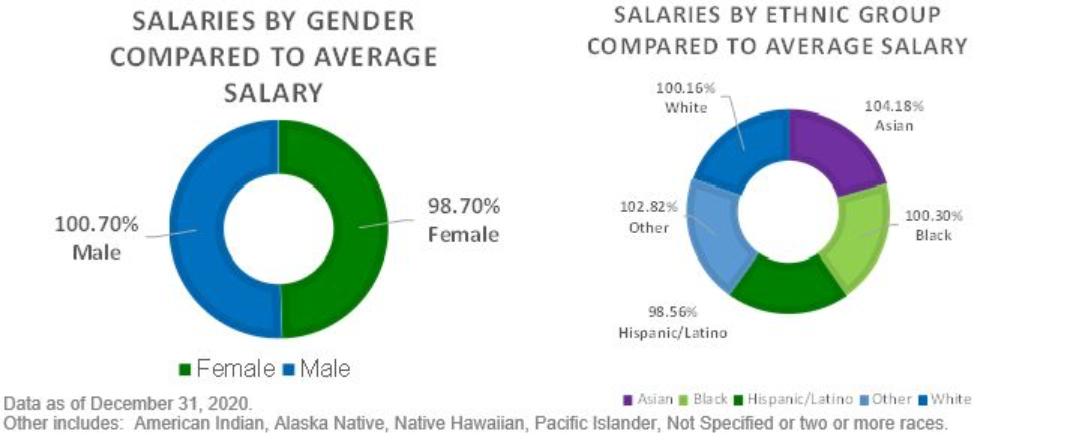

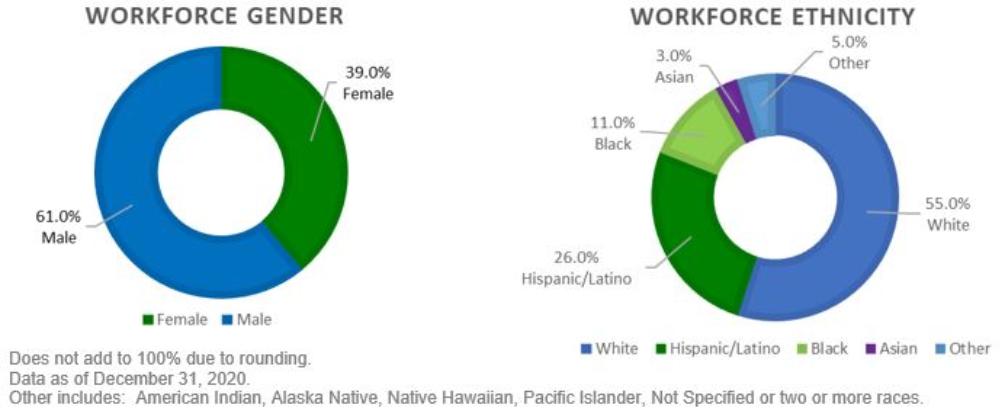

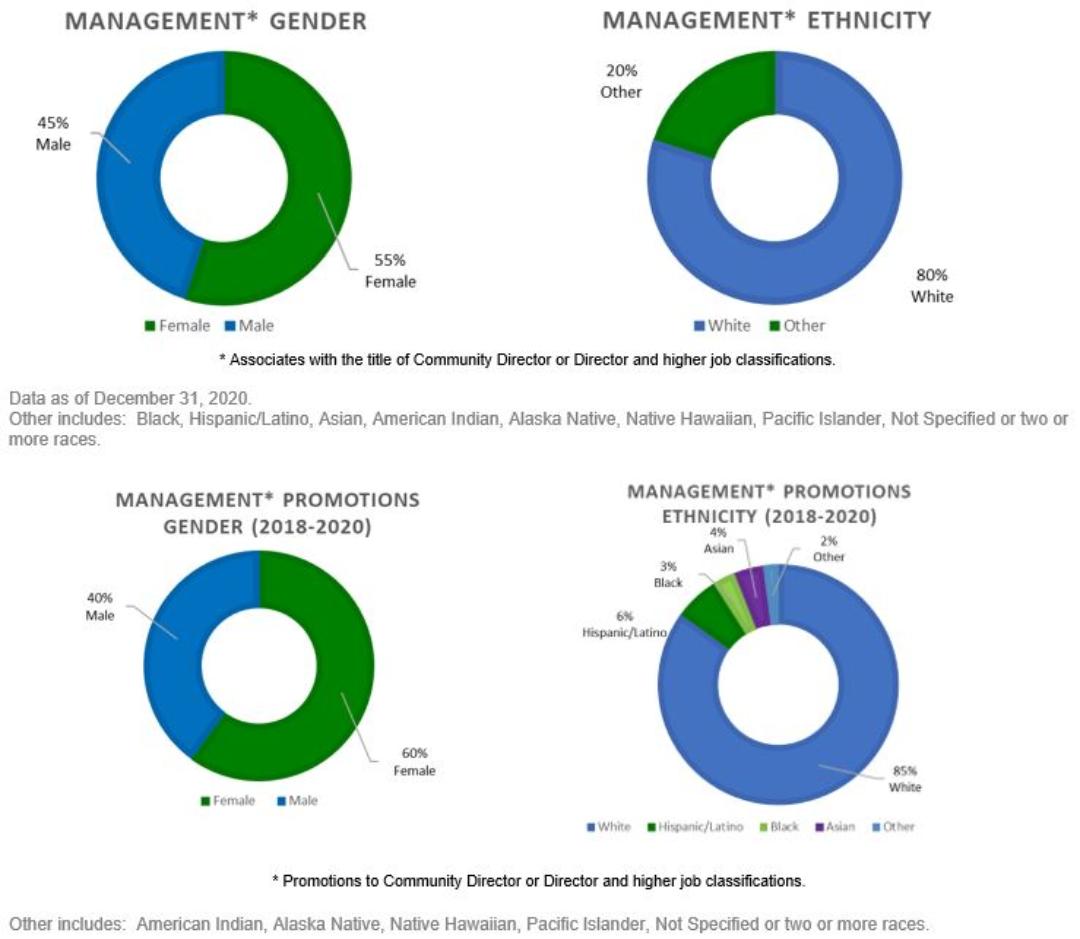

Social - Human Capital

We have increased our disclosure of human capital related efforts in this proxy statement. See pages 42 through 45. Our associates and their collective engagement are a key driver of our success and ability to execute our strategic plan. Accordingly, we emphasize hiring and retaining associates with necessary skills while also fostering a culture that encourages inclusion and innovation. To ensure that we provide our associates the tools they need to succeed and drive our success, we have established a wide-ranging training program, which also fosters career mobility opportunities. In 2020, we enhanced the training available to our associates, both through a more robust set of mandatory learning modules as well as the expansion of our library of elective training courses. Regarding UDR’s culture, in 2020, we updated our culture statement and launched an associate-facing website devoted to our cultural values to ensure our associates understand our values and have an opportunity to participate in their evolution. Diversity, equity and inclusion (“DEI”) are also important in the hiring and retaining of associates and to our business generally. Accordingly, beginning in 2020 and continuing into 2021, we are formalizing our DEI efforts and have created a committee dedicated to overseeing those efforts. In addition, we have created a high-level DEI strategy and more focused implementation plan, both of which have been discussed with the board. Pursuant to the plan, we retained a third-party consultant with the appropriate expertise to survey all UDR associates on DEI topics. Our consultant then conducted focus groups with UDR associates at all levels of the Company to ensure we have the appropriate feedback and information to help guide our efforts. Based on the results of the survey and focus groups, we are creating programs designed to specifically target and therefore strengthen our DEI efforts. The results should also help us to create DEI-related goals against which we can measure our progress, which will be reported to the board at least annually. Last, understanding that our associates’ mental well-being is important, in 2020 we created and distributed to all associates a brochure outlining mental health resources available to them under our benefit plans. As further described below, we also include metrics in our short-term compensation program for the “Health of the Workforce” and for ESG/DEI. In addition, we report to the board on human capital issues on a regular basis.

Governance

Similar to recent years, we made governance-related changes in 2020. In October, Diane M. Morefield was appointed to the board, furthering our board refreshment efforts. Thirty-three percent (33%) of our board is now comprised of female directors. In addition, in early 2020 our board formally adopted a “Rooney Rule” with respect to board refreshment and to enhance third-party led search efforts related to succession planning for the role of chief executive officer. While we have always considered board and senior officer candidates with a wide variety of backgrounds and traits, the explicit inclusion of this rule in our governance documents formalizes our efforts to increase diversity amongst our board and senior officer ranks.

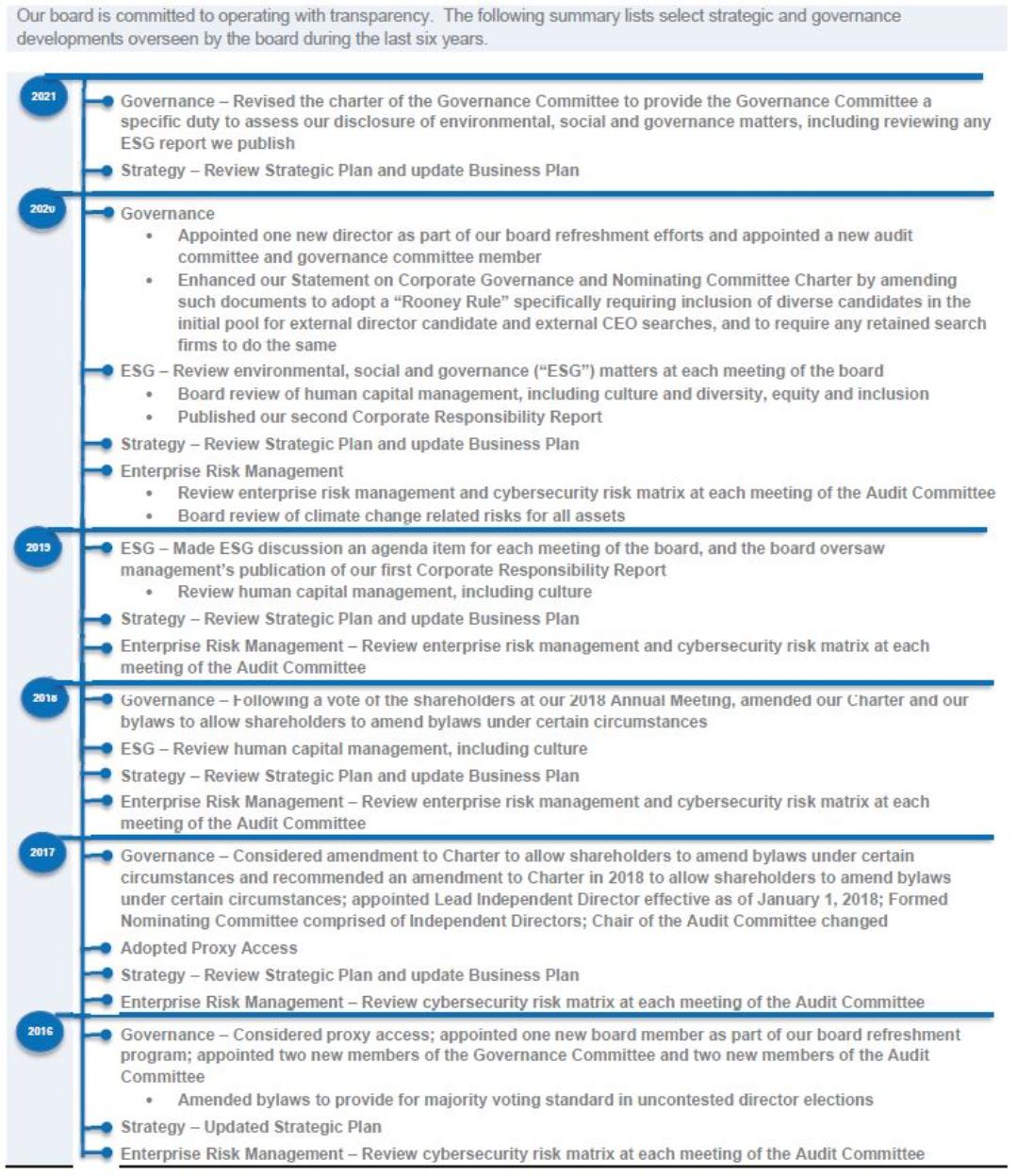

In addition, in early 2021 we adopted changes to certain of our governance documents including a change to the charter of the Governance Committee to provide that the Governance Committee will assess our disclosure of ESG matters, including reviewing any annual reports published with respect to such matters. See pages 24 through 36.

6 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

Compensation

Over time, we have enhanced the framework used to align short-term and long-term executive compensation with business results, including tying specific compensation metrics to our business plan. However, executive compensation remains a primary topic of conversation with our shareholders and other stakeholders each year. In response to comments we have received, and in connection with the approval of the Amended and Restated 1999 Long-Term Incentive Plan (see Proposal No. 4), we are changing certain features of our incentive compensation plan in 2021. These changes include replacing a “single-trigger” acceleration provision upon a change of control with a “double-trigger” provision and, generally, requiring all equity grants to have a minimum vesting period of 12 months. Also, for 2021, we added an ESG/DEI metric to our short-term incentive program for senior officers, including our named executive officers, to tie a portion of their compensation to our results with respect to our ESG and DEI efforts. The new ESG/DEI metric complements the Health of the Workforce metric added in 2019. See discussion starting on page 48.

7 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

| | | | |

Executive Compensation Highlights | ||||

Say-on-pay approved every year since it was first introduced in 2011; over the last five years, shareholder support for the vote on executive compensation has averaged 87%.

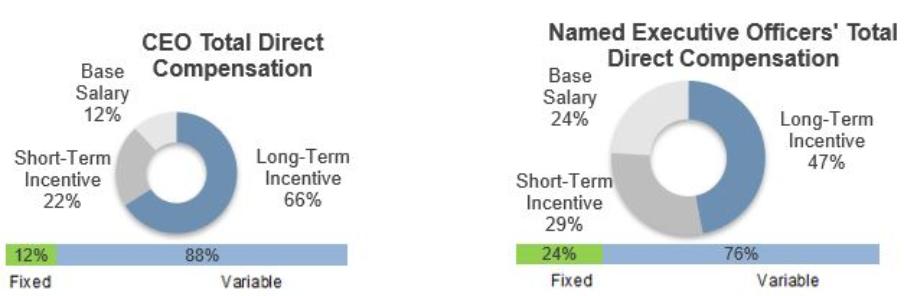

Focus on Variable Pay Linked to both Short-Term and Long-Term Performance

Focus on Performance-Based Compensation

Our focus on equity-based compensation, together with our robust CEO and executive stock ownership guidelines of 110,000 shares for the CEO and the President, 50,000 shares for any Executive Vice President and 20,000 shares for any Senior Vice President, assist in creating long-term alignment with our shareholders.

| |||

Compensation Framework | |||

| Salary | Short Term Incentive Plan | Long Term Incentive Plan |

Who Receives | All Named Executive Officers | All Named Executive Officers | All Named Executive Officers |

When Received | Annually | Annually, generally in February of the year following the end of the performance period | Annually, generally in February of the year following the end of the applicable performance period |

Form | Cash | Cash or Equity (decision made by executive in prior year) | Equity |

Performance Period | Continuous | 1 Year | Typically 3 Years for 70% of Award; 1 Year for 30% of Award |

How Payment Determined | Committee Judgment | Performance Metrics for 70%; Individual Performance for 30% | 100% Performance Metrics |

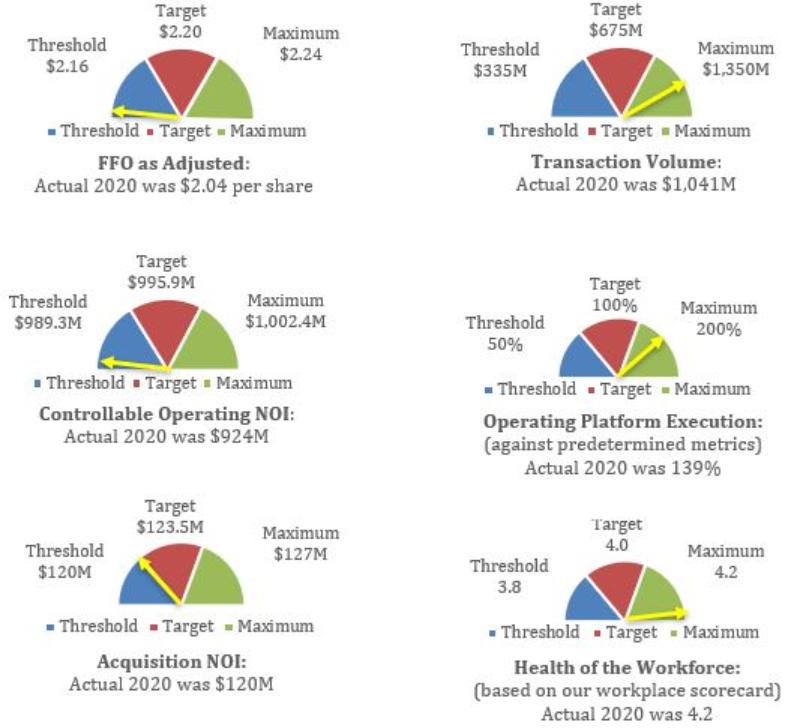

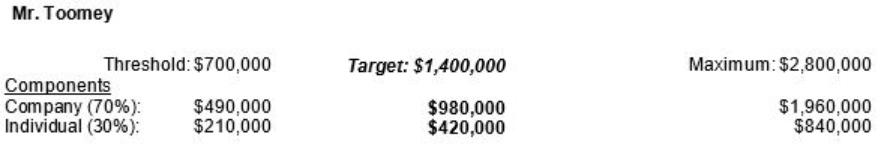

Due to the high percentage of the compensation of our named executive officers that is variable and based on the performance of the Company, the effects of the COVID-19 pandemic negatively impacted the compensation earned by our named executive officers in 2020 (see page 57).

8 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

| | | | |

Corporate Governance Highlights | ||||

Shareholder Engagement

In 2020 and early 2021, we had 517 interactions with our investors through meetings and property tours, representing ownership of approximately 84.1% of our outstanding common stock. In addition, we proactively contacted the governance or stewardship departments of 110 of our investors and received responses from and had engagement meetings with representatives of 29 of such departments, representing ownership of approximately 44.3% of our outstanding common stock.

Proxy Access

The Company’s Amended and Restated Bylaws (“bylaws”) include a proxy access provision, which permits a shareholder, or a group of up to 20 shareholders, owning 3% or more of the Company’s outstanding common stock continuously for at least three years, to nominate and include in the Company’s proxy materials director candidates constituting up to 20% of the board.

Majority Voting

The Company’s bylaws specify a majority voting standard in uncontested director elections, which incorporates a director resignation policy for any director who does not receive the requisite vote.

Bylaw Amendment

Prior to our 2018 annual meeting, we reached out to shareholders holding approximately 74% of our outstanding common stock regarding a proposed amendment to our bylaws. Following such discussions, we amended our charter and our bylaws to provide that a shareholder, or a group of up to 20 shareholders, owning 3% or more of the Company’s outstanding common stock continuously for at least three years, may propose binding amendments to our bylaws. In order to implement the amendment to our bylaws we were required to amend our charter, which previously provided that our bylaws could only be amended by our board. The amendment to our charter received the approval of 74% of the votes cast.

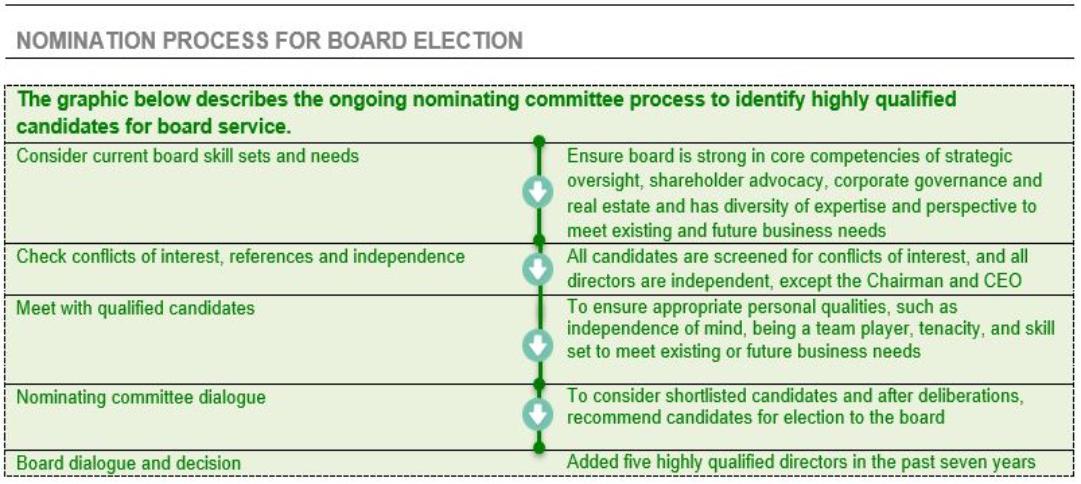

Succession Planning

We remain focused on refreshing the membership of the board. Over the past seven years, we have added five new independent directors to the board, most recently including the addition of Diane M. Morefield in 2020, Clint D. McDonnough in 2016, and Mary Ann King in 2015.

To formalize our commitment to seeking diverse candidates for open board positions, in early 2020 our board adopted modifications to our Statement on Corporate Governance and our Nominating Committee Charter to enhance such documents by adopting a “Rooney Rule” specifically requiring that diverse candidates, based on gender and ethnicity, be included in the initial pool for any external search for director candidates and any external search for a Chief Executive Officer, and to further provide that any search firm used for conducting any such search is required to include such candidates in its initial pool of candidates. While our board has always considered diverse candidates in such searches, these modifications formalize our continued commitment to diversity.

We also focus on the development of our executive management team. Effective January 1, 2021 two Vice Presidents were promoted to Senior Vice Presidents and the titles and roles of other members of management were changed. In 2019, the board appointed Jerry A. Davis to President – Chief Operating Officer and five Vice Presidents were appointed to Senior Vice President. Further, over the three years ending December 31, 2020, 740 of our associates were promoted, building a deeper and more diverse associate pool. Of associates that were promoted to the positions of community director or director, or a higher job classification, over such three year time period, 60% were female and 15% were of ethnic backgrounds other than White.

We have also formalized our efforts with respect to diversity, equity, and inclusion for the Company. Our efforts have been discussed with our board and include formation of a committee dedicated to overseeing our efforts in this area, engagement of a consultant with expertise in the area to help guide our efforts, and an all associate survey to help identify potential areas of focus.

Lead Independent Director

In 2017, our board determined that it was appropriate to appoint our Chief Executive Officer and President, Thomas W. Toomey, as Chairman of the Board, and, in connection therewith, to appoint James D. Klingbeil as Lead Independent Director in accordance with our governance standards. Such appointments were effective January 1, 2018.

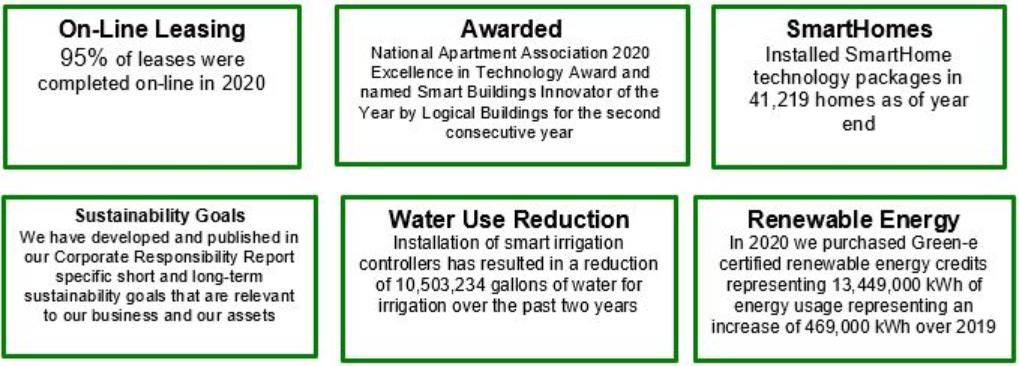

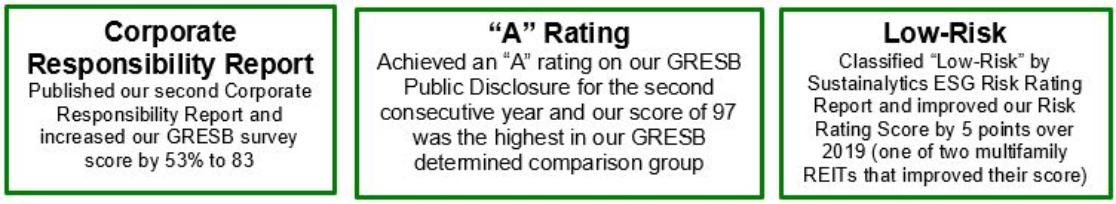

Corporate Responsibility

Because of its importance to our stakeholders including our associates, residents and investors, we have made corporate responsibility a part of our culture. Building on our efforts in 2019 and previous years, we had many successes in this area in 2020. In 2020 we again reported to GRESB and based upon our submission we received a survey score of 83 and, for

9 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

the second consecutive year, a GRESB Public Disclosure rating of “A”. Our survey score of 83 resulted in our earning a “4 Star” designation from GRESB, and our disclosure score of 97 was the highest within the GRESB determined comparison group. In addition, in October of 2020 we published our second annual Corporate Responsibility Report. The 2020 report was significantly enhanced by the inclusion of SASB real estate specific disclosures with respect to energy management, water management, management of tenant sustainability, and climate change adaption as well as the addition of the TCFD framework enhancing our disclosure around climate-related management. In addition, in 2020 we obtained, and published in our Corporate Responsibility Report, independent third party assurance that our processes for measuring, compiling, and reporting primary electric, gas, water, and GHG-based metrics are accurate and complete.

We take an inclusive approach to corporate responsibility, addressing not only governance, see pages 24 through 36, but also the impact that our efforts have on the lives of our associates and our residents and the communities of which we are a part, as well as the impact of our apartment communities on the environment. Some highlights with respect to our associates and residents are set forth elsewhere in this proxy statement, see pages 42 and 46. In particular, in 2020 we formalized our approach to diversity, equity and inclusion and revised our culture statement and associate communication with respect to our culture and we include metrics in our short-term compensation program for senior management that are based on our success in these areas. With respect to our communities, for a number of years we have considered environmental impacts when making decisions regarding acquisitions, development and re-development:

COVID-19 Pandemic

The COVID-19 pandemic negatively impacted not only our business, but also our residents and associates, and required targeted and intentional responses. With respect to our residents, we worked with those residents who experienced financial hardship by, among other things, providing payment plans, allowing for payment by credit card without an additional fee, providing installment payment options without an additional fee, and, in certain markets, waiving late fees and foregoing rent increases. We also have created processes to assist residents who qualify in seeking governmental rent assistance funds. In addition, we enhanced our cleaning protocols, provided residents with opportunities to participate in virtual activities, and, using technologies incorporated into our Next Generation Operating Platform, expanded services available to residents and potential residents in a non-contact manner, for example by expanding the activities available to be completed on our app and by increasing the use of self-guided tours and adding virtual tours. With respect to our associates, we offered additional time-off, one-time bonuses, flexible work schedules, work-from-home options, vacation buy-out programs, mental wellness programs and other benefits to assist with addressing the impacts of COVID-19 on associates and their families. We also utilized our governmental affairs group, which was formed in early 2020, to track and report on a daily basis legislation and regulation on federal, state and local levels to help ensure we were aware of the rapidly changing regulatory landscape

10 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

PROXY SUMMARY

This summary highlights selected information about the items to be voted on at the annual meeting. This summary does not contain all of the information that you should consider in deciding how to vote. You should read the entire proxy statement carefully before voting.

Meeting Agenda and Voting Recommendations

| | | | |

| Election of 9 Directors | | ||

|

| The Board recommends a vote FOR each of the director nominees. | | |

| | ● | Diverse slate of directors with broad leadership experience. | |

| | ● | All candidates are highly successful executives with relevant skills and expertise. | |

| | ● | Average director tenure of 11.8 years with 8 of 9 directors to be voted upon independent of management. | |

| | | | |

| | |

| |

| | | | |

Our Existing Board

| | Years of Tenure | | # of Other Public Company Boards | | | Committee Memberships (2) | ||||||||||||

Name | Principal Professional Experience (1) |

|

| | AC | CC | GC | NC | EC | ||||||||||

Katherine A. Cattanach | General Partner of INVESCO Private Capital, Inc. | | | 15 | 0 |

| |

| |

| |||||||||

Jon A. Grove | Chairman, President and CEO of ASR Investments Corporation | | | 23 | 0 | |

| | | ||||||||||

Mary Ann King | Co-Head of Financial Services and Head of Institutional Sales of Berkadia | | | 6 | 0 |

| |

| | | |||||||||

James D. Klingbeil(3) | Chairman and CEO of Klingbeil Capital Management and The Klingbeil Company | | | 23 | 0 | | | | C | C | |||||||||

Clint D. McDonnough | Office Managing Partner for Ernst & Young LLP’s Dallas office | | | 5 | 1 | C | | |

| | |||||||||

Robert A. McNamara | Group Chief Risk Officer of Lend Lease Corporation | | | 7 | 1 | |

| C |

| | |||||||||

Diane M. Morefield(4) | Executive Vice President, Chief Financial Officer of CyrusOne | | | 0 | 1 |

| |

| | | |||||||||

Mark R. Patterson | President of MRP Holdings LLC | | | 7 | 3 | | C | |

| | |||||||||

Thomas W. Toomey(5) | Chairman and CEO of UDR, Inc. | | | 20 | 0 | | | | |

| |||||||||

| ||

(1) | The professional experiences listed for Dr. Cattanach, Messrs. Grove, McDonnough and McNamara, and Ms. Morefield are these nominees’ former principal occupations.. | |

(2) | Committee assignments for the period from the 2021 annual meeting to the 2022 annual meeting will be made after the annual election of directors at the 2021 annual meeting. | |

(3) | Lead Independent Director. | |

(4) | Ms. Morefield was appointed to the Board of Directors in October 2020. | |

(5) | Chairman and Chief Executive Officer. | |

KEY: AC = Audit and Risk Management Committee CC = Compensation and Management Development Committee GC = Governance Committee | ||

11 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

Information About Our Board And Committees (Page 34)

| | | | | | |

| | Number of Members |

| Independent | | Number of Meetings During 2020 |

Full Board of Directors |

| 9 | | 88.9% | | 8* |

Audit and Risk Management Committee |

| 4 | | 100.0% | | 8 |

Compensation and Management Development Committee |

| 3 | | 100.0% | | 6 |

Governance Committee |

| 4 | | 100.0% | | 4 |

Nominating Committee | | 4 | | 100.0% | | 1* |

Executive Committee |

| 3 | | 66.7% | | 0 |

___________

* Also acted by unanimous written consent during the year.

The number of meetings of the board as well as communication to the board increased in 2020 as a direct result of COVID-19.

GOVERNANCE HIGHLIGHTS (Page 24)

UDR has a history of strong corporate governance guided by three primary principles – dialogue, transparency and responsiveness. The board has adjusted our governance approach over time to align with evolving best practices, drive sustained shareholder value and best serve the interests of shareholders. | |||

Shareholder |

| Annual election of all directors | |

Rights |

| Majority voting in uncontested director elections | |

|

| Proxy access for eligible director candidates nominated by eligible shareholders | |

|

| No shareholder rights plan (poison pill) | |

|

| Confidential voting | |

|

| No material restrictions on shareholders’ right to call a special meeting | |

|

| Active shareholder engagement with holders of approximately 84.1% of outstanding shares in 2020 and early 2021 | |

|

| Ability for shareholders to propose binding bylaw amendments | |

Independent Oversight |

| Strong Lead Independent Director role with clearly articulated responsibilities | |

| Audit, Compensation, Governance and Nominating Committees consist entirely of Independent Directors | ||

|

| All directors are independent, except the Chairman and Chief Executive Officer | |

|

| Independent directors meet regularly in executive session | |

Good Governance |

| Extensive board dialogue with formal processes for shareholder engagement and frequent cross-committee and board communications | |

| Annual board and committee self-evaluations | ||

|

| Annual individual director evaluation process | |

|

| Periodic continuing education for directors | |

|

| All directors attended at least 75% of meetings held Policies requiring the initial pools of candidates for the board of directors and external searches for a Chief Executive Officer to include diverse candidates | |

|

| Annual advisory approval of named executive officer compensation | |

|

| Robust Code of Business Conduct and Ethics, and Code of Ethics for Senior Financial Officers | |

|

| Stock ownership guidelines for executive officers and directors | |

|

| Prohibition on hedging transactions | |

|

| Pledging transactions prohibited without prior approval | |

|

| Policy on recoupment of performance-based incentives No employment agreements with executives Annual ESG reporting Double-trigger acceleration of vesting in the event of a change in control Twelve month minimum vesting on awards generally Board and committee oversight of material risks, ESG and human capital management | |

12 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

| Independent Registered Public Accounting Firm | | ||

|

| The Board recommends a vote FOR ratification of Ernst & Young LLP for 2021. | | |

| | ● | Independent firm with few ancillary services and reasonable fees. | |

| | ● | Significant industry and financial reporting expertise. | |

| | | | |

| | |

| |

| | | | |

Ernst & Young LLP, independent registered public accounting firm, served as our auditors for fiscal 2020. Our Audit Committee has selected Ernst & Young LLP to audit our financial statements for fiscal 2021. Although it is not required to do so, the board is submitting the Audit Committee’s selection of our independent registered public accounting firm for ratification by the shareholders at the annual meeting in order to ascertain the view of our shareholders regarding such selection. Below is summary information about Ernst & Young’s fees for services during fiscal years 2020 and 2019:

Description of Services |

| 2020 |

|

| 2019 |

| ||

Audit Fees |

| $ | 1,512,986 |

|

| $ | 1,813,186 |

|

Audit-Related Fees |

|

| — |

|

|

| — |

|

Tax Fees |

|

| 36,928 |

|

|

| 106,539 |

|

All Other Fees |

|

| — |

|

|

| — |

|

TOTAL |

| $ | 1,549,914 |

|

| $ | 1,919,725 |

|

13 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

| | | | |

| Say-on-Pay: Advisory Vote on the Compensation of the Named Executive Officers | | ||

|

| The Board recommends a vote FOR this proposal. | | |

| | ● | Independent oversight by our Compensation and Management Development Committee, with the | |

| | ● | Executive compensation comprised of a mix of base salary, short-term incentive compensation and | |

| | ● | Executive compensation that is competitive with our peers and that is structured to be aligned with total return to shareholders and our strategy. | |

| | ● | Our total shareholder return compares favorably to the peer group. | |

| | | | |

| | |

| |

| | | | |

Executive Compensation Matters (Page 48)

We are requesting your non-binding vote to approve the compensation of our named executive officers as described on pages 48 through 86 of this proxy statement. The goals for our executive compensation program are to (i) attract, retain and motivate effective executive officers, (ii) align the interests of our executive officers with the interests of the Company, our shareholders, our associates and our residents, (iii) incentivize our executive officers based on clearly defined performance goals and measures of successful achievement, and (iv) align market competitive compensation with our long-term and short-term performance.

Our shareholders have consistently supported our executive compensation program. At our 2020 Annual Meeting of Shareholders, 83% of the votes cast were voted in favor of our resolution seeking advisory approval of our executive compensation. Over the last five years, shareholder support for our advisory vote on executive compensation has averaged 87% (with no year below 83%). While we have consistently had strong shareholder support for our executive compensation program, we do continue to engage in a dialogue with shareholders on executive compensation issues. We will continue to consider the outcome of future advisory votes on executive compensation when establishing the Company’s compensation programs and policies and making compensation decisions regarding our named executive officers. With respect to awards made in 2021 and thereafter, subject to shareholder approval (see Proposal No. 4), we have made changes to our compensation programs in part due to feedback we have received from shareholders. These changes include adding a “double-trigger”” acceleration provision in connection with a change of control and adding a minimum 12 month vesting provision, subject to specific exclusions.

14 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

| | | | |

| Approval of Amended and Restated 1999 Long-Term Incentive Plan | | ||

|

| The Board recommends a vote FOR this proposal. | | |

| | ● | The 1999 Amended and Restated 1999 Long-Term Incentive Plan has not been submitted to | |

| | ● | Increase the number of shares available for issuance from 19,000,000 to 35,000,000. | |

| | ● | Provide for double-trigger acceleration of vesting in connection with a change of control with respect to grants made in 2021 and thereafter. | |

| | ● | Provide for a minimum vesting period of one year, subject to certain exceptions described below, with respect to grants made in 2021 and thereafter. | |

| | | | |

| | |

| |

| | | | |

| | |

| | |

| Our Use of Abbreviations: We use a number of abbreviations in this proxy statement. We refer to UDR, Inc. as “UDR,” “the Company,” “we,” “us” or “our” and to our board of directors as the “board.” The term “proxy materials” includes this proxy statement, as well as the enclosed proxy card. References to “fiscal 2020” and “fiscal 2021” mean our 2020 fiscal year, which began on January 1, 2020 and ended on December 31, 2020, and our 2021 fiscal year, which began on January 1, 2021 and will end on December 31, 2021, respectively. We refer to the Audit and Risk Management Committee as the “Audit Committee.” We refer to the Compensation and Management Development Committee as the “Compensation Committee.” We refer to the U.S. Securities and Exchange Commission as the “SEC” and we refer to the New York Stock Exchange as the “NYSE.” Our 2021 Annual Meeting of Shareholders to be held on May 27, 2021 is simply referred to as the “meeting” or the “annual meeting.” | |

15 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

The nine individuals listed below, each of whom is currently a member of the board, have been nominated for election to the board at the 2021 annual meeting of shareholders. If any of the nominees is unable or declines to serve as a director at the time of the meeting, the proxies will be voted for any nominee who is designated by the present board to fill the vacancy. It is not expected that any nominee will be unable or will decline to serve as a director. The directors elected will hold their respective offices until the next annual meeting of shareholders or until their successors are elected and qualified.

Each nominee brings a strong and unique background and set of skills to our board, giving the board as a whole competence and experience in a wide variety of areas of value to the Company, including corporate governance and board service, executive management, corporate finance and financial markets, real estate investment and the real estate industry and civic leadership. For each of our director nominees, set forth below are the specific experience, qualifications, attributes or skills that led the board to conclude that the person should serve as a director for the Company. There is no family relationship between any of our directors or executive officers.

16 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

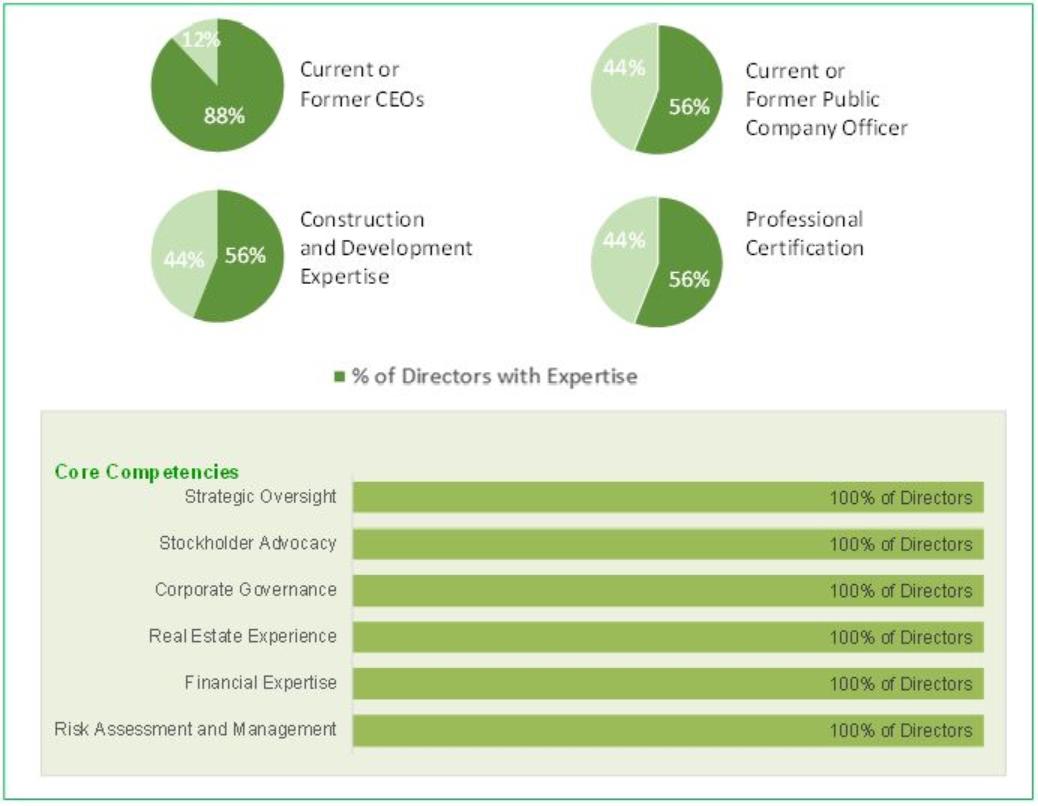

Board Expertise

At UDR, we believe that diversity of background and perspective is an important attribute of a well-functioning board. Collectively, the members of our board standing for election embody a range of viewpoints, backgrounds and expertise. Currently, 33% of the members of our board are women and, while our board does not currently have members who represent underrepresented populations, all recent searches have included ethnically diverse candidates (utilizing search firms with specific expertise with underrepresented populations) and we have adopted a “Rooney Rule” for all board searches. The diversity of our board will continue to be a point of focus in connection with our board refreshment efforts:

17 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

| KATHERINE A. CATTANACH, PH.D. | |

| JON A. GROVE | ||||

| Age: | 76 | | | Age: | 76 | ||

| UDR Board Service | | | UDR Board Service | ||||

| ● | Tenure: 15 years (2006) | | | ● | Tenure: 23 years (1998) | ||

| ● | Audit Committee | | | ● | Compensation Committee | ||

| ● | Executive Committee | | | | | ||

| ● | Governance Committee | | | | | ||

| | | | | | | ||

| | Independent | | | | Independent | ||

| | | | | | | | |

Professional Experience ● Former General Partner of INVESCO Private Capital, Inc. (formerly Sovereign Financial Services, Inc.), a company specializing in private equity investments, from 1987 to 2005. Relevant Skills ● Currently a member of the Institute of Chartered Financial Analysts. ● Has a strong background in both business and academia, and her expertise in investments and finance is recognized nationally and internationally. ● Has executive management experience, having served as Founder and Chief Executive Officer of Sovereign Financial Services, Inc. and as Executive Vice President of Captiva Corporation. ● Has a Ph.D. in Finance and has served on the faculty of the College of Business at the University of Denver and as an Associate Professor of Finance at the University of Denver’s Graduate School of Business. Other ● Former Secretary and a member of the Board of Trustees of Great Outdoors Colorado. She is active in, and serves as a member of, numerous charitable organizations. ● Member of the board of directors and chair of the audit committee of Great West Trust Company. ● Extensive civic leadership, including the Colorado Commission on Higher Education, the Governing Board for the Colorado State University System, the Foundation for Metropolitan State College, the Board of Trustees for the Colorado Chapter of the Nature Conservancy and the Board of Trustees for the Yellowstone Association. ● From 2005 to March 2006, she served as a director and member of the audit and compensation committees of Collect America, Ltd. ● Has served as a member of several corporate boards and board committees and on several partnership advisory boards. | | Professional Experience ● Former Chairman, President and Chief Executive Officer of ASR Investments Corporation from its organization in 1987 until our acquisition of ASR in 1998. ● Former Chairman and director of American Southwest Holdings, LLC and SecurNet Mortgage Securities LLC. Relevant Skills ● From 1987 to 1998, served as the Chairman, President and Chief Executive Officer of a publicly traded real estate investment trust that owned and operated apartment communities. | ||||||

18 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

| MARY ANN KING | |

| JAMES D. KLINGBEIL | ||||

| Age: | 68 | | | Age: | 85 | ||

| UDR Board Service | | | UDR Board Service | ||||

| ● | Tenure: 6 years (2015) | | | ● | Tenure: 23 years (1998) | ||

| ● | Audit Committee | | | ● | Lead Independent Director | ||

| ● | Governance Committee | | | ● | Executive Committee Chair | ||

| | | | | ● | Nominating Committee Chair | ||

| | | | | | | ||

| | Independent | | | | Independent | ||

| | | | | | | | |

Professional Experience ● Co-Head of Investment Sales and the Head of Institutional Sales for Berkadia, a privately-held commercial real estate firm that provides multifamily and commercial clients with a suite of services that include investment sales, mortgage banking and servicing. ● Formerly, Ms. King was the Co-Chairman of Moran & Company, a real estate brokerage firm focusing exclusively on multifamily assets and mixed-use assets with significant multifamily components, whose investment sales operations were purchased by Berkadia in January of 2021. Relevant Skills ● Ms. King has been in the apartment industry since 1983. ● Has served three terms as a Urban Land Institute (ULI) Trustee. ● Is currently a member of the National Multifamily Housing Council’s Executive Committee. ● Previously served on the National Multifamily Housing Council’s Leadership Team from 2000 to 2008 and was Chair of that organization from 2006 to 2008. Other ● Over the Rainbow Association – Member of the Board of Directors, Member of the Executive Committee and Development Committee and Member and Chairman of the Association’s LIFE Fund. ● Member of the Advisory Board of Sack Properties. ● Full Member of ULI and Member of MFC-Blue Product Council; former Trustee from 2012-2015 and former Product Council Counselor for all four Multifamily Product Councils. | | Professional Experience ● Lead Independent Director since January 2018. ● Chairman of the Board of Directors from March 2010 to December 2017 and Vice Chairman of the Board from October 2000 until March 2010. ● Chairman of Klingbeil Capital Management and The Klingbeil Company. ● Chairman and Chief Executive Officer of American Apartment Communities II from 1995 until its merger with the Company in December of 1998. ● He currently serves as a director of numerous private companies and on the Board of Trustees of The Ohio State University. He is also the past Chairman and a lifetime member of the Board of Trustees of the Urban Land Institute and a member of the ULI Foundation Board. Relevant Skills ● Mr. Klingbeil has been active in nearly every aspect of real estate investment, development and management for over 60 years, with a special focus on building, acquiring, managing and/or selling multifamily communities. ● Chairman and Chief Executive Officer of American Apartment Communities II, which had a value of $800 million when we acquired it in December 1998, and he has demonstrated exceptional leadership abilities as a member of our board since that acquisition. | ||||||

19 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

| CLINT D. MCDONNOUGH | |

| ROBERT A. MCNAMARA | ||||

| Age: | 66 | | | Age: | 67 | ||

| UDR Board Service | | | UDR Board Service | ||||

| ● | Tenure: 5 years (2016) | | | ● | Tenure: 7 years (2014) | ||

| ● | Audit Committee Chair | | | ● | Compensation Committee | ||

| ● | Nominating Committee | | | ● | Governance Committee Chair | ||

| | | | | ● | Nominating Committee | ||

| | | | | | | ||

| | Independent | | | | Independent | ||

| | | | | | | | |

Professional Experience ● Managing Partner of McDonnough Consulting LLC, a consulting firm, since May 2016. ● Served 38 years for Ernst & Young LLP before retiring in June, 2015. ● In his role as Office Managing Partner for Dallas, Texas, he was responsible for day-to-day practice operations. ● Prior to serving as the Office Managing Partner, Mr. McDonnough was the firm’s Managing Partner of Assurance & Advisory Business Services for the Southwest Area practice. He also served as Ernst & Young’s National Director of Real Estate Advisory Services. Relevant Skills ● Served as Ernst & Young’s National Director of Real Estate Advisory Services, creating a unified national real estate consulting practice. ● Has an extensive background in accounting, auditing and advisory services, having worked for 38 years with Ernst & Young LLP, including as the firm’s Office Managing Partner for Dallas, Texas, as Managing Partner of Assurance & Advisory Business Services for the Southwest Practice Area and as Director of Real Estate Advisory Services. Other ● Mr. McDonnough serves on the board of directors and is chair of the audit committee of Forterra (Nasdaq), a manufacturer of water and drainage pipe and products, and previously served on the board of directors and as chair of the audit committee of Orix USA, a diversified financial services company. ● Currently a board member of the Dallas City Council. ● Active in, and previously served on the boards of, several charitable, civic and educational organizations. | | Professional Experience ● Former Group Chief Risk Officer of Lend Lease Corporation (ASX), an international property and infrastructure firm from 2014 to 2017. ● Former Chief Executive Officer Americas of Lend Lease Corporation (ASX) from 2010 to 2014. ● Former Chairman and Chief Executive Officer of Penhall/LVI International, an environmental remediation, concrete services and infrastructure repair firm, from 2006 to 2010. ● Mr. McNamara held various positions at Fluor Corporation, a global engineering and construction company, from 1996 to 2006, including Senior Executive and Group President. ● Mr. McNamara began his career at Marshall Contractors, Inc., a general contractor, where he held various positions from 1978 to 1996, including President and Chief Operating Officer. Relevant Skills ● Was responsible for ensuring Lend Lease achieves world’s best practice in risk management and operational excellence. He also oversaw Lend Lease’s Building, Engineering and Services business in Australia. ● Mr. McNamara is an accomplished senior executive with significant expertise in construction, development and real estate investment. ● He brings to the board over 35 years of experience managing global businesses in the development, design and delivery of projects in the government, institutional, infrastructure and industrial sectors in senior management positions. Other ● Member of the Board of Directors and a member of the audit committee of Jacobs Engineering Group, Inc. (NYSE), a provider of technical, professional and construction services. ● Former Board member of several privately-held firms. ● Mr. McNamara has also served on the board of the US China Business Council and as Chairman for the Construction Industry Institute’s Technology Implementation Task Force. | ||||||

20 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

| DIANE M. MOREFIELD | |

| MARK R. PATTERSON | ||

| Age: | 62 | | | Age: | 60 |

| UDR Board Service | | | UDR Board Service | ||

| ● | Tenure: <1 years (2020) | | | ● | Tenure: 7 years (2014) |

| ● | Audit Committee | | | ● | Compensation Committee Chair |

| ● | Governance Committee | | | ● | Nominating Committee |

| | | | | | |

| | | | | | |

| | Independent | | | | Independent |

Professional Experience ● Retired EVP and Chief Financial Officer of CyrusOne, a publicly-traded global data center REIT with revenue over $1 billion and a total enterprise value in excess of $12 billion, from 2016 through 2020. ● Former EVP and Chief Financial Officer of Strategic Hotels & Resorts, a publicly-traded hotel REIT, from 2010 to 2015. ● Prior to Strategic Hotels, Ms. Morefield was the SVP Operations of Equity Office and Chief Financial Officer of Equity International for 12 years. Relevant Skills ● Was responsible for CyrusOne’s accounting, finance, capital markets, tax, procurement and investor relations. During her tenure, she raised in excess of $13 billion of capital in numerous equity and debt transactions. She served on the executive leadership team that set strategy and oversaw the global expansion. ● Ms. Morefield is a financial and operating executive with over 35 years of experience in CFO and corporate executive roles, primarily of publicly-traded real estate companies (REITs). She has successfully led all aspects of finance organizations and has extensive experience in M&A, having been involved with multiple acquisitions and divestitures over the course of her career. Ms. Morefield’s career also includes public accounting, consulting and real estate commercial banking. Other ● Ms. Morefield currently serves on the Board of Directors of Copart Inc. (Nasdaq) where she is Chair of the Governance and Nominating Committee and a member of the Audit Committee. ● She also currently serves on the board, and is the Audit Committee Chair, of Link Logistics Real Estate, a logistics real estate portfolio owned by the Blackstone funds. ● She served six years on the Board of Directors of Spirit Realty Capital, Inc. (NYSE) and as their Audit Committee Chair. ● She has served on several other advisory and non-public boards. ● Ms. Morefield earned her BS in Accountancy from the University of Illinois and is a CPA. She has her MBA from the University of Chicago Booth School of Business. | | Professional Experience ● Currently a real estate consultant and financial advisor and is a director and President of MRP Holdings LLC. ● From September 2010 until March 2016, Mr. Patterson was Chairman, and until January 2015, Chairman and Chief Executive Officer, of Boomerang Systems, Inc., a manufacturer of fully automated, robotic parking systems. In August 2015, Boomerang Systems, Inc. filed for bankruptcy under Chapter 11 of the US Bankruptcy Code. ● Until January 2009, Mr. Patterson was a Managing Director and the Head of Real Estate Global Principal Investments at Merrill Lynch, where he oversaw the real estate principal investing activities of Merrill Lynch. Mr. Patterson joined Merrill Lynch in April 2005 as the Global Head of Real Estate Investment Banking and in 2006 he also became the Co-Head of Global Commercial Real Estate, which encompassed real estate investment banking, principal investing and mortgage debt. ● Prior to joining Merrill Lynch, Mr. Patterson spent 16 years at Citigroup, where he was the Global Head of Real Estate Investment Banking since 1996. ● Previously, Mr. Patterson was with Chemical Realty Trust in New York from 1987 to 1989, as an Associate in the Real Estate Investment Banking group and in the Real Estate Group at Arthur Andersen in Houston, Texas from 1982 to 1985. Relevant Skills ● Mr. Patterson has a strong background in real estate finance. During his tenure as Managing Director and Head of Real Estate Global Principal Investments at Merrill Lynch, Mr. Patterson oversaw investment banking, private equity and real estate debt. Other ● Mr. Patterson is Chair of the board of directors, Chair of the governance committee and was previously a member of the compensation committee and the investment committee of Americold Realty Trust (NYSE), a REIT focused on temperature-controlled warehouses, serves on the board of directors and is a member of the nominating and governance committee and compensation committee of Digital Realty Trust (NYSE), a REIT focused on data centers, and serves as lead director and is a member of the governance committee of Paramount Group, Inc. (NYSE), a REIT focused on Class A office properties. ● Between 2011 and 2017, Mr. Patterson served on the board of directors and was a member of the audit, compensation and governance committees of General Growth Properties, a REIT focused on shopping malls, which was listed on the NYSE until its acquisition in 2018. ● Mr. Patterson is an Advisory Director for Investcorp International, Inc., a global private equity manager, and a Senior Advisor to Rockefeller Capital Management, a private wealth management firm. | ||||

21 | UDR

PROXY STATEMENT and notice of annual meeting of SHAREHOLDERS | 2021 |

| THOMAS W. TOOMEY | | | | ||

| Age: | 60 | | | | |

| UDR Board Service | | | | ||

| ● | Tenure: 20 years (2001) | | | | |

| ● | Chairman of the Board | | | | |

| ● | Executive Committee | | | | |

| | | | | | |

| | | | | | |

| | | | | | |