- UDR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

UDR (UDR) CORRESPCorrespondence with SEC

Filed: 7 Feb 07, 12:00am

UNITED DOMINION REALTY TRUST, INC.

1745 Shea Center Drive

Suite 200

Highlands Ranch, Colorado 80129

February 7, 2007

VIA EDGAR

Mr. Daniel L. Gordon

Branch Chief

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

Mail Stop 4561

RE: United Dominion Realty Trust, Inc.

Form 10-K for the fiscal year ended December 31, 2005

Filed March 7, 2006

File No. 001-10524

Dear Mr. Gordon:

This letter is in response to your comment letter dated January 18, 2007 regarding the Annual Report on Form 10-K for the fiscal year ended December 31, 2005 filed by United Dominion Realty Trust, Inc. (the “Company”). For your convenience, we have set forth each of your comments below followed by our response to each comment.

Note 10. Commitments and Contingencies

Contingencies

Series C Out-Performance Program, page 66

1. Please provide us with more details regarding the valuation of the Series C Out-Performance shares. Specifically address whether you are arriving at the value of the Out-Performance shares by discounting the expected dividend stream, and if so specify the assumptions used for future dividend payments. In addition, tell us the basis for each of the assumptions you used to value the Series C Out-Performance shares. Tell us how you determined that it was

appropriate to take discounts to reflect the non-transferability of the shares and to reflect the increased potential tax liability of the holder. In your response provide us with the amount of each discount taken.

Response: The Company engaged Citigroup to advise the Compensation Committee on appropriate methodology for valuing the Series C Out-Performance limited liability membership interests (OPPS). Citigroup concluded that the Series C OPPS should be viewed, for valuation purposes, as a security having a non-transferable option-like component (i.e. during the period prior to the measurement date) and an illiquid income producing component (i.e. following the measurement date if the out-performance thresholds are met).(1) In other words, because the number of operating partnership (“OP”) units that will be earned if the out-performance thresholds are met will be determined in part by the stock price of the common stock on the measurement date, just valuing the income stream of the common stock would have ignored other market variables that form a part of the price of the common stock. Therefore, it was deemed appropriate to use a valuation methodology that would account for market influences on the value of the common stock prior to the measurement date and not just the discounted future dividends on the common stock.(2)

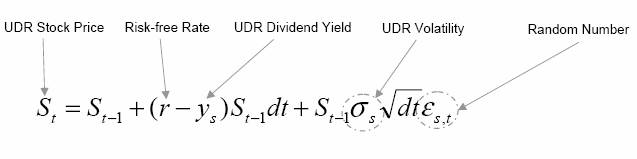

Consequently, the value of the OPPS was computed as the discounted expected value of those OPPS (less dividends at the current rate being paid on the Company’s common stock) under a basic Monte Carlo simulation methodology, using the calculation described in Appendix A. The dividend yield was assumed to remain constant. In addition, the valuation involved the assumption of a log-normal price with a risk-free drift, or rate of return, and an appropriate volatility.(3) Citigroup also looked at the historical volatility of the Company’s common stock, as well as the implied volatility from options traded on the Company’s common stock, and determined that a 15% volatility assumption was reasonable and appropriate. Using a 15% volatility assumption and applying a discount rate equal to the three-year Treasury rate, Citigroup estimated the present value of each OPPS (before applicable discounts) to be $4.28 at the time the Series C OPPS program was established.

Citigroup recommended, based on various research studies which are specified in Appendix B, that four discounts should be applied to the option value as follows:

a. a discount for the non-transferability of the option component in the range of 25%-50% was determined to be appropriate because the interests in the Series C OPPS program prior to the measurement date are not transferable by the participant;

(1) As discussed in response to question number 2, if the out-performance thresholds are not met, the value of the OPPS becomes zero and the program participant’s investment will be lost.

(2) Once the number of OP units is fixed on the valuation date, other market variables that affect the value of the common stock become less important in the valuation of the OPPS because the OPPS are not transferable by their holders and are only redeemable on the occurrence of a change of control. Consequently, as discussed in response to question 2 below, the OPPS and the Company’s shares of common stock are substantially different securities both in terms of the rights they represent and their values.

(3) By “log-normal” we mean that the distribution of the logarithms of the stock prices were assumed to have a normal distribution (i.e. a “bell curve” distribution).

b. a discount for the non-transferability of the underlying OPPS in the range of 25%-50% was determined to be appropriate because the participants cannot transfer the interests in the LLC after the measurement date (assuming the thresholds are met and the OPPS value is greater than zero);

c. a discount for potential taxes in the range of 20%-40% was determined to be appropriate because the income from the OPPS could be subject to higher tax rates than the dividends on, and appreciation in the price of, the Company’s common stock; and

d. a discount for pending dilution of 1% was determined to be appropriate because the OPPS would have a dilutive effect on the common stock, capped at 1% of the Company’s market value on the measurement date, in the event that they were redeemed upon a change of control.

Taking all of the above four discounts into consideration results in a total discount range of 55.5% to 85.1%. No forfeiture discount was used in determining the OPPS value.

The Company did not make individual assumptions on each discount; however, after deliberations with management, the Compensation Committee made a good faith determination that, based upon the Citigroup study, that an overall discount of 76.6% was appropriate, which resulted in a $1.00 per OPPS value.

2. Please provide us with the mathematical calculation demonstrating the difference between receiving a Series C Out-Performance share after the measurement period versus receiving a share of common stock after the measurement period.

Response: Although they are related because part of the value of the Company’s common stock reflects the expected present value to an investor of the dividend stream on the common stock, while the OPPS reflect the right to a comparable income stream, the two are distinct securities that do not represent the same rights. The value of a share of the Company’s common stock at measurement period’s end is the value of the Company’s common stock price as quoted on the New York Stock Exchange at the measurement time. That value, in addition to the present value of the expected dividend stream, includes other market variables that change from time to time.

In contrast, because neither the OPPS nor the underlying operating partnership units held by the LLC are transferable, the participants cannot immediately realize the value of the OPPS in the same way a shareholder can by selling a share of common stock into the market. As a result, other positive or negative market influences should not generally affect the value of the OPPS. The value of the Series C Out-performance interest after the measurement period is zero if the out-performance thresholds are not met. If the out-performance thresholds are met, then the value of the OPPS should be approximately equal to the Company’s common stock price at the measurement time discounted as described above ranging from

approximately 41% to 70%, excluding the non-transferability of options discount as the option component will have “vested” and no longer be a component of the security.

As disclosed in the Company’s proxy statement dated April 1, 2005 (the “2005 Proxy Statement”) in connection with the shareholder approval of the Series C Out-Performance Program, if the Company achieves a total return to shareholders of 48.86%, approximately $1.078 billion of additional shareholder value will have been created with the aggregate value of the OPPS estimated to be approximately $9.9 million. (See Appendix C attached hereto.) Based on the assumptions set forth in the 2005 Proxy Statement, at a 48.86% total return over the measurement period, the value of a share of common stock would be $29.00, while the implied undiscounted value of each OPPS would be approximately $13.20. Nevertheless, as discussed above, unlike a share of the Company’s common stock, neither the OPPS nor the operating partnership units held by the LLC are transferable, so the only way that a participant can realize the value of his or her investment in the OPPS, in the absence of a change of control, is by continuing to receive his or her proportionate share of the income stream received and distributed by the LLC. As a result, after applying the applicable discounts, the implied value of each OPPS would be approximately $3.96 to $7.79.

3. Please tell us how the company considered whether to consolidate the LLC.

Response: For convenience of reference, a diagram of the structure of the LLC and the Company is attached as Appendix D.

In January 2003, the FASB issued Financial Interpretation Number 46 (FIN 46), Consolidation of Variable Interest Entities, an Interpretation of Accounting Research Bulletin 51 (ARB 51). Paragraph 5 of FIN 46 states that an entity is subject to consolidation if any of the following conditions exists:

a. The total equity investment at risk is not sufficient to permit the entity to finance its activities without additional subordinated financial support provided by any parties, including equity holders.

b. As a group of holders of the equity investment at risk lack any one of the following three characteristics of a controlling financial interest:

i. The direct or indirect ability through voting rights or similar rights to make decisions about an entity’s activities that have a significant effect on the success of the entity.

ii. The obligation to absorb the expected losses of the entity.

iii. The right to receive the expected residual returns of the entity.

c. The equity investors as a group also are considered to lack characteristic (b) (i) if the voting rights of some investors are not proportional to their obligations to absorb the expected losses of the entity and substantially all of the entity’s activities either involve or are conducted on behalf of an investor that has disproportionately few voting rights.

In analyzing paragraph 5.a., the Series C Out-Performance LLC (LLC) has sufficient equity at risk. All of the outstanding membership interests in the LLC are owned by its members and the members have provided 100% of the equity at risk. Further, the LLC has no liabilities and no additional capital will be needed or required to finance the activities of the LLC.

In analyzing paragraph 5.b.i.-iii., the members participate directly in the activities of the LLC. Any profits or losses are shared by the members according to their respective ownership percentages.

Voting power is vested solely in the members and all matters requiring a vote are determined by a vote of the members. All business matters of the LLC are managed by a Board of Managers who are elected by the members. The members own all of the outstanding membership interests.

In analyzing paragraph 5.c., the members have voting rights, obligations to absorb losses and rights to participate in future earnings that are directly proportional to their ownership percentages.

Based on the above analysis, as the LLC does not meet the definition of a variable interest entity, it is not subject to consolidation under FIN 46. Therefore, consolidation of the LLC is determined under ARB 51.

ARB 51 states that “the usual condition for a controlling financial interest is ownership of a majority voting interest, and, therefore, as a general rule ownership by one company, directly or indirectly, of over fifty percent of the outstanding voting shares of another company is a condition pointing toward consolidation”. The Company does not have any financial interest in the LLC, does not own any membership interests of the LLC and is not entitled to vote on any matter requiring a vote of the members of the LLC.

The Board of Managers of the LLC consists of four persons who are elected by a vote of the members. The officers of the LLC are selected from among the members. The Company does not have contractual or other legal right or ability to elect or appoint members of the Board of Managers or to exert any control or influence over the activities and decision making process of the LLC. The Board of Managers is obligated to fulfill its fiduciary responsibility to the owners of the LLC membership interests. The Board of Managers of the LLC currently includes the Chairman of the Board of Directors of the Company and the Chairman of the Compensation Committee of the Company and two members.

None of the conditions under FIN 46 or ARB 51 have been met for consolidation; therefore, the Series C Out-Performance LLC has not been consolidated on the books of the Company.

We trust the responses above adequately address the Staff’s comments set forth in its comment letter dated January 18, 2007. Further, the Company hereby acknowledges that:

· the Company is responsible for the adequacy and accuracy of the disclosure in the filing;

· staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and

· the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Please direct any comments or inquiries regarding the foregoing to Brian V. Caid, Esq., of Morrison & Foerster LLP; telephone: (303) 592-2253; facsimile: (303) 592-1510 or the undersigned; telephone: (720) 283-6139; facsimile (720) 283-2451.

Sincerely,

/s/ David Messenger |

|

David Messenger

Senior Vice President and Chief Accounting Officer

cc: | William Demarest, U.S. Securities and Exchange Commission |

| Warren L. Troupe, Esq., Morrison & Foerster LLP |

| Robert Langer, Ernst & Young LLP |

Appendix A

Methodology

Sample Path for UDR

Underlying Dynamics

1

Option Description and Sample Calculation

· The option payoff is determined by the extent to which UDR “out-performs” the Morgan Stanley REIT index subject to an annualized hurdle return

· If UDR’s return is less than 12% on an annualized basis, then total “out-performance” is equal to zero

· If UDR’s total return is more than 12% on an annualized basis, then total “out-performance” is equal to UDR’s total return minus the total return of an investment that yields 12% on an annualized basis

· Total value at option expiration is equal to total “out-performance” multiplied by 2% of UDR’s average market capitalization

· Holders of the options receive UDR shares whose total value is equal to the total option value(1) subject to a “dilution cap” which limits the total shares distributed to be equal to at most 1% of the shares outstanding

Example

Time to Expiration | 3 years | Hurdle return = (1.12)3.0 — 1 = 40% |

|

|

|

UDR total return | 60% | Return hurdle = 40% |

|

|

|

UDR average market capitalization | $3.14bn | Out-performance = 60% - 40% = 20% |

|

|

|

UDR share price | $22.94 | Total payoff = 0.02 ´ $3.14 bn ´ 0.20 = $13 mm |

|

|

|

UDR current shares outstanding | 134mm | Total shares delivered = $12.3 mm/ $22.94 = 0.54 mm |

|

|

|

|

| Maximum possible shares = .01 ´ 134 mm = 1.34 mm |

(1) The price per share used in this calculation is UDR’s share price on 01/01/06, a proxy for the average price over the 20 trading days preceding option expiration

(2) UDR’s total market capitalization on 01/01/06 is used as a proxy for average market capitalization

2

Appendix B

Studies supporting discount assumptions:

Gelman Study, German, Milton, “An Economist-Financial Analyst’s Approach to Valuing Stock of a Closely Held Company,” JOURNAL OF TAXATION, June 1972, at p. 353.

Hall/Polacek (FMV) Study (1969-1992), Hall, Lance S. and Polacek, Timothy C., “Strategies for Obtaining the Largest Valuation Discounts,” ESTATE PLANNING, January-February, 1994, pp. 38-44.

Johnson Study, Johnson, Bruce, “Restricted Stock Discounts, 1991-95”, SHANNON PRATT’S BUSINESS VALUATION UPDATE, Vol. 5, No. 3, March 1999, pp. 1-3.

Maher Study, Maher, J. Michael, “Discounts for Lack of Marketability for Closely Held Business Interests,” TAXES – THE TAX MAGAZINE, September, 1976, pp. 562-571.

Management Planning Study, Mercer, Z. Christopher, QUANTIFYING MARKETABILITY DISCOUNTS: DEVELOPING AND SUPPORTING MARKETABILITY DISCOUNTS IN THE APPRAISAL OF CLOSELY HELD BUSINESS INTEREST, Memphis, Tennessee: Peabody Publishing, LP, 1997, pp. 345-370.

Moroney Study, Moroney, Robert E., “Most Courts Overvalue Closely Held Stocks,” TAXES – THE TAX MAGAZINE, March, 1973, pp. 144-155.

SEC Study, INSTITUTIONAL INVESTOR STUDY REPORT OF THE SECURITIES AND EXCHANGE COMMISSION (Washington, D.C.: U.S. Government Printing Office, March 10, 1971). The portion relating to the discounts observed with the issuance of restricted stocks is titled “Discounts Involved in Purchases of Common Stock,” at Volume 5:2444-2456, Document No. 92-64, Part 5.

Silber Study, Silber, William L., “Discounts on Restricted Stock: The Impact of Illiquidity on Stock Prices,” FINANCIAL ANALYSTS JOURNAL, July-August, 1991, pp. 60-64.

Stryker/Pittock Study, Pittock, William F. and Stryker, Charles H., “Revenue Ruling 77-287 Revisited,” SRC QUARTERLY REPORTS, Spring, 1983, pp. 1-3.

Trout Study, Trout, Robert R., “Estimation of the Discount Associated with the Transfer of Restricted Securities,” TAXES, June, 1977, pp. 381-385.

Willamette Management Study, Pratt, Shannon P., VALUING A BUSINESS, Third Edition, p. 341.

Bajaj/Denis/Ferris/Sarin Study, 2001, “Firm Value and Marketability Discounts”, Journal of Corporate Law, v27.

Appendix C

2005 Proxy Disclosure

Examples of the Value of Series C OPPSs

The following table illustrates the value of the Series C OPPSs under different share prices and Total Returns at the Valuation Date, assuming the starting price of our common stock for the valuation period was $22.00.

|

| Value of Stockholders |

| Value of Series C |

| ||||

Stock Price at Valuation Date |

| UDR Total |

| Stockholder Value |

| OPPSs |

| ||

|

|

|

| (Million) |

| (Million) |

| ||

$23.00 |

| 21.59 | % | $ | 173 |

| $ | — |

|

$24.00 |

| 26.14 |

| 324 |

| — |

| ||

$25.00 |

| 30.68 |

| 475 |

| — |

| ||

$26.00 |

| 35.23 |

| 625 |

| — |

| ||

$27.00 |

| 39.77 |

| 776 |

| 2.81 |

| ||

$28.00 |

| 44.32 |

| 927 |

| 6.29 |

| ||

$29.00 |

| 48.86 |

| 1,078 |

| 9.91 |

| ||

$30.00 |

| 53.41 |

| 1,229 |

| 13.67 |

| ||

$31.00 |

| 57.95 |

| 1,380 |

| 17.56 |

| ||

$32.00 |

| 62.50 |

| 1,531 |

| 21.59 |

| ||

$33.00 |

| 67.05 |

| 1,682 |

| 25.76 |

| ||

$34.00 |

| 71.59 |

| 1,833 |

| 30.07 |

| ||

$35.00 |

| 76.14 |

| 1,984 |

| 34.51 |

| ||

$36.00 |

| 80.68 |

| 2,135 |

| 39.09 |

| ||

$37.00 |

| 85.23 |

| 2,286 |

| 43.80 |

| ||

(1) Total Return to our stockholders, assuming a 3% dividend growth rate.

(2) Total Return multiplied by beginning market capitalization of $3.3 billion (based on 150,000,000 outstanding shares of common stock, common stock equivalents and OP Units, and an assumed per share price of $22.00 at the beginning of the Series C OPPSs).

(3) Out-Performance stockholder value multiplied by management participation of 2% subject to 1% dilution limit.

The numbers used in the table are for illustrative purposes only, and actual outcomes may not be within the ranges used. The results set forth in the table may be affected by the market value of our common stock during any Measurement Period, general economic conditions, local real estate conditions and our dividend policy.

1

Appendix D

Corporate Structure Diagram