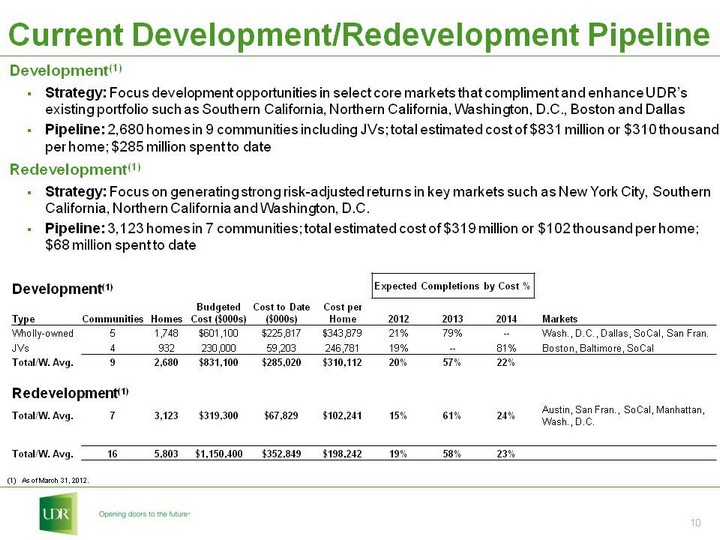

| Current Development/Redevelopment Pipeline Development(1) Strategy: Focus development opportunities in select core markets that compliment and enhance UDR's existing portfolio such as Southern California, Northern California, Washington, D.C., Boston and Dallas Pipeline: 2,680 homes in 9 communities including JVs; total estimated cost of $831 million or $310 thousand per home; $285 million spent to date Redevelopment(1) Strategy: Focus on generating strong risk-adjusted returns in key markets such as New York City, Southern California, Northern California and Washington, D.C. Pipeline: 3,123 homes in 7 communities; total estimated cost of $319 million or $102 thousand per home; $68 million spent to date As of March 31, 2012. Development(1) Development(1) Expected Completions by Cost % Expected Completions by Cost % Expected Completions by Cost % Type Communities Homes Budgeted Cost ($000s) Cost to Date ($000s) Cost per Home 2012 2013 2014 Markets Wholly-owned 5 1,748 $601,100 $225,817 $343,879 21% 79% -- Wash., D.C., Dallas, SoCal, San Fran. JVs 4 932 230,000 59,203 246,781 19% -- 81% Boston, Baltimore, SoCal Total/W. Avg. 9 2,680 $831,100 $285,020 $310,112 20% 57% 22% Redevelopment(1) Redevelopment(1) Total/W. Avg. 7 3,123 $319,300 $67,829 $102,241 15% 61% 24% Austin, San Fran., SoCal, Manhattan, Wash., D.C. Total/W. Avg. 16 5,803 $1,150,400 $352,849 $198,242 19% 58% 23% |