Exhibit 99.2

Attachment 4(A)

UDR, Inc.

Selected Financial Information(1)

(Unaudited)

| | | | | | | | |

| | | QTD Weighted | | | December 31, | |

Common Stock Equivalents | | Average | | | 2012 | |

Common shares | | | 249,808,619 | | | | 249,811,185 | |

Stock options and restricted stock | | | 1,282,569 | | | | 1,288,433 | |

Operating partnership units | | | 7,650,126 | | | | 7,643,543 | |

Preferred operating partnership units | | | 1,751,671 | | | | 1,751,671 | |

Convertible preferred Series E stock | | | 3,035,548 | | | | 3,035,548 | |

| | | | | | | | |

Total common stock equivalents | | | 263,528,533 | | | | 263,530,380 | |

| | | | | | | | |

| | | | | | | | |

Market Capitalization, In thousands | | Balance | | | % of Total | |

Total debt | | $ | 3,409,333 | | | | 35.2 | % |

Common stock equivalents at $23.78 | | | 6,266,752 | | | | 64.8 | % |

| | | | | | | | |

Total market capitalization | | $ | 9,676,085 | | | | 100.0 | % |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Gross | | | % of | |

| | | Number of | | | QTD NOI(1) | | | | | | Carrying Value | | | Total Gross | |

Asset Summary | | Homes | | | ($000s) | | | % of NOI | | | ($000s) | | | Carrying Value | |

Unencumbered assets | | | 27,700 | | | $ | 82,770 | | | | 66.3 | % | | $ | 5,733,770 | | | | 71.2 | % |

Encumbered assets | | | 13,871 | | | | 42,111 | | | | 33.7 | % | | | 2,322,058 | | | | 28.8 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | 41,571 | | | $ | 124,881 | | | | 100.0 | % | | $ | 8,055,828 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

Attachment 4(B)

UDR, Inc.

Selected Financial Information

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Weighted | | | Weighted | |

| | | | | | | | | | | Average | | | Average Years | |

Debt Structure, In thousands | | Balance | | | % of Total | | | Interest Rate | | | to Maturity | |

Secured | | Fixed | | $ | 1,086,611 | (1) | | | 31.8 | % | | | 5.2 | % | | | 4.8 | |

| | Floating | | | 343,524 | (2) | | | 10.1 | % | | | 1.7 | % | | | 6.1 | |

| | | | | | | | | | | | | | | | | | |

| | Combined | | | 1,430,135 | | | | 41.9 | % | | | 4.4 | % | | | 5.1 | |

| | | | | |

Unsecured | | Fixed | | | 1,868,198 | (3) | | | 54.8 | % | | | 4.7 | % | | | 4.1 | |

| | Floating | | | 111,000 | | | | 3.3 | % | | | 1.5 | % | | | 2.9 | |

| | | | | | | | | | | | | | | | | | |

| | Combined | | | 1,979,198 | | | | 58.1 | % | | | 4.5 | % | | | 4.1 | |

| | | | | |

Total Debt | | Fixed | | | 2,954,809 | | | | 86.6 | % | | | 4.9 | % | | | 4.4 | |

| | Floating | | | 454,524 | | | | 13.4 | % | | | 1.6 | % | | | 5.4 | |

| | | | | | | | | | | | | | | | | | |

| | Combined | | $ | 3,409,333 | | | | 100.0 | % | | | 4.4 | % | | | 4.5 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Percentage | | | Weighted Average | |

Debt Maturities, In thousands | | Secured Debt | | | Unsecured Debt | | | Balance | | | of Total | | | Interest Rate | |

2013 | | $ | 37,415 | | | $ | 122,500 | | | $ | 159,915 | | | | 4.7 | % | | | 4.9 | % |

2014 | | | 36,375 | (4) | | | 312,411 | | | | 348,786 | | | | 10.3 | % | | | 5.3 | % |

2015 | | | 202,145 | | | | 400,913 | (5) | | | 603,058 | | | | 17.7 | % | | | 4.9 | % |

2016 | | | 133,489 | (6) | | | 433,260 | | | | 566,749 | | | | 16.6 | % | | | 3.6 | % |

2017 | | | 259,614 | | | | — | | | | 259,614 | | | | 7.6 | % | | | 4.4 | % |

2018 | | | 224,787 | | | | 297,678 | | | | 522,465 | | | | 15.3 | % | | | 4.2 | % |

2019 | | | 509,310 | | | | — �� | | | | 509,310 | | | | 14.9 | % | | | 4.2 | % |

2020 | | | — | | | | — | | | | — | | | | — | | | | — | |

2021 | | | — | | | | — | | | | — | | | | — | | | | — | |

2022 | | | — | | | | 396,759 | | | | 396,759 | | | | 11.6 | % | | | 4.7 | % |

Thereafter | | | 27,000 | | | | 15,677 | | | | 42,677 | | | | 1.3 | % | | | 3.8 | % |

| | | | | | | | | | | | | | | | | | | | |

| | $ | 1,430,135 | | | $ | 1,979,198 | | | $ | 3,409,333 | | | | 100.0 | % | | | 4.4 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Debt Maturities With Extensions, | | | | | | | | | | | Percentage | | | Weighted Average | |

In thousands | | Secured Debt | | | Unsecured Debt | | | Balance | | | of Total | | | Interest Rate | |

2013 | | $ | 37,415 | | | $ | 122,500 | | | $ | 159,915 | | | | 4.7 | % | | | 4.9 | % |

2014 | | | — | | | | 312,411 | | | | 312,411 | | | | 9.2 | % | | | 5.3 | % |

2015 | | | 238,519 | | | | 324,913 | | | | 563,432 | | | | 16.5 | % | | | 5.4 | % |

2016 | | | 63,440 | | | | 509,260 | | | | 572,700 | | | | 16.8 | % | | | 3.0 | % |

2017 | | | 329,664 | | | | — | | | | 329,664 | | | | 9.7 | % | | | 4.7 | % |

2018 | | | 224,787 | | | | 297,678 | | | | 522,465 | | | | 15.3 | % | | | 4.2 | % |

2019 | | | 509,310 | | | | — | | | | 509,310 | | | | 14.9 | % | | | 4.2 | % |

2020 | | | — | | | | — | | | | — | | | | — | | | | — | |

2021 | | | — | | | | — | | | | — | | | | — | | | | — | |

2022 | | | — | | | | 396,759 | | | | 396,759 | | | | 11.6 | % | | | 4.7 | % |

Thereafter | | | 27,000 | | | | 15,677 | | | | 42,677 | | | | 1.3 | % | | | 3.8 | % |

| | | | | | | | | | | | | | | | | | | | |

| | $ | 1,430,135 | | | $ | 1,979,198 | | | $ | 3,409,333 | | | | 100.0 | % | | | 4.4 | % |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Includes $194.8 million of floating rate debt that has been fixed using interest rate swaps at an average rate of 4.25%. |

| (2) | Includes $184.7 million of debt with an average interest cap of 6.1%. |

| (3) | Includes $315.0 million of debt that has been fixed using interest rate swaps at an average rate of 2.85%. |

| (4) | Includes $36.4 million of permanent financing with a one year extension at UDR’s option. |

| (5) | There are $76.0 million of borrowings outstanding on UDR’s $900 million line of credit at December 31, 2012. The facility has an initial term of four years, includes a one-year extension option and contains an accordion feature that allows UDR to increase the facility to $1.35 billion. |

| (6) | Includes $70 million permanent financing with a one-year extension at UDR’s option. |

2

Attachment 4(C)

UDR, Inc.

Selected Financial Information(1)

(Unaudited)

| | | | |

| | | Quarter Ended | |

Coverage Ratios | | December 31, 2012 | |

Net income/(loss) attributable to UDR, Inc. | | $ | (12,300 | ) |

| |

Adjustments (includes continuing and discontinued operations): | | | | |

Interest expense | | | 30,660 | |

Real estate depreciation and amortization | | | 83,456 | |

Real estate depreciation and amortization on unconsolidated joint ventures | | | 9,897 | |

Other depreciation and amortization | | | 1,092 | |

Non-controlling interests | | | (655 | ) |

Net loss/(gain) on the sale of depreciable property, excluding RE3 | | | (156 | ) |

Income tax expense/(benefit) | | | (2,974 | ) |

| | | | |

EBITDA | | $ | 109,020 | |

| | | | |

Acquisition-related costs (including joint ventures) | | | 550 | |

Hurricane-related charges, net | | | 9,262 | |

Severance charge | | | 484 | |

Tax valuation allowance for RE3 | | | 1,346 | |

| | | | |

EBITDA—adjusted for non-recurring items | | $ | 120,662 | |

| | | | |

Annualized EBITDA | | $ | 482,648 | |

| | | | |

Interest expense | | $ | 30,660 | |

Capitalized interest expense | | | 8,764 | |

| | | | |

Total interest | | $ | 39,424 | |

Preferred dividends | | $ | 931 | |

Total debt | | $ | 3,409,333 | |

Cash | | | 12,115 | |

| | | | |

Net debt | | $ | 3,397,218 | |

| | | | |

Interest Coverage Ratio | | | 2.77x | |

| | | | |

Fixed Charge Coverage Ratio | | | 2.70x | |

| | | | |

Interest Coverage Ratio—adjusted for non-recurring items | | | 3.06x | |

| | | | |

Fixed Charge Coverage Ratio—adjusted for non-recurring items | | | 2.99x | |

| | | | |

Net Debt-to-EBITDA, adjusted for non-recurring items | | | 7.0x | |

| | | | |

Debt Covenant Overview

| | | | | | | | | | | | |

Unsecured Line of Credit Covenants(2) | | Required | | | Actual | | | Compliance | |

Maximum Leverage Ratio | | | £60.0 | % | | | 43.0 | % | | | Yes | |

Minimum Fixed Charge Coverage Ratio | | | ³1.5 | | | | 2.6 | | | | Yes | |

Maximum Secured Debt Ratio | | | £40.0 | % | | | 21.5 | % | | | Yes | |

Minimum Unencumbered Pool Leverage Ratio | | | ³150.0 | % | | | 290.4 | % | | | Yes | |

| | | | | | | | | | | | |

Senior Unsecured Note Covenants(3) | | Required | | | Actual | | | Compliance | |

Debt as a percentage of Total Assets | | | £60.0 | % | | | 38.8 | % | | | Yes | |

Consolidated Income Available for Debt Service to Annual Service Charge | | | ³1.5 | | | | 3.0 | | | | Yes | |

Secured Debt as a percentage of Total Assets | | | £40.0 | % | | | 16.2 | % | | | Yes | |

Total Unencumbered Assets to Unsecured Debt | | | ³150.0 | % | | | 322.3 | % | | | Yes | |

| | | | | | | | | | | | |

Securities Ratings | | Debt | | | Preferred | | | Outlook | |

Moody’s Investors Service | | | Baa2 | | | | Baa3 | | | | Stable | |

Standard & Poor’s | | | BBB | | | | BB+ | | | | Stable | |

| (1) | See Attachment 16 for definition and other terms. |

| (2) | As defined in our Credit Agreement dated October 25, 2011. |

| (3) | As defined in our indenture dated November 1, 1995 as amended, supplemented or modified from time to time. |

3

Attachment 5

UDR, Inc.

Operating Information(1)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total | | | Quarter Ended | | | Quarter Ended | | | Quarter Ended | | | Quarter Ended | | | Quarter Ended | |

Dollars in thousands | | Homes | | | December 31, 2012 | | | September 30, 2012 | | | June 30, 2012 | | | March 31, 2012 | | | December 31, 2011 | |

Revenues | | | | | | | | | | | | | | | | | | | | | | | | |

Same-Store Communities | | | 36,889 | | | $ | 150,508 | | | $ | 149,430 | | | $ | 146,957 | | | $ | 143,981 | | | $ | 142,392 | |

Stabilized, Non-Mature Communities | | | 2,353 | | | | 13,689 | | | | 13,585 | | | | 12,492 | | | | 10,031 | | | | 9,779 | |

Acquired Communities | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Redevelopment Communities | | | 2,253 | | | | 13,818 | | | | 13,745 | | | | 14,065 | | | | 14,292 | | | | 14,669 | |

Development Communities | | | 76 | | | | 184 | | | | 85 | | | | 121 | | | | 17 | | | | 49 | |

Non-Residential / Other | | | | | | | 4,246 | | | | 4,921 | | | | 3,840 | | | | 3,921 | | | | 3,798 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 41,571 | | | $ | 182,445 | | | $ | 181,766 | | | $ | 177,475 | | | $ | 172,242 | | | $ | 170,687 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | | | | | | | | | | | | |

Same-Store Communities | | | | | | $ | 46,205 | | | $ | 48,506 | | | $ | 46,880 | | | $ | 45,922 | | | $ | 45,153 | |

Stabilized, Non-Mature Communities | | | | | | | 3,963 | | | | 4,333 | | | | 3,902 | | | | 3,392 | | | | 2,992 | |

Acquired Communities | | | | | | | — | | | | — | | | | — | | | | — | | | | — | |

Redevelopment Communities | | | | | | | 5,248 | | | | 5,529 | | | | 5,525 | | | | 5,469 | | | | 6,499 | |

Development Communities | | | | | | | 494 | | | | 184 | | | | 66 | | | | (15 | ) | | | 51 | |

Non-Residential / Other | | | | | | | 1,654 | | | | 920 | | | | 769 | | | | 532 | | | | 1,201 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | $ | 57,564 | | | $ | 59,472 | | | $ | 57,142 | | | $ | 55,300 | | | $ | 55,896 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Operating Income | | | | | | | | | | | | | | | | | | | | | | | | |

Same-Store Communities | | | | | | $ | 104,303 | | | $ | 100,924 | | | $ | 100,077 | | | $ | 98,059 | | | $ | 97,239 | |

Stabilized, Non-Mature Communities | | | | | | | 9,726 | | | | 9,252 | | | | 8,590 | | | | 6,639 | | | | 6,787 | |

Acquired Communities | | | | | | | — | | | | — | | | | — | | | | — | | | | — | |

Redevelopment Communities | | | | | | | 8,570 | | | | 8,216 | | | | 8,540 | | | | 8,823 | | | | 8,170 | |

Development Communities | | | | | | | (310 | ) | | | (99 | ) | | | 55 | | | | 32 | | | | (2 | ) |

Non-Residential / Other(2) | | | | | | | 2,592 | | | | 4,001 | | | | 3,071 | | | | 3,389 | | | | 2,597 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | $ | 124,881 | | | $ | 122,294 | | | $ | 120,333 | | | $ | 116,942 | | | $ | 114,791 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating Margin | | | | | | | | | | | | | | | | | | | | | | | | |

Same-Store Communities | | | | | | | 69.3 | % | | | 67.5 | % | | | 68.1 | % | | | 68.1 | % | | | 68.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Revenue Per Occupied Home | | | | | | | | | | | | | | | | | | | | | | | | |

Same-Store Communities | | | | | | $ | 1,420 | | | $ | 1,409 | | | $ | 1,386 | | | $ | 1,364 | | | $ | 1,352 | |

Stabilized, Non-Mature Communities | | | | | | | 2,033 | | | | 2,015 | | | | 2,099 | | | | 2,368 | | | | 2,415 | |

Acquired Communities | | | | | | | — | | | | — | | | | — | | | | — | | | | — | |

Redevelopment Communities | | | | | | | 2,377 | | | | 2,341 | | | | 2,318 | | | | 2,272 | | | | 2,233 | |

Development Communities | | | | | | | 2,253 | | | | — | | | | — | | | | — | | | | 961 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | $ | 1,503 | | | $ | 1,490 | | | $ | 1,470 | | | $ | 1,395 | | | $ | 1,369 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Physical Occupancy | �� | | | | | | | | | | | | | | | | | | | | | | | |

Same-Store Communities | | | | | | | 95.8 | % | | | 95.8 | % | | | 95.8 | % | | | 95.4 | % | | | 95.2 | % |

Stabilized, Non-Mature Communities | | | | | | | 95.4 | % | | | 95.5 | % | | | 92.5 | % | | | 82.0 | % | | | 88.8 | % |

Acquired Communities | | | | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

Redevelopment Communities | | | | | | | 86.0 | % | | | 86.9 | % | | | 89.7 | % | | | 93.0 | % | | | 95.5 | % |

Development Communities | | | | | | | 28.1 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 53.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | 95.1 | % | | | 95.3 | % | | | 94.9 | % | | | 94.3 | % | | | 94.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Return on Invested Capital | | | | | | | | | | | | | | | | | | | | | | | | |

Same-Store Communities | | | | | | | 7.1 | % | | | 7.0 | % | | | 7.0 | % | | | 7.0 | % | | | 6.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Sold and Held For Disposition Communities | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | | | | | $ | — | | | $ | — | | | $ | 13,215 | | | $ | 17,101 | | | $ | 22,104 | |

Expenses | | | | | | | — | | | | — | | | | 4,637 | | | | 5,929 | | | | 8,515 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Operating Income | | | | | | $ | — | | | $ | — | | | $ | 8,578 | | | $ | 11,172 | | | $ | 13,589 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definition and other terms. |

| (2) | A $400,000 benefit to NOI was recognized in the three months ending December 31, 2012, and a $1.9 million benefit to NOI was recognized in the three months ending September 30, 2012, to reflect the establishment of a receivable from former residents previously written off at move out. |

4

Attachment 6

UDR, Inc.

Same-Store Operating Expense Information

(Dollars in Thousands)

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | % of 4Q 2012 | | | | | | | | | | |

| | | SS Operating | | | | | | | | | | |

Year-Over-Year Comparison | | Expenses | | | 4Q 2012 | | | 4Q 2011 | | | % Change | |

Real estate taxes | | | 32.2 | % | | $ | 14,886 | | | $ | 13,756 | | | | 8.2 | % |

Personnel | | | 23.8 | % | | | 11,010 | | | | 11,113 | | | | -0.9 | % |

Utilities | | | 16.8 | % | | | 7,752 | | | | 7,843 | | | | -1.2 | % |

Repair and maintenance | | | 15.5 | % | | | 7,140 | | | | 7,250 | | | | -1.5 | % |

Administrative and marketing | | | 7.0 | % | | | 3,251 | | | | 3,002 | | | | 8.3 | % |

Insurance | | | 4.7 | % | | | 2,166 | | | | 2,189 | | | | -1.1 | % |

| | | | | | | | | | | | | | | | |

Same-store operating expenses | | | 100.0 | % | | $ | 46,205 | | | $ | 45,153 | | | | 2.3 | % |

| | | | | | | | | | | | | | | | |

Same-store Homes | | | 36,889 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | % of 4Q 2012 | | | | | | | | | | |

| | | SS Operating | | | | | | | | | | |

Sequential Comparison | | Expenses | | | 4Q 2012 | | | 3Q 2012 | | | % Change | |

Real estate taxes | | | 32.2 | % | | $ | 14,886 | | | $ | 14,993 | | | | -0.7 | % |

Personnel | | | 23.8 | % | | | 11,010 | | | | 11,770 | | | | -6.5 | % |

Utilities | | | 16.8 | % | | | 7,752 | | | | 8,164 | | | | -5.0 | % |

Repair and maintenance | | | 15.5 | % | | | 7,140 | | | | 8,197 | | | | -12.9 | % |

Administrative and marketing | | | 7.0 | % | | | 3,251 | | | | 3,423 | | | | -5.0 | % |

Insurance | | | 4.7 | % | | | 2,166 | | | | 1,959 | | | | 10.6 | % |

| | | | | | | | | | | | | | | | |

Same-store operating expenses | | | 100.0 | % | | $ | 46,205 | | | $ | 48,506 | | | | -4.7 | % |

| | | | | | | | | | | | | | | | |

Same-store Homes | | | 36,889 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | % of YTD 2012 | | | | | | | | | | |

| | | SS Operating | | | | | | | |

Year-to-Date Comparison | | Expenses | | | YTD 2012 | | | YTD 2011 | | | % Change | |

Real estate taxes | | | 32.4 | % | | $ | 53,714 | | | $ | 49,269 | | | | 9.0 | % |

Personnel | | | 23.4 | % | | | 38,806 | | | | 40,182 | | | | -3.4 | % |

Utilities | | | 16.3 | % | | | 27,051 | | | | 27,537 | | | | -1.8 | % |

Repair and maintenance | | | 16.3 | % | | | 27,136 | | | | 25,965 | | | | 4.5 | % |

Administrative and marketing | | | 6.8 | % | | | 11,371 | | | | 10,375 | | | | 9.6 | % |

Insurance | | | 4.8 | % | | | 8,009 | | | | 8,241 | | | | -2.8 | % |

| | | | | | | | | | | | | | | | |

Same-store operating expenses | | | 100.0 | % | | $ | 166,087 | | | $ | 161,569 | | | | 2.8 | % |

| | | | | | | | | | | | | | | | |

Same-store Homes | | | 33,823 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

5

Attachment 7(A)

UDR, Inc.

Apartment Home Breakout(1)

Portfolio Overview as of Quarter Ended

December 31, 2012

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Unconsolidated | | | | |

| | | Total | | | Non-Mature Homes | | | Total | | | Joint Venture | | | Total | |

| | | Same-Store | | | | | | Non- | | | Consolidated | | | Operating | | | Homes | |

| | | Homes | | | Stabilized(2) | | | Stabil. /Other(3) | | | Homes | | | Homes(4) | | | (incl. JV)(4) | |

West Region | | | | | | | | | | | | | | | | | | | | | | | | |

Orange County, CA | | | 3,290 | | | | — | | | | 964 | | | | 4,254 | | | | — | | | | 4,254 | |

San Francisco, CA | | | 2,028 | | | | 408 | | | | — | | | | 2,436 | | | | 110 | | | | 2,546 | |

Seattle, WA | | | 2,165 | | | | — | | | | — | | | | 2,165 | | | | 555 | | | | 2,720 | |

Los Angeles, CA | | | 919 | | | | — | | | | 583 | | | | 1,502 | | | | 269 | | | | 1,771 | |

Monterey Peninsula, CA | | | 1,565 | | | | — | | | | — | | | | 1,565 | | | | — | | | | 1,565 | |

Inland Empire, CA | | | 654 | | | | — | | | | — | | | | 654 | | | | — | | | | 654 | |

Sacramento, CA | | | 914 | | | | — | | | | — | | | | 914 | | | | — | | | | 914 | |

Portland, OR | | | 716 | | | | — | | | | — | | | | 716 | | | | — | | | | 716 | |

San Diego, CA | | | 366 | | | | — | | | | — | | | | 366 | | | | 307 | | | | 673 | |

| | | 12,617 | | | | 408 | | | | 1,547 | | | | 14,572 | | | | 1,241 | | | | 15,813 | |

| | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | | | 4,313 | | | | — | | | | 76 | | | | 4,389 | | | | 923 | | | | 5,312 | |

Baltimore, MD | | | 2,301 | | | | — | | | | — | | | | 2,301 | | | | 379 | | | | 2,680 | |

Richmond, VA | | | 1,358 | | | | — | | | | — | | | | 1,358 | | | | — | | | | 1,358 | |

Norfolk, VA | | | 1,438 | | | | — | | | | | | | | 1,438 | | | | — | | | | 1,438 | |

Other Mid-Atlantic | | | 168 | | | | — | | | | — | | | | 168 | | | | 150 | | | | 318 | |

| | | 9,578 | | | | — | | | | 76 | | | | 9,654 | | | | 1,452 | | | | 11,106 | |

| | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | | | | | | | |

New York, NY | | | 493 | | | | 715 | | | | 706 | | | | 1,914 | | | | 710 | | | | 2,624 | |

Boston, MA | | | 1,179 | | | | — | | | | — | | | | 1,179 | | | | 1,542 | | | | 2,721 | |

Philadelphia | | | — | | | | — | | | | — | | | | — | | | | 290 | | | | 290 | |

| | | 1,672 | | | | 715 | | | | 706 | | | | 3,093 | | | | 2,542 | | | | 5,635 | |

| | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | | | | | | |

Tampa, FL | | | 3,452 | | | | — | | | | — | | | | 3,452 | | | | — | | | | 3,452 | |

Orlando, FL | | | 3,167 | | | | — | | | | — | | | | 3,167 | | | | — | | | | 3,167 | |

Nashville, TN | | | 2,260 | | | | — | | | | — | | | | 2,260 | | | | — | | | | 2,260 | |

Other Florida | | | 636 | | | | — | | | | — | | | | 636 | | | | — | | | | 636 | |

| | | 9,515 | | | | — | | | | — | | | | 9,515 | | | | — | | | | 9,515 | |

| | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | | | | | | |

Dallas, TX | | | 3,117 | | | | 347 | | | | — | | | | 3,464 | | | | 2,657 | | | | 6,121 | |

Austin, TX | | | 390 | | | | 883 | | | | — | | | | 1,273 | | | | 259 | | | | 1,532 | |

Other Southwest | | | — | | | | — | | | | — | | | | — | | | | 1,407 | | | | 1,407 | |

| | | 3,507 | | | | 1,230 | | | | — | | | | 4,737 | | | | 4,323 | | | | 9,060 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | | 36,889 | | | | 2,353 | | | | 2,329 | | | | 41,571 | | | | 9,558 | | | | 51,129 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Communities | | | 131 | | | | 8 | | | | 6 | | | | 145 | | | | 39 | | | | 184 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Homes (incl. joint ventures)(4) | | | | | | | | | | | 51,129 | | | | | | | | | | | | | |

| | | | | | |

Homes in Development, less Completed | | | | | | | | | | | | | | | | | | | | | | | | |

Current Pipeline Wholly-Owned | | | | | | | | | | | 2,546 | | | | | | | | | | | | | |

Current Pipeline Joint Venture(5) | | | | | | | | | | | 520 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total expected homes (including development) | | | | | | | | 54,195 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | Represents homes included in Stabilized, Non-Mature category on Attachment 5. |

| (3) | Represents homes included in Acquisition, Development, Redevelopment and Other categories on Attachment 5. |

| (4) | Represents joint venture homes at 100 percent. See Attachment 12 for UDR’s joint venture ownership interests. |

| (5) | Represents joint venture homes at 100 percent. See Attachment 9 for UDR’s development joint venture ownership interests. |

6

Attachment 7(B)

UDR, Inc.

Non-Mature Home Summary(1)

Portfolio Overview as of Quarter Ended

December 31, 2012

(Unaudited)

Non-Mature Home Breakout—By Region

| | | | | | | | | | |

| | | | | # of | | | Same-Store | |

Community | | Category | | Homes | | | Date | |

West Region | | | | | | | | | | |

Orange County, CA | | | | | | | | | | |

Pine Brook Village I & II | | Redevelopment | | | 496 | | | | 3Q15 | |

Villa Venetia | | Redevelopment | | | 468 | | | | 3Q15 | |

| | | |

San Francisco, CA | | | | | | | | | | |

Bay Terrace | | Stabilized, Non-Mature | | | 120 | | | | 2Q13 | |

CitySouth | | Stabilized, Non-Mature | | | 288 | | | | 3Q13 | |

| | | |

Los Angeles, CA | | | | | | | | | | |

The Westerly on Lincoln | | Redevelopment | | | 583 | | | | 3Q14 | |

| | | |

Mid-Atlantic Region | | | | | | | | | | |

Metropolitan D.C. | | | | | | | | | | |

Capitol View on Fourteenth(2) | | Development | | | 76 | | | | 2Q15 | |

| | | |

Northeast Region | | | | | | | | | | |

New York, NY | | | | | | | | | | |

21 Chelsea | | Stabilized, Non-Mature | | | 207 | | | | 1Q13 | |

95 Wall | | Stabilized, Non-Mature(3) | | | 508 | | | | 2Q14 | |

Rivergate | | Redevelopment | | | 706 | | | | 4Q15 | |

| | | |

Southwest Region | | | | | | | | | | |

Dallas, TX | | | | | | | | | | |

Savoye2 | | Stabilized, Non-Mature | | | 347 | | | | 4Q13 | |

| | | |

Austin, TX | | | | | | | | | | |

Barton Creek Landing | | Stabilized, Non-Mature | | | 250 | | | | 2Q13 | |

Lakeline Villas | | Stabilized, Non-Mature | | | 309 | | | | 3Q13 | |

Red Stone Ranch | | Stabilized, Non-Mature | | | 324 | | | | 3Q13 | |

| | | | | | | | | | |

Total | | | | | 4,682 | | | | | |

| | | | | | | | | | |

Non-Mature Home Breakout—By Date (Quarter Indicates Date of Same-Store Inclusion)

| | | | | | |

Date & Community | | Category | | # of

Homes | |

1Q13 | | | | | | |

21 Chelsea | | Stabilized, Non-Mature | | | 207 | |

| | |

2Q13 | | | | | | |

Barton Creek Landing | | Stabilized, Non-Mature | | | 250 | |

Bay Terrace | | Stabilized, Non-Mature | | | 120 | |

| | | | | | |

| | | | | 370 | |

| | | | | | |

3Q13 | | | | | | |

CitySouth | | Stabilized, Non-Mature | | | 288 | |

Lakeline Villas | | Stabilized, Non-Mature | | | 309 | |

Red Stone Ranch | | Stabilized, Non-Mature | | | 324 | |

| | | | | | |

| | | | | 921 | |

| | | | | | |

4Q13 | | | | | | |

Savoye2 | | Stabilized, Non-Mature | | | 347 | |

| | |

2Q14 | | | | | | |

95 Wall | | Stabilized, Non-Mature | | | 508 | |

| | |

3Q14 | | | | | | |

The Westerly on Lincoln | | Redevelopment | | | 583 | |

| | |

2Q15 | | | | | | |

Capitol View on Fourteenth(2) | | Development | | | 76 | |

| | |

3Q15 | | | | | | |

Pine Brook Village I & II | | Redevelopment | | | 496 | |

Villa Venetia | | Redevelopment | | | 468 | |

| | | | | | |

| | | | | 964 | |

| | | | | | |

4Q15 | | | | | | |

Rivergate | | Redevelopment | | | 706 | |

| | | | | | |

Total | | | | | 4,682 | |

| | | | | | |

Non-Mature Home Sequential Change For the Most Recent Quarter

| | | | | | | | |

| | | Category | | # of | |

Community | | From | | To | | Homes | |

View 14 | | Stabilized, Non-Mature | | QTD Mature | | | 185 | |

Dominion Middle Ridge | | Stabilized, Non-Mature | | QTD Mature | | | 252 | |

Capitol View on Fourteenth(2) | | Development | | | 76 | |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | Community will have 255 homes at completion. |

| (3) | Property results were affected by Hurricane Sandy, therefore the same-store date was adjusted. |

7

Attachment 7(C)

UDR, Inc.

Total Revenue Per Occupied Home Summary(1)

Portfolio Overview as of Quarter Ended

December 31, 2012

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Non-Mature Homes | | | Unconsolidated | | | | |

| | | Total | | | | | | | | | Total | | | Joint Venture | | | Total | |

| | | Same-Store | | | | | | Non- | | | Consolidated | | | Operating | | | Homes | |

| | | Homes | | | Stabilized(2) | | | Stabilized (3) | | | Homes | | | Homes(4) | | | (incl. pro rata JV)(4) | |

West Region | | | | | | | | | | | | | | | | | | | | | | | | |

Orange County, CA | | $ | 1,651 | | | $ | — | | | $ | 1,645 | | | $ | 1,650 | | | $ | — | | | $ | 1,650 | |

San Francisco, CA | | | 2,565 | | | | 2,247 | | | | — | | | | 2,513 | | | | 3,327 | | | | 2,516 | |

Seattle, WA | | | 1,439 | | | | — | | | | — | | | | 1,439 | | | | 2,956 | | | | 1,610 | |

Los Angeles, CA | | | 2,061 | | | | — | | | | 1,783 | | | | 1,958 | | | | 3,933 | | | | 2,012 | |

Monterey Peninsula, CA | | | 1,136 | | | | — | | | | — | | | | 1,136 | | | | — | | | | 1,136 | |

Inland Empire, CA | | | 1,437 | | | | — | | | | — | | | | 1,437 | | | | — | | | | 1,437 | |

Sacramento, CA | | | 876 | | | | — | | | | — | | | | 876 | | | | — | | | | 876 | |

Portland, OR | | | 1,061 | | | | — | | | | — | | | | 1,061 | | | | — | | | | 1,061 | |

San Diego, CA | | | 1,424 | | | | — | | | | — | | | | 1,424 | | | | 3,110 | | | | 1,619 | |

| | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | | | 1,783 | | | | — | | | | 2,253 | | | | 1,784 | | | | 2,575 | | | | 1,822 | |

Baltimore, MD | | | 1,434 | | | | — | | | | — | | | | 1,434 | | | | 1,716 | | | | 1,439 | |

Richmond, VA | | | 1,177 | | | | — | | | | — | | | | 1,177 | | | | — | | | | 1,177 | |

Norfolk, VA | | | 989 | | | | — | | | | — | | | | 989 | | | | — | | | | 989 | |

Other Mid-Atlantic | | | 990 | | | | — | | | | — | | | | 990 | | | | 2,802 | | | | 1,171 | |

| | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | | | | | | | |

New York, NY | | | 3,349 | | | | 3,390 | | | | 3,737 | | | | 3,503 | | | | 4,302 | | | | 3,629 | |

Boston, MA | | | 2,059 | | | | — | | | | — | | | | 2,059 | | | | 1,996 | | | | 2,035 | |

Philadelphia | | | — | | | | — | | | | — | | | | — | | | | 2,888 | | | | 2,888 | |

| | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | | | | | | |

Tampa, FL | | | 1,057 | | | | — | | | | — | | | | 1,057 | | | | — | | | | 1,057 | |

Orlando, FL | | | 977 | | | | — | | | | — | | | | 977 | | | | — | | | | 977 | |

Nashville, TN | | | 970 | | | | — | | | | — | | | | 970 | | | | — | | | | 970 | |

Other Florida | | | 1,242 | | | | — | | | | — | | | | 1,242 | | | | — | | | | 1,242 | |

| | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | | | | | | |

Dallas, TX | | | 1,085 | | | | 1,470 | | | | — | | | | 1,123 | | | | 1,231 | | | | 1,137 | |

Austin, TX | | | 1,332 | | | | 1,090 | | | | — | | | | 1,164 | | | | 3,754 | | | | 1,401 | |

Other Southwest | | | — | | | | — | | | | — | | | | — | | | | 1,051 | | | | 1,051 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Weighted Average | | $ | 1,420 | | | $ | 2,033 | | | $ | 2,375 | | | $ | 1,503 | | | $ | 2,385 | | | $ | 1,558 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | Represents homes included in Stabilized, Non-Mature category on Attachment 5. |

| (3) | Represents homes included in Acquisition, Development, Redevelopment and Other categories on Attachment 5. |

| (4) | Represents joint ventures at UDR’s pro-rata ownership interests. See Attachment 12 for UDR’s joint venture ownership interests. |

8

Attachment 7(D)

UDR, Inc.

Net Operating Income Breakout By Market(1)

December 31, 2012

(Dollars in Thousands)

(Unaudited)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, 2012 | |

| | | Same-Store | | | Non Same-Store | | | Pro-Rata Share of JVs(2) | | | Total | |

| | | | | | | | | | | | | | | | |

Net Operating Income | | $ | 104,303 | | | $ | 20,578 | | | $ | 14,312 | | | $ | 139,193 | |

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, 2012 | | | | | Three Months Ended December 31, 2012 | |

| | | As a % of NOI | | | | | As a % of NOI | |

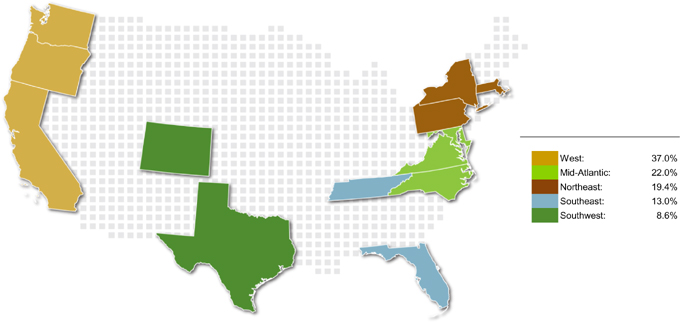

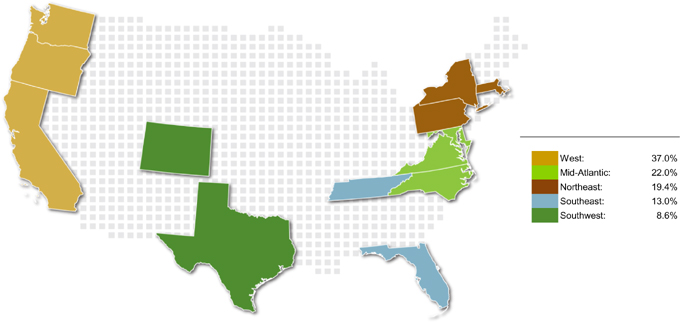

| | | Same-Store | | | Total | | | Region | | Same-Store | | | Total | |

West Region | | | | | | | | | | Northeast Region | | | | | | | | |

Orange County, CA | | | 10.9 | % | | | 10.1 | % | | New York, NY | | | 3.6 | % | | | 12.9 | % |

San Francisco, CA | | | 10.7 | % | | | 9.5 | % | | Boston, MA | | | 4.8 | % | | | 5.8 | % |

Seattle, WA | | | 6.0 | % | | | 6.2 | % | | Philadelphia | | | 0.0 | % | | | 0.7 | % |

| | | | | | | | | | | | | | | | | | |

Los Angeles, CA | | | 3.5 | % | | | 4.2 | % | | | | | 8.4 | % | | | 19.4 | % |

Monterey Peninsula, CA | | | 3.2 | % | | | 2.4 | % | | Southeast Region | | | | | | | | |

Inland Empire, CA | | | 1.9 | % | | | 1.5 | % | | Tampa, FL | | | 6.4 | % | | | 4.8 | % |

Sacramento, CA | | | 1.4 | % | | | 1.1 | % | | Orlando, FL | | | 5.6 | % | | | 4.2 | % |

Portland, OR | | | 1.4 | % | | | 1.0 | % | | Nashville, TN | | | 4.0 | % | | | 3.0 | % |

San Diego, CA | | | 1.0 | % | | | 1.0 | % | | Other Florida | | | 1.4 | % | | | 1.0 | % |

| | | | | | | | | | | | | | | | | | |

| | | 40.0 | % | | | 37.0 | % | | | | | 17.4 | % | | | 13.0 | % |

Mid-Atlantic Region | | | | | | | | | | Southwest Region | | | | | | | | |

Metropolitan DC | | | 15.0 | % | | | 12.3 | % | | Dallas, TX | | | 5.7 | % | | | 5.7 | % |

Baltimore, MD | | | 6.5 | % | | | 4.9 | % | | Austin, TX | | | 0.8 | % | | | 2.5 | % |

Richmond, VA | | | 3.3 | % | | | 2.5 | % | | Other Southwest | | | 0.0 | % | | | 0.4 | % |

| | | | | | | | | | | | | | | | | | |

Norfolk, VA | | | 2.6 | % | | | 1.9 | % | | | | | 6.5 | % | | | 8.6 | % |

| | | | | | | | | | | | | | | | | | |

Other Mid-Atlantic | | | 0.3 | % | | | 0.4 | % | | Total | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | |

| | | 27.7 | % | | | 22.0 | % | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

| (2) | Includes UDR’s pro rata share of joint venture net operating income. |

9

Attachment 8(A)

UDR, Inc.

Same-Store Operating Information By Major Market(1)

Current Quarter vs. Prior Year Quarter

December 31, 2012

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | % of Same- | | | | | | | | | | | | | | | | | | | |

| | | Total | | | Store Portfolio | | | Same-Store | |

| | | Same-Store | | | Based on | | | Physical Occupancy | | | Total Revenue per Occupied Home | |

| | | Homes | | | QTD 2012 NOI | | | 4Q 12 | | | 4Q 11 | | | Change | | | 4Q 12 | | | 4Q 11 | | | Change | |

West Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Orange County, CA | | | 3,290 | | | | 10.9 | % | | | 94.9 | % | | | 94.3 | % | | | 0.6 | % | | $ | 1,651 | | | $ | 1,559 | | | | 5.9 | % |

San Francisco, CA | | | 2,028 | | | | 10.7 | % | | | 96.3 | % | | | 95.9 | % | | | 0.4 | % | | | 2,565 | | | | 2,350 | | | | 9.1 | % |

Seattle, WA | | | 2,165 | | | | 6.0 | % | | | 96.7 | % | | | 95.2 | % | | | 1.5 | % | | | 1,439 | | | | 1,363 | | | | 5.6 | % |

Los Angeles, CA | | | 919 | | | | 3.5 | % | | | 95.6 | % | | | 96.1 | % | | | -0.5 | % | | | 2,061 | | | | 1,960 | | | | 5.2 | % |

Monterey Peninsula, CA | | | 1,565 | | | | 3.2 | % | | | 92.2 | % | | | 93.5 | % | | | -1.3 | % | | | 1,136 | | | | 1,133 | | | | 0.3 | % |

Inland Empire, CA | | | 654 | | | | 1.9 | % | | | 94.1 | % | | | 95.6 | % | | | -1.5 | % | | | 1,437 | | | | 1,405 | | | | 2.3 | % |

Sacramento, CA | | | 914 | | | | 1.4 | % | | | 93.0 | % | | | 92.4 | % | | | 0.6 | % | | | 876 | | | | 874 | | | | 0.2 | % |

Portland, OR | | | 716 | | | | 1.4 | % | | | 95.9 | % | | | 94.6 | % | | | 1.3 | % | | | 1,061 | | | | 1,021 | | | | 3.9 | % |

San Diego, CA | | | 366 | | | | 1.0 | % | | | 95.7 | % | | | 93.2 | % | | | 2.5 | % | | | 1,424 | | | | 1,366 | | | | 4.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12,617 | | | | 40.0 | % | | | 95.0 | % | | | 94.7 | % | | | 0.3 | % | | | 1,625 | | | | 1,538 | | | | 5.7 | % |

| | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | | | 4,313 | | | | 15.0 | % | | | 96.9 | % | | | 96.2 | % | | | 0.7 | % | | | 1,783 | | | | 1,711 | | | | 4.2 | % |

Baltimore, MD | | | 2,301 | | | | 6.5 | % | | | 96.0 | % | | | 96.5 | % | | | -0.5 | % | | | 1,434 | | | | 1,397 | | | | 2.6 | % |

Richmond, VA | | | 1,358 | | | | 3.3 | % | | | 95.6 | % | | | 95.5 | % | | | 0.1 | % | | | 1,177 | | | | 1,161 | | | | 1.4 | % |

Norfolk, VA | | | 1,438 | | | | 2.6 | % | | | 94.3 | % | | | 93.5 | % | | | 0.8 | % | | | 989 | | | | 989 | | | | 0.0 | % |

Other Mid-Atlantic | | | 168 | | | | 0.3 | % | | | 97.9 | % | | | 95.3 | % | | | 2.6 | % | | | 990 | | | | 982 | | | | 0.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9,578 | | | | 27.7 | % | | | 96.1 | % | | | 95.7 | % | | | 0.4 | % | | | 1,483 | | | | 1,439 | | | | 3.1 | % |

| | | | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Boston, MA | | | 1,179 | | | | 4.8 | % | | | 95.8 | % | | | 96.1 | % | | | -0.3 | % | | | 2,059 | | | | 1,878 | | | | 9.6 | % |

New York, NY | | | 493 | | | | 3.6 | % | | | 97.4 | % | | | 96.9 | % | | | 0.5 | % | | | 3,349 | | | | 3,103 | | | | 7.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1,672 | | | | 8.4 | % | | | 96.3 | % | | | 96.4 | % | | | -0.1 | % | | | 2,443 | | | | 2,240 | | | | 9.1 | % |

| | | | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tampa, FL | | | 3,452 | | | | 6.4 | % | | | 96.3 | % | | | 95.8 | % | | | 0.5 | % | | | 1,057 | | | | 1,004 | | | | 5.3 | % |

Orlando, FL | | | 3,167 | | | | 5.6 | % | | | 95.9 | % | | | 94.6 | % | | | 1.3 | % | | | 977 | | | | 933 | | | | 4.7 | % |

Nashville, TN | | | 2,260 | | | | 4.0 | % | | | 96.8 | % | | | 95.8 | % | | | 1.0 | % | | | 970 | | | | 916 | | | | 5.9 | % |

Other Florida | | | 636 | | | | 1.4 | % | | | 96.6 | % | | | 92.8 | % | | | 3.8 | % | | | 1,242 | | | | 1,217 | | | | 2.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9,515 | | | | 17.4 | % | | | 96.3 | % | | | 95.2 | % | | | 1.1 | % | | | 1,022 | | | | 973 | | | | 5.0 | % |

| | | | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dallas, TX | | | 3,117 | | | | 5.7 | % | | | 95.5 | % | | | 94.9 | % | | | 0.6 | % | | | 1,085 | | | | 1,014 | | | | 7.0 | % |

Austin, TX | | | 390 | | | | 0.8 | % | | | 96.7 | % | | | 95.6 | % | | | 1.1 | % | | | 1,332 | | | | 1,255 | | | | 6.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 3,507 | | | | 6.5 | % | | | 95.6 | % | | | 95.0 | % | | | 0.6 | % | | | 1,113 | | | | 1,041 | | | | 6.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Avg. | | | 36,889 | | | | 100 | % | | | 95.8 | % | | | 95.2 | % | | | 0.6 | % | | $ | 1,420 | | | $ | 1,352 | | | | 5.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

10

Attachment 8(B)

UDR, Inc.

Same-Store Operating Information By Major Market(1)

Current Quarter vs. Prior Year Quarter

December 31, 2012

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total | | | Same-Store ($000s) | |

| | | Same-Store | | | Revenues | | | Expenses | | | Net Operating Income | |

| | | Homes | | | 4Q 12 | | | 4Q 11 | | | Change | | | 4Q 12 | | | 4Q 11 | | | Change | | | 4Q 12 | | | 4Q 11 | | | Change | |

West Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Orange County, CA | | | 3,290 | | | $ | 15,463 | | | $ | 14,507 | | | | 6.6 | % | | $ | 4,134 | | | $ | 4,297 | | | | -3.8 | % | | $ | 11,329 | | | $ | 10,210 | | | | 11.0 | % |

San Francisco, CA | | | 2,028 | | | | 15,026 | | | | 13,708 | | | | 9.6 | % | | | 3,854 | | | | 3,859 | | �� | | -0.1 | % | | | 11,172 | | | | 9,849 | | | | 13.4 | % |

Seattle, WA | | | 2,165 | | | | 9,040 | | | | 8,425 | | | | 7.3 | % | | | 2,738 | | | | 2,673 | | | | 2.4 | % | | | 6,302 | | | | 5,752 | | | | 9.6 | % |

Los Angeles, CA | | | 919 | | | | 5,433 | | | | 5,193 | | | | 4.6 | % | | | 1,820 | | | | 1,821 | | | | -0.1 | % | | | 3,613 | | | | 3,372 | | | | 7.1 | % |

Monterey Peninsula, CA | | | 1,565 | | | | 4,919 | | | | 4,972 | | | | -1.1 | % | | | 1,621 | | | | 1,483 | | | | 9.3 | % | | | 3,298 | | | | 3,489 | | | | -5.5 | % |

Inland Empire, CA | | | 654 | | | | 2,654 | | | | 2,635 | | | | 0.7 | % | | | 643 | | | | 691 | | | | -6.9 | % | | | 2,011 | | | | 1,944 | | | | 3.4 | % |

Sacramento, CA | | | 914 | | | | 2,233 | | | | 2,215 | | | | 0.8 | % | | | 737 | | | | 686 | | | | 7.4 | % | | | 1,496 | | | | 1,529 | | | | -2.2 | % |

Portland, OR | | | 716 | | | | 2,185 | | | | 2,075 | | | | 5.3 | % | | | 728 | | | | 680 | | | | 7.1 | % | | | 1,457 | | | | 1,395 | | | | 4.4 | % |

San Diego, CA | | | 366 | | | | 1,497 | | | | 1,398 | | | | 7.1 | % | | | 431 | | | | 509 | | | | -15.3 | % | | | 1,066 | | | | 889 | | | | 19.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12,617 | | | | 58,450 | | | | 55,128 | | | | 6.0 | % | | | 16,706 | | | | 16,699 | | | | 0.0 | % | | | 41,744 | | | | 38,429 | | | | 8.6 | % |

| | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | | | 4,313 | | | | 22,360 | | | | 21,292 | | | | 5.0 | % | | | 6,757 | | | | 6,339 | | | | 6.6 | % | | | 15,603 | | | | 14,953 | | | | 4.3 | % |

Baltimore, MD | | | 2,301 | | | | 9,506 | | | | 9,303 | | | | 2.2 | % | | | 2,756 | | | | 2,669 | | | | 3.3 | % | | | 6,750 | | | | 6,634 | | | | 1.7 | % |

Richmond, VA | | | 1,358 | | | | 4,585 | | | | 4,519 | | | | 1.5 | % | | | 1,152 | | | | 1,096 | | | | 5.1 | % | | | 3,433 | | | | 3,423 | | | | 0.3 | % |

Norfolk, VA | | | 1,438 | | | | 4,024 | | | | 3,989 | | | | 0.9 | % | | | 1,316 | | | | 1,261 | | | | 4.4 | % | | | 2,708 | | | | 2,728 | | | | -0.7 | % |

Other Mid-Atlantic | | | 168 | | | | 488 | | | | 472 | | | | 3.4 | % | | | 163 | | | | 168 | | | | -3.0 | % | | | 325 | | | | 304 | | | | 6.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9,578 | | | | 40,963 | | | | 39,575 | | | | 3.5 | % | | | 12,144 | | | | 11,533 | | | | 5.3 | % | | | 28,819 | | | | 28,042 | | | | 2.8 | % |

Northeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Boston, MA | | | 1,179 | | | | 6,976 | | | | 6,384 | | | | 9.3 | % | | | 2,015 | | | | 1,875 | | | | 7.5 | % | | | 4,961 | | | | 4,509 | | | | 10.0 | % |

New York, NY | | | 493 | | | | 4,824 | | | | 4,447 | | | | 8.5 | % | | | 972 | | | | 1,157 | | | | -16.0 | % | | | 3,852 | | | | 3,290 | | | | 17.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1,672 | | | | 11,800 | | | | 10,831 | | | | 8.9 | % | | | 2,987 | | | | 3,032 | | | | -1.5 | % | | | 8,813 | | | | 7,799 | | | | 13.0 | % |

| | | | | | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tampa, FL | | | 3,452 | | | | 10,545 | | | | 9,962 | | | | 5.9 | % | | | 3,840 | | | | 3,533 | | | | 8.7 | % | | | 6,705 | | | | 6,429 | | | | 4.3 | % |

Orlando, FL | | | 3,167 | | | | 8,900 | | | | 8,384 | | | | 6.2 | % | | | 3,100 | | | | 2,914 | | | | 6.4 | % | | | 5,800 | | | | 5,470 | | | | 6.0 | % |

Nashville, TN | | | 2,260 | | | | 6,367 | | | | 5,952 | | | | 7.0 | % | | | 2,155 | | | | 1,875 | | | | 14.9 | % | | | 4,212 | | | | 4,077 | | | | 3.3 | % |

Other Florida | | | 636 | | | | 2,289 | | | | 2,155 | | | | 6.2 | % | | | 863 | | | | 911 | | | | -5.3 | % | | | 1,426 | | | | 1,244 | | | | 14.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9,515 | | | | 28,101 | | | | 26,453 | | | | 6.2 | % | | | 9,958 | | | | 9,233 | | | | 7.9 | % | | | 18,143 | | | | 17,220 | | | | 5.4 | % |

| | | | | | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dallas, TX | | | 3,117 | | | | 9,687 | | | | 9,002 | | | | 7.6 | % | | | 3,769 | | | | 4,079 | | | | -7.6 | % | | | 5,918 | | | | 4,923 | | | | 20.2 | % |

Austin, TX | | | 390 | | | | 1,507 | | | | 1,403 | | | | 7.4 | % | | | 641 | | | | 577 | | | | 11.1 | % | | | 866 | | | | 826 | | | | 4.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 3,507 | | | | 11,194 | | | | 10,405 | | | | 7.6 | % | | | 4,410 | | | | 4,656 | | | | -5.3 | % | | | 6,784 | | | | 5,749 | | | | 18.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | | 36,889 | | | $ | 150,508 | | | $ | 142,392 | | | | 5.7 | % | | $ | 46,205 | | | $ | 45,153 | | | | 2.3 | % | | $ | 104,303 | | | $ | 97,239 | | | | 7.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

11

Attachment 8(C)

UDR, Inc.

Same-Store Operating Information By Major Market(1)

Current Quarter vs. Last Quarter

December 31, 2012

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total | | | Same-Store | |

| | | Same-Store | | | Physical Occupancy | | | Total Revenue per Occupied Home | |

| | | Homes | | | 4Q 12 | | | 3Q 12 | | | Change | | | 4Q 12 | | | 3Q 12 | | | Change | |

West Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Orange County, CA | | | 3,290 | | | | 94.9 | % | | | 94.8 | % | | | 0.1 | % | | $ | 1,651 | | | $ | 1,622 | | | | 1.8 | % |

San Francisco, CA | | | 2,028 | | | | 96.3 | % | | | 96.4 | % | | | -0.1 | % | | | 2,565 | | | | 2,532 | | | | 1.3 | % |

Seattle, WA | | | 2,165 | | | | 96.7 | % | | | 95.6 | % | | | 1.1 | % | | | 1,439 | | | | 1,430 | | | | 0.6 | % |

Los Angeles, CA | | | 919 | | | | 95.6 | % | | | 94.7 | % | | | 0.9 | % | | | 2,061 | | | | 2,031 | | | | 1.5 | % |

Monterey Peninsula, CA | | | 1,565 | | | | 92.2 | % | | | 94.7 | % | | | -2.5 | % | | | 1,136 | | | | 1,133 | | | | 0.3 | % |

Inland Empire, CA | | | 654 | | | | 94.1 | % | | | 93.9 | % | | | 0.2 | % | | | 1,437 | | | | 1,436 | | | | 0.1 | % |

Sacramento, CA | | | 914 | | | | 93.0 | % | | | 93.2 | % | | | -0.2 | % | | | 876 | | | | 885 | | | | -1.0 | % |

Portland, OR | | | 716 | | | | 95.9 | % | | | 95.4 | % | | | 0.5 | % | | | 1,061 | | | | 1,044 | | | | 1.6 | % |

San Diego, CA | | | 366 | | | | 95.7 | % | | | 95.3 | % | | | 0.4 | % | | | 1,424 | | | | 1,428 | | | | -0.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12,617 | | | | 95.0 | % | | | 95.1 | % | | | -0.1 | % | | | 1,625 | | | | 1,605 | | | | 1.2 | % |

| | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | | | 4,313 | | | | 96.9 | % | | | 97.1 | % | | | -0.2 | % | | | 1,783 | | | | 1,760 | | | | 1.3 | % |

Baltimore, MD | | | 2,301 | | | | 96.0 | % | | | 96.7 | % | | | -0.7 | % | | | 1,434 | | | | 1,442 | | | | -0.6 | % |

Richmond, VA | | | 1,358 | | | | 95.6 | % | | | 95.5 | % | | | 0.1 | % | | | 1,177 | | | | 1,193 | | | | -1.3 | % |

Norfolk, VA | | | 1,438 | | | | 94.3 | % | | | 94.2 | % | | | 0.1 | % | | | 989 | | | | 989 | | | | 0.0 | % |

Other Mid-Atlantic | | | 168 | | | | 97.9 | % | | | 95.7 | % | | | 2.2 | % | | | 990 | | | | 977 | | | | 1.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9,578 | | | | 96.1 | % | | | 96.3 | % | | | -0.2 | % | | | 1,483 | | | | 1,477 | | | | 0.4 | % |

| | | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Boston, MA | | | 1,179 | | | | 95.8 | % | | | 95.9 | % | | | -0.1 | % | | | 2,059 | | | | 2,011 | | | | 2.4 | % |

New York, NY | | | 493 | | | | 97.4 | % | | | 98.4 | % | | | -1.0 | % | | | 3,349 | | | | 3,314 | | | | 1.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1,672 | | | | 96.3 | % | | | 96.6 | % | | | -0.3 | % | | | 2,443 | | | | 2,403 | | | | 1.6 | % |

| | | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tampa, FL | | | 3,452 | | | | 96.3 | % | | | 96.2 | % | | | 0.1 | % | | | 1,057 | | | | 1,057 | | | | 0.0 | % |

Orlando, FL | | | 3,167 | | | | 95.9 | % | | | 95.9 | % | | | 0.0 | % | | | 977 | | | | 974 | | | | 0.3 | % |

Nashville, TN | | | 2,260 | | | | 96.8 | % | | | 96.7 | % | | | 0.1 | % | | | 970 | | | | 966 | | | | 0.4 | % |

Other Florida | | | 636 | | | | 96.6 | % | | | 94.6 | % | | | 2.0 | % | | | 1,242 | | | | 1,243 | | | | -0.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9,515 | | | | 96.3 | % | | | 96.1 | % | | | 0.2 | % | | | 1,022 | | | | 1,020 | | | | 0.2 | % |

| | | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dallas, TX | | | 3,117 | | | | 95.5 | % | | | 96.3 | % | | | -0.8 | % | | | 1,085 | | | | 1,075 | | | | 0.9 | % |

Austin, TX | | | 390 | | | | 96.7 | % | | | 96.5 | % | | | 0.2 | % | | | 1,332 | | | | 1,305 | | | | 2.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 3,507 | | | | 95.6 | % | | | 96.3 | % | | | -0.7 | % | | | 1,113 | | | | 1,101 | | | | 1.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Avg. | | | 36,889 | | | | 95.8 | % | | | 95.8 | % | | | 0.0 | % | | $ | 1,420 | | | $ | 1,409 | | | | 0.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

12

Attachment 8(D)

UDR, Inc.

Same-Store Operating Information By Major Market(1)

Current Quarter vs. Last Quarter

December 31, 2012

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total | | | Same-Store ($000s) | |

| | | Same-Store | | | Revenues | | | Expenses | | | Net Operating Income | |

| | | Homes | | | 4Q 12 | | | 3Q 12 | | | Change | | | 4Q 12 | | | 3Q 12 | | | Change | | | 4Q 12 | | | 3Q 12 | | | Change | |

West Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Orange County, CA | | | 3,290 | | | $ | 15,463 | | | $ | 15,173 | | | | 1.9 | % | | $ | 4,134 | | | $ | 4,375 | | | | -5.5 | % | | $ | 11,329 | | | $ | 10,798 | | | | 4.9 | % |

San Francisco, CA | | | 2,028 | | | | 15,026 | | | | 14,850 | | | | 1.2 | % | | | 3,854 | | | | 4,027 | | | | -4.3 | % | | | 11,172 | | | | 10,823 | | | | 3.2 | % |

Seattle, WA | | | 2,165 | | | | 9,040 | | | | 8,880 | | | | 1.8 | % | | | 2,738 | | | | 2,733 | | | | 0.2 | % | | | 6,302 | | | | 6,147 | | | | 2.5 | % |

Los Angeles, CA | | | 919 | | | | 5,433 | | | | 5,304 | | | | 2.4 | % | | | 1,820 | | | | 1,863 | | | | -2.3 | % | | | 3,613 | | | | 3,441 | | | | 5.0 | % |

Monterey Peninsula, CA | | | 1,565 | | | | 4,919 | | | | 5,036 | | | | -2.3 | % | | | 1,621 | | | | 1,863 | | | | -13.0 | % | | | 3,298 | | | | 3,173 | | | | 3.9 | % |

Inland Empire, CA | | | 654 | | | | 2,654 | | | | 2,646 | | | | 0.3 | % | | | 643 | | | | 942 | | | | -31.7 | % | | | 2,011 | | | | 1,704 | | | | 18.0 | % |

Sacramento, CA | | | 914 | | | | 2,233 | | | | 2,261 | | | | -1.2 | % | | | 737 | | | | 886 | | | | -16.8 | % | | | 1,496 | | | | 1,375 | | | | 8.8 | % |

Portland, OR | | | 716 | | | | 2,185 | | | | 2,139 | | | | 2.2 | % | | | 728 | | | | 707 | | | | 3.0 | % | | | 1,457 | | | | 1,432 | | | | 1.7 | % |

San Diego, CA | | | 366 | | | | 1,497 | | | | 1,494 | | | | 0.2 | % | | | 431 | | | | 521 | | | | -17.3 | % | | | 1,066 | | | | 973 | | | | 9.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12,617 | | | | 58,450 | | | | 57,783 | | | | 1.2 | % | | | 16,706 | | | | 17,917 | | | | -6.8 | % | | | 41,744 | | | | 39,866 | | | | 4.7 | % |

| | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | | | 4,313 | | | | 22,360 | | | | 22,109 | | | | 1.1 | % | | | 6,757 | | | | 7,024 | | | | -3.8 | % | | | 15,603 | | | | 15,085 | | | | 3.4 | % |

Baltimore, MD | | | 2,301 | | | | 9,506 | | | | 9,627 | | | | -1.3 | % | | | 2,756 | | | | 2,767 | | | | -0.4 | % | | | 6,750 | | | | 6,860 | | | | -1.6 | % |

Richmond, VA | | | 1,358 | | | | 4,585 | | | | 4,641 | | | | -1.2 | % | | | 1,152 | | | | 1,308 | | | | -11.9 | % | | | 3,433 | | | | 3,333 | | | | 3.0 | % |

Norfolk, VA | | | 1,438 | | | | 4,024 | | | | 4,020 | | | | 0.1 | % | | | 1,316 | | | | 1,336 | | | | -1.5 | % | | | 2,708 | | | | 2,684 | | | | 0.9 | % |

Other Mid-Atlantic | | | 168 | | | | 488 | | | | 471 | | | | 3.6 | % | | | 163 | | | | 181 | | | | -9.9 | % | | | 325 | | | | 290 | | | | 12.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9,578 | | | | 40,963 | | | | 40,868 | | | | 0.2 | % | | | 12,144 | | | | 12,616 | | | | -3.7 | % | | | 28,819 | | | | 28,252 | | | | 2.0 | % |

| | | | | | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Boston, MA | | | 1,179 | | | | 6,976 | | | | 6,820 | | | | 2.3 | % | | | 2,015 | | | | 2,071 | | | | -2.7 | % | | | 4,961 | | | | 4,749 | | | | 4.5 | % |

New York, NY | | | 493 | | | | 4,824 | | | | 4,823 | | | | 0.0 | % | | | 972 | | | | 1,086 | | | | -10.5 | % | | | 3,852 | | | | 3,737 | | | | 3.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1,672 | | | | 11,800 | | | | 11,643 | | | | 1.3 | % | | | 2,987 | | | | 3,157 | | | | -5.4 | % | | | 8,813 | | | | 8,486 | | | | 3.9 | % |

| | | | | | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tampa, FL | | | 3,452 | | | | 10,545 | | | | 10,532 | | | | 0.1 | % | | | 3,840 | | | | 4,100 | | | | -6.3 | % | | | 6,705 | | | | 6,432 | | | | 4.2 | % |

Orlando, FL | | | 3,167 | | | | 8,900 | | | | 8,876 | | | | 0.3 | % | | | 3,100 | | | | 3,303 | | | | -6.1 | % | | | 5,800 | | | | 5,573 | | | | 4.1 | % |

Nashville, TN | | | 2,260 | | | | 6,367 | | | | 6,332 | | | | 0.6 | % | | | 2,155 | | | | 2,057 | | | | 4.8 | % | | | 4,212 | | | | 4,275 | | | | -1.5 | % |

Other Florida | | | 636 | | | | 2,289 | | | | 2,243 | | | | 2.1 | % | | | 863 | | | | 805 | | | | 7.2 | % | | | 1,426 | | | | 1,438 | | | | -0.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9,515 | | | | 28,101 | | | | 27,983 | | | | 0.4 | % | | | 9,958 | | | | 10,265 | | | | -3.0 | % | | | 18,143 | | | | 17,718 | | | | 2.4 | % |

| | | | | | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dallas, TX | | | 3,117 | | | | 9,687 | | | | 9,680 | | | | 0.1 | % | | | 3,769 | | | | 3,847 | | | | -2.0 | % | | | 5,918 | | | | 5,833 | | | | 1.5 | % |

Austin, TX | | | 390 | | | | 1,507 | | | | 1,473 | | | | 2.3 | % | | | 641 | | | | 704 | | | | -8.9 | % | | | 866 | | | | 769 | | | | 12.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 3,507 | | | | 11,194 | | | | 11,153 | | | | 0.4 | % | | | 4,410 | | | | 4,551 | | | | -3.1 | % | | | 6,784 | | | | 6,602 | | | | 2.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 36,889 | | | $ | 150,508 | | | $ | 149,430 | | | | 0.7 | % | | $ | 46,205 | | | $ | 48,506 | | | | -4.7 | % | | $ | 104,303 | | | $ | 100,924 | | | | 3.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

13

Attachment 8(E)

UDR, Inc.

Same-Store Operating Information By Major Market(1)

Current Year-to-Date vs. Prior Year-to-Date

December 31, 2012

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | % of Same- | | | | | | | | | | | | | | | | | | | |

| | | Total | | | Store Portfolio | | | Same-Store | |

| | | Same-Store | | | Based on | | | Physical Occupancy | | | Total Revenue per Occupied Home | |

| | | Homes | | | YTD 2012 NOI | | | YTD 12 | | | YTD 11 | | | Change | | | YTD 12 | | | YTD 11 | | | Change | |

West Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Orange County, CA | | | 3,290 | | | | 12.4 | % | | | 94.9 | % | | | 94.8 | % | | | 0.1 | % | | $ | 1,621 | | | $ | 1,526 | | | | 6.2 | % |

San Francisco, CA | | | 1,477 | | | | 8.7 | % | | | 96.4 | % | | | 96.7 | % | | | -0.3 | % | | | 2,386 | | | | 2,133 | | | | 11.9 | % |

Seattle, WA | | | 2,165 | | | | 6.9 | % | | | 96.0 | % | | | 95.8 | % | | | 0.2 | % | | | 1,414 | | | | 1,327 | | | | 6.6 | % |

Los Angeles, CA | | | 919 | | | | 3.9 | % | | | 95.1 | % | | | 95.6 | % | | | -0.5 | % | | | 2,023 | | | | 1,932 | | | | 4.7 | % |

Monterey Peninsula, CA | | | 1,565 | | | | 3.7 | % | | | 93.5 | % | | | 93.8 | % | | | -0.3 | % | | | 1,111 | | | | 1,110 | | | | 0.1 | % |

Inland Empire, CA | | | 654 | | | | 2.1 | % | | | 94.3 | % | | | 94.9 | % | | | -0.6 | % | | | 1,434 | | | | 1,379 | | | | 4.0 | % |

Sacramento, CA | | | 914 | | | | 1.7 | % | | | 92.7 | % | | | 93.1 | % | | | -0.4 | % | | | 885 | | | | 882 | | | | 0.3 | % |

Portland, OR | | | 716 | | | | 1.6 | % | | | 95.0 | % | | | 95.5 | % | | | -0.5 | % | | | 1,043 | | | | 998 | | | | 4.5 | % |

San Diego, CA | | | 366 | | | | 1.1 | % | | | 95.0 | % | | | 94.8 | % | | | 0.2 | % | | | 1,413 | | | | 1,365 | | | | 3.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12,066 | | | | 42.1 | % | | | 94.9 | % | | | 95.1 | % | | | -0.2 | % | | | 1,539 | | | | 1,451 | | | | 6.1 | % |

| | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | | | 3,516 | | | | 13.9 | % | | | 97.0 | % | | | 96.9 | % | | | 0.1 | % | | | 1,744 | | | | 1,669 | | | | 4.5 | % |

Baltimore, MD | | | 2,301 | | | | 7.7 | % | | | 96.5 | % | | | 96.5 | % | | | 0.0 | % | | | 1,428 | | | | 1,373 | | | | 4.0 | % |

Richmond, VA | | | 1,358 | | | | 3.9 | % | | | 95.4 | % | | | 95.8 | % | | | -0.4 | % | | | 1,172 | | | | 1,130 | | | | 3.7 | % |

Norfolk, VA | | | 1,438 | | | | 3.1 | % | | | 94.5 | % | | | 94.7 | % | | | -0.2 | % | | | 989 | | | | 980 | | | | 0.9 | % |

Other Mid-Atlantic | | | 168 | | | | 0.3 | % | | | 95.7 | % | | | 94.8 | % | | | 0.9 | % | | | 987 | | | | 982 | | | | 0.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 8,781 | | | | 28.9 | % | | | 96.2 | % | | | 96.2 | % | | | 0.0 | % | | | 1,437 | | | | 1,385 | | | | 3.8 | % |

| | | | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Boston, MA | | | 346 | | | | 2.2 | % | | | 96.2 | % | | | 96.7 | % | | | -0.5 | % | | | 2,774 | | | | 2,558 | | | | 8.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 346 | | | | 2.2 | % | | | 96.2 | % | | | 96.7 | % | | | -0.5 | % | | | 2,774 | | | | 2,558 | | | | 8.4 | % |

| | | | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tampa, FL | | | 3,452 | | | | 7.4 | % | | | 96.0 | % | | | 95.7 | % | | | 0.3 | % | | | 1,042 | | | | 998 | | | | 4.4 | % |

Orlando, FL | | | 3,167 | | | | 6.5 | % | | | 95.7 | % | | | 95.0 | % | | | 0.7 | % | | | 964 | | | | 926 | | | | 4.1 | % |

Nashville, TN | | | 2,260 | | | | 4.8 | % | | | 96.9 | % | | | 96.3 | % | | | 0.6 | % | | | 948 | | | | 894 | | | | 6.0 | % |

Other Florida | | | 636 | | | | 1.6 | % | | | 95.0 | % | | | 93.2 | % | | | 1.8 | % | | | 1,246 | | | | 1,214 | | | | 2.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9,515 | | | | 20.3 | % | | | 96.1 | % | | | 95.5 | % | | | 0.6 | % | | | 1,007 | | | | 963 | | | | 4.6 | % |

| | | | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dallas, TX | | | 2,725 | | | | 5.6 | % | | | 96.2 | % | | | 96.1 | % | | | 0.1 | % | | | 1,027 | | | | 952 | | | | 7.9 | % |

Austin, TX | | | 390 | | | | 0.9 | % | | | 96.3 | % | | | 95.8 | % | | | 0.5 | % | | | 1,282 | | | | 1,195 | | | | 7.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 3,115 | | | | 6.5 | % | | | 96.2 | % | | | 96.0 | % | | | 0.2 | % | | | 1,059 | | | | 983 | | | | 7.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Avg. | | | 33,823 | | | | 100.0 | % | | | 95.7 | % | | | 95.6 | % | | | 0.1 | % | | $ | 1,331 | | | $ | 1,265 | | | | 5.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

14

Attachment 8(F)

UDR, Inc.

Same-Store Operating Information By Major Market(1)

Current Year-to-Date vs. Prior Year-to-Date

December 31, 2012

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total | | | Same-Store ($000s) | |

| | | Same-Store | | | Revenues | | | Expenses | | | Net Operating Income | |

| | | Homes | | | YTD 12 | | | YTD 11 | | | Change | | | YTD 12 | | | YTD 11 | | | Change | | | YTD 12 | | | YTD 11 | | | Change | |

West Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Orange County, CA | | | 3,290 | | | $ | 60,718 | | | $ | 57,105 | | | | 6.3 | % | | $ | 17,268 | | | $ | 17,165 | | | | 0.6 | % | | $ | 43,450 | | | $ | 39,940 | | | | 8.8 | % |

San Francisco, CA | | | 1,477 | | | | 40,765 | | | | 36,563 | | | | 11.5 | % | | | 10,247 | | | | 9,623 | | | | 6.5 | % | | | 30,518 | | | | 26,940 | | | | 13.3 | % |

Seattle, WA | | | 2,165 | | | | 35,265 | | | | 33,033 | | | | 6.8 | % | | | 10,888 | | | | 10,671 | | | | 2.0 | % | | | 24,377 | | | | 22,362 | | | | 9.0 | % |

Los Angeles, CA | | | 919 | | | | 21,220 | | | | 20,371 | | | | 4.2 | % | | | 7,514 | | | | 6,995 | | | | 7.4 | % | | | 13,706 | | | | 13,376 | | | | 2.5 | % |

Monterey Peninsula, CA | | | 1,565 | | | | 19,510 | | | | 19,558 | | | | -0.2 | % | | | 6,477 | | | | 6,253 | | | | 3.6 | % | | | 13,033 | | | | 13,305 | | | | -2.0 | % |

Inland Empire, CA | | | 654 | | | | 10,611 | | | | 10,270 | | | | 3.3 | % | | | 3,222 | | | | 3,209 | | | | 0.4 | % | | | 7,389 | | | | 7,061 | | | | 4.6 | % |

Sacramento, CA | | | 914 | | | | 8,996 | | | | 9,011 | | | | -0.2 | % | | | 3,198 | | | | 3,038 | | | | 5.3 | % | | | 5,798 | | | | 5,973 | | | | -2.9 | % |

Portland, OR | | | 716 | | | | 8,512 | | | | 8,187 | | | | 4.0 | % | | | 2,835 | | | | 2,617 | | | | 8.3 | % | | | 5,677 | | | | 5,570 | | | | 1.9 | % |

San Diego, CA | | | 366 | | | | 5,897 | | | | 5,684 | | | | 3.7 | % | | | 2,005 | | | | 1,909 | | | | 5.0 | % | | | 3,892 | | | | 3,775 | | | | 3.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12,066 | | | | 211,494 | | | | 199,782 | | | | 5.9 | % | | | 63,654 | | | | 61,480 | | | | 3.5 | % | | | 147,840 | | | | 138,302 | | | | 6.9 | % |

| | | | | | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | | | 3,516 | | | | 71,391 | | | | 68,241 | | | | 4.6 | % | | | 22,718 | | | | 22,133 | | | | 2.6 | % | | | 48,673 | | | | 46,108 | | | | 5.6 | % |

Baltimore, MD | | | 2,301 | | | | 38,045 | | | | 36,577 | | | | 4.0 | % | | | 11,062 | | | | 10,823 | | | | 2.2 | % | | | 26,983 | | | | 25,754 | | | | 4.8 | % |

Richmond, VA | | | 1,358 | | | | 18,227 | | | | 17,634 | | | | 3.4 | % | | | 4,715 | | | | 4,661 | | | | 1.2 | % | | | 13,512 | | | | 12,973 | | | | 4.2 | % |

Norfolk, VA | | | 1,438 | | | | 16,128 | | | | 16,023 | | | | 0.7 | % | | | 5,278 | | | | 5,158 | | | | 2.3 | % | | | 10,850 | | | | 10,865 | | | | -0.1 | % |

Other Mid-Atlantic | | | 168 | | | | 1,903 | | | | 1,877 | | | | 1.4 | % | | | 676 | | | | 657 | | | | 2.9 | % | | | 1,227 | | | | 1,220 | | | | 0.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 8,781 | | | | 145,694 | | | | 140,352 | | | | 3.8 | % | | | 44,449 | | | | 43,432 | | | | 2.3 | % | | | 101,245 | | | | 96,920 | | | | 4.5 | % |

| | | | | | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Boston, MA | | | 346 | | | | 11,080 | | | | 10,271 | | | | 7.9 | % | | | 3,459 | | | | 2,910 | | | | 18.9 | % | | | 7,621 | | | | 7,361 | | | | 3.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 346 | | | | 11,080 | | | | 10,271 | | | | 7.9 | % | | | 3,459 | | | | 2,910 | | | | 18.9 | % | | | 7,621 | | | | 7,361 | | | | 3.5 | % |

| | | | | | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tampa, FL | | | 3,452 | | | | 41,457 | | | | 39,569 | | | | 4.8 | % | | | 15,419 | | | | 14,978 | | | | 2.9 | % | | | 26,038 | | | | 24,591 | | | | 5.9 | % |

Orlando, FL | | | 3,167 | | | | 35,048 | | | | 33,444 | | | | 4.8 | % | | | 12,380 | | | | 12,007 | | | | 3.1 | % | | | 22,668 | | | | 21,437 | | | | 5.7 | % |

Nashville, TN | | | 2,260 | | | | 24,924 | | | | 23,359 | | | | 6.7 | % | | | 8,151 | | | | 8,481 | | | | -3.9 | % | | | 16,773 | | | | 14,878 | | | | 12.7 | % |

Other Florida | | | 636 | | | | 9,032 | | | | 8,633 | | | | 4.6 | % | | | 3,293 | | | | 3,336 | | | | -1.3 | % | | | 5,739 | | | | 5,297 | | | | 8.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 9,515 | | | | 110,461 | | | | 105,005 | | | | 5.2 | % | | | 39,243 | | | | 38,802 | | | | 1.1 | % | | | 71,218 | | | | 66,203 | | | | 7.6 | % |

| | | | | | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dallas, TX | | | 2,725 | | | | 32,322 | | | | 29,908 | | | | 8.1 | % | | | 12,712 | | | | 12,567 | | | | 1.2 | % | | | 19,610 | | | | 17,341 | | | | 13.1 | % |

Austin, TX | | | 390 | | | | 5,777 | | | | 5,356 | | | | 7.9 | % | | | 2,570 | | | | 2,378 | | | | 8.1 | % | | | 3,207 | | | | 2,978 | | | | 7.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 3,115 | | | | 38,099 | | | | 35,264 | | | | 8.0 | % | | | 15,282 | | | | 14,945 | | | | 2.3 | % | | | 22,817 | | | | 20,319 | | | | 12.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 33,823 | | | $ | 516,828 | | | $ | 490,674 | | | | 5.3 | % | | $ | 166,087 | | | $ | 161,569 | | | | 2.8 | % | | $ | 350,741 | | | $ | 329,105 | | | | 6.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

15

Attachment 8(G)

UDR, Inc.

Same-Store Operating Information By Major Market(1)

December 31, 2012

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Effective New

Lease Rate

Growth | | | Effective

Renewal

Lease Rate

Growth | | | Turnover | |

| | | Q4 2012 | | | Q4 2012 | | | 4Q 2012 | | | 4Q 2011 | | | TTM 2012 | | | TTM 2011 | |

West Region | | | | | | | | | | | | | | | | | | | | | | | | |

Orange County, CA | | | 2.3 | % | | | 5.2 | % | | | 54.2 | % | | | 53.3 | % | | | 61.8 | % | | | 57.2 | % |

San Francisco, CA | | | 4.3 | % | | | 7.2 | % | | | 48.9 | % | | | 45.6 | % | | | 55.7 | % | | | 51.3 | % |

Seattle, WA | | | 5.8 | % | | | 5.5 | % | | | 47.9 | % | | | 53.4 | % | | | 57.1 | % | | | 56.0 | % |

Los Angeles, CA | | | 4.5 | % | | | 4.9 | % | | | 48.3 | % | | | 41.3 | % | | | 56.9 | % | | | 51.0 | % |

Monterey Peninsula, CA | | | -4.1 | % | | | 3.9 | % | | | 77.4 | % | | | 72.1 | % | | | 66.0 | % | | | 61.3 | % |

Inland Empire, CA | | | -2.4 | % | | | 5.4 | % | | | 57.5 | % | | | 41.6 | % | | | 63.1 | % | | | 56.7 | % |

Sacramento, CA | | | 0.7 | % | | | 6.5 | % | | | 50.8 | % | | | 49.5 | % | | | 61.2 | % | | | 59.5 | % |

Portland, OR | | | 5.5 | % | | | 5.7 | % | | | 39.1 | % | | | 56.4 | % | | | 58.0 | % | | | 55.3 | % |

San Diego, CA | | | 2.5 | % | | | 2.8 | % | | | 66.7 | % | | | 71.0 | % | | | 71.0 | % | | | 66.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2.5 | % | | | 5.7 | % | | | 54.1 | % | | | 53.3 | % | | | 60.5 | % | | | 56.6 | % |

| | | | | | |

Mid-Atlantic Region | | | | | | | | | | | | | | | | | | | | | | | | |

Metropolitan DC | | | 1.9 | % | | | 5.5 | % | | | 38.0 | % | | | 42.9 | % | | | 42.9 | % | | | 43.7 | % |

Baltimore, MD | | | -3.9 | % | | | 5.5 | % | | | 43.3 | % | | | 45.0 | % | | | 50.3 | % | | | 51.5 | % |

Richmond, VA | | | -5.6 | % | | | 3.3 | % | | | 56.0 | % | | | 45.9 | % | | | 64.9 | % | | | 54.9 | % |

Norfolk, VA | | | -3.9 | % | | | 4.7 | % | | | 53.7 | % | | | 61.8 | % | | | 56.7 | % | | | 60.4 | % |

Other Mid-Atlantic | | | -2.4 | % | | | 0.3 | % | | | 38.1 | % | | | 52.4 | % | | | 58.9 | % | | | 64.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | -1.4 | % | | | 5.2 | % | | | 44.2 | % | | | 46.9 | % | | | 50.8 | % | | | 50.6 | % |

| | | | | | |

Northeast Region | | | | | | | | | | | | | | | | | | | | | | | | |

New York, NY | | | 7.4 | % | | | 6.1 | % | | | 40.6 | % | | | 32.5 | % | | | n/a | | | | n/a | |

Boston, MA | | | 5.7 | % | | | 6.6 | % | | | 41.7 | % | | | 34.6 | % | | | 49.7 | % | | | 38.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 6.4 | % | | | 6.4 | % | | | 41.4 | % | | | 34.0 | % | | | 49.7 | % | | | 38.2 | % |

| | | | | | |

Southeast Region | | | | | | | | | | | | | | | | | | | | | | | | |

Tampa, FL | | | 0.3 | % | | | 5.5 | % | | | 44.1 | % | | | 38.7 | % | | | 51.0 | % | | | 49.2 | % |

Orlando, FL | | | 1.8 | % | | | 5.3 | % | | | 48.2 | % | | | 52.3 | % | | | 54.6 | % | | | 52.6 | % |

Nashville, TN | | | 1.1 | % | | | 5.1 | % | | | 49.0 | % | | | 53.8 | % | | | 53.5 | % | | | 56.8 | % |

Other Florida | | | 4.2 | % | | | 6.1 | % | | | 34.6 | % | | | 53.5 | % | | | 49.8 | % | | | 56.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1.3 | % | | | 5.3 | % | | | 46.0 | % | | | 47.8 | % | | | 52.7 | % | | | 52.6 | % |

| | | | | | |

Southwest Region | | | | | | | | | | | | | | | | | | | | | | | | |

Dallas, TX | | | 3.9 | % | | | 6.9 | % | | | 50.3 | % | | | 47.5 | % | | | 53.5 | % | | | 49.8 | % |

Austin, TX | | | 2.8 | % | | | 6.4 | % | | | 42.1 | % | | | 52.3 | % | | | 55.1 | % | | | 56.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 3.8 | % | | | 6.8 | % | | | 49.4 | % | | | 48.0 | % | | | 53.7 | % | | | 50.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Avg. | | | 1.7 | % | | | 5.6 | % | | | 48.4 | % | | | 48.8 | % | | | 55.0 | % | | | 53.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Combined New and Renewal Lease Rate Growth | | | | 3.6 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | See Attachment 16 for definitions and other terms. |

16

Attachment 9

UDR, Inc.

Development Summary(1)

December 31, 2012

(Dollars in Thousands)

(Unaudited)

Wholly-Owned

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | # of | | | Compl. | | | Cost to | | | Budgeted | | | Est. Cost | | | Estimated Qtr of | | | Percentage | |

Community | | Location | | Homes | | | Homes | | | Date | | | Cost | | | per Home | | | Compl. | | | Stabil. | | | Leased | | | Occupied | |

Projects Under Construction | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capitol View on Fourteenth | | Washington, DC | | | 255 | | | | 76 | | | $ | 117,851 | | | $ | 126,100 | | | $ | 495 | (2) | | | 1Q 13 | | | | 1Q 14 | | | | 36.9 | % | | | 28.1 | % |

Fiori on Vitruvian Park® | | Addison, TX | | | 391 | | | | — | | | | 70,315 | | | | 98,350 | | | | 252 | | | | 3Q 13 | | | | 4Q 14 | | | | 1.3 | % | | | — | |

The Residences at Bella Terra | | Huntington Beach, CA | | | 467 | | | | — | | | | 89,809 | | | | 150,000 | | | | 321 | (3) | | | 4Q 13 | | | | 1Q 15 | | | | — | | | | — | |

Mission Bay | | San Francisco, CA | | | 315 | | | | — | | | | 77,444 | | | | 139,600 | | | | 443 | (4) | | | 4Q 13 | | | | 1Q 15 | | | | — | | | | — | |

Los Alisos | | Mission Viejo, CA | | | 320 | | | | — | | | | 47,723 | | | | 87,050 | | | | 272 | | | | 4Q 13 | | | | 1Q 15 | | | | — | | | | — | |

The Calvert (5) | | Alexandria, VA | | | 332 | | | | — | | | | 39,670 | | | | 132,000 | | | | 398 | | | | 2Q 14 | | | | 3Q 15 | | | | — | | | | — | |

Beach Walk | | Huntington Beach, CA | | | 173 | | | | — | | | | 15,895 | | | | 50,700 | | | | 293 | | | | 2Q 14 | | | | 3Q 15 | | | | — | | | | — | |

Pier 4 | | Boston, MA | | | 369 | | | | — | | | | 32,341 | | | | 217,700 | | | | 590 | (6) | | | 2Q 15 | | | | 3Q 16 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | 2,622 | | | | 76 | | | $ | 491,048 | | | $ | 1,001,500 | | | $ | 382 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Completed Projects, Non-Stabilized | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

N/A | | N/A | | | — | | | | — | | | $ | — | | | $ | — | | | $ | — | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | |

Completed Projects, Stabilized During Quarter (6) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

N/A | | N/A | | | — | | | | — | | | $ | — | | | $ | — | | | $ | — | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total—Wholly Owned | | | | | 2,622 | | | | 76 | | | $ | 491,048 | | | $ | 1,001,500 | | | $ | 382 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Operating Income From Wholly-Owned Projects | | | | | | Capitalized Interest for Current Development Projects | | | | | | | | | |

| | | | | QTD NOI | | | | | | | | | | | | | 4Q 12 | | | 4Q 11 | | | YTD 12 | | | YTD 11 | |

Projects Under Construction | | | | $ | (310 | ) | | | | | | | | | | | | $ | 4,784 | | | $ | 1,665 | | | $ | 14,792 | | | $ | 5,509 | |

Completed, Non-Stabilized | | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Completed, Stabilized During Quarter(7) | | | | | — | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | $ | (310 | ) | | Projected Weighted Average Stabilized Yield of Wholly-owned Projects: | | | | 6.0% to 6.5% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Unconsolidated Joint Ventures

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Own. | | | # of | | | Compl. | | | Cost to | | | Budgeted | | | Estimated Qtr of | | | Percentage | |

Community | | Location | | Interest | | | Homes | | | Homes | | | Date | | | Cost | | | Compl. | | | Stabil. | | | Leased | | | Occupied | |

Projects Under Construction | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

13th & Market | | San Diego, CA | | | 95 | % | | | 264 | | | | — | | | $ | 36,358 | | | $ | 75,500 | (8) | | | 1Q 14 | | | | 2Q 15 | | | | — | | | | — | |

Domain College Park | | College Park, MD | | | 95 | % | | | 256 | | | | — | | | | 30,620 | | | | 65,100 | (9) | | | 1Q 14 | | | | 2Q 15 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | 520 | | | | — | | | $ | 66,978 | | | $ | 140,600 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |