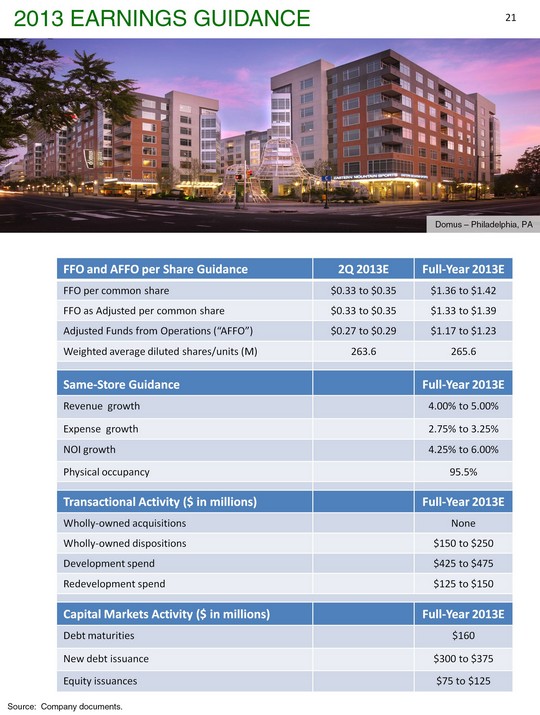

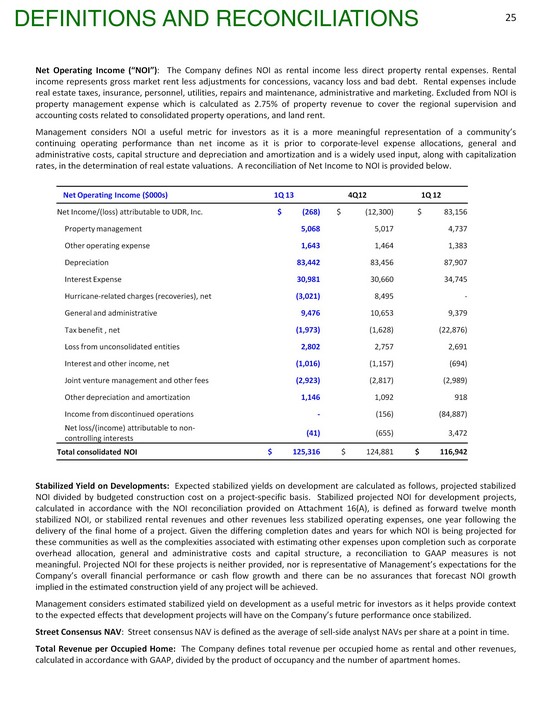

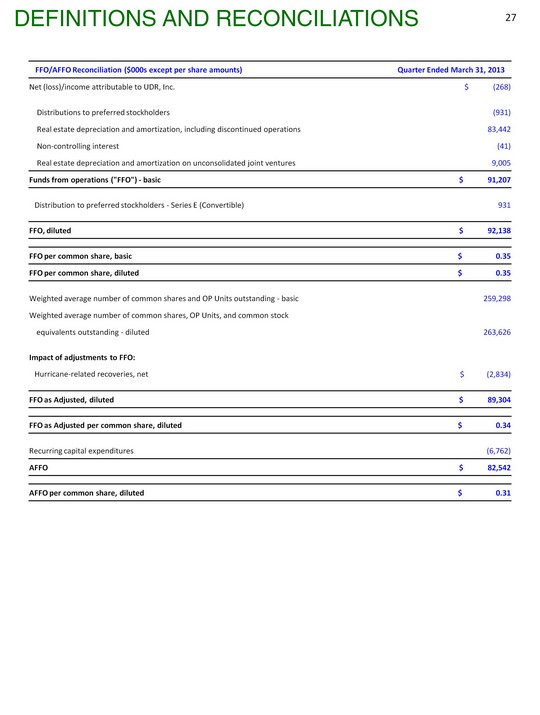

| Net Operating Income ("NOI"): The Company defines NOI as rental income less direct property rental expenses. Rental income represents gross market rent less adjustments for concessions, vacancy loss and bad debt. Rental expenses include real estate taxes, insurance, personnel, utilities, repairs and maintenance, administrative and marketing. Excluded from NOI is property management expense which is calculated as 2.75% of property revenue to cover the regional supervision and accounting costs related to consolidated property operations, and land rent. Management considers NOI a useful metric for investors as it is a more meaningful representation of a community's continuing operating performance than net income as it is prior to corporate-level expense allocations, general and administrative costs, capital structure and depreciation and amortization and is a widely used input, along with capitalization rates, in the determination of real estate valuations. A reconciliation of Net Income to NOI is provided below. Stabilized Yield on Developments: Expected stabilized yields on development are calculated as follows, projected stabilized NOI divided by budgeted construction cost on a project-specific basis. Stabilized projected NOI for development projects, calculated in accordance with the NOI reconciliation provided on Attachment 16(A), is defined as forward twelve month stabilized NOI, or stabilized rental revenues and other revenues less stabilized operating expenses, one year following the delivery of the final home of a project. Given the differing completion dates and years for which NOI is being projected for these communities as well as the complexities associated with estimating other expenses upon completion such as corporate overhead allocation, general and administrative costs and capital structure, a reconciliation to GAAP measures is not meaningful. Projected NOI for these projects is neither provided, nor is representative of Management's expectations for the Company's overall financial performance or cash flow growth and there can be no assurances that forecast NOI growth implied in the estimated construction yield of any project will be achieved. Management considers estimated stabilized yield on development as a useful metric for investors as it helps provide context to the expected effects that development projects will have on the Company's future performance once stabilized. Street Consensus NAV: Street consensus NAV is defined as the average of sell-side analyst NAVs per share at a point in time. Total Revenue per Occupied Home: The Company defines total revenue per occupied home as rental and other revenues, calculated in accordance with GAAP, divided by the product of occupancy and the number of apartment homes. Net Operating Income ($000s) 1Q 13 4Q12 1Q 12 Net Income/(loss) attributable to UDR, Inc. $ (268) $ (12,300) $ 83,156 Property management 5,068 5,017 4,737 Other operating expense 1,643 1,464 1,383 Depreciation 83,442 83,456 87,907 Interest Expense 30,981 30,660 34,745 Hurricane-related charges (recoveries), net (3,021) 8,495 - General and administrative 9,476 10,653 9,379 Tax benefit , net (1,973) (1,628) (22,876) Loss from unconsolidated entities 2,802 2,757 2,691 Interest and other income, net (1,016) (1,157) (694) Joint venture management and other fees (2,923) (2,817) (2,989) Other depreciation and amortization 1,146 1,092 918 Income from discontinued operations - (156) (84,887) Net loss/(income) attributable to non-controlling interests (41) (655) 3,472 Total consolidated NOI $ 125,316 $ 124,881 $ 116,942 Definitions and reconciliations 25 |