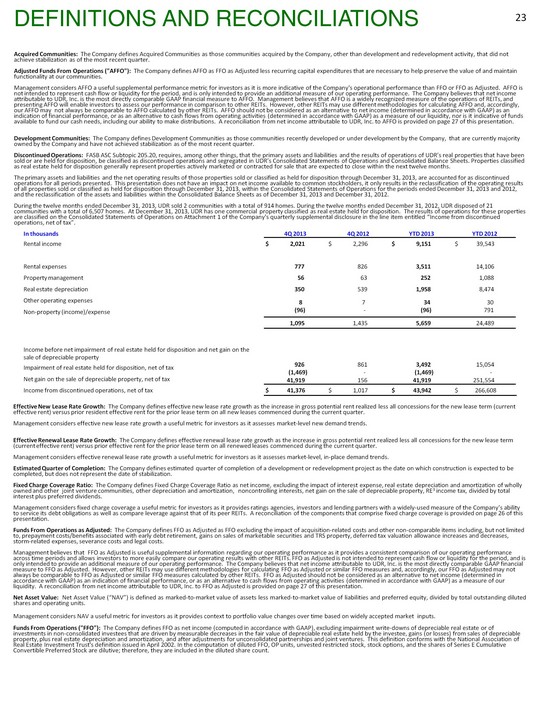

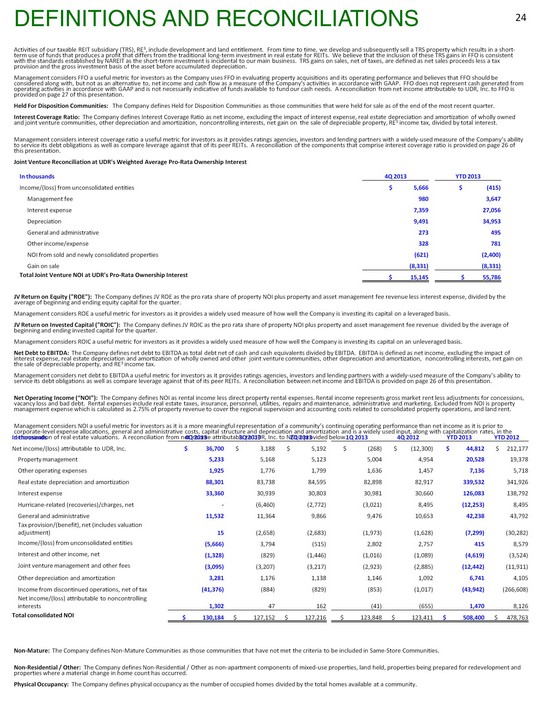

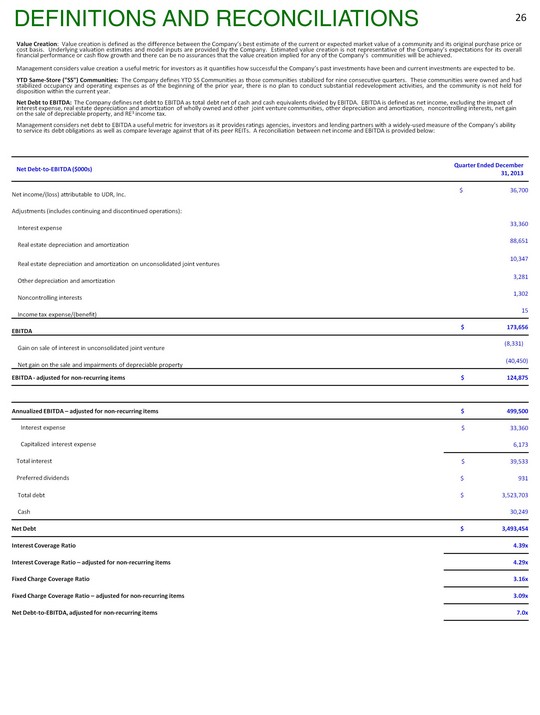

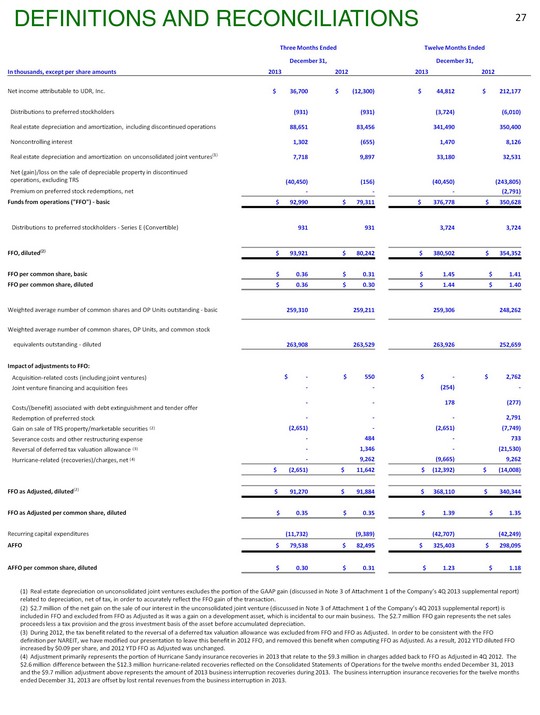

| Definitions and reconciliations Activities of our taxable REIT subsidiary (TRS), RE3, include development and land entitlement. From time to time, we develop and subsequently sell a TRS property which results in a short- term use of funds that produces a profit that differs from the traditional long-term investment in real estate for REITs. We believe that the inclusion of these TRS gains in FFO is consistent with the standards established by NAREIT as the short-term investment is incidental to our main business. TRS gains on sales, net of taxes, are defined as net sales proceeds less a tax provision and the gross investment basis of the asset before accumulated depreciation. Management considers FFO a useful metric for investors as the Company uses FFO in evaluating property acquisitions and its operating performance and believes that FFO should be considered along with, but not as an alternative to, net income and cash flow as a measure of the Company's activities in accordance with GAAP. FFO does not represent cash generated from operating activities in accordance with GAAP and is not necessarily indicative of funds available to fund our cash needs. A reconciliation from net income attributable to UDR, Inc. to FFO is provided on page 27 of this presentation. Held For Disposition Communities: The Company defines Held for Disposition Communities as those communities that were held for sale as of the end of the most recent quarter. Interest Coverage Ratio: The Company defines Interest Coverage Ratio as net income, excluding the impact of interest expense, real estate depreciation and amortization of wholly owned and joint venture communities, other depreciation and amortization, noncontrolling interests, net gain on the sale of depreciable property, RE3 income tax, divided by total interest. Management considers interest coverage ratio a useful metric for investors as it provides ratings agencies, investors and lending partners with a widely-used measure of the Company's ability to service its debt obligations as well as compare leverage against that of its peer REITs. A reconciliation of the components that comprise interest coverage ratio is provided on page 26 of this presentation. Joint Venture Reconciliation at UDR's Weighted Average Pro-Rata Ownership Interest JV Return on Equity ("ROE"): The Company defines JV ROE as the pro rata share of property NOI plus property and asset management fee revenue less interest expense, divided by the average of beginning and ending equity capital for the quarter. Management considers ROE a useful metric for investors as it provides a widely used measure of how well the Company is investing its capital on a leveraged basis. JV Return on Invested Capital ("ROIC"): The Company defines JV ROIC as the pro rata share of property NOI plus property and asset management fee revenue divided by the average of beginning and ending invested capital for the quarter. Management considers ROIC a useful metric for investors as it provides a widely used measure of how well the Company is investing its capital on an unleveraged basis. Net Debt to EBITDA: The Company defines net debt to EBITDA as total debt net of cash and cash equivalents divided by EBITDA. EBITDA is defined as net income, excluding the impact of interest expense, real estate depreciation and amortization of wholly owned and other joint venture communities, other depreciation and amortization, noncontrolling interests, net gain on the sale of depreciable property, and RE3 income tax. Management considers net debt to EBITDA a useful metric for investors as it provides ratings agencies, investors and lending partners with a widely-used measure of the Company's ability to service its debt obligations as well as compare leverage against that of its peer REITs. A reconciliation between net income and EBITDA is provided on page 26 of this presentation. Net Operating Income ("NOI"): The Company defines NOI as rental income less direct property rental expenses. Rental income represents gross market rent less adjustments for concessions, vacancy loss and bad debt. Rental expenses include real estate taxes, insurance, personnel, utilities, repairs and maintenance, administrative and marketing. Excluded from NOI is property management expense which is calculated as 2.75% of property revenue to cover the regional supervision and accounting costs related to consolidated property operations, and land rent. Management considers NOI a useful metric for investors as it is a more meaningful representation of a community's continuing operating performance than net income as it is prior to corporate-level expense allocations, general and administrative costs, capital structure and depreciation and amortization and is a widely used input, along with capitalization rates, in the determination of real estate valuations. A reconciliation from net income attributable to UDR, Inc. to NOI is provided below. Non-Mature: The Company defines Non-Mature Communities as those communities that have not met the criteria to be included in Same-Store Communities. Non-Residential / Other: The Company defines Non-Residential / Other as non-apartment components of mixed-use properties, land held, properties being prepared for redevelopment and properties where a material change in home count has occurred. Physical Occupancy: The Company defines physical occupancy as the number of occupied homes divided by the total homes available at a community. In thousands 4Q 2013 3Q 2013 2Q 2013 1Q 2013 4Q 2012 YTD 2013 YTD 2012 Net income/(loss) attributable to UDR, Inc. $ 36,700 $ 3,188 $ 5,192 $ (268) $ (12,300) $ 44,812 $ 212,177 Property management 5,233 5,168 5,123 5,004 4,954 20,528 19,378 Other operating expenses 1,925 1,776 1,799 1,636 1,457 7,136 5,718 Real estate depreciation and amortization 88,301 83,738 84,595 82,898 82,917 339,532 341,926 Interest expense 33,360 30,939 30,803 30,981 30,660 126,083 138,792 Hurricane-related (recoveries)/charges, net - (6,460) (2,772) (3,021) 8,495 (12,253) 8,495 General and administrative 11,532 11,364 9,866 9,476 10,653 42,238 43,792 Tax provision/(benefit), net (includes valuation adjustment) 15 (2,658) (2,683) (1,973) (1,628) (7,299) (30,282) Income/(loss) from unconsolidated entities (5,666) 3,794 (515) 2,802 2,757 415 8,579 Interest and other income, net (1,328) (829) (1,446) (1,016) (1,089) (4,619) (3,524) Joint venture management and other fees (3,095) (3,207) (3,217) (2,923) (2,885) (12,442) (11,911) Other depreciation and amortization 3,281 1,176 1,138 1,146 1,092 6,741 4,105 Income from discontinued operations, net of tax (41,376) (884) (829) (853) (1,017) (43,942) (266,608) Net income/(loss) attributable to noncontrolling interests 1,302 47 162 (41) (655) 1,470 8,126 Total consolidated NOI $ 130,184 $ 127,152 $ 127,216 $ 123,848 $ 123,411 $ 508,400 $ 478,763 24 In thousands 4Q 2013 YTD 2013 Income/(loss) from unconsolidated entities $ 5,666 $ (415) Management fee 980 3,647 Interest expense 7,359 27,056 Depreciation 9,491 34,953 General and administrative 273 495 Other income/expense 328 781 NOI from sold and newly consolidated properties (621) (2,400) Gain on sale (8,331) (8,331) Total Joint Venture NOI at UDR's Pro-Rata Ownership Interest $ 15,145 $ 55,786 |