Exhibit 99.2

| The Right Properties in the Right Markets June 2008 |

| Table of Contents _____ Pg. 1 Portfolio Overview 3 Orange County, CA 7 Metro D.C. 11 San Francisco Bay Area, CA 15 Tampa, FL 19 Seattle, WA 23 Baltimore, MD 27 LA County, CA 31 Orlando, FL 35 Richmond, VA 39 Dallas, TX 43 Nashville, TN 47 San Diego County, CA 51 Monterey, CA 53 Jacksonville, FL 55 Norfolk / Virginia Beach, VA 57 Inland Empire, CA 59 Phoenix, AZ 61 Sacramento, CA 63 Portland, OR 65 Austin, TX |

| UDR (NYSE:UDR) is a leading multifamily real estate investment trust (REIT) with a demonstrated performance history of delivering superior and _____ dependable returns by successfully managing, buying, selling, developing _____ and redeveloping attractive real estate properties in targeted U.S. markets. For over 30 years, UDR has delivered long-term value to shareholders, the best standard of service to residents, and the highest quality experience for _____ associates. Additional information can be found on the Company’s website _____ at www.udr.com. UDR Portfolio Characteristics Same Non- Average Pro forma NOI Store Mature Monthly _____ Rank _____ Market % of Total* Homes Homes Rent** 1 Orange County, CA 14.4 4,067 — $ 1,573 2 Metro D.C. 12.1 2,097 1,888 1,325 3 San Francisco Bay Area, CA 8.7 1,768 321 1,785 4 Tampa, FL 6.4 3,081 209 962 5 Seattle, WA 5.5 1,199 71 1,117 6 Baltimore, MD 5.3 1,556 564 1,173 7 LA County, CA 5.1 1,052 328 1,535 8 Orlando, FL 4.8 2,140 1,027 983 9 Richmond, VA 4.6 1,958 253 987 10 Dallas, TX 4.0 305 4,147 1,609 11 Nashville, TN 3.5 1,874 386 869 12 San Diego County, CA 3.1 1,123 — 1,368 13 Monterey / Salinas, CA 3.1 1,565 — 999 14 Jacksonville, FL 2.9 1,557 300 870 15 Norfolk / Virginia Beach, VA 2.8 1,438 — 964 16 Inland Empire, CA 2.8 660 414 1,165 17 Phoenix, AZ 2.1 914 — 960 18 Sacramento, CA 1.6 914 — 915 19 Portland, OR 1.4 716 — 973 20 Austin, TX 1.4 250 — 954 TOTAL: 95.6% 30,234 9,908 $ 1,168 *EOY 2008 pro forma full portfolio NIO, including jvs, planned acquisitions, developments, redevelopments, etc. **As of March 31, 2008 |

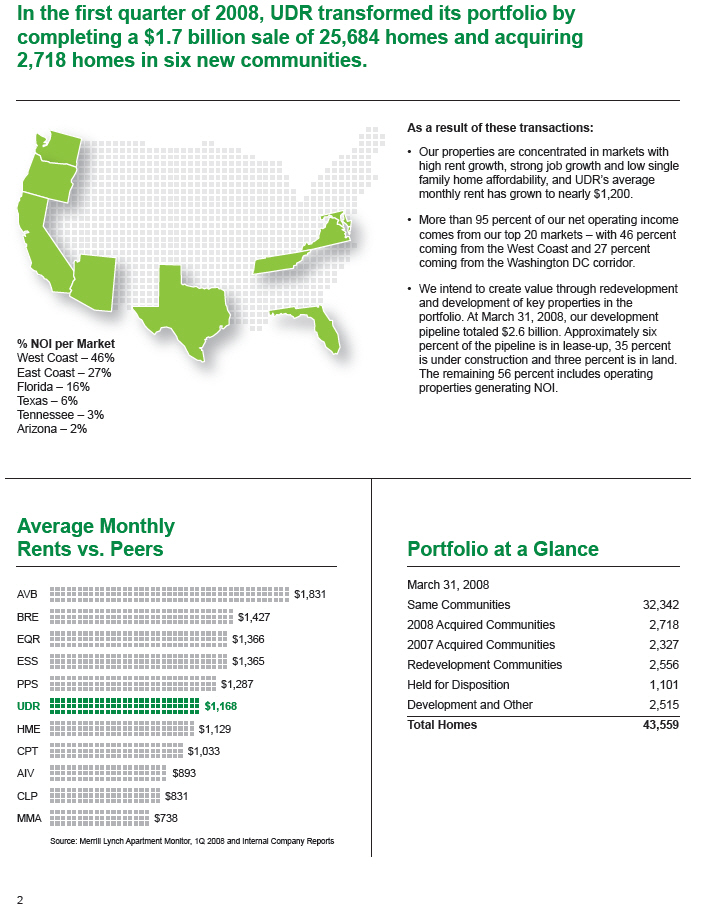

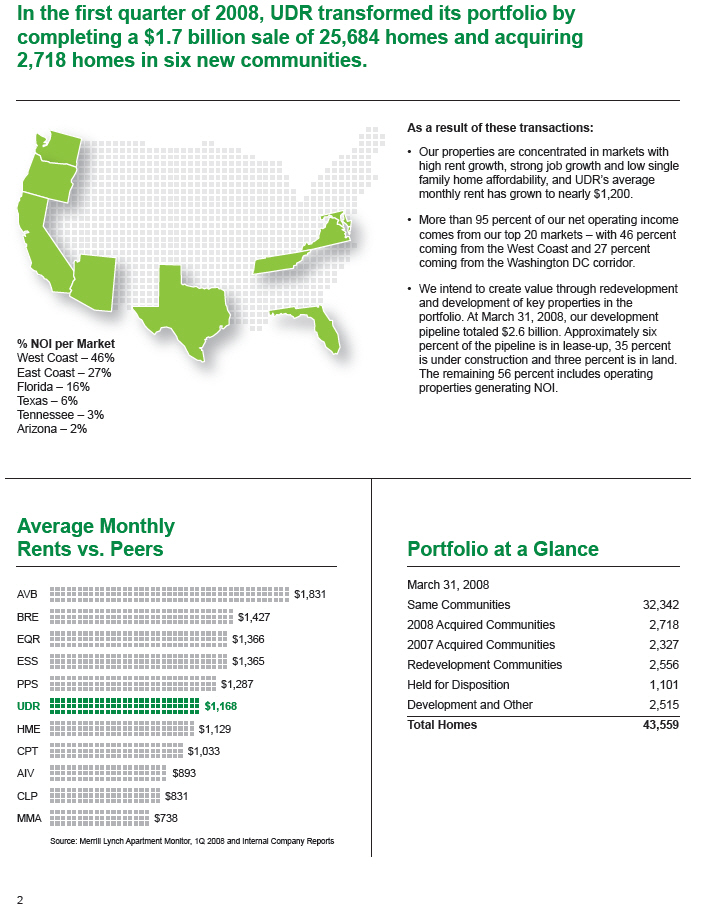

| In the first quarter of 2008, UDR transformed its portfolio by completing a $1.7 billion sale of 25,684 homes and acquiring 2,718 homes in six new communities. As a result of these transactions: Our properties are concentrated in markets with high rent growth, strong job growth and low single family home affordability, and UDR’s average monthly rent has grown to nearly $1,200. More than 95 percent of our net operating income comes from our top 20 markets — with 46 percent coming from the West Coast and 27 percent coming from the Washington DC corridor. We intend to create value through redevelopment and development of key properties in the portfolio. At March 31, 2008, our development pipeline totaled $2.6 billion. Approximately six _____ % NOI per Market percent of the pipeline is in lease-up, 35 percent West Coast — 46% is under construction and three percent is in land. East Coast — 27% The remaining 56 percent includes operating Florida — 16% properties generating NOI. Texas — 6% Tennessee — 3% Arizona — 2% Average Monthly Rents vs. Peers Portfolio at a Glance March 31, 2008 AVB $1,831 Same Communities 32,342 BRE $1,427 2008 Acquired Communities 2,718 EQR $1,366 2007 Acquired Communities 2,327 ESS $1,365 Redevelopment Communities 2,556 PPS $1,287 Held for Disposition 1,101 UDR $1,168 Development and Other 2,515 HME $1,129 Total Homes 43,559 CPT $1,033 AIV $893 CLP $831 MMA $738 Source: Merrill Lynch Apartment Monitor, 1Q 2008 and Internal Company Reports |

| | |

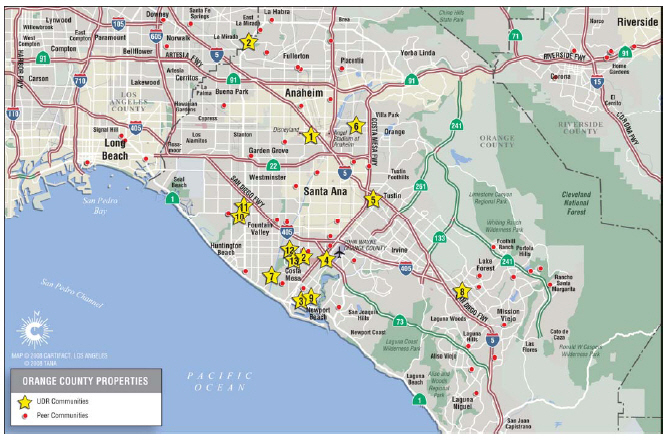

| | Orange County

Market Fact Sheet |

Market Statistics & Peer Comparison

| | | | | |

| Orange Co. Portfolio | | Homes | |

| Same Store Pool | | | 4,067 | |

| Non-Matures | | | — | |

| Development Pipeline | | | 260 | |

| | | | |

Total | | | 4,327 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 1,573 | |

| 1Q08 Occupancy | | | 95 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| CPT | | | 1,216 | | | $ | 1,659 | |

| EQR | | | 3,179 | | | | 1,601 | |

| BRE | | | 2,899 | | | | 1,574 | |

| UDR | | | 4,067 | | | | 1,573 | |

| HME | | | 2,016 | | | | 1,542 | |

| AIV | | | 247 | | | | 1,499 | |

| AVB | | | 1,174 | | | | 1,486 | |

| | | | | | | |

| | | | 14,798 | | | $ | 1,574 | |

Sources: 1Q ’08 SSP Homes — Axiometrics; 1Q ’08 SSP Ave. Rent — Merrill Lynch

Orange County is UDR’s

#1market, and is expected

to contribute14.4%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

Orange County Market Statistics

| | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | $ | 1,495 | | | Ave. Market Rent | | $ | 1,574 | | | Population | | | 2,997,033 | |

| Occupancy Rate (Q4) | | | 93.1 | % | | Mo Payment (Entry Level*): | | | | | | Job Growth | | | -0.8 | % |

| Rental Rate Growth | | | -2.0 | % | | Home | | $ | 3,610 | | | Median Income | | $ | 78,700 | |

| Effective Rent (‘09F) | | $ | 1,551 | | | Condo | | $ | 3,048 | | | Housing Stock | | | | |

| Effective Rent (‘10F) | | $ | 1,616 | | | Median Home Price | | $ | 630,000 | | | Renter | | | 386,511 | |

| Multifamily Permits | | | 5,277 | | | Housing Affordability Index | | | 57.2 | | | % of Total | | | 37.8 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

The Orange County, California market represents UDR’s largest concentration of apartment homes as measured by NOI. These homes are in premier coastal locations and many communities are just minutes from the beach.

The Company is creating value in this market through the following initiatives:

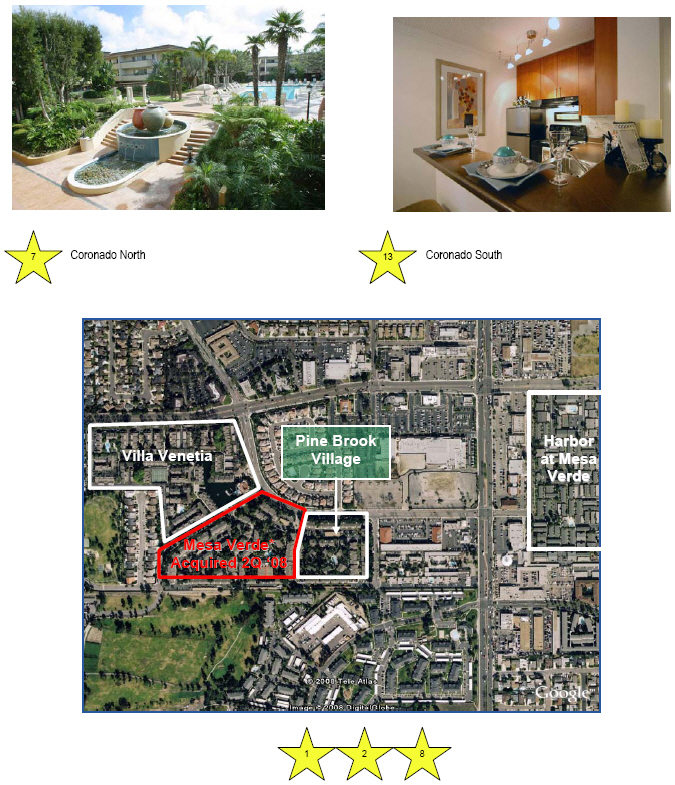

| | • | | Acquisitions: Mesa Verde Villas, a 296 unit community, was purchased on May 15th in Costa Mesa, CA. This community is a twin to Pine Brook Village, a 200 unit community. The property was constructed by the same builder as Pine Brook Village. The two properties share the same architecture, design and floor plans. Pine Brook Village and Mesa Verde also share the main entry into both properties, making Mesa Verde an excellent candidate to be merged with Pine Brook. This merger creates value immediately through operating efficiencies in leasing staff, maintenance staff and purchasing. |

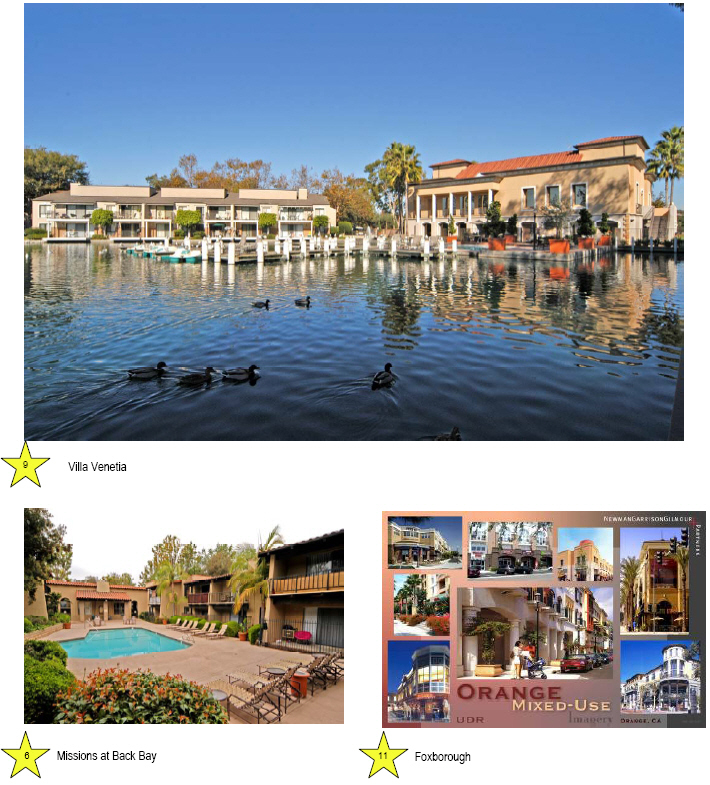

| | • | �� | Development: Foxborough, a 260 home, $77M development in Orange, CA |

| | • | | Redevelopment: More than 1,600 kitchen and bath renovations have been completed at an average cost of $10,800 and we are realizing an average annual return of 13.3%. Example of average rent increases include Huntington Vista: $1,600 before, $1,775 after, a 10.9% increase |

The local economy has recently softened due to the loss of 7,000 jobs in the sub-prime lending industry, but long term prospects are excellent. The region enjoys employment diversity, a highly educated work force and an attractive year round climate affording a variety of recreational activities.

3

Orange County

Market Fact Sheet

Villa Venetia Foxborough

Missions at Back Bay |

4

Orange County

Market Fact Sheet

Coronado South

Coronado NorthMesa Verde* Acquired 2Q ‘08 Harbor at Mesa Verde |

5

Orange County

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | | Occupancy* | | | Home* | |

| 1 Harbor at Mesa Verde | | | 384 | | | | 1965 | | | | K/B | | | | 94 | % | | $ | 1,621 | |

| 2 Pine Brook Village | | | 200 | | | | 1979 | | | | K/B | | | | 97 | % | | | 1,718 | |

| 3 Pacific Shores | | | 264 | | | | 1971 | | | | K/B | | | | 96 | % | | | 1,559 | |

| 4 Huntington Vista | | | 220 | | | | 1970 | | | | K/B | | | | 95 | % | | | 1,768 | |

| 5 Pacific Palms | | | 149 | | | | 1962 | | | | | | | | 96 | % | | | 1,314 | |

| 6 Missions at Back Bay | | | 104 | | | | 1969 | | | | K/B | | | | 95 | % | | | 1,517 | |

| 7 Coronado North | | | 732 | | | | 1968 | | | | K/B | | | | 94 | % | | | 1,455 | |

| 8 Huntington Villas | | | 400 | | | | 1972 | | | | K/B | | | | 97 | % | | | 1,682 | |

| 9 Villa Venetia | | | 468 | | | | 2008 | | | | K/B | | | | 95 | % | | | 1,662 | |

| 10 Vista Del Ray | | | 116 | | | | 1969 | | | | K/B | | | | 99 | % | | | 1,414 | |

| 11 Foxborough | | | 90 | | | | 1969 | | | | | | | | 96 | % | | | 1,816 | |

| 12 The Arboretum at Lake Forest | | | 225 | | | | 1970 | | | | K/B | | | | 94 | % | | | 1,591 | |

| 13 Coronado South | | | 715 | | | | 1970 | | | | K/B | | | | 95 | % | | | 1,504 | |

| | | | | | | | | | | | | | | | |

Grand Total | | | 4,067 | | | | | | | | | | | | 95 | % | | $ | 1,573 | |

| | | | | | | | | | | | | | | | |

*As of 1Q 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Budgeted | | | Cost per | | | Expected | |

| Development Pipeline | | Expected Return | | | # of Homes | | | Cost | | | Home | | | Completion | |

| (11) Foxborough II | | | 6.0%-6.5% | | | | 260 | | | $ | 76,562 | | | $ | 294,469 | | | | 2011 | |

| | | | | | | | | | | | | | | | | | | |

Total | | | | | | | 260 | | | $ | 76,562 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

6

| | |

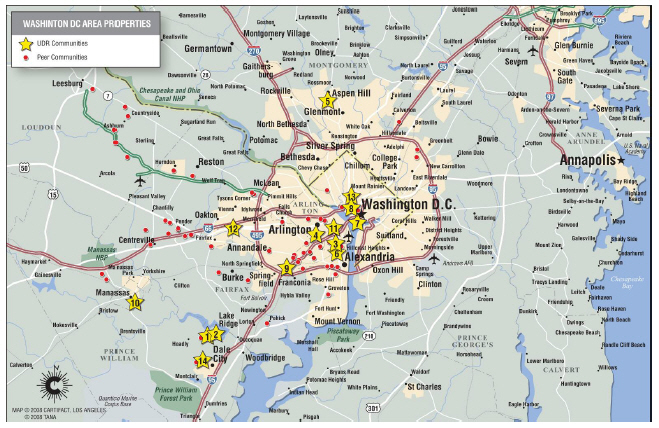

| | Metro D.C.

Market Fact Sheet |

Market Statistics & Peer Comparison

| | | | | |

| Metro DC Portfolio | | Homes | |

| Same Store Pool | | | 2,097 | |

| Non-Matures | | | 1,888 | |

| Development Pipeline | | | 813 | |

| | | | |

Total | | | 4,798 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 1,325 | |

| 1Q08 Occupancy | | | 96 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| AVB | | | 2,793 | | | $ | 1,735 | |

| CPT | | | 2,740 | | | | 1,446 | |

| EQR | | | 7,740 | | | | 1,395 | |

| UDR | | | 2,097 | | | | 1,325 | |

| HME | | | 4,549 | | | | 1,184 | |

| AIV | | | 8,340 | | | | 1,120 | |

| | | | | | | |

| | | | 28,259 | | | $ | 1,313 | |

Sources: 1Q ’08 SSP Homes — Axiometrics; 1Q ’08 SSP Ave. Rent — Merrill Lynch

Metro DC is UDR’s

#2market, and is expected

to contribute12.1%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

Metro DC Market Statistics

| | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | $ | 1431 | | | Ave. Market Rent | | $ | 1,313 | | | Population | | | 4,151,047 | |

| Occupancy Rate (Q4) | | | 94.2 | % | | Mo Payment (Entry Level*): | | | | | | Job Growth | | | 0.9 | % |

| Rental Rate Growth | | | 2.3 | % | | Home | | $ | 2,353 | | | Median Income | | $ | 94,500 | |

| Effective Rent (’09F) | | $ | 1,434 | | | Condo | | $ | 1,971 | | | Housing Stock | | | | |

| Effective Rent (‘10F) | | $ | 1,518 | | | Median Home Price | | $ | 400,100 | | | Renter | | | 558,818 | |

| Multifamily Permits | | | 6,685 | | | Housing Affordability Index | | | 103.1 | | | % of Total | | | 33.7 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

In the 1st quarter of 2008, we acquired two communities (Delancey at Shirlington and Circle Towers) with 847 homes. UDR intends to expand its presence in this market by buying communities in lease-up and well located properties with renovation potential

Value Creation:

| • | | In the first quarter of 2008 we purchased Circle Towers, a mixed use development that includes 606 apartment homes and more than 50,000 SF of office and retail space for $144.3M. This project is slated for redevelopment in 2009. |

| • | | In the first quarter of 2008 we completed the interior renovation portion of the full redevelopment of Wellington Place, a 372 home community in Manassas, VA that we purchased for $50.1M or $135,000 per home in 2005. Following the completion of the exterior upgrades, we expect to realize an 8.0% cash on cash return from the incremental investment, a nearly 30% improvement in cash flow, and estimate value creation of over $11M. |

| • | | The 2nd quarter of 2008 will see the start of major work for the full redevelopment of Taylor Place, a 218 home mid-rise community, located in Arlington, VA. This $13.9M redevelopment project is expected to realize a 8.0% return on incremental investment, a 41% improvement in cash flow, and estimated value creation of $18M. |

| • | | We’ve completed more than 1,500 kitchen and bath renovations at an average cost of $9,836 and are realizing an average annual return of 9.2%. |

| • | | We intend to construct an 11 story tower on existing property adjacent to Waterside Towers; a 550 home mid-rise structure located 15 minutes from the National Mall. |

7

Metro D.C.

Market Fact Sheet

8

Metro D.C.

Market Fact Sheet

9

Metro D.C.

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | Occupancy* | | | Home* | |

| 1 Dominion Middle Ridge | | | 280 | | | | 1990 | | | K/B | | | 94 | % | | $ | 1,273 | |

| 2 Dominion Lake Ridge | | | 192 | | | | 1987 | | | K/B | | | 95 | % | | | 1,272 | |

| 3 Presidential Greens | | | 396 | | | | 1988 | | | K/B | | | 96 | % | | | 1,105 | |

| 4 Taylor Place | | | 218 | | | | 2008 | | | Full | | | 98 | % | | | 1,472 | |

| 5 Ridgewood I | | | 274 | | | | 1988 | | | K/B | | | 96 | % | | | 1,373 | |

| 6 The Calvert | | | 187 | | | | 1962 | | | K/B | | | 95 | % | | | 1,341 | |

| 7 Waterside Towers | | | 550 | | | | 1971 | | | K/B | | | 98 | % | | | 1,437 | |

| | | | | | | | | | | | | | |

Subtotal | | | 2,097 | | | | | | | | | | 96 | % | | | 1,325 | |

Non-Mature | | | | | | | | | | | | | | | | | | |

| 8 Andover House | | | 171 | | | | 2004 | | | | | | 98 | % | | | 2,307 | |

| 9 Sullivan Place — In Lease-Up | | | 498 | | | | 2007 | | | | | | 65 | % | | | 1,617 | |

| 10 Wellington Place — Under Redev. | | | 372 | | | | 2007 | | | Full | | | 77 | % | | | 1,115 | |

| 11 Delancey at Shirlington (in Lease-up) | | | 241 | | | | 2008 | | | | | | 76 | % | | | 2,024 | |

| 12 Circle Towers | | | 606 | | | | 1972 | | | Full | | | 92 | % | | | 1,507 | |

| | | | | | | | | | | | | | |

Subtotal | | | 1,888 | | | | | | | | | | | | | | 1,581 | |

| | | | | | | | | | | | | | |

Grand Total | | | 3,985 | | | | | | | | | | | | | $ | 1,441 | |

| | | | | | | | | | | | | | |

*As of 1Q 2008

| | | | | | | | | | | | | | | | | |

| | | | | # of | | | Budgeted | | | Cost per | | | Expected |

| Development Pipeline | | Expected Return | | Homes | | | Cost | | | Home | | | Completion |

13 2400 14th Street | | 5.5%-6.0% | | | 255 | | | $ | 124,000 | | | $ | 486,275 | | | 2010 |

| (7) Waterside Towers | | TBD | | | 198 | | | | 101,000 | | | | 510,101 | | | TBD |

| 14 Signal Hill — Woodbridge, VA | | 6.0%-6.5% | | | 360 | | | | 75,000 | | | $ | 208,333 | | | 2010 |

| | | | | | | | | | | | | | | |

Total | | | | | 813 | | | $ | 300,000 | | | | | | | |

| | | | | | | | | | | | | | | |

10

San Francisco

Market Fact Sheet

Market Statistics & Peer Comparison

| | | | | |

| San Francisco Portfolio | | Homes | |

| Same Store Pool | | | 1,768 | |

| Non-Matures | | | 321 | |

| Development Pipeline | | | 200 | |

| | | | |

Total | | | 2,289 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 1,785 | |

| 1Q08 Occupancy | | | 96 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| AVB | | | 2,482 | | | $ | 2,151 | |

| BRE | | | 775 | | | | 1,809 | |

| UDR | | | 1,768 | | | | 1,785 | |

| ESS | | | 846 | | | | 1,766 | |

| EQR | | | 736 | | | | 1,601 | |

| AIV | | | 418 | | | | 1,485 | |

| | | | | | | |

| | | | 7,025 | | | $ | 1,878 | |

Sources: 1Q ‘08 SSP Homes — Axiometrics; 1Q ‘08 SSP Ave. Rent — Merrill Lynch

San Francisco is UDR’s

#3market, and is expected

to contribute8.7%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

San Francisco Market Statistics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | | | | | $ | 2,061 | | | Ave. Market Rent | | | | | | $ | 1,878 | | | Population | | | | | | | 1,720,056 | |

| Occupancy Rate (Q4) | | | | | | | 95.8 | % | | Mo Payment: Entry Level*: | | | | | | | | | | Job Growth | | | | | | | 2.2 | % |

| Rental Rate Growth | | | | | | | 2.2 | % | | Home | | | | | | $ | 4,551 | | | Median Income | | | | | | $ | 86,500 | |

| Effective Rent (‘09F) | | | | | | $ | 2,008 | | | Condo | | | | | | $ | 3,845 | | | Housing Stock | | | | | | | | |

| Effective Rent (‘10F) | | | | | | $ | 2,100 | | | Median Home Price | | | | | | $ | 840,000 | | | Renter | | | | | | | 347,146 | |

| Multifamily Permits | | | | | | | 3,206 | | | Housing Affordability Index | | | | | | | 49.6 | | | % of Total | | | | | | | 47.5 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

In the first quarter of 2008, UDR acquired Edgewater, a 193 home community in the Mission Bay district of San Francisco. The property was constructed in 2007 and is strategically located near public transportation and entertainment venues. Rents range from $2,200 for a studio apartment to $3,800 for a two bedroom home.

In the fourth quarter, 2007, the Company expanded its presence in this market with the purchase of 104 apartment homes in San Rafael. The community is located directly adjacent to Highlands of Marin, an existing UDR property. Both properties will be completely renovated with new exterior siding, kitchens, baths, and more with expected rent increases of approximately $200 — $250 per home.

The company is improving existing homes though its kitchen and bath renovation program:

| | • | | Over 350 kitchen and bath renovations have been completed at an average cost of $14,250 and we are realizing an average annual return of 9.8%. |

| | • | | Example of average rent increases: $1,270 before, $1,337 after, a 5.3% increase |

The region enjoys employment diversity, a highly educated work force and an attractive year round climate affording a variety of recreational activities. The median existing home price is $840,000 making this one of the least affordable markets in the U.S. UDR plans to expand its presence in this market.

11

San Francisco

Market Fact Sheet

12

San Francisco

Market Fact Sheet

| Birch Creek River Terrace 2000 Post Highlands of Marin |

13

San Francisco

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | | Occupancy* | | | Home* | |

| 1 2000 Post Street I | | | 304 | | | | 1987 | | | | K/B | | | | 98 | % | | $ | 2,230 | |

| 2 Birch Creek | | | 184 | | | | 1968 | | | | | | | | 97 | % | | | 1,741 | |

| 3 Highlands of Marin | | | 220 | | | | 2008 | | | | Full | | | | 94 | % | | | 1,615 | |

| 4 Marina Playa | | | 272 | | | | 1971 | | | | | | | | 98 | % | | | 1,640 | |

| 5 Crossroads Apartments | | | 130 | | | | 1986 | | | | K/B | | | | 93 | % | | | 1,414 | |

| 6 River Terrace | | | 250 | | | | 2005 | | | | | | | | 96 | % | | | 2,043 | |

| 7 Lake Pines | | | 288 | | | | 2008 | | | | | | | | 96 | % | | | 1,522 | |

| 8 Bay Terrace | | | 120 | | | | 1962 | | | | | | | | 98 | % | | | 1,819 | |

| | | | | | | | | | | | | | | | |

Subtotal | | | 1,768 | | | | | | | | | | | | 96 | % | | | 1,785 | |

Non-Mature | | | | | | | | | | | | | | | | | | | | |

| (1) 2000 Post Street II | | | 24 | | | | 2006 | | | | K/B | | | | 63 | % | | | 2,412 | |

| (3) Highlands of Marin II | | | 104 | | | | 2008 | | | | Full | | | | 98 | % | | | 1,339 | |

| 9 Edgewater | | | 193 | | | | 2008 | | | | | | | | 98 | % | | | ~3,000 | |

| | | | | | | | | | | | | | | | |

Subtotal | | | 321 | | | | | | | | | | | | | | | | 2,418 | |

| | | | | | | | | | | | | | | | |

Grand Total | | | 2,089 | | | | | | | | | | | | | | | $ | 1,882 | |

| | | | | | | | | | | | | | | | |

*As of 1Q 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Budgeted | | | Cost per | | | Expected | |

| Development Pipeline | | Expected Return | | | # of Homes | | | Cost | | | Home | | | Completion | |

| (8) Bay Terrace | | | 5.5%-6.0% | | | | 200 | | | $ | 78,906 | | | $ | 394,528 | | | | 2010 | |

| | | | | | | | | | | | | | | | | | | |

Total | | | | | | | 200 | | | $ | 78,906 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

14

| | |

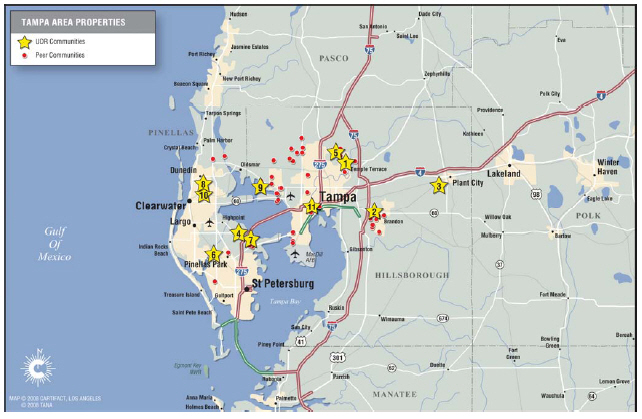

| | Tampa

Market Fact Sheet |

Market Statistics & Peer Comparison

| | | | | |

| Tampa Portfolio | | Homes | |

| Same Store Pool | | | 3,081 | |

| Non-Matures | | | 209 | |

| Development Pipeline | | | 249 | |

| | | | |

Total | | | 3,593 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 962 | |

| 1Q08 Occupancy | | | 95 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| UDR | | | 3,081 | | | $ | 962 | |

| CPT | | | 5,225 | | | | 855 | |

| MAA | | | 1,120 | | | | 852 | |

| EQR | | | 2,887 | | | | 823 | |

| AIV | | | 4,265 | | | | 796 | |

| | | | | | | |

| | | | 16,578 | | | $ | 854 | |

Sources: 1Q ’08 SSP Homes & Avg. Rent — Axiometrics;

Tampa is UDR’s

#4market, and is expected

to contribute6.4%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

Tampa Market Statistics

| | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | $ | 869 | | | Ave. Market Rent | | $ | 854 | | | Population | | | 2,723,949 | |

| Occupancy Rate (Q4) | | | 92.1 | % | | Mo Payment: Entry Level*: | | | | | | Job Growth | | | -0.5 | % |

| Rental Rate Growth | | | -1.5 | % | | Home | | $ | 1,372 | | | Median Income | | $ | 53,900 | |

| Effective Rent (‘09F) | | $ | 878 | | | Condo | | $ | 1,129 | | | Housing Stock | | | | |

| Effective Rent (‘10F) | | $ | 896 | | | Median Home Price | | $ | 201,600 | | | Renter | | | 360,743 | |

| Multifamily Permits | | | 3,580 | | | Housing Affordability Index | | | 116.4 | | | % of Total | | | 27.9 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

The Company has demonstrated success in creating additional value from its Tampa properties in a variety of ways:

| | • | | Redevelopment — we recently completed full redevelopment of two communities totaling 609 units. In addition to the redevelopment program, we have completed more than 1,600 kitchen and bath renovations. |

| |

| | • | | New Development — We have a pre-sale agreement to purchase upon completion in 2009 a 249 home community, Vintage Lofts, at North Hyde Park in Tampa. The budgeted cost is $48.1M or $193,400 per home. |

Recent issues in the housing and lending sectors have slowed Tampa’s economy but AXIOMetrics forecasts solid job growth in a number of sectors, including education and health services, government, other services, leisure and hospitality and trade, transportation and utilities.

15

Tampa

Market Fact Sheet

16

Tampa

Market Fact Sheet

17

Tampa

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | Occupancy* | | | Home* | |

| 1 Summit West | | | 266 | | | | 1972 | | | — | | | 94 | % | | $ | 859 | |

| 2 Lakewood Place | | | 346 | | | | 1986 | | | K/B | | | 94 | % | | | 853 | |

| 3 Hunters Ridge | | | 352 | | | | 1992 | | | K/B | | | 90 | % | | | 841 | |

| 4 Bay Meadows | | | 288 | | | | 1985 | | | K/B | | | 98 | % | | | 992 | |

| 5 Cambridge Woods | | | 275 | | | | 1985 | | | K/B | | | 97 | % | | | 865 | |

| 6 Sugar Mill Creek | | | 212 | | | | 1988 | | | K/B | | | 94 | % | | | 907 | |

| 7 Inlet Bay at Gateway | | | 464 | | | | 1988 | | | Full | | | 97 | % | | | 990 | |

| 8 MacAlpine Place | | | 478 | | | | 2001 | | | — | | | 95 | % | | | 1,126 | |

| 9 Island Walk | | | 400 | | | | 1985 | | | Full | | | 93 | % | | | 1,073 | |

| | | | | | | | | | | | | | | |

Subtotal | | | 3,081 | | | | | | | | | | 95 | % | | | 962 | |

Non-Mature | | | | | | | | | | | | | | | | | | |

| 10 The Breyley Apartments | | | 209 | | | | 1977 | | | Full | | | 98 | % | | | 952 | |

| | | | | | | | | | | | | | | |

Subtotal | | | 209 | | | | | | | | | | 84 | % | | | 952 | |

| | | | | | | | | | | | | | | |

Grand Total | | | 3,290 | | | | | | | | | | | | | $ | 961 | |

| | | | | | | | | | | | | | | |

*As of 1Q 2008

| | | | | | | | | | | | | | | | | |

| | | Expected | | | | | | Budgeted | | | Cost per | | | Expected |

| Development Pipeline | | Return | | # of Homes | | | Cost | | | Home | | | Completion |

| 11 Vintage Lofts (Presale) | | 6.5%-7.0% | | | 249 | | | $ | 48,100 | | | $ | 193,400 | | | 2009 |

| | | | | | | | | | | | | | | |

Total | | | | | 249 | | | $ | 48,100 | | | | | | | |

| | | | | | | | | | | | | | | |

18

| | |

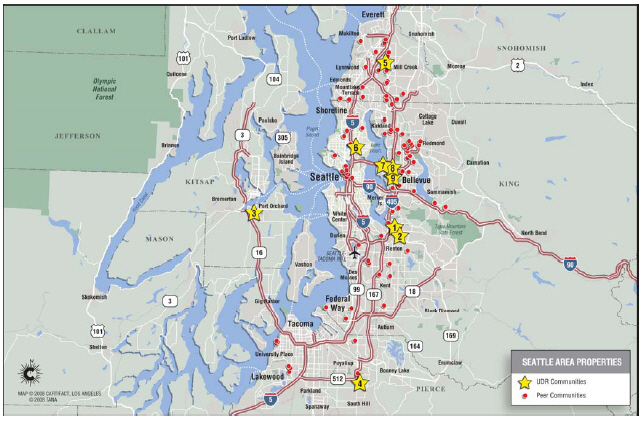

| | Seattle

Market Fact Sheet |

Market Statistics & Peer Comparison

| | | | | |

| Seattle Portfolio | | Homes | |

| Same Store Pool | | | 1,199 | |

| Non-Matures | | | 71 | |

| Development Pipeline | | | 704 | |

| | | | |

Total | | | 1,974 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 1,117 | |

| 1Q08 Occupancy | | | 96 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| AVB | | | 2,892 | | | $ | 1,295 | |

| BRE | | | 3,068 | | | | 1,252 | |

| UDR | | | 1,280 | | | | 1,117 | |

| ESS | | | 4,553 | | | | 1,130 | |

| EQR | | | 6,967 | | | | 1,119 | |

| AIV | | | 364 | | | | 1,023 | |

| | | | | | | |

| | | | 19,124 | | | $ | 1,168 | |

Sources: 1Q ’08 SSP Homes & Avg. Rent — Axiometrics;

Seattle is UDR’s

#5market, expected to

contribute5.5%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

Seattle Market Statistics

| | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | $ | 1,187 | | | Ave. Market Rent | | $ | 1,168 | | | Population | | | 2,536,182 | |

| Occupancy Rate (Q4) | | | 94.1 | % | | Mo Payment: Entry Level*: | | | | | | Job Growth | | | 2.9 | % |

| Rental Rate Growth | | | 0.5 | % | | Home | | $ | 2,274 | | | Median Income | | $ | 75,600 | |

| Effective Rent (‘09F) | | $ | 1,193 | | | Condo | | $ | 1,903 | | | Housing Stock | | | | |

| Effective Rent (‘10F) | | $ | 1,246 | | | Median Home Price | | $ | 377,500 | | | Renter | | | 396,722 | |

| Multifamily Permits | | | 8,476 | | | Housing Affordability Index | | | 91.8 | | | % of Total | | | 36.9 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

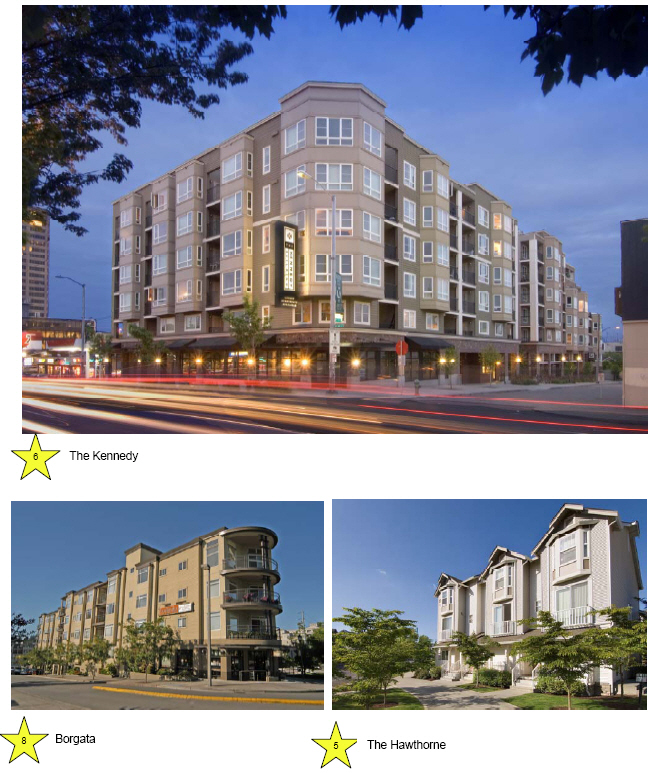

The Company has been expanding its presence in the Seattle/Bellevue market. Recent activity includes:

| | • | | Closing on a 49% joint venture interest in 989 Elements in January, 2007. This is a recently completed 23-story high-rise mixed use property located in the central business district of Bellevue with 166-apartment homes and 17,611 square feet of commercial space. |

| | • | | The acquisition of Borgata Apartments in May, 2007. This is a mixed-use community with 71-apartment homes and 5,358 square feet of retail space in Bellevue. The community was completed in 2001 and will be undergoing kitchen and bath upgrades. |

Two joint venture developments are underway with Su Development in which UDR has a 49% interest:

| | • | | Ashwood Commons, a 271 home high-rise community with ground floor retail. Construction is underway and expected completion is end of 2008. |

| | • | | Bellevue Plaza, a 400 home high rise community with ground floor retail. Construction is underway and completion is expected in late 2010. |

Seattle enjoys a strong and diverse local economy with a highly educated work force. 2007 job growth was 2.9% and AXIOMetrics forecasts 1.9% growth for 2008 and 2009, both approximately double their forecast for the U.S. average.

19

Seattle

Market Fact Sheet

20

Seattle

Market Fact Sheet

21

Seattle

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | Occupancy* | | | Home* | |

| 1 Hilltop | | | 156 | | | | 1985 | | | K/B | | | 97 | % | | $ | 959 | |

| 2 Crown Pointe | | | 196 | | | | 1987 | | | K/B | | | 97 | % | | | 918 | |

| 3 Arbor Terrace | | | 276 | | | | 1996 | | | K/B | | | 95 | % | | | 919 | |

| 4 Aspen Creek | | | 162 | | | | 1996 | | | — | | | 92 | % | | | 969 | |

| 5 The Hawthorne Apartments | | | 284 | | | | 2003 | | | — | | | 96 | % | | | 1,400 | |

| 6 The Kennedy Building | | | 125 | | | | 2005 | | | — | | | 96 | % | | | 1,604 | |

| | | | | | | | | | | | | | | |

Subtotal | | | 1,199 | | | | | | | | | | 95 | % | | | 1,117 | |

Non-Mature and Other | | | | | | | | | | | | | | | | | | |

| 7 989 Elements (JV) | | | 166 | | | | 2007 | | | | | | 94 | % | | | 2,105 | |

| 8 Borgata Apartment Homes | | | 71 | | | | 2007 | | | K/B | | | 93 | % | | | 2,352 | |

| | | | | | | | | | | | | | | |

Subtotal | | | 71 | * | | | | | | | | | | | | | 2,178 | |

| | | | | | | | | | | | | | | |

Grand Total | | | 1,270 | | | | | | | | | | | | | $ | 1,660 | |

| | | | | | | | | | | | | | | |

*As of 1Q 2008

| | | | | | | | | | | | | | | | | |

| | | | | # of | | | Budgeted Cost | | | Cost per | | | Expected |

| Development Pipeline | | Expected Return | | Homes | | | (000) | | | Home | | | Completion |

| 7 Ashwood Commons/Elements II | | 6.0%-6.5% | | | 274 | | | $ | 97,000 | | | $ | 358,000 | | | 2008 |

| 9 Bellevue Plaza | | 6.0%-6.5% | | | 430 | | | | 135,000 | | | $ | 270,000 | | | 2010 |

| | | | | | | | | | | | | | | |

Total | | | | | 704 | | | $ | 232,000 | | | | | | | |

| | | | | | | | | | | | | | | |

*Excludes joint venture homes

22

Baltimore

Market Fact Sheet

Market Statistics & Peer Comparison

| | | | | |

| Baltimore Portfolio | | Homes | |

| Same Store Pool | | | 1,556 | |

| Non-Matures | | | 564 | |

| Development Pipeline | | | — | |

| | | | |

Total | | | 2,120 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 1,173 | |

| 1Q08 Occupancy | | | 97 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| CPT | | | 628 | | | $ | 1,436 | |

| AVB | | | 1,290 | | | | 1,205 | |

| AIV | | | 1,247 | | | | 1,186 | |

| UDR | | | 1,566 | | | | 1,173 | |

| EQR | | | 438 | | | | 1,082 | |

| HME | | | 4,715 | | | | 1,054 | |

| | | | | | | |

| | | | 9,884 | | | $ | 1,135 | |

Sources: 1Q ’08 SSP Homes & Avg. Rent — Axiometrics;

Baltimore is UDR’s

#6market, and is expected

to contribute5.3%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

Baltimore Market Statistics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | | | | | $ | 1,147 | | | Ave. Market Rent | | | | | | $ | 1,135 | | | Population | | | | | | | 2,668,056 | |

| Occupancy Rate (Q4) | | | | | | | 95.1 | % | | Mo Payment: Entry Level*: | | | | | | | | | | Job Growth | | | | | | | 0.9 | % |

| Rental Rate Growth | | | | | | | 2.5 | % | | Home | | | | | | $ | 1,865 | | | Median Income | | | | | | $ | 75,800 | |

| Effective Rent (‘09F) | | | | | | $ | 1,151 | | | Condo | | | | | | $ | 1,552 | | | Housing Stock | | | | | | | | |

| Effective Rent (‘10F) | | | | | | $ | 1,194 | | | Median Home Price | | | | | | $ | 275,100 | | | Renter | | | | | | | 344,827 | |

| Multifamily Permits | | | | | | | 1,515 | | | Housing Affordability Index | | | | | | | 120.3 | | | % of Total | | | | | | | 31.3 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

In the 1st quarter of 2008, we acquired Dulaney Crescent, a 264-home community in Towson, MD. The Company has demonstrated success in creating additional value in this market in a variety of ways:

| | • | | Redevelopment – we are nearing the completion of the full redevelopment of Dominion Great Oaks, a 300-home community now known as Ellicott Grove. This is expected to result in a 7.9% cash-on-cash return with a 43% growth in cash flow to $3.3 million, for total value creation of $16 million. |

In addition to the redevelopment program, we have completed more than 1,000 kitchen and bath renovations.

The area has a stable employment base led by substantial government jobs and institutional employment in the education and health sectors. The median existing home price is $275,100 making it less affordable than the national average.

23

Baltimore

Market Fact Sheet

| Dulaney At Crescent Ellicott Grove redeveloped 2008 |

24

Baltimore

Market Fact Sheet

| Arbor View Dominion Kings Place Calvert’s Walk tamar Meadow |

25

Baltimore

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | | Occupancy* | | | Home* | |

| 1 Dominion Kings Place | | | 170 | | | | 1983 | | | | K/B | | | | 97 | % | | $ | 1,187 | |

| | | | | | | | | | | | | | | | |

| 2 Dominion at Eden Brook | | | 232 | | | | 1984 | | | | K/B | | | | 97 | % | | | 1,209 | |

| 3 Dominion Constant Friendship | | | 136 | | | | 1990 | | | | K/B | | | | 94 | % | | | 1,107 | |

| | | | | | | | | | | | | | | | |

| 4 Lakeside Mill | | | 192 | | | | 1989 | | | | K/B | | | | 98 | % | | | 1.104 | |

| 5 Tamar Meadow | | | 178 | | | | 1990 | | | | K/B | | | | 97 | % | | | 1,439 | |

| | | | | | | | | | | | | | | | |

| 6 Calvert’s Walk | | | 276 | | | | 1988 | | | | K/B | | | | 96 | % | | | 1,104 | |

| 7 Arborview | | | 372 | | | | 1992 | | | | K/B | | | | 97 | % | | | 1,129 | |

| | | | | | | | | | | | | | | | |

Subtotal | | | 1,556 | | | | | | | | | | | | 97 | % | | | 1,173 | |

*As of 1Q 2008 | | | | | | | | | | | | | | | | | | | | |

| Non-Mature and Other | | | | | | | | | | | | | | | | | | | | |

| 8 Dulaney Crescent | | | 264 | | | | 2003 | | | | | | | | 96 | % | | | 1,400 | |

| 9 Ellicott Grove | | | 300 | | | | 2008 | | | | | | | | 73 | % | | | 1,016 | |

| | | | | | | | | | | | | | | | |

Subtotal | | | 564 | | | | | | | | | | | | | | | | 1,196 | |

| | | | | | | | | | | | | | | | |

Grand Total | | | 2,120 | | | | | | | | | | | | | | | $ | 1,179 | |

| | | | | | | | | | | | | | | | |

26

| | |

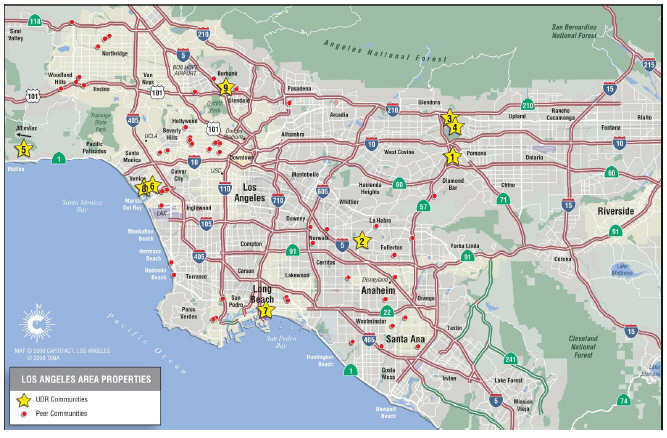

| | Los Angeles County

Market Fact Sheet |

Market Statistics & Peer Comparison

| | | | | |

| LA County Portfolio | | Homes | |

| Same Store Pool | | | 1,052 | |

| Non-Matures | | | 328 | |

| Development Pipeline | | | 516 | |

| | | | |

Total | | | 1,896 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 1,535 | |

| 1Q08 Occupancy | | | 95 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| AIV | | | 1,980 | | | $ | 2,266 | |

| CPT | | | 538 | | | | 2,013 | |

| AVB | | | 2,077 | | | | 1,914 | |

| ESS | | | 2,958 | | | | 1,892 | |

| BRE | | | 2,142 | | | | 1,797 | |

| EQR | | | 5,831 | | | | 1,691 | |

| UDR | | | 1,052 | | | | 1,535 | |

| | | | | | | |

| | | | 16,578 | | | $ | 1,838 | |

Sources: 1Q ’08 SSP Homes & Avg. Rent — Axiometrics;

LA County is UDR’s

#7market, and is expected

to contribute5.1%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

LA County Market Statistics

| | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | $ | 1,838 | | | Ave. Market Rent | | $ | 1,838 | | | Population | | | 9,878,554 | |

| Occupancy Rate (Q4) | | | 95.2 | % | | Mo Payment: Entry Level*: | | | | | | Job Growth | | | 0.3 | % |

| Rental Rate Growth | | | 0.4 | % | | Home | | $ | 3,024 | | | Median Income | | $ | 56,500 | |

| Effective Rent (‘09F) | | $ | 1,860 | | | Condo | | $ | 2,546 | | | Housing Stock | | | | |

| Effective Rent (‘10F) | | $ | 1,931 | | | Median Home Price | | $ | 521,000 | | | Renter | | | 1,681,679 | |

| Multifamily Permits | | | 10,806 | | | Housing Affordability Index | | | 48.5 | % | | % of Total | | | 50.1 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

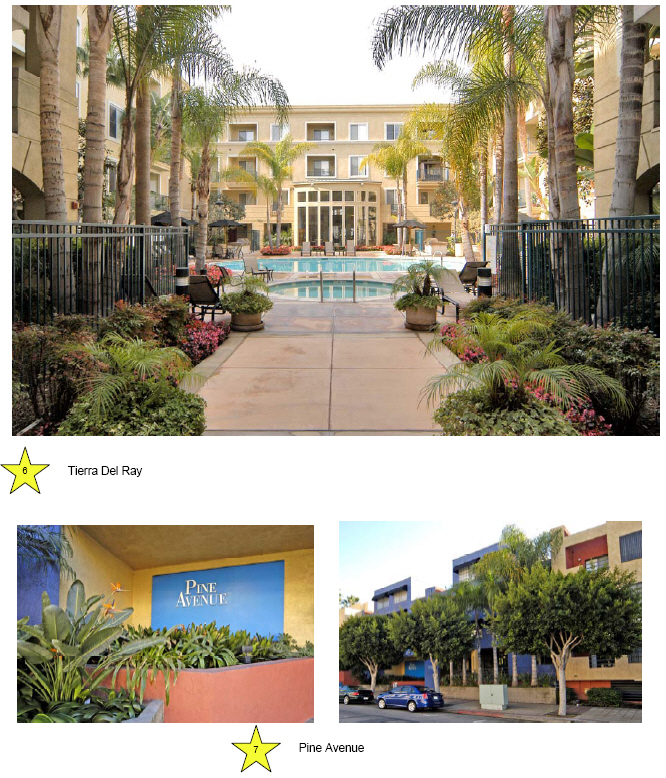

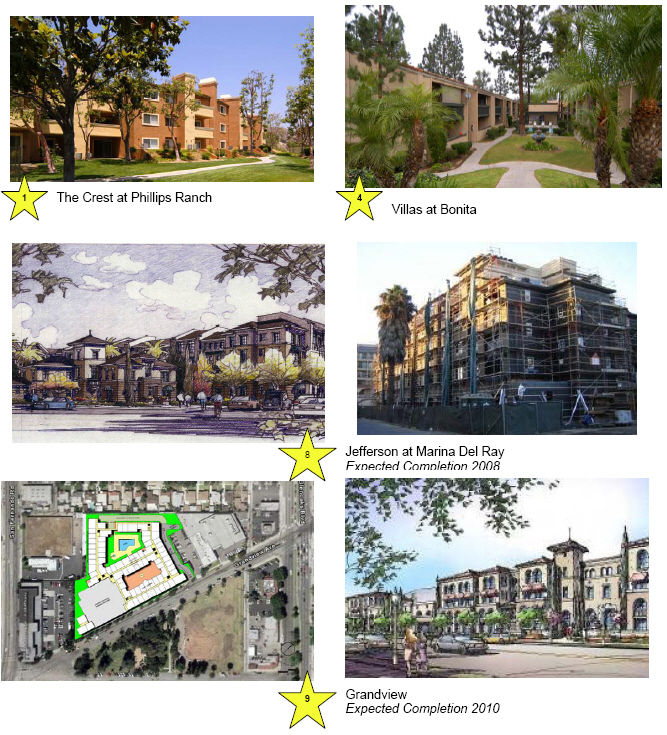

UDR is expanding its presence in this market with one recent acquisition and two new developments:

| | • | | Tierra Del Rey, Marina del Ray, CA — 170-home community acquired in Q4 2007 for $76 million. Built in 1999, this community is undergoing a kitchen and bath renovation. |

| | • | | Jefferson at Marina del Rey — 298 homes at an average cost of $463,000 per home, being developed in a joint venture with JPI. Completion is expected in the first quarter, 2008. |

| | • | | Grandview, Glendale, CA — wholly owned development of 218 homes at an average cost of $307,000 per home, expected to yield a return of 6.0% — 6.5%. This project is underway with an expected completion of late 2009. |

The local economy has recently softened, however key local industries including Leisure and Hospitality, Other Services, and Education and Health Services, the entertainment sector and the ports of Los Angeles and Long Beach remain strong. The region enjoys a highly educated work force and an attractive year round climate affording a variety of recreational activities.

The median existing home price is $521,000 placing it among the least affordable markets in the U.S.

27

Los Angeles County

Market Fact Sheet

28

Los Angeles County

Market Fact Sheet

29

Los Angeles County

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | Occupancy* | | | Home* | |

| 1 The Crest at Phillips Ranch | | | 501 | | | | 1989 | | | K/B | | | 97 | % | | $ | 1,616 | |

| 2 Rosebeach | | | 174 | | | | 1970 | | | K/B | | | 95 | % | | | 1,429 | |

| 3 The Villas at San Dimas | | | 156 | | | | 1981 | | | K/B | | | 93 | % | | | 1,497 | |

| 4 The Villas at Bonita | | | 102 | | | | 1981 | | | | | | 95 | % | | | 1,472 | |

| 5 Ocean Villas | | | 119 | | | | 1965 | | | | | | 95 | % | | | 1,440 | |

| | | | | | | | | | | | | | | |

Subtotal | | | 1,052 | | | | | | | | | | 95 | % | | | 1,535 | |

Non-Mature and Other | | | | | | | | | | | | | | | | | | |

| 6 Tierra del Rey | | | 170 | | | | 1999 | | | K/B | | | 92 | % | | | 2,605 | |

| 7 Pine Avenue | | | 158 | | | | 1987 | | | Full | | | 69 | % | | | 1,348 | |

| | | | | | | | | | | | | | | |

Subtotal | | | 328 | | | | | | | | | | | | | $ | 2,089 | |

| | | | | | | | | | | | | | | |

Grand Total | | | 1,380 | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

*As of 1Q 2008

| | | | | | | | | | | | | | | | | |

| | | | | # of | | | Budgeted | | | Cost per | | | Expected |

| Development Pipeline | | Expected Return | | Homes | | | Cost ($000) | | | Home | | | Completion |

| 8 Marina Del Rey | | 5.5% - 6.0% | | | 298 | | | $ | 138,000 | | | $ | 463,087 | | | 2008 |

| 9 Grandview | | | | | 218 | | | | 67,419 | | | $ | 309,261 | | | 2010 |

| | | | | | | | | | | | | | | |

Total | | | | | 516 | | | $ | 205,419 | | | | | | | |

| | | | | | | | | | | | | | | |

30

| | |

| | | |

| |

Orlando

Market Fact Sheet |

Market Statistics & Peer Comparison

| | | | | |

| Orlando Portfolio | | Homes | |

| Same Store Pool | | | 2,140 | |

| Non-Matures | | | 1,027 | |

| Development Pipeline | | | 395 | |

| | | | |

Total | | | 3,562 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 983 | |

| 1Q08 Occupancy | | | 92 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| CLP | | | 2,251 | | | $ | 996 | |

| UDR | | | 2,140 | | | | 983 | |

| CPT | | | 3,296 | | | | 925 | |

| EQR | | | 7,296 | | | | 902 | |

| AIV | | | 3,888 | | | | 851 | |

| MAA | | | 288 | | | | 839 | |

| | | | | | | |

| | | | 19,159 | | | $ | 915 | |

Sources: 1Q ’08 SSP Homes & Avg. Rent — Axiometrics;

Orlando is UDR’s

#8market, and is expected

to contribute4.8%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

Orlando Market Statistics

| | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | $ | 920 | | | Ave. Market Rent | | $ | 915 | | | Population | | | 2,032,496 | |

| Occupancy Rate (Q4) | | | 93.2 | % | | Mo Payment: Entry Level*: | | | | | | Job Growth | | | 1.7 | % |

| Rental Rate Growth | | | -1.2 | % | | Home | | $ | 1,570 | | | Median Income | | $ | 54,900 | |

| Effective Rent (‘09F) | | $ | 910 | | | Condo | | $ | 1,299 | | | Housing Stock | | | | |

| Effective Rent (‘10F) | | $ | 921 | | | Median Home Price | | $ | 240,400 | | | Renter | | | 274,932 | |

| Multifamily Permits | | | 7,309 | | | Housing Affordability Index | | | 91.8 | % | | % of Total | | | 32.2 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

UDR has demonstrated success in creating addition value from its Orlando properties in a variety of ways:

| | • | | Redevelopment – we recently completed full redevelopment of two communities: Altamira Place and Canopy Villas (656 units). |

| |

| | • | | Kitchen and Bath Program: We’ve completed more than 800 kitchen and bath renovations at an average cost of $13,800 and are realizing an average annual return of 9.8%. |

| |

| | • | | New Development: This included a presale agreement to purchase upon completion a 370 home community, The Place at Millenia in Orlando. In the first quarter of 2008, we completed the purchase at a cost of $50.1M or $135,127 per home. |

Orlando’s economy has been impacted by the housing slump and high fuel prices; however, Real Data reports that in the past year the area added over 18,000 new jobs, with education and health services and professional and business services as the fastest growing industries. The local economy in influenced by the leisure and hospitality industry but is diversified with significant employment in the transportation and utility sectors as well.

31

Orlando

Market Fact Sheet

| Ashton At Waterford Lakes Regatta Shores Seabrook |

32

Orlando

Market Fact Sheet

| Altamira Place - Redeveloped 2007 Canopy Villas - Redeveloped 2008 Millenia Mail Phase I - Completed 2008 Phase II - Expected Completion 2010 |

33

Orlando

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | | Occupancy* | | | Home* | |

| 1 Seabrook | | | 200 | | | | 2004 | | | | | | | | 88 | % | | $ | 999 | |

| 2 Regatta Shores | | | 256 | | | | 2007 | | | Full | | | 90 | % | | | 827 | |

| 3 Alafaya Woods | | | 296 | | | | 2006 | | | Full | | | 91 | % | | | 998 | |

| 4 Los Altos | | | 328 | | | | 2004 | | | K/B | | | 94 | % | | | 964 | |

| 5 Lotus Landing | | | 260 | | | | 2006 | | | K/B | | | 95 | % | | | 889 | |

| 6 Seville on the Green | | | 170 | | | | 2004 | | | | | | | | 97 | % | | | 984 | |

| 7 Ashton at Waterford Lakes | | | 292 | | | | 2000 | | | Full | | | 94 | % | | | 1,175 | |

| 8 Arbors at Lee Vista | | | 338 | | | | 2007 | | | K/B | | | 90 | % | | | 997 | |

| | | | | | | | | | | | | | | | |

Subtotal | | | 2,140 | | | | | | | | | | | | 92 | % | | | 983 | |

Non-Mature and Other | | | | | | | | | | | | | | | | | | | | |

| 9 Altamira Place | | | 360 | | | | 2007 | | | Full | | | 96 | % | | | 943 | |

| 10 Canopy Villas | | | 296 | | | | 2008 | | | Full | | | 87 | % | | | 978 | |

| 11 The Place at Millenia (Lease-up) | | | 370 | | | | 2007 | | | Full | | | n/a | | | | n/a | |

| | | | | | | | | | | | | | | | |

Subtotal | | | 1,027 | | | | | | | | | | | | | | | $ | 958 | |

| | | | | | | | | | | | | | | | |

Grand Total | | | 3,167 | | | | | | | | | | | | | | | $ | 977 | |

| | | | | | | | | | | | | | | | |

*As of 1Q 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | # of | | | Budgeted | | | Cost per | | | Expected | |

| Development Pipeline | | Expected Return | | | Homes | | | Cost $000) | | | Home | | | Completion | |

| 11 The Place at Millenia -Phase II | | 6.0% - 6.5% | | | 395 | | | $ | 64,276 | | | $ | 162,724 | | | | 2010 | |

| | | | | | | | | | | | | | | | | | | |

Total | | | | | | | 395 | | | $ | 64,276 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

34

| | |

| | Richmond

Market Fact Sheet |

Market Statistics & Peer Comparison

| | | | | |

| Richmond Portfolio | | Homes | |

| Same Store Pool | | | 1,958 | |

| Non-Matures | | | 253 | |

| Development Pipeline | | | — | |

| | | | |

Total | | | 2,211 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 987 | |

| 1Q08 Occupancy | | | 92 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| UDR | | | 2,211 | | | $ | 987 | |

| AIV | | | 744 | | | | 903 | |

| CLP | | | 1,368 | | | | 812 | |

| | | | | | | |

| | | | 4,323 | | | $ | 917 | |

Sources: 1Q ‘08 SSP Homes & Avg. Rent — Axiometrics;

Richmond is UDR’s

#9market, and is expected

to contribute4.6%of the

Company’s total net

operating income*

| | |

| * | EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc. |

Richmond Market Statistics

| | | | | | | | | | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | | | Economy | |

| Effective Rent (Q4) | | | | $ | 900 | | | Ave. Market Rent | | $ | | | 917 | | | | | Population | | | | | 1,212,977 | |

| Occupancy Rate (Q4) | | | | | 94.1 | % | | Mo Payment: Entry Level*: | | | | | | | | | | Job Growth | | | | | 1.0 | % |

| Rental Rate Growth | | | | | 2.0 | % | | Home | | $ | | | 1,482 | | | | | Median Income | | | | $ | 68,700 | |

| Effective Rent (‘09F) | | | | $ | 910 | | | Condo | | $ | | | 1,224 | | | | | Housing Stock | | | | | | |

| Effective Rent (‘10F) | | | | $ | 933 | | | Median Home Price | | $ | | | 225,700 | | | | | Renter | | | | | 155,191 | |

| Multifamily Permits | | | | | 1,062 | | | Housing Affordability Index | | | | | 134.3 | % | | | | % of Total | | | | | 30.8 | % |

Source: Axiometrics

| | |

| * | Assumes 30 yr fixed at 6.31% |

Recent Activity

UDR’s apartment communities in the Richmond market are in excellent locations and the Company has invested to modernize the homes in several ways:

| | • | | Redevelopment: Two communities, Legacy at Mayland and Gayton Pointe Townhomes, have been completely redeveloped. Legacy at Mayland completed in late 2006, produced an increase in cash flow of 85% and estimated value creation of $33.6M. Construction at Gayton Pointe has recently been completed with focus on lease-up activities. Once stabilized, we expect a 7.7% return on incremental capital invested with an estimated $17M in value created. |

| |

| | • | | Kitchen and Bath Program: Over 1,300 kitchen and bath renovations have been completed at an average cost of $9,604, and are yielding an average annual return of 11.9%. |

Richmond has a diversified economy with significant employment in the government sector and in trade, transportation and utilities. Job growth is expected to be 0.4% in 2009 and 1.6% in 2010.

35

Richmond

Market Fact Sheet

| Carriage Homes At Wyndham Legacy at Mayland Redeveloped 2007 |

36

Richmond

Market Fact Sheet

| Dominion Olde West Dominion Creekwood Waterside at Ironbridge gayton Pointe Redeveloped 2008 |

37

Richmond

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | | Occupancy* | | | Home* | |

| 1 Dominion Olde West | | | 287 | | | | 1978 | | | Full | | | 96 | % | | $ | 883 | |

| 2 Dominion Creekwood | | | 216 | | | | 1984 | | | | K/B | | | | 95 | % | | | 850 | |

| 3 Dominion West End | | | 350 | | | | 1989 | | | | K/B | | | | 97 | % | | | 962 | |

| 4 Waterside at Ironbridge | | | 265 | | | | 1987 | | | | K/B | | | | 95 | % | | | 945 | |

| 5 Carriage House at Wyndham | | | 264 | | | | 1998 | | | | K/B | | | | 93 | % | | | 1,275 | |

| 6 Legacy at Mayland | | | 576 | | | | 2007 | | | Full | | | 96 | % | | | 998 | |

| | | | | | | | | | | | | | | | |

Subtotal | | | 1,958 | | | | | | | | | | | | 96 | % | | | 987 | |

| | | | | | | | | | | | | | | | |

*As of 1Q 2008 | | | | | | | | | | | | | | | | | | | | |

Non-Mature | | | | | | | | | | | | | | | | | | | | |

| 7 Gayton Pointe Townhomes | | | 253 | | | | 2007 | | | Full | | | 67 | % | | | 1,010 | |

| | | | | | | | | | | | | | | | |

Subtotal | | | 253 | | | | | | | | | | | | | | | | 1,010 | |

| | | | | | | | | | | | | | | | |

Grand Total | | | 2,211 | | | | | | | | | | | | | | | $ | 990 | |

| | | | | | | | | | | | | | | | |

38

| | |

| | Dallas

Market Fact Sheet |

Market Statistics & Peer Comparison

| | | | | |

| Dallas Portfolio | | Homes | |

| Same Store Pool | | | 305 | |

| Non-Matures | | | 4,147 | |

| Development Pipeline | | | 6,903 | |

| | | | |

Total | | | 11,355 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 1,609 | |

| 1Q08 Occupancy | | | 91 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| UDR | | | 680 | | | $ | 1,609 | |

| EQR | | | 3,643 | | | | 902 | |

| CPT | | | 5,191 | | | | 747 | |

| AIV | | | 2,385 | | | | 733 | |

| MAA | | | 3,195 | | | | 731 | |

| CLP | | | 2,710 | | | | 722 | |

| | | | | | | |

| | | | 17,429 | | | $ | 786 | |

Sources: 1Q ’08 SSP Homes & Avg. Rent — Axiometrics;

Dallas is UDR’s

#10market and is expected

to contribute4.0%of the

Company’s total net

operating income*

| | | |

| * EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc. |

Dallas Market Statistics

| | | | | | | | | | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | | | Economy | |

| Effective Rent (Q4) | | | | $ | 859 | | | Ave. Market Rent | | | | $ | 786 | | | | | Population | | | | | 4,111,529 | |

| Occupancy Rate (Q4) | | | | | 94.1 | % | | Mo Payment: Entry Level*: | | | | | | | | | | Job Growth | | | | | 2.8 | % |

| Rental Rate Growth | | | | | 2.1 | % | | Home | | | | $ | 1,097 | | | | | Median Income | | | | $ | 62,200 | |

| Effective Rent (‘09F) | | | | $ | 849 | | | Condo | | | | $ | 894 | | | | | Housing Stock | | | | | | |

| Effective Rent (‘10F) | | | | $ | 871 | | | Median Home Price | | | | $ | 145,000 | | | | | Renter | | | | | 601,729 | |

| Multifamily Permits | | | | | 10,804 | | | Housing Affordability Index | | | | | 168.1 | | | | | % of Total | | | | | 39.0 | % |

Source: Axiometrics

| | |

| * Assumes 30 yr fixed at 6.31% |

Recent Activity

The Company has been active in the Dallas market in a variety of ways:

| | • | | In the first quarter of 2008, we acquired Legacy Village (three communities) consisting of 1,043 homes in the Plano submarket. |

| |

| | • | | At Thirty 377, we have completed 70 kitchen and bath renovations at an average cost of $18,869 and we are realizing an average annual return of 11.8%. |

| |

| | • | | Construction of 202 homes at Riachi at One21 in the Dallas suburb of Plano was completed in the fourth quarter of 2007. Construction of 198 units in Phase II of the community has begun and completion is anticipated 1Q2009. |

| |

| | • | | An assemblage of 99 acres in Addison, named Vitruvian Park, was completed in the second quarter of 2007. The city of Addison has approved doubling the density to over 5,500 homes and zoning for 500,000 square feet of retail and office space. The Company anticipates that the development will be completed in conjunction with one or more institutional investors. |

The Dallas economy is diverse with significant employment in the energy sector, trade, transportation, government, education and the health sector.

39

Dallas

Market Fact Sheet

| Legacy Portfolio Lincoin at Town Square (Texas JV) In Development - expected Completion 2008 Thirty 337 |

40

Dallas

Market Fact Sheet

| Riachi at One 21 Phase I - Completed 2008 Phase II - Expected Completion 2009 The Meridian (Texas JV) The Mandolin (Texas JV) Vitruvian Park Expected Completion 2005 - 2010 |

41

Dallas

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | | | |

| Operating Properties | | # Homes | | | Year Built

ReDev | | | Redev. | | | Occupancy* | | | Rent per Occ.

Home* | |

| 1 Thirty377 | | | 305 | | | | 2007 | | | | K/B | | | | 91 | % | | $ | 1,609 | |

| | | | | | | | | | | | | | | | |

Subtotal | | | 305 | | | | | | | | | | | | 91 | % | | | 1,609 | |

| | | | | | | | | | | | | | | | | | | | | |

Non-Mature* | | | | | | | | | | | | | | | | | | | | |

| 6 Villas at Ridgeview | | | 48 | | | | 2007 | | | | | | | | 69 | % | | | 1,872 | |

| 7 Riachi at One21 - Phase I | | | 202 | | | | 2007 | | | | | | | | 75 | % | | | 902 | |

| 8 Highlands of Preston | | | 380 | | | | 2007 | | | | | | | | 87 | % | | | 758 | |

| 9 Legacy Village | | | 1,043 | | | | ’05-‘07 | | | | | | | | 92 | % | | | 1,000 | |

| 10 Addison/Vitruvian Park (In demolition) | | | 1,987 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Subtotal | | | 4,147 | | | | | | | | | | | | 84 | % | | | 955 | |

| | | | | | | | | | | | | | | | |

Grand Total | | | 4,452 | | | | | | | | | | | | | | | $ | 1,003 | |

| | | | | | | | | | | | | | | | | | | | | |

| Development Pipeline | | Expected Return | | | # of

Homes | | | Budgeted

Cost ($000) | | | Cost per

Home | | | Expected

Completion | |

| 10 Addison/Vitruvian Park | | | 6.5%-7.0% | | | | 5,949 | | | $ | 805,000 | | | $ | 135,343 | | | | 2009-2015 | |

| (7) Riachi at One21 - Phase II | | | 7.5%-8.0% | | | | 200 | | | | 18,955 | | | | 94,775 | | | | 2009 | |

| 11 Mustang Park | | | 7.0%-7.5% | | | | 289 | | | | 29,000 | | | | 100,346 | | | | 2009 | |

| 12 Belmont (formerly Bennett) | | | 6.5%-7.0% | | | | 465 | | | | 63,000 | | | $ | 135,484 | | | | 2010 | |

| | | | | | | | | | | | | | | | | | | |

Total | | | | | | | 6,903 | | | $ | 915,955 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | |

| * | Stars 2-5 designate Texas JV properties; non-mature properties subtotal includes 487 homes in other Texas markets. |

42

| | |

| | | |

| |

Nashville

Market Fact Sheet |

Market Statistics & Peer Comparison

| | | | | |

| Nashville Portfolio | | Homes | |

| Same Store Pool | | | 1,874 | |

| Non-Matures | | | 386 | |

| Development Pipeline | | | — | |

| | | | |

Total | | | 2,260 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 869 | |

| 1Q08 Occupancy | | | 96 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| EQR | | | 396 | | | $ | 949 | |

| UDR | | | 1,874 | | | | 869 | |

| AIV | | | 2,166 | | | | 815 | |

| MAA | | | 1,855 | | | | 785 | |

| | | | | | | |

| | | | 6,291 | | | $ | 831 | |

Sources: 1Q ‘08 SSP Homes & Avg. Rent — Axiometrics;

Nashville is UDR’s

#11market, and is expected

to contribute3.5%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

Recent Activity

Nashville Market Statistics

| | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | $ | 830 | | | Ave. Market Rent | | $ | 831 | | | Population | | | 1,521,437 | |

| Occupancy Rate (Q4) | | | 93.2 | % | | Mo Payment: Entry Level*: | | | | | | Job Growth | | | 1.3 | % |

| Rental Rate Growth | | | -0.2 | % | | Home | | $ | 1,041 | | | Median Income | | $ | 60,100 | |

| Effective Rent (‘09F) | | $ | 832 | | | Condo | | $ | 846 | | | Housing Stock | | | | |

| Effective Rent (‘10F) | | $ | 853 | | | Median Home Price | | $ | 154,700 | | | Renter | | | 200,811 | |

| Multifamily Permits | | | 1,744 | | | Housing Affordability Index | | | 159.7 | | | % of Total | | | 32.0 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

UDR has demonstrated success in creating addition value from its Nashville properties in a variety of ways:

| | • | | Redevelopment — we are nearing the completion of the full redevelopment of Polo Park, a 386 home community we purchased for $20.9M or $54,082 per home in 2006. It is expected to deliver a cash on cash return of 7.9%, an increase in total cash flow of 48% for total value creation of $4 million. |

| |

| | • | | Kitchens/Baths — In addition to the redevelopment program, we have completed over 800 kitchen and bath renovations at an average cost of $12,113 and are yielding an average annual return of 10.3%. |

Nashville has a diversified economy with significant employment in trade, transportation and utilities and education and health activity. The median existing home price is $154,700 making it more affordable than the national average.

43

Nashville

Market Fact Sheet

| The Preserve at Brentwood Carrington Hills |

44

Nashville

Market Fact Sheet

| The Colonnade Hickory Run Breckenridge Polo ParkRedeveloped 2008 |

45

Nashville

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | Occupancy* | | | Home* | |

| 1 Legacy Hill | | | 206 | | | | 1977 | | | K/B | | | 97 | % | | $ | 856 | |

| 2 Brookridge | | | 176 | | | | 1986 | | | K/B | | | 95 | % | | | 744 | |

| 3 Breckenridge | | | 190 | | | | 1986 | | | K/B | | | 96 | % | | | 762 | |

| 4 Hickory Run | | | 294 | | | | 1989 | | | K/B | | | 97 | % | | | 785 | |

| 5 The Colonnade | | | 288 | | | | 1998 | | | K/B | | | 95 | % | | | 813 | |

| 6 The Preserve at Brentwood | | | 360 | | | | 1998 | | | K/B | | | 97 | % | | | 987 | |

| 7 Carrington Hills | | | 360 | | | | 1999 | | | K/B | | | 95 | % | | | 987 | |

| | | | | | | | | | | | | | | |

Subtotal | | | 1,874 | | | | | | | | | | 96 | % | | | 869 | |

*As of 1Q 2008 | | | | | | | | | | | | | | | | | | |

Non-Mature | | | | | | | | | | | | | | | | | | |

| 8 Polo Park | | | 386 | | | | 1987 | | | Full | | | 71 | % | | | 696 | |

| | | | | | | | | | | | | | | |

Subtotal | | | 386 | | | | | | | | | | 71 | % | | | 696 | |

| | | | | | | | | | | | | | | |

Grand Total | | | 2,260 | | | | | | | | | | | | | $ | 846 | |

| | | | | | | | | | | | | | | |

46

| | | |

| | San Diego County

Market Fact Sheet

|

Market Statistics & Peer Comparison

| | | | | |

| San Diego Portfolio | | Homes | |

| Same Store Pool | | | 1,123 | |

| Non-Matures | | | — | |

| Development Pipeline | | | — | |

| | | | |

Total | | | 1,123 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 1,368 | |

| 1Q08 Occupancy | | | 94 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| CPT | | | 582 | | | $ | 1,734 | |

| BRE | | | 3,711 | | | | 1,546 | |

| EQR | | | 4,000 | | | | 1,527 | |

| AVB | | | 1,057 | | | | 1,433 | |

| AIV | | | 1,830 | | | | 1,379 | |

| UDR | | | 1,123 | | | | 1,368 | |

| ESS | | | 2,984 | | | | 1,114 | |

| | | | | | | |

| | | | 15,287 | | | $ | 1.423 | |

Sources: 1Q ‘08 SSP Homes & Avg. Rent — Axiometrics;

San Diego is UDR’s

#12market, and is expected

to contribute3.1%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

San Diego Market Statistics

| | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | $ | 1,418 | | | Ave. Market Rent | | $ | 1,423 | | | Population | | | 2,974,859 | |

| Occupancy Rate (Q4) | | | 94.8 | % | | Mo Payment: Entry Level*: | | | | | | Job Growth | | | 0.4 | % |

| Rental Rate Growth | | | -0.8 | % | | Home | | $ | 2,867 | | | Median Income | | $ | 69,400 | |

| Effective Rent (‘09F) | | $ | 1,417 | | | Condo | | $ | 2,411 | | | Housing Stock | | | | |

| Effective Rent (‘10F) | | $ | 1,460 | | | Median Home Price | | $ | 500,000 | | | Renter | | | 469,302 | |

| Multifamily Permits | | | 3,287 | | | Housing Affordability Index | | | 63.0 | | | % of Total | | | 41.7 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

UDR expects to expand its presence in this market, with plans underway to add 49 new apartment homes to Presidio at Rancho Del Oro, in Oceanside. In addition, there are plans to tear down and rebuild The Summit at Mission Bay, making it multiple levels with subterranean parking. This will increase the size of the property by 135 apartment homes and offer ocean views.

The company continues to improve its existing homes through the Kitchen and Bath program:

| | • | | 230 kitchen and bath renovations have been completed at an average cost of $6,000 to $7,000 with an annualized average return of 21.6%. The average increase in market rent is $150.00. |

The local housing market has softened and home ownership less is attainable. While San Diego County experienced a loss of jobs in 2007 due to fall out of the sub prime market, as well as loss of construction starts, it continues to be an attractive place to live with its diverse population, highly skilled and educated workforce, as well as several military bases. In addition the climate is very mild year round and provides multiple options for outdoor activities and tourism.

47

San Diego County

Market Fact Sheet

48

San Diego County

Market Fact Sheet

| Villas at Carlsbad Summit at Mission Bay |

49

San Diego County

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | Occupancy* | | | Home* | |

| 1 Presidio at Rancho del Oro | | | 264 | | | | 1987 | | | K/B | | | 91 | % | | $ | 1,268 | |

| 2 Villas at Carlsbad | | | 102 | | | | 1966 | | | K/B | | | 91 | % | | | 1,536 | |

| 3 Summit at Mission Bay | | | 323 | | | | 1953 | | | — | | | 96 | % | | | 1,264 | |

| 4 Rancho Vallecitos | | | 184 | | | | 1988 | | | K/B | | | 94 | % | | | 1,464 | |

| 5 Milazzo | | | 250 | | | | 1986 | | | K/B | | | 94 | % | | | 1,474 | |

| | | | | | | | | | | | | | | |

Grand Total | | | 1,123 | | | | | | | | | | 94 | % | | $ | 1,368 | |

| | | | | | | | | | | | | | | |

*As of 1Q 2008

50

| | | |

| | Monterey/Salinas

Market Fact Sheet

|

Market Statistics & Peer Comparison

| | | | | |

| Monterey Portfolio | | Homes | |

| Same Store Pool | | | 1,565 | |

| Non-Matures | | | — | |

| Development Pipeline | | | — | |

| | | | |

Total | | | 1,565 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 999 | |

| 1Q08 Occupancy | | | 92 | % |

Source: Company Reports

Monterey is UDR’s

#13market, and is expected

to contribute3.1%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

Monterey Market Statistics

| | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | $ | 1,108 | | | Ave. Market Rent | | $ | 999 | | | Population | | | 407,637,000 | |

| Occupancy Rate (Q4) | | | 92.4 | % | | Mo Payment: Entry Level*: | | | | | | Job Growth | | | 2.2 | % |

| Rental Rate Growth | | | 1.1 | % | | Home | | $ | 2,930 | | | Median Income | | $ | 63,400 | |

| Effective Rent (‘09F) | | $ | 1,116 | | | Condo | | $ | 2,465 | | | Housing Stock | | | | |

| Effective Rent (‘10F) | | $ | 1,142 | | | Median Home Price | | $ | 520,000 | | | Renter | | | 59,382 | |

| Multifamily Permits | | | 243 | | | Housing Affordability Index | | | 55.9 | | | % of Total | | | 42.8 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

UDR’s Monterey portfolio consists of 1,565 apartment homes in seven communities in Salinas, CA. Average rents are $1,000.

The Salinas economy is heavily influenced by the agricultural industry and is known as “America’s Salad Bowl”. The market has heavy population fluctuations related to the seasonality of the farming industry with highs in the March-November months. UDR’s occupancy tends to fluctuate between 91% in the low season and as high as 98% in the high season. 2007 job growth was 0.8% and AXIOMetrics forecasts 0.1% growth for 2008 and 1.6% growth for 2009.

51

Monterey/Salinas

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | Occupancy* | | | Home* | |

| 1 Garden Court | | | 107 | | | | 1986 | | | — | | | 92 | % | | $ | 869 | |

| 2 Cambridge Court | | | 332 | | | | 1974 | | | K/B | | | 89 | % | | | 942 | |

| 3 The Pointe at Westlake | | | 139 | | | | 1979 | | | K/B | | | 97 | % | | | 914 | |

| 4 Laurel Tree | | | 157 | | | | 1979 | | | K/B | | | 95 | % | | | 916 | |

| 5 Boranda Manor | | | 204 | | | | 1977 | | | K/B | | | 91 | % | | | 886 | |

| 6 The Pointe at Northridge | | | 187 | | | | 1975 | | | K/B | | | 93 | % | | | 1,085 | |

| 7 The Pointe at Harden Ranch | | | 439 | | | | 1973 | | | K/B | | | 93 | % | | | 1,144 | |

| | | | | | | | | | | | | | | |

Grand Total | | | 1,565 | | | | | | | | | | 92 | % | | $ | 999 | |

| | | | | | | | | | | | | | | |

*As of 1Q 2008

52

| | | |

| | Jacksonville

Market Fact Sheet

|

Market Statistics & Peer Comparison

| | | | | |

| Jacksonville Portfolio | | Homes | |

| Same Store Pool | | | 1,557 | |

| Non-Matures | | | 300 | |

| Development Pipeline | | | — | |

| | | | |

Total | | | 1,857 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 870 | |

| 1Q08 Occupancy | | | 95 | |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| AIV | | | 1,919 | | | $ | 880 | |

| UDR | | | 1,557 | | | | 870 | |

| MAA | | | 3,346 | | | | 816 | |

| EQR | | | 3,474 | | | | 803 | |

| | | | | | | |

| | | | 10,296 | | | $ | 832 | |

Sources: 1Q ‘08 SSP Homes & Avg. Rent — Axiometrics; & Internal Company Reports

Jacksonville is UDR’s

#14market, and is expected

to contribute2.9%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

Jacksonville Market Statistics

| | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | $ | 836 | | | Ave. Market Rent | | $ | 832 | | | Population | | | 1,300,823 | |

| Occupancy Rate (Q4) | | | 93.0 | % | | Mo Payment: Entry Level*: | | | | | | Job Growth | | | 1,1 | % |

| Rental Rate Growth | | | -0.6 | % | | Home | | $ | 1,201 | | | Median Income | | $ | 59,700 | |

| Effective Rent (‘09F) | | $ | 817 | | | Condo | | $ | 983 | | | Housing Stock | | | | |

| Effective Rent (‘10F) | | $ | 831 | | | Median Home Price | | $ | 177,600 | | | Renter | | | 179,448 | |

| Multifamily Permits | | | 2,523 | | | Housing Affordability Index | | | 142.4 | | | %of Total | | | 31.5 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

UDR has demonstrated success in creating additional value from its Jacksonville properties in a variety of ways.

| | • | | Kitchen and Bath program. We have completed 455 Kitchen and bath renovations at an average cost of $10,200 and are realizing an average return of 9% |

| |

| | • | | We have also completed a limited scope reposition of 352 units. |

AXIOMetrics most recent report shows Jacksonville’s population grew at +1.7% in 2007, above the national average. Jacksonville’s household income is slightly above the US average. Annual job growth is expected to decline slightly, feeling the pressure of the weakened national business climate. Most new jobs are coming from professional, business services, education, health services as well as leisure and hospitality industries.

AXIOMETRICS reports that single-family permitting decreased -31.2% from a year ago. Multi-family permitting decreased -53.2% from a year ago with 2,523 units permitted. Permitting is expected to increase +22.9% in 2009 and +21.8% in 2010.

53

Jacksonville

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | Occupancy* | | | Home* | |

| 1 The Antlers | | | 400 | | | | 1985 | | | — | | | 97 | % | | $ | 844 | |

| 2 Green Tree Place | | | 352 | | | | 1986 | | | K/B | | | 96 | % | | | 858 | |

| 3 St John’s Plantation | | | 400 | | | | 1989 | | | K/B | | | 95 | % | | | 930 | |

| 4 Westland Park | | | 405 | | | | 1990 | | | K/B | | | 92 | % | | | 850 | |

| | | | | | | | | | | | | | | |

Subtotal | | | 1,557 | | | | | | | | | | 95 | % | | | 870 | |

Non-Mature | | | | | | | | | | | | | | | | | | |

| 5 The Kensley Apartment Homes | | | 300 | | | | 2004 | | | — | | | 91 | % | | | 930 | |

| | | | | | | | | | | | | | | |

Subtotal | | | 300 | | | | | | | | | | 91 | % | | | 930 | |

| | | | | | | | | | | | | | | |

Grand Total | | | 1,857 | | | | | | | | | | | | | $ | 880 | |

| | | | | | | | | | | | | | | |

As of Q12008

54

| | | |

| | Norfolk/VA Beach

Market Fact Sheet

|

Market Statistics & Peer Comparison

| | | | | |

| Norfolk/VA Beach Portfolio | | Homes | |

| Same Store Pool | | | 1,438 | |

| Non-Matures | | | — | |

| Development Pipeline | | | — | |

| | | | |

Total | | | 1,438 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 964 | |

| 1Q08 Occupancy | | | 95 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| AIV | | | 3,161 | | | $ | 998 | |

| UDR | | | 1,438 | | | | 964 | |

| CLP | | | 497 | | | | 837 | |

| | | | | | | |

| | | | 5,096 | | | $ | 973 | |

Sources: 1Q ‘08 SSP Homes & Avg. Rent — Axiometrics; & Internal Company Reports

Norfolk is UDR’s

#15market, and is expected

to contribute2.8%of the

Company’s total net

operating income*

*EOY 2008 pro forma full portfolio NOI, including JV’s, planned acquisitions, developments, redevelopments, etc.

Norfolk/VA Beach Market Statistics

| | | | | | | | | | | | | | | | | |

| 2008 Forecast | | | Low Home Affordability | | | Economy | |

| Effective Rent (Q4) | | $ | 967 | | | Ave. Market Rent | | $ | 973 | | | Population | | | 1,658,754 | |

| Occupancy Rate (Q4) | | | 93.2 | % | | Mo Payment: Entry Level*: | | | | | | Job Growth | | | 0.9 | % |

| Rental Rate Growth | | | 0.8 | % | | Home | | $ | 1,544 | | | Median Income | | $ | 64,100 | |

| Effective Rent (‘09F) | | $ | 979 | | | Condo | | $ | 1,277 | | | Housing Stock | | | | |

| Effective Rent (‘10F) | | $ | 1,011 | | | Median Home Price | | $ | 236,000 | | | Renter | | | 235,029 | |

| Multifamily Permits | | | 1,105 | | | Housing Affordability Index | | | 118.5 | | | % of Total | | | 34.7 | % |

Source: Axiometrics

* Assumes 30 yr fixed at 6.31%

Recent Activity

Norfolk/Virginia Beach apartment communities are in solid locations and the Company has invested to modernize the homes in the following way:

| | • | | Kitchen and Bath Program: Over 1,400 kitchen and bath renovations have been completed at an average cost of $9,760, and are yielding an average annual return of 8.0%. |

Virginia Beach has a diversified economy with significant employment in the government sector and in trade, transportation and utilities. Job growth is expected to be 0.6% in 2009 and 1.2% in 2010. The median existing home price is $236,000 so housing affordably is in line with the national average.

55

Norfolk/VA Beach

Market Fact Sheet

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Year Built | | | | | | | | | | | Inc. per Occ. | |

| Operating Properties | | # Homes | | | ReDev | | | Redev. | | | Occupancy* | | | Home* | |

| 1 Dominion Waterside/Lynnhaven | | | 192 | | | | 1966 | | | | K/B | | | | 94 | % | | $ | 996 | |

| 2 Eastwind | | | 200 | | | | 1970 | | | | K/B | | | | 96 | % | | | 1,087 | |

| 3 Heather Lake | | | 252 | | | | 1972 | | | | K/B | | | | 93 | % | | | 971 | |

| 4 Woodscape | | | 296 | | | | 1974 | | | | — | | | | 93 | % | | | 779 | |

| 5 Forest Lakes at Oyster Pt. | | | 296 | | | | 1986 | | | | K/B | | | | 98 | % | | | 988 | |

| 6 Dominion Yorkshire Downs | | | 202 | | | | 1987 | | | | K/B | | | | 97 | % | | | 1,029 | |

| | | | | | | | | | | | | | | | |

Grand Total | | | 1,438 | | | | | | | | | | | | 95 | % | | $ | 964 | |

| | | | | | | | | | | | | | | | |

As of Q12008

56

| | | |

| | Inland Empire, CA

Market Fact Sheet

|

Market Statistics & Peer Comparison

| | | | | |

| Inland Empire Portfolio | | Homes | |

| Same Store Pool | | | 660 | |

| Non-Matures | | | 414 | |

| Development Pipeline | | | — | |

| | | | |

Total | | | 1,074 | |

| 1Q08 Mo. Inc./ Home (SS) | | $ | 1,165 | |

| 1Q08 Occupancy | | | 92.0 | % |

Source: Company Reports

| | | | | | | | | |

| Company | | # of Homes | | | Ave. Rent | |

| CPT | | | 264 | | | $ | 1,331 | |

| EQR | | | 4,098 | | | | 1,244 | |

| BRE | | | 2,929 | | | | 1,206 | |

| UDR | | | 660 | | | | 1,165 | |

| AIV | | | 198 | | | | 1,063 | |

| ESS | | | 588 | | | | 998 | |

| AVB | | | 320 | | | | 939 | |

| | | | | | | |