Exhibit 99.1

Investor Presentation November 2012

During the course of this presentation the Company will be making forward - looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995 ) that are based on our current expectations, beliefs and assumptions about the industry and markets in which US Ecology, Inc . and its subsidiaries operate . Because such statements include risks and uncertainties, actual results may differ materially from what is expressed herein and no assurance can be given that the Company will meet its 2012 earnings estimates, successfully execute its growth strategy, or declare or pay future dividends . For information on other factors that could cause actual results to differ materially from expectations, please refer to US Ecology, Inc . ’s December 31 , 2011 Annual Report on Form 10 - K and other reports filed with the Securities and Exchange Commission . Many of the factors that will determine the Company’s future results are beyond the ability of management to control or predict . Participants should not place undue reliance on forward - looking statements, reflect management’s views only as of the date hereof . The Company undertakes no obligation to revise or update any forward - looking statements, or to make any other forward - looking statements, whether as a result of new information, future events or otherwise . Important assumptions and other important factors that could cause actual results to differ materially from those set forth in the forward - looking information include a loss of a major customer or contract, compliance with and changes to applicable laws, rules, or regulations, access to cost effective transportation services, access to insurance, surety bonds and other financial assurances, loss of key personnel, lawsuits, labor disputes, adverse economic conditions, government funding or competitive pressures, incidents or adverse weather conditions that could limit or suspend specific operations, implementation of new technologies, market conditions, average selling prices for recycled materials, our ability to replace business from recently completed large projects, our ability to perform under required contracts, our ability to permit and contract for timely construction of new or expanded disposal cells, our willingness or ability to pay dividends and our ability to effectively close and integrate future acquisitions . Safe Harbor 2

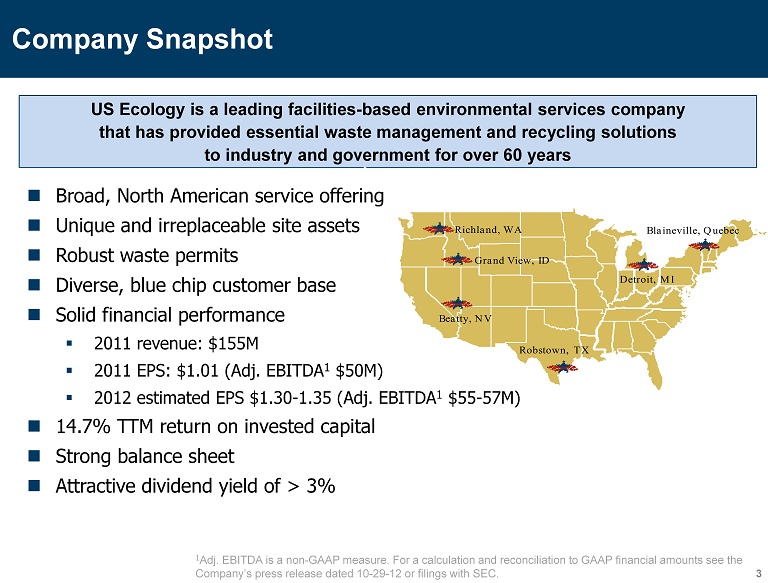

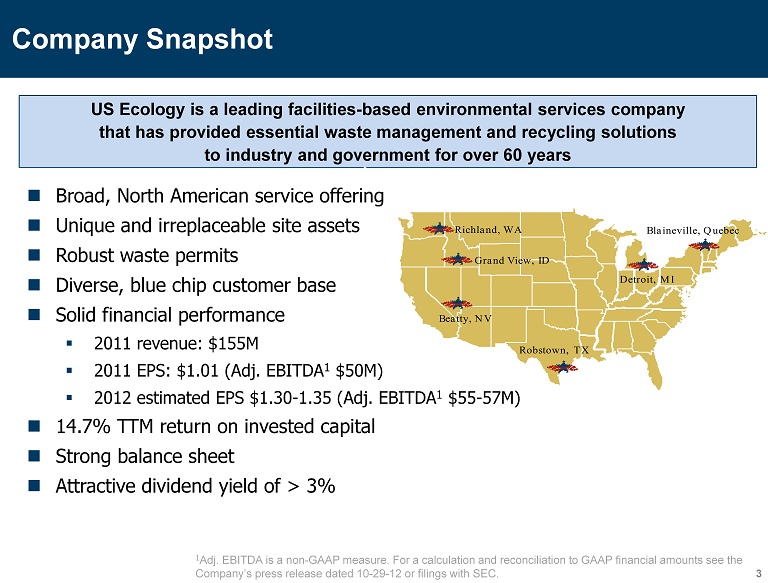

Company Snapshot US Ecology is a leading facilities - based environmental services company that has provided essential waste management and recycling solutions t o industry and government for over 60 years 3 Broad, North American service offering Unique and irreplaceable site assets Robust waste permits Diverse , blue chip customer base Solid financial performance ▪ 2011 revenue: $155M ▪ 2011 EPS: $1.01 (Adj. EBITDA 1 $50M) ▪ 2012 estimated EPS $1.30 - 1.35 (Adj. EBITDA 1 $55 - 57M) 14.7% TTM return on invested capital Strong balance sheet Attractive dividend yield of > 3% Richland, WA Grand View, ID Beatty, NV Robstown, TX Detroit, MI Blaineville , Quebec 1 Adj. EBITDA is a non - GAAP measure. For a calculation and reconciliation to GAAP financial amounts s ee the Company’s press release dated 10 - 29 - 12 or filings with SEC.

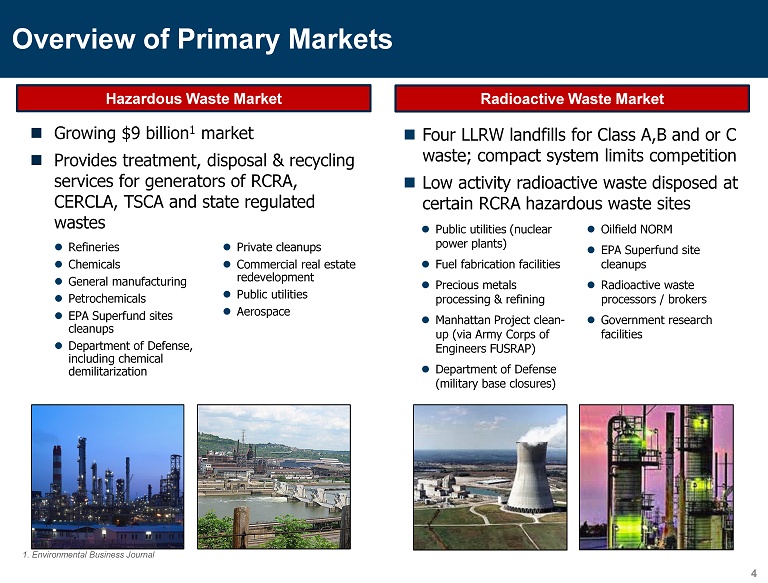

Refineries Chemicals General manufacturing Petrochemicals EPA Superfund sites cleanups Department of Defense, including chemical demilitarization Private cleanups Commercial real estate redevelopment Public utilities Aerospace Overview of Primary Markets 4 Radioactive Waste Market Hazardous Waste Market Public utilities (nuclear power plants) Fuel fabrication facilities Precious metals processing & refining Manhattan Project clean - up (via Army Corps of Engineers FUSRAP ) Department of Defense (military base closures) Oilfield NORM EPA Superfund site cleanups Radioactive waste processors / brokers Government research facilities 1. Environmental Business Journal Growing $9 billion 1 market Provides treatment, disposal & recycling services for generators of RCRA, CERCLA, TSCA and state regulated wastes Four LLRW landfills for Class A,B and or C waste; compact system limits competition Low activity radioactive waste disposed at certain RCRA hazardous waste sites

Broad, National Service Offering Treatment Disposal Transportation (83% of 2011 Revenue) (17% of 2011 Revenue) 5 treatment facilities Stabilization Solidification Encapsulation Catalyst recycling Brokering /recycling Oil reclamation Hazardous liquids processing 4 North American hazardous waste landfills 1 radioactive waste landfill (class A, B, and C) 1 thermal desorption recycling operation 1 wastewater treatment facility with POTW disposal On - site t ransportation logistics support 3 rail transfer facilities 21,000+ feet of private track 15 specialty tankers and trailers and 8 power units 234 company - owned railcars Cross - border expertise 5 5

Irreplaceable Assets 6 ▪ Grand View, Idaho • “Hybrid” site with both Hazardous & Radioactive capabilities • Specializing in high volume treatment or direct disposal hazardous projects • Decades of permitted capacity ▪ Robstown, Texas • Well situated in large Gulf Coast oil and gas market (adjacent to Eagle Ford field); specializing in difficult - to - treat, container, and bulk waste ▪ Beatty, Nevada • Remote desert location serving large CA/AZ market and specializing in difficult - to - treat, container and bulk waste ▪ Blainville, Quebec (Stablex) • Located near large industrial markets; significant base business • Unique permit capabilities for ‘niche’ waste streams (e.g. mercury, oxidizers) ▪ Richland, WA • NRC regulated Low - Level Radioactive Waste • Serves Northwest & Rocky Mtn. Compact. Stable, rate regulated r evenue requirement

Complementary , Specialized Services 7 ▪ Thermal Recycling of Oil Bearing Hazardous Waste • Co - located at Robstown, TX site • Leverages existing infrastructure • Internalizes recycling residuals • Profitable secondary revenue stream for recovered oil and metals ▪ Transportation Services • 234 owned gondola railcars • Hazardous & Radioactive transportation and logistics expertise ▪ Field Services • US Ecology personnel provide service at customer locations • Oversee loading, packaging, manifesting of hazardous & radioactive material ▪ Off Site Services • Broker material that we cannot dispose at our landfills • Delivers ‘one shipment solution’ to customer

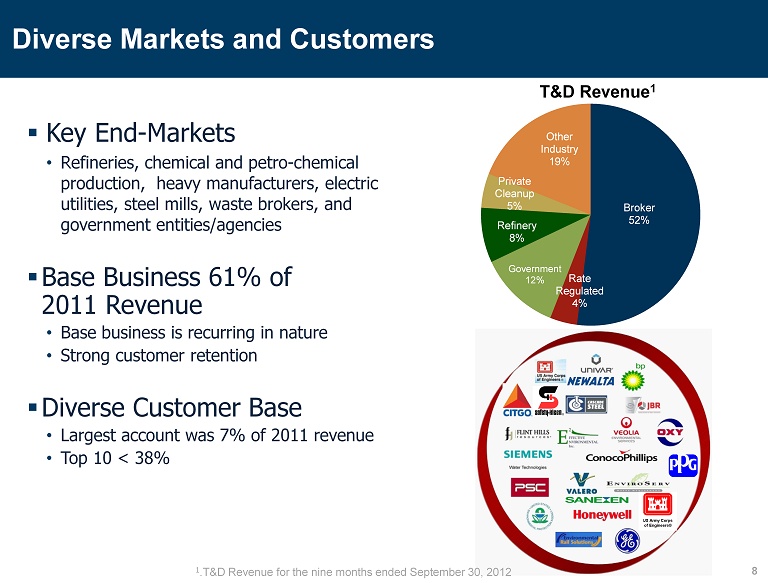

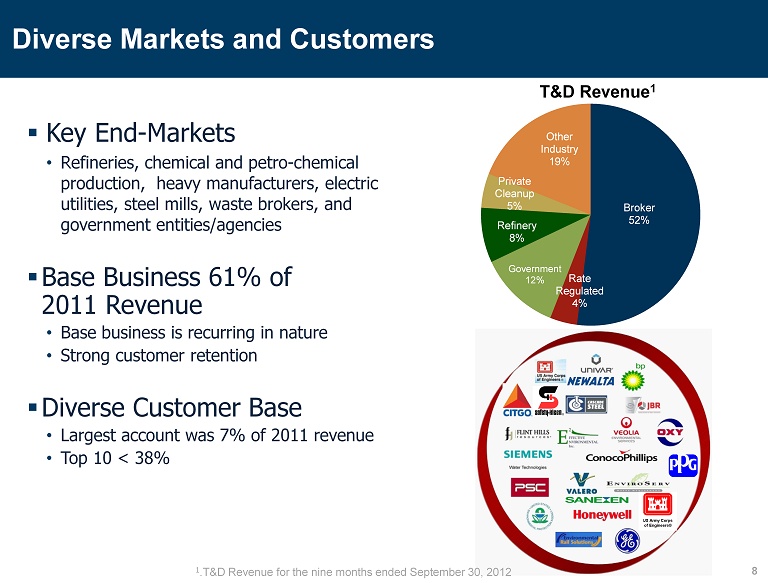

Diverse Markets and Customers ▪ Key End - Markets • Refineries, chemical and petro - chemical production, heavy manufacturers, electric utilities, steel mills, waste brokers, and government entities/agencies ▪ Base Business 61% of 2011 Revenue • Base business is recurring in nature • Strong customer retention ▪ Diverse Customer Base • Largest account was 7% of 2011 revenue • Top 10 < 38% 8 Broker 52% Rate Regulated 4% Government 12 % Refinery 8% Private Cleanup 5% Other Industry 19% T&D Revenue 1 1 .T&D Revenue for the nine months ended September 30, 2012

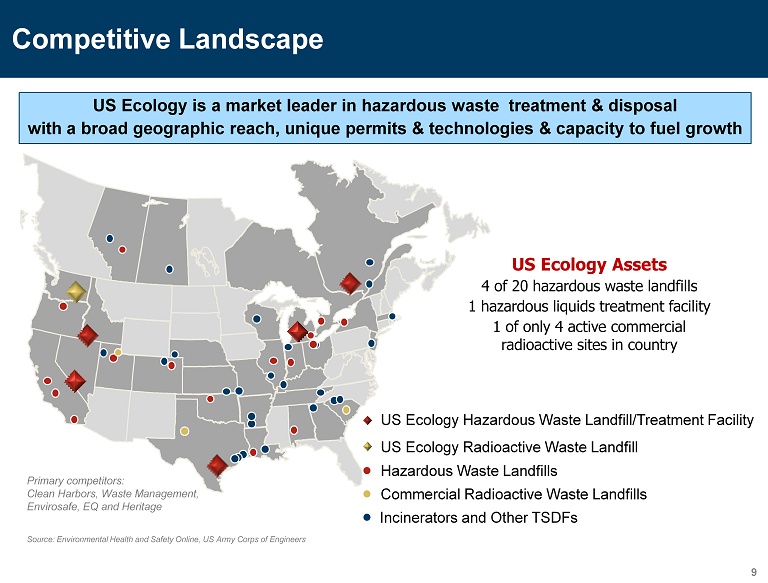

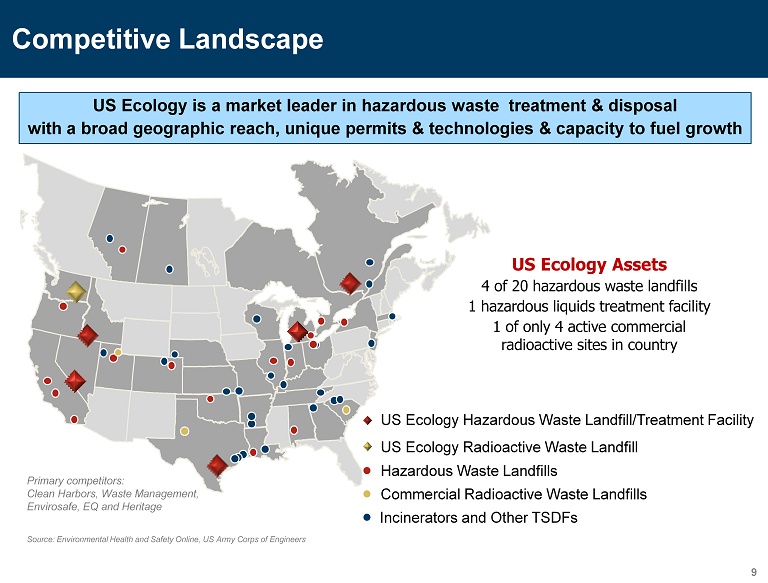

US Ecology is a market leader in hazardous waste treatment & disposal with a broad geographic reach, unique permits & technologies & capacity to fuel growth Competitive Landscape 9 Source: Environmental Health and Safety Online, US Army Corps of Engineers US Ecology Assets 4 of 20 hazardous waste landfills 1 hazardous liquids treatment facility 1 of only 4 active commercial radioactive sites in country Incinerators and Other TSDFs Hazardous Waste Landfills Commercial Radioactive Waste Landfills US Ecology Hazardous Waste Landfill/Treatment Facility US Ecology Radioactive Waste Landfill Primary competitors: Clean Harbors, Waste Management, Envirosafe , EQ and Heritage

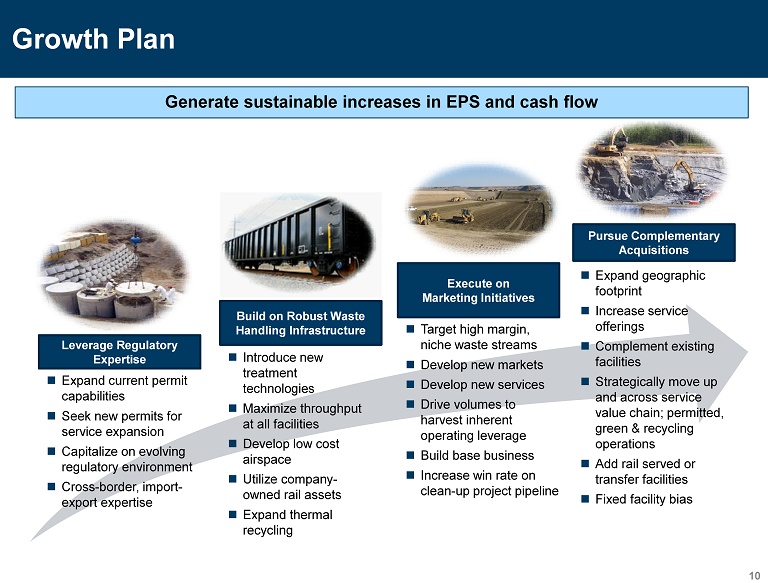

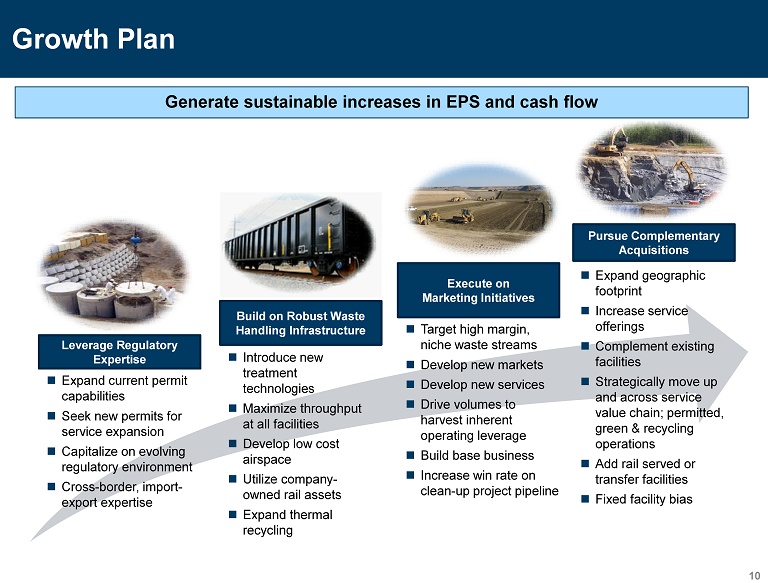

Growth Plan Leverage Regulatory Expertise Expand current permit capabilities Seek new permits for service expansion Capitalize on evolving regulatory environment Cross - border, import - export expertise Pursue Complementary Acquisitions Expand geographic footprint Increase service offerings Complement existing facilities Strategically move up and across service value chain; permitted, green & recycling operations Add rail served or transfer facilities Fixed facility bias Build on Robust Waste Handling Infrastructure Introduce new treatment technologies Maximize throughput at all facilities Develop low cost airspace Utilize company - owned rail assets Expand thermal recycling 10 Execute on Marketing Initiatives Target high margin, niche waste streams Develop new markets Develop new services Drive volumes to harvest inherent operating leverage Build base business Increase win rate on clean - up project pipeline Generate sustainable increases in EPS and cash flow

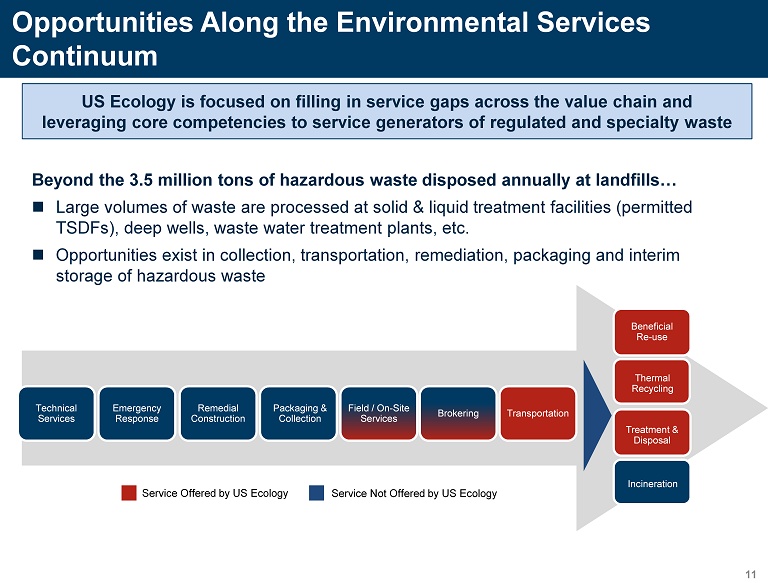

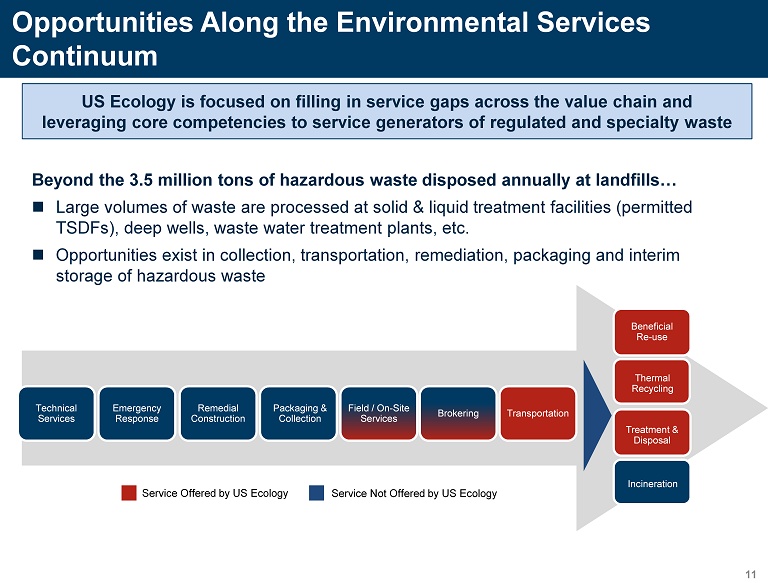

Opportunities Along the Environmental Services Continuum Low High Technical Services Emergency Response Remedial Construction Packaging & Collection Brokering Transportation Beneficial Re - use Thermal Recycling Incineration Treatment & Disposal US Ecology is focused on filling in service gaps across the value chain and leveraging core competencies to service generators of regulated and specialty waste Service Offered by US Ecology Field / On - Site Services 11 Service Not Offered by US Ecology Beyond the 3.5 million tons of hazardous waste disposed annually at landfills… Large volumes of waste are processed at solid & liquid treatment facilities (permitted TSDFs), deep wells, waste water treatment plants, etc. O pportunities exist in collection, transportation, remediation, packaging and interim storage of hazardous waste

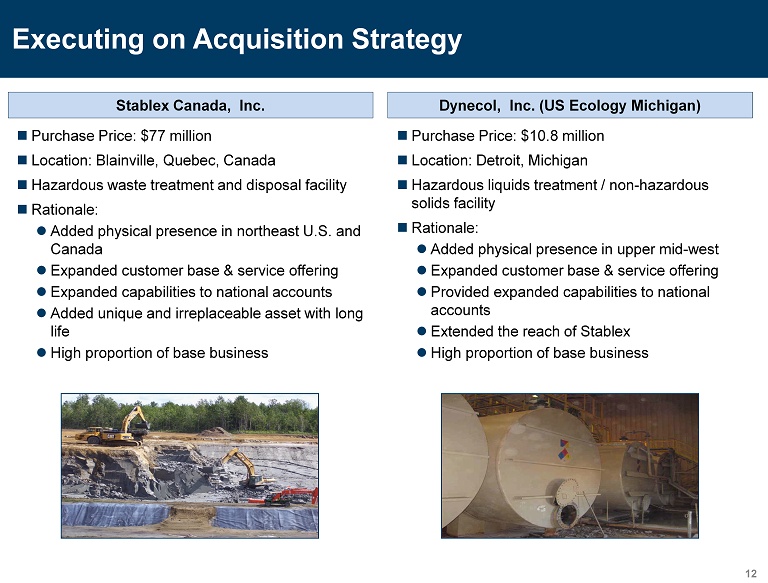

Executing on Acquisition Strategy 12 Stablex Canada, Inc. Dynecol , Inc. (US Ecology Michigan) Purchase Price: $77 million Location: Blainville , Quebec, Canada Hazardous waste treatment and disposal facility Rationale: Added physical presence in northeast U.S. and Canada Expanded customer base & service offering Expanded capabilities to national accounts Added unique and irreplaceable asset with long life High proportion of base business Purchase Price: $10.8 million Location: Detroit, Michigan Hazardous liquids treatment / non - hazardous solids facility Rationale: Added physical presence in upper mid - west Expanded customer base & service offering Provided expanded capabilities to national accounts Extended the reach of Stablex High proportion of base business

Historical Revenue / Operating Income Strong Revenue Growth • Base Business CAGR (‘ 05 - ’11) of 21% • Treatment & Disposal Rev. CAGR (‘ 05 - ’11 ) of 14% Underlying growth rate masked by Event business & transportation lumpiness Operating income CAGR (‘05 - ’11) of 9% 13 $19 $25 $31 $35 $23 $20 $32 $40 $- $5 $10 $15 $20 $25 $30 $35 $40 $45 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 2005 2006 2007 2008 2009 2010 2011 TTM Operating Income Revenue Base Business Event Business Transportation Operating Income

1 Adj. EBITDA and EPS are non - GAAP measures. For a calculation and reconciliation to GAAP financial amounts s ee the Company’s press release dated 10 - 29 - 12 or filings with SEC. ▪ T&D Revenue up 11% (46.3% T&D gross margin) ▪ 742,000 tons disposed; up 6% over prior year period ▪ Adjusted EBITDA 1 up 24% to $42.7 million ▪ Operating Income up 36% to $29.8 million ▪ Cash flow statistics • $24.8 cash from operations • $9.0 million debt borrowings ( Dynecol acquisition on May 31 st ) • $9.9 million dividend payments • $12.4 million capital expenditures ▪ Net Income $19.5 million, $1.07 per share ▪ Adjusted EPS 1 up 42% to $1.04 ▪ Return metrics remain solid – 25.3% ROE and 14.7% ROIC ▪ Strong across the board performance First Nine Months 2012 Highlights 14

▪ EPS to range from $1.30 to $1.35 1 • Raised from $1.05 to $1.15 • Most recent guidance reflects more diverse customer base • No one customer anticipated to account for > 8% of 2012 revenue ▪ Adjusted EBITDA to range from $55 million to $57 million • Previous A djusted EBITDA guidance was $48 million to $52 million ▪ T&D disposal margin expectations increased to between 46% and 47% due to strong volume - driven operating leverage & waste mix ▪ Expect Capital Expenditures to range from $17.5 to $18.5 million • Down from initial estimate of $18.5 to $19.5 million • New landfill construction in Idaho and Quebec represents almost half of 2012 spending • Continued reinvestment in waste handling infrastructure 2012 Business Outlook: Financial 1 Guidance excludes foreign currency translation gains or losses 15

▪ Strategy: Build on our successes in 2011 & YTD 2012 • Drive organic growth with increased market penetration and expanded service offering – keep taking market share • Operational Excellence - Flawless execution • Expand asset base through acquisitions via a hub & spoke model • Ongoing commitment to Health, Safety & Compliance ▪ Continued revenue & EBITDA growth projected in 2013 • Base Business growth expected to continue • Event Business looks strong with opportunities in higher margin niche waste • Thermal recycling business expected to grow from 2012 with regulatory requirements clarified Business Outlook: Strategy & Initial 2013 Outlook 16

▪ Unique and irreplaceable set of disposal assets ▪ High barriers to entry ▪ Highly leveragable business model with earnings upside ▪ Experienced management team ▪ Return on invested capital: 14.7% TTM ▪ Attractive dividend yield of over 3% ▪ Strong balance sheet with available borrowing capacity ▪ Acquisitions part of future growth strategy 17 US Ecology Investment Highlights

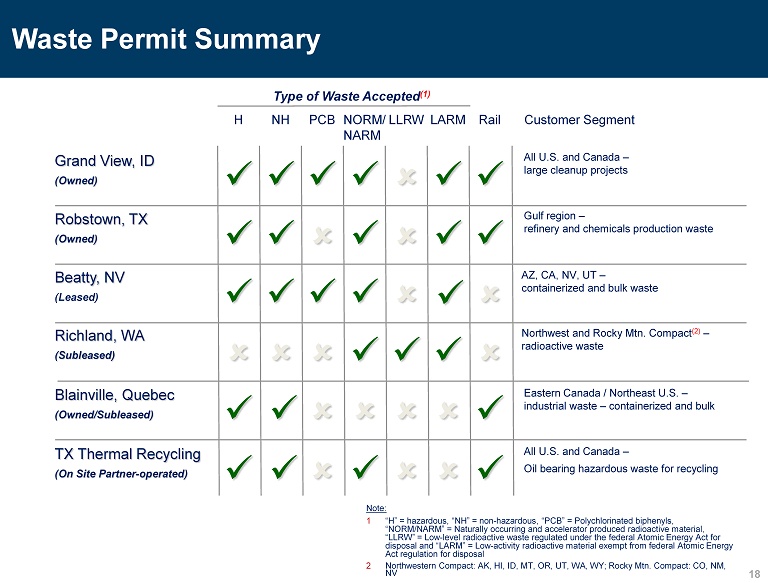

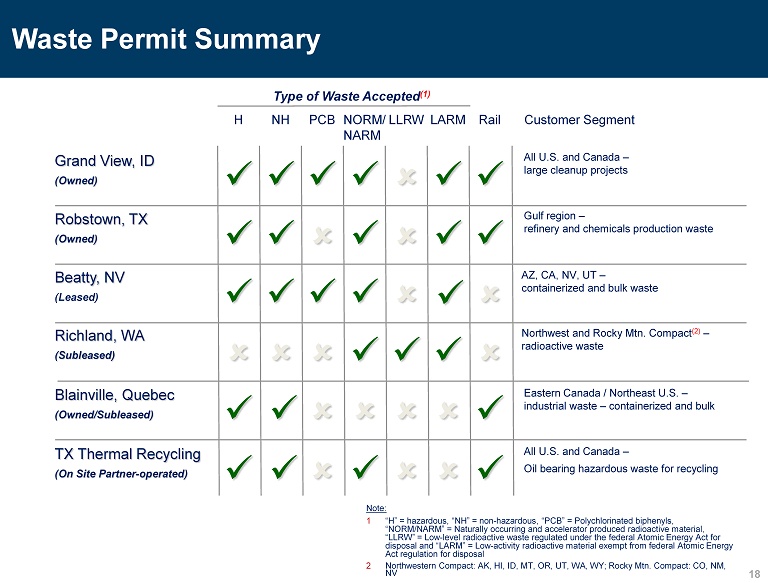

Waste Permit Summary 18 Type of Waste Accepted (1) H NH Rail Customer Segment Robstown, TX (Owned) Gulf region – refinery and chemicals production waste PCB NORM/ NARM LARM LLRW Grand View, ID (Owned) All U.S. and Canada – large cleanup projects x x x x x x Blainville, Quebec (Owned/Subleased) Eastern Canada / Northeast U.S. – industrial waste – containerized and bulk x x x x x x Beatty, NV (Leased) AZ, CA, NV, UT – containerized and bulk waste x x x x Richland, WA (Subleased) x x x Northwest and Rocky Mtn. Compact (2) – radioactive waste TX Thermal Recycling (On Site Partner - operated) All U.S. and Canada – Oil bearing hazardous waste for recycling x x x x x x x Note: 1 “H” = hazardous, “NH” = non - hazardous, “PCB” = Polychlorinated biphenyls, “ NORM/NARM” = Naturally occurring and accelerator produced radioactive material , “LLRW” = Low - level radioactive waste regulated under the federal Atomic Energy Act for disposal and “LARM” = Low - activity radioactive material exempt from federal Atomic Energy Act regulation for disposal 2 Northwestern Compact: AK, HI, ID, MT, OR, UT, WA, WY; Rocky Mtn. Compact: CO, NM, NV 18