Exhibit 99.1

Investor Presentation May 2014

During the course of this presentation the Company will be making forward - looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995 ) that are based on our current expectations, beliefs and assumptions about the industry and markets in which US Ecology, Inc . and its subsidiaries operate as well as the proposed acquisition of The Environmental Quality Company . Such statements may include, but are not limited to, statements about the Company’s ability to close its proposed acquisition, its ability to raise the capital necessary to complete the transaction, expected synergies from the transaction, projections of the financial results of the combined company and other statements that are not historical facts . Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including general economic and business conditions, conditions affecting the industries served by US Ecology, The Environmental Quality Company and their respective subsidiaries, conditions affecting our customers and suppliers, competitor responses to our products and services, the overall market acceptance of such products and services, the integration and performance of acquisitions (including the proposed acquisition of The Environmental Quality Company) and other factors disclosed in the Company’s periodic reports filed with the Securities and Exchange Commission . For information on other factors that could cause actual results to differ materially from expectations, please refer to US Ecology, Inc . ’s December 31 , 2013 Annual Report on Form 10 - K and other reports filed with the Securities and Exchange Commission . Many of the factors that will determine the Company’s future results are beyond the ability of management to control or predict . Participants should not place undue reliance on forward - looking statements, which reflect management’s views only as of the date hereof . The Company undertakes no obligation to revise or update any forward - looking statements, or to make any other forward - looking statements, whether as a result of new information, future events or otherwise . Important assumptions and other important factors that could cause actual results to differ materially from those set forth in the forward - looking information include a loss of a major customer or contract, compliance with and changes to applicable laws, rules, or regulations, access to cost effective transportation services, access to insurance, surety bonds and other financial assurances, loss of key personnel, lawsuits, labor disputes, adverse economic conditions, government funding or competitive pressures, incidents or adverse weather conditions that could limit or suspend specific operations, implementation of new technologies, market conditions, average selling prices for recycled materials, our ability to replace business from recently completed large projects, our ability to perform under required contracts, our ability to permit and contract for timely construction of new or expanded disposal cells, our willingness or ability to pay dividends and our ability to effectively close, integrate and realize anticipated synergies from future acquisitions, which can be impacted by the failure of the acquired company to achieve anticipated revenues, earnings or cash flows, assumption of liabilities that exceed our estimates, potential compliance issues, diversion of management’s attention or other resources from our existing business, risks associated with entering product / service areas in which we have limited experience, increases in working capital investment, unexpected capital expenditures, potential losses of key employees and customers of the acquired company and future write - offs of intangible and other assets, including goodwill, if the acquired operations fail to generate sufficient cash flows . Safe Harbor 2

Company Snapshot US Ecology is a leading “facilities - based” environmental services company providing essential waste management and recycling solutions to industry and government for over 60 years • Broad, North American service offering • Unique and irreplaceable site assets • Robust waste permits • Diverse , blue chip customer base • Solid financial performance ▪ 2013 revenue: $201 million ▪ 2013 Adjusted EPS 1 : $1.82 (Adj. EBITDA 1 $71 million) ▪ 2014 estimated EPS $1.60 - 1.70 (Adj. EBITDA 1 $74 - 78M) • 17.3% return on invested capital • 18.7% return on equity • Strong balance sheet • Attractive dividend yield of over 1.5% 1 See reconciliation of Adjusted EBITDA and Adjusted earnings per share in the appendix to this presentation or attached as Exh ibi t A to our earnings release filed with the SEC on Form 8 - K. Richland, WA Beatty, NV Grand View, ID Robstown, TX Detroit, MI Blainville, QC

• Refineries • Chemicals • General manufacturing • Petrochemicals • EPA Superfund sites cleanups • Department of Defense, including chemical demilitarization • Private cleanups • Commercial real estate redevelopment • Public utilities • Aerospace Markets Served Radioactive Waste Hazardous Waste • Public utilities (nuclear power plants) • Fuel fabrication facilities • Precious metals processing & refining • Manhattan Project clean - up (via Army Corps of Engineers FUSRAP 2 ) • Department of Defense (military base closures) • Oilfield NORM 2 • EPA Superfund site cleanups • Radioactive waste processors / brokers • Government research facilities 1 Environmental Business Journal, August 2013 2 RCRA – Resource Conservation and Recovery Act of 1976; CERCLA – Comprehensive Environmental Response, Compensation and Liability Act of 1980; TSCA – Toxic Substances Control Act of 1976; LLRW – Low - Level Radioactive Waste; NORM – Naturally Occurring Radioactive Material; FUSRAP – Formerly Utilized Sites Remedial Action Program • Growing $ 9 billion 1 opportunity • Provides treatment, disposal & recycling services for generators of RCRA 2 , CERCLA 2 , TSCA 2 and state regulated wastes • Stable $1 billion 1 opportunity • Four LLRW 2 landfills for Class A,B and or C waste; compact system limits competition • Low activity radioactive waste disposed at certain RCRA 2 hazardous waste sites 4

Broad Service Offering Treatment Disposal Complementary Services (82% of 2013 Revenue) ( 18% of 2013 Revenue) • 5 treatment facilities • Stabilization • Solidification • Encapsulation • Catalyst recycling • Brokering /recycling • Oil reclamation • Hazardous liquids processing • 4 North American hazardous waste landfills • 1 radioactive waste landfill (class A, B, and C) • 1 thermal desorption recycling operation • 1 wastewater treatment facility with POTW 1 disposal • On - site t ransportation logistics support • 3 rail transfer facilities • 21,000+ feet of private track • 15 specialty tankers and trailers and 8 power units • 234 company - owned railcars • Cross - border expertise 5 5 1 POTW – Publicly Owned Treatment Works

Diverse Markets and Customers ▪ Direct and Indirect/broker sales channels serve a diverse range of customers and waste generators ▪ Largest customer was 9% of 2013 revenue; Top 10 customers accounted for < 39% of 2013 revenue ▪ Recurring Base business revenue was 62% of 2013 revenue 2013 T&D Revenue Indirect 48% Rate Regulated 4% Government 6% Refinery 11% Private Cleanup 15% Other Industry 16% Service Providers Brokers & Aggregators Regional TSDFs 6 Broker

Competitive Landscape 7 US Ecology Assets 4 of 20 hazardous waste landfills 1 hazardous liquids treatment facility 1 of only 4 active commercial radioactive sites in country Competing Hazardous Waste Landfills Competing Commercial Radioactive Waste Landfills US Ecology Hazardous Waste Landfill/Treatment Facility US Ecology Radioactive Waste Landfill Primary competitors: Clean Harbors, Waste Management, Envirosafe, EQ and Heritage US Ecology is a leader in hazardous waste treatment & disposal with a broad geographic reach, unique permits & technologies, and capacity to fuel growth

Strong Organic Growth Opportunities Leverage Regulatory Expertise • Expand current permit capabilities • Seek new permits for service expansion • Capitalize on evolving regulatory environment • Cross - border, import - export expertise Build on Robust Waste Handling Infrastructure • Introduce new treatment technologies • Maximize throughput at all facilities • Develop low cost airspace • Utilize transportation assets • Expand thermal recycling Execute on Marketing Initiatives • Target high margin, niche waste streams • Develop new markets • Develop new services • Drive volumes to harvest inherent operating leverage • Build base business • Increase win rate on clean - up project pipeline Generate sustainable increases in EPS and cash flow 8 Commitment to Customer Service • Customer - centric focus • Listening to customers is critical to success • Research solutions for customer challenges • Provide unequalled customer service

Growth Opportunities and Acquisitions Low High Technical Services Emergency Response Remedial Construction Packaging & Collection Brokering Transportation Beneficial Re - use Thermal Recycling Incineration Treatment & Disposal US Ecology is focused on filling in service gaps across the value chain and leveraging core competencies to service generators of regulated and specialty waste Service Currently Offered by US Ecology Field / On - Site Services Service Not Currently Offered by US Ecology • Large volumes of waste are processed at solid & liquid treatment facilities (permitted TSDFs), deep wells, waste water treatment plants, etc. • O pportunities exist in collection, transportation, remediation, packaging and interim storage of hazardous waste • Targeted acquisitions to expand breadth of services offered 9 Lower Higher Margin

US Ecology Financial Overview 10

Treatment and Disposal Historical Revenue Breakdown • Strategic Emphasis on Base Business ▪ Increased predictability and recurring properties ▪ Covers fixed overhead costs • 26% Organic Sales CAGR (2010 – 2013) 11 Base $47 $44 $50 $79 $95 $99 $0 $20 $40 $60 $80 $100 $120 2008 2009 2010 2011 2012 2013 Event $46 $35 $36 $50 $51 $66 $0 $10 $20 $30 $40 $50 $60 $70 $80 2008 2009 2010 2011 2012 2013 • Event Business provides Upside and Increased Variability ▪ Represents discrete projects that vary in size, duration and pricing ▪ Significant portion is generally realized as operating income and net income ▪ Approximately 30% of Event Business has recurring attributes • 23% Organic Sales CAGR (2010 – 2013) • Sales pipeline remains strong In millions In millions 50% 56% 58% 61% 65% 60% 50% 44% 42% 39% 35% 40% % of total T&D revenue % of total T&D revenue

1 Adj. EBITDA is a non - GAAP measure. For a calculation and reconciliation to GAAP financial amounts see the appendices to this presentation or filings with SEC. Adj. EBITDA and Operating Income margins calculated as a percent of T&D revenue. 2 Calculated as operating income less applicable taxes divided by the sum of stockholders’ equity, long - term debt, closure and pos t - closure obligations and monetized operating leases, less cash and short - term investments Historical EBITDA & Return on Invested Capital 18.8% 14.5% 12.3% 11.7% 14.6% 17.3% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 2008 2009 2010 2011 2012 2013 Return on Invested Capital 2 • Strong Adj. EBITDA Growth ▪ 22% growth in 2013 over 2012 ▪ 33% CAGR from 2010 – 2013 • Robust margins of 43% • Strong cash flow to support growth initiatives, and return capital to stockholders • Strong and Improving Returns on Invested Capital ▪ Driven by strong growth and margin profile ▪ Disciplined approach to capital allocation 12 44.9% 47.3% 48.1% 48.0% 40.4% 35.8% 38.6% 40.0% 43.1% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% $- $20 $40 $60 $80 2005 2006 2007 2008 2009 2010 2011 2012 2013 in millions Adj. EBITDA 1 Adj. EBITDA Adj. EBITDA T&D Margin

Historical Capital Expenditures • C apital expenditures have increased to support maintenance and growth projects at all of our disposal facilities, including: ▪ Landfill construction and other infrastructure investments to increase surge capacity ▪ Equipment purchases Over $70 million of capital expenditures over the last 5 years has positioned US Ecology for continued growth 13 8% 7% 14% 7% 9% 11% 0% 5% 10% 15% - 5 10 15 20 25 2008 2009 2010 2011 2012 2013 in millions Capital Expenditures Capital Expenditures % of Total Revenue

Revenue First Quarter 2014 Results 14 Operating Income/EBITDA 1 • Total revenue up 24% ▪ Event Business up 58% ▪ Base Business up 4% ▪ Transportation revenue increase tied to Event Business ▪ Volumes up 32% • Operating income up 60% • Adjusted EBITDA 1 up 46% • Net income $9.4 million, $0.43 per diluted share ▪ Adjusted EPS 1 up 50% to $0.48 1 See reconciliation of adjusted EBITDA & adjusted EPS in appendix to this presentation or attached as Exhibit A to our earnin gs release filed with the SEC on Form 8 - K $0 $10 $20 $30 $40 $50 $60 Q1'13 Q1'14 in millions Base Event Transportation $0 $5,000 $10,000 $15,000 $20,000 $25,000 Q1'13 Q1'14 In thousands Operating Income Non Cash items

Revised 2014 Outlook – Excludes Pending Acquisition of EQ 15 1 Guidance excludes non - cash foreign currency translation gains or losses and business development expenses and excludes pending acquisition of EQ - The Environmental Quality Company • Earnings per share estimated at $ 1.60 - $ 1.70 1 • Previous EPS guidance $ 1.50 - $ 1.60 1 • Adjusted EBITDA estimated to range from $74 - $78 million • Previous Adjusted EBITDA guidance of $70 - $74 million • Favorable business activity trends continue • Business Climate: • Base Business expected to be steady • Event Business sales pipeline remains healthy with new opportunities – Commercial activity continues to be strong – Improved outlook for government sector balance of year • Capital Expenditures estimated at $20 - $21 million • Includes $2.3 million carryover not spent in 2013 • Guidance to be revised upon closing of EQ

Acquisition : EQ - The Environmental Quality Company 16

Pending Acquisition: EQ • Entered into Definitive Stock Purchase Agreement to purchase EQ on April 6, 2014 • Transaction expected to close in the second or third quarter of 2014, subject to regulatory approvals and customary closing conditions • Total purchase consideration of $465 million • To be funded with cash and approximately $415 million of term loan • Received commitment from Wells Fargo and Credit Suisse for new credit facility; total commitment includes a $415 million term loan and a $125 million revolving line of credit • Low cost financing will enhance accretion to adjusted EPS and returns to stockholders, while maintaining a conservative and flexible capital structure Consideration A Compelling Combination: Broader Geographic Footprint and Greater Array of Services to Drive Value Transaction Financing 17

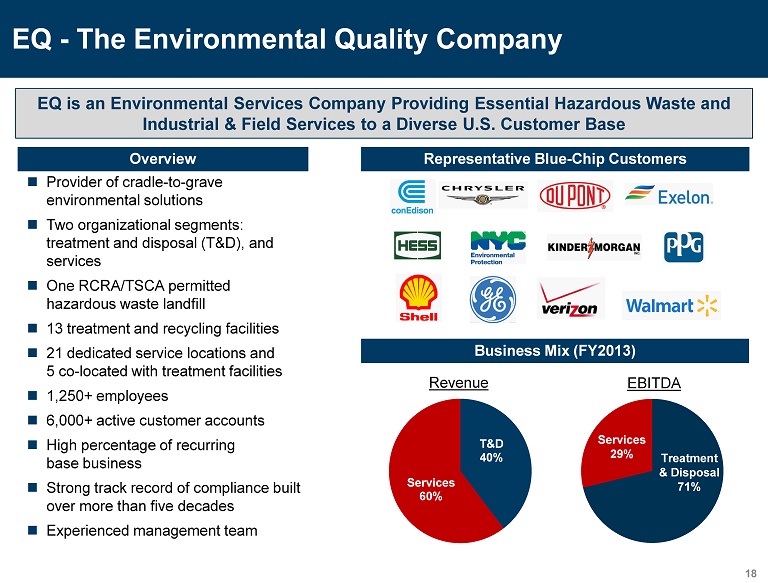

EQ - The Environmental Quality Company EQ is an Environmental Services Company Providing Essential Hazardous Waste and Industrial & Field Services to a Diverse U.S. Customer Base Overview • Provider of cradle - to - grave environmental solutions • Two organizational segments: treatment and disposal (T&D), and services • One RCRA/TSCA permitted hazardous waste landfill • 13 treatment and recycling facilities • 21 dedicated service locations and 5 co - located with treatment facilities • 1,250+ employees • 6,000+ active customer accounts • High percentage of recurring base business • Strong track record of compliance built over more than five decades • Experienced management team Business Mix (FY2013) Revenue Representative Blue - Chip Customers 18 Treatment & Disposal 71% Services 29% EBITDA T&D 40% Services 60%

Hazardous Waste Source: Environmental Business Journal • $10 billion opportunity • Provides treatment, disposal & recycling services for generators of RCRA, CERCLA, TSCA and state regulated wastes • Chemical and energy industries comprise the majority of waste generated, driven by sources such as refineries, chemical plants and general manufacturing plants • Radioactive waste constitutes $1 billion • Four LLRW landfills for Class A,B and or C waste; compact system limits competition • Low activity radioactive waste disposed at certain RCRA hazardous waste sites 19 Environmental Services Constitute a $24 Billion 1 Opportunity I ncluding Treatment , Disposal and Management of a Wide Range of Hazardous and Industrial Waste Streams Stable and Growing Revenue Opportunity 1 Environmental Business Journal; based on the aggregate size of Hazardous Waste Management and Remediation/Industrial Services Industrial & Field Services $9.3 $9.4 $9.6 $9.0 $9.4 $9.7 $10.1 $11.6 $12.2 $12.6 $12.1 $12.8 $13.1 $13.6 $20.8 $21.6 $22.1 $21.2 $22.2 $22.8 $23.7 $0.0 $10.0 $20.0 $30.0 2006 2007 2008 2009 2010 2011 2012 Hazardous Waste Industrial & Field Services ($ in billions) • $14 billion opportunity • Consists of cleanup of contaminated sites, buildings, and environmental cleaning of operating facilities • Private customers include industrials firm in addition to property owners/developers • Government agencies a major customer of environmental remediation Environmental Services Industry Overview

Acquisition Fit Alignment with our core strategic vision Opportunity to expand our customer base and service offering Cultural fit US Ecology Acquisition Approach & Criteria EQ Ability to improve our competitive positioning Financial returns x Longstanding relationships with a diverse customer base x Exceptional regulatory compliance track record x Recurring base revenue with upside from events x Will add back - end treatment and disposal assets complementary with existing geographies x Will provide access to a complementary set of services and capabilities x Serves over 6,000 active customers, ranging from Fortune 1,000 to small public and private companies x Committed to compliance and health & safety x Knowledge of the industry and end markets x Results - oriented management team x Will position ECOL to better service the Midwest and Eastern U.S. x Will increase diversity of service offering, improving ability to serve as a total solutions provider x Will improve revenue and EBITDA growth prospects x Cross - selling opportunities and integration will create potential for synergies 20

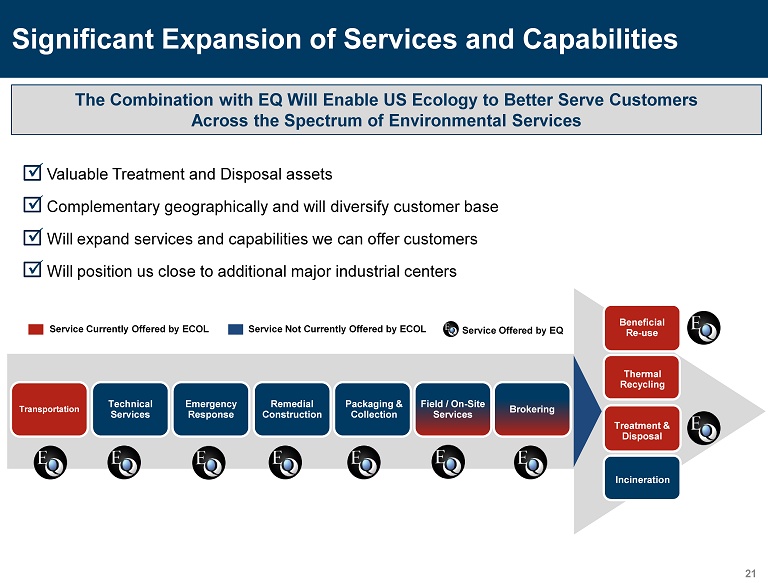

Significant Expansion of Services and Capabilities x Valuable Treatment and Disposal assets x Complementary geographically and will diversify customer base x Will expand services and capabilities we can offer customers x Will position us close to additional major industrial centers The Combination with EQ Will Enable US Ecology to Better Serve Customers Across the Spectrum of Environmental Services Service Offered by EQ High Technical Services Emergency Response Remedial Construction Packaging & Collection Brokering Transportation Beneficial Re - use Thermal Recycling Incineration Treatment & Disposal Service Currently Offered by ECOL Service Not Currently Offered by ECOL Field / On - Site Services 21

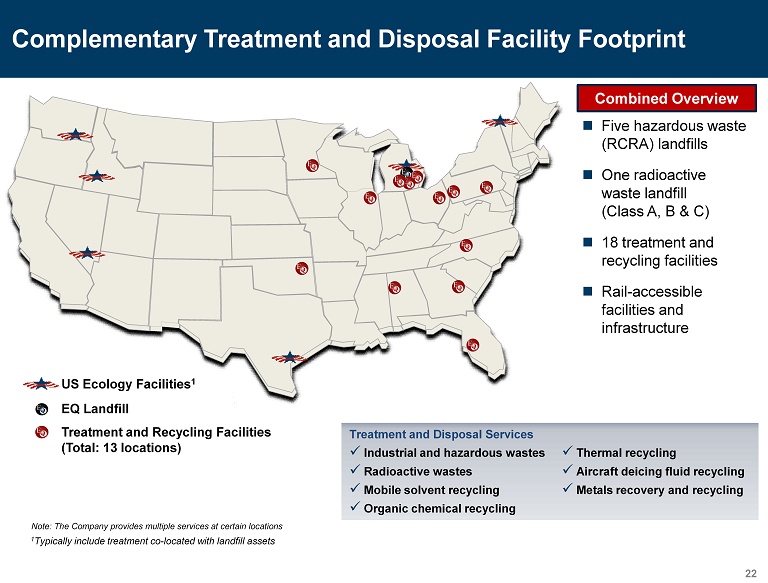

Complementary Treatment and Disposal Facility Footprint • Five hazardous waste (RCRA) landfills • One radioactive waste landfill (Class A, B & C) • 18 treatment and recycling facilities • Rail - accessible facilities and infrastructure Combined Overview Treatment and Disposal Services x Industrial and hazardous wastes x Radioactive wastes x Mobile solvent recycling x Organic chemical recycling x Thermal recycling x Aircraft deicing fluid recycling x Metals recovery and recycling US Ecology Facilities 1 EQ Landfill Treatment and Recycling Facilities (Total: 13 locations) Note: The Company provides multiple services at certain locations 22 1 Typically include treatment co - located with landfill assets

Industrial and Field Services Broaden Customer Solutions • Industrial Services: Comprehensive suite of maintenance and cleaning, tank & oil processing and sewer services • Field Services: Turnkey environmental solutions, including remediation, transfer and processing, less than truckload (“LTL”) and retail services Services Overview Industrial and Field Services x Industrial cleaning and maintenance x Waste transportation x In - plant services x Retail services x Remediation x Emergency response x Waste management x Household hazardous waste 23 Note: The Company provides multiple services at certain locations and the Company co - locates services at certain of its treatment facilities. Industrial and Field Services Facilities • 15 Field Services Sites (5 Co - located at Treatment Sites) • 11 Industrial Services Sites

Increased Diversification of Business Model 2013 Revenue 2013 Revenue: $201m 2013 Pro Forma Revenue: $577m 24 (1) EQ revenue and EBITDA is pro forma for the acquisition of Allstate Power Vac , I nc. (completed on July 30, 2013), as though the transaction was completed on or before January 1, 2013. See Page 33 for a calculation of EQ adjusted pro f orma EBITDA. (2) See pages 28 - 29 for a reconciliation of US Ecology adjusted EBITDA 2013 EBITDA 2013 Revenue: $376m 2013 EBITDA: $71m 2013 EBITDA: $54m US Ecology EQ Pro Forma (1) US Ecology (2) EQ Pro Forma (1) Services 46% T&D 54% 2013 Pro Forma EBITDA: $126m Services (Transport.) 18% T&D 54% Services 46% Services 29% T&Dh 100 % T&D 88% Services 12% T&D 71% T&D 82% T&D 40% Services 60%

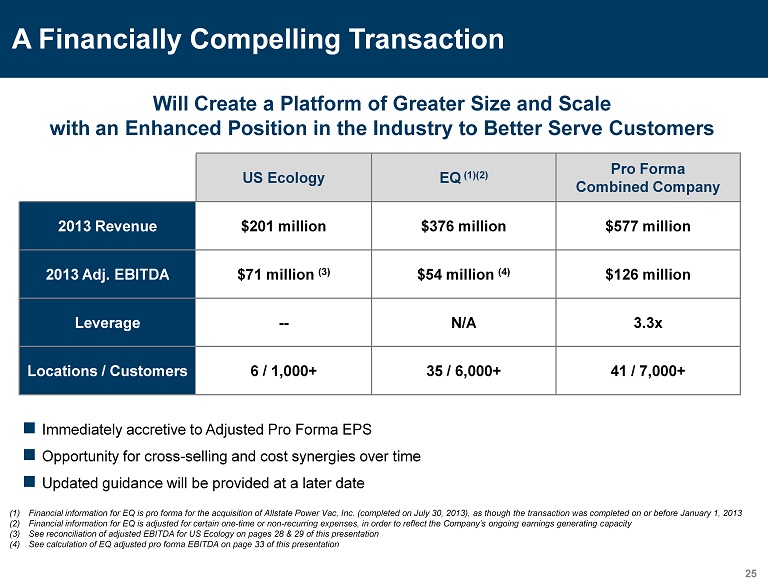

A Financially Compelling Transaction US Ecology EQ (1)(2) Pro Forma Combined Company 2013 Revenue $201 million $376 million $577 million 2013 Adj. EBITDA $71 million (3) $54 million (4) $126 million Leverage -- N/A 3.3x Locations / Customers 6 / 1,000+ 35 / 6,000+ 41 / 7,000+ • Immediately accretive to Adjusted Pro Forma EPS • Opportunity for cross - selling and cost synergies over time • Updated guidance will be provided at a later date 25 (1) Financial information for EQ is pro forma for the acquisition of Allstate Power Vac , I nc. (completed on July 30, 2013), as though the transaction was completed on or before January 1, 2013 (2) Financial information for EQ is adjusted for certain one - time or non - recurring expenses, in order to reflect the Company’s ongoi ng earnings generating capacity (3) See reconciliation of adjusted EBITDA for US Ecology on pages 28 & 29 of this presentation (4) See calculation of EQ adjusted pro forma EBITDA on page 33 of this presentation Will Create a Platform of Greater Size and Scale with an Enhanced Position in the Industry to Better Serve Customers

▪ Unique and high value set of disposal assets ▪ Highly leveragable business model with earnings upside ▪ Experienced management team with strong execution track record ▪ Industry leading return on invested capital: 17 % TTM ▪ Attractive dividend yield at 1.5% ▪ Strong balance sheet ▪ EQ acquisition provides levers for future growth 26 US Ecology Investment Highlights

27 Appendix

28 Appendix: US Ecology Adjusted EBITDA & EPS Non - GAAP Results and Reconciliation US Ecology reports adjusted EBITDA and adjusted earnings per diluted share results, which are non - GAAP financial measures, as a complement to results provided in accordance with generally accepted accounting principles in the United States (GAAP) and believes that such information provides analysts, shareholders, and other users information to better understand the Company’ s operating performance. Because adjusted EBITDA and adjusted earnings per diluted share are not measurements determined in accordance with GAAP and are thus susceptible to varying calculations they may not be comparable to similar measures used by other companies. Items excluded from adjusted EBITDA and adjusted earnings per diluted share are significant components in understanding and assessing financial performance. Adjusted EBITDA and adjusted earnings per diluted share should not be considered in isolation or as an alternative to, or sub sti tute for, net income, cash flows generated by operations, investing or financing activities, or other financial statement data pre sen ted in the consolidated financial statements as indicators of financial performance or liquidity. Adjusted EBITDA and adjusted earn ing s per diluted share have limitations as analytical tools and should not be considered in isolation or a substitute for analyzin g o ur results as reported under GAAP. Some of the limitations are: - Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; - Adjusted EBITDA does not reflect our interest expense, or the requirements necessary to service interest or principal payments on our debt; - Adjusted EBITDA does not reflect our income tax expenses or the cash requirements to pay our taxes; - Adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; and - although depreciation and amortization charges are non - cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect cash requirements for such replacements.

29 Appendix: US Ecology Adjusted EBITDA 2013 & 2012 Adjusted EBITDA The Company defines Adjusted EBITDA as net income before interest expense, interest income, income tax expense, depreciation, amortization, stock based compensation, accretion of closure and post - closure liabilities, foreign currency gain/loss and other income/expense, which are not considered part of usual business operations. The following reconciliation itemizes the differ enc es between reported net income and Adjusted EBITDA for the years ended December 31, 2013 and 2012: (in thousands) 2013 2012 Net Income 32,151$ 25,659$ Income tax expense 17,996 16,059 Interest expense 828 878 Interest income (19) (17) Foreign currency (gain)/loss 2,327 (1,213) Other income (352) (728) Depreciation and amortization of plant and equipment 14,815 13,916 Amortization of intangible assets 1,461 1,469 Stock-based compensation 865 846 Accretion and non-cash adjustments of closure & post- closure obligations 1,114 1,483 Adjusted EBITDA 71,186$ 58,352$ For the Year Ended December 31,

30 Appendix: US Ecology Adjusted Earnings Per Share 2013 & 2012 The Company defines adjusted earnings per diluted share as net income plus the after tax impact of non - cash, non - operational for eign currency gains or losses (“Foreign Currency Gain/Loss”) plus the after tax impact of business development cost divided by the diluted shares us ed in the earnings per share calculation. The Foreign Currency Gain/Loss excluded from the earnings per diluted share calculation are related to in ter company loans between our Canadian subsidiary and the U.S. parent which have been established as part of our tax and treasury management st rat egy. These intercompany loans are payable in CAD requiring us to revalue the outstanding loan balance through our consolidated income st ate ment based on the CAD/USD currency movements from period to period. We believe excluding the currency movements for these intercompany financi al instruments provides meaningful information to investors regarding the operational and financial performance of the Company. Business development costs relate to expenses incurred to evaluate businesses for potential acquisition or costs related to c los ing and integrating successfully acquired businesses. Business development costs in 2012 include the acquisition of Dynecol, Inc. which closed o n M ay 31, 2012 and other business development and strategic planning activities. We believe excluding these business development costs provides me aningful information to investors regarding the operational and financial performance of the Company. The following reconciliation itemizes the differences between reported net income and earnings per diluted share to adjusted net income and adjusted earnings per diluted share for the years ended December 31, 2013 and 2012: (in thousands, except per share data) per share per share Net income / earnings per diluted share 32,151$ 1.72$ 25,659$ 1.40$ Business development costs, net of tax 254 0.01 628 0.03 Non-cash foreign currency (gain)/loss, net of tax 1,597 0.09 (713) (0.04) Adjusted net income / adjusted earnings per diluted share 34,002$ 1.82$ 25,574$ 1.39$ Shares used in earnings per diluted share calculation 18,676 18,281 For the Year Ended December 31, 2013 2012

31 Appendix: US Ecology Adjusted EBITDA Q1’14 & Q1’13 Adjusted EBITDA The Company defines Adjusted EBITDA as net income before interest expense, interest income, income tax expense, depreciation, amortization, stock based compensation, accretion of closure and post - closure liabilities, foreign currency gain/loss and other income/expense, which are not considered part of usual business operations. The following reconciliation itemizes the differ enc es between reported net income and Adjusted EBITDA for the three months ended March 31, 2014 and 2013: (in thousands) 2014 2013 Net Income 9,361$ 5,406$ Income tax expense 5,227 3,193 Interest expense 86 221 Interest income (44) (5) Foreign currency (gain)/loss 940 938 Other income (86) (97) Depreciation and amortization of plant and equipment 3,839 3,439 Amortization of intangible assets 352 367 Stock-based compensation 270 146 Accretion and non-cash adjustments of closure & post- closure obligations 330 307 Adjusted EBITDA 20,275$ 13,915$ Three Months Ended March 31,

32 Appendix: US Ecology Adjusted Earnings Per Share Q1’14 & Q1’13 The Company defines adjusted earnings per diluted share as net income plus the after tax impact of non - cash, non - operational for eign currency gains or losses (“Foreign Currency Gain/Loss”) plus the after tax impact of business development cost divided by the diluted shares us ed in the earnings per share calculation. The Foreign Currency Gain/Loss excluded from the earnings per diluted share calculation are related to in ter company loans between our Canadian subsidiary and the U.S. parent which have been established as part of our tax and treasury management st rat egy. These intercompany loans are payable in CAD requiring us to revalue the outstanding loan balance through our consolidated income st ate ment based on the CAD/USD currency movements from period to period. We believe excluding the currency movements for these intercompany financi al instruments provides meaningful information to investors regarding the operational and financial performance of the Company. Business development costs relate to expenses incurred to evaluate businesses for potential acquisition or costs related to c los ing and integrating successfully acquired businesses. Business development costs in 2012 include the acquisition of Dynecol, Inc. which closed o n M ay 31, 2012 and other business development and strategic planning activities. We believe excluding these business development costs provides me aningful information to investors regarding the operational and financial performance of the Company. The following reconciliation itemizes the differences between reported net income and earnings per diluted share to adjusted net income and adjusted earnings per diluted share for the three months ended March 31, 2014 and 2013: (in thousands, except per share data) per share per share Net income / earnings per diluted share 9,361$ 0.43$ 5,406$ 0.29$ Business development costs, net of tax 120 0.01 - - Non-cash foreign currency (gain)/loss, net of tax 703 0.04 595 0.03 Adjusted net income / adjusted earnings per diluted share 10,184$ 0.48$ 6,001$ 0.32$ Shares used in earnings per diluted share calculation 21,586 18,407 Three Months Ended March 31, 2014 2013

EQ Adjusted Pro Forma EBITDA Calculation 33 The following table presents the calculation of adjusted pro forma EBITDA for EQ for the year ended December 31, 2013: EQ Adjusted Pro Forma EBITDA Reconciliation (in thousands) 2013 Net Income 2,997$ Income tax expense 3,334 Interest expense 4,619 Depreciation expense 12,781 Amortization - intangible assets 13,304 Accretion expense 1,674 Allstate pro forma adjustments 6,210 Allstate acquisition and financing Fees 3,648 Cash payments and losses on defined remediation project 693 Related party loss on sale of wetland 1,353 Incurred expenses related to sale process 1,080 Share-based compensation 790 Private equity sponsor management fees 775 Other 1,061 EQ - Adjusted Pro Forma EBITDA 54,319$