Morgan Stanley Basic Materials Corporate Access Day New York, NY February 14, 2017 TM Exhibit 99.1

Forward-Looking Statements 2 This communication includes forward-looking statements. These statements relate to analyses and other information that are based on management’s beliefs, certain assumptions made by management, forecasts of future results, and current expectations, estimates and projections about the markets and economy in which we and our various segments operate. These statements may include statements regarding our recent acquisition of the U.S. chlor-alkali and downstream derivatives businesses (the “Acquired Business”), the expected benefits and synergies of the transaction, and future opportunities for the combined company following the transaction. The statements contained in this communication that are not statements of historical fact may include forward- looking statements that involve a number of risks and uncertainties. We have used the words “anticipate,” “intend,” “may,” “expect,” “believe,” “should,” “plan,” “project,” “estimate,” “forecast,” “optimistic,” and variations of such words and similar expressions in this communication to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict and many of which are beyond our control. Therefore, actual outcomes and results may differ materially from those matters expressed or implied in such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: factors relating to the possibility that Olin may be unable to achieve expected synergies and operating efficiencies in connection with the transaction within the expected time-frames or at all; the integration of the acquired chlorine products businesses being more difficult, time- consuming or costly than expected; the effect of any changes resulting from the transaction in customer, supplier and other business relationships; general market perception of the transaction; exposure to lawsuits and contingencies associated with the acquired chlorine products business; the ability to attract and retain key personnel; prevailing market conditions; changes in economic and financial conditions of our chlorine products business; uncertainties and matters beyond the control of management; and the other risks detailed in Olin’s Form 10-K for the fiscal year ended December 31, 2015 and Olin’s Form 10-Q for the quarter ended September 30, 2016. The forward-looking statements should be considered in light of these factors. In addition, other risks and uncertainties not presently known to Olin or that Olin considers immaterial could affect the accuracy of our forward-looking statements. The reader is cautioned not to rely unduly on these forward-looking statements. Olin undertakes no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. In addition to U.S. GAAP financial measures, this presentation includes certain non-GAAP financial measures including Adjusted EBITDA. These non-GAAP measures are in addition to, not a substitute for or superior to, measures for financial performance prepared in accordance with U.S. GAAP. Definitions of these measures and reconciliation of GAAP to non-GAAP measures are provided in the appendix to this presentation.

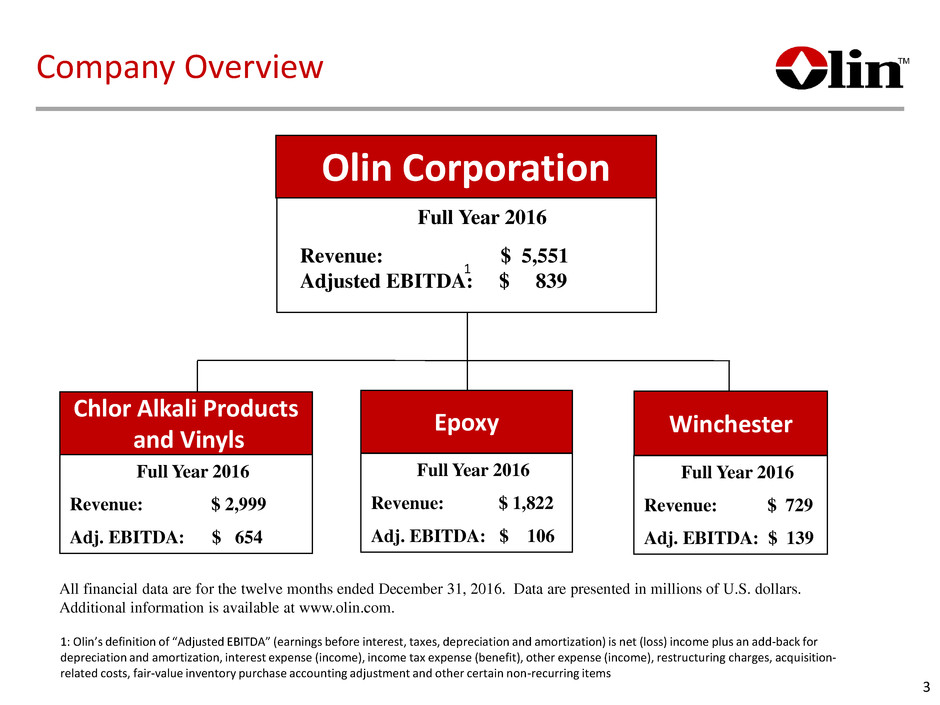

All financial data are for the twelve months ended December 31, 2016. Data are presented in millions of U.S. dollars. Additional information is available at www.olin.com. Winchester Chlor Alkali Products and Vinyls Full Year 2016 Revenue: $ 2,999 Adj. EBITDA: $ 654 Revenue: $ 5,551 Adjusted EBITDA: $ 839 Olin Full Year 2016 Olin Corporation Epoxy Company Overview Full Year 2016 Revenue: $ 1,822 Adj. EBITDA: $ 106 Full Year 2016 Revenue: $ 729 Adj. EBITDA: $ 139 3 1: Olin’s definition of “Adjusted EBITDA” (earnings before interest, taxes, depreciation and amortization) is net (loss) income plus an add-back for depreciation and amortization, interest expense (income), income tax expense (benefit), other expense (income), restructuring charges, acquisition- related costs, fair-value inventory purchase accounting adjustment and other certain non-recurring items 1

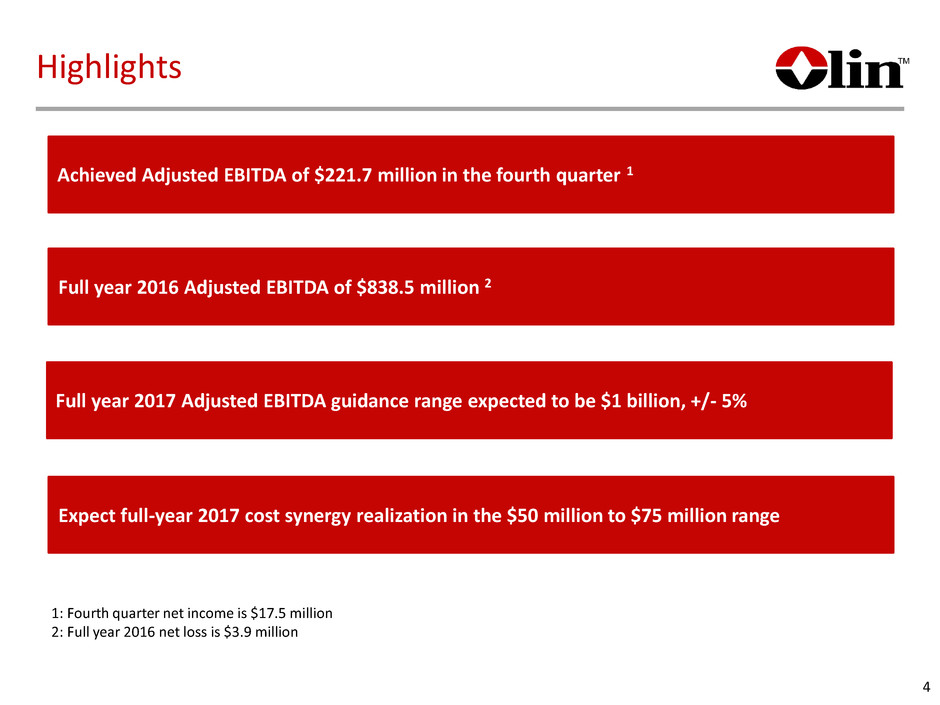

Highlights 4 3 Achieved Adjusted EBITDA of $221.7 million in the fourth quarter 1 Full year 2016 Adjusted EBITDA of $838.5 million 2 Expect full-year 2017 cost synergy realization in the $50 million to $75 million range Full year 2017 Adjusted EBITDA guidance range expected to be $1 billion, +/- 5% 1: Fourth quarter net income is $17.5 million 2: Full year 2016 net loss is $3.9 million

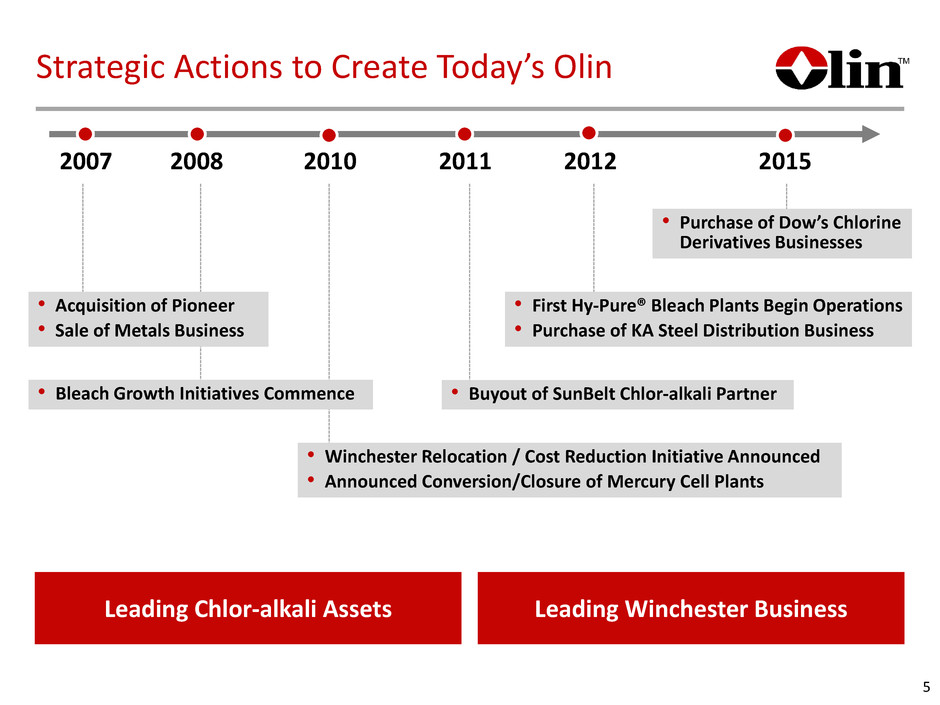

Strategic Actions to Create Today’s Olin Leading Chlor-alkali Assets Leading Winchester Business 2007 2008 2010 2011 2012 2015 • Winchester Relocation / Cost Reduction Initiative Announced • Announced Conversion/Closure of Mercury Cell Plants • First Hy-Pure® Bleach Plants Begin Operations • Purchase of KA Steel Distribution Business • Purchase of Dow’s Chlorine Derivatives Businesses • Acquisition of Pioneer • Sale of Metals Business • Buyout of SunBelt Chlor-alkali Partner • Bleach Growth Initiatives Commence 5

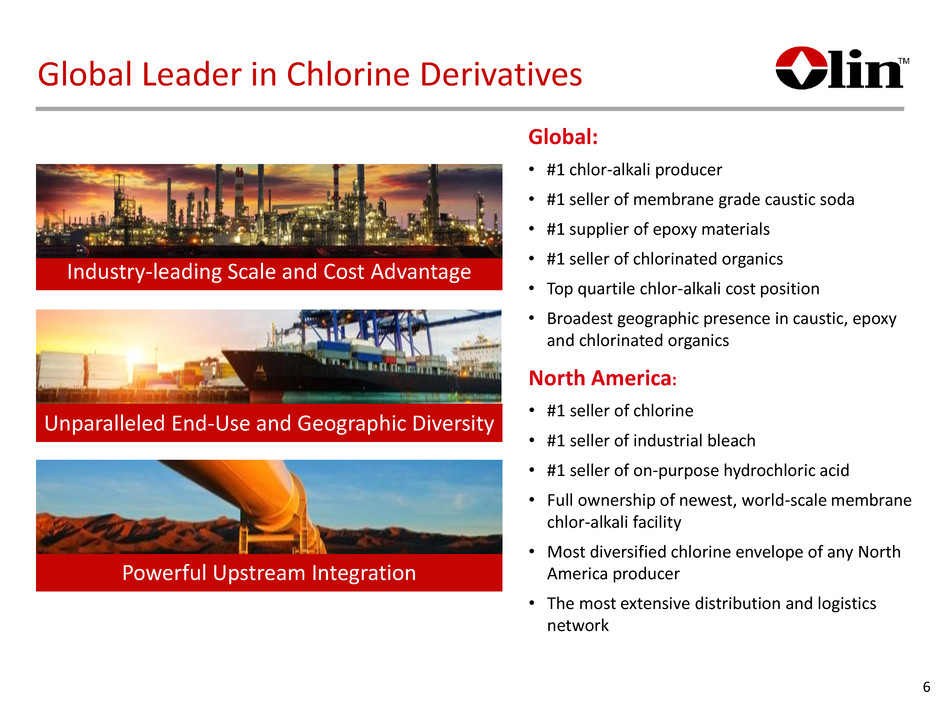

Global Leader in Chlorine Derivatives Global: • #1 chlor-alkali producer • #1 seller of membrane grade caustic soda • #1 supplier of epoxy materials • #1 seller of chlorinated organics • Top quartile chlor-alkali cost position • Broadest geographic presence in caustic, epoxy and chlorinated organics Industry-leading Scale and Cost Advantage Powerful Upstream Integration Unparalleled End-Use and Geographic Diversity 6 North America: • #1 seller of chlorine • #1 seller of industrial bleach • #1 seller of on-purpose hydrochloric acid • Full ownership of newest, world-scale membrane chlor-alkali facility • Most diversified chlorine envelope of any North America producer • The most extensive distribution and logistics network

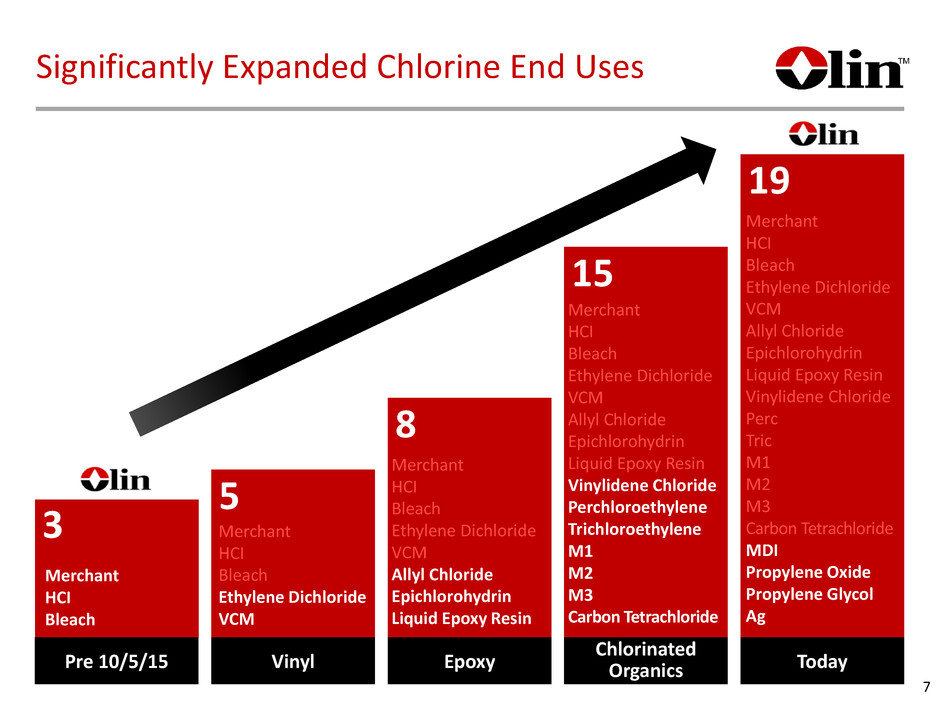

Significantly Expanded Chlorine End Uses 3 Merchant HCI Bleach 19 Merchant HCI Bleach Ethylene Dichloride VCM Allyl Chloride Epichlorohydrin Liquid Epoxy Resin Vinylidene Chloride Perc Tric M1 M2 M3 Carbon Tetrachloride MDI Propylene Oxide Propylene Glycol Ag 5 Merchant HCI Bleach Ethylene Dichloride VCM Vinyl 8 Merchant HCI Bleach Ethylene Dichloride VCM Allyl Chloride Epichlorohydrin Liquid Epoxy Resin Epoxy 15 Merchant HCI Bleach Ethylene Dichloride VCM Allyl Chloride Epichlorohydrin Liquid Epoxy Resin Vinylidene Chloride Perchloroethylene Trichloroethylene M1 M2 M3 Carbon Tetrachloride Chlorinated Organics 7 Pre 10/5/15 Today

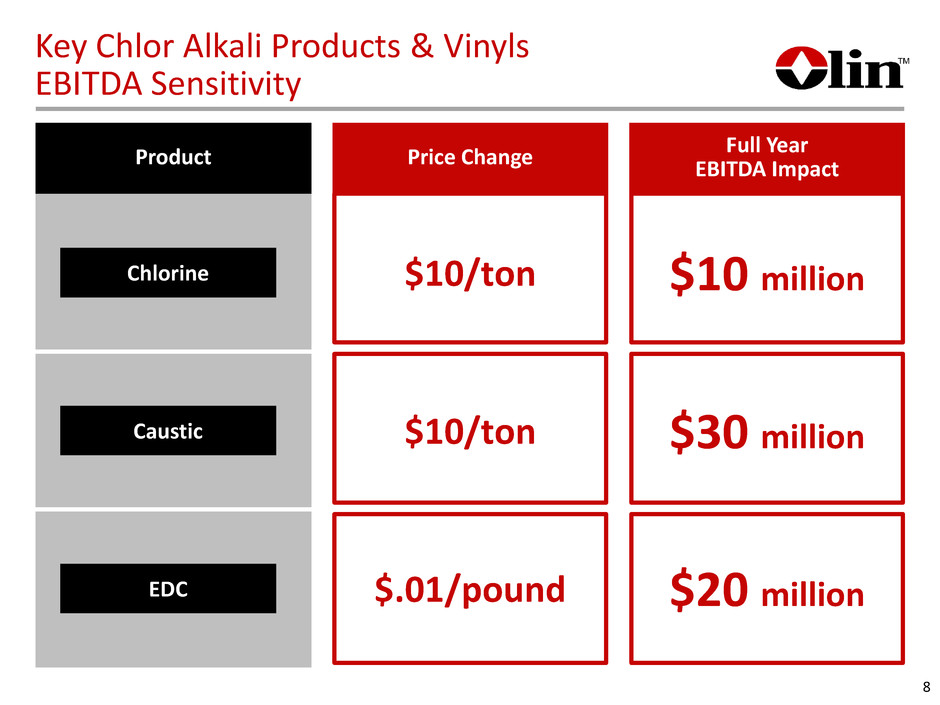

8 Product Price Change Full Year EBITDA Impact Chlorine $10/ton $10 million Caustic $10/ton $30 million EDC $.01/pound $20 million Key Chlor Alkali Products & Vinyls EBITDA Sensitivity

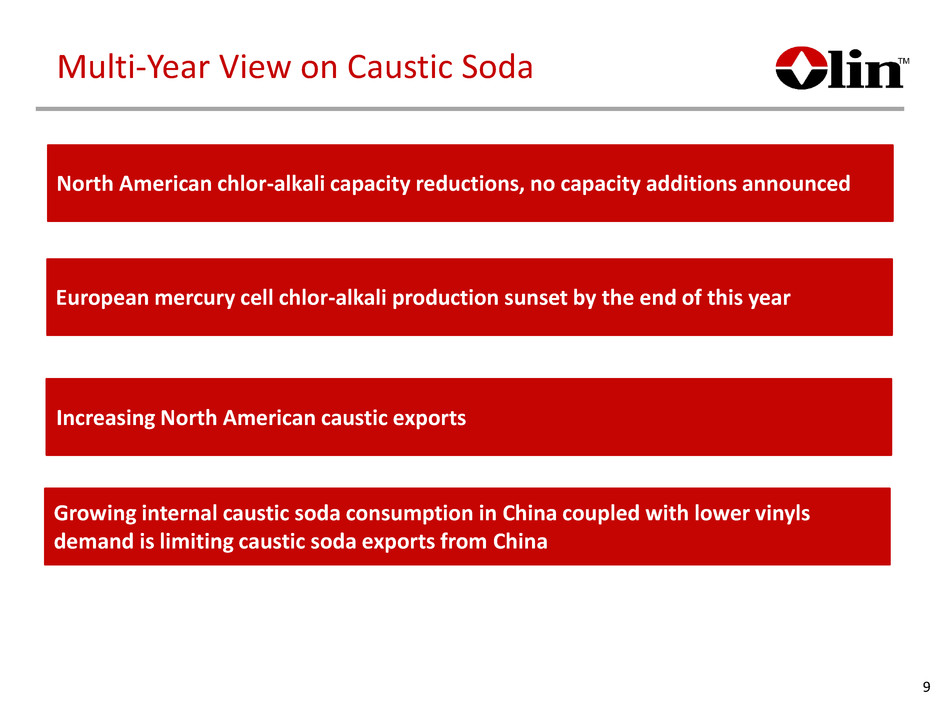

Multi-Year View on Caustic Soda North American chlor-alkali capacity reductions, no capacity additions announced Increasing North American caustic exports European mercury cell chlor-alkali production sunset by the end of this year Growing internal caustic soda consumption in China coupled with lower vinyls demand is limiting caustic soda exports from China 9

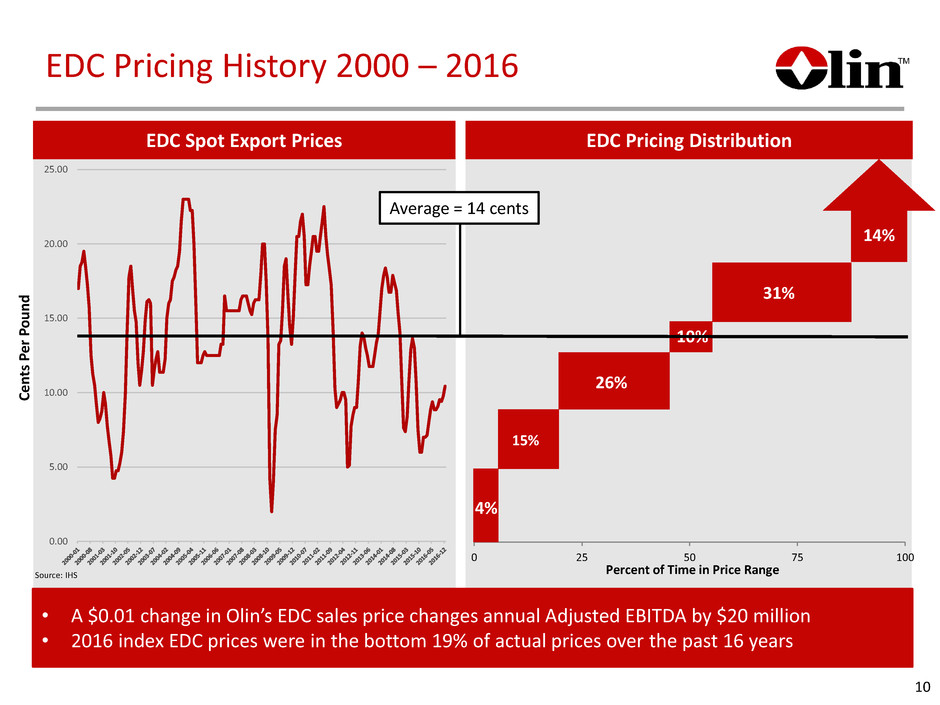

0.00 5.00 10.00 15.00 20.00 25.00 0 25 50 75 100 EDC Pricing History 2000 – 2016 EDC Spot Export Prices Ce n ts P er P o u n d Source: IHS EDC Pricing Distribution Percent of Time in Price Range • A $0.01 change in Olin’s EDC sales price changes annual Adjusted EBITDA by $20 million • 2016 index EDC prices were in the bottom 19% of actual prices over the past 16 years 10 Average = 14 cents 4% 15% 26% 31% 14% 10%

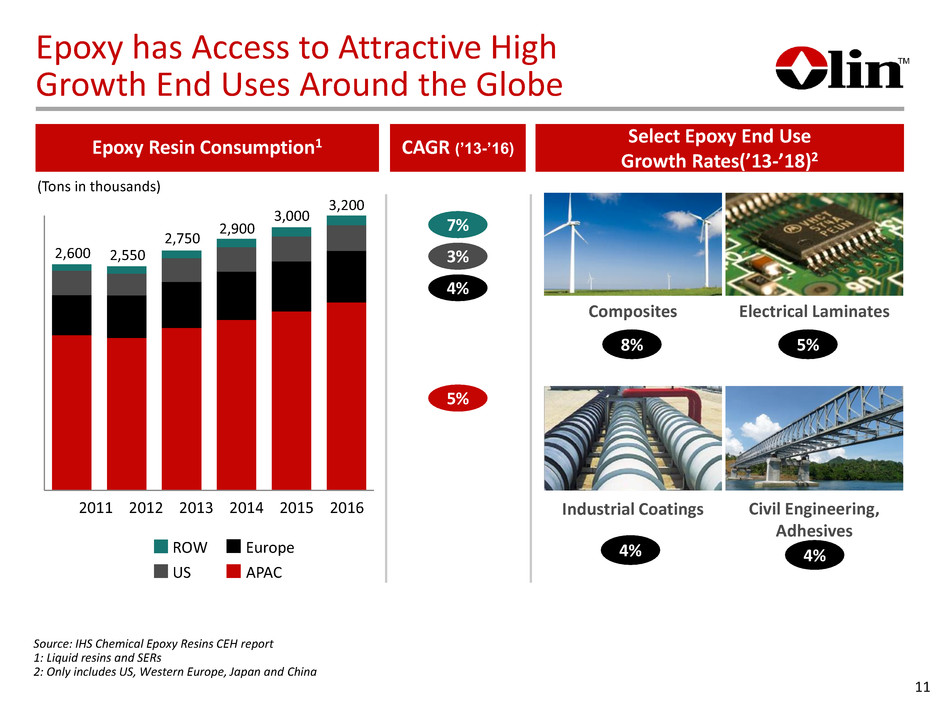

Epoxy has Access to Attractive High Growth End Uses Around the Globe Select Epoxy End Use Growth Rates(’13-’18)2 Composites Civil Engineering, Adhesives Industrial Coatings Electrical Laminates 2016 3,200 2015 3,000 2014 2,900 2013 2,750 2012 2,550 2011 2,600 Epoxy Resin Consumption1 3% CAGR (’13-’16) 4% 5% 7% Source: IHS Chemical Epoxy Resins CEH report 1: Liquid resins and SERs 2: Only includes US, Western Europe, Japan and China (Tons in thousands) 11 APAC Europe US ROW 4% 8% 5% 4%

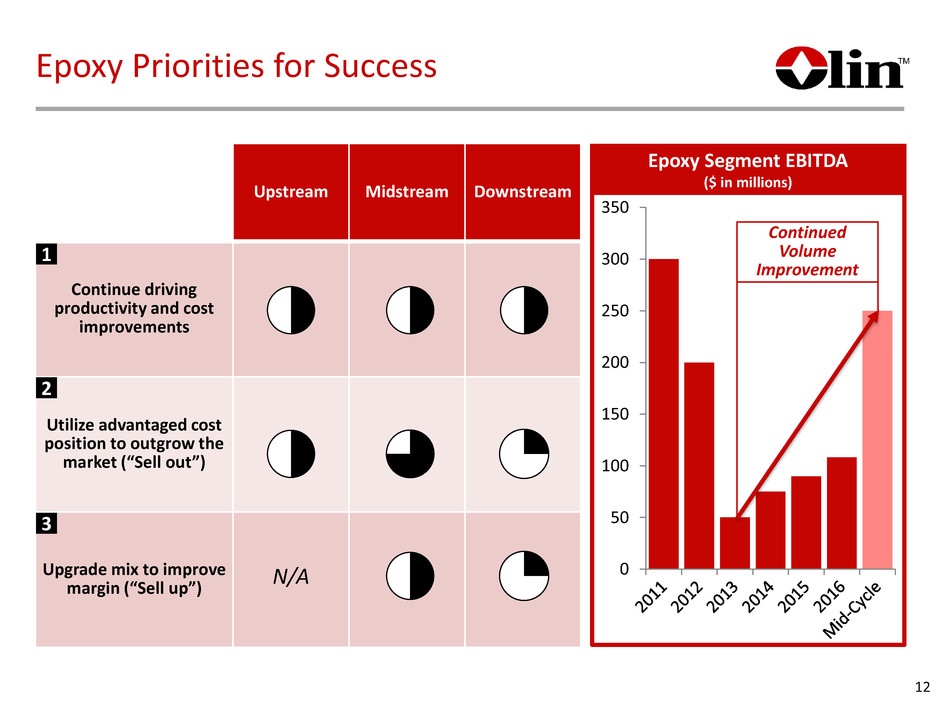

Epoxy Priorities for Success 12 0 50 100 150 200 250 300 350 Epoxy Segment EBITDA ($ in millions) Upstream Midstream Downstream Continue driving productivity and cost improvements Utilize advantaged cost position to outgrow the market (“Sell out”) Upgrade mix to improve margin (“Sell up”) Continued Volume Improvement N/A 1 2 3

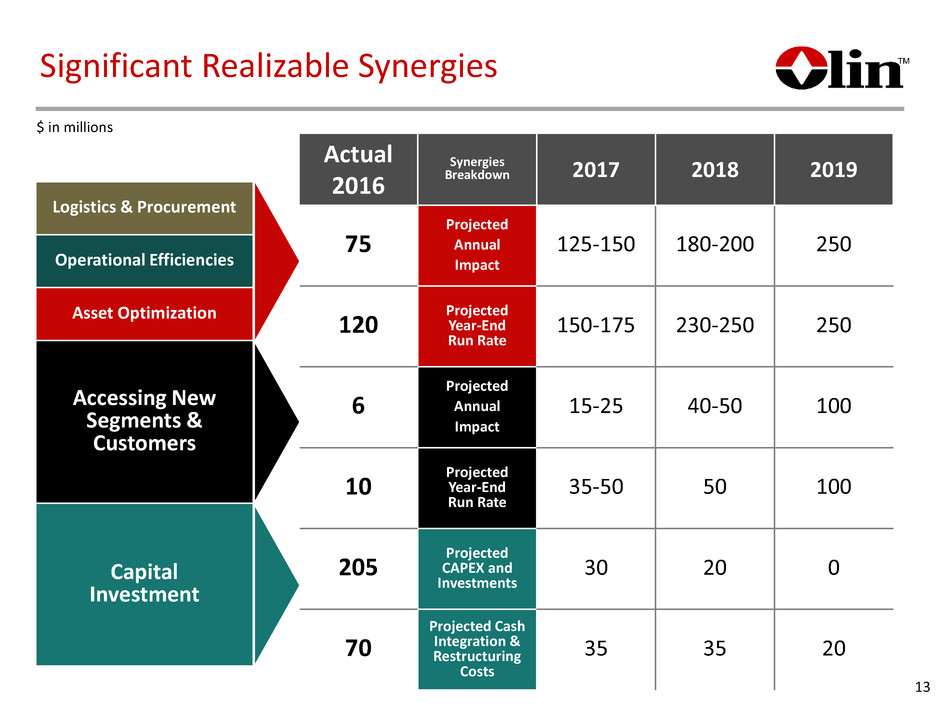

Significant Realizable Synergies $250 Logistics & Procurement Operational Efficiencies Asset Optimization Accessing New Segments & Customers Capital Investment Actual 2016 Synergies Breakdown 2017 2018 2019 75 Projected Annual Impact 125-150 180-200 250 120 Projected Year-End Run Rate 150-175 230-250 250 6 Projected Annual Impact 15-25 40-50 100 10 Projected Year-End Run Rate 35-50 50 100 205 Projected CAPEX and Investments 30 20 0 70 Projected Cash Integration & Restructuring Costs 35 35 2 13 $ in millions

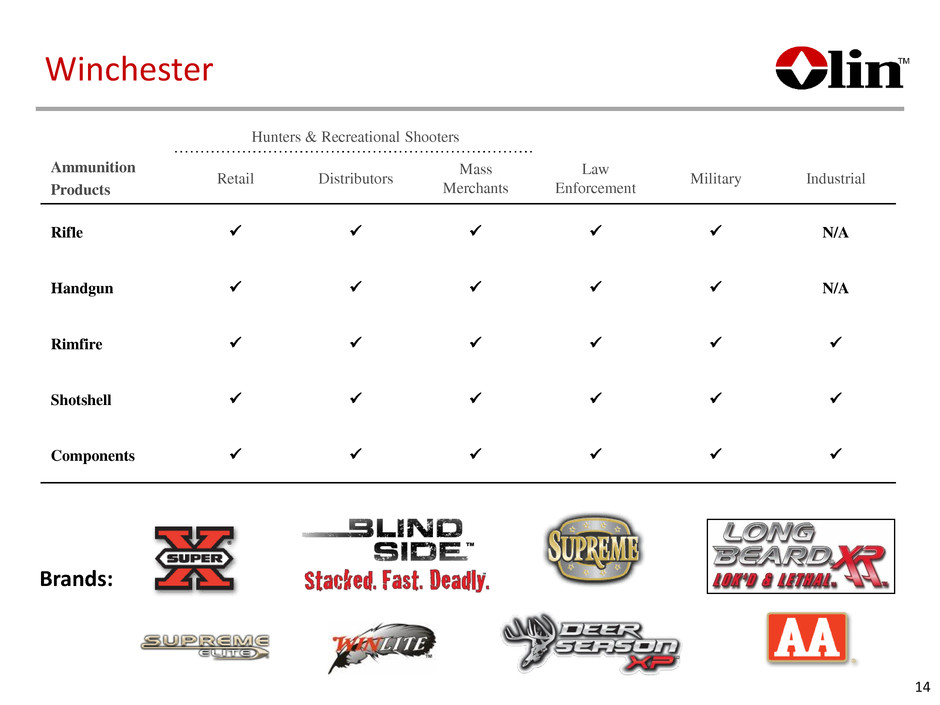

Winchester Brands: Hunters & Recreational Shooters Ammunition Products Retail Distributors Mass Merchants Law Enforcement Military Industrial Rifle N/A Handgun N/A Rimfire Shotshell Components 14

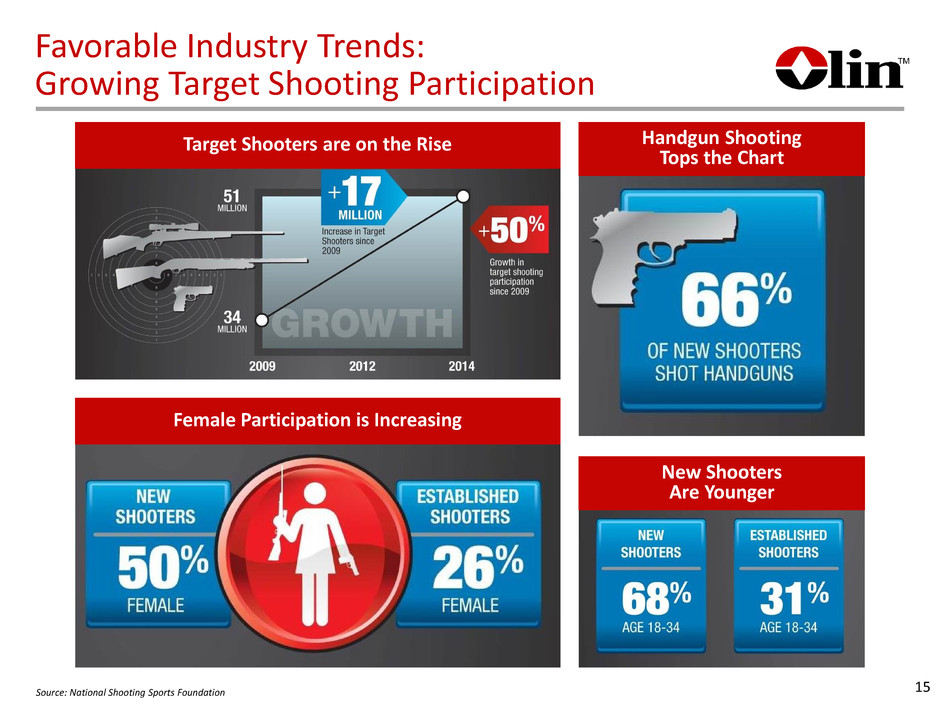

Favorable Industry Trends: Growing Target Shooting Participation Female Participation is Increasing Target Shooters are on the Rise Handgun Shooting Tops the Chart New Shooters Are Younger Source: National Shooting Sports Foundation 15

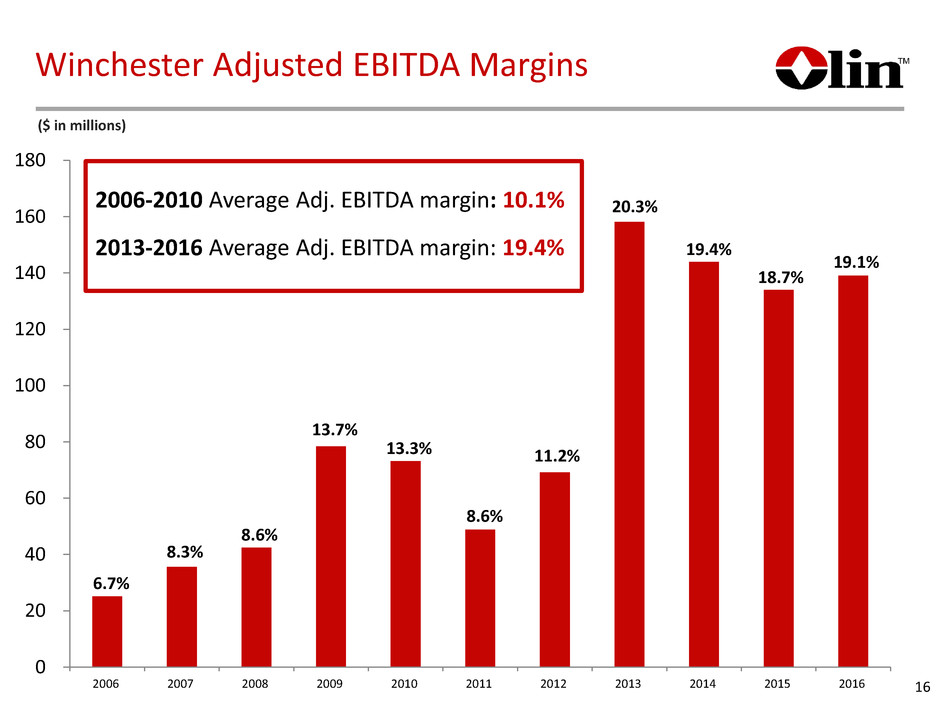

0 20 40 60 80 100 120 140 160 180 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Winchester Adjusted EBITDA Margins 6.7% 8.3% 8.6% 13.7% 13.3% 8.6% 11.2% 20.3% 19.4% 18.7% 2006-2010 Average Adj. EBITDA margin: 10.1% 2013-2016 Average Adj. EBITDA margin: 19.4% 16 ($ in millions) 19.1%

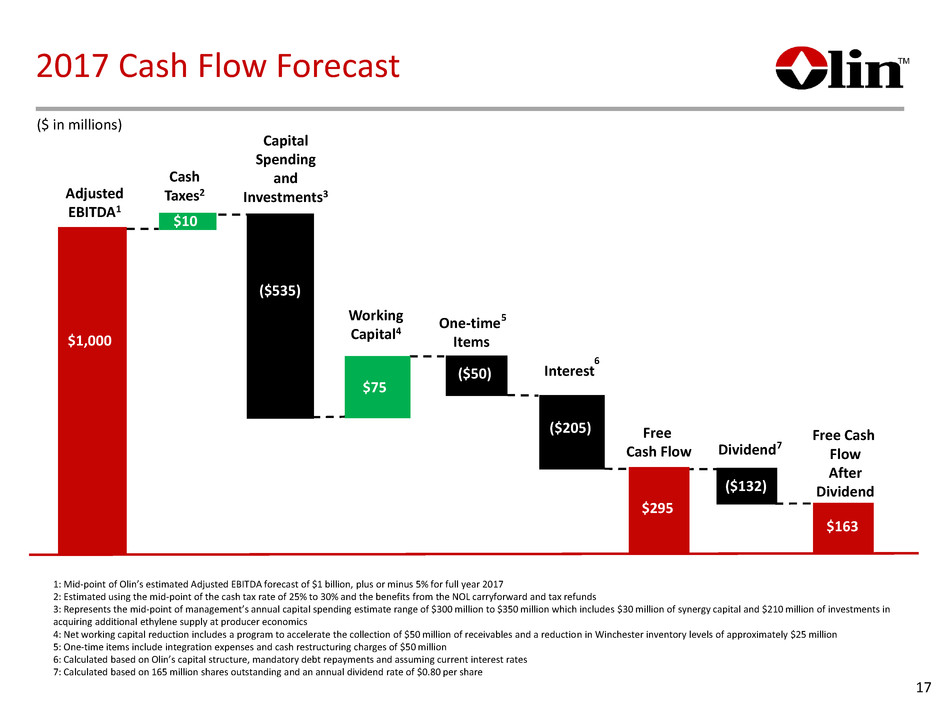

Working Capital4 Adjusted EBITDA1 Free Cash Flow After Dividend Cash Taxes2 Capital Spending and Investments3 Free Cash Flow 1: Mid-point of Olin’s estimated Adjusted EBITDA forecast of $1 billion, plus or minus 5% for full year 2017 2: Estimated using the mid-point of the cash tax rate of 25% to 30% and the benefits from the NOL carryforward and tax refunds 3: Represents the mid-point of management’s annual capital spending estimate range of $300 million to $350 million which includes $30 million of synergy capital and $210 million of investments in acquiring additional ethylene supply at producer economics 4: Net working capital reduction includes a program to accelerate the collection of $50 million of receivables and a reduction in Winchester inventory levels of approximately $25 million 5: One-time items include integration expenses and cash restructuring charges of $50 million 6: Calculated based on Olin’s capital structure, mandatory debt repayments and assuming current interest rates 7: Calculated based on 165 million shares outstanding and an annual dividend rate of $0.80 per share 2017 Cash Flow Forecast One-time Items 5 Dividend 7 Interest 6 ($ in millions) 17 $1,000 ($535) $75 ($50) ($205) $295 ($132) $163 $10

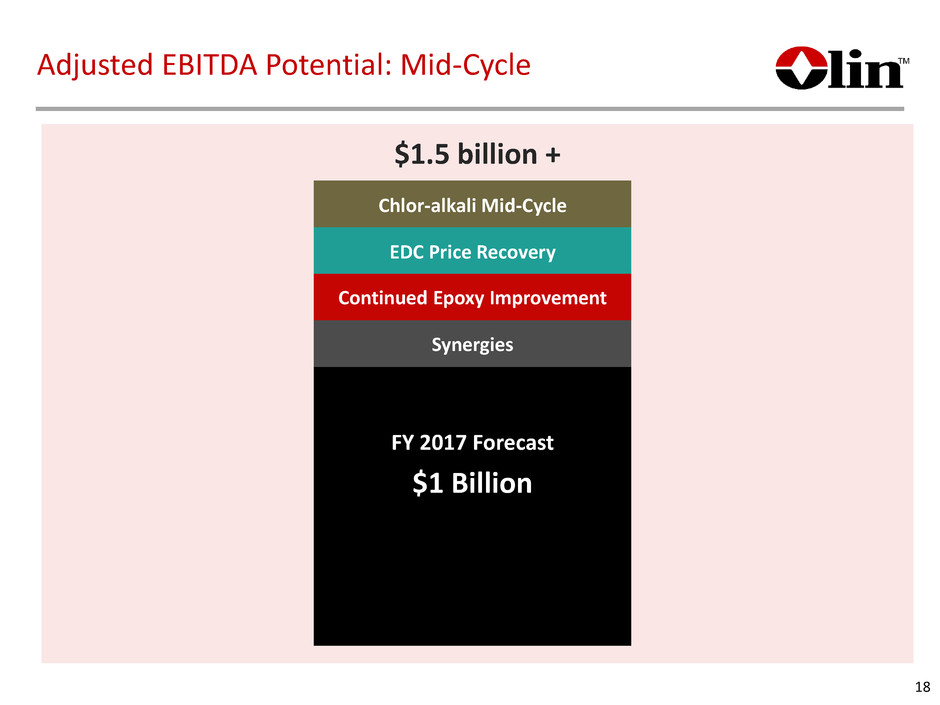

$1.5 billion + FY 2017 Forecast $1 Billion Chlor-alkali Mid-Cycle EDC Price Recovery Continued Epoxy Improvement Synergies Adjusted EBITDA Potential: Mid-Cycle 18

Appendix

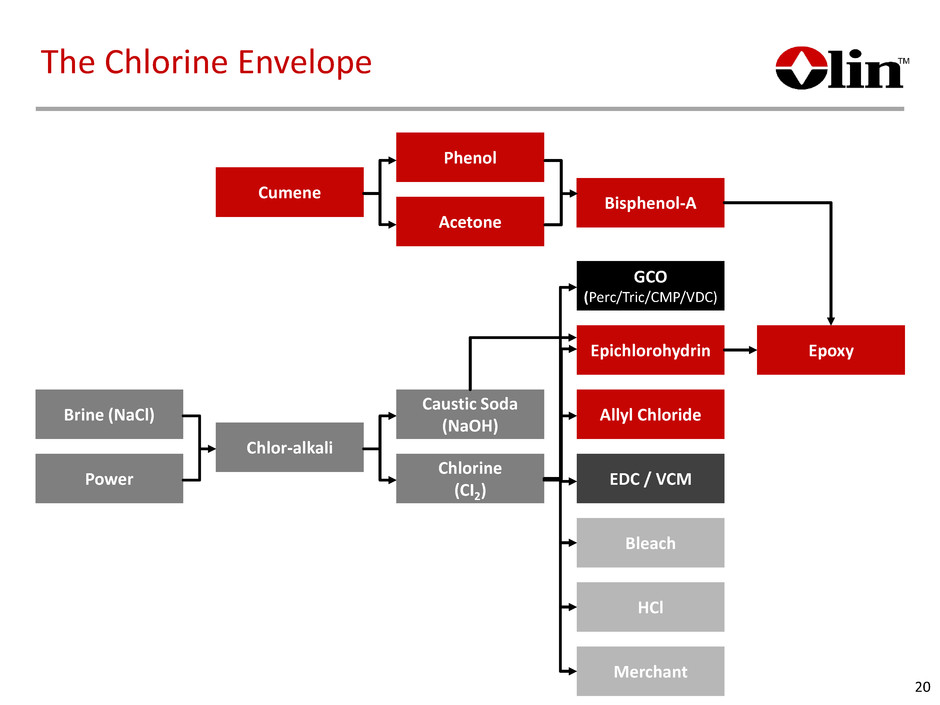

The Chlorine Envelope 20 Epoxy Brine (NaCl) Power Phenol Acetone Caustic Soda (NaOH) Chlorine (CI2) Bisphenol-A GCO (Perc/Tric/CMP/VDC) Epichlorohydrin Allyl Chloride EDC / VCM Chlor-alkali Cumene Bleach HCl Merchant

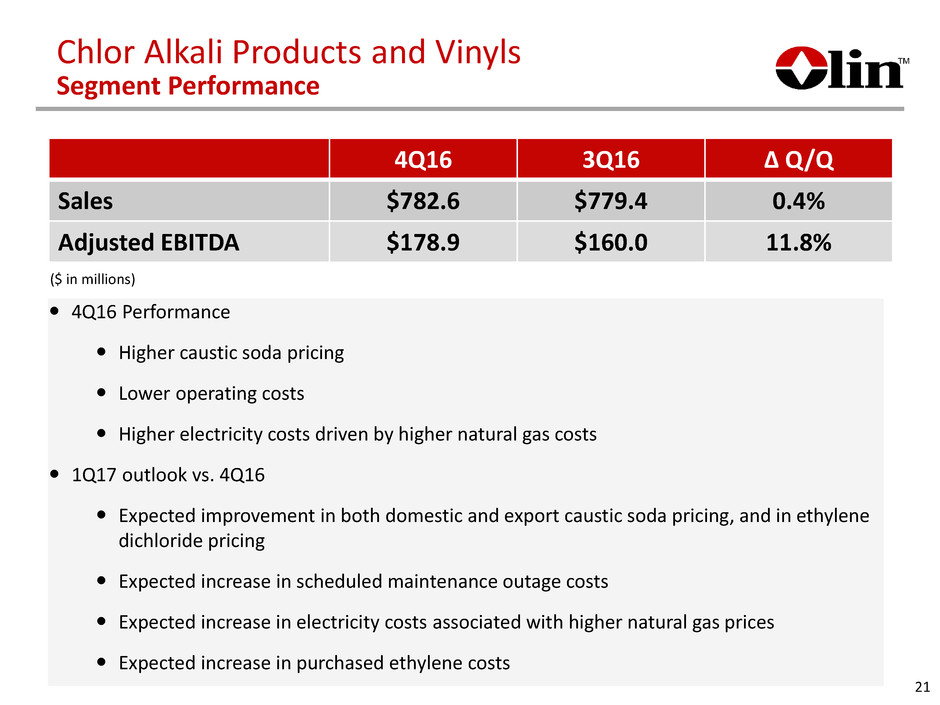

4Q16 3Q16 ∆ Q/Q Sales $782.6 $779.4 0.4% Adjusted EBITDA $178.9 $160.0 11.8% 4Q16 Performance Higher caustic soda pricing Lower operating costs Higher electricity costs driven by higher natural gas costs 1Q17 outlook vs. 4Q16 Expected improvement in both domestic and export caustic soda pricing, and in ethylene dichloride pricing Expected increase in scheduled maintenance outage costs Expected increase in electricity costs associated with higher natural gas prices Expected increase in purchased ethylene costs ($ in millions) Chlor Alkali Products and Vinyls Segment Performance 21

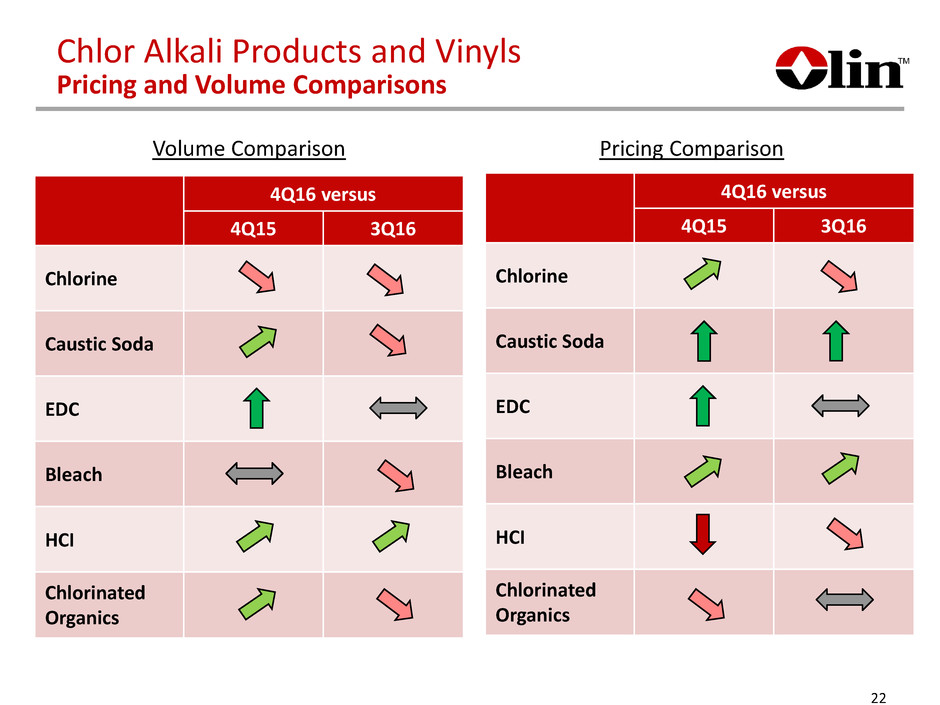

4Q16 versus 4Q15 3Q16 Chlorine Caustic Soda EDC Bleach HCI Chlorinated Organics Chlor Alkali Products and Vinyls Pricing and Volume Comparisons 4Q16 versus 4Q15 3Q16 Chlorine Caustic Soda EDC Bleach HCI Chlorinated Organics Volume Comparison Pricing Comparison 22

Olin Caustic Soda Price Realization • A $10 per ton change in Olin’s caustic soda selling price changes annual Adjusted EBITDA by approximately $30 million Fundamental Principle Domestic Sales • A significant portion of domestic sales are linked to index prices • Index price changes typically occur 30 to 90 days post our price nomination • Depending on market conditions 30% to 70% of index price changes are realized • Overall price realization lags index price changes by 30 to 120 days Export Sales • Sold on a combination of negotiated sales and export index price • Changes in export index prices are typically realized on a 30 to 90 day lag • Realization of index price changes are typically 80% to 100% 23

4Q16 3Q16 ∆ Q/Q Sales $441.7 $470.1 -6.0% Adjusted EBITDA $19.6 $32.9 -40.4% 4Q16 Performance Lower volumes Higher operating costs 1Q17 outlook vs. 4Q16 Expected higher pricing and higher volumes Expected higher raw materials costs associated with benzene and propylene Expected lower operating costs ($ in millions) Epoxy Segment Performance 24

4Q16 Performance Sequentially lower volumes to commercial customers reflecting a normal seasonal pattern Year-over-year sales increased 3% Adjusted EBITDA was 11.2% higher than 4Q15 1Q17 outlook vs. 4Q16 Expected sequential increase from the normal seasonally weak 4Q16 Expected customer inventory reductions Expected higher commodity and materials costs Winchester Segment Performance 25 4Q16 3Q16 ∆ Q/Q Sales $161.4 $203.2 -20.6% Adjusted EBITDA $29.7 $40.7 -27.0% ($ in millions)

Corporate & Other 26 4Q16 3Q16 Pension Income $13.4 $15.4 Environmental Expense $(3.7) $(0.4) Other Corporate and Unallocated Costs $(18.5) $(28.2) Restructuring Charges $(6.7) $(5.2) Acquisition-related Costs $(9.2) $(13.1) ($ in millions) Corporate and other unallocated costs are consistent with our full year 2016 expectations that levels will be higher than the full year 2015 due to the build out of our corporate capabilities since the acquisition Corporate and other unallocated costs are lower in 4Q16 due to lower legal and litigation costs and decreased asset retirement costs at past manufacturing locations Restructuring charges are primarily related to the closure of 433,000 tons of chlor alkali capacity Acquisition-related costs are associated with our integration of the Acquired Business

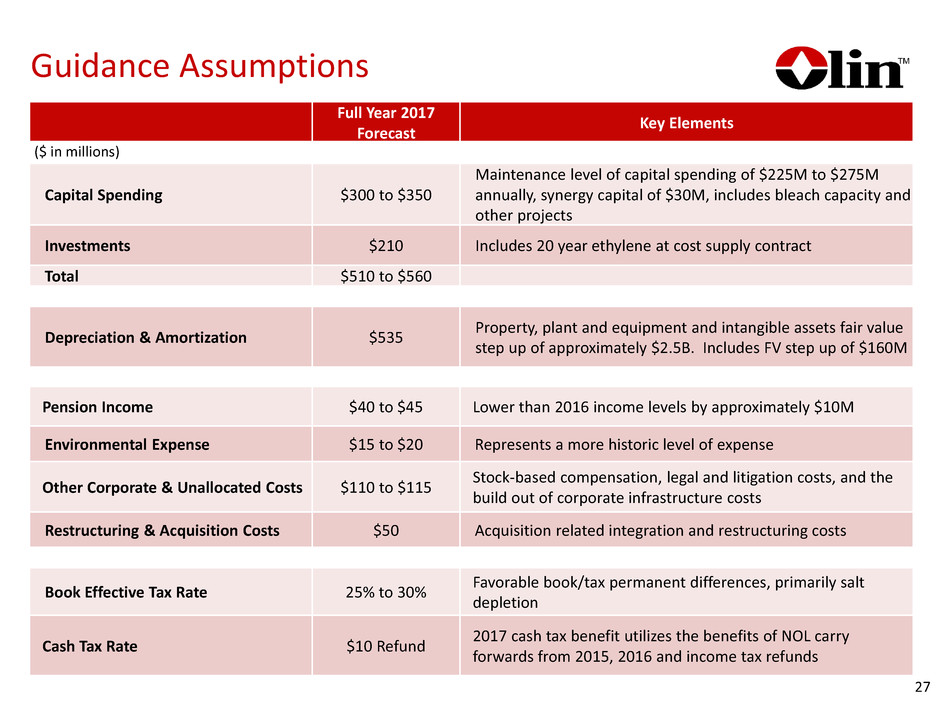

Full Year 2017 Forecast Key Elements Capital Spending $300 to $350 Maintenance level of capital spending of $225M to $275M annually, synergy capital of $30M, includes bleach capacity and other projects Investments $210 Includes 20 year ethylene at cost supply contract Total $510 to $560 Depreciation & Amortization $535 Property, plant and equipment and intangible assets fair value step up of approximately $2.5B. Includes FV step up of $160M Pension Income $40 to $45 Lower than 2016 income levels by approximately $10M Environmental Expense $15 to $20 Represents a more historic level of expense Other Corporate & Unallocated Costs $110 to $115 Stock-based compensation, legal and litigation costs, and the build out of corporate infrastructure costs Restructuring & Acquisition Costs $50 Acquisition related integration and restructuring costs Book Effective Tax Rate 25% to 30% Favorable book/tax permanent differences, primarily salt depletion Cash Tax Rate $10 Refund 2017 cash tax benefit utilizes the benefits of NOL carry forwards from 2015, 2016 and income tax refunds ($ in millions) 27 Guidance Assumptions

Advantaged Ethylene Arrangement •A series of three supply agreements with Dow •Pipeline supply without operating or start-up risk •Producer economics Tranche Effective Date Annual Volume (short-tons) Cost (millions) #1 Acquired at closing Up to 180,000 $433* #2 Available ~ 2H 2017 Up to 160,000 ~$210 #3 Available ~ 4Q 2020 Up to 300,000 $425-$465 * Includes option payments for Tranches #2 and #3 28

Non-GAAP Financial Measures – Adjusted EBITDA (a) (a) Unaudited. (b) Restructuring charges were primarily associated with the closure of 433,000 tons of chlor alkali capacity across three separate Olin locations, of which $76.6 million was non- cash impairment charges for equipment and facilities for the year ended December 31, 2016. (c) Acquisition-related costs were associated with our acquisition of the Acquired Business. (d) Certain non-recurring items for the year ended December 31, 2016 included an $11.0 million insurance recovery for property damage and business interruption related to a 2008 Henderson, NV chlor alkali facility incident. 29 Olin's definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net income (loss) plus an add-back for depreciation and amortization, interest expense (income), income tax expense (benefit), other expense (income), restructuring charges, acquisition-related costs and certain other non-recurring items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors as a supplemental financial measure to assess the financial performance of our assets without regard to financing methods, capital structures, taxes, or historical cost basis. The use of non-GAAP financial measures is not intended to replace any measures of performance determined in accordance with GAAP and Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies. Reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures are omitted from this release because Olin is unable to provide such reconciliations without the use of unreasonable efforts. This inability results from the inherent difficulty in forecasting generally and quantifying certain projected amounts that are necessary for such reconciliations. In particular, sufficient information is not available to calculate certain adjustments required for such reconciliations, including interest expense (income), income tax expense (benefit), other expense (income), restructuring charges, and acquisition-related costs. Because of our inability to calculate such adjustments, forward-looking net income guidance is also omitted from this release. We expect these adjustments to have a potentially significant impact on our future GAAP financial results. Year Ended December 31, September 30, December 31, (In millions) 2016 2016 2016 Reconciliation of Net Income (Loss) to Adjusted EBITDA: Net Income (Loss) 17.5$ 17.5$ (3.9)$ Add Back: Interest Expense 48.3 47.5 191.9 Interest Income (2.1) (0.5) (3.4) Income Tax Provision (Benefit) 6.0 3.8 (30.3) De eciation and Amortization 136.1 135.3 533.5 EBITDA 205.8 203.6 687.8 A d B ck: Restructuring Charges (b) 6.7 5.2 112.9 Acquisition-related Costs (c) 9.2 13.1 48.8 Certain Non-recurring Items (d) - - (11.0) Adjusted EBITDA 221.7$ 221.9$ 838.5$ Three Months Ended

Non-GAAP Financial Measures – Net Income (loss) from Operations per share (a) (a) Unaudited. (b) Restructuring charges were primarily associated with the closure of 433,000 tons of chlor alkali capacity across three separate Olin locations, of which $76.6 million was non- cash impairment charges for equipment and facilities for the year ended December 31, 2016. (c) Acquisition-related costs were associated with our acquisition of the Acquired Business. (d) Certain non-recurring items for the year ended December 31, 2016 included an $11.0 million insurance recovery for property damage and business interruption related to a 2008 Henderson, NV chlor alkali facility incident. (e) Step-up depreciation and amortization of $40.3 million for both the three months ended December 31, 2016 and September 30, 2016 and $161.4 million for the year ended December 31, 2016 was associated with the increase to fair value of property, plant and equipment, acquired intangible assets and long-term supply contracts at the acquisition date related to the purchase accounting of the Acquired Business. (f) The effective tax rate on the pretax adjustments from net income (loss) per share to adjusted net income from operations per share is approximately 37%. 30 Olin's definition of adjusted net income (loss) from operations per share is net income (loss) per share plus a per dilutive share add-back for step-up depreciation and amortization recorded in conjunction with the Acquired Business, restructuring charges, acquisition-related costs, certain other non-recurring items and the tax impact of the aforementioned adjustments. Adjusted net income (loss) from operations per share is a non-GAAP financial measure excluding certain items that we do not consider part of ongoing operations. Management believes that this supplemental financial measure is meaningful to investors as a financial performance metric which is useful to investors for comparative purposes. The use of non-GAAP financial measures is not intended to replace any measures of performance determined in accordance with GAAP and adjusted net income (loss) from operations per share presented may not be comparable to similarly titled measures of other companies. Year Ended December 31, September 30, December 31, 2016 2016 2016 Reconciliation of Net Income (Loss) Per Share to Adjusted Net Income from Operations Per Share: Net Income (Loss) Per Share 0.10$ 0.11$ (0.02)$ Add Back: Re t ucturing Charges (b) 0.04 0.03 0.68 A q isition-related Costs (c) 0.06 0.08 0.30 Certain Non-recurring Items (d) - - (0.07) Step-Up Depreciation and Amortization (e) 0.24 0.24 0.98 Income Tax Impact (f) (0.13) (0.13) (0.71) Adjusted Net Income from Operations Per Share 0.31$ 0.33$ 1.16$ Three Months Ended

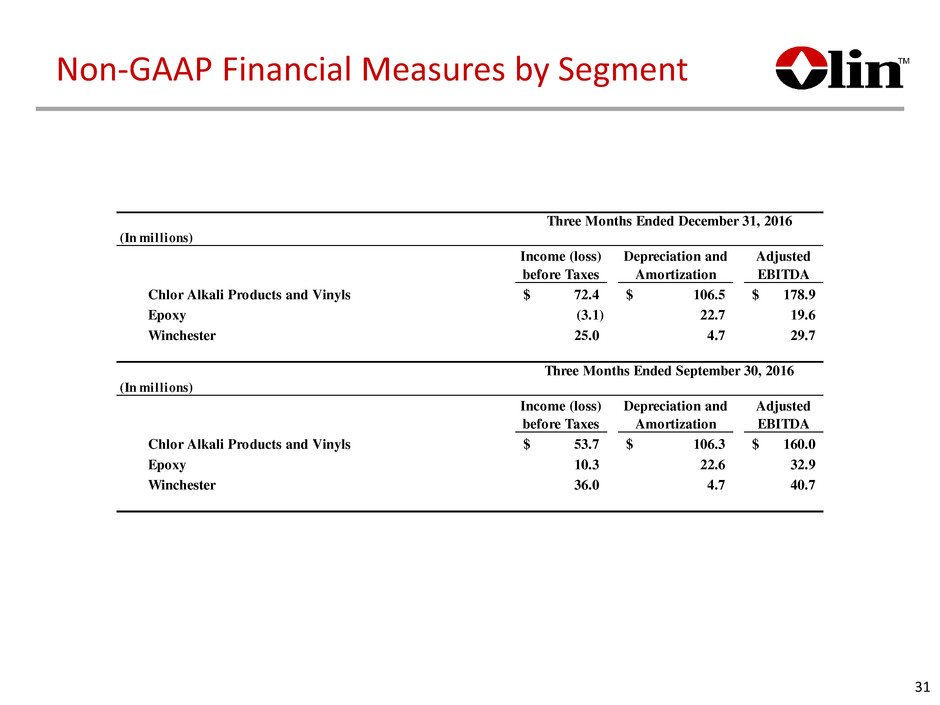

Non-GAAP Financial Measures by Segment 31 (In millions) Income (loss) before Taxes Depreciation and Amortization Adjusted EBITDA Chlor Alkali Products and Vinyls 72.4$ 106.5$ 178.9$ Epoxy (3.1) 22.7 19.6 Winchester 25.0 4.7 29.7 (In millions) Income (loss) before Taxes Depreciation and Amortization Adjusted EBITDA Chlor Alkali Products and Vinyls 53.7$ 106.3$ 160.0$ Epoxy 10.3 22.6 32.9 Winchester 36.0 4.7 40.7 Three Months Ended December 31, 2016 Three Months Ended September 30, 2016