- OLN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Olin (OLN) 8-KFinancial statements and exhibits

Filed: 24 Feb 04, 12:00am

Exhibit 99.1

Morgan Stanley Presentation

New York City February 24, 2004

1

Attending Today

• Joseph D. Rupp – President and Chief Executive Officer

• Anthony W. Ruggiero – Executive Vice President and Chief Financial Officer

• John L. McIntosh — President, Chlor Alkali Products

• John E. Fischer – Vice President, Finance

• Richard E. Koch – Vice President, Investor Relations and Public Affairs

2

Joseph D. Rupp

President & Chief Executive Officer

3

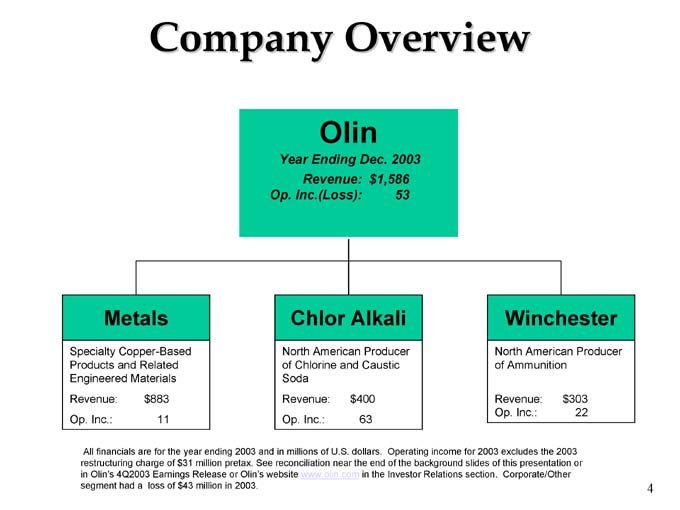

Company Overview

Olin

Year Ending Dec. 2003

Revenue: $1,586

Op. Inc.(Loss): 53

Metals

Specialty Copper-Based Products and Related Engineered Materials

Revenue: $883

Op. Inc.: 11

Chlor Alkali

North American Producer of Chlorine and Caustic Soda

Revenue: $400

Op. Inc.: 63

Winchester

North American Producer of Ammunition

Revenue: $ 303

Op. Inc.: 22

All financials are for the year ending 2003 and in millions of U.S. dollars. Operating income for 2003 excludes the 2003 restructuring charge of $31 million pretax. See reconciliation near the end of the background slides of this presentation or in Olin’s 4Q2003 Earnings Release or Olin’s website www.olin.com in the Investor Relations section. Corporate/Other segment had a loss of $43 million in 2003.

4

Olin Corporate Strategy

Olin Corporation Goal: Superior Shareholder Returns

TRS in Top Third S&P Mid Cap 400 ROCE Over Cost of Capital Over the Cycle

Focused Portfolio of Businesses

• Improve Profitability of the Metals Business

• Increase the Value of and Generate Cash From Chlor Alkali

• Leverage Winchester’s Strengths

Global Market Leadership

• #1 or #2 in the Markets We Choose to Serve

• Strong Technical Innovation in Metals and Winchester

• Increase Metal’s Worldwide Presence

Operational Excellence

• A Low Cost Producer in Our Strategic Businesses

• Continuous Improvement in Operating Margins

5

Olin’s Improved Results in 2003

• Significant Improvement Due to Higher Chlor Alkali Prices

• Metals Volumes Were Down—Similar to Industry Peers. Better than Expected 4Q 2003 Demand

• Seeing Signs of Improvement in our Sectors

– Sustainability Still Uncertain

• Winchester Sales and Operating Income Aided by Domestic Military Orders

6

Investment Highlights

• Significant Operating Leverage

• Chlor Alkali Selling Prices Forecast to Increase in Late 2004 and 2005

• A Better Economy Is Expected to Improve Metals Results

• Winchester Has Additional Earnings Potential from Defense Related Opportunities

7

John L. McIntosh

President, Chlor Alkali Products

8

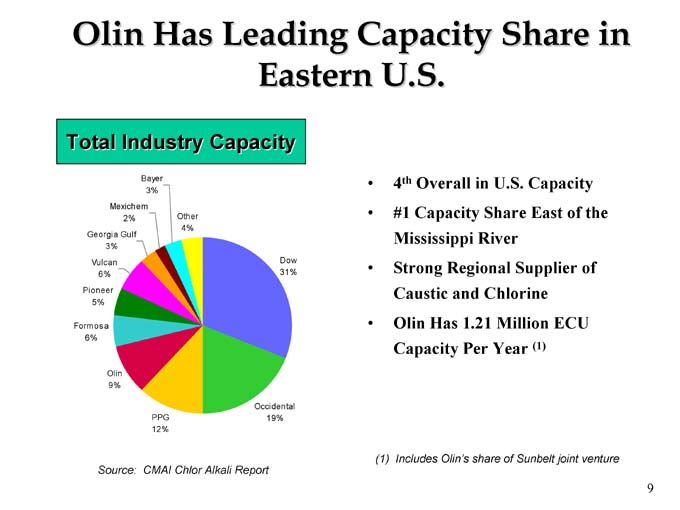

Olin Has Leading Capacity Share in Eastern U.S.

Total Industry Capacity

Other 4%

Bayer 3%

Mexichem 2%

Georgia Gulf 3%

Vulcan 6%

Pioneer 5%

Formosa 6%

Olin 9%

PPG 12%

Occidental 19%

Dow 31%

Source: CMAI Chlor Alkali Report

• 4th Overall in U.S. Capacity

• #1 Capacity Share East of the Mississippi River

• Strong Regional Supplier of Caustic and Chlorine

• Olin Has 1.21 Million ECU Capacity Per Year (1)

(1) Includes Olin’s share of Sunbelt joint venture

9

A $10 Per ECU Change Equates to a $12 Million Change in Pretax Income at Full Capacity, or $.11 Per Share @ 40% Tax Rate

10

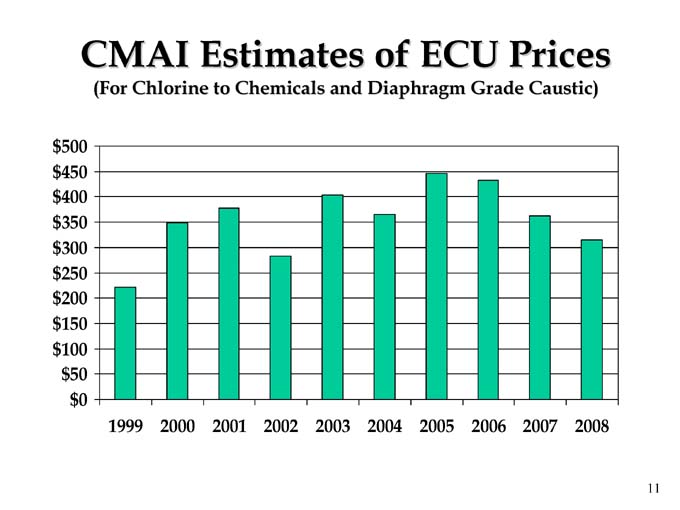

CMAI Estimates of ECU Prices

(For Chlorine to Chemicals and Diaphragm Grade Caustic)

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

11

Olin Chlor Alkali Factors

• Olin Operating Rates Expected to Be in 90% Range in 2004

• Olin’s Electricity Costs, a Key Component of Manufacturing Costs, Have Remained Relatively Stable

• High Gas Prices Impacting Other Chlor Alkali Producers May Cause Prices to Increase

($1 / MMBTU = $25-$35 / ECU)

• 12% of U.S. Capacity Shut Down Since 2000

12

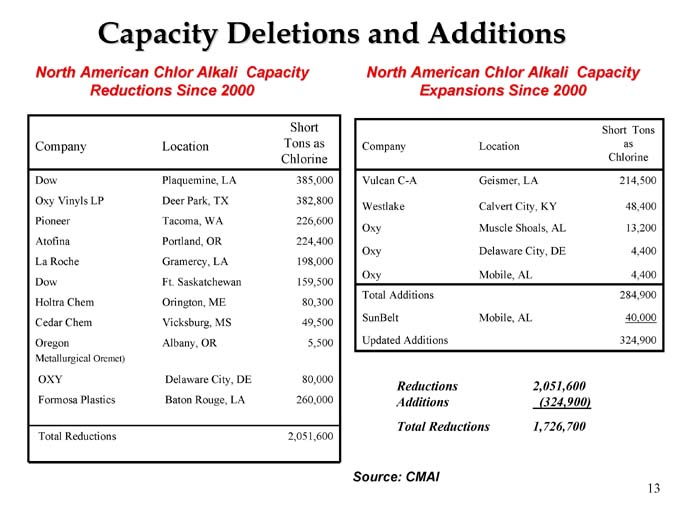

Capacity Deletions and Additions

North American Chlor Alkali Capacity Reductions Since 2000

Short

Company Location Tons as

Chlorine

Dow Plaquemine, LA 385,000

Oxy Vinyls LP Deer Park, TX 382,800

Pioneer Tacoma, WA 226,600

Atofina Portland, OR 224,400

La Roche Gramercy, LA 198,000

Dow Ft. Saskatchewan 159,500

Holtra Chem Orington, ME 80,300

Cedar Chem Vicksburg, MS 49,500

Oregon Albany, OR 5,500

Metallurgical Oremet)

OXY Delaware City, DE 80,000

Formosa Plastics Baton Rouge, LA 260,000

Total Reductions 2,051,600

North American Chlor Alkali Capacity Expansions Since 2000

Short Tons

Company Location as

Chlorine

Vulcan C-A Geismer, LA 214,500

Westlake Calvert City, KY 48,400

Oxy Muscle Shoals, AL 13,200

Oxy Delaware City, DE 4,400

Oxy Mobile, AL 4,400

Total Additions 284,900

SunBelt Mobile, AL 40,000

Updated Additions 324,900

Reductions 2,051,600

Additions (324,900)

Total Reductions 1,726,700

Source: CMAI

13

Chlor Alkali Products

• Full Year 2003 / 2002 Comparative Results:

– Sales Increased $79 million or 25% From 2002

($ 400 M vs. $321 M)

– Operating Income Increased $87 Million (Income of $63 M vs. Loss of $24 M)

– Olin’s ECU Netback for 2003, Excluding Sunbelt Joint Venture, Was $325 Compared With $235 in 2002

14

Chlor Alkali Products

First Quarter 2004

• Seasonal Improvement of Demand From 4Q Levels

• Olin ECU Prices May Be Slightly Below 1Q2003 Due to Falling Caustic Prices

• Demand in January and February Somewhat Better than Expected

• A Chlorine Price Increase of $75 per ton Has Been Announced

15

Metals

• Olin is Leading Manufacturer of Copper Alloy Strip and Brass Rod in the U.S.

• Large Size Provides Economies of Scale and Manufacturing Efficiencies

• Olin Possesses Leading Technology Position

• Olin is the Leading Copper Based Sheet and Strip Distributor in the U.S.

16

Metals

• Significant Earnings Leverage as a Result of Cost Cutting and Capacity Rationalization

• As the Following Slides Show, 2001, 2002 and 2003 Were Well Below Historical Consumption

17

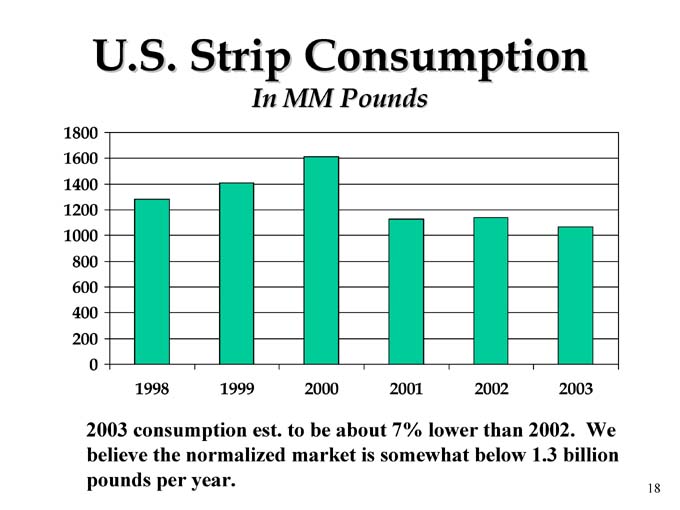

U.S. Strip Consumption

In MM Pounds

1998 1999 2000 2001 002 2003

2003 consumption est. to be about 7% lower than 2002. We believe the normalized market is somewhat below 1.3 billion pounds per year.

18

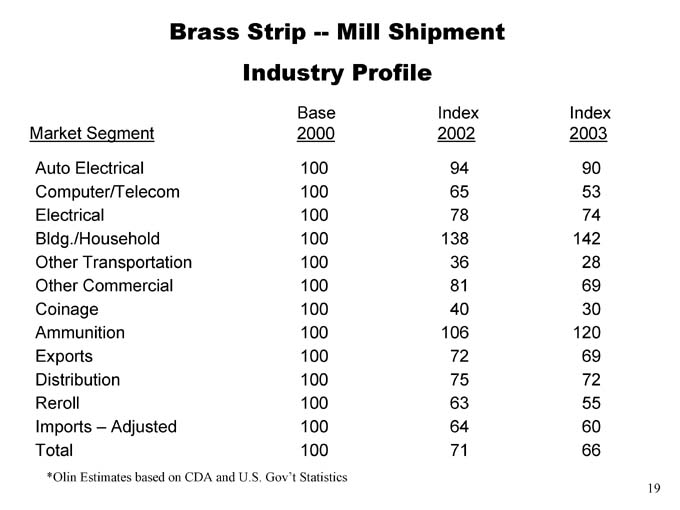

Brass Strip — Mill Shipment Industry Profile

Base Index Index

Market Segment 2000 2002 2003

Auto Electrical 100 94 90

Computer/Telecom 100 65 53

Electrical 100 78 74

Bldg./Household 100 138 142

Other Transportation 100 36 28

Other Commercial 100 81 69

Coinage 100 40 30

Ammunition 100 106 120

Exports 100 72 69

Distribution 100 75 72

Reroll 100 63 55

Imports – Adjusted 100 64 60

Total 100 71 66

*Olin Estimates based on CDA and U.S. Gov’t Statistics

19

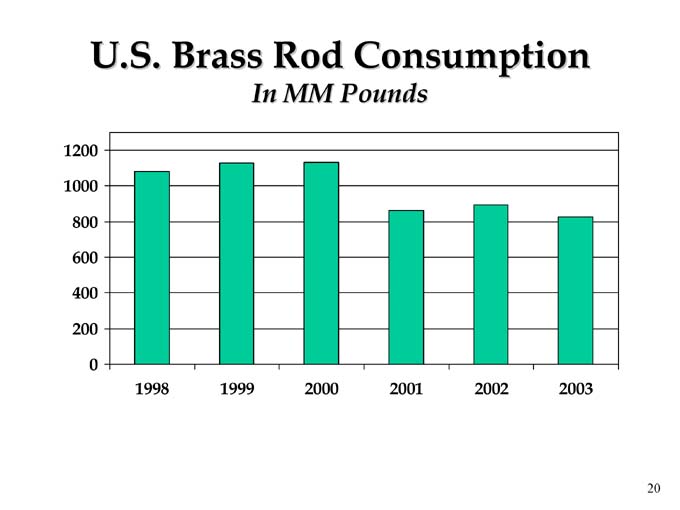

U.S. Brass Rod Consumption

In MM Pounds

1998 1999 2000 2001 2002 2003

20

Metals

• Full Year 2003/2002 Comparative Results:

– Sales Were $883 Million (Including Sales of $222 Million From Chase) Compared With $697 Million in 2002 (Including 4Q2002 Chase Sales of $52 Million)

– Excluding Chase, Sales Were $661 Million vs. $645 Million

– Shipment Volumes, Excluding Chase, Down 4% From 2002 Due to Softer Demand in Automotive and Coinage

– Operating Profit of $11 Million (Including $8 Million of Chase Profits), Compared With $19 Million in 2002 (Including $2 Million of Chase Profits in 4Q2002)

– Excluding Chase, Operating Profits Were $3 Million vs. $17 Million

21

Metals Summary

• We See Improving Macro-Economic Factors

• Historically our Businesses Generally Lag the Recovery by About Six Months

• Visibility Has Improved but Remains Limited

• Cost Reduction Initiatives Are Expected to Offset Cost Increases

22

China Joint Venture

• Olin-Loutong Metals (GZ) Ltd., Co.

• Distribution Center in Guangzhou, China

• Will Process and Distribute Both Olin and Luoyang’s Copper Alloy Products

• Expect to be Operational in 1Q’04

23

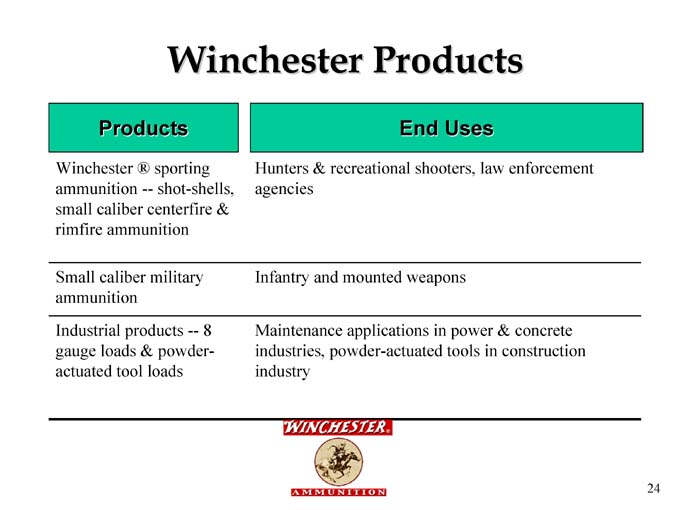

Winchester Products

Products

Winchester ® sporting ammunition — shot-shells, small caliber centerfire & rimfire ammunition

Small caliber military ammunition

Industrial products — 8 gauge loads & powder-actuated tool loads

End Uses

Hunters & recreational shooters, law enforcement agencies

Infantry and mounted weapons

Maintenance applications in power & concrete industries, powder-actuated tools in construction industry

24

Winchester

• Full Year 2003 / 2002 Comparative Results:

– Sales Up 7% Compared to 2002, Primarily Due to Higher Volumes

– Operating Income Increased to $22 Million, From $16 Million in 2002

– Increase Primarily Due From Increased Military Demand

25

Rimfire

• To Improve Its Competitive Position, Winchester is Considering Relocating Its Rimfire Manufacturing Operation from East Alton

• No Final Geographic Decision Made As Yet

26

Corporate Office Moves

• Closing Norwalk, CT Headquarters and Moving to East Alton, IL by End of 2004

• Decision Driven By Organizational, Strategic, Economic Advantages

• One-time Costs of Approximately $12 Million; Annualized Savings of about $6 Million

27

A. W. Ruggiero

Executive Vice President and CFO

28

Recent Stock Offering

• 10 Million Shares of Common Stock

• Done Overnight on February 3, 2004

• Net Proceeds: $178 Million

•$ 125 Million Contributed to Pension Plan

•$ 53 Million for General Corporate Purposes

– Debt Maturities: March 2004 = $17.5 Million; June 2004 = $8.1 Million; June 2005 = $50 Million

29

Rationale for Stock Issuance

• Strengthens Balance Sheet and Increase Financial Flexibility

– Companies with Stronger Financial Positions Have Better Multiples

• Company Stock Price Was Close to 52-Week High and Reasonably Close to Its Average High Price for the Past 5 Years

• Market Receptive to Chemical Equity Issuances; Duration of Window Unknown

• Financial Benefits by Pre-funding Pension Plan

30

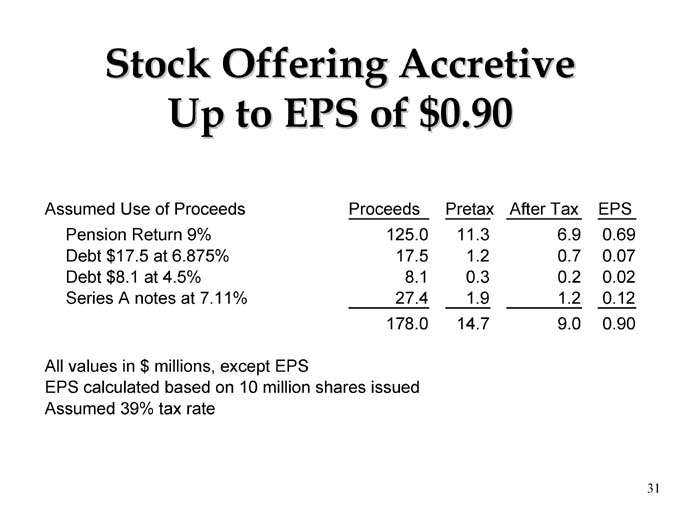

Stock Offering Accretive Up to EPS of $0.90

Assumed Use of Proceeds Proceeds Pretax After Tax EPS

Pension Return 9% 125.0 11.3 6.9 0.69

Debt $17.5 at 6.875% 17.5 1.2 0.7 0.07

Debt $8.1 at 4.5% 8.1 0.3 0.2 0.02

Series A notes at 7.11% 27.4 1.9 1.2 0.12

178.0 14.7 9.0 0.90

All values in $ millions, except EPS

EPS calculated based on 10 million shares issued Assumed 39% tax rate

31

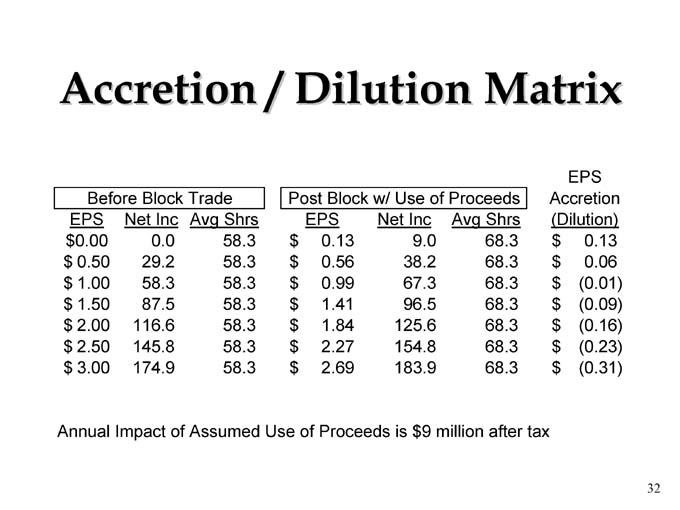

Accretion / Dilution Matrix

EPS

Before Block Trade Post Block w/ Use of Proceeds Accretion

EPS Net Inc Avg Shrs EPS Net Inc Avg Shrs (Dilution)

$ 0.00 0.0 58.3 $ 0.13 9.0 68.3 $ 0.13

$ 0.50 29.2 58.3 $ 0.56 38.2 68.3 $ 0.06

$ 1.00 58.3 58.3 $ 0.99 67.3 68.3 $ (0.01)

$ 1.50 87.5 58.3 $ 1.41 96.5 68.3 $ (0.09)

$ 2.00 116.6 58.3 $ 1.84 125.6 68.3 $ (0.16)

$ 2.50 145.8 58.3 $ 2.27 154.8 68.3 $ (0.23)

$ 3.00 174.9 58.3 $ 2.69 183.9 68.3 $ (0.31)

Annual Impact of Assumed Use of Proceeds is $9 million after tax

32

Pension Plan

• At 12/31/2003, Pension Plan Under-funded by

Approximately $400 MM (as measured under SFAS 87) Before Recent $125 MM Pension Contribution.

• During 2003, a 24% Gain in Value of Plan Assets Was More Than Offset by Interest Rate Effect

• In 2002, We Recorded a Pretax Charge of $360 MM

($220 MM After Tax) to Shareholders’ Equity. In 2003, an Additional Pretax Charge of $32 MM ($19.5 MM After Tax)

• These Were Non-Cash Charges

• Significant Cash Contributions to the Plan Not Now Expected Until 2008

• Expect Annual Pension Expense Could Increase in the $10 MM Per Year Range for Several Years

33

2003 Overview

• 2003 Full Years Results:

– Sales Increased 22%

– Net Loss of $24 Million, Compared With Net Loss of $31 Million in 2002

– Excluding Certain Charges, Olin Reported Adjusted Net Income of $21 Million ($0.36 Per Diluted Share), Compared With Net Loss of $21 Million ($0.42 Per Diluted Share) in 2002

See full reconciliation near the end of the background slides of this presentation or in Olin’s 4Q2003 Earnings Release or Olin’s website www.olin.com in the Investor Relations section.

34

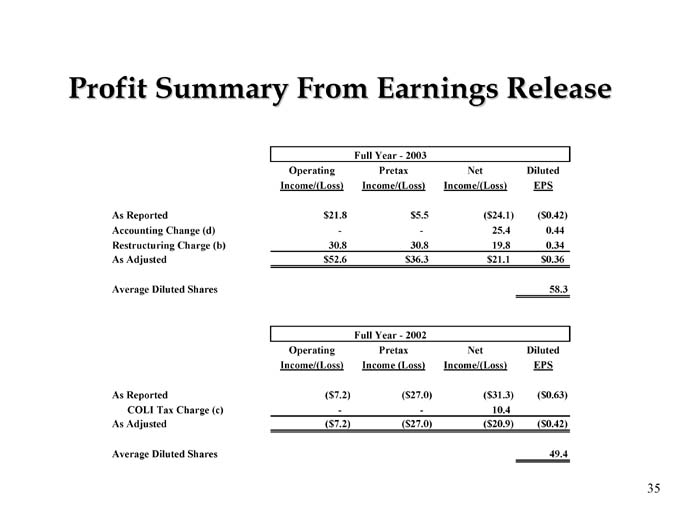

Profit Summary From Earnings Release

Full Year—2003

Operating Pretax Net Diluted

Income/(Loss) Income/(Loss) Income/(Loss) EPS

As Reported $ 21.8 $ 5.5 ($ 24.1) ($ 0.42)

Accounting Change (d) - - 25.4 0.44

Restructuring Charge (b) 30.8 30.8 19.8 0.34

As Adjusted $ 52.6 $ 36.3 $ 21.1 $ 0.36

Average Diluted Shares 58.3

Full Year—2002

Operating Pretax Net Diluted

Income/(Loss) Income (Loss) Income/(Loss) EPS

As Reported ($ 7.2) ($ 27.0) ($ 31.3) ($ 0.63)

COLI Tax Charge (c) - - 10.4

As Adjusted ($ 7.2) ($ 27.0) ($ 20.9) ($ 0.42)

Average Diluted Shares 49.4

35

First Quarter 2004

• Expect Earnings At Least Breakeven

• Compared to 4Q 2003:

– Metals Expecting Improved Results Due to Higher Volumes From Improving Economy and Normal Seasonal Factors

– Winchester’s Profits Will Improve Primarily Because of Seasonal Factors

– Chlor Alkali Profits Expected to Approximate 4Q as Increased Volumes Expected to Offset Lower Prices

36

Investment Rationale

• Yield @ $16.00 = 5%; @ $18.00 = 4.4%

• Potential for Improved Performance Based On:

– Higher Expected ECU Prices in the Next Several Years

– A Better Economy Is Expected to Improve Metals Results

– Winchester Is a Solid Business and Provides Profits, Cash Flow and Participation in Increased Military Spending

• Strong Financial Discipline to Meet Our Obligations

37

Cap. Ex. and D&A

($ MM)

76

78

1997

78

78

1998

80

73

1999

95

81

2000

87

65

2001

88

41

2002

82

55

2003

75

60

2004 E

Capital Expenditures D&A

38

Investment Rationale

(continued)

• Commitment to Investment Grade Rating

• Projecting Financial Covenant Compliance under Existing Revolver

39

Forward-Looking Statements

This presentation contains estimates of future performance, which are forward-looking statements and results could differ materially from those anticipated in the forward-looking statements. Some of the factors that could cause actual results to differ are described in the business and outlook sections of Olin’s Form 10-K for the year ended December 31, 2002 and in Olin’s Fourth Quarter 2003 Earnings Release. These reports are filed with the U.S. Securities and Exchange Commission.

40

Proud Heritage … Promising Future

41

The Following Slides Are Provided as Background Information and Come Primarily from Previous Presentations. These Slides May or May Not Be Used in the Presentation. In Some Cases, They Are Duplicate Slides From What Was Covered in the Above Slides.

42

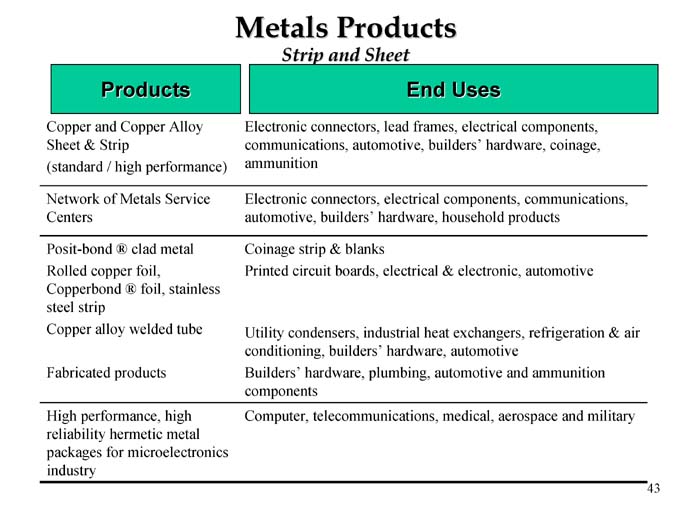

Metals Products

Strip and Sheet

Products

Copper and Copper Alloy Sheet & Strip (standard / high performance)

Network of Metals Service Centers

Posit-bond ® clad metal Rolled copper foil, Copperbond ® foil, stainless steel strip Copper alloy welded tube

Fabricated products

High performance, high reliability hermetic metal packages for microelectronics industry

End Uses

Electronic connectors, lead frames, electrical components, communications, automotive, builders’ hardware, coinage, ammunition

Electronic connectors, electrical components, communications, automotive, builders’ hardware, household products

Coinage strip & blanks

Printed circuit boards, electrical & electronic, automotive

Utility condensers, industrial heat exchangers, refrigeration & air conditioning, builders’ hardware, automotive Builders’ hardware, plumbing, automotive and ammunition components

Computer, telecommunications, medical, aerospace and military

43

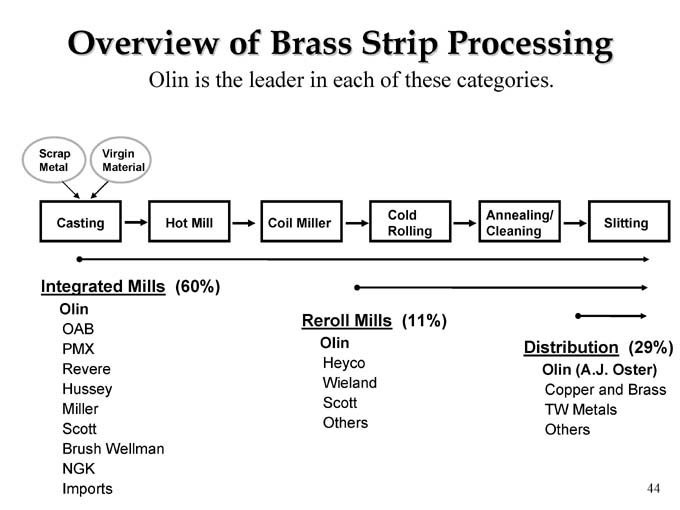

Overview of Brass Strip Processing

Olin is the leader in each of these categories.

Scrap Metal

Virgin Material

Casting

Hot Mill

Coil Miller

Cold Rolling

Annealing/ Cleaning

Slitting

Integrated Mills (60%)

Olin

OAB

PMX

Revere

Hussey

Miller

Scott

Brush Wellman

NGK

Imports

Reroll Mills (11%)

Olin

Heyco

Wieland

Scott

Others

Distribution (29%)

Olin (A.J. Oster)

Copper and Brass

TW Metals

Others

44

Key Drivers – Brass Strip

• Sensitive to Changes in the Economy

• Changes in Demand for Specific Sectors Affect Olin Performance:

– Automotive

– Computers

– Telecommunications

– Housing

• Coinage Market Is Sensitive to Swings in the Economy

45

Olin Brass Competitive Advantages

• Largest Brass Mill in U.S. Provides Economies of Scale

• Outstanding Manufacturing Capabilities

• More Patents Than Competitors

• Largest Distribution Business in U.S. (A.J. Oster)

• High Performance Alloys and Specialty Products

46

Chase Industries

Chase

• Chase is a Leader in Brass Rod

• Competitive Advantages

Manufacturing Excellence, Low Cost, High Quality

“Blue Dot” Trademark

Leading Market Share

Customer Service Focus

• Leverage to Enhance Long-term Profitability and Return on Investment

• Chase has New Efficient Facilities, Future Cash Flow Potential Since Capital Already Spent

48

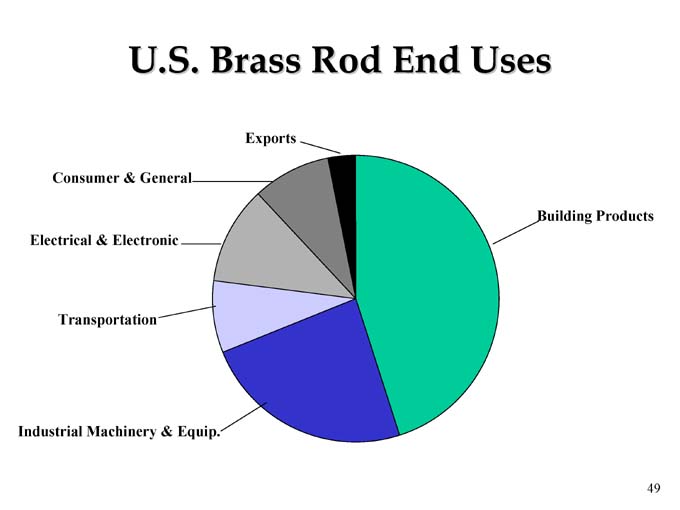

U.S. Brass Rod End Uses

Exports

Consumer & General

Electrical & Electronic

Transportation

Industrial Machinery & Equip.

Building Products

49

Demand Drivers

Building Products

– Housing Starts

– # of Bathrooms – Home

– Intensity of Use

– Product Innovation

– Average Age of Homes

– Existing Home Sales

– Low Mortgage Rates

Industrial Machinery & Equipment

– GDP

– Industrial Production

Transportation

– US Auto Sales

– Class Eight Truck Sales

Consumer & General Products / Electrical & Electronics

– CPI

– Consumer Spending

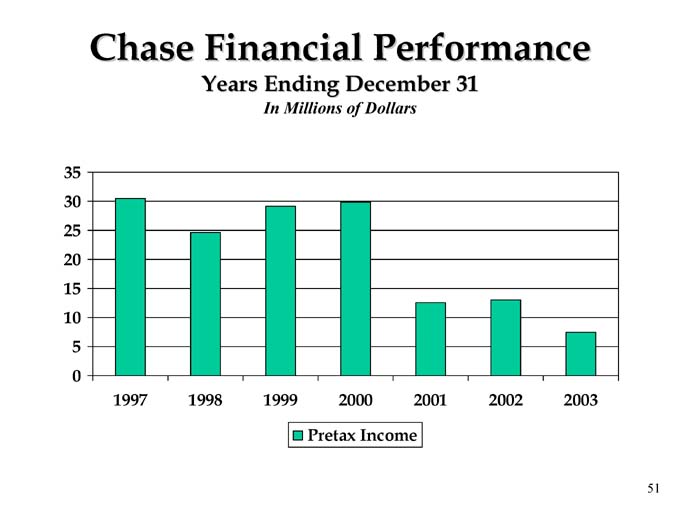

Chase Financial Performance

Years Ending December 31

In Millions of Dollars

1997 1998 1999 2000 2001 2002 2003

Pretax Income

51

Factors Affecting Chase Brass in 2003

• Lower Commercial Construction

• Less Capital Spending for Industrial Machinery

• Lower Automotive and Truck Sales

• Housing Remains at Healthy Levels

52

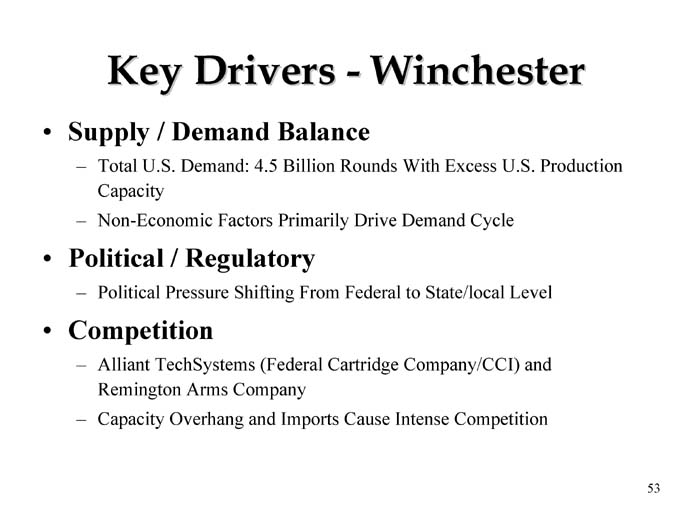

Key Drivers—Winchester

• Supply / Demand Balance

– Total U.S. Demand: 4.5 Billion Rounds With Excess U.S. Production Capacity

– Non-Economic Factors Primarily Drive Demand Cycle

• Political / Regulatory

– Political Pressure Shifting From Federal to State/local Level

• Competition

– Alliant TechSystems (Federal Cartridge Company/CCI) and Remington Arms Company

– Capacity Overhang and Imports Cause Intense Competition

53

Winchester Strategy

• Leverage Existing Strengths to Grow Sales

– Legendary Winchester® Brand Name

– Received “Ammunition of the Year” Award Last Six Years From Shooting Industry Academy of Excellence

– Manufacturer of the Year Award from National Association of Sporting Goods Wholesalers in 2002

• Continue to Offer a Full Line of Ammunition Products to Selected Markets

– Non-toxic and Special Purpose Ammunition Are Opportunities

• Aggressively Pursue a Low-cost Producer Status

– Optimize Supply Chain

– Reduce Total Product Cost Through the Use of Technology and Process Improvement Initiatives

54

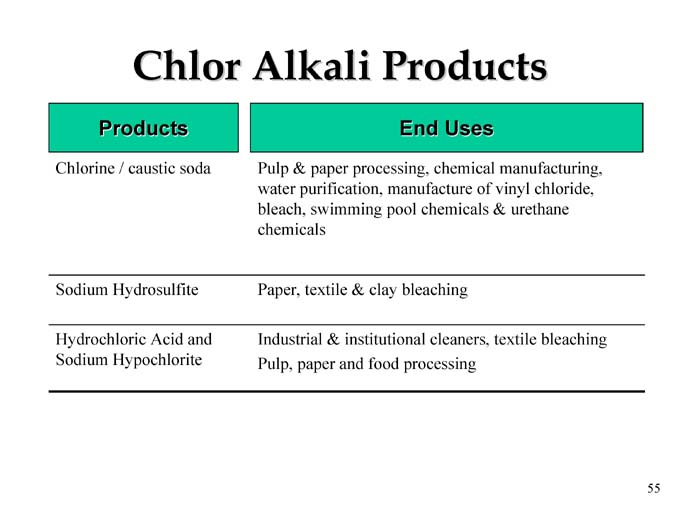

Chlor Alkali Products

Products

Chlorine / caustic soda

Sodium Hydrosulfite

Hydrochloric Acid and Sodium Hypochlorite

End Uses

Pulp & paper processing, chemical manufacturing, water purification, manufacture of vinyl chloride, bleach, swimming pool chemicals & urethane chemicals

Paper, textile & clay bleaching

Industrial & institutional cleaners, textile bleaching Pulp, paper and food processing

55

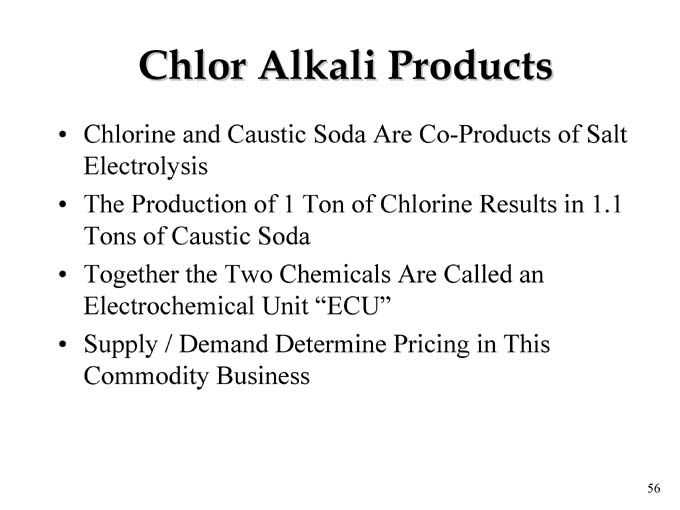

Chlor Alkali Products

• Chlorine and Caustic Soda Are Co-Products of Salt Electrolysis

• The Production of 1 Ton of Chlorine Results in 1.1 Tons of Caustic Soda

• Together the Two Chemicals Are Called an Electrochemical Unit “ECU”

• Supply / Demand Determine Pricing in This Commodity Business

56

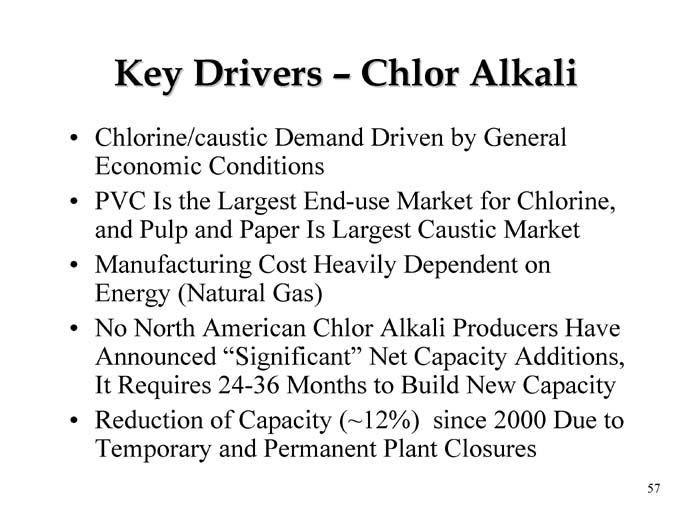

Key Drivers – Chlor Alkali

• Chlorine/caustic Demand Driven by General Economic Conditions

• PVC Is the Largest End-use Market for Chlorine, and Pulp and Paper Is Largest Caustic Market

• Manufacturing Cost Heavily Dependent on Energy (Natural Gas)

• No North American Chlor Alkali Producers Have Announced “Significant” Net Capacity Additions, It Requires 24-36 Months to Build New Capacity

• Reduction of Capacity (~12%) since 2000 Due to Temporary and Permanent Plant Closures

57

Chlor Alkali Products Competitive Advantages / Strategies

• Olin’s Electricity Costs Have Been Relatively Stable Over Time Because We Purchase Electricity From Utilities That Are Primarily Coal, Nuclear and Hydro-Power Based

• Olin’s Sunbelt Joint Venture Has Low Manufacturing Costs Due to Membrane Technology and Low Power Costs

• Olin’s Southeastern U.S. Plants Are Relatively Close to Their Caustic Customers

58

Chlor Alkali Products Competitive Advantages / Strategies

• Focus on Being the Preferred Supplier to the Merchant Chlor Alkali Market

• Continue Our Partnership Philosophy With Our Customers

• Continue to Drive Cost Improvements Through Manufacturing and Logistics Optimization

• Significant Opportunities to Increase the Value of the Business at Modest Capital Cost

• Be a Strong Cash Generator and Value Enhancer to Olin Corporation

59

Why Olin’s ECU Netbacks Differ from Other Chlor Alkali Producers

• Methodologies and Definitions May Differ Among Producers

• Pricing to Customers Can Vary Depending on Customer End Use and Location and Method of Shipment (Pipeline, Railcar, Truck, Barge, Terminal)

• Delivered Price – Freight = Netback

• Contractual Terms: Escalation Provisions, and Duration of Contracts. These Will Change Over Time Due to Market Conditions

60

Olin’s Chlor Alkali System

• Olin Contracts Nearly 100% of Its Chlorine and Caustic Sales

• On About Two-Thirds of the Chlorine Volume and One-Third of the Caustic Volume, Prices Change Quarterly, with a Combination of Formula-based and Negotiated Pricing

• Many Contracts Have a One Quarter Lag in Them, Which Delays Price Increases in a Tightening Market, But Helps in a Softening Market

• Competitive Forces Dictate Contract Duration and Terms

61

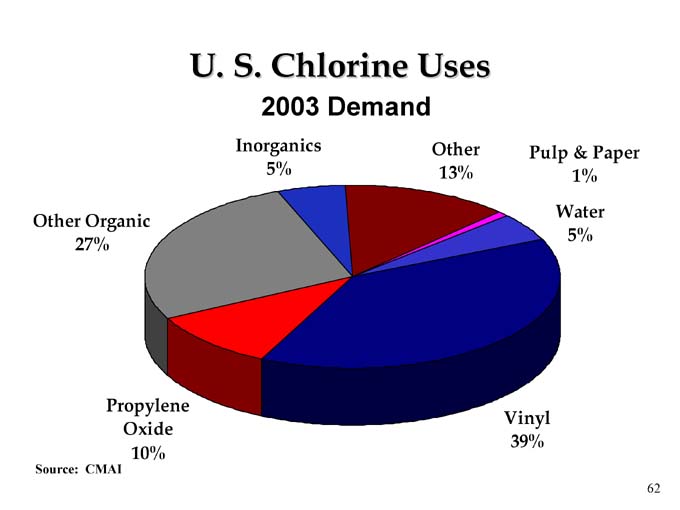

U. S. Chlorine Uses

2003 Demand

Inorganics 5%

Other 13%

Pulp & Paper 1%

Water 5%

Vinyl 39%

Propylene Oxide 10%

Other Organic 27%

Source: CMAI

62

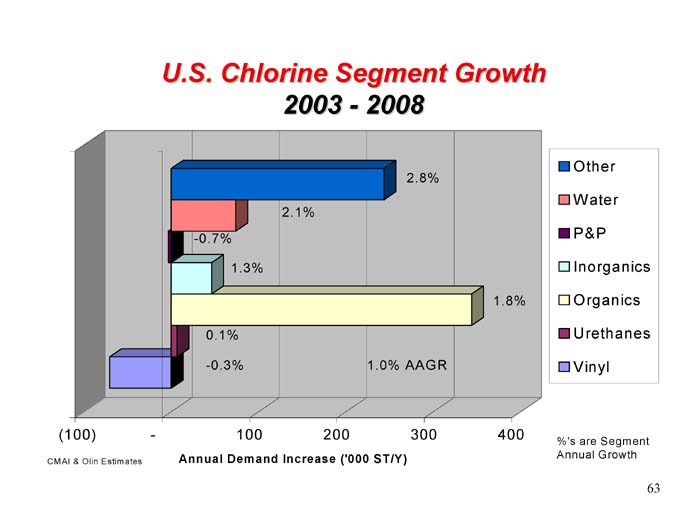

U.S. Chlorine Segment Growth 2003—2008

2.8%

Other

2.1%

Water

-0.7%

P&P

1.3%

Inorganics

1.8%

Organics

0.1%

Urethanes

-0.3%

Vinyl

1.0%

AAGR

%’s are Segment Annual Growth

CMAI & Olin Estimates

Annual Demand Increase (‘000 ST/Y)

63

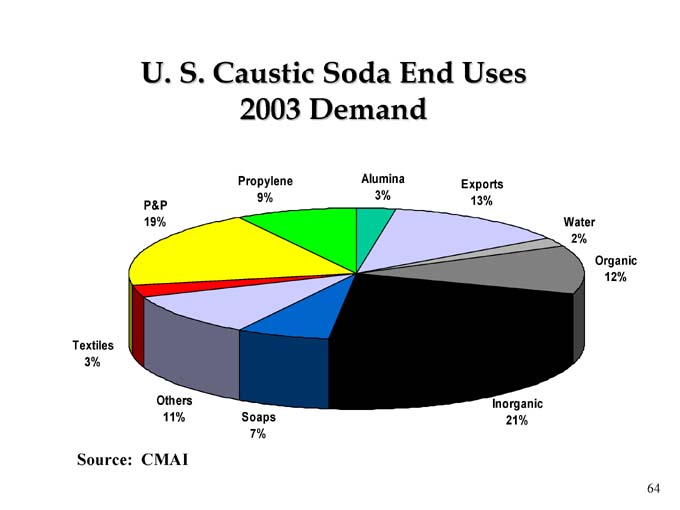

U. S. Caustic Soda End Uses 2003 Demand

P&P 19%

Propylene 9%

Alumina 3%

Exports 13%

Water 2%

Organic 12%

Inorganic 21%

Soaps 7%

Others 11%

Textiles 3%

Source: CMAI

64

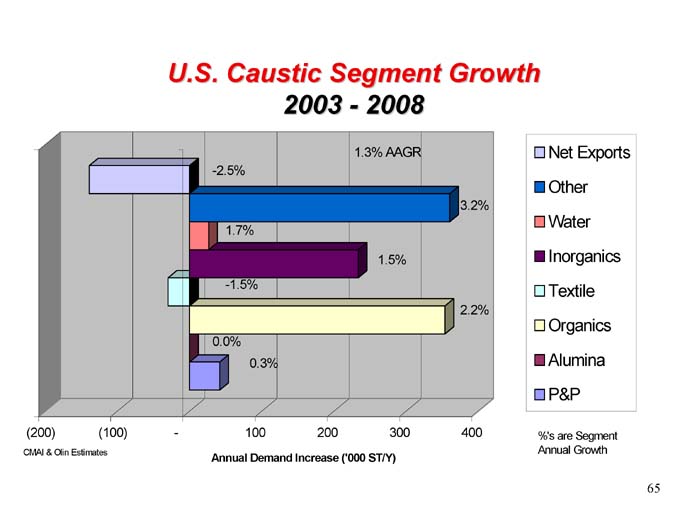

U.S. Caustic Segment Growth 2003—2008

1.3% AAGR

-2.5%

Net Exports

3.2%

Other

1.7%

Water

1.5%

Inorganics

-1.5%

Textile

2.2%

Organics

0.0%

Alumina

0.3%

P&P

%’s are Segment Annual Growth

Annual Demand Increase (‘000 ST/Y)

CMAI & Olin Estimates

65

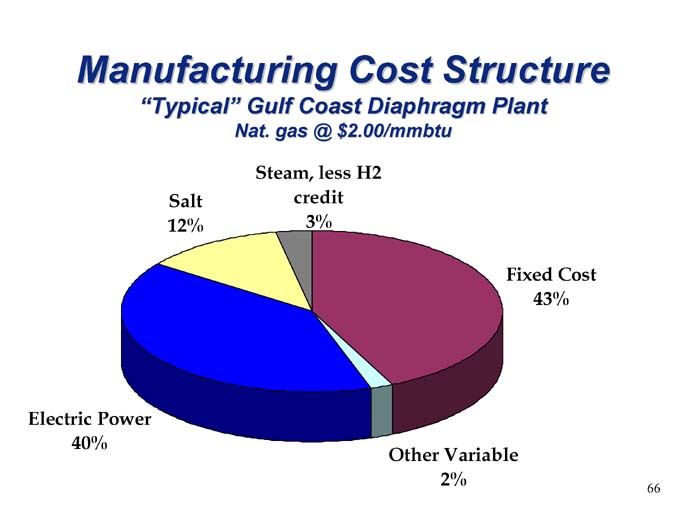

Manufacturing Cost Structure

“Typical” Gulf Coast Diaphragm Plant

Nat. gas @ $2.00/mmbtu

Steam, less H2 credit 3%

Salt 12%

Electric Power 40%

Other Variable 2%

Fixed Cost 43%

66

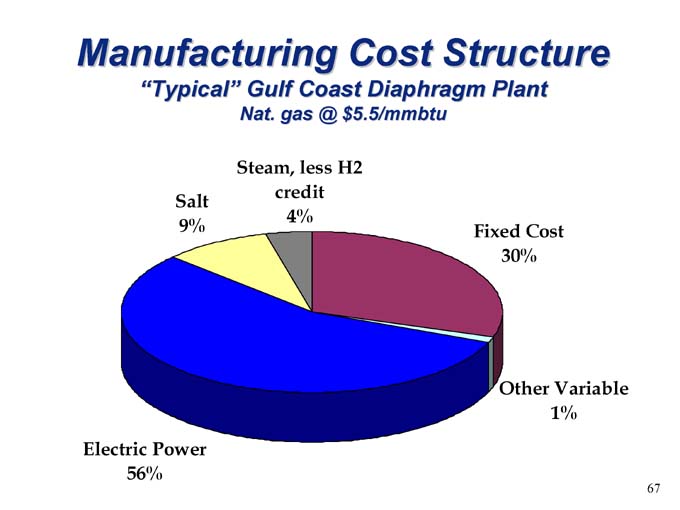

Manufacturing Cost Structure

“Typical” Gulf Coast Diaphragm Plant

Nat. gas @ $5.5/mmbtu

Steam, less H2 credit 4%

Salt 9%

Electric Power 56%

Fixed Cost 30%

Other Variable 1%

67

The Next Slides Provide the Same Information Provided on the Profit Summary Exhibit to Olin’s January 29, 2004 Earnings Release and Reconciles Reported and Adjusted Earnings

68

Profit Summary From Earnings Release

(In millions, except EPS)

The following table summarizes the significant unusual items impacting the reported operating results. Management monitors earnings per share excluding unusual items such as restructuring charges, unusual charges/credits and accounting changes. Management believes that these items are unique and are not part of the ongoing business results. Management believes that providing this information to investors will better enable them to understand our historical and future trends by excluding these items from our results. The table below reconciles operating income/(loss), pretax income/(loss), net income/(loss) and diluted earnings per share on a generally accepted accounting principles basis, as reflected in our Consolidated Statements of Income, to diluted earnings per share as adjusted for each of the unusual items.

On September 2002 we completed our acquisition of Chase Industries. The acquisition was accounted for using the purchase method of accounting. Accordingly, the operating results of Chase have been included in the accompanying financial statements since the date of acquisition. We believe that a meaningful analysis of our financial performance requires that we exclude the Chase operating results when comparing results in 2003 to results in 2002 that do not include Chase. In order to assist investors in analyzing comparable results, we have included sales and income before taxes of Chase in footnote b in the segment information table for each period since the date of the acquisition.

69

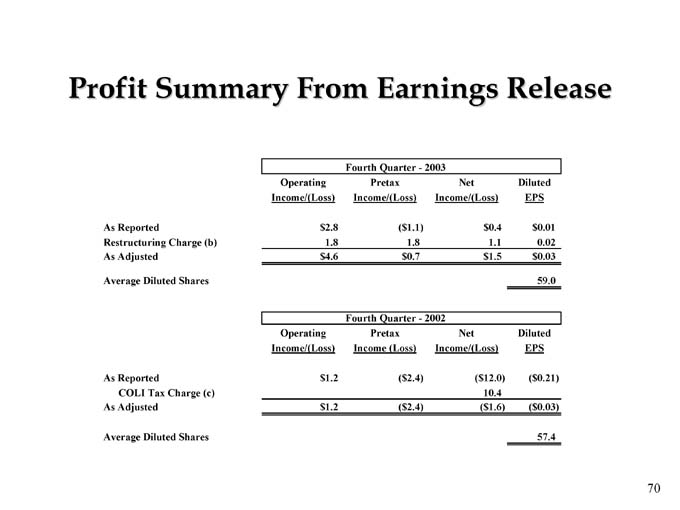

Profit Summary From Earnings Release

Fourth Quarter—2003

Operating Pretax Net Diluted

Income/(Loss) Income/(Loss) Income/(Loss) EPS

As Reported $ 2.8 ($ 1.1) $0.4 $ 0.01

Restructuring Charge (b) 1.8 1.8 1.1 0.02

As Adjusted $ 4.6 $ 0.7 $1.5 $ 0.03

Average Diluted Shares 59.0

Fourth Quarter—2002

Operating Pretax Net Diluted

Income/(Loss) Income (Loss) Income/(Loss) EPS

As Reported $ 1.2 ($ 2.4) ($ 12.0) ($ 0.21)

COLI Tax Charge (c) 10.4

As Adjusted $ 1.2 ($ 2.4) ( $1.6) ($ 0.03)

Average Diluted Shares 57.4

70

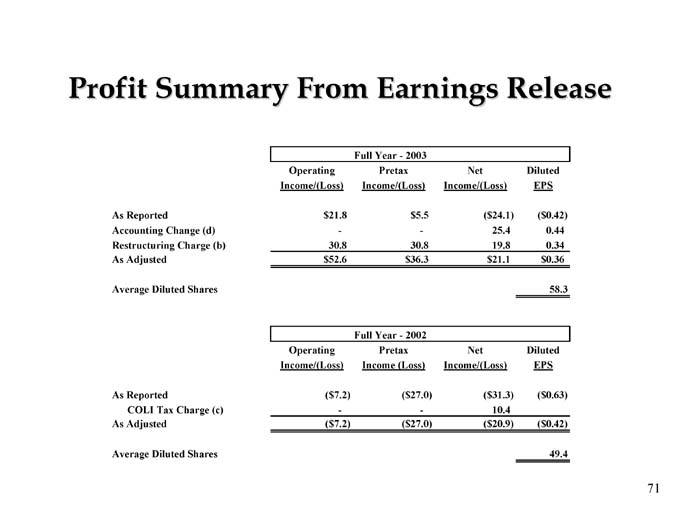

Profit Summary From Earnings Release

Full Year—2003

Operating Pretax Net Diluted

Income/(Loss) Income/(Loss) Income/(Loss) EPS

As Reported $ 21.8 $ 5.5 ($ 24.1) ($ 0.42)

Accounting Change (d) - - 25.4 0.44

Restructuring Charge (b) 30.8 30.8 19.8 0.34

As Adjusted $ 52.6 $ 36.3 $ 21.1 $ 0.36

Average Diluted Shares 58.3

Full Year—2002

Operating Pretax Net Diluted

Income/(Loss) Income (Loss) Income/(Loss) EPS

As Reported ($ 7.2) ($ 27.0) ($ 31.3) ($ 0.63)

COLI Tax Charge (c) - - 10.4

As Adjusted ($ 7.2) ($ 27.0) ($ 20.9) ($ 0.42)

Average Diluted Shares 49.4

71

Profit Summary From Earnings Release

(a) Unaudited

(b) Reflects the restructuring charge for the shutdown of our Indianapolis Brass mill and certain other actions.

(c) Income taxes for the 2002 fourth quarter and year included a provision in connection with the surrender of life insurance policies purchased by us under the Company Owned Life Insurance program.

(d) Reflects the cumulative charge for the adoption of SFAS 143, “Accounting for Asset Retirement Obligations”, which we adopted on January 1, 2003.

72

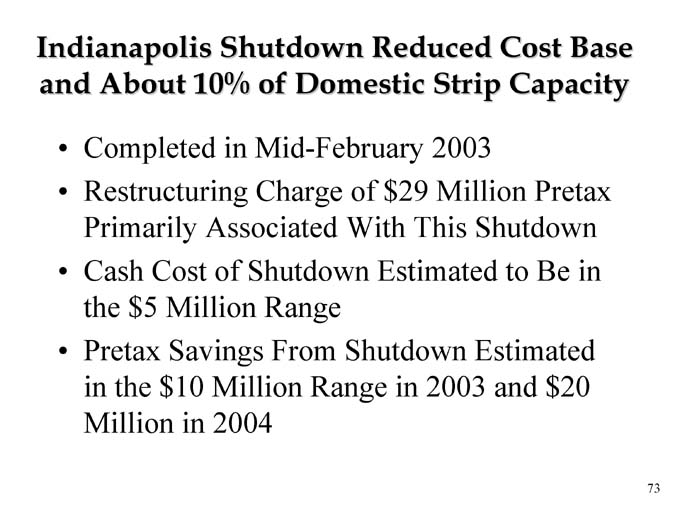

Indianapolis Shutdown Reduced Cost Base and About 10% of Domestic Strip Capacity

• Completed in Mid-February 2003

• Restructuring Charge of $29 Million Pretax Primarily Associated With This Shutdown

• Cash Cost of Shutdown Estimated to Be in the $5 Million Range

• Pretax Savings From Shutdown Estimated in the $10 Million Range in 2003 and $20 Million in 2004

73

Key Initiatives Have Increased Olin’s Financial Flexibility

• Completed $200 Million Public Senior Note Offering on December 11, 2001

• Closed on $140 Million Three-Year Revolving Credit Facility on January 3, 2002

• Completed Common Stock Offering on March 11, 2002 Which Raised $56 Million and Lowered Olin’s Debt to Total Capital Ratio

• IRB Refinancing in March 2002 Provided Additional Borrowing Capability Under the Revolving Credit Agreement

• Issued 9.8 Million Shares of Common Stock to Acquire Chase in September 2002

• In February 2004, issued 10.0 Million Shares of Common Stock to Partially Fund Pension Plan and for General Corporate Purposes

• Ratings of Baa3/BBB- from Moody’s/S&P

74

Financial Policies and Objectives

• Commitment to Maximizing Total Return to Shareholders (TRS) Over the Long Run

• Commitment to Lower Cost Structure

– Targeted Headcount Reductions

– Optimized Manufacturing

– Reduced Capital Spending

• Commitment to Investment Grade Rating

• Commitment to Maximizing Return on Capital

• Continually Evaluate the Sale of Non-core Assets

75

Olin’s Demonstrated Shareholder Orientation

• Compensation System Assures Alignment With Shareholder Interests

– Long Term Incentive Plan is 100% Stock Options and Performance Shares

– Senior Management Compensation Highly Oriented to Stock Performance

– Stock Ownership Guidelines for Senior Management

– Board of Directors Substantially Paid in Stock

76

FORWARD-LOOKING STATEMENTS

This communication includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to analyses and other information that are based on management’s beliefs, certain assumptions made by management, forecasts of future results, and current expectations, estimates and projections about the markets and economy in which we and our various segments operate. The statements contained in this communication that are not statements of historical fact may include forward-looking statements that involve a number of risks and uncertainties.

We have used the words “anticipate,” “intend,” “may,” “expect,” “believe,” “should,” “plan,” “will,” “estimate,” and variations of such words and similar expressions in this communication to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict and many of which are beyond our control. Therefore, actual outcomes and results may differ materially from those matters expressed or implied in such forward-looking statements. We undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. Relative to the dividend, the payment of cash dividends is subject to the discretion of our Board of Directors and will be determined in light of then-current conditions, including our earnings, our operations, our financial conditions, our capital requirements and other factors deemed relevant by our Board of Directors. In the future, our Board of Directors may change our dividend policy, including the frequency or amount of any dividend, in light of then-existing conditions.

The risks, uncertainties and assumptions involved in our forward-looking statements, many of which are discussed in more detail in our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2002, include, but are not limited to, the following,:

| • | sensitivity to economic, business and market conditions in the United States and overseas, including economic instability or a downturn in the sectors served by us, such as automotive, electronics, coinage, telecommunications, ammunition, housing, vinyls and pulp and paper; |

| • | extraordinary events, such as additional terrorist attacks or war with one or more countries; |

| • | continued or additional economic and industry downturns that result in diminished product demand and excess manufacturing capacity in any of our segments and that, in many cases, result in lower selling prices and profits; |

| • | the cyclical nature of our operating results, particularly declines in average selling prices in the chlor alkali industry and the supply/demand balance for our products, including the impact of excess industry capacity or an imbalance in demand for our chlor alkali products; |

| • | an increase in our indebtedness or higher-than-expected interest rates, affecting our ability to generate sufficient cash flow for debt service; |

| • | unforeseen effects of competition, including the migration by United States customers to low-cost foreign locations; |

| • | costs and other expenditures in excess of those projected for environmental investigation and remediation or other legal proceedings; |

| • | unexpected litigation outcomes or the impact of changes in laws and regulations; |

| • | higher-than-expected raw material and utility or transportation and/or logistics costs; |

| • | the occurrence of unexpected manufacturing interruptions and outages, including those occurring as a result of production hazards; |

| • | unexpected additional taxes and related interest as the result of pending income tax audits; and |

| • | the effects of any declines in global equity markets on asset values and any declines in interest rates used to value the liabilities in our pension plan. |

All of our forward-looking statements should be considered in light of these factors. In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of our forward-looking statements.