Exhibit 99.1

Lin Morgan Stanley Chicago

May 3, 2005

1

Attending Today

Joseph D. Rupp – President and Chief Executive Officer John E. Fischer – VP Finance and Controller John L. McIntosh – President, Chlor Alkali Products Richard E. Koch – Vice President, Investor Relations and Public Affairs

2

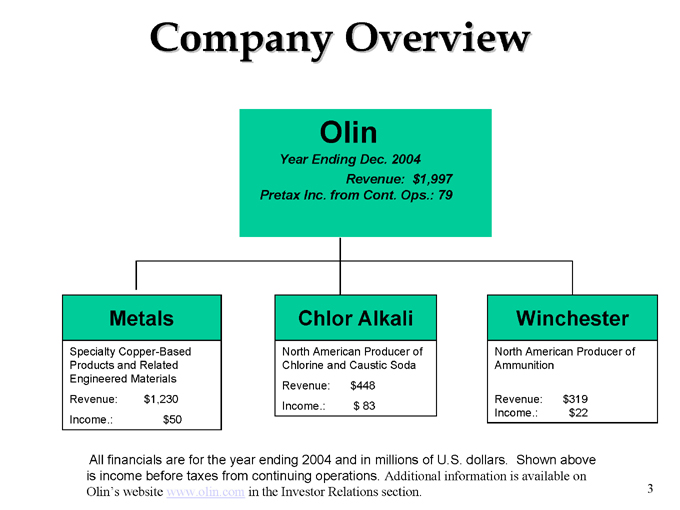

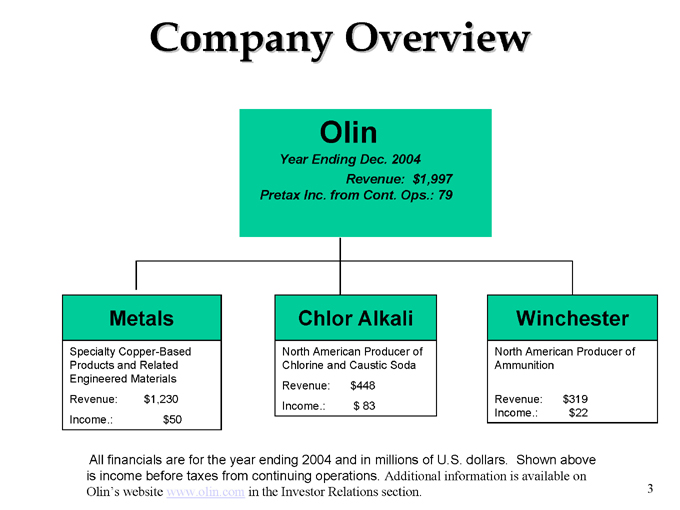

Company Overview

Olin

Year Ending Dec. 2004 Revenue: $1,997 Pretax Inc. from Cont. Ops.: 79

Metals

Specialty Copper-Based Products and Related Engineered Materials Revenue: $1,230 Income.: $50

Chlor Alkali

North American Producer of Chlorine and Caustic Soda Revenue: $448 Income.: $ 83

Winchester

North American Producer of Ammunition

Revenue: $319 Income.: $22

All financials are for the year ending 2004 and in millions of U.S. dollars. Shown above is income before taxes from continuing operations. Additional information is available on Olin’s website www.olin.com in the Investor Relations section.

3

Olin Corporate Strategy

Olin Corporation Goal: Superior Shareholder Returns

TRS in Top Third S&P Mid Cap 400 ROCE Over Cost of Capital Over the Cycle

Focused Portfolio of Businesses

Improve Profitability of the Metals Business Increase the Value of and Generate Cash From Chlor Alkali Leverage Winchester’s Strengths

Global Market Leadership

#1 or #2 in the Markets We Choose to Serve Strong Technical Innovation in Metals and Winchester Increase Metal’s Worldwide Presence

Operational Excellence

A Low Cost Producer in Our Strategic Businesses Continuous Improvement in Operating Margins

4

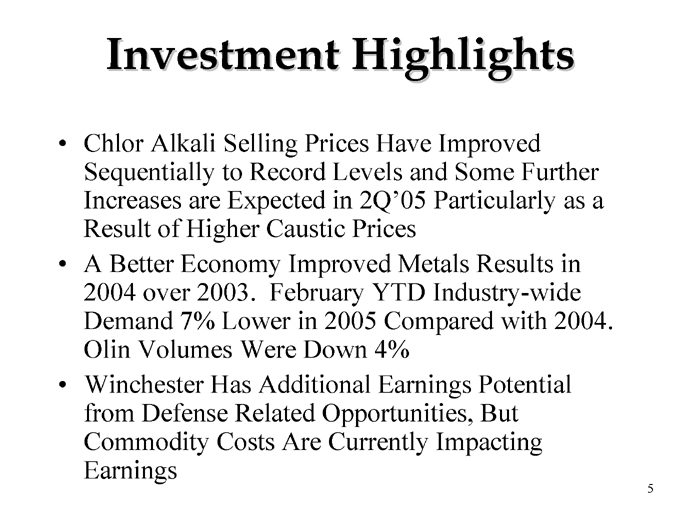

Investment Highlights

Chlor Alkali Selling Prices Have Improved Sequentially to Record Levels and Some Further Increases are Expected in 2Q’05 Particularly as a Result of Higher Caustic Prices A Better Economy Improved Metals Results in 2004 over 2003. February YTD Industry-wide Demand 7% Lower in 2005 Compared with 2004. Olin Volumes Were Down 4% Winchester Has Additional Earnings Potential from Defense Related Opportunities, But Commodity Costs Are Currently Impacting Earnings

5

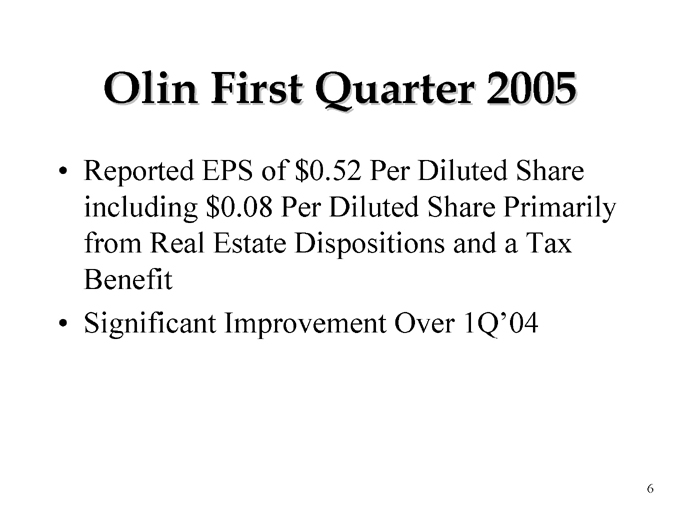

Olin First Quarter 2005

Reported EPS of $0.52 Per Diluted Share including $0.08 Per Diluted Share Primarily from Real Estate Dispositions and a Tax Benefit Significant Improvement Over 1Q’04

6

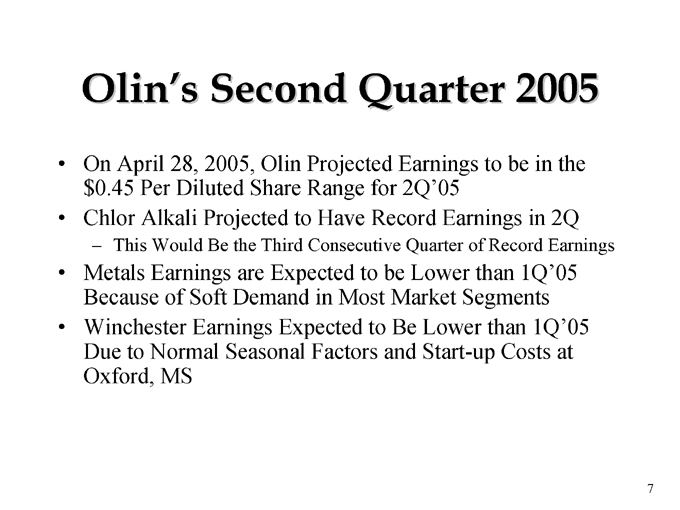

Olin’s Second Quarter 2005

On April 28, 2005, Olin Projected Earnings to be in the $0.45 Per Diluted Share Range for 2Q’05 Chlor Alkali Projected to Have Record Earnings in 2Q

This Would Be the Third Consecutive Quarter of Record Earnings

Metals Earnings are Expected to be Lower than 1Q’05 Because of Soft Demand in Most Market Segments Winchester Earnings Expected to Be Lower than 1Q’05 Due to Normal Seasonal Factors and Start-up Costs at Oxford, MS

7

Chlor Alkali Products

1Q’05 vs. 1Q’04

Substantial YOY Profit Improvement Segment Income Increased from $10.4 Million to $58.6 Million in 1Q’05 Selling Prices Increased 62% 1Q’05 Had Higher Electricity Costs and Slightly Lower Sales Volumes Due to Rail Service Problems and Customer Outages

8

Olin ECU Netbacks

1Q04 300 2Q04 300 3Q04 335 4Q04 410 1Q05 485

Olin Operating Rates Expected to Be Near Capacity (ex. Planned Outages) in 2005 Netback = Gross Selling Price less Transportation Costs less Discounts

9

Olin Chlor Alkali Factors

Olin’s Electricity Costs Have Increased Over the Last Five Years, But Have Remained Well Below Natural Gas Generated Electricity Prices High Gas Prices Impacting Other Chlor Alkali Producers Have Caused Pricing Pressures for Last 2-3 Years

($1 / MMBTU = $25-$35 / ECU)

10

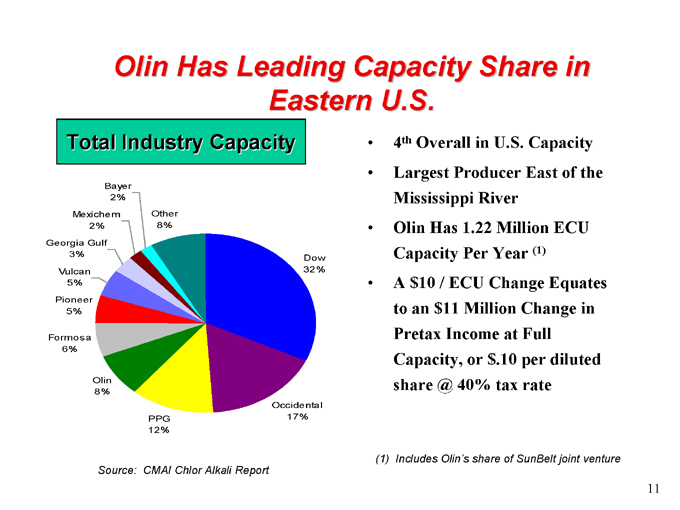

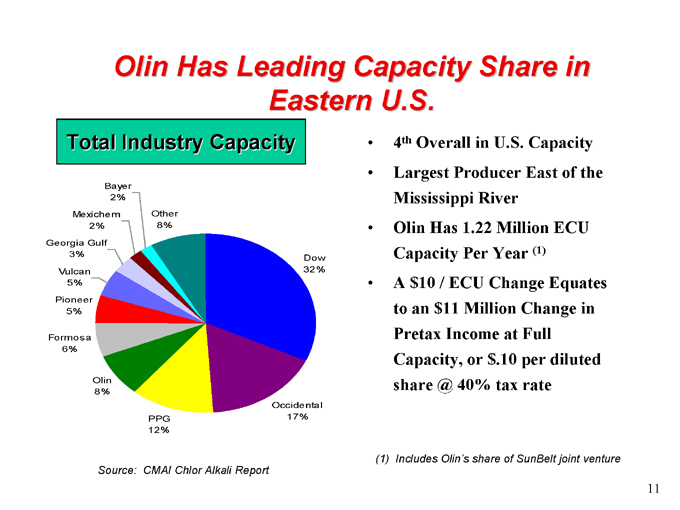

Olin Has Leading Capacity Share in Eastern U.S.

Total Industry Capacity

4th Overall in U.S. Capacity Largest Producer East of the Mississippi River Olin Has 1.22 Million ECU Capacity Per Year (1) A $10 / ECU Change Equates to an $11 Million Change in Pretax Income at Full Capacity, or $.10 per diluted share @ 40% tax rate

Bayer 2%

Other 8%

Dow 32%

Occidental 17%

PPG 12%

Olin 8%

Formosa 6%

Pioneer 5%

Vulcan 5%

Georgia Gulf 3%

Mexichem 2%

Source: CMAI Chlor Alkali Report

(1) Includes Olin’s share of SunBelt joint venture

11

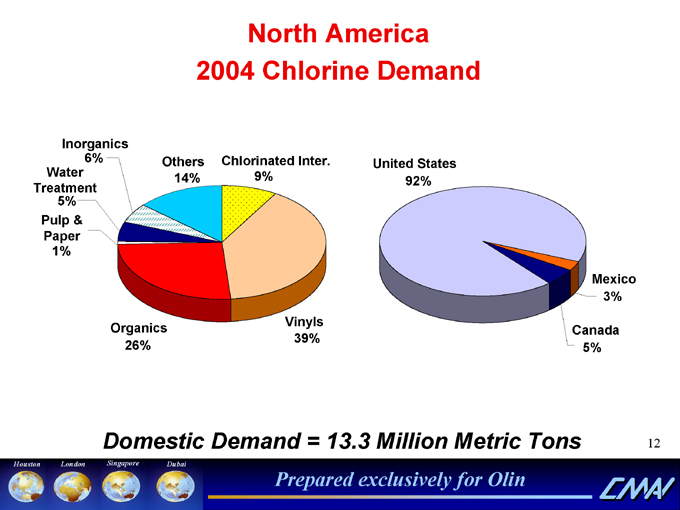

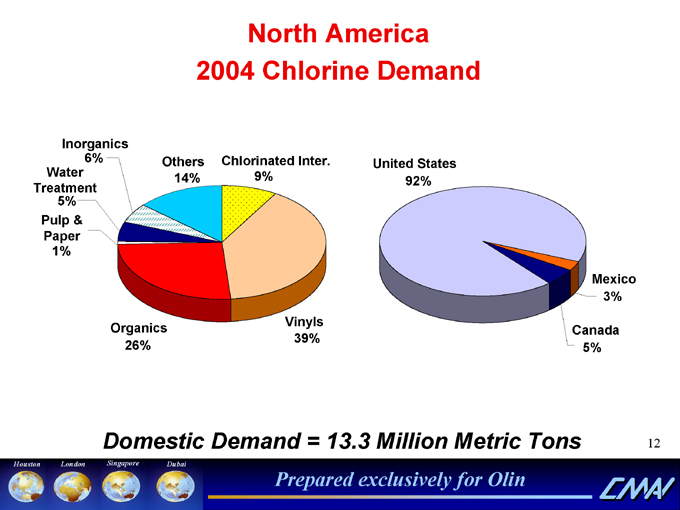

North America 2004 Chlorine Demand

Inorganics 6% Water Treatment 5% Pulp & Paper 1%

Others 14%

Chlorinated Inter.

9%

Vinyls 39%

Organics 26%

United States 92%

Mexico 3%

Canada 5%

Domestic Demand = 13.3 Million Metric Tons 12

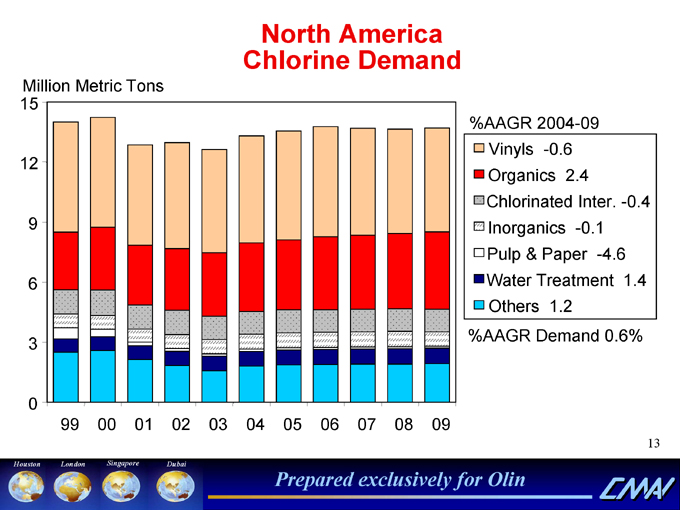

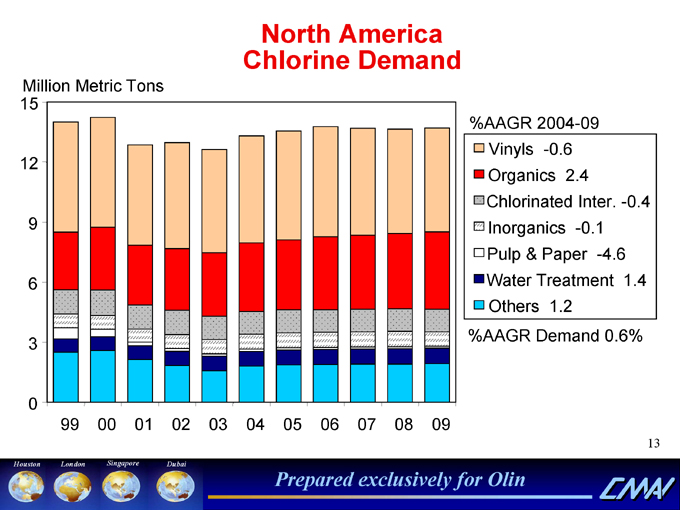

North America Chlorine Demand

Million Metric Tons 15

12 9 6 3

0

99 00 01 02 03 04 05 06 07 08 09

%AAGR 2004-09

Vinyls -0.6 Organics 2.4 Chlorinated Inter. -0.4 Inorganics -0.1 Pulp & Paper - -4.6 Water Treatment 1.4 Others 1.2

%AAGR Demand 0.6%

13

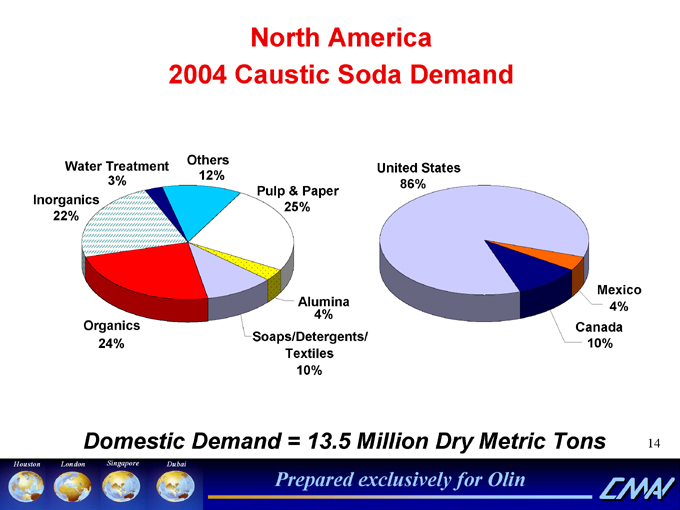

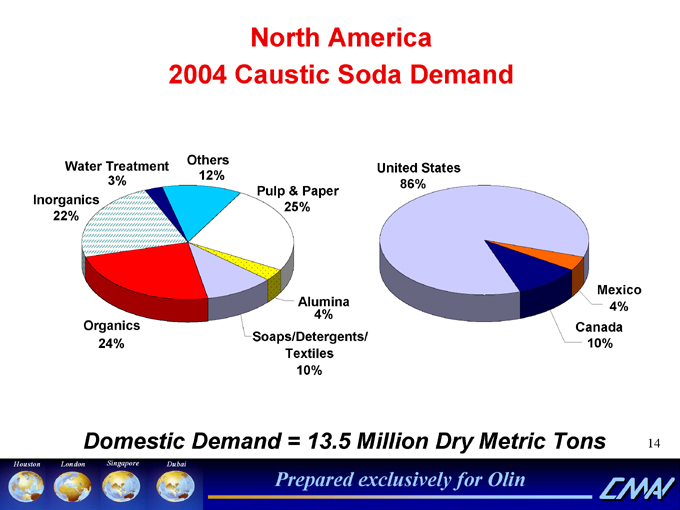

North America 2004 Caustic Soda Demand

Others Water Treatment

3% 12%

Pulp & Paper Inorganics 25% 22%

Alumina 4% Organics Soaps/Detergents/ 24% Textiles 10%

United States 86%

Mexico 4% Canada 10%

Domestic Demand = 13.5 Million Dry Metric Tons 14

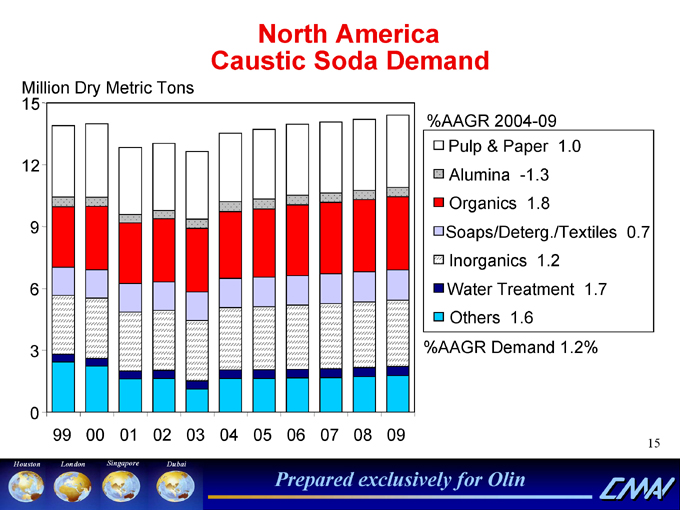

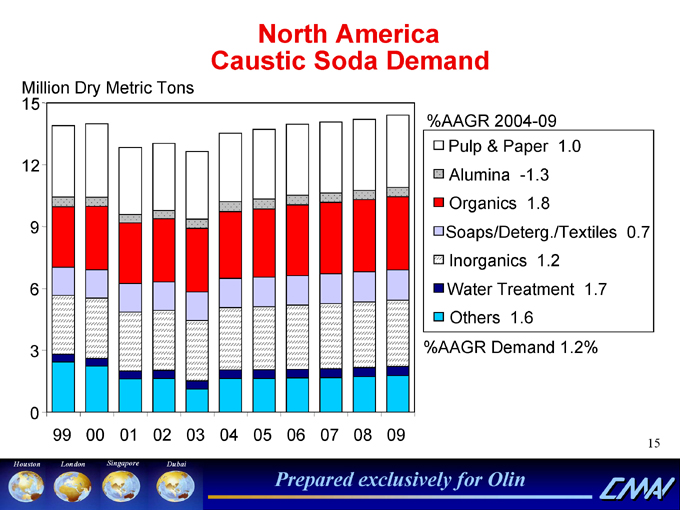

North America Caustic Soda Demand

Million Dry Metric Tons 15

12 9 6 3

0

99 00 01 02 03 04 05 06 07 08 09

%AAGR 2004-09

Pulp & Paper 1.0 Alumina -1.3 Organics 1.8

Soaps/Deterg./Textiles 0.7 Inorganics 1.2 Water Treatment 1.7 Others 1.6

%AAGR Demand 1.2%

15

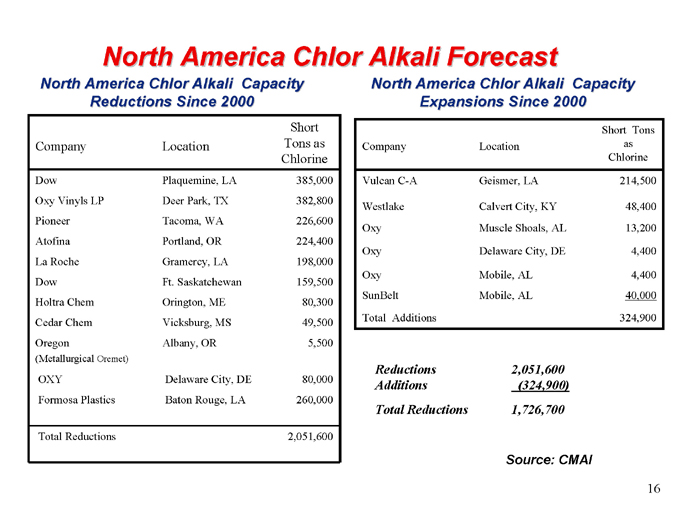

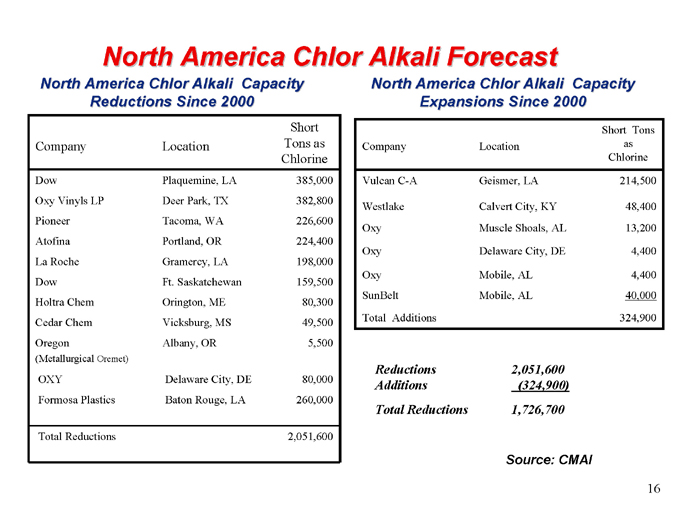

North America Chlor Alkali Forecast

North America Chlor Alkali Capacity Reductions Since 2000

Company

Location

Short Tons as Chlorine

Dow Plaquemine, LA 385,000 Oxy Vinyls LP Deer Park, TX 382,800 Pioneer Tacoma, WA 226,600 Atofina Portland, OR 224,400 La Roche Gramercy, LA 198,000 Dow Ft. Saskatchewan 159,500 Holtra Chem Orington, ME 80,300 Cedar Chem Vicksburg, MS 49,500 Oregon Albany, OR 5,500

(Metallurgical Oremet)

OXY Delaware City, DE 80,000 Formosa Plastics Baton Rouge, LA 260,000

Total Reductions 2,051,600

North America Chlor Alkali Capacity Expansions Since 2000

Company Location

Short Tons as Chlorine

Vulcan C-A Geismer, LA 214,500

Westlake Calvert City, KY 48,400 Oxy Muscle Shoals, AL 13,200

Oxy Delaware City, DE 4,400

Oxy Mobile, AL 4,400 SunBelt Mobile, AL 40,000 Total Additions 324,900

Reductions 2,051,600 Additions (324,900) Total Reductions 1,726,700

Source: CMAI

16

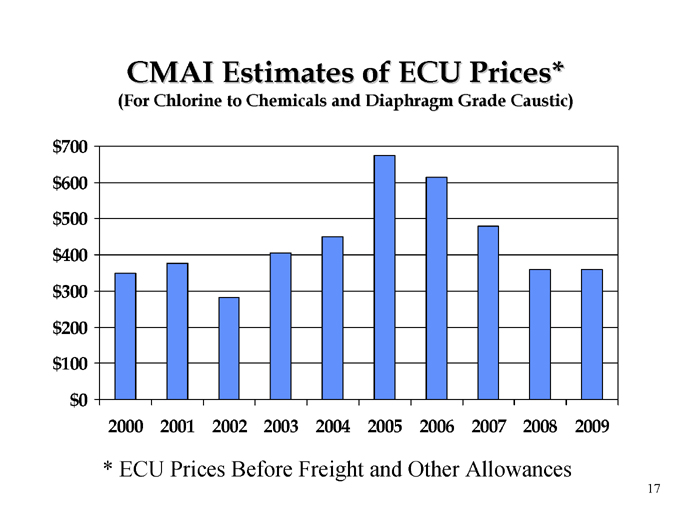

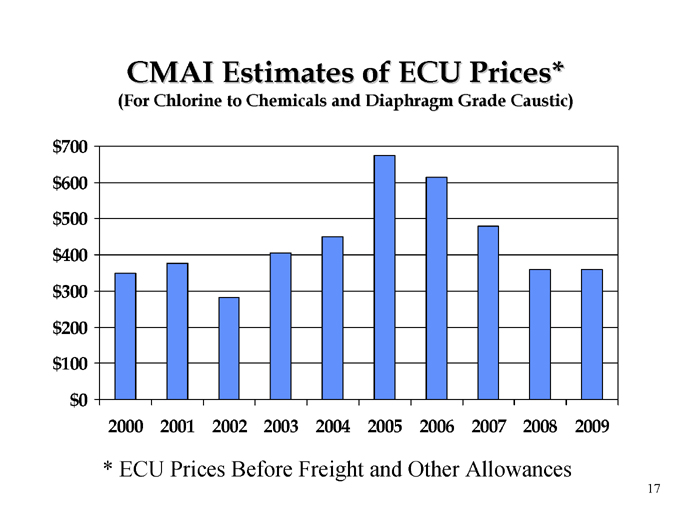

CMAI Estimates of ECU Prices*

(For Chlorine to Chemicals and Diaphragm Grade Caustic)

$700 $600 $500 $400 $300 $200 $100 $0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

* ECU Prices Before Freight and Other Allowances

17

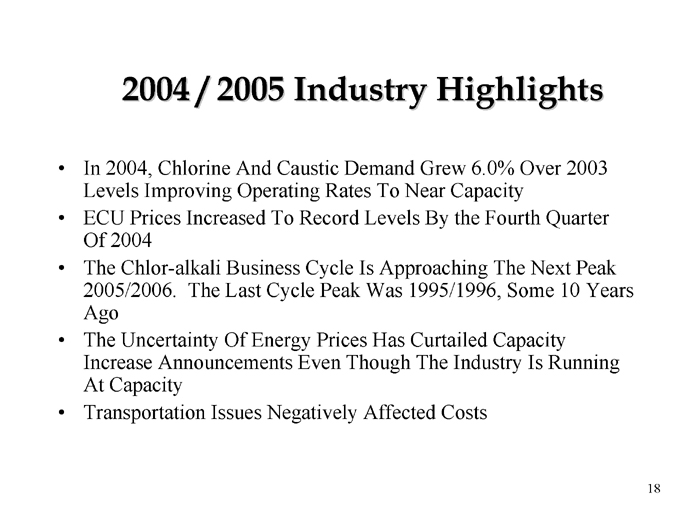

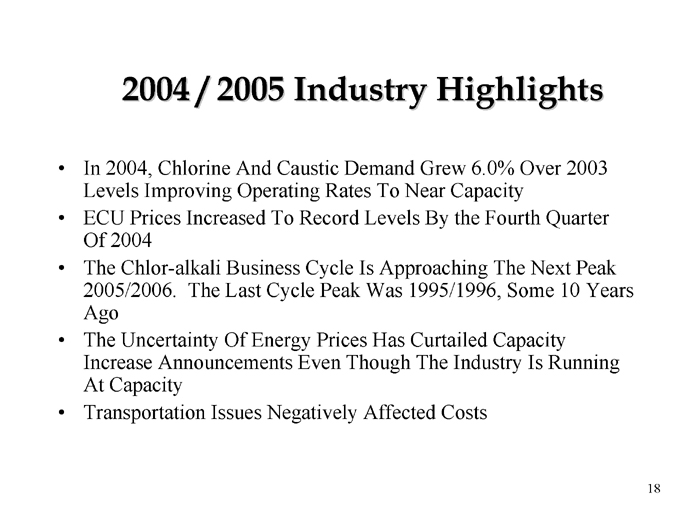

2004 / 2005 Industry Highlights

In 2004, Chlorine And Caustic Demand Grew 6.0% Over 2003 Levels Improving Operating Rates To Near Capacity ECU Prices Increased To Record Levels By the Fourth Quarter Of 2004 The Chlor-alkali Business Cycle Is Approaching The Next Peak 2005/2006. The Last Cycle Peak Was 1995/1996, Some 10 Years Ago The Uncertainty Of Energy Prices Has Curtailed Capacity Increase Announcements Even Though The Industry Is Running At Capacity Transportation Issues Negatively Affected Costs

18

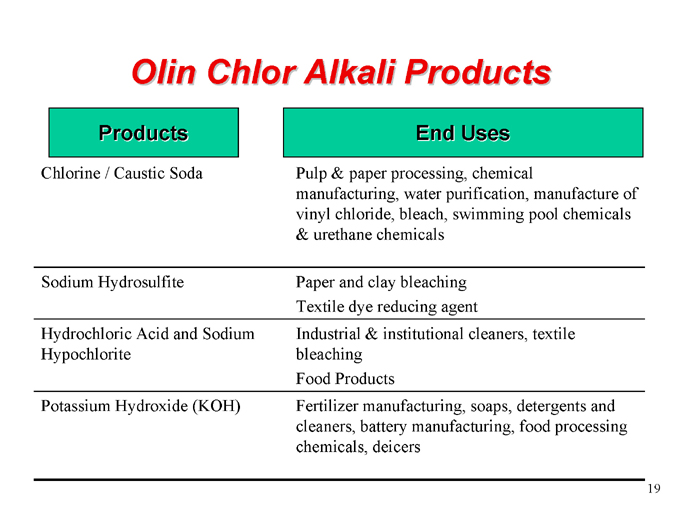

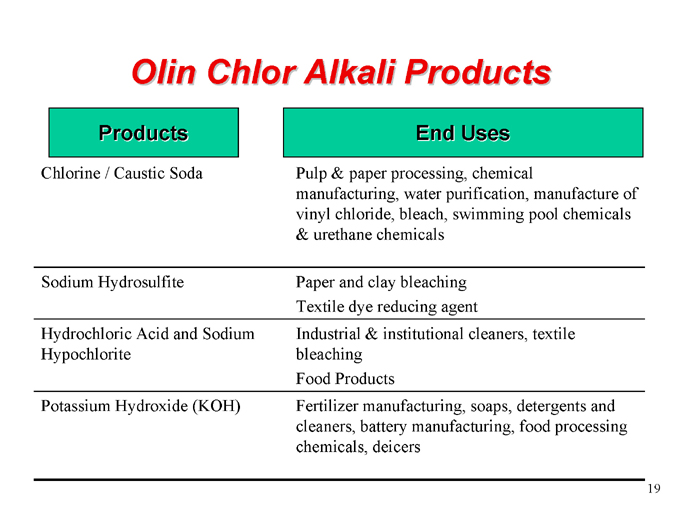

Olin Chlor Alkali Products

Products End Uses

Chlorine / Caustic Soda Pulp & paper processing, chemical manufacturing, water purification, manufacture of vinyl chloride, bleach, swimming pool chemicals & urethane chemicals

Sodium Hydrosulfite Paper and clay bleaching Textile dye reducing agent

Hydrochloric Acid and Sodium Industrial & institutional cleaners, textile Hypochlorite bleaching Food Products Potassium Hydroxide (KOH) Fertilizer manufacturing, soaps, detergents and cleaners, battery manufacturing, food processing chemicals, deicers

19

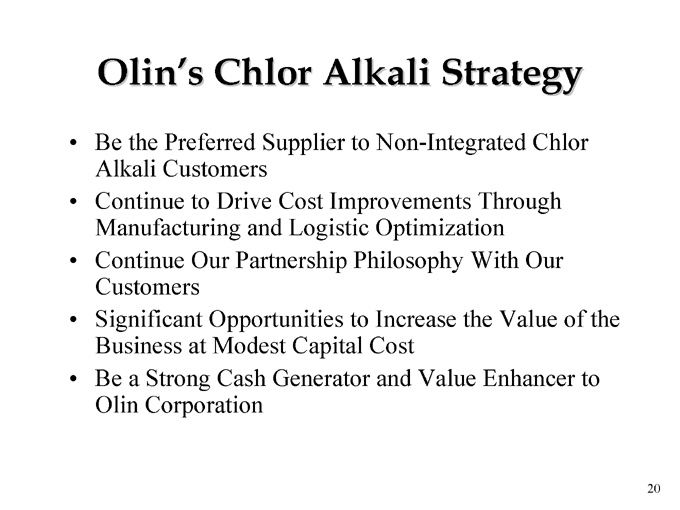

Olin’s Chlor Alkali Strategy

Be the Preferred Supplier to Non-Integrated Chlor Alkali Customers Continue to Drive Cost Improvements Through Manufacturing and Logistic Optimization Continue Our Partnership Philosophy With Our Customers Significant Opportunities to Increase the Value of the Business at Modest Capital Cost Be a Strong Cash Generator and Value Enhancer to Olin Corporation

20

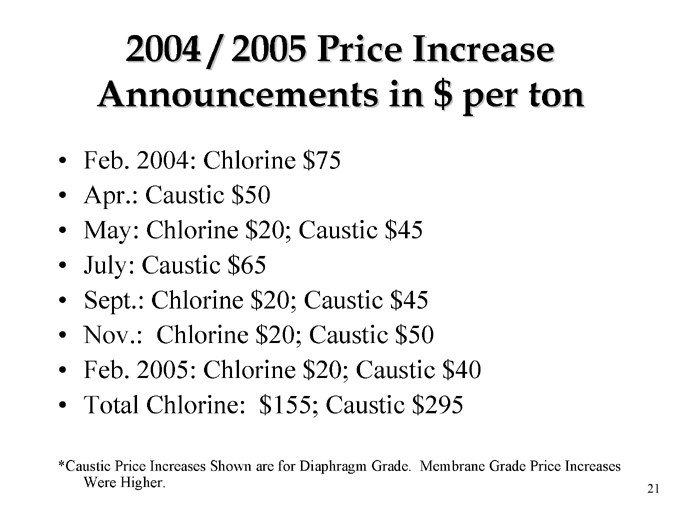

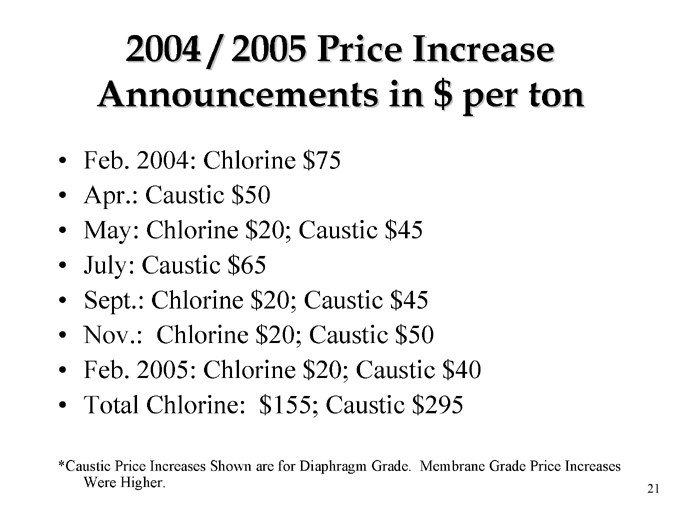

2004 / 2005 Price Increase Announcements in $ per ton

Feb. 2004: Chlorine $75 Apr.: Caustic $50 May: Chlorine $20; Caustic $45 July: Caustic $65 Sept.: Chlorine $20; Caustic $45 Nov.: Chlorine $20; Caustic $50 Feb. 2005: Chlorine $20; Caustic $40 Total Chlorine: $155; Caustic $295

*Caustic Price Increases Shown are for Diaphragm Grade. Membrane Grade Price Increases

Were Higher. 21

Impact Of High Chlorine Prices On Chlor Alkali Profitability

Chlorine Buyers are Highly Concentrated Some Large Chlorine Buyers Have Contractual Caps and /or Discounts Which Dampen Impact of Price Increases at High End of Contract Range Chlorine Contracts are Multi-Year and Recognize Cycle Pricing Trends Olin Has Been Able to Increase Chlorine Selling Prices Above Our Historical Highs

22

Caustic Price Increases Are A Key to Higher ECU Values

Historically, Olin’s Chlor Alkali Business Has Seen Peak Earnings During Times of High Caustic Prices Caustic Customers are Smaller and More Numerous Caustic Demand Improvement Normally Lags Chlorine by Six Months Olin Sells 10% More Caustic Than Chlorine Proximity to Customers Creates a Freight Advantage

23

Metals Olin is Leading Manufacturer of Copper Alloy Strip and Brass Rod in the U.S. Large Size Provides Economies of Scale and Manufacturing Efficiencies Olin Possesses Leading Technology Position Olin is the Leading Copper Based Sheet and Strip Distributor in the U.S.

24

Metals

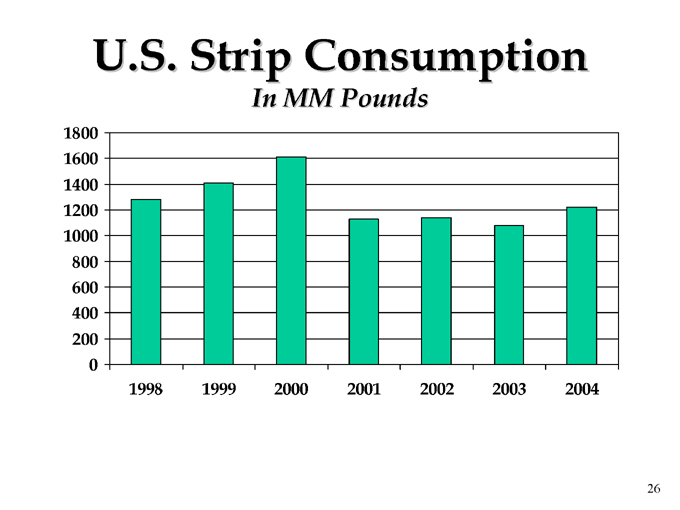

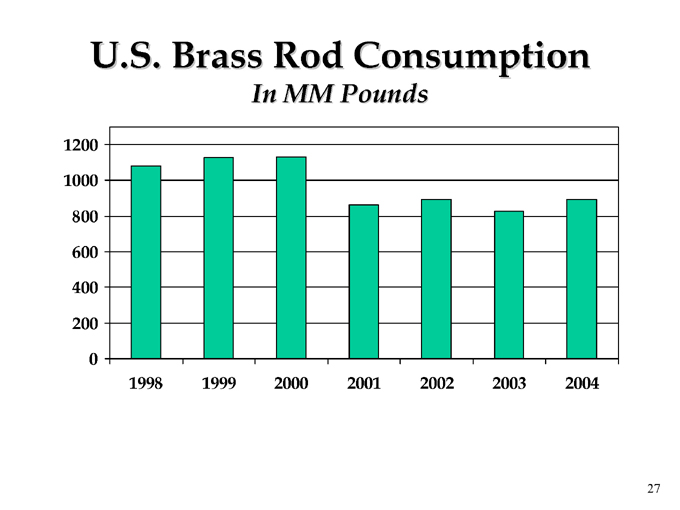

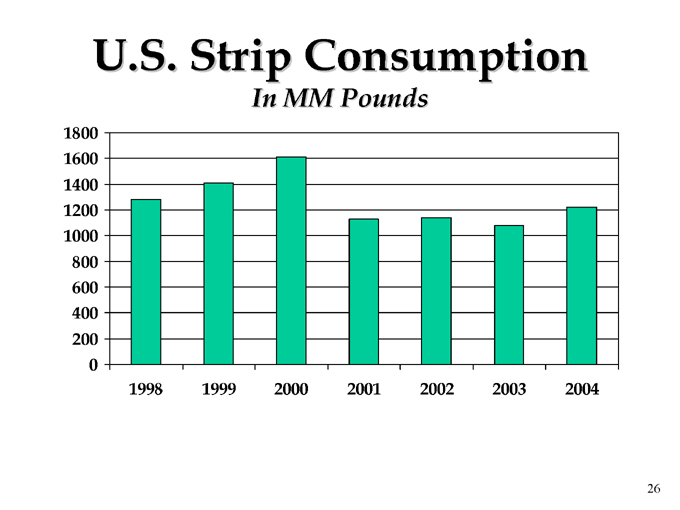

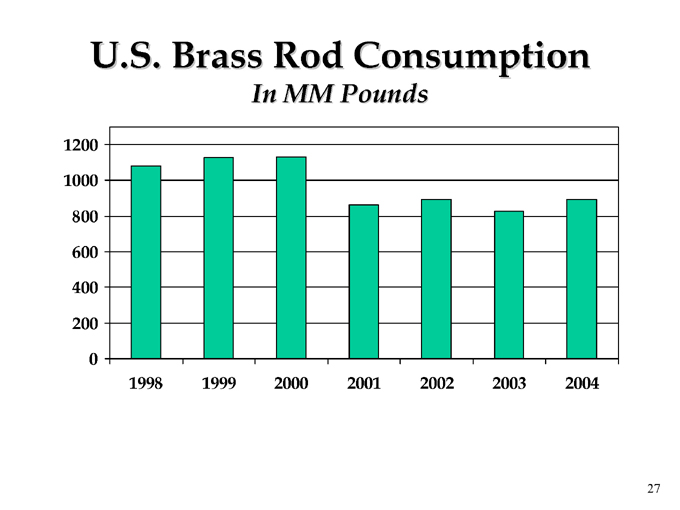

Earnings Leverage as a Result of Cost Cutting and Capacity Rationalization As the Following Slides Show, 2001, 2002 and 2003 Were Well Below Historical Consumption In 2004, Demand Increased Over 2003 for Both Sheet and Rod Products by 13% and 8%, Respectively

25

U.S. Strip Consumption

In MM Pounds

1800 1600 1400 1200 1000 800 600 400 200 0

1998 1999 2000 2001 2002 2003 2004

26

U.S. Brass Rod Consumption

In MM Pounds

1200 1000 800 600 400 200

0

1998 1999 2000 2001 2002 2003 2004

27

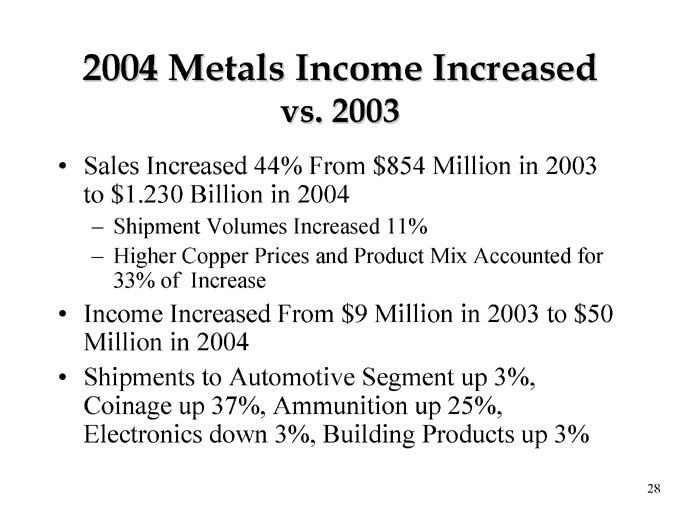

2004 Metals Income Increased

vs. 2003

Sales Increased 44% From $854 Million in 2003 to $1.230 Billion in 2004

Shipment Volumes Increased 11%

Higher Copper Prices and Product Mix Accounted for 33% of Increase

Income Increased From $9 Million in 2003 to $50 Million in 2004 Shipments to Automotive Segment up 3%, Coinage up 37%, Ammunition up 25%, Electronics down 3%, Building Products up 3%

28

Metals First Quarter 2005 Results

Industry Demand Was Down by 7% Each for Strip and Rod Olin’s Total Strip and Rod Demand Was Down 4% Metals Segment Income Decreased from $14.6 MM in 1Q’04 to $13.7 MM in 1Q’05

29

Winchester Products

Products End Uses

Winchester ® sporting Hunters & recreational shooters, law enforcement ammunition — shot-shells, agencies small caliber centerfire & rimfire ammunition

Small caliber military Infantry and mounted weapons ammunition

Industrial products — 8 Maintenance applications in power & concrete gauge loads & powder- industries, powder-actuated tools in construction actuated tool loads industry

30

Winchester 1Q’05 Results

Sales Up 11.5% From 1Q’04 Primarily Due to Higher Military and Law Enforcement Demand Higher Sales Volumes and Selling Prices More than Offset by Increased Commodity Costs 1Q Income Was $3.4 Million in 2005 Compared to $6.1 Million in 2004

31

Rimfire

To Improve Its Competitive Position, Winchester is Relocating Its Rimfire Manufacturing Operation from East Alton to Oxford, MS.

Expect New Facility to be Operational in Second Quarter 2005

32

Winchester’s Military Business Is Growing

In May 2004, Winchester Began Deliveries Of 5.56MM M855 Ball Ammunition As Part Of A $18 Million Contract. Winchester Was Awarded A $6.5 Million Contract By The US Army To Produce 7.62MM M80 Ball Linked Ammunition With Deliveries Beginning In 2005 And Continuing Through A Portion Of 2006.

33

Winchester Potential Second Source for US Army

The Contract Is Being Competitively Bid Olin’s Winchester Division Is Bidding As Part Of The General Dynamics Team Second Source Contract Could Generate $150 Million Of Revenue Per Year According to Military Estimates Contract Award Expected in June 2005

34

Financial Highlights

In February, 2004 Issued $178 Million of Common Stock to Strengthen Balance Sheet and Increase Financial Flexibility $125 Million Pension Contribution Made in February 2004 Additional $43 Million Voluntary Contribution in September 2004 Repaid $27 Million of Debt in 2004 and Expected to Repay $52 Million in 2005

35

Financial Highlights

(continued)

2005 Pension Expense Expected to Increase by Approximately $16 Million Over 2004 Projected 2005 Effective Tax Rate of 39% Commitment to Investment Grade Credit Rating Capital Spending Levels Expected to Be in Line With Depreciation in 2005

36

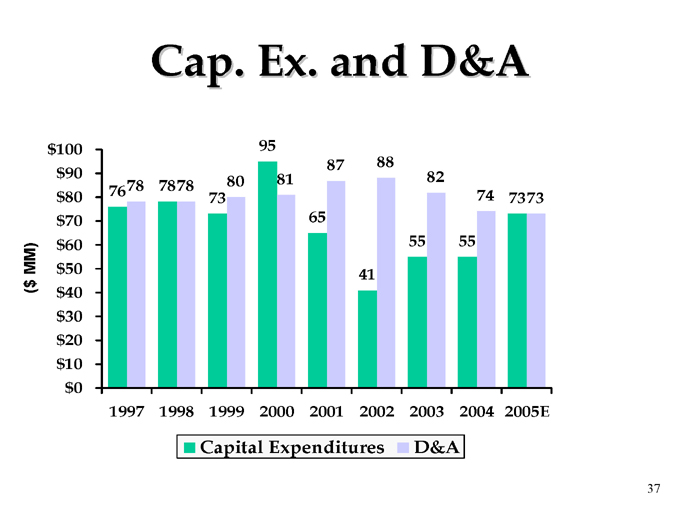

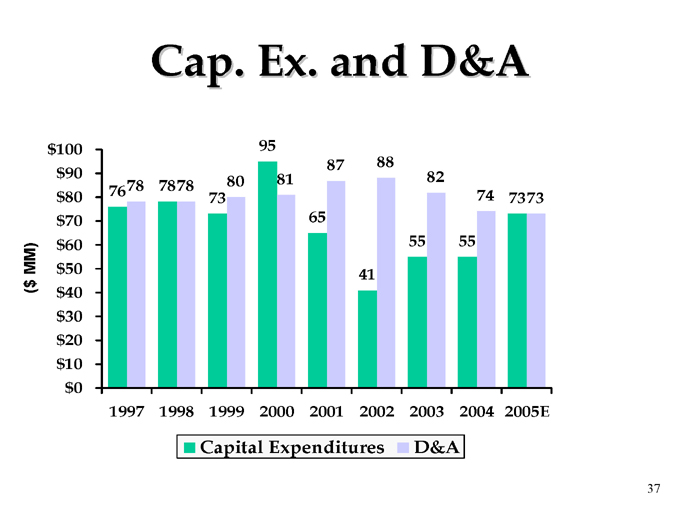

Cap. Ex. and D&A

$100 95

87 88

$90 81 82

78 7878 80

$80 76 73 74 7373

$70 65

$60 55 55

MM) $50

41 $

($ 40 $30 $20 $10 $0

1997 1998 1999 2000 2001 2002 2003 2004 2005E

Capital Expenditures D&A

37

Investment Rationale

Potential for Improved Performance Based On:

Expected Record ECU Prices

Metals Results Will Depend on Demand In Key Sectors of the Economy Such as Automotive, Electronics, Coinage, Building Products, Ammunition, and Industrial Construction Winchester Participation in Increased Military Spending

strong financial discipline Commitment to Investment Grade Rating Dividend for 314 Consecutive Quarters

Yield @ $16.00 = 5%; @ $20.00 = 4%; @$24.00 = 3.3%;

38

Forward-Looking Statements

This presentation contains estimates of future performance, which are forward-looking statements and results could differ materially from those anticipated in the forward-looking statements. Some of the factors that could cause actual results to differ are described in the business and outlook sections of Olin’s Form 10-K for the year ended December 31, 2004 and in Olin’s First Quarter 2005 Earnings Release. These reports are filed with the U.S. Securities and Exchange Commission.

39

Proud Heritage … Promising Future

40