1st Quarter 2023 �Earnings Presentation April 25, 2023 Exhibit 99.2

Safe Harbor Statement Worthington Armstrong Joint Venture (“WAVE”). Disclosures in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation, those relating to future financial and operational results, expected savings from cost management initiatives, the performance of our WAVE1 joint venture, market and broader economic conditions and guidance. Those statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. This includes annual guidance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that could cause our actual results to differ materially from those projected, anticipated or implied is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Form 10-K and 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”), including the Form 10-Q for the three months ended March 31, 2023, that the Company expects to file today. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. In addition, we will be referring to non-Generally Accepted Accounting Principles (“GAAP”) financial measures within the meaning �of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance �with GAAP are included within this presentation and available on the Investor Relations page of our website at www.armstrongceilings.com. The guidance in this presentation is only effective as of the date given, April 25, 2023, and will not be updated or affirmed unless �and until we publicly announce updated or affirmed guidance.

Basis of Presentation Explanation The deferred compensation accruals are for cash and stock awards that will be recorded over each awards’ respective vesting period, as such payments are subject to the sellers’ and employees’ continued employment with the Company. Results throughout this presentation are presented on a normalized basis. We remove the impact of certain discrete expenses and income in certain measures including adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), adjusted diluted net earnings per share (“EPS”) and adjusted free cash flow. The Company excludes certain acquisition related expenses (i.e. – changes in the fair value of contingent consideration, deferred compensation accruals1, impact of adjustments related to the fair value of inventory) for recent acquisitions. The Company excludes all acquisition-related amortization from adjusted net earnings and in calculations of adjusted diluted EPS. Examples of other excluded items have included plant closures, restructuring charges and related costs, impairments, separation costs and other cost reduction initiatives, environmental site expenses and related insurance recoveries, endowment level charitable contributions, and certain other gains and losses. The Company also excludes income/expense from its U.S. Retirement Income Plan (“RIP”) in the non-GAAP results as it represents the actuarial net periodic benefit credit/cost recorded. Our tax rate may be adjusted for certain discrete items which are identified in the footnotes. Investors should not consider non-GAAP measures as a substitute for GAAP measures. Excluding adjusted diluted EPS, non-GAAP figures are rounded to the nearest million and corresponding percentages are based on unrounded figures. Operating Segments: “MF”: Mineral Fiber, “AS”: Architectural Specialties, “UC”: Unallocated Corporate All dollar figures throughout the presentation are in $ millions, expect per share data, and all comparisons are versus prior year unless otherwise noted. Figures may not sum due to rounding.

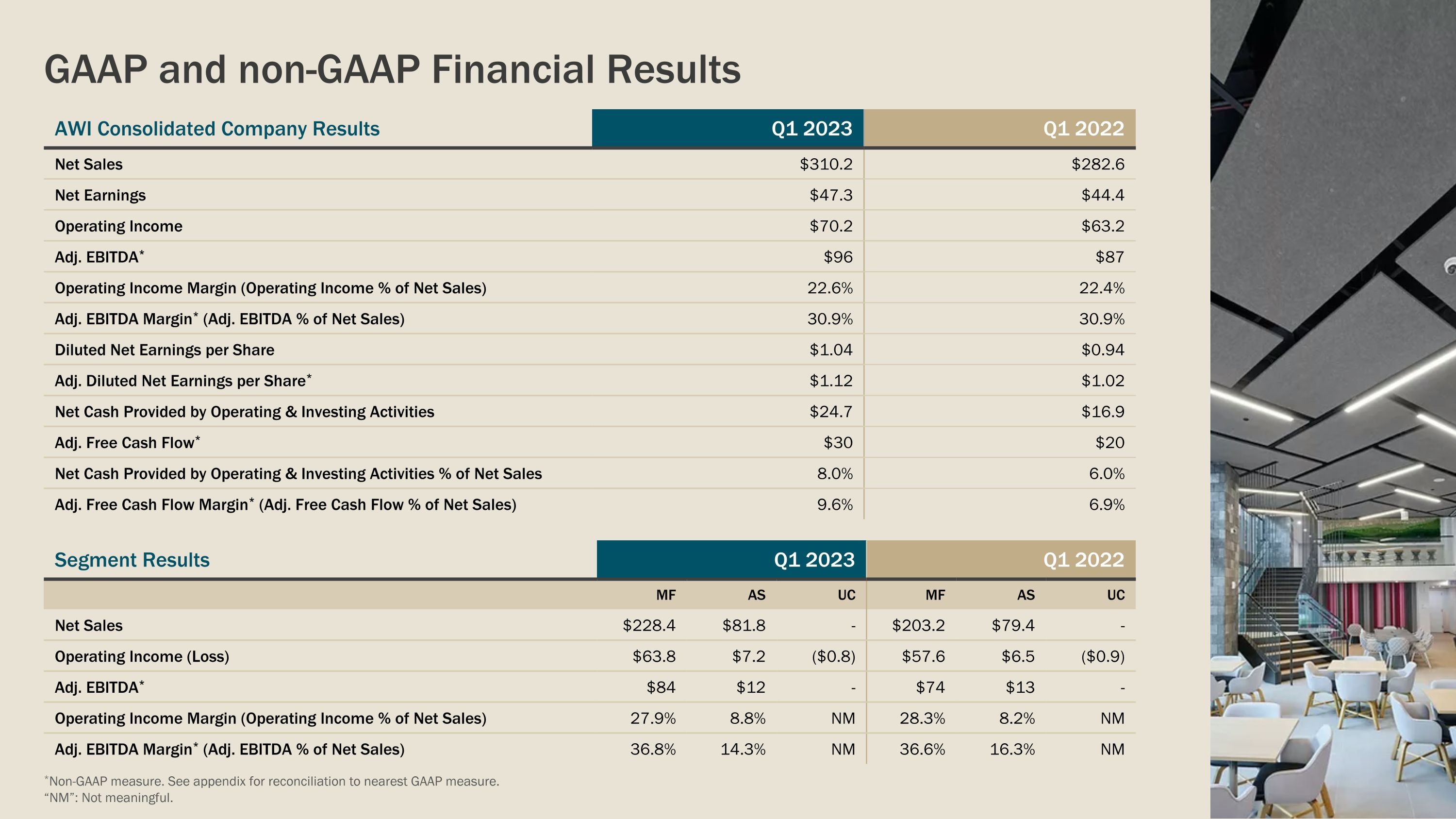

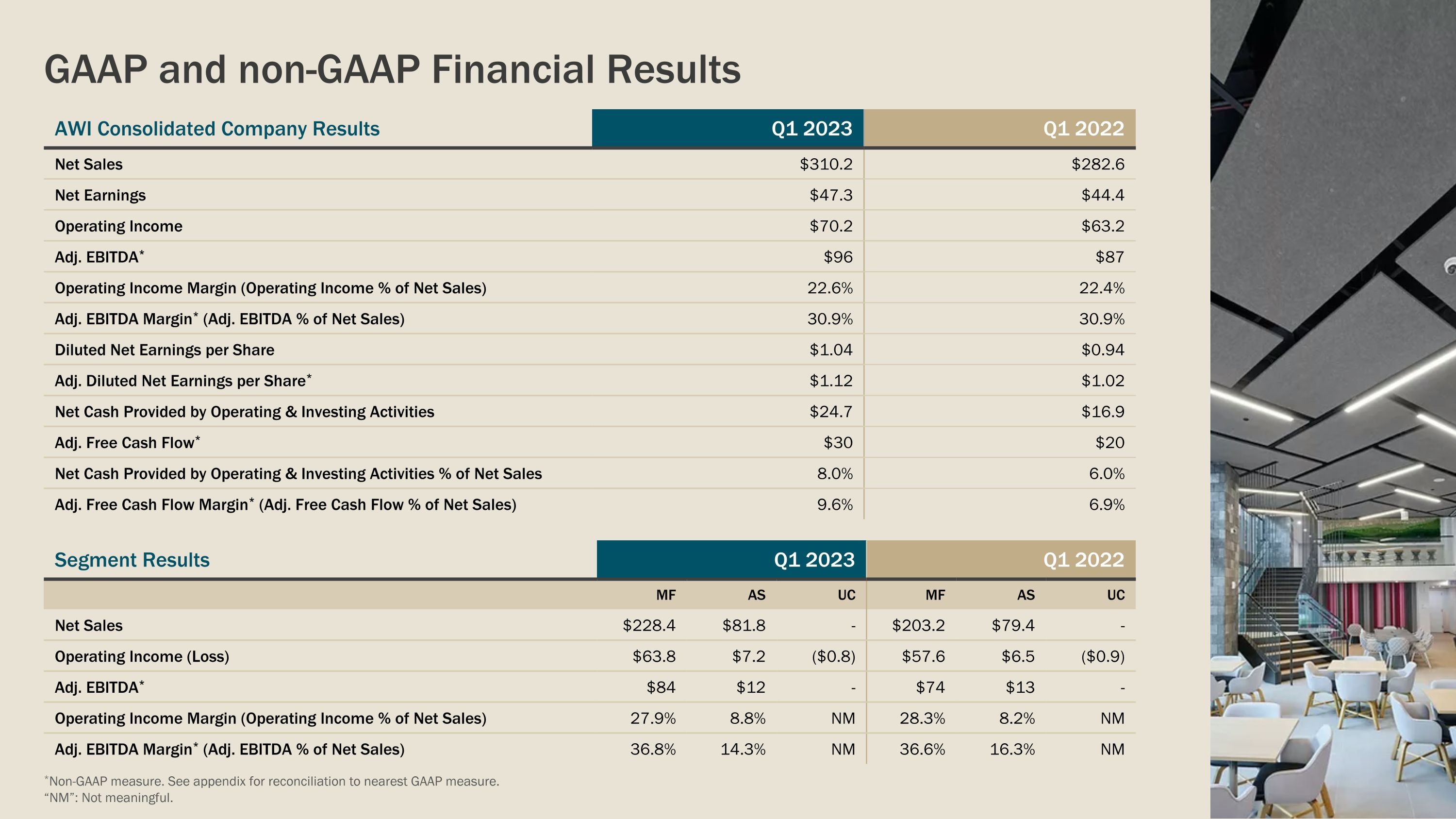

GAAP and non-GAAP Financial Results AWI Consolidated Company Results Q1 2023 Q1 2022 Net Sales $310.2 $282.6 Net Earnings $47.3 $44.4 Operating Income $70.2 $63.2 Adj. EBITDA* $96 $87 Operating Income Margin (Operating Income % of Net Sales) 22.6% 22.4% Adj. EBITDA Margin* (Adj. EBITDA % of Net Sales) 30.9% 30.9% Diluted Net Earnings per Share $1.04 $0.94 Adj. Diluted Net Earnings per Share* $1.12 $1.02 Net Cash Provided by Operating & Investing Activities $24.7 $16.9 Adj. Free Cash Flow* $30 $20 Net Cash Provided by Operating & Investing Activities % of Net Sales 8.0% 6.0% Adj. Free Cash Flow Margin* (Adj. Free Cash Flow % of Net Sales) 9.6% 6.9% Segment Results Q1 2023 Q1 2022 MF AS UC MF AS UC Net Sales $228.4 $81.8 - $203.2 $79.4 - Operating Income (Loss) $63.8 $7.2 ($0.8) $57.6 $6.5 ($0.9) Adj. EBITDA* $84 $12 - $74 $13 - Operating Income Margin (Operating Income % of Net Sales) 27.9% 8.8% NM 28.3% 8.2% NM Adj. EBITDA Margin* (Adj. EBITDA % of Net Sales) 36.8% 14.3% NM 36.6% 16.3% NM *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. “NM”: Not meaningful.

$310M (+10% VPY) Net Sales $96M (+9% VPY) Adj. EBITDA* $1.12 (+10% VPY) Adj. Diluted EPS* $30M (+52% VPY) Adj. Free Cash Flow* 1st Quarter 2023 Key Takeaways Solid Performance with Top & Bottom-Line Growth *Non-GAAP measure. See slide 4 and appendix for reconciliation to nearest GAAP measure. 1. Average Unit Value (“AUV”). Includes both like-for-like price and mix impacts. Net Sales up 10% �Driven by 12% Mineral Fiber sales growth and 3% AS sales growth Mineral Fiber segment Adj. EBITDA* up 13%�Driven by 9% volume growth, AUV1 improvement and positive WAVE contribution; EBITDA margin* expansion of 20 bps Architectural Specialties segment soft start to year�Driven by project timing headwinds; Adj. EBITDA* declined 10% Maintaining full-year 2023 guidance

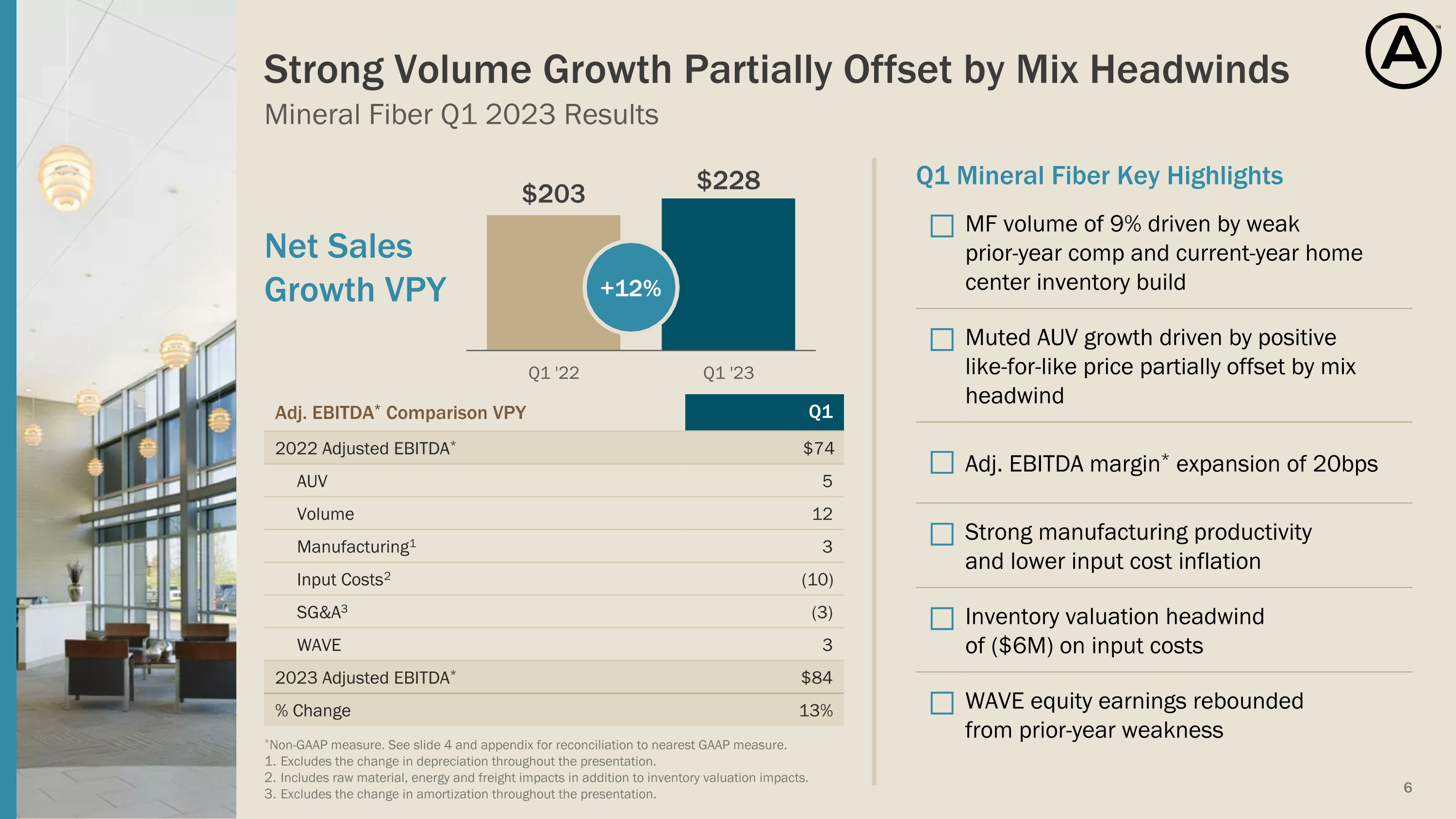

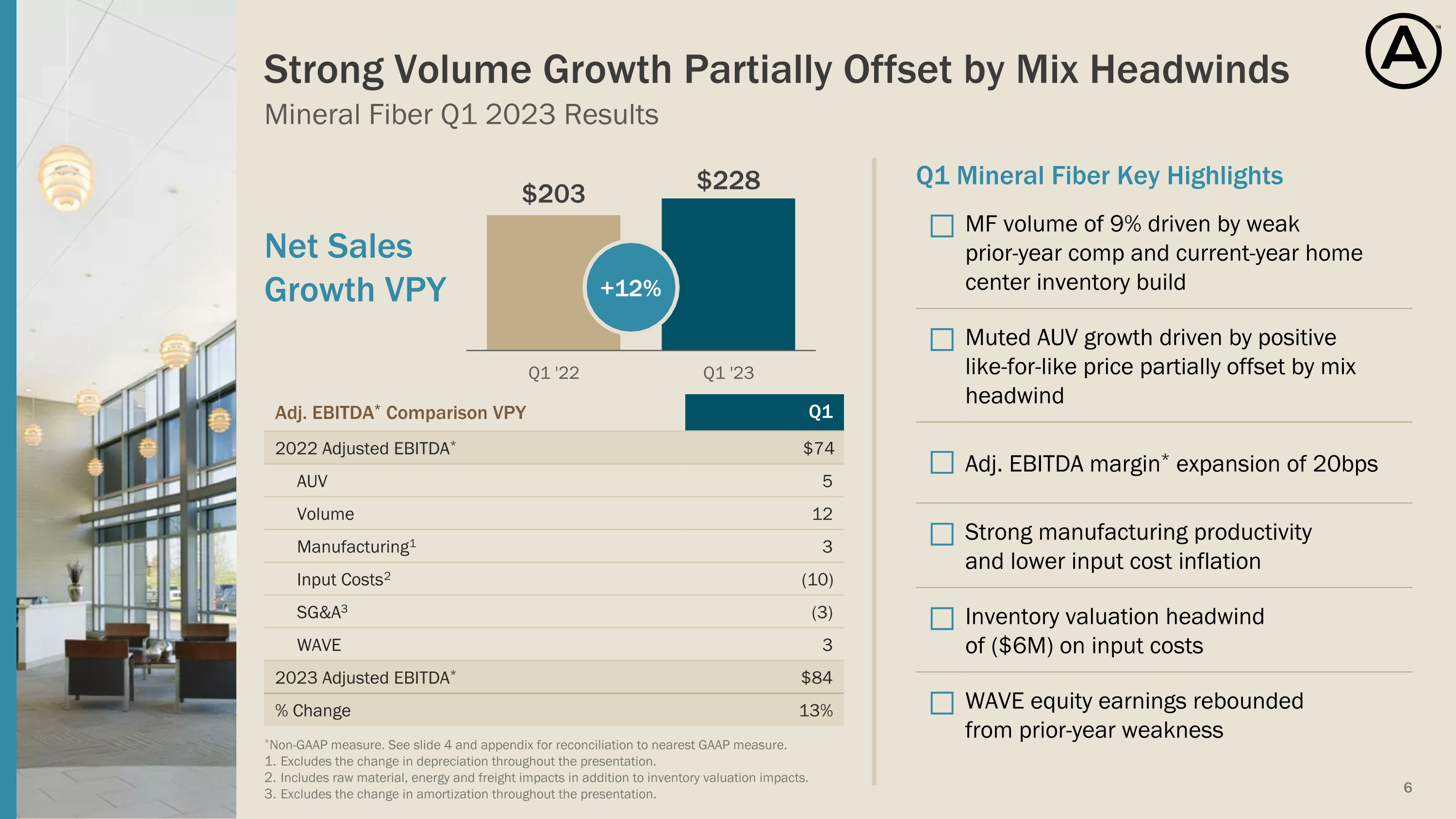

Mineral Fiber Q1 2023 Results Strong Volume Growth Partially Offset by Mix Headwinds *Non-GAAP measure. See slide 4 and appendix for reconciliation to nearest GAAP measure. Excludes the change in depreciation throughout the presentation. Includes raw material, energy and freight impacts in addition to inventory valuation impacts. Excludes the change in amortization throughout the presentation. Net Sales Growth VPY Q1 Mineral Fiber Key Highlights ● MF volume of 9% driven by weak �prior-year comp and current-year home center inventory build ● Muted AUV growth driven by positive like-for-like price partially offset by mix headwind ● Adj. EBITDA margin* expansion of 20bps ● Strong manufacturing productivity �and lower input cost inflation ● Inventory valuation headwind�of ($6M) on input costs ● WAVE equity earnings rebounded �from prior-year weakness Adj. EBITDA* Comparison VPY Q1 2022 Adjusted EBITDA* $74 AUV 5 Volume 12 Manufacturing1 3 Input Costs2 (10) SG&A3 (3) WAVE 3 2023 Adjusted EBITDA* $84 % Change 13% +12%

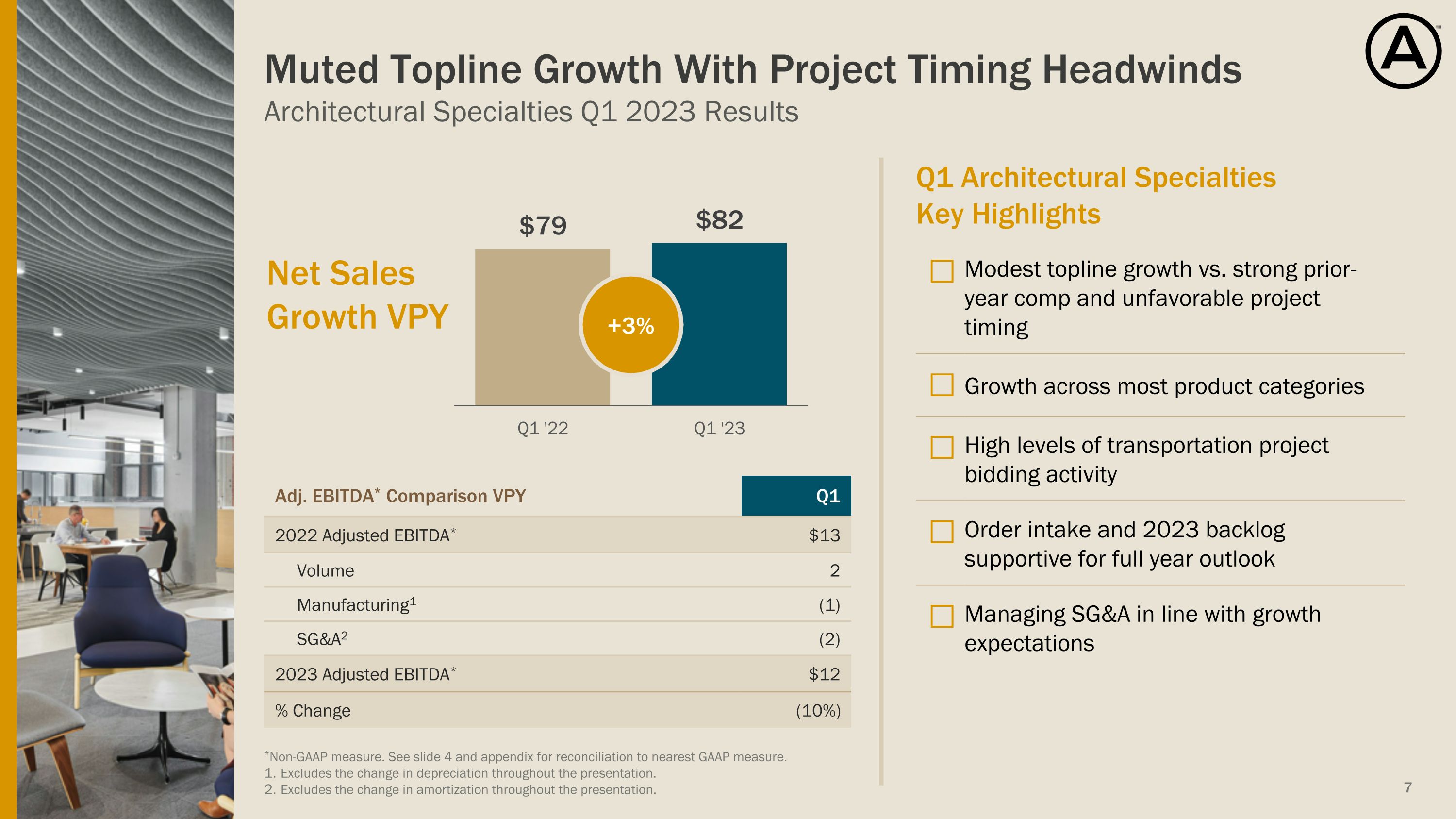

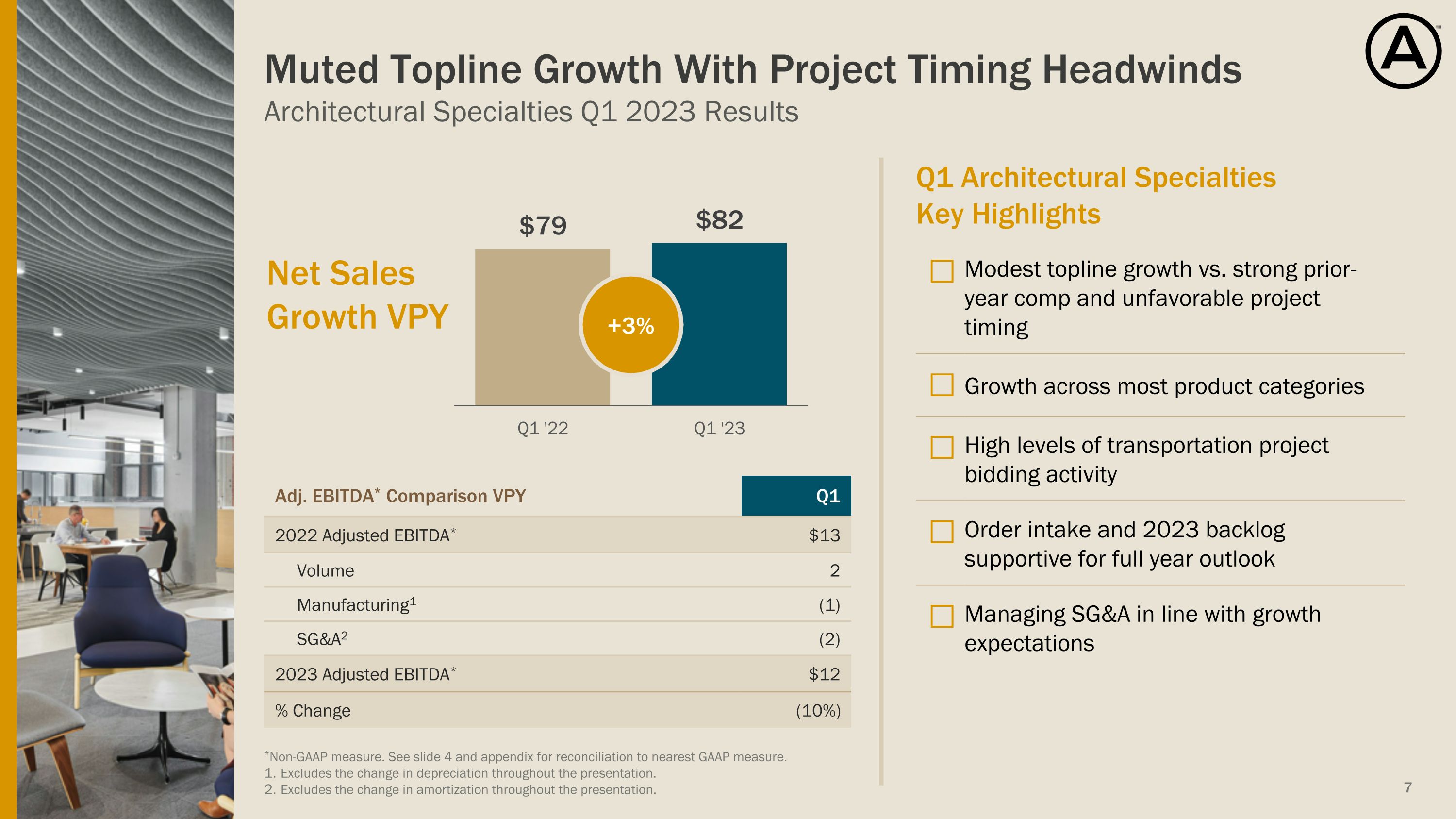

Architectural Specialties Q1 2023 Results Muted Topline Growth With Project Timing Headwinds Adj. EBITDA* Comparison VPY Q1 2022 Adjusted EBITDA* $13 Volume 2 Manufacturing1 (1) SG&A2 (2) 2023 Adjusted EBITDA* $12 % Change (10%) Q1 Architectural Specialties Key Highlights ● Modest topline growth vs. strong prior-year comp and unfavorable project timing ● Growth across most product categories ● High levels of transportation project bidding activity ● Order intake and 2023 backlog supportive for full year outlook ● Managing SG&A in line with growth expectations Net Sales Growth VPY +3% *Non-GAAP measure. See slide 4 and appendix for reconciliation to nearest GAAP measure. Excludes the change in depreciation throughout the presentation. Excludes the change in amortization throughout the presentation.

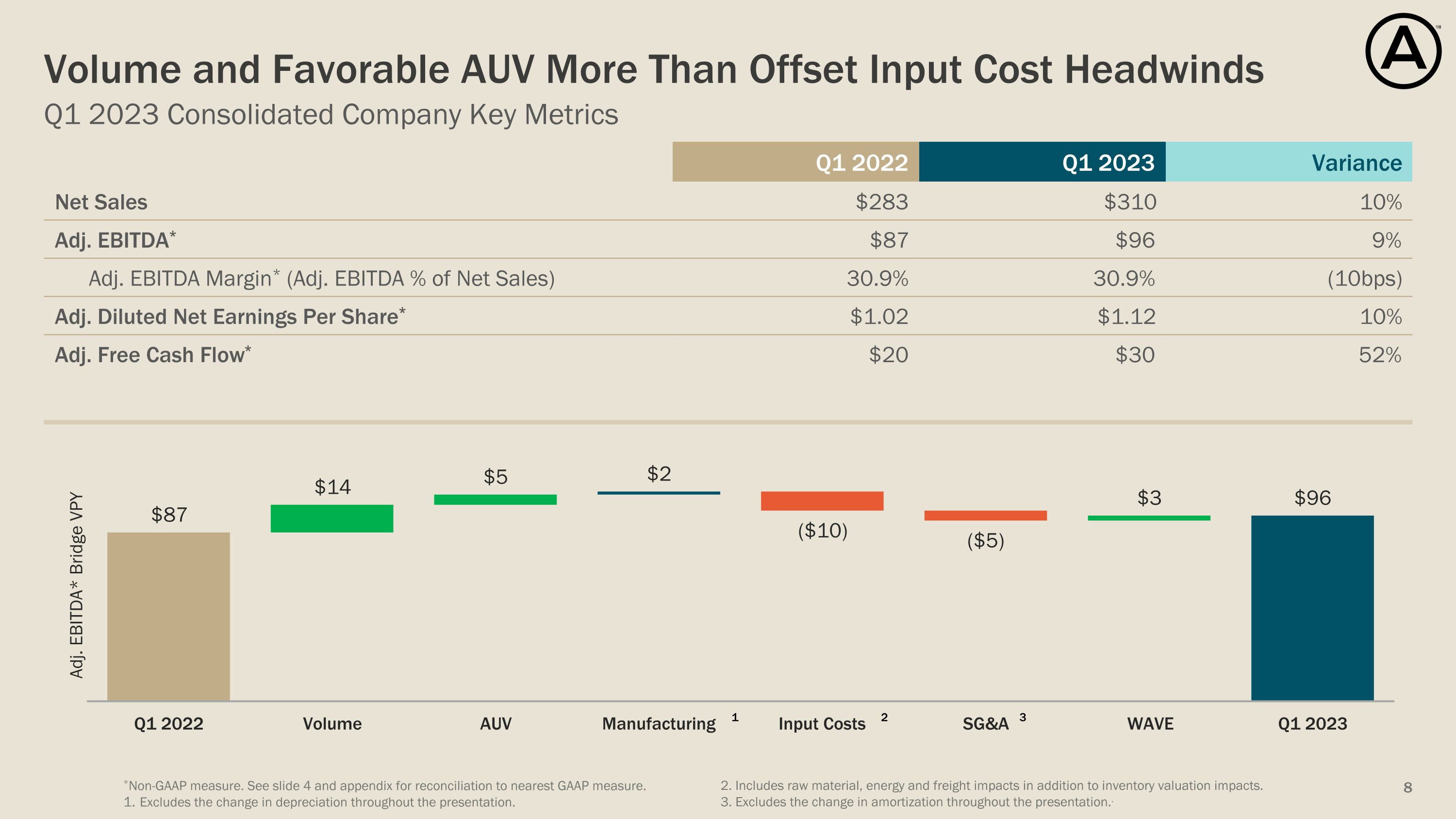

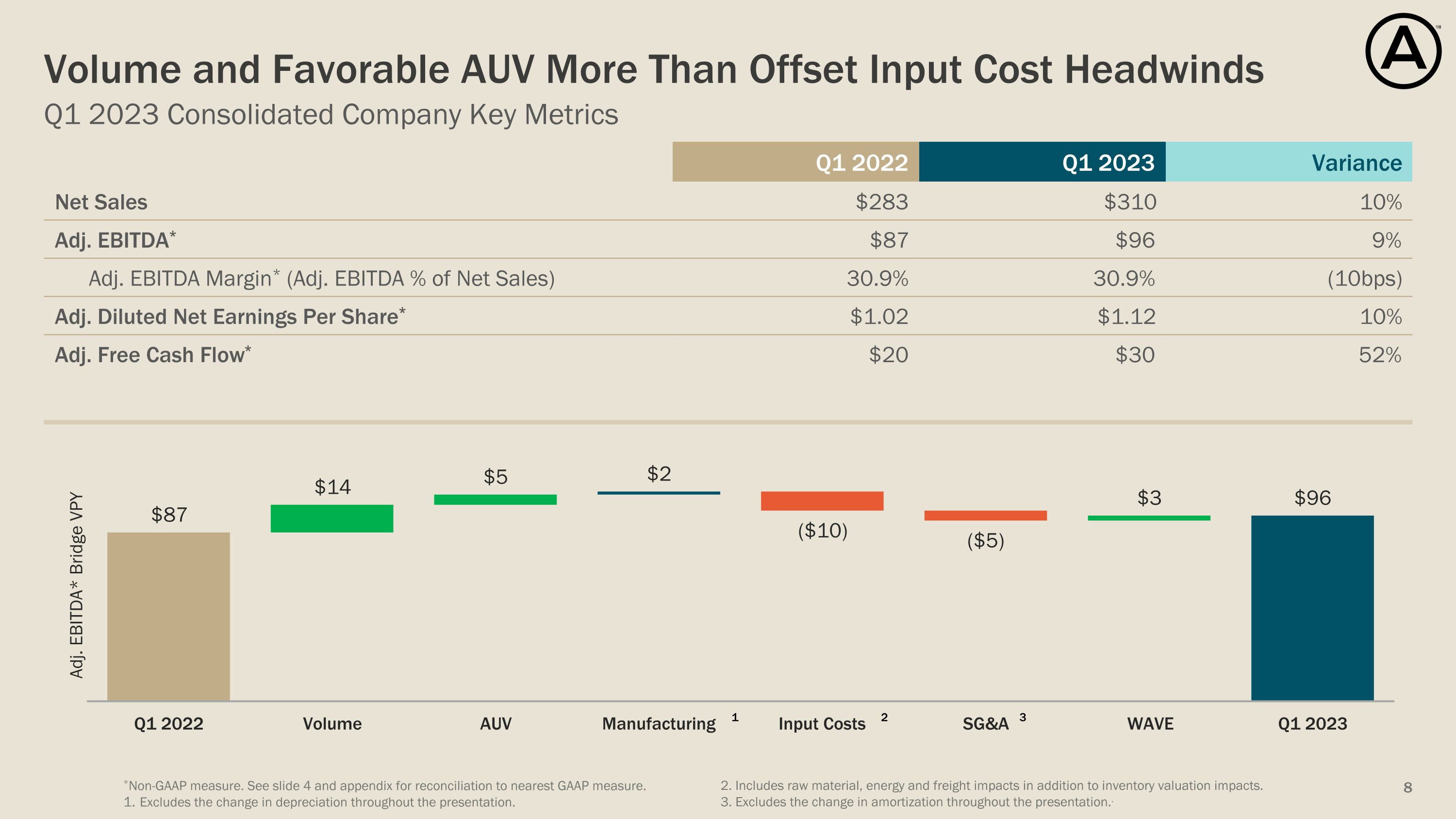

Q1 2023 Consolidated Company Key Metrics Volume and Favorable AUV More Than Offset Input Cost Headwinds Q1 2022 Q1 2023 Variance Net Sales $283 $310 10% Adj. EBITDA* $87 $96 9% Adj. EBITDA Margin* (Adj. EBITDA % of Net Sales) 30.9% 30.9% (10bps) Adj. Diluted Net Earnings Per Share* $1.02 $1.12 10% Adj. Free Cash Flow* $20 $30 52% *Non-GAAP measure. See slide 4 and appendix for reconciliation to nearest GAAP measure. Excludes the change in depreciation throughout the presentation. 2. Includes raw material, energy and freight impacts in addition to inventory valuation impacts. 3. Excludes the change in amortization throughout the presentation.. 1 2 3

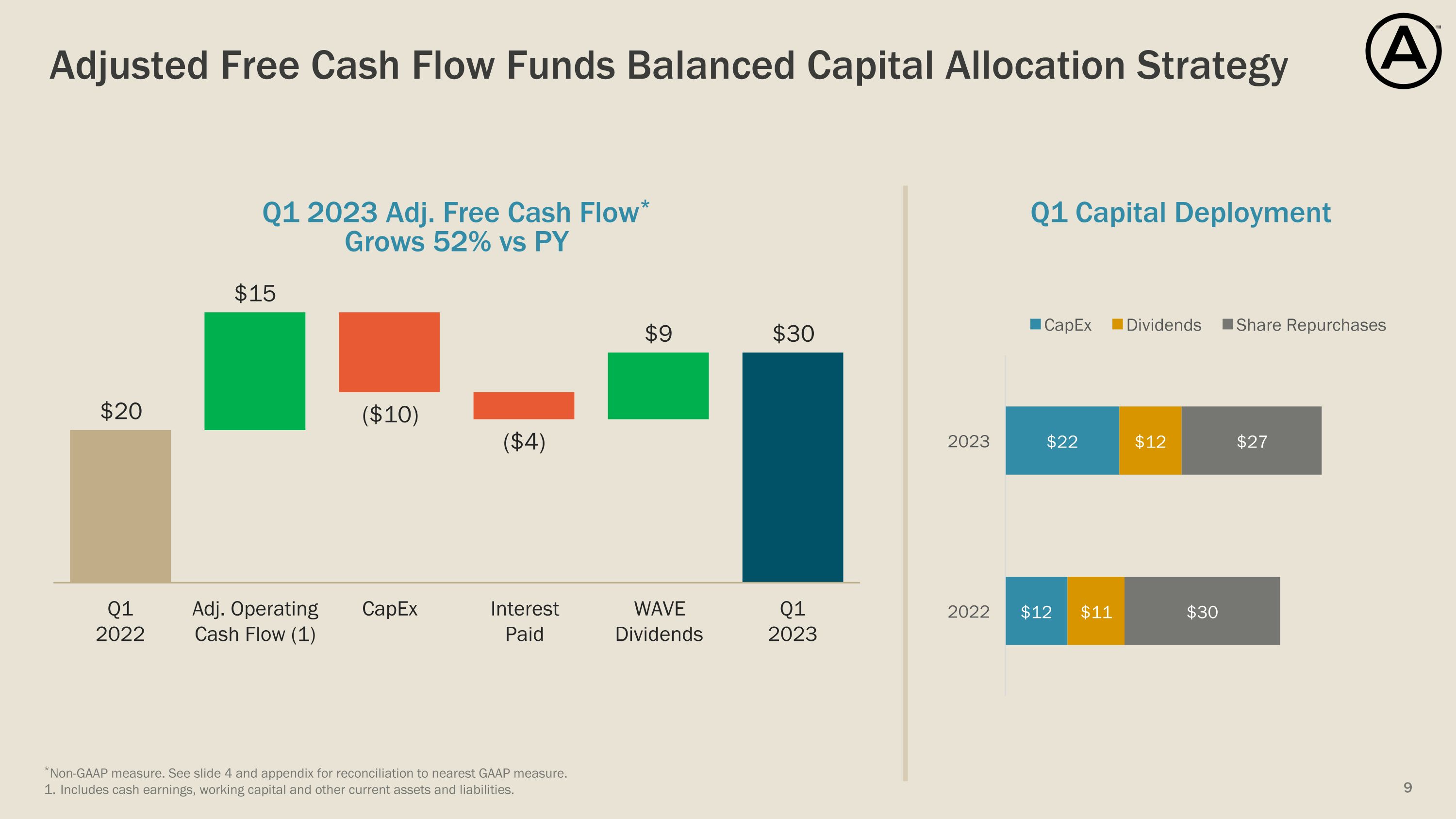

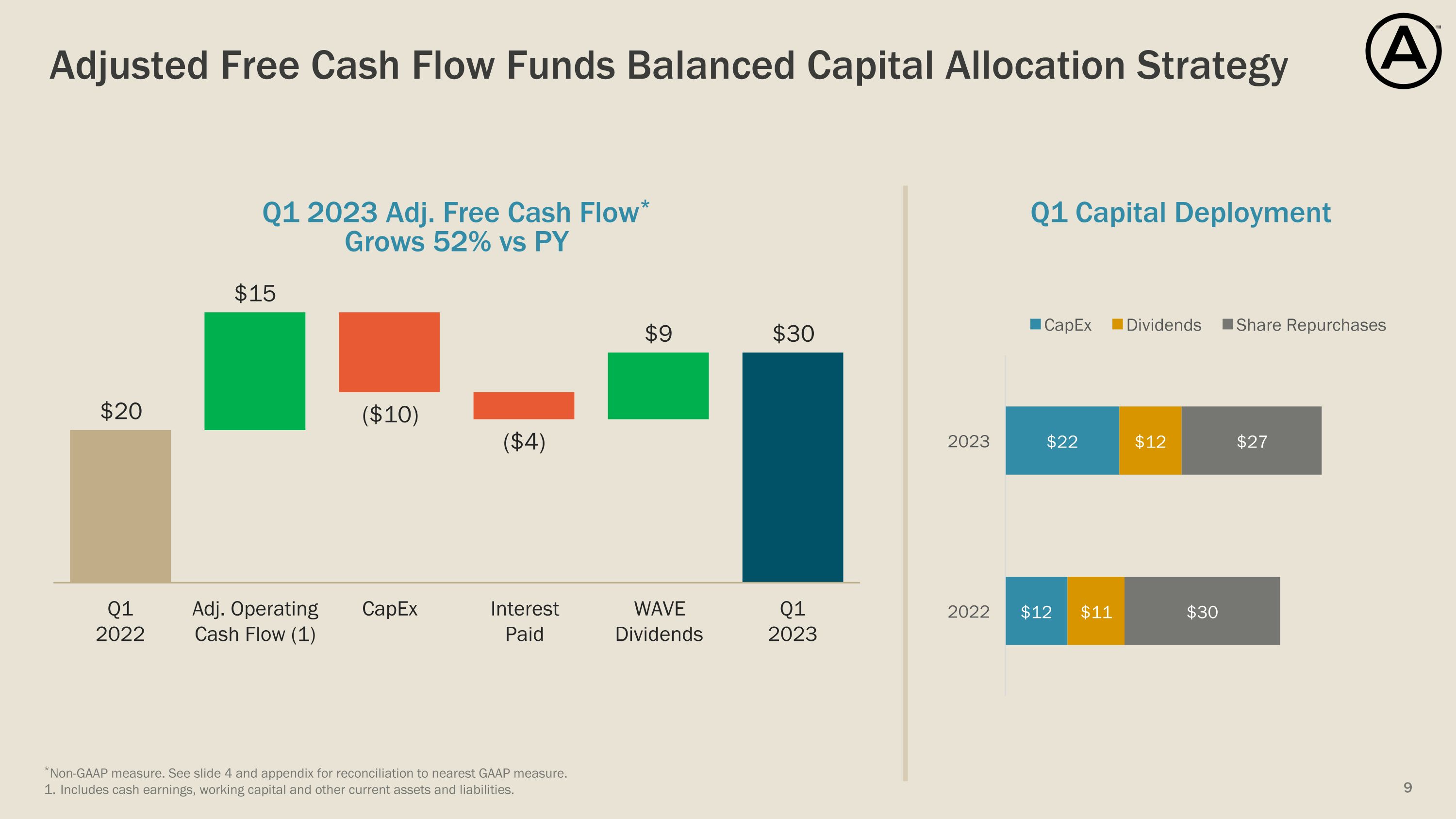

Adjusted Free Cash Flow Funds Balanced Capital Allocation Strategy *Non-GAAP measure. See slide 4 and appendix for reconciliation to nearest GAAP measure. Includes cash earnings, working capital and other current assets and liabilities. Q1 Capital Deployment Q1 2023 Adj. Free Cash Flow* �Grows 52% vs PY

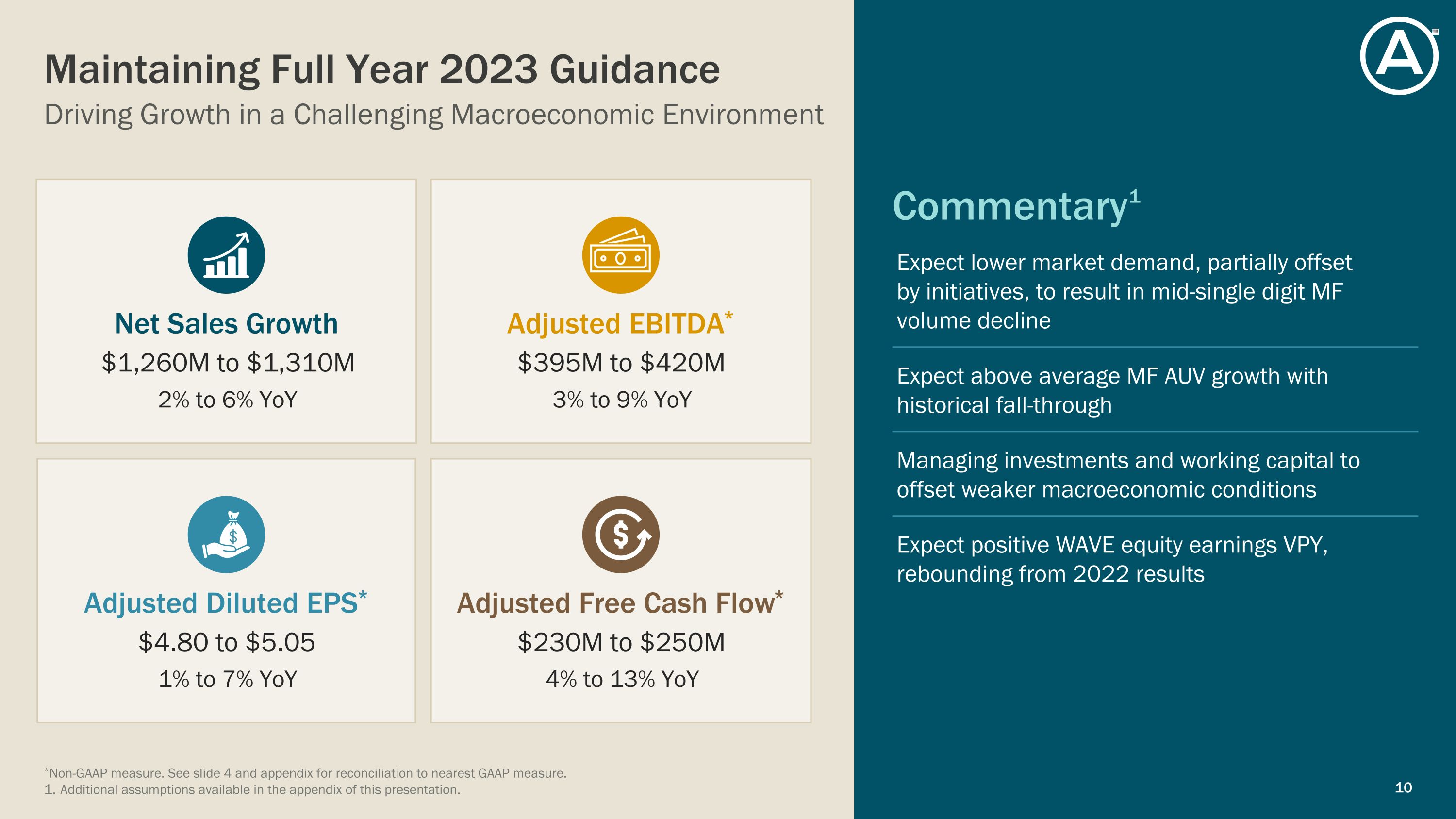

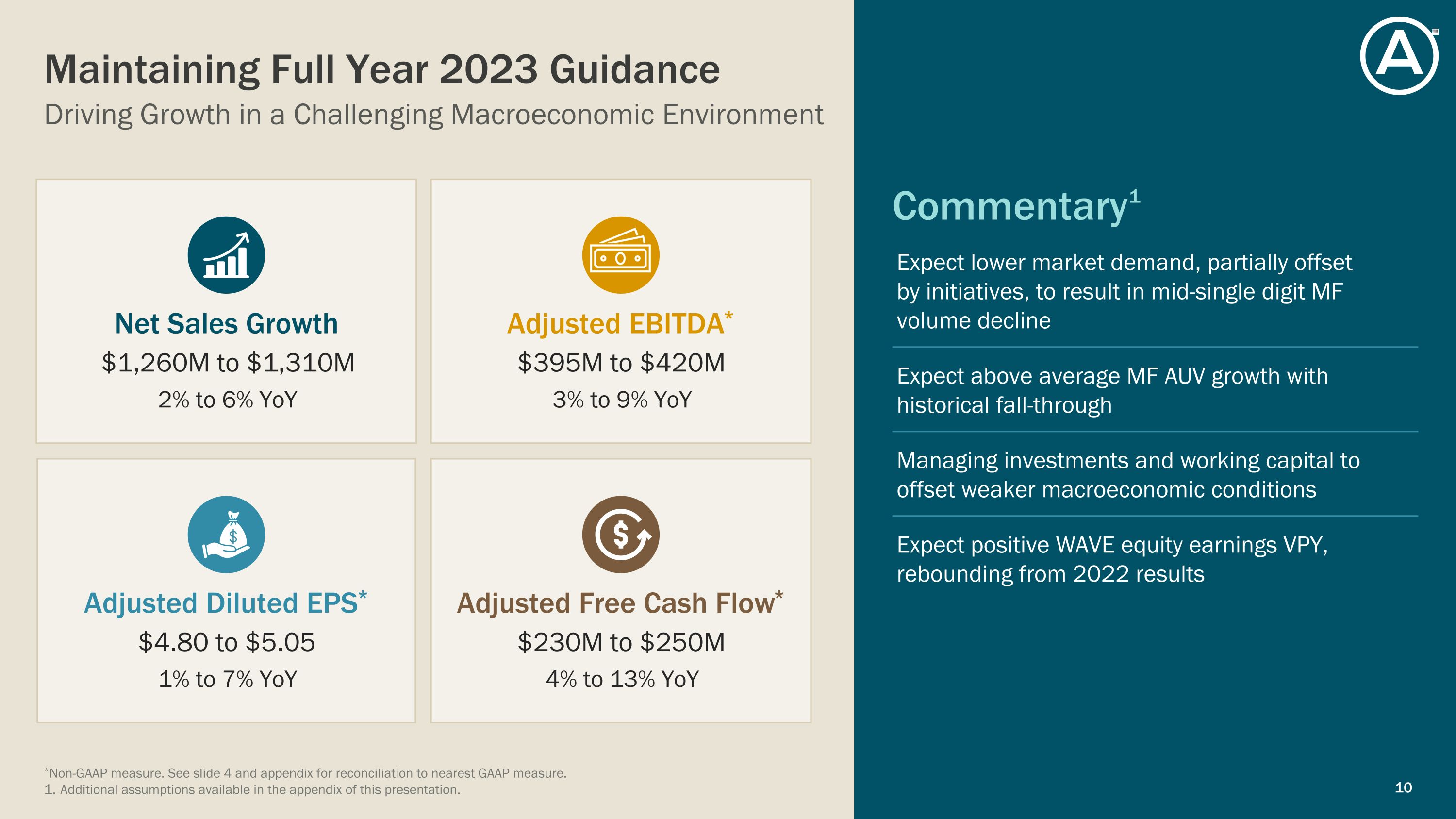

Driving Growth in a Challenging Macroeconomic Environment Maintaining Full Year 2023 Guidance Commentary1 $1,260M to $1,310M 2% to 6% YoY Net Sales Growth $4.80 to $5.05 1% to 7% YoY Adjusted Diluted EPS* $395M to $420M 3% to 9% YoY Adjusted EBITDA* $230M to $250M 4% to 13% YoY Adjusted Free Cash Flow* Expect lower market demand, partially offset�by initiatives, to result in mid-single digit MF volume decline Expect above average MF AUV growth with historical fall-through Managing investments and working capital to offset weaker macroeconomic conditions Expect positive WAVE equity earnings VPY, rebounding from 2022 results *Non-GAAP measure. See slide 4 and appendix for reconciliation to nearest GAAP measure. Additional assumptions available in the appendix of this presentation.

Appendix

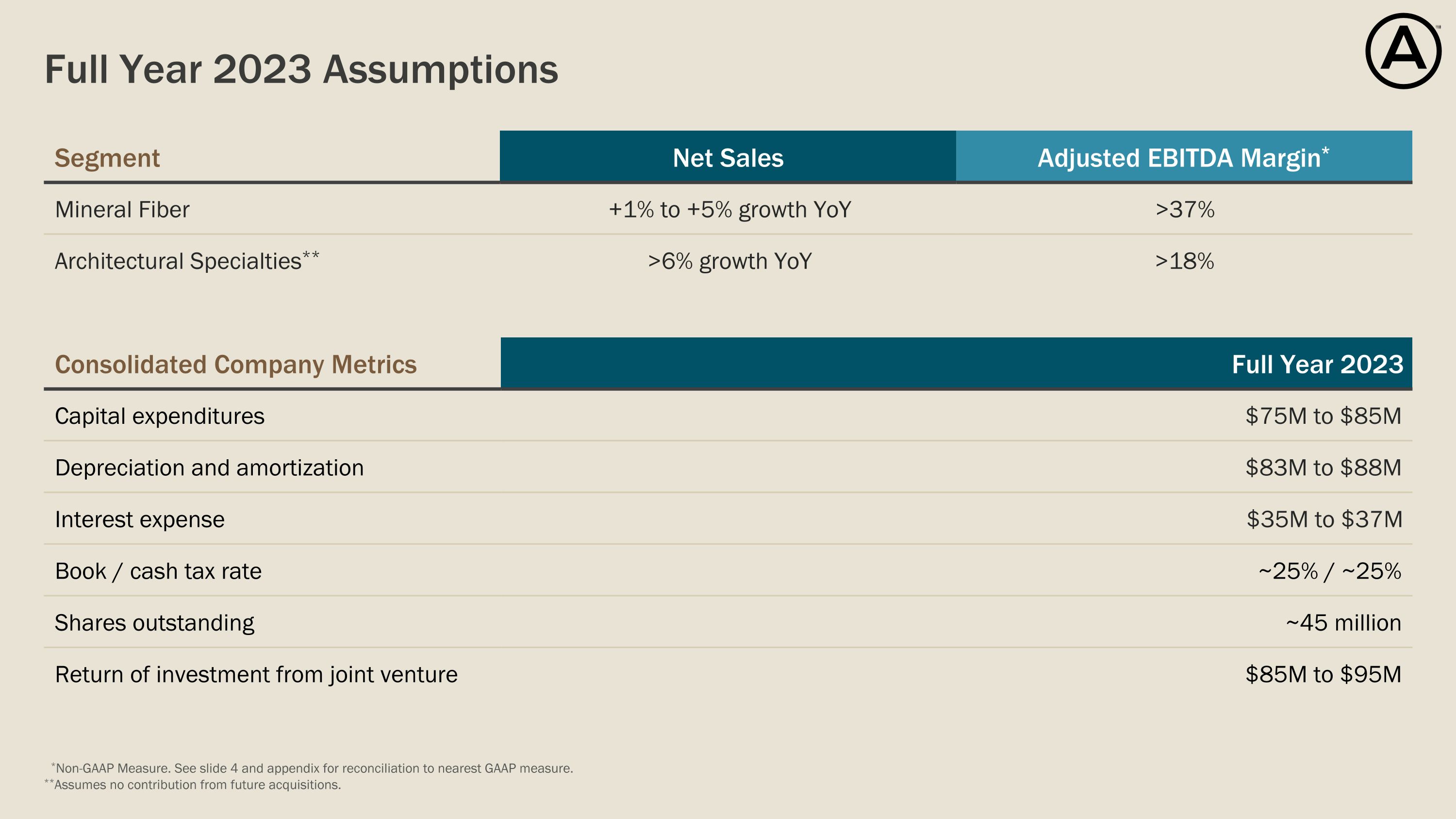

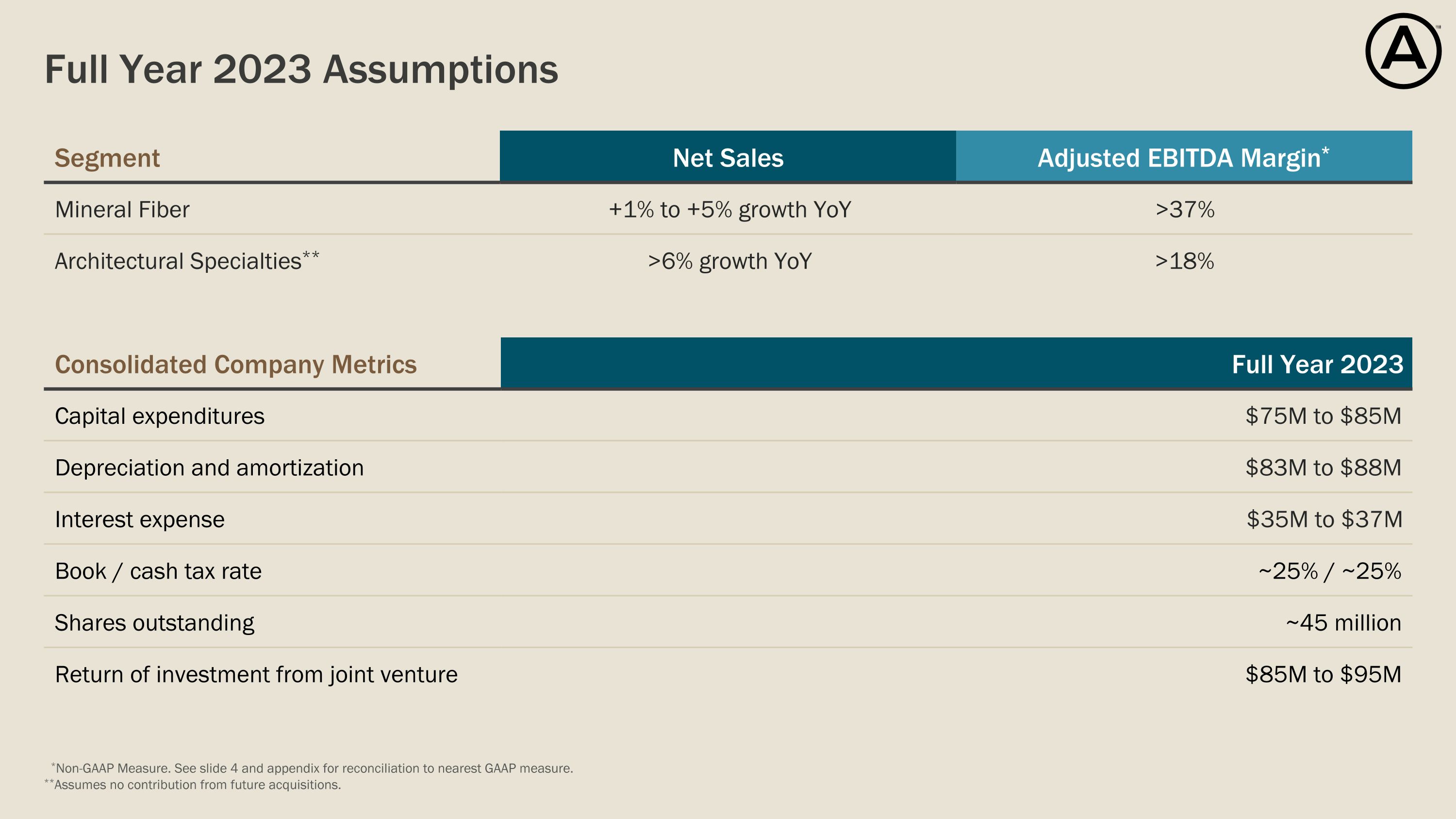

Full Year 2023 Assumptions *Non-GAAP Measure. See slide 4 and appendix for reconciliation to nearest GAAP measure. **Assumes no contribution from future acquisitions. Segment Net Sales Adjusted EBITDA Margin* Mineral Fiber +1% to +5% growth YoY >37% Architectural Specialties** >6% growth YoY >18% Consolidated Company Metrics Full Year 2023 Capital expenditures $75M to $85M Depreciation and amortization $83M to $88M Interest expense $35M to $37M Book / cash tax rate ~25% / ~25% Shares outstanding ~45 million Return of investment from joint venture $85M to $95M

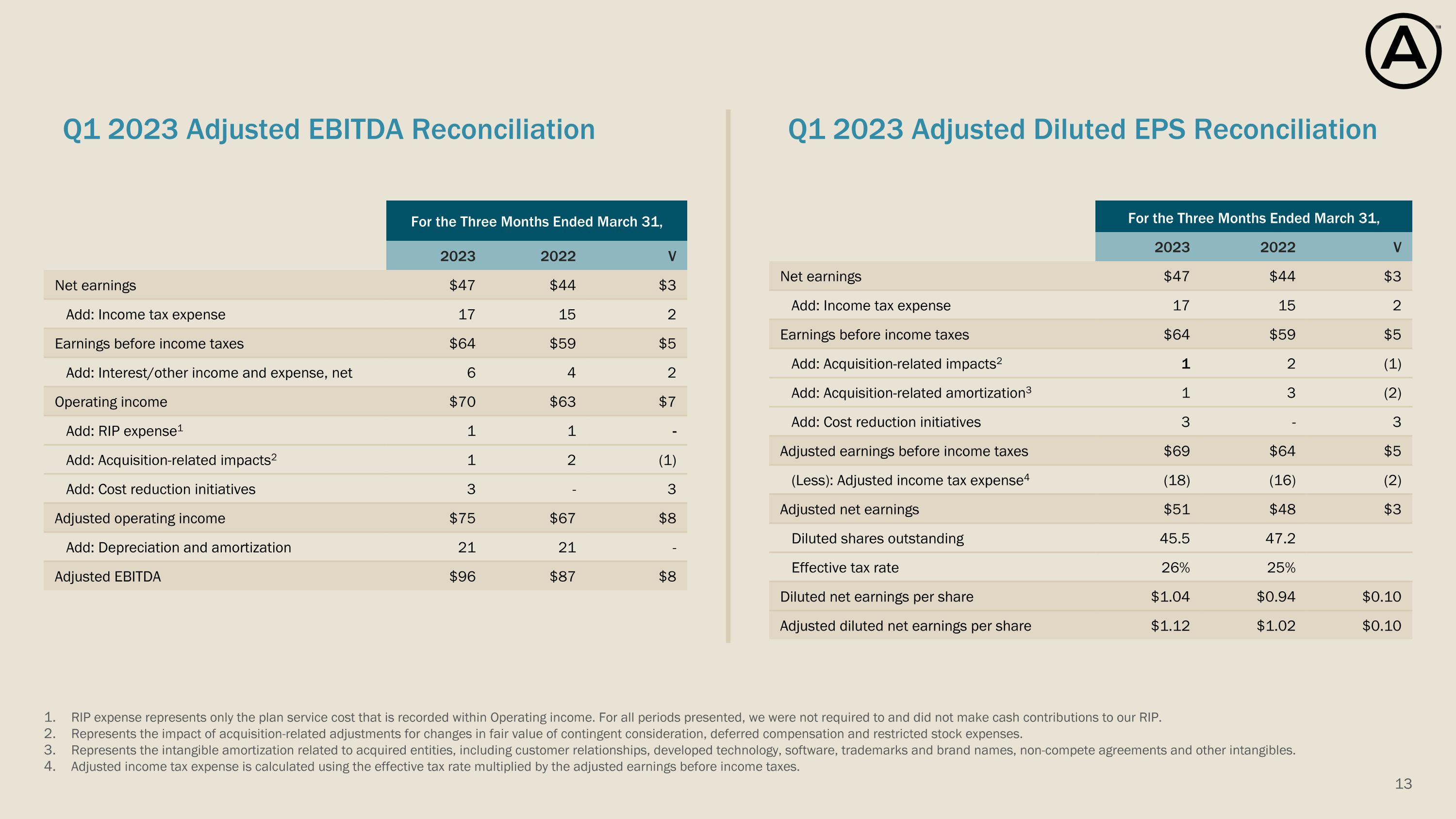

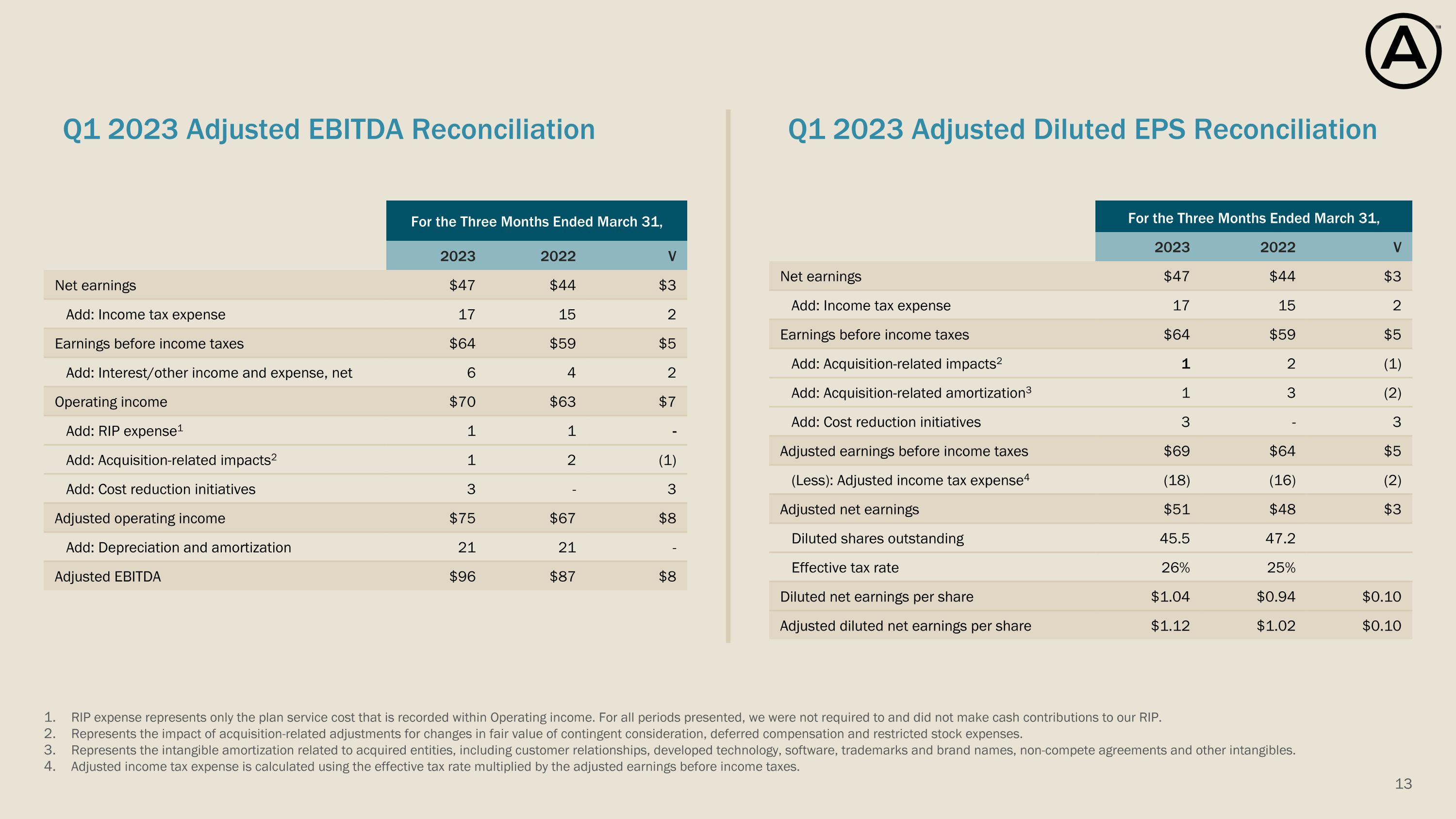

For the Three Months Ended March 31, 2023 2022 V Net earnings $47 $44 $3 Add: Income tax expense 17 15 2 Earnings before income taxes $64 $59 $5 Add: Interest/other income and expense, net 6 4 2 Operating income $70 $63 $7 Add: RIP expense1 1 1 - Add: Acquisition-related impacts2 1 2 (1) Add: Cost reduction initiatives 3 - 3 Adjusted operating income $75 $67 $8 Add: Depreciation and amortization 21 21 - Adjusted EBITDA $96 $87 $8 RIP expense represents only the plan service cost that is recorded within Operating income. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for changes in fair value of contingent consideration, deferred compensation and restricted stock expenses. Represents the intangible amortization related to acquired entities, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements and other intangibles. Adjusted income tax expense is calculated using the effective tax rate multiplied by the adjusted earnings before income taxes. For the Three Months Ended March 31, 2023 2022 V Net earnings $47 $44 $3 Add: Income tax expense 17 15 2 Earnings before income taxes $64 $59 $5 Add: Acquisition-related impacts2 1 2 (1) Add: Acquisition-related amortization3 1 3 (2) Add: Cost reduction initiatives 3 - 3 Adjusted earnings before income taxes $69 $64 $5 (Less): Adjusted income tax expense4 (18) (16) (2) Adjusted net earnings $51 $48 $3 Diluted shares outstanding 45.5 47.2 Effective tax rate 26% 25% Diluted net earnings per share $1.04 $0.94 $0.10 Adjusted diluted net earnings per share $1.12 $1.02 $0.10 Q1 2023 Adjusted EBITDA Reconciliation Q1 2023 Adjusted Diluted EPS Reconciliation

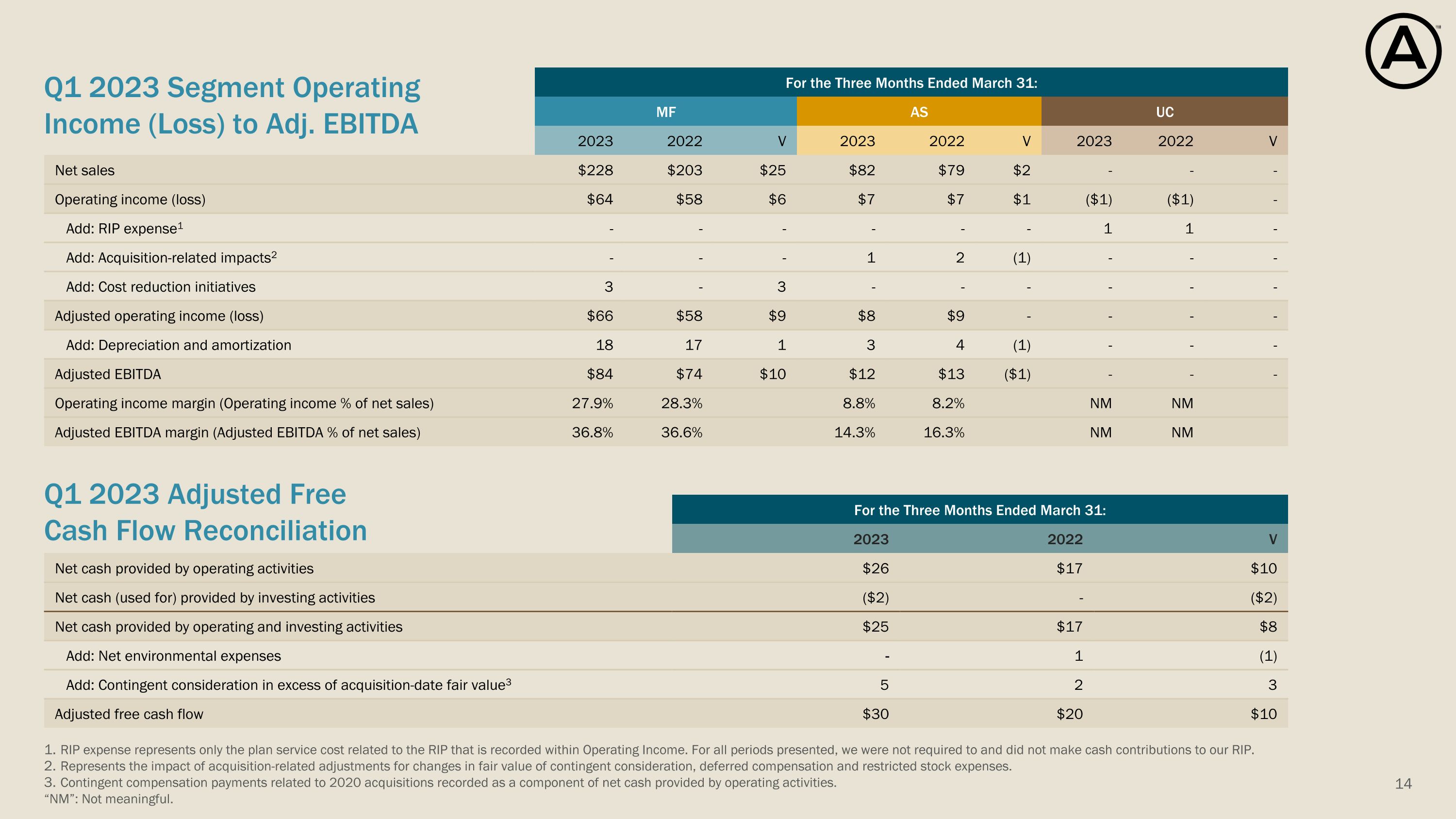

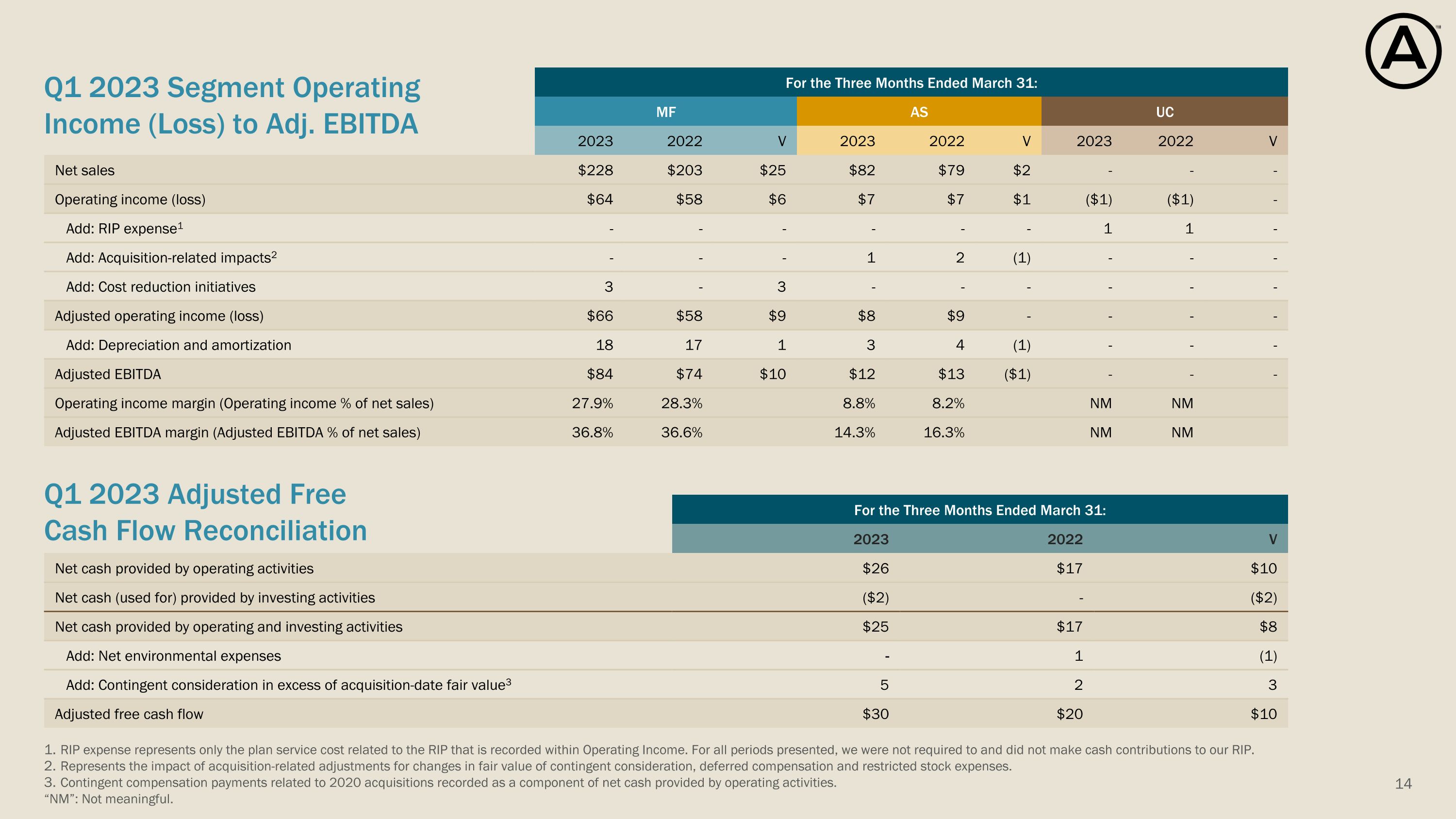

RIP expense represents only the plan service cost related to the RIP that is recorded within Operating Income. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for changes in fair value of contingent consideration, deferred compensation and restricted stock expenses. Contingent compensation payments related to 2020 acquisitions recorded as a component of net cash provided by operating activities. “NM”: Not meaningful. For the Three Months Ended March 31: 2023 2022 V Net cash provided by operating activities $26 $17 $10 Net cash (used for) provided by investing activities ($2) - ($2) Net cash provided by operating and investing activities $25 $17 $8 Add: Net environmental expenses - 1 (1) Add: Contingent consideration in excess of acquisition-date fair value3 5 2 3 Adjusted free cash flow $30 $20 $10 For the Three Months Ended March 31: MF AS UC UNALLOCATED CORPORATE 2023 2022 V 2023 2022 V 2023 2022 V Net sales $228 $203 $25 $82 $79 $2 - - - Operating income (loss) $64 $58 $6 $7 $7 $1 ($1) ($1) - Add: RIP expense1 - - - - - - 1 1 - Add: Acquisition-related impacts2 - - - 1 2 (1) - - - Add: Cost reduction initiatives 3 - 3 - - - - - - Adjusted operating income (loss) $66 $58 $9 $8 $9 - - - - Add: Depreciation and amortization 18 17 1 3 4 (1) - - - Adjusted EBITDA $84 $74 $10 $12 $13 ($1) - - - Operating income margin (Operating income % of net sales) 27.9% 28.3% 8.8% 8.2% NM NM Adjusted EBITDA margin (Adjusted EBITDA % of net sales) 36.8% 36.6% 14.3% 16.3% NM NM Q1 2023 Adjusted Free Cash Flow Reconciliation Q1 2023 Segment Operating Income (Loss) to Adj. EBITDA

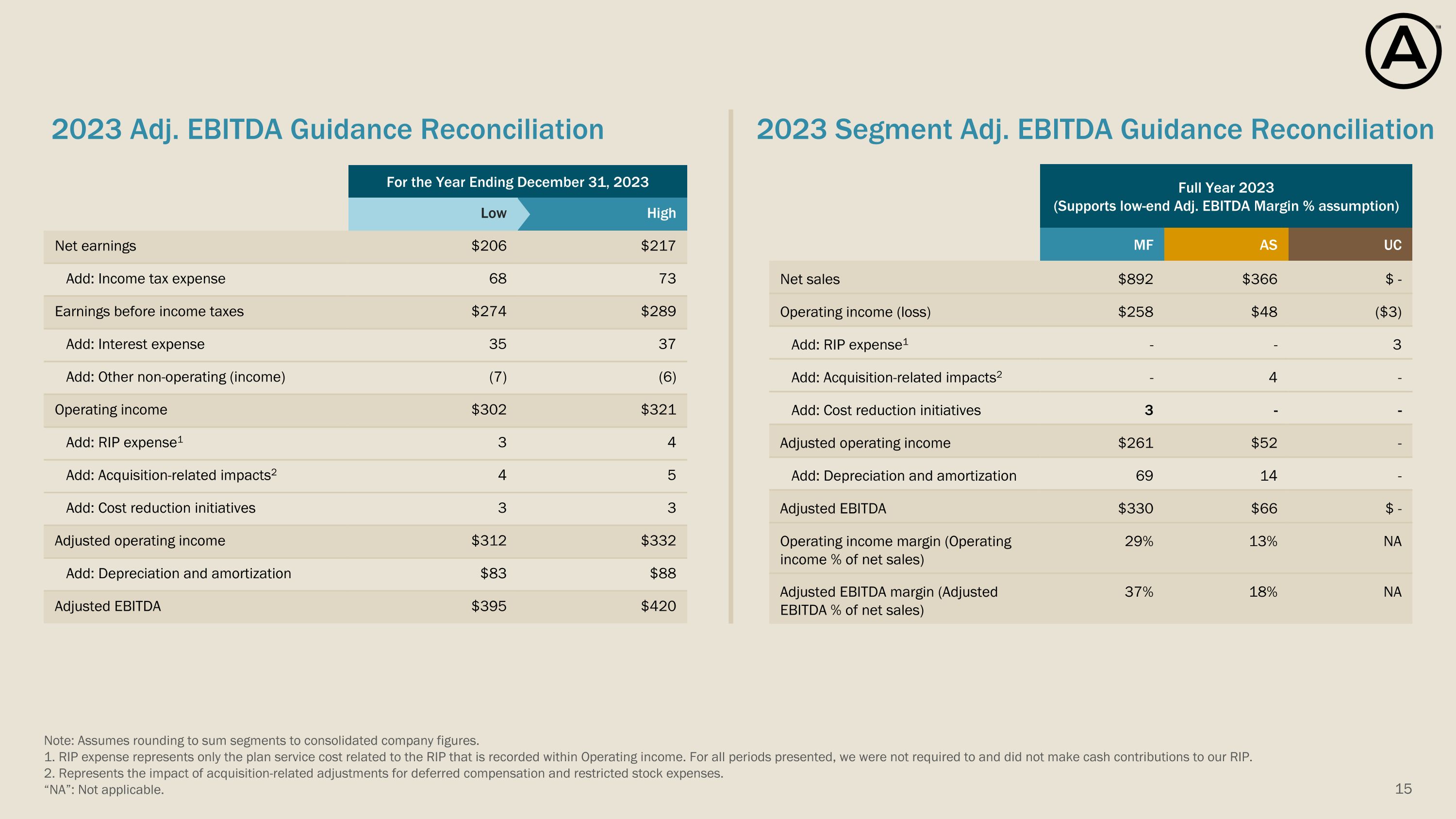

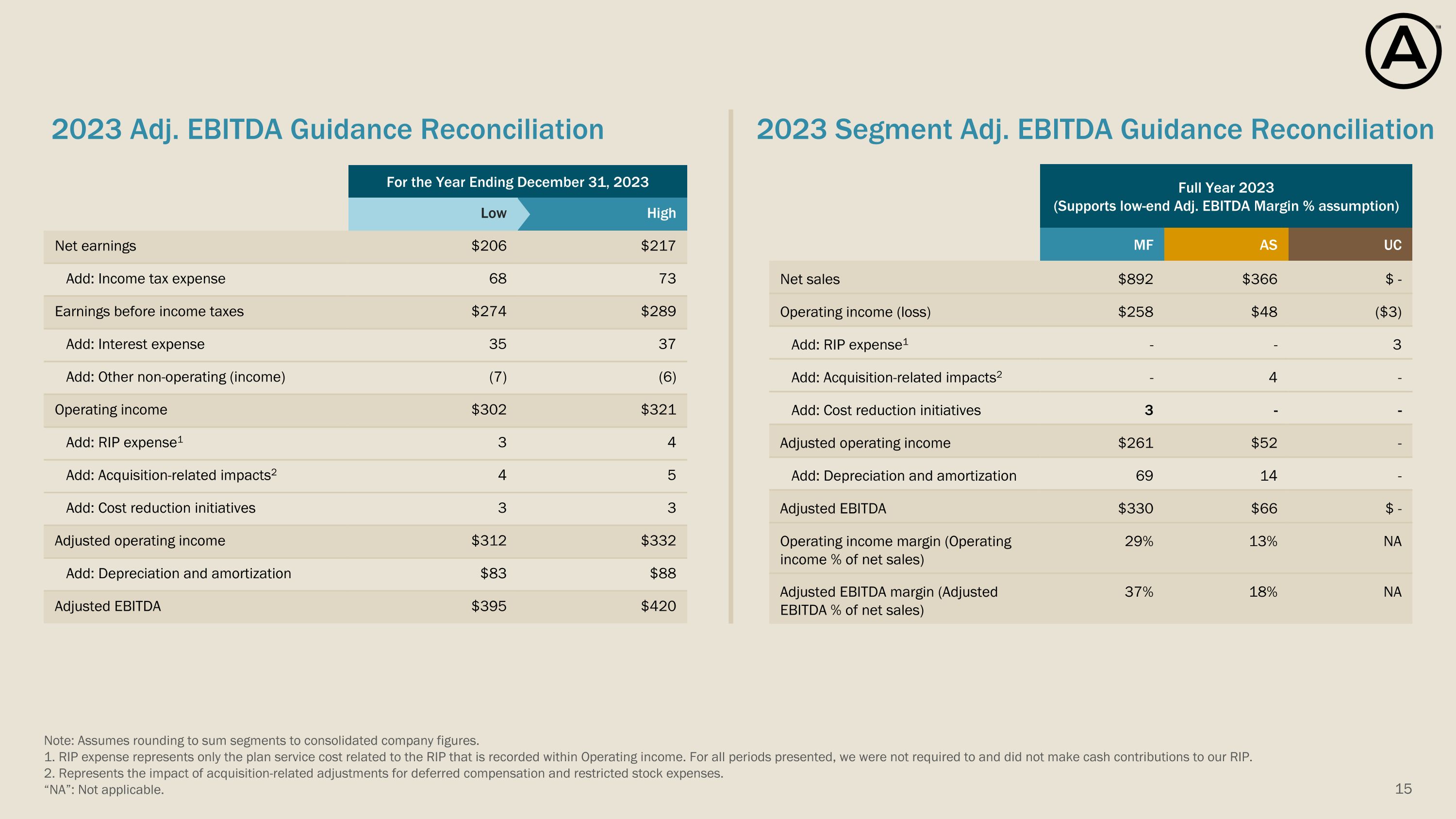

For the Year Ending December 31, 2023 Low High Net earnings $206 $217 Add: Income tax expense 68 73 Earnings before income taxes $274 $289 Add: Interest expense 35 37 Add: Other non-operating (income) (7) (6) Operating income $302 $321 Add: RIP expense1 3 4 Add: Acquisition-related impacts2 4 5 Add: Cost reduction initiatives 3 3 Adjusted operating income $312 $332 Add: Depreciation and amortization $83 $88 Adjusted EBITDA $395 $420 Note: Assumes rounding to sum segments to consolidated company figures. 1. RIP expense represents only the plan service cost related to the RIP that is recorded within Operating income. For all periods presented, we were not required to and did not make cash contributions to our RIP. 2. Represents the impact of acquisition-related adjustments for deferred compensation and restricted stock expenses. “NA”: Not applicable. Full Year 2023 (Supports low-end Adj. EBITDA Margin % assumption) For the Three months Ended March 31, MF AS UC Net sales $892 $366 $ - Operating income (loss) $258 $48 ($3) Add: RIP expense1 - - 3 Add: Acquisition-related impacts2 - 4 - Add: Cost reduction initiatives 3 - - Adjusted operating income $261 $52 - Add: Depreciation and amortization 69 14 - Adjusted EBITDA $330 $66 $ - Operating income margin (Operating income % of net sales) 29% 13% NA Adjusted EBITDA margin (Adjusted EBITDA % of net sales) 37% 18% NA 2023 Adj. EBITDA Guidance Reconciliation 2023 Segment Adj. EBITDA Guidance Reconciliation

RIP (credit) represents the entire actuarial net periodic pension (credit) recorded as a component of Net earnings. We do not expect to make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for deferred compensation and restricted stock expenses. Represents the intangible amortization related to acquired entities, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements and other intangibles. Adjusted income tax expense is based on an adjusted effective tax rate of ~25%, multiplied by adjusted earnings before income tax. For the Year Ending December 31, 2023 Low High Net earnings $206 $217 Add: Income tax expense 68 73 Earnings before income taxes $274 $289 Add: RIP (credit)1 (1) (2) Add: Acquisition-related impacts2 4 5 Add: Acquisition-related amortization3 5 6 Add: Cost reduction initiatives 3 3 Adjusted earnings before income taxes $285 $301 (Less): Adjusted income tax expense4 (70) (74) Adjusted net earnings $215 $227 Diluted shares outstanding ~45M ~45M Effective tax rate ~25% ~25% Diluted net earnings per share $4.57 $4.81 Adjusted diluted net earnings per share $4.80 $5.05 For the Year Ending December 31, 2023 Low High Net cash provided by operating activities $220 $240 Add: Return of investment from joint venture 85 95 Adjusted net cash provided by operating activities $305 $335 (Less): Capital expenditures (75) (85) Adjusted Free Cash Flow $230 $250 2023 Adj. Diluted EPS Guidance Reconciliation 2023 Adj. Free Cash Flow Guidance Reconciliation