2nd Quarter 2024�Earnings Presentation July 30, 2024 Exhibit 99.2

Safe Harbor Statement Worthington Armstrong Joint Venture (“WAVE”). Disclosures in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation, those relating to future financial and operational results, expected savings from cost management initiatives, the performance of our WAVE1 joint venture, market and broader economic conditions and guidance. Those statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. This includes annual guidance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that could cause our actual results to differ materially from those projected, anticipated or implied is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Form 10-K and Form 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”), including our report for the quarterly period ended June 30, 2024, that the Company expects to file today. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. In addition, we will be referring to non-Generally Accepted Accounting Principles in the United States (“GAAP”) financial measures within the meaning of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance �with GAAP is included within this presentation and available on the Investor Relations page of our website at www.armstrongceilings.com. The guidance in this presentation is only effective as of the date given, July 30, 2024, and will not be updated or affirmed unless �and until we publicly announce updated or affirmed guidance.

Basis of Presentation Explanation The deferred compensation accruals were for cash and stock awards that are recorded over each awards’ respective vesting period, as such payments were subject to the sellers’ and employees’ continued employment with the Company. Results throughout this presentation are presented on a normalized basis. We remove the impact of certain discrete expenses and income in certain measures including adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), adjusted diluted earnings per share (“EPS”) and adjusted free cash flow. The Company excludes certain acquisition related expenses (i.e. – impact of adjustments related to the fair value of inventory, contingent third-party professional fees, changes in the fair value of contingent consideration and deferred compensation accruals1 for acquisitions). The Company also excludes all acquisition-related amortization from adjusted net earnings and in calculations of adjusted diluted EPS. Examples of other excluded items have included plant closures, restructuring charges and related costs, impairments, separation costs and other cost reduction initiatives, environmental site expenses and environmental insurance recoveries, endowment level charitable contributions, the impact of defined benefit plan settlements, and certain other gains and losses. The Company also excludes income/expense from its U.S. Retirement Income Plan (“RIP”) in the non-GAAP results as it represents the actuarial net periodic benefit credit/cost recorded. For all periods presented, the Company was not required to and did not make cash contributions to the RIP based on guidelines established by the Pension Benefit Guaranty Corporation, nor does the Company expect to make cash contributions to the plan in 2024. Our tax rate may be adjusted for certain discrete items, which are identified in the footnotes. Investors should not consider non-GAAP measures as a substitute for GAAP measures. Excluding adjusted diluted EPS, non-GAAP figures are rounded to the nearest million and corresponding percentages are based on unrounded figures. Operating Segments: “MF”: Mineral Fiber, “AS”: Architectural Specialties, “UC”: Unallocated Corporate All dollar figures throughout the presentation are in $ millions, except per share data, and all comparisons are versus the applicable prior-year period unless otherwise noted. Figures may not sum due to rounding.

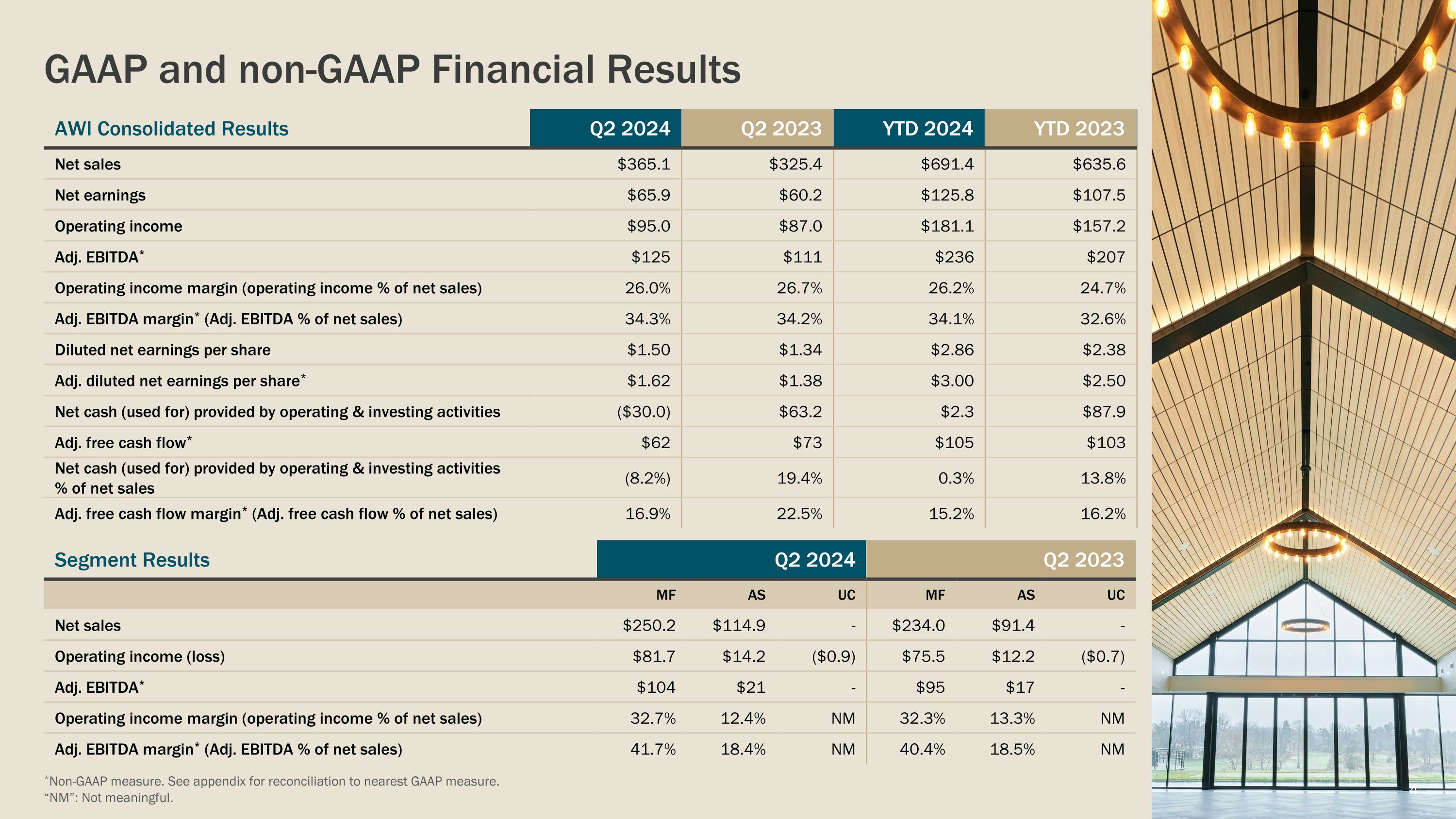

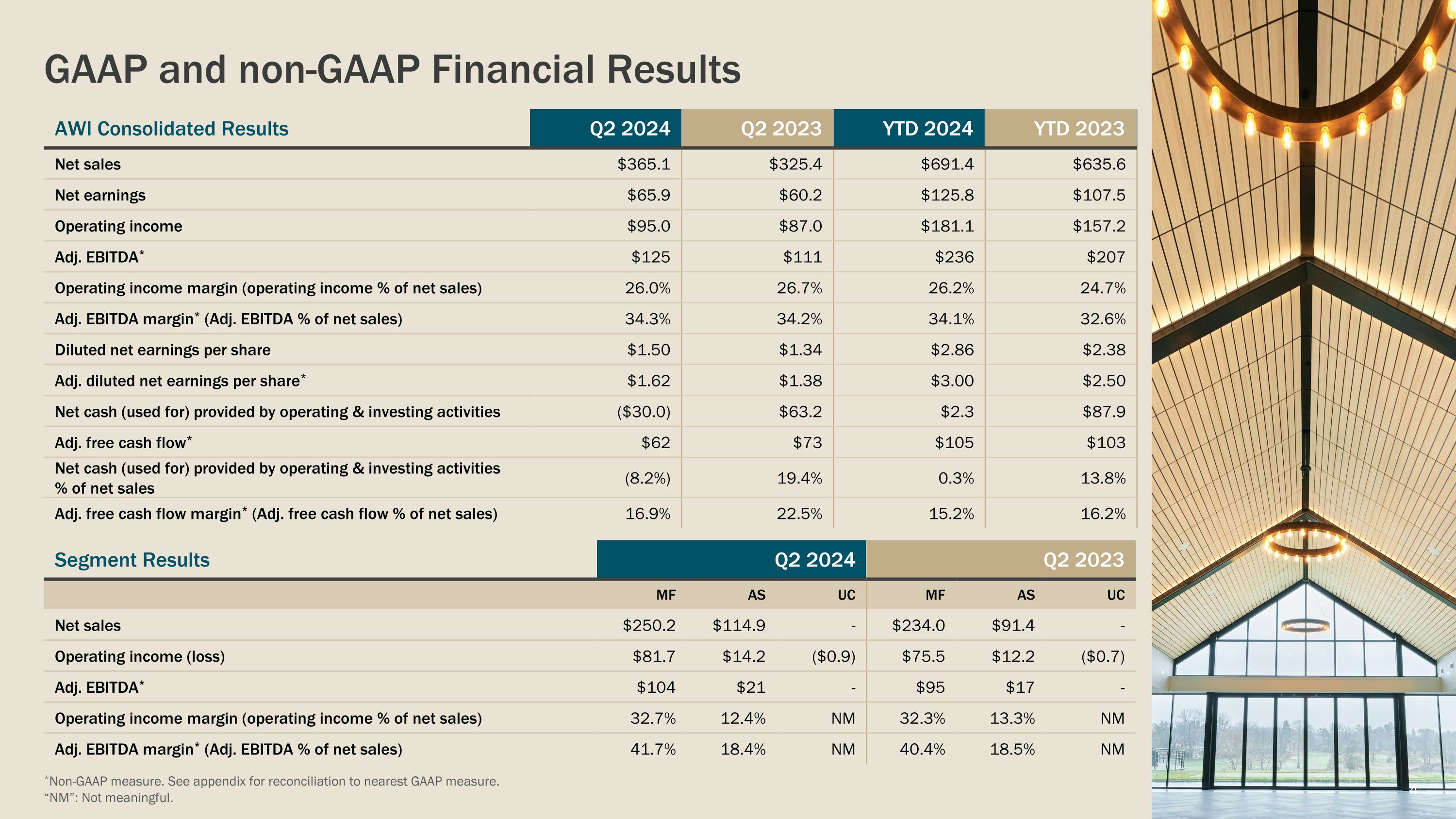

GAAP and non-GAAP Financial Results AWI Consolidated Results Q2 2024 Q2 2023 YTD 2024 YTD 2023 Net sales $365.1 $325.4 $691.4 $635.6 Net earnings $65.9 $60.2 $125.8 $107.5 Operating income $95.0 $87.0 $181.1 $157.2 Adj. EBITDA* $125 $111 $236 $207 Operating income margin (operating income % of net sales) 26.0% 26.7% 26.2% 24.7% Adj. EBITDA margin* (Adj. EBITDA % of net sales) 34.3% 34.2% 34.1% 32.6% Diluted net earnings per share $1.50 $1.34 $2.86 $2.38 Adj. diluted net earnings per share* $1.62 $1.38 $3.00 $2.50 Net cash (used for) provided by operating & investing activities ($30.0) $63.2 $2.3 $87.9 Adj. free cash flow* $62 $73 $105 $103 Net cash (used for) provided by operating & investing activities % of net sales (8.2%) 19.4% 0.3% 13.8% Adj. free cash flow margin* (Adj. free cash flow % of net sales) 16.9% 22.5% 15.2% 16.2% Segment Results Q2 2024 Q2 2023 MF AS UC MF AS UC Net sales $250.2 $114.9 - $234.0 $91.4 - Operating income (loss) $81.7 $14.2 ($0.9) $75.5 $12.2 ($0.7) Adj. EBITDA* $104 $21 - $95 $17 - Operating income margin (operating income % of net sales) 32.7% 12.4% NM 32.3% 13.3% NM Adj. EBITDA margin* (Adj. EBITDA % of net sales) 41.7% 18.4% NM 40.4% 18.5% NM *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. “NM”: Not meaningful.

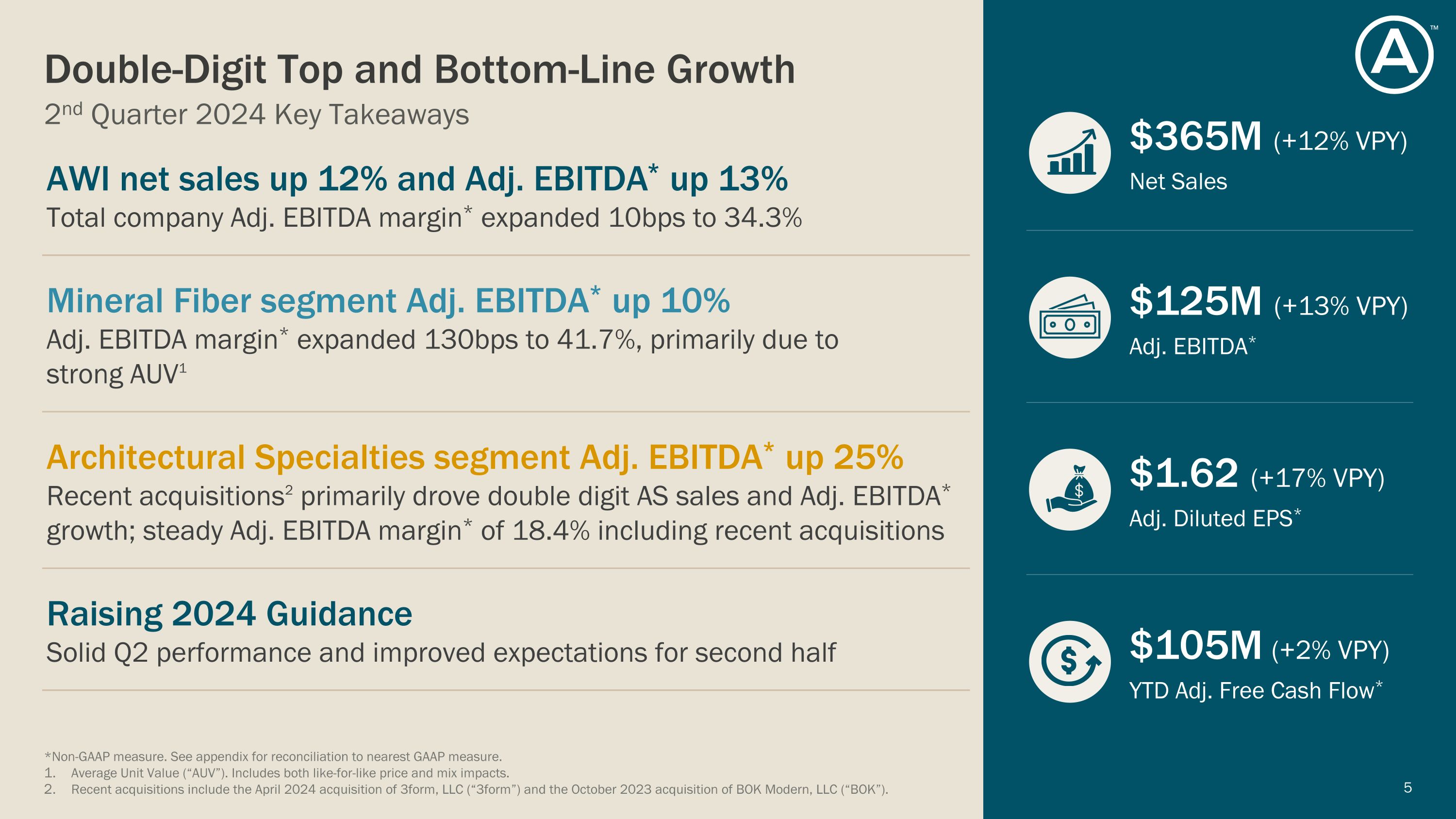

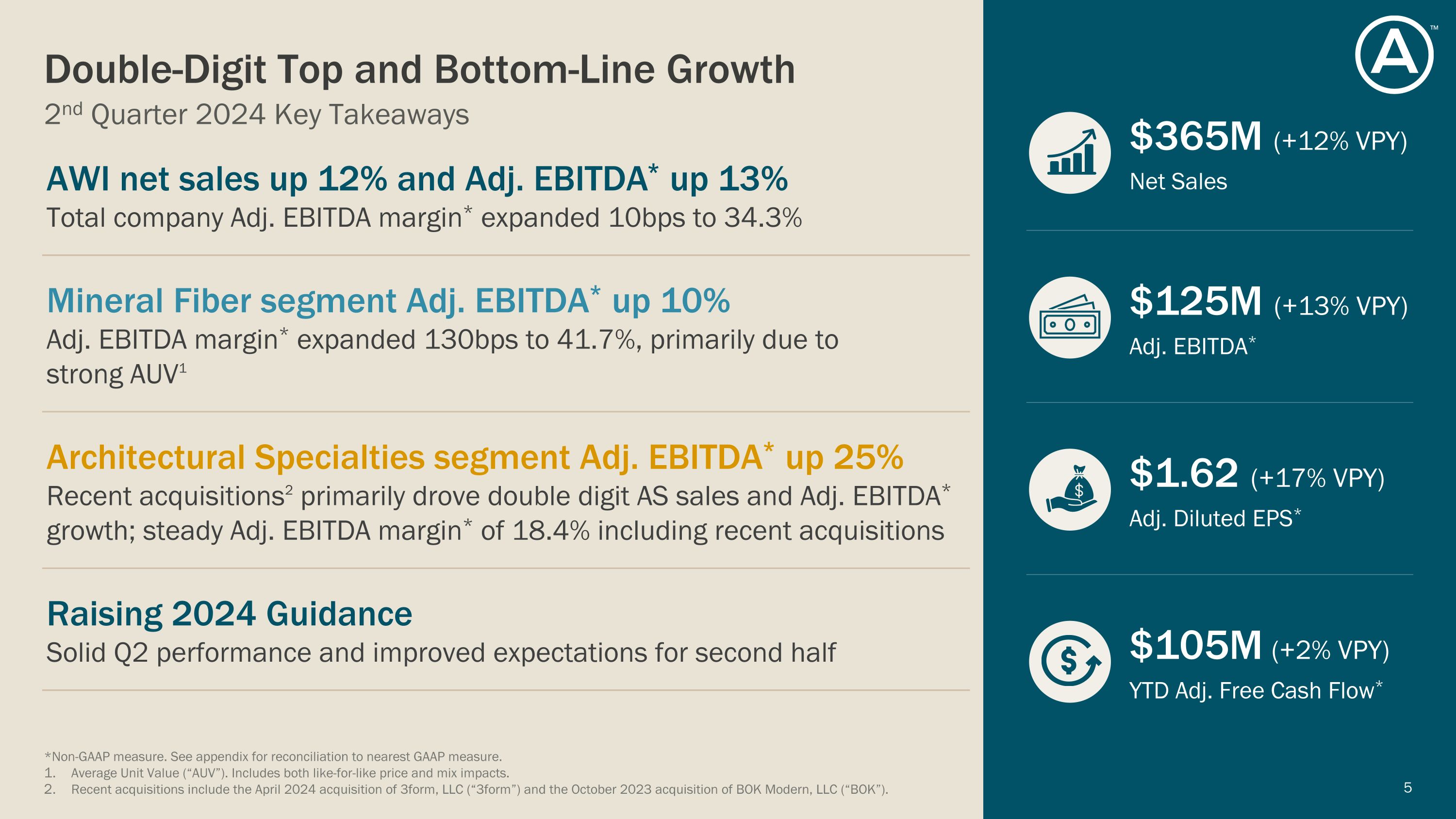

$365M (+12% VPY) Net Sales $125M (+13% VPY) Adj. EBITDA* $1.62 (+17% VPY) Adj. Diluted EPS* $105M (+2% VPY) YTD Adj. Free Cash Flow* 2nd Quarter 2024 Key Takeaways Double-Digit Top and Bottom-Line Growth *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Average Unit Value (“AUV”). Includes both like-for-like price and mix impacts. Recent acquisitions include the April 2024 acquisition of 3form, LLC (“3form”) and the October 2023 acquisition of BOK Modern, LLC (“BOK”). AWI net sales up 12% and Adj. EBITDA* up 13% Total company Adj. EBITDA margin* expanded 10bps to 34.3% Mineral Fiber segment Adj. EBITDA* up 10%�Adj. EBITDA margin* expanded 130bps to 41.7%, primarily due to �strong AUV1 Architectural Specialties segment Adj. EBITDA* up 25%�Recent acquisitions2 primarily drove double digit AS sales and Adj. EBITDA* growth; steady Adj. EBITDA margin* of 18.4% including recent acquisitions Raising 2024 Guidance Solid Q2 performance and improved expectations for second half ™

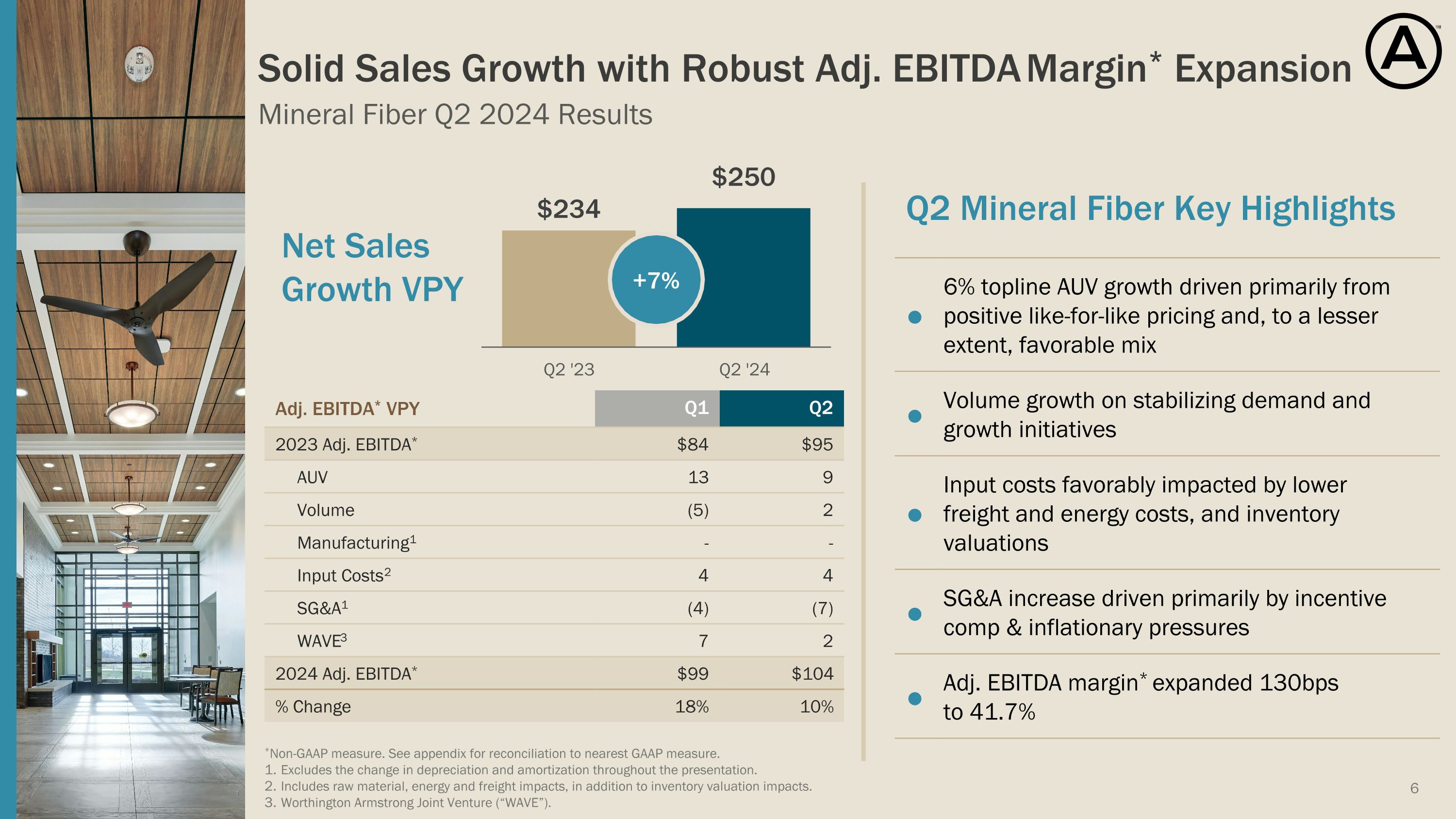

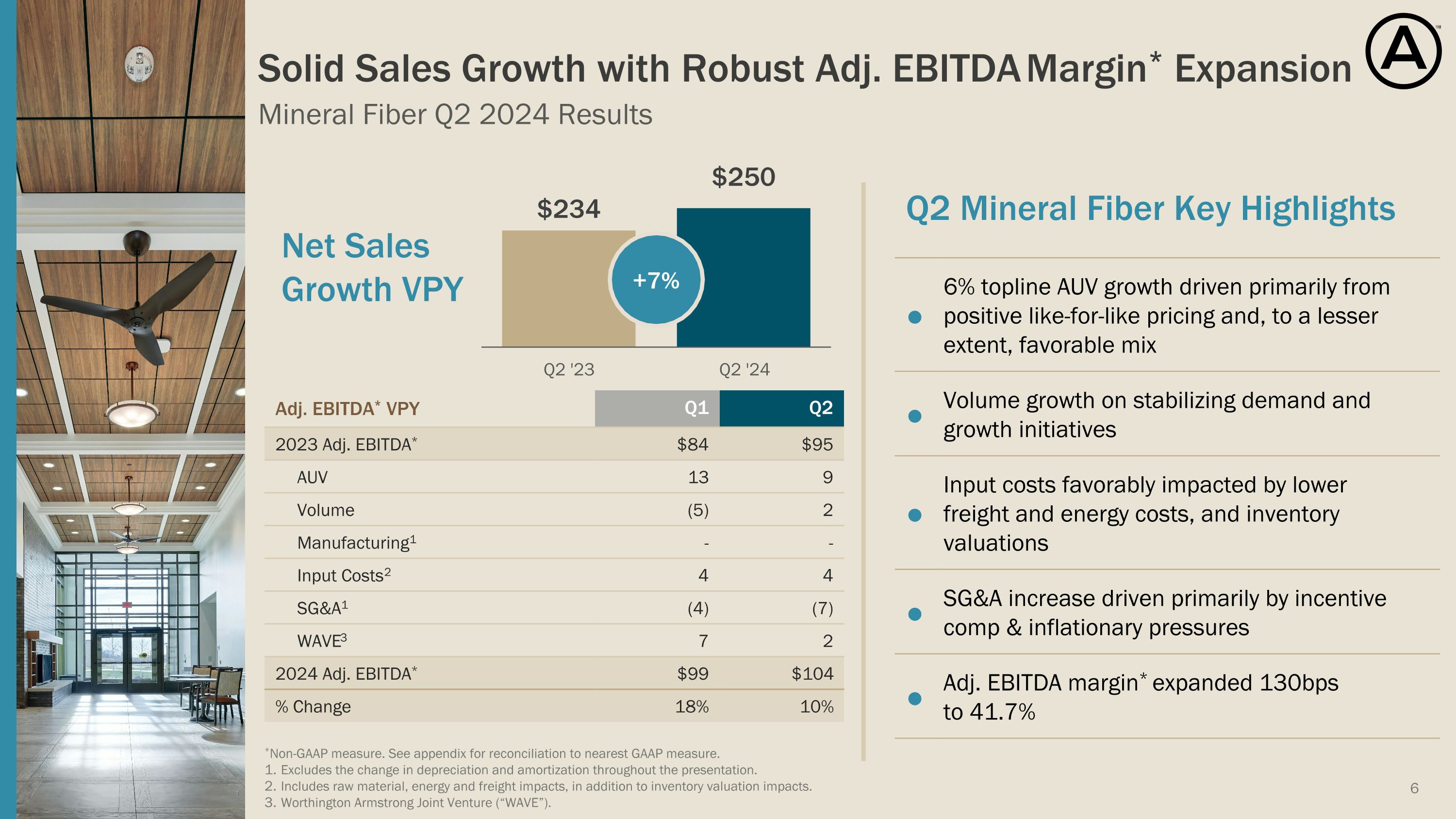

Mineral Fiber Q2 2024 Results Solid Sales Growth with Robust Adj. EBITDA Margin* Expansion *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Excludes the change in depreciation and amortization throughout the presentation. Includes raw material, energy and freight impacts, in addition to inventory valuation impacts. Worthington Armstrong Joint Venture (“WAVE”). Net Sales Growth VPY Q2 Mineral Fiber Key Highlights ● 6% topline AUV growth driven primarily from positive like-for-like pricing and, to a lesser extent, favorable mix ● Volume growth on stabilizing demand and growth initiatives ● Input costs favorably impacted by lower freight and energy costs, and inventory valuations ● SG&A increase driven primarily by incentive comp & inflationary pressures ● Adj. EBITDA margin* expanded 130bps to 41.7% Adj. EBITDA* VPY Q1 Q2 2023 Adj. EBITDA* $84 $95 AUV 13 9 Volume (5) 2 Manufacturing1 - - Input Costs2 4 4 SG&A1 (4) (7) WAVE3 7 2 2024 Adj. EBITDA* $99 $104 % Change 18% 10% +7%

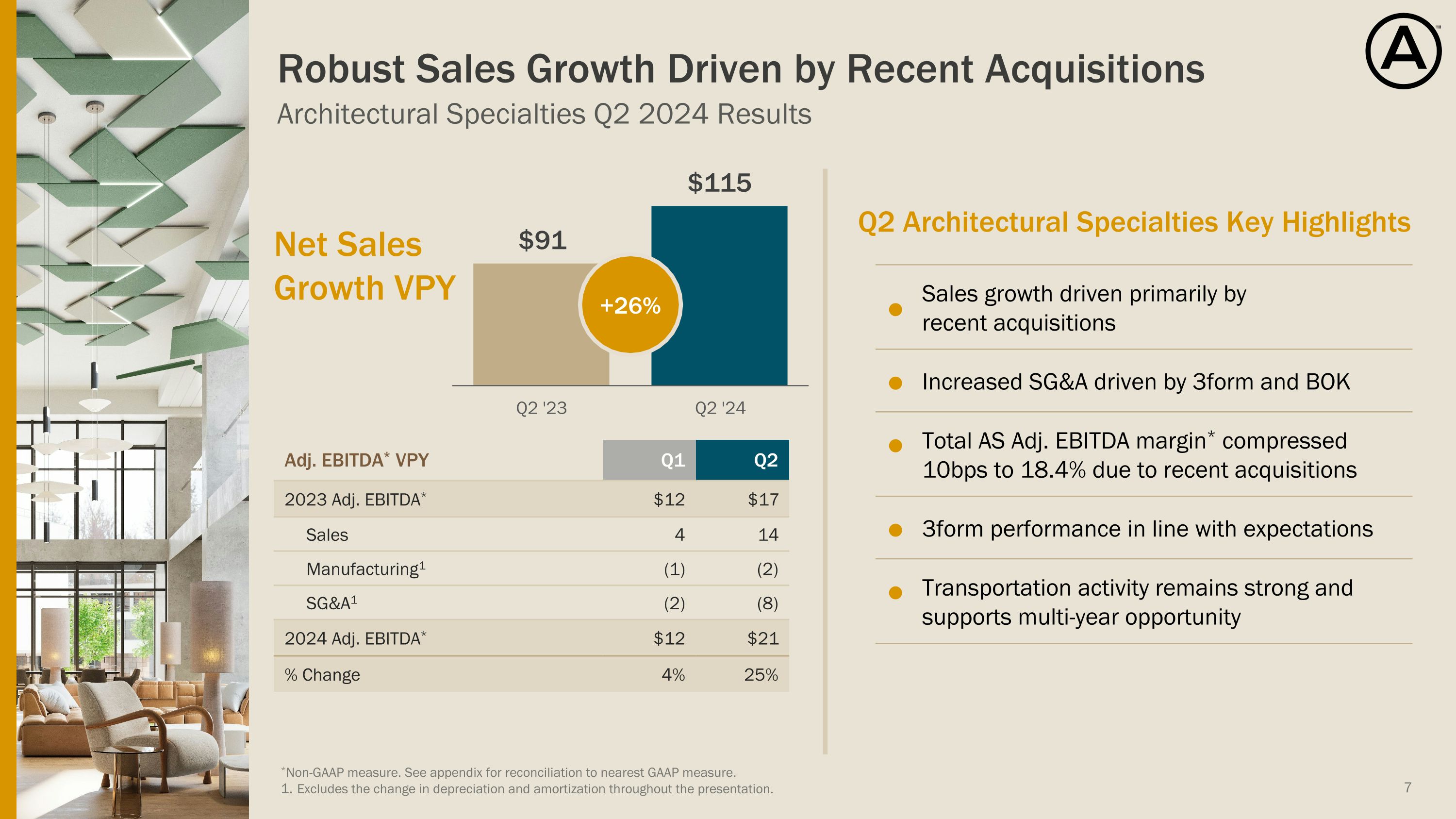

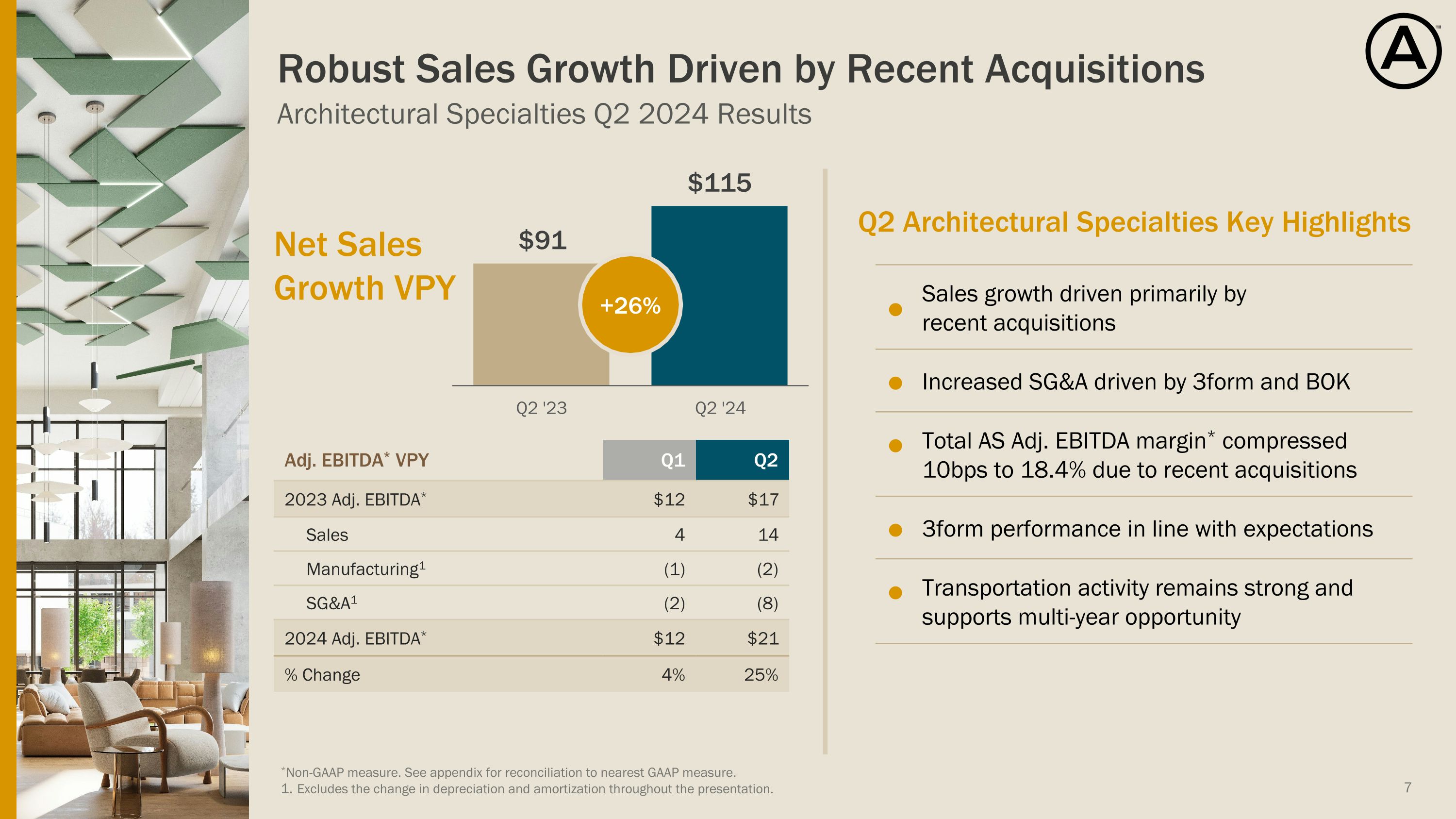

Architectural Specialties Q2 2024 Results Robust Sales Growth Driven by Recent Acquisitions *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Excludes the change in depreciation and amortization throughout the presentation. Adj. EBITDA* VPY Q1 Q2 2023 Adj. EBITDA* $12 $17 Sales 4 14 Manufacturing1 (1) (2) SG&A1 (2) (8) 2024 Adj. EBITDA* $12 $21 % Change 4% 25% Q2 Architectural Specialties Key Highlights ● Sales growth driven primarily by �recent acquisitions ● Increased SG&A driven by 3form and BOK ● Total AS Adj. EBITDA margin* compressed 10bps to 18.4% due to recent acquisitions ● 3form performance in line with expectations ● Transportation activity remains strong and supports multi-year opportunity Net Sales Growth VPY +26%

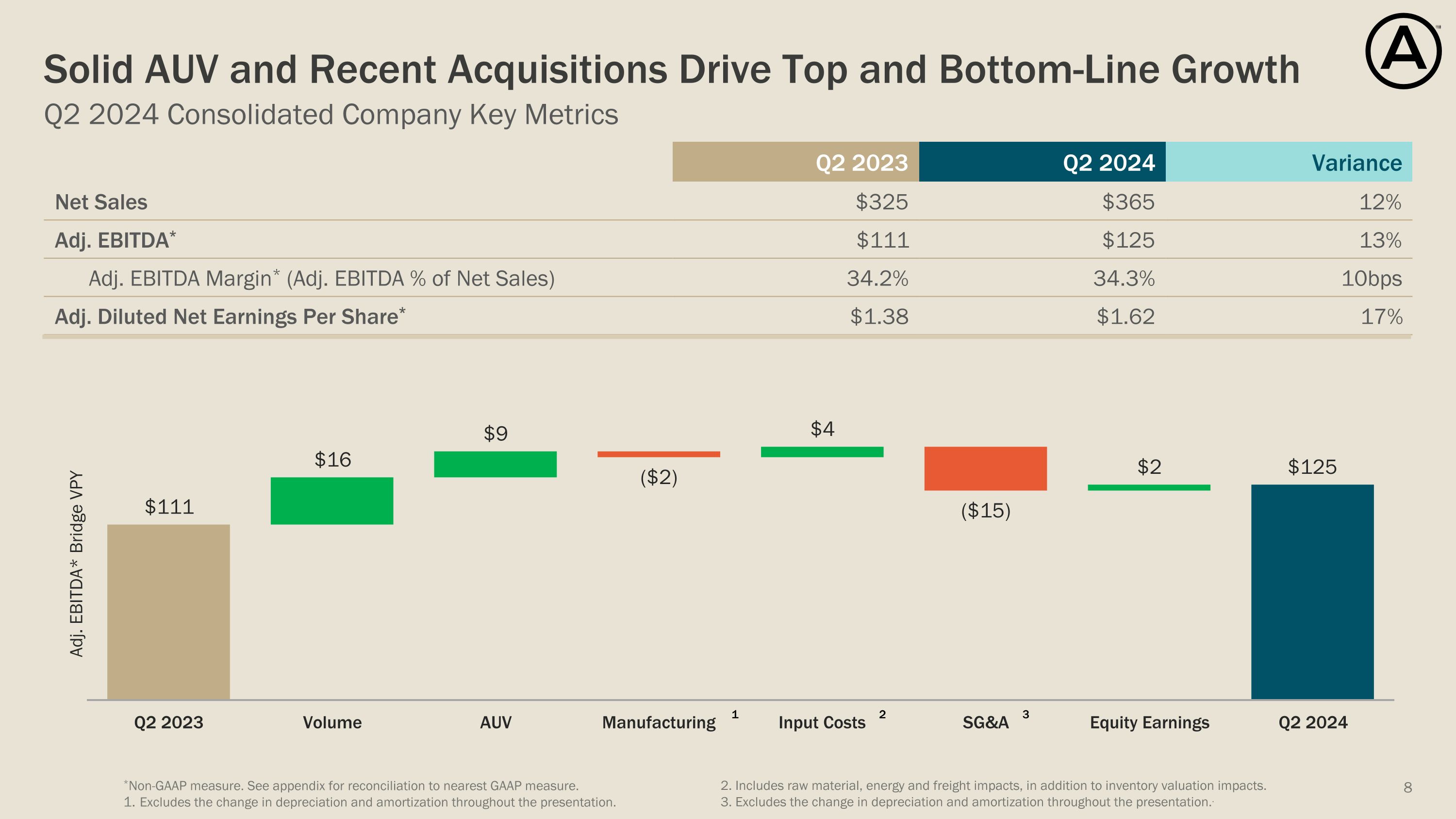

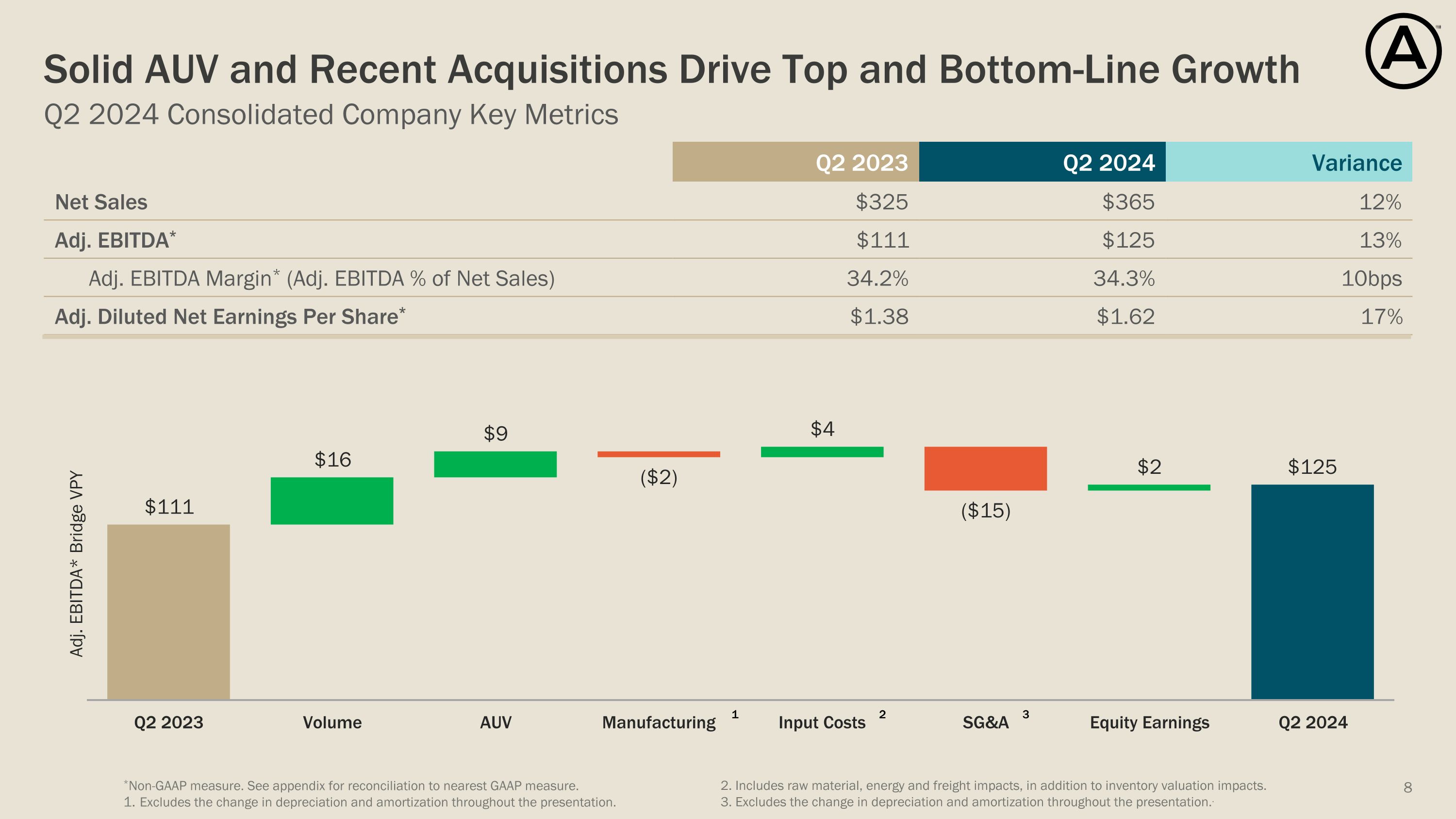

Q2 2024 Consolidated Company Key Metrics Solid AUV and Recent Acquisitions Drive Top and Bottom-Line Growth Q2 2023 Q2 2024 Variance Net Sales $325 $365 12% Adj. EBITDA* $111 $125 13% Adj. EBITDA Margin* (Adj. EBITDA % of Net Sales) 34.2% 34.3% 10bps Adj. Diluted Net Earnings Per Share* $1.38 $1.62 17% *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Excludes the change in depreciation and amortization throughout the presentation. 2. Includes raw material, energy and freight impacts, in addition to inventory valuation impacts. 3. Excludes the change in depreciation and amortization throughout the presentation.. 1 2 3

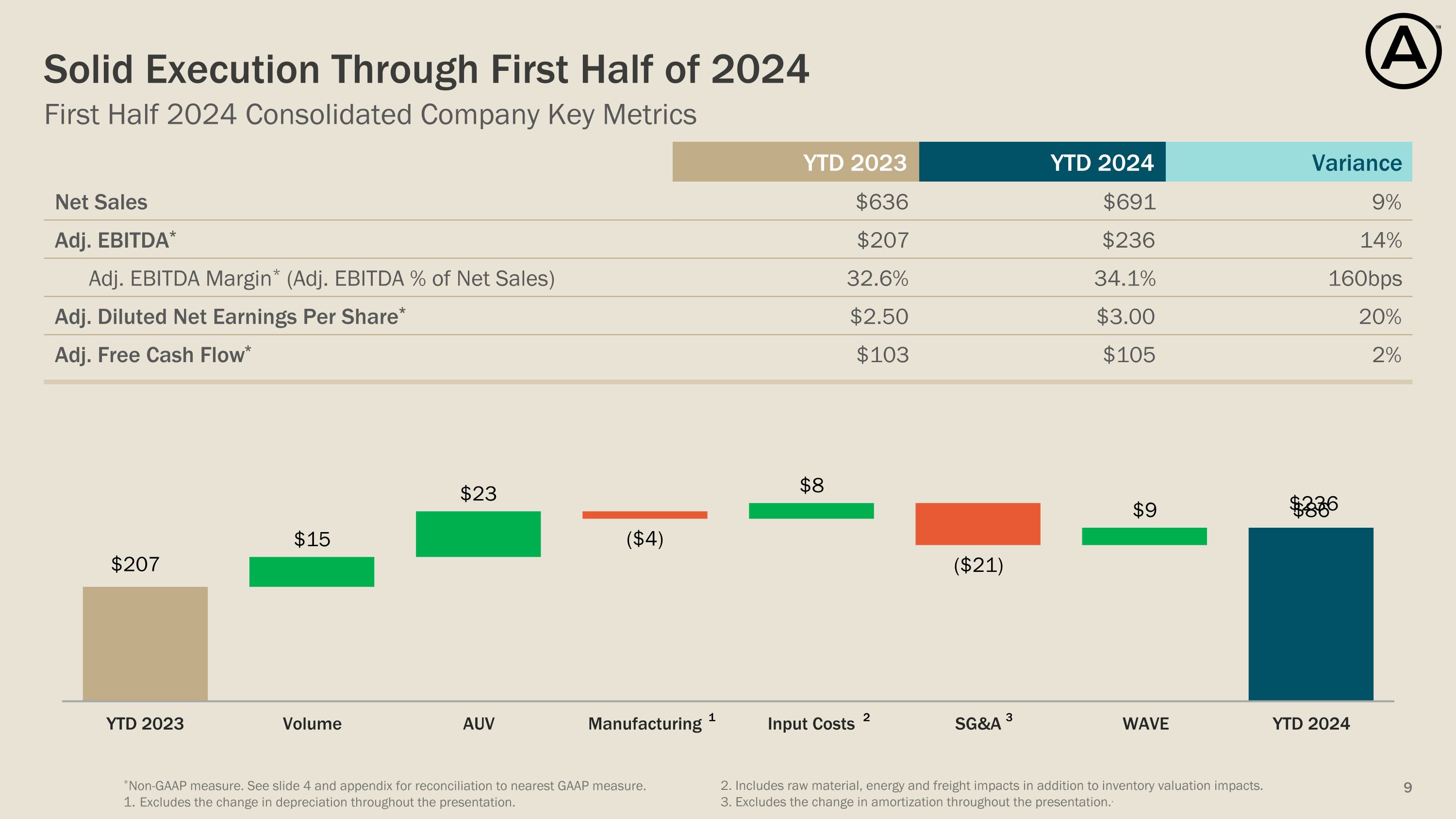

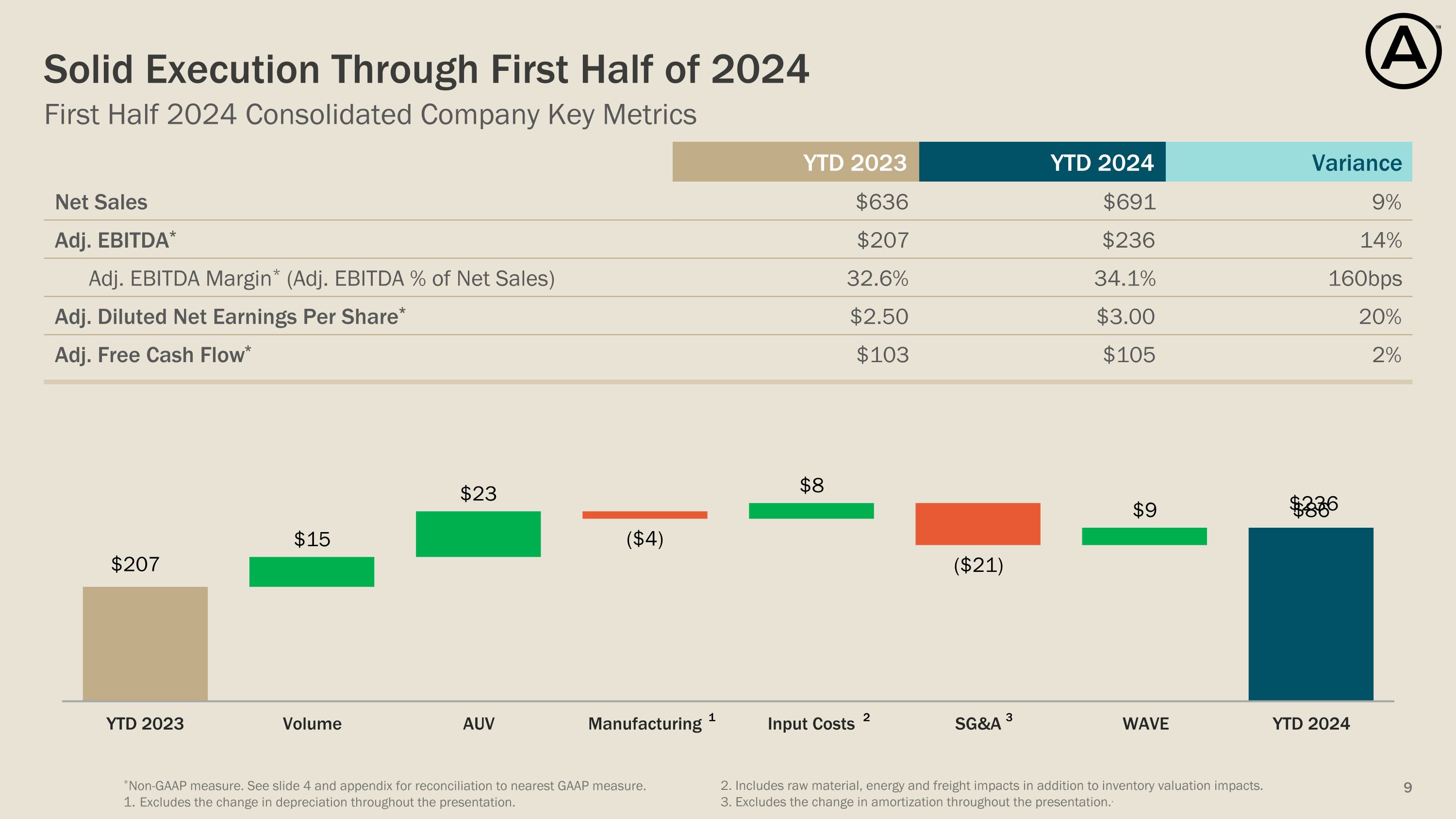

First Half 2024 Consolidated Company Key Metrics Solid Execution Through First Half of 2024 YTD 2023 YTD 2024 Variance Net Sales $636 $691 9% Adj. EBITDA* $207 $236 14% Adj. EBITDA Margin* (Adj. EBITDA % of Net Sales) 32.6% 34.1% 160bps Adj. Diluted Net Earnings Per Share* $2.50 $3.00 20% Adj. Free Cash Flow* $103 $105 2% *Non-GAAP measure. See slide 4 and appendix for reconciliation to nearest GAAP measure. Excludes the change in depreciation throughout the presentation. 2. Includes raw material, energy and freight impacts in addition to inventory valuation impacts. 3. Excludes the change in amortization throughout the presentation.. 1 2 3 $207 $236

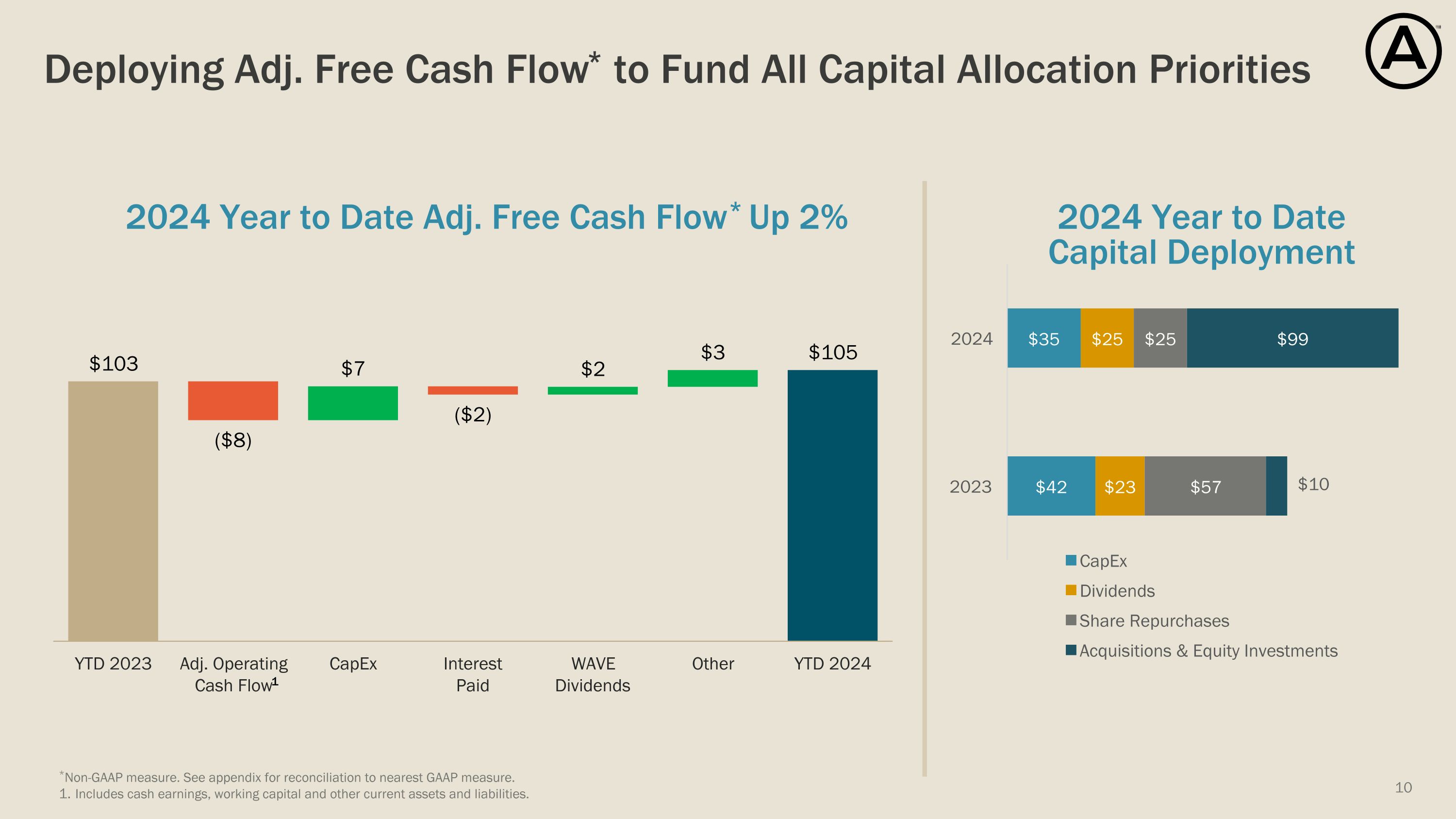

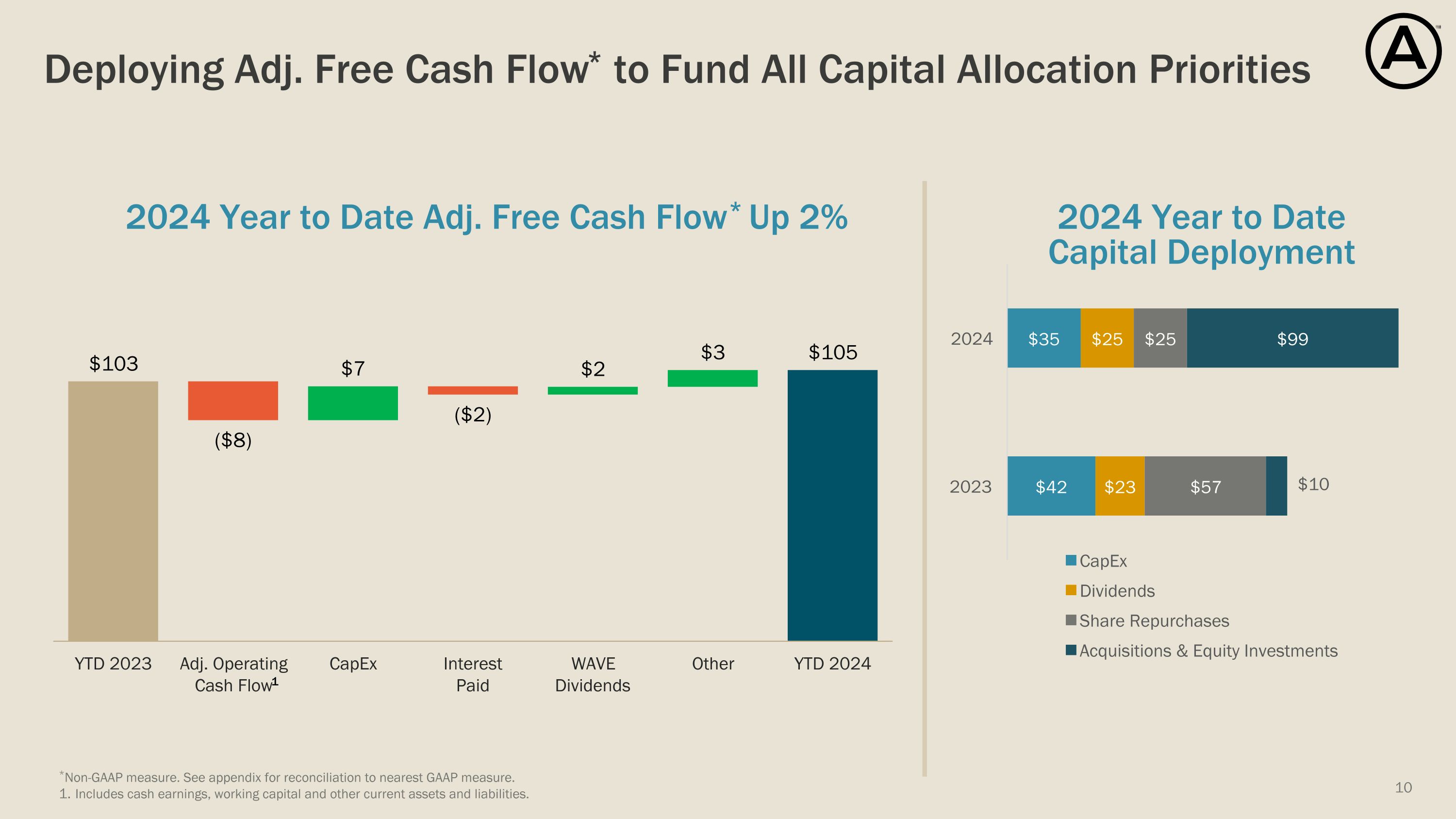

Deploying Adj. Free Cash Flow* to Fund All Capital Allocation Priorities *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Includes cash earnings, working capital and other current assets and liabilities. 2024 Year to Date Capital Deployment 2024 Year to Date Adj. Free Cash Flow* Up 2% 1

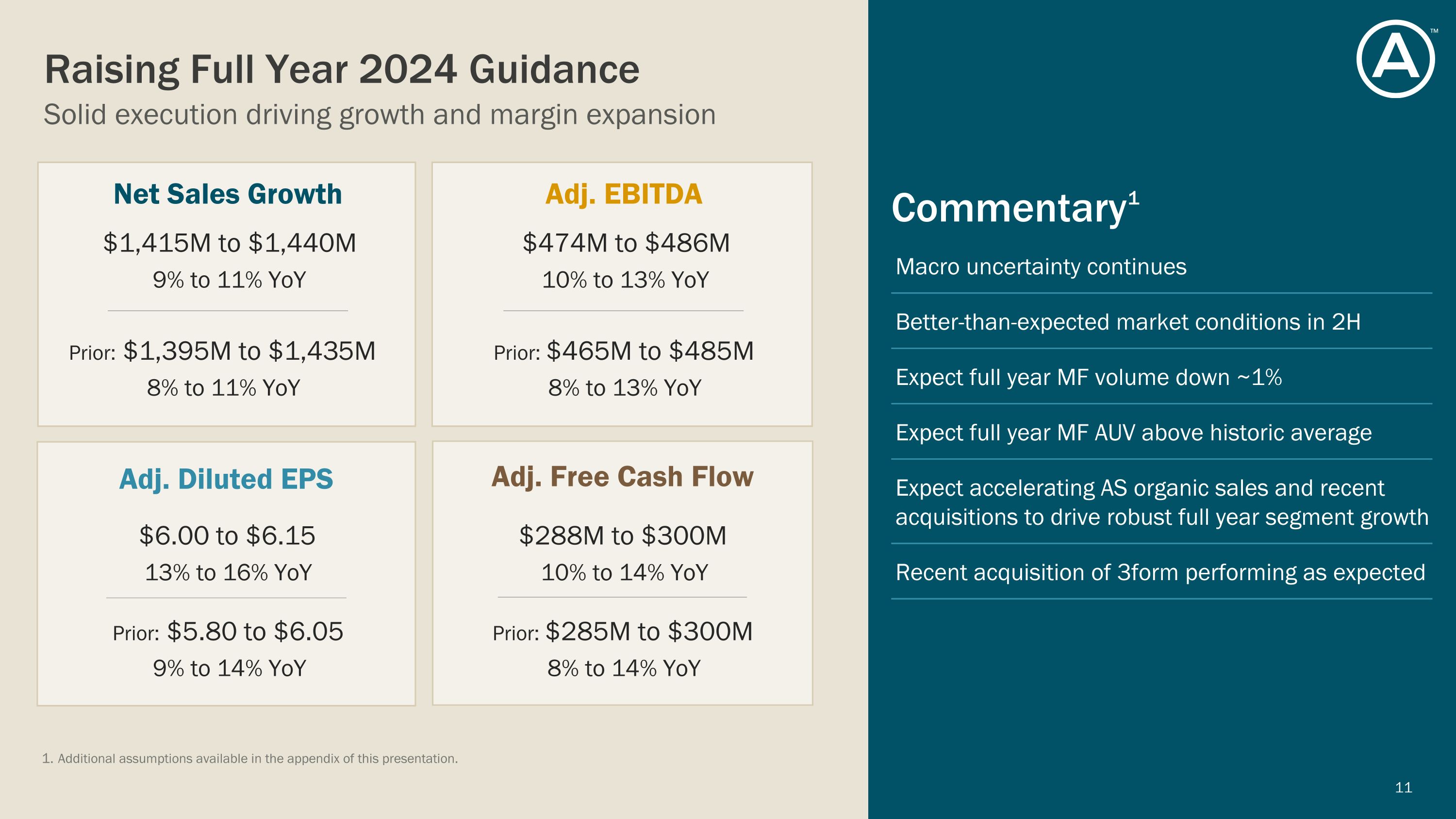

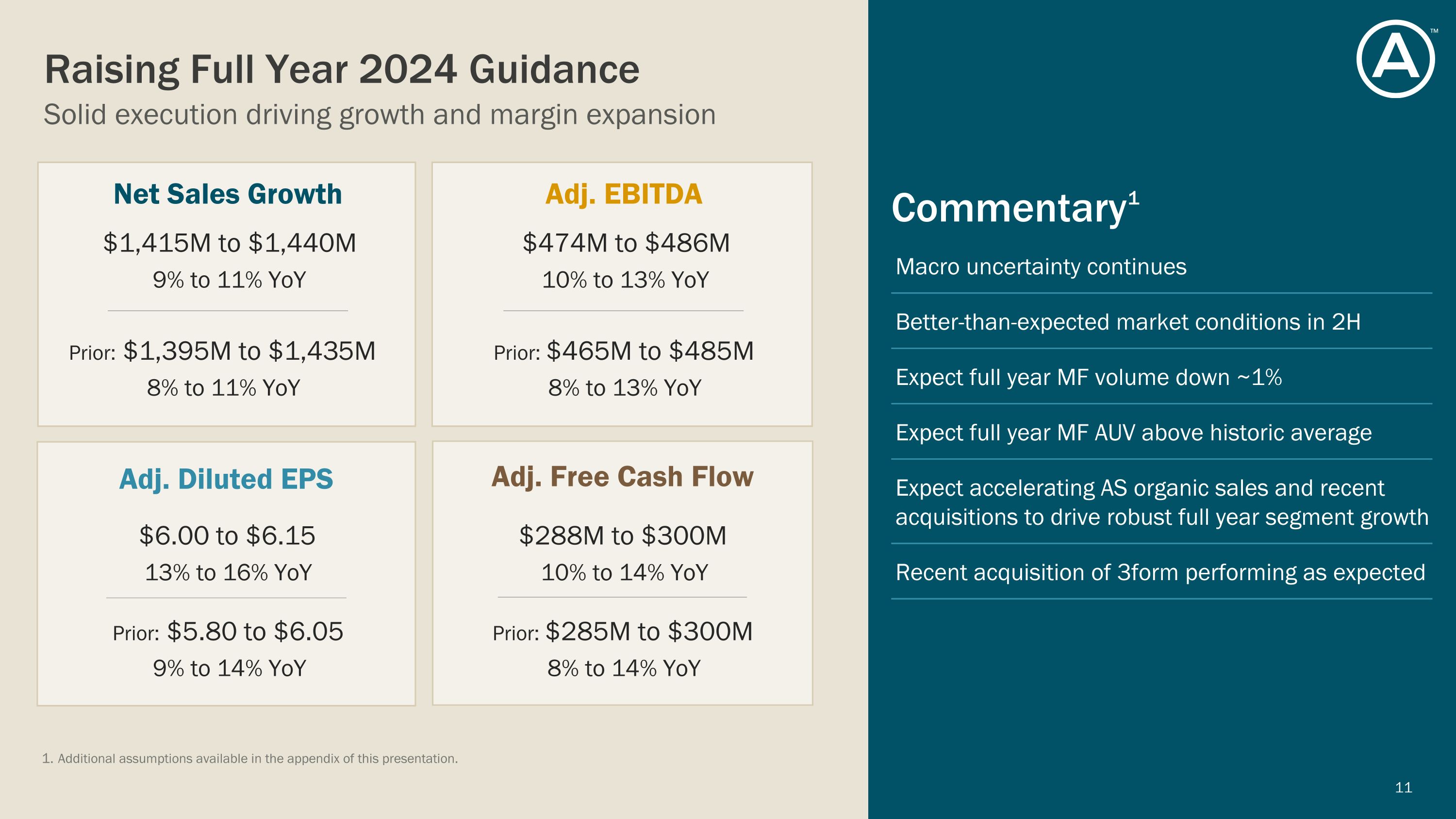

Solid execution driving growth and margin expansion Raising Full Year 2024 Guidance Commentary1 Prior: $1,395M to $1,435M 8% to 11% YoY Net Sales Growth Prior: $5.80 to $6.05 9% to 14% YoY Adj. Diluted EPS Prior: $465M to $485M 8% to 13% YoY Adj. EBITDA Prior: $285M to $300M 8% to 14% YoY Adj. Free Cash Flow Additional assumptions available in the appendix of this presentation. Macro uncertainty continues Better-than-expected market conditions in 2H Expect full year MF volume down ~1% Expect full year MF AUV above historic average Expect accelerating AS organic sales and recent acquisitions to drive robust full year segment growth Recent acquisition of 3form performing as expected $474M to $486M 10% to 13% YoY $1,415M to $1,440M 9% to 11% YoY $288M to $300M 10% to 14% YoY $6.00 to $6.15 13% to 16% YoY ™

Appendix

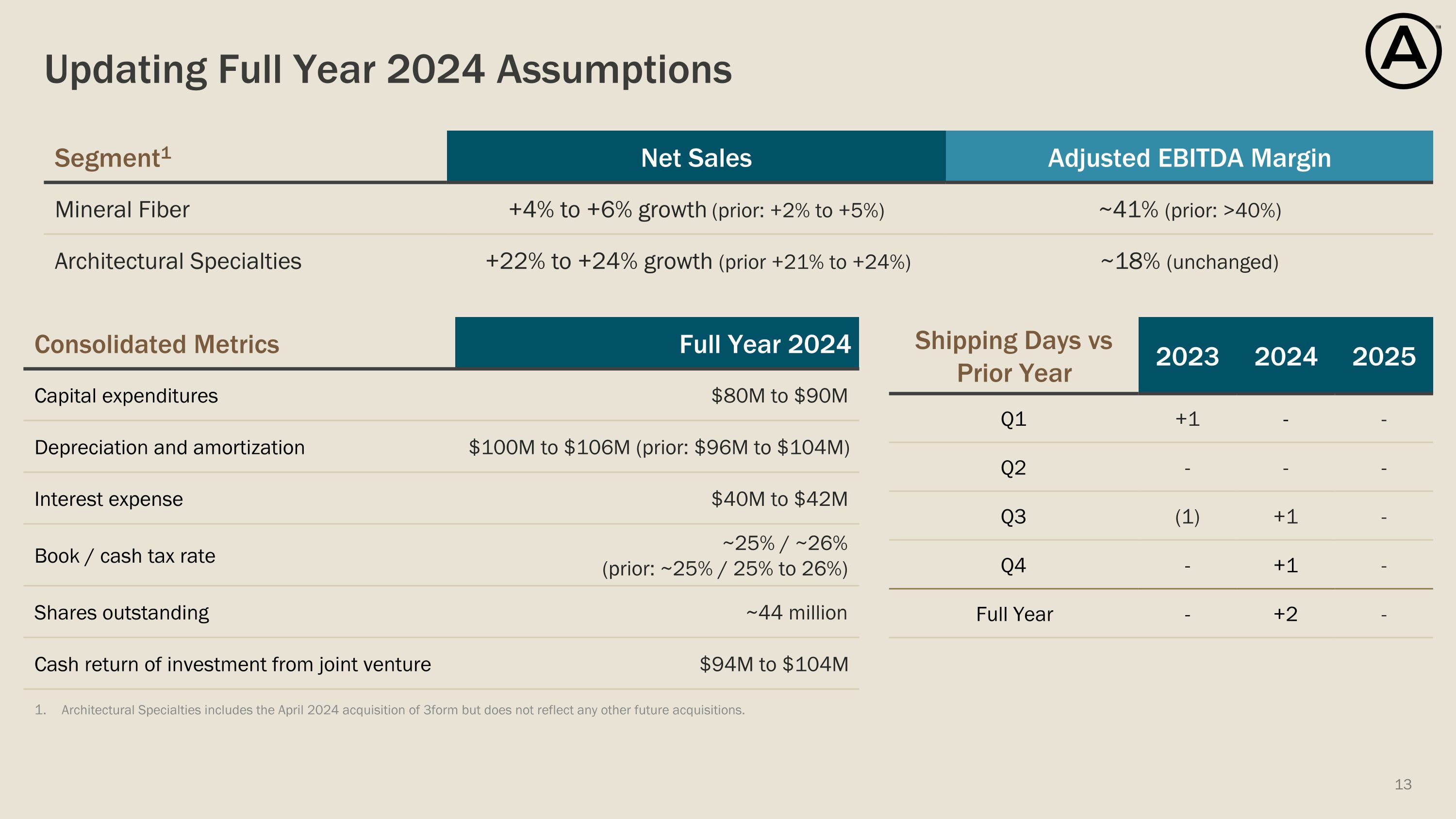

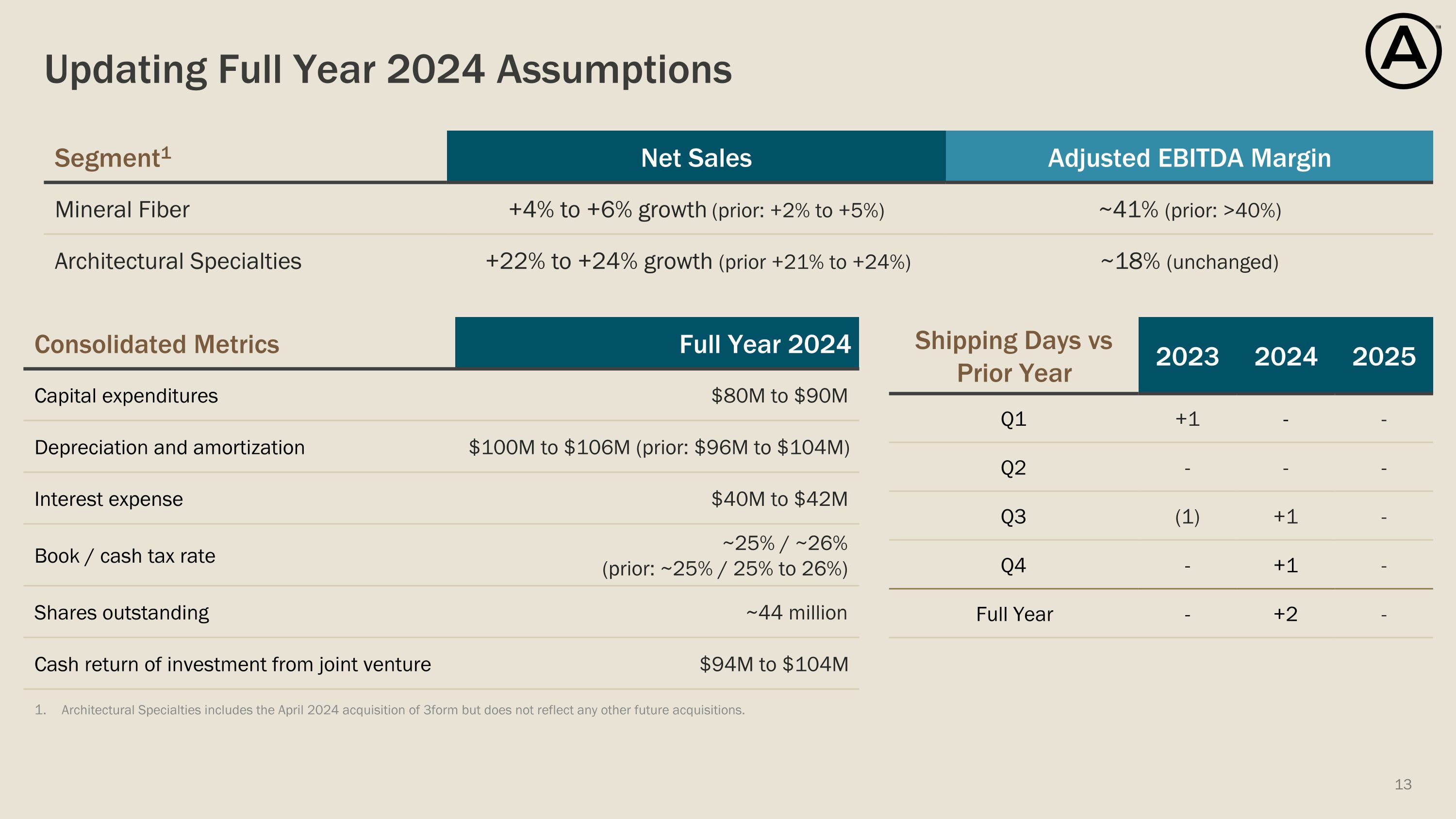

Updating Full Year 2024 Assumptions Shipping Days vs Prior Year 2023 2024 2025 Q1 +1 - - Q2 - - - Q3 (1) +1 - Q4 - +1 - Full Year - +2 - 13 Architectural Specialties includes the April 2024 acquisition of 3form but does not reflect any other future acquisitions. Segment1 Net Sales Adjusted EBITDA Margin Mineral Fiber +4% to +6% growth (prior: +2% to +5%) ~41% (prior: >40%) Architectural Specialties +22% to +24% growth (prior +21% to +24%) ~18% (unchanged) Consolidated Metrics Full Year 2024 Capital expenditures $80M to $90M Depreciation and amortization $100M to $106M (prior: $96M to $104M) Interest expense $40M to $42M Book / cash tax rate ~25% / ~26% �(prior: ~25% / 25% to 26%) Shares outstanding ~44 million Cash return of investment from joint venture $94M to $104M

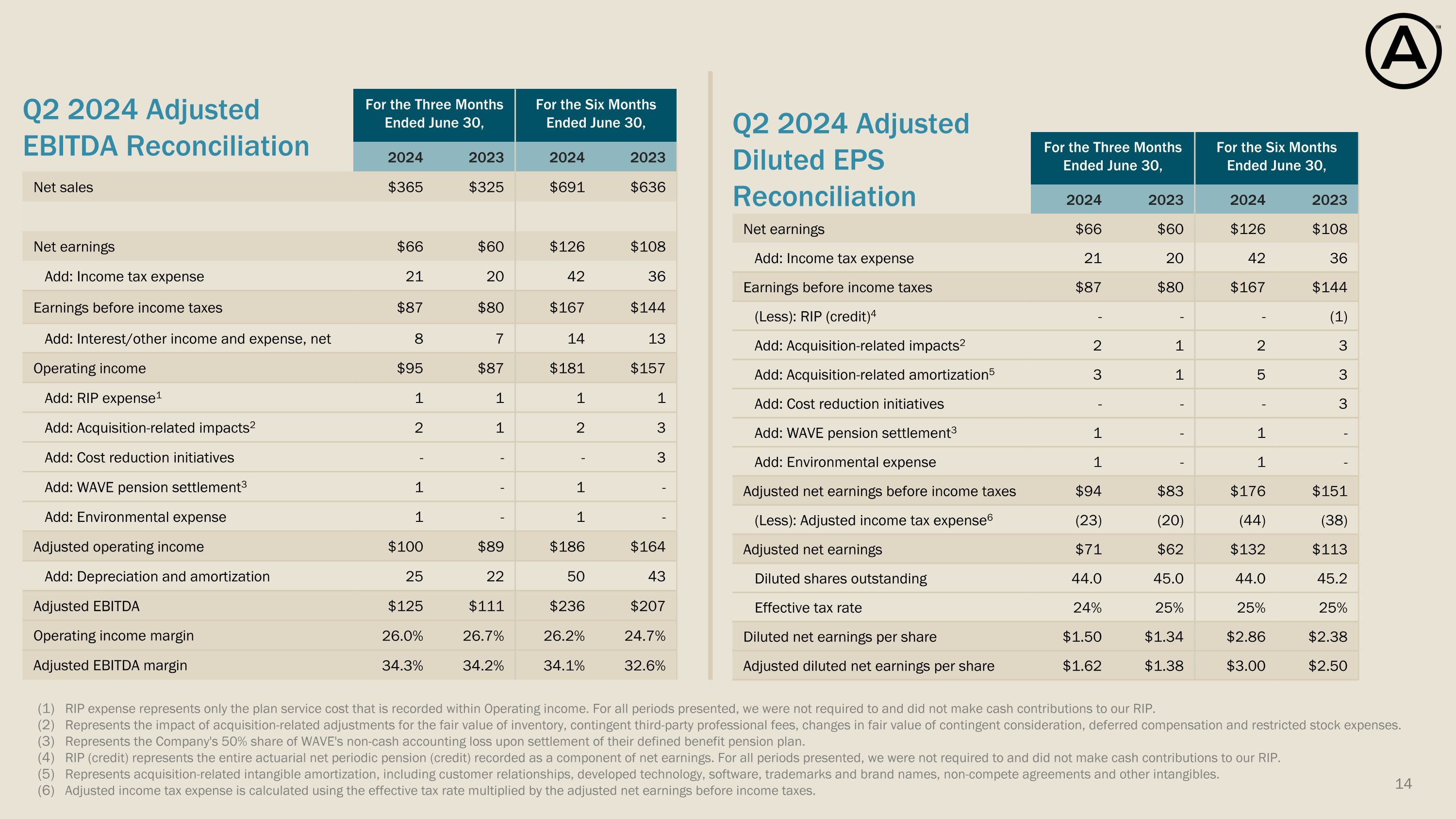

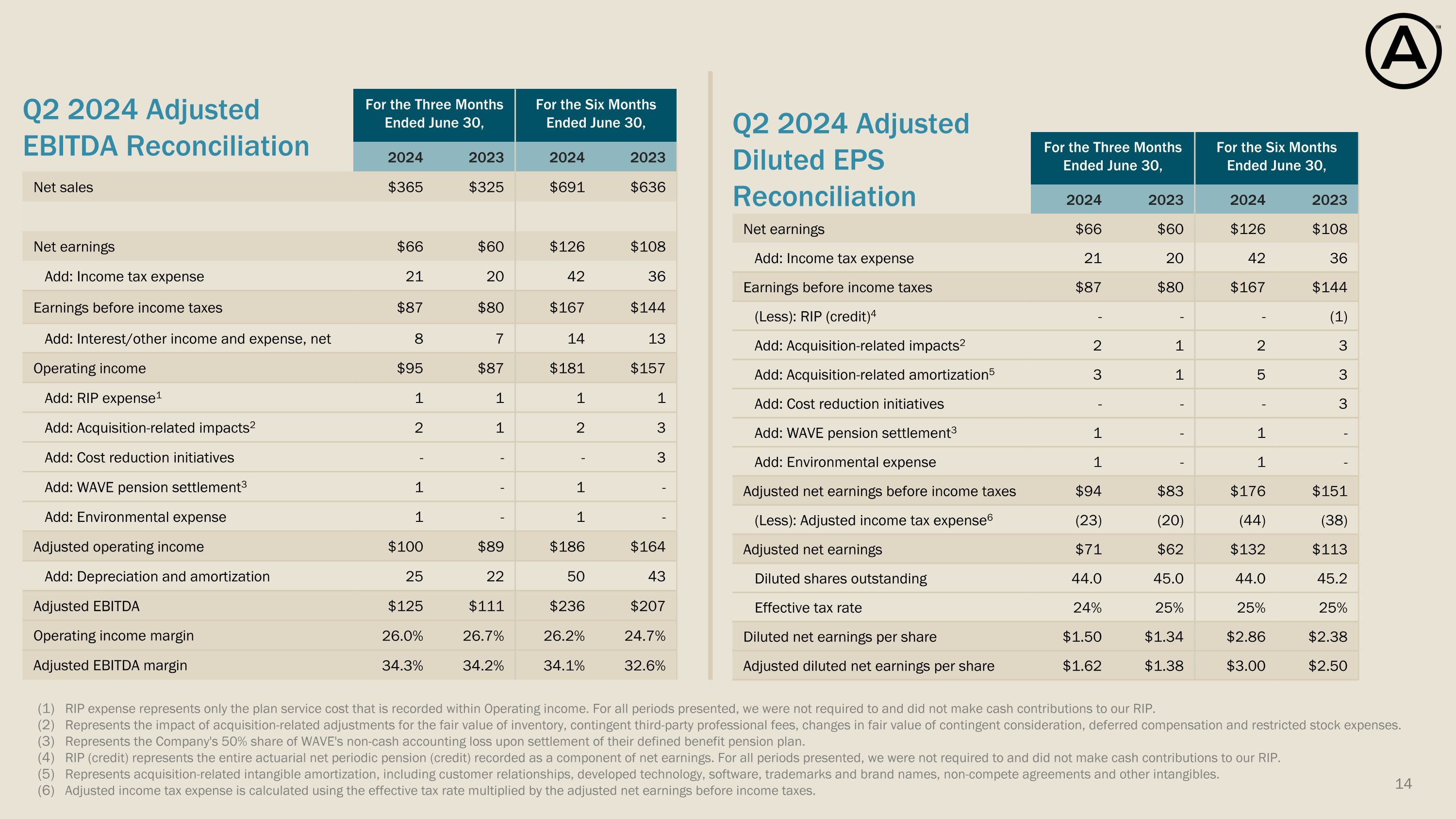

RIP expense represents only the plan service cost that is recorded within Operating income. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of inventory, contingent third-party professional fees, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses. Represents the Company's 50% share of WAVE's non-cash accounting loss upon settlement of their defined benefit pension plan. RIP (credit) represents the entire actuarial net periodic pension (credit) recorded as a component of net earnings. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents acquisition-related intangible amortization, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements and other intangibles. Adjusted income tax expense is calculated using the effective tax rate multiplied by the adjusted net earnings before income taxes. For the Three Months Ended June 30, For the Six Months Ended June 30, 2024 2023 2024 2023 Net sales $365 $325 $691 $636 Net earnings $66 $60 $126 $108 Add: Income tax expense 21 20 42 36 Earnings before income taxes $87 $80 $167 $144 Add: Interest/other income and expense, net 8 7 14 13 Operating income $95 $87 $181 $157 Add: RIP expense1 1 1 1 1 Add: Acquisition-related impacts2 2 1 2 3 Add: Cost reduction initiatives - - - 3 Add: WAVE pension settlement3 1 - 1 - Add: Environmental expense 1 - 1 - Adjusted operating income $100 $89 $186 $164 Add: Depreciation and amortization 25 22 50 43 Adjusted EBITDA $125 $111 $236 $207 Operating income margin 26.0% 26.7% 26.2% 24.7% Adjusted EBITDA margin 34.3% 34.2% 34.1% 32.6% For the Three Months Ended June 30, For the Six Months Ended June 30, 2024 2023 2024 2023 Net earnings $66 $60 $126 $108 Add: Income tax expense 21 20 42 36 Earnings before income taxes $87 $80 $167 $144 (Less): RIP (credit)4 - - - (1) Add: Acquisition-related impacts2 2 1 2 3 Add: Acquisition-related amortization5 3 1 5 3 Add: Cost reduction initiatives - - - 3 Add: WAVE pension settlement3 1 - 1 - Add: Environmental expense 1 - 1 - Adjusted net earnings before income taxes $94 $83 $176 $151 (Less): Adjusted income tax expense6 (23) (20) (44) (38) Adjusted net earnings $71 $62 $132 $113 Diluted shares outstanding 44.0 45.0 44.0 45.2 Effective tax rate 24% 25% 25% 25% Diluted net earnings per share $1.50 $1.34 $2.86 $2.38 Adjusted diluted net earnings per share $1.62 $1.38 $3.00 $2.50 Q2 2024 Adjusted EBITDA Reconciliation Q2 2024 Adjusted Diluted EPS Reconciliation

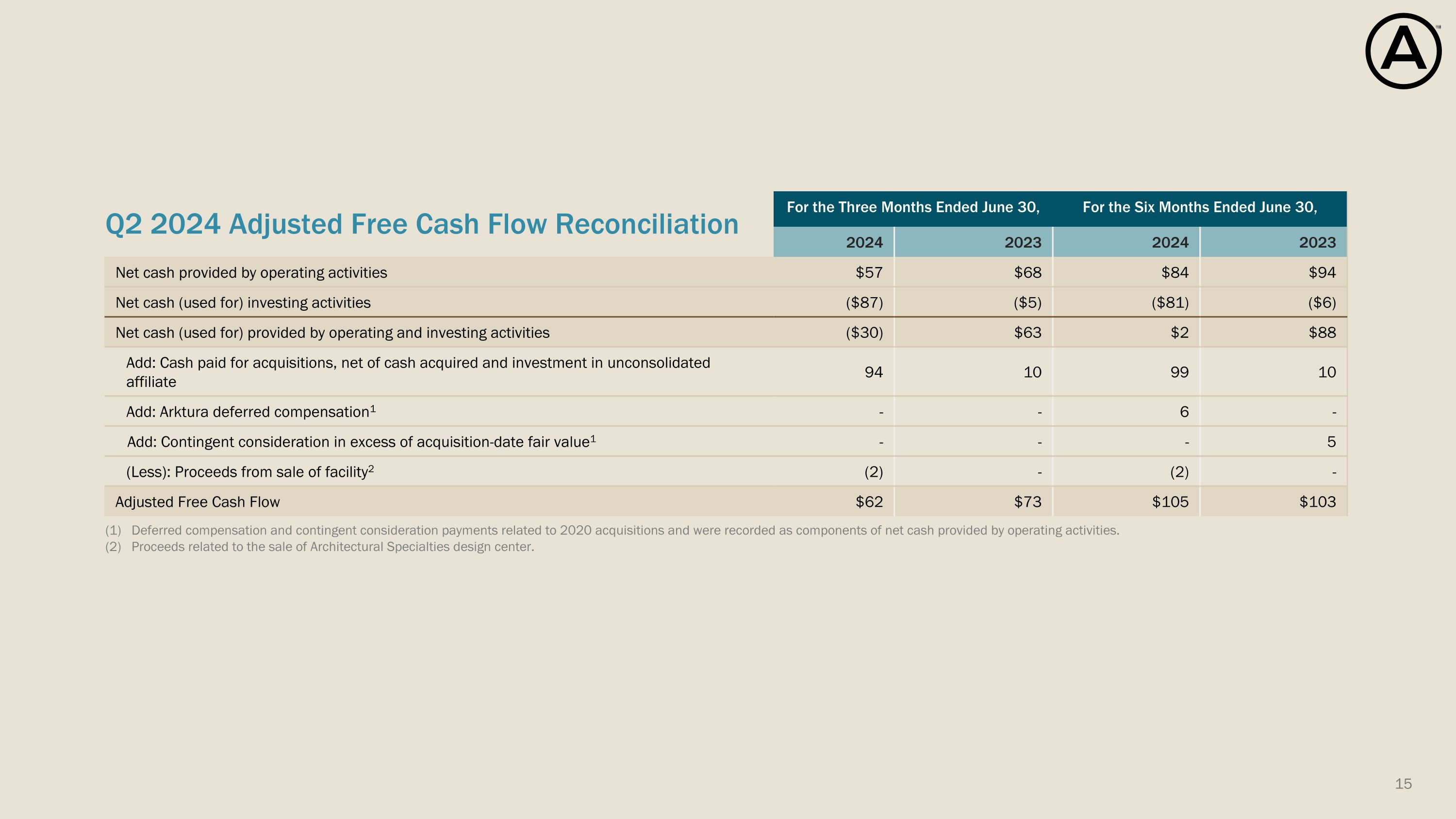

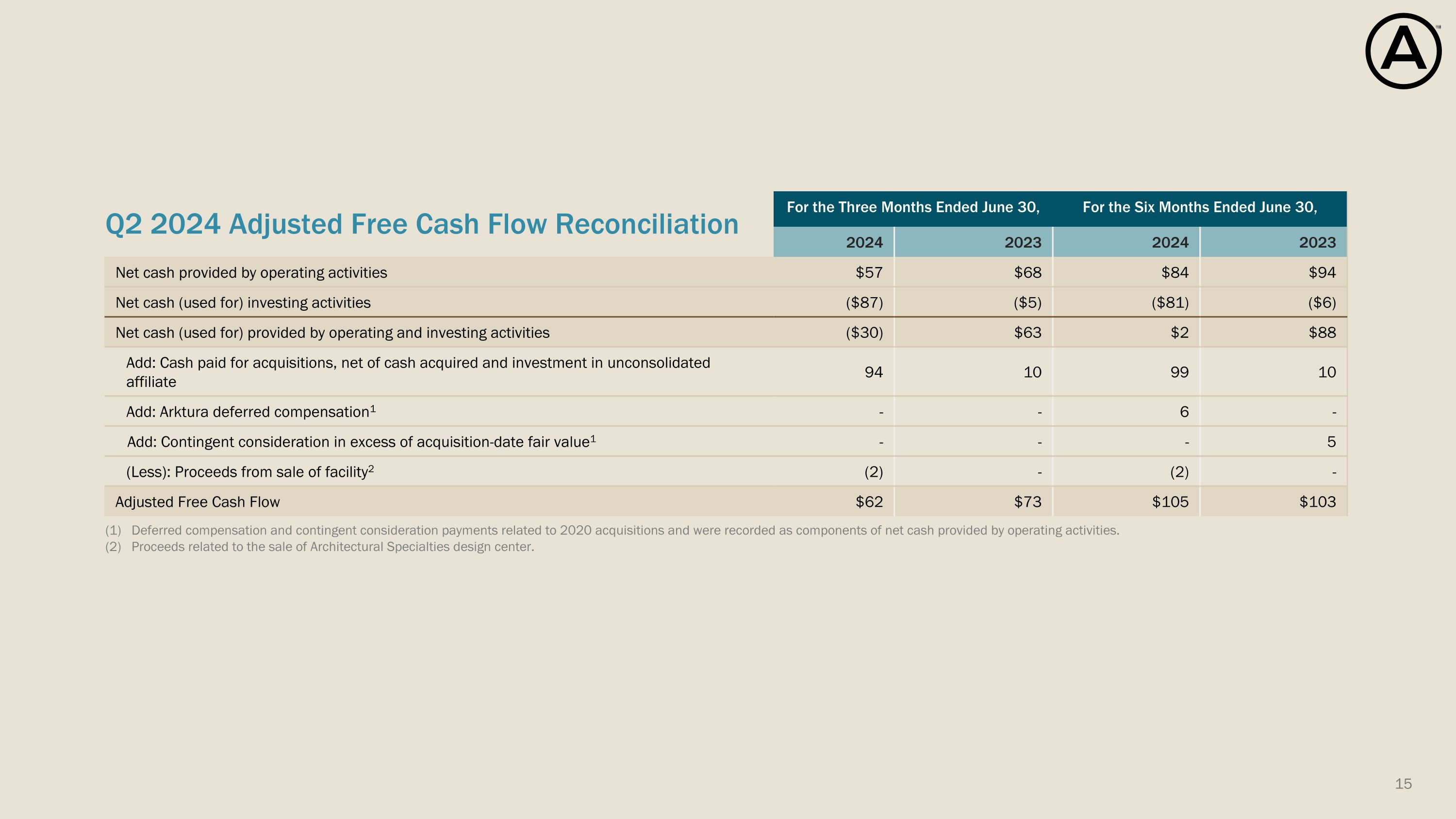

(1) Deferred compensation and contingent consideration payments related to 2020 acquisitions and were recorded as components of net cash provided by operating activities. (2) Proceeds related to the sale of Architectural Specialties design center. For the Three Months Ended June 30, For the Six Months Ended June 30, 2024 2023 2024 2023 Net cash provided by operating activities $57 $68 $84 $94 Net cash (used for) investing activities ($87) ($5) ($81) ($6) Net cash (used for) provided by operating and investing activities ($30) $63 $2 $88 Add: Cash paid for acquisitions, net of cash acquired and investment in unconsolidated affiliate 94 10 99 10 Add: Arktura deferred compensation1 - - 6 - Add: Contingent consideration in excess of acquisition-date fair value1 - - - 5 (Less): Proceeds from sale of facility2 (2) - (2) - Adjusted Free Cash Flow $62 $73 $105 $103 Q2 2024 Adjusted Free Cash Flow Reconciliation

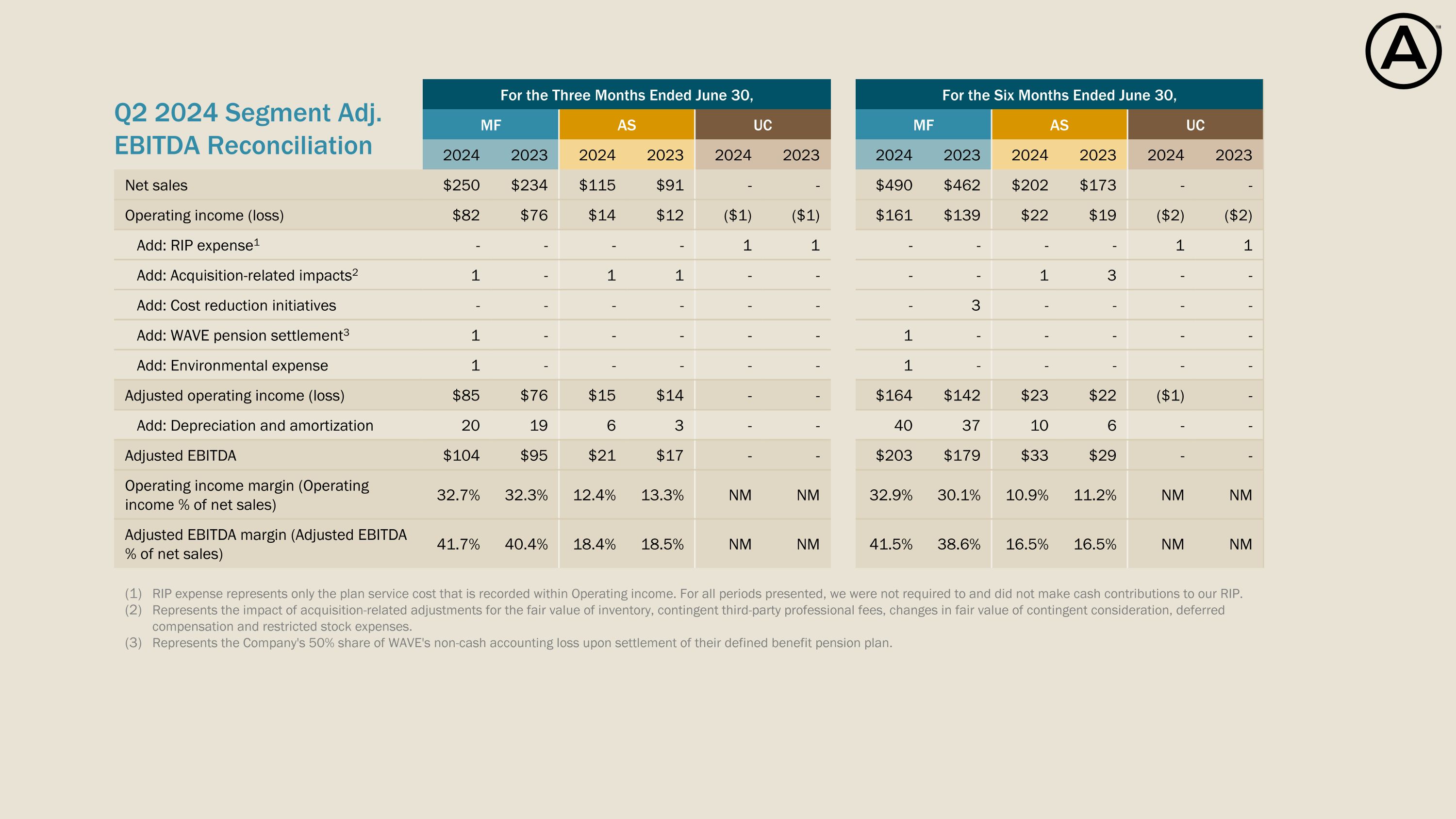

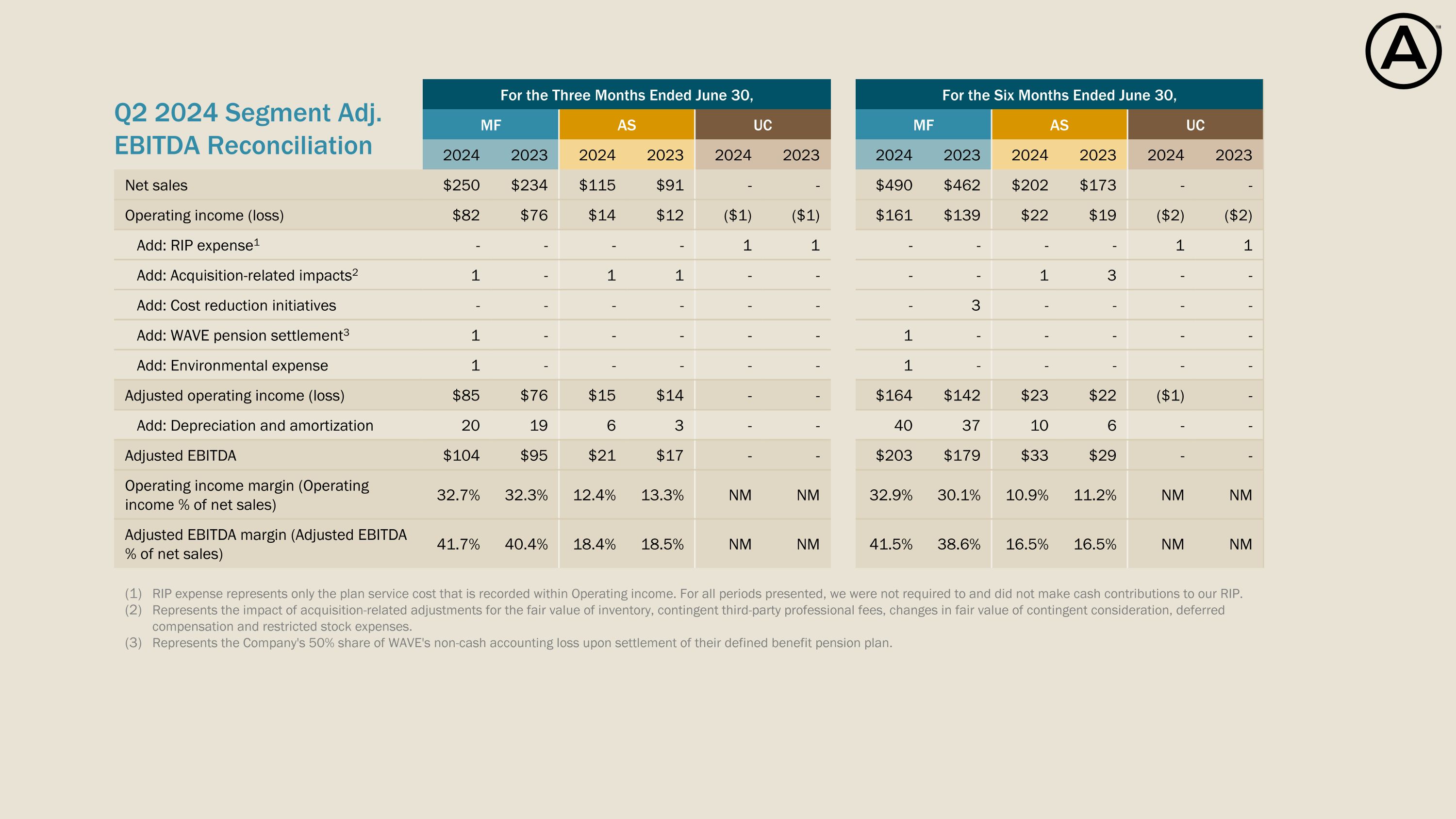

For the Three Months Ended June 30, For the Six Months Ended June 30, MF AS UC UNALLOCATED CORPORATE MF AS UC UNALLOCATED CORPORATE 2024 2023 2024 2023 2024 2023 2024 2023 2024 2023 2024 2023 Net sales $250 $234 $115 $91 - - $490 $462 $202 $173 - - Operating income (loss) $82 $76 $14 $12 ($1) ($1) $161 $139 $22 $19 ($2) ($2) Add: RIP expense1 - - - - 1 1 - - - - 1 1 Add: Acquisition-related impacts2 1 - 1 1 - - - - 1 3 - - Add: Cost reduction initiatives - - - - - - - 3 - - - - Add: WAVE pension settlement3 1 - - - - - 1 - - - - - Add: Environmental expense 1 - - - - - 1 - - - - - Adjusted operating income (loss) $85 $76 $15 $14 - - $164 $142 $23 $22 ($1) - Add: Depreciation and amortization 20 19 6 3 - - 40 37 10 6 - - Adjusted EBITDA $104 $95 $21 $17 - - $203 $179 $33 $29 - - Operating income margin (Operating income % of net sales) 32.7% 32.3% 12.4% 13.3% NM NM 32.9% 30.1% 10.9% 11.2% NM NM Adjusted EBITDA margin (Adjusted EBITDA % of net sales) 41.7% 40.4% 18.4% 18.5% NM NM 41.5% 38.6% 16.5% 16.5% NM NM Q2 2024 Segment Adj. EBITDA Reconciliation RIP expense represents only the plan service cost that is recorded within Operating income. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of inventory, contingent third-party professional fees, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses. Represents the Company's 50% share of WAVE's non-cash accounting loss upon settlement of their defined benefit pension plan.

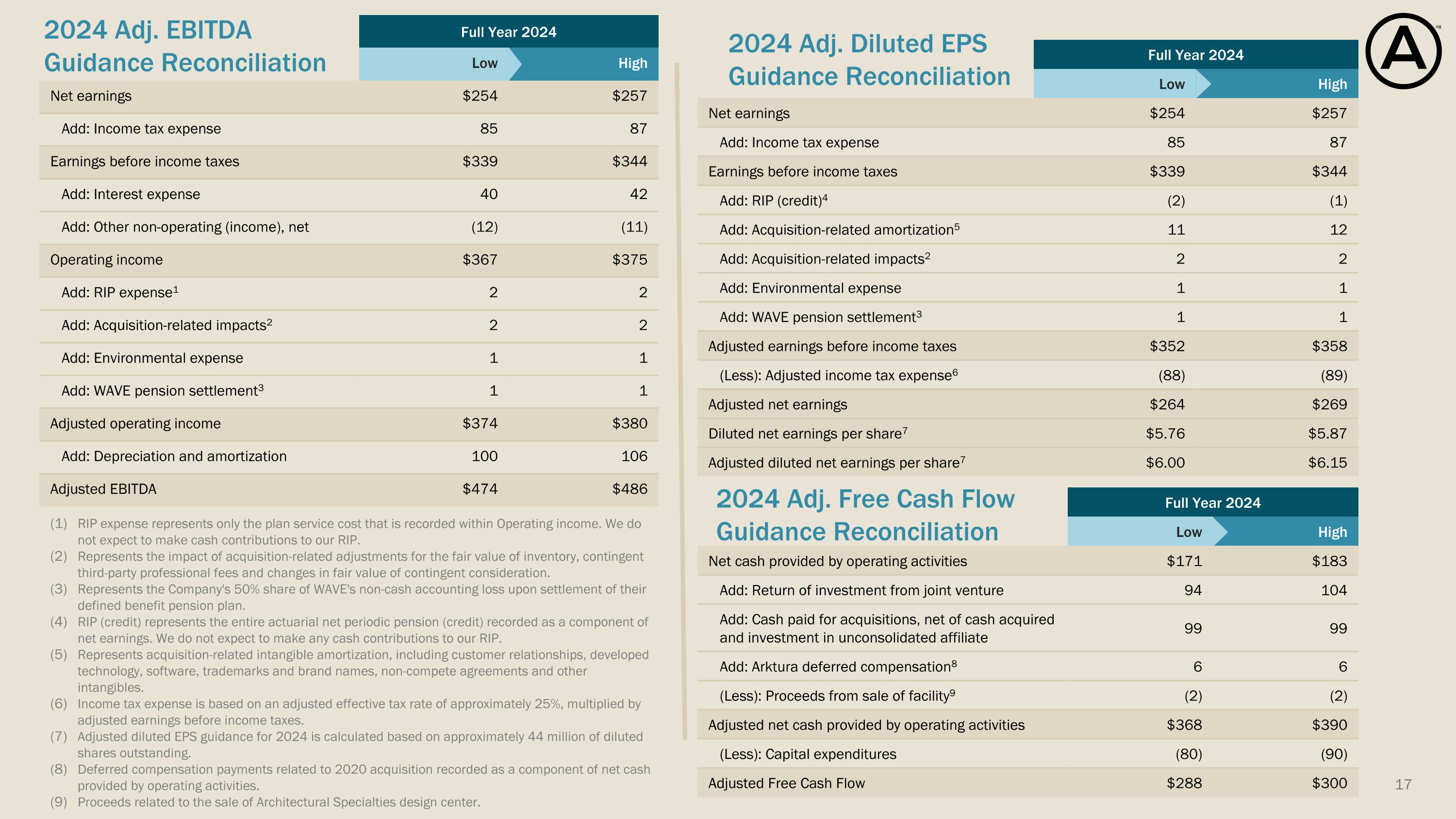

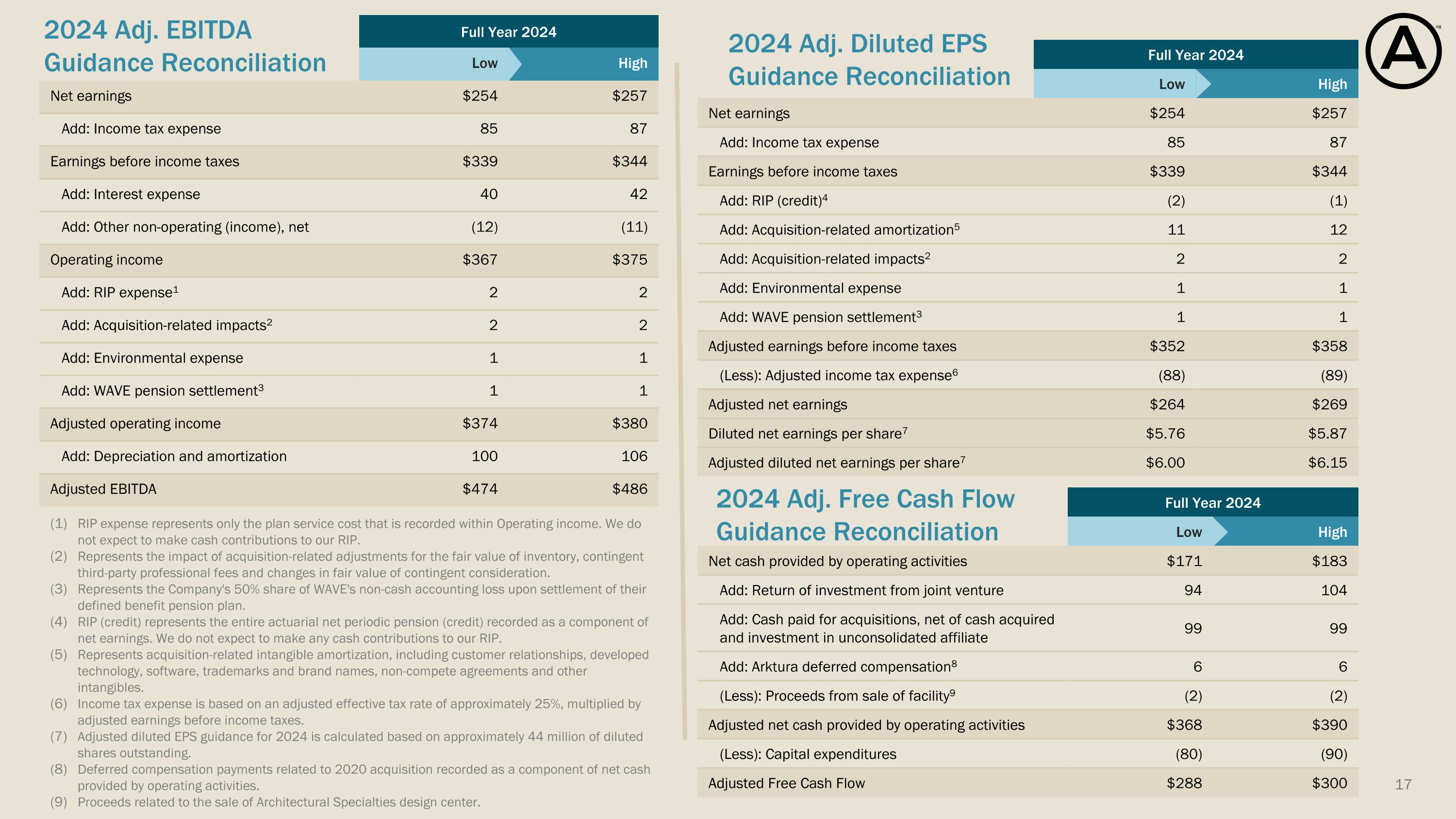

Full Year 2024 Low High Net cash provided by operating activities $171 $183 Add: Return of investment from joint venture 94 104 Add: Cash paid for acquisitions, net of cash acquired and investment in unconsolidated affiliate 99 99 Add: Arktura deferred compensation8 6 6 (Less): Proceeds from sale of facility9 (2) (2) Adjusted net cash provided by operating activities $368 $390 (Less): Capital expenditures (80) (90) Adjusted Free Cash Flow $288 $300 Full Year 2024 Low High Net earnings $254 $257 Add: Income tax expense 85 87 Earnings before income taxes $339 $344 Add: Interest expense 40 42 Add: Other non-operating (income), net (12) (11) Operating income $367 $375 Add: RIP expense1 2 2 Add: Acquisition-related impacts2 2 2 Add: Environmental expense 1 1 Add: WAVE pension settlement3 1 1 Adjusted operating income $374 $380 Add: Depreciation and amortization 100 106 Adjusted EBITDA $474 $486 2024 Adj. EBITDA Guidance Reconciliation 2024 Adj. Free Cash Flow Guidance Reconciliation 2024 Adj. Diluted EPS Guidance Reconciliation Full Year 2024 Low High Net earnings $254 $257 Add: Income tax expense 85 87 Earnings before income taxes $339 $344 Add: RIP (credit)4 (2) (1) Add: Acquisition-related amortization5 11 12 Add: Acquisition-related impacts2 2 2 Add: Environmental expense 1 1 Add: WAVE pension settlement3 1 1 Adjusted earnings before income taxes $352 $358 (Less): Adjusted income tax expense6 (88) (89) Adjusted net earnings $264 $269 Diluted net earnings per share7 $5.76 $5.87 Adjusted diluted net earnings per share7 $6.00 $6.15 RIP expense represents only the plan service cost that is recorded within Operating income. We do not expect to make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of inventory, contingent third-party professional fees and changes in fair value of contingent consideration. Represents the Company's 50% share of WAVE's non-cash accounting loss upon settlement of their defined benefit pension plan. RIP (credit) represents the entire actuarial net periodic pension (credit) recorded as a component of net earnings. We do not expect to make any cash contributions to our RIP. Represents acquisition-related intangible amortization, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements and other intangibles. Income tax expense is based on an adjusted effective tax rate of approximately 25%, multiplied by adjusted earnings before income taxes. Adjusted diluted EPS guidance for 2024 is calculated based on approximately 44 million of diluted shares outstanding. Deferred compensation payments related to 2020 acquisition recorded as a component of net cash provided by operating activities. Proceeds related to the sale of Architectural Specialties design center.