Armstrong World Industries Acquires �A. Zahner Company, LLC (“Zahner®”) December 4, 2024 Exhibit 99.2

Safe Harbor Statement Disclosures in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation, those relating to future financial and operational results, market and broader economic conditions and guidance. Those statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. This includes annual guidance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that could cause our actual results to differ materially from those projected, anticipated or implied is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Form 10-K and Form 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”), including our report for the quarterly period ended September 30, 2024. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. In addition, we will be referring to non-Generally Accepted Accounting Principles (“GAAP”) financial measures within the meaning �of SEC Regulation G.

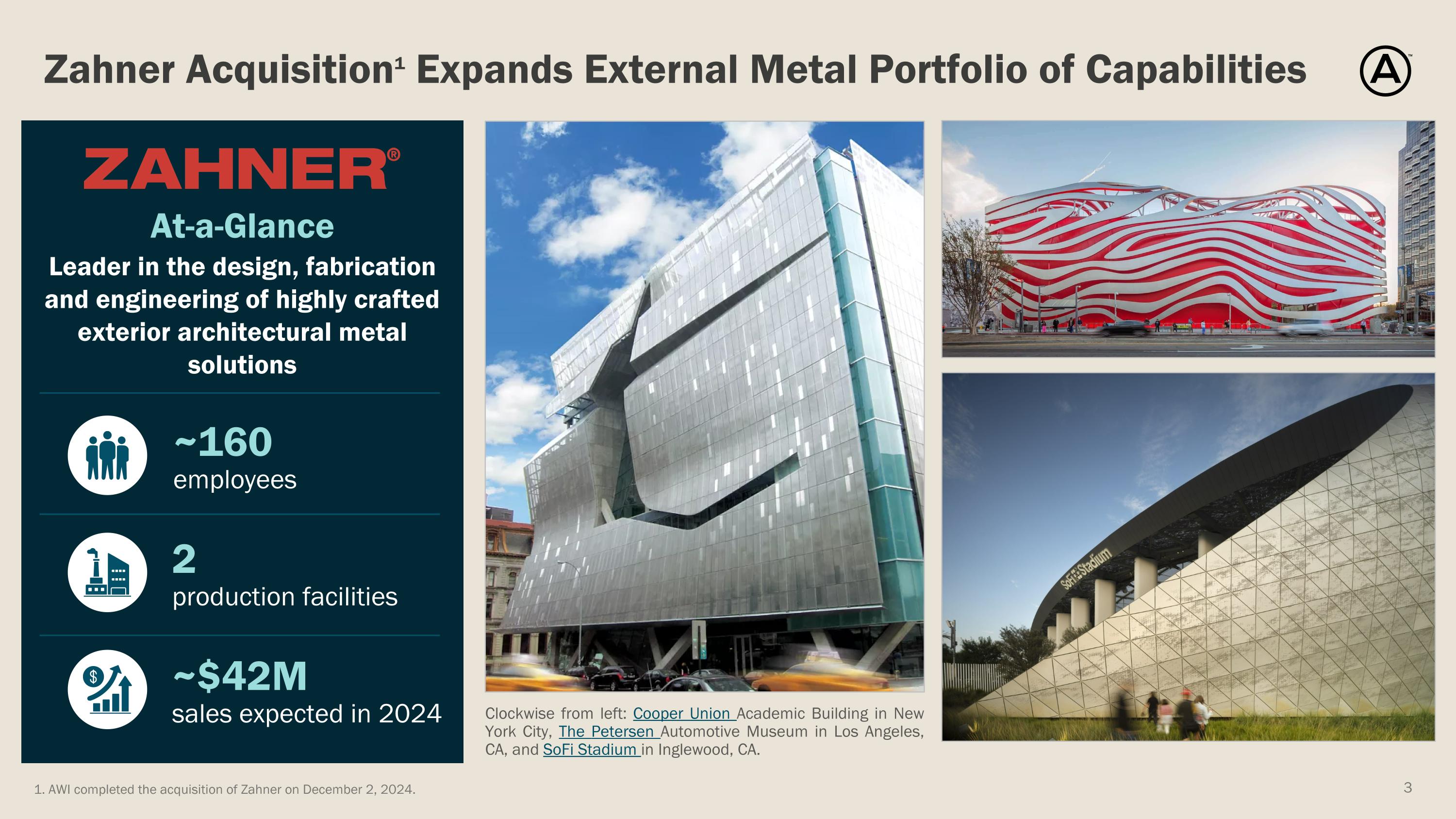

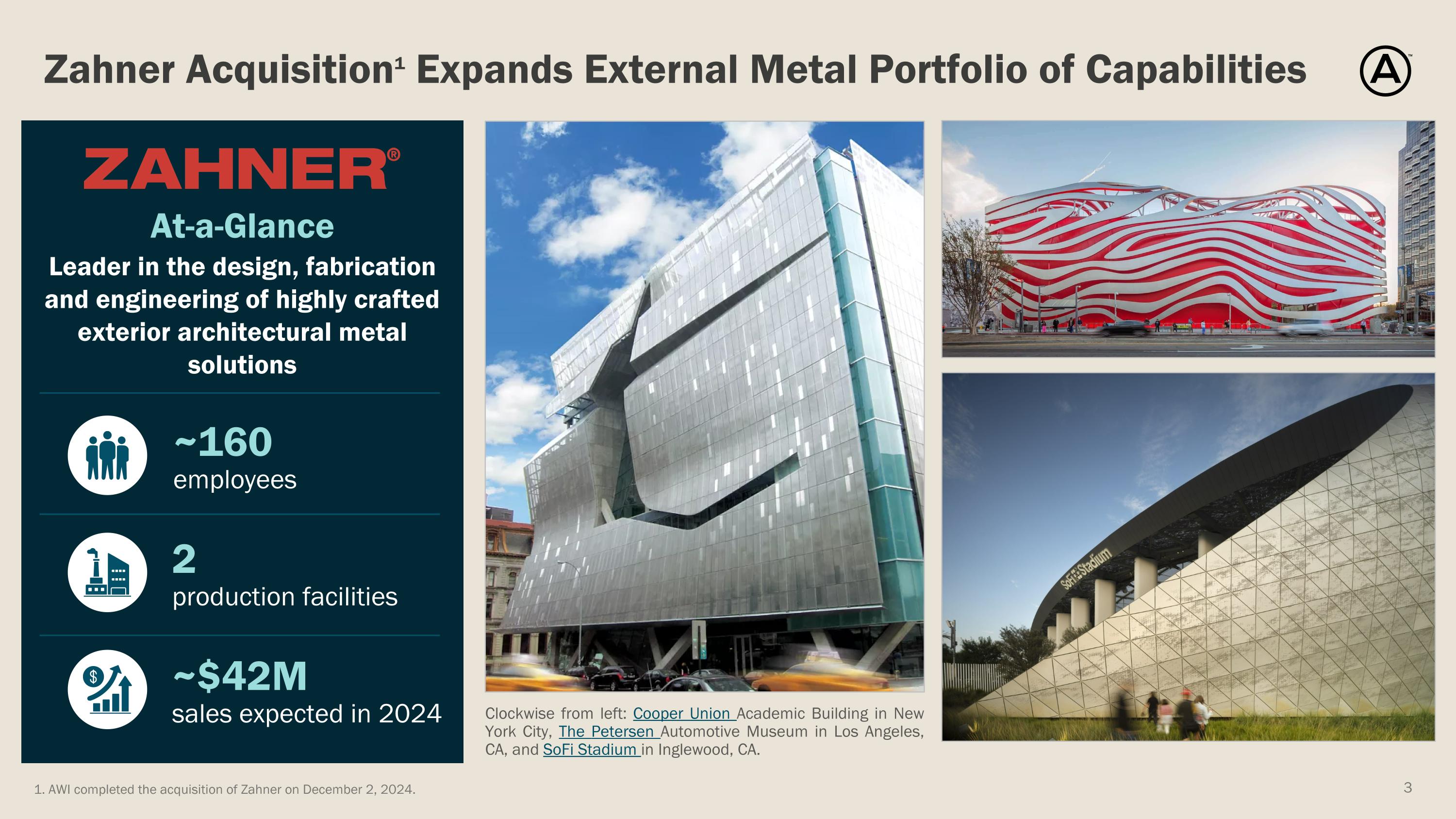

Zahner Acquisition1 Expands External Metal Portfolio of Capabilities At-a-Glance Leader in the design, fabrication and engineering of highly crafted exterior architectural metal solutions ~160 employees ~$42M sales expected in 2024 2 production facilities 1. AWI completed the acquisition of Zahner on December 2, 2024. Clockwise from left: Cooper Union Academic Building in New York City, The Petersen Automotive Museum in Los Angeles, CA, and SoFi Stadium in Inglewood, CA.

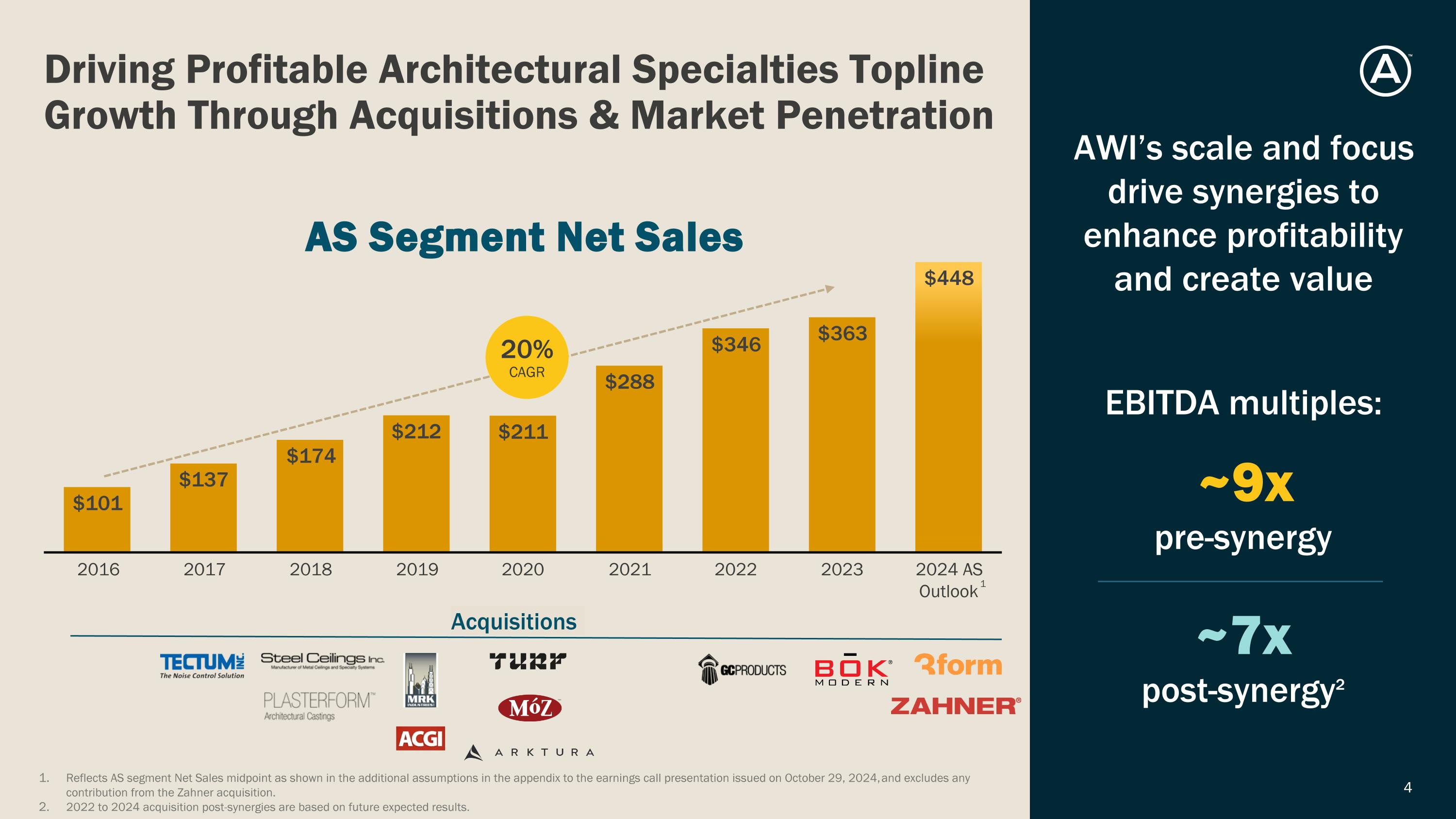

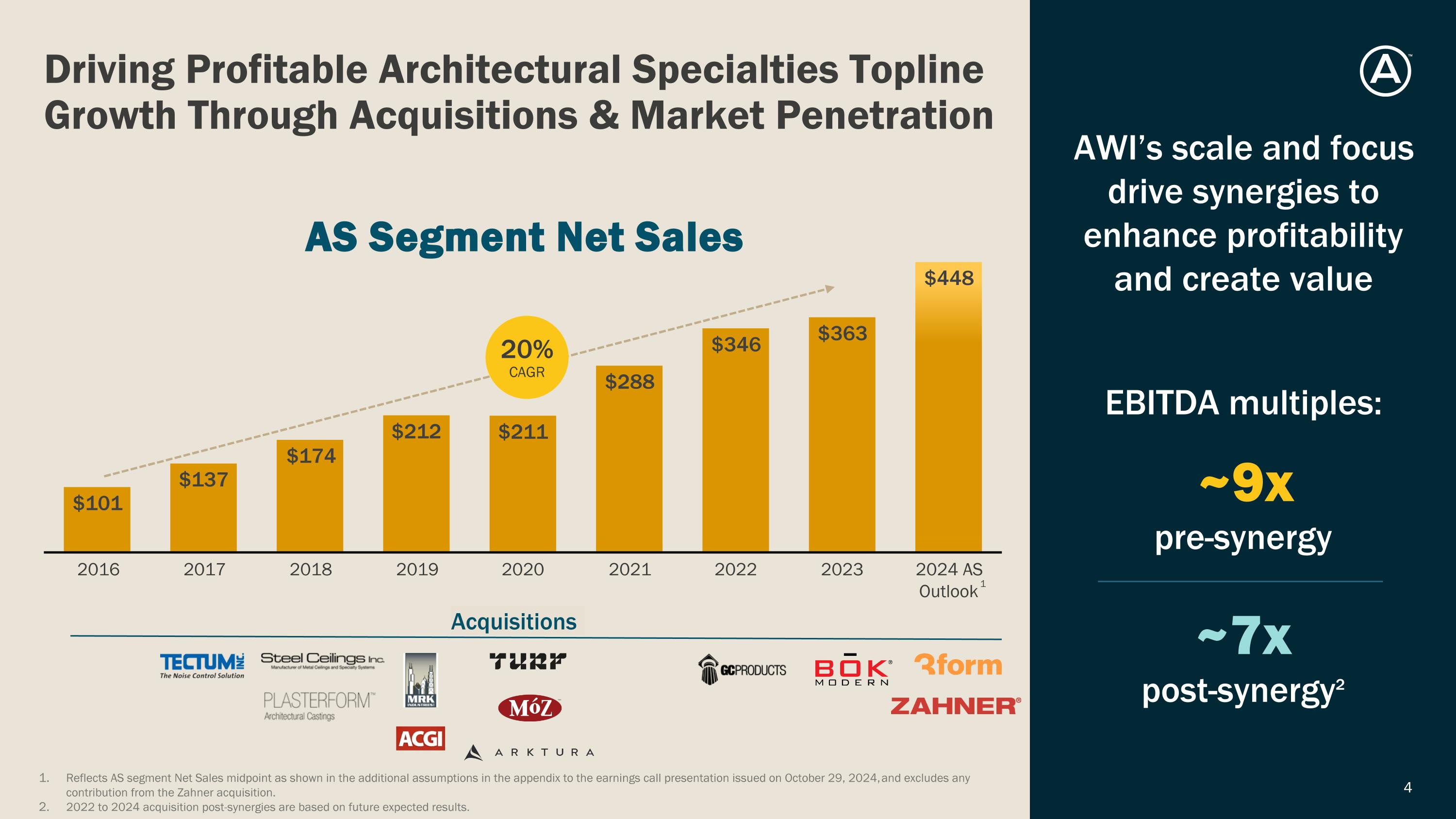

Driving Profitable Architectural Specialties Topline �Growth Through Acquisitions & Market Penetration 4 Acquisitions AWI’s scale and focus drive synergies to enhance profitability and create value EBITDA multiples: ~9x pre-synergy ~7x post-synergy2 AS Segment Net Sales 20% CAGR Reflects AS segment Net Sales midpoint as shown in the additional assumptions in the appendix to the earnings call presentation issued on October 29, 2024, and excludes any contribution from the Zahner acquisition. 2022 to 2024 acquisition post-synergies are based on future expected results. 1

Advancing External Metal Capabilities to Unlock an Additional�$1B Architectural Specialties Market Opportunity “TAM”: Total Addressable Market. Based on internal company estimates. Today… Looking forward… ~$1.5B�TAM1 Interior Applications Primarily interior metal, wood, felt, glass reinforced gypsum and translucents $2.5B+ TAM1 Interior Applications Exterior Metal 2023 July 2024 December