Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2003

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

ARMSTRONG HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 333-32530 | 23-3033414 | ||

| (State or other jurisdiction of incorporation or organization) | Commission file number | (I.R.S. Employer Identification No.) |

| P. O. Box 3001, Lancaster, Pennsylvania | 17604 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (717) 397-0611

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class | ||

Common Stock ($1 par value) | ||

Preferred Stock Purchase Rights |

ARMSTRONG WORLD INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 1-2116 | 23-0366390 | ||

| (State or other jurisdiction of incorporation or organization) | Commission file number | (I.R.S. Employer Identification No.) |

| P. O. Box 3001, Lancaster, Pennsylvania | 17604 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (717) 397-0611

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

1

Table of Contents

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days.

Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act).

Yes¨ Nox

The aggregate market value of the Common Stock of Armstrong Holdings, Inc. held by non-affiliates based on the closing price ($1.98 per share) on the over-the-counter (OTC) Bulletin Board (trading symbol ACKHQ) on June 30, 2003, was approximately $73.9 million. As of February 10, 2004, the number of shares outstanding of registrant’s Common Stock was 40,668,892. This amount includes the 1,911,533 shares of Common Stock as of December 31, 2003, held by JPMorgan Chase Bank, as Trustee for the employee stock ownership accounts of the company’s Retirement Savings and Stock Ownership Plan.

Documents Incorporated by Reference

None

2

Table of Contents

SECTION | PAGES | |||

| 4 | ||||

PART I | ||||

Item 1. | 7 | |||

Item 2. | 14 | |||

Item 3. | 15 | |||

Item 4. | 15 | |||

PART II | ||||

Item 5. | Market for the Registrant’s Common Equity and Related Stockholder Matters | 16 | ||

Item 6. | 17 | |||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 | ||

Item 7A. | 44 | |||

Item 8. | Financial Statements and Supplementary Data | |||

| 46 | ||||

| 47 | ||||

| 49 | ||||

| 102 | ||||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 154 | ||

Item 9A. | 154 | |||

PART III | ||||

Item 10. | 155 | |||

Item 11. | 160 | |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management | 166 | ||

Item 13. | 168 | |||

Item 14. | 169 | |||

PART IV | ||||

Item 15. | Exhibits, Financial Statement Schedules and Reports on Form 8-K | 170 | ||

| 177 | ||||

3

Table of Contents

Cautionary Factors That May Affect Future Results

This report and other written reports and oral statements made from time to time by the company may contain cautionary or “forward looking statements” as defined in the Private Securities Litigation Reform Act of 1995.

These statements can be identified by the use of the words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words of similar meaning. In particular, these include statements relating to intentions, beliefs or current expectations concerning, among other things, future performance, results of operations, the outcome of contingencies such as legal proceedings, and financial conditions. Forward-looking statements give current expectations or forecasts of future events. They do not relate strictly to historical or current facts.

Any or all of the forward-looking statements made in this report and in any other public statements may turn out to be incorrect. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that actual future results of operations may vary materially from forward looking statements. Any forward-looking statements made in this report speak only as of the date of such statement. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. However, you should consult any further disclosures we make on related subjects in Forms 10-Q, 8-K, 10-K or other reports filed with the Securities and Exchange Commission.

It is not possible to predict or identify all factors that could potentially cause actual results to differ materially from expected and historical results. Some such factors are:

Chapter 11

| • | Factors relating to Armstrong World Industries, Inc.’s (“AWI”) Chapter 11 Filing, such as: the possible disruption of relationships with creditors, customers, suppliers and employees; the ultimate size of AWI’s asbestos-related and other liabilities; the ability to confirm and implement a plan of reorganization; the availability of financing and refinancing for both AWI and its subsidiaries that are not parties to its Chapter 11 Filing; legislation that might affect AWI’s liabilities; and AWI’s ability to comply with covenants in its debtor-in-possession credit facility (the “DIP Facility”). |

| • | Factors relating to AWI’s emergence from bankruptcy, such as emergence-related costs; AWI’s debt service costs for debt planned to be issued to finance its plan of reorganization and to meet operating cash requirements after emergence. Debt service costs will affect net income and cash flow. |

| • | Covenants in the Agreements governing our anticipated emergence-related debt may impose restrictions that limit operating and financial flexibility. |

Business Environment

| • | Our business is cyclical in nature and is affected by the same economic factors that affect the residential, office, commercial and institutional renovation and construction industries in general, such as the availability of credit, consumer confidence, changes in interest rates, governmental budgets and general economic conditions. Despite our efforts to foresee and plan for the effects of changes in these circumstances, we cannot predict their impact with certainty. For example, economic weakness can lead customers to delay or cancel construction plans or could lead to further industry overcapacity. For more information on these matters, see the discussion of Market Risk in Item 7A of this report. |

4

Table of Contents

| • | The major markets for our products, particularly in the renovation and construction industries, are highly competitive. Business combinations among our competitors or suppliers could affect our competitive position in any of our business units. Competition from foreign competitors who have lower cost structure than us is a threat in the flooring business. Similarly, combinations or alliances among our major customers could increase their purchasing power in dealing with us. If we should enter into one or more business combinations, our business, finances and capital structure could be affected. |

| • | The level of success of our new product introductions and those of our competitors will impact our market share, as well as new patents. |

| • | The extent to which we successfully achieve integration of and synergies from acquisitions as well as the impact of divestitures, plant closings, including the ability to derive cost savings, and other unusual items that may result from evolving business strategies and organizational restructuring. |

Sales Environment

| • | We have several key customers and the loss of one of these customers could affect our financial performance. Although builders, dealers and other retailers represent other channels of distribution for our products, the loss of a significant portion of sales from a major customer would have a material adverse impact on our results of operations. |

| • | Business decisions made by our major customers and business conditions that affect our major customers and distribution networks may adversely affect our business. |

| • | Increased retail trade consolidation, especially in markets such as the United States, could make us more dependent upon key retailers whose relative bargaining strength may increase. |

| • | We are affected by changes in the policies and marketing strategies of our retail trade customers, such as inventory shifts or fluctuations, limitations on access to shelf space and other conditions. Many of our customers, particularly major home center retailers, have engaged with us in continuous efforts to reduce their inventory levels and improve delivery fulfillment. |

| • | Profitability can be affected by changes over time in consumer preferences for one type of product versus another. This may create a shift in demand from products with higher margins to those with lower margins or to products we do not sell. |

International

| • | We face political, social and economic risks related to our international operations which can negatively affect our business, operating results, profitability and financial condition. The risk of war and terrorism may adversely affect the economy and the demand for our products. |

| • | Various worldwide economic and political factors, such as changes in the competitive structures of the markets, credit risks in emerging markets, variations in residential and commercial construction rates, and economic growth rates in various areas of the world in which we do business could affect the end-use markets for our products. |

| • | Profitability can be affected by margin erosion if sales shift to developing markets with lower profitability. |

| • | Changes in intellectual property legal protections and remedies, trade regulations, tariff classifications or duty rates, and procedures and actions affecting production, pricing and marketing of products, intergovernmental disputes, possible nationalization and unstable governments and legal systems could impact our business. |

5

Table of Contents

| • | Fluctuations in exchange rates, particularly the Euro, can significantly affect our reported results from one period to the next. Tax inefficiencies in repatriating cash flow from non-U.S. subsidiaries could adversely affect us. |

Legal Claims

| • | Claims of undetermined merit and amount have been asserted against us for various legal matters, including asbestos-related litigation and claims. We could face potential product liability or warranty claims relating to products we manufacture or distribute. For more information on these matters, see the discussion of Legal Proceedings in Part I, Item 3 in this report. |

Raw Materials and Sourced Products

| • | The availability of raw materials, energy, water and sourced products due to changes in conditions that impact our suppliers, including environmental conditions, laws and regulations, litigation involving our suppliers, transportation disruptions and/or business decisions made by our suppliers may have an adverse impact on our results of operations. |

| • | We purchase a significant amount of certain raw materials, such as lumber, veneers, PVC resin, plasticizers, mineral fibers and natural gas. Prices of these raw materials, as well as transportation costs, can change dramatically and can have a significant adverse impact on our manufacturing costs. |

Environmental Regulations

| • | We are subject to a wide variety of increasingly complex and stringent federal, state and local laws and regulations pertinent to our operations. Changes in environmental regulations that affect our business could lead to significant, unforeseen expenses. |

6

Table of Contents

PART I

| ITEM 1. | BUSINESS |

General

Armstrong World Industries, Inc. (“AWI”) is a Pennsylvania corporation incorporated in 1891. Armstrong Holdings, Inc. is a Delaware corporation and the publicly held parent holding company of AWI. AHI’s only significant asset and operation is its indirect ownership, through Armstrong Worldwide, Inc., of all of the capital stock of AWI. We include separate financial statements for Armstrong Holdings, Inc. and its subsidiaries and AWI and its subsidiaries in this report because both companies have public securities that are registered under the Securities Exchange Act of 1934. The difference between the financial statements of Armstrong Holdings, Inc. and its subsidiaries and AWI and its subsidiaries is primarily due to transactions that occurred in 2000 related to the formation of Armstrong Holdings, Inc. and to employee compensation-related stock activity. However, there are no differences in the income statements of AHI and AWI and its subsidiaries and minimal differences in the remaining three financial statements of each entity. Due to the lack of material differences in the financial statements, when we refer in this document to Armstrong Holdings, Inc. and its subsidiaries as “AHI,” “Armstrong,” “we,” “us,” and “ourselves,” we are also effectively referring to AWI and its subsidiaries. We use the term “AWI” when we are referring solely to Armstrong World Industries, Inc.

We maintain a Web site at http://www.armstrong.com. Information contained on our website is not incorporated into this document. Annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, all amendments to those reports and other information about us are available free of charge through this website as soon as reasonably practicable after the reports are electronically filed with the Securities and Exchange Commission (“SEC”).

We are a leading global producer of flooring products and ceiling systems for use primarily in the construction and renovation of residential, commercial and institutional buildings. Through our United States (“U.S.”) operations and U.S. and international subsidiaries, we design, manufacture and sell flooring products (resilient, wood, carpeting and sports flooring) and ceiling systems (primarily mineral fiber, fiberglass and metal), around the world. We also design, manufacture and sell kitchen and bathroom cabinets in the U.S. We own and operate 44 manufacturing plants in 12 countries, including 26 plants located throughout the United States. Through WAVE, our joint venture with Worthington Industries, Inc., we also have an interest in 8 additional plants in 5 countries that produce suspension system (grid) products for our ceiling systems.

Our business strategy focuses on product innovation, product quality and customer service. In our businesses, these factors are the primary determinants of market share gain or loss. Our objective is to ensure that anyone buying a floor or ceiling can find an Armstrong product that meets their needs. Our cabinet strategy is more focused – on stock cabinets in select geographic markets. In these segments, we have the same objectives: high quality, good customer service and products that meet our customers’ needs. Our markets are very competitive, which limits our pricing flexibility. This requires that we increase our productivity each year – both in our plants and in our administration of the businesses.

Chapter 11 Proceeding

On December 6, 2000, AWI filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) in order to use the court-supervised reorganization process to achieve a resolution of its asbestos liability. Also filing under Chapter 11 were two of AWI’s wholly-owned subsidiaries, Nitram Liquidators, Inc. and Desseaux Corporation of North America, Inc. The Chapter 11 cases are being jointly administered under case number 00-4471 (the “Chapter 11 Case”). AWI is operating its business and managing its properties as a debtor-in-possession subject to the provisions of the Bankruptcy Code. See Note 1 of the Consolidated Financial Statements for information on the Chapter 11 Case and Note 32 of the Consolidated Financial Statements for information on asbestos litigation.

7

Table of Contents

Reportable Segments

Resilient Flooring — produces a broad range of floor coverings for homes and commercial and institutional buildings. Resilient Flooring products include vinyl sheet, vinyl tile, linoleum flooring and luxury vinyl tile. In addition, our Resilient Flooring segment sources and sells laminate products, adhesives, installation and maintenance materials and accessories, and has recently introduced ceramic tile products. Resilient Flooring products are offered in a wide variety of types, designs, and colors, and provide ease of installation and reduced maintenance (no-wax). We sell these products to wholesalers, large home centers, retailers, contractors, and to the manufactured homes industry.

Wood Flooring — produces wood flooring products for use in new residential construction and renovation, with some commercial applications in stores, restaurants and high-end offices. The product offering includes solid wood (pre-finished or unfinished) and engineered wood floors in various wood species (with oak being the primary species of choice). Virtually all of our Wood Flooring’s sales are in the U.S. Our Wood Flooring products are generally sold to independent wholesale flooring distributors and large home centers under the brand names Bruce®, Hartco® and Robbins®.

Textiles and Sports Flooring (“TSF”) — produces carpeting and sports flooring products that are sold mainly in Europe. Carpeting products consist principally of carpet tiles and broadloom used in commercial applications and in the leisure and travel industry. Sports flooring products include artificial turf and other sports surfaces. Our TSF products are sold primarily through retailers, contractors, distributors and other industrial businesses.

Building Products — produces suspended mineral fiber, soft fiber and metal ceiling systems for use in commercial, institutional and residential settings. In addition, our Building Products segment sources and sells wood ceiling systems. The products are available in numerous colors, performance characteristics and designs, and offer attributes such as acoustical control, rated fire protection, and aesthetic appeal. Commercial ceiling materials and accessories are sold to ceiling systems contractors and to resale distributors. Residential ceiling products are sold through wholesalers and retailers (including large home centers). Suspension system (grid) products manufactured by WAVE are sold by both Armstrong and the WAVE joint venture.

Cabinets — produces kitchen and bathroom cabinetry and related products, which are used primarily in the U.S. residential new construction and renovation markets. Through our system of company-owned and independent distribution centers and through direct sales to builders, our Cabinets segment provides design, fabrication and installation services to single and multi-family homebuilders, remodelers and consumers under the brand names IXL®, Bruce® and Armstrong™.

We also report on two other segments, All Other (which relates to a corporate equity investment) and Unallocated Corporate Expense.

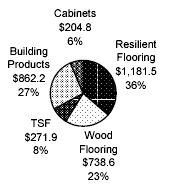

The following chart illustrates the breakdown of our consolidated net sales for the year ended December 31, 2003 by segment:

2003 Consolidated Net Sales By Segment

(in $ millions)

Table of Contents

See Note 3 of the Consolidated Financial Statements for additional financial information on our reportable segments.

Markets

The major markets we compete in are as follows:

North American Residential markets.The North American residential markets account for nearly one-half of our total consolidated net sales. Our Resilient Flooring, Wood Flooring, Building Products and Cabinets segments sell products for use in the home. Homeowners have a multitude of finishing solution options for every room in their house. For flooring, they can choose from our vinyl and wood products, for which we are the market’s largest provider, or from our laminate and recently introduced ceramic products. We compete directly with other domestic and international suppliers of these products. Our flooring products also compete with carpet, which we do not offer in this market. Our ceiling products compete against mineral fiber and fiberglass products from other manufacturers, as well as drywall installations. In the kitchen and bath areas, we compete with thousands of other cabinet manufacturers that include large diversified corporations as well as small local craftsmen.

Our products are used in new home construction and existing home renovation work. Industry estimates are that existing home renovation (also known as replacement / remodel) work represents approximately two-thirds of the total North American residential market opportunity. Key U.S. statistics that indicate market opportunity include existing home sales (a key indicator for renovation opportunity), housing starts, housing completions, interest rates and consumer confidence. For our Resilient Flooring and Wood Flooring products, we believe there is some longer-term correlation between these statistics and our revenue, especially with the new construction statistics, after reflecting a lag period between change in construction activity and our operating results of approximately several months. However, we believe that consumers’ preferences for product type, style, color, availability and affordability also significantly impact our revenue. Further, changes in inventory levels and product focus at national home centers, which are our largest customers, can also significantly impact our revenue. Sales of our ceiling products in this market appear to follow the trend of existing home sales, with a several month lag period between change in existing home sales and our operating results.

North American Commercial markets. The North American commercial markets account for approximately one-fourth of our total consolidated net sales. Many of our products, primarily ceilings and Resilient Flooring, are used in commercial and institutional buildings. Our revenue opportunities come from new construction as well as renovation of existing buildings. Renovation work is estimated to represent more than two-thirds of the total North American commercial market opportunity. We focus on four major segments of commercial building – office, education, retail and healthcare, as most of our revenue in these markets comes from these building segments. We monitor U.S. construction starts (an indicator of U.S. monthly construction activity that provides us a reasonable indication of upcoming opportunity) and follow new projects. We have found that our revenue from new construction can lag behind construction starts by as much as one year. We also monitor office vacancy rates and general employment levels, which can indicate movement in renovation and new construction opportunities. We believe that these statistics, taking into account the time-lag effect, provide a reasonable indication of our future revenue opportunity from these markets.

Non-North American markets. The non-North American markets account for approximately one-fourth of our total consolidated net sales. The vast majority of our revenues generated outside of North America are commercial in nature. For the countries in which we have significant revenue, we monitor various national statistics (such as GDP) as well as known new projects. Revenues come primarily from new construction and renovation work.

9

Table of Contents

The following table provides an estimate of our segments’ 2003 net sales, by major markets.

(Estimated percentages of individual segment’s sales) | North American Residential | North American Commercial | Non-North American | Total | ||||||||

Resilient Flooring | 50 | % | 30 | % | 20 | % | 100 | % | ||||

Wood Flooring | 95 | % | 5 | % | — | 100 | % | |||||

Textiles & Sports Flooring | — | — | 100 | % | 100 | % | ||||||

Building Products | 10 | % | 50 | % | 40 | % | 100 | % | ||||

Cabinets | 100 | % | — | — | 100 | % |

Geographic Areas

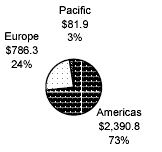

We sell our products in more than 80 countries. Approximately 73% of our 2003 revenue was derived from sales in the Americas, the vast majority of which came in North America (primarily the United States and Canada). The following chart illustrates the breakdown of our consolidated net sales for the year ended December 31, 2003 by region, based on where the sale was made:

2003 Consolidated Net Sales by Region

(in $ million)

See Note 3 of the Consolidated Financial Statements for financial information by geographic areas.

Customers

We have used our market positions and brand recognition to develop long-standing relationships with our customers. We principally sell products through building materials distributors, who re-sell our products to retailers, builders, contractors, installers and others. In the retail market, which sells to end-users in the light commercial and residential segments, we have important relationships with major national retailers such as The Home Depot, Inc. and Lowe’s Companies, Inc. In the residential market, which is experiencing consolidation within the homebuilding industry, we have important relationships with major homebuilders and buying groups. In the commercial market, we are a long-standing supplier to several building materials distributors who in turn sell our products to major national contractors and to national subcontractors’ alliances.

In 2003, our net sales to The Home Depot, Inc. and Lowe’s Companies, Inc. were $400.0 million and $318.7 million, respectively. In 2002 and 2001, our net sales to The Home Depot, Inc., were $380.3 million and $340.8 million, respectively. Our net sales to Lowe’s Companies, Inc. in years prior to 2003 were less than 10% of our total consolidated net sales. No other customers accounted for 10% or more of our total consolidated net sales.

10

Table of Contents

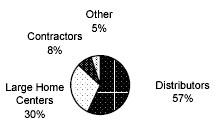

The following charts illustrate the estimated breakdown of our 2003 consolidated net sales geographically by distribution channel:

| 2003 Americas Sales by Customer Type | 2003 Non-Americas Sales by Customer Type | |

|  | |

Competition

There is strong competition in all of the reportable segments in which we do business. Principal methods of competition include product performance, product styling, service and price. Competition in the U.S. markets comes from both domestic manufacturers and international producers. Additionally, some of our products compete with alternative products in certain markets, such as our resilient, laminate and wood flooring products competing with carpet products, and our ceiling products competing with drywall. Over recent years, there has continued to be excess industry capacity in many geographic markets, which tends to increase price competition. The following companies are our primary competitors, none of which we view as dominant in the general market place:

Flooring segments – Congoleum Corporation, Mannington Mills, Inc., Mohawk Industries, Inc., Pergo AB, Shaw Industries, Inc., Tarkett AG and Wilsonart International.

Building Products – Celotex Limited, Chicago Metallic Corporation, Knauf AMF GmbH & Co. KG, Odenwald Faserplattenwerk GmbH, Rockfon A/S and USG Corporation.

Cabinets – American Woodmark Corporation, Fortune Brands, Inc. and Masco Corporation

Raw Materials

Raw materials essential to our businesses are purchased worldwide in the ordinary course of business from numerous suppliers. The principal raw materials used in each business include the following:

Business | Principal Raw Materials | |

Resilient Flooring | Polyvinylchloride (“PVC”) resins and films, plasticizers, backings, limestone, pigments, linseed oil, inks and stabilizers | |

Wood Flooring | Hardwood lumber, veneer, coatings, and stains | |

Textiles and Sports Flooring | Yarn, latex, bitumen and wool | |

Building Products | Mineral fibers, perlite, soft fibers, waste paper, clays, starches, and steel used in the production of metal ceilings and for our joint venture’s manufacturing of ceiling grids | |

Cabinets | Lumber, veneer, plywood, particleboard, fiberboard and components, such as doors and countertops | |

11

Table of Contents

We also purchase significant amounts of packaging materials for all products and use substantial amounts of energy, such as electricity and natural gas, and water in our manufacturing operations.

In general, adequate supplies of raw materials are available to all of our businesses. However, availability can change for a number of reasons, including environmental conditions, laws and regulations, shifts in demand by other industries competing for the same materials, transportation disruptions and/or business decisions made by, or events that affect, our suppliers. There is no assurance that a significant shortage of raw materials will not occur.

Prices for certain high usage raw materials can fluctuate dramatically. Cost increases for these materials can have a significant adverse impact on our manufacturing costs. Given the competitiveness of our markets, we may not be able to recover the increased manufacturing costs through increasing selling prices to our customers.

Sourced Products

Some of the products that we sell are sourced from third parties. The primary sourced products include laminate, wood flooring, vinyl tile and ceramic products, specialized ceiling products, and installation-related products and accessories for some of our manufactured products. For certain sourced products, the majority of our purchases come from one supplier. Sales of sourced products represented approximately 10% of our total consolidated revenue in both 2003 and 2002.

We purchase some of our sourced products from suppliers that are located outside of the U.S. The costs for these products are exposed to changes in foreign currency exchange rates, which can adversely affect our reported results from one period to the next. Our largest foreign currency exposure for sourced products is to the Euro.

In general, we believe we have adequate supplies of sourced products. We cannot guarantee that a significant shortage will not occur.

Hedging

We use financial instruments to hedge currency exposures, for raw material and sourced product purchases, and commodity exposures for natural gas. We use derivative financial instruments as risk management tools and not for speculative trading purposes. See “Item 7A. Quantitative and Qualitative Disclosure About Market Risk” for more information.

Patent and Intellectual Property Rights

Patent protection is important to our business in the U.S. and other markets. Our competitive position has been enhanced by U.S. and foreign patents on products and processes developed or perfected within Armstrong or obtained through acquisitions and licenses. In addition, we also benefit from our trade secrets for certain products and processes.

Patent protection extends for varying periods according to the date of patent filing or grant and the legal term of a patent in the various countries where patent protection is obtained. The actual protection afforded by a patent, which can vary from country to country, depends upon the type of patent, the scope of its coverage, and the availability of legal remedies in the country. Although we consider that, in the aggregate, our patents, licenses and trade secrets constitute a valuable asset of material importance to our business, we do not regard any of our businesses as being materially dependent upon any single patent or trade secret, or any group of related patents or trade secrets.

Certain of our trademarks, including without limitation, house marks , Armstrong™, Bruce®, Hartco®, Robbins®, and DLW™, and product line marks Allwood™, Cirrus®, Corlon®, Cortega®, Designer Solarian®, Excelon®, Fundamentals®, i-ceilings®, IXL®, Medintech®, Natural Inspirations™, Nature’s Gallery™, Second Look®, Solarian®, SuperLock™, SwiftLock™, ToughGuard® and Ultima™ are important to our business because of their significant brand name recognition. Trademark protection continues in some countries as long as the mark is used, and

, Armstrong™, Bruce®, Hartco®, Robbins®, and DLW™, and product line marks Allwood™, Cirrus®, Corlon®, Cortega®, Designer Solarian®, Excelon®, Fundamentals®, i-ceilings®, IXL®, Medintech®, Natural Inspirations™, Nature’s Gallery™, Second Look®, Solarian®, SuperLock™, SwiftLock™, ToughGuard® and Ultima™ are important to our business because of their significant brand name recognition. Trademark protection continues in some countries as long as the mark is used, and

12

Table of Contents

continues in other countries, as long as the mark is registered. Registrations are generally for fixed, but renewable, terms.

Employees

As of December 31, 2003, we had approximately 15,200 full-time and part-time employees worldwide, with approximately 10,600 employees located in the United States. Approximately 10,000 of the 15,200 are production and maintenance employees, of whom approximately 7,400 are located in the U.S. and 2,600 located outside the U.S. Approximately 69% of the production and maintenance employees in the U.S. are represented by labor unions. This percentage includes all production and maintenance employees at our plants and warehouses where labor unions exist, regardless of whether or not the employees actually pay union dues. About 71% of our total international employees are represented by labor unions.

Research & Development

Research and development (“R&D”) activities are important and necessary in helping us improve our products’ competitiveness. Principal R&D functions include the development and improvement of products and manufacturing processes. We spent $44.4 million in 2003, $49.2 million in 2002 and $56.3 million in 2001 on R&D activities worldwide.

Environmental Matters

Most of our manufacturing and certain of our research facilities are affected by various federal, state and local environmental requirements relating to the discharge of materials or the protection of the environment. We have made, and intend to continue to make, necessary expenditures for compliance with applicable environmental requirements at our operating facilities.

We are involved in proceedings under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), and similar state “Superfund” laws at approximately 26 sites. We have also been remediating environmental contamination resulting from past industrial activity at certain of our former plant sites. Certain of AWI’s environmental liabilities are subject to discharge through its Chapter 11 Case while others are not. Those environmental obligations that AWI has with respect to property that it owns or operates are likely to be unaffected by the Chapter 11 Case. Therefore, AWI will be required to continue meeting its ongoing environmental compliance obligations at the properties that AWI owns and operates.

See Note 32 of the Consolidated Financial Statements for a full description of our environmental matters.

Information Filed With the Bankruptcy Court

Under applicable bankruptcy law, AWI is required to file periodically with the Bankruptcy Court various documents, including certain financial information on an unconsolidated basis. This information includes statements, schedules, and monthly operating reports in forms prescribed by Federal Bankruptcy Law. We caution that such materials are prepared according to requirements under Federal Bankruptcy Law. While they accurately provide then-current information required under Federal Bankruptcy Law, they are nonetheless unconsolidated, unaudited, and are prepared in a format different from that used in our consolidated financial statements filed under the securities laws. Accordingly, we believe the substance and format do not allow meaningful comparison with our regular publicly disclosed consolidated financial statements. The materials filed with the Bankruptcy Court are not prepared for the purpose of providing a basis for an investment decision relating to the stock of AHI or the debt securities of AWI, or for comparison with other financial information filed with the SEC.

Notwithstanding the foregoing, most of AWI’s filings with the Bankruptcy Court are available to the public at the office of the Clerk of the Bankruptcy Court. Those filings may also be obtained through private document retrieval services. We undertake no obligation to make any further public announcement with respect to the documents filed with the Bankruptcy Court or any matters referred to in them.

See Note 1 of the Consolidated Financial Statements for discussions of the information that AWI has filed with the Bankruptcy Court.

13

Table of Contents

| ITEM 2. | PROPERTIES |

Our world headquarters are in Lancaster, Pennsylvania. We own a 100-acre, multi-building campus comprising the site of our corporate headquarters, most operational headquarters, our U.S. R&D operations and marketing and service headquarters. Altogether, our headquarters’ operations occupy approximately one million square feet of floor space.

We produce and market Armstrong products and services throughout the world, owning and operating 44 manufacturing plants in 12 countries as of December 31, 2003. Twenty-six of these facilities are located throughout the United States. In addition, Armstrong has an interest through a joint venture in 8 additional plants in 5 countries.

Business Segment | Number of Plants | Location of Principal Facilities | ||

Resilient Flooring | 13 | California, Illinois, Mississippi, Oklahoma, Pennsylvania, Australia, Canada, Germany, Sweden and the U.K. | ||

Wood Flooring | 10 | Arkansas, Kentucky, Tennessee, Texas and West Virginia | ||

Textiles and Sports Flooring | 3 | Belgium, Germany and The Netherlands | ||

Building Products | 15 | Alabama, Florida, Georgia, Oregon, Pennsylvania, China, France, Germany and the U.K. | ||

Cabinets | 3 | Nebraska, Pennsylvania and Tennessee | ||

Sales offices are leased and owned worldwide, and leased facilities are utilized to supplement our owned warehousing facilities.

For information on plants that were closed during 2003, see Note 15 of the Consolidated Financial Statements and “Item 7. Management Discussion and Analysis—Cost Reduction Initiatives.” In January 2004, we announced that we will cease production at one of our Building Products plants by the end of 2004. See Note 33 of the Consolidated Financial Statements.

Productive capacity and the extent of utilization of our facilities are difficult to quantify with certainty. In any one facility, maximum capacity and utilization vary periodically depending upon the product that is being manufactured, and individual facilities manufacture multiple products. We believe our facilities have sufficient production capacity to meet anticipated needs for the next two to three years. Additional incremental investments in plant facilities are made as appropriate to balance capacity with anticipated demand, improve quality and service, and to reduce costs.

14

Table of Contents

| ITEM 3. | LEGAL PROCEEDINGS |

See Note 32 of the Consolidated Financial Statements for a full description of our legal proceedings.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

At a special meeting on January 7, 2004, shareholders of Armstrong Holdings, Inc. voted to approve a Plan of Dissolution for that company. The dissolution will occur following AWI’s Chapter 11 Plan of Reorganization (POR) becoming effective.

See “AHI’s Plan of Dissolution” in Note 1 of the Consolidated Financial Statements for a description of the dissolution.

The holders of 22,468,250 shares of common stock were represented at the January 7, 2004 meeting, which constituted over 55% of the outstanding shares. These shares were voted as follows on the proposal for dissolution:

FOR - | 17,183,055 | |||

AGAINST - | 4,818,280 | |||

The balance of the shares represented (about 466,900) abstained.

15

Table of Contents

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS |

As a result of filing the POR on November 4, 2002, the New York Stock Exchange stopped trading on the Exchange of the common stock of AHI (traded under the ticker symbol “ACK”). As of November 14, 2002, Armstrong Holding’s common stock trades on the over-the-counter (OTC) Bulletin Board under the ticker symbol (ACKHQ). As of February 10, 2004, there were approximately 7,039 holders of record of Armstrong Holding’s Common Stock.

2003 | First | Second | Third | Fourth | Total Year | ||||||||||

Price range of common stock—high | $ | 0.83 | $ | 2.33 | $ | 3.04 | $ | 2.00 | $ | 3.04 | |||||

Price range of common stock—low | $ | 0.37 | $ | 0.53 | $ | 1.26 | $ | 0.80 | $ | 0.37 | |||||

2002 | |||||||||||||||

Price range of common stock—high | $ | 4.10 | $ | 3.82 | $ | 1.98 | $ | 1.85 | $ | 4.10 | |||||

Price range of common stock—low | $ | 2.70 | $ | 1.79 | $ | 1.28 | $ | 0.24 | $ | 0.24 | |||||

There were no dividends declared or paid during 2003 or 2002. The DIP Facility stipulates that AWI will not declare or pay any dividends either directly or indirectly and bankruptcy law bars dividends by companies in Chapter 11.

16

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The following data is presented for continuing operations.

(Dollars in millions except for per-share data) For Year | 2003 | 2002 | 2001 | 2000 | 1999 | |||||||||||||||

Income statement data | ||||||||||||||||||||

Net sales | $ | 3,259.0 | $ | 3,172.3 | $ | 3,138.7 | $ | 3,248.9 | $ | 3,322.0 | ||||||||||

Cost of goods sold | 2,597.4 | 2,404.5 | 2,364.7 | 2,386.2 | 2,291.5 | |||||||||||||||

Selling, general and administrative expenses | 603.1 | 624.9 | 596.6 | 595.3 | 605.9 | |||||||||||||||

Charge for asbestos liability, net | 81.0 | 2,500.0 | 22.0 | 236.0 | 335.4 | |||||||||||||||

Restructuring and reorganization charges (reversals), net | 8.6 | 1.9 | 9.0 | 18.8 | (1.4 | ) | ||||||||||||||

Goodwill amortization | — | — | 22.8 | 23.9 | 25.5 | |||||||||||||||

Equity (earnings) from affiliates, net | (20.7 | ) | (21.7 | ) | (16.5 | ) | (18.0 | ) | (16.8 | ) | ||||||||||

Operating income (loss) | (10.4 | ) | (2,337.3 | ) | 140.1 | 6.7 | 81.9 | |||||||||||||

Interest expense | 10.3 | 13.8 | 13.1 | 102.9 | 105.2 | |||||||||||||||

Other non-operating expense | 15.7 | 8.2 | 11.8 | 3.7 | 10.4 | |||||||||||||||

Other non-operating (income) | (4.8 | ) | (6.0 | ) | (13.0 | ) | (80.4 | ) | (17.0 | ) | ||||||||||

Chapter 11 reorganization costs, net | 9.4 | 23.5 | 12.5 | 103.3 | — | |||||||||||||||

Income tax expense (benefit) | (1.7 | ) | (827.8 | ) | 42.5 | (37.7 | ) | (0.5 | ) | |||||||||||

Earnings (loss) from continuing operations before cumulative change in accounting principle | (39.3 | ) | (1,549.0 | ) | 73.2 | (85.1 | ) | (16.2 | ) | |||||||||||

Per common share – basic(a) | (0.97 | ) | (38.25 | ) | 1.81 | (2.12 | ) | (0.41 | ) | |||||||||||

Per common share – diluted(a) | (0.97 | ) | (38.25 | ) | 1.79 | (2.12 | ) | (0.41 | ) | |||||||||||

Cumulative effect of a change in accounting principle, Net of tax of $2.2 | — | (593.8 | ) | — | — | — | ||||||||||||||

Net earnings (loss) | (39.3 | ) | (2,142.8 | ) | 92.8 | 12.2 | 14.3 | |||||||||||||

Per common share – basic(a) | (0.97 | ) | (52.91 | ) | 2.29 | 0.30 | 0.36 | |||||||||||||

Per common share – diluted(a) | (0.97 | ) | (52.91 | ) | 2.27 | 0.30 | 0.36 | |||||||||||||

Dividends declared per share of common stock | — | — | — | $ | 1.44 | $ | 1.92 | |||||||||||||

(Dollars in millions except for per-share data) For Year | 2003 | 2002 | 2001 | 2000 | 1999 | |||||||||||||||

Average number of common shares outstanding (millions) | 40.5 | 40.5 | 40.5 | 40.2 | 39.9 | |||||||||||||||

Average number of employees | 15,800 | 16,700 | 16,800 | 16,500 | 16,900 | |||||||||||||||

Balance sheet data (December 31) | ||||||||||||||||||||

Working capital | $ | 943.3 | $ | 859.3 | $ | 748.0 | $ | 618.3 | $ | 322.5 | ||||||||||

Total assets | 4,647.8 | 4,504.8 | 4,038.1 | 4,005.2 | 4,081.6 | |||||||||||||||

Liabilities subject to compromise | 4,858.5 | 4,861.1 | 2,357.6 | 2,385.2 | — | |||||||||||||||

Net long-term debt(b) | 39.4 | 39.9 | 50.3 | 56.9 | 1,412.9 | |||||||||||||||

Shareholders’ equity (deficit) | (1,330.2 | ) | (1,346.7 | ) | 760.4 | 665.1 | 679.2 | |||||||||||||

Notes:

| (a) | See definition of basic and diluted earnings per share in Note 2 of the Consolidated Financial Statements. |

| (b) | 2003, 2002, 2001 and 2000 net long-term debt excludes debt subject to compromise. |

Certain prior year amounts have been reclassified to conform to the current year presentation. See Note 2 of the Consolidated Financial Statements.

17

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Separate financial statements for AHI and AWI and its subsidiaries are included in this document because both have outstanding public securities. However, there are no differences in the income statement and minimal differences in the remaining three financial statements. Due to the lack of differences in the financial statements, the following discussion and analysis pertains to both AHI and AWI and its subsidiaries.

This discussion should be read in conjunction with the financial statements and the accompanying notes included elsewhere in this Form 10-K. It contains forward-looking statements based on our current expectations, which are inherently subject to risks and uncertainties. Actual results and the timing of certain events may differ significantly from those referred to in such forward-looking statements. We undertake no obligation beyond what is required under applicable securities law to publicly update or revise any forward-looking statement to reflect current or future events or circumstances, including those set forth in the section entitled “Cautionary Factors” and elsewhere in this Form 10-K.

References to performance excluding the translation effect of changes in foreign exchange rates, and operating income prior to asbestos-related charges and goodwill amortization, are non-GAAP measures. We believe that this information improves the comparability of business performance by excluding the impacts of changes in foreign exchange rates when translating comparable foreign currency amounts, the impacts of charges related to our prepetition asbestos liability and the change in accounting for goodwill. We calculate the translation effect of foreign exchange rates by applying the current year’s foreign exchange rates to the equivalent period’s foreign currency amounts as reported in the prior year.

OVERVIEW

We are a leading global producer of flooring products and ceiling systems for use primarily in the construction and renovation of residential, commercial and institutional buildings. Through our United States (“U.S.”) operations and U.S. and international subsidiaries, we design, manufacture and sell flooring products (resilient, wood, carpeting and sports flooring) and ceiling systems (primarily mineral fiber, fiberglass and metal), around the world. We also design, manufacture and sell kitchen and bathroom cabinets in the U.S. We own and operate 44 manufacturing plants in 12 countries, including 26 plants located throughout the United States. Through WAVE, our joint venture with Worthington Industries, Inc., we also have an interest in 8 additional plants in 5 countries that produce suspension system (grid) products for our ceiling systems.

We report our financial results through the following segments: Resilient Flooring, Wood Flooring, Textiles and Sports Flooring, Building Products, Cabinets, All Other and Unallocated Corporate Expense. See “Reportable Segment Results” for additional financial information on our segments.

See “Item 1. Business” for a description of our segments, customers, markets and other information about our business.

On December 6, 2000, AWI filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) in order to use the court-supervised reorganization process to achieve a resolution of its asbestos liability. Also filing under Chapter 11 were two of AWI’s wholly-owned subsidiaries, Nitram Liquidators, Inc. and Desseaux Corporation of North America, Inc. The Chapter 11 cases are being jointly administered under case number 00-4471 (the “Chapter 11 Case”). AWI is operating its business and managing its properties as a debtor-in-possession subject to the provisions of the Bankruptcy Code. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Proceedings Under Chapter 11” for information on the Chapter 11 Case and Note 32 of the Consolidated Financial Statements for information on asbestos litigation.

18

Table of Contents

Our consolidated net sales for 2003 were approximately $3.26 billion, which were approximately 3% greater than consolidated net sales in 2002. After excluding the translation effect of changes in foreign exchange rates, net sales in 2003 declined by approximately 2% from net sales in 2002. Operating income prior to asbestos-related charges was approximately $71 million in 2003, as compared to approximately $163 million in 2002. Cash and cash equivalents increased by approximately $104 million of cash in 2003, which was slightly higher than the cash increase in 2002. In 2003:

| • | Demand for Resilient Flooring products continued to shift from high-end vinyl products to lower margin vinyl and laminate products, and to Wood Flooring products, for both new construction and renovation. |

| • | Resilient Flooring’s performance in commercial markets was mixed, but was helped by our good position in product offering and service. |

| • | Building Products generated good results in North America, despite lower sales in a difficult commercial market. |

| • | Both Resilient Flooring and Building Products experienced lower sales in Europe but profitable growth in the Pacific area. |

| • | We incurred significant cost increases for certain items, such as the cost of lumber. |

| • | We implemented several initiatives to improve our cost structure and enhance our competitive position, the cost of which adversely affected 2003’s results. |

| • | We reduced the amount of capital investment activities, in consideration of both market conditions and the cost reduction initiatives. |

Factors Affecting Revenues

Markets. We compete in building material markets around the world. The majority of our sales opportunity is in the North American and European markets. During 2003, these markets experienced the following:

| • | In the North American residential market, housing construction remained very strong, with approximately 1.85 million housing units started in 2003 compared to approximately 1.7 million in 2002. Sales of existing homes were also very strong in 2003, with approximately 6.1 million homes sold in 2003 compared to approximately 5.56 million in 2002. A key consideration in changes in market segments is that margins for products sold into new construction tend to be lower than those sold into the renovation segment. |

For several years, the amount of vinyl flooring products, measured as a percent of the total residential flooring market, has been declining, while laminate, ceramic and hardwood flooring products have increased. This trend of changing consumer preferences for flooring also continued in 2003. For 2004, we estimate the residential replacement markets will be flat to up slightly, but it is unlikely that new construction demand will exceed record 2003 levels. Further, we expect the category of vinyl products to continue to decline in units sold, while laminate, ceramic and hardwood flooring should continue to increase.

| • | In the North American commercial market, we estimate that the overall market declined in 2003 by approximately 3-4% compared to 2002, with renovation declining slightly and construction starts in the office, healthcare and education segments declining by approximately 12%, 7% and 6%, respectively. Retail construction starts increased by approximately 9%. Industry statistics indicate that commercial starts will marginally improve in 2004, with improvements anticipated in retail, office and health care, while the education segment will decline slightly. Further, indications are for a decline in office vacancy rates, which could also positively impact the renovation segment of this market. |

19

Table of Contents

| • | In Europe, we experienced significant market slowdown in the Western European countries, especially in Germany and the U.K. The economic environment has adversely impacted both price and volume. While Germany is a very important European market for Resilient Flooring and Textiles and Sports Flooring, it is not a significant market for Building Products. As a result, performance of the flooring segments in Western Europe has suffered more than that of Building Products. At the same time, we benefited from growth in opportunities in Eastern Europe, particularly Russia. In 2004, we anticipate marginal improvement in the Western Europe markets and difficult growth conditions in Eastern Europe. |

Quality and Customer Service. Our quality and customer service is a critical component of the total value proposition we offer our customers. In 2003, we experienced the following:

| • | In Wood Flooring, our sales increased during the year, but not as much as the market grew. This was partly the result of product quality that was not competitive. Our quality did not decline, but the quality of competing products improved substantially, led by imported engineered wood flooring products. |

Since the middle of 2003, we have had Six Sigma teams working on improving our wood product quality. The dimensional consistency of our products (both solid and engineered) is dramatically better. The number of defects a customer might find in a typical order has declined by almost 70%, and are now at a rate that is equal to or better than industry norms.

| • | In Cabinets, we experienced severe customer service problems starting in 2002. As a result of this, we lost sales opportunities in 2003 as the customers decided to source their products from other suppliers. |

Customer service (product quality, on-time performance) has been restored to excellent levels. For the three months ending January 31, 2004, we shipped an average of 98% of our orders on time and complete. We are slowly regaining the trust of our customers.

| • | In Building Products we continued to provide our customers with extremely high levels of quality and customer service. |

Pricing Initiatives. During 2003, increased costs for raw materials, labor and labor-related expenses, energy and other areas caused us to initiate several price increases to our customers. The most significant of these increases included the following.

| • | In Resilient Flooring, we implemented price increases for selected U.S. commercial products in July. We also implemented an increase on selected U.S. residential products in November. |

| • | In Wood Flooring, we implemented a price increase on solid wood products in April. We also announced another increase on solid wood products that became effective in November 2003 and January 2004, depending on the customer channel. |

| • | In Building Products, a price increase was announced for most commercial acoustical ceiling products in the North American markets, effective July 1. Price increases on certain products to our large home center customers in the U.S. were implemented in August and September. We also increased prices for certain U.S. residential-oriented products sold through distribution in July. An additional increase for most commercial products was announced in the fourth quarter of 2003, which became effective January 1, 2004. |

| • | In Cabinets, we announced price increases in September to our retail customers depending on the market conditions in the different geographic areas. At the same time, we also increased prices to our builder customers. |

20

Table of Contents

In certain cases, price increases actually realized were less than the announced price increases, as we had to adjust to competitive actions and changing market conditions. Also during 2003, we made several price concessions in some of our segments and geographic regions, again to respond to competition and market conditions. Sales were also adversely affected due to reducing our Euro-based prices to compete with U.S. producers’ U.S. dollar-based selling prices in Europe.

We estimate that the various pricing actions provided a net increase to our total consolidated net sales in 2003 compared to 2002 by approximately $12 million.

Asbestos-Related Charges

During 2003, we reduced our previously recorded insurance asset for asbestos-related personal injury claims by $73 million, reflecting management’s current assessment of probable insurance recoveries based upon an unfavorable ruling in an alternative dispute resolution procedure. We also recorded an $8 million charge to reflect an agreement to settle claims from the Center for Claims Resolution and a surety bond insurance company. During 2002, we recorded a $2.5 billion charge to increase our estimate of probable asbestos-related liability. All amounts are reflected as a charge to asbestos liability, net. See “Asbestos-Related Litigation” in this section for additional information.

Factors Affecting Operating Costs

Operating Expenses. Our operating expenses consist of direct production (principally raw materials, labor and energy) and manufacturing overhead costs, costs to purchase sourced products and selling, general and administrative expenses (“SG&A”).

Our largest individual raw material expenditures are for lumber and veneers, PVC, backings for various flooring products and plasticizers. Fluctuations in the prices of these raw materials are generally beyond our control and have a direct impact on our financial results. The most significant change in raw material costs in 2003 was for hardwood lumber used by Wood Flooring. Starting in late 2002 and continuing throughout 2003, lumber prices increased, as the availability of lumber for flooring decreased due to poor weather conditions for timbering and reductions in industry saw mill capacity, while demand for the lumber (for flooring and other products such as railroad ties and pallets) remained strong. Our cost for acquiring lumber in 2003 was approximately $40 million greater than in 2002. Since December 2003, lumber costs have continued to increase. We believe that lumber costs for the year 2004 could exceed those in 2003, with the amount of increase dependent on the same factors that impacted costs in 2003.

PVC is an oil-based raw material and is used in many industries. Generally, we experience cost pressures on PVC when energy prices increase and when industrial demand for the material increases to support a growing economy. The cost to purchase PVC resins and film increased by approximately $9 million in 2003 compared to 2002.

We consume large quantities of energy in our manufacturing processes, in particular natural gas in our mineral fiber ceilings manufacturing process. Costs for natural gas have increased significantly over the past several years. In 2003, we incurred approximately $7 million of additional costs for natural gas compared to 2002.

Year over year, we normally incur additional costs in production wages and non-production salaries due to wage and salary rate increases. This increased cost in 2003 compared to 2002 was approximately $30 million.

Our 2003 costs also increased by approximately $28 million compared to 2002 due to a lower U.S. pension credit. This resulted primarily from changes in actuarial assumptions. We do not anticipate a material change in the net periodic pension credit in 2004.

21

Table of Contents

Cost Reduction Initiatives. During 2003, we implemented several manufacturing and organizational changes to improve our cost structure and enhance our competitive position. Specifically:

| • | We ceased production of our residential stencil product line. |

| • | We closed two Wood Flooring facilities that manufactured engineered wood floors, consolidating their production volume into another Wood Flooring facility. |

| • | We closed a Textiles and Sports Flooring plant in The Netherlands as part of the continuing 2002 restructuring plan. |

| • | We consolidated several sales, operational and administrative support organizations throughout our company to more effectively manage the business. This consolidation included integrating our Resilient Flooring and Wood Flooring organizations that manage the Americas markets. |

The costs for these initiatives incurred in 2003 totaled approximately $55 million, of which approximately $33 million was for accelerated depreciation (reported as a component of cost of goods sold and SG&A). The remaining amount was primarily for severances (reported as a component of cost of goods sold, restructuring or SG&A) and related inventory obsolescence (reported as a component of cost of goods sold). These initiatives also reduced our headcount (see “Overview – Employees”). The expenses associated with the 2003 cost reduction initiatives, by segment, are as follows:

2003 Expenses for Cost Reduction Initiatives | |||||||||

(amounts in millions) | Accelerated Depreciation | Other | Total Expenses | ||||||

Resilient Flooring | $ | 7.0 | $ | 6.3 | $ | 13.3 | |||

Wood Flooring | 24.6 | 3.6 | 28.2 | ||||||

Textiles & Sports Flooring | 0.3 | 7.2 | 7.5 | ||||||

Building Products | — | 2.1 | 2.1 | ||||||

Cabinets | 0.8 | — | 0.8 | ||||||

Corporate Unallocated | — | 2.8 | 2.8 | ||||||

Total Consolidated | $ | 32.7 | $ | 22.0 | $ | 54.7 | |||

We also implemented several initiatives in 2002, primarily for reorganizing our flooring organizations in Europe. The cost of these initiatives was approximately $2 million. We believe that the incremental cost savings in 2004 generated from both years’ initiatives will be approximately $30 million.

We anticipate implementing additional cost reduction actions in 2004. In January 2004, we announced that we will cease production at our Building Products plant in The Netherlands by the end of 2004, subject to positive advice from the Works Council, in order to eliminate excess capacity for serving the European markets.

Factors Affecting Cash Flow

Historically, excluding the cash demands for asbestos-related claims in 2000 and prior years, we typically generate positive cash flow from our operating activities. The amount of cash generated in any one period is dependent on a number of factors, including the amount of operating profit generated and the amount of working capital (such as inventory, receivables and payables) required to operate our businesses. We typically invest in property, plant & equipment (“PP&E”) and computer software.

During 2003, our cash and cash equivalents balance increased by $104.3 million, which was $1.7 million more than during 2002. The increase was primarily due to reducing PP&E and computer software purchases. In consideration of both market conditions and cost reduction initiatives, we elected to defer or stop certain investments, resulting in approximately $47 million less spending in 2003 than in 2002. We believe the decision to reduce our investing activities has not, and will not, negatively impact our

22

Table of Contents

business. We anticipate using more cash for investing activities in 2004 than was used in 2003, but less than the amounts used in 2002 or recent prior years.

We used approximately $10 million less in financing activities during 2003 than in 2002, primarily due to lower short-term debt payment requirements in 2003.

Operating activities generated $165.8 million of net cash, which was approximately $58 million less than in 2002. Cash generated from the net earnings, after adjusting for non-cash charges, restructuring and reorganization activities, accounted for the decline, primarily from the increased operating costs discussed above. The amount by which operating assets and liabilities (primarily receivables, inventories and payables) were reduced’ was greater than the reductions achieved in 2002.

Employees

As of December 31, 2003, we had approximately 15,200 full-time and part-time employees worldwide. This compares to approximately 16,300 employees as of December 31, 2002. The reduction of employees in 2003 is primarily due to the previously described cost reduction initiatives.

During 2003, we negotiated 11 collective bargaining agreements, with one location experiencing a five day work stoppage. There was no negative effect on the business as a result of the work stoppage. Throughout 2004, collective bargaining agreements covering certain employees at eight plants and two warehouses will expire. As of the date of this filing, approximately 330 employees at one plant are working under an expired contract. The timing of resolution is uncertain and a work stoppage at this location is possible. A work stoppage, if one should occur, could have a significant effect on the results of operations during the period of the event.

CRITICAL ACCOUNTING POLICIES

Many accounting entries require us to make estimates. These entries include asbestos-related liability, insurance assets, allowances for bad debts, inventory obsolescence and lower of cost or market charges, warranty, workers compensation, general liability and environmental claims. When preparing an entry that requires an estimate to be made, we determine what factors are most likely to affect the estimate. We gather information relevant to these factors from inside and outside the company. This information is evaluated and an estimate is made.

The following are the critical accounting policies that management believes could have a significant impact to the financial statements if the estimates and judgments used by management turn out to be incorrect. In addition, management has discussed the application of these critical accounting policies with our Audit Committee.

Asbestos-related Estimates –We record contingent liabilities, including asbestos-related liabilities, when a loss is probable and the amount of loss can be reasonably estimated. Prior to its Chapter 11 Filing, AWI estimated its probable asbestos-related personal injury liability based upon a variety of factors including historical settlement amounts, the incidence of past claims, the mix of the injuries and occupations of the plaintiffs, the number of cases pending against it and the status and results of broad-based settlement discussions. As of September 30, 2000, AWI had recorded a liability of $758.8 million for its asbestos-related personal injury liability that it determined was probable and estimable through 2006. Due to the increased uncertainty created as a result of the Filing, the only change made to the previously recorded liability through the third quarter of 2002 was to record October and November 2000 payments of $68.2 million against the accrual. The asbestos-related personal injury liability balance recorded at December 31, 2001 was $690.6 million, which was recorded in liabilities subject to compromise.

AWI filed an initial POR and disclosure statement with respect to the POR during the fourth quarter of 2002. In March 2003, AWI filed an amended POR and disclosure statement. Based upon the foregoing, the discussions AWI had with the different creditors’ committees and the hearings held before the Bankruptcy Court, management believed that it was reasonably likely that the asbestos-related personal injury liability would be satisfied substantially in the manner set forth in the POR. As a result, AWI

23

Table of Contents

concluded that it could reasonably estimate its probable liability for current and future asbestos-related personal injury claims. Accordingly, in the fourth quarter of 2002, AWI recorded a $2.5 billion charge to increase the liability in accordance with AICPA Statement of Position 90-7, “Financial Reporting by Entities in Reorganization under the Bankruptcy Code” (“SOP 90-7”). The recorded asbestos-related liability for personal injury claims of approximately $3.2 billion at December 31, 2003 and 2002, which was treated as a liability subject to compromise, represents the estimated amount of liability that is implied based upon the negotiated resolution reflected in the POR, the total consideration expected to be paid to the Asbestos PI Trust pursuant to the POR and a recovery value percentage for the allowed claims of the Asbestos PI Trust that is equal to the estimated recovery value percentage for the allowed non-asbestos unsecured claims. See “Asbestos-Related Litigation” for further discussion on the Asbestos PI Trust and the treatment of asbestos-related claims under the POR.

AWI is unable to predict when and if the POR will be confirmed and, if confirmed, when the POR will be implemented. See “Recent Developments and Next Steps in the Chapter 11 Process”. Therefore, the timing and terms of resolution of the Chapter 11 Case remain uncertain. As long as this uncertainty exists, future changes to the recorded asbestos-related personal injury liability are possible and could be material to AWI’s financial position and the results of its operations. Management will continue to review the recorded liability in light of future developments in the Chapter 11 Case and make changes to the recorded liability if and when it is appropriate.

Additionally, AWI has a recorded asset of $103.1 million as of December 31, 2003 representing estimated insurance recoveries related to its asbestos liability. Of the total recorded asset at December 31, 2003, approximately $14.0 million represents partial settlement for previous claims that will be paid in a fixed and determinable flow and is reported at its net present value discounted at 6.50%. Approximately $79 million of the $103.1 million asset is determined from agreed coverage in place and is therefore directly related to the amount of the asbestos liability. During the second quarter of 2003, AWI reduced its previously recorded insurance asset for asbestos-related personal injury claims by $73 million reflecting management’s current assessment of probable insurance recoveries in light of an unfavorable ruling in an alternative dispute resolution procedure. See “Asbestos-Related Litigation” for further discussion.

The total amount of the estimated insurance recoveries asset recorded reflects the belief in the availability of insurance in this amount, based upon prior success in insurance recoveries, settlement agreements that provide such coverage, the nonproducts recoveries by other companies and the opinion of outside counsel. In our opinion, such insurance is either available through settlement or probable of recovery through negotiation or litigation. Although AWI revised its recorded asbestos liability by $2.5 billion in the fourth quarter of 2002, no increase has been recorded in the estimated insurance recovery asset. While we believe that the process of pursuing disputed insurance coverage may result in additional settlement amounts beyond those recorded, there has been no increase in the recorded amounts due to the uncertainties remaining in the process. The estimate of probable recoveries may be revised depending on the developments in the matters discussed above as well as events that occur in AWI’s Chapter 11 Case.

U.S. Pension Credit and Postretirement Benefit Costs – We maintain pension and postretirement plans throughout the world, with the most significant plans located in the U.S. Our defined benefit pension and postretirement benefit costs are developed from actuarial valuations. These valuations are calculated using a number of assumptions. These assumptions are determined in accordance with generally accepted accounting principles (“GAAP”). Each assumption represents management’s best estimate of the future. The assumptions that have the most significant impact on reported results are the discount rate, the estimated long-term return on plan assets and the estimated inflation in health care costs. These assumptions are updated annually at the beginning of the year and applied in the valuations recorded for that year.

The discount rate is used to determine retirement liabilities and to determine the interest cost component of net periodic pension and postretirement cost. Our actuary provides the expected modified duration of the liabilities. Management determines the appropriate discount rate by referencing the yield on investment grade fixed-income securities of a similar duration (14 years) to that of the expected liabilities,

24

Table of Contents

as well as the yield for Moody’s AA-rated long-term corporate bonds. As of December 31, 2003, we assumed a discount rate of 6.00% compared with a discount rate of 6.50% as of December 31, 2002 for the U.S. plans. This decrease is consistent with the decline in U.S. corporate bond yields during the year. The effects of the decreased discount rate, which increases our liabilities, will be amortized against earnings as described below. A one-quarter percentage point decrease in the discount rate would reduce 2004 operating income by $0.8 million, while a one-quarter percentage point increase in the discount rate would increase 2004 operating income by $0.8 million.

Effective January 1, 2003, we updated the mortality table used in our U.S. pension and postretirement benefit cost calculations to reflect more current information. The new table (RP2000) is based upon actual 1990 to 1994 general population mortality rates, with improvements projected to 2003. The impact of this change was a $4.7 million reduction in 2003 operating income.

We have two U.S. defined benefit pension plans, a qualified funded plan and a nonqualified unfunded plan. For the funded plan, the expected long-term return on plan assets represents a long-term view of the future estimated investment return on plan assets. This percentage is determined based on allocation of plan assets among asset classes and input from investment professionals and academic sources on the expected performance of the equity and bond markets over approximately 10 to 20 years. Over the last 10 years, the annualized return on the fund was approximately 9.8% compared to an average expected return of 8.75%. The expected long-term return on plan assets used in determining our 2003 U.S. pension credit was 8.00%. The actual return on plan assets achieved for 2003 was 24.4%. In accordance with GAAP, this excess will be amortized into earnings as described below. We do not expect to be required to make cash contributions to the qualified funded plan during 2004. We have assumed a return on plan assets during 2004 of 8.00%. A one-quarter percentage point increase or decrease in this assumption would increase or decrease 2004 operating income by approximately $4.6 million. Contributions to the unfunded plan were $3.2 million in 2003 and are made on a monthly basis to fund benefit payments. We estimate the contributions to be approximately $3 million in 2004. See Note 18 of the Consolidated Financial Statements for more details.

The estimated inflation in health care costs represents a long-term view (approximately 5-10 years) of the expected inflation in our postretirement health care costs. We separately estimate expected health care cost increases for pre-65 retirees and post-65 retirees due to the influence of Medicare coverage at age 65, as illustrated below:

| Assumptions | Actual | |||||||||||||||||

| Post 65 | Pre 65 | Overall | Post 65 | Pre 65 | Overall | |||||||||||||

2002 | 13 | % | 11 | % | 12 | % | 5 | % | 11 | % | 6 | % | ||||||

2003 | 12 | 10 | 11 | 7 | 7 | 7 | ||||||||||||

2004 | 11 | 9 | 10 | |||||||||||||||