Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

AWI similar filings

- 30 Jul 12 Armstrong World Industries Reports Second Quarter 2012 Results

- 26 Jun 12 Submission of Matters to a Vote of Security Holders

- 23 May 12 This presentation consists of this slide deck and the associated remarks and comments, all of which are integrally related and are intended to be

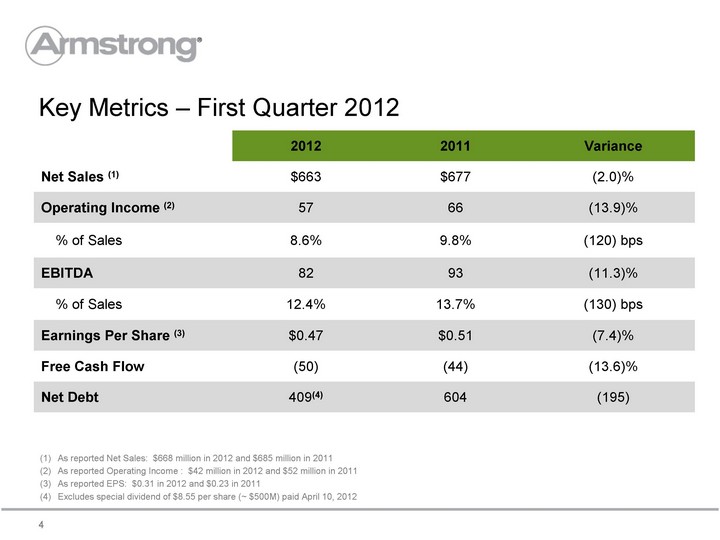

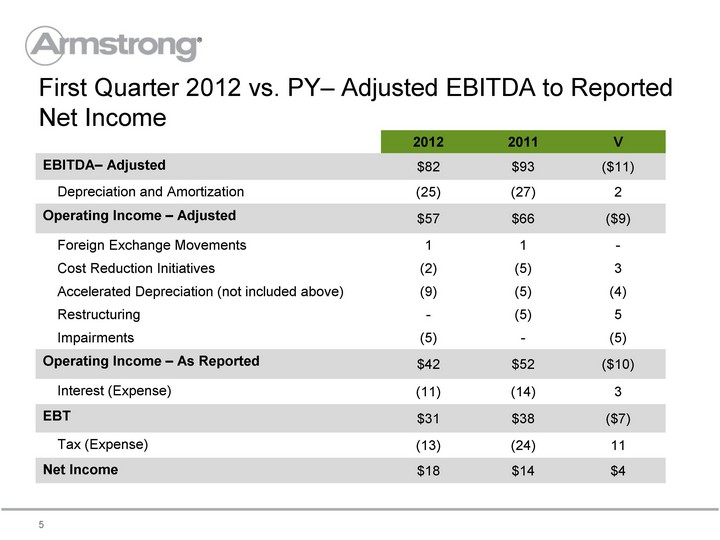

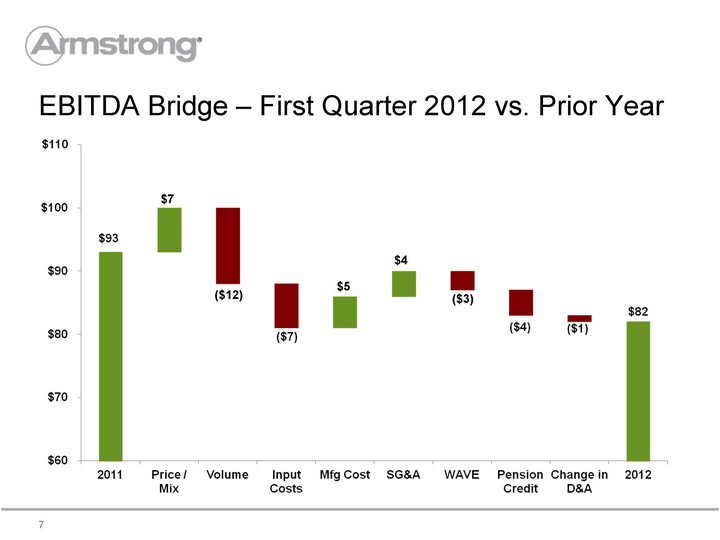

- 30 Apr 12 Armstrong World Industries Reports First Quarter 2012 Results

- 23 Mar 12 Armstrong World Industries Declares Special Cash Dividend

- 13 Mar 12 Armstrong World Industries Considers Special Cash Dividend

- 27 Feb 12 Armstrong World Industries Reports Fourth Quarter and Year End 2011 Results

Filing view

External links