Exhibit 99.1

Armstrong World Industries

Investor Day 2012

May 23, 2012

Safe Harbor Statement

This presentation consists of this slide deck and the associated remarks and comments, all of which are integrally related and are intended to be

presented and understood together. Our disclosures in this presentation, including without limitation, those relating to guidance, and in our other

public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those

statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,”

“project,” “intend,” “plan,” “believe,” “outlook,” and other words or phrases of similar meaning in connection with any discussion of future

operating or financial performance, including, in this presentation, all statements and projections relating to the building products “mid-cycle”

outlook. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and

depend on circumstances that may or may not occur in the future. A more detailed discussion of the risks and uncertainties that may affect our

ability to achieve the projected performance is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our recent

reports on Forms 10-K and 10-Q filed with the SEC. As a result, our actual results may differ materially from our expected results and from those

expressed in our forward-looking statements. Forward-looking statements speak only as of the date they are made. We undertake no obligation

to update any forward-looking statements beyond what is required under applicable securities law. The information in this presentation is only

effective as of the date given, May 23, 2012, and is subject to change. Any distribution of this presentation after May 23, 2012 is not intended and

will not be construed as updating or confirming such information.

In addition, we will be referring to “non-GAAP financial measures” as defined by the SEC. A reconciliation of the differences between these

measures with the most directly comparable financial measures calculated in accordance with GAAP can be found in our SEC filings and on the

Investor Relations section of our website at www.armstrong.com. Adjusted EBITDA is earnings before interest, taxes, depreciation, amortization,

net the impact of discrete expenses and income, including, for example plant closures, restructuring actions, and other large unusual items. Net

sales includes the impact of foreign exchange rates.

Armstrong competes globally in many diverse markets. References to “market” or “share” data are simply estimations based on a combination of

internal and external sources and assumptions. They are intended only to assist discussion of the relative performance of product segments and

categories for marketing and related purposes. No conclusion has been reached or should be reached regarding a “product market,” a

“geographic market” or “market share,” as such terms may be used or defined for any economic, legal or other purpose.

Agenda

Agenda

Strategic Overview

What You Will Hear Today

Armstrong has two great global

businesses delivering exceptional

service, and innovative products and

solutions to our customers

We have exciting growth opportunities

We are committed to delivering

outstanding operational and financial

results

We are constantly focused on creating

shareholder value

Diversified Global Building Products Company

Leading global manufacturer of floors

and ceilings for use in renovation and

new construction.

$2.9 billion in sales in 2011

Market leader in geographies

representing over 80% of sales

Sales profile

70% domestic - 30% international

60% commercial - 40% residential

70% renovation - 30% new

32 manufacturing locations in 8 countries

Management Team

Matt Espe, President and CEO

Frank Ready, EVP and CEO of Armstrong Floor Products

Vic Grizzle, EVP and CEO of Armstrong Building Products

Tom Mangas, SVP and CFO

Mark Hershey, SVP General Counsel and Secretary

Don Maier, SVP Operations

Tom Kane, SVP Human Resources

Steve Poole, VP Business Development

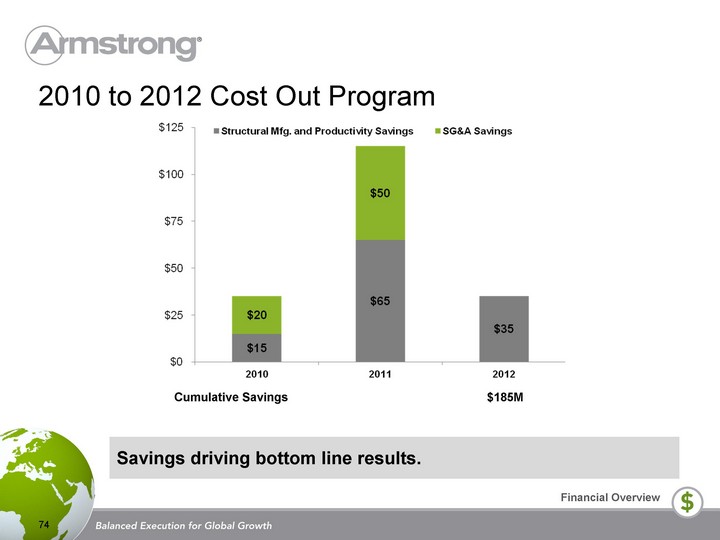

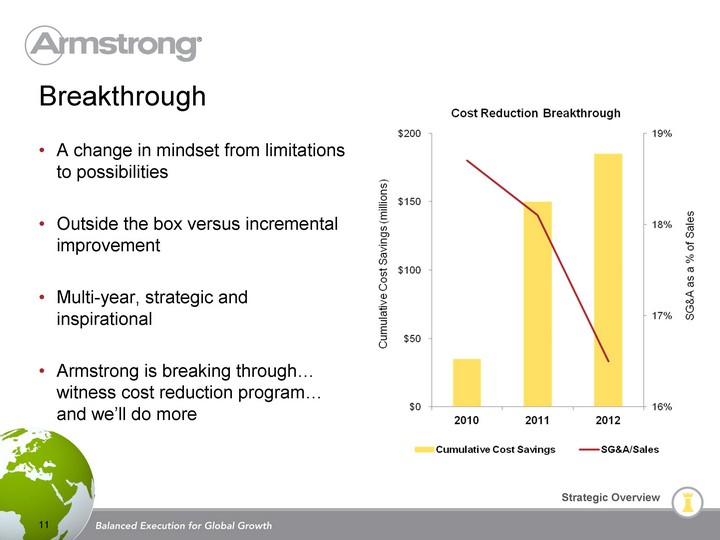

Reduced costs by $150 million

With planned reduction of $35

million more in 2012

Increased adjusted EBITDA from $296

million in 2009 to $377 million in 2011

Despite lower volume

Fixed an inefficient balance sheet and

returned $1.3 billion to shareholders

Strategic Priorities

Build a competitive cost structure

Fix underperforming businesses

Deliver profitable growth in our core

North America businesses

Drive dramatic organic growth in

priority emerging markets

Expand profit from attractive

adjacencies

Build a winning team and global

organization

Path to Growth

Invest in growing markets

Building four plants in China &

Russia

Added 130 sales and marketing

resources in emerging markets

Invest in growing adjacencies

Architectural Specialties

Emphasize breakthrough thinking

Recovery in the US and Western

Europe

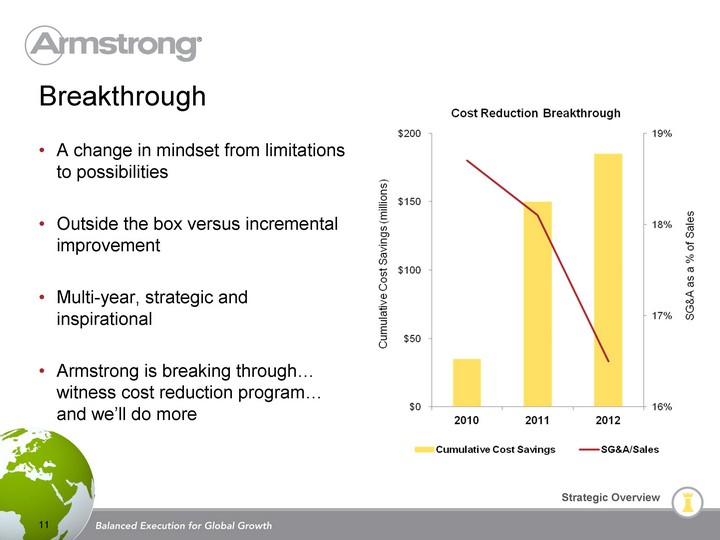

Breakthrough

A change in mindset from limitations

to possibilities

Outside the box versus incremental

improvement

Multi-year, strategic and

inspirational

Armstrong is breaking through...

witness cost reduction program...

and we’ll do more

Keys to Success

Leverage our position as a trusted

brand

Deliver innovative products and

services to drive mix improvement

Win share by being the partner of

choice for architects, retail consumers,

builders, designers and our entire

customer base

Armstrong in the Future

Larger and more profitable

More international in our operations

and our mindset

A globally integrated industry leader

in new product development,

sustainability and safety

Larger and more profitable

More international in our operations

and our mindset

A globally integrated industry leader

in new product development,

sustainability and safety

Business Update and Strategic

Priority Review

Armstrong Building Products

Business Overview

Victor Grizzle, Executive Vice President and CEO Armstrong Building Products

Building Products

Wood Ceilings & Walls

Exposed Plenum Solutions

Suspension Systems

Wet Felt Mineral Ceilings

Metal Ceilings & Walls

Soft/Fiberglass Ceilings

$1.2 billion Worldwide sales

20 Manufacturing facilities in 9 countries

3,300 Team members worldwide

132 Countries have Armstrong ceilings

50,000+ Architect/Designer relationships

1,000,000’s Installations globally

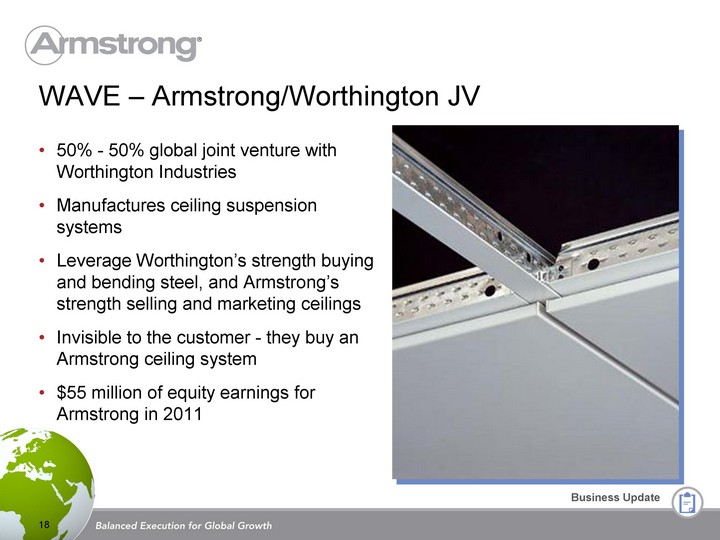

WAVE - Armstrong/Worthington JV

50% - 50% global joint venture with

Worthington Industries

Manufactures ceiling suspension

systems

Leverage Worthington’s strength buying

and bending steel, and Armstrong’s

strength selling and marketing ceilings

Invisible to the customer - they buy an

Armstrong ceiling system

$55 million of equity earnings for

Armstrong in 2011

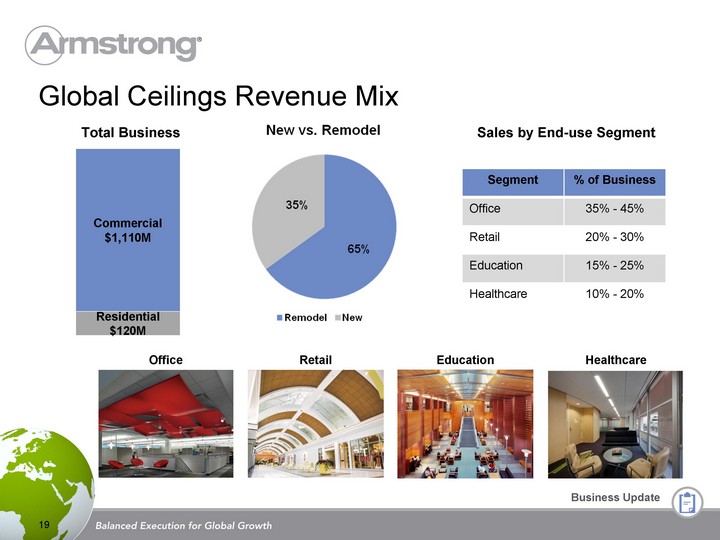

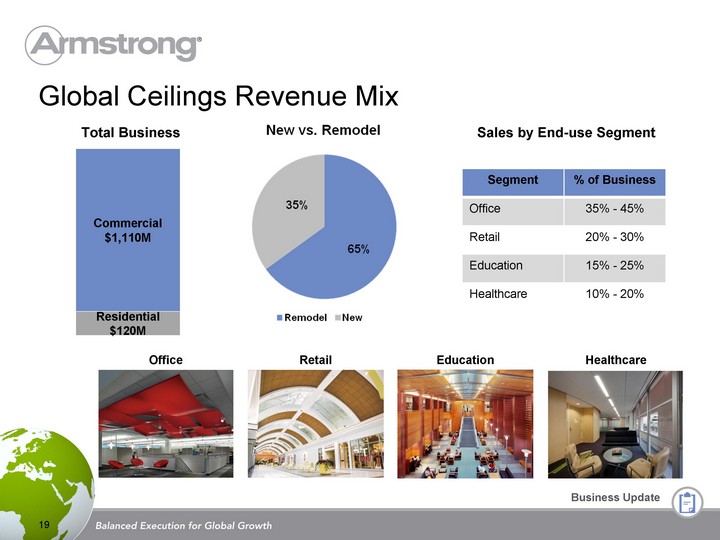

Global Ceilings Revenue Mix

Residential

$120M

Commercial

$1,110M

Total Business

Sales by End-use Segment

Office

Retail

Education

Healthcare

Segment % of Business

Office 35% - 45%

Retail 20% - 30%

Education 15% - 25%

Healthcare 10% - 20%

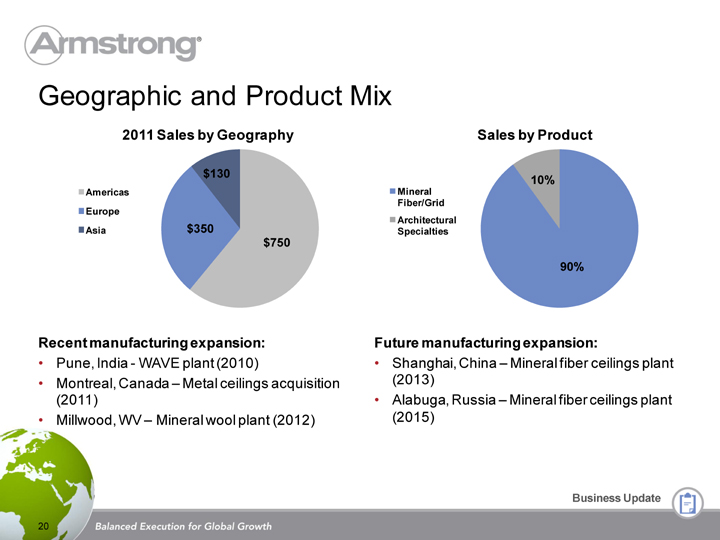

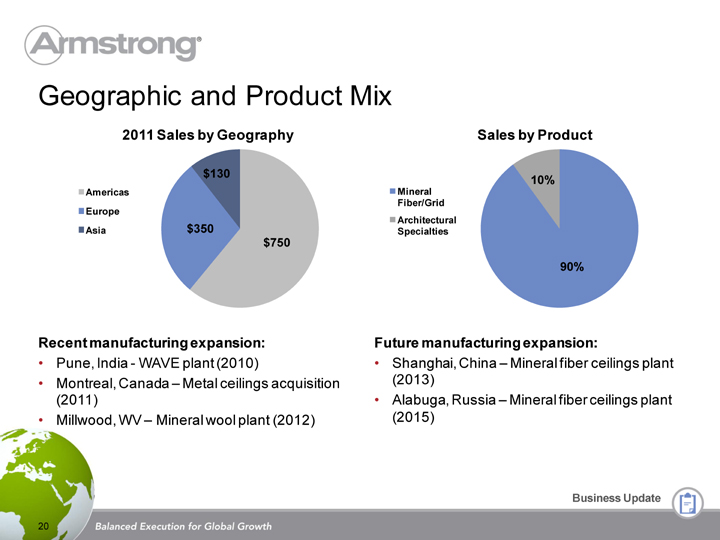

Future manufacturing expansion:

Shanghai, China - Mineral fiber ceilings plant

(2013)

Alabuga, Russia - Mineral fiber ceilings plant

(2015)

Geographic and Product Mix

20

Recent manufacturing expansion:

Pune, India - WAVE plant (2010)

Montreal, Canada - Metal ceilings acquisition

(2011)

Millwood, WV - Mineral wool plant (2012)

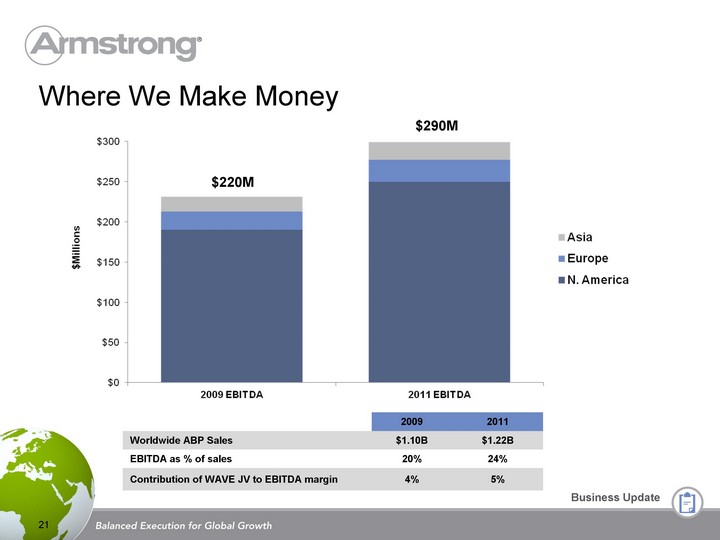

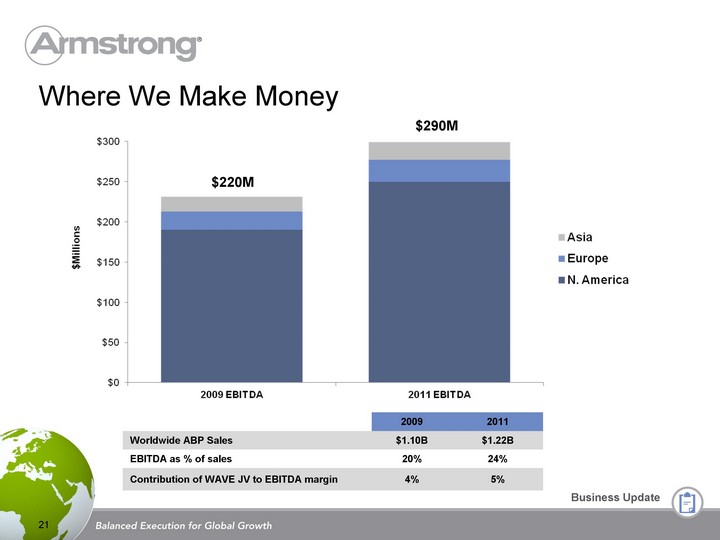

Where We Make Money

21

$220M

$290M

2009 2011

Worldwide ABP Sales $1.10B $1.22B

EBITDA as % of sales 20% 24%

Contribution of WAVE JV to EBITDA margin 4% 5%

Business Drivers

We improve the building environment for its occupants....

Acoustics

Fire

Seismic

Hygiene

Humidity

Environment

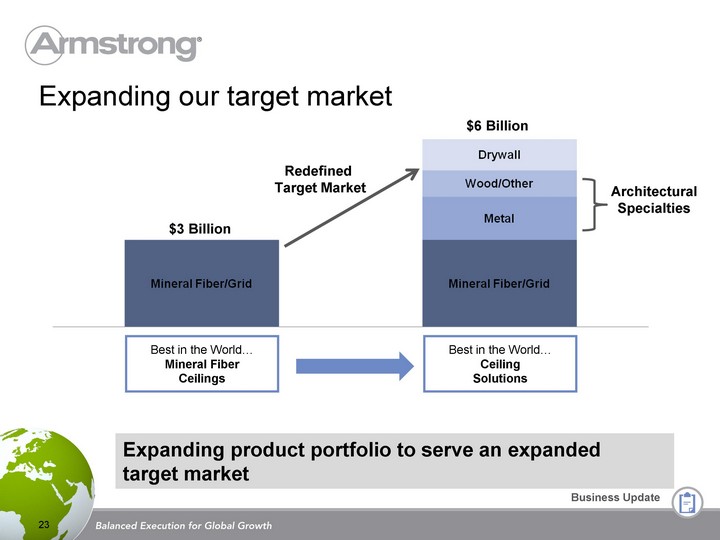

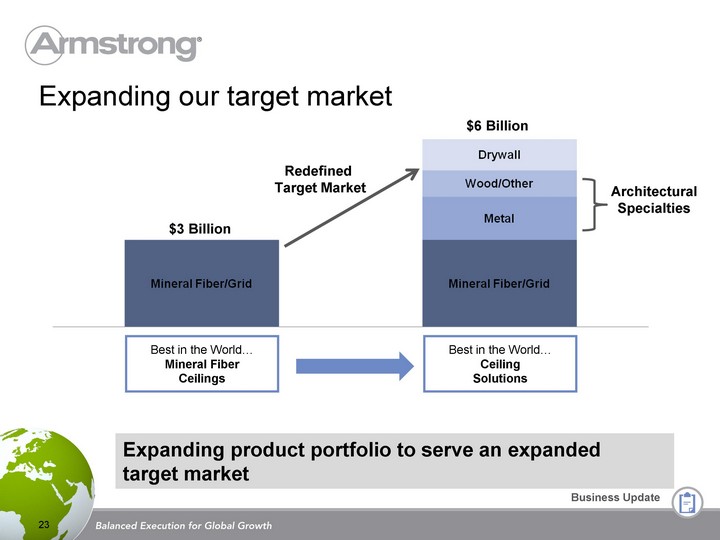

23

Expanding product portfolio to serve an expanded

target market

Redefined

Target Market

Best in the World...

Mineral Fiber

Ceilings

Best in the World...

Ceiling

Solutions

Architectural

Specialties

$3 Billion

$6 Billion

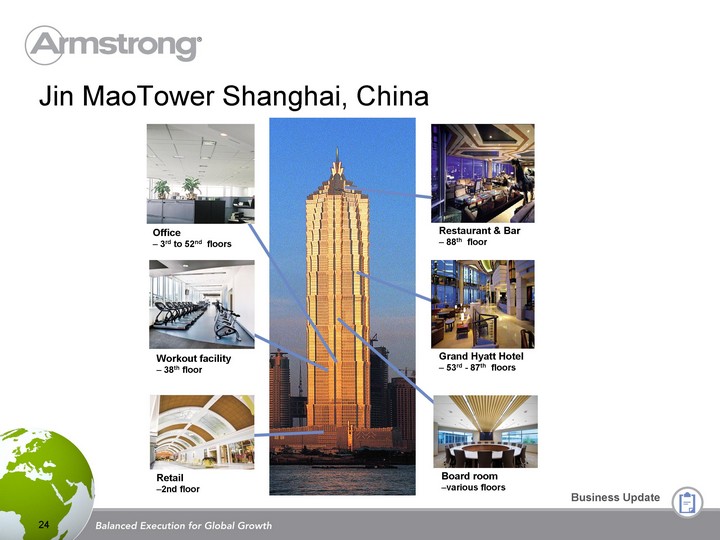

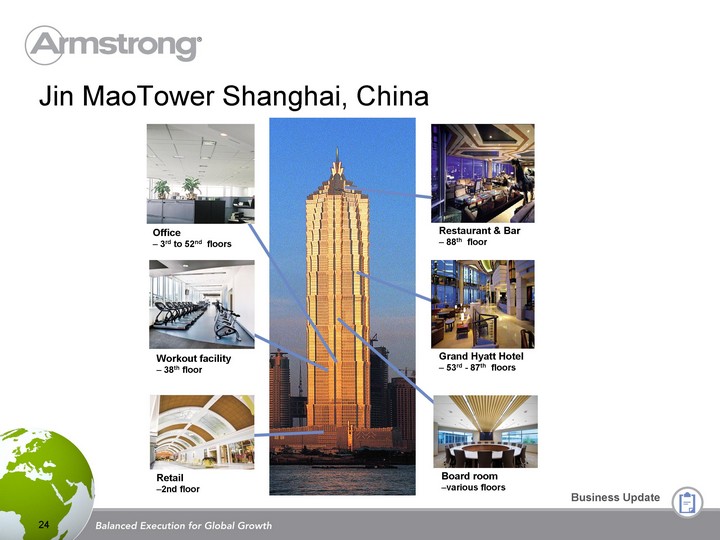

Retail space

1st - 2nd floors

Grand Hyatt Hotel

53rd - 87th floors

Office

3rd to 52nd floors

Restaurant & Bar

88th floor

Workout facility

38th floor

Board room

various floors

Retail

2nd floor

Jin MaoTower Shanghai, China

24

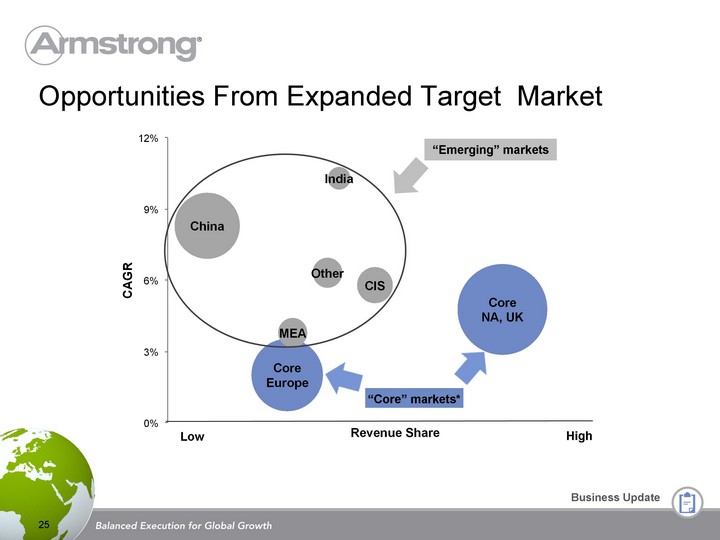

Low

High

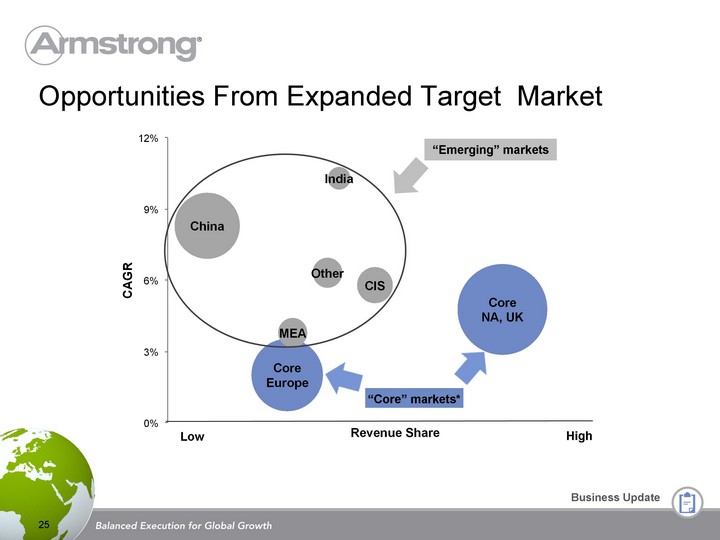

“Core” markets*

“Emerging” markets

Opportunities From Expanded Target Market

25

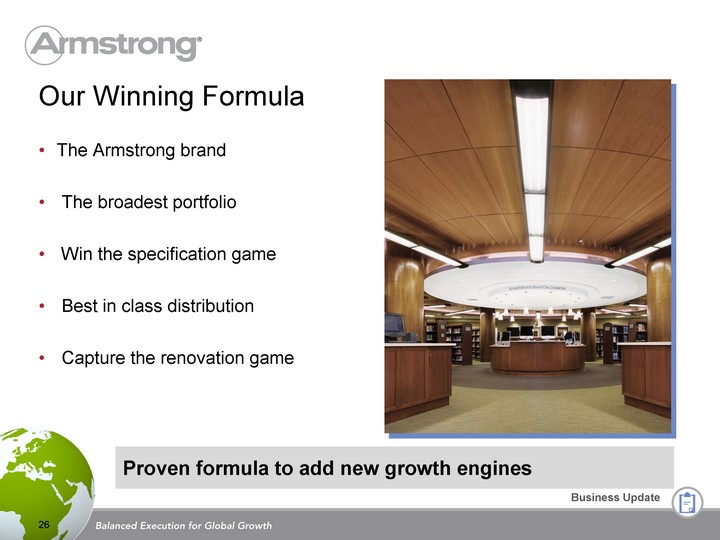

Our Winning Formula

Proven formula to add new growth engines

The Armstrong brand

The broadest portfolio

Win the specification game

Best in class distribution

Capture the renovation game26

Expanded target market

From $3B to $6B market

2 additional growth engines

Emerging markets

Architectural Specialties

Building blocks to win

Industry leading brand...globally

Broadest portfolio...getting broader

Architectural relationships

Global footprint...and growing

Summary

27

Armstrong Floor Products

Business Overview

Frank Ready, Executive Vice President and CEO Armstrong Floor Products

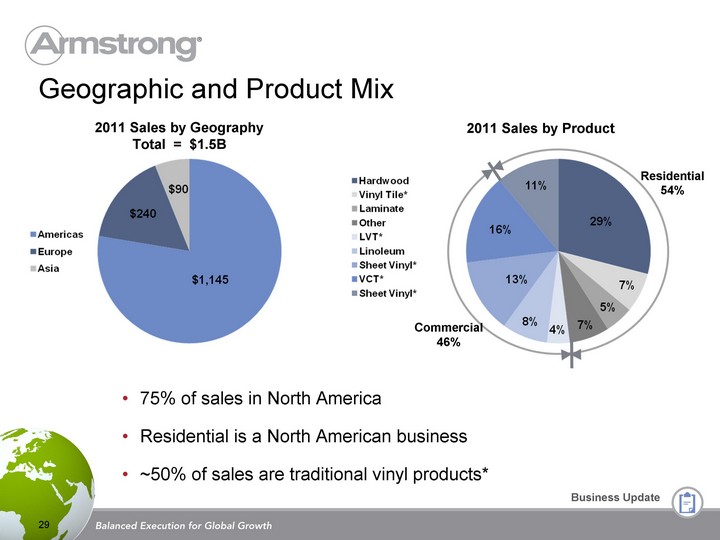

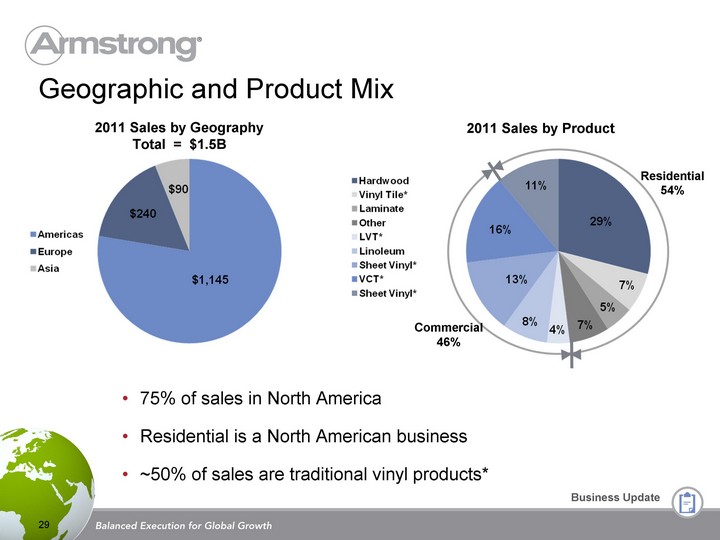

Geographic and Product Mix

2011 Sales by Geography

Total = $1.5B

75% of sales in North America

Residential is a North American business

~50% of sales are traditional vinyl products*

2011 Sales by Product

Residential

54%

Commercial

46%

29

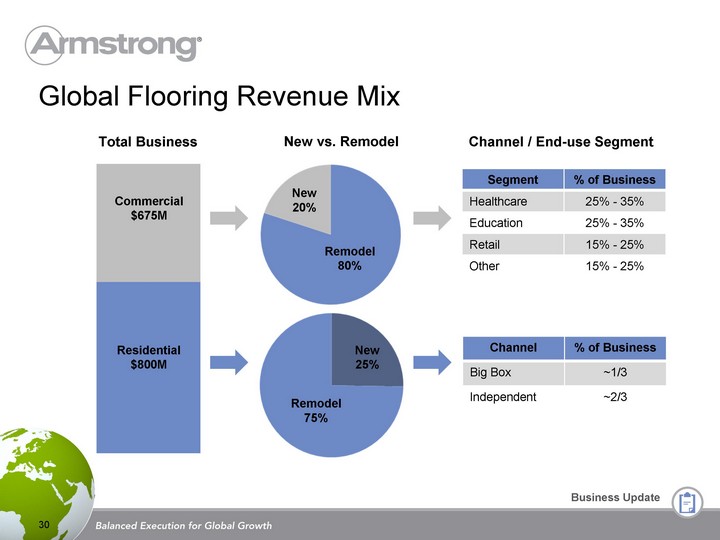

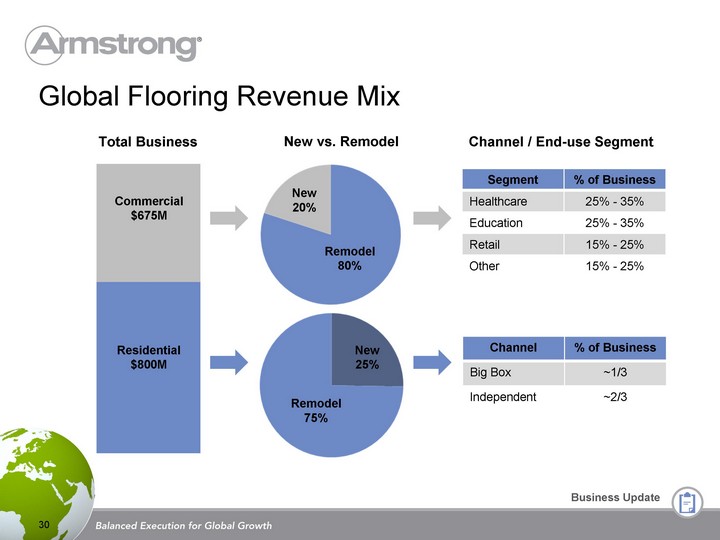

Global Flooring Revenue Mix

Commercial

$675M

Residential

$800M

Total Business

Remodel

80%

New

20%

Remodel

75%

New

25%

New vs. Remodel

Channel / End-use Segment

Segment % of Business

Healthcare 25% - 35%

Education 25% - 35%

Retail 15% - 25%

Other 15% - 25%

Channel % of Business

Big Box ~1/3

Independent ~2/3

30

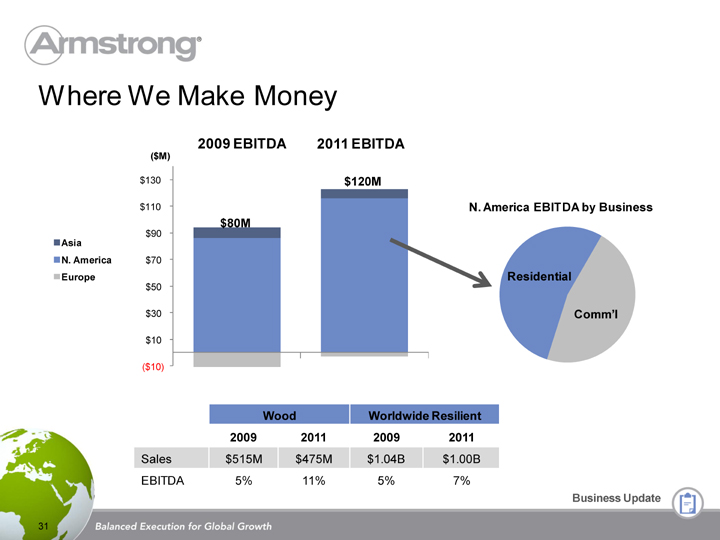

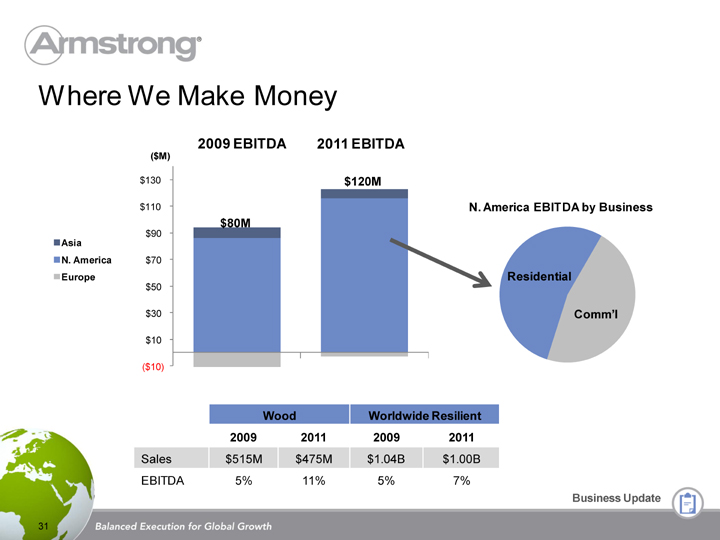

Where We Make Money

2009 EBITDA

$80M

($M)

N. America EBITDA by Business

Comm’l

Residential

2011 EBITDA

$120M

Wood Wood

2009 2011

Sales $515M $475M

EBITDA 5% 11%

Worldwide Resilient Worldwide Resilient

2009 2011

$1.04B $1.00B

5% 7%

31

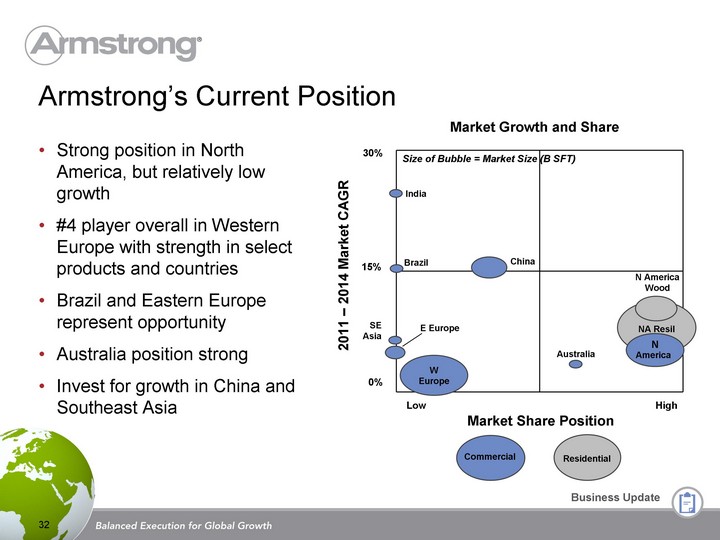

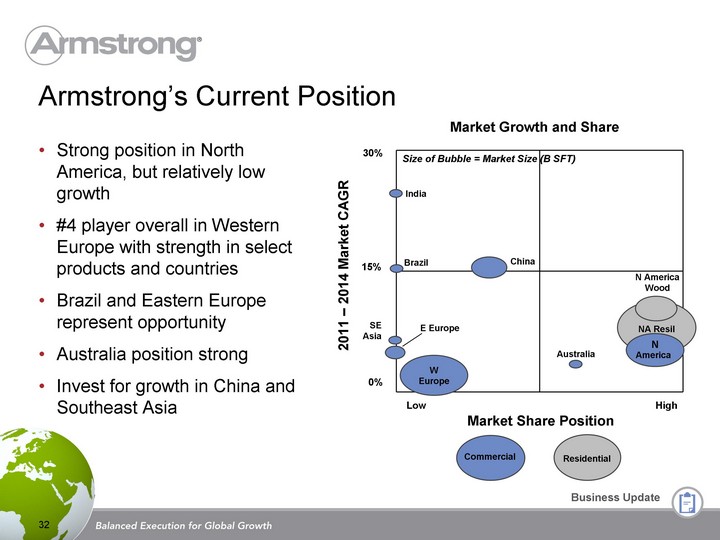

Armstrong’s Current Position

Strong position in North

America, but relatively low growth

#4 player overall in Western

Europe with strength in select

products and countries

Brazil and Eastern Europe

represent opportunity

Australia position strong

Invest for growth in China and

Southeast Asia32

Market Share Position

Commercial

Residential

Market Growth and Share

2011 - 2014 Market CAGR

0%

30%

Low

High Size of Bubble = Market Size (B SFT)

W Europe

15%

Brazil

India

China

E Europe

SE

Asia

Australia

NA Resil

N America

Wood

N America

Market Trends

Sustainability / Environmental focused on recycled content

and Bio-based materialsArmstrong Position

Migrations Tile

Linoleum

33

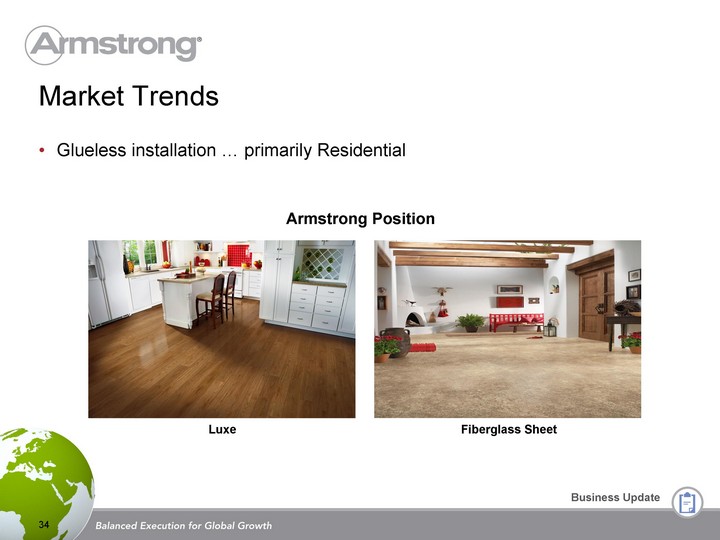

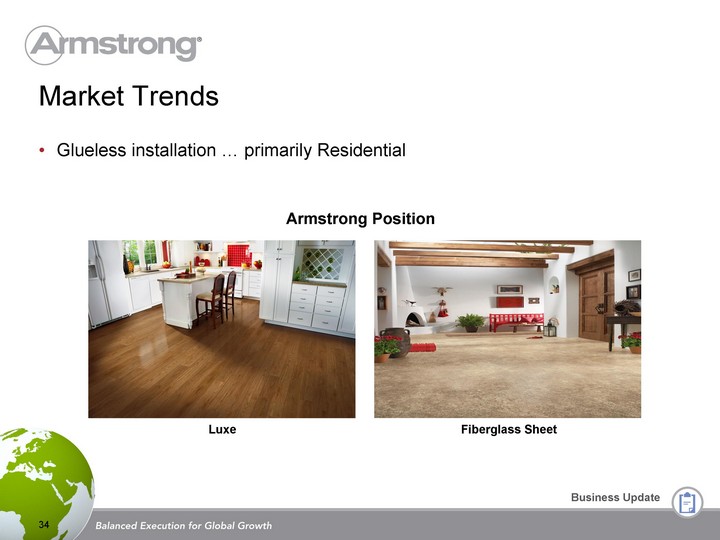

Market Trends

Glueless installation ... primarily Residential

Armstrong Position

Fiberglass Sheet

Luxe

34

Market Trends

Luxury Vinyl Tile (LVT) growth ... Residential and Commercial

Armstrong Position

Natural Creations

Alterna

35

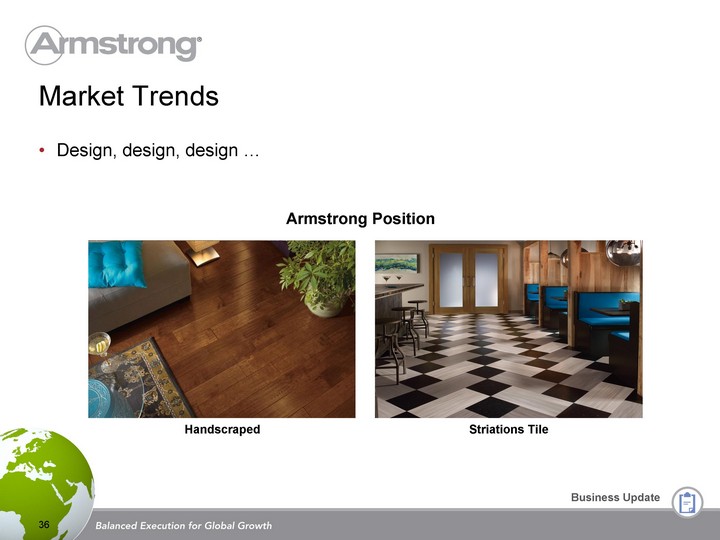

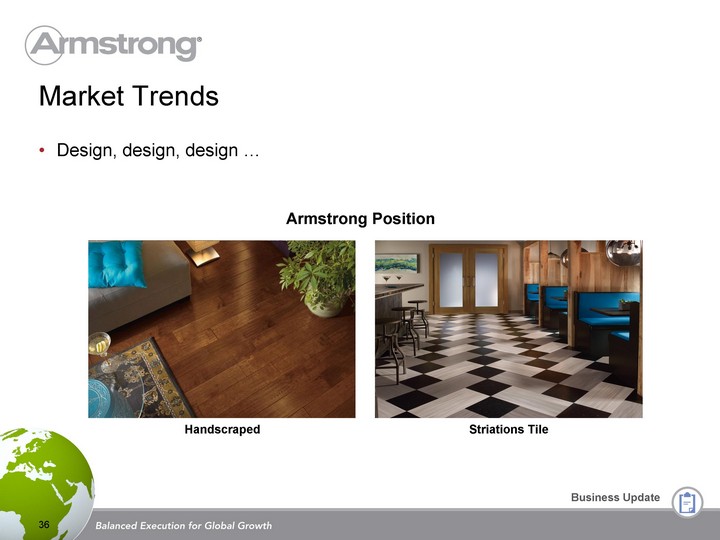

Market Trends

Design, design, design ...

Armstrong Position

Striations Tile

Handscraped

36

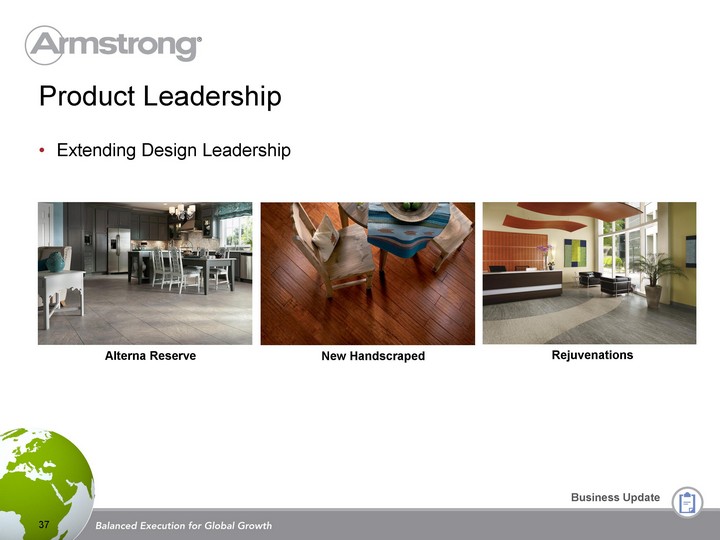

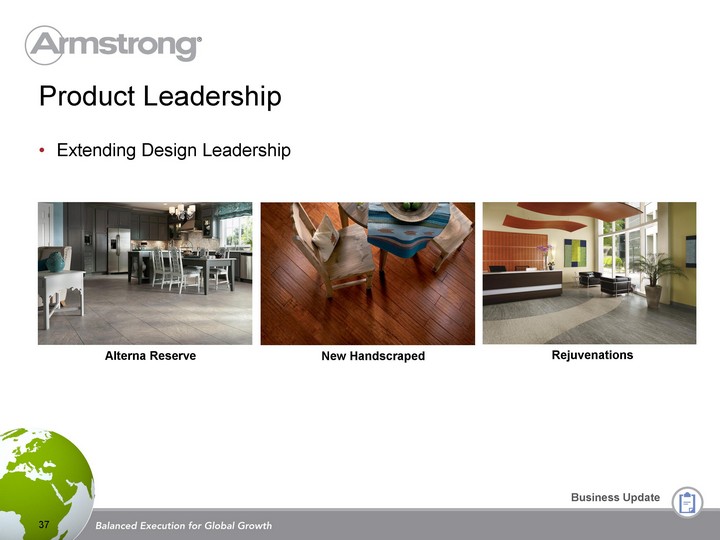

Product Leadership

Extending Design Leadership

Alterna Reserve

New Handscraped

Rejuvenations

37

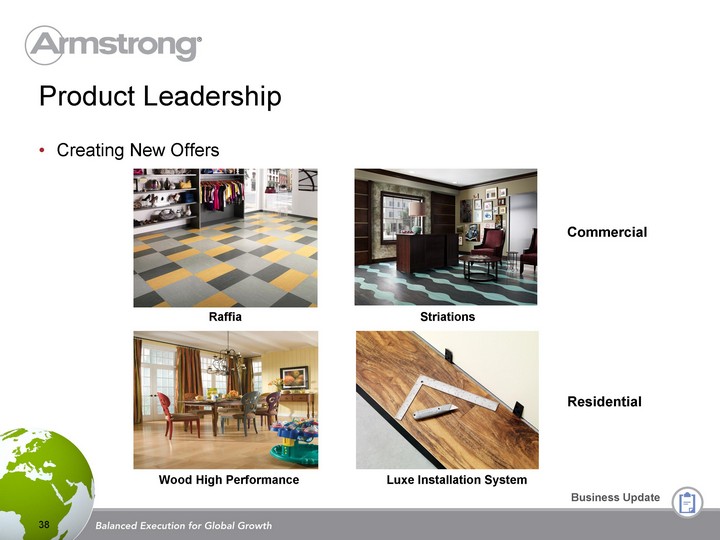

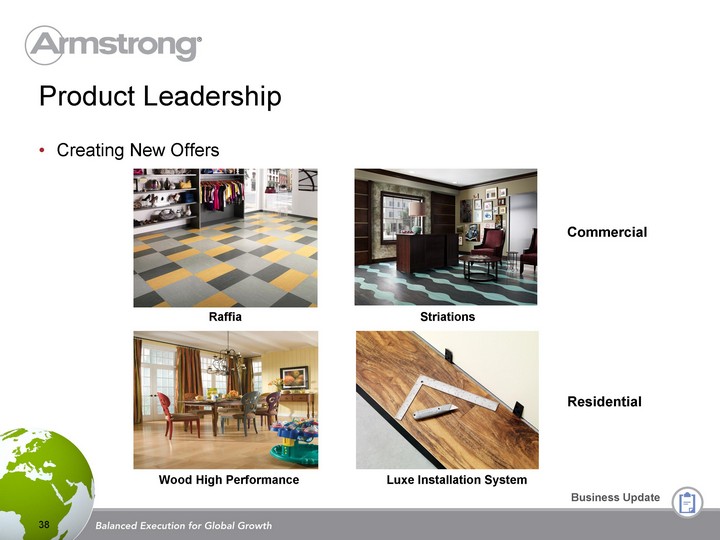

Product Leadership

Creating New Offers

Raffia

Striations

Commercial

Wood High Performance

Luxe Installation System

Residential

38

Product Leadership

Driving New Capability

New China Plants

Homogeneous

Heterogeneous

Lancaster Glass Plant

39

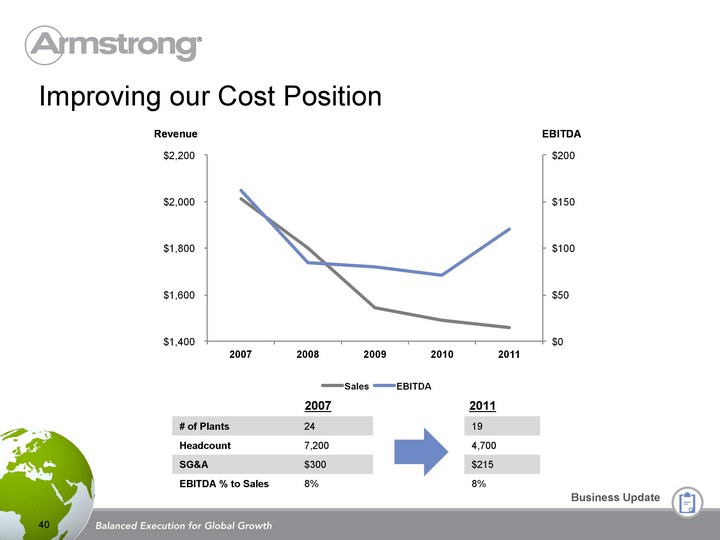

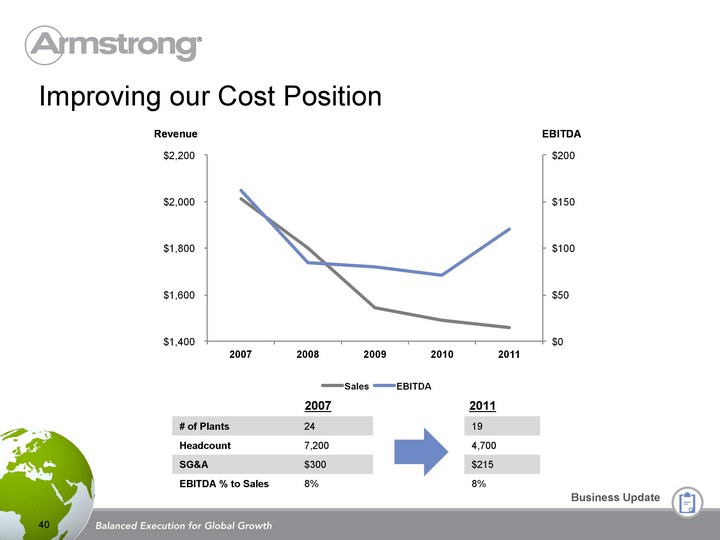

Improving our Cost Position

40

# of Plants 24

Headcount 7,200

SG&A $300

EBITDA % to Sales 8%

19

4,700

$215

8%

2007

2011

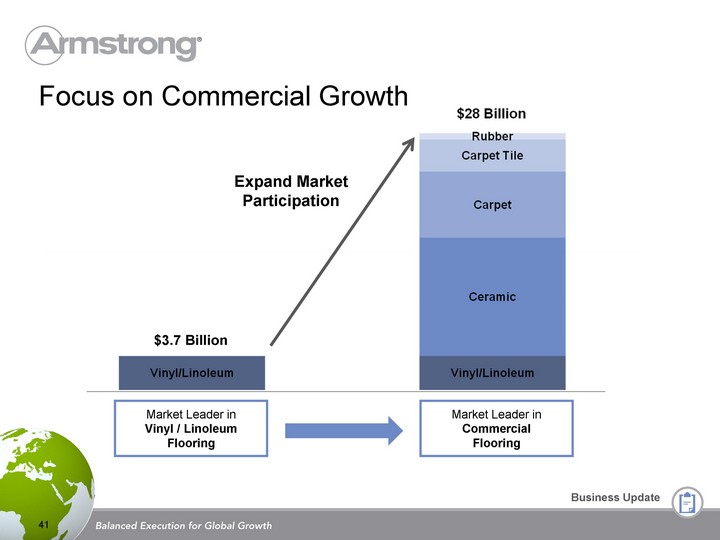

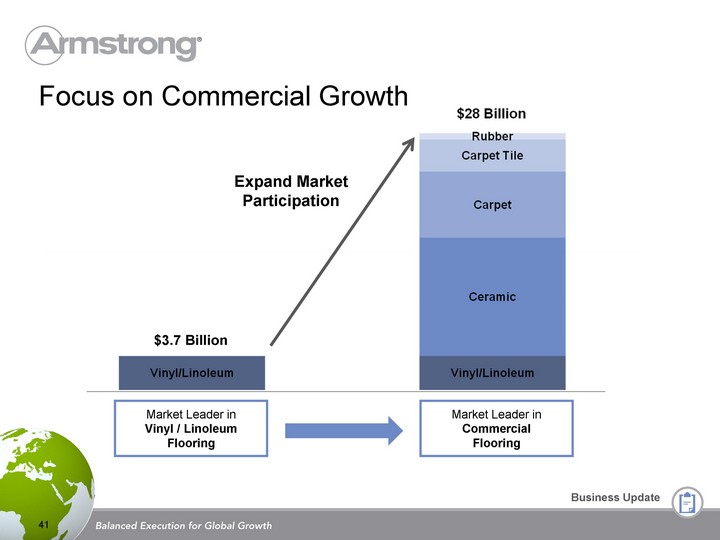

Focus on Commercial Growth

41

Expand Market

Participation

$3.7 Billion

Market Leader in

Vinyl / Linoleum

Flooring

Market Leader in

Commercial

Flooring

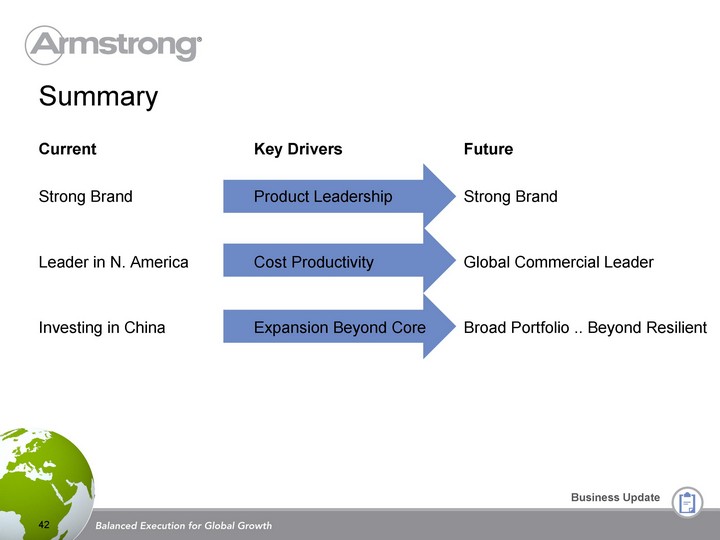

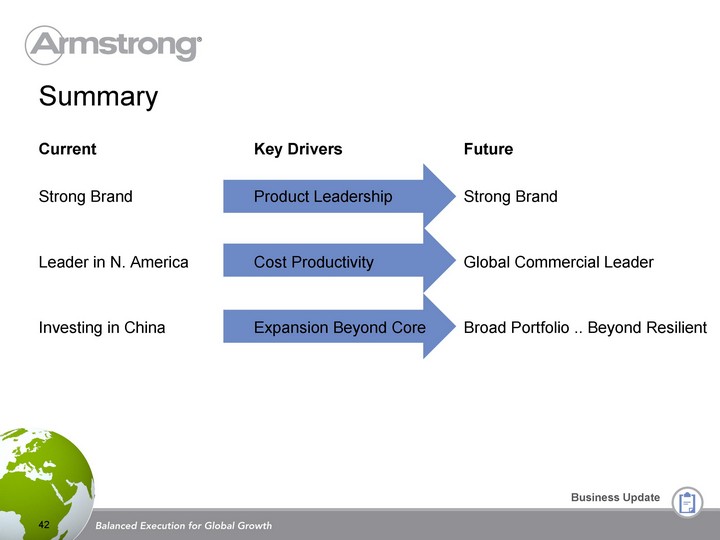

Summary

Current

Strong Brand

Leader in N. America

Investing in China

42

Future

Strong Brand

Global Commercial Leader

Broad Portfolio .. Beyond Resilient

Key Drivers

Product Leadership

Cost Productivity

Expansion Beyond Core

Growth Drivers

Selected Growth Opportunities Overview

Russia

China

Architectural Specialties

44

Growth Opportunities in Europe

Edwin de Wolf, CEO, Armstrong Building Products Europe

Russia

Armstrong brought the suspended ceiling category to Russia in 1992

Most seasoned specification sales force

Strong brand recognition... 1st mover advantage

60% share of “western” tier market

Large market - 3rd largest in the world with significant future growth

Very high logistics cost (30% of landed cost)

Limited in-country production... <15% of total market size

85% of today’s market in office and retail . . . Healthcare and Education offer

opportunities for growth

46

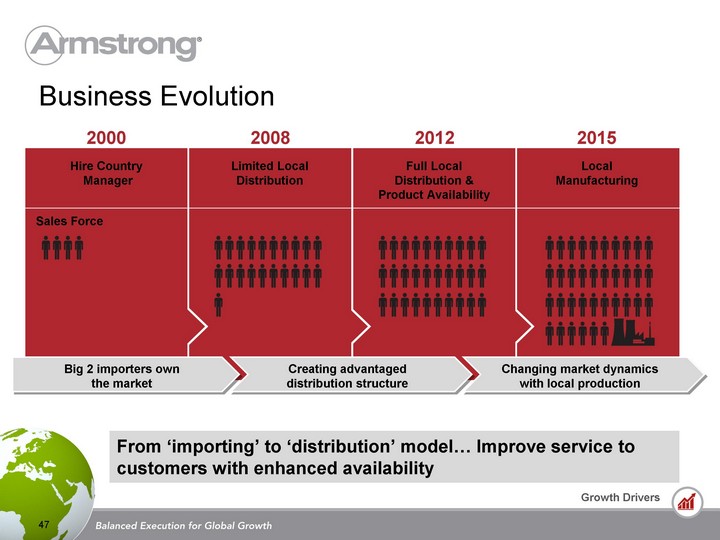

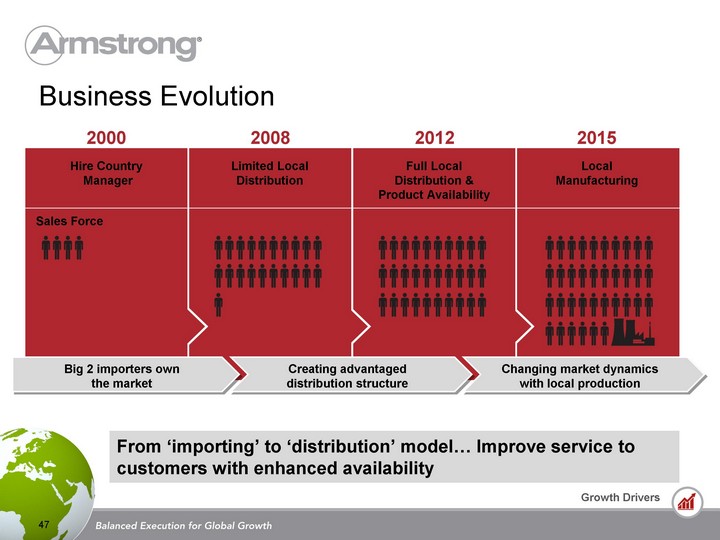

Business Evolution

From ‘importing’ to ‘distribution’ model... Improve service to

customers with enhanced availability

2015

Local

Manufacturing

Changing market dynamics

with local production

2012

Full Local

Distribution &

Product Availability

Creating advantaged

distribution structure

2000

2008

Limited Local

Distribution

Big 2 importers own

the market

Hire Country

Manager

Sales Force

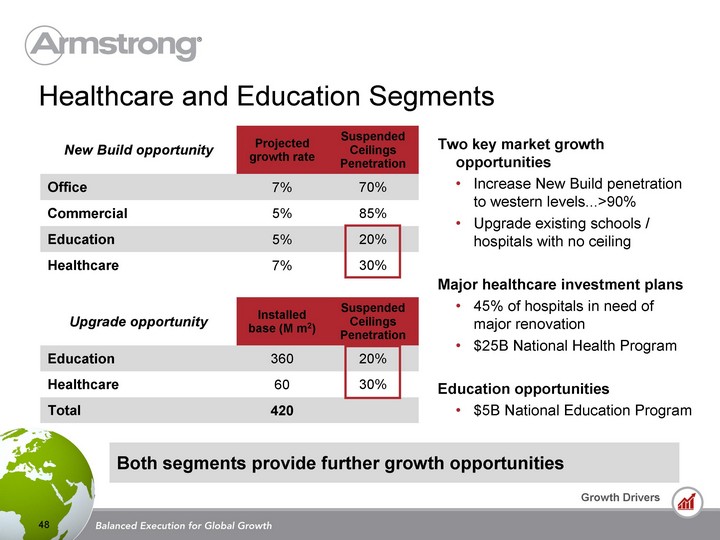

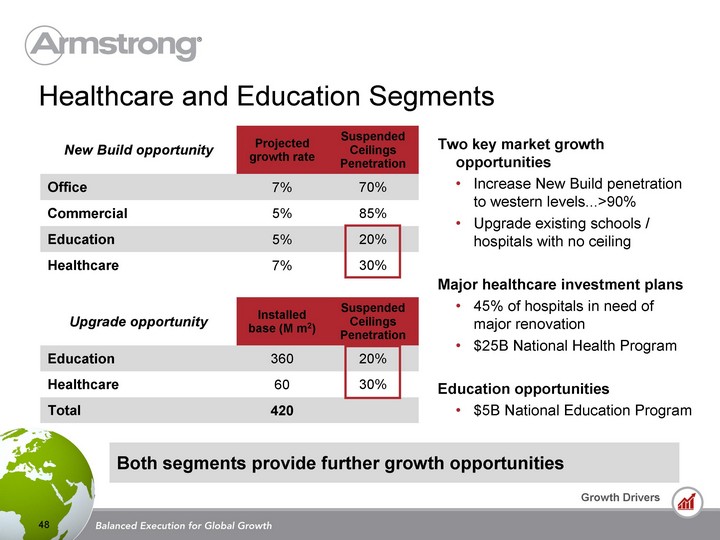

Healthcare and Education Segments

Two key market growth

opportunities

Increase New Build penetration

to western levels...>90%

Upgrade existing schools /

hospitals with no ceiling

Major healthcare investment plans

45% of hospitals in need of

major renovation

$25B National Health Program

Education opportunities

$5B National Education Program

New Build opportunity Projected growth rate Suspended Ceilings Penetration

Office 7% 70%

Commercial 5% 85%

Education 5% 20%

Healthcare 7% 30%

Upgrade opportunity Installed base (M m2) Suspended Ceilings Penetration

Education 360 20%

Healthcare 60 30%

Total 420

Both segments provide further growth opportunities

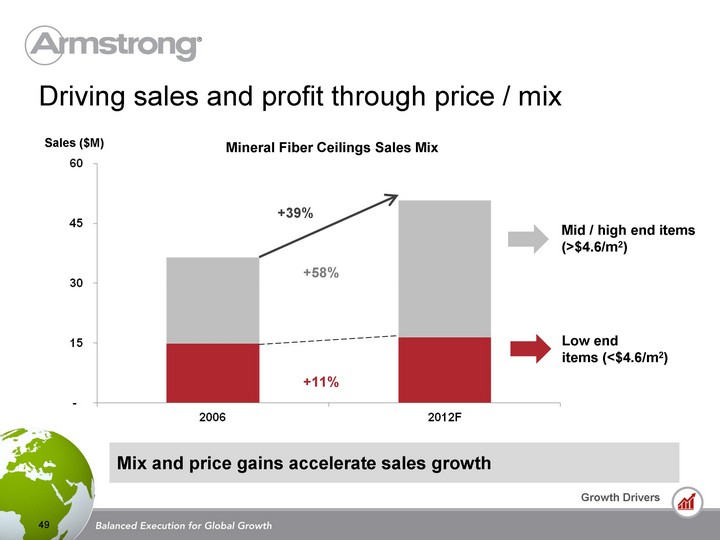

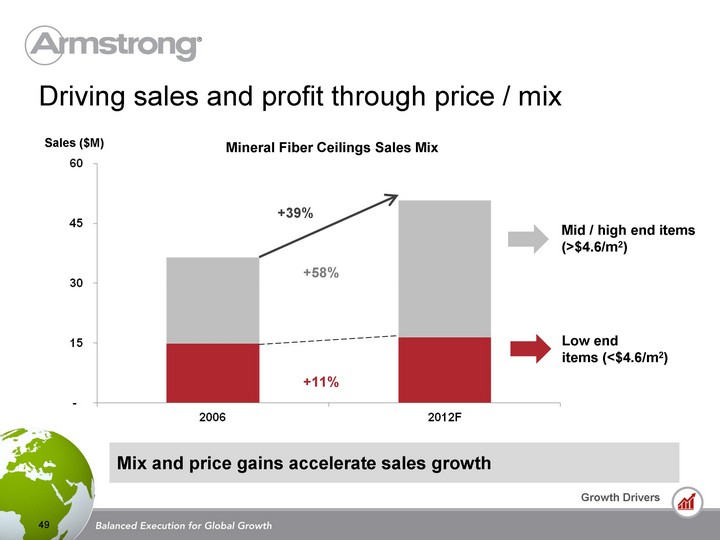

+11%

+58%

+39%

Mid / high end items

(>$4.6/m2)

Low end

items (<$4.6/m2)

Sales ($M)

Mineral Fiber Ceilings Sales Mix

Driving sales and profit through price / mix

Mix and price gains accelerate sales growth

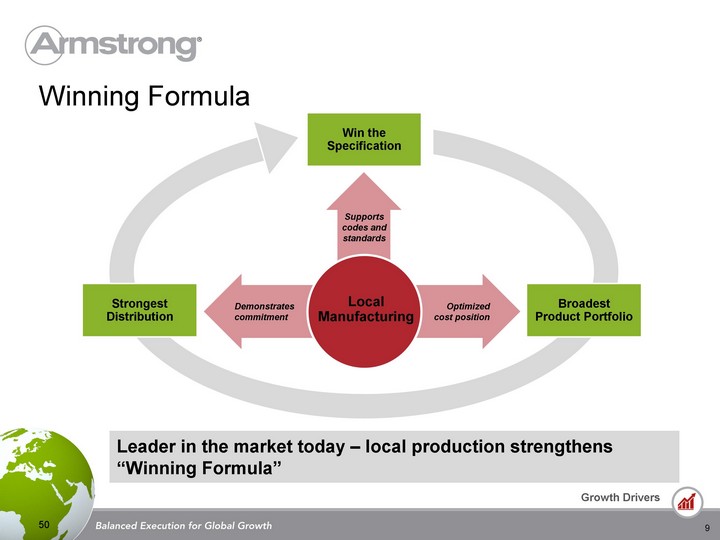

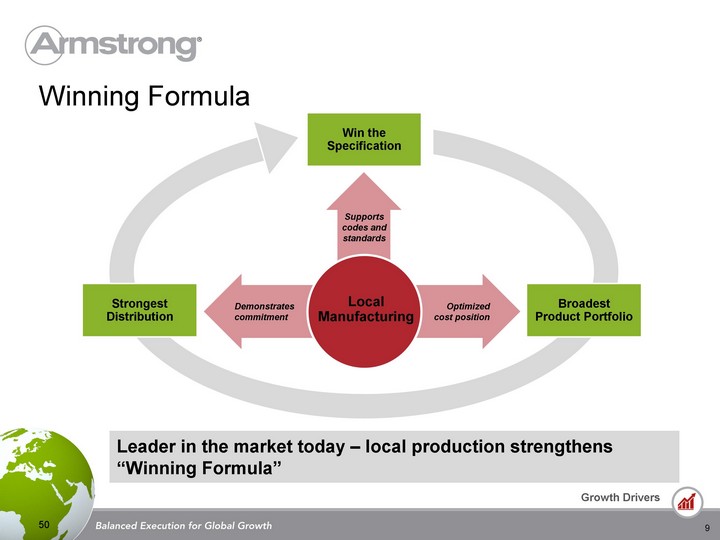

Optimized

cost position

Demonstrates

commitment

9

Leader in the market today - local production strengthens

“Winning Formula”

Winning Formula

Win the

Specification

Broadest

Product Portfolio

Strongest

Distribution

Supports

codes and

standards

Local

Manufacturing

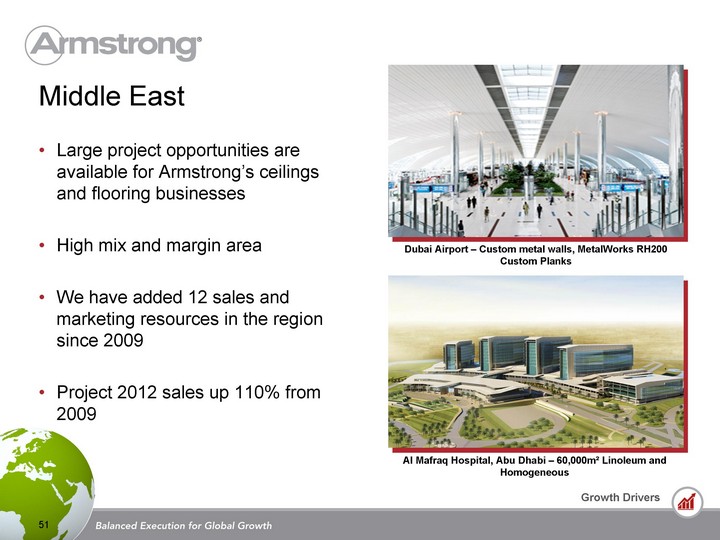

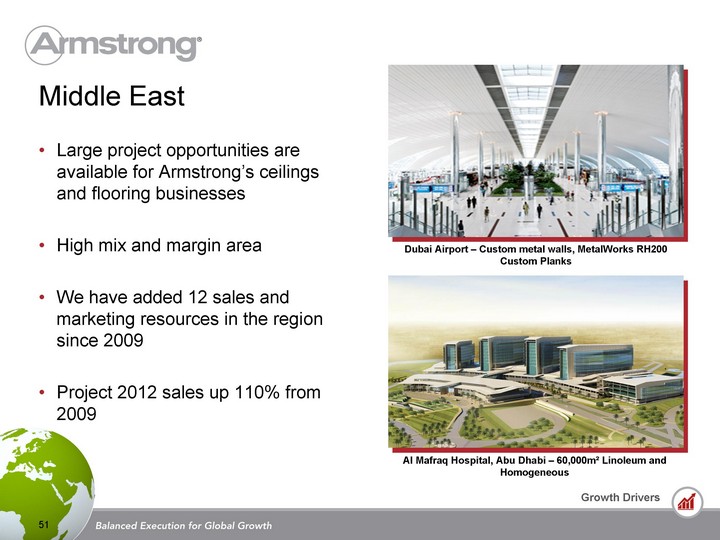

Al Mafraq Hospital, Abu Dhabi - 60,000m2 Linoleum and

Homogeneous

Dubai Airport - Custom metal walls, MetalWorks RH200

Custom Planks

Middle East

Large project opportunities are

available for Armstrong’s ceilings

and flooring businesses

High mix and margin area

We have added 12 sales and

marketing resources in the region

since 2009

Project 2012 sales up 110% from

2009

Summary

Russian ceilings market is large, fast

growing and Armstrong is the leading

brand

Significant opportunities in under

penetrated healthcare and education

segments

Local manufacturing to serve local needs

and eliminate high logistics costs

Current and future opportunities in the

Middle East

Growth Opportunities in Asia

Chia-ling Hsueh, Armstrong Flooring Products Managing Director Asia Pacific

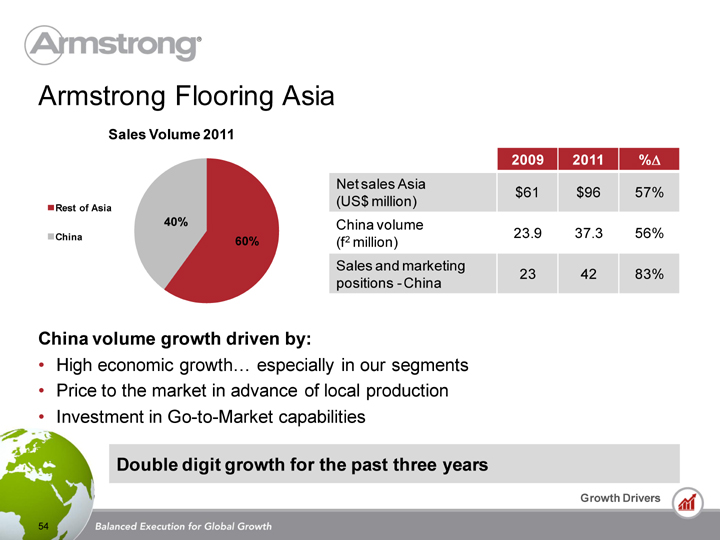

Armstrong Flooring Asia

54

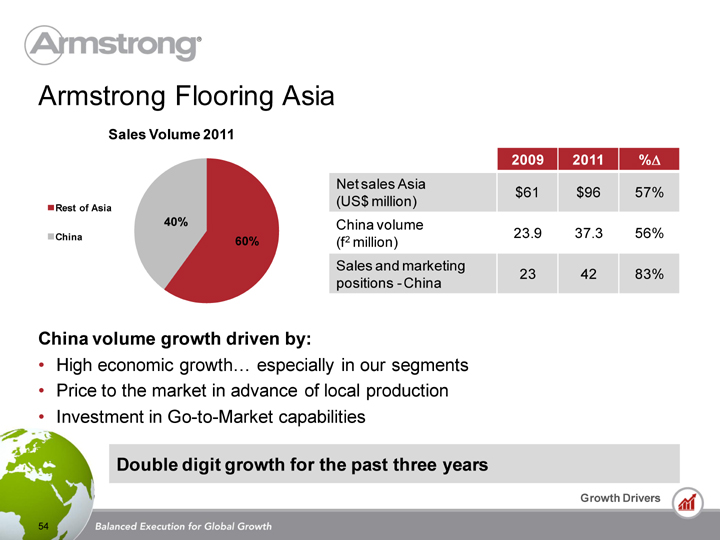

2009 2011 %?

Net sales Asia

(US$ million) $61 $96 57%

China volume

(f2 million) 23.9 37.3 56%

Sales and marketing positions - China 23 42 83%

Double digit growth for the past three years

China volume growth driven by:

High economic growth... especially in our segments

Price to the market in advance of local production

Investment in Go-to-Market capabilities

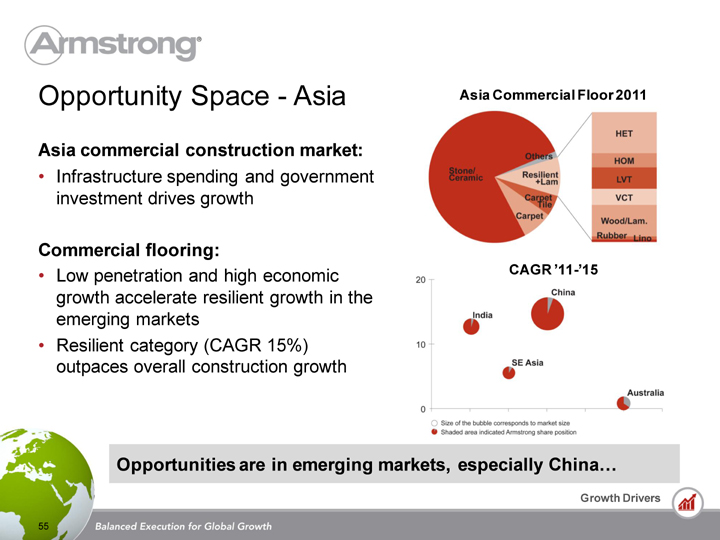

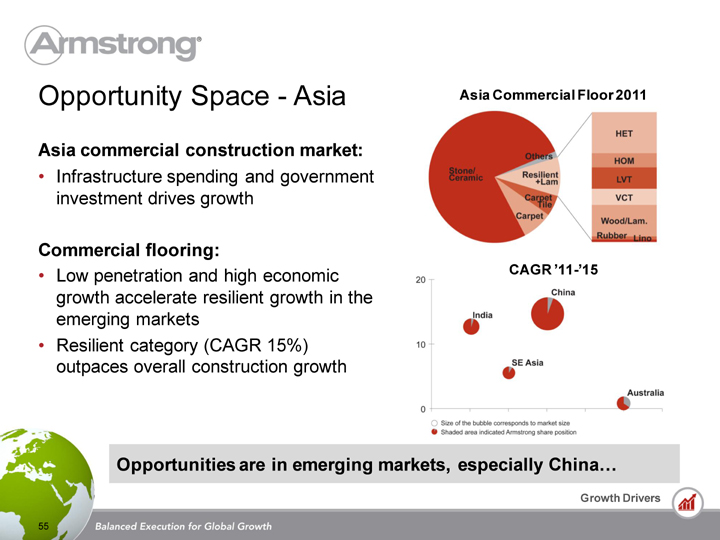

Opportunity Space - Asia

Asia commercial construction market:

Infrastructure spending and government

investment drives growth

Commercial flooring:

Low penetration and high economic

growth accelerate resilient growth in the

emerging markets

Resilient category (CAGR 15%) outpaces

overall construction growth

Opportunities are in emerging markets, especially China...

Asia Commercial Floor 2011

CAGR ‘11-’15

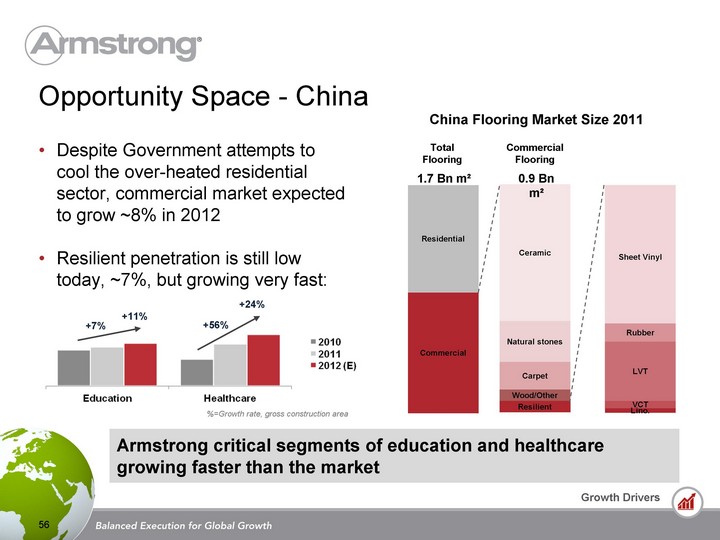

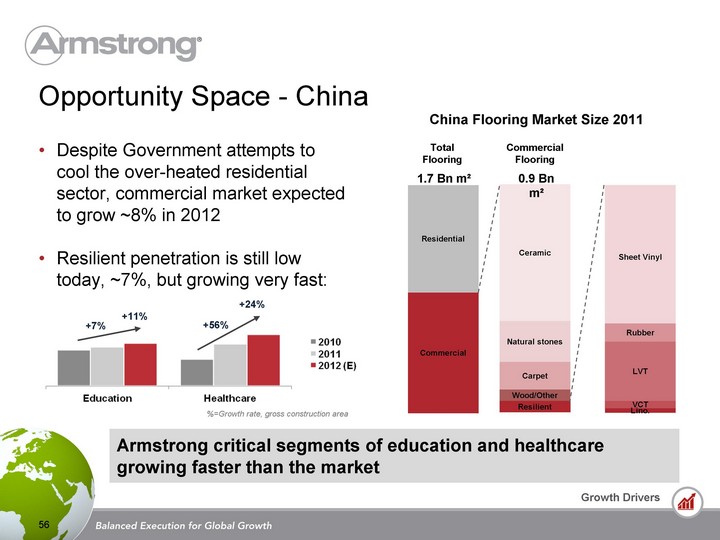

Opportunity Space - China

Despite Government attempts to

cool the over-heated residential

sector, commercial market expected

to grow ~8% in 2012

Resilient penetration is still low

today, ~7%, but growing very fast:

Armstrong critical segments of education and healthcare

growing faster than the market

Sheet Vinyl

Residential

Commercial

VCT

Resilient

Wood/Other

Carpet

Natural stones

Ceramic

Total

Flooring

Commercial

Flooring

0.9 Bn

m2

1.7 Bn m2

LVT

Lino.

Rubber

China Flooring Market Size 2011

+7%

+56%

+11%

+24%

%=Growth rate, gross construction area

What drives the conversion?

Performance / Benefits we offer

Healthcare:

Seamless, anti-bacteria

Slip resistance

Acoustics

Warmth

Environmental

Education:

Safety

Acoustics

Aesthetic design

High growth, low category penetration, but conversion is

accelerating

Before

After

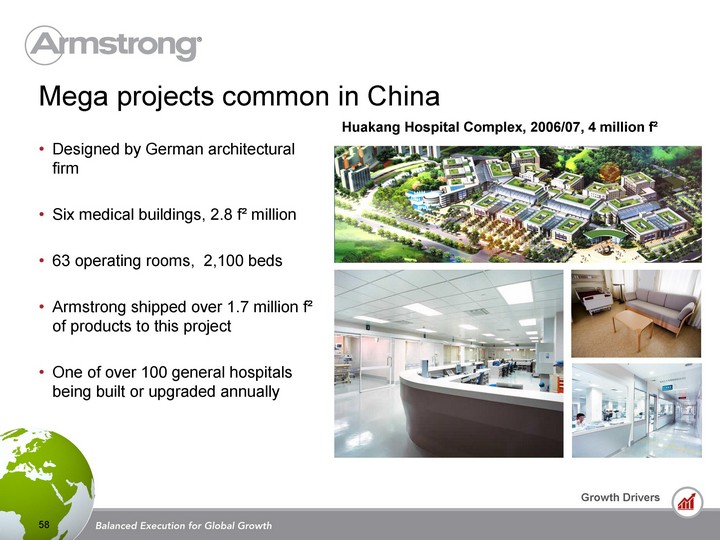

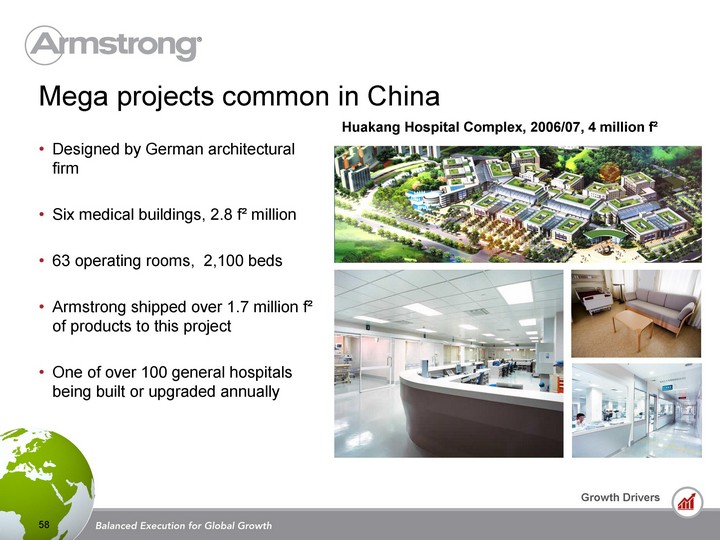

Mega projects common in China

Designed by German architectural

firm

Six medical buildings, 2.8 f2 million

63 operating rooms, 2,100 beds

Armstrong shipped over 1.7 million f2

of products to this project

One of over 100 general hospitals

being built or upgraded annually

More recent mega projects...

59

Binhai Hospital (2012) - 2.4 million f2

Tongji University, Jiading Shanghai (2011) - 4.3 million f2

Fuchun No. 3 kindergarten (2012) - 208,000 f2

HZ Xiasha Hospital (2011) - 1.3 million f2

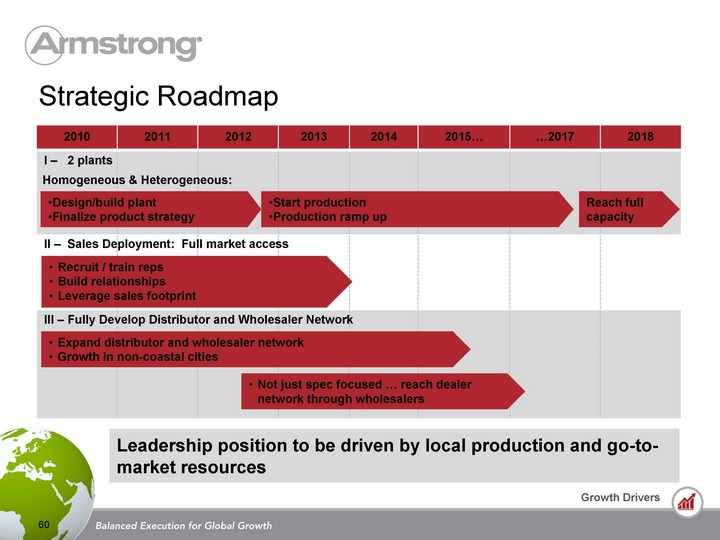

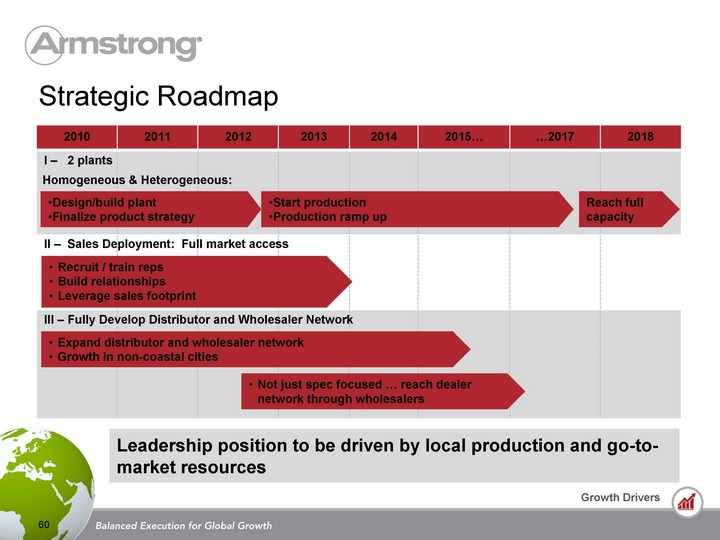

Strategic Roadmap

60

2010 2011 2012 2013 2014 2015... ...2017 2018

I - 2 plants

II - Sales Deployment: Full market access

III - Fully Develop Distributor and Wholesaler Network

Recruit / train reps

Build relationships

Leverage sales footprint

Expand distributor and wholesaler network

Growth in non-coastal cities

Design/build plant

Finalize product strategy

Start production

Production ramp up

Reach full

capacity

Homogeneous & Heterogeneous:

Not just spec focused ... reach dealer

network through wholesalers

Leadership position to be driven by local production and go-to-

market resources

Summary

Fast growing market

China volume up 56% since 2009

Resilient flooring a small part of the market

Large opportunity

Material substitution and high growth segments enhance the opportunity

Local manufacturing to serve local needs

Growth Opportunities for

Architectural Specialties

Mike Shirk, Vice President Worldwide Architectural Specialties

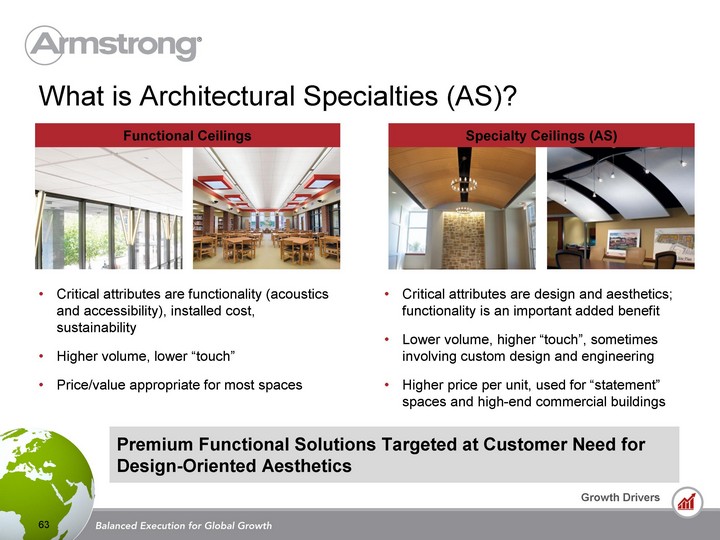

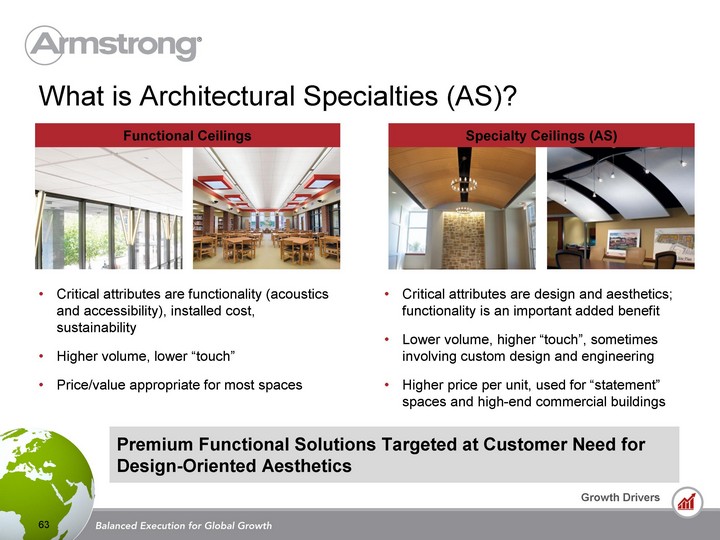

What is Architectural Specialties (AS)?

Critical attributes are functionality (acoustics

and accessibility), installed cost,

sustainability

Higher volume, lower “touch”

Price/value appropriate for most spaces

63

Critical attributes are design and aesthetics;

functionality is an important added benefit

Lower volume, higher “touch”, sometimes

involving custom design and engineering

Higher price per unit, used for “statement”

spaces and high-end commercial buildings

Premium Functional Solutions Targeted at Customer Need for

Design-Oriented Aesthetics

Functional Ceilings

Specialty Ceilings (AS)

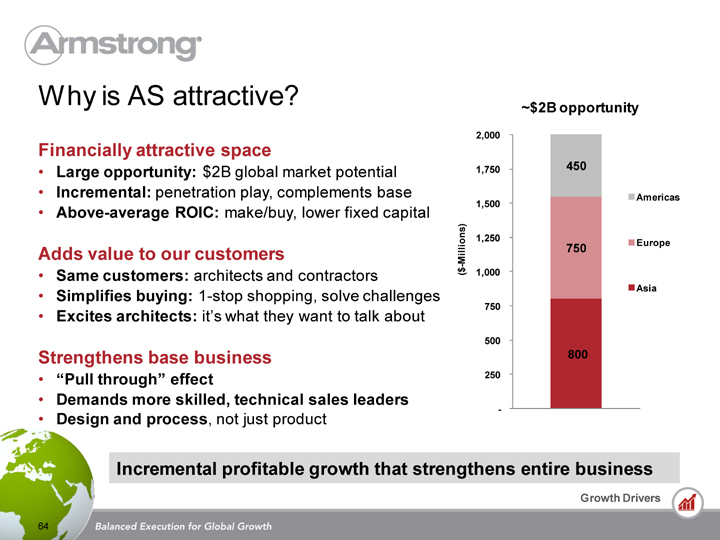

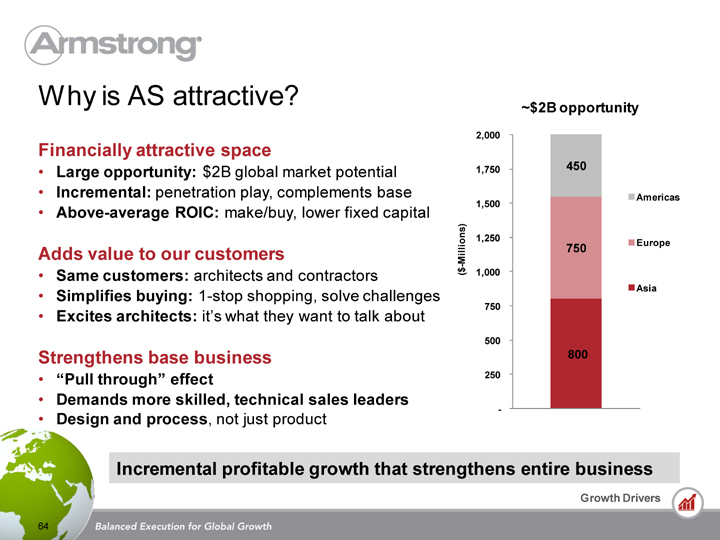

Why is AS attractive?

~$2B opportunity

Incremental profitable growth that strengthens entire business

Financially attractive space

Large opportunity: $2B global market potential

Incremental: penetration play, complements base

Above-average ROIC: make/buy, lower fixed capital

Adds value to our customers

Same customers: architects and contractors

Simplifies buying: 1-stop shopping, solve challenges

Excites architects: it’s what they want to talk about

Strengthens base business

“Pull through” effect

Demands more skilled, technical sales leaders

Design and process, not just product

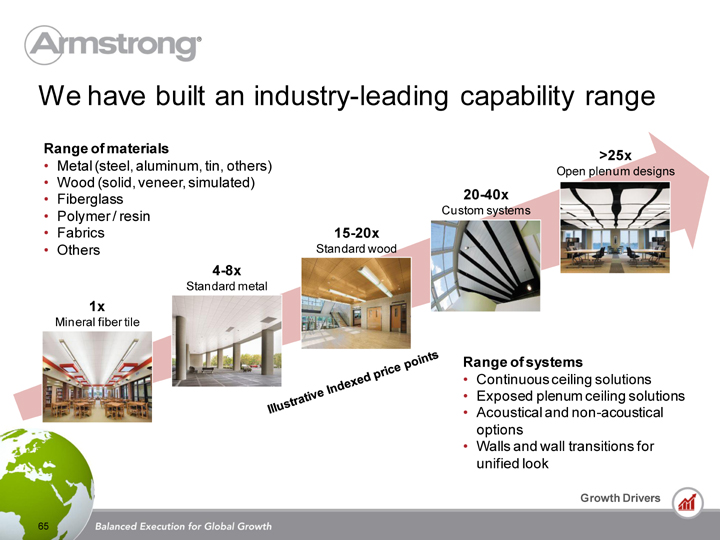

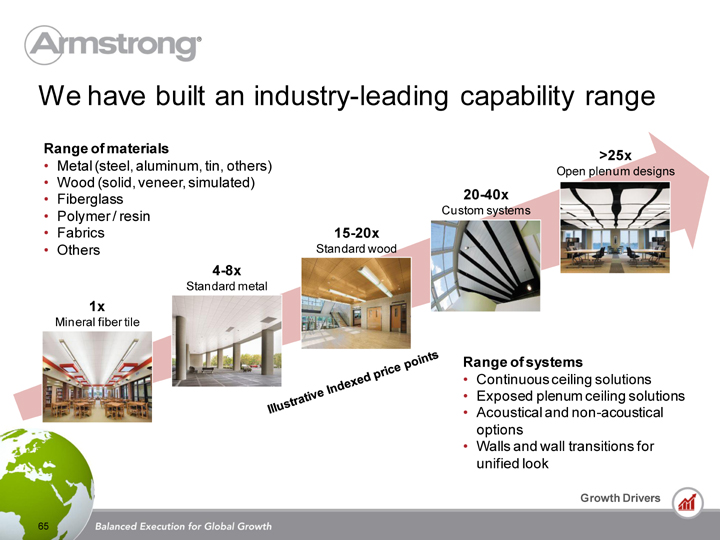

Range of materials

Metal (steel, aluminum, tin, others)

Wood (solid, veneer, simulated)

Fiberglass

Polymer / resin

Fabrics

Others

We have built an industry-leading capability range

1x

Mineral fiber tile

4-8x

Standard metal

15-20x

Standard wood

20-40x

Custom systems

>25x

Open plenum designs

Illustrative Indexed price points

Range of systems

Continuous ceiling solutions

Exposed plenum ceiling solutions

Acoustical and non-acoustical

options

Walls and wall transitions for unified

look

Currently building out a global footprint

Over 50 engineers and project

managers

Over 50 supply partners globally

Evaluating further organic and inorganic

investments in priority geographies

Montreal, Canada - 2011

Stafford, UK

Guangzhou, China (JV) - 2010

Rankweil, Austria

Armstrong factory

Engineering office

Montreal,

Canada

Lancaster, US

Stafford, UK

Paris,

France

Moscow,

Russia

St. Gallen, Switz.

Dubai, UAE

Shanghai, China

Mumbai, India

Establishing a global track record of customer success

North America

EMEA

Asia

Club Nokia, California, U.S.

Helen Devos Children’s Hospital,

Michigan, U.S.

Dubai International Airport, UAE

Splash Leisure Center, UK

Shanghai Huawei R&D Center, China

Lucknow Airport, India

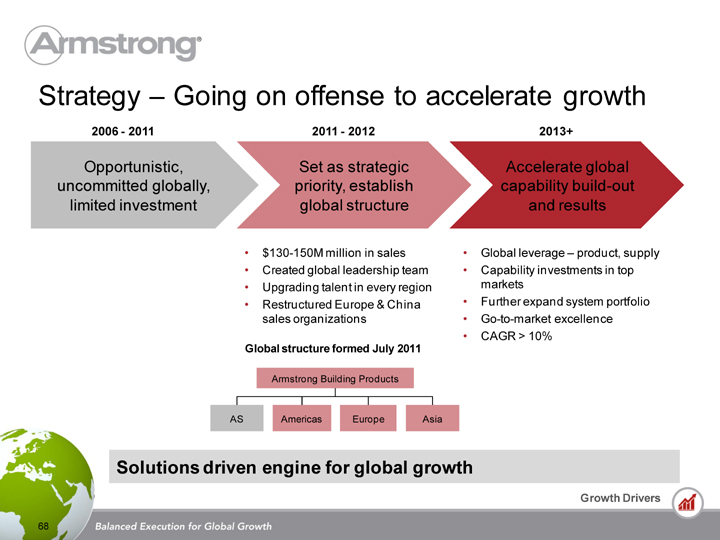

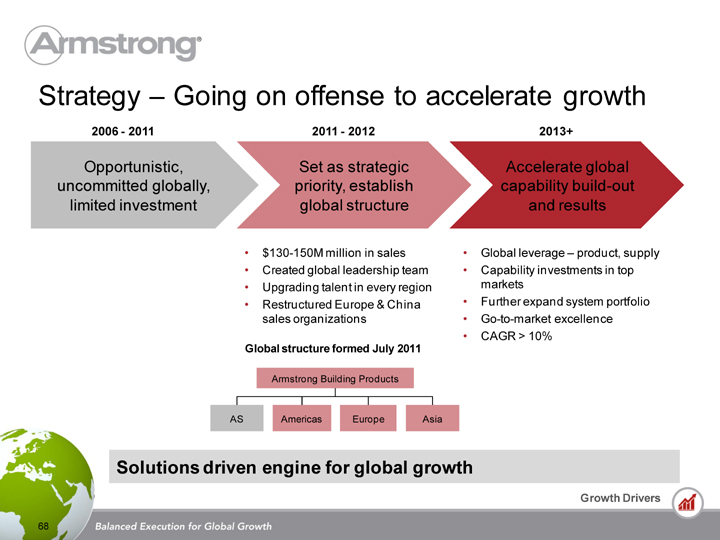

Strategy - Going on offense to accelerate growth

$130-150M million in sales

Created global leadership team

Upgrading talent in every region

Restructured Europe & China

sales organizations

Global leverage - product, supply

Capability investments in top

markets

Further expand system portfolio

Go-to-market excellence

CAGR > 10%

Opportunistic,

uncommitted globally,

limited investment

Set as strategic priority,

establish global structure

Accelerate global capability

build-out and results

2006 - 2011

2011 - 2012

2013+

Solutions driven engine for global growth

Armstrong Building Products

AS

Americas

Europe

Asia

Global structure formed July 2011

Summary

Financially attractive space - $2B opportunity, incremental, above average

ROIC

Adds value to customers and strengthens base business

Not new - leveraging 10+ years of experience

Moving forward to build-out capability and global footprint with a more

aggressive and purposeful approach

Growth Opportunities Summary

Three tangible opportunities for significant growth that don’t involve a

recovery in the US or Europe

Emerging markets and AS can both double in four to six years

Emerging markets and AS are both natural extensions of our core businesses

Geographic expansion

Product category adjacencies

China and Russia are only part of the emerging market opportunity

India, Brazil, the Middle East and southeast Asia all have great potential

Financial Overview

Thomas Mangas, Senior Vice President and CFO

Focused on creating shareholder value

Cost reduction and disciplined

spending

Growth via recovery and aggressive

organic investments / mid-cycle outlook

ROIC goal driven

Balance sheet management

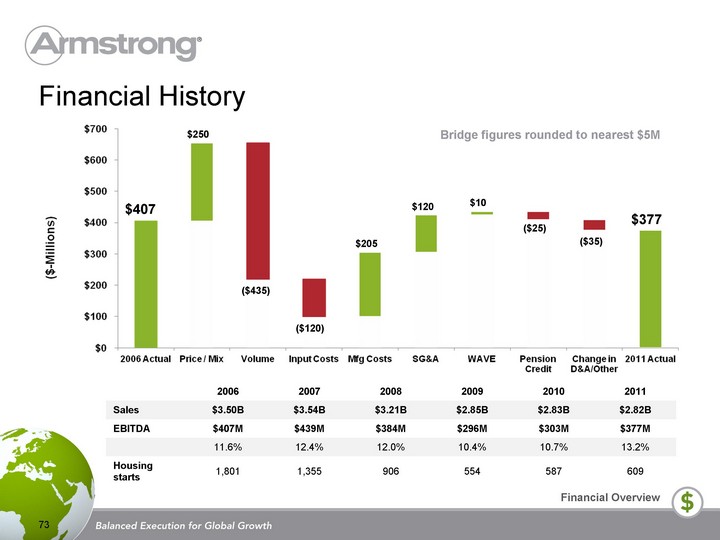

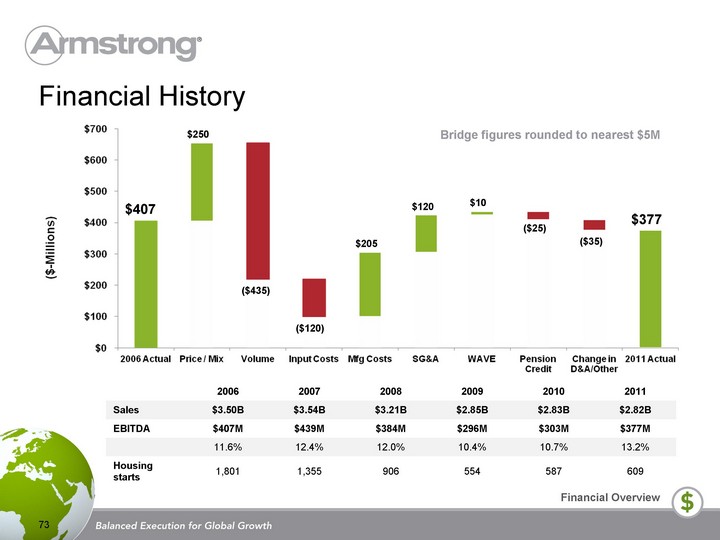

Financial History

73

$407

$377

$250

($435)

($120)

$120

$10

($25)

Bridge figures rounded to nearest $5M

$205

($35)

2006 2007 2008 2009 2010 2011

Sales $3.50B $3.54B $3.21B $2.85B $2.83B $2.82B

EBITDA $407M $439M $384M $296M $303M $377M

11.6% 12.4% 12.0% 10.4% 10.7% 13.2%

Housing starts 1,801 1,355 906 554 587 609

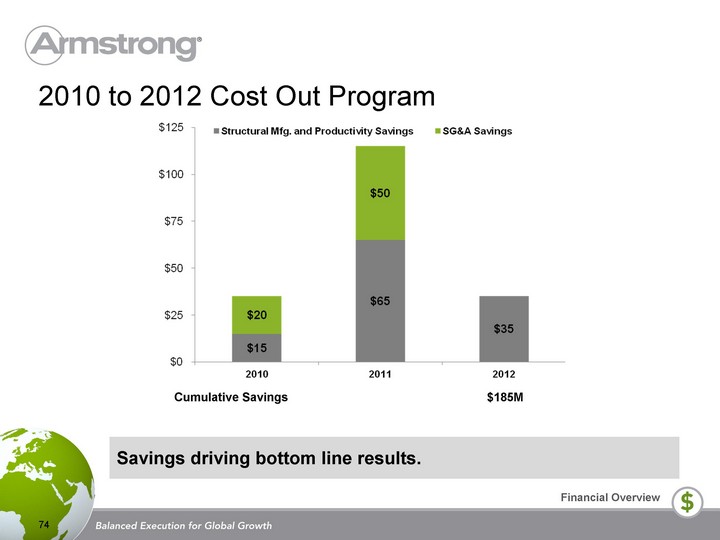

2010 to 2012 Cost Out Program

74

Savings driving bottom line results.

Cumulative Savings

$185M

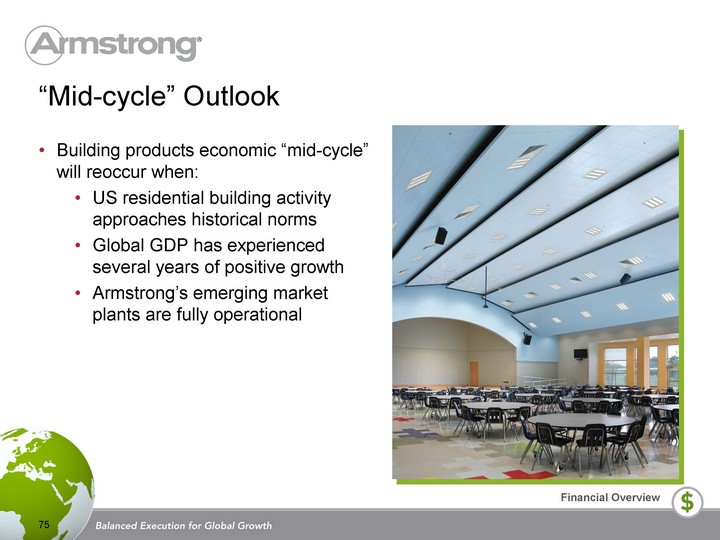

“Mid-cycle” Outlook

Building products economic “mid-cycle”

will reoccur when:

US residential building activity

approaches historical norms

Global GDP has experienced

several years of positive growth

Armstrong’s emerging market

plants are fully operational

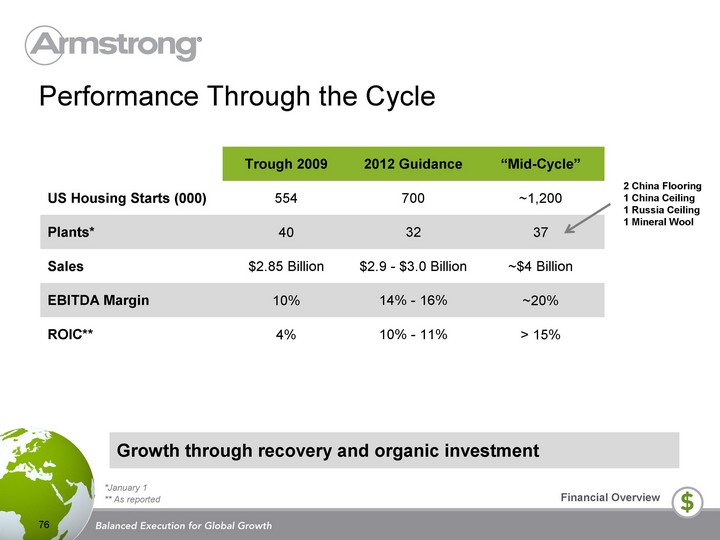

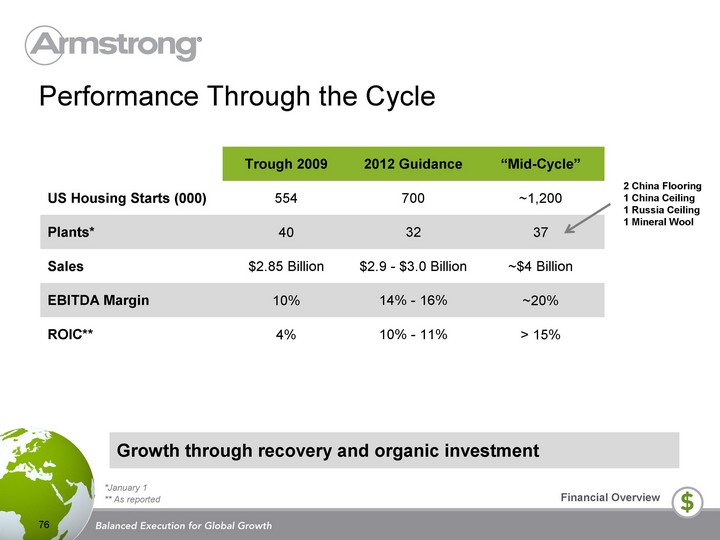

Performance Through the Cycle

76

Trough 2009 2012 Guidance “Mid-Cycle”

US Housing Starts (000) 554 700 ~1,200

Plants* 40 32 37

Sales $2.85 Billion $2.9 - $3.0 Billion ~$4 Billion

EBITDA Margin 10% 14% - 16% ~20%

ROIC** 4% 10% - 11% > 15%

*January 1

** As reported

Growth through recovery and organic investment

2 China Flooring

1 China Ceiling

1 Russia Ceiling

1 Mineral Wool

Performance Through the Cycle

76

Trough 2009 2012 Guidance “Mid-Cycle”

US Housing Starts (000) 554 700 ~1,200

Plants* 40 32 37

Sales $2.85 Billion $2.9 - $3.0 Billion ~$4 Billion

EBITDA Margin 10% 14% - 16% ~20%

ROIC** 4% 10% - 11% > 15%

*January 1

** As reported

Growth through recovery and organic investment

2 China Flooring

1 China Ceiling

1 Russia Ceiling

1 Mineral Wool

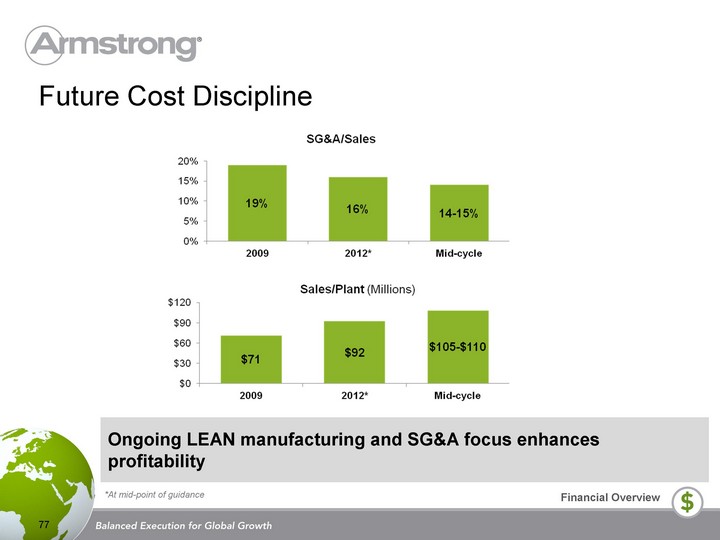

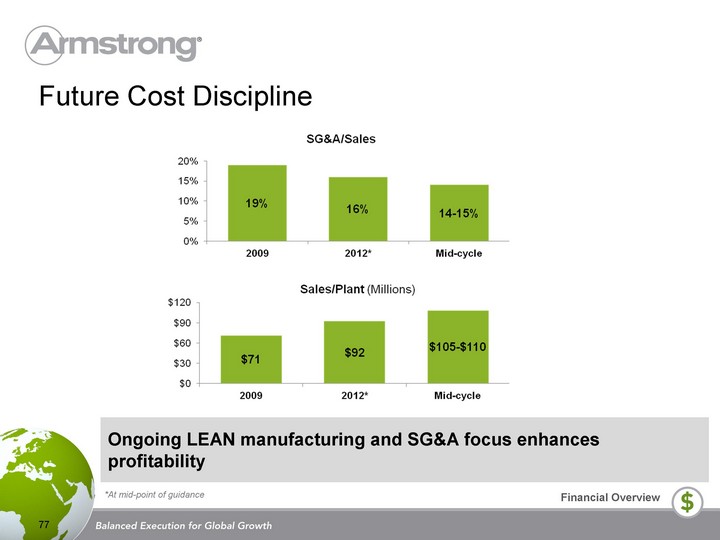

Future Cost Discipline

77

Ongoing LEAN manufacturing and SG&A focus enhances

profitability

*At mid-point of guidance

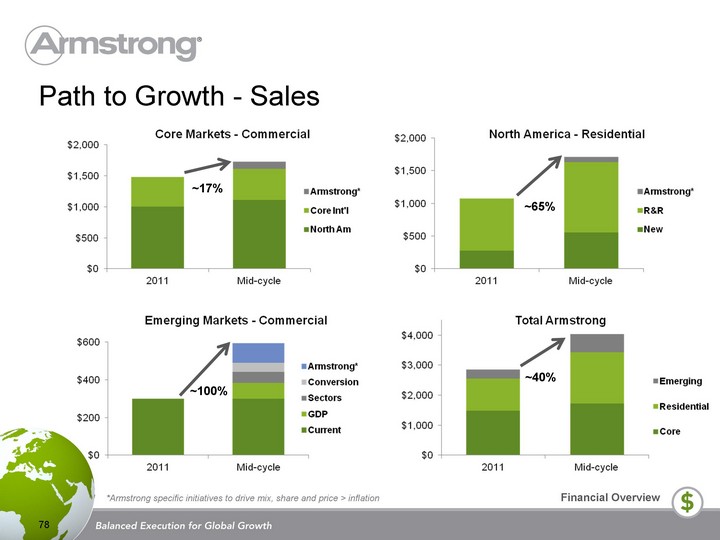

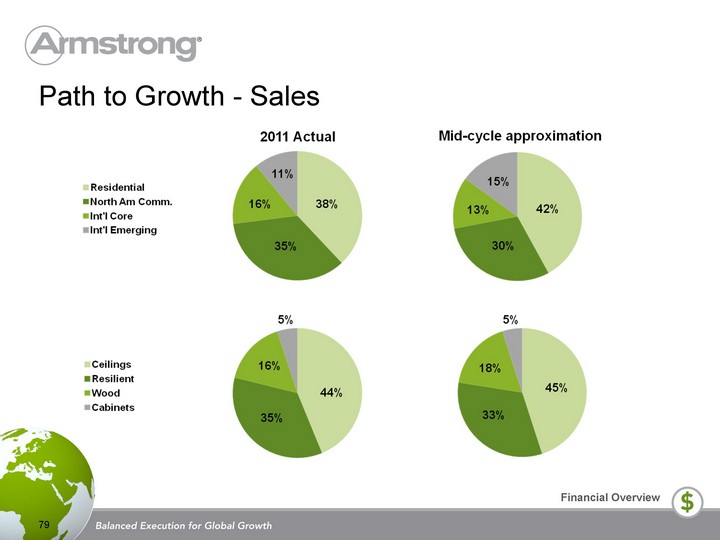

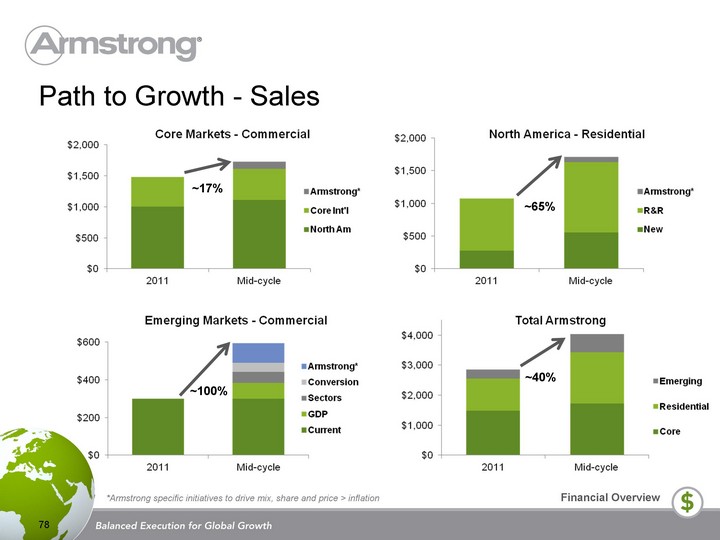

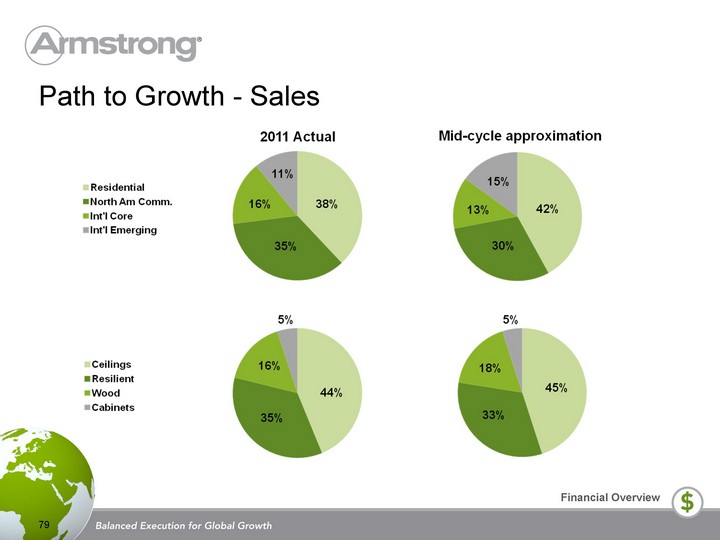

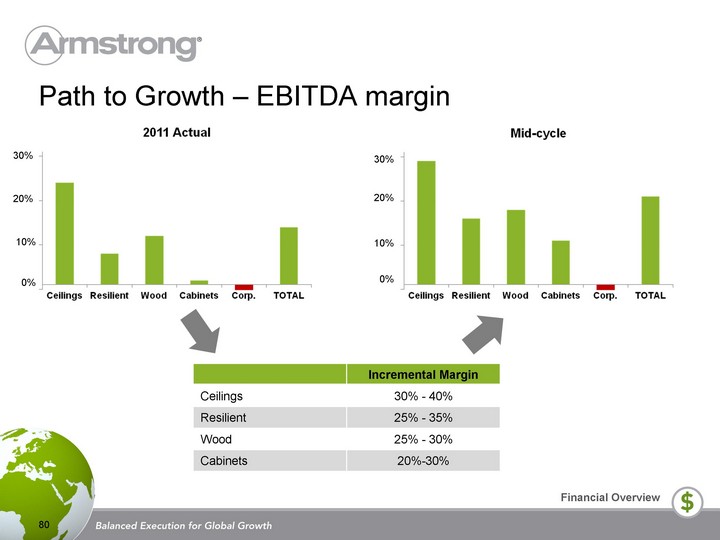

Path to Growth - Sales

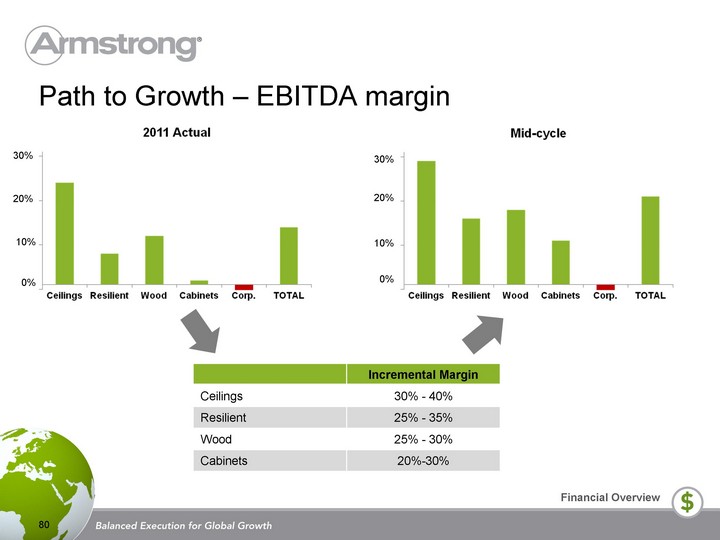

Path to Growth - EBITDA margin

80

Incremental Margin

Ceilings 30% - 40%

Resilient 25% - 35%

Wood 25% - 30%

Cabinets 20%-30%

30%

20%

10%

0%

30%

20%

10%

0%

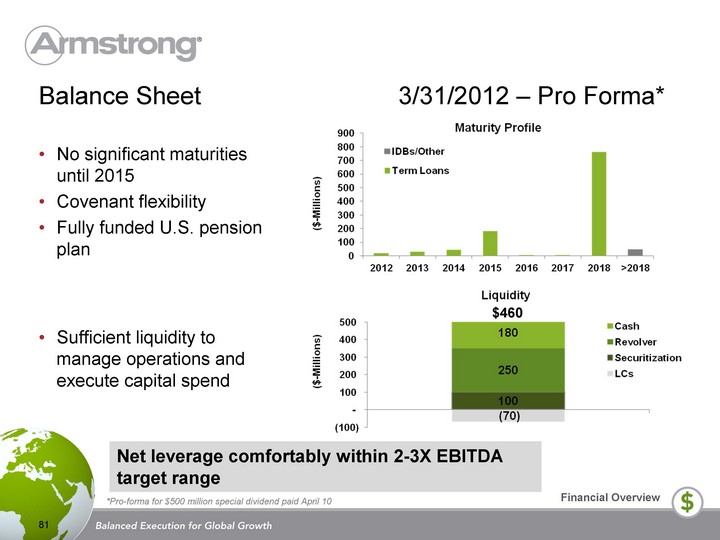

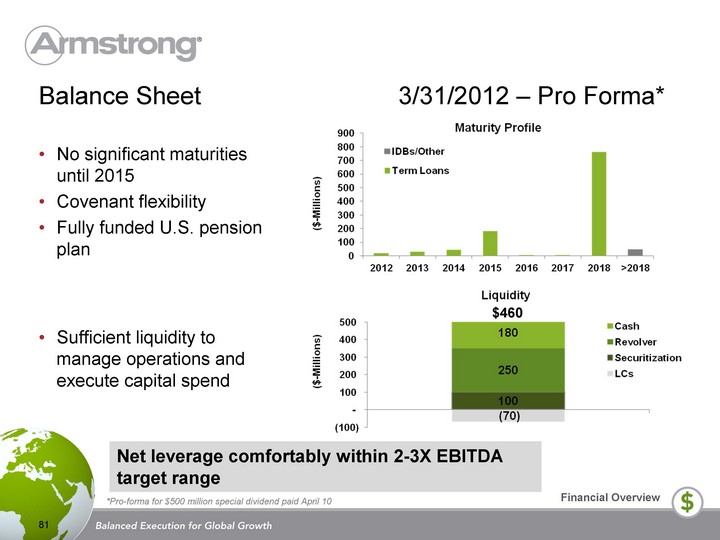

Balance Sheet 3/31/2012 - Pro Forma*

81

No significant maturities

until 2015

Covenant flexibility

Fully funded U.S. pension

plan

Sufficient liquidity to

manage operations and

execute capital spend

$460

Net leverage comfortably within 2-3X EBITDA

target range

*Pro-forma for $500 million special dividend paid April 10

Capital Deployment

Created and maintained an efficient balance sheet

Returned surplus cash to shareholders via special dividends

$1.3 billion in the last two years

Prioritizing investments in capital expenditures to drive global growth

82

* Mid-point of 2012 guidance

Projection

Acquisitions

83

Acquisitions have not been a driver to

historical growth, and are not

contemplated in mid-cycle guidance...

but could be an accelerator

Acquisitions must create shareholder

value

Appealing acquisitions would include:

Products that flow through our

current channels

Touch the same decision makers

we call on today

Provide new technology, capability,

or access to growing geographies

Focused on creating shareholder value

Cost reduction and disciplined

spending

Growth via recovery and aggressive

organic investments

ROIC goal driven

Balance sheet management

Wrap Up

What You Heard Today

Armstrong has two great global

businesses delivering exceptional

products and solutions to our customers

We have exciting growth opportunities

We are committed to delivering

outstanding operational and financial

results

We are constantly focused on creating

shareholder value

Q&A

Thomas J. Waters, Vice President Treasury & Investor Relations

Thomas J. Waters is Vice President, Treasury and Investor

Relations of Armstrong World Industries, Inc., in Lancaster,

Pennsylvania.

Mr. Waters joined Armstrong in 1998 as Manager, Capital Markets.

Since then he has held the positions of Director of Investor

Relations, General Manager of Finance and IT for Building Products

Europe, General Manager Financial Planning and Analysis for North

American Floor Products. He was named Treasurer in 2008, and

added investor relations responsibilities in 2010.

Prior to Armstrong, Mr. Waters worked for American Airlines in

Dallas, TX in both Treasury and Operational Finance roles.

Mr. Waters earned a BA from Binghamton University, and a MBA

from the Walter A. Haas School of Business at the University of

California, Berkeley.

Matthew J. Espe, Chief Executive Officer and President

In July 2010, Matthew J. Espe was appointed CEO of Armstrong

World Industries, Inc., in Lancaster, Pennsylvania. He brings 30

years of experience in sales, marketing, distribution and

management in global manufacturing businesses to Armstrong

from his previous position at Ricoh Americas Corporation, a

subsidiary of Ricoh Company, Ltd., where he served as Chairman

and CEO. Prior to this role, Mr. Espe was Chairman and CEO of

IKON Office Solutions, Inc., a $4 billion office equipment distributor

and services provider with 24,000 employees. The company was

acquired by Ricoh in 2008.

Before joining IKON in 2002, Mr. Espe was president and CEO of

GE Lighting. In a career that spanned 22 years there, he managed

multiple functional areas, including sales, marketing, distribution

and manufacturing as well as management within several business

units. Along with a wealth of experience, he also brings a finely-

tuned global perspective, having led businesses in Europe, Asia

and North America.

Mr. Espe is also a member of the board of Unisys Corporation. He

is an active volunteer and member of the board of United Way of

Southeastern Pennsylvania. He graduated from the University of

Idaho and has an MBA from Whittier College.

Victor Grizzle, Executive Vice President, CEO, Armstrong Building Products

Victor “Vic” Grizzle is executive vice president and CEO, Armstrong

Building Products, in Lancaster, Pennsylvania.

Mr. Grizzle has 23 years of experience in process improvement,

sales, marketing and global business leadership. He comes to

Armstrong from Valmont Industries, a $2 billion global leader of

infrastructure support structures for utility, telecom and lighting

markets, and manufacturer of mechanized irrigation equipment for

large scale farming, where he was group president of Global

Structures, Coatings and Tubing since 2005. Prior to Valmont, Mr.

Grizzle was president of the commercial power division of

EaglePicher Corporation, a $700 million diversified manufacturer

and marketer of advanced technology and industrial products for

space, defense, automotive, filtration, pharmaceutical,

environmental and commercial applications. Before that, he spent

16 years at General Electric Corporation.

Mr. Grizzle graduated from California Polytechnic University with a

Bachelor of Science in Mechanical Engineering.

90

Frank J. Ready, Executive Vice President, CEO, Armstrong Floor Products

Frank J. Ready is executive vice president and CEO of Armstrong

Floor Products Worldwide, in Lancaster, Pennsylvania.

Mr. Ready joined Armstrong in 1983 in Building Products Operations

Sales and progressed through positions in Marketing before moving

to the company’s flooring business in 1996. He served in positions of

increasing responsibility including senior vice president of Sales and

Marketing - Armstrong Floor Products, where he worked with “Big

Box” customers, builders and independent retailers. He also briefly

managed flooring manufacturing operations.

Mr. Ready is a member of the board of directors of the Tropical

Forest Foundation, a coalition of industry, conservation and scientific

leaders who work together to achieve sustainable management of

tropical timber in the major producing regions. He is also a member

of the board of directors of the National Association of Manufacturers.

A native of Cherry Hill, New Jersey, Mr. Ready earned a bachelor’s

degree in Business Administration from Franklin & Marshall College.

91

Edwin de Wolf is CEO, Armstrong Building Products Europe, of

Armstrong World Industries, Inc., and he is based in Uxbridge,

England. Edwin joined Armstrong in January 2012.

Prior to Armstrong, Mr. De Wolf was employed by Pregis as

managing director, protective packaging Europe. Prior to Pregis, Mr.

De Wolf was with GE, where he started his career in 1989 as a

marketing specialist with GE Plastics Europe. He progressed

through a number of commercial positions, including European

account manager, sales management roles for Europe and Benelux,

master black belt, Pacific Supply Chain director and global Supply

Chain director (based in the USA). He then moved to GE Polymer

Shapes as business unit director, Europe. Following that role, he

was executive director, Automotive for GE Advanced Materials

before taking his final position while at GE, general manager, Europe

Middle East Africa (AMEA) GE Security.

Mr. De Wolf is a native of the Netherlands. He earned his degree in

Chemical Engineering from Technical University Eindhoven, in the

Netherlands.

92

Edwin De Wolf, CEO, Armstrong Building Products Europe

Chia-ling Hsueh, Armstrong Floor Products Managing Director Asia Pacific

Chialing Hsueh is Managing Director, Armstrong Flooring Products

Asia Pacific, of Armstrong World Industries, Inc., and she is based in

Shanghai China.

Ms. Hsueh joined Armstrong in January 2011. She has a broad

business background in sales and marketing as well as consulting

and finance. She worked in the U.S. early in her career and has

been in Greater China for the last 15 years. Prior to Armstrong, Ms.

Hsueh worked for various multi-national companies including Philips

Electronics where she held a number of progressive management

positions and ultimately served as Vice President, Philips

Semiconductor- Multimedia, Greater China Region.

Ms. Hsueh is a Taiwan national who has spent the last 12 years

living and working in China. Ms. Hsueh earned a MS from

University of Massachusetts, Amherst.

Michael F. Shirk, Vice President Worldwide Architectural Specialties

Michael F. Shirk is Vice President, Worldwide Architectural

Specialties, of Armstrong World Industries, Inc., and he is based in

Lancaster, PA.

Mr. Shirk became Vice President, Worldwide Architectural

Specialties in July 2011 and has responsibility for developing and

growing the specialty ceilings business globally. Mr. Shirk joined

Armstrong in late 2009 as Vice President, Business

Development. He came to Armstrong from Bain and Company,

where he led a variety of strategy and performance improvement

programs in the industrials, technology and consumer products

industries. Prior to Bain, he worked at Lockheed Martin Corporation

in various sales, operations and engineering roles.

Mr. Shirk is a member of the Board of The High Companies, a

diversified industrial manufacturer and commercial real estate

company. He earned a BS in Mechanical Engineering from

Bucknell University, an MS in Mechanical Engineering from

University of Pennsylvania and an MBA from MIT’s Sloan School of

Management.

94

Thomas B. Mangas, Senior Vice President and Chief Financial Officer

Thomas B. Mangas is senior vice president and CFO of Armstrong

World Industries, Inc., in Lancaster, Pennsylvania.

Mr. Mangas joined Armstrong in February 2010. Prior, he was vice

president and CFO of the $28 billion beauty and grooming

business of Procter & Gamble Co. after a steady progression of

finance roles at that company. He has broad domestic and

international experience including implementing tough cost

management initiatives, exploiting new growth opportunities,

acquisition integration, strategic planning, resource allocation, cost

accounting, Sarbanes-Oxley implementation and controls, tax

compliance and organization development.

He earned his bachelor’s degree in Economics and History from

the University of Virginia in 1990 where he was elected to the Phi

Beta Kappa honorary society.

95

Armstrong Attendees

Speakers

Matthew Espe, President & CEO

Thomas Mangas, Senior Vice President and CFO

Victor Grizzle, Executive Vice President & CEO Armstrong Building Products

Frank Ready, Executive Vice President & CEO Armstrong Floor Products

Thomas Waters, Vice President Treasury and Investor Relations

Edwin de Wolf, CEO Armstrong Building Products

Chia-ling Hsueh, Armstrong Floor Products Managing Director Asia Pacific

Mike Shirk, Vice President Worldwide Architectural Specialties

Armstrong Building Products

Charlie Chiappone, Vice President Global Marketing & Commercial Excellence Armstrong Building Products

Dave Cookson, Senior Vice President Armstrong Building Products Americas

Joann Davis Brayman, Vice President Commercial Marketing Armstrong Building Products Americas

Dave Schulz, Vice President Finance Worldwide Armstrong Building Products

96

Armstrong Attendees

Armstrong Flooring Products

Kevin Biedermann, Senior Vice President NA Residential Armstrong Floor Products

Julia Pierce, Director Marketing & Design Commercial Armstrong Floor Products

Mara Villanueva-Heras, Vice President Residential Marketing Armstrong Floor Products

Bill Rodruan, Vice President Finance Worldwide Armstrong Floor Products

Dominic Rice, Vice President & General Manager Commercial Armstrong Floor Products

Corporate

Don Maier, Senior Vice President Global Operations

Linda Toth, Vice President Corporate Communications & Public Affairs

Jennifer Johnson, Senior Manager Corporate Communications & Public Affairs

Tom Kane, Senior Vice President HR & Government Relations

Steve Poole, Vice President Business Development

Chris Parisi, Vice President Corporate Governance

Mark Hershey, Senior Vice President General Counsel & Secretary

Steve McNamara, Vice President & Controller

Kristy Rohrbaugh, Manager Investor Relations

97