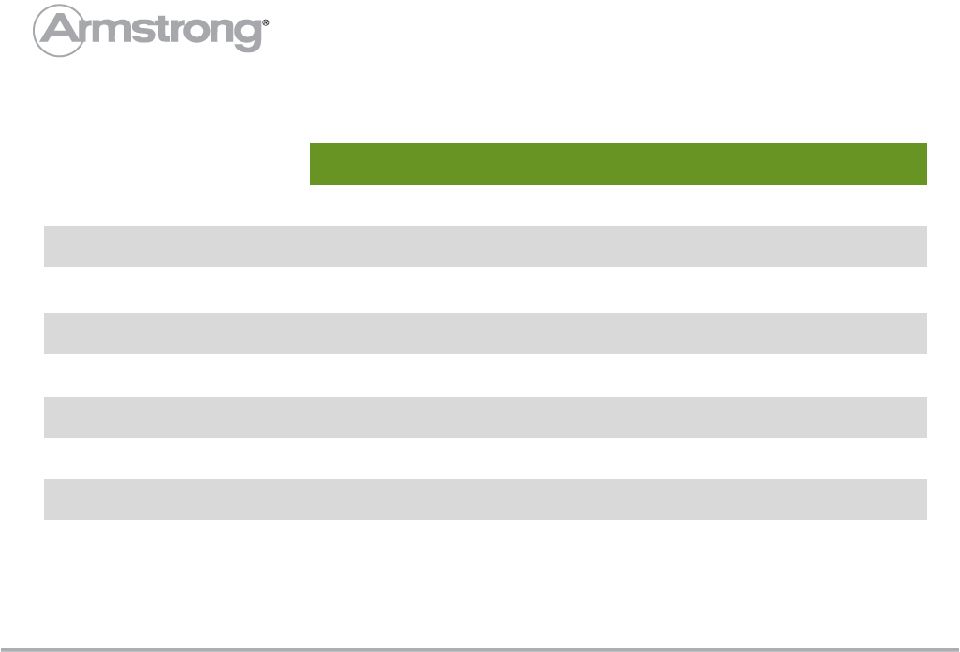

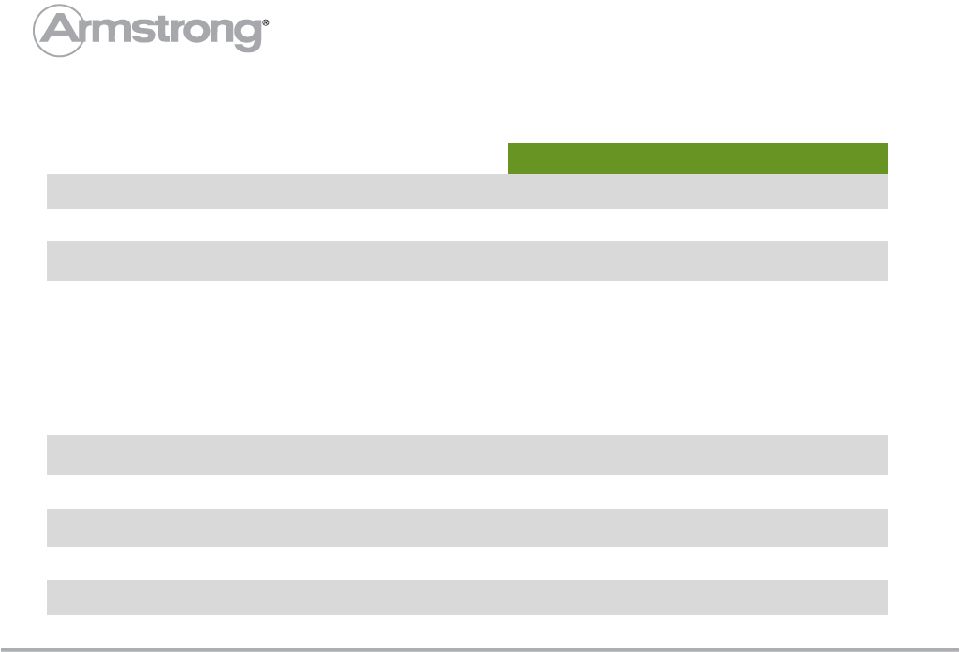

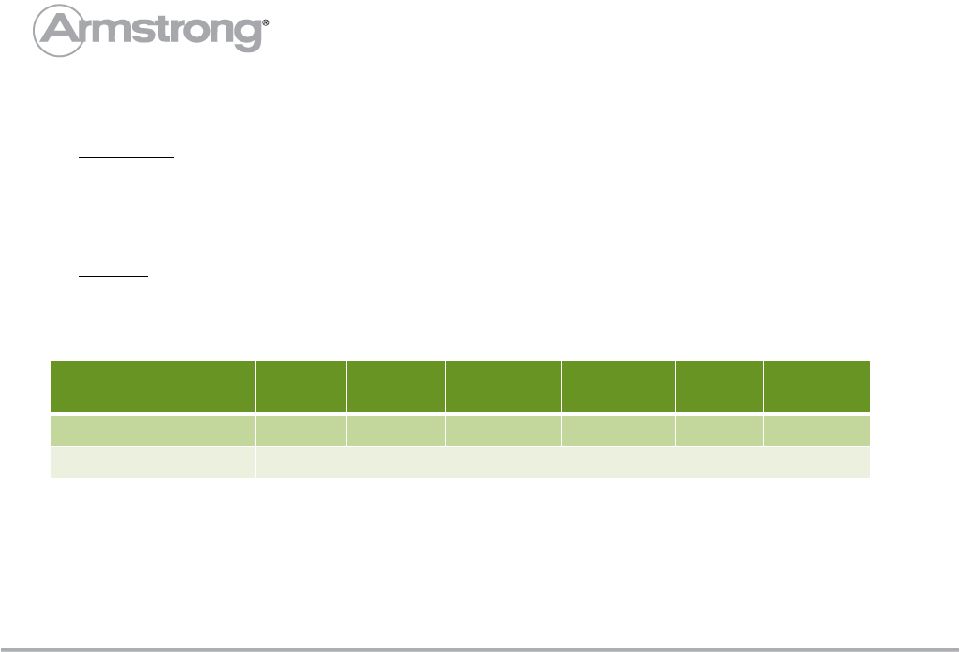

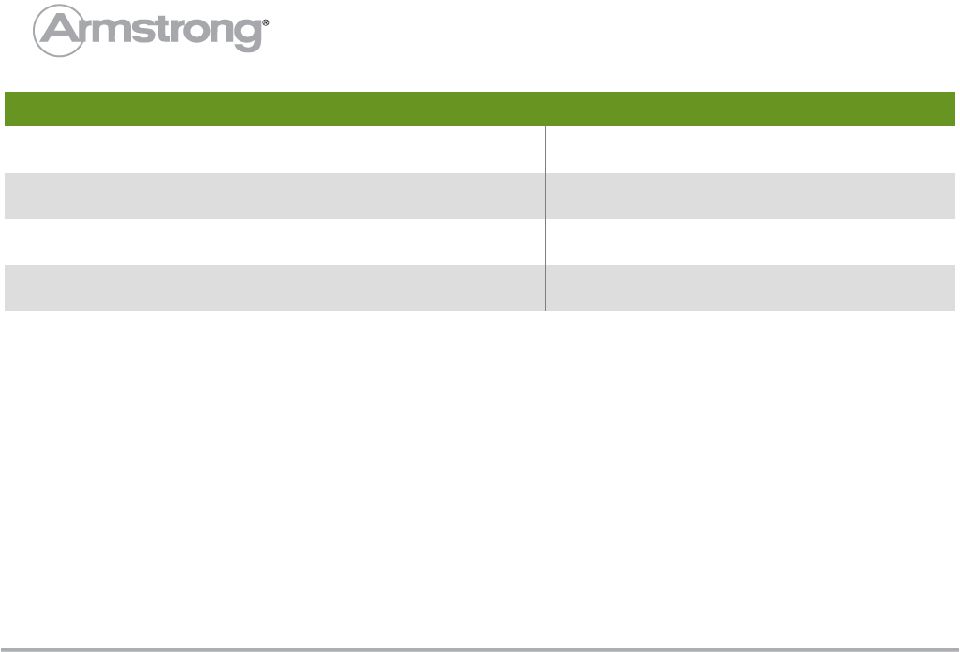

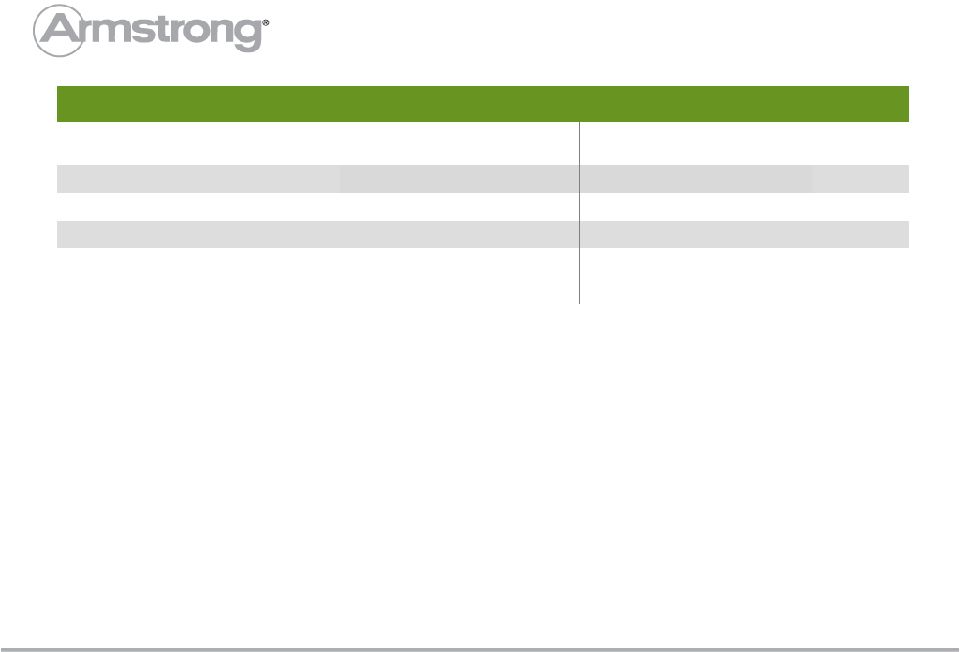

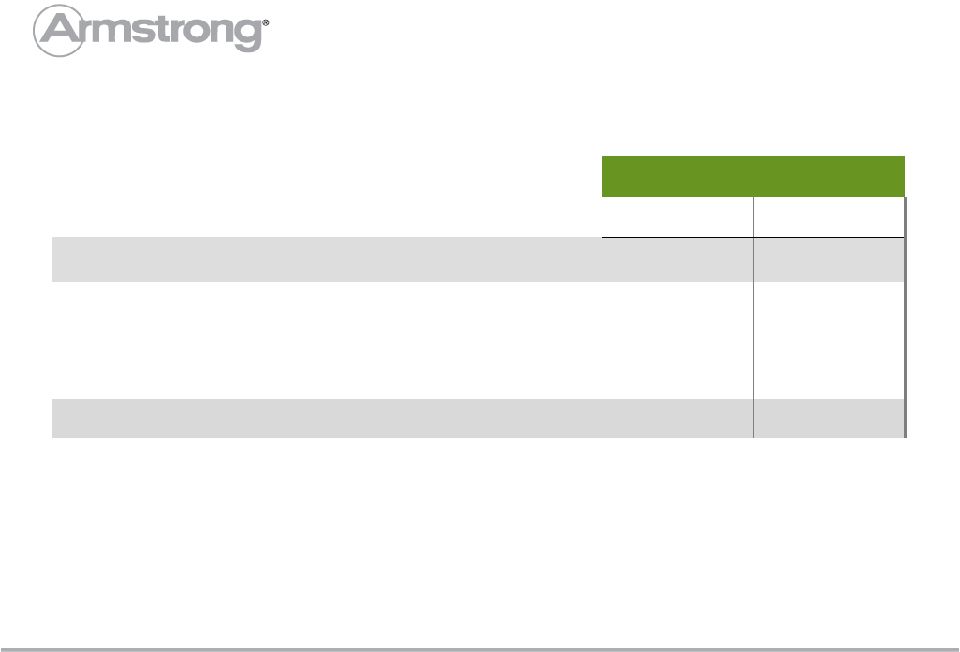

All figures throughout the presentation are in $ millions unless otherwise noted. Figures may not add due to rounding. Basis of Presentation Explanation When reporting our financial results within this presentation, we make several adjustments. Management uses the non-GAAP measures below in managing the business and believes the adjustments provide meaningful comparisons of operating performance between periods. As reported results will be footnoted throughout the presentation. 3 • We report in comparable dollars to remove the effects of currency translation on the P&L. The budgeted exchange rate for 2013 is used for all currency translations in 2013 and prior years. Guidance is presented using the 2013 budgeted exchange rate for the year. • We remove the impact of discrete expenses and income. Examples include plant closures, restructuring actions, and other large unusual items. • Taxes for normalized Net Income and EPS are calculated using a constant 39% for 2013 results and guidance and 40% for 2012, which are based on the full year historical tax rates. • In the fourth quarter of 2012, we completed the sale of Cabinets business. The financial results of the Cabinets business, which were previously shown as a separate reporting segment, have been reclassified and presented as discontinued operations. The financial results included within this presentation, including historical results, are presented on a continuing operations basis unless specifically noted otherwise. Comparable Dollars Other Adjustments Net Sales Yes No Gross Profit Yes Yes SG&A Expense Yes Yes Equity Earnings Yes Yes Operating Income Yes Yes Net Income Yes Yes Cash Flow No No Return on Capital Yes Yes EBITDA Yes Yes What Items Are Adjusted |