Table of Contents

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

ARMSTRONG WORLD INDUSTRIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

ARMSTRONG WORLD INDUSTRIES, INC. 2500 COLUMBIA AVE., LANCASTER, PA 17603 P.O. BOX 3001, LANCASTER, PA 17604

www.armstrong.com

April 23, 2014 |

Thomas M. Armstrong Founder 1860

|

2014 ANNUAL MEETING OF SHAREHOLDERS

Dear Fellow Shareholders:

We look forward to your attendance virtually via the Internet, in person, or by proxy at the 2014 Armstrong World Industries, Inc. Annual Shareholders’ Meeting. We will hold the meeting at 8:00 a.m. Eastern Time on Friday, June 20, 2014.

Please refer to the proxy statement for detailed information on each of the matters to be acted on at the meeting. Your vote is important, and we strongly urge you to cast your vote. For most items, including the election of directors, your shares will not be voted if you do not provide voting instructions via the Internet, by telephone, or by returning a proxy or voting instruction card. We encourage you to vote promptly, even if you plan to attend the meeting.

On behalf of your Board of Directors, thank you for your continued support of Armstrong.

Very truly yours,

James J. O’Connor

Chairman of the Board

Table of Contents

ARMSTRONG WORLD INDUSTRIES, INC.

NOTICE OF 2014 ANNUAL MEETING OF SHAREHOLDERS

Time and Date | 8:00 a.m. Eastern Time on Friday, June 20, 2014 |

Attendance | Online atwww.virtualshareholdermeeting.com/awi2014, or in person at 2500 Columbia Avenue, Lancaster, Pennsylvania 17603 |

Record Date | April 7, 2014 |

| Agenda | Items of Business | Board Recommendation | ||

1. Elect as directors the 11 nominees named in the attached proxy statement | FOR EACH DIRECTOR NOMINEE | |||

2. Ratify the selection of KPMG LLP as our independent registered public accounting firm for 2014 | FOR | |||

3. Provide advisory approval of our executive compensation | FOR | |||

How To Vote | • | Please act as soon as possible to vote your shares, even if you plan to attend the annual meeting via the Internet or in person. |

| • | Your broker willnot be able to vote your shares with respect to the election of directors and the advisory approval of our executive compensation unless you have given your broker specific instructions to do so. We strongly encourage you to vote. |

| • | You may vote via the Internet, by telephone, or, if you have received a printed version of these proxy materials, by mail. |

| • | See “ADDITIONAL MEETING INFORMATION” on page 54 of this proxy statement for further information. |

Attending the Meeting | via the Internet: |

| Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted atwww.virtualshareholdermeeting.com/awi2014. |

| Shareholders may vote and submit questions while attending the meeting on the Internet. |

| in person: |

| Proof of Armstrong World Industries, Inc. stock ownership and photo identification will be required to attend the annual meeting. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE ANNUAL MEETING

TO BE HELD ON JUNE 20, 2014:

The Notice of Annual Meeting, this Proxy Statement and

the Company’s 2013 Annual Report are available at www.proxyvote.com.

Table of Contents

| 1 | ||||

| 2 | ||||

| 9 | ||||

Corporate Governance Principles and Other Corporate Governance Documents | 9 | |||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, MANAGEMENT AND DIRECTORS | 16 | |||

| 16 | ||||

| 17 | ||||

| 18 | ||||

ITEM 2 – RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 19 |

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 36 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 52 | |||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 58 | ||||

ANNEX A | A-1 |

Table of Contents

PROXY STATEMENT

This proxy statement was prepared under the direction of our Board of Directors (“Board”) to solicit your proxy for use at the annual meeting. When we refer to “we,” “our,” “us,” “Armstrong” and the “Company” in this proxy statement, we are referring to Armstrong World Industries, Inc. This proxy statement and the related materials are first being distributed to shareholders on or about April 23, 2014.

On the recommendation of the Nominating and Governance Committee (“Governance Committee”), our Board has nominated the 11 directors listed below for election at the Annual Meeting. The nominees include 10 independent directors, as determined by the Board in accordance with the NYSE listing standards and our Corporate Governance Principles. The eleventh nominee is our President and Chief Executive Officer (“CEO”), Matthew J. Espe. Each nominee’s term would, if elected, run from the date of his election until our next annual shareholders’ meeting, or until his successor, if any, is elected or appointed. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected.

On March 18, 2014, Kevin R. Burns, a director since 2009, informed us of his intention to not stand for reelection as a director when his term expires at the Annual Meeting. On April 11, 2014, the Board adopted a resolution to fix the number of directors at eleven effective at the Annual Meeting when Mr. Burns’ term expires.

The Governance Committee performs an assessment of the qualifications and experience needed to properly oversee the interests of the Company. In doing so, the Governance Committee believes that aligning director qualifications and skill sets with our business and strategy is essential to forming a Board that adds value for shareholders. While the Board does not have a formal diversity

policy with respect to director nominations, it believes that a Board composed of individuals with diverse attributes and backgrounds enhances the quality of the Board’s deliberations and decisions. The Board has an expansive view of diversity, going beyond the traditional concepts of race, gender and national origin. The Board believes that the diversity of viewpoints, educational backgrounds, and differences in professional experiences and expertise represented on the Board evidences diversity in many respects. The Board believes that this diversity, coupled with the personal and professional ethics, integrity and values of all of the directors, results in a Board that can guide the Company with good business judgment.

The Governance Committee expects each of the Company’s directors to have proven leadership, sound judgment, integrity and a commitment to the success of the Company. In evaluating director candidates and considering incumbent directors for nomination to the Board, the Governance Committee considers a variety of factors. These include each nominee’s independence, financial literacy, personal and professional accomplishments, and experience in light of the needs of the Company. For incumbent directors, the factors also include past performance on the Board and contributions to their respective committees. The Board is also particularly interested in maintaining a mix of skills and qualifications that include the following:

| Public | Company CEO or COO within 5 years |

| Senior | Executive Leadership |

| Manufacturing | & Distribution Operations |

| Financial | Literacy |

| Significant | International Experience |

Finance and Capital Markets Transactions

Technology

M&A

Risk Management

Corporate Governance/Law

| 2014 Proxy Statement | 1 | ||||||

Table of Contents

ITEM 1 – ELECTION OF DIRECTORS(CONTINUED)

Each nominee’s biography in the pages that follow includes notable skills and qualifications that contributed to his selection as a nominee. Director skills and qualifications are also featured in the chart immediately following the biographies.

OUR BOARD RECOMMENDS THAT YOU VOTEFOR THE ELECTION OF THE FOLLOWING NOMINEES:

| Name | Age | Director Since | Committee(s)† | Independent* | ||||||||

Stan A. Askren | 53 | 2008 | MDCC^ | ü | ||||||||

Matthew J. Espe | 55 | 2010 | ||||||||||

James J. Gaffney | 73 | 2006 | NGC^, MDCC | ü | ||||||||

Tao Huang | 51 | 2010 | AC | ü | ||||||||

Michael F. Johnston | 66 | 2010 | ü | |||||||||

Jeffrey Liaw | 37 | 2012 | ü | |||||||||

Larry S. McWilliams | 58 | 2010 | AC, MDCC | ü | ||||||||

James C. Melville | 62 | 2012 | MDCC | ü | ||||||||

James J. O’Connor (Chair) | 77 | 2007 | NGC | ü | ||||||||

John J. Roberts | 69 | 2006 | AC^, NGC | ü | ||||||||

Richard E. Wenz | 64 | 2010 | ü | |||||||||

| † | Committees: AC (Audit); MDCC (Management Development & Compensation); NGC (Nominating & Governance) |

| * | As defined in NYSE listing standards and our Corporate Governance Principles |

| ^ | Denotes Chair of the Committee |

| 2 |  | 2014 Proxy Statement | ||||||

Table of Contents

ITEM 1 – ELECTION OF DIRECTORS(CONTINUED)

All nominees currently serve as directors. Information concerning the nominees is provided below:

| STAN A. ASKREN Director since: 2008 Age: 53

Independent

|

Mr. Askren has been chairman and CEO of HNI Corporation (“HNI”), the second largest office furniture manufacturer in the world and the nation’s leading manufacturer and marketer of hearth products, since 2004, and president since 2003. Previously, he was executive vice president of HNI from 2001 to 2003. Mr. Askren has worked at HNI for 21 years, including as vice president of marketing, vice president of human resources, and as an executive vice president and president of HNI’s hearth products operating segment. Mr Askren has also worked in several industries and previously held multiple executive management and general management positions with Emerson Electric, Thomson S.A. and HNI Corporation. In November 2012, Mr. Askren was appointed to the board of directors of Arctic Cat Inc., a publicly held designer, engineer and manufacturer of all-terrain vehicles and snowmobiles, and serves as a member of its compensation committee. Mr. Askren also serves on the boards of directors of the National Association of Manufacturers, the Institutional Furniture Manufacturers Association International (past chair), and the Iowa Business Council (past chair). Mr. Askren brings to our Board extensive operating, senior executive leadership, manufacturing, sales and distribution expertise, as well as valuable insights from his experience as a public company chief executive officer.

| MATTHEW J. ESPE Director since: 2010 Age: 55

|

Mr. Espe has been our President and CEO since he joined the Company in July 2010. Previously, Mr. Espe was chairman and chief executive officer of Ricoh Americas Corporation, a subsidiary of Ricoh Company, Ltd., a leading provider of document management solutions and services. Prior to that role, Mr. Espe was chairman of the board of directors and chief executive officer (2002 to 2008) of IKON Office Solutions, Inc. (“IKON”), an office equipment distributor and services provider, which was acquired by Ricoh in 2008. Mr. Espe was employed by General Electric for 22 years, serving as president and chief executive officer of GE Lighting prior to joining IKON in 2002. Since 2004, Mr. Espe has served on the board of directors of Unisys Corporation, a publicly held worldwide information technology company, as chairman of the finance committee and a member of the audit committee. As of May 1, 2014, Mr. Espe will not be standing for re-election for this Unisys Corporation directorship. Mr. Espe previously served as a director of Graphic Packaging Holding Company, a publicly held provider of packaging solutions for consumer products companies (2009 to 2010). As our President and CEO, Mr. Espe provides our Board with important insights regarding our operations, strategic planning and senior management personnel matters. In addition, Mr. Espe’s long tenure as chairman and chief executive officer at Ricoh and IKON (formerly a public company), his service on other public company boards of directors and their committees and his senior executive experience at General Electric, brings management experience, leadership capabilities, financial knowledge and business acumen to our Board.

| 2014 Proxy Statement | 3 | ||||||

Table of Contents

ITEM 1 – ELECTION OF DIRECTORS(CONTINUED)

| JAMES J. GAFFNEY Director since: 2006 Age: 73

Independent

|

From 1997 to 2003, Mr. Gaffney was a consultant to GS Capital Partners, II, LP, a private investment fund affiliated with Water Street Corporate Recovery Fund I, LP and Goldman, Sachs & Co., and other affiliated investment funds. From 1995 to 1997, Mr. Gaffney served as chairman of the board of directors and chief executive officer of General Aquatics, Inc., composed of companies involved in the manufacturing of swimming pool equipment and pool construction. Mr. Gaffney was president and chief executive officer of KDI Corporation, a conglomerate with companies involved in swimming pool construction and manufactured products (1993 to 1995). Mr. Gaffney serves on the boards of directors of the following publicly held companies: Pool Corporation, a distributor of swimming pool supplies, equipment and related leisure products and a distributor of irrigation and landscape products (since 1998), and Beacon Roofing Inc., a distributor of residential and non-residential roofing materials (since 2004). Mr. Gaffney also serves on the board of directors of C&D Technologies, Inc. (since December 2010), which went private in 2012. Mr. Gaffney previously served on the boards of directors of World Color Press Inc. (f/k/a Quebecor World Inc.) (2009 to 2010) and Imperial Sugar Company (2001 to 2012; Chairman 2003 to 2012). Mr. Gaffney brings our Board broad leadership, business and corporate governance expertise, as well as comprehensive experience in operations, manufacturing, financial, and risk management matters.

| TAO HUANG Director since: 2010 Age: 51

Independent

|

Mr. Huang was previously the chief operating officer of Morningstar, Inc., a leading independent provider of investment research, until his retirement in December 2010. Mr. Huang spent almost 20 years with Morningstar, taking on increasing levels of responsibility from his start as an entry level technical programmer. He was named Director of Technology in 1992 and Chief Technology Officer in 1996; he started Morningstar’s International Operation in 1998, held the position of President of International Division until 2000; he was promoted as the Company’s Chief Operating Officer in October 2000 and served in this position until his retirement. Mr. Huang led Morningstar initiatives enabling significant growth, both organically and through acquisition, and oversaw continuous improvements in the operations of the firm’s core businesses. Mr. Huang brings to our Board expertise developed from his experience in a data-intense and technology-driven organization managing growth and integration of acquisitions, as well as experience in international operations.

| 4 |  | 2014 Proxy Statement | ||||||

Table of Contents

ITEM 1 – ELECTION OF DIRECTORS(CONTINUED)

| MICHAEL F. JOHNSTON Director since: 2010 Age: 66

Independent

|

Mr. Johnston was previously with Visteon Corporation, an automotive components supplier, until 2008. At Visteon, he served as chairman of the board of directors, CEO, president, and chief operating officer at various times from 2000 to 2008. Before joining Visteon, Mr. Johnston held various positions in the automotive and building services industry, including serving as president, North America/Asia Pacific for Johnson Controls’ Automotive Systems Group. Mr. Johnston also serves as a member of the boards of directors of the following publicly held companies: Whirlpool Corporation, a leading manufacturer and marketer of major home appliances (since 2003), serving as Presiding Director and a member of its audit committee; and Dover Corporation, a diversified global manufacturer (since February 2013), serving as a member of its audit committee. Mr. Johnston previously served on the board of directors of Flowserve Corporation (2007 to 2013) including as the chairman of its corporate governance and nominating committee and a member of its finance committee. Mr. Johnston’s executive leadership and board of directors experience offers our Board a seasoned corporate governance perspective, and he brings to our Board extensive operational, manufacturing and design, innovation, engineering and financial experience.

| JEFFREY LIAW Director since: 2012 Age: 37

Independent

|

Mr. Liaw is the chief financial officer of FleetPride, Inc., a nationwide supplier of heavy-duty truck and trailer parts. Prior to joining FleetPride in December 2012, Mr. Liaw was a principal of TPG Capital for seven years and was active in TPG’s energy and industrial investing practice areas. Before joining TPG in 2005, Mr. Liaw was an associate at Bain Capital, a private equity investment firm, in its Industrials practice. Mr. Liaw previously served as a member of the board of directors of Graphic Packaging Holding Company, a publicly held provider of packaging solutions for consumer products companies (2008 to 2013), and served as a member of its nominating and corporate governance committee. Mr. Liaw is also a member of the board of directors of Oncor Electric Delivery Company, LLC, a privately held company. Mr. Liaw served as an observer to our Board on TPG’s behalf from 2009 until June 2012, at which time he was elected as a member of our Board. In addition to his financial expertise and experience working with a broad range of manufacturing companies, Mr. Liaw possesses intimate knowledge of the Company that he gained through his role as a Board observer for TPG.

| 2014 Proxy Statement | 5 | ||||||

Table of Contents

ITEM 1 – ELECTION OF DIRECTORS(CONTINUED)

| LARRY S. MCWILLIAMS Director since: 2010 Age: 58

Independent

|

Mr. McWilliams was previously the president and chief executive officer of Keystone Foods, a producer of proteins, from May 2011 to May 2012. From April 2011 to June 2011, Mr. McWilliams served as chief operating officer of Keystone Foods, and from May 2005 to October 2010, he served as a senior vice president at Campbell Soup Company and subsequently became the president of Campbell International, responsible for all of Campbell Soup’s business in Europe, Latin America and Asia Pacific. Mr. McWilliams joined Campbell Soup in March 2001 as senior vice president – sales and chief customer officer, overseeing the company’s relationships with its global retail partners. In April 2003, he assumed the position of president – North America Soup. Mr. McWilliams was named senior vice president and president – Campbell USA in March 2004. Prior to Campbell Soup, Mr. McWilliams held positions at Coca-Cola from 1995 to 2001 and the Pillsbury Company from 1993 to 1995. Mr. McWilliams also serves on the board of directors of Godiva Chocolatiers International, a privately held company (since 2012). Mr. McWilliams formerly served on the Board of Governors of St. Josephs University Food Marketing Council and the Grocery Manufacturers’ Association’s Industry Affairs Council. Mr. McWilliams offers our Board senior executive leadership capabilities and experience, as well as extensive knowledge of sales, marketing, customer service relationships, international markets and distribution channels.

| JAMES C. MELVILLE Director since: 2012 Age: 62

Independent

|

Mr. Melville is a member of the Minneapolis-based law firm of Kaplan, Strangis and Kaplan, P.A., where he has practiced in the corporate, governance, mergers and acquisitions, securities and financial areas since 1994. Prior to joining Kaplan, Strangis and Kaplan, P.A., Mr. Melville practiced with Dorsey and Whitney in their Minneapolis and London, England offices. Mr. Melville previously served as a member of our Board from September 2009 until July 2010. Mr. Melville presently serves as a member of the board of directors of the Minnesota Orchestral Association and is also active in numerous local and civic organizations and their boards. Mr. Melville served as an observer of our Board on behalf of the Armstrong World Industries, Inc. Asbestos Personal Injury Settlement Trust (the “Trust”) from August 2010 until February 2012. Mr. Melville brings extensive knowledge of the law, mergers and acquisitions, and corporate governance matters, international experience and financial acumen to our Board. He has also gained intimate knowledge of the Company through his prior service on the Board and his prior role as a Board observer for the Trust.

| 6 |  | 2014 Proxy Statement | ||||||

Table of Contents

ITEM 1 – ELECTION OF DIRECTORS(CONTINUED)

| JAMES J. O’CONNOR Director since: 2007 Age: 77

Independent

|

Mr. O’Connor is a retired chairman of the board of directors and chief executive officer of Unicom Corporation. Mr. O’Connor joined Commonwealth Edison Company in 1963, became president in 1977, a director in 1978 and chairman and chief executive officer in 1980. In 1994, Mr. O’Connor was also named chairman and chief executive officer of Unicom Corporation, which then became the parent company of Commonwealth Edison Company, from which he retired in 1998. Mr. O’Connor previously served on the boards of directors of the following companies: Trizec Properties, Inc. (2003 to 2006); Corning, Inc. (1984 to 2011); Smurfit – Stone Container Corporation (2000 to 2011); and United Continental Holdings, Inc. (1984 to 2012). Mr. O’Connor has a broad business background, having served in several chief and senior executive positions with large companies and on the boards of companies as diverse as a utility company, an industrial manufacturing company and an airline. Mr. O’Connor also offers our Board extensive knowledge and expertise in senior executive leadership, management, and corporate governance and board practices of other major corporations.

| JOHN J. ROBERTS Director since: 2006 Age: 69

Independent

|

Mr. Roberts served as global managing partner for PricewaterhouseCoopers LLP from 1998 until his retirement in June 2002. Mr. Roberts held numerous positions at Coopers & Lybrand LLP from 1967 until its merger with Pricewaterhouse LLP in 1998. From 1994 to 1998, Mr. Roberts served as one of three members of the Office of the chairman of Coopers & Lybrand’s United States operations. Prior to that time, Mr. Roberts held other positions at Coopers & Lybrand, including deputy vice chairman, vice chairman and managing partner. While serving in various executive capacities at PricewaterhouseCoopers, Mr. Roberts performed and supervised audit, tax and business consultative services, and developed extensive expertise in public company audits and financial reporting matters. Mr. Roberts serves on the boards of directors and audit committees of the following publicly held companies: Safeguard Scientifics, Inc., a provider of capital as well as strategic, operational and management resources to growth-stage businesses (since 2003; also serves on the compensation committee), the Pennsylvania Real Estate Investment Trust, a business trust with primary investment focus on retail shopping malls (since 2003; also serves on the compensation committee), and Vonage Holdings Corporation, a provider of communications services (since 2004). Mr. Roberts previously served on the board of directors of Sicor, Inc. (2002 to 2004) and served as a director of our former holding company, Armstrong Holdings, Inc. (2003 to 2006). Mr. Roberts brings an extensive public accounting background, financial expertise, experience as an accounting executive and as a board member of businesses in diverse industries, and risk management, strategic planning and corporate governance capabilities to our Board.

| 2014 Proxy Statement | 7 | ||||||

Table of Contents

ITEM 1 – ELECTION OF DIRECTORS(CONTINUED)

| RICHARD E. WENZ Director since: 2010 Age: 64

Independent

|

Mr. Wenz is a private investor. From 2002 to 2003, Mr. Wenz was the chief executive officer of Jenny Craig International, a weight loss, weight management, and nutrition company. From 2000 to 2002, Mr. Wenz was an operating affiliate of DB Capital Partners. From 1997 to 2000, Mr. Wenz was president and chief operating officer of Safety 1st, Inc. During 1995 and 1996, Mr. Wenz was the partner in charge of the Chicago office of The Lucas Group, a business strategy consulting firm. Prior to 1995, Mr. Wenz held senior executive positions with Professional Golf Corporation,

Electrolux Corporation, The Regina Company and Wilson Sporting Goods Company. Mr. Wenz began his career in 1971 with Arthur Young & Co. (predecessor of Ernst & Young LLP) and left the firm as a partner in 1983. Mr. Wenz is a certified public accountant, and he serves on the board of directors of Summer Infant, Inc., a publicly held global designer, marketer, and distributor of branded juvenile health, safety and wellness products (since 2007; also serves as Chair of the audit committee). Mr. Wenz also serves on the boards of directors of the following privately held companies: Easton-Bell Sports, Inc. and Pet Supplies Plus. Mr. Wenz previously served on the boards of directors of Radica Games, Inc. (2004 to 2006) and Strategic Partners, Inc. (2004 to 2010). Mr. Wenz brings extensive senior executive leadership, board service, including audit committee, at companies with diverse businesses, public accounting, risk management, and strategic planning experience to our Board.

Skills and Qualifications of Board of Directors

| 8 |  | 2014 Proxy Statement | ||||||

Table of Contents

CORPORATE GOVERNANCE PRINCIPLES AND OTHER CORPORATE GOVERNANCE DOCUMENTS

Our Corporate Governance Principles include guidelines regarding the responsibilities, duties, service and qualifications of our Board, the determination of a director’s independence and any conflict of interests, Board access to management and independent advisors, director compensation and stock ownership requirements, Board committees and other matters relating to corporate governance. Our Corporate Governance Principles are available on our website under “Company Information” and then “Corporate Governance” http://www.armstrong.com/corporate/corporate-governance.html. Also available at the same location on our website are the charters of the Audit Committee, the Management Development and Compensation Committee (“Compensation Committee”), and Governance Committee of the Board, the Armstrong Code of Business Conduct and the Armstrong Code of Ethics for Financial Professionals. Our website is not part of this proxy statement and references to our website address in this proxy statement are intended to be inactive textual references only.

It is the policy of the Company that the Board consist of a majority of directors who are not employees and are independent under all applicable legal and regulatory requirements, including the independence requirements of the New York Stock Exchange (“NYSE”). For purposes of evaluating the independence of directors, in accordance with our Corporate Governance Principles, the Board will consider all relevant facts and circumstances in making an independence determination, and not merely from the standpoint of the director, but also from that of persons or organizations with which the director has an affiliation. Consistent with our Corporate Governance Principles, to be considered “independent,” the Governance Committee has established qualifications to assist in the determination, which either meet or exceed the independence requirements of the NYSE.

The Board has determined that all of our directors, with the exception of Mr. Espe, our President and CEO, are independent under NYSE listing

standards and our Corporate Governance Principles. In addition, the Board has further determined that each of the members of the Audit Committee, the Compensation Committee and the Governance Committee are independent within the meaning of the NYSE listing standards, any applicable minimum standards required by the Securities and Exchange Act of 1934 (the “Exchange Act”) and enhanced standards required for membership on such committees by our Bylaws, namely that directors serving on such committees meet the independence criteria under both NYSE rules and Rule 10A-3(b)(1) under the Exchange Act.

BOARD’S ROLE IN RISK MANAGEMENT OVERSIGHT

The Board oversees the Company’s risk profile and management’s processes for assessing and managing risk, both as a full Board and through its committees, which meet regularly and report to the full Board. Management is charged with managing risk through robust internal policies and controls.

The Company has maintained an enterprise risk management program since 2005. Risk management is an integral part of the Company’s culture. Management’s role is to identify, mitigate, guide and review the efforts of our business units, consider whether the residual risks are acceptable, and approve plans to deal with serious risks. The Board’s role in risk management is to review the performance and functioning of the Company’s overall risk management function and management’s establishment of appropriate systems for managing risk. Specifically, the Board reviews management’s:

| • | processes to identify matters that create inappropriate risk to achieving our business plans; |

| • | processes to assess the likelihood and impact of such risks in order to prioritize them; |

| • | identification of major risks and how we define “major;” |

| • | identification of primary risk mitigation owners; |

| • | mitigation of major risks, and our view of the resulting residual risk; and |

| • | monitoring of major risks. |

| 2014 Proxy Statement | 9 | ||||||

Table of Contents

CORPORATE GOVERNANCE(CONTINUED)

Under the direction of a cross-functional steering committee composed primarily of senior corporate leaders, management provides its feedback on business unit risks during periodic business reviews and annual strategic planning discussions. The enterprise risk management steering committee periodically meets with designated risk mitigation owners and assesses control measures. In addition, the steering committee regularly reevaluates the appropriateness of risk assessments and priorities. This process includes identifying risks that could prevent achievement of business goals or plans. The internal audit group uses the resulting information as a basis for developing its audit plan.

Annually, the Board reviews summary reports that assess the strategic, operational, infrastructure and external risks facing the Company. Each Board committee, consistent with its charter, assists the Board in overseeing the review of certain risks that are particularly within its purview, including as described in “BOARD MEETINGS AND COMMITTEES” below.

BOARD’S ROLE IN SUCCESSION PLANNING

The Board is actively engaged and involved in talent management. The Board reviews the Company’s “Organization Vitality” in support of its business strategy at least annually. This includes a detailed discussion of the Company’s global leadership bench and succession plans with a focus on key positions at the senior officer level, including CEO. During 2013, the Board and the Compensation Committee, as well as an ad hoc CEO succession planning committee, met on several occasions in furtherance of these initiatives. In addition, the committees of the Board regularly discuss the talent pipeline for specific critical roles. High potential leaders are given exposure and visibility to Board members through formal presentations and informal events. More broadly, the Board is regularly updated on key talent indicators for the overall workforce, including diversity, recruiting and development programs.

Our Bylaws and Corporate Governance Principles provide the Board with the flexibility to determine what leadership structure works best for us, including whether the same individual should serve

as both our Chairman and our CEO. In February 2010, the Board determined to split the positions of Chairman and CEO. At that time, Mr. O’Connor, who had been independent Lead Director from February 2008 through February 2010, was named Chairman and continues to serve in that capacity. The split of these positions allows Mr. Espe, our President and CEO, to focus on managing the business, while Mr. O’Connor, as Chairman, oversees the Board’s functions. The Board will continue to evaluate its leadership and governance structure within the context of the specific needs of the business, current Board composition, and the best interests of Company shareholders.

Responsibilities of the Chairman include recruiting new Board members, overseeing the evaluation and compensation of the CEO, ensuring an appropriate succession plan, overseeing independent evaluation of risk, coordinating Board meeting schedules and agenda, chairing and leading the discussions at the meetings, and overseeing the annual performance evaluations of the Board, its committees and its individual members. The Chairman ensures information provided by management to the Board is sufficient for the Board to fulfill its duties and communicates with other directors on key issues and concerns outside of regularly scheduled meetings. The Chairman is also responsible for ensuring the effective functioning of the committees through appropriate delegation to, and membership of, the committees. Finally, the Chairman provides effective leadership for our independent directors to facilitate the independent oversight required by our Bylaws and Corporate Governance Principles, including by ensuring that:

| • | a majority of our directors are independent; |

| • | all of the members of the Audit Committee, the Compensation Committee and the Governance Committee are independent directors; and |

| • | the Board meets at regularly scheduled executive sessions, outside of the presence of management and those directors not deemed to be Independent Directors (as defined in our Articles and Bylaws) by the Board. Mr. O’Connor, our Chairman, presides at these sessions. In addition, each of the Board’s three standing committees regularly meet at similar executive sessions, at which the respective committee Chairs preside. |

| 10 |  | 2014 Proxy Statement | ||||||

Table of Contents

CORPORATE GOVERNANCE(CONTINUED)

Any person who wishes to communicate with the Board, nonemployee directors as a group, or individual directors, including the Chairman, may direct a written communication to the attention of the Corporate Secretary at the Company’s corporate offices at 2500 Columbia Avenue, Lancaster, Pennsylvania 17603. The Corporate Secretary will forward these communications to the intended recipient director(s). You may also send general messages to directors by email todirectors@armstrong.com. If you wish to send an email message to the Governance Committee, including a recommendation regarding a prospective director, please send the message to the CorpGovernance@armstrong.com. The Corporate Secretary will forward these messages, as appropriate.

The Board met seven times during 2013. In addition, the disinterested Board members met once in connection with the repurchase and secondary offering transactions in September 2013.

There are three standing committees of the Board: the Audit Committee, the Compensation Committee, and the Governance Committee, each described below.

Each standing committee has a charter and consists solely of ‘independent’ or ‘outside’ directors who meet applicable independence standards required by the NYSE, the U.S. Securities and Exchange Commission (the “SEC”), and the Internal Revenue Service, and under our Articles and Bylaws. Each committee reports to the Board regularly and evaluates the effectiveness of its performance annually. The membership of each committee is determined by the Board on the recommendation of the Governance Committee. The Company’s Corporate Governance Principles provide that (i) directors who are currently fully employed should not serve on more than two other corporate boards and (ii) other directors should not serve on more than four other corporate boards. The Board, after considering the circumstances of Mr. Roberts’ service on three other public company audit committees, determined that such service does not impact his ability to effectively serve on the Audit Committee.

All director nominees who served on the Board during 2013 participated in at least 75% of all meetings of the Board and meetings of the Committees on which they served. The average attendance of all directors during 2013 was 96%. Board members are expected to attend annual meetings in person or virtually, via the Internet.

Audit Committee The Audit Committee met five times during 2013. The members of the Audit Committee are John J. Roberts (Chair), Tao Huang and Larry S. McWilliams. Under its charter, the Audit Committee:

| • | oversees (i) auditing and accounting matters, including the selection, supervision and compensation of the Company’s independent registered public accounting firm and other independent auditors, (ii) the scope of the annual audits, non-audit services performed by the Company’s independent registered public accounting firm, and (iii) the Company’s accounting practices and internal accounting controls; |

| • | has sole authority to engage, retain and dismiss the independent registered public accounting firm; |

| • | reviews and discusses with management and our independent registered public accounting firm the annual audited financial statements and quarterly financial statements included in our SEC filings; |

| • | assists the Board in monitoring the integrity of the Company’s financial statements and the independent registered public accounting firm’s qualifications, independence and performance; |

| • | considers risks associated with overall financial reporting, legal compliance and disclosure processes; and |

| • | supervises and reviews the effectiveness of the Company’s internal audit and legal compliance functions and compliance by the Company with legal and regulatory requirements. |

Each member of the Audit Committee meets the NYSE and SEC financial literacy requirements. The Board has determined that at least one member of the Audit Committee, Mr. Roberts, qualifies as an “Audit Committee Financial Expert” as defined in the Exchange Act. The Audit Committee regularly meets independently with the Company’s internal and independent auditors, with the leaders of the Company’s compliance function, and with management.

| 2014 Proxy Statement | 11 | ||||||

Table of Contents

CORPORATE GOVERNANCE(CONTINUED)

Management Development and Compensation Committee The Compensation Committee met seven times during 2013. The members of the Compensation Committee are Stan A. Askren (Chair), James J. Gaffney, Larry S. McWilliams and James C. Melville. Under its charter, the Compensation Committee:

| • | oversees the design of our executive compensation and benefit programs and employment practices; |

| • | administers and makes recommendations regarding our incentive and equity compensation plans; |

| • | reviews and approves corporate goals and individual objectives relevant to the compensation of the CEO and evaluates the CEO’s performance relative to those goals and objectives, and recommends CEO compensation to the independent directors based on the evaluation; |

| • | oversees the evaluation of the other executive officers and establishes their compensation levels in collaboration with the CEO; |

| • | reviews incentive compensation to confirm that such compensation does not encourage unnecessary risk-taking; and |

| • | monitors senior management succession planning. |

Nominating and Governance Committee The Governance Committee met four times during 2013. The members of the Governance Committee are James J. Gaffney (Chair), James J. O’Connor and John J. Roberts. Under its charter, the Governance Committee:

| • | monitors the independence of nonemployee directors; |

| • | reviews and evaluates director candidates and makes recommendations to the Board concerning nominees for election as Board members; |

| • | establishes criteria for the selection of candidates to serve on the Board; |

| • | recommends directors for appointment to Board committees; |

| • | makes recommendations to the Board regarding corporate governance matters; |

| • | reviews and makes recommendations to the Board regarding the compensation of nonemployee directors; |

| • | oversees the Company’s director education and orientation programs; and |

| • | coordinates an annual evaluation of the performance of the Board and each committee. |

Other Committees In addition to the three standing committees described above, members of the Board regularly meet on an ad hoc basis to discuss and approve matters through other committees that have been previously established by the Board. Such committees address such matters as refinancing, succession planning and crisis response. In connection with the Company’s secondary public offering and repurchase transactions during 2013, the Board established a pricing committee which met several times to review and approve the terms of those transactions.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the members of the Compensation Committee has ever been an officer or employee of the Company or its subsidiaries, or had any relationship with the Company that requires disclosure under applicable SEC regulations.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Any related party transaction that may arise is required to be reviewed and approved by the Governance Committee, who must have no connection with the transaction. Related party transactions would include transactions by the Company or any subsidiary with any director, director nominee, executive officer, shareholders owning more than 5% of the Company’s outstanding shares of our common stock, par value $0.01 per share (“Common Shares”), or immediate family member of any of the foregoing, and transactions with businesses affiliated with any director or director nominee that meet the specifications in Item 404 of Regulation S-K under the Exchange Act. The Chair of the Governance Committee has authority to approve transactions involving sums less than the disclosure threshold set in Item 404. The material details of any such matters are required to be disclosed to the Governance Committee at its next regular meeting.

| 12 |  | 2014 Proxy Statement | ||||||

Table of Contents

SHAREHOLDER-RECOMMENDED DIRECTOR CANDIDATES

The Governance Committee will consider director candidates nominated by shareholders. The procedures for recommending candidates are posted at www.armstrong.com/corporatena/article9748.html under “About Armstrong” and “Corporate Governance.” Shareholders who wish to suggest individuals for service on the Board are requested to review the following documents posted on this site: “Process for Evaluation of Director Candidates,” “Director Responsibilities and Qualifications,” and “Position Description for an Armstrong Director.” Shareholders should write to the Corporate Secretary at the Company’s corporate offices at 2500 Columbia Avenue, Lancaster, Pennsylvania 17603 and supply the following information:

| • | the full name, address, education and professional experience of the proposed nominee and a statement explaining why this person would be a good director; |

| • | the consent of the proposed nominee to be considered and to serve, if elected; |

| • | the proposed nominee’s own self-assessment of qualifications and independence under SEC, NYSE rules and our Corporate Governance Principles; and |

| • | the number of Common Shares held by both the proposed nominee, and by the person(s) supporting the proposed nominee. |

When evaluating the candidacy of nominees proposed by shareholders, the Governance Committee also considers the number of shares owned by the nominating shareholder, as well as each nominee’s responses to the Company’s prospective director questionnaire, the presence or absence of any conflicts of interest, and background information. There have been no changes to the procedure by which shareholders may recommend nominees to the Board within the past year.

| 2014 Proxy Statement | 13 | ||||||

Table of Contents

In establishing director compensation, including the overall value of compensation and the mix of cash and equity, the Board analyzes competitive market data and any underlying director compensation trends generally, and compares our program to those of similarly sized companies in comparable industries. The Board is compensated through a combination of annual retainers and equity grants in the form of stock units. The Board believes that this level of compensation supports the Company’s ability to attract directors with suitable backgrounds and experiences. A director who is an officer or employee of the Company or its subsidiaries is not compensated for service on the Board or on any committee of the Board.

In April 2013, the Governance Committee reviewed the compensation program for nonemployee

directors, including the 2008 Directors Stock Unit Plan, as amended (“Directors Stock Unit Plan”). The review included an analysis of competitive market data and any underlying director compensation trends with assistance from an independent compensation consultant, Frederic W. Cook & Co. (“Cook & Co.”). Following that review, and a recommendation by the Governance Committee, the Board approved an increase of $5,000 to each annual retainer fee (cash and equity) for directors, and a $10,000 increase to each annual retainer fee (cash and equity) for the Chair, all effective June 21, 2013. On average, the total compensation levels, as well as cash and equity compensation levels, for our nonemployee directors approximated the 75th percentile, on a per director basis.

The following table describes the elements of the compensation program for nonemployee directors:

2013 Director Compensation Program (effective – June 21, 2013)

| Element | Amount | Terms | ||

Annual Retainer (Cash) | $ 90,000 $190,000 (Chair) | paid in quarterly installments, in arrears | ||

Annual Retainer (Equity) | $105,000 $205,000 (Chair) | annual (or pro-rated) grant of restricted stock units • Directors Stock Unit Plan • vest at one year anniversary or earlier change in control if serving on such date • pre-2011 grants deliverable six months following end of service (except removal for cause) • 2011 and later grants deliverable on date of end of service (except removal for cause) • one share per one unit upon delivery • no voting power until delivered • dividend equivalent rights | ||

Committee Chair Fees | $20,000 (AC; MDCC) $10,000 (NGC) | paid in quarterly installments, in arrears | ||

Special Assignment Fees | $2,500 per diem ($1,250 for less than four hours) | may be paid in connection with: • one-on-one meetings with the CEO • plant visits • other non-scheduled significant activities |

| * | Committees: AC (Audit); MDCC (Management Development & Development); NGC (Nominating & Governance) |

Annual grants for the equity portion of the retainer are effective as of the first business day following the date of the Annual Shareholders’ Meeting, and

the amount of each grant is determined by the NYSE closing price of our Common Shares on that date.

| 14 |  | 2014 Proxy Statement | ||||||

Table of Contents

COMPENSATION OF DIRECTORS(CONTINUED)

Director Compensation Table – 2013

Name (a) | Fees Earned or Paid in Cash ($) (b) | Stock Awards ($)(1) (c) | Option Awards ($)(2) (d) | Non-Equity Incentive Plan Compensation ($) (e) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(3) (f) | All Other Compensation ($)(4) (g) | Total ($) (h) | |||||||||||||||||||||

S. Askren | 107,625 | 105,000 | — | — | — | — | 212,625 | |||||||||||||||||||||

J. Gaffney | 97,625 | 105,000 | — | — | — | 1,205 | 203,830 | |||||||||||||||||||||

T. Huang | 87,625 | 105,000 | — | — | — | 1,465 | 194,090 | |||||||||||||||||||||

M. Johnston | 87,625 | 105,000 | — | — | — | — | 192,625 | |||||||||||||||||||||

J. Liaw | 77,000 | (5) | 105,000 | — | 182,000 | |||||||||||||||||||||||

L. McWilliams | 87,625 | 105,000 | — | — | — | 1,265 | 193,890 | |||||||||||||||||||||

J. Melville | 87,625 | 105,000 | 72,285 | 264,910 | ||||||||||||||||||||||||

J. O’Connor | 185,250 | 205,000 | — | — | — | 395 | 390,645 | |||||||||||||||||||||

J. Roberts | 107,625 | 105,000 | — | — | — | 225 | 212,850 | |||||||||||||||||||||

R. Wenz | 87,625 | 105,000 | — | — | — | 800 | 193,425 | |||||||||||||||||||||

| (1) | The Board approved a $5,000 increase to the annual equity retainer, effective June 21, 2013. Represents amounts that are in units of our Common Shares. The amounts reported represent the aggregate grant date fair value for restricted stock units granted during the fiscal year, as calculated under the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718. Under ASC Topic 718, the grant date fair value is calculated using the closing market price of our Common Shares on the date of the grant. For the number of stock units credited to each director’s account as of March 31, 2014, see SECURITIES OWNERSHIPOF CERTAIN BENEFICIAL OWNERS, MANAGEMENTAND DIRECTORS on page 17. |

| (2) | The directors do not receive stock options as part of their compensation for service on our Board. |

| (3) | There is no plan or arrangement for directors to defer the compensation that they receive as part of their compensation for service on our Board. |

| (4) | Reflects incremental costs incurred by the Company for spouse travel and lodging at the February 2013 Board meeting. Mr. Melville’s amount also reflects the amount he received for special assignment fees in connection with certain non-scheduled significant activities and projects. |

| (5) | Mr. Liaw received a pro-rated payment of the first quarterly installment of the 2013 annual cash retainer in March 2013 following the Board’s determination on February 15, 2013 that, as a result of Mr. Liaw’s new position as CFO of FleetPride, Inc. and corresponding separation from TPG, effective on that date, he would become a participant in the nonemployee directors’ compensation program. |

In accordance with our Corporate Governance Principles, each nonemployee director must acquire and then hold until six months following the end of his service, phantom units and/or Common Shares equal in value to three times the director’s annual retainer at the time he joined the Board. Directors endeavor to reach that level of ownership within five years of joining the Board. With the exception of

Messrs. Melville and Liaw, all of the current directors have already achieved this ownership requirement. Mr. Espe is an officer of the Company and, therefore, not subject to the stock ownership guidelines for nonemployee directors. Mr. Melville served on our Board from 2009 to 2010 and was reappointed to our Board in February 2012. Mr. Liaw first became eligible to participate in the nonemployee director compensation program in February 2013.

| 2014 Proxy Statement | 15 | ||||||

Table of Contents

The following table sets forth information regarding persons or groups known to us to be beneficial owners of more than 5% of our outstanding Common Shares as of March 31, 2014 or the date of any applicable reports filed by such persons or groups prior to that date. Beneficial ownership is determined in accordance with applicable rules of the SEC.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class Outstanding(1) | ||||||||

Armstrong World Industries, Inc. Asbestos Personal Injury Settlement Trust (the “Trust”) c/o Edward E. Steiner Keating Muething & Klekamp PLL One East Fourth Street, Suite 1400 Cincinnati, OH 45202 | 9,533,118 | (2) | 17.39 | % | ||||||

Wellington Management Company, LLP 280 Congress Street Boston, MA 02210 | 7,481,601 | (3) | 13.65 | % | ||||||

FMR LLC c/o Scott C. Goebel 245 Summer Street Boston, MA 02210 | 2,932,284 | (4) | 5.35 | % | ||||||

| (1) | Based on 54,807,025 shares of our Common Shares outstanding as of March 31, 2013, as reported to the NYSE (59,864,407 shares reported, less 5,057,382 shares held in treasury). |

| (2) | On a Schedule 13D Amendment No. 5 filed with the SEC on March 12, 2014, the Trust reported that, as of March 10, 2014, it had sole voting and dispositive power with respect to these Common Shares. |

| (3) | On a Schedule 13D Amendment No. 1 filed with the SEC on February 14, 2014, Wellington Management Company, LLP reported that, as of December 31, 2013, it had shared voting power for 4,880,620 of these Common Shares, and shared dispositive power for all of these Common Shares, as a result of acting as an investment advisor under Section 203 of the Investment Advisors Act of 1940. |

| (4) | On a Schedule 13G Amendment No. 6 filed on February 14, 2014, by Scott C. Goebel on behalf of FMR LLC, Edward C. Johnson 3d and Fidelity Management & Research Company (“Fidelity”) it was reported that FMR LLC has sole voting power for 25,997 and sole dispositive power for all of these Common Shares. Fidelity, a wholly-owned subsidiary of FMR, LLC and an investment advisor registered under Section 203 of the Investment Advisors Act of 1940, is the beneficial owner of 2,875,487 of these Common Shares as a result of acting as investment advisor to various investment companies registered under Section 8 of the Investment Company Act of 1940. Edward C. Johnson 3d and FMR LLC, through its control of Fidelity and the funds, each has sole power to dispose of the 2,875,487 shares owned by the funds. |

| 16 |  | 2014 Proxy Statement | ||||||

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, MANAGEMENT AND DIRECTORS(CONTINUED)

The following table sets forth, as of March 31, 2014, the amount of Common Shares beneficially owned by all directors, the Company’s currently serving named executive officers (“NEOs”) as identified in the “COMPENSATION DISCUSSION AND ANALYSIS” section on page 22 and all directors and executive officers as a group in accordance with applicable SEC rules.

| Name | Number of Beneficially | Number of Within 60 Days | Total Number of Shares Beneficially Owned(2) | Restricted Stock Units(3) / Unvested Options(4) | Total Common Shares Beneficially Owned Plus Restricted Stock Units and Unvested Options | |||||||||||||||

Stan A. Askren | 0 | * | * | 0 | 21,467 | 21,467 | ||||||||||||||

Matthew J. Espe | 52,709 | 562,151 | 614,860 | 168,094 | 782,954 | |||||||||||||||

James J. Gaffney | 0 | * | * | 0 | 15,467 | 15,467 | ||||||||||||||

Victor D. Grizzle | 16,449 | 69,880 | 86,329 | 44,204 | 130,533 | |||||||||||||||

Mark A. Hershey | 3,714 | 25,997 | 29,711 | 34,846 | 64,557 | |||||||||||||||

Tao Huang | 0 | * | * | 0 | 14,785 | 14,785 | ||||||||||||||

Michael F. Johnston | 0 | * | * | 0 | 14,785 | 14,785 | ||||||||||||||

Jeffrey Liaw | 0 | * | * | 0 | 2,916 | 2,916 | ||||||||||||||

Donald R. Maier | 13,664 | 24,941 | 38,605 | 43,318 | 81,923 | |||||||||||||||

Thomas B. Mangas | 23,788 | 244,180 | 267,968 | 108,085 | 376,053 | |||||||||||||||

Larry S. McWilliams | 0 | * | * | 0 | 14,785 | 14,785 | ||||||||||||||

James C. Melville | 4,229 | * | * | 4,229 | 5,105 | 9,334 | ||||||||||||||

James J. O’Connor | 7,000 | * | * | 7,000 | 33,654 | 40,654 | ||||||||||||||

John J. Roberts | 0 | * | * | 0 | 15,467 | 15,467 | ||||||||||||||

David S. Schulz | 384 | 8,530 | 8,914 | 16,362 | 25,276 | |||||||||||||||

Richard E. Wenz | 0 | * | * | 0 | 14,785 | 14,785 | ||||||||||||||

Directors and Executive Officers as a group (18 persons)(5) | 129,910 | 981,379 | 1,111,289 | 599,499 | 1,710,788 | |||||||||||||||

| (1) | Directors do not receive stock option grants under the Directors Stock Unit Plan or as part of the compensation program for directors. |

| (2) | No individual director or executive officer other than Mr. Espe beneficially owns 1% of the Common Shares outstanding as of March 31, 2014. The directors and executive officers as a group beneficially own approximately 2% of the Common Shares outstanding as of March 31, 2014. |

| (3) | Represents, in the case of NEOs, unvested time-based restricted stock units (“RSUs”) granted to them under the 2006 and 2011 Long-Term Incentive Plan, as applicable, and, in the case of nonemployee directors, vested and unvested restricted stock units (“Director RSUs”) granted to them as part of their annual retainer for Board service that are not acquirable by the director within 60 days of March 31, 2014 under the terms of the Directors Stock Unit Plan. See Directors Aggregate Ownership table below for further information. Neither the unvested NEOs’ RSUs nor the Director RSUs have voting power. |

| (4) | Messrs. Espe, Grizzle, Hershey, Maier, Mangas and Schulz do not have unvested time-based RSUs. |

| (5) | Includes amounts for Ellen R. Romano, SVP, Human Resources, and Stephen F. McNamara, VP, Controller. |

| 2014 Proxy Statement | 17 | ||||||

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, MANAGEMENT AND DIRECTORS(CONTINUED)

Directors – Aggregate Ownership

The table below sets forth, as of March 31, 2014, additional detail as to each nonemployee director’s ownership and rights to ownership in the Company’s equity.

| Name | Common Shares | Vested Restricted Stock Units(1) | Unvested Restricted Stock Units(2) | Phantom Stock Units(3) | Total Equity | Total Value(4) | ||||||||||||||||||

Stan A. Askren | 0 | 19,195 | 2,272 | 0 | 21,467 | $ | 1,143,118 | |||||||||||||||||

James J. Gaffney | 0 | 13,195 | 2,272 | 10,038 | 15,467 | $ | 1,358,141 | |||||||||||||||||

Tao Huang | 0 | 12,513 | 2,272 | 0 | 14,785 | $ | 787,301 | |||||||||||||||||

Michael F. Johnston | 0 | 12,513 | 2,272 | 0 | 14,785 | $ | 787,301 | |||||||||||||||||

Jeffrey Liaw | 0 | 0 | 2,916 | 0 | 2,916 | $ | 155,277 | |||||||||||||||||

Larry S. McWilliams | 0 | 12,513 | 2,272 | 0 | 14,785 | $ | 787,301 | |||||||||||||||||

James C. Melville | 4,229 | 2,833 | 2,272 | 0 | 9,335 | $ | 497,089 | |||||||||||||||||

James J. O’Connor | 7,000 | 29,219 | 4,435 | 0 | 40,654 | $ | 2,164,826 | |||||||||||||||||

John J. Roberts | 0 | 13,195 | 2,272 | 10,038 | 15,467 | $ | 1,358,141 | |||||||||||||||||

Richard E. Wenz | 0 | 12,513 | 2,272 | 0 | 14,785 | $ | 787,301 | |||||||||||||||||

Total | 11,229 | 127,689 | 25,527 | 20,076 | 164,445 | $ | 9,825,796 | |||||||||||||||||

| (1) | Under the terms of the Directors Stock Unit Plan, the director RSUs granted to each director as part of his retainer for Board service are not acquirable by the director until (i) for those director RSUs granted prior to June 2011, the earlier of the six-month anniversary of the director’s separation from the Board for any reason other than a removal for cause or the date of a Change in Control Event (as defined in the Directors Stock Unit Plan); or (ii) for those director RSUs granted during and after June 2011, on the date of the director’s separation from the Board for any reason other than a removal for cause or the date of a Change in Control Event (as defined in the Directors Stock Unit Plan). |

| (2) | Under the terms of the Directors Stock Unit Plan, director RSUs vest on the first anniversary of the grant date. All of the director RSUs listed in this column will vest on June 26, 2014. |

| (3) | Phantom Stock Units awarded under the Company’s 2006 Phantom Stock Unit Plan (“Phantom Stock Unit Plan”) become payable (“Phantom Units Payment Date”) in cash on the earlier of the six-month anniversary of the director’s separation from the Board for any reason other than a removal for cause or the date of a Change in Control Event (as defined in the Phantom Stock Unit Plan). The cash payment amount will be equal to the number of units multiplied by the closing price of the Common Shares on the stock exchange on which such shares are traded on the Phantom Units Payment Date. |

| (4) | Represents an amount equal to the sum of the number of Common Shares beneficially owned, plus the number of vested and unvested director RSUs, plus the number of Phantom Stock Units held, as applicable, multiplied by $53.25, which was the closing price of our Common Shares on the NYSE on March 31, 2014. |

| 18 |  | 2014 Proxy Statement | ||||||

Table of Contents

The Audit Committee selected KPMG LLP to audit our consolidated financial statements and our internal control over financial reporting for 2014. In accordance with past practice, this selection will be presented to the shareholders for ratification at the annual meeting; however, consistent with the requirements of the Sarbanes-Oxley Act of 2002, the Audit Committee has ultimate authority in respect of the selection of our independent registered public accounting firm. The Audit

Committee may reconsider its selection if the appointment is not ratified by the shareholders.

A representative of KPMG LLP will be in attendance at the annual meeting to respond to appropriate questions and will be afforded the opportunity to make a statement at the meeting, if he or she desires to do so.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTEFOR THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP.

| 2014 Proxy Statement | 19 | ||||||

Table of Contents

The Audit Committee engaged KPMG LLP as the Company’s independent registered public accounting firm for 2013. In making this selection, the Audit Committee considered KPMG LLP’s qualifications, discussed with KPMG LLP its independence, and reviewed the audit and non-audit services provided by KPMG LLP to the Company.

Management of the Company has primary responsibility for preparing the Company’s financial statements and establishing effective internal control over financial reporting. KPMG LLP is responsible for auditing those financial statements and expressing an opinion on the conformity of the Company’s audited financial statements with accounting principles generally accepted in the United States and on the effectiveness of the Company’s internal control over financial reporting based on the criteria established in 1992 by the Committee of Sponsoring Organizations of the Treadway Commission. Accordingly, the Audit Committee reviewed and discussed the audited consolidated financial statements for fiscal 2013 with the Company’s management. The Audit Committee also reviewed and discussed with management the critical accounting policies applied by the Company in the preparation of those financial statements. The Audit Committee also discussed with KPMG LLP the matters required to be discussed by applicable standards of the Public Company Accounting Oversight Board, and had the opportunity to ask KPMG LLP questions relating to such matters. The discussions included the quality, and not just the acceptability, of the accounting principles utilized, the reasonableness of significant accounting judgments, and the clarity of disclosures in the financial statements.

The Audit Committee considers the independence, qualifications and performance of KPMG. Such consideration includes reviewing the written disclosures and the letter received from KPMG required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accountants’ communications with the Audit Committee concerning independence, and discussing with KPMG their independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in Armstrong’s Annual Report on Form 10-K for the year ended December 31, 2013. The Audit Committee has also engaged KPMG as the Company’s independent registered public accounting firm for 2014. The Audit Committee and the Board believe that the continued retention of KPMG to serve as the Company’s independent registered public accounting firm is in the best interests of the Company and its shareholders and have recommended that shareholders ratify the appointment of KPMG as the Company’s independent registered public accounting firm for the fiscal year 2014.

Submitted by the Audit Committee

John J. Roberts (Chair)

Tao Huang

Larry S. McWilliams

| 20 |  | 2014 Proxy Statement | ||||||

Table of Contents

The following table presents fees for professional audit services rendered by KPMG LLP for the audit of our annual consolidated financial statements for 2013 and 2012 and fees billed for other services rendered by KPMG LLP. All fees in 2013 and 2012 were pre-approved by the Audit Committee.

| (amounts in thousands) | ||||||||

| 2013 | 2012 | |||||||

Audit Fees(1) | $ | 4,203 | $ | 4,228 | ||||

Audit Related Fees(2) | 215 | 110 | ||||||

Audit and Audit Related Fees Subtotal | 4,418 | 4,338 | ||||||

Tax Fees(3) | 1,490 | 629 | ||||||

All Other Fees(4) | — | — | ||||||

Total Fees | $ | 5,908 | $ | 4,967 | ||||

| (1) | Audit Fees are for services rendered in connection with the integrated audit of Armstrong’s consolidated financial statements as of and for the year, for which a portion of the billings occurred the following year. Audit fees were also incurred for reviews of consolidated financial statements included in Armstrong’s quarterly reports on Form 10-Q, services normally provided in connection with statutory and regulatory filings, and services for comfort letters. |

| (2) | Audit Related Fees consisted principally of fees for audits of financial statements of certain employee benefit plans, agreed-upon procedures, accounting research assistance on technical topics and other matters with respect to non-U.S. statutory financial statements. |

| (3) | Tax Fees were primarily for preparation of tax returns in non-U.S. jurisdictions, assistance with tax audits and appeals and other tax consultation and compliance services. |

The Audit Committee has considered whether the provision by KPMG LLP of the non-audit services described above was allowed under Rule 2-01(c)(4) of Regulation S-X and was compatible with maintaining auditor independence, and has concluded that KPMG LLP was and is independent of the Company in all respects.

Audit Committee Pre-Approval Policy

The Audit Committee adheres to a policy that requires the Audit Committee’s prior approval of any audit, audit-related and non-audit services provided by the firm that serves as our independent registered public accounting firm. Pursuant to this policy, management cannot engage the firm for any services without the Audit Committee’s pre-approval. The Audit Committee delegates to the Audit Committee Chair the authority to pre-approve non-audit services not exceeding 5% of the total audit fees for the year for purposes of handling immediate needs, with a report to the full Audit Committee of such approvals at its next meeting. The policy complies with Section 10A(i) of the Exchange Act.

| 2014 Proxy Statement | 21 | ||||||

Table of Contents

INTRODUCTION

This compensation discussion and analysis (“CD&A”) includes a detailed description of our executive compensation philosophy and programs, which is generally applicable to all of our management employees. However, this CD&A focuses primarily on the material components of our executive compensation program as they apply to our NEOs, who, in 2013 were(1):

Matthew J. Espe President and CEO

David S. Schulz(2) Senior Vice President and CFO

Thomas B. Mangas(3) Executive Vice President and CEO, Armstrong Floor Products (“AFP”) and former Senior Vice President and CFO

Victor D. Grizzle Executive Vice President and CEO, Armstrong Building Products (“ABP”)

Donald R. Maier(4) Senior Vice President, Global Operations Excellence

Mark A Hershey Senior Vice President, General Counsel and Secretary, and Chief Compliance Officer

Frank J. Ready(5) Former Executive Vice President and CEO, Armstrong Floor Products

| (1) | We determined the above NEOs for 2013 in accordance with SEC rules, which require that we include: all individuals who served as our principal executive officer (Mr. Espe) and principal financial officer (Messrs. Schulz and Mangas), regardless of compensation level during the year; our three most highly compensated executive officers other than the principal executive officer and principal financial officer who were serving as executive officers at the end of the last completed fiscal year (Messrs. Grizzle, Maier and Hershey); and up to two additional individuals for whom disclosure would have been provided under the applicable rules except for the fact that the individual was not serving as an executive officer at the end of the last completed fiscal year (Mr. Ready). |

| (2) | Mr. Schulz joined us in June 2011 and has served as our CFO since November 2013; |

| (3) | Mr. Mangas served as CFO between 2010 and November 2013, and has served as our global AFP leader since November 2013; |

| (4) | Mr. Maier’s role as SVP, Global Operations Excellence will terminate on December 31, 2014 and he will provide transition services to us until February 28, 2015 per a Transition Agreement filed with the SEC on Form 8-K on April 4, 2014. |

| (5) | Mr. Ready served as our global AFP leader until November 2013 and retired effective December 31, 2013. |

Executive Summary

Our Business

We are a global leader in the design and manufacture of floors and ceilings. As of December 31, 2013, we operated 35 plants in eight countries and had approximately 8,500 employees worldwide. For more information about our business, please see “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K filed with the SEC on February 24, 2014.

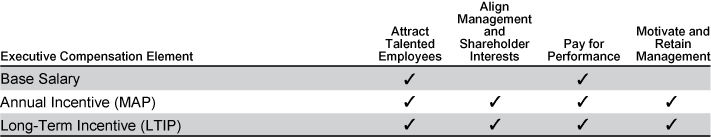

Executive Compensation Programs

Our executive compensation programs are designed to attract and retain high caliber talent, reward performance and align with the interests of our shareholders. We execute this philosophy through the payment of base salaries, cash

incentive awards under our Management Achievement Plan (“MAP”), and grants of a combination of time-based and performance-based restricted stock units (“RSU” and “PSU”, respectively) and stock options under our 2011 Long-Term Incentive Plan (“LTIP”).

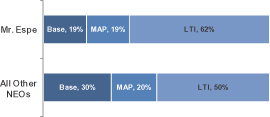

To focus our NEOs on delivering both short- and long-term results, a significant amount of their target total direct compensation (“TDC”, composed of base salary, short-term and long-term incentive compensation) mix is dependent upon achieving specified results and is, therefore, “at risk”. We also employ specific policies and practices to supplement our compensation philosophy, including:

| • | Stock ownership guidelines to ensure that NEOs have significant exposure to changes in our stock price, thereby aligning NEO and long-term shareholder interests. |

| 22 |  | 2014 Proxy Statement | ||||||

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS(CONTINUED)

| • | Recoupment policy applicable to short- and long-term incentive awards that enables us to exercise discretion and take action to recoup the amount of any cash or stock-based awards in the event we are required to prepare an accounting restatement due to a material noncompliance with any financial reporting requirement under the securities laws as a result of fraud, misconduct, or gross negligence. To the extent that the SEC may adopt future rules for clawback policies that require changes to our policy, we will revise our policy accordingly. |

| • | Policy prohibiting derivative transactions in our Common Shares, including: trading in puts, calls, covered calls, or other derivative products involving our securities; engaging in any hedging or monetization transaction with respect to our securities; or, holding company securities in a margin account or pledging our securities as collateral for a loan. |

| • | We do not have any plans or agreements that provide tax gross-ups under Section 280G of the Code to our NEOs. |

2013 Business Highlights

In 2013, we focused on growing our core businesses in established and emerging markets and continued our disciplined effort to create a lean and productive culture while facing challenging market conditions.

Key performance highlights included:

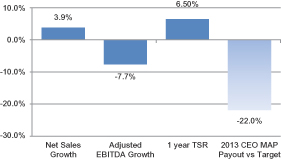

| • | Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”)* of $371 million was down 7.7 percent from 2012 due to increases in manufacturing and input costs driven by rising lumber prices as well as higher SG&A expenses. |

| • | Consolidated net sales increased by $101 million, or 4 percent. The increase was driven by higher volumes and pricing in Wood Flooring and higher volumes across all geographies in ABP, with pricing, volume and mix all positive at a consolidated level. |

| • | $68 million of Free Cash Flow (“FCF”), which was lower than 2012, primarily due to lower cash earnings and higher capital expenditures which were only partially offset by improvements in working capital and lower cash interest expense when compared to the prior year. |

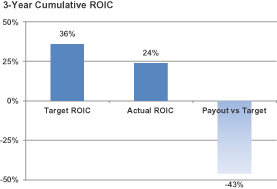

| • | Unadjusted return on invested capital (“ROIC”), (as reported), was 8.2%, a decrease of 130 basis points over 2012 and, while lower than 2012, was the second highest since emergence from bankruptcy in 2006. |

| • | Despite lower earnings, our share price increased by 6.5 percent. |

We also made significant progress with respect to a variety of strategic, financial and operational initiatives.

| • | We strengthened our Balance Sheet. |

| • | We bought back approximately 5 million shares for approximately $261 million. |

| • | We refinanced our senior credit facility to extend maturities and lower future cash interest expense. |

| • | We continued to make significant progress with our plant construction projects. |

| • | We completed construction of three plants in China: a homogeneous flooring plant, a heterogeneous flooring plant, and a mineral fiber ceilings plant. |

| • | We began construction of our first mineral fiber ceilings plant in Russia and continued to expand our new ceiling distribution center. |

| • | We announced a $41 million investment to manufacture luxury vinyl tile in the U.S. |

| • | We significantly increased our focus on new product development and commercialization. |

| • | We realized approximately 31% of our sales from products introduced in the past five years. |

| • | We implemented new procedures to increase the quantity of invention submissions and prioritize them so that patent filings are aligned with R&D and business unit strategies. |

| • | Overall, the Compensation Committee believed that we made progress in many areas, but fell short of our aspirational EBITDA goal. |

| * | Continuing operations basis. Please refer to Annex A for a reconciliation of Adjusted EBITDA to U.S. GAAP. |

| 2014 Proxy Statement | 23 | ||||||

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS(CONTINUED)

2013 Executive Compensation Highlights

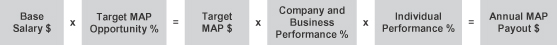

Our 2013 EBITDA performance resulted in a 78% MAP payout factor at the Consolidated level, 22% below target. NEOs received between 23% and 105% of target.

Our three-year cumulative ROIC performance (2011 – 2013 PSU plan) resulted in a 57% payout factor, 43% below target, reflecting actual performance relative to an aspirational goal that we did not achieve.