ARMSTRONG FLOORING, INC. Investor Presentation March 2016 Exhibit 99.2

SAFE HARBOR STATEMENT Our disclosures in this presentation, including without limitation, those relating to future financial results guidance and the possible separation of our flooring business from our building products business, and in our other public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those statements provide our future expectations or forecasts and can be identified by our use of words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "outlook," "target," "predict," "may," "will," "would," "could," "should," "seek," and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance or the separation of our businesses. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. A more detailed discussion of the risks and uncertainties that may affect our ability to achieve the projected performance is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of Armstrong Flooring, Inc. recent Form 10 filing with the SEC. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. The information in this presentation is only effective as of the date given, March 10, 2016, and is subject to change. Any distribution of this presentation after March 10, 2016 is not intended and will not be construed as updating or confirming such information. In addition, we will be referring to “non-GAAP financial measures” within the meaning of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance with GAAP can be found in the appendix section of this presentation. Armstrong competes globally in many diverse markets. References to "market" or "share" data are simply estimations based on a combination of internal and external sources and assumptions. They are intended only to assist discussion of the relative performance of product segments and categories for marketing and related purposes. No conclusion has been reached or should be reached regarding a "product market," a "geographic market" or “market share,” as such terms may be used or defined for any economic, legal or other purpose.

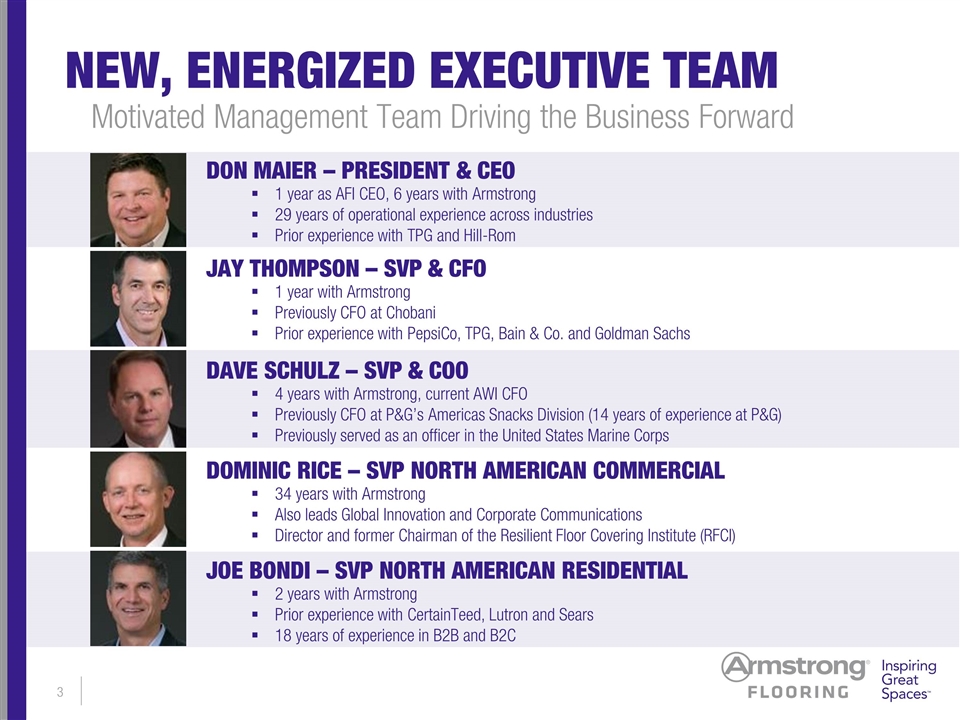

NEW, ENERGIZED EXECUTIVE TEAM Motivated Management Team Driving the Business Forward DON MAIER – PRESIDENT & CEO 1 year as AFI CEO, 6 years with Armstrong 29 years of operational experience across industries Prior experience with TPG and Hill-Rom JAY THOMPSON – SVP & CFO 1 year with Armstrong Previously CFO at Chobani Prior experience with PepsiCo, TPG, Bain & Co. and Goldman Sachs DAVE SCHULZ – SVP & COO 4 years with Armstrong, current AWI CFO Previously CFO at P&G’s Americas Snacks Division (14 years of experience at P&G) Previously served as an officer in the United States Marine Corps DOMINIC RICE – SVP NORTH AMERICAN COMMERCIAL 34 years with Armstrong Also leads Global Innovation and Corporate Communications Director and former Chairman of the Resilient Floor Covering Institute (RFCI) JOE BONDI – SVP NORTH AMERICAN RESIDENTIAL 2 years with Armstrong Prior experience with CertainTeed, Lutron and Sears 18 years of experience in B2B and B2C

UNIQUE OPPORTUNITY TO BUILD VALUE Leading hard surfaces flooring company Most recognized brands Expansive product portfolio Renewed focus on innovation Differentiated go-to-market system Operational, financial and organizational transformation

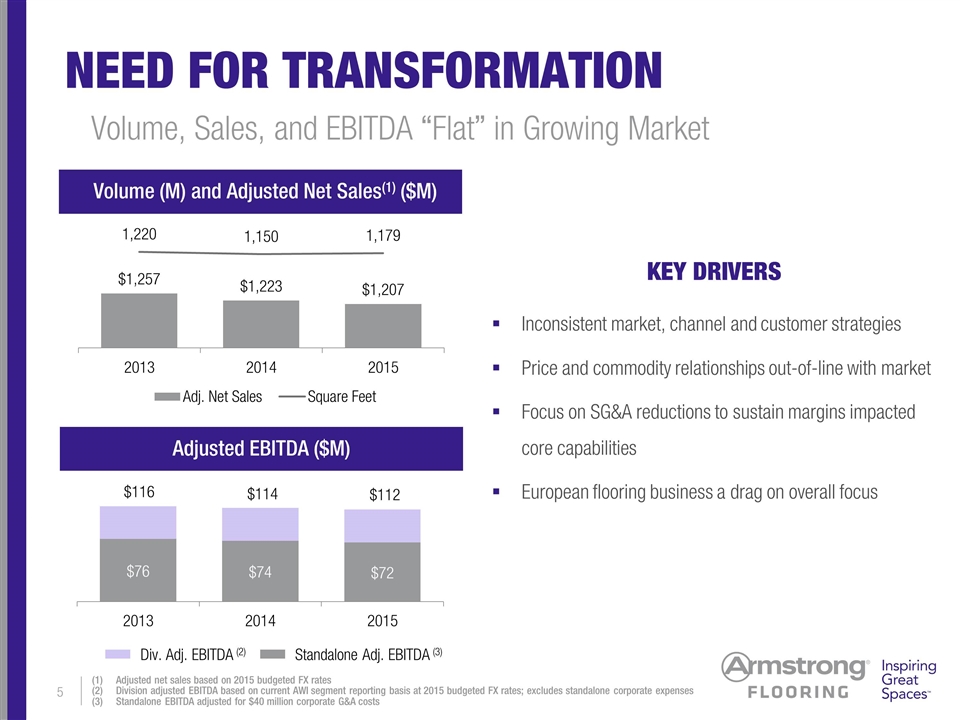

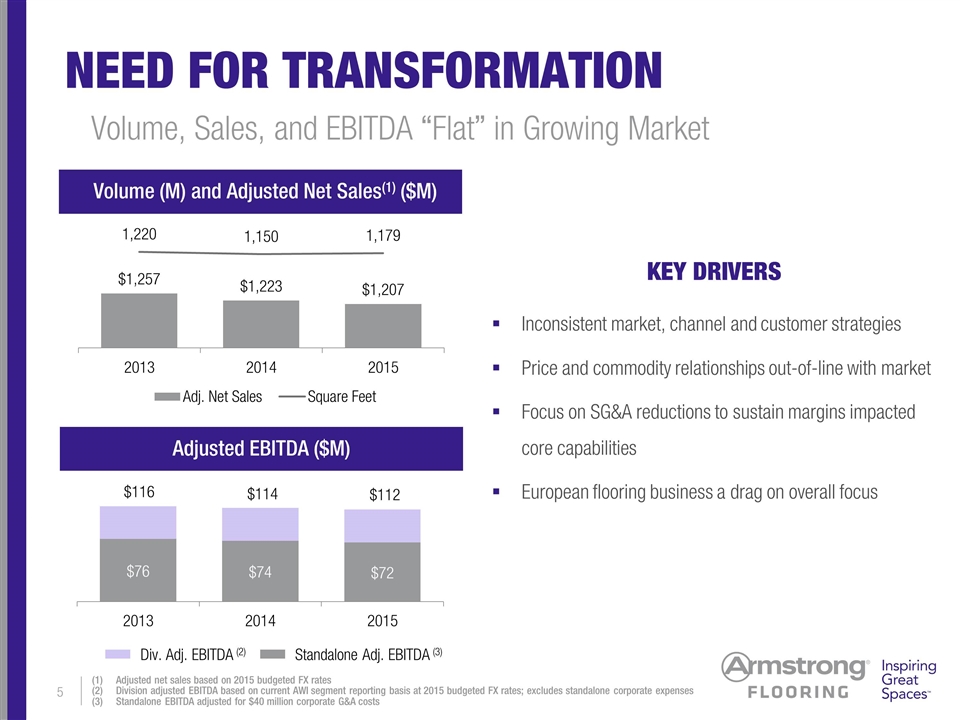

NEED FOR TRANSFORMATION Volume, Sales, and EBITDA “Flat” in Growing Market Adjusted net sales based on 2015 budgeted FX rates Division adjusted EBITDA based on current AWI segment reporting basis at 2015 budgeted FX rates; excludes standalone corporate expenses Standalone EBITDA adjusted for $40 million corporate G&A costs Volume (M) and Adjusted Net Sales(1) ($M) Adjusted EBITDA ($M) Div. Adj. EBITDA (2) Standalone Adj. EBITDA (3) Inconsistent market, channel and customer strategies Price and commodity relationships out-of-line with market Focus on SG&A reductions to sustain margins impacted core capabilities European flooring business a drag on overall focus $116 $114 $112 KEY DRIVERS

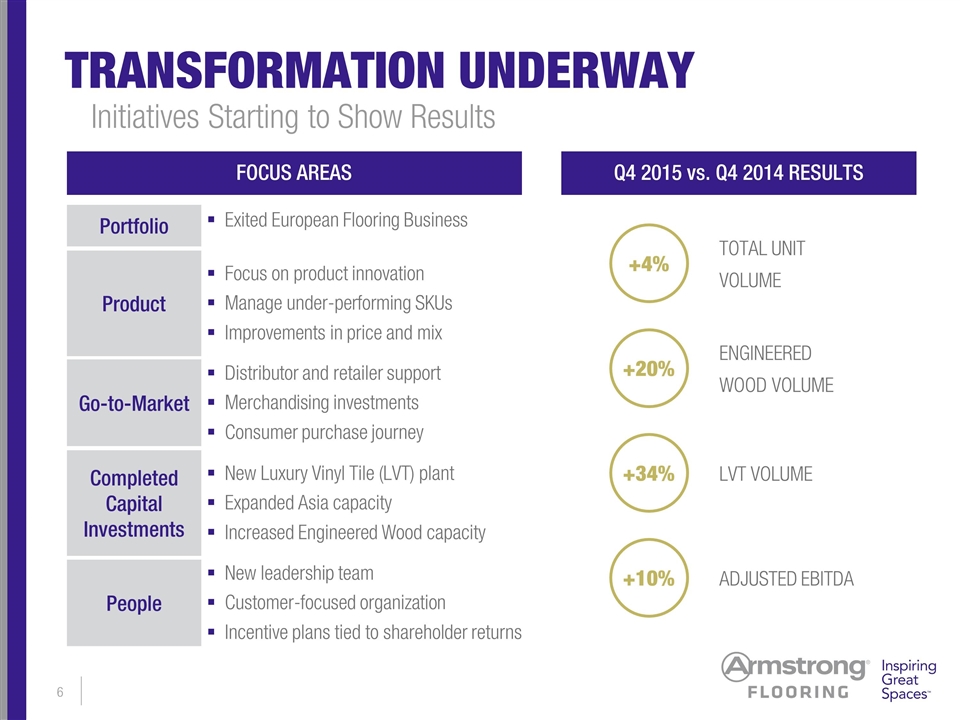

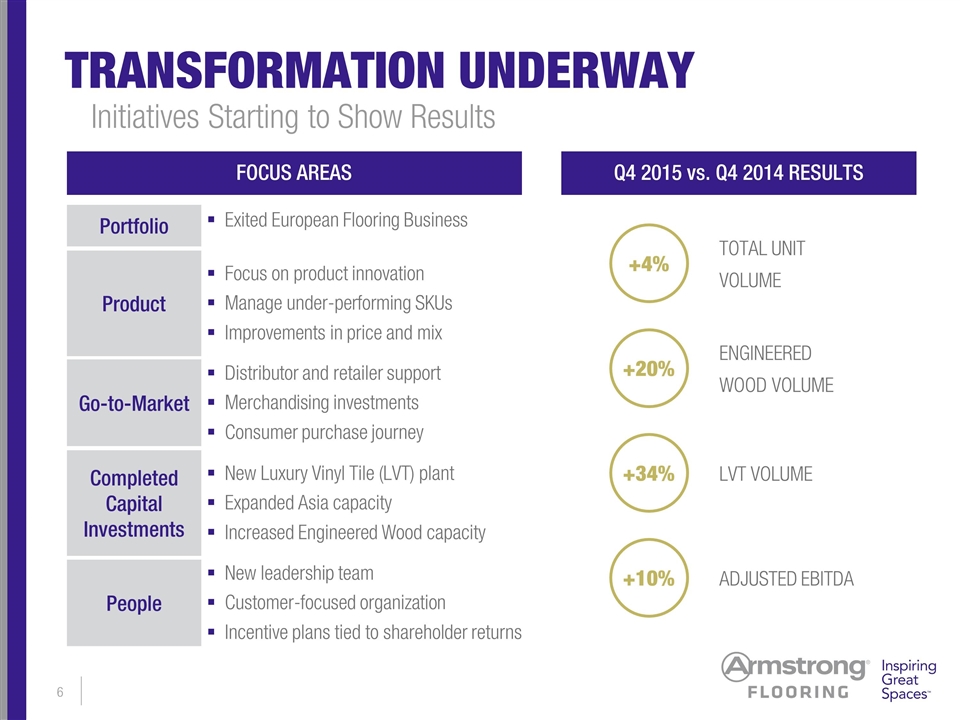

Initiatives Starting to Show Results Product Go-to-Market Completed Capital Investments People TRANSFORMATION UNDERWAY Focus on product innovation Manage under-performing SKUs Improvements in price and mix Distributor and retailer support Merchandising investments Consumer purchase journey New Luxury Vinyl Tile (LVT) plant Expanded Asia capacity Increased Engineered Wood capacity New leadership team Customer-focused organization Incentive plans tied to shareholder returns Portfolio Exited European Flooring Business Q4 2015 vs. Q4 2014 RESULTS TOTAL UNIT VOLUME +4% ADJUSTED EBITDA +10% ENGINEERED WOOD VOLUME +20% LVT VOLUME +34% FOCUS AREAS

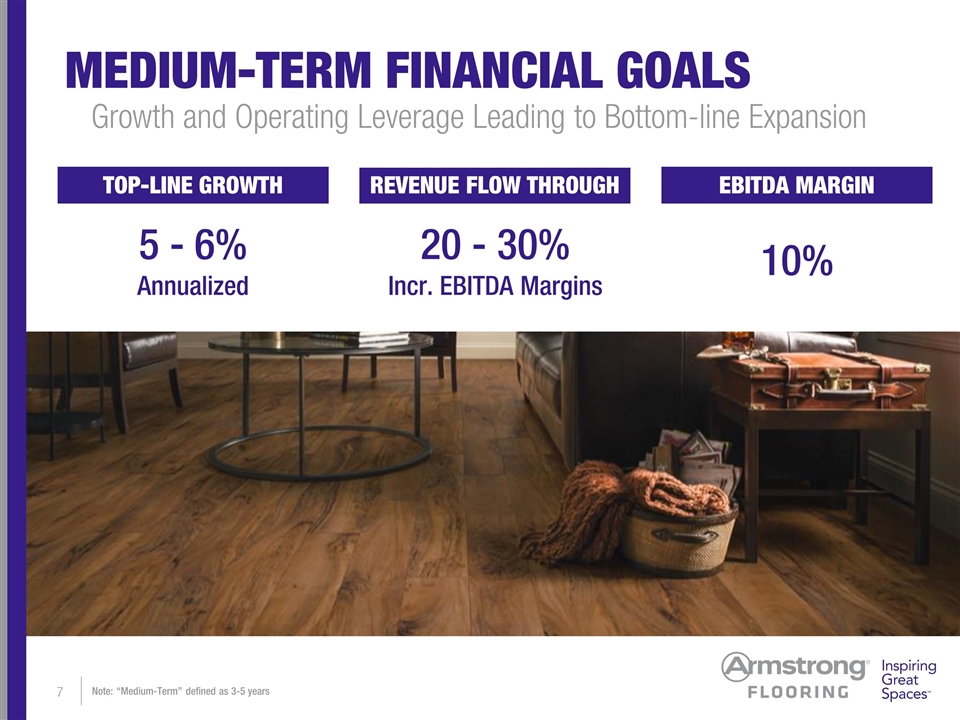

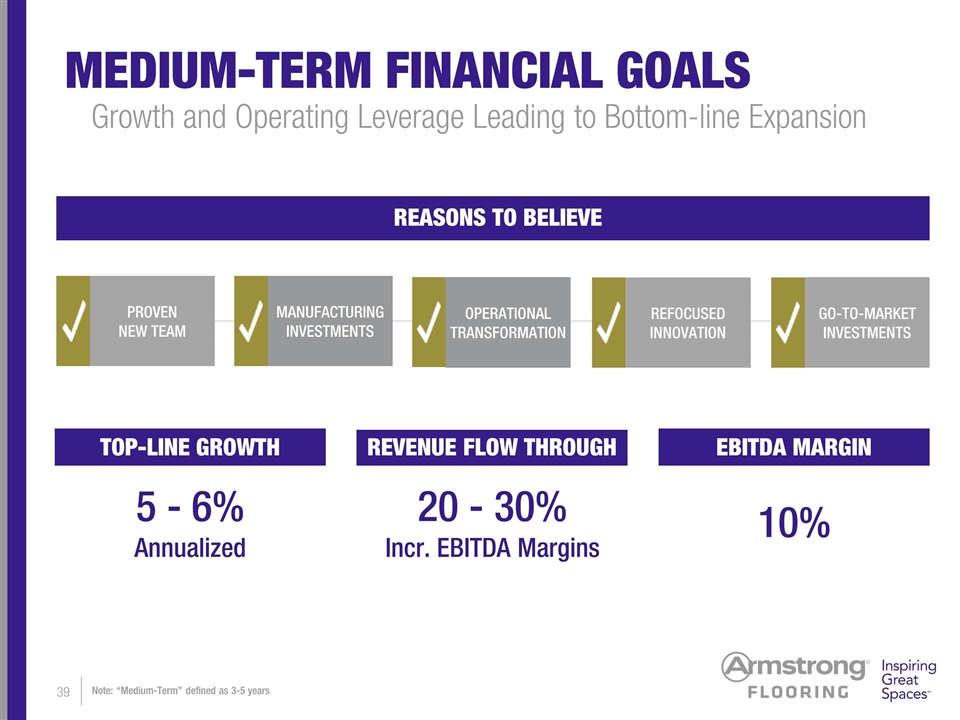

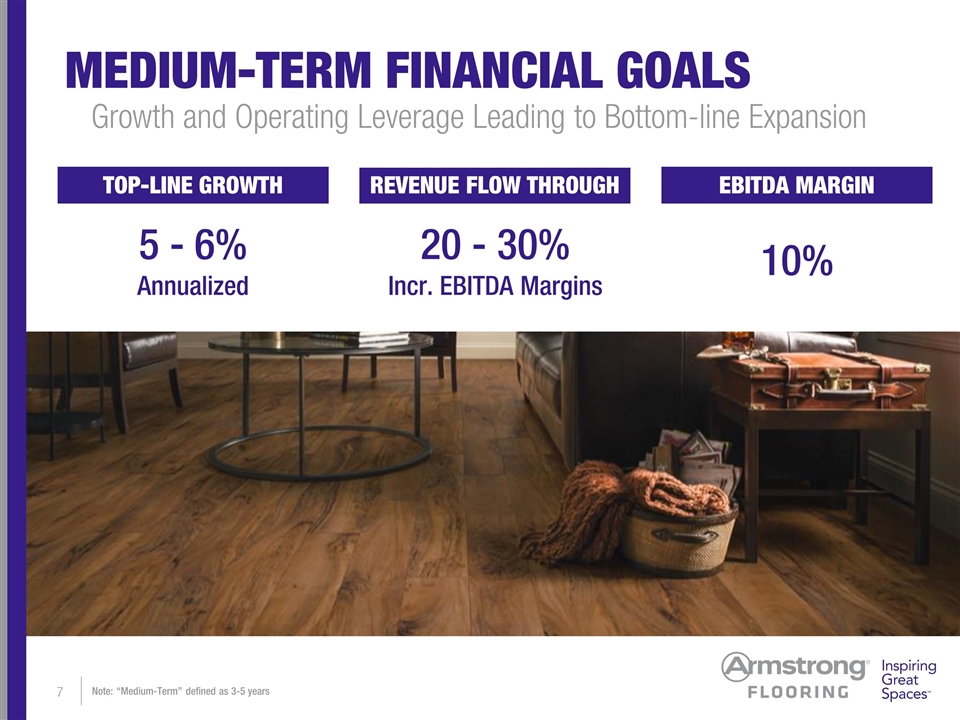

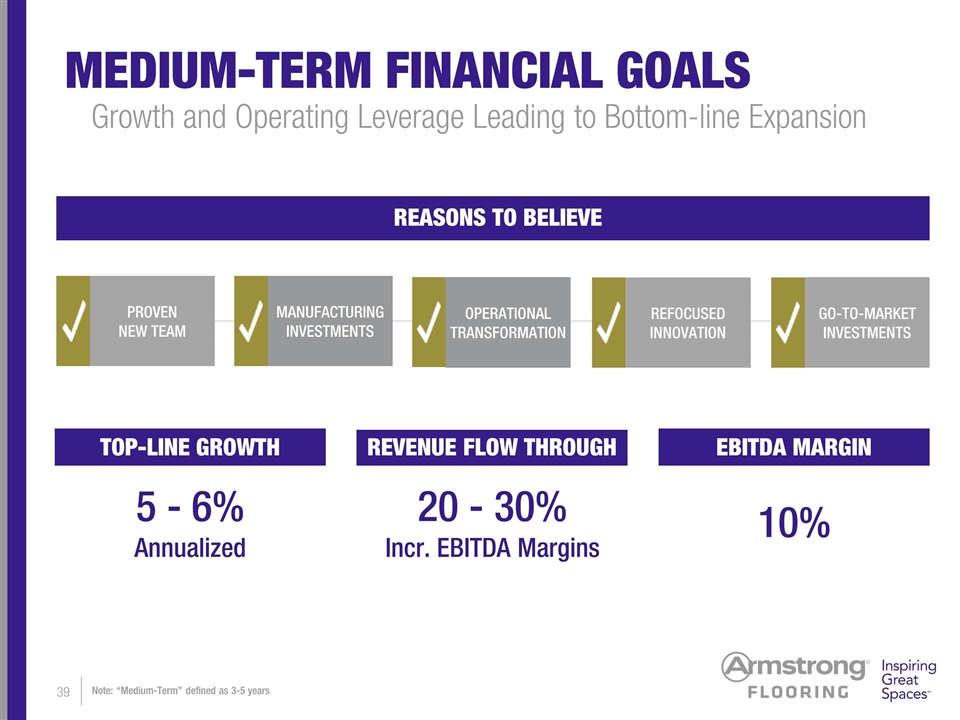

MEDIUM-TERM FINANCIAL GOALS Growth and Operating Leverage Leading to Bottom-line Expansion TOP-LINE GROWTH REVENUE FLOW THROUGH EBITDA MARGIN 5 - 6% Annualized 10% 20 - 30% Incr. EBITDA Margins Note: “Medium-Term” defined as 3-5 years

AGENDA OUR BUSINESS INVESTMENT HIGHLIGHTS FINANCIAL OUTLOOK

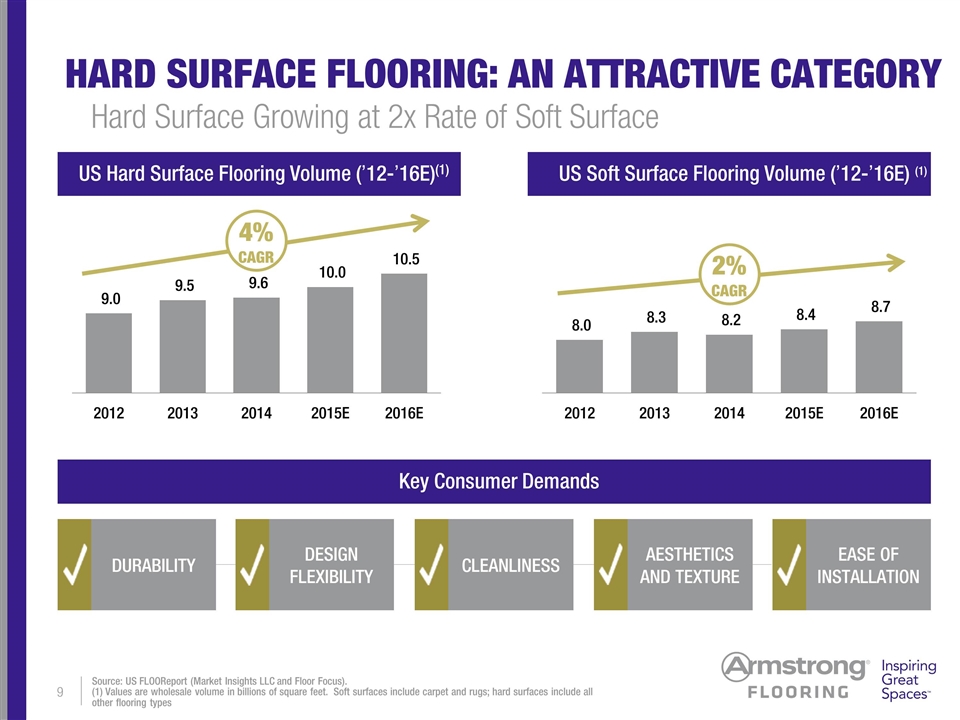

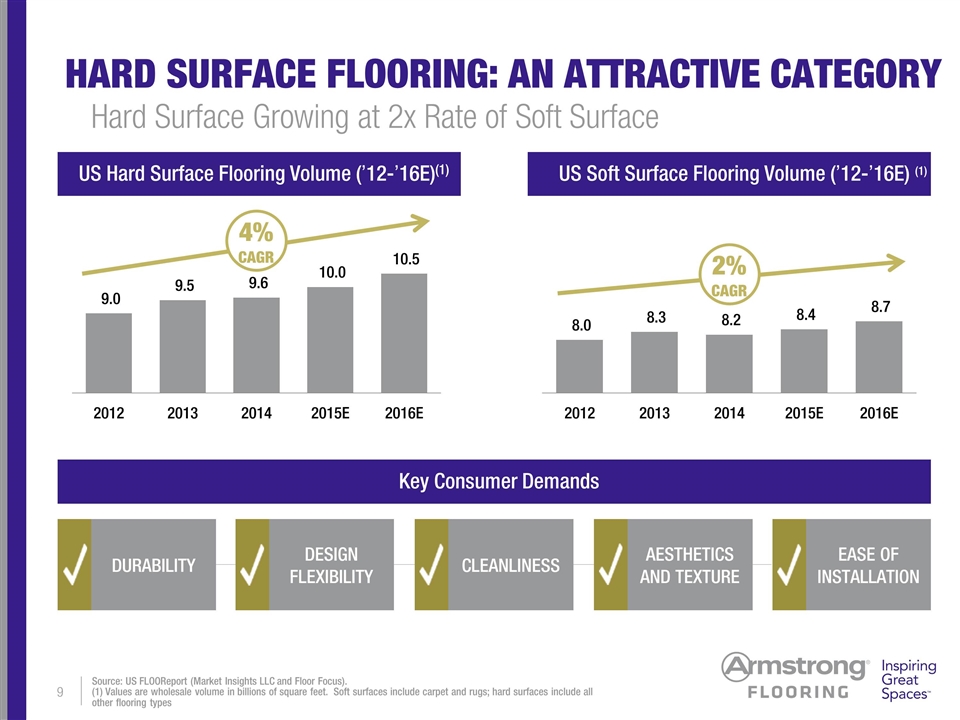

HARD SURFACE FLOORING: AN ATTRACTIVE CATEGORY US Hard Surface Flooring Volume (’12-’16E)(1) US Soft Surface Flooring Volume (’12-’16E) Key Consumer Demands DURABILITY DESIGN FLEXIBILITY EASE OF INSTALLATION CLEANLINESS AESTHETICS AND TEXTURE (1) Hard Surface Growing at 2x Rate of Soft Surface Source: US FLOOReport (Market Insights LLC and Floor Focus). (1) Values are wholesale volume in billions of square feet. Soft surfaces include carpet and rugs; hard surfaces include all other flooring types 4% CAGR 2% CAGR

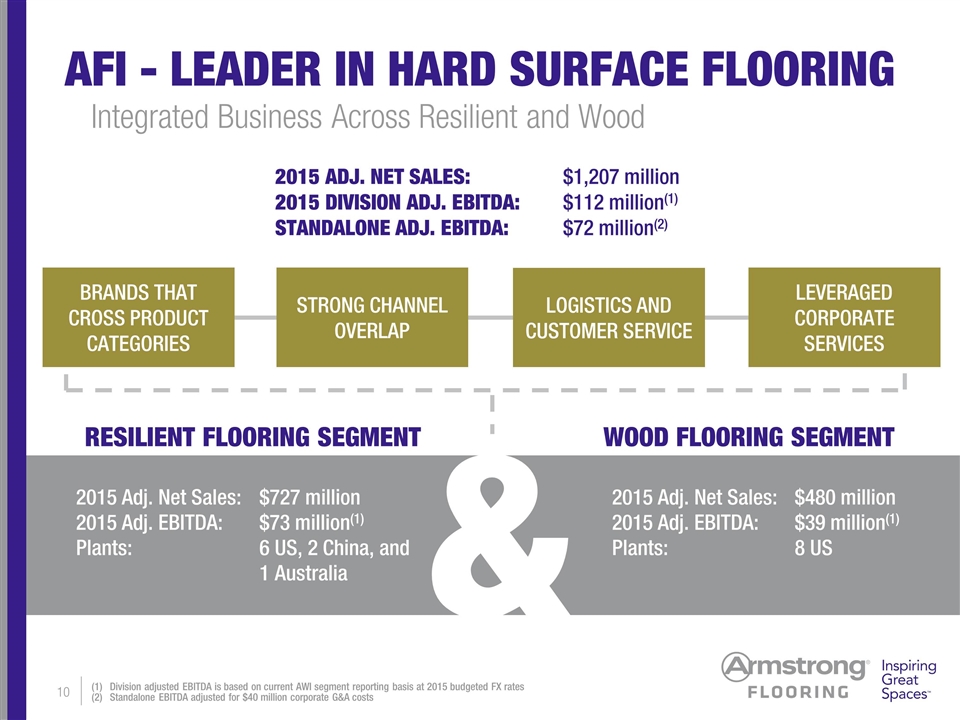

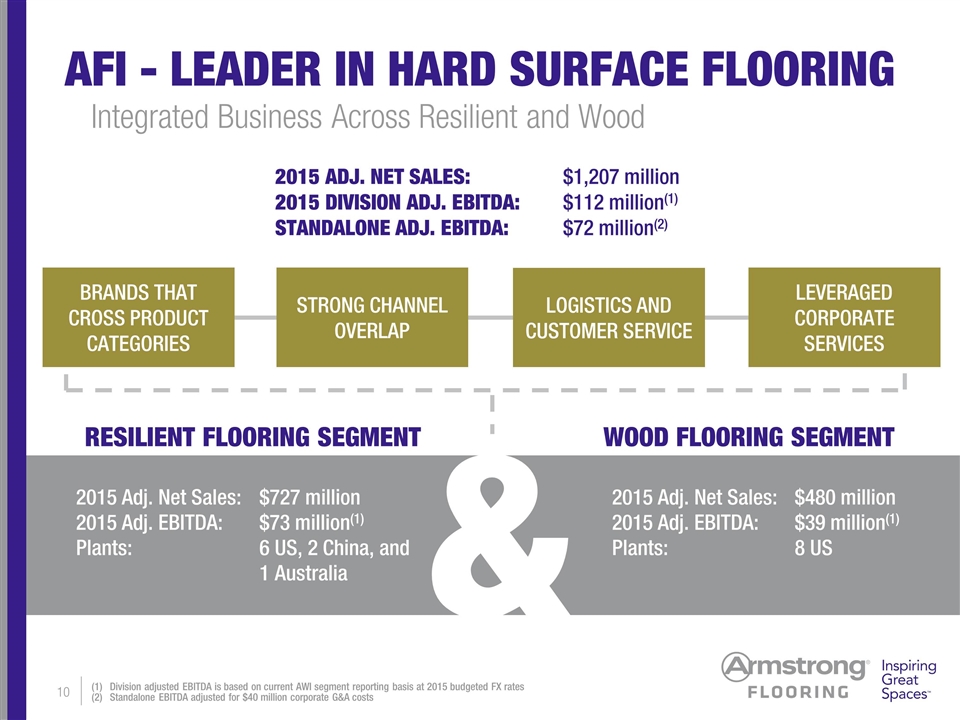

RESILIENT FLOORING SEGMENT 2015 Adj. Net Sales: 2015 Adj. EBITDA: Plants: $480 million $39 million(1) 8 US 2015 Adj. Net Sales: 2015 Adj. EBITDA: Plants: $727 million $73 million(1) 6 US, 2 China, and 1 Australia WOOD FLOORING SEGMENT & AFI - LEADER IN HARD SURFACE FLOORING Integrated Business Across Resilient and Wood Division adjusted EBITDA is based on current AWI segment reporting basis at 2015 budgeted FX rates Standalone EBITDA adjusted for $40 million corporate G&A costs LOGISTICS AND CUSTOMER SERVICE STRONG CHANNEL OVERLAP LEVERAGED CORPORATE SERVICES BRANDS THAT CROSS PRODUCT CATEGORIES 2015 ADJ. NET SALES: $1,207 million 2015 DIVISION ADJ. EBITDA: $112 million(1) STANDALONE ADJ. EBITDA: $72 million(2)

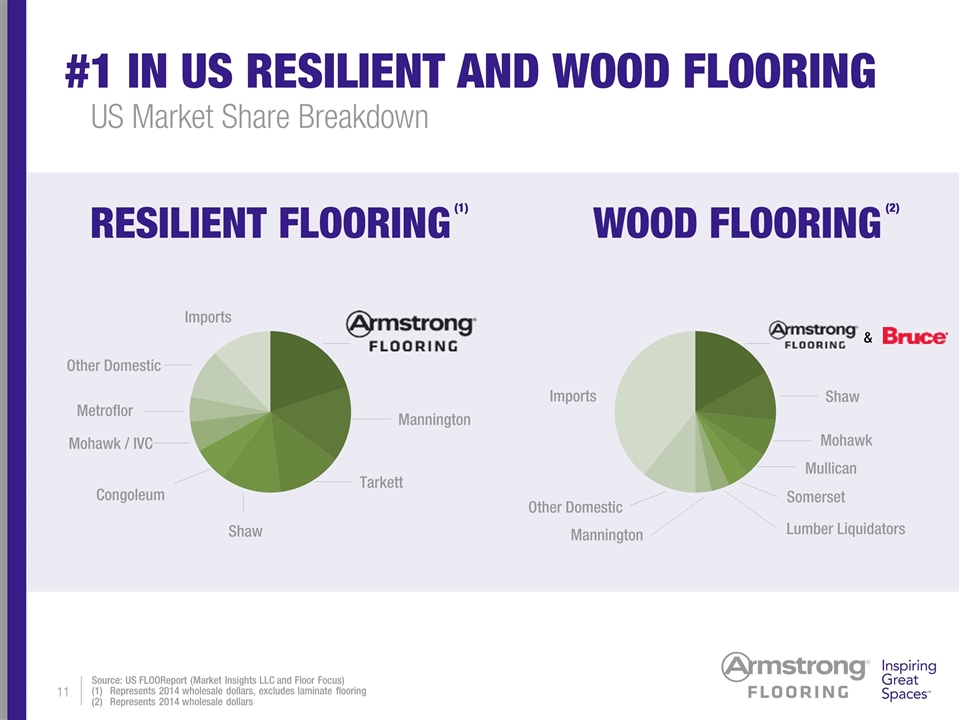

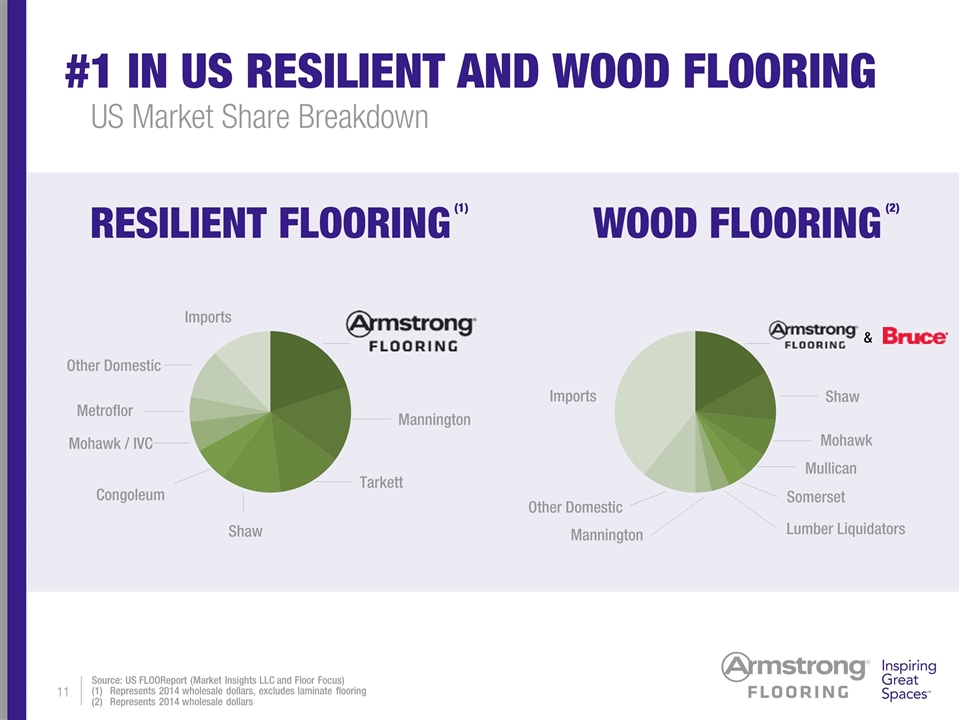

#1 IN US RESILIENT AND WOOD FLOORING RESILIENT FLOORING Other Domestic Imports Shaw Mohawk & Mullican Somerset Lumber Liquidators Mannington WOOD FLOORING (1) (2) US Market Share Breakdown Source: US FLOOReport (Market Insights LLC and Floor Focus) Represents 2014 wholesale dollars, excludes laminate flooring Represents 2014 wholesale dollars Mohawk / IVC Imports Mannington Other Domestic Metroflor Congoleum Tarkett Shaw

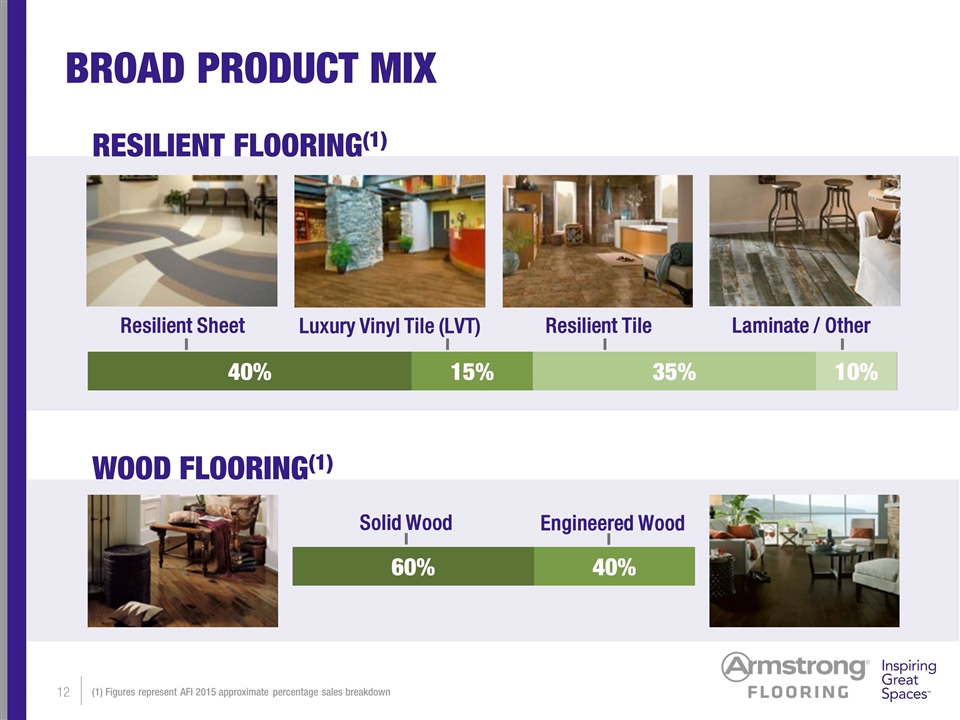

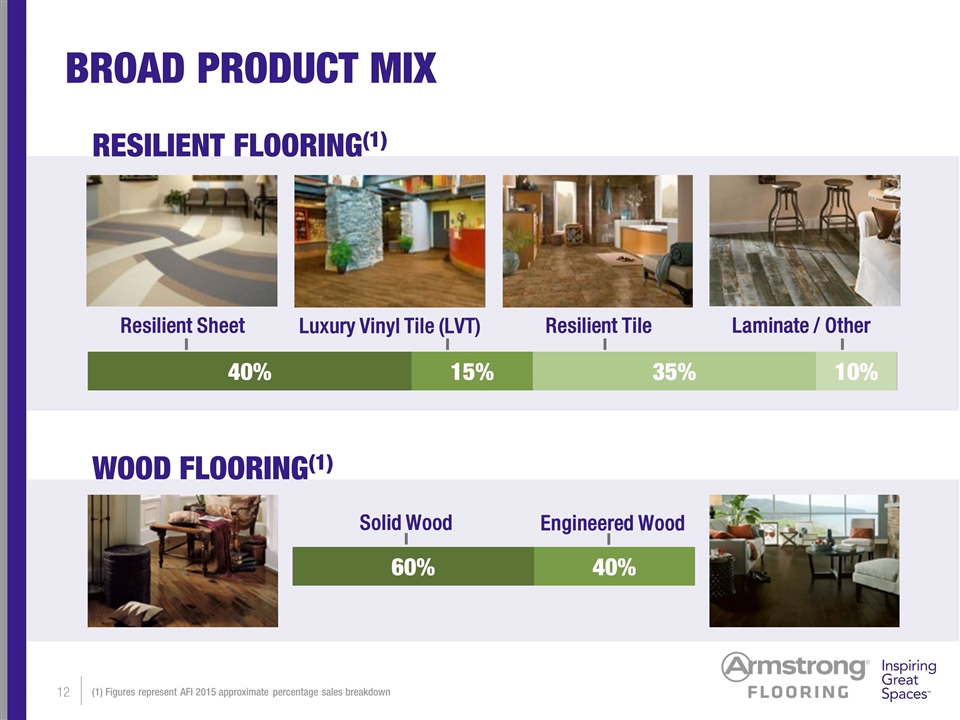

WOOD FLOORING(1) RESILIENT FLOORING(1) BROAD PRODUCT MIX Engineered Wood Solid Wood Luxury Vinyl Tile (LVT) Resilient Tile Resilient Sheet Laminate / Other (1) Figures represent AFI 2015 approximate percentage sales breakdown

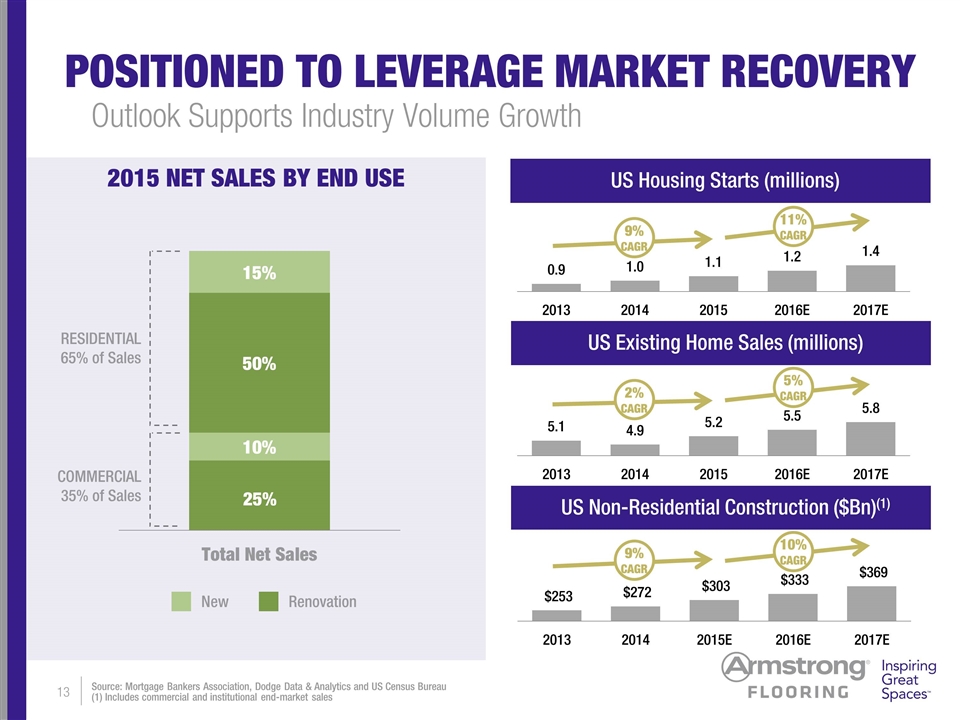

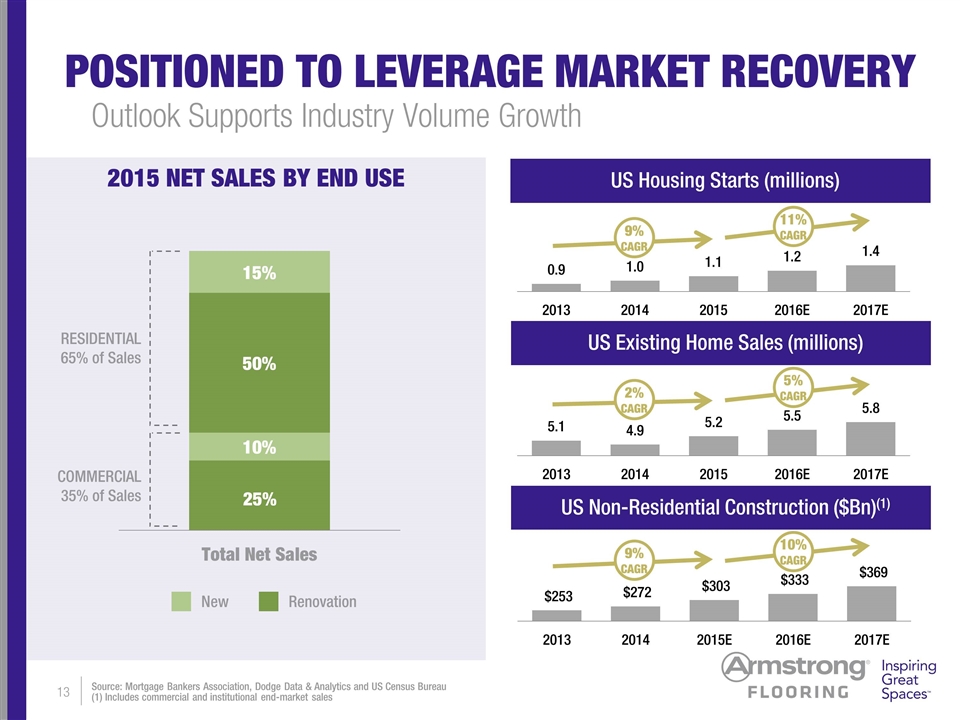

POSITIONED TO LEVERAGE MARKET RECOVERY Outlook Supports Industry Volume Growth US Housing Starts (millions) US Existing Home Sales (millions) US Non-Residential Construction ($Bn)(1) Source: Mortgage Bankers Association, Dodge Data & Analytics and US Census Bureau (1) Includes commercial and institutional end-market sales 5% CAGR 2% CAGR 9% CAGR 10% CAGR 9% CAGR 11% CAGR 2015 NET SALES BY END USE RESIDENTIAL 65% of Sales COMMERCIAL 35% of Sales 25% New Renovation

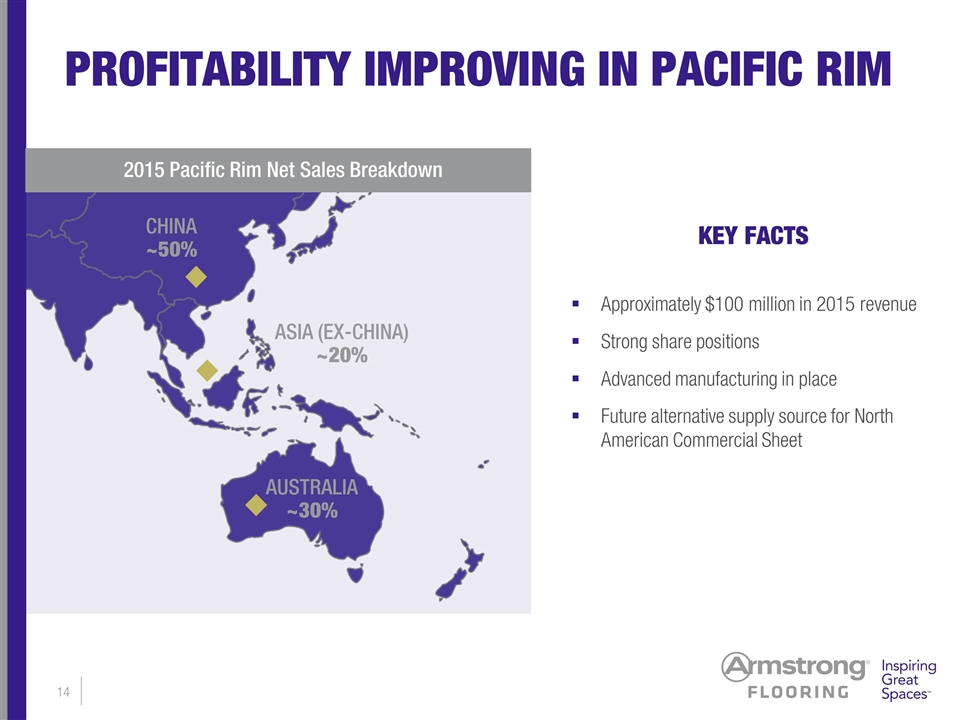

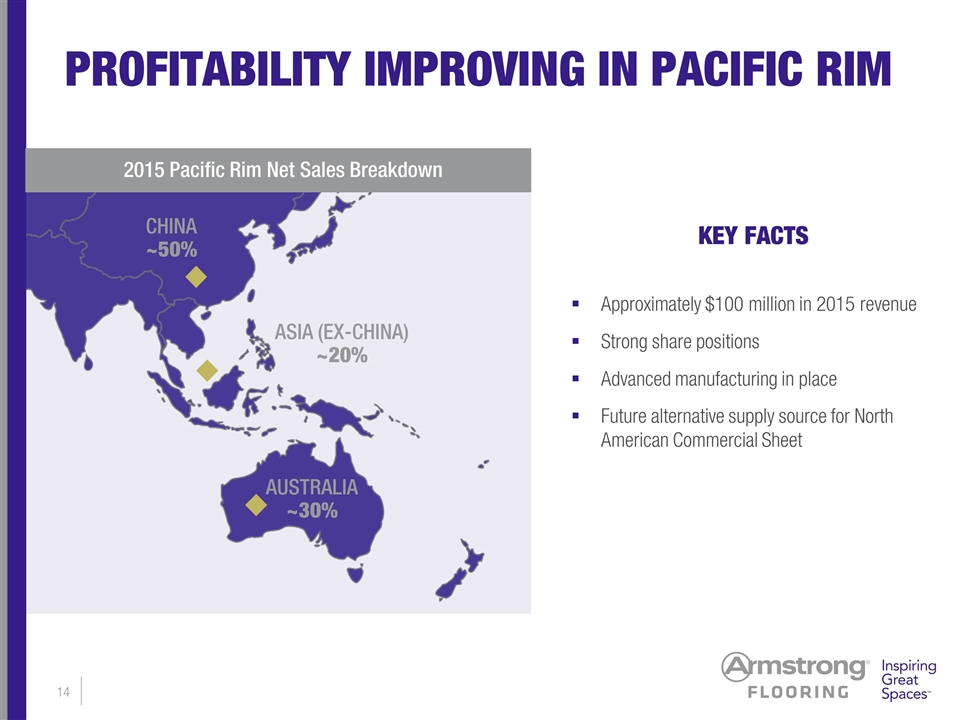

PROFITABILITY IMPROVING IN PACIFIC RIM CHINA ~50% AUSTRALIA ~30% ASIA (EX-CHINA) ~20% KEY FACTS 2015 Pacific Rim Net Sales Breakdown Approximately $100 million in 2015 revenue Strong share positions Advanced manufacturing in place Future alternative supply source for North American Commercial Sheet

AGENDA OUR BUSINESS INVESTMENT HIGHLIGHTS FINANCIAL OUTLOOK

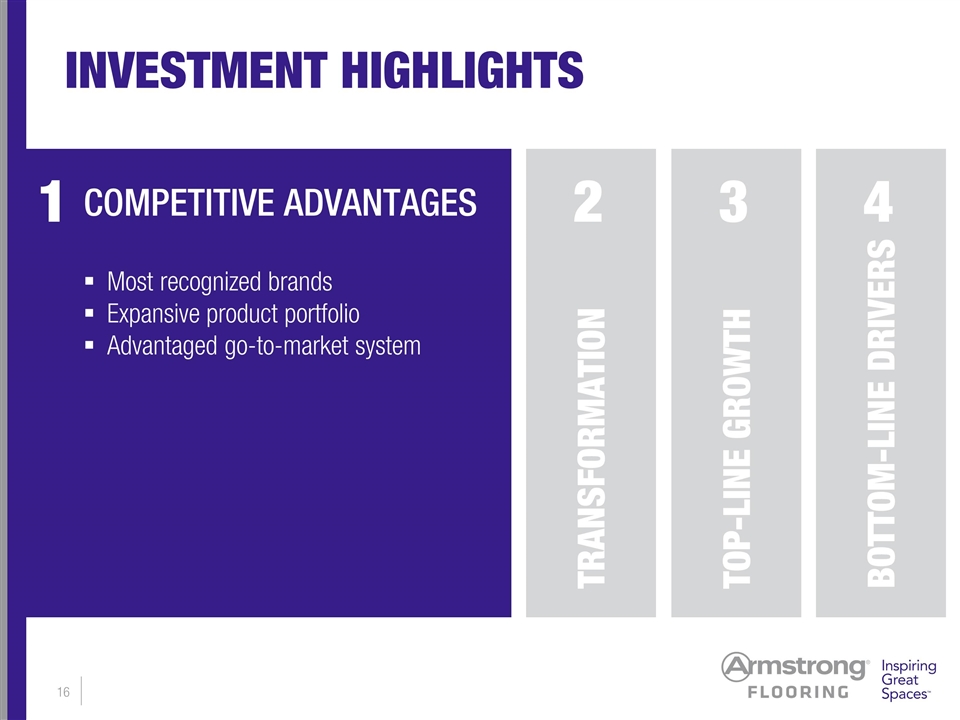

INVESTMENT HIGHLIGHTS COMPETITIVE ADVANTAGES 1 Most recognized brands Expansive product portfolio Advantaged go-to-market system TRANSFORMATION TOP-LINE GROWTH BOTTOM-LINE DRIVERS 2 3 4

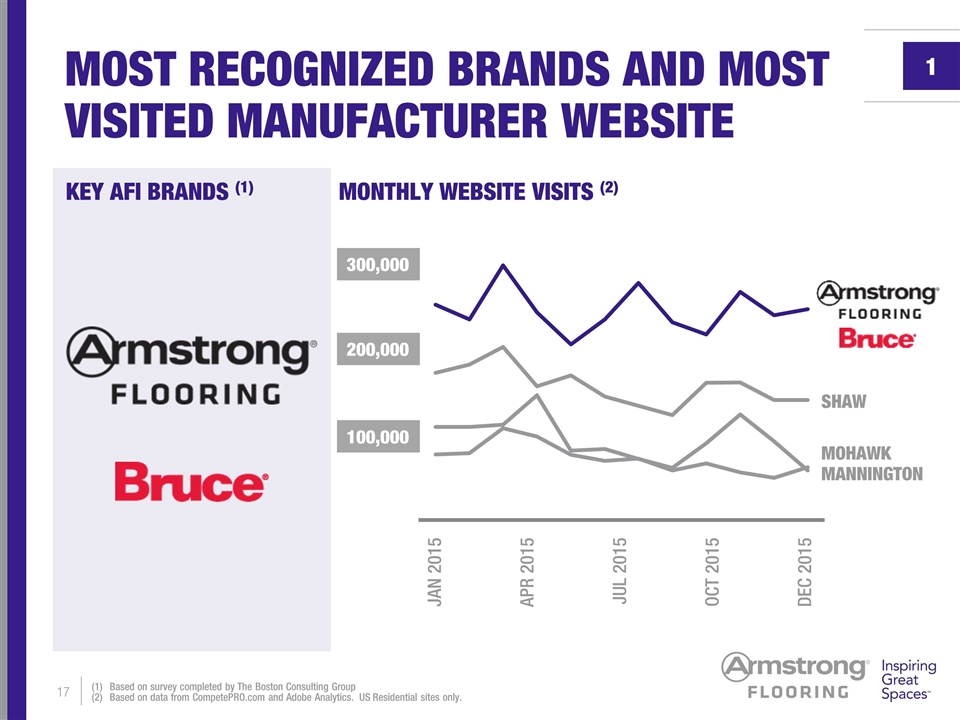

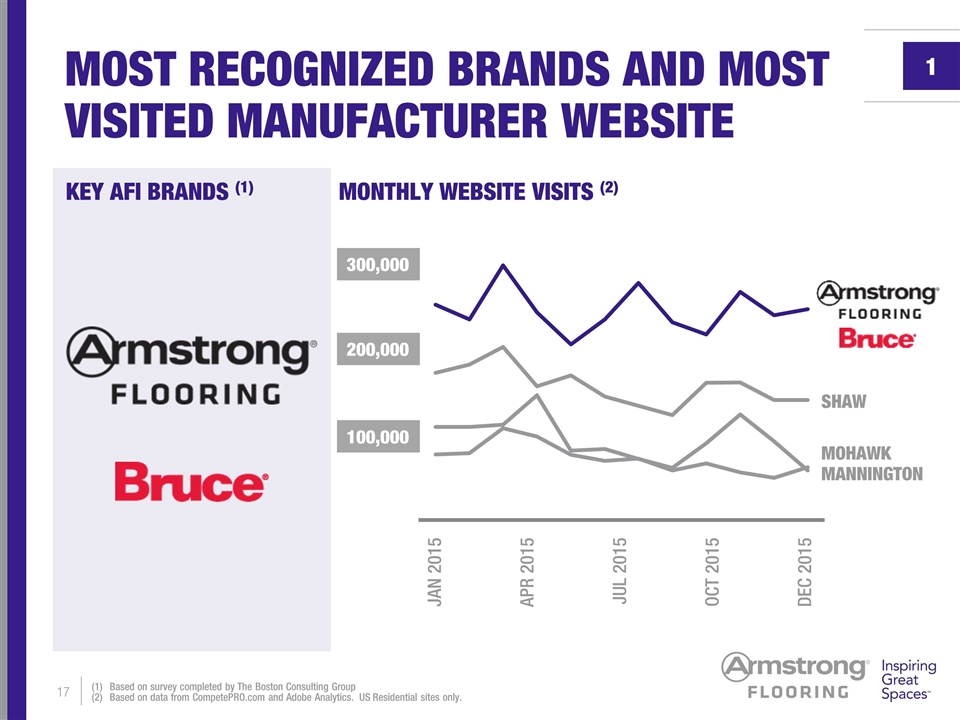

MOST RECOGNIZED BRANDS AND MOST VISITED MANUFACTURER WEBSITE 1 MONTHLY WEBSITE VISITS (2) KEY AFI BRANDS (1) Based on survey completed by The Boston Consulting Group Based on data from CompetePRO.com and Adobe Analytics. US Residential sites only. SHAW MOHAWK MANNINGTON JAN 2015 APR 2015 JUL 2015 OCT 2015 DEC 2015 300,000 200,000 100,000

EXPANSIVE PRODUCT PORTFOLIO Leadership Position Creates Opportunity 1 AFI MARKET POSITION Source: US FLOOReport (Market Insights LLC and Floor Focus) (1) LVT includes both Residential and Commercial LVT products VCT Commercial Sheet LVT (1) Linoleum Residential Vinyl Tile Solid Wood Engineered Wood Residential Sheet New pic #1 #1 #1 #1 #2 #1 #1 #4

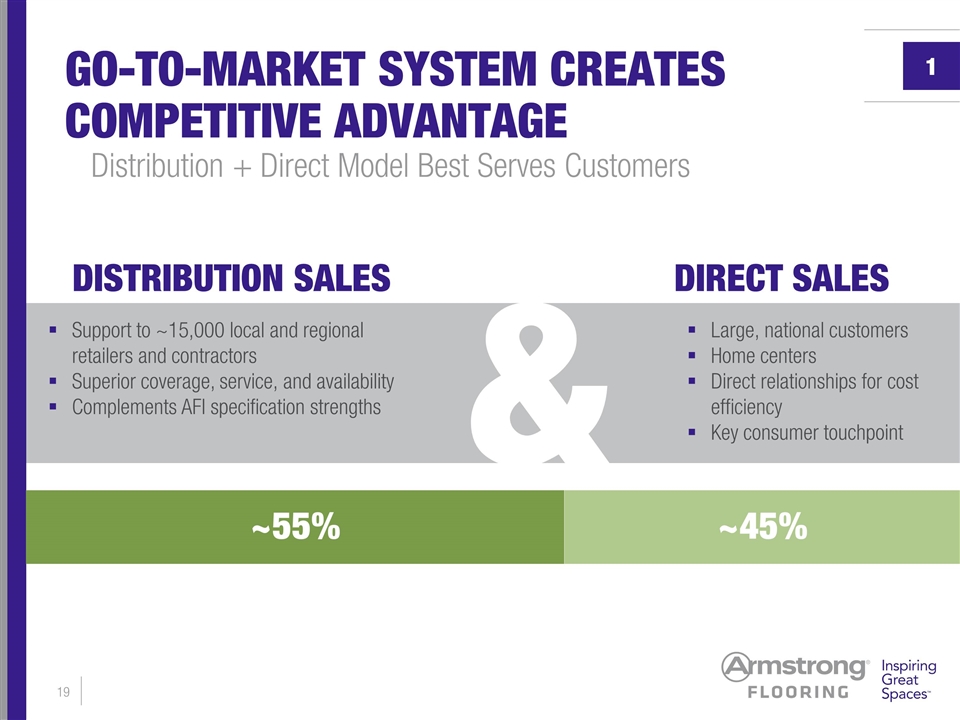

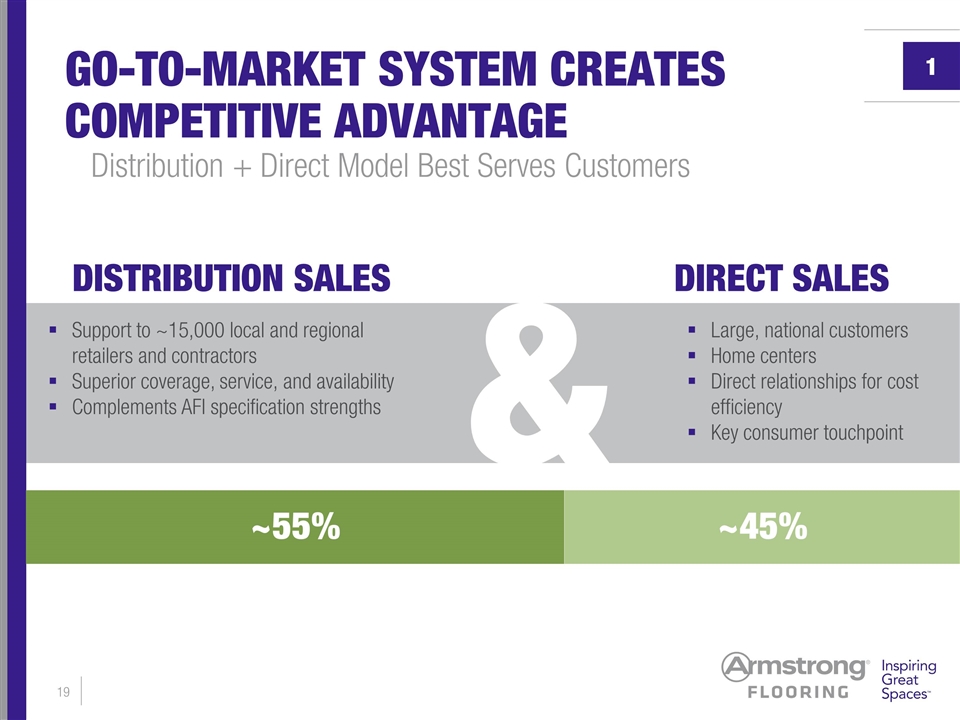

GO-TO-MARKET SYSTEM CREATES COMPETITIVE ADVANTAGE Distribution + Direct Model Best Serves Customers 1 DISTRIBUTION SALES DIRECT SALES & Large, national customers Home centers Direct relationships for cost efficiency Key consumer touchpoint Support to ~15,000 local and regional retailers and contractors Superior coverage, service, and availability Complements AFI specification strengths ~55% ~45%

INVESTMENT HIGHLIGHTS TRANSFORMATION 2 Positioning to high growth categories Renewed focus on distribution Improved innovation process COMPETITIVE ADV. TOP-LINE GROWTH BOTTOM-LINE DRIVERS 3 4 1

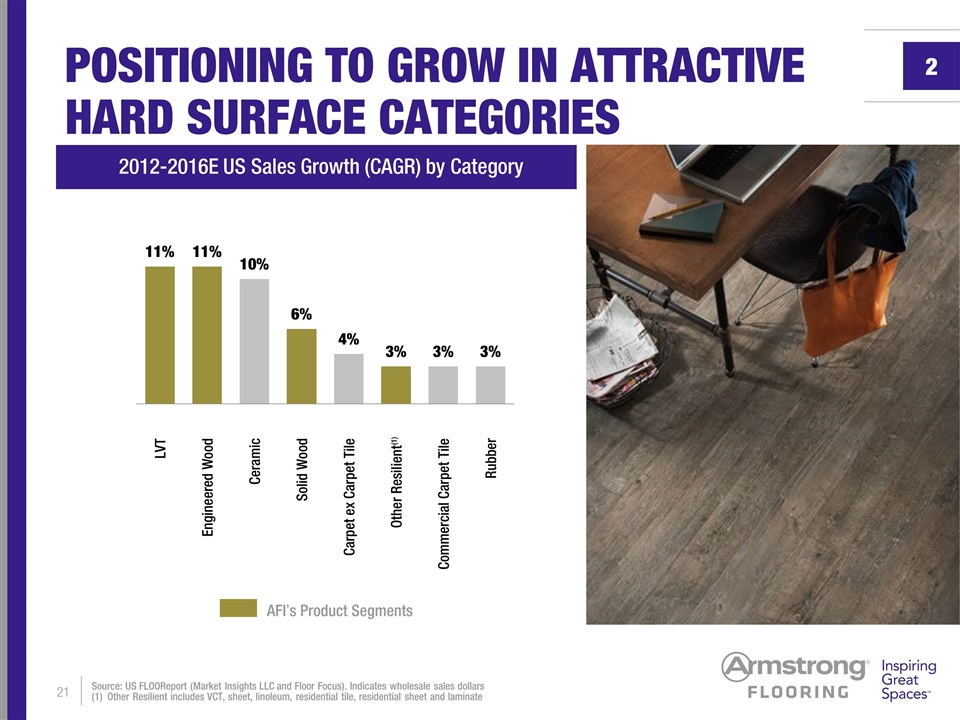

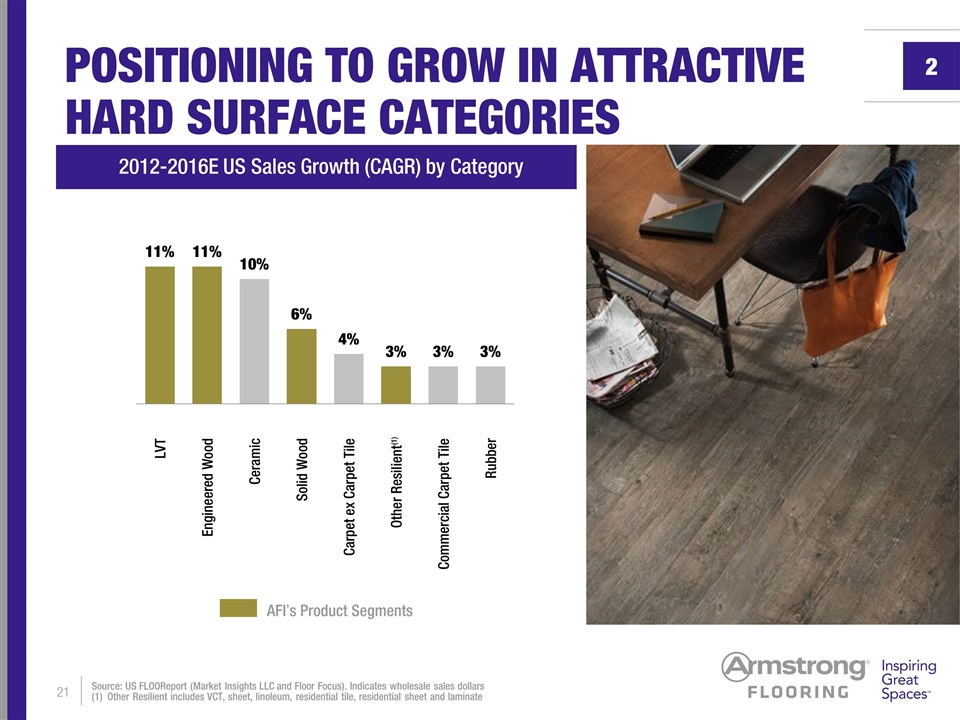

POSITIONING TO GROW IN ATTRACTIVE HARD SURFACE CATEGORIES Source: US FLOOReport (Market Insights LLC and Floor Focus). Indicates wholesale sales dollars (1) Other Resilient includes VCT, sheet, linoleum, residential tile, residential sheet and laminate AFI’s Product Segments (1) 2012-2016E US Sales Growth (CAGR) by Category 2

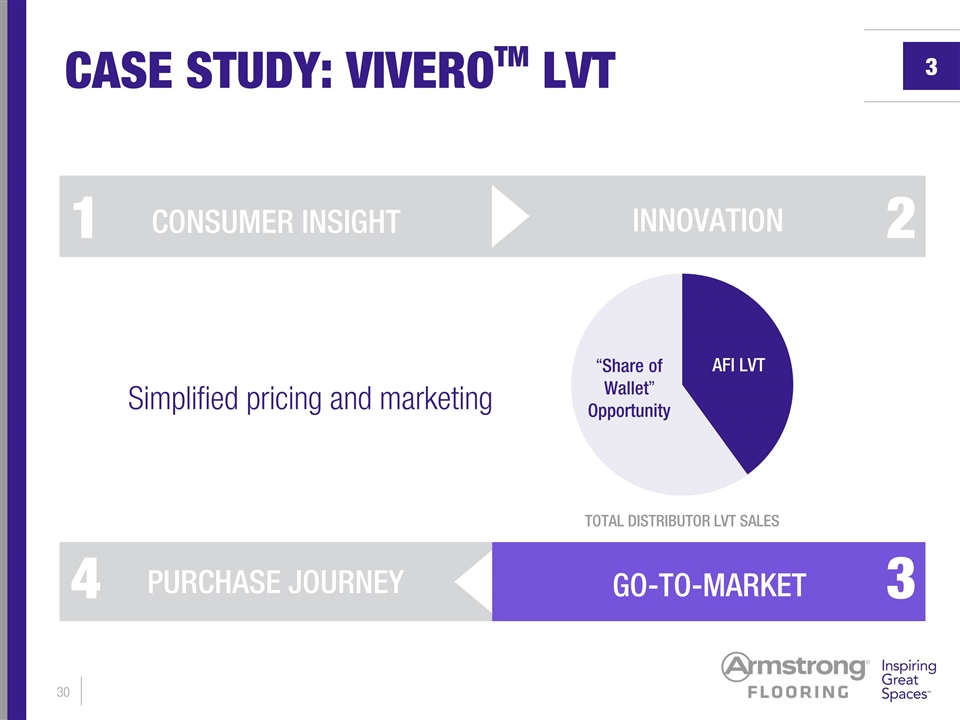

WINNING WITH DISTRIBUTION OPPORTUNITY TO DOUBLE CURRENT DISTRIBUTOR SALES 2 Source: Floor Covering Weekly and AFI internal estimates DISTRIBUTION INITIATIVES DISTRIBUTOR “SHARE OF WALLET” OPPORTUNITY PERCENT OF AFI DISTRIBUTOR SALES IN 2015 – TOTAL $2.6B Current Sales of AFI Products Addressable Opportunity Non – AFI Products STRATEGIC ALIGNMENT GREATER COMMUNICATION STREAMLINED PROCESSES JOINT DEMAND GENERATION ~1/3 ~1/3 ~1/3

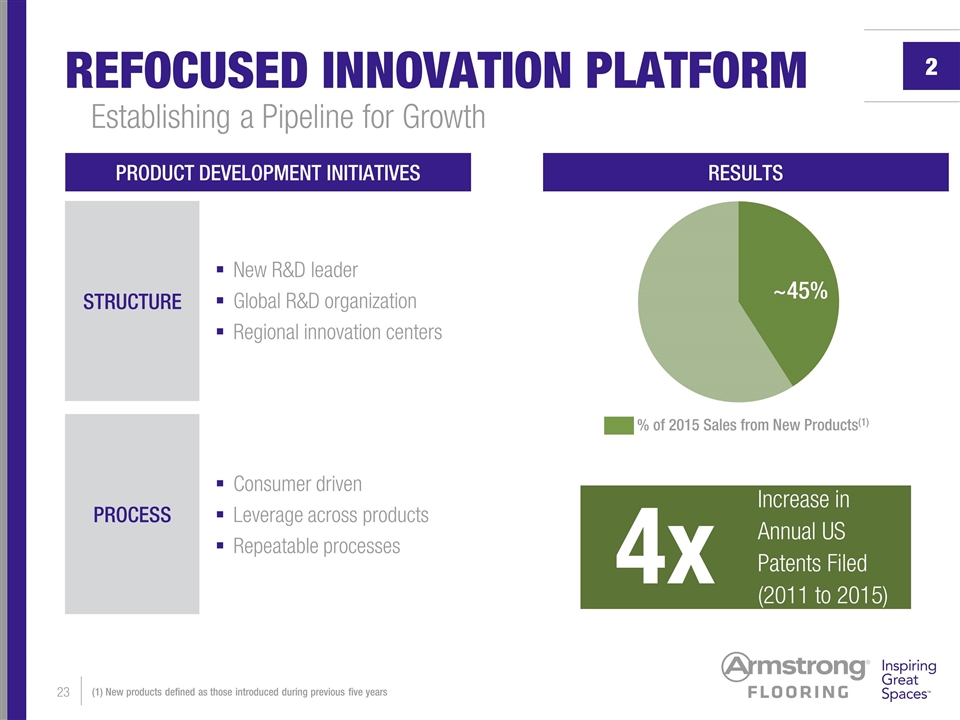

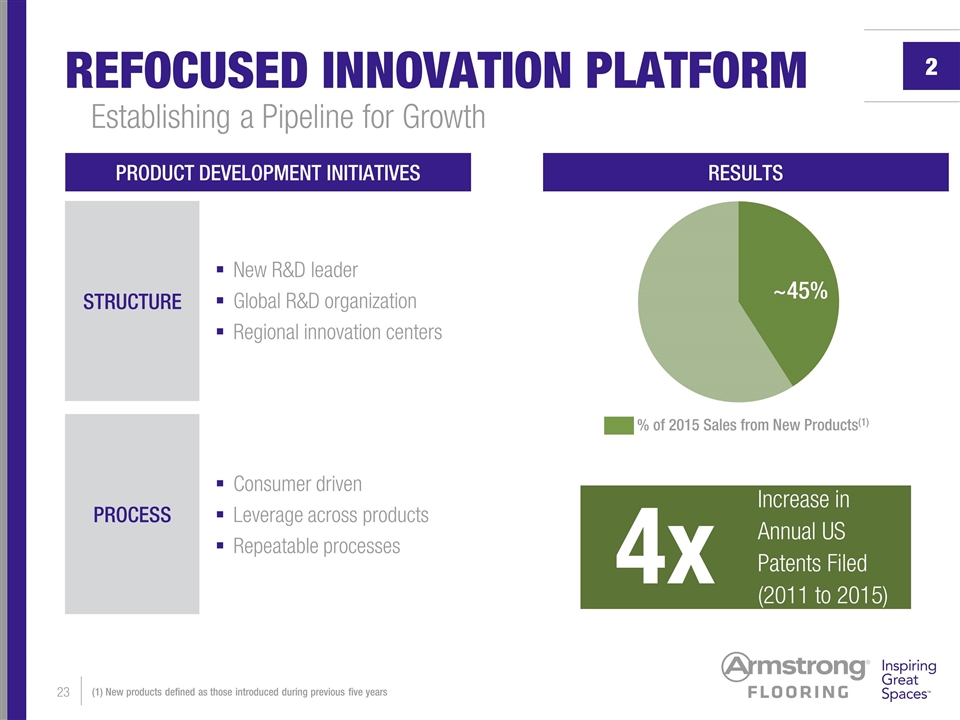

Establishing a Pipeline for Growth New R&D leader Global R&D organization Regional innovation centers STRUCTURE PROCESS Consumer driven Leverage across products Repeatable processes % of 2015 Sales from New Products(1) ~45% (1) New products defined as those introduced during previous five years 2 REFOCUSED INNOVATION PLATFORM 4x Increase in Annual US Patents Filed (2011 to 2015) PRODUCT DEVELOPMENT INITIATIVES RESULTS

INCREASED RATE OF PRODUCT INNOVATION DIAMOND10™ Technology Installation Materials Design Performance Plus™ with Acrylic Impregnation VIVERO™ Luxury Vinyl Tile LUXE PLANK® with Rigid Core Technology Striations BBT™ Bio-flooring Fastak™ and I-Set™ Durability 2 Alterna™ Luxury Vinyl Tile and Architectural Remnants™ Laminate Performance Plus™ VIVERO™ with IntegriLock™

INVESTMENT HIGHLIGHTS TOP-LINE GROWTH 3 Consumer-centric innovation VIVERO™ LVT Case Study COMPETITIVE ADV. 1 BOTTOM-LINE DRIVERS 4 TRANSFORMATION 2

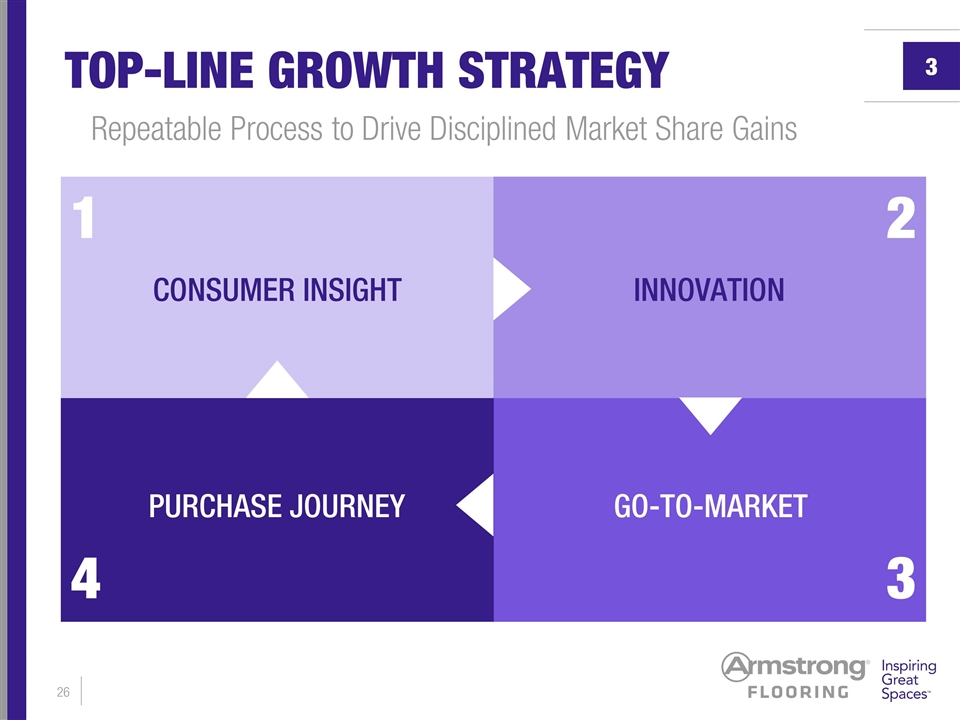

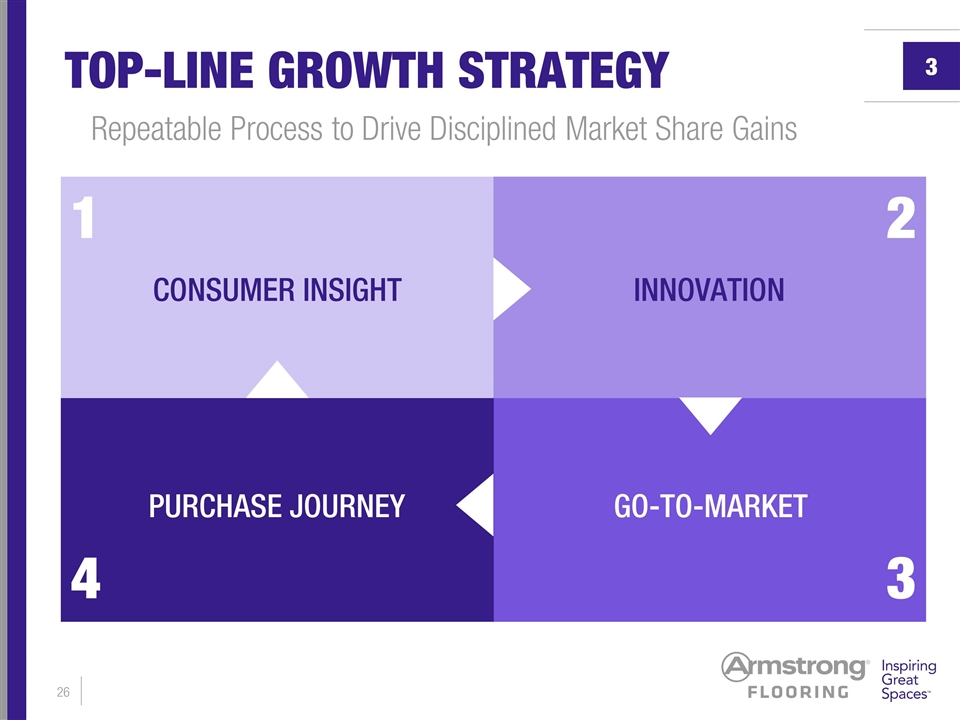

TOP-LINE GROWTH STRATEGY Repeatable Process to Drive Disciplined Market Share Gains 4 3 2 1 3 CONSUMER INSIGHT PURCHASE JOURNEY INNOVATION GO-TO-MARKET

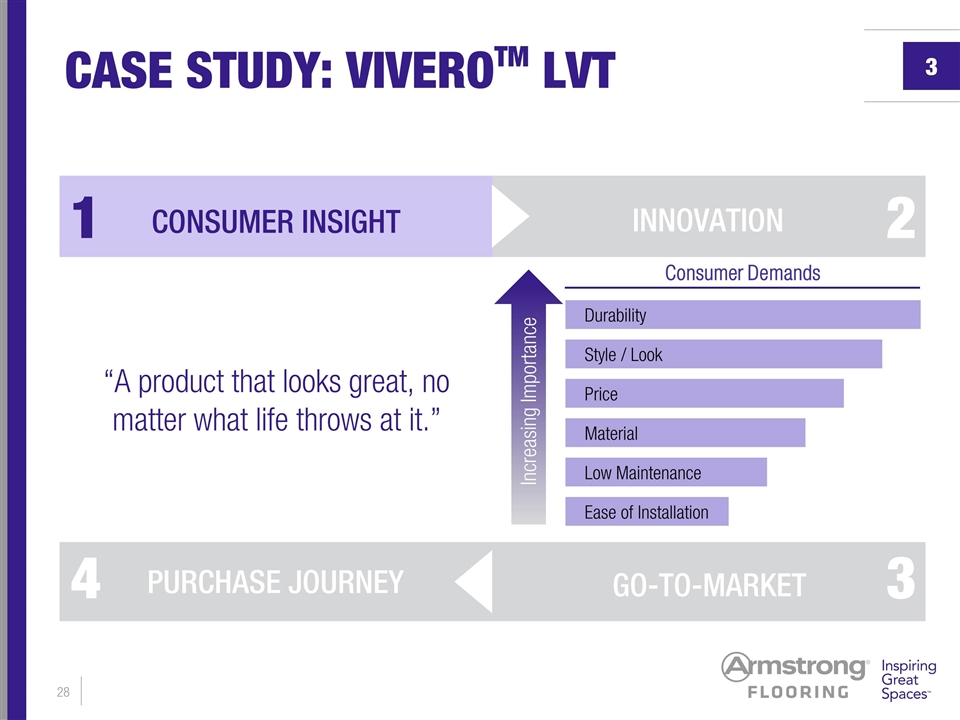

CASE STUDY: VIVEROTM LVT AFI’s new Luxury Vinyl Tile with DIAMOND10™ Technology

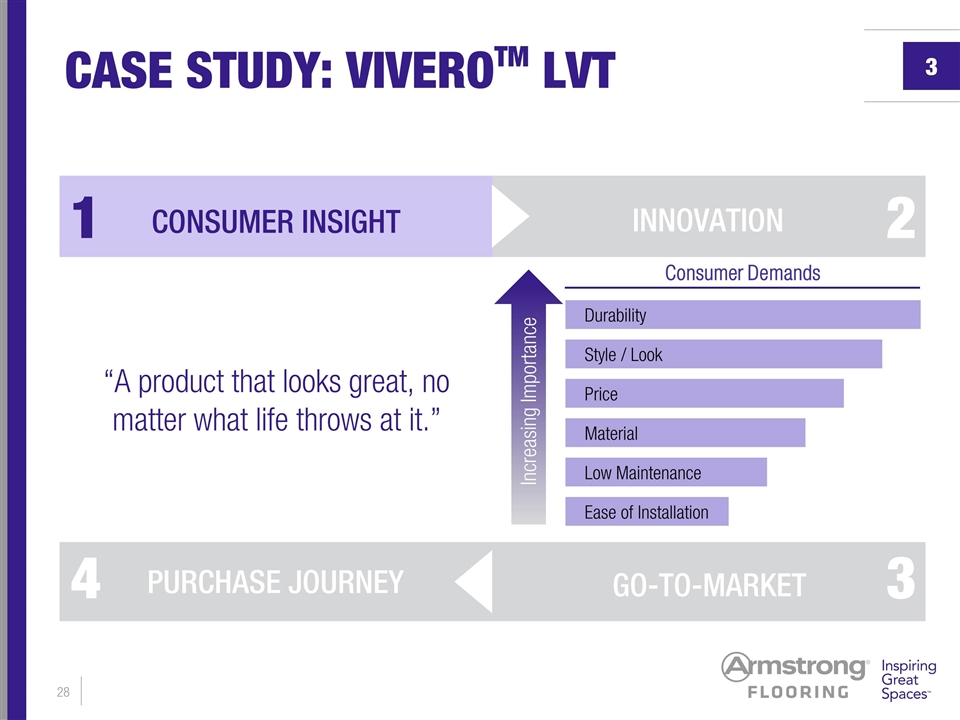

CASE STUDY: VIVEROTM LVT 3 CONSUMER INSIGHT PURCHASE JOURNEY INNOVATION GO-TO-MARKET “A product that looks great, no matter what life throws at it.” 4 3 2 1 Consumer Demands Increasing Importance Durability Style / Look Price Material Low Maintenance Ease of Installation

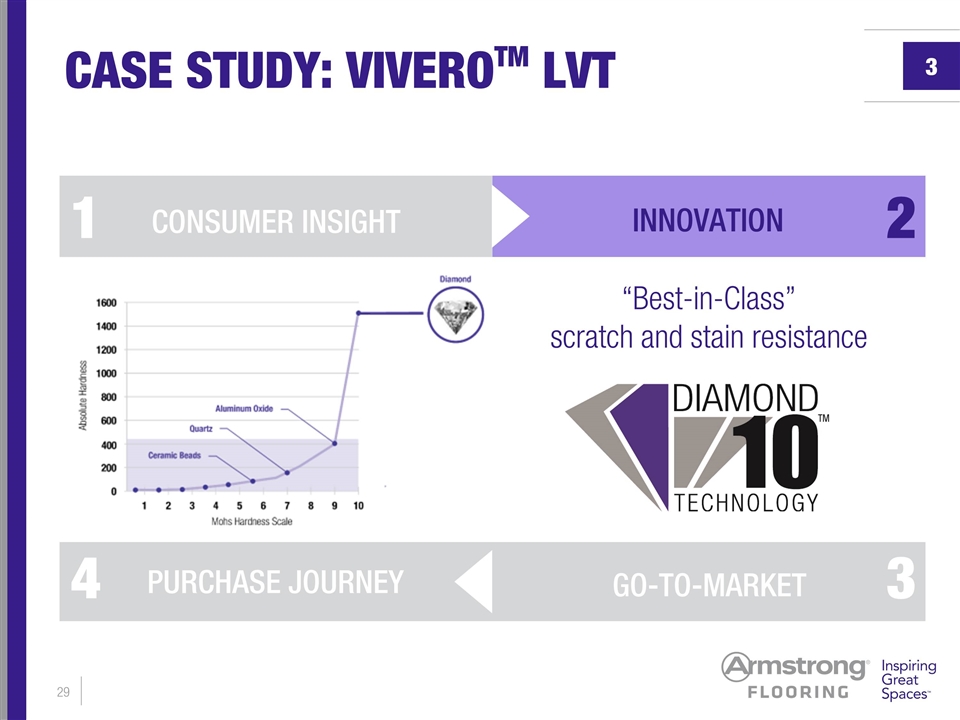

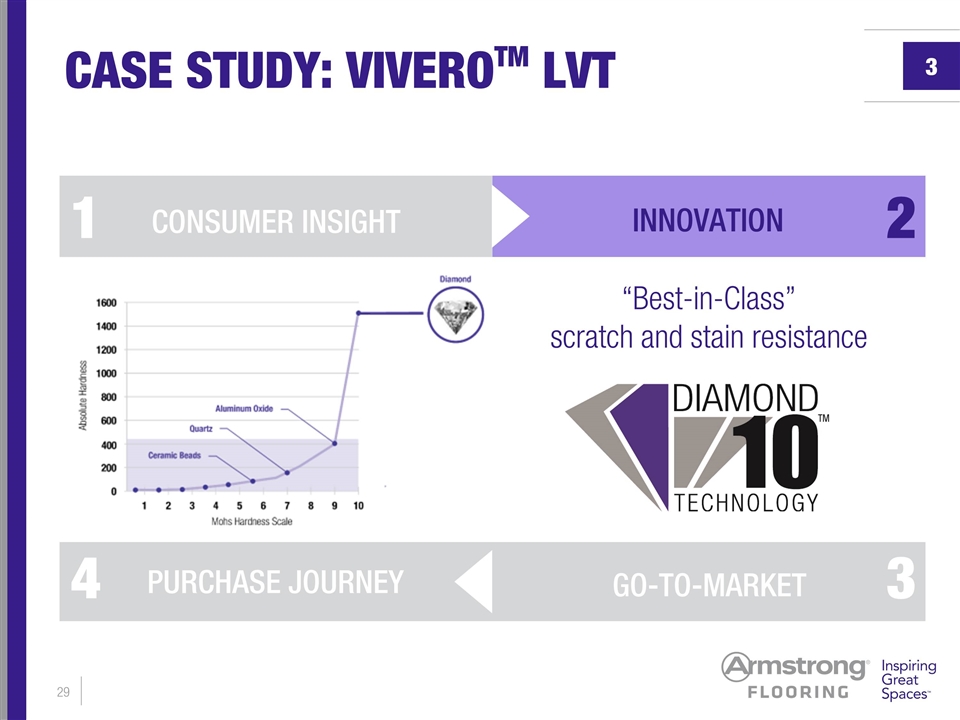

3 CONSUMER INSIGHT INNOVATION 2 1 PURCHASE JOURNEY GO-TO-MARKET 4 3 “Best-in-Class” scratch and stain resistance CASE STUDY: VIVEROTM LVT

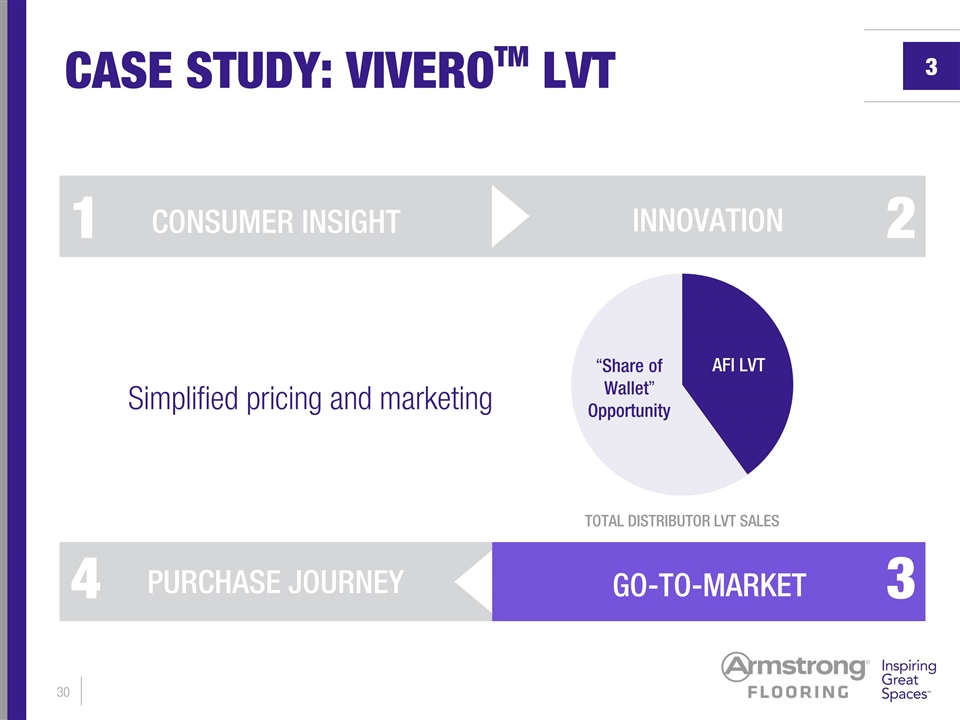

CASE STUDY: VIVEROTM LVT 3 Simplified pricing and marketing “Share of Wallet” Opportunity AFI LVT TOTAL DISTRIBUTOR LVT SALES CONSUMER INSIGHT INNOVATION 2 1 PURCHASE JOURNEY GO-TO-MARKET 4 3

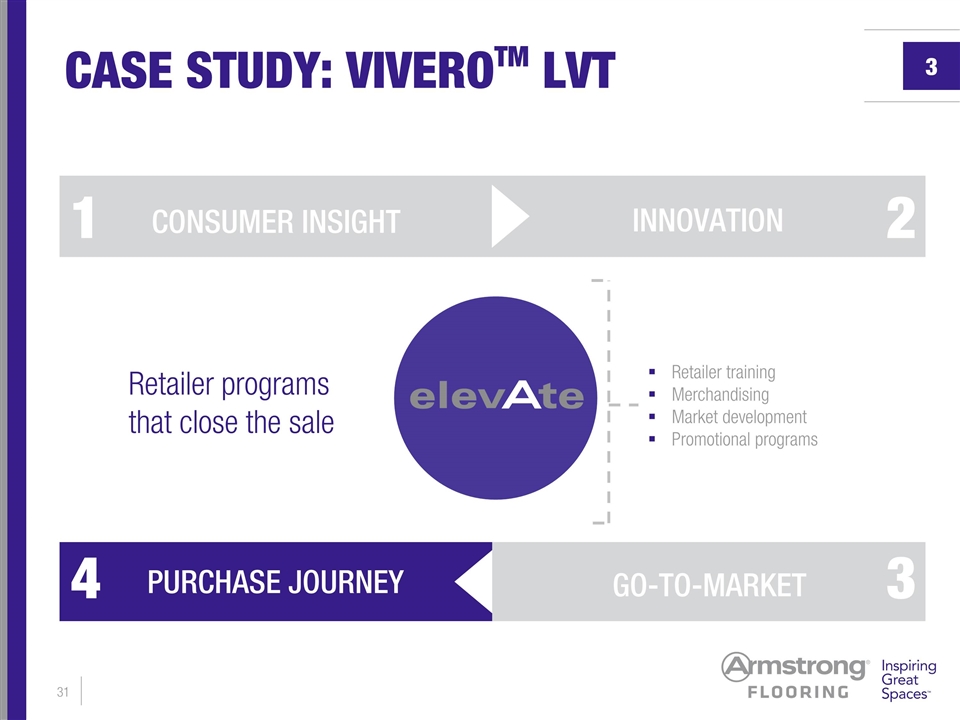

CASE STUDY: VIVEROTM LVT 3 Retailer training Merchandising Market development Promotional programs Retailer programs that close the sale CONSUMER INSIGHT INNOVATION 2 1 PURCHASE JOURNEY GO-TO-MARKET 4 3

VIDEO PLACEHOLDER HERE To view the video included in this presentation, visit: www.armstrong.com/diamond10

INVESTMENT HIGHLIGHTS BOTTOM-LINE DRIVERS 4 Portfolio mix Wood economics Continuous improvement COMPETITIVE ADV. 1 TRANSFORMATION 2 TOP-LINE GROWTH 3

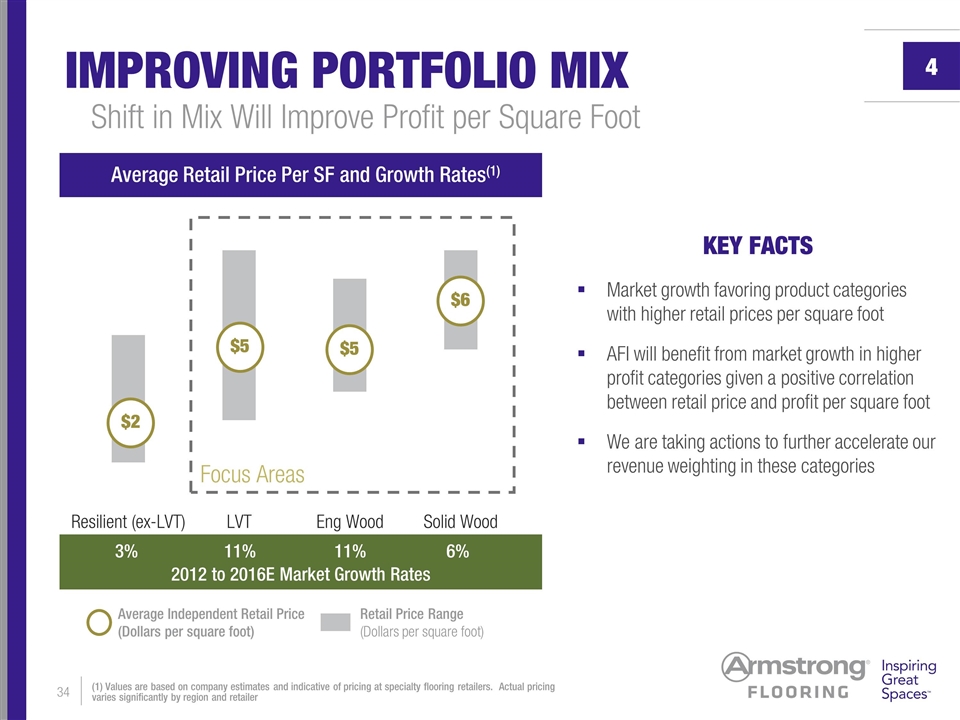

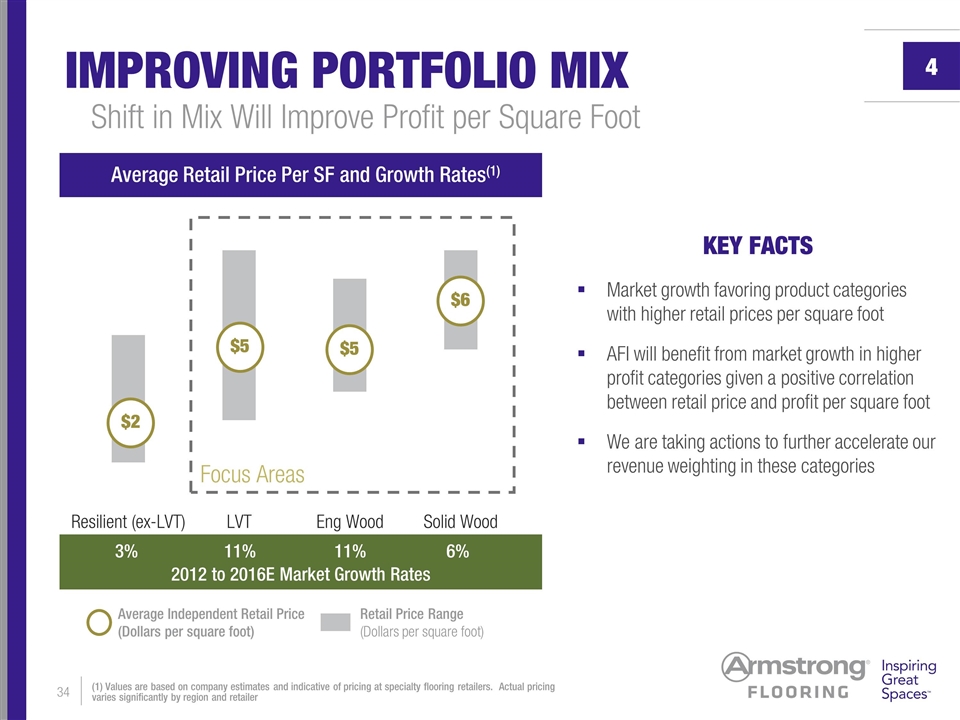

2012 to 2016E Market Growth Rates IMPROVING PORTFOLIO MIX Average Retail Price Per SF and Growth Rates(1) 4 (1) Values are based on company estimates and indicative of pricing at specialty flooring retailers. Actual pricing varies significantly by region and retailer KEY FACTS Market growth favoring product categories with higher retail prices per square foot AFI will benefit from market growth in higher profit categories given a positive correlation between retail price and profit per square foot We are taking actions to further accelerate our revenue weighting in these categories $6 $5 $5 $2 Average Independent Retail Price (Dollars per square foot) Retail Price Range (Dollars per square foot) 3% 11% 11% 6% Focus Areas Shift in Mix Will Improve Profit per Square Foot

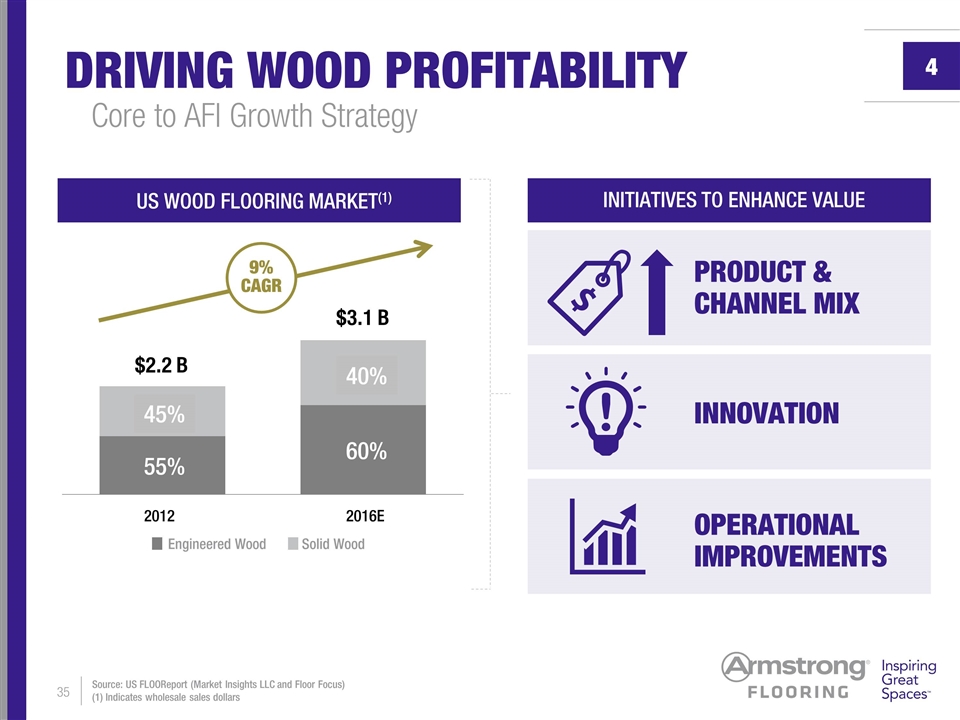

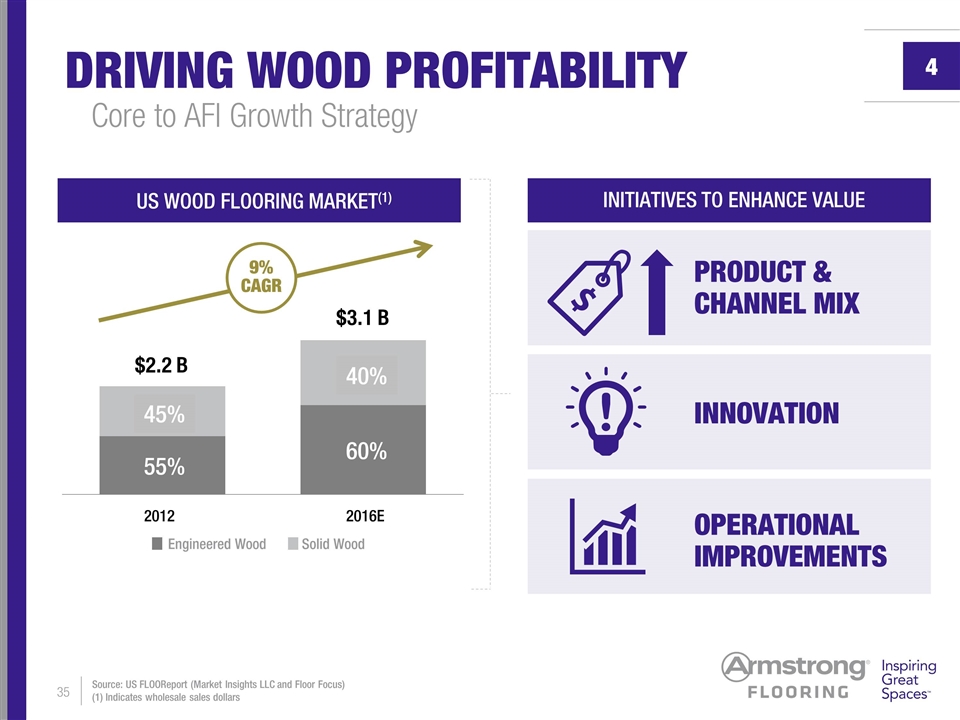

DRIVING WOOD PROFITABILITY Core to AFI Growth Strategy Engineered Wood Solid Wood $2.2 B $3.1 B 2012 2016E US WOOD FLOORING MARKET(1) Source: US FLOOReport (Market Insights LLC and Floor Focus) (1) Indicates wholesale sales dollars 4 9% CAGR INITIATIVES TO ENHANCE VALUE INNOVATION PRODUCT & CHANNEL MIX OPERATIONAL IMPROVEMENTS 45% 40% 55% 60%

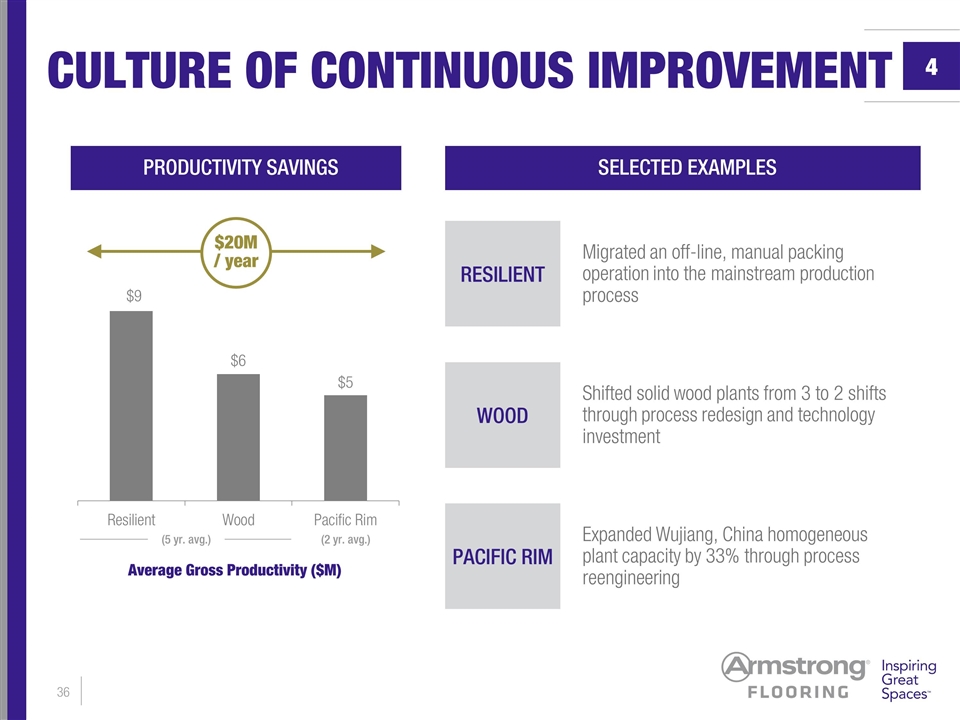

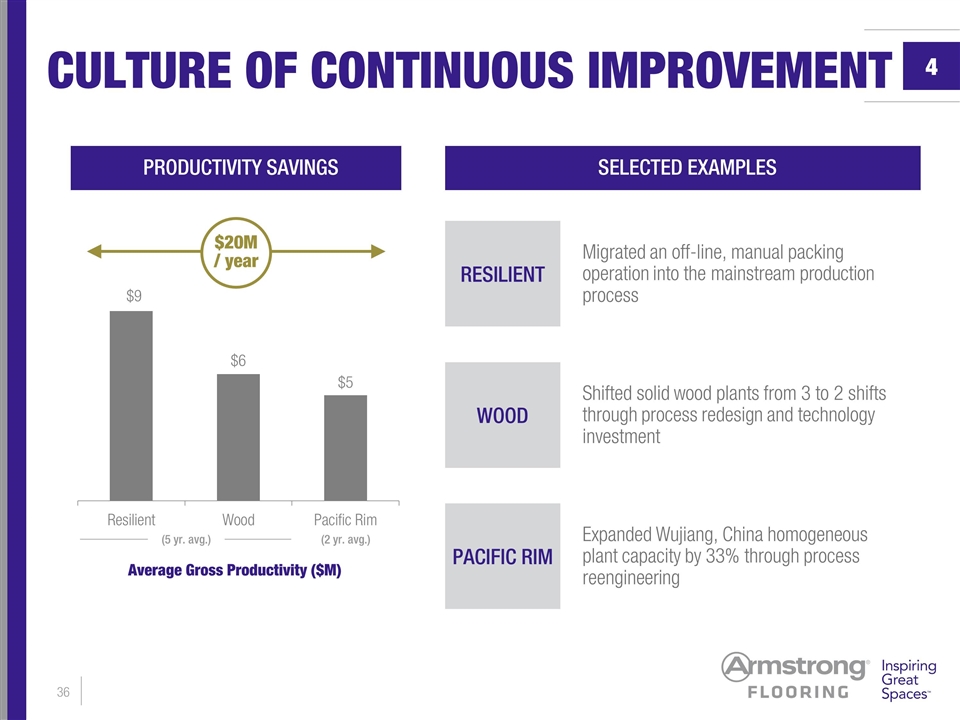

CULTURE OF CONTINUOUS IMPROVEMENT PRODUCTIVITY SAVINGS 4 (5 yr. avg.) $6 $9 $5 (2 yr. avg.) Average Gross Productivity ($M) $20M / year SELECTED EXAMPLES WOOD Shifted solid wood plants from 3 to 2 shifts through process redesign and technology investment RESILIENT Migrated an off-line, manual packing operation into the mainstream production process PACIFIC RIM Expanded Wujiang, China homogeneous plant capacity by 33% through process reengineering

AGENDA OUR BUSINESS INVESTMENT HIGHLIGHTS FINANCIAL OUTLOOK

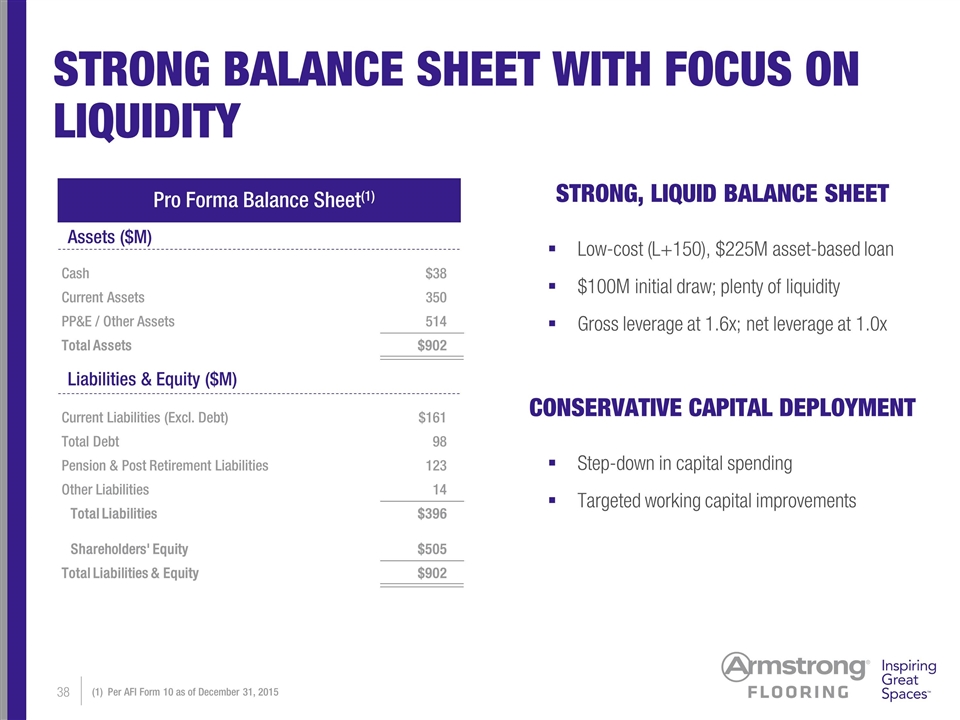

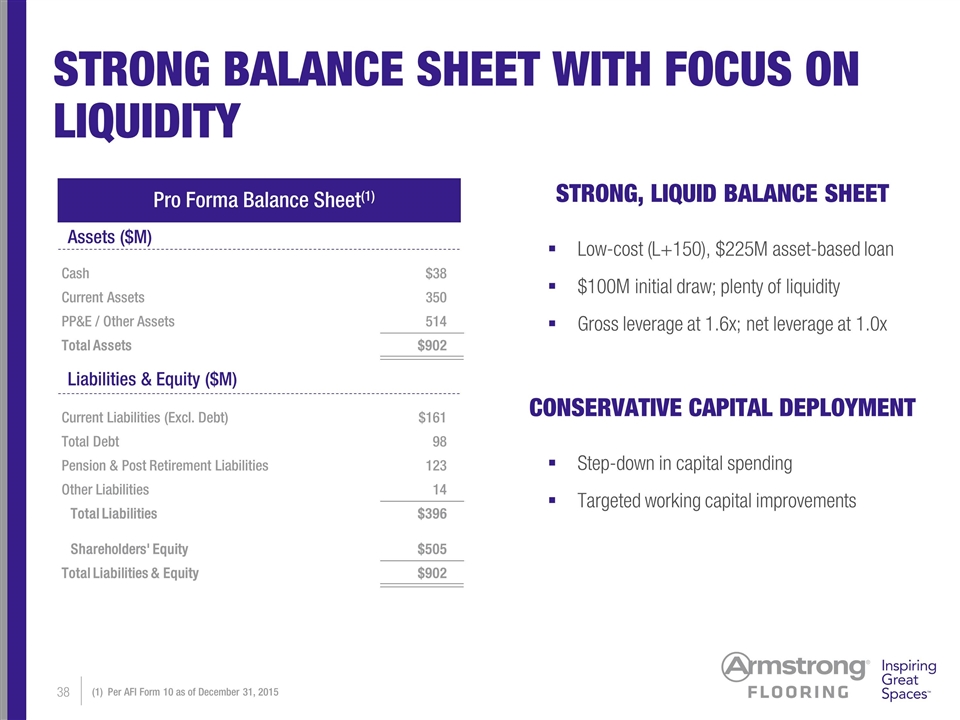

STRONG BALANCE SHEET WITH FOCUS ON LIQUIDITY Cash $38 Current Assets 350 PP&E / Other Assets 514 Total Assets $902 Current Liabilities (Excl. Debt) $161 Total Debt 98 Pension & Post Retirement Liabilities 123 Other Liabilities 14 Total Liabilities $396 Shareholders' Equity $505 Total Liabilities & Equity $902 Assets ($M) Liabilities & Equity ($M) Pro Forma Balance Sheet(1) STRONG, LIQUID BALANCE SHEET Low-cost (L+150), $225M asset-based loan $100M initial draw; plenty of liquidity Gross leverage at 1.6x; net leverage at 1.0x CONSERVATIVE CAPITAL DEPLOYMENT Step-down in capital spending Targeted working capital improvements (1) Per AFI Form 10 as of December 31, 2015

REASONS TO BELIEVE PROVEN NEW TEAM MANUFACTURING INVESTMENTS GO-TO-MARKET INVESTMENTS REFOCUSED INNOVATION OPERATIONAL TRANSFORMATION MEDIUM-TERM FINANCIAL GOALS Growth and Operating Leverage Leading to Bottom-line Expansion TOP-LINE GROWTH REVENUE FLOW THROUGH EBITDA MARGIN 5 - 6% Annualized 10% 20 - 30% Incr. EBITDA Margins Note: “Medium-Term” defined as 3-5 years

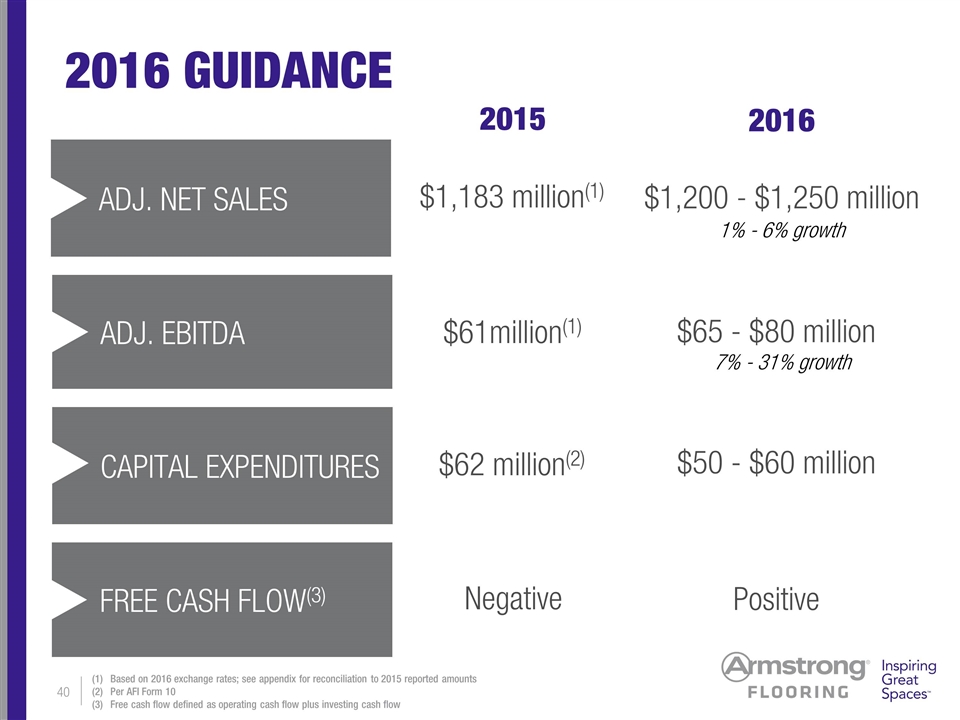

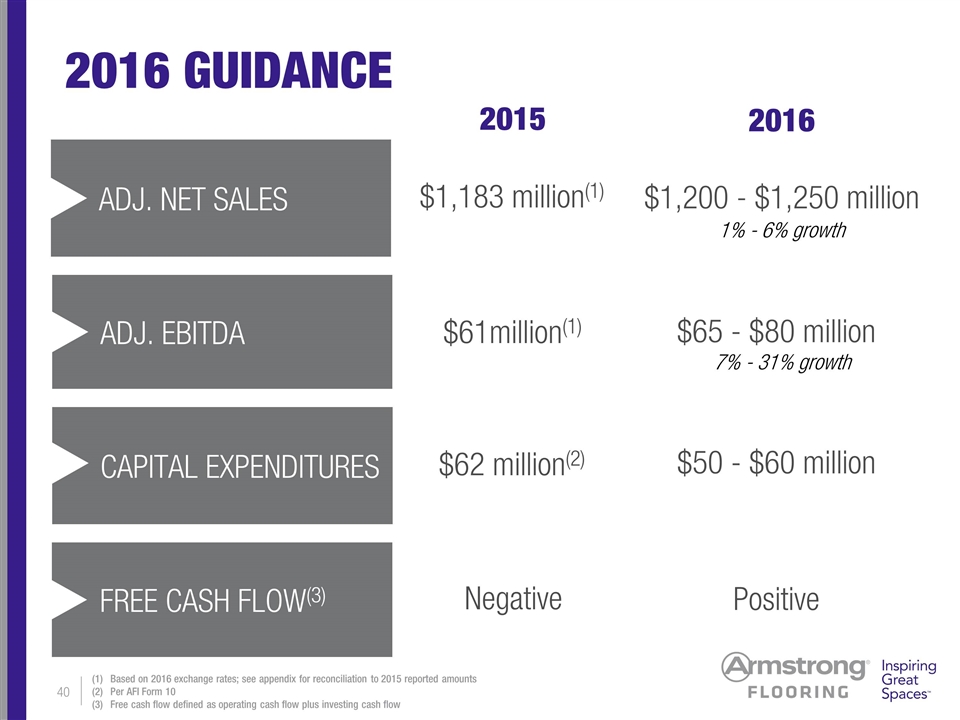

2016 GUIDANCE Negative Positive FREE CASH FLOW(3) 2015 2016 Based on 2016 exchange rates; see appendix for reconciliation to 2015 reported amounts Per AFI Form 10 Free cash flow defined as operating cash flow plus investing cash flow ADJ. NET SALES $1,200 - $1,250 million $1,183 million(1) 1% - 6% growth $61million(1) $65 - $80 million ADJ. EBITDA 7% - 31% growth $50 - $60 million CAPITAL EXPENDITURES $62 million(2)

VIDEO PLACEHOLDER HERE To view the video included in this presentation, visit: www.armstrong.com/diamond10

UNIQUE OPPORTUNITY TO BUILD VALUE Leading hard surfaces flooring company Most recognized brands Expansive product portfolio Renewed focus on innovation Differentiated go-to-market system Operational, financial and organizational transformation

Appendix

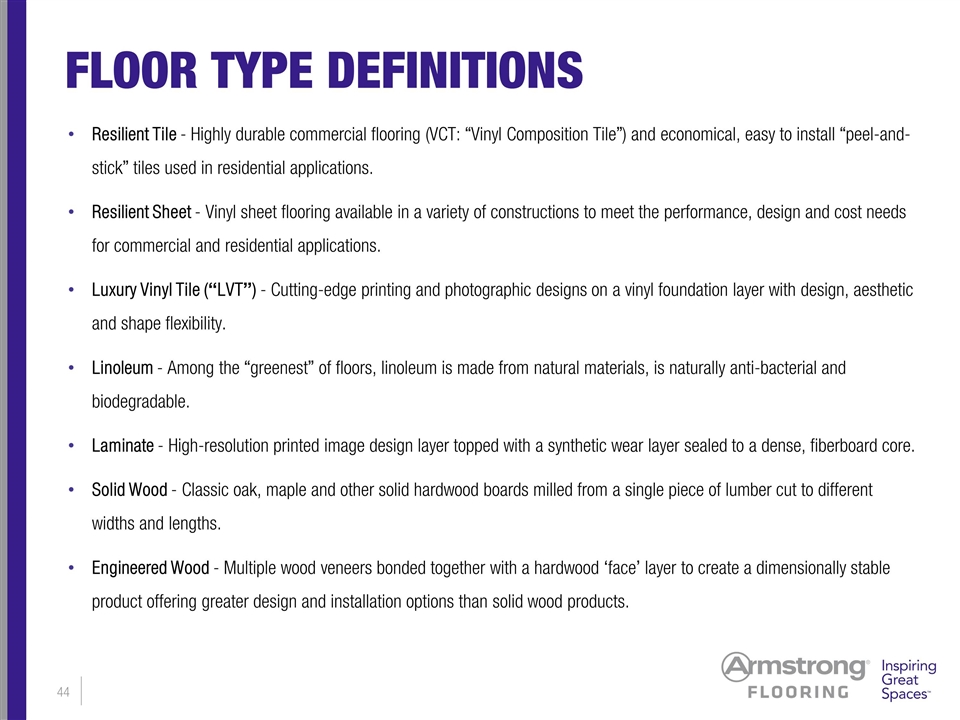

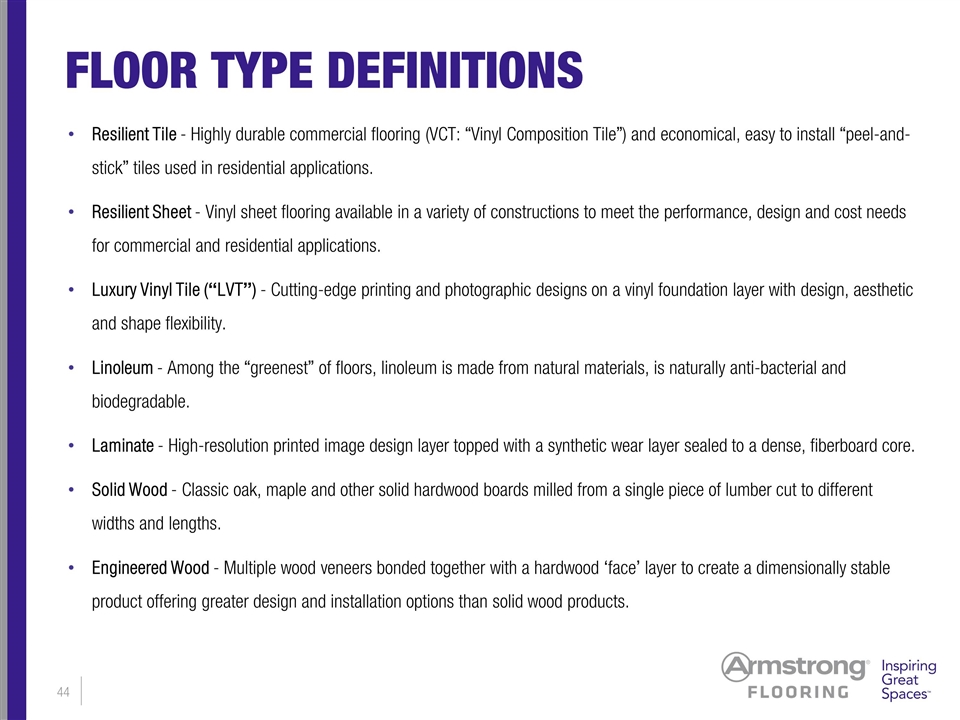

Resilient Tile - Highly durable commercial flooring (VCT: “Vinyl Composition Tile”) and economical, easy to install “peel-and-stick” tiles used in residential applications. Resilient Sheet - Vinyl sheet flooring available in a variety of constructions to meet the performance, design and cost needs for commercial and residential applications. Luxury Vinyl Tile (“LVT”) - Cutting-edge printing and photographic designs on a vinyl foundation layer with design, aesthetic and shape flexibility. Linoleum - Among the “greenest” of floors, linoleum is made from natural materials, is naturally anti-bacterial and biodegradable. Laminate - High-resolution printed image design layer topped with a synthetic wear layer sealed to a dense, fiberboard core. Solid Wood - Classic oak, maple and other solid hardwood boards milled from a single piece of lumber cut to different widths and lengths. Engineered Wood - Multiple wood veneers bonded together with a hardwood ‘face’ layer to create a dimensionally stable product offering greater design and installation options than solid wood products. FLOOR TYPE DEFINITIONS

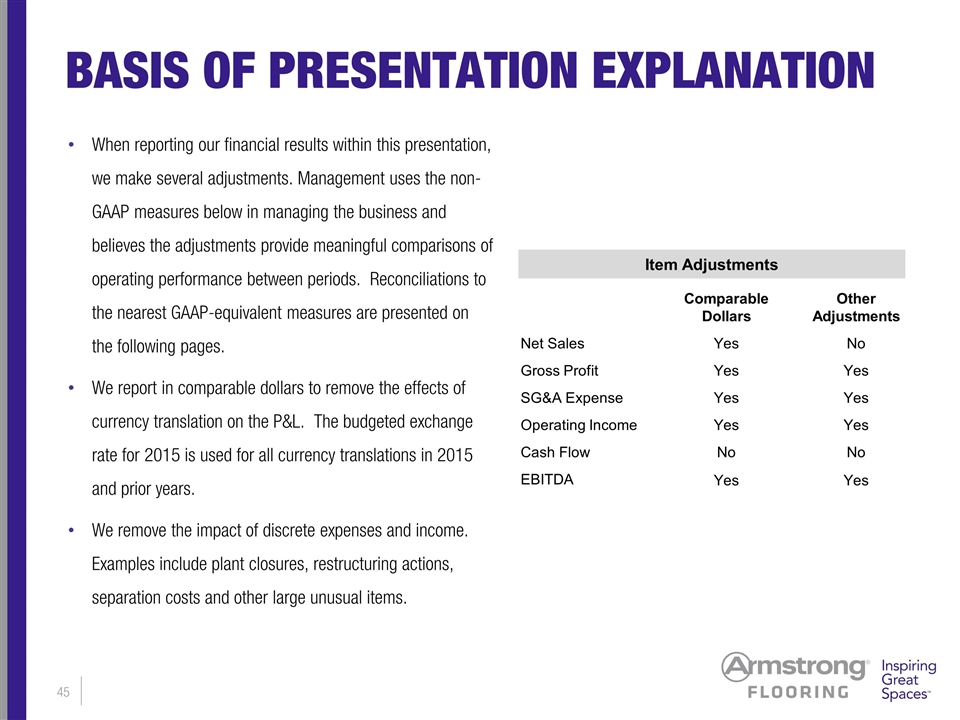

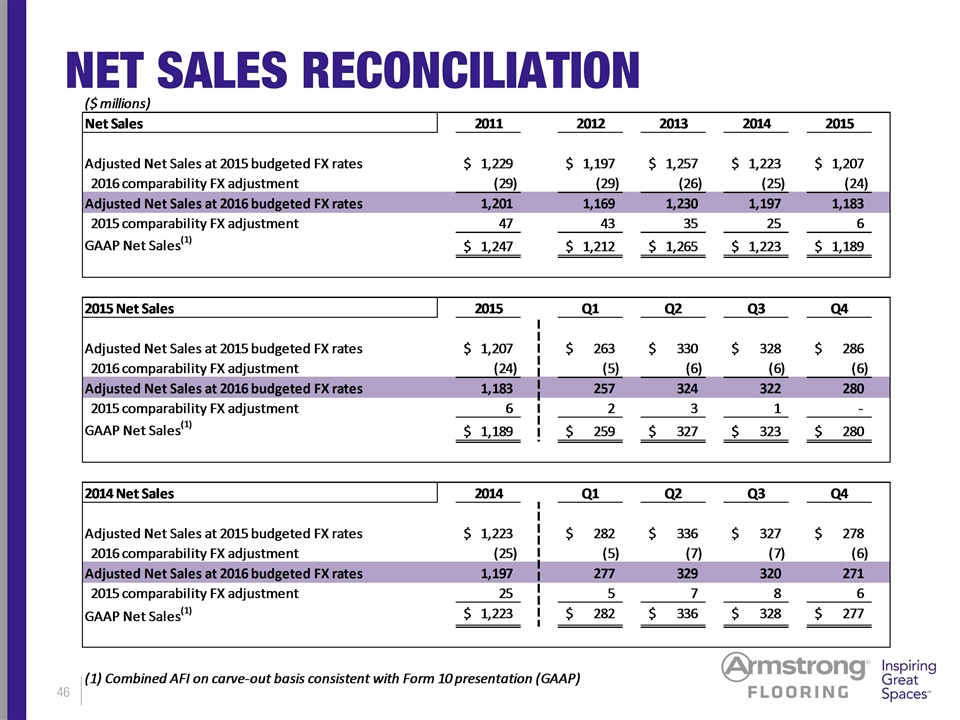

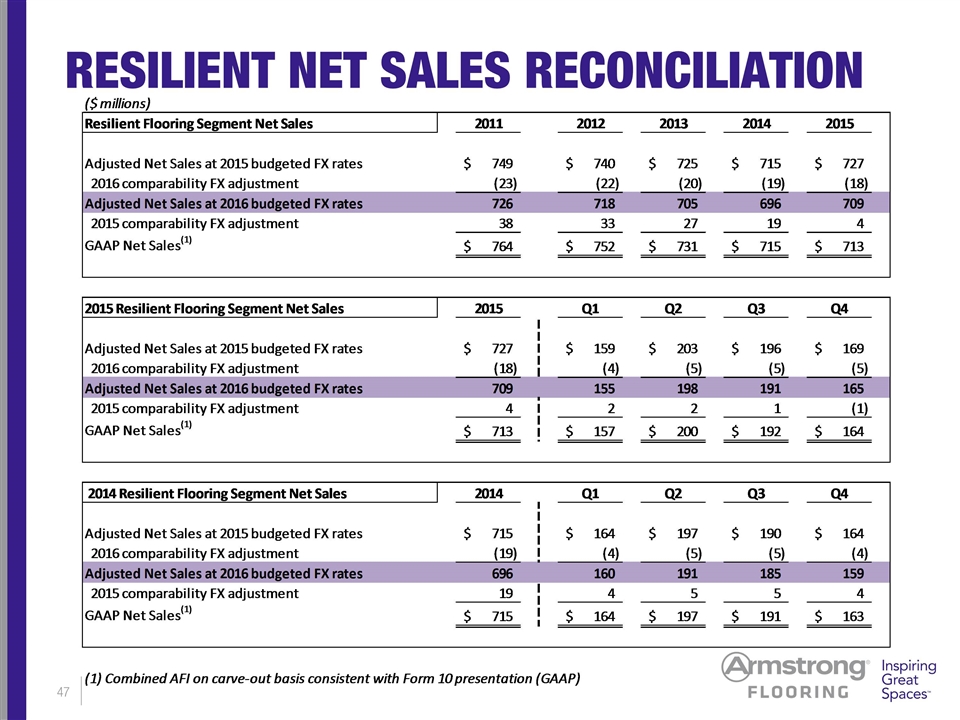

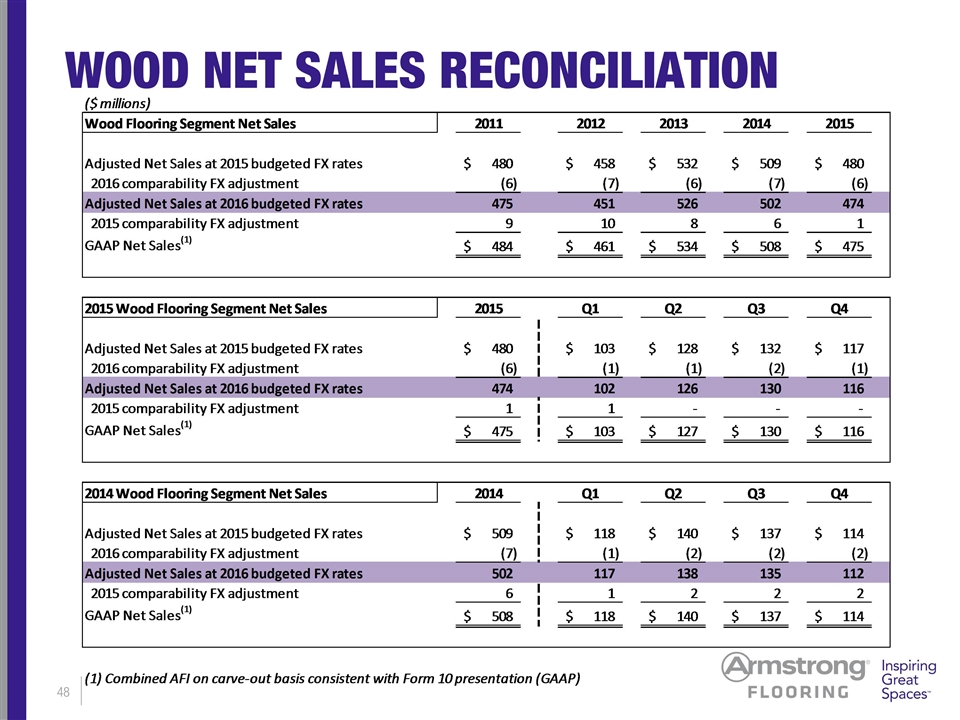

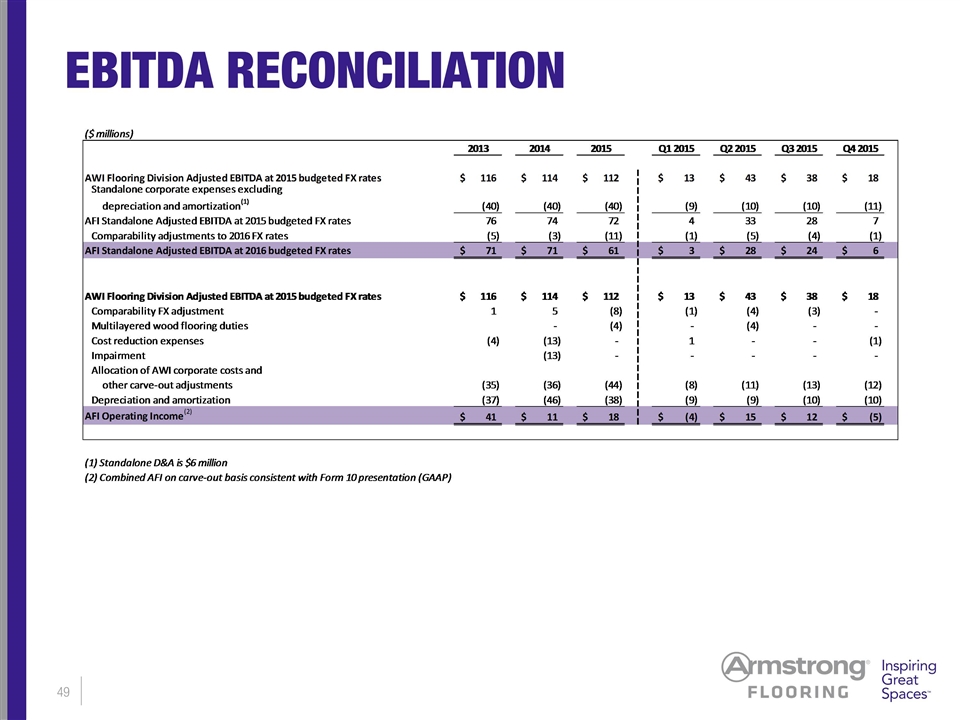

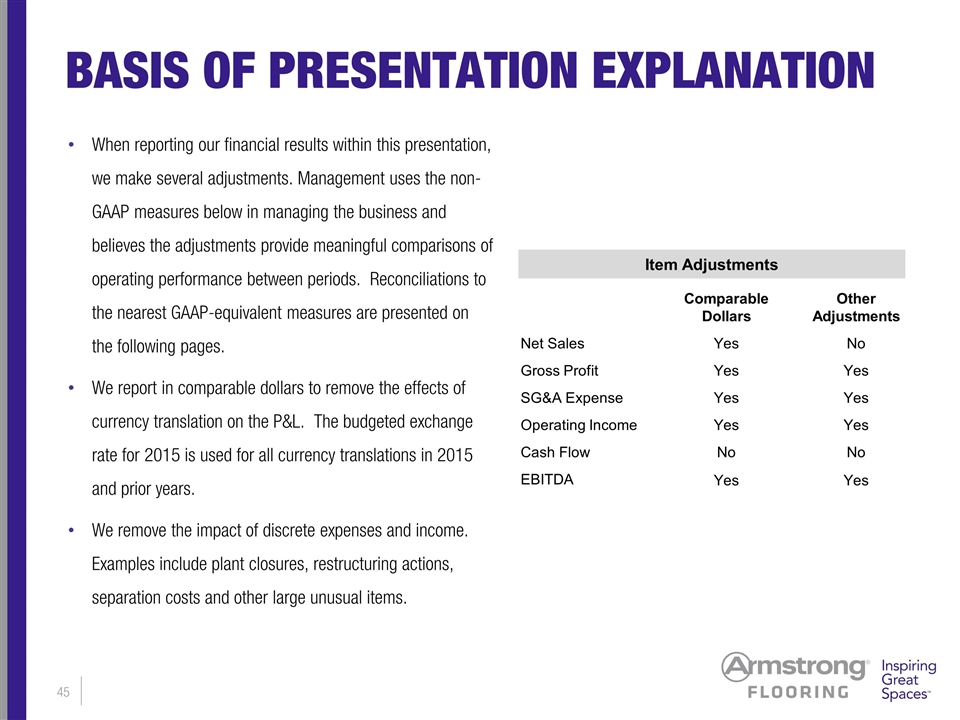

When reporting our financial results within this presentation, we make several adjustments. Management uses the non-GAAP measures below in managing the business and believes the adjustments provide meaningful comparisons of operating performance between periods. Reconciliations to the nearest GAAP-equivalent measures are presented on the following pages. We report in comparable dollars to remove the effects of currency translation on the P&L. The budgeted exchange rate for 2015 is used for all currency translations in 2015 and prior years. We remove the impact of discrete expenses and income. Examples include plant closures, restructuring actions, separation costs and other large unusual items. Item Adjustments Comparable Dollars Other Adjustments Net Sales Yes No Gross Profit Yes Yes SG&A Expense Yes Yes Operating Income Yes Yes Cash Flow No No EBITDA Yes Yes BASIS OF PRESENTATION EXPLANATION

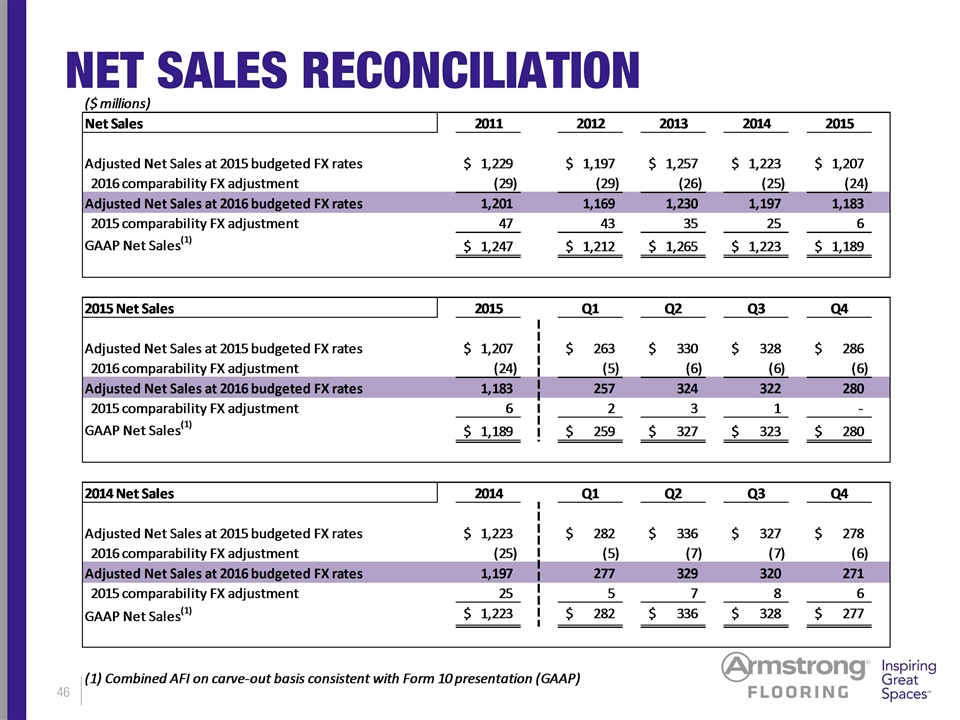

NET SALES RECONCILIATION

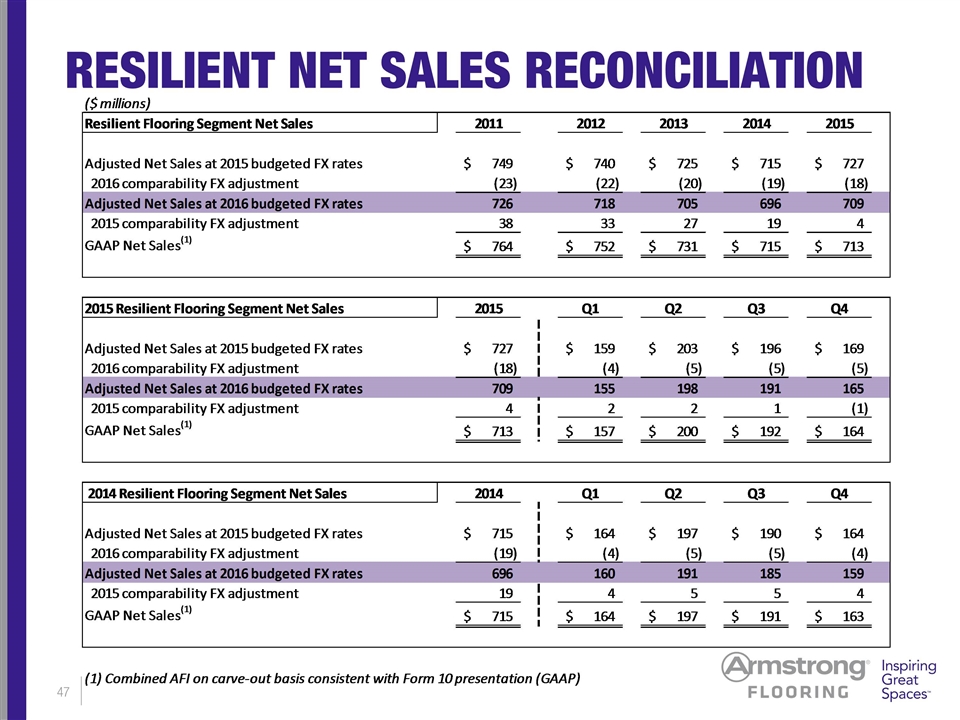

RESILIENT NET SALES RECONCILIATION

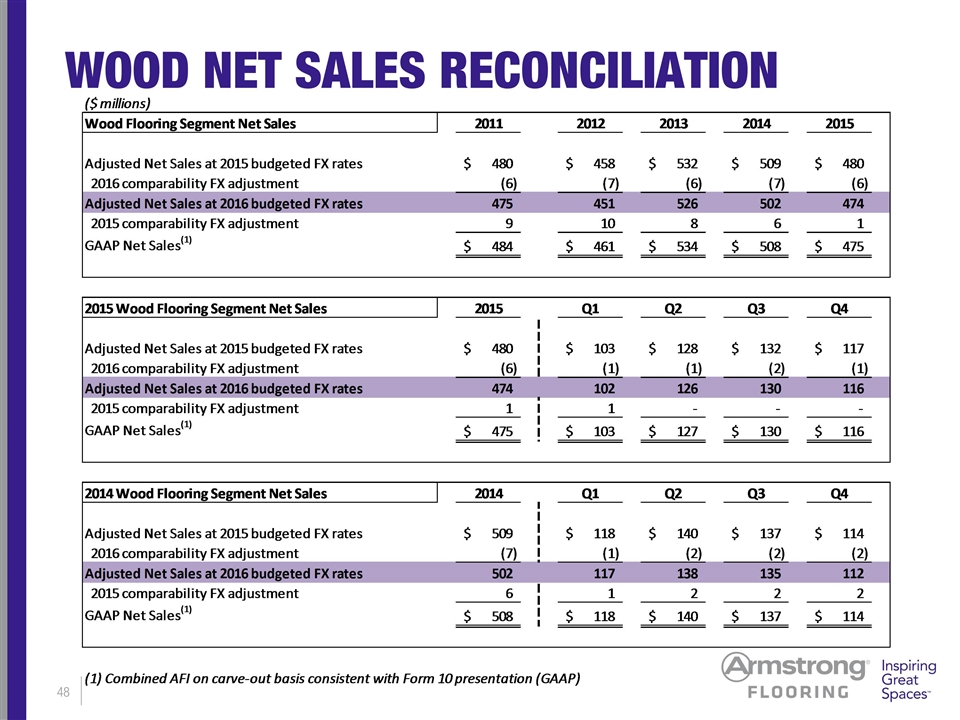

WOOD NET SALES RECONCILIATION

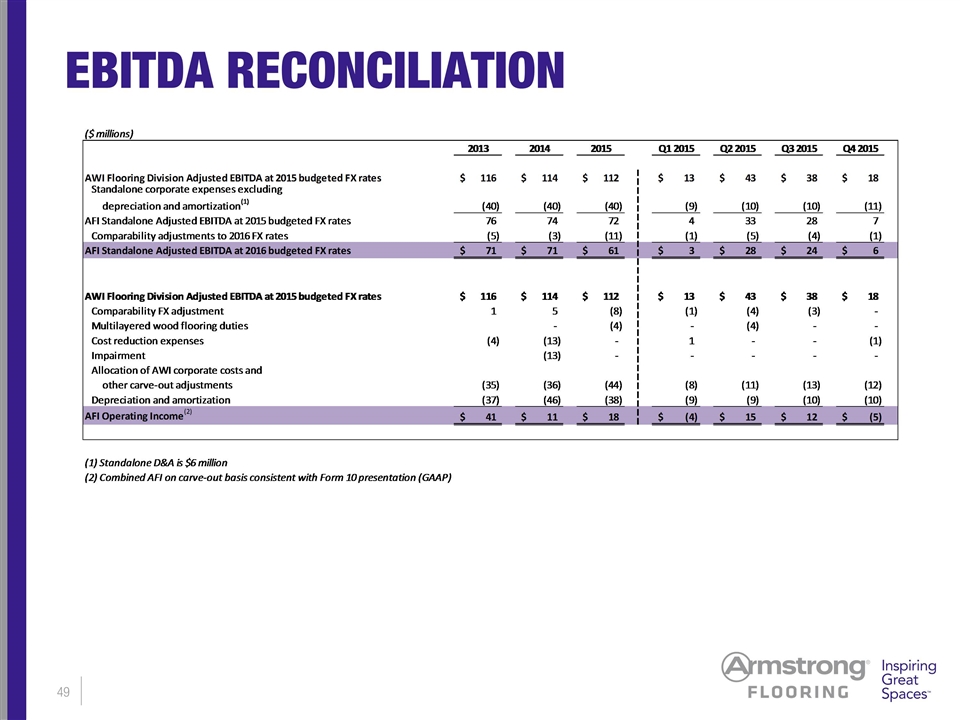

EBITDA RECONCILIATION

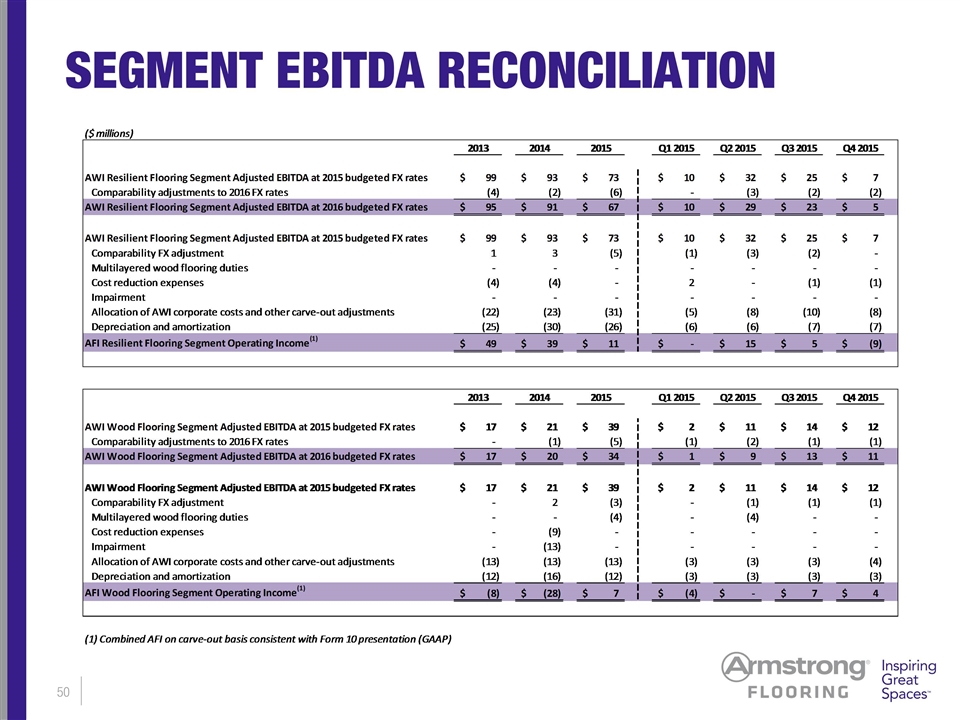

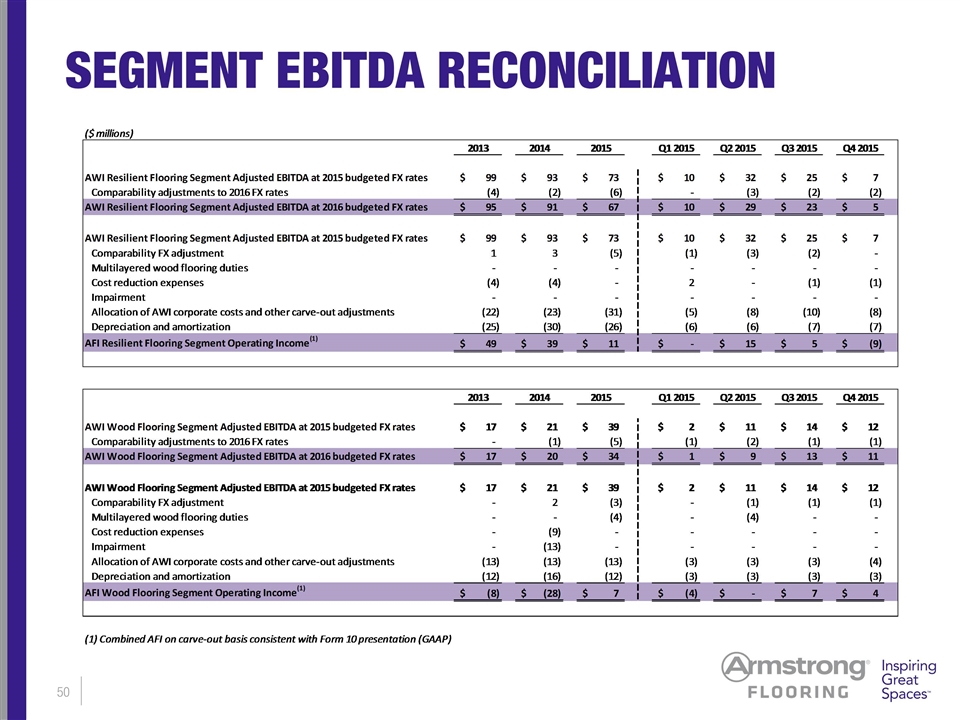

SEGMENT EBITDA RECONCILIATION