Earnings Call Presentation 2nd Quarter 2016 July 29, 2016 Exhibit 99.2

Our disclosures in this presentation, including without limitation, those relating to future financial results market conditions and guidance, and in our other public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those statements provide our future expectations or forecasts and can be identified by our use of words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "outlook," "target," "predict," "may," "will," "would," "could," "should," "seek," and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance or the separation of our businesses. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that may affect our ability to achieve the projected performance is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Forms 10-K and 10-Q filed with the SEC. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. In addition, we will be referring to non-GAAP financial measures within the meaning of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance with GAAP are included within this presentation and available on the Investor Relations page of our website at www.armstrongceilings.com. The guidance in this presentation is only effective as of the date given, July 29, 2016, and will not be updated or affirmed unless and until we publicly announce updated or affirmed guidance. Safe Harbor Statement

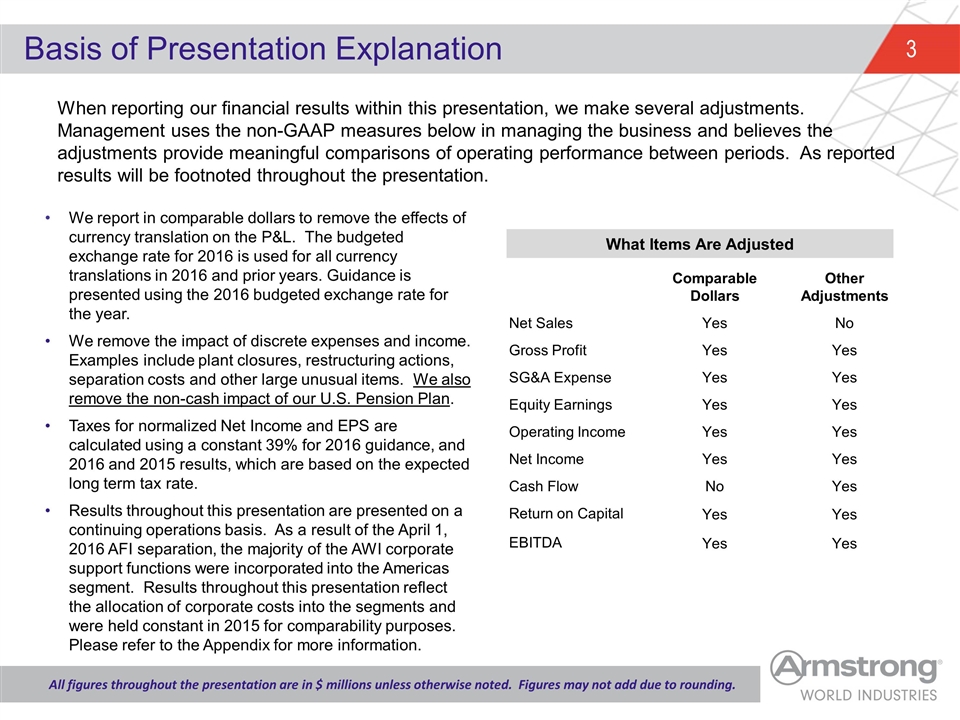

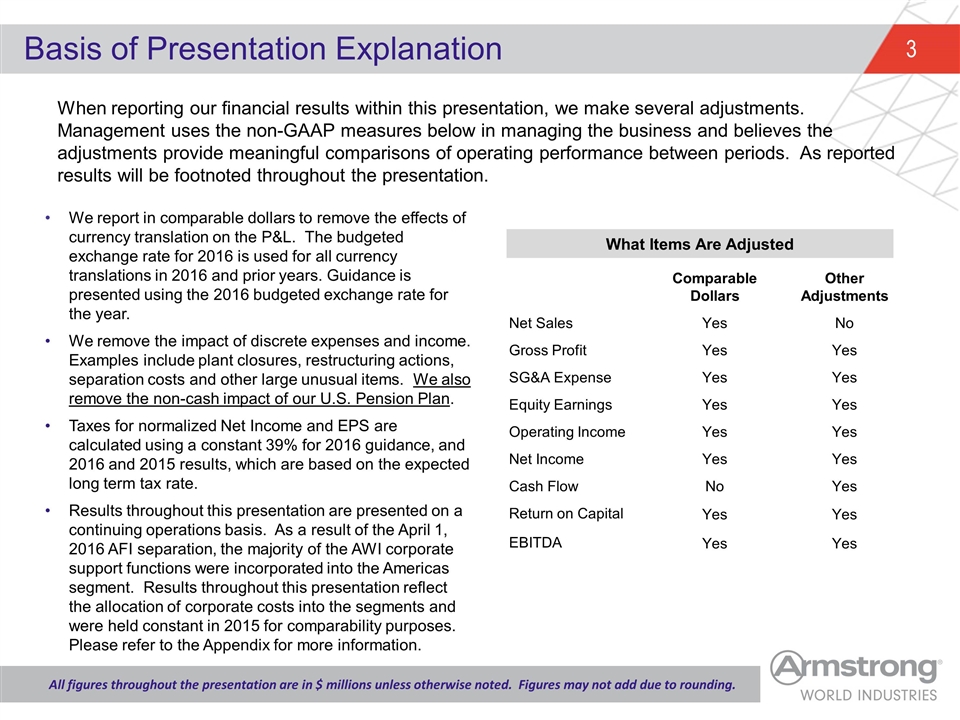

All figures throughout the presentation are in $ millions unless otherwise noted. Figures may not add due to rounding. When reporting our financial results within this presentation, we make several adjustments. Management uses the non-GAAP measures below in managing the business and believes the adjustments provide meaningful comparisons of operating performance between periods. As reported results will be footnoted throughout the presentation. Basis of Presentation Explanation We report in comparable dollars to remove the effects of currency translation on the P&L. The budgeted exchange rate for 2016 is used for all currency translations in 2016 and prior years. Guidance is presented using the 2016 budgeted exchange rate for the year. We remove the impact of discrete expenses and income. Examples include plant closures, restructuring actions, separation costs and other large unusual items. We also remove the non-cash impact of our U.S. Pension Plan. Taxes for normalized Net Income and EPS are calculated using a constant 39% for 2016 guidance, and 2016 and 2015 results, which are based on the expected long term tax rate. Results throughout this presentation are presented on a continuing operations basis. As a result of the April 1, 2016 AFI separation, the majority of the AWI corporate support functions were incorporated into the Americas segment. Results throughout this presentation reflect the allocation of corporate costs into the segments and were held constant in 2015 for comparability purposes. Please refer to the Appendix for more information. What Items Are Adjusted Comparable Dollars Other Adjustments Net Sales Yes No Gross Profit Yes Yes SG&A Expense Yes Yes Equity Earnings Yes Yes Operating Income Yes Yes Net Income Yes Yes Cash Flow No Yes Return on Capital Yes Yes EBITDA Yes Yes

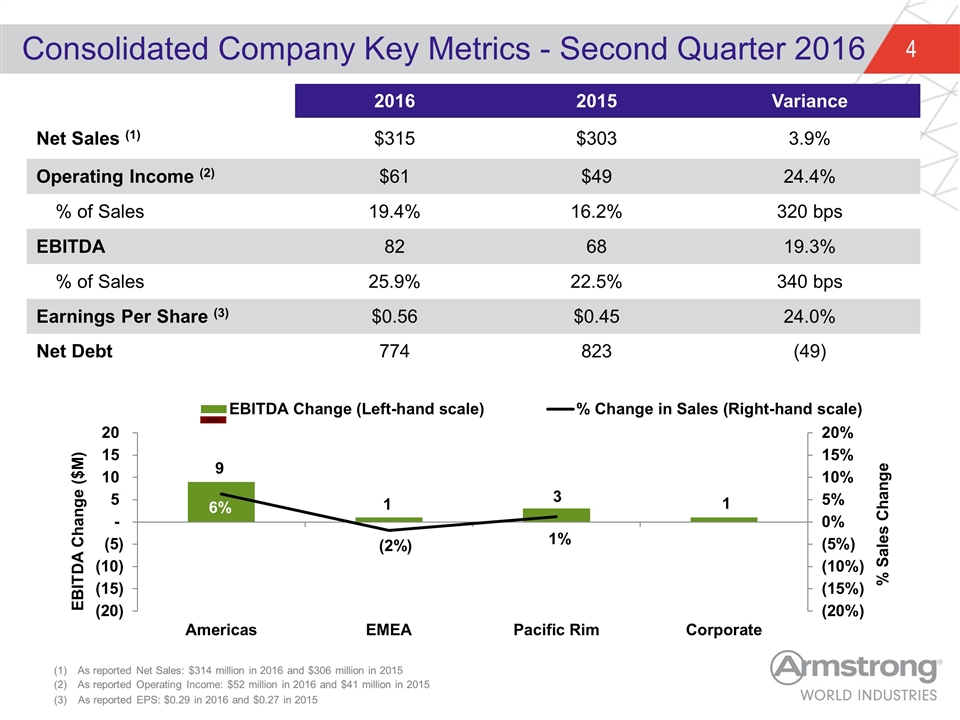

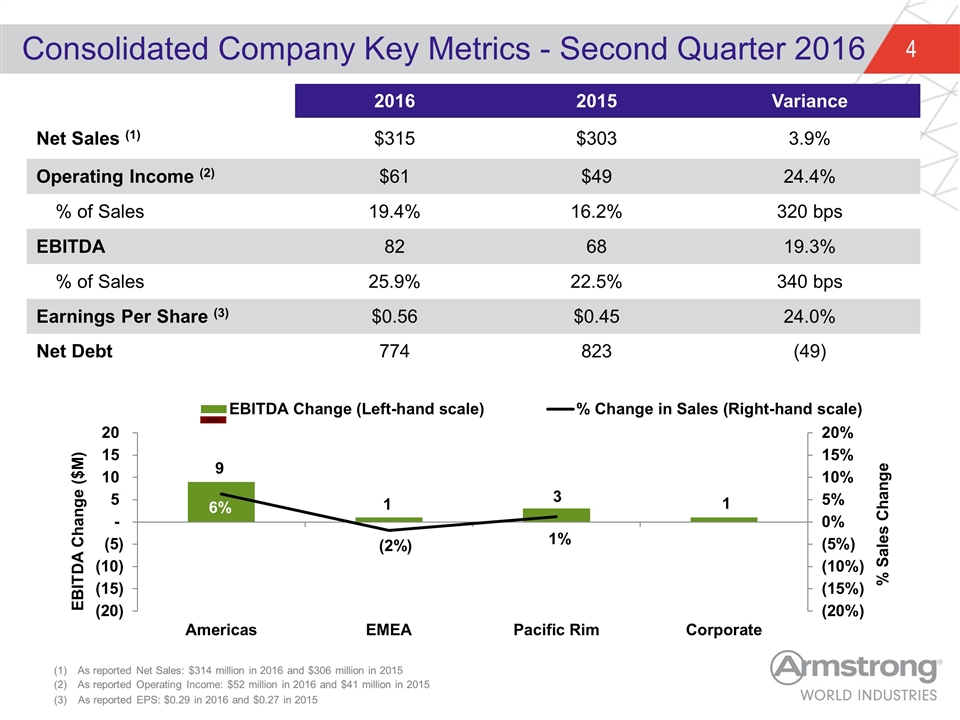

Consolidated Company Key Metrics - Second Quarter 2016 2016 2015 Variance Net Sales (1) $315 $303 3.9% Operating Income (2) $61 $49 24.4% % of Sales 19.4% 16.2% 320 bps EBITDA 82 68 19.3% % of Sales 25.9% 22.5% 340 bps Earnings Per Share (3) $0.56 $0.45 24.0% Net Debt 774 823 (49) As reported Net Sales: $314 million in 2016 and $306 million in 2015 As reported Operating Income: $52 million in 2016 and $41 million in 2015 As reported EPS: $0.29 in 2016 and $0.27 in 2015

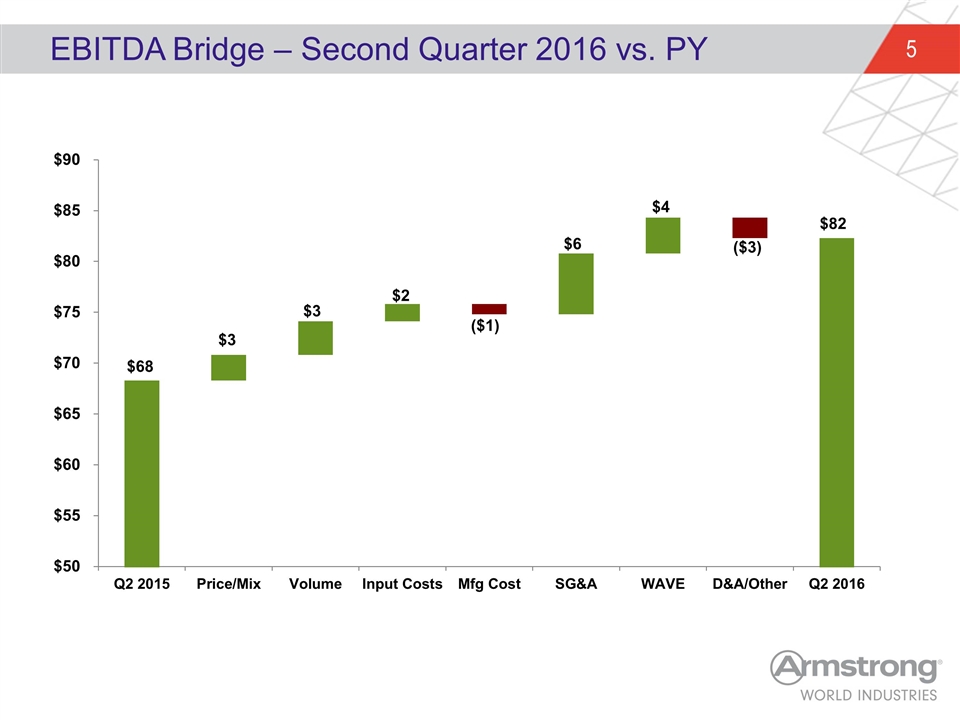

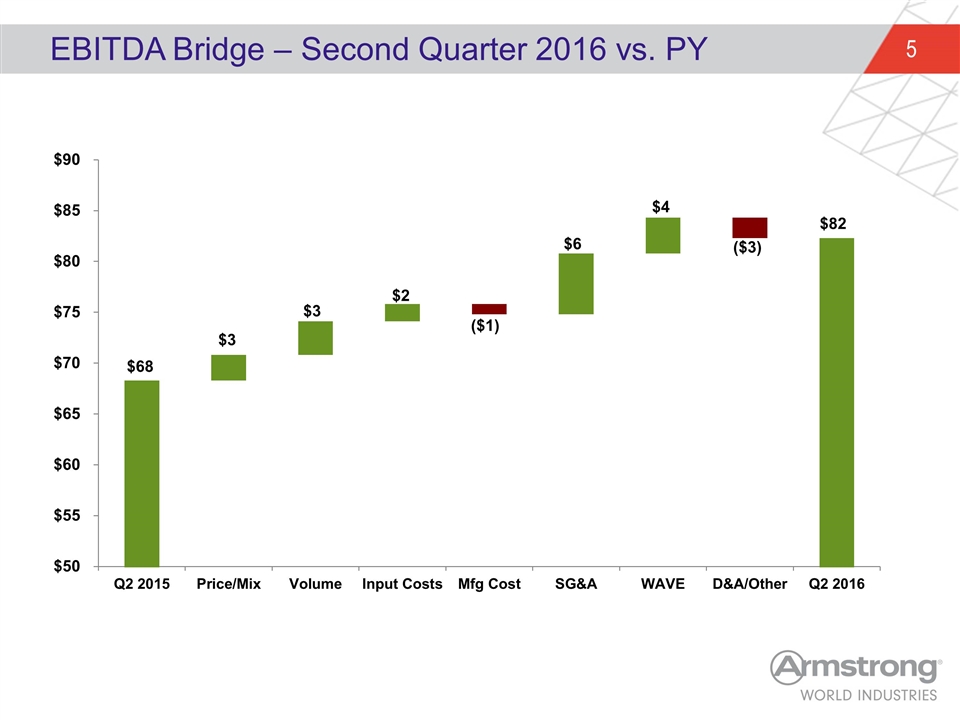

EBITDA Bridge – Second Quarter 2016 vs. PY $3 $3 $2 ($1) $6 ($3) $4 $82

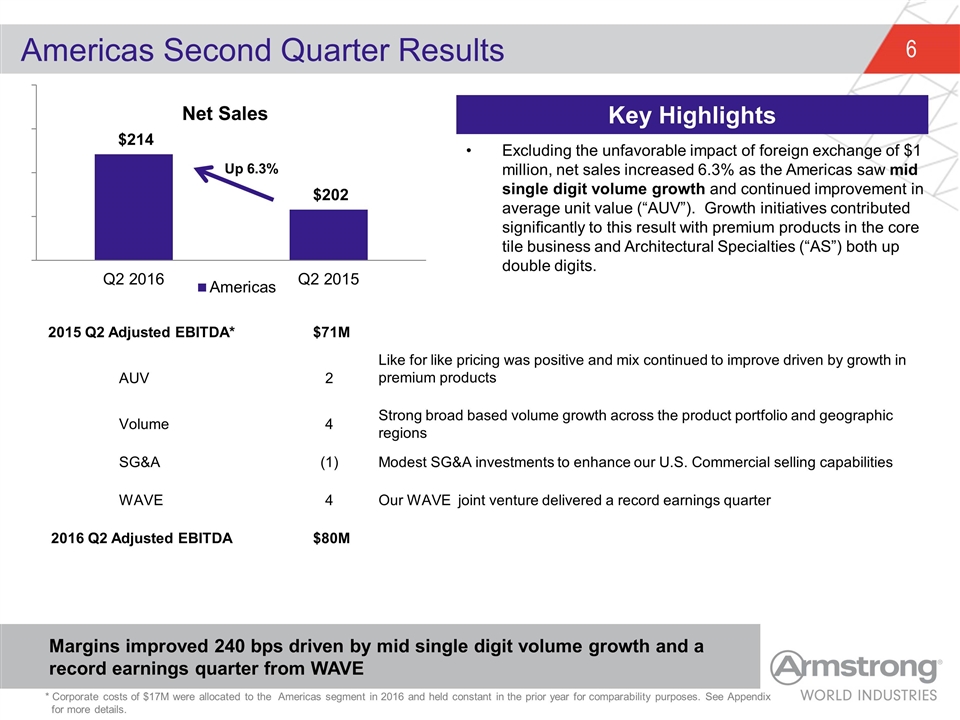

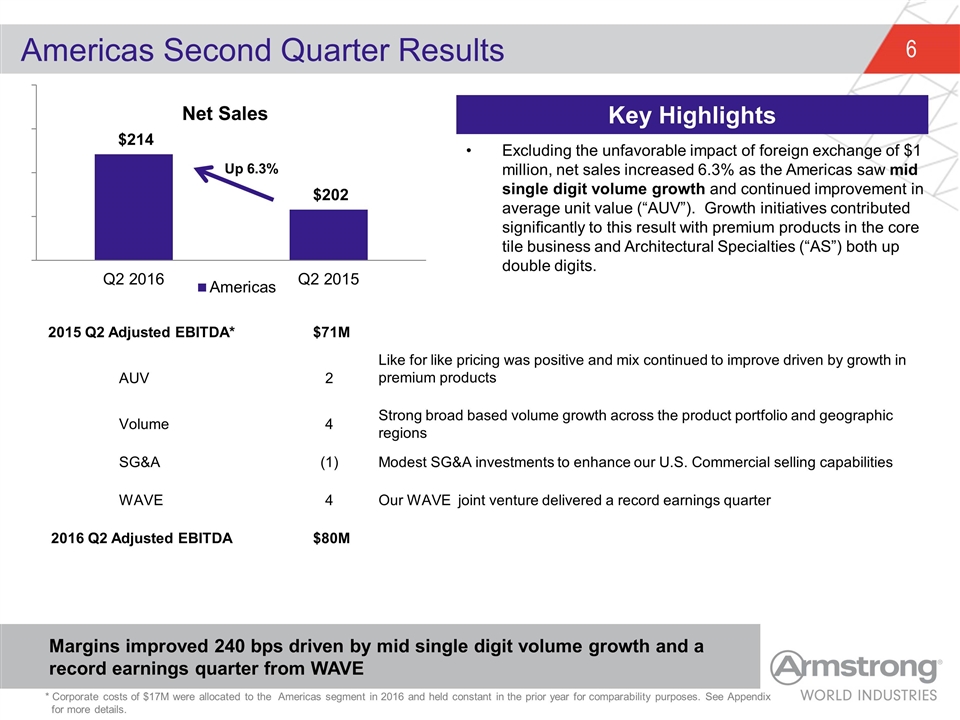

Excluding the unfavorable impact of foreign exchange of $1 million, net sales increased 6.3% as the Americas saw mid single digit volume growth and continued improvement in average unit value (“AUV”). Growth initiatives contributed significantly to this result with premium products in the core tile business and Architectural Specialties (“AS”) both up double digits. Americas Second Quarter Results Margins improved 240 bps driven by mid single digit volume growth and a record earnings quarter from WAVE Key Highlights * Corporate costs of $17M were allocated to the Americas segment in 2016 and held constant in the prior year for comparability purposes. See Appendix for more details. 2015 Q2 Adjusted EBITDA* $71M AUV 2 Like for like pricing was positive and mix continued to improve driven by growth in premium products Volume 4 Strong broad based volume growth across the product portfolio and geographic regions SG&A (1) Modest SG&A investments to enhance our U.S. Commercial selling capabilities WAVE 4 Our WAVE joint venture delivered a record earnings quarter 2016 Q2 Adjusted EBITDA $80M

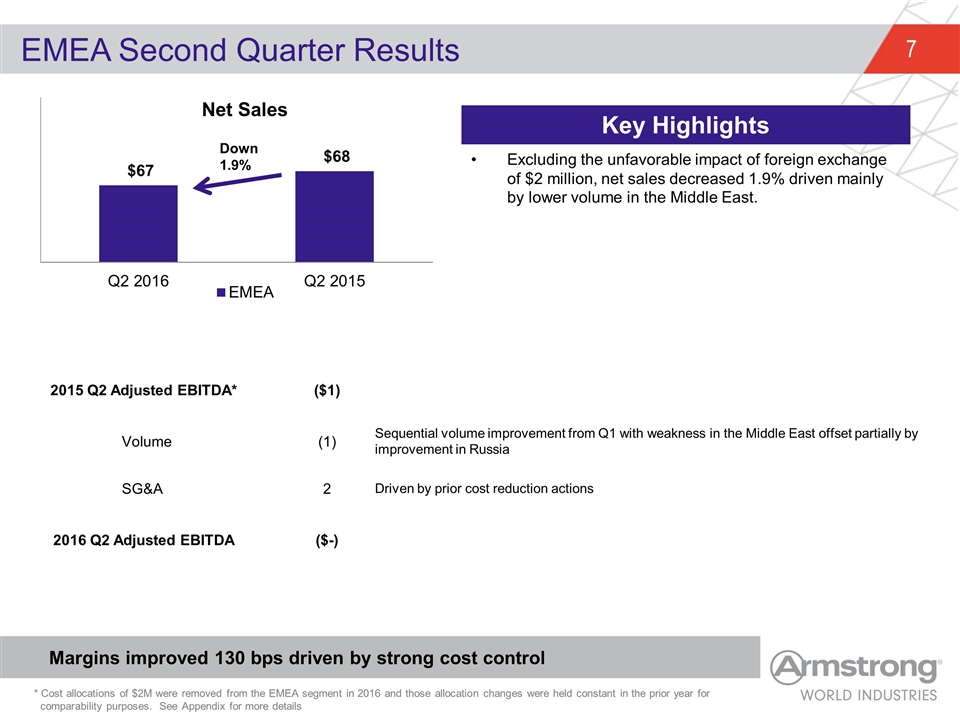

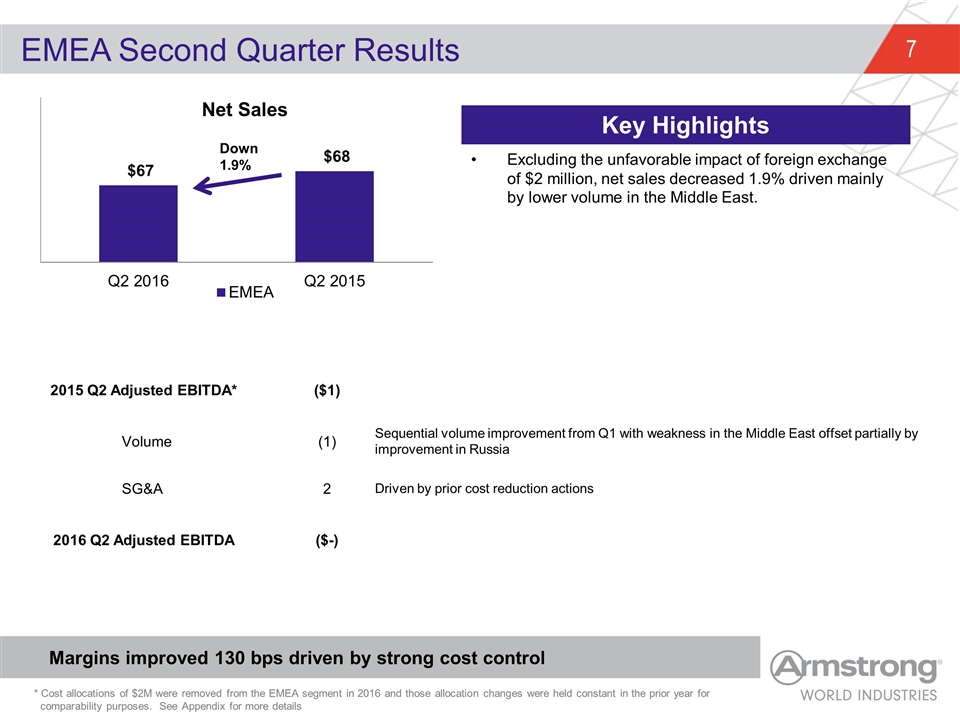

Excluding the unfavorable impact of foreign exchange of $2 million, net sales decreased 1.9% driven mainly by lower volume in the Middle East. EMEA Second Quarter Results Margins improved 130 bps driven by strong cost control Key Highlights * Cost allocations of $2M were removed from the EMEA segment in 2016 and those allocation changes were held constant in the prior year for comparability purposes. See Appendix for more details 2015 Q2 Adjusted EBITDA* ($1) Volume (1) Sequential volume improvement from Q1 with weakness in the Middle East offset partially by improvement in Russia SG&A 2 Driven by prior cost reduction actions 2016 Q2 Adjusted EBITDA ($-)

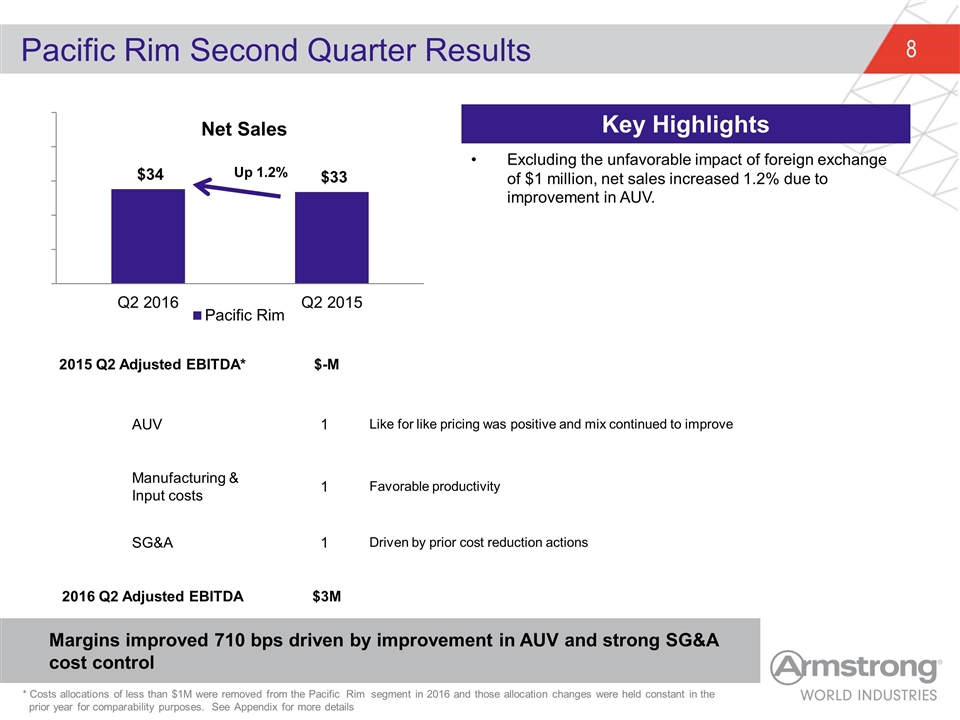

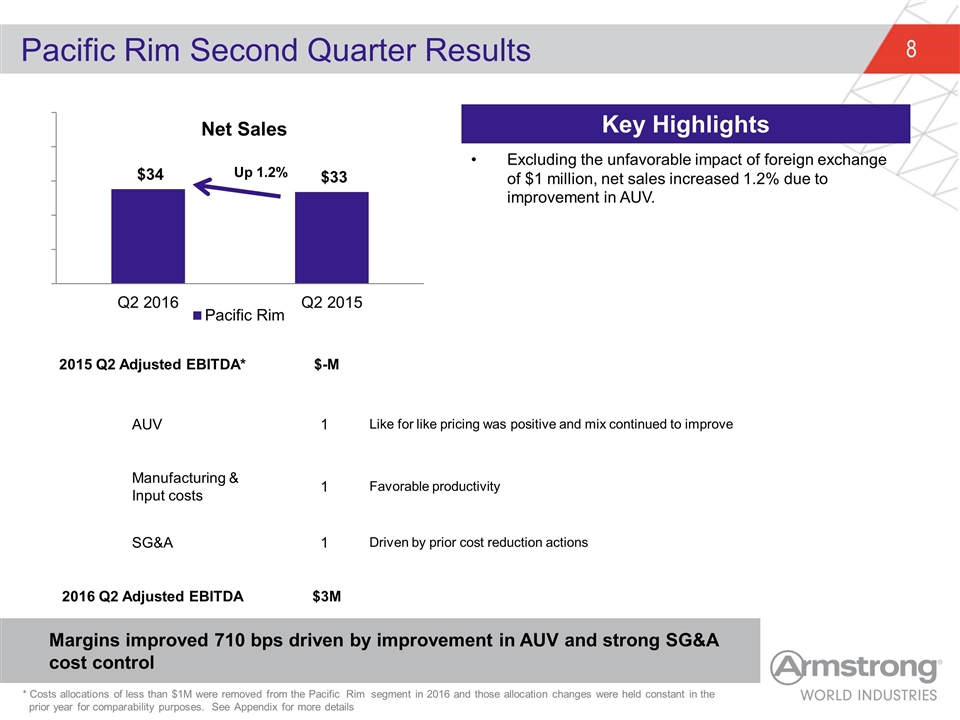

Excluding the unfavorable impact of foreign exchange of $1 million, net sales increased 1.2% due to improvement in AUV. Pacific Rim Second Quarter Results Margins improved 710 bps driven by improvement in AUV and strong SG&A cost control Key Highlights * Costs allocations of less than $1M were removed from the Pacific Rim segment in 2016 and those allocation changes were held constant in the prior year for comparability purposes. See Appendix for more details 2015 Q2 Adjusted EBITDA* $-M AUV 1 Like for like pricing was positive and mix continued to improve Manufacturing & Input costs 1 Favorable productivity SG&A 1 Driven by prior cost reduction actions 2016 Q2 Adjusted EBITDA $3M

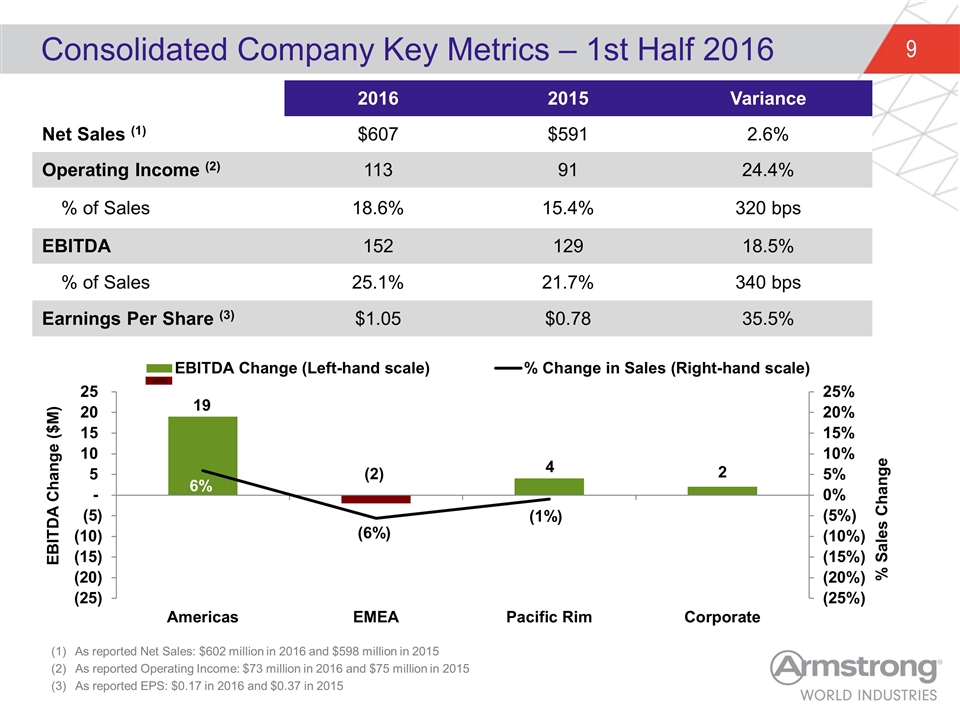

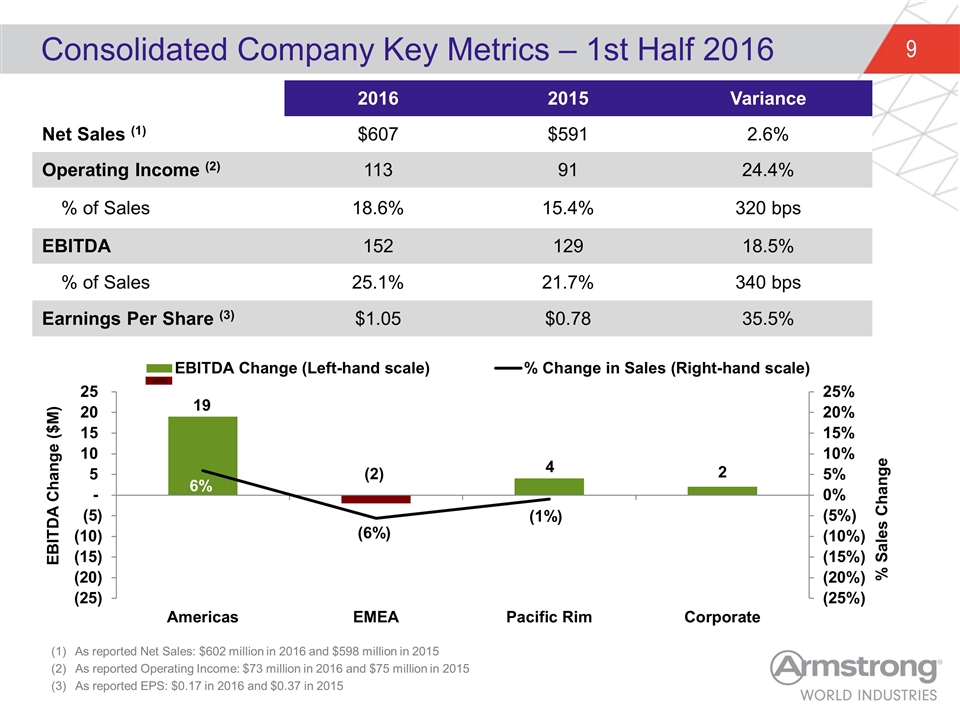

Consolidated Company Key Metrics – 1st Half 2016 2016 2015 Variance Net Sales (1) $607 $591 2.6% Operating Income (2) 113 91 24.4% % of Sales 18.6% 15.4% 320 bps EBITDA 152 129 18.5% % of Sales 25.1% 21.7% 340 bps Earnings Per Share (3) $1.05 $0.78 35.5% As reported Net Sales: $602 million in 2016 and $598 million in 2015 As reported Operating Income: $73 million in 2016 and $75 million in 2015 As reported EPS: $0.17 in 2016 and $0.37 in 2015

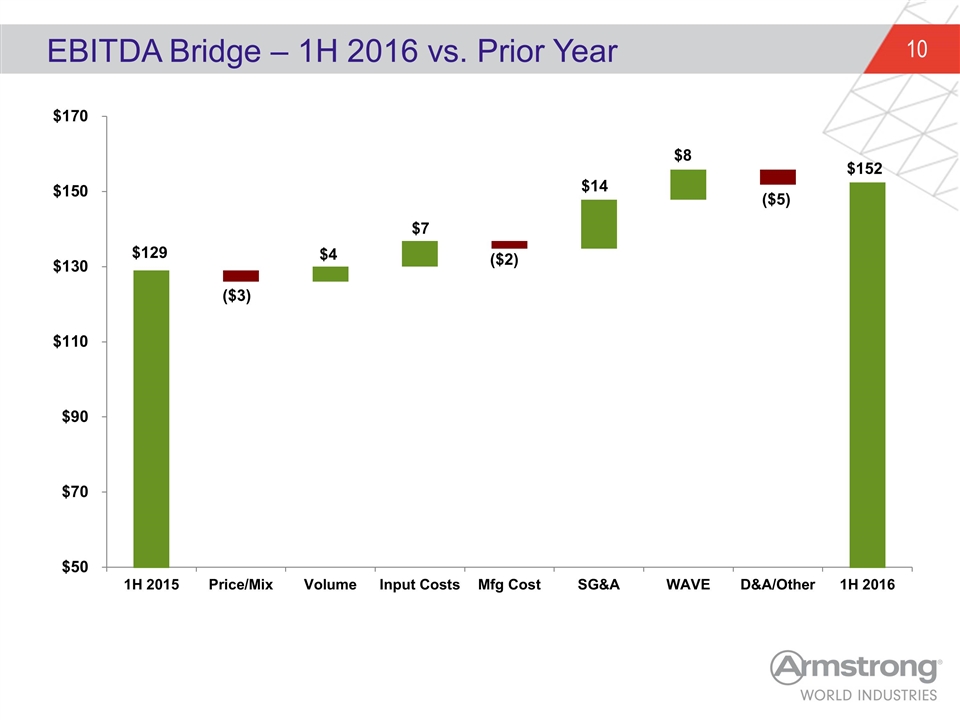

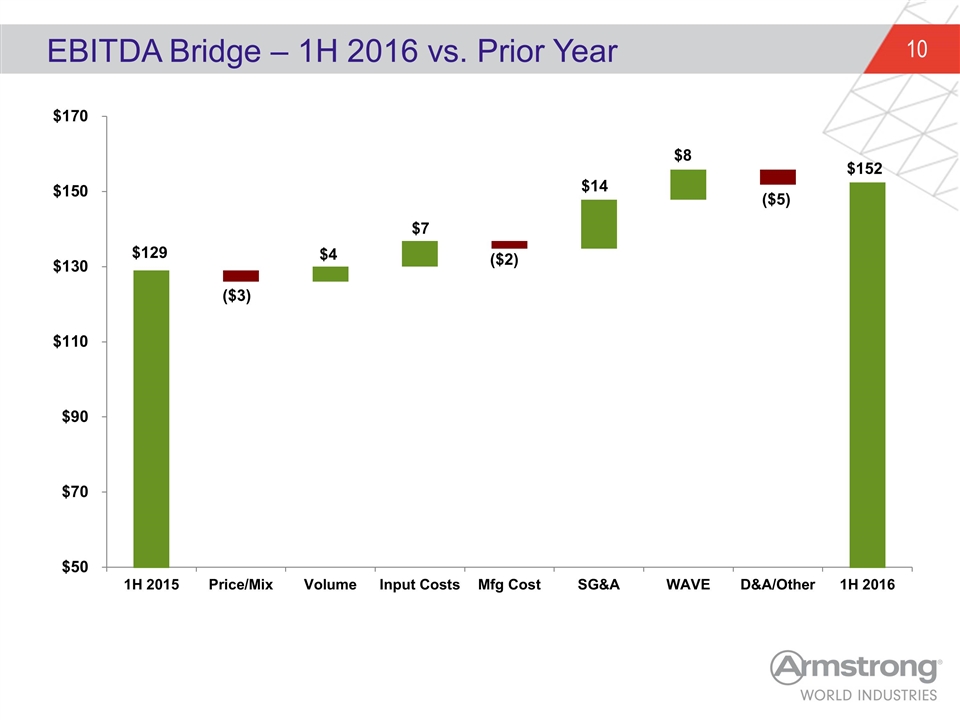

EBITDA Bridge – 1H 2016 vs. Prior Year $4 $7 $14 ($5) $152

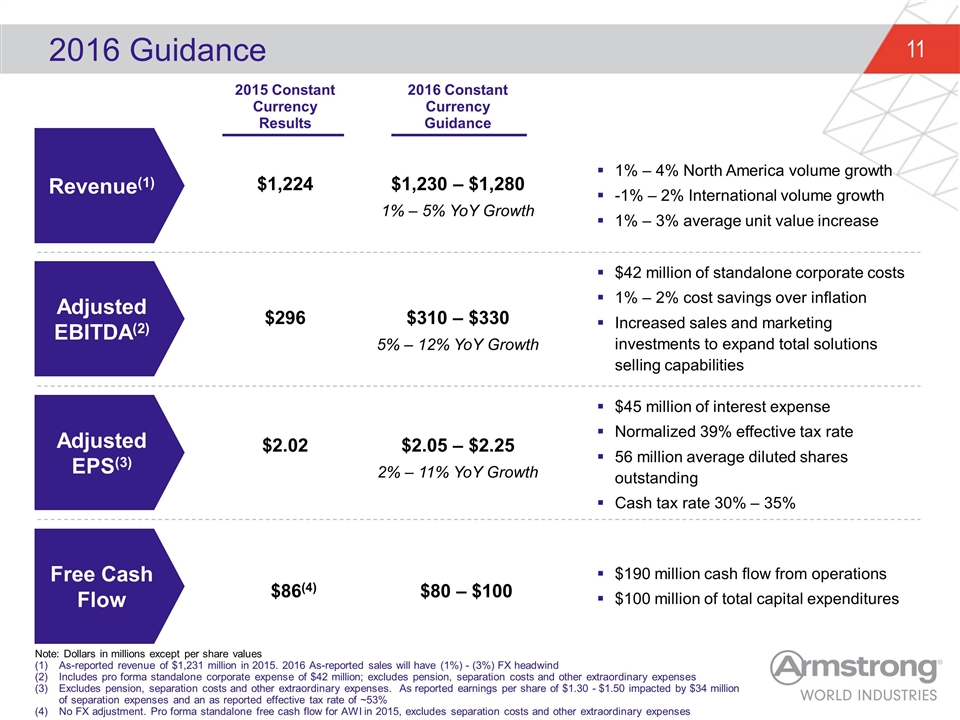

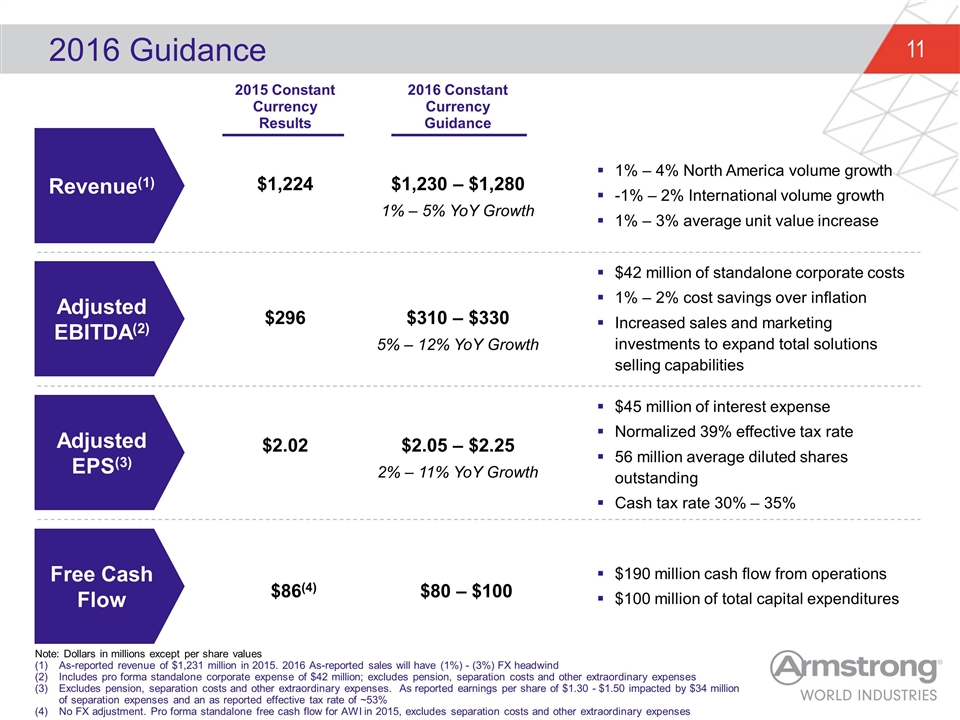

2016 Guidance $2.05 – $2.25 2% – 11% YoY Growth $2.02 Adjusted EBITDA(2) Adjusted EPS(3) Free Cash Flow Revenue(1) 1% – 4% North America volume growth -1% – 2% International volume growth 1% – 3% average unit value increase $42 million of standalone corporate costs 1% – 2% cost savings over inflation Increased sales and marketing investments to expand total solutions selling capabilities $45 million of interest expense Normalized 39% effective tax rate 56 million average diluted shares outstanding Cash tax rate 30% – 35% $190 million cash flow from operations $100 million of total capital expenditures Note: Dollars in millions except per share values As-reported revenue of $1,231 million in 2015. 2016 As-reported sales will have (1%) - (3%) FX headwind Includes pro forma standalone corporate expense of $42 million; excludes pension, separation costs and other extraordinary expenses Excludes pension, separation costs and other extraordinary expenses. As reported earnings per share of $1.30 - $1.50 impacted by $34 million of separation expenses and an as reported effective tax rate of ~53% No FX adjustment. Pro forma standalone free cash flow for AWI in 2015, excludes separation costs and other extraordinary expenses 2015 Constant Currency Results $1,224 $296 $1,230 – $1,280 1% – 5% YoY Growth $310 – $330 5% – 12% YoY Growth $80 – $100 2016 Constant Currency Guidance $86(4)

Appendix

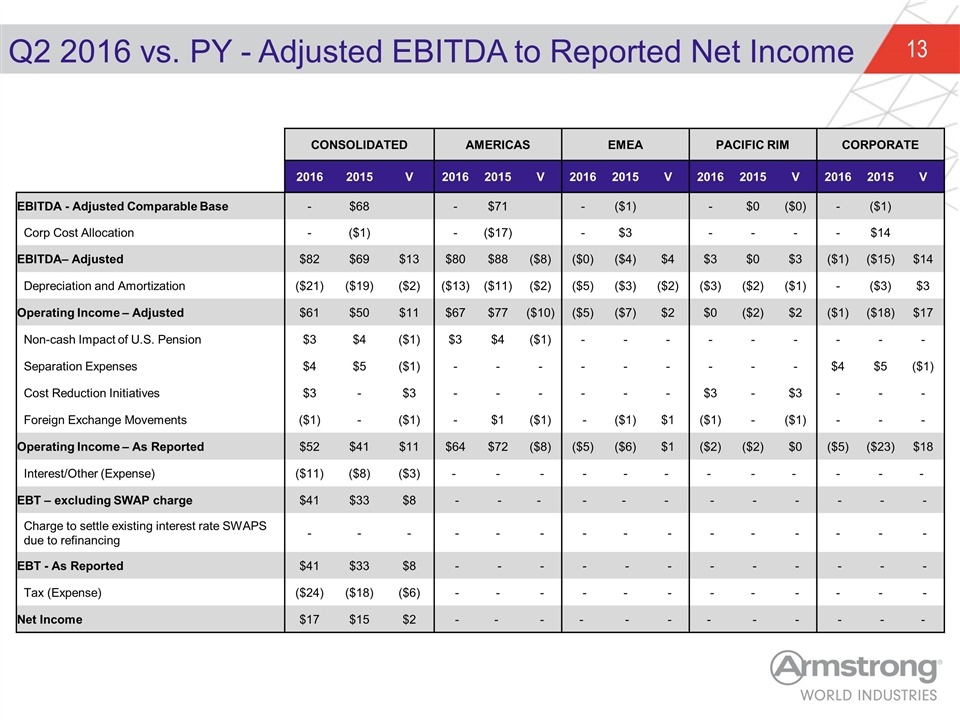

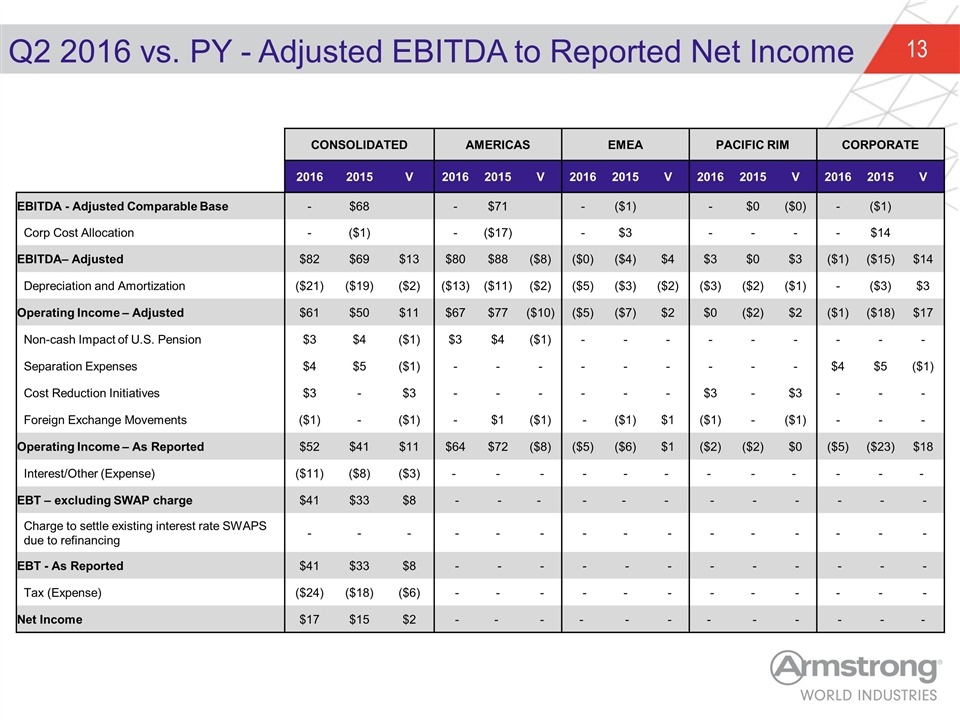

Q2 2016 vs. PY - Adjusted EBITDA to Reported Net Income CONSOLIDATED AMERICAS EMEA PACIFIC RIM CORPORATE 2016 2015 V 2016 2015 V 2016 2015 V 2016 2015 V 2016 2015 V EBITDA - Adjusted Comparable Base - $68 - $71 - ($1) - $0 ($0) - ($1) Corp Cost Allocation - ($1) - ($17) - $3 - - - - $14 EBITDA– Adjusted $82 $69 $13 $80 $88 ($8) ($0) ($4) $4 $3 $0 $3 ($1) ($15) $14 Depreciation and Amortization ($21) ($19) ($2) ($13) ($11) ($2) ($5) ($3) ($2) ($3) ($2) ($1) - ($3) $3 Operating Income – Adjusted $61 $50 $11 $67 $77 ($10) ($5) ($7) $2 $0 ($2) $2 ($1) ($18) $17 Non-cash Impact of U.S. Pension $3 $4 ($1) $3 $4 ($1) - - - - - - - - - Separation Expenses $4 $5 ($1) - - - - - - - - - $4 $5 ($1) Cost Reduction Initiatives $3 - $3 - - - - - - $3 - $3 - - - Foreign Exchange Movements ($1) - ($1) - $1 ($1) - ($1) $1 ($1) - ($1) - - - Operating Income – As Reported $52 $41 $11 $64 $72 ($8) ($5) ($6) $1 ($2) ($2) $0 ($5) ($23) $18 Interest/Other (Expense) ($11) ($8) ($3) - - - - - - - - - - - - EBT – excluding SWAP charge $41 $33 $8 - - - - - - - - - - - - Charge to settle existing interest rate SWAPS due to refinancing - - - - - - - - - - - - - - - EBT - As Reported $41 $33 $8 - - - - - - - - - - - - Tax (Expense) ($24) ($18) ($6) - - - - - - - - - - - - Net Income $17 $15 $2 - - - - - - - - - - - -

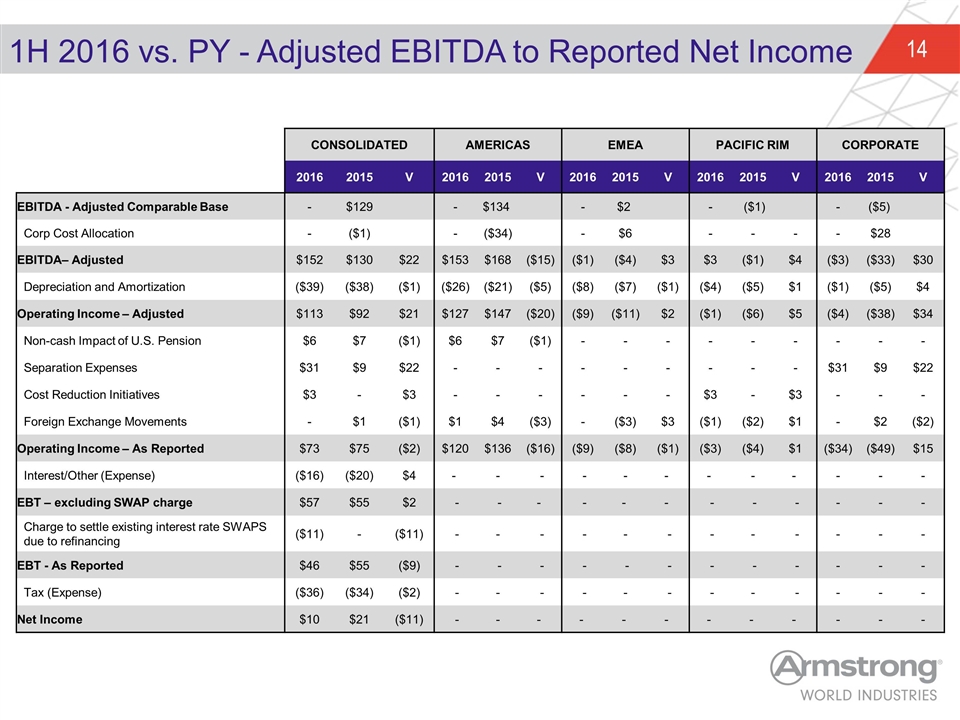

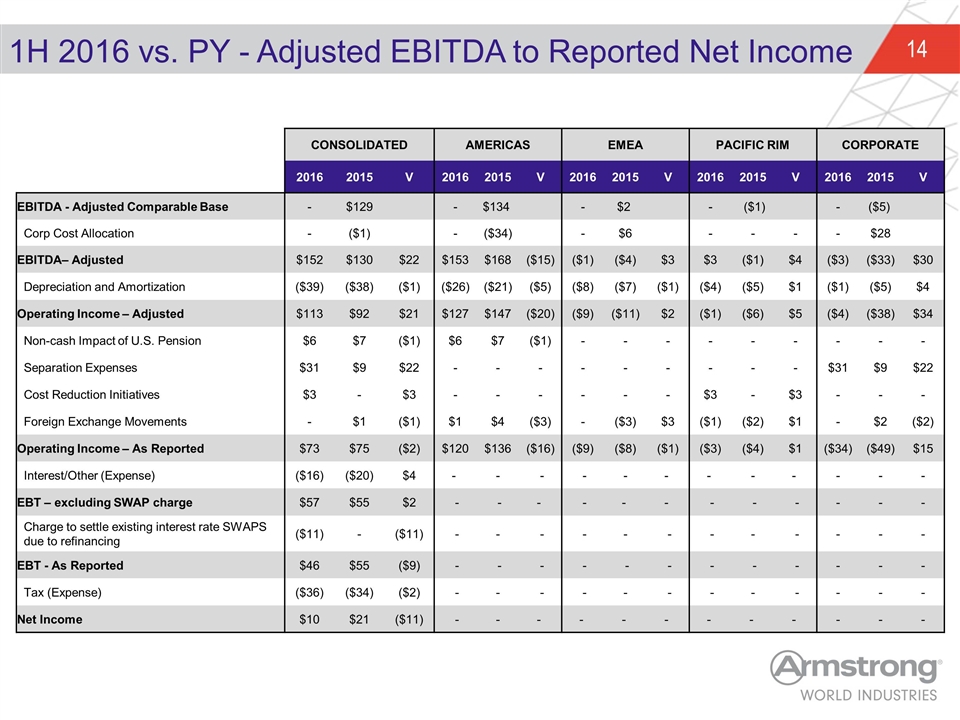

1H 2016 vs. PY - Adjusted EBITDA to Reported Net Income CONSOLIDATED AMERICAS EMEA PACIFIC RIM CORPORATE 2016 2015 V 2016 2015 V 2016 2015 V 2016 2015 V 2016 2015 V EBITDA - Adjusted Comparable Base - $129 - $134 - $2 - ($1) - ($5) Corp Cost Allocation - ($1) - ($34) - $6 - - - - $28 EBITDA– Adjusted $152 $130 $22 $153 $168 ($15) ($1) ($4) $3 $3 ($1) $4 ($3) ($33) $30 Depreciation and Amortization ($39) ($38) ($1) ($26) ($21) ($5) ($8) ($7) ($1) ($4) ($5) $1 ($1) ($5) $4 Operating Income – Adjusted $113 $92 $21 $127 $147 ($20) ($9) ($11) $2 ($1) ($6) $5 ($4) ($38) $34 Non-cash Impact of U.S. Pension $6 $7 ($1) $6 $7 ($1) - - - - - - - - - Separation Expenses $31 $9 $22 - - - - - - - - - $31 $9 $22 Cost Reduction Initiatives $3 - $3 - - - - - - $3 - $3 - - - Foreign Exchange Movements - $1 ($1) $1 $4 ($3) - ($3) $3 ($1) ($2) $1 - $2 ($2) Operating Income – As Reported $73 $75 ($2) $120 $136 ($16) ($9) ($8) ($1) ($3) ($4) $1 ($34) ($49) $15 Interest/Other (Expense) ($16) ($20) $4 - - - - - - - - - - - - EBT – excluding SWAP charge $57 $55 $2 - - - - - - - - - - - - Charge to settle existing interest rate SWAPS due to refinancing ($11) - ($11) - - - - - - - - - - - - EBT - As Reported $46 $55 ($9) - - - - - - - - - - - - Tax (Expense) ($36) ($34) ($2) - - - - - - - - - - - - Net Income $10 $21 ($11) - - - - - - - - - - - -

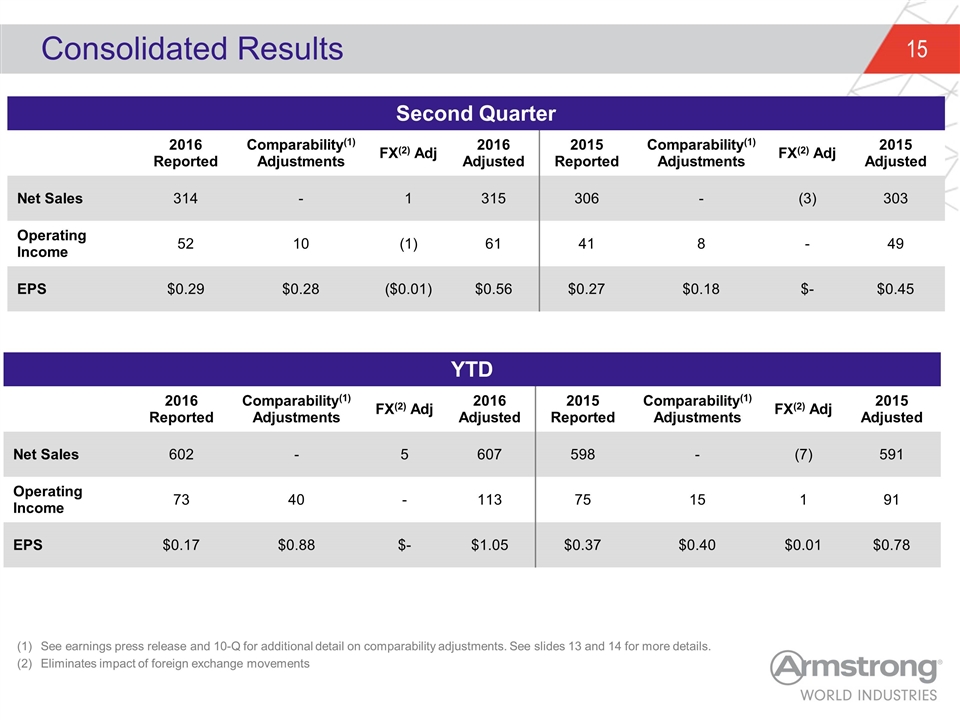

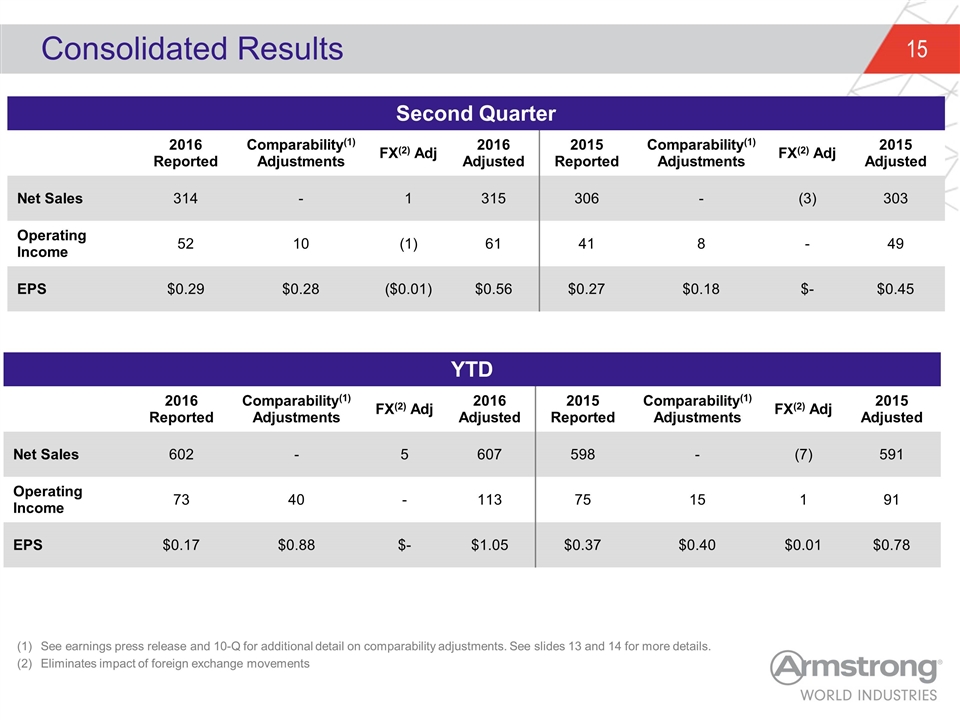

Consolidated Results Second Quarter 2016 Reported Comparability(1) Adjustments FX(2) Adj 2016 Adjusted 2015 Reported Comparability(1) Adjustments FX(2) Adj 2015 Adjusted Net Sales 314 - 1 315 306 - (3) 303 Operating Income 52 10 (1) 61 41 8 - 49 EPS $0.29 $0.28 ($0.01) $0.56 $0.27 $0.18 $- $0.45 See earnings press release and 10-Q for additional detail on comparability adjustments. See slides 13 and 14 for more details. Eliminates impact of foreign exchange movements YTD 2016 Reported Comparability(1) Adjustments FX(2) Adj 2016 Adjusted 2015 Reported Comparability(1) Adjustments FX(2) Adj 2015 Adjusted Net Sales 602 - 5 607 598 - (7) 591 Operating Income 73 40 - 113 75 15 1 91 EPS $0.17 $0.88 $- $1.05 $0.37 $0.40 $0.01 $0.78

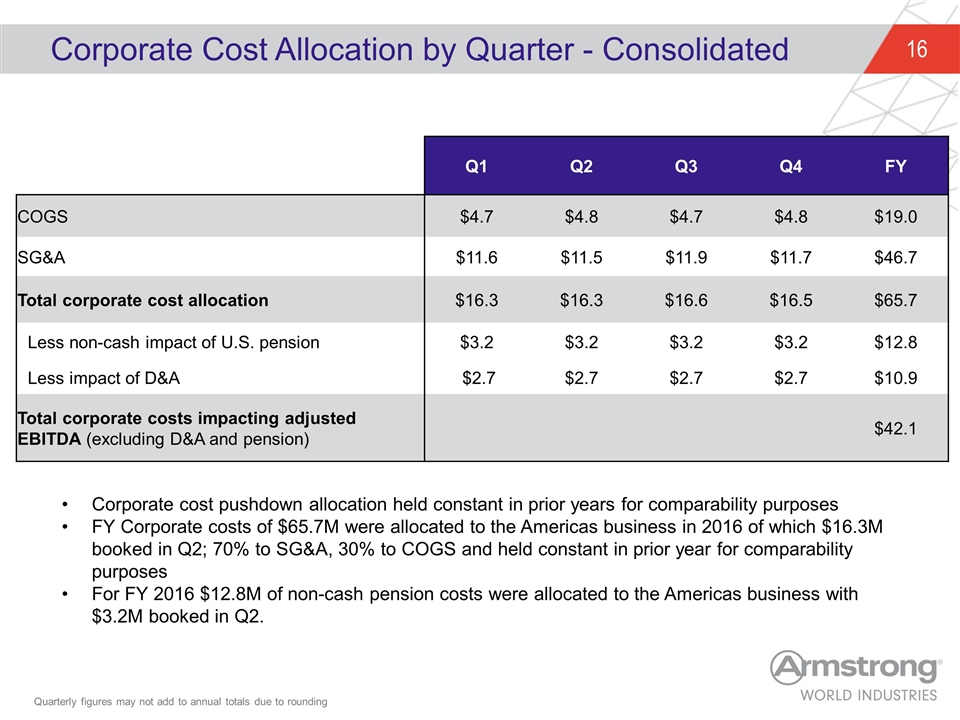

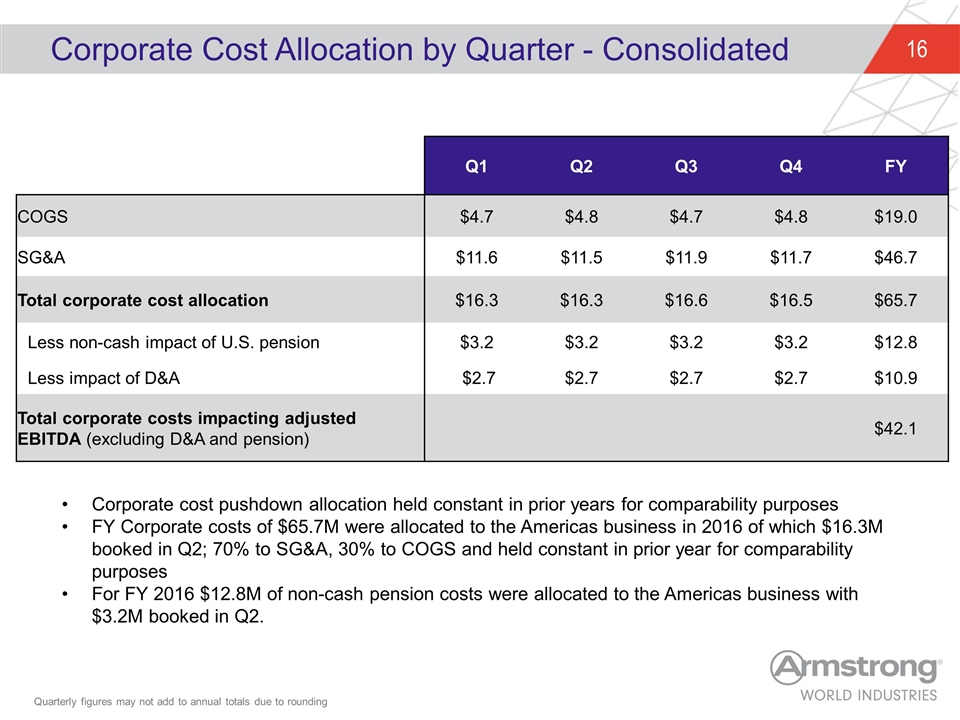

Corporate Cost Allocation by Quarter - Consolidated Corporate cost pushdown allocation held constant in prior years for comparability purposes FY Corporate costs of $65.7M were allocated to the Americas business in 2016 of which $16.3M booked in Q2; 70% to SG&A, 30% to COGS and held constant in prior year for comparability purposes For FY 2016 $12.8M of non-cash pension costs were allocated to the Americas business with $3.2M booked in Q2. Q1 Q2 Q3 Q4 FY COGS $4.7 $4.8 $4.7 $4.8 $19.0 SG&A $11.6 $11.5 $11.9 $11.7 $46.7 Total corporate cost allocation $16.3 $16.3 $16.6 $16.5 $65.7 Less non-cash impact of U.S. pension $3.2 $3.2 $3.2 $3.2 $12.8 Less impact of D&A $2.7 $2.7 $2.7 $2.7 $10.9 Total corporate costs impacting adjusted EBITDA (excluding D&A and pension) $42.1 Quarterly figures may not add to annual totals due to rounding