ARMSTRONG WORLD INDUSTRIES Brian MacNeal, CFO – R.W. Baird Conference Presentation November 8, 2016 Exhibit 99.1

Safe Harbor Statement Our disclosures in this presentation, including without limitation, those relating to future financial results guidance, and in our other public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those statements provide our future expectations or forecasts and can be identified by our use of words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "outlook," "target," "predict," "may," "will," "would," "could," "should," "seek," and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance or the separation of our businesses. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. A more detailed discussion of the risks and uncertainties that may affect our ability to achieve the projected performance is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our recent reports on Forms 10-K and 10-Q filed with the SEC. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. The information in this presentation is only effective as of the date given November 8, 2016, and is subject to change. Any distribution of this presentation after November 8, 2016 is not intended and will not be construed as updating or confirming such information. In addition, we will be referring to “non-GAAP financial measures” within the meaning of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance with GAAP can be found in the appendix to this presentation, in our SEC filings and on the Investor Relations section of our website at www.armstrongceilings.com. Armstrong World Industries competes globally in many diverse markets. References to "market" or "share" data are simply estimations based on a combination of internal and external sources and assumptions. They are intended only to assist discussion of the relative performance of product segments and categories for marketing and related purposes. No conclusion has been reached or should be reached regarding a "product market," a "geographic market" or “market share,” as such terms may be used or defined for any economic, legal or other purpose.

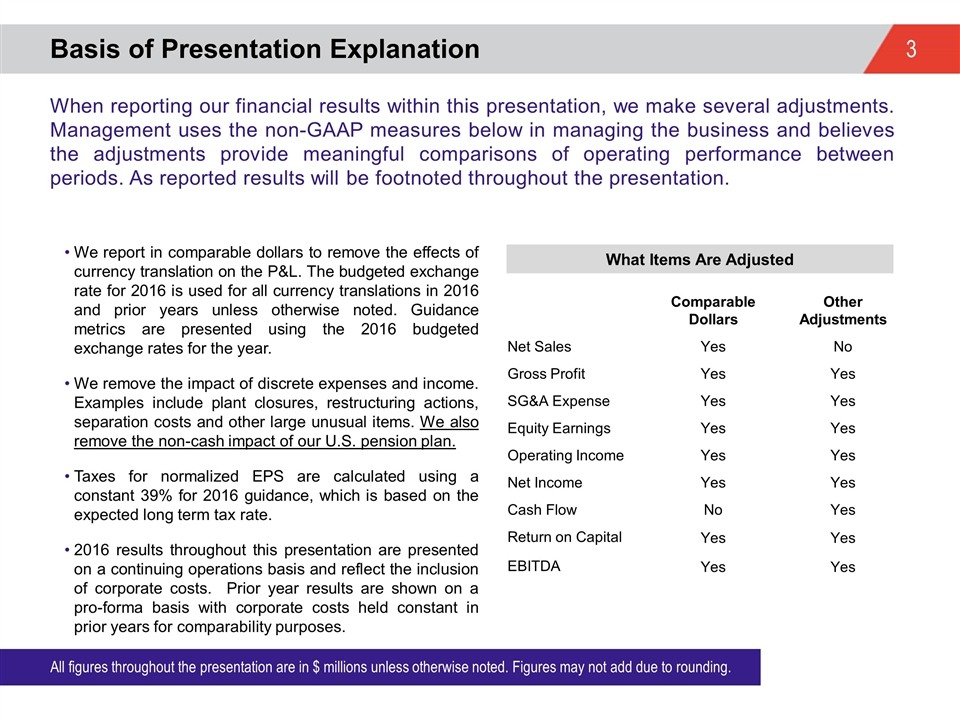

When reporting our financial results within this presentation, we make several adjustments. Management uses the non-GAAP measures below in managing the business and believes the adjustments provide meaningful comparisons of operating performance between periods. As reported results will be footnoted throughout the presentation. Basis of Presentation Explanation All figures throughout the presentation are in $ millions unless otherwise noted. Figures may not add due to rounding. We report in comparable dollars to remove the effects of currency translation on the P&L. The budgeted exchange rate for 2016 is used for all currency translations in 2016 and prior years unless otherwise noted. Guidance metrics are presented using the 2016 budgeted exchange rates for the year. We remove the impact of discrete expenses and income. Examples include plant closures, restructuring actions, separation costs and other large unusual items. We also remove the non-cash impact of our U.S. pension plan. Taxes for normalized EPS are calculated using a constant 39% for 2016 guidance, which is based on the expected long term tax rate. 2016 results throughout this presentation are presented on a continuing operations basis and reflect the inclusion of corporate costs. Prior year results are shown on a pro-forma basis with corporate costs held constant in prior years for comparability purposes. Comparable Dollars Other Adjustments Net Sales Yes No Gross Profit Yes Yes SG&A Expense Yes Yes Equity Earnings Yes Yes Operating Income Yes Yes Net Income Yes Yes Cash Flow No Yes Return on Capital Yes Yes EBITDA Yes Yes What Items Are Adjusted

The New AWI Investment Thesis Standout Global Leader in Attractive Ceilings Industry 1 Best-in-Class, Stable Cash Flow Through the Cycle Attractive, Multi-Faceted Growth Opportunities Financial Overview & Value Creation Model 1 Standout Leader 2 3 4 2 3 4 Best-in-Class Cash Flow 1 3 4 2 Growth Levers 1 2 4 3 Additional Profit Drivers 1 2 3 4 4 Levers for Value 1 2 3 2 Robust Cash Flow 3 4 1 3 Attractive Growth 4 1 2

Leadership Position in Attractive Ceilings Industry Strong Leader in Largest Global Profit Pool Consolidated industry structure Large installed base with stable repair & remodel demand Established product specifications Multi-faceted sales process involving architects, designers, distributors, contractors and end-users High value but low cost product with limited substitutes and lack of imports End users demonstrate brand loyalty and reward customer service and innovation Looking for external references to validate 1 Standout Leader 2 3 4

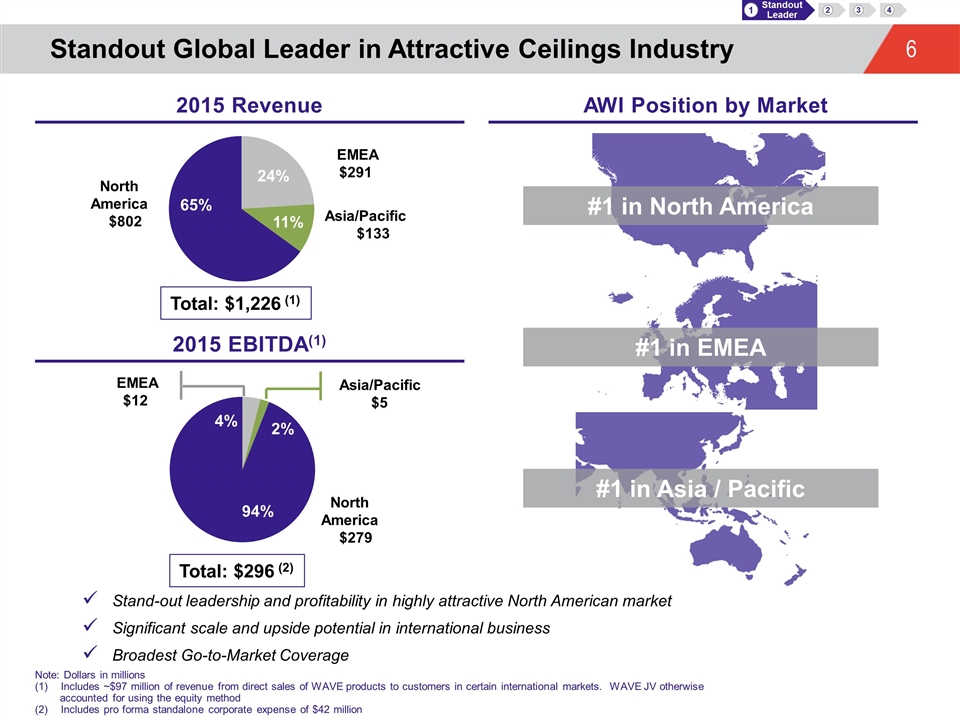

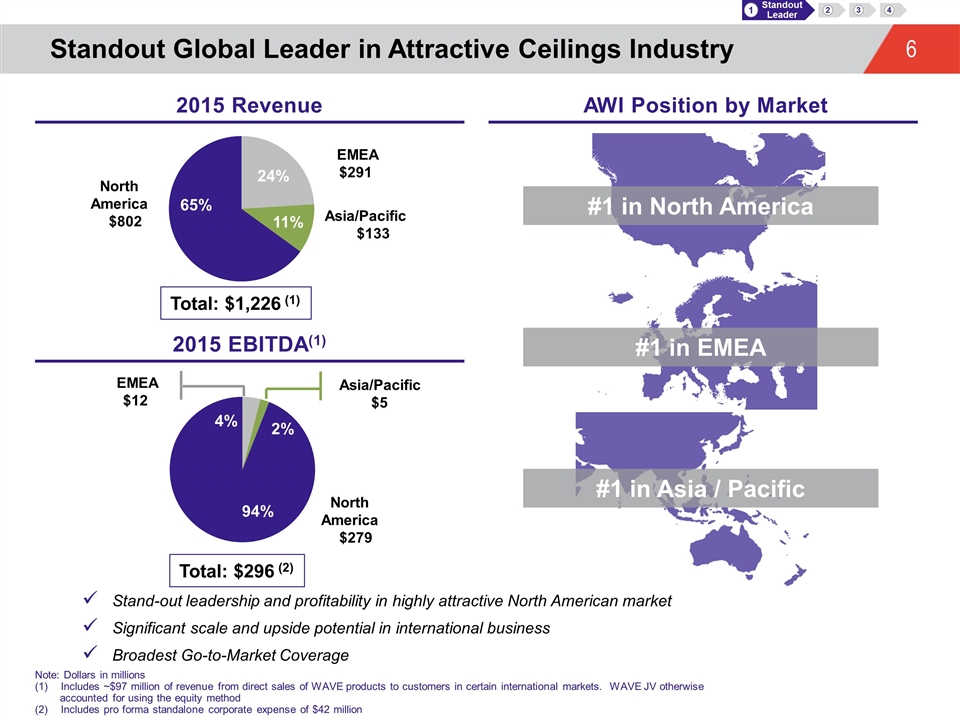

Standout Global Leader in Attractive Ceilings Industry 1 Standout Leader 2 3 4 Total: $1,226 (1) Stand-out leadership and profitability in highly attractive North American market Significant scale and upside potential in international business Broadest Go-to-Market Coverage Total: $296 (2) #1 in North America #1 in EMEA #1 in Asia / Pacific 2015 Revenue AWI Position by Market 2015 EBITDA(1) Note: Dollars in millions Includes ~$97 million of revenue from direct sales of WAVE products to customers in certain international markets. WAVE JV otherwise accounted for using the equity method Includes pro forma standalone corporate expense of $42 million Asia/Pacific $5 North America $279 EMEA $12 EMEA $291 North America $802

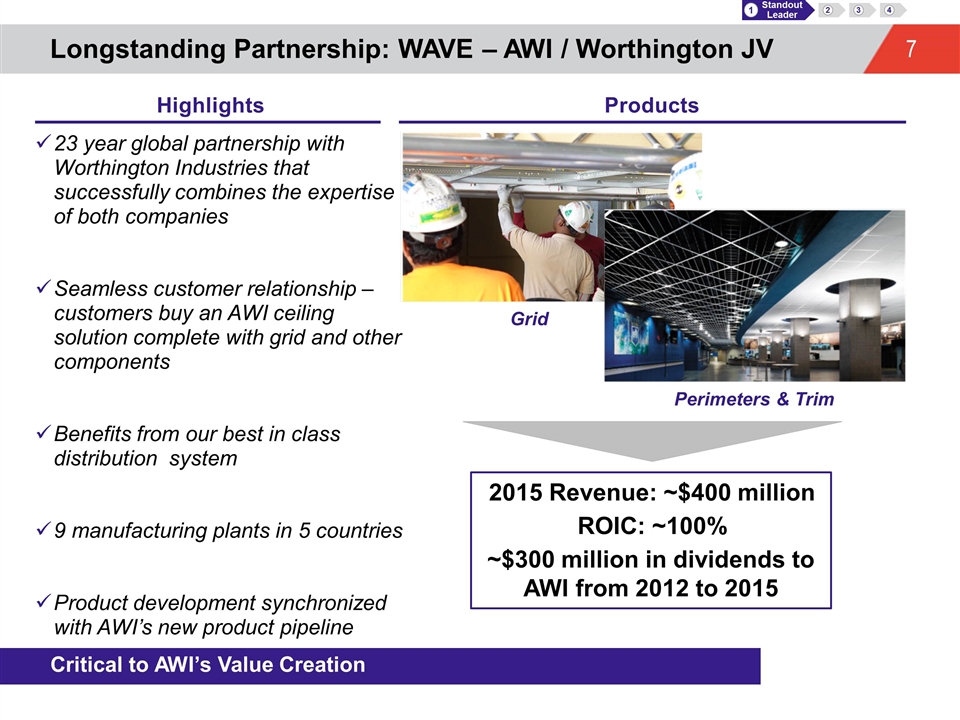

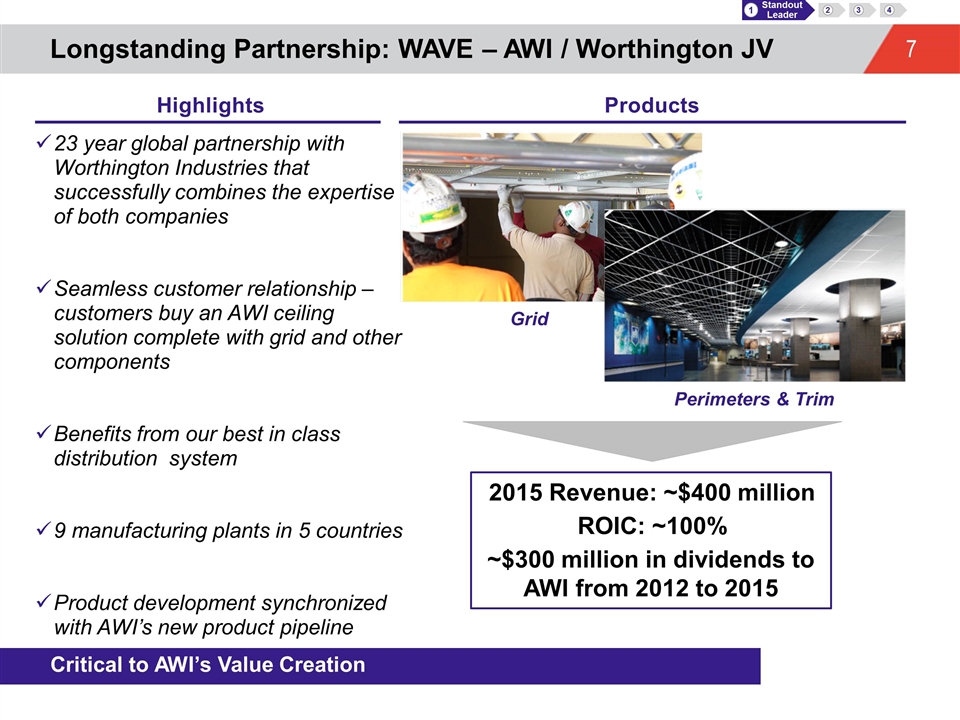

Longstanding Partnership: WAVE – AWI / Worthington JV Critical to AWI’s Value Creation 23 year global partnership with Worthington Industries that successfully combines the expertise of both companies Seamless customer relationship – customers buy an AWI ceiling solution complete with grid and other components Benefits from our best in class distribution system 9 manufacturing plants in 5 countries Product development synchronized with AWI’s new product pipeline Grid Perimeters & Trim 2015 Revenue: ~$400 million ~$300 million in dividends to AWI from 2012 to 2015 ROIC: ~100% 1 Standout Leader 2 3 4 Highlights Products

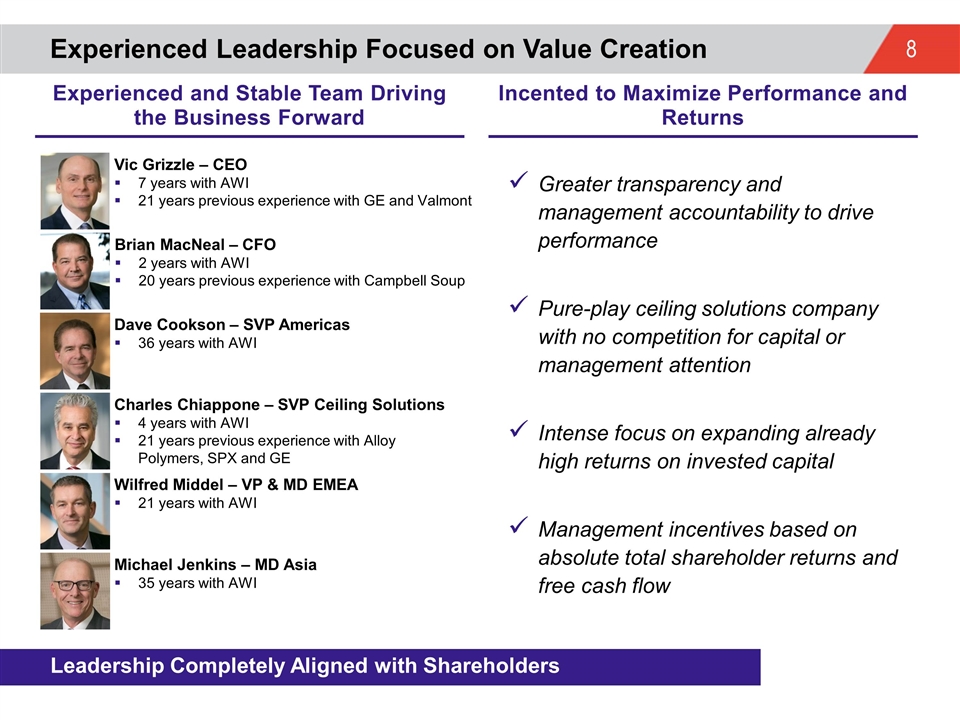

Experienced Leadership Focused on Value Creation Leadership Completely Aligned with Shareholders Greater transparency and management accountability to drive performance Pure-play ceiling solutions company with no competition for capital or management attention Intense focus on expanding already high returns on invested capital Management incentives based on absolute total shareholder returns and free cash flow Vic Grizzle – CEO 7 years with AWI 21 years previous experience with GE and Valmont Brian MacNeal – CFO 2 years with AWI 20 years previous experience with Campbell Soup Dave Cookson – SVP Americas 36 years with AWI Charles Chiappone – SVP Ceiling Solutions 4 years with AWI 21 years previous experience with Alloy Polymers, SPX and GE Wilfred Middel – VP & MD EMEA 21 years with AWI Michael Jenkins – MD Asia 35 years with AWI Experienced and Stable Team Driving the Business Forward Incented to Maximize Performance and Returns

The New AWI Investment Thesis 1 Standout Leader 2 3 4 Standout Global Leader in Attractive Ceilings Industry 1 Best-in-Class, Stable Cash Flow Through the Cycle Attractive, Multi-Faceted Growth Opportunities Financial Overview & Value Creation Model 2 3 4 Best-in-Class Cash Flow 1 3 4 2 Growth Levers 1 2 4 3 Additional Profit Drivers 1 2 3 4

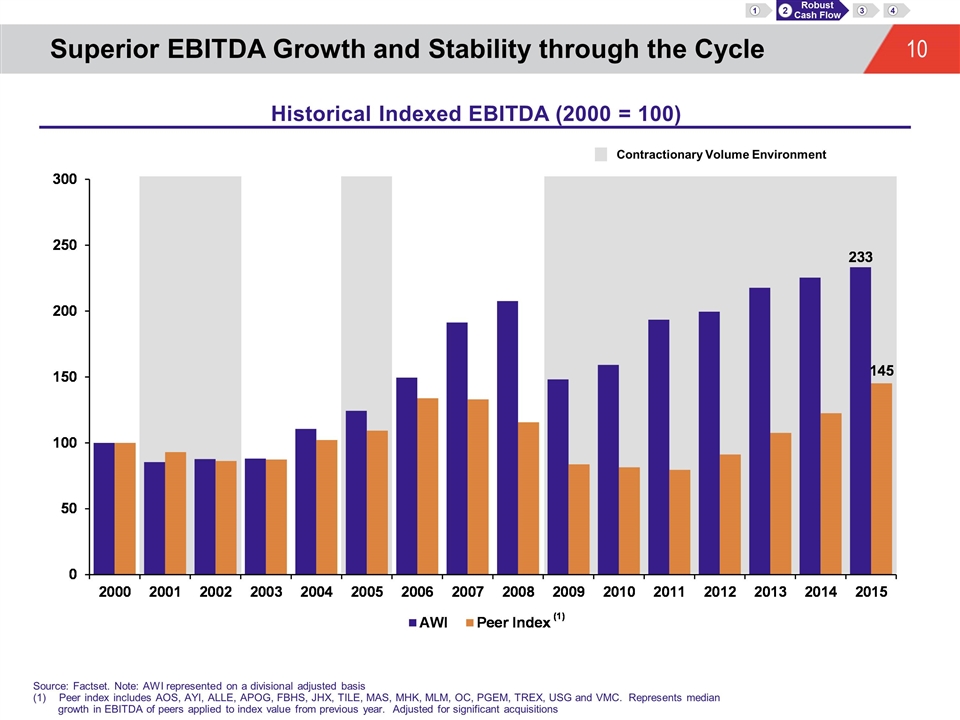

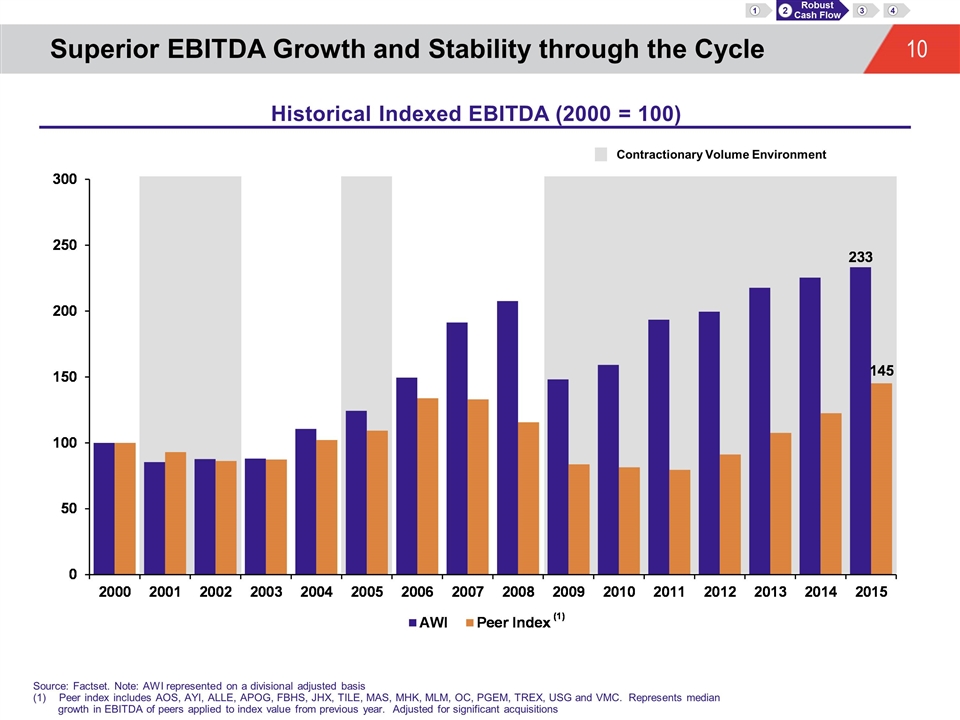

Superior EBITDA Growth and Stability through the Cycle 2 Robust Cash Flow 3 4 1 Historical Indexed EBITDA (2000 = 100) Contractionary Volume Environment Source: Factset. Note: AWI represented on a divisional adjusted basis Peer index includes AOS, AYI, ALLE, APOG, FBHS, JHX, TILE, MAS, MHK, MLM, OC, PGEM, TREX, USG and VMC. Represents median growth in EBITDA of peers applied to index value from previous year. Adjusted for significant acquisitions

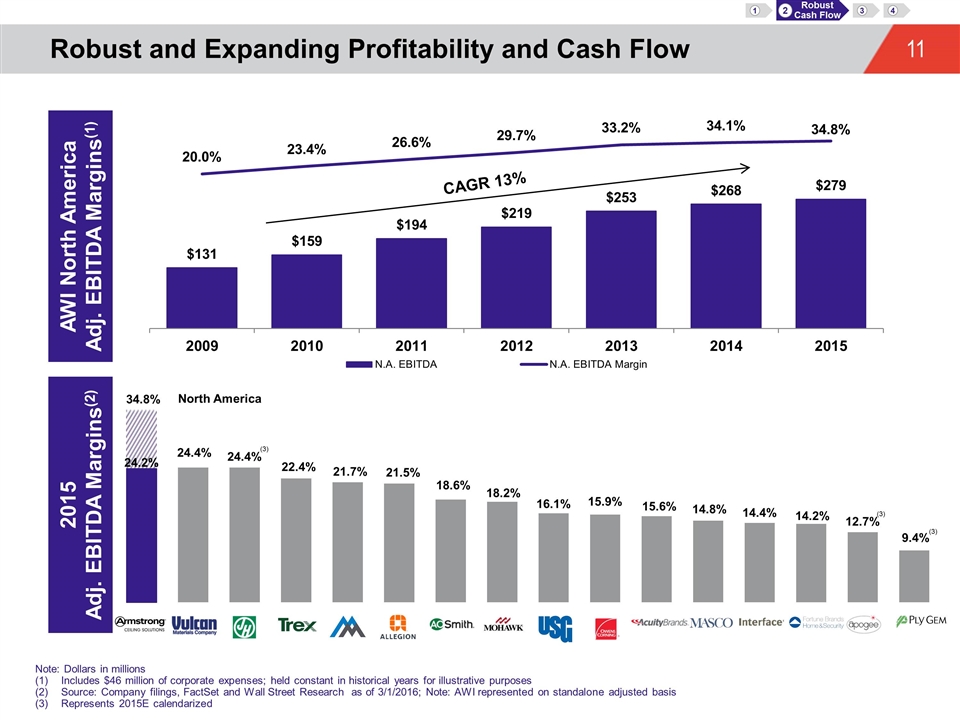

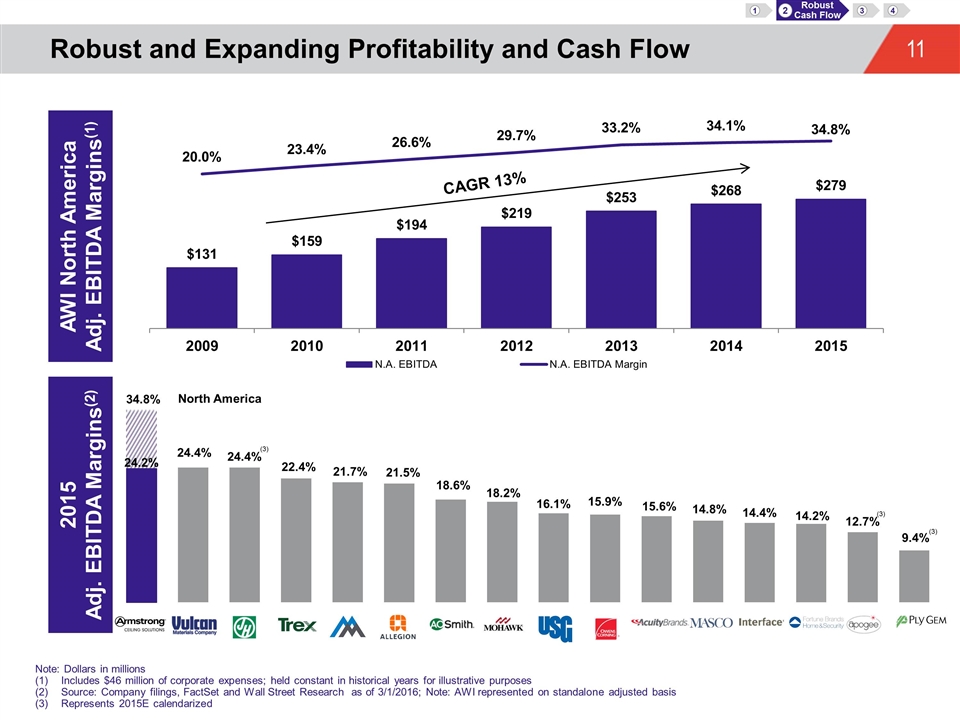

Robust and Expanding Profitability and Cash Flow Note: Dollars in millions Includes $46 million of corporate expenses; held constant in historical years for illustrative purposes Source: Company filings, FactSet and Wall Street Research as of 3/1/2016; Note: AWI represented on standalone adjusted basis Represents 2015E calendarized 2 Robust Cash Flow 3 4 1 2015 Adj. EBITDA Margins(2) AWI North America Adj. EBITDA Margins(1) North America 34.8% (3) (3) (3)

The New AWI Investment Thesis 1 Standout Leader 2 3 4 Standout Global Leader in Attractive Ceilings Industry 1 Best-in-Class, Stable Cash Flow Through the Cycle Attractive, Multi-Faceted Growth Opportunities Financial Overview & Value Creation Model 2 3 4 Best-in-Class Cash Flow 1 3 4 2 Growth Levers 1 2 4 3 Additional Profit Drivers 1 2 3 4

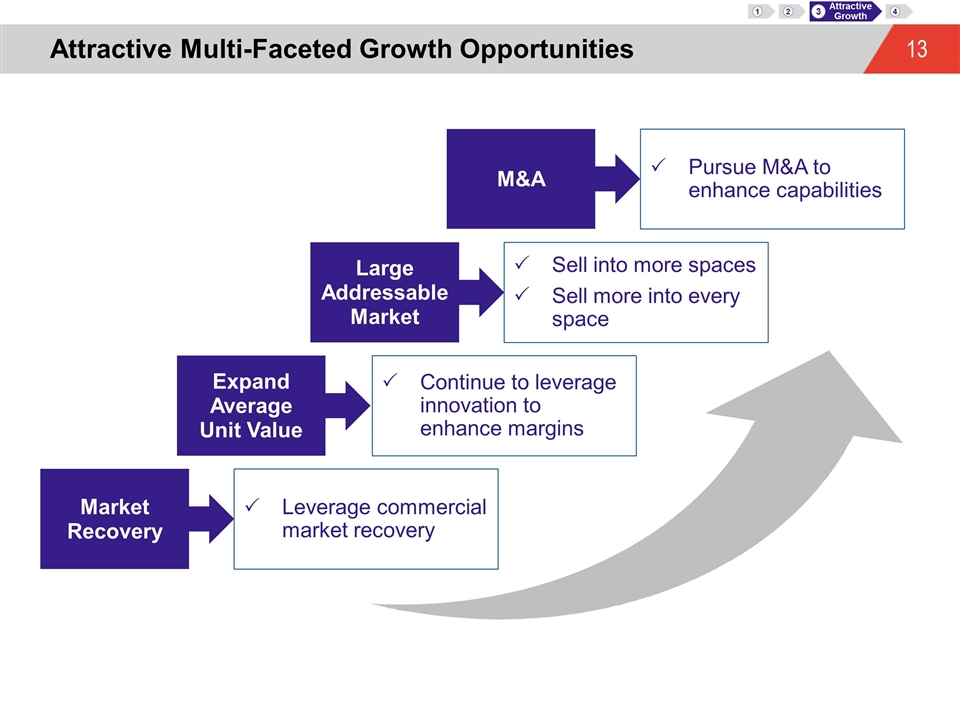

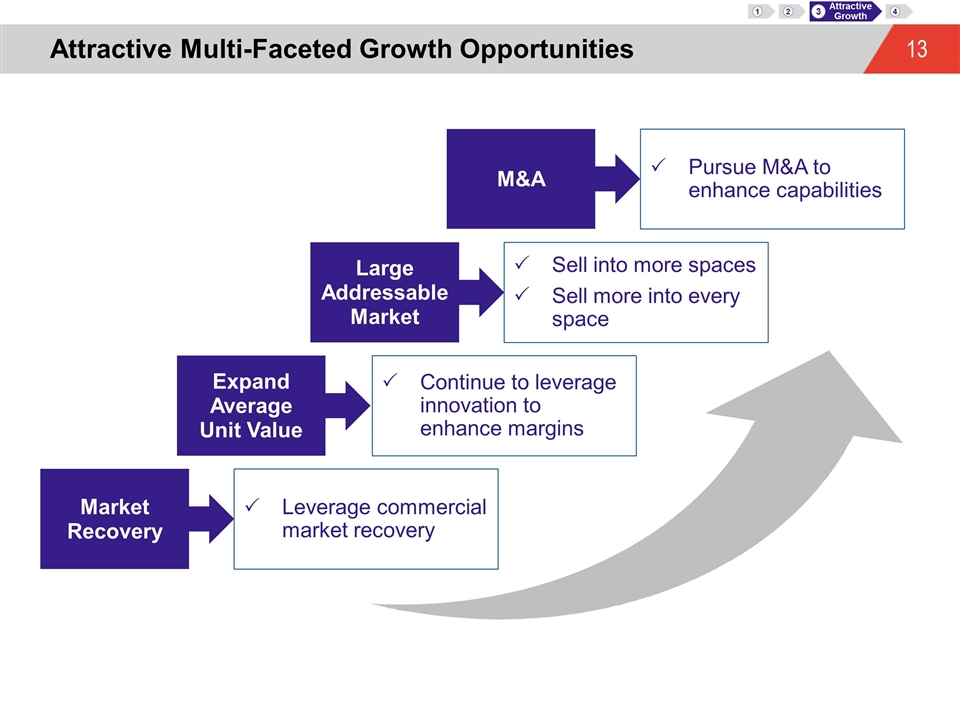

Attractive Multi-Faceted Growth Opportunities 3 Attractive Growth 4 1 2 Market Recovery Leverage commercial market recovery Expand Average Unit Value Continue to leverage innovation to enhance margins Large Addressable Market Sell into more spaces Sell more into every space Pursue M&A to enhance capabilities M&A Expansion of overall market and Armstrong share

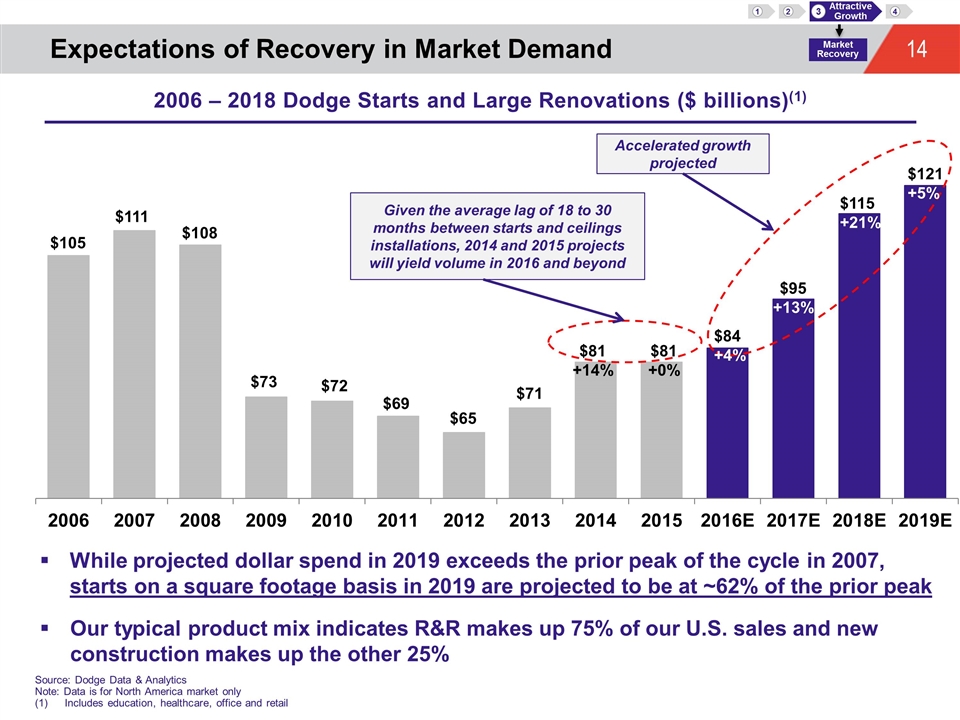

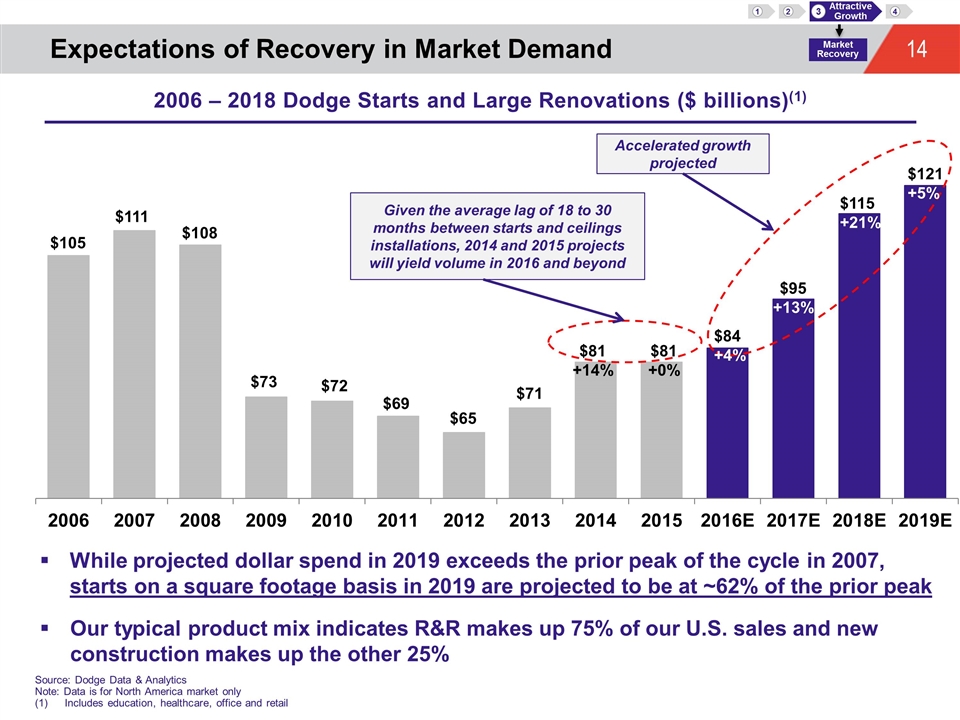

Expectations of Recovery in Market Demand Market Recovery 3 Attractive Growth 4 1 2 2006 – 2018 Dodge Starts and Large Renovations ($ billions)(1) Source: Dodge Data & Analytics Note: Data is for North America market only Includes education, healthcare, office and retail Accelerated growth projected Given the average lag of 18 to 30 months between starts and ceilings installations, 2014 and 2015 projects will yield volume in 2016 and beyond $69 $65 $71 $111 $105 $84 +4% $95 +13% $115 +21% $81 +0% $81 +14% $72 $73 $108 While projected dollar spend in 2019 exceeds the prior peak of the cycle in 2007, starts on a square footage basis in 2019 are projected to be at ~62% of the prior peak Our typical product mix indicates R&R makes up 75% of our U.S. sales and new construction makes up the other 25% $121+5%

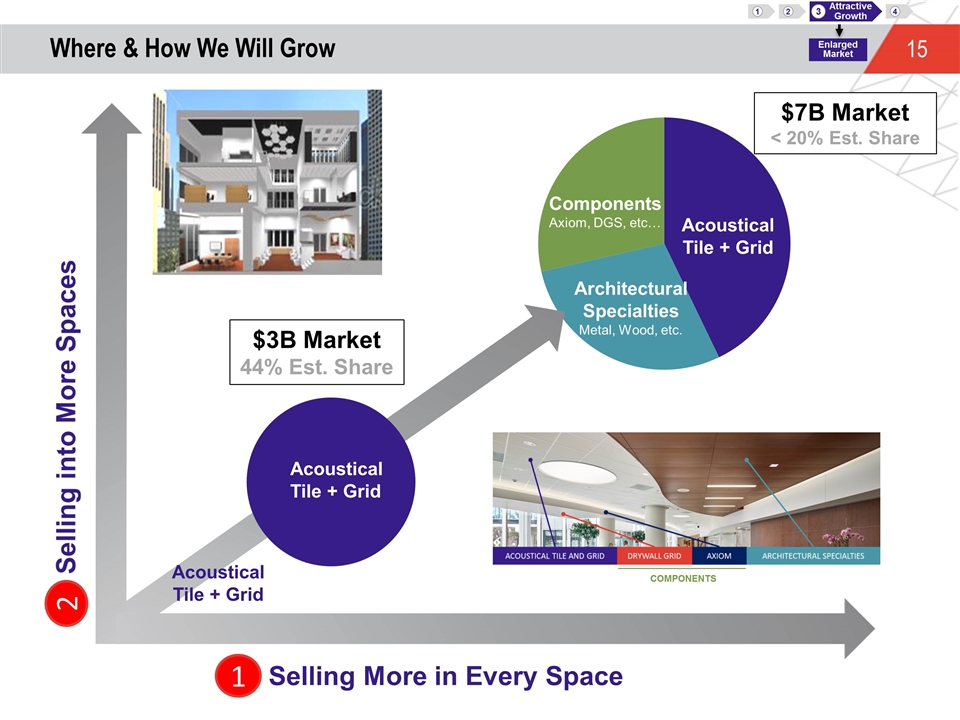

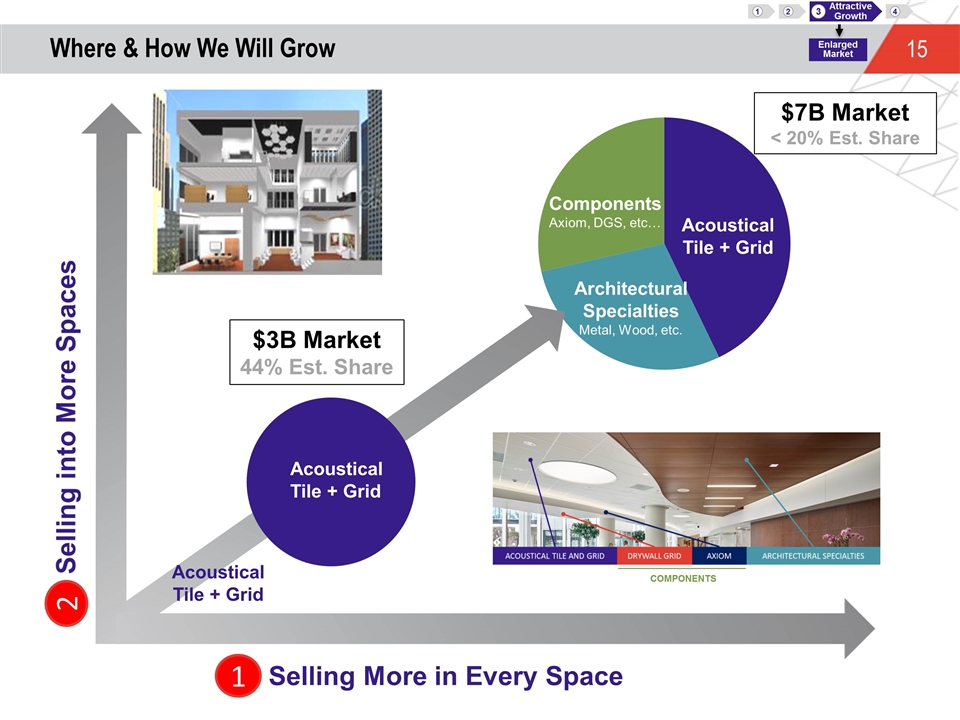

Where & How We Will Grow Selling into More Spaces Selling More in Every Space Acoustical Tile + Grid $3B Market 44% Est. Share Acoustical Tile + Grid Architectural Specialties Metal, Wood, etc. $7B Market < 20% Est. Share Components Axiom, DGS, etc… Acoustical Tile + Grid COMPONENTS 1 2 Enlarged Market 3 Attractive Growth 4 1 2

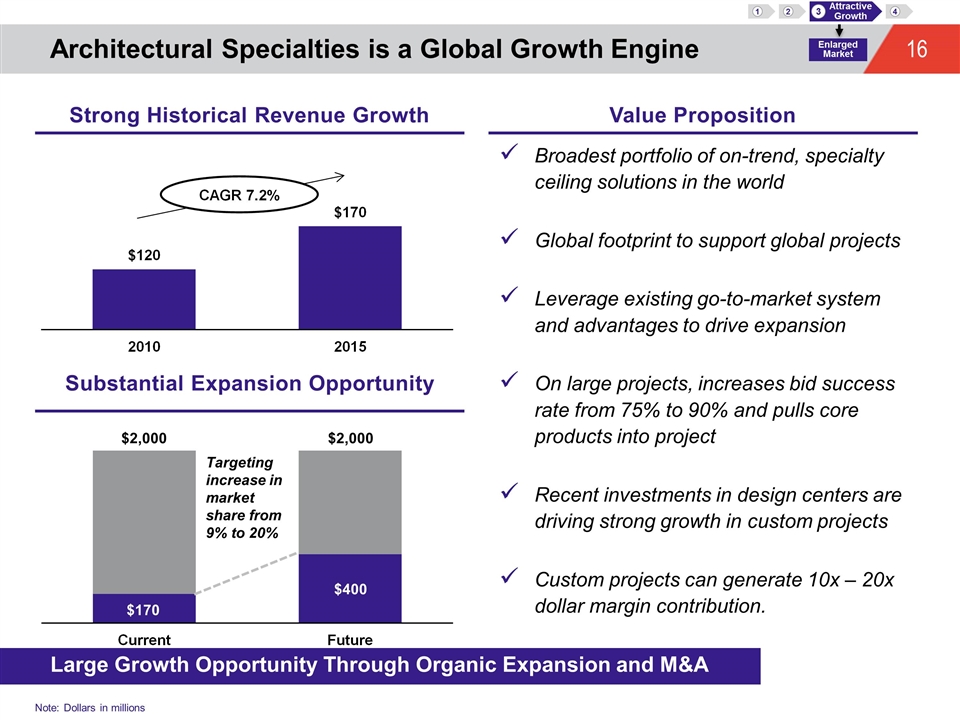

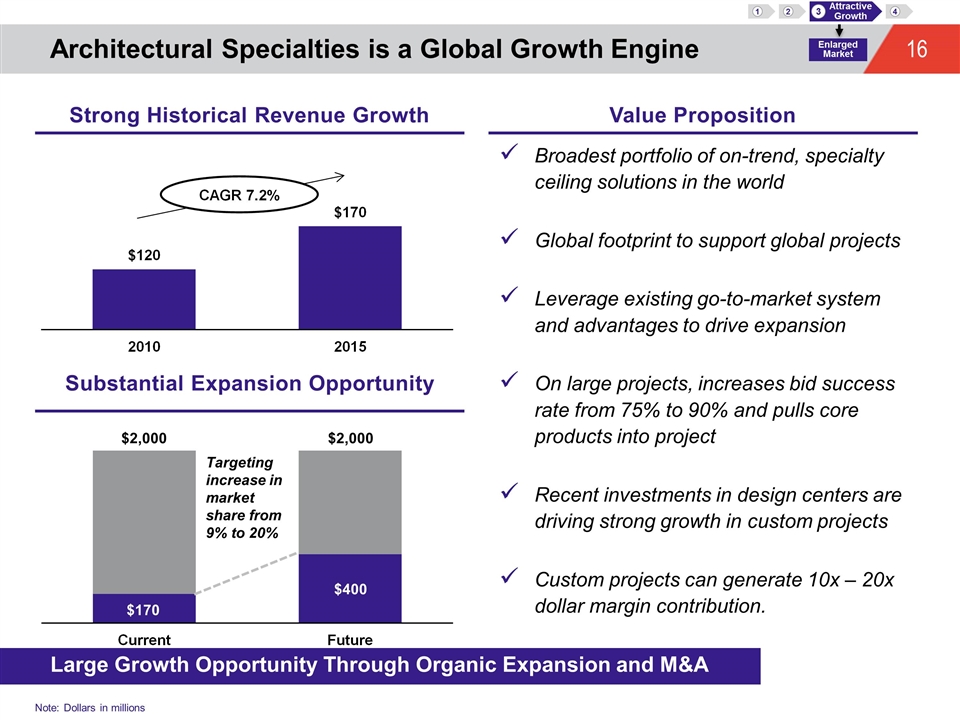

Architectural Specialties is a Global Growth Engine Large Growth Opportunity Through Organic Expansion and M&A Broadest portfolio of on-trend, specialty ceiling solutions in the world Global footprint to support global projects Leverage existing go-to-market system and advantages to drive expansion On large projects, increases bid success rate from 75% to 90% and pulls core products into project Recent investments in design centers are driving strong growth in custom projects Custom projects can generate 10x – 20x dollar margin contribution. $2,000 Targeting increase in market share from 9% to 20% $170 $400 $2,000 Enlarged Market 3 Attractive Growth 4 1 2 Strong Historical Revenue Growth Value Proposition Substantial Expansion Opportunity Note: Dollars in millions

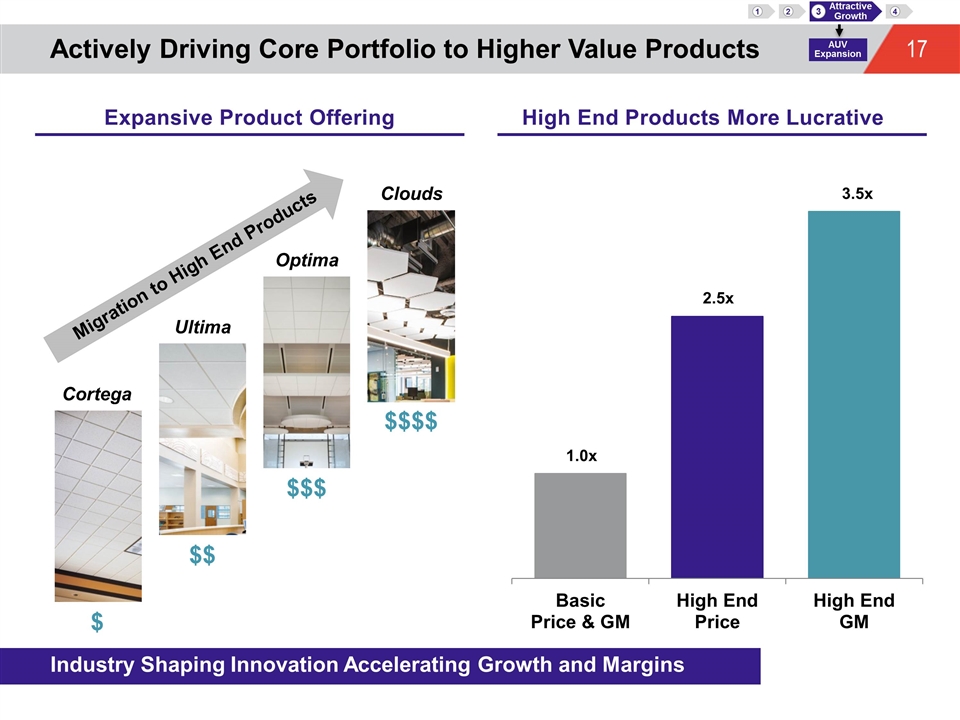

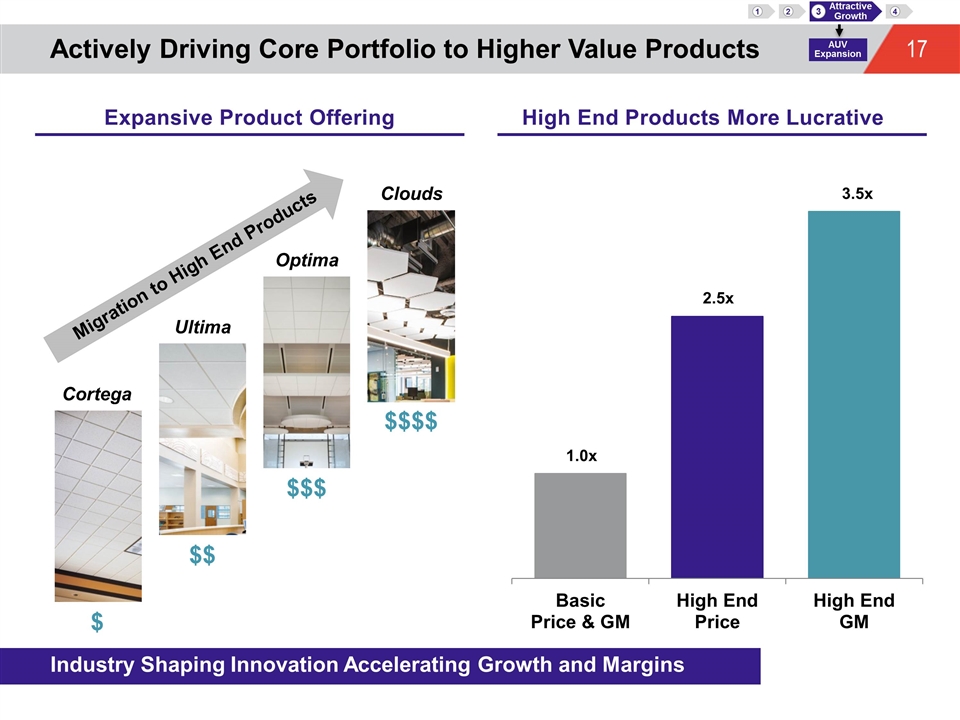

Actively Driving Core Portfolio to Higher Value Products Industry Shaping Innovation Accelerating Growth and Margins Cortega $ Ultima $$ Optima $$$ $$$$ Clouds Migration to High End Products AUV Expansion 3 Attractive Growth 4 1 2 Expansive Product Offering High End Products More Lucrative 1.0x 2.5x 3.5x

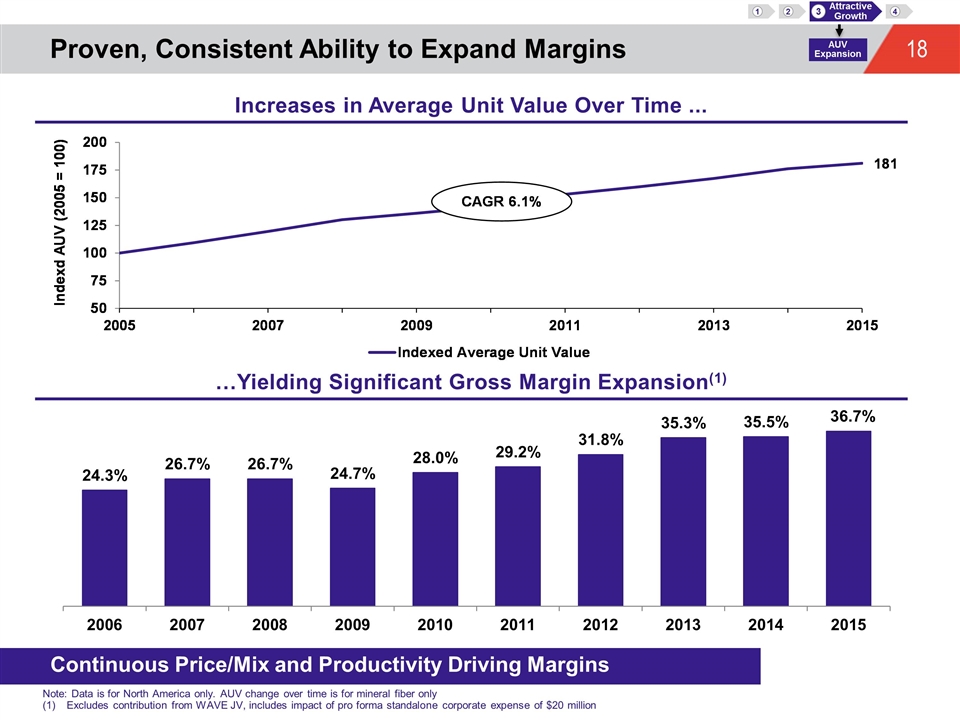

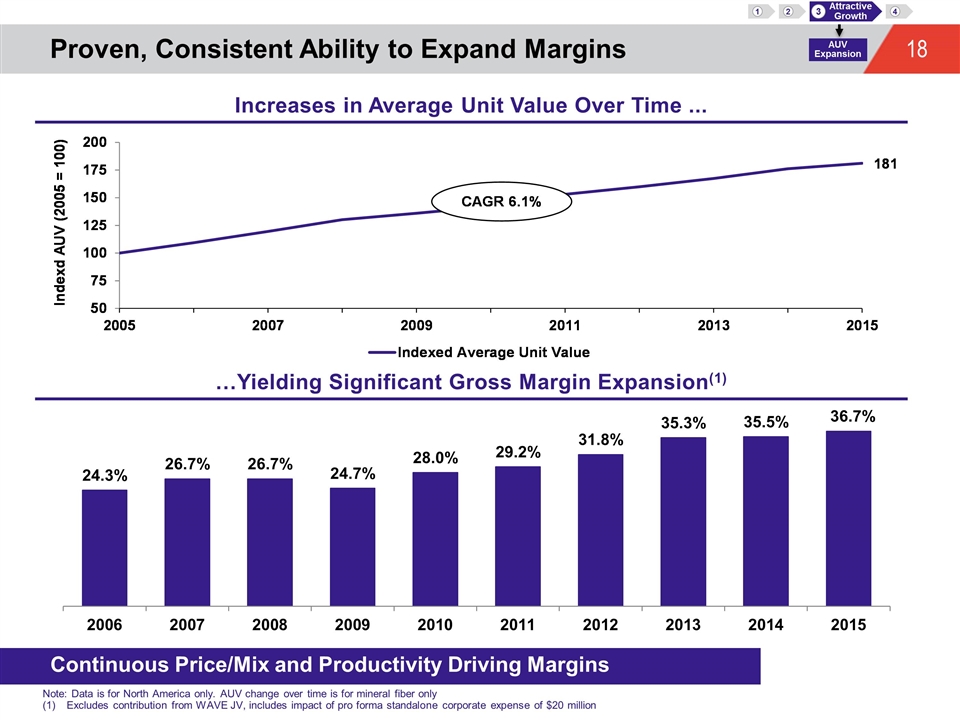

Proven, Consistent Ability to Expand Margins Continuous Price/Mix and Productivity Driving Margins Note: Data is for North America only. AUV change over time is for mineral fiber only Excludes contribution from WAVE JV, includes impact of pro forma standalone corporate expense of $20 million Increases in Average Unit Value Over Time ... …Yielding Significant Gross Margin Expansion(1) 3 Attractive Growth 4 1 2 AUV Expansion

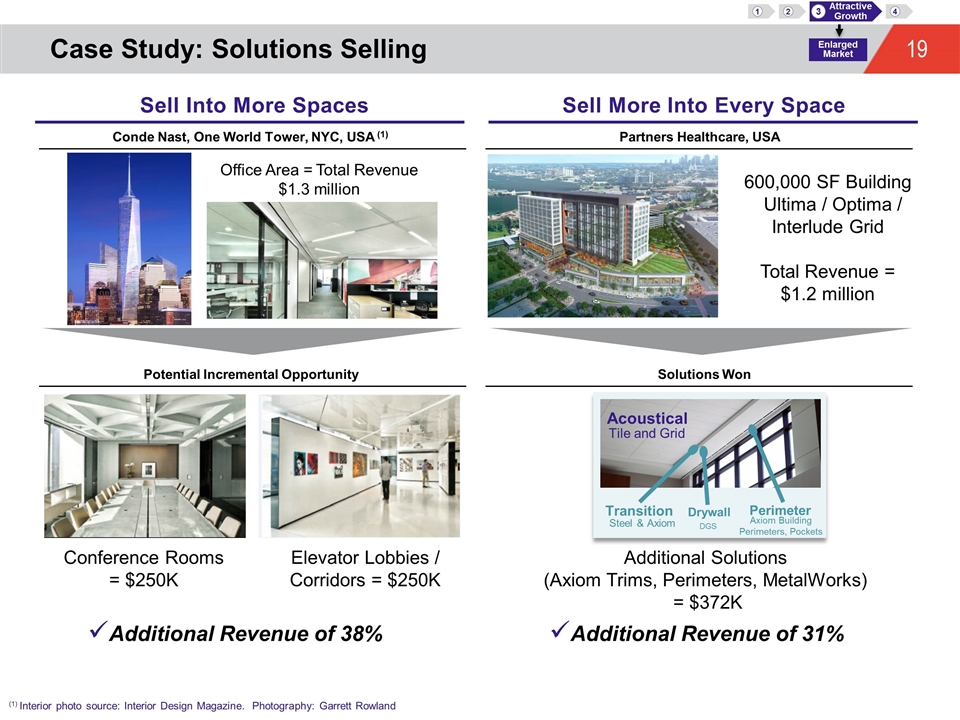

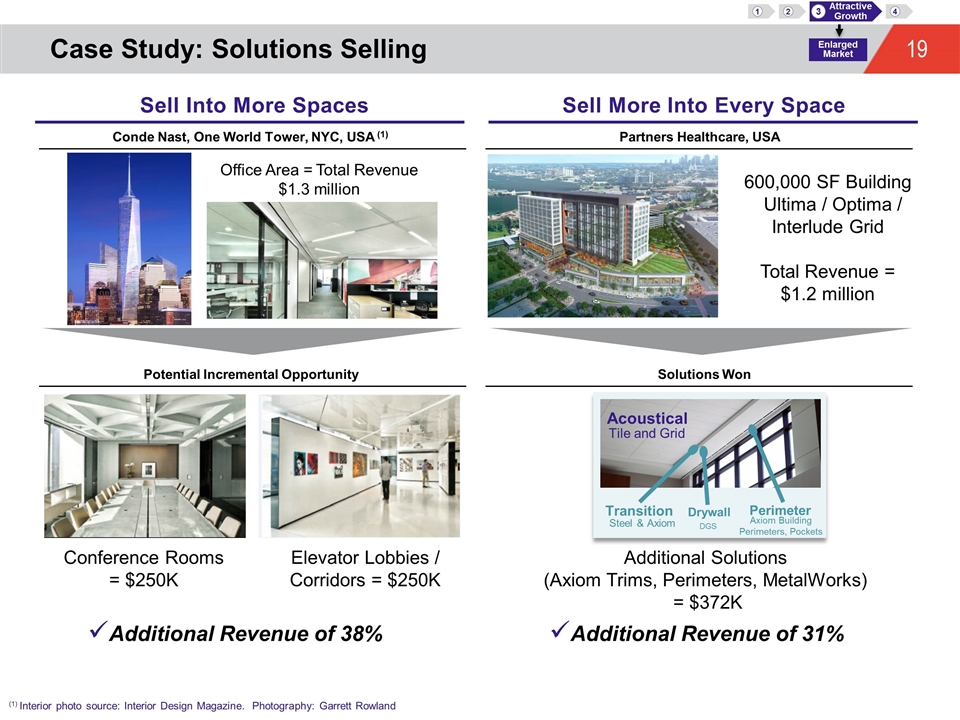

Case Study: Solutions Selling Office Area = Total Revenue $1.3 million Conference Rooms = $250K Elevator Lobbies / Corridors = $250K Partners Healthcare, USA Additional Solutions (Axiom Trims, Perimeters, MetalWorks) = $372K Additional Revenue of 31% 600,000 SF Building Ultima / Optima / Interlude Grid Total Revenue = $1.2 million Additional Revenue of 38% Potential Incremental Opportunity Solutions Won Transition Drywall Perimeter Steel & Axiom DGS Axiom Building Perimeters, Pockets Acoustical Tile and Grid Enlarged Market 3 Attractive Growth 4 1 2 Sell More Into Every Space Sell Into More Spaces Conde Nast, One World Tower, NYC, USA (1) (1) Interior photo source: Interior Design Magazine. Photography: Garrett Rowland

The New AWI Investment Thesis 1 Standout Leader 2 3 4 Standout Global Leader in Attractive Ceilings Industry 1 Best-in-Class, Stable Cash Flow Through the Cycle Attractive, Multi-Faceted Growth Opportunities Financial Overview & Value Creation Model 2 3 4 Best-in-Class Cash Flow 1 3 4 2 Growth Levers 1 2 4 3 Additional Profit Drivers 1 2 3 4

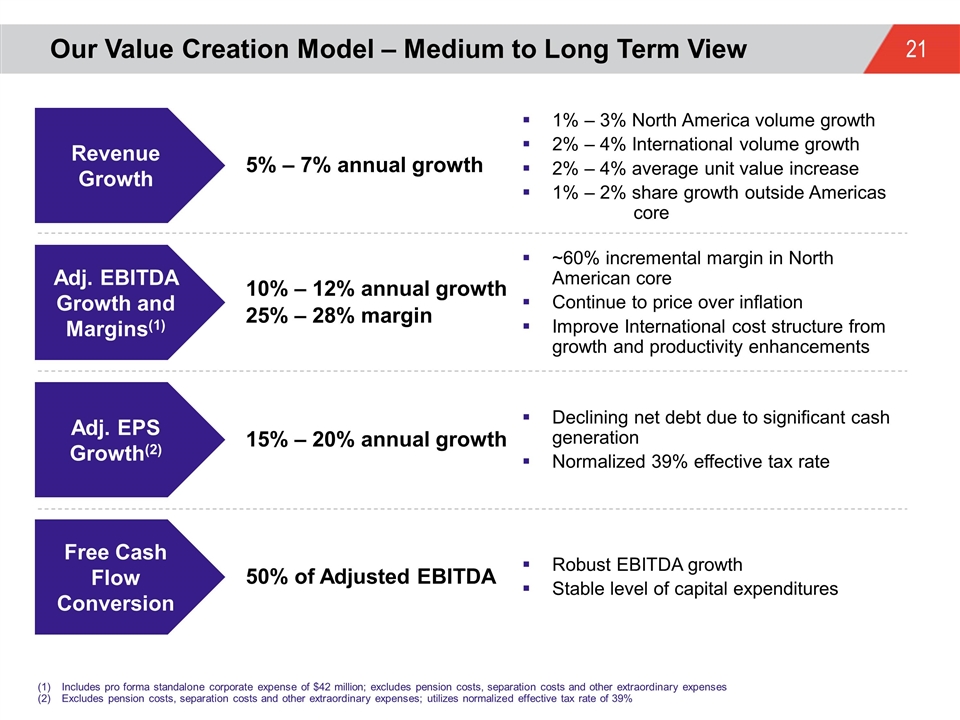

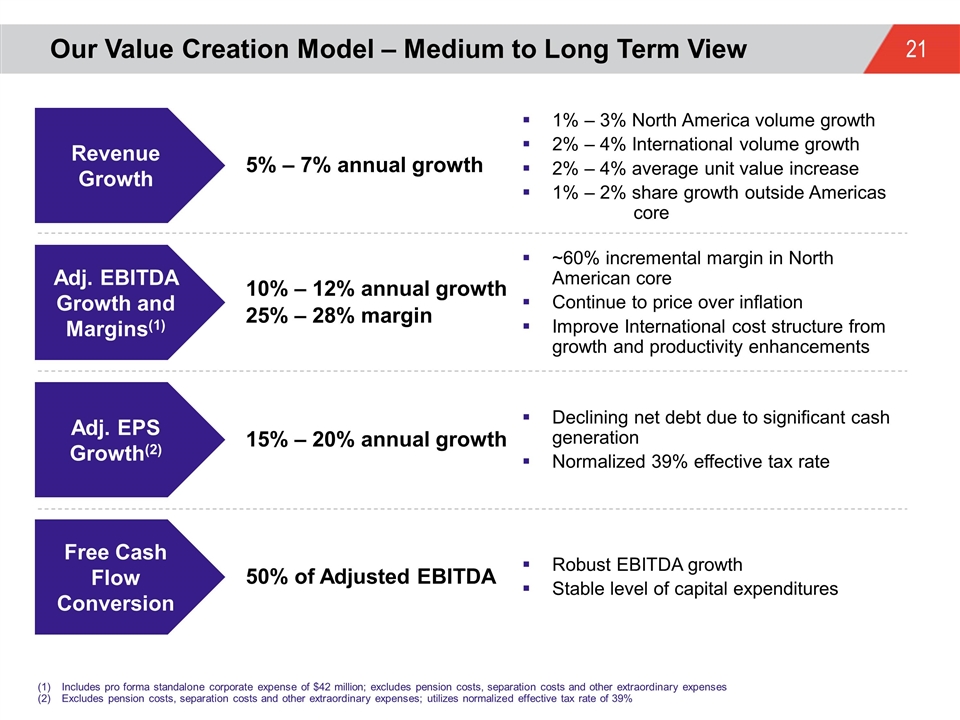

Our Value Creation Model – Medium to Long Term View Includes pro forma standalone corporate expense of $42 million; excludes pension costs, separation costs and other extraordinary expenses Excludes pension costs, separation costs and other extraordinary expenses; utilizes normalized effective tax rate of 39% Revenue Growth 5% – 7% annual growth Adj. EBITDA Growth and Margins(1) 10% – 12% annual growth 25% – 28% margin Adj. EPS Growth(2) 15% – 20% annual growth Free Cash Flow Conversion 50% of Adjusted EBITDA 1% – 3% North America volume growth 2% – 4% International volume growth 2% – 4% average unit value increase 1% – 2% share growth outside Americas core ~60% incremental margin in North American core Continue to price over inflation Improve International cost structure from growth and productivity enhancements Declining net debt due to significant cash generation Normalized 39% effective tax rate Robust EBITDA growth Stable level of capital expenditures

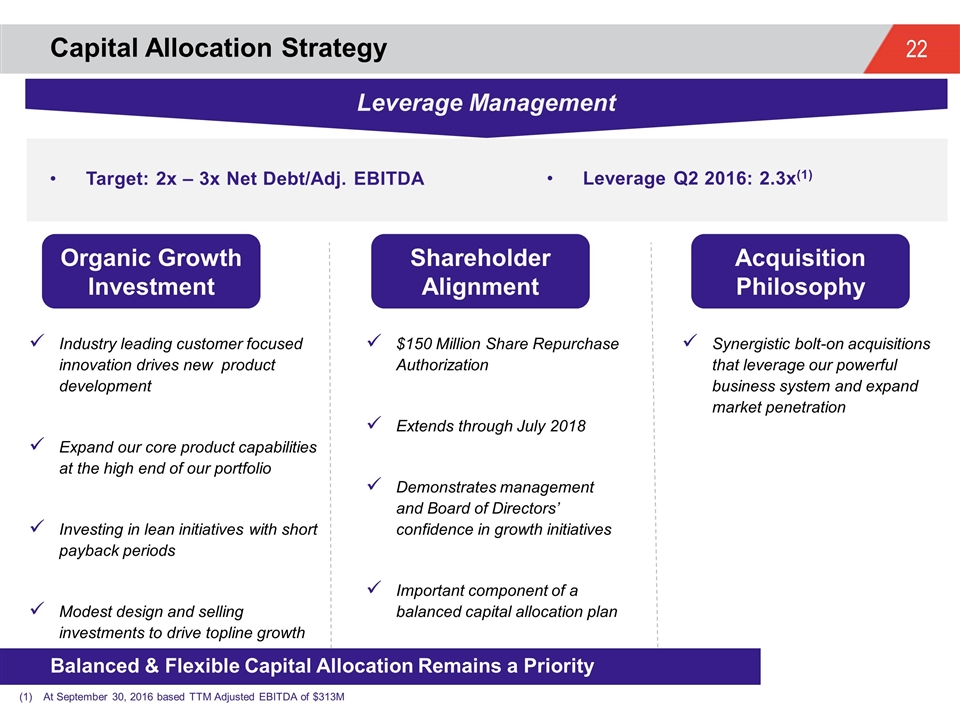

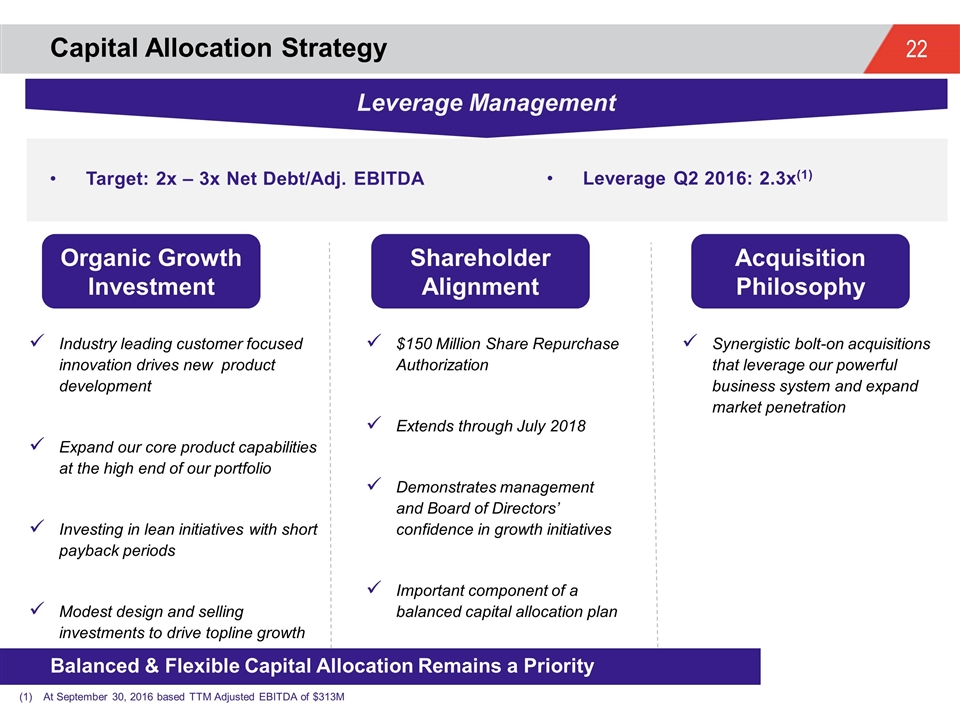

Capital Allocation Strategy Balanced & Flexible Capital Allocation Remains a Priority Organic Growth Investment Acquisition Philosophy Shareholder Alignment Industry leading customer focused innovation drives new product development Expand our core product capabilities at the high end of our portfolio Investing in lean initiatives with short payback periods Modest design and selling investments to drive topline growth $150 Million Share Repurchase Authorization Extends through July 2018 Demonstrates management and Board of Directors’ confidence in growth initiatives Important component of a balanced capital allocation plan Synergistic bolt-on acquisitions that leverage our powerful business system and expand market penetration Leverage Management Target: 2x – 3x Net Debt/Adj. EBITDA Leverage Q2 2016: 2.3x(1) At September 30, 2016 based TTM Adjusted EBITDA of $313M

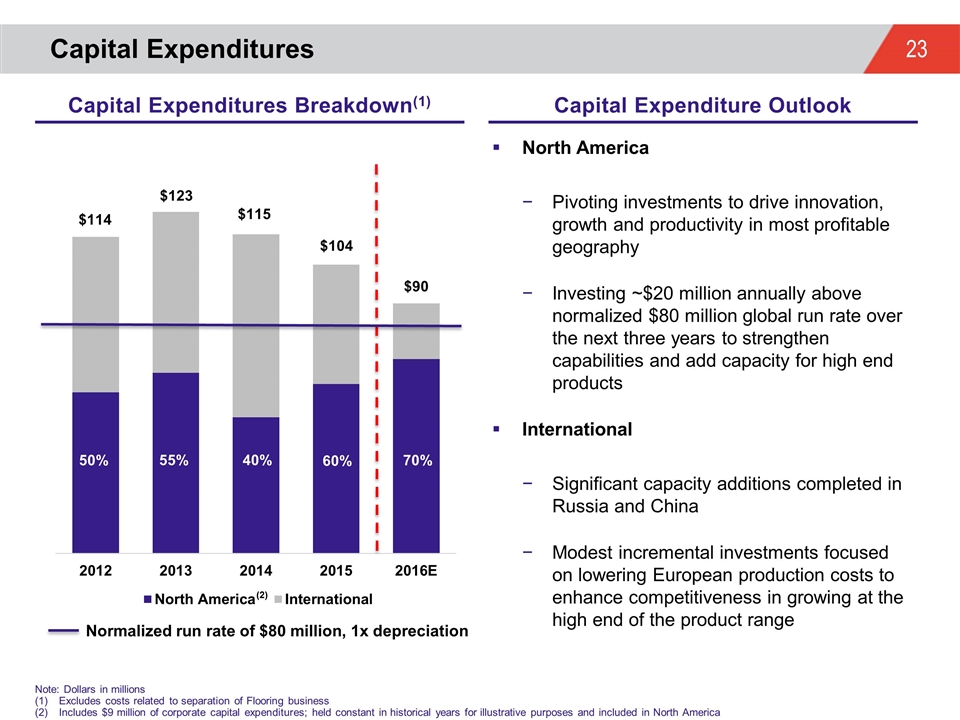

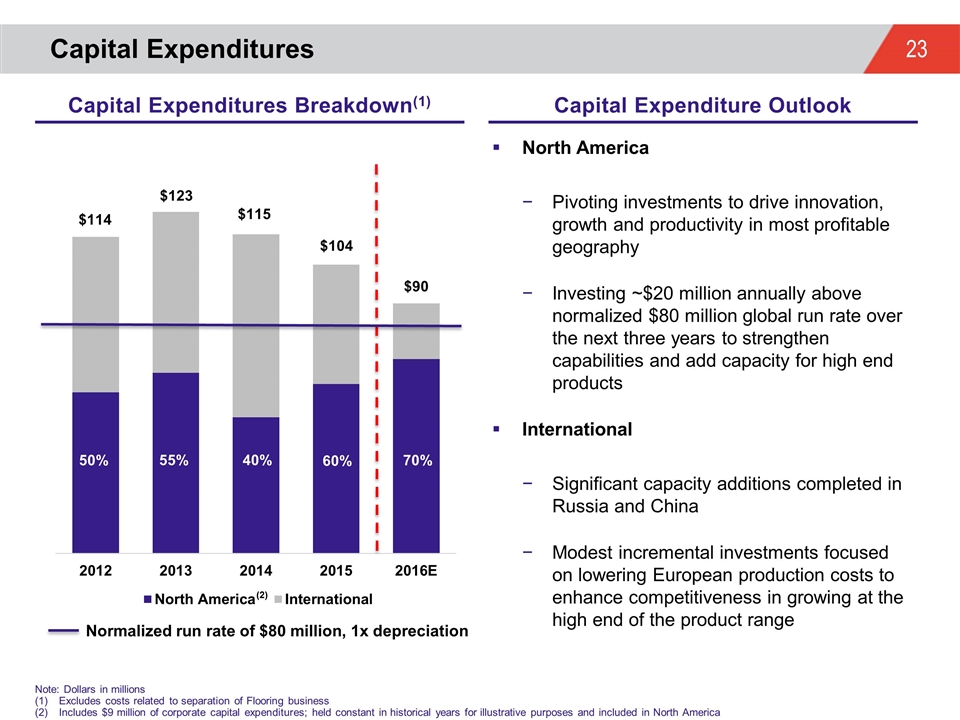

Capital Expenditures North America Pivoting investments to drive innovation, growth and productivity in most profitable geography Investing ~$20 million annually above normalized $80 million global run rate over the next three years to strengthen capabilities and add capacity for high end products International Significant capacity additions completed in Russia and China Modest incremental investments focused on lowering European production costs to enhance competitiveness in growing at the high end of the product range Note: Dollars in millions Excludes costs related to separation of Flooring business Includes $9 million of corporate capital expenditures; held constant in historical years for illustrative purposes and included in North America $114 $123 $115 $104 $90 50% 55% 40% 60% 70% Normalized run rate of $80 million, 1x depreciation Capital Expenditures Breakdown(1) Capital Expenditure Outlook (2)

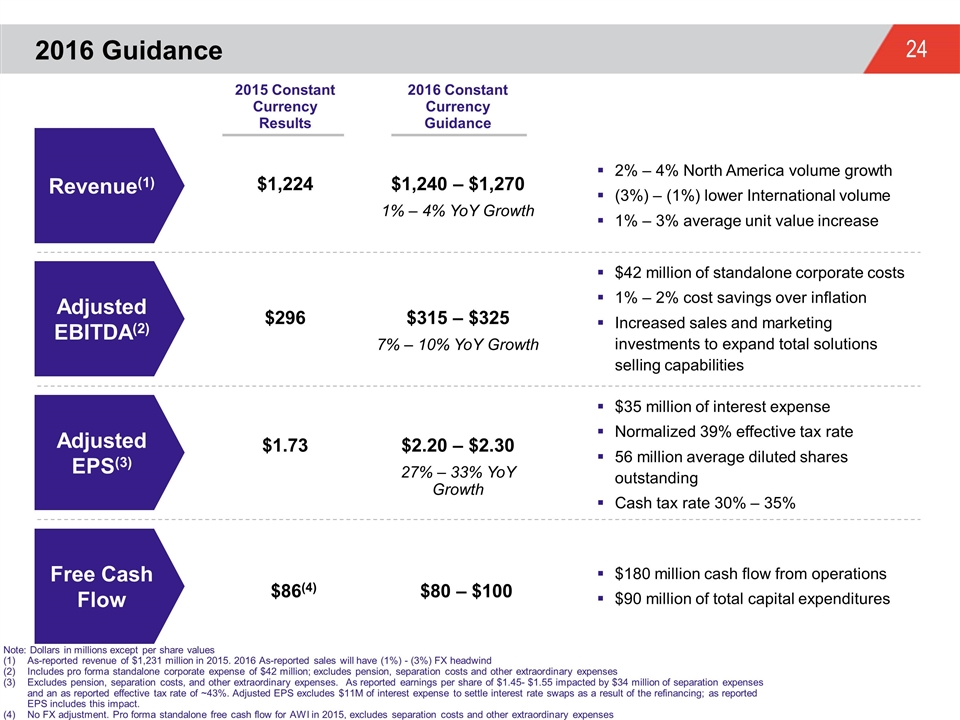

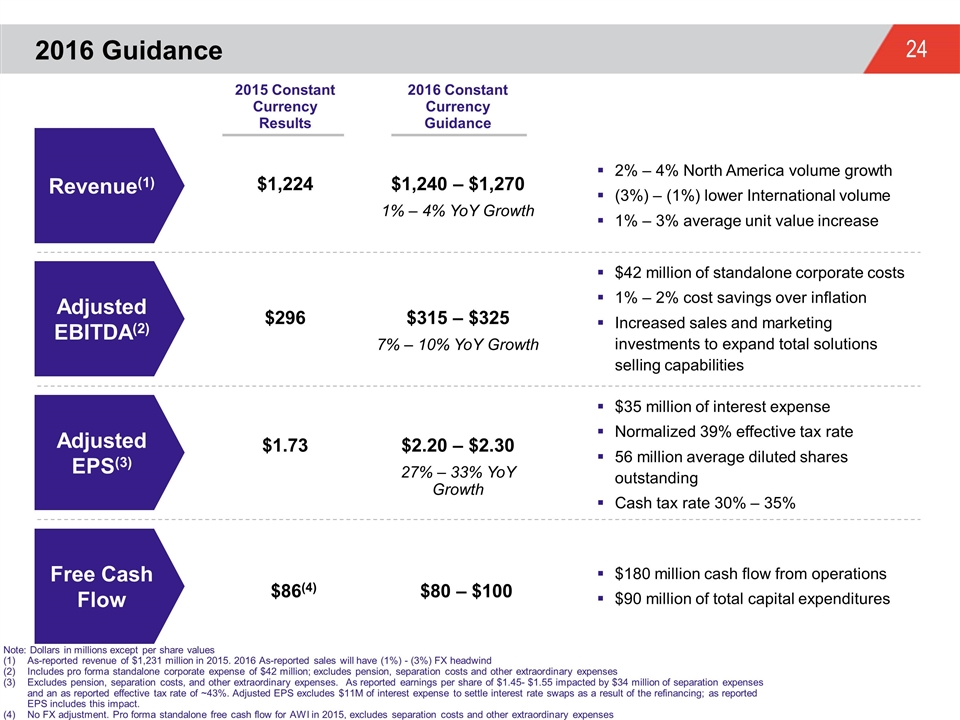

2016 Guidance $2.20 – $2.30 27% – 33% YoY Growth $1.73 Adjusted EBITDA(2) Adjusted EPS(3) Free Cash Flow Revenue(1) 2% – 4% North America volume growth (3%) – (1%) lower International volume 1% – 3% average unit value increase $42 million of standalone corporate costs 1% – 2% cost savings over inflation Increased sales and marketing investments to expand total solutions selling capabilities $35 million of interest expense Normalized 39% effective tax rate 56 million average diluted shares outstanding Cash tax rate 30% – 35% $180 million cash flow from operations $90 million of total capital expenditures Note: Dollars in millions except per share values As-reported revenue of $1,231 million in 2015. 2016 As-reported sales will have (1%) - (3%) FX headwind Includes pro forma standalone corporate expense of $42 million; excludes pension, separation costs and other extraordinary expenses Excludes pension, separation costs, and other extraordinary expenses. As reported earnings per share of $1.45- $1.55 impacted by $34 million of separation expenses and an as reported effective tax rate of ~43%. Adjusted EPS excludes $11M of interest expense to settle interest rate swaps as a result of the refinancing; as reported EPS includes this impact. No FX adjustment. Pro forma standalone free cash flow for AWI in 2015, excludes separation costs and other extraordinary expenses 2015 Constant Currency Results $1,224 $296 $1,240 – $1,270 1% – 4% YoY Growth $315 – $325 7% – 10% YoY Growth $80 – $100 2016 Constant Currency Guidance $86(4)

Focused on Value Creation Standout market leader in attractive ceilings industry with unmatched profitability and cash flow Accelerating growth trajectory of the business Intense focus on expanding returns on invested capital Management incentive plan aligned to absolute total shareholder returns and free cash flow

Our Why

Appendix Management Biographies Reconciliation of Non-GAAP Financial Measures Executive Compensation 2016 Results

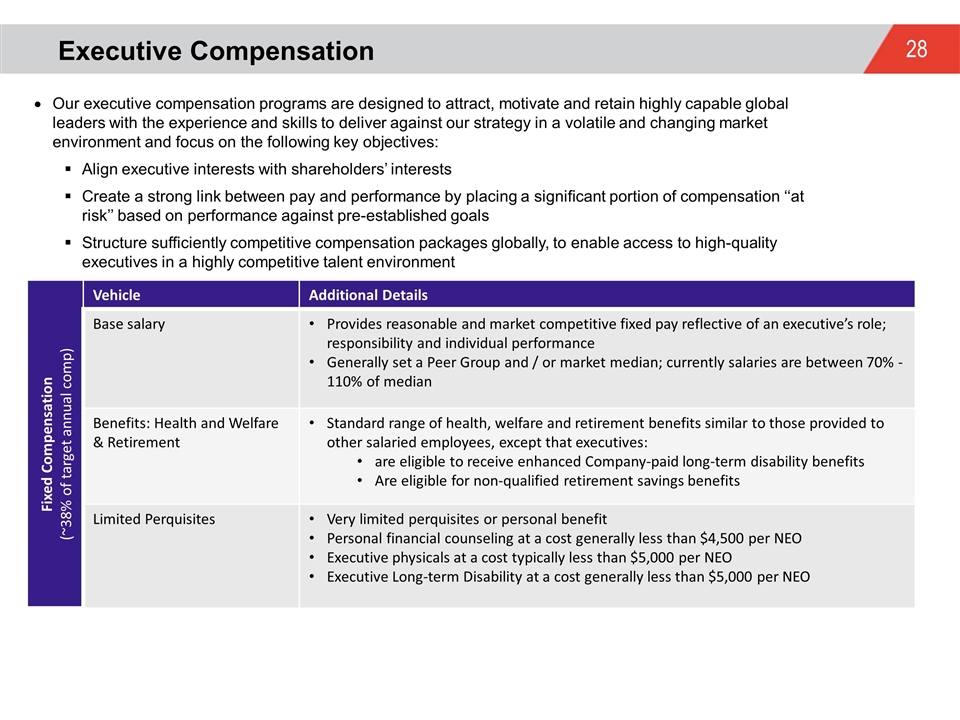

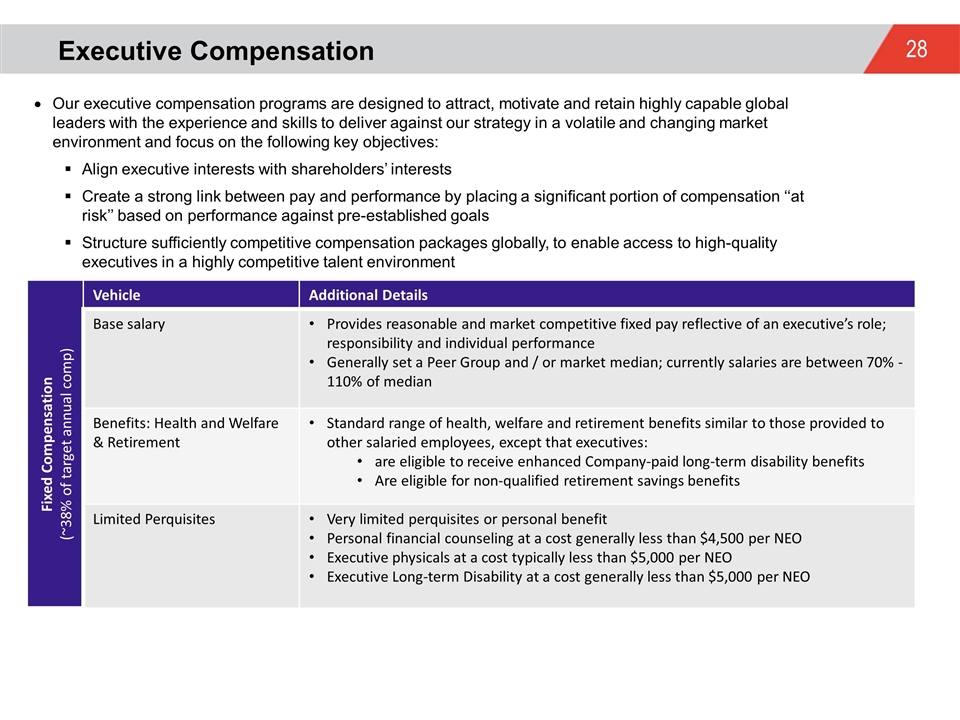

Executive Compensation Fixed Compensation (~38% of target annual comp) Vehicle Additional Details Base salary Provides reasonable and market competitive fixed pay reflective of an executive’s role; responsibility and individual performance Generally set a Peer Group and / or market median; currently salaries are between 70% - 110% of median Benefits: Health and Welfare & Retirement Standard range of health, welfare and retirement benefits similar to those provided to other salaried employees, except that executives: are eligible to receive enhanced Company-paid long-term disability benefits Are eligible for non-qualified retirement savings benefits Limited Perquisites Very limited perquisites or personal benefit Personal financial counseling at a cost generally less than $4,500 per NEO Executive physicals at a cost typically less than $5,000 per NEO Executive Long-term Disability at a cost generally less than $5,000 per NEO Our executive compensation programs are designed to attract, motivate and retain highly capable global leaders with the experience and skills to deliver against our strategy in a volatile and changing market environment and focus on the following key objectives: Align executive interests with shareholders’ interests Create a strong link between pay and performance by placing a significant portion of compensation ‘‘at risk’’ based on performance against pre-established goals Structure sufficiently competitive compensation packages globally, to enable access to high-quality executives in a highly competitive talent environment

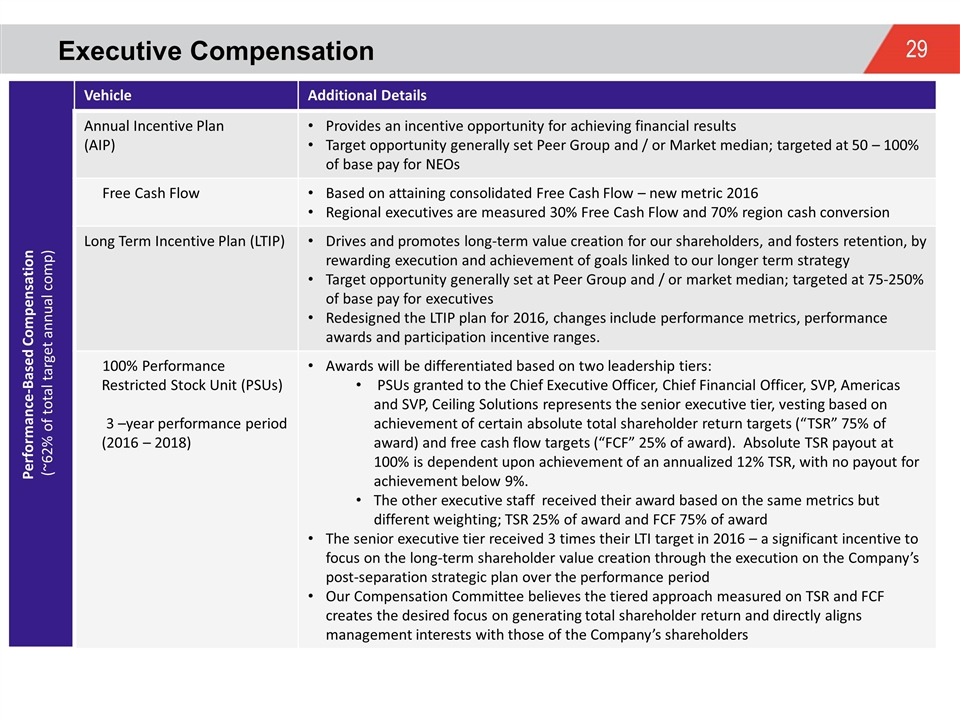

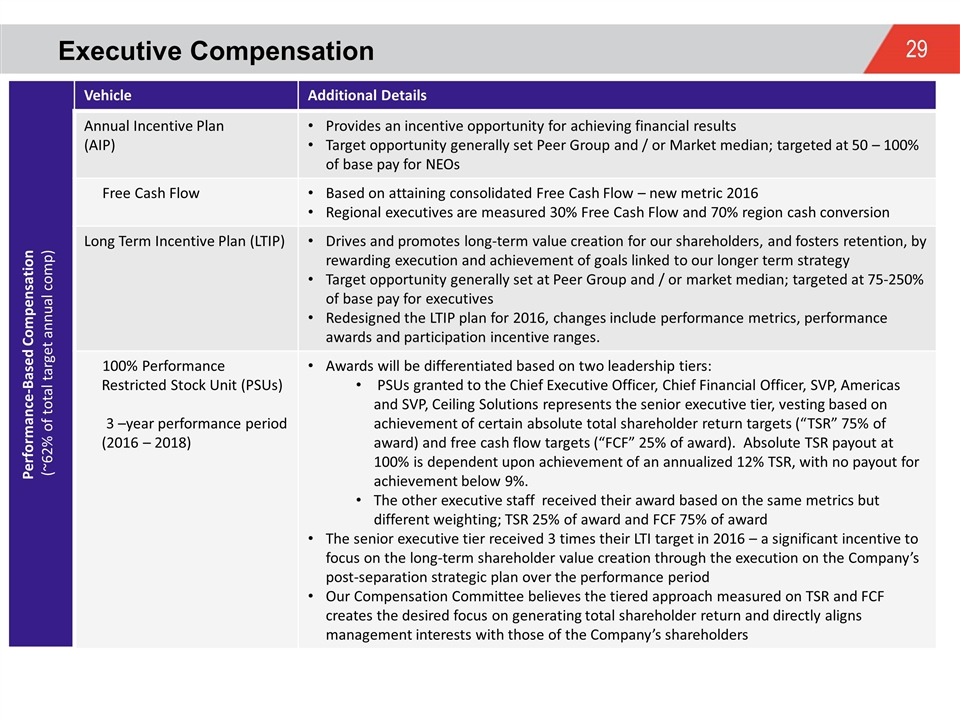

Executive Compensation Performance-Based Compensation (~62% of total target annual comp) Vehicle Additional Details Annual Incentive Plan (AIP) Provides an incentive opportunity for achieving financial results Target opportunity generally set Peer Group and / or Market median; targeted at 50 – 100% of base pay for NEOs Free Cash Flow Based on attaining consolidated Free Cash Flow – new metric 2016 Regional executives are measured 30% Free Cash Flow and 70% region cash conversion Long Term Incentive Plan (LTIP) Drives and promotes long-term value creation for our shareholders, and fosters retention, by rewarding execution and achievement of goals linked to our longer term strategy Target opportunity generally set at Peer Group and / or market median; targeted at 75-250% of base pay for executives Redesigned the LTIP plan for 2016, changes include performance metrics, performance awards and participation incentive ranges. 100% Performance Restricted Stock Unit (PSUs) 3 –year performance period (2016 – 2018) Awards will be differentiated based on two leadership tiers: PSUs granted to the Chief Executive Officer, Chief Financial Officer, SVP, Americas and SVP, Ceiling Solutions represents the senior executive tier, vesting based on achievement of certain absolute total shareholder return targets (“TSR” 75% of award) and free cash flow targets (“FCF” 25% of award). Absolute TSR payout at 100% is dependent upon achievement of an annualized 12% TSR, with no payout for achievement below 9%. The other executive staff received their award based on the same metrics but different weighting; TSR 25% of award and FCF 75% of award The senior executive tier received 3 times their LTI target in 2016 – a significant incentive to focus on the long-term shareholder value creation through the execution on the Company’s post-separation strategic plan over the performance period Our Compensation Committee believes the tiered approach measured on TSR and FCF creates the desired focus on generating total shareholder return and directly aligns management interests with those of the Company’s shareholders

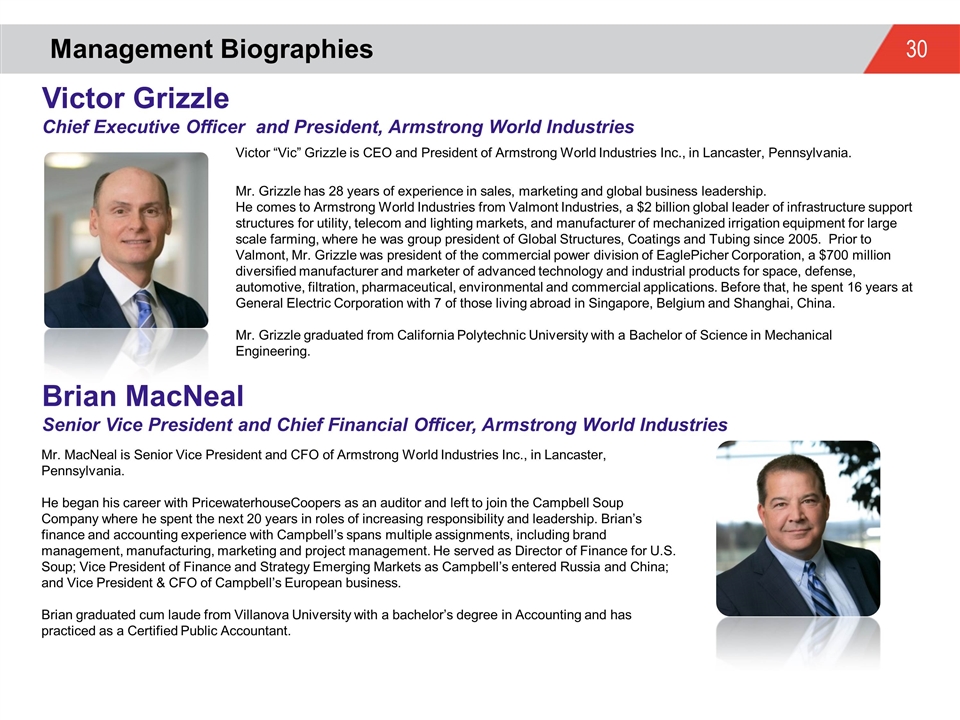

Management Biographies Brian MacNeal Senior Vice President and Chief Financial Officer, Armstrong World Industries Victor “Vic” Grizzle is CEO and President of Armstrong World Industries Inc., in Lancaster, Pennsylvania. Mr. Grizzle has 28 years of experience in sales, marketing and global business leadership. He comes to Armstrong World Industries from Valmont Industries, a $2 billion global leader of infrastructure support structures for utility, telecom and lighting markets, and manufacturer of mechanized irrigation equipment for large scale farming, where he was group president of Global Structures, Coatings and Tubing since 2005. Prior to Valmont, Mr. Grizzle was president of the commercial power division of EaglePicher Corporation, a $700 million diversified manufacturer and marketer of advanced technology and industrial products for space, defense, automotive, filtration, pharmaceutical, environmental and commercial applications. Before that, he spent 16 years at General Electric Corporation with 7 of those living abroad in Singapore, Belgium and Shanghai, China. Mr. Grizzle graduated from California Polytechnic University with a Bachelor of Science in Mechanical Engineering. Mr. MacNeal is Senior Vice President and CFO of Armstrong World Industries Inc., in Lancaster, Pennsylvania. He began his career with PricewaterhouseCoopers as an auditor and left to join the Campbell Soup Company where he spent the next 20 years in roles of increasing responsibility and leadership. Brian’s finance and accounting experience with Campbell’s spans multiple assignments, including brand management, manufacturing, marketing and project management. He served as Director of Finance for U.S. Soup; Vice President of Finance and Strategy Emerging Markets as Campbell’s entered Russia and China; and Vice President & CFO of Campbell’s European business. Brian graduated cum laude from Villanova University with a bachelor’s degree in Accounting and has practiced as a Certified Public Accountant. Victor Grizzle Chief Executive Officer and President, Armstrong World Industries

Investor Relations Contact Information Mrs. Olshan is Director Investor & Public Relations of Armstrong World Industries, Inc., in Lancaster, Pennsylvania. Mrs. Olshan joined Armstrong World Industries in November of 2008 as External Reporting Manager, moved into Investor Relations in December of 2010 and had public relations responsibilities added in February of 2016. Prior to Armstrong World Industries, Mrs. Olshan spent over 5 years in public accounting as an auditor and advisor to clients in the construction, engineering, banking, utility, and manufacturing industries with a focus on SEC reporting and Sarbanes-Oxley compliance. Mrs. Olshan is also a Certified Public Accountant and member of the AICPA and NIRI. She previously served on the board as Treasurer of the York Hospital Auxiliary, a Wellspan affiliated non-profit organization. Mrs. Olshan graduated summa cum laude earning a bachelor of science with dual degrees in Business Administration and Accounting, and an MBA from York College of Pennsylvania. Kristy Olshan, Director Investor & Public Relations, Armstrong World Industries Kristy Olshan, CPA, MBA Director Investor & Public Relations Armstrong World Industries 2500 Columbia Avenue Lancaster, PA 17603 P: 717-396-6354 F: 717-396-6128 E: ksolshan@armstrongceilings.com

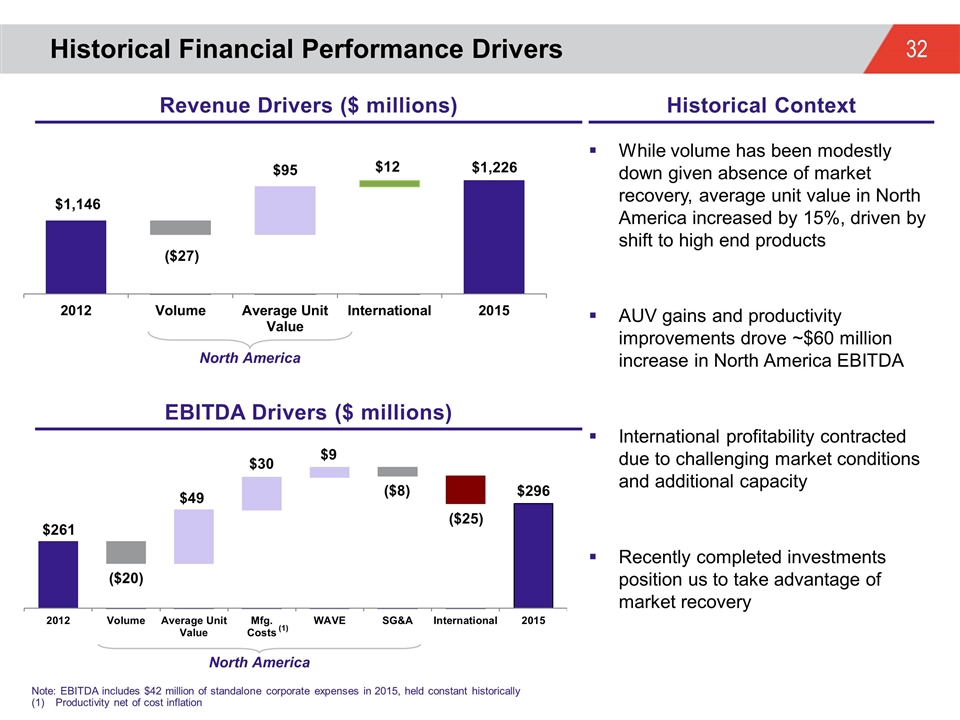

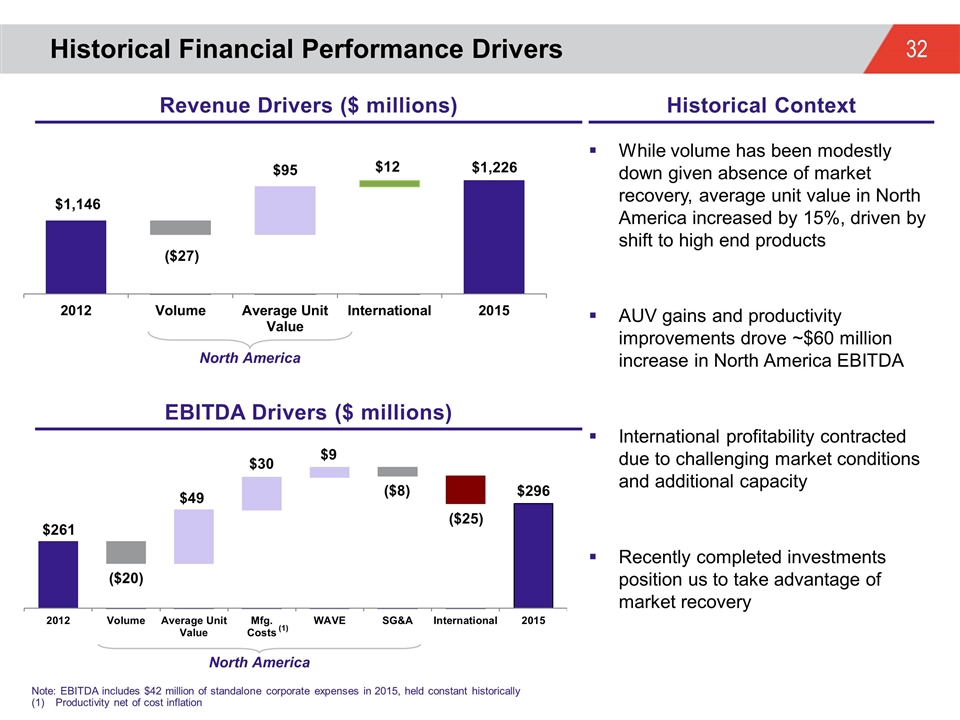

Historical Financial Performance Drivers While volume has been modestly down given absence of market recovery, average unit value in North America increased by 15%, driven by shift to high end products AUV gains and productivity improvements drove ~$60 million increase in North America EBITDA International profitability contracted due to challenging market conditions and additional capacity Recently completed investments position us to take advantage of market recovery $261 Note: EBITDA includes $42 million of standalone corporate expenses in 2015, held constant historically Productivity net of cost inflation North America North America Revenue Drivers ($ millions) Historical Context EBITDA Drivers ($ millions) (1) ($27) $95 $1,226 $12 $1,146 $296 ($20) $49 $30 $9 ($8) ($25)

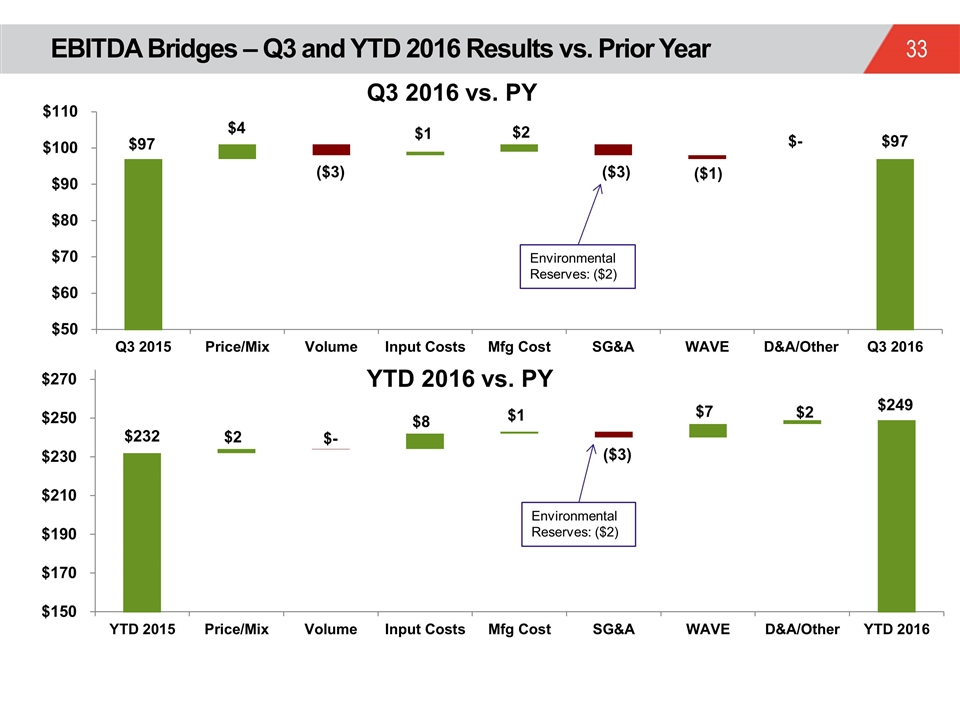

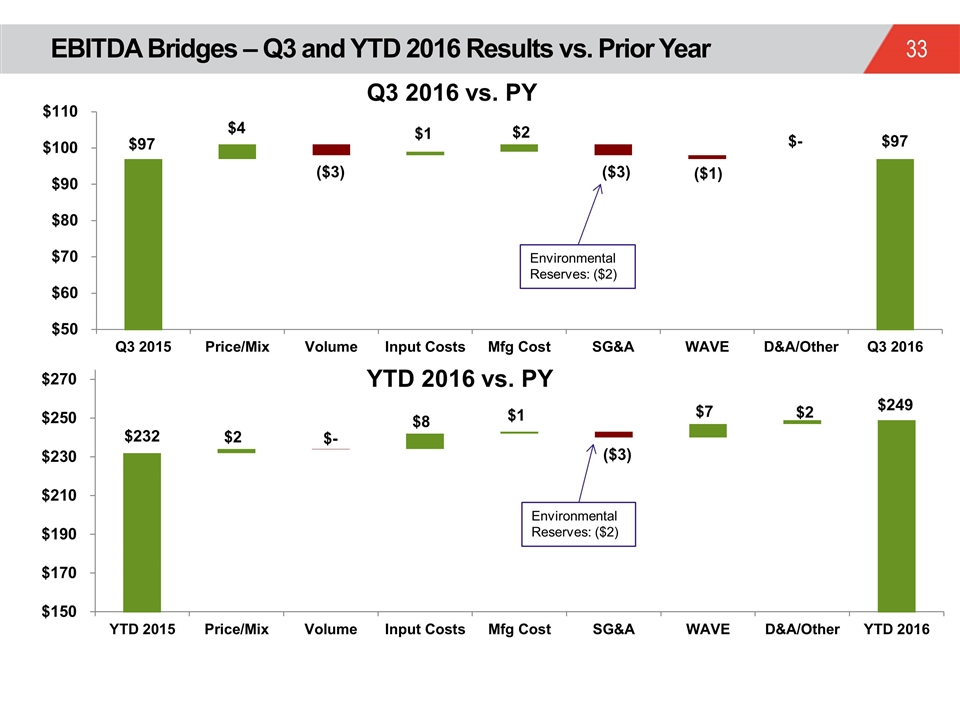

EBITDA Bridges – Q3 and YTD 2016 Results vs. Prior Year Q3 2016 vs. PY YTD 2016 vs. PY $4 ($3) $1 $2 ($3) ($1) Environmental Reserves: ($2) $97 Environmental Reserves: ($2) ($3) $2 $249 $7 $- $8 $2 $-

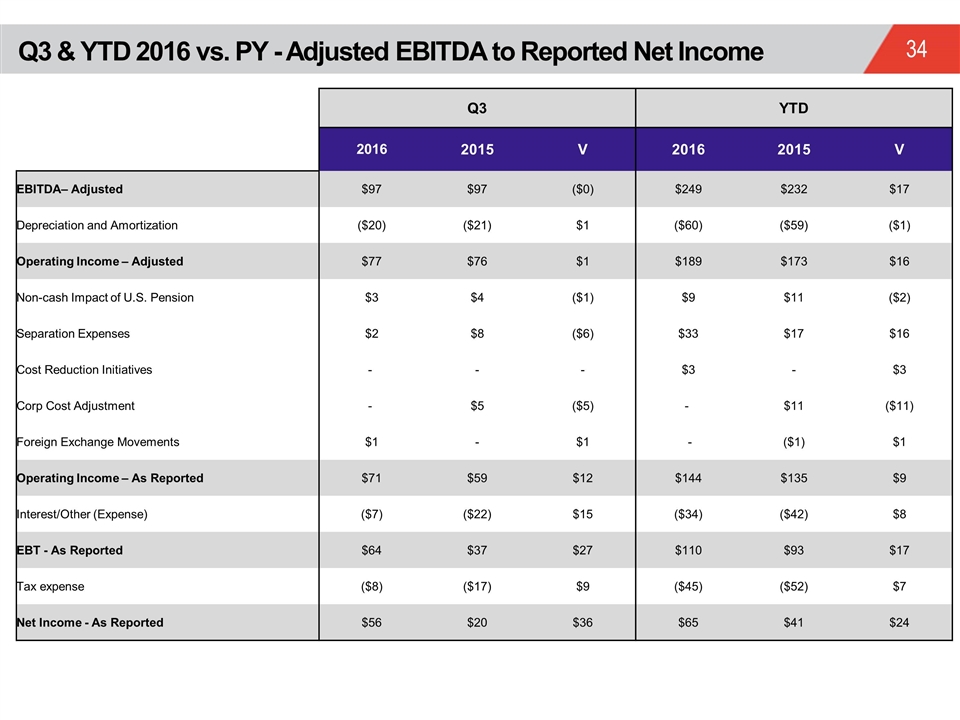

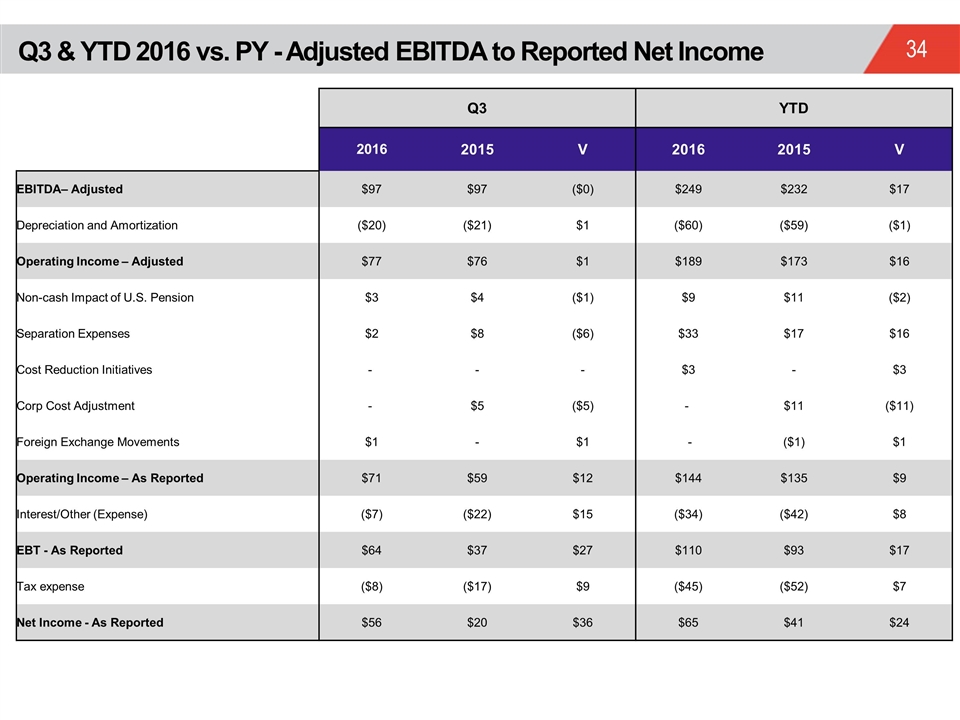

Q3 & YTD 2016 vs. PY - Adjusted EBITDA to Reported Net Income Q3 YTD 2016 2015 V 2016 2015 V EBITDA– Adjusted $97 $97 ($0) $249 $232 $17 Depreciation and Amortization ($20) ($21) $1 ($60) ($59) ($1) Operating Income – Adjusted $77 $76 $1 $189 $173 $16 Non-cash Impact of U.S. Pension $3 $4 ($1) $9 $11 ($2) Separation Expenses $2 $8 ($6) $33 $17 $16 Cost Reduction Initiatives - - - $3 - $3 Corp Cost Adjustment - $5 ($5) - $11 ($11) Foreign Exchange Movements $1 - $1 - ($1) $1 Operating Income – As Reported $71 $59 $12 $144 $135 $9 Interest/Other (Expense) ($7) ($22) $15 ($34) ($42) $8 EBT - As Reported $64 $37 $27 $110 $93 $17 Tax expense ($8) ($17) $9 ($45) ($52) $7 Net Income - As Reported $56 $20 $36 $65 $41 $24

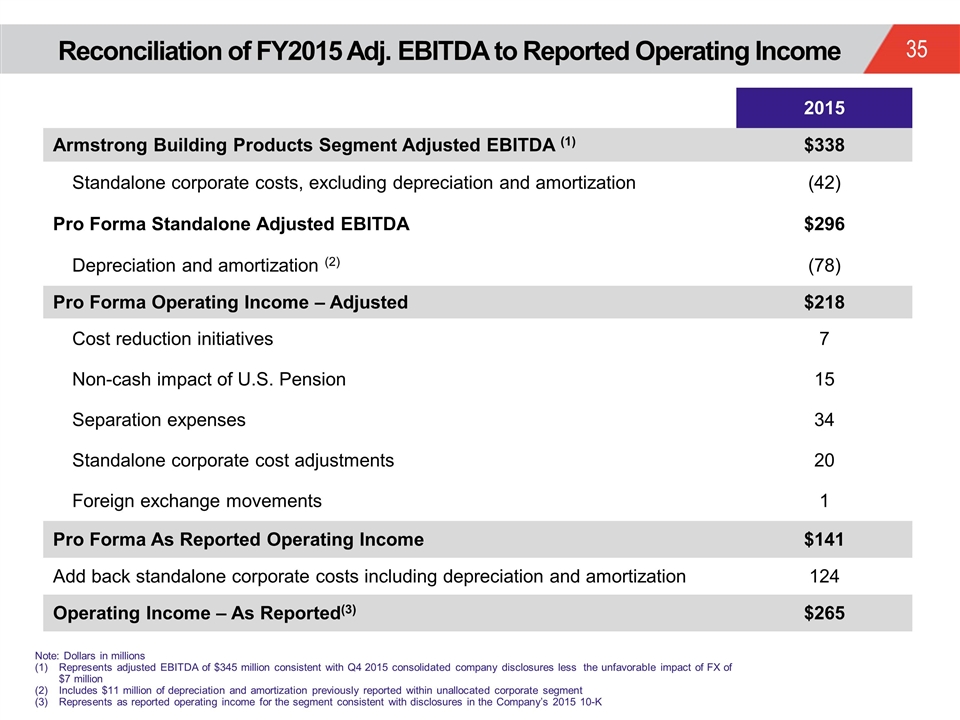

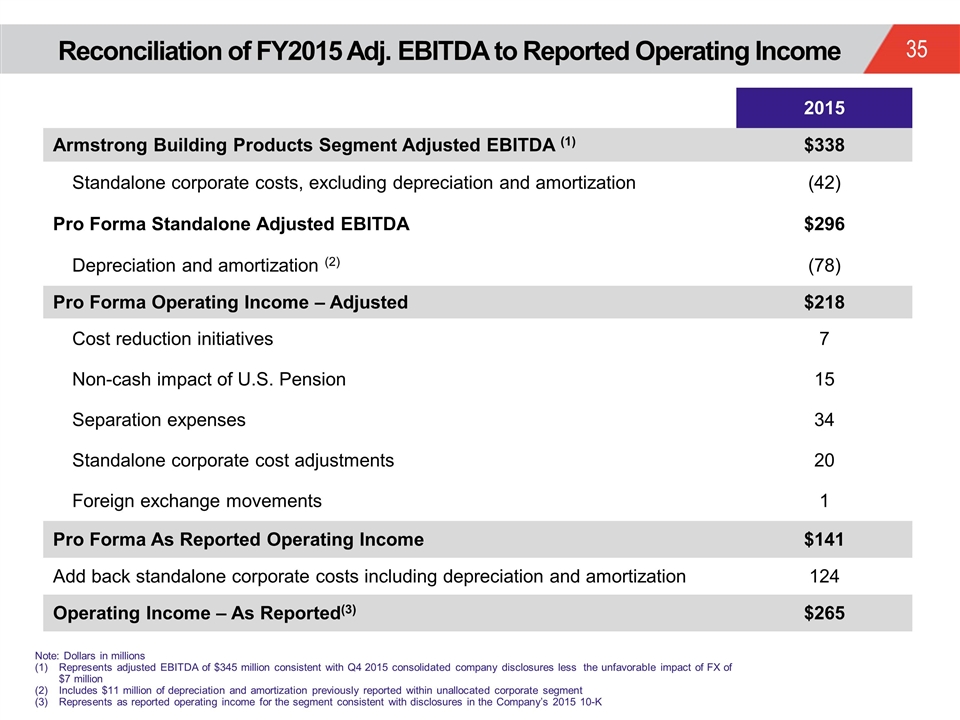

Reconciliation of FY2015 Adj. EBITDA to Reported Operating Income 2015 Armstrong Building Products Segment Adjusted EBITDA (1) $338 Standalone corporate costs, excluding depreciation and amortization (42) Pro Forma Standalone Adjusted EBITDA $296 Depreciation and amortization (2) (78) Pro Forma Operating Income – Adjusted $218 Cost reduction initiatives 7 Non-cash impact of U.S. Pension 15 Separation expenses 34 Standalone corporate cost adjustments 20 Foreign exchange movements 1 Pro Forma As Reported Operating Income $141 Add back standalone corporate costs including depreciation and amortization 124 Operating Income – As Reported(3) $265 Note: Dollars in millions Represents adjusted EBITDA of $345 million consistent with Q4 2015 consolidated company disclosures less the unfavorable impact of FX of $7 million Includes $11 million of depreciation and amortization previously reported within unallocated corporate segment Represents as reported operating income for the segment consistent with disclosures in the Company’s 2015 10-K