ARMSTRONG WORLD INDUSTRIES INVESTOR PRESENTATION Deutsche Bank Global Industrials and Materials Summit Chicago, IL June 6, 2018 Exhibit 99.1

Safe Harbor Statement Our disclosures in this presentation, including without limitation, those relating to future financial results guidance, and in our other public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those statements provide our future expectations or forecasts and can be identified by our use of words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "outlook," "target," "predict," "may," "will," "would," "could," "should," "seek," and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. A more detailed discussion of the risks and uncertainties that may affect our ability to achieve the projected performance is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our recent reports on Forms 10-K and 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”). As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. The information in this presentation is only effective as of the date given June 6, 2018 and is subject to change. Any distribution of this presentation after June 6, 2018 is not intended and will not be construed as updating or confirming such information. In addition, we will be referring to “non-GAAP financial measures” within the meaning of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance with GAAP can be found in the appendix to this presentation, in our SEC filings and on the Investor Relations section of our website at www.armstrongceilings.com. Armstrong World Industries competes globally in many diverse markets. References to "market" or "share" data are simply estimations based on a combination of internal and external sources and assumptions. They are intended only to assist discussion of the relative performance of product segments and categories for marketing and related purposes. No conclusion has been reached or should be reached regarding a "product market," a "geographic market" or “market share,” as such terms may be used or defined for any economic, legal or other purpose.

All dollar figures throughout the presentation are in $ millions (except for earnings per share) unless otherwise noted. Figures may not add due to rounding. When reporting our financial results within this presentation, we make several adjustments. Management uses the non-GAAP measures in managing the business and believes the adjustments provide meaningful comparisons of operating performance between periods. As reported results will be footnoted throughout the presentation. Basis of Presentation Explanation Results throughout this presentation are presented on a continuing operations basis with the exception of cash flow. With the pending sale of our EMEA and Pacific Rim businesses, we no longer adjust our sales for movements in foreign exchange rates as we expect these to have minimal impact on revenue. We remove the impact of certain discrete expenses and income. Examples include plant closures, restructuring actions, environmental site expenses and related insurance recoveries, and other large unusual items. We also adjust for our U.S. pension plan (credit) expense(1). Taxes for adjusted net income and adjusted diluted EPS are calculated using a constant 25% rate. Segment SG&A cost structures reflect updated cost allocation methodology. U.S. pension (credit) expense represents the actuarial net periodic benefit cost expected to be recorded as a component of operating income. For all periods presented, we were not required and did not make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation, nor do we expect to make cash contributions to the plan in 2018.

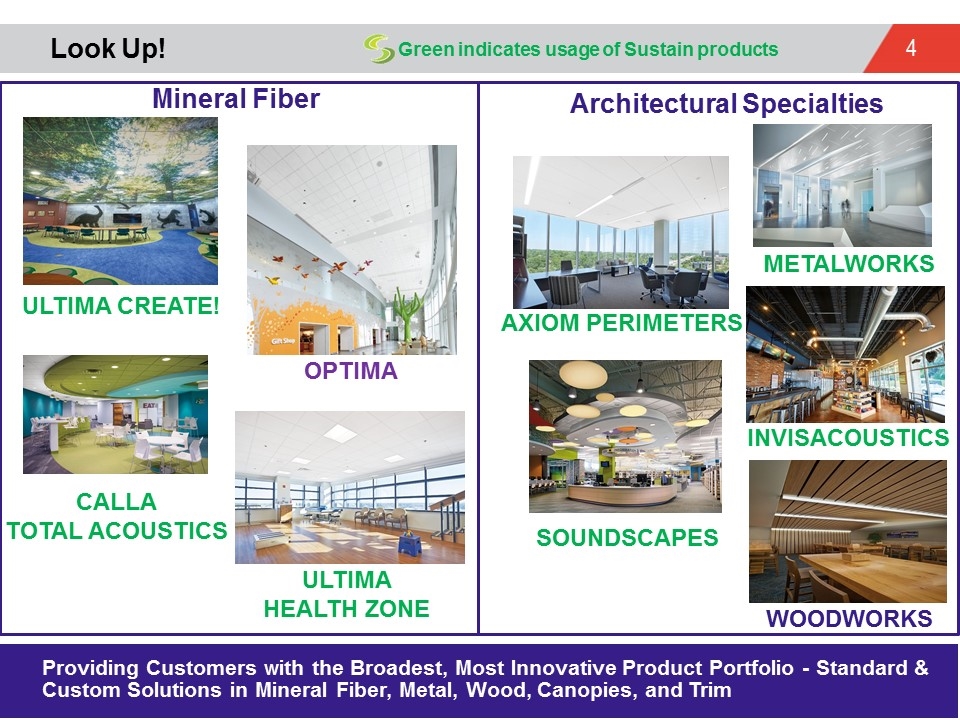

Look Up! Providing Customers with the Broadest, Most Innovative Product Portfolio - Standard & Custom Solutions in Mineral Fiber, Metal, Wood, Canopies, and Trim METALWORKS AXIOM PERIMETERS WOODWORKS SOUNDSCAPES ULTIMA CREATE! INVISACOUSTICS OPTIMA CALLA TOTAL ACOUSTICS ULTIMA HEALTH ZONE Mineral Fiber Architectural Specialties Green indicates usage of Sustain products

The AWI Investment Thesis Standout Leader in Attractive Ceilings Industry 1 Best-in-Class, Stable Cash Flow Through the Cycle Attractive, Multi-Faceted Growth Opportunities Additional Levers to Create Shareholder Value 1 Standout Leader 2 3 4 2 3 4 Best-in-Class Cash Flow 1 3 4 2 Growth Levers 1 2 4 3 Additional Profit Drivers 1 2 3 4 4 Levers for Value 1 2 3 2 Robust Cash Flow 3 4 1 3 Attractive Growth 4 1 2

Leader in Attractive Americas Ceilings Industry Leading Position in Highest Margin Industry Consolidated industry structure Large installed base with stable repair & remodel demand Established product specifications Multi-faceted sales process involving architects, designers, distributors, contractors and end-users High value but low cost product with limited substitutes End users demonstrate brand loyalty, and reward customer service and innovation 1 Standout Leader 2 3 4

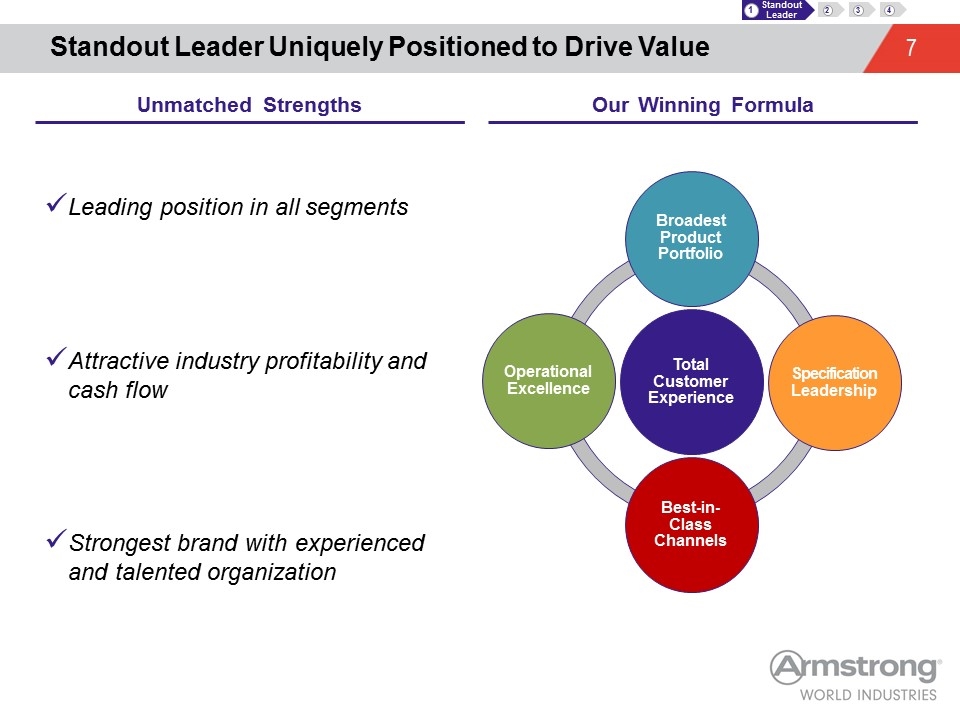

Leading position in all segments Attractive industry profitability and cash flow Strongest brand with experienced and talented organization Standout Leader Uniquely Positioned to Drive Value Unmatched Strengths Our Winning Formula 1 Standout Leader 2 3 4 Total Customer Experience Broadest Product Portfolio Specification Leadership Best-in-Class Channels Operational Excellence

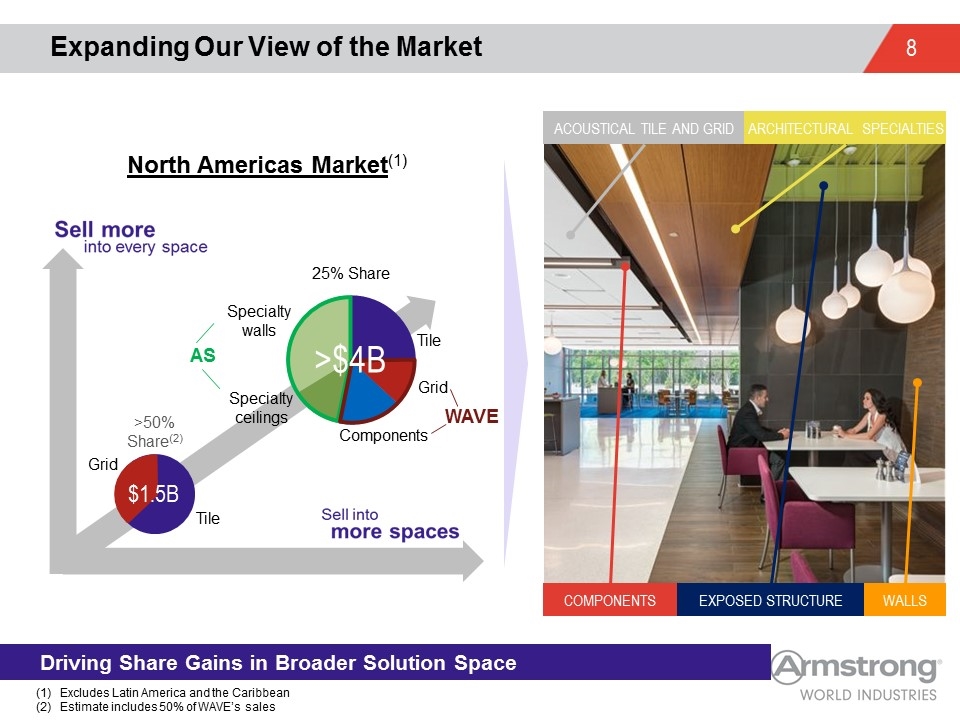

Components Tile >50% Share(2) 25% Share Specialty walls Specialty ceilings AS North Americas Market(1) Expanding Our View of the Market Driving Share Gains in Broader Solution Space COMPONENTS EXPOSED STRUCTURE WALLS ACOUSTICAL TILE AND GRID ARCHITECTURAL SPECIALTIES Excludes Latin America and the Caribbean Estimate includes 50% of WAVE’s sales Grid $1.5B Tile >$4B Grid WAVE

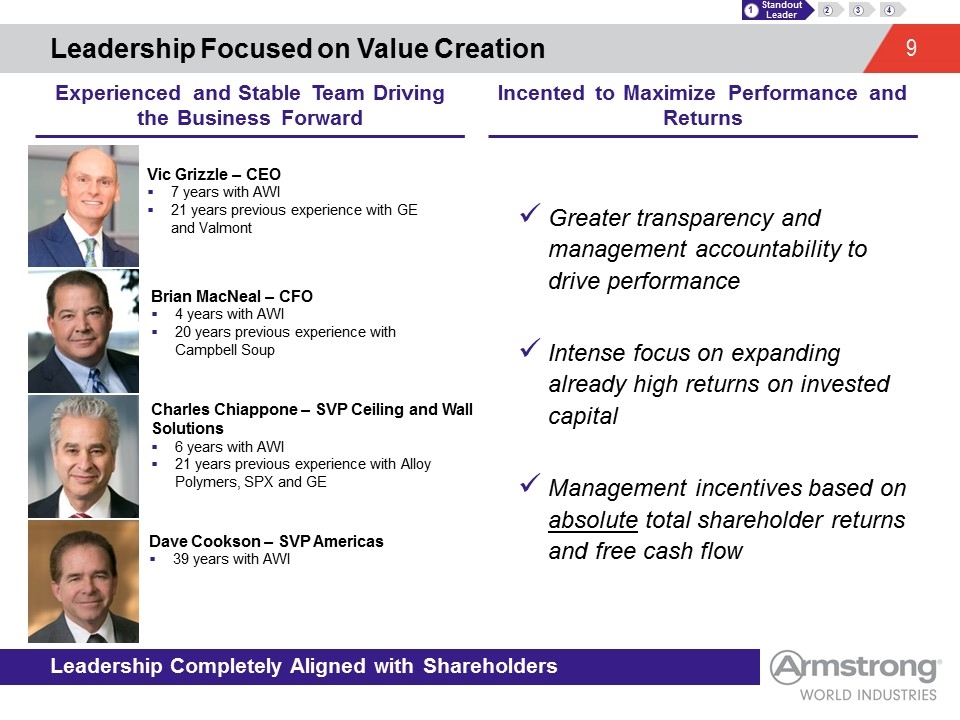

Leadership Focused on Value Creation Leadership Completely Aligned with Shareholders Greater transparency and management accountability to drive performance Intense focus on expanding already high returns on invested capital Management incentives based on absolute total shareholder returns and free cash flow Vic Grizzle – CEO 7 years with AWI 21 years previous experience with GE and Valmont Brian MacNeal – CFO 4 years with AWI 20 years previous experience with Campbell Soup Dave Cookson – SVP Americas 39 years with AWI Charles Chiappone – SVP Ceiling and Wall Solutions 6 years with AWI 21 years previous experience with Alloy Polymers, SPX and GE Experienced and Stable Team Driving the Business Forward Incented to Maximize Performance and Returns 1 Standout Leader 2 3 4

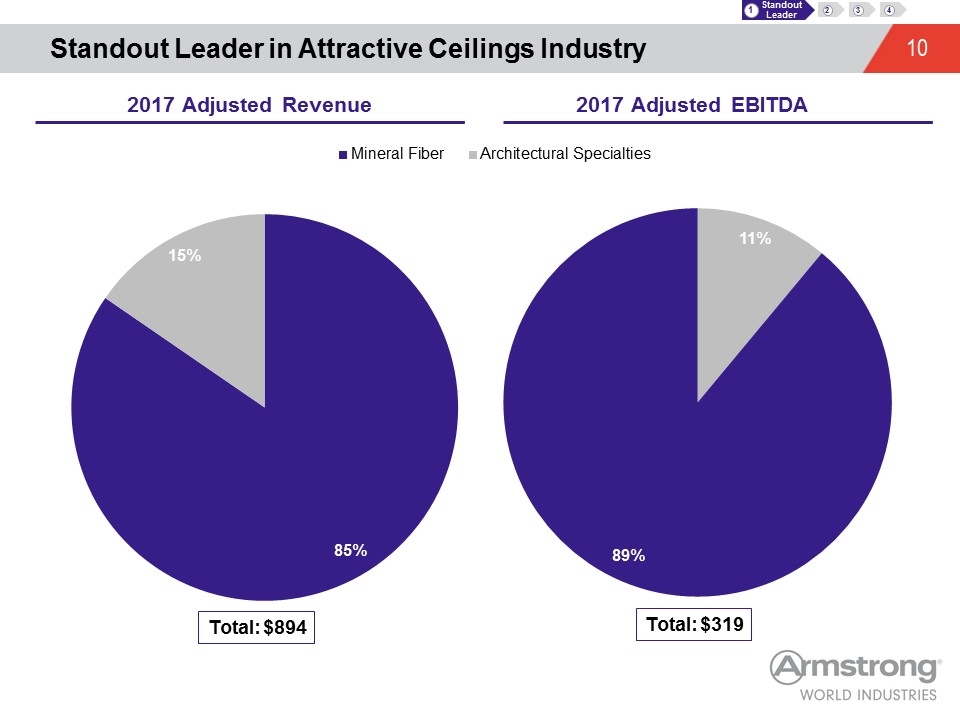

Standout Leader in Attractive Ceilings Industry 1 Standout Leader 2 3 4 Total: $894 Total: $319 2017 Adjusted Revenue 2017 Adjusted EBITDA

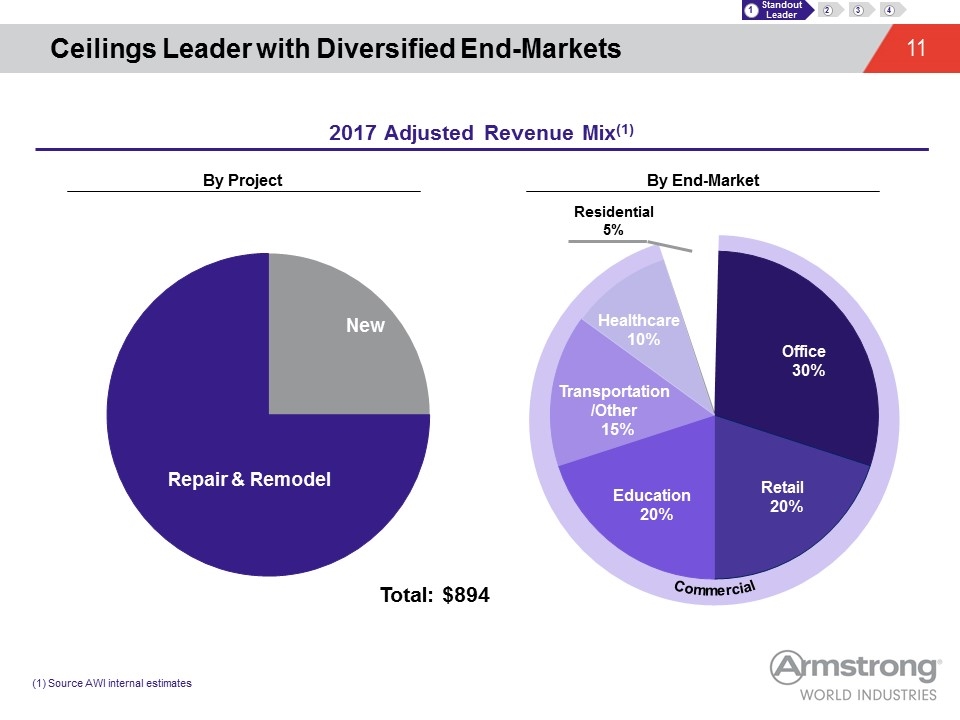

Ceilings Leader with Diversified End-Markets Commercial Total: $894 1 Standout Leader 2 3 4 2017 Adjusted Revenue Mix(1) By End-Market By Project (1) Source AWI internal estimates Office 30% Transportation/Other 15% Education 20% Retail 20% Healthcare 10% Residential 5%

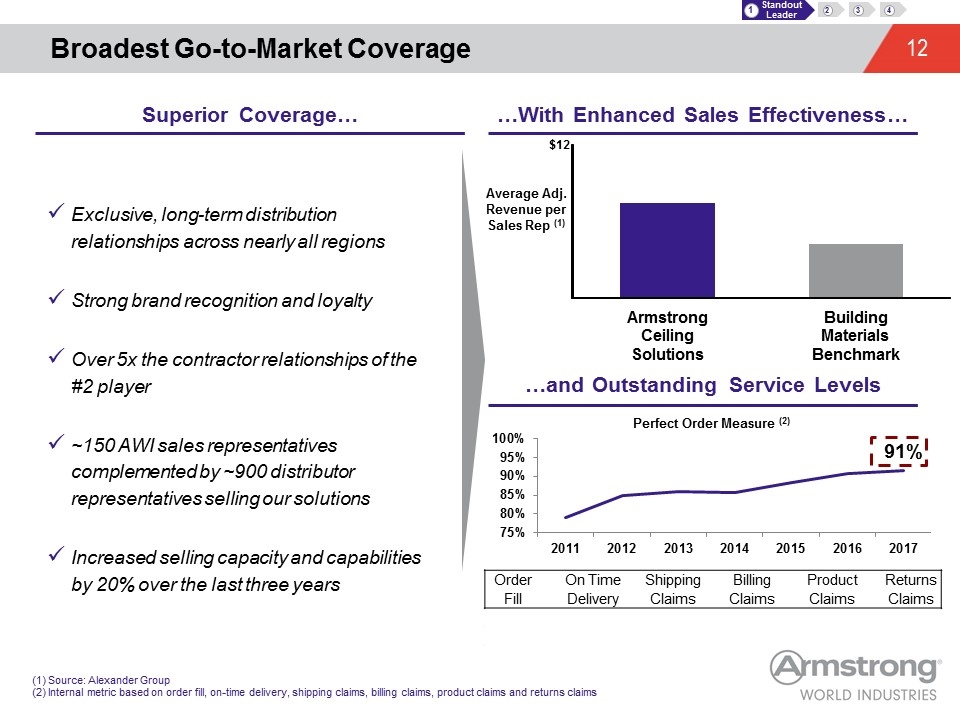

Perfect Order Measure (2) Broadest Go-to-Market Coverage Exclusive, long-term distribution relationships across nearly all regions Strong brand recognition and loyalty Over 5x the contractor relationships of the #2 player ~150 AWI sales representatives complemented by ~900 distributor representatives selling our solutions Increased selling capacity and capabilities by 20% over the last three years 1 Standout Leader 2 3 4 Superior Coverage… …With Enhanced Sales Effectiveness… …and Outstanding Service Levels Average Adj. Revenue per Sales Rep (1) (1) Source: Alexander Group (2) Internal metric based on order fill, on-time delivery, shipping claims, billing claims, product claims and returns claims Order On Time Shipping Billing Product Returns Fill Delivery Claims Claims Claims Claims 97.2% 91.3% 97.5% 98.9% 98.9% 99.3% $12 Armstrong Ceiling Solutions Building Materials Benchmark

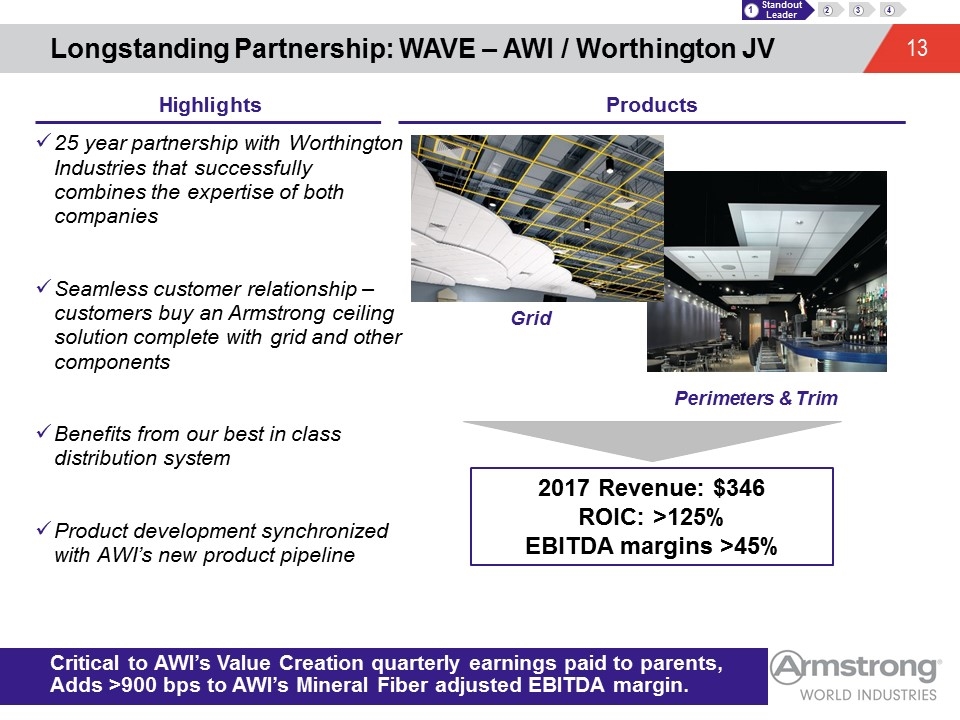

Longstanding Partnership: WAVE – AWI / Worthington JV Critical to AWI’s Value Creation quarterly earnings paid to parents, Adds >900 bps to AWI’s Mineral Fiber adjusted EBITDA margin. 25 year partnership with Worthington Industries that successfully combines the expertise of both companies Seamless customer relationship – customers buy an Armstrong ceiling solution complete with grid and other components Benefits from our best in class distribution system Product development synchronized with AWI’s new product pipeline Grid Perimeters & Trim 2017 Revenue: $346 ROIC: >125% EBITDA margins >45% 1 Standout Leader 2 3 4 Highlights Products

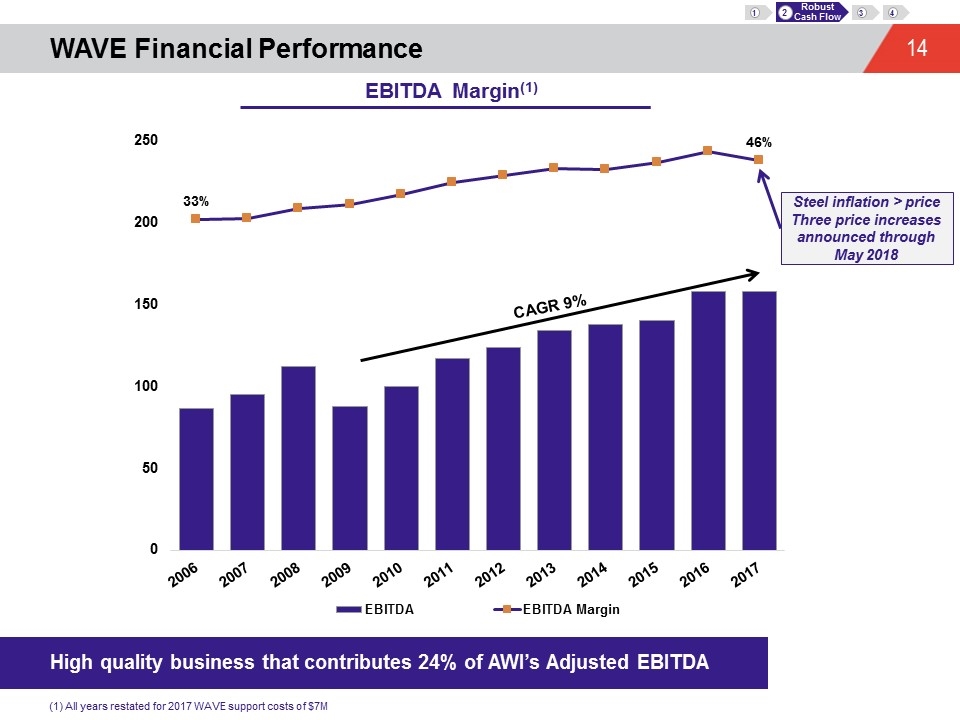

WAVE Financial Performance EBITDA Margin(1) (1) All years restated for 2017 WAVE support costs of $7M 2 Robust Cash Flow 3 4 1 CAGR 9% High quality business that contributes 24% of AWI’s Adjusted EBITDA Steel inflation > price Three price increases announced through May 2018

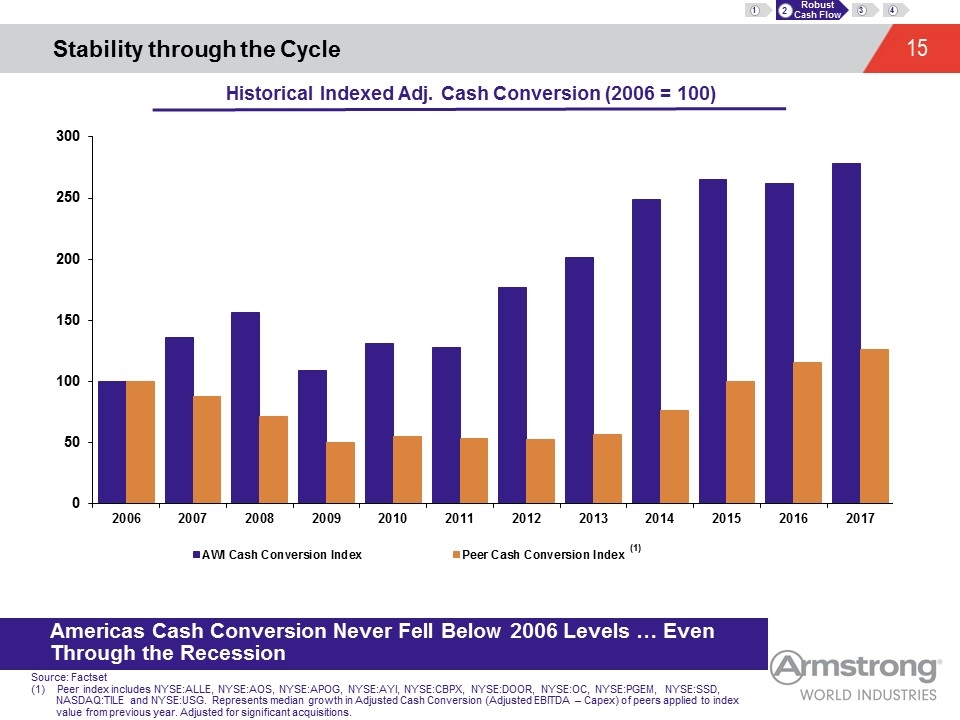

Historical Indexed Adj. Cash Conversion (2006 = 100) Stability through the Cycle 2 Robust Cash Flow 3 4 1 Source: Factset Peer index includes NYSE:ALLE, NYSE:AOS, NYSE:APOG, NYSE:AYI, NYSE:CBPX, NYSE:DOOR, NYSE:OC, NYSE:PGEM, NYSE:SSD, NASDAQ:TILE and NYSE:USG. Represents median growth in Adjusted Cash Conversion (Adjusted EBITDA – Capex) of peers applied to index value from previous year. Adjusted for significant acquisitions. Americas Cash Conversion Never Fell Below 2006 Levels … Even Through the Recession

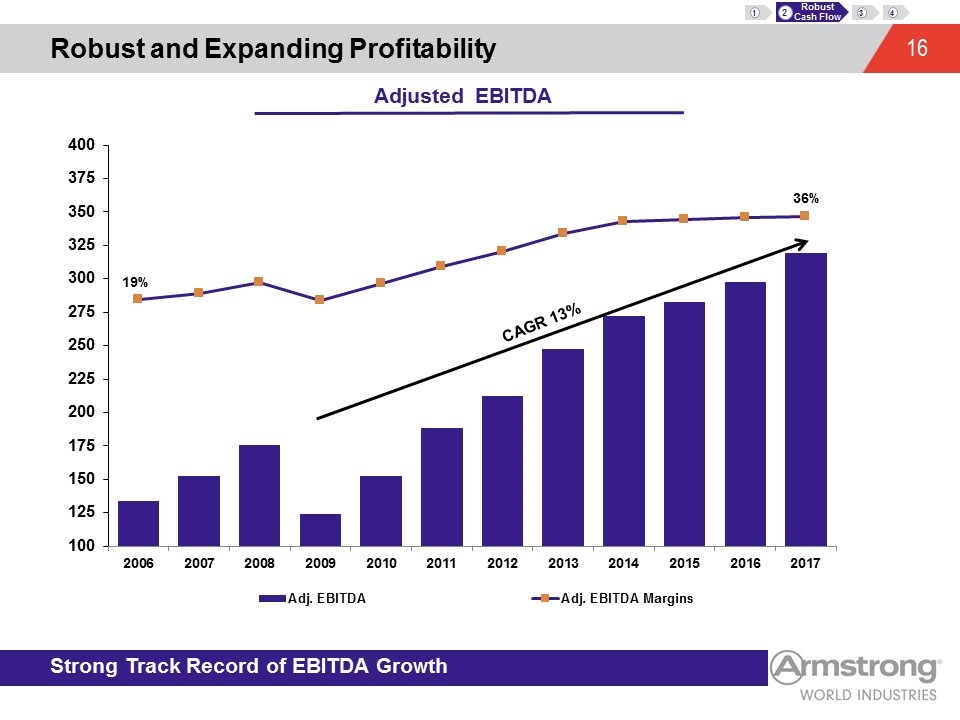

Robust and Expanding Profitability Adjusted EBITDA 2 Robust Cash Flow 3 4 1 Strong Track Record of EBITDA Growth

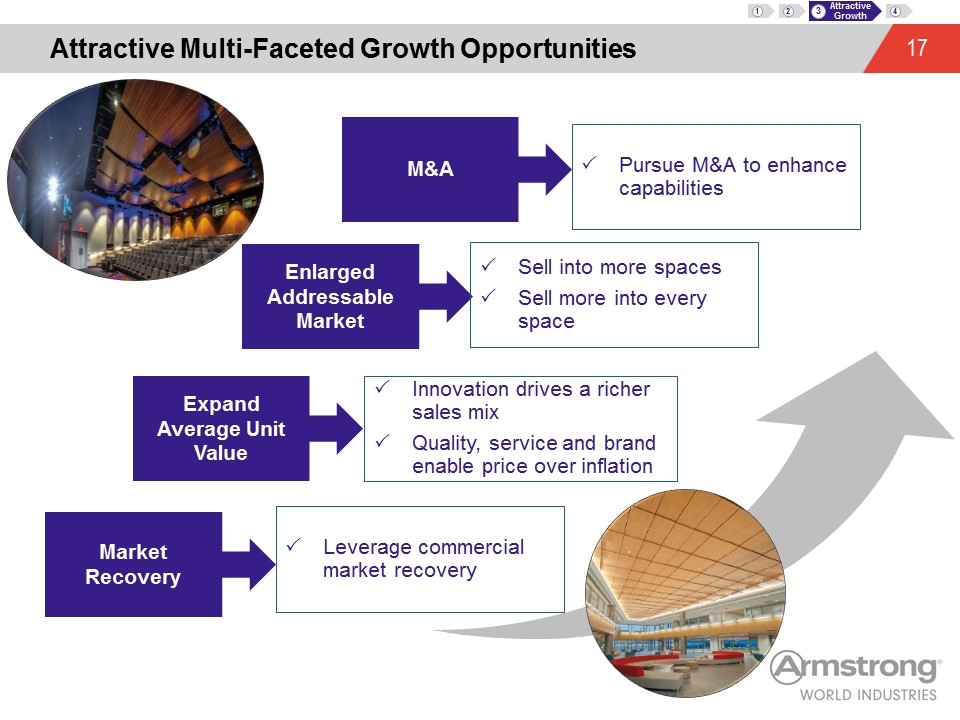

Attractive Multi-Faceted Growth Opportunities 3 Attractive Growth 4 1 2 Market Recovery Leverage commercial market recovery Expand Average Unit Value Innovation drives a richer sales mix Quality, service and brand enable price over inflation Enlarged Addressable Market Sell into more spaces Sell more into every space Pursue M&A to enhance capabilities M&A Expansion of overall market and Armstrong share

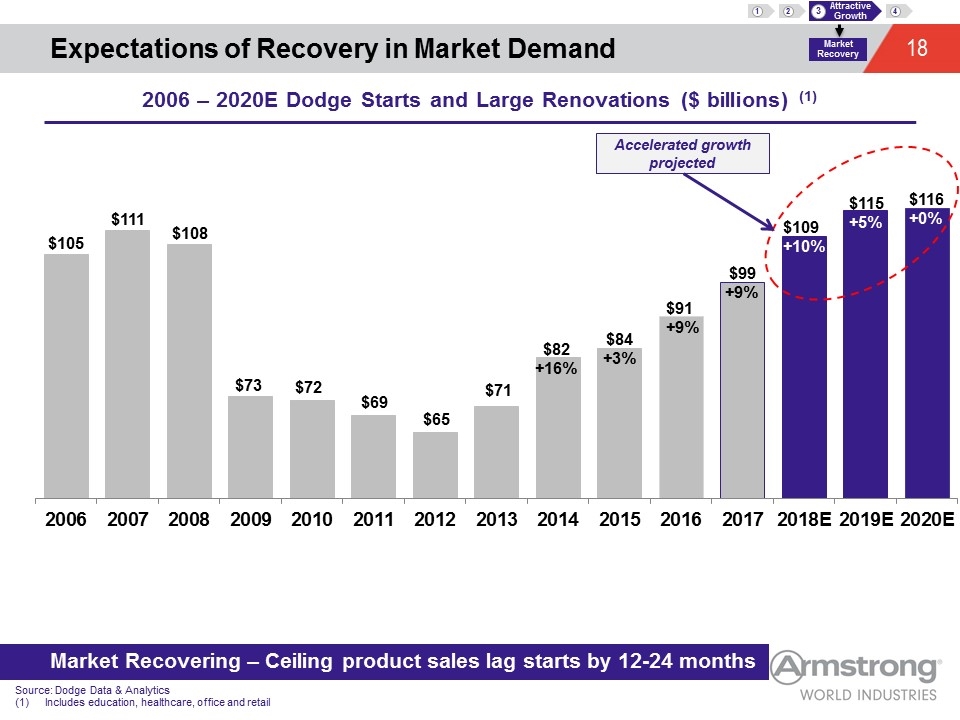

Expectations of Recovery in Market Demand Market Recovery 3 Attractive Growth 4 1 2 2006 – 2020E Dodge Starts and Large Renovations ($ billions) (1) Source: Dodge Data & Analytics Includes education, healthcare, office and retail Accelerated growth projected $69 $65 $71 $111 $105 $91 +9% $99 +9% $109 +10% $84 +3% $82 +16% $72 $73 $108 $115+5% Market Recovering – Ceiling product sales lag starts by 12-24 months

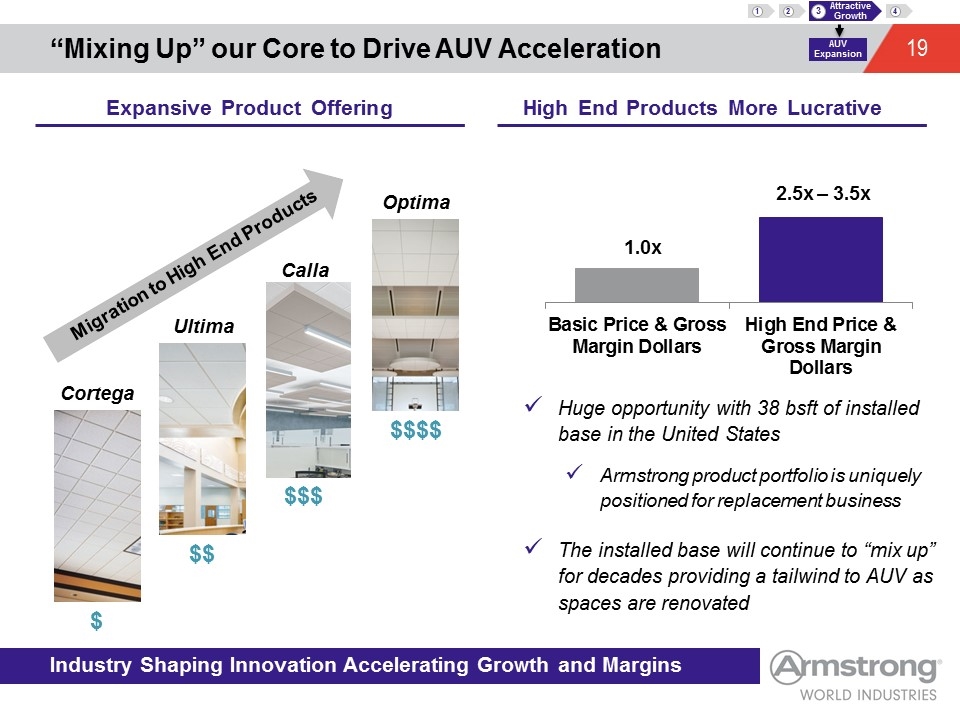

Huge opportunity with 38 bsft of installed base in the United States Armstrong product portfolio is uniquely positioned for replacement business The installed base will continue to “mix up” for decades providing a tailwind to AUV as spaces are renovated “Mixing Up” our Core to Drive AUV Acceleration Industry Shaping Innovation Accelerating Growth and Margins Cortega $ Ultima $$ Optima $$$$ $$$ Calla Migration to High End Products AUV Expansion 3 Attractive Growth 4 1 2 Expansive Product Offering High End Products More Lucrative 2.5x – 3.5x 1.0x

Innovation leadership that meets key industry sustainability standards Industry's first collection of high performance ceiling systems that are simple and transparent Includes Mineral Fiber, Architectural Specialties, and Component Solutions First in the industry to have a platform that is completely free of all “chemicals of concern” Industry Leading Innovation Driving Sustainable Products for Every Space, >30% of 2017 Mineral Fiber sales were Sustain products SustainTM – Creating Better Environments For Everyone AUV Expansion 3 Attractive Growth 4 1 2

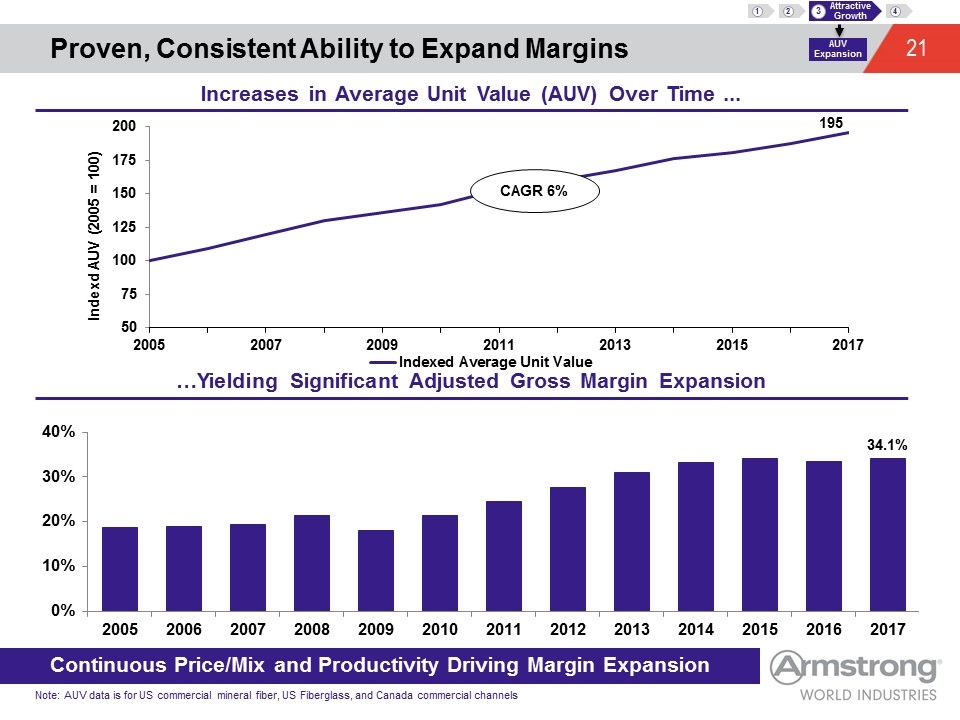

Proven, Consistent Ability to Expand Margins Continuous Price/Mix and Productivity Driving Margin Expansion Note: AUV data is for US commercial mineral fiber, US Fiberglass, and Canada commercial channels Increases in Average Unit Value (AUV) Over Time ... …Yielding Significant Adjusted Gross Margin Expansion AUV Expansion 3 Attractive Growth 4 1 2

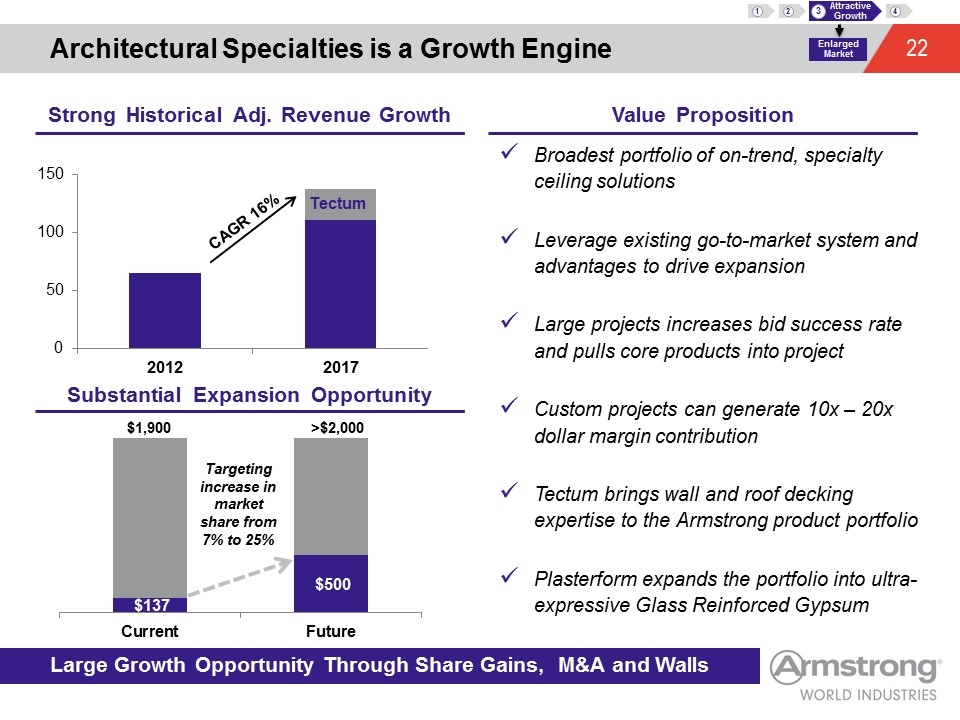

Architectural Specialties is a Growth Engine Large Growth Opportunity Through Share Gains, M&A and Walls Broadest portfolio of on-trend, specialty ceiling solutions Leverage existing go-to-market system and advantages to drive expansion Large projects increases bid success rate and pulls core products into project Custom projects can generate 10x – 20x dollar margin contribution Tectum brings wall and roof decking expertise to the Armstrong product portfolio Plasterform expands the portfolio into ultra-expressive Glass Reinforced Gypsum $1,900 Targeting increase in market share from 7% to 25% >$2,000 Enlarged Market 3 Attractive Growth 4 1 2 Strong Historical Adj. Revenue Growth Value Proposition Substantial Expansion Opportunity CAGR 16%

You Inspire Solutions Center – Making Designs a Reality Recent Investments in Design Capabilities Driving >20% Growth in Custom Project Work Helps our customers with unique, one of a kind solutions for statement spaces Generate truly incremental sales and has a pull through effect on the core product portfolio Strengths and grows architectural relationships Dollar per square foot can greatly exceed Mineral Fiber Enlarged Market 3 Attractive Growth 4 1 2 Reality – US Bank in Los Angeles Rendering of the Design

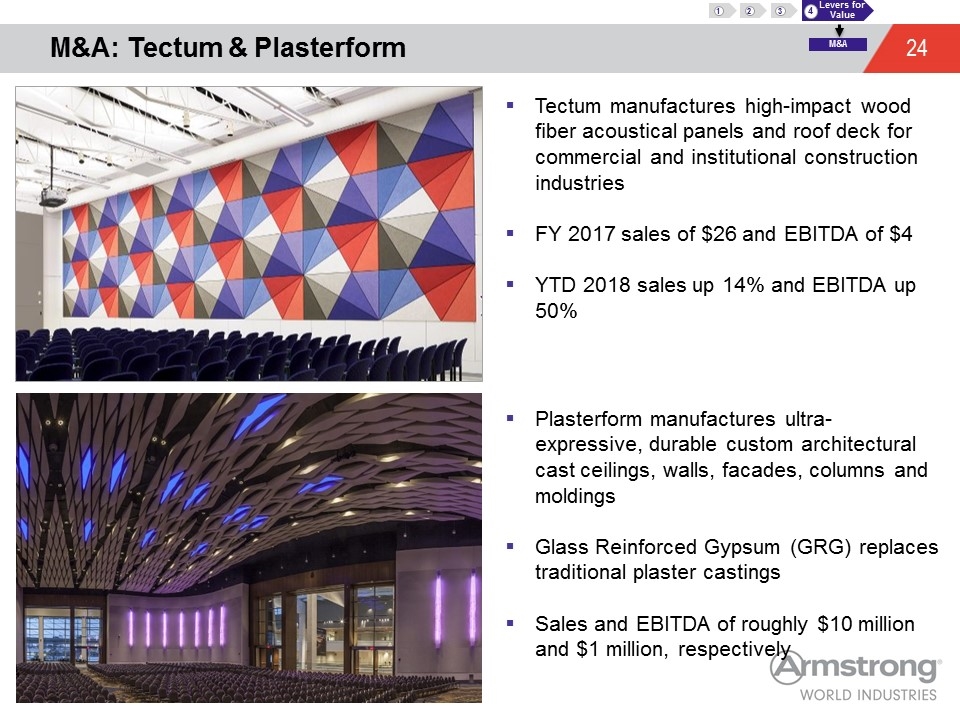

M&A: Tectum & Plasterform Tectum manufactures high-impact wood fiber acoustical panels and roof deck for commercial and institutional construction industries FY 2017 sales of $26 and EBITDA of $4 YTD 2018 sales up 14% and EBITDA up 50% 4 Levers for Value 1 2 3 M&A Plasterform manufactures ultra-expressive, durable custom architectural cast ceilings, walls, facades, columns and moldings Glass Reinforced Gypsum (GRG) replaces traditional plaster castings Sales and EBITDA of roughly $10 million and $1 million, respectively

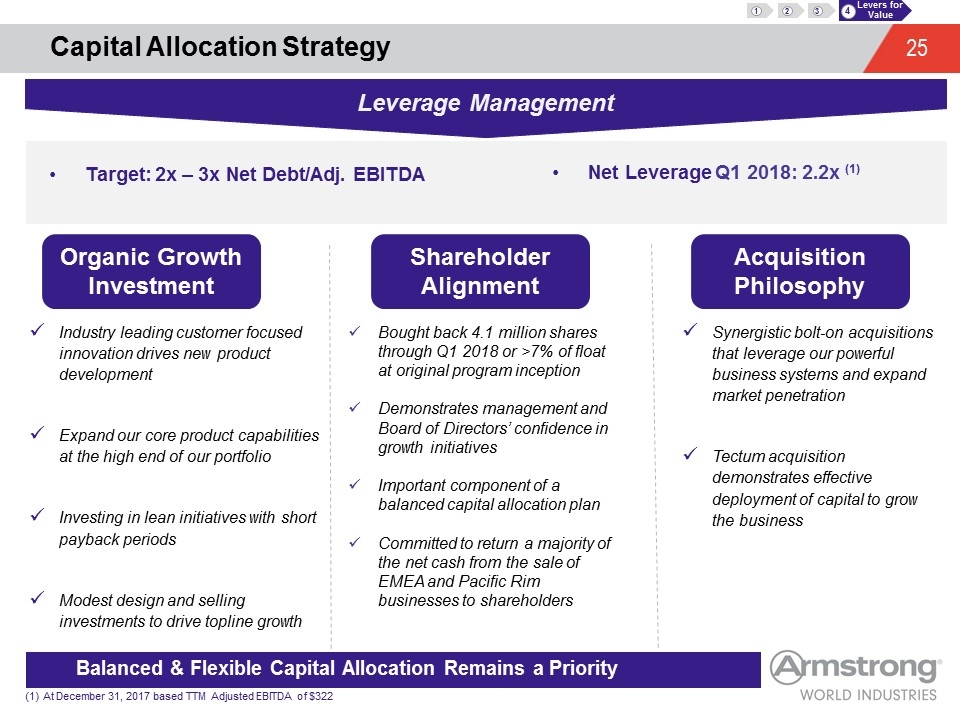

Capital Allocation Strategy Balanced & Flexible Capital Allocation Remains a Priority Organic Growth Investment Acquisition Philosophy Shareholder Alignment Industry leading customer focused innovation drives new product development Expand our core product capabilities at the high end of our portfolio Investing in lean initiatives with short payback periods Modest design and selling investments to drive topline growth Synergistic bolt-on acquisitions that leverage our powerful business systems and expand market penetration Tectum acquisition demonstrates effective deployment of capital to grow the business Leverage Management Target: 2x – 3x Net Debt/Adj. EBITDA Net Leverage Q1 2018: 2.2x (1) At December 31, 2017 based TTM Adjusted EBITDA of $322 4 Levers for Value 1 2 3 Bought back 4.1 million shares through Q1 2018 or >7% of float at original program inception Demonstrates management and Board of Directors’ confidence in growth initiatives Important component of a balanced capital allocation plan Committed to return a majority of the net cash from the sale of EMEA and Pacific Rim businesses to shareholders

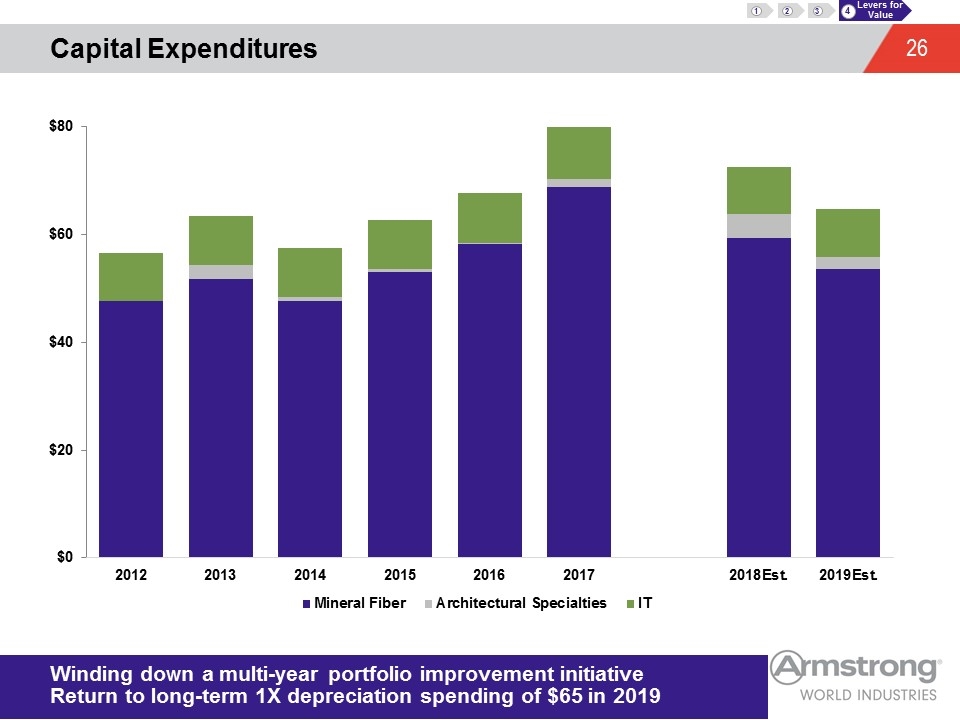

Capital Expenditures 4 Levers for Value 1 2 3 Winding down a multi-year portfolio improvement initiative Return to long-term 1X depreciation spending of $65 in 2019

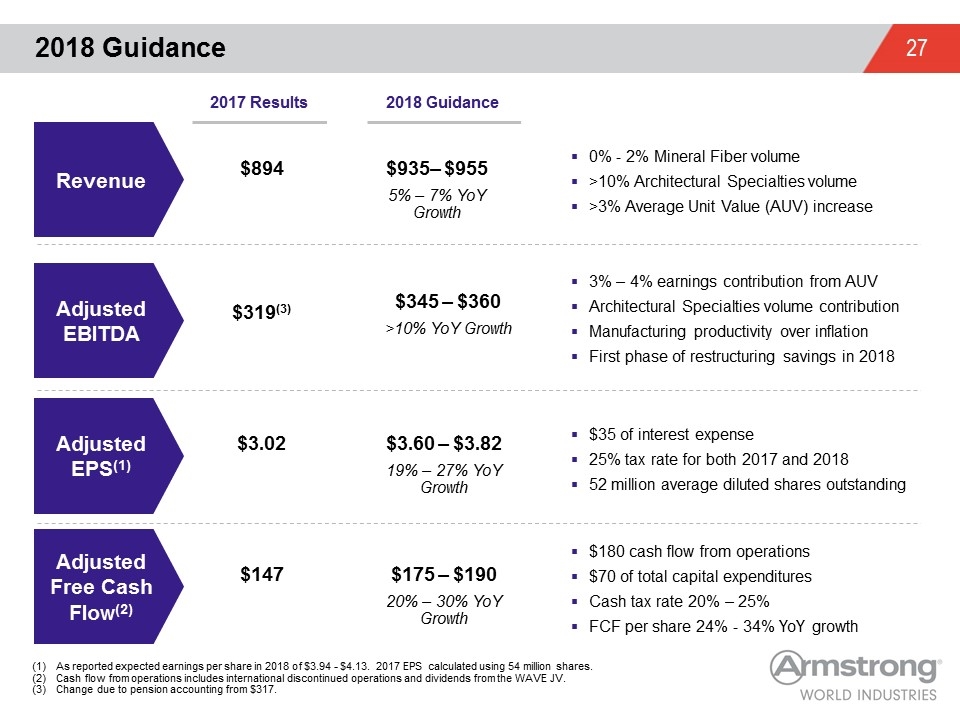

2018 Guidance $3.60 – $3.82 19% – 27% YoY Growth $3.02 Adjusted EBITDA Adjusted EPS(1) Adjusted Free Cash Flow(2) Revenue $894 $319(3) $935– $955 5% – 7% YoY Growth $345 – $360 >10% YoY Growth $175 – $190 20% – 30% YoY Growth $147 As reported expected earnings per share in 2018 of $3.94 - $4.13. 2017 EPS calculated using 54 million shares. Cash flow from operations includes international discontinued operations and dividends from the WAVE JV. Change due to pension accounting from $317. 0% - 2% Mineral Fiber volume >10% Architectural Specialties volume >3% Average Unit Value (AUV) increase 3% – 4% earnings contribution from AUV Architectural Specialties volume contribution Manufacturing productivity over inflation First phase of restructuring savings in 2018 $180 cash flow from operations $70 of total capital expenditures Cash tax rate 20% – 25% FCF per share 24% - 34% YoY growth 2017 Results 2018 Guidance $35 of interest expense 25% tax rate for both 2017 and 2018 52 million average diluted shares outstanding

Focused on Value Creation Standout market leader in attractive ceilings industry with unmatched profitability and cash flow Accelerating growth trajectory of the business Intense focus on expanding returns on invested capital Management long-term incentive plan aligned to absolute total shareholder returns and adjusted free cash flow

Appendix Management Biographies Appendix Items Reconciliations to GAAP

Management Biographies Brian MacNeal Senior Vice President and Chief Financial Officer, Armstrong World Industries Victor “Vic” Grizzle is CEO and President of Armstrong World Industries Inc., in Lancaster, Pennsylvania. Mr. Grizzle has 30 years of experience in sales, marketing and global business leadership. He comes to Armstrong World Industries from Valmont Industries, a $2 billion global leader of infrastructure support structures for utility, telecom and lighting markets, and manufacturer of mechanized irrigation equipment for large scale farming, where he was group president of Global Structures, Coatings and Tubing since 2005. Prior to Valmont, Mr. Grizzle was president of the commercial power division of EaglePicher Corporation, a $700 million diversified manufacturer and marketer of advanced technology and industrial products for space, defense, automotive, filtration, pharmaceutical, environmental and commercial applications. Before that, he spent 16 years at General Electric Corporation with 7 of those living abroad in Singapore, Belgium and Shanghai, China. Mr. Grizzle graduated from California Polytechnic University with a Bachelor of Science in Mechanical Engineering. Brian MacNeal is Senior Vice President and CFO of Armstrong World Industries Inc., in Lancaster, Pennsylvania. He began his career with PricewaterhouseCoopers as an auditor and left to join the Campbell Soup Company where he spent the next 20 years in roles of increasing responsibility and leadership. Brian’s finance and accounting experience with Campbell’s spans multiple assignments, including brand management, manufacturing, marketing and project management. He served as Director of Finance for U.S. Soup; Vice President of Finance and Strategy Emerging Markets as Campbell’s entered Russia and China; and Vice President & CFO of Campbell’s European business. Mr. MacNeal graduated cum laude from Villanova University with a bachelor’s degree in Accounting and has practiced as a Certified Public Accountant. Victor Grizzle Chief Executive Officer and President, Armstrong World Industries

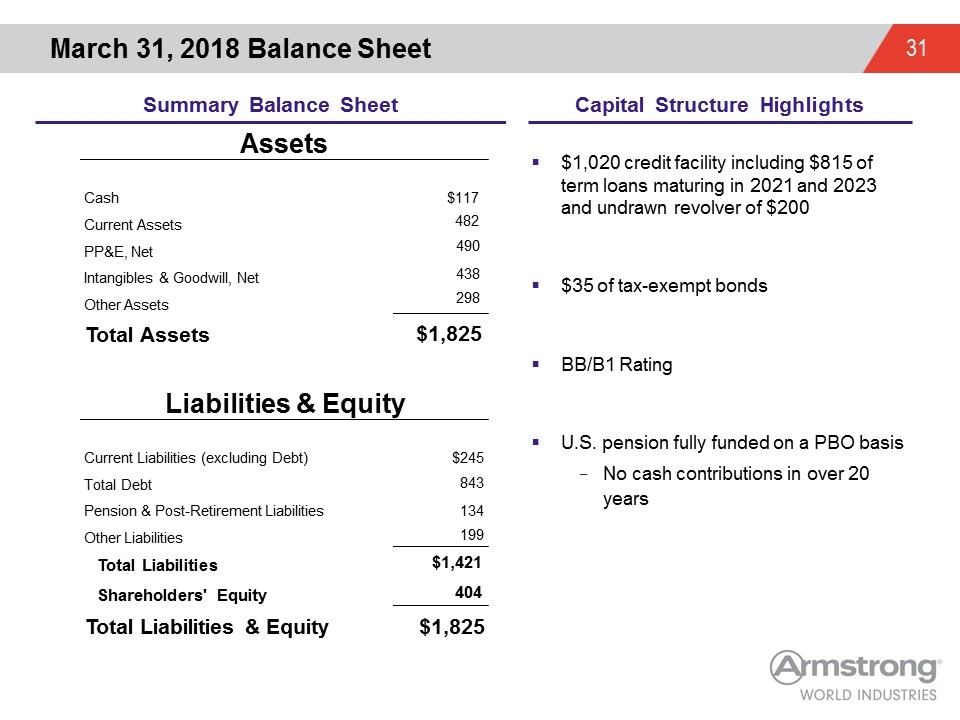

March 31, 2018 Balance Sheet $1,020 credit facility including $815 of term loans maturing in 2021 and 2023 and undrawn revolver of $200 $35 of tax-exempt bonds BB/B1 Rating U.S. pension fully funded on a PBO basis No cash contributions in over 20 years Summary Balance Sheet Capital Structure Highlights Cash $117 Current Assets 482 PP&E, Net 490 Intangibles & Goodwill, Net 438 Other Assets 298 Total Assets $1,825 Current Liabilities (excluding Debt) $245 Total Debt 843 Pension & Post-Retirement Liabilities 134 Other Liabilities 199 Total Liabilities $1,421 Shareholders' Equity 404 Total Liabilities & Equity $1,825 Assets Liabilities & Equity

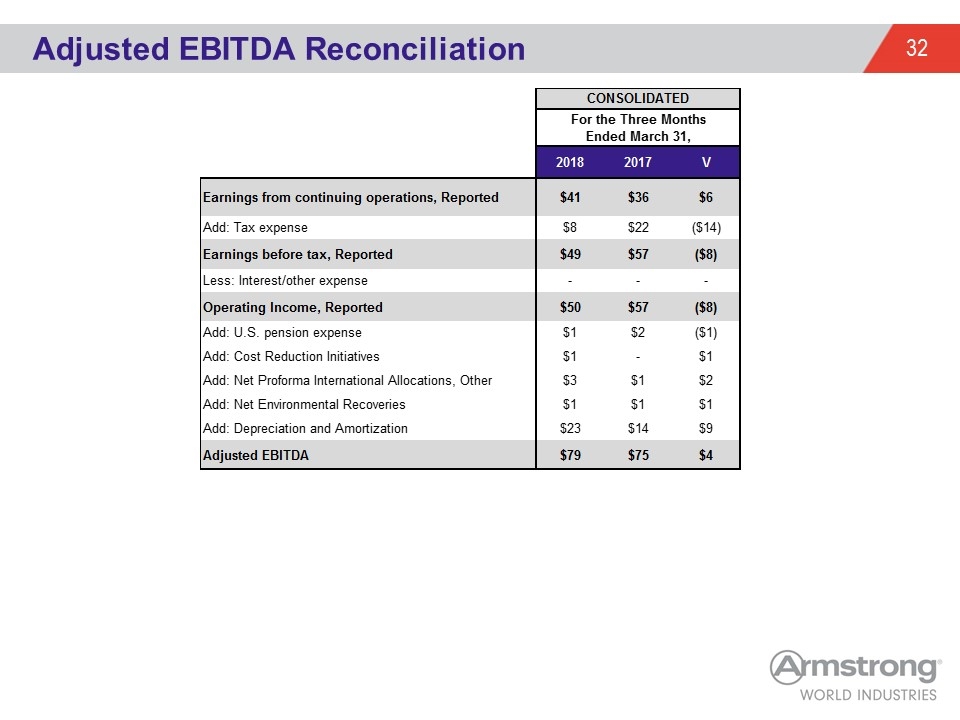

Adjusted EBITDA Reconciliation CONSOLIDATED For the Three MonthsEnded March 31, qtr YTD 2018 2017 V 2016 V Earnings from continuing operations, Reported 41.2 35.500000000000014 5.6999999999999886 99 122 rounding Add: Tax expense 8.1999999999999993 21.8 -13.600000000000001 51 -50 Earnings before tax, Reported 49.400000000000006 57.300000000000011 -7.9000000000000057 151 71 rounding Less: Interest/other expense 0 0 0 -38 5 Operating Income, Reported 49.6 57.3 -7.6999999999999957 189 66 Add: U.S. pension expense 1.4346810000000001 2.085121 -0.65043999999999991 13 -18 Add: Cost Reduction Initiatives 0.60928300000000002 0 0.60928300000000002 0 7 Add: Net Proforma International Allocations, Other 2.8489149999999999 1.2 1.6489149999999999 0 8 Add: Net Environmental Recoveries 1.354652 0.69169400000000003 0.66295799999999994 0 -15 Add: Depreciation and Amortization 22.863247999999999 13.662050999999998 9.2011970000000005 55 12 Adjusted EBITDA 78.849778999999998 75.223873999999995 3.625905000000003 295 22 rounding

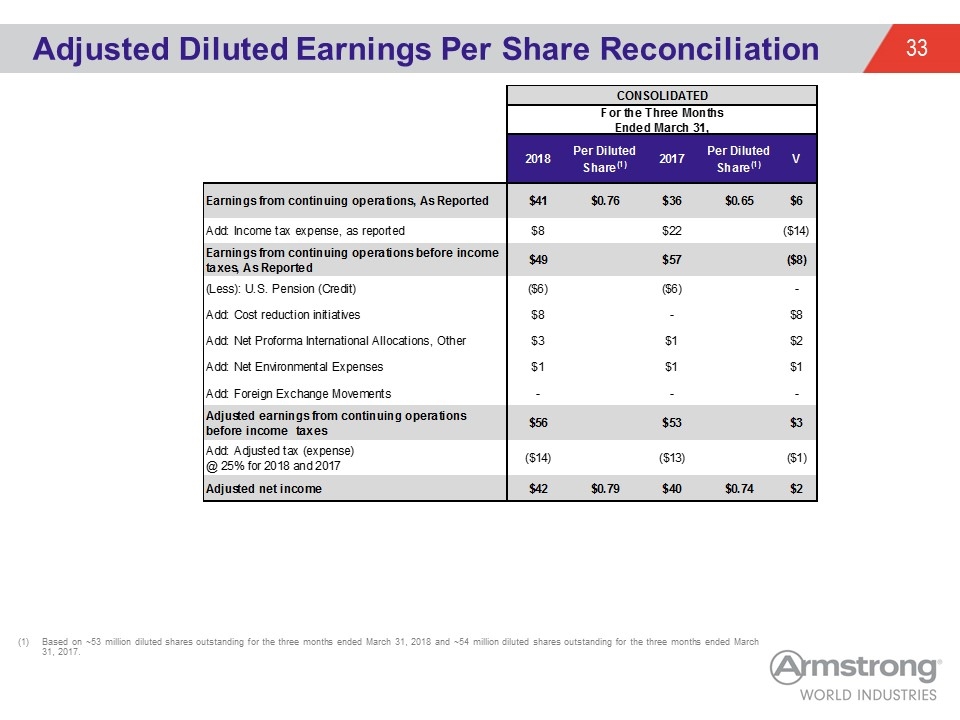

Adjusted Diluted Earnings Per Share Reconciliation Based on ~53 million diluted shares outstanding for the three months ended March 31, 2018 and ~54 million diluted shares outstanding for the three months ended March 31, 2017. CONSOLIDATED For the Three MonthsEnded March 31, 2018 Per DilutedShare(1) 2017 Per DilutedShare(1) V Qtr YTD Earnings from continuing operations, As Reported 41.2 $0.76 35.500000000000014 $0.65 5.6999999999999886 rounding Add: Income tax expense, as reported 8.1999999999999993 21.8 -13.600000000000001 Earnings from continuing operations before income taxes, As Reported 49.400000000000006 57.300000000000011 -7.9000000000000057 rounding rounding (Less): U.S. Pension (Credit) -6 -6 0 Add: Cost reduction initiatives 8.3092830000000006 0 8.3092830000000006 Add: Net Proforma International Allocations, Other 2.8489149999999999 1.2 1.6489149999999999 Add: Net Environmental Expenses 1.354652 0.69169400000000003 0.66295799999999994 Add: Foreign Exchange Movements 0 0 0 Adjusted earnings from continuing operations before income taxes 55.912850000000006 53.191694000000012 2.7211559999999935 Add: Adjusted tax (expense) @ 25% for 2018 and 2017 -14 -13 -1 Adjusted net income 41.912850000000006 $0.79080849056603786 40.191694000000012 $0.74429062962962989 1.7211559999999935

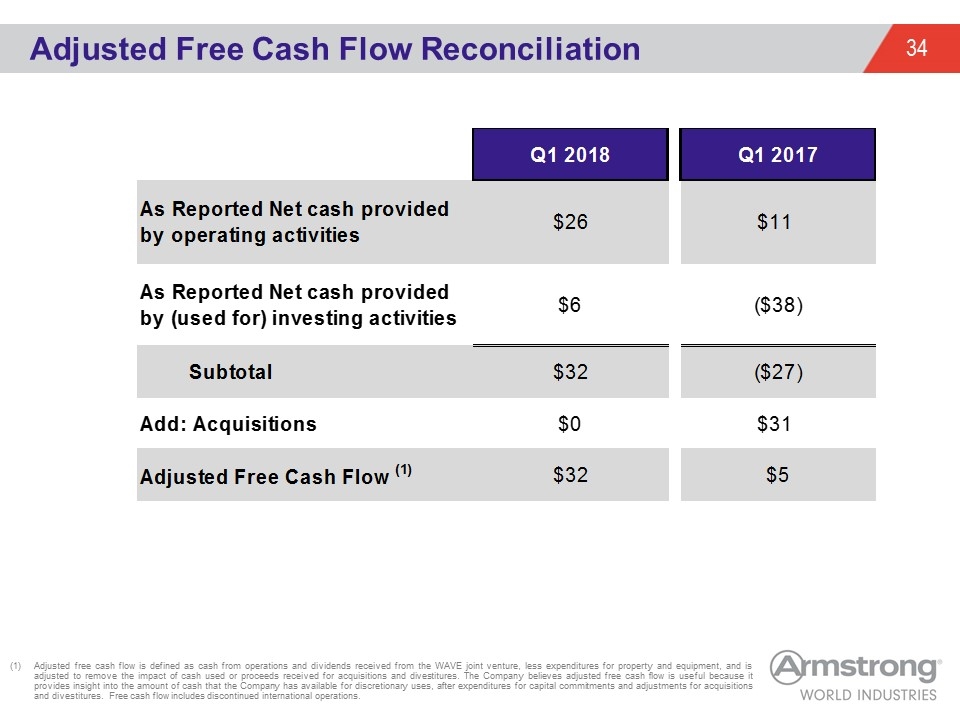

Adjusted Free Cash Flow Reconciliation Adjusted free cash flow is defined as cash from operations and dividends received from the WAVE joint venture, less expenditures for property and equipment, and is adjusted to remove the impact of cash used or proceeds received for acquisitions and divestitures. The Company believes adjusted free cash flow is useful because it provides insight into the amount of cash that the Company has available for discretionary uses, after expenditures for capital commitments and adjustments for acquisitions and divestitures. Free cash flow includes discontinued international operations. Q1 2018 Q1 2017 As Reported Net cash provided by operating activities $26 $10.599999999999993 As Reported Net cash provided by (used for) investing activities $5.8000000000000007 $-37.5 Subtotal $31.8 $-26.900000000000006 Add: Acquisitions $0 $31.4 Adjusted Free Cash Flow (1) $31.8 $5

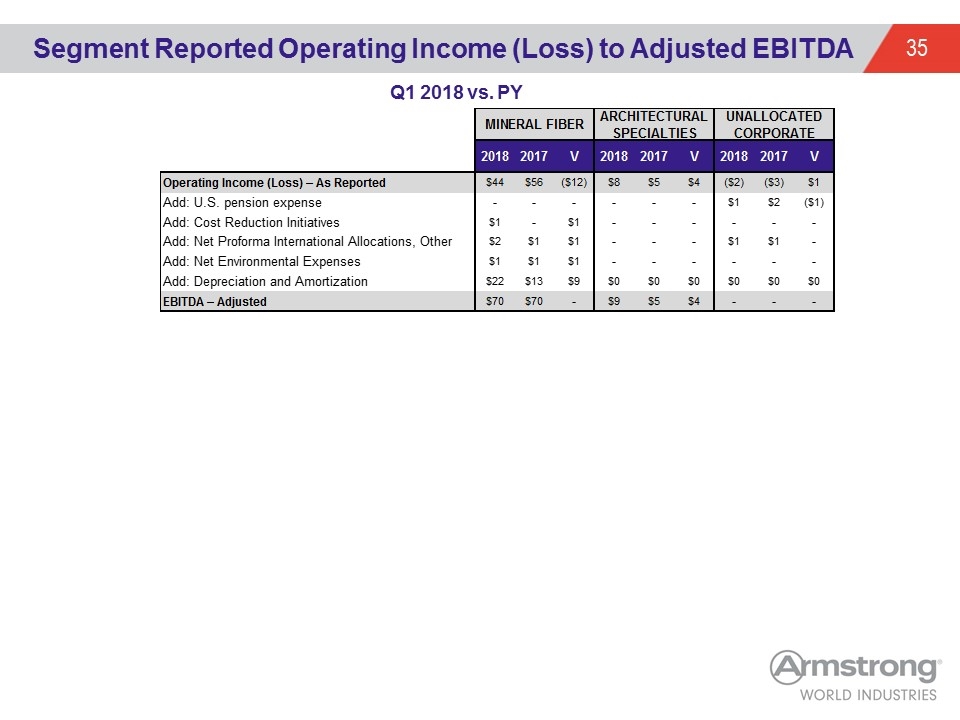

Segment Reported Operating Income (Loss) to Adjusted EBITDA Q1 2018 vs. PY MINERAL FIBER ARCHITECTURAL SPECIALTIES UNALLOCATED CORPORATE rounding factor 2016 V 2018 2017 V 2018 2017 V 2018 2017 V Operating Income (Loss) – As Reported 43.7 55.5 -11.799999999999997 8.3000000000000007 4.8 3.5000000000000009 -2.4 -3 0.60000000000000009 Add: U.S. pension expense 0 0 0 0 0 0 1.4346810000000001 2.085121 -0.65043999999999991 Add: Cost Reduction Initiatives 0.60928300000000002 0 0.60928300000000002 0 0 0 0 0 0 Add: Net Proforma International Allocations, Other 2 0.52500000000000002 1.4750000000000001 0 0 0 0.84891499999999986 0.67500000000000004 0 check cell n12, was not working properly Add: Net Environmental Expenses 1.354652 0.69169400000000003 0.66295799999999994 0 0 0 0 0 0 Add: Depreciation and Amortization 22.335254000000006 13.180316000000005 9.1549380000000014 0.44591399999999837 0.40786800000000056 3.8045999999997804E-2 0.11640399999999995 0.1 1.6403999999999946E-2 EBITDA – Adjusted 69.991274000000004 70.105636000000004 0 8.8585049999999992 5.2161980000000003 3.6423069999999989 0 0 0

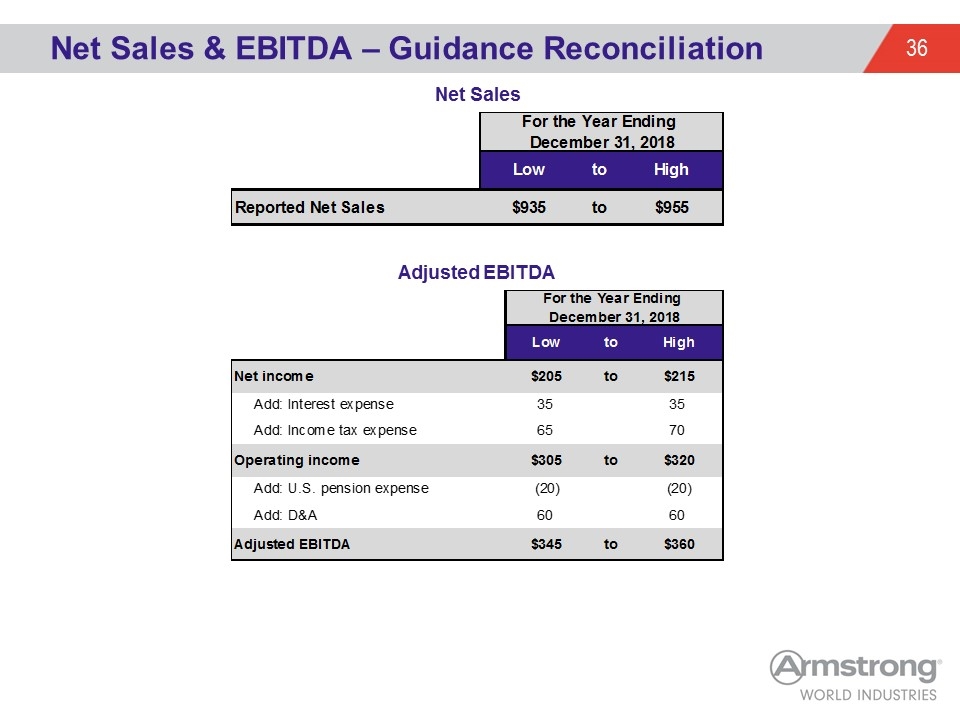

Net Sales & EBITDA – Guidance Reconciliation Net Sales Adjusted EBITDA For the Year Ending December 31, 2018 Low to High Reported Net Sales $935 to $955 For the Year Ending December 31, 2018 Low to High Net income $205 to $215 Add: Interest expense 35 35 Add: Income tax expense 65 70 Operating income $305 to $320 Add: U.S. pension expense -20 -20 Add: D&A 60 60 Adjusted EBITDA $345 to $360

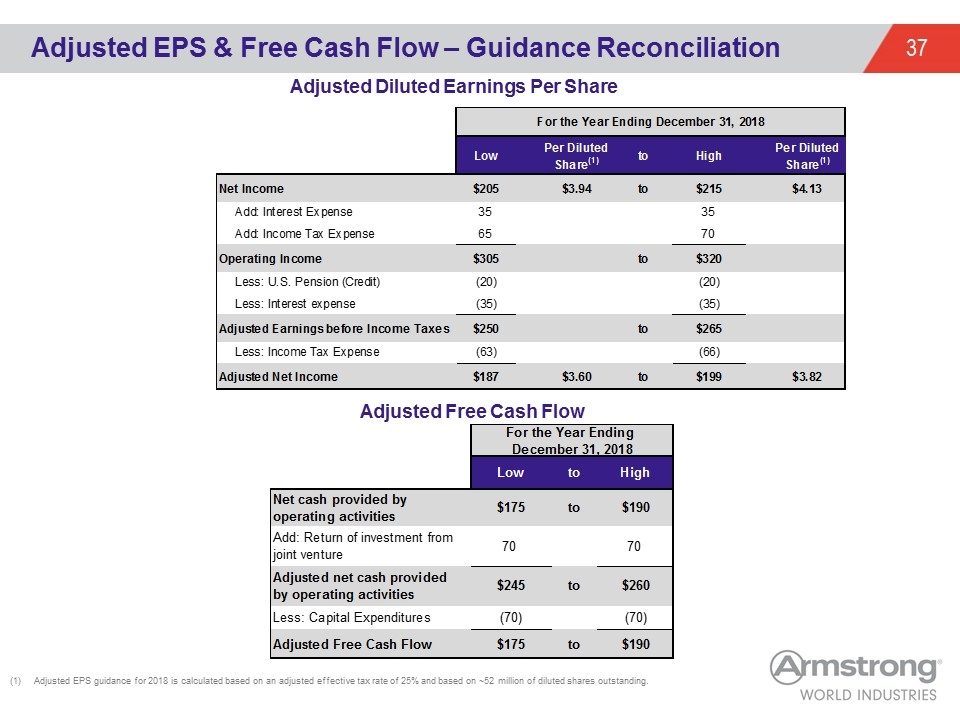

Adjusted EPS & Free Cash Flow – Guidance Reconciliation Adjusted Diluted Earnings Per Share Adjusted Free Cash Flow Adjusted EPS guidance for 2018 is calculated based on an adjusted effective tax rate of 25% and based on ~52 million of diluted shares outstanding. For the Year Ending December 31, 2018 Low to High Net cash provided by operating activities $175 to $190 Add: Return of investment from joint venture 70 70 Adjusted net cash provided by operating activities $245 to $260 Less: Capital Expenditures -70 -70 Adjusted Free Cash Flow $175 to $190 For the Year Ending December 31, 2018 Low Per DilutedShare(1) to High Per DilutedShare(1) Net Income $205 $3.94 to $215 $4.13 Add: Interest Expense 35 35 Add: Income Tax Expense 65 70 Operating Income $305 to $320 Less: U.S. Pension (Credit) -20 -20 Less: Interest expense -35 -35 Adjusted Earnings before Income Taxes $250 to $265 Less: Income Tax Expense -63 -66.25 Adjusted Net Income $187 $3.6 to $198.75 $3.82

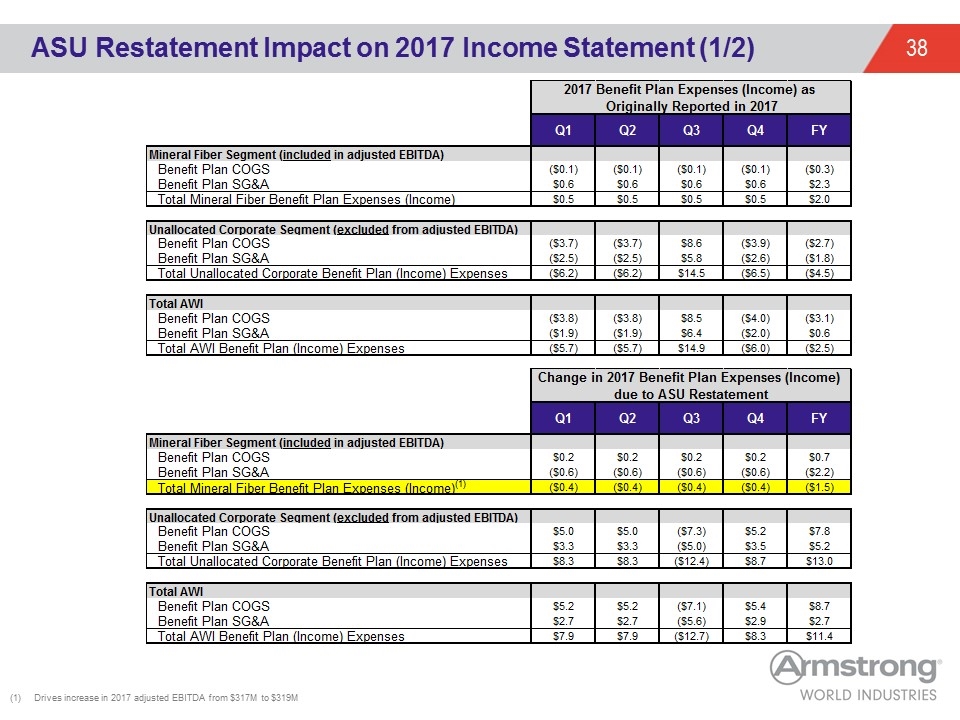

ASU Restatement Impact on 2017 Income Statement (1/2) Drives increase in 2017 adjusted EBITDA from $317M to $319M 2017 Benefit Plan Expenses (Income) as Originally Reported in 2017 Q1 Q2 Q3 Q4 FY Mineral Fiber Segment (included in adjusted EBITDA) Benefit Plan COGS $-0.1 $-0.1 $-0.1 $-0.1 $-0.3 Benefit Plan SG&A $0.6 $0.6 $0.6 $0.6 $2.2999999999999998 Total Mineral Fiber Benefit Plan Expenses (Income) $0.5 $0.5 $0.5 $0.5 $2 Unallocated Corporate Segment (excluded from adjusted EBITDA) Benefit Plan COGS $-3.7 $-3.7 $8.6 $-3.9 $-2.7 Benefit Plan SG&A $-2.5 $-2.5 $5.8 $-2.6 $-1.8 Total Unallocated Corporate Benefit Plan (Income) Expenses $-6.2 $-6.2 $14.5 $-6.5 $-4.5 Total AWI Benefit Plan COGS $-3.8 $-3.8 $8.5 $-4 $-3.1 Benefit Plan SG&A $-1.9 $-1.9 $6.4 $-2 $0.6 Total AWI Benefit Plan (Income) Expenses $-5.7 $-5.7 $14.9 $-6 $-2.5 Change in 2017 Benefit Plan Expenses (Income) due to ASU Restatement Q1 Q2 Q3 Q4 FY Mineral Fiber Segment (included in adjusted EBITDA) Benefit Plan COGS $0.2 $0.2 $0.2 $0.2 $0.7 Benefit Plan SG&A $-0.6 $-0.6 $-0.6 $-0.6 $-2.2000000000000002 Total Mineral Fiber Benefit Plan Expenses (Income)(1) $-0.39999999999999997 $-0.39999999999999997 $-0.39999999999999997 $-0.39999999999999997 $-1.5000000000000002 Unallocated Corporate Segment (excluded from adjusted EBITDA) Benefit Plan COGS $5 $5 $-7.3 $5.2 $7.8 Benefit Plan SG&A $3.3 $3.3 $-5 $3.5 $5.2 Total Unallocated Corporate Benefit Plan (Income) Expenses $8.3000000000000007 $8.3000000000000007 $-12.4 $8.6999999999999993 $13 Total AWI Benefit Plan COGS $5.2 $5.2 $-7.1 $5.4 $8.6999999999999993 Benefit Plan SG&A $2.6999999999999997 $2.6999999999999997 $-5.6 $2.9 $2.7 Total AWI Benefit Plan (Income) Expenses $7.9 $7.9 $-12.7 $8.2999999999999989 $11.4

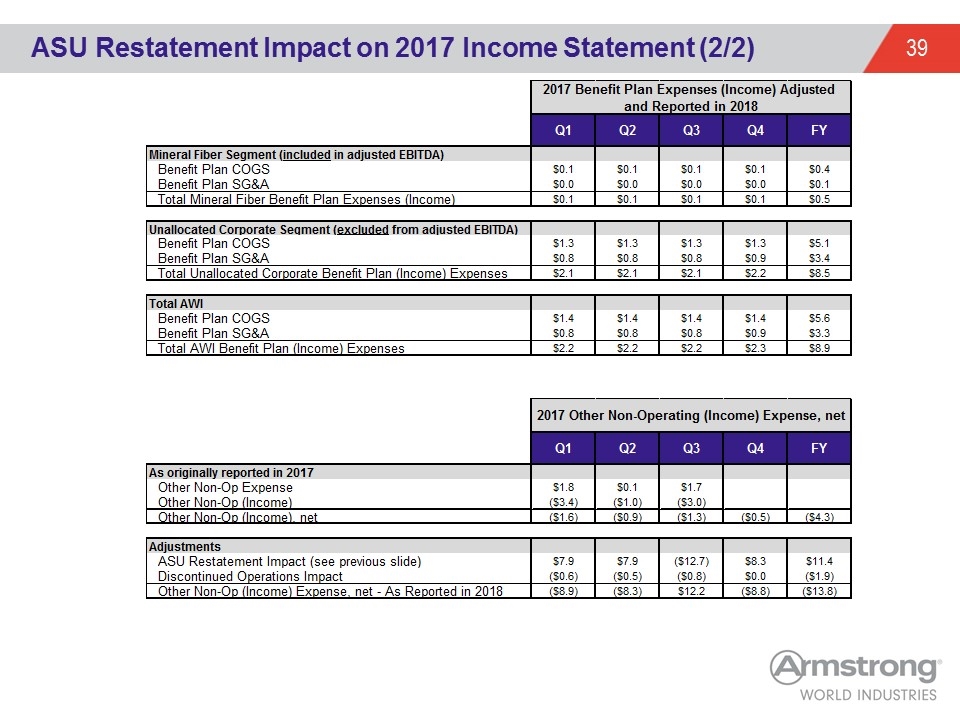

ASU Restatement Impact on 2017 Income Statement (2/2) 2017 Benefit Plan Expenses (Income) Adjusted and Reported in 2018 Q1 Q2 Q3 Q4 FY Mineral Fiber Segment (included in adjusted EBITDA) Benefit Plan COGS $0.1 $0.1 $0.1 $0.1 $0.4 Benefit Plan SG&A $0 $0 $0 $0 $0.1 Total Mineral Fiber Benefit Plan Expenses (Income) $0.1 $0.1 $0.1 $0.1 $0.5 Unallocated Corporate Segment (excluded from adjusted EBITDA) Benefit Plan COGS $1.3 $1.3 $1.3 $1.3 $5.0999999999999996 Benefit Plan SG&A $0.8 $0.8 $0.8 $0.9 $3.4 Total Unallocated Corporate Benefit Plan (Income) Expenses $2.1 $2.1 $2.1 $2.2000000000000002 $8.5 Total AWI Benefit Plan COGS $1.4 $1.4 $1.4 $1.4 $5.6 Benefit Plan SG&A $0.8 $0.8 $0.8 $0.9 $3.3 Total AWI Benefit Plan (Income) Expenses $2.2000000000000002 $2.2000000000000002 $2.2000000000000002 $2.2999999999999998 $8.9 2017 Other Non-Operating (Income) Expense, net Q1 Q2 Q3 Q4 FY As originally reported in 2017 Other Non-Op Expense $1.8 $0.1 $1.7 Other Non-Op (Income) $-3.4 $-1 $-3 Other Non-Op (Income), net $-1.5999999999999999 $-0.9 $-1.3 $-0.5 $-4.3 Adjustments ASU Restatement Impact (see previous slide) $7.9 $7.9 $-12.7 $8.3000000000000007 $11.4 Discontinued Operations Impact $-0.6 $-0.5 $-0.8 $0 $-1.9 Other Non-Op (Income) Expense, net - As Reported in 2018 $-8.9 $-8.3000000000000007 $12.2 $-8.8000000000000007 $-13.8

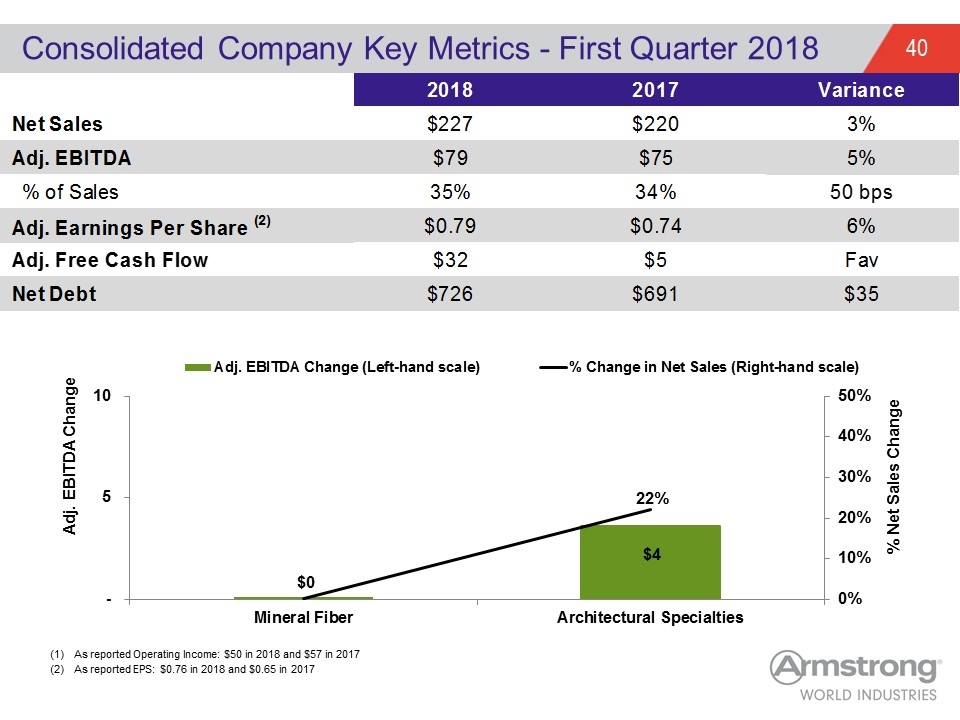

Consolidated Company Key Metrics - First Quarter 2018 As reported Operating Income: $50 in 2018 and $57 in 2017 As reported EPS: $0.76 in 2018 and $0.65 in 2017 2018 2017 Variance Net Sales $227.3 $219.8 3.4121929026387665E-2 Adj. EBITDA $78.849778999999998 64 $75.223873999999995 4.8201519108149071E-2 % of Sales 0.34675048632276806 0.34174564936852175 50 Adj. Earnings Per Share (2) $0.79080849056603786 $0.74429062962962989 6.2499592342786785E-2 Adj. Free Cash Flow $32 $5 Fav Net Debt $725.7 $690.6 $35.100000000000023

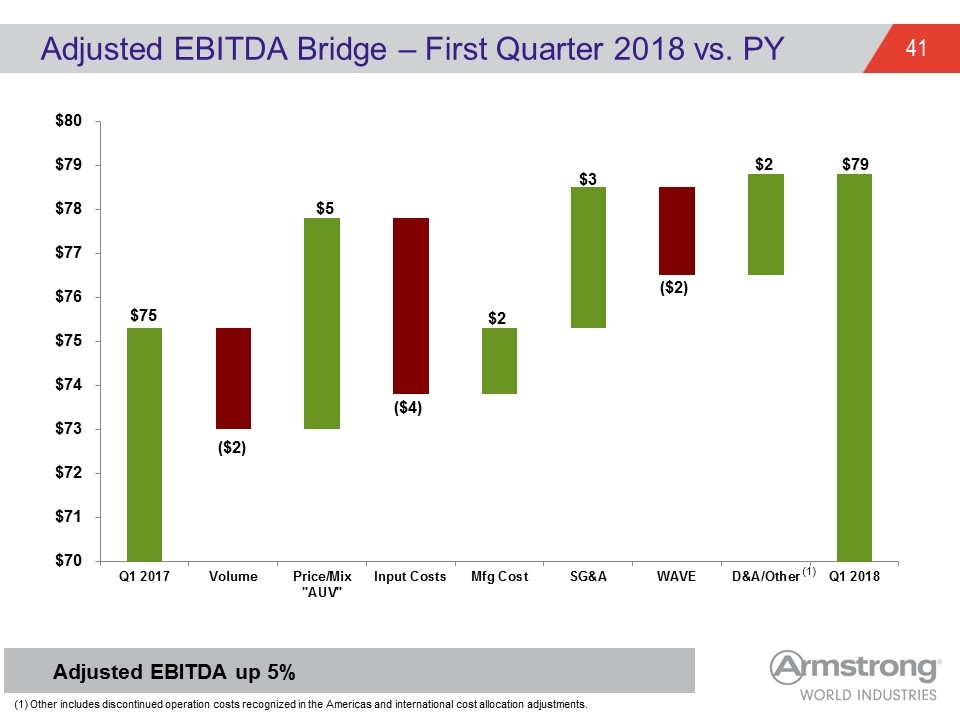

Adjusted EBITDA Bridge – First Quarter 2018 vs. PY ($2) $5 ($4) $3 $2 ($2) Adjusted EBITDA up 5% $2 (1) (1) Other includes discontinued operation costs recognized in the Americas and international cost allocation adjustments.

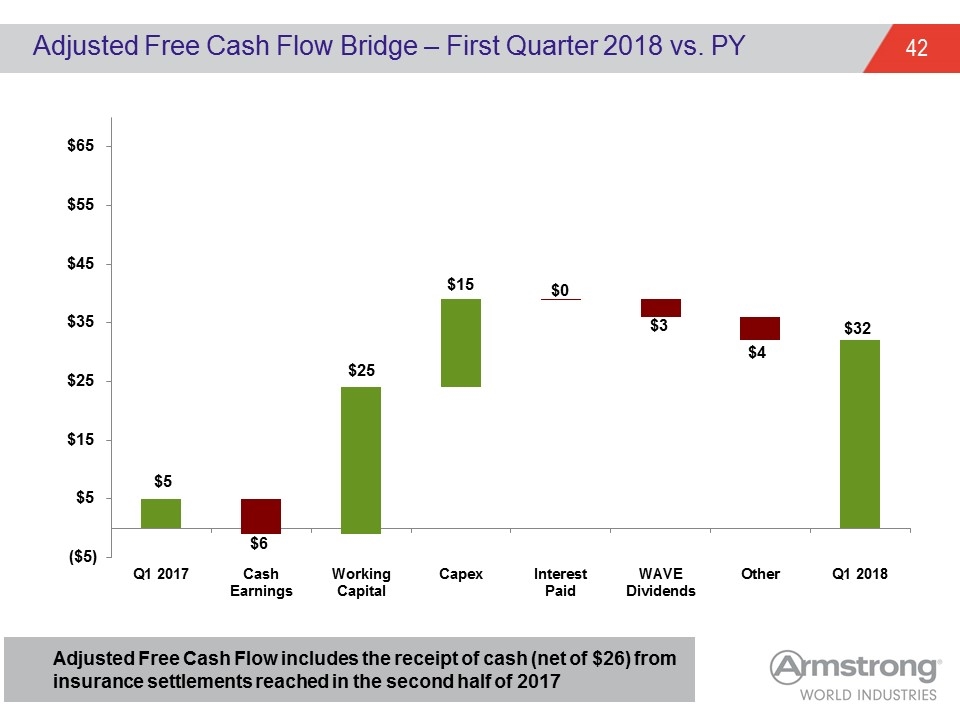

Adjusted Free Cash Flow Bridge – First Quarter 2018 vs. PY $6 Adjusted Free Cash Flow includes the receipt of cash (net of $26) from insurance settlements reached in the second half of 2017