Earnings Call Presentation 2nd Quarter 2018 July 31, 2018 Exhibit 99.2

Our disclosures in this presentation, including without limitation, those relating to future financial results market conditions and guidance, and in our other public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that may affect our ability to achieve the projected performance is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Forms 10-K and 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”). Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. In addition, we will be referring to non-GAAP financial measures within the meaning of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance with GAAP are included within this presentation and available on the Investor Relations page of our website at www.armstrongceilings.com. The guidance in this presentation is only effective as of the date given, July 31, 2018 and will not be updated or affirmed unless and until we publicly announce updated or affirmed guidance. Safe Harbor Statement

All dollar figures throughout the presentation are in $ millions (except earnings per share) unless otherwise noted. Figures may not add due to rounding. When reporting our financial results within this presentation, we make several adjustments. Management uses the non-GAAP measures in managing the business and believes the adjustments provide meaningful comparisons of operating performance between periods. As reported results will be footnoted throughout the presentation. Basis of Presentation Explanation Results throughout this presentation are presented on a continuing operations basis with the exception of cash flow. With the pending sale of our EMEA and Pacific Rim businesses, we no longer adjust our sales for movements in foreign exchange rates as we expect these to have minimal impact on revenue. We remove the impact of certain discrete expenses and income. Examples include plant closures, restructuring actions, environmental site expenses and related insurance recoveries, and other large unusual items. We also adjust for our U.S. pension plan (credit) expense(1). Taxes for adjusted net income and adjusted diluted EPS are calculated using a constant 25% rate. Segment SG&A cost structures reflect updated cost allocation methodology. U.S. pension (credit) expense represents the actuarial net periodic benefit cost expected to be recorded as a component of operating income. For all periods presented, we were not required and did not make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation, nor do we expect to make cash contributions to the plan in 2018.

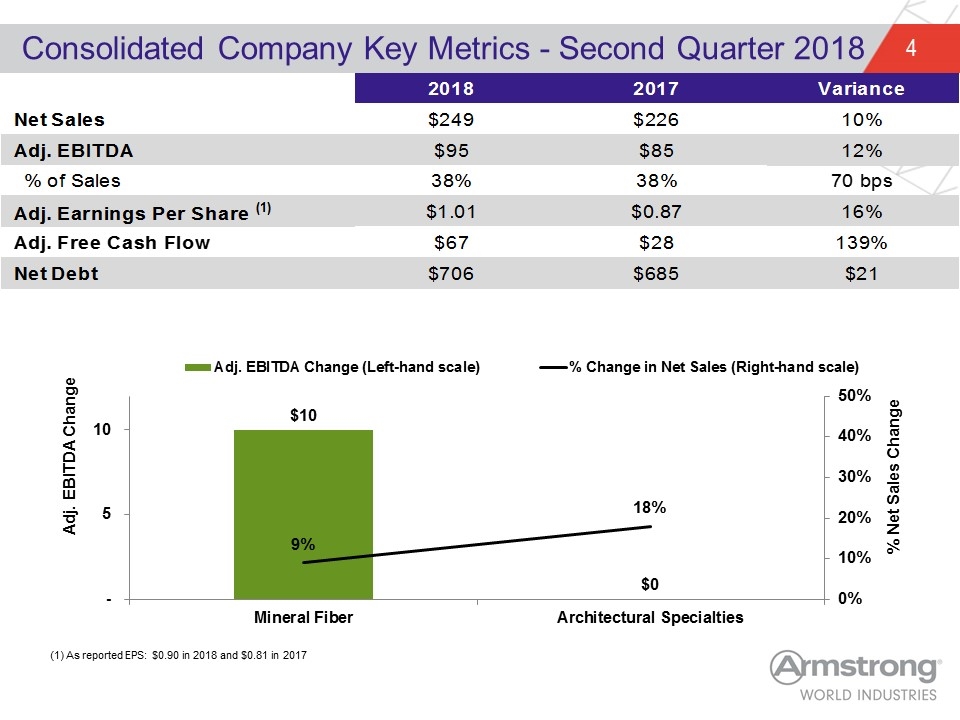

Consolidated Company Key Metrics - Second Quarter 2018 (1) As reported EPS: $0.90 in 2018 and $0.81 in 2017 2018 2017 Variance Net Sales $248.6 $225.6 0.10195035460992918 Adj. EBITDA $95.1 64 $84.741 0.12224307006053725 % of Sales 0.38254223652453739 0.37562499999999999 70 Adj. Earnings Per Share (1) $1.0054069615384611 $0.86815994444444433 0.15808955247508494 Adj. Free Cash Flow $67 $28 1.3928571428571428 Net Debt $706 $684.7 $21.299999999999955

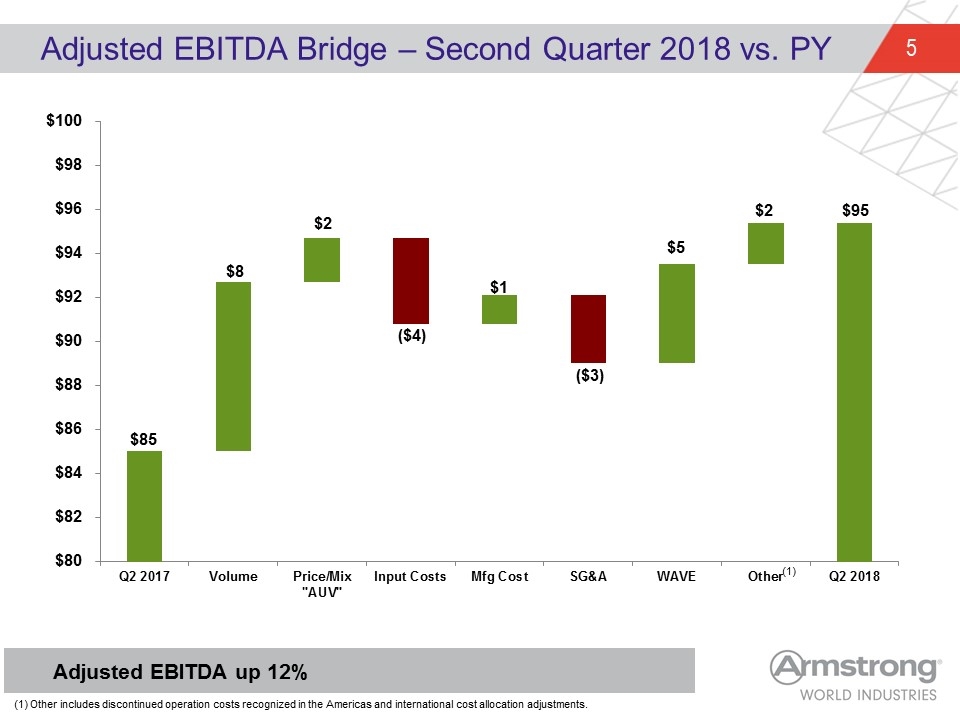

Adjusted EBITDA Bridge – Second Quarter 2018 vs. PY $8 $2 ($4) ($3) $1 $5 Adjusted EBITDA up 12% $2 (1) (1) Other includes discontinued operation costs recognized in the Americas and international cost allocation adjustments.

Adjusted Free Cash Flow Bridge – Second Quarter 2018 vs. PY $0 “Other” driven mainly by $12M increase in income taxes payable $0 $18 $4 $4 $13

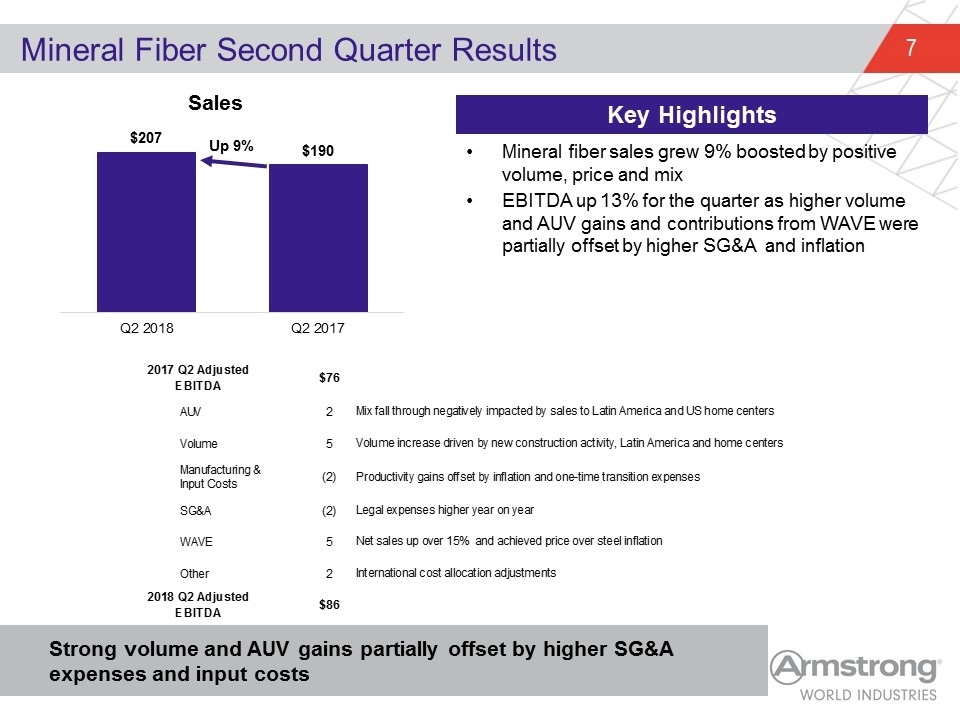

Mineral fiber sales grew 9% boosted by positive volume, price and mix EBITDA up 13% for the quarter as higher volume and AUV gains and contributions from WAVE were partially offset by higher SG&A and inflation Mineral Fiber Second Quarter Results Strong volume and AUV gains partially offset by higher SG&A expenses and input costs Key Highlights 2017 Q2 Adjusted EBITDA $76 AUV 2 Mix fall through negatively impacted by sales to Latin America and US home centers Volume 5 Volume increase driven by new construction activity, Latin America and home centers Manufacturing & Input Costs -2 Productivity gains offset by inflation and one-time transition expenses SG&A -2 Legal expenses higher year on year WAVE 5 Net sales up over 15% and achieved price over steel inflation Other 2 International cost allocation adjustments 2018 Q2 Adjusted EBITDA $86

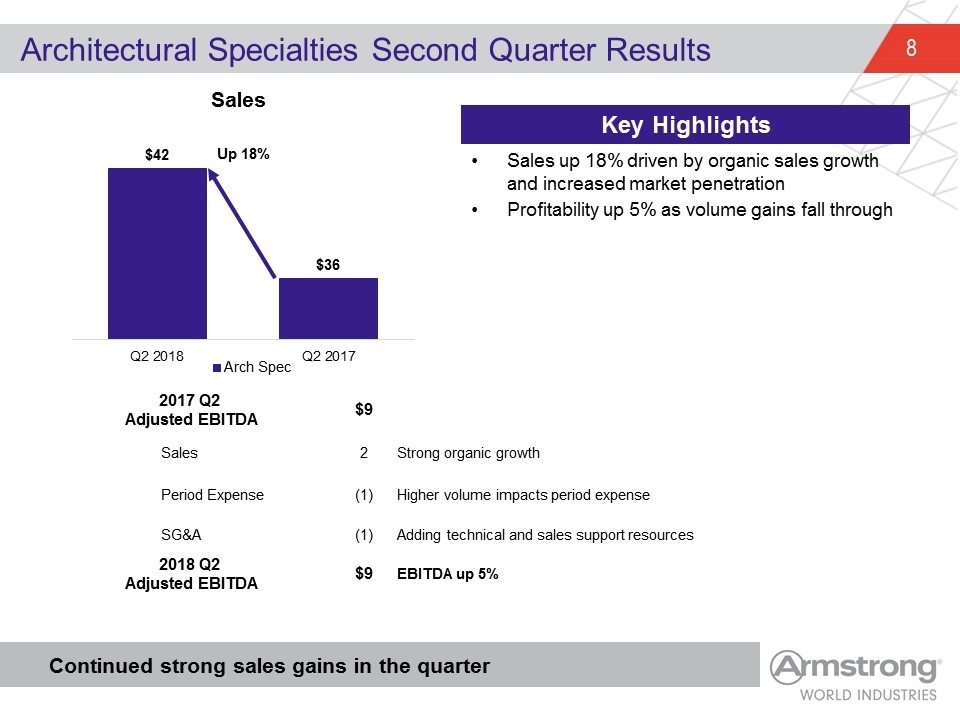

Sales up 18% driven by organic sales growth and increased market penetration Profitability up 5% as volume gains fall through Architectural Specialties Second Quarter Results Continued strong sales gains in the quarter Key Highlights 2017 Q2 Adjusted EBITDA $9 Sales 2 Strong organic growth Period Expense (1) Higher volume impacts period expense SG&A (1) Adding technical and sales support resources 2018 Q2 Adjusted EBITDA $9 EBITDA up 5%

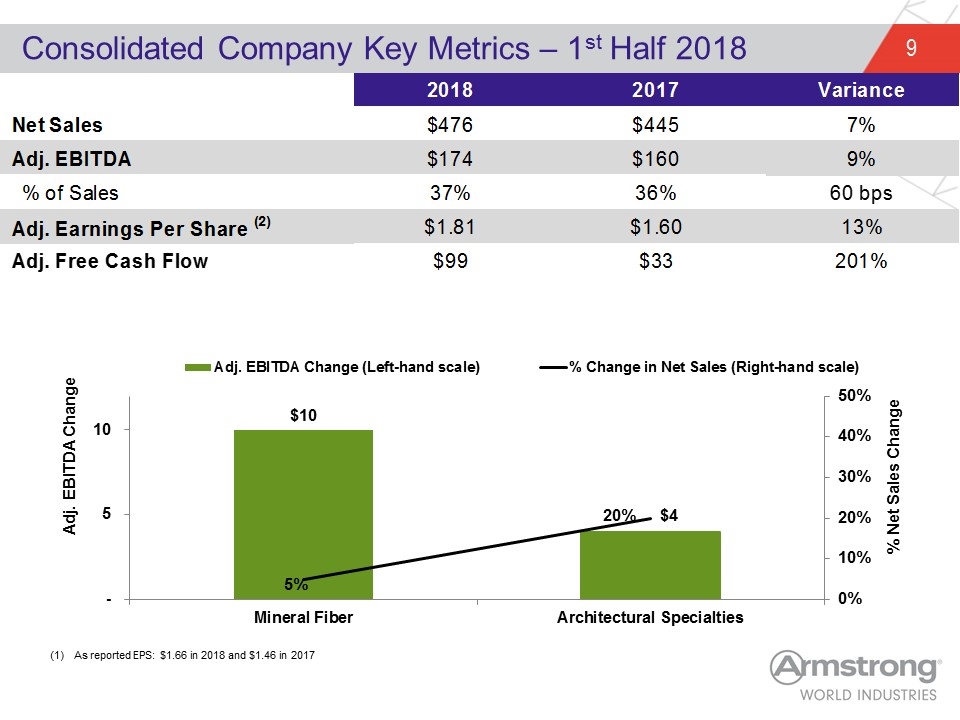

Consolidated Company Key Metrics – 1st Half 2018 As reported EPS: $1.66 in 2018 and $1.46 in 2017 2018 2017 Variance Net Sales $475.9 $445.4 6.8477772788504643E-2 Adj. EBITDA $173.93029200000001 64 $159.965 8.7302172350201657E-2 % of Sales 0.36547655389787775 0.35914907947911989 60 Adj. Earnings Per Share (2) $1.64 $1.6 2.4999999999999911E-2 Adj. Free Cash Flow $99.299999999999983 $33 2.0090909090909084

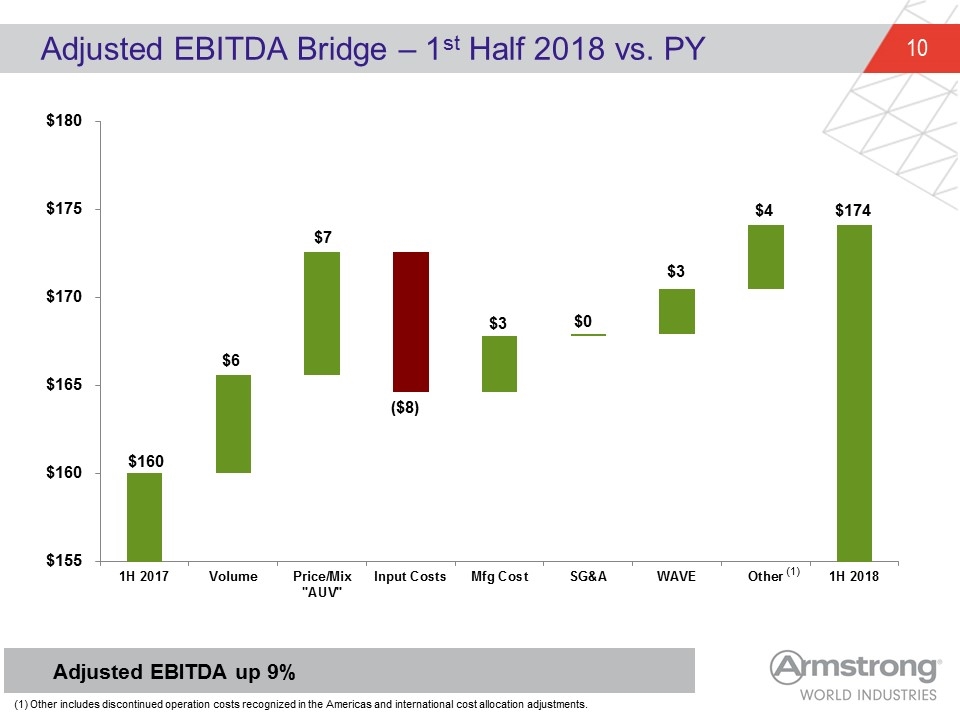

Adjusted EBITDA Bridge – 1st Half 2018 vs. PY $6 $7 ($8) $0 $3 $3 Adjusted EBITDA up 9% $4 (1) (1) Other includes discontinued operation costs recognized in the Americas and international cost allocation adjustments.

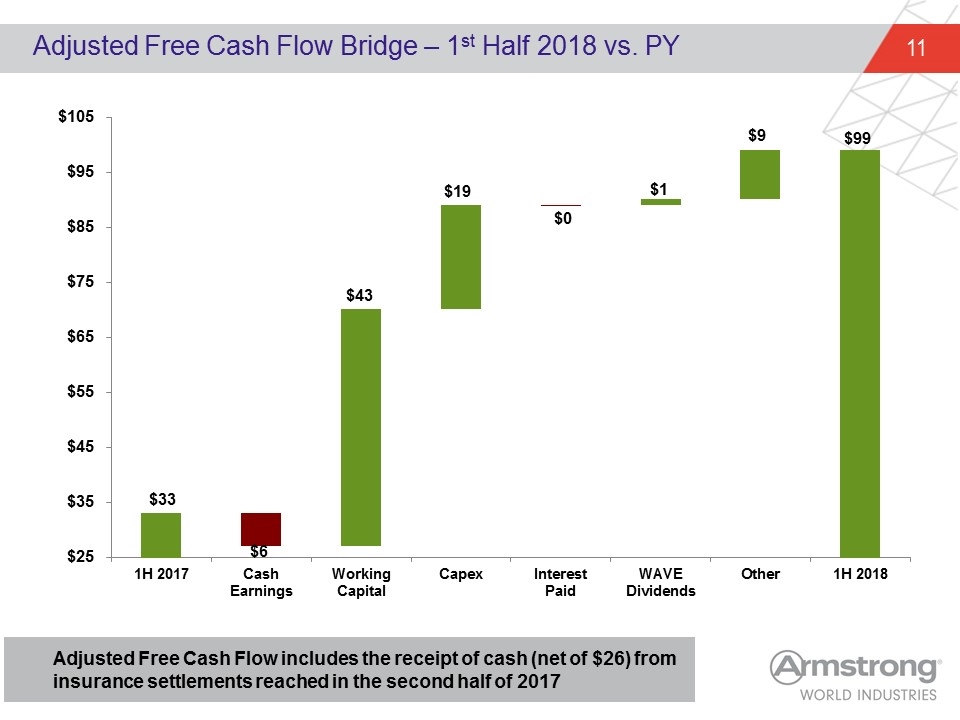

Adjusted Free Cash Flow Bridge – 1st Half 2018 vs. PY $6 Adjusted Free Cash Flow includes the receipt of cash (net of $26) from insurance settlements reached in the second half of 2017 $43 $19 $0 $1 $9

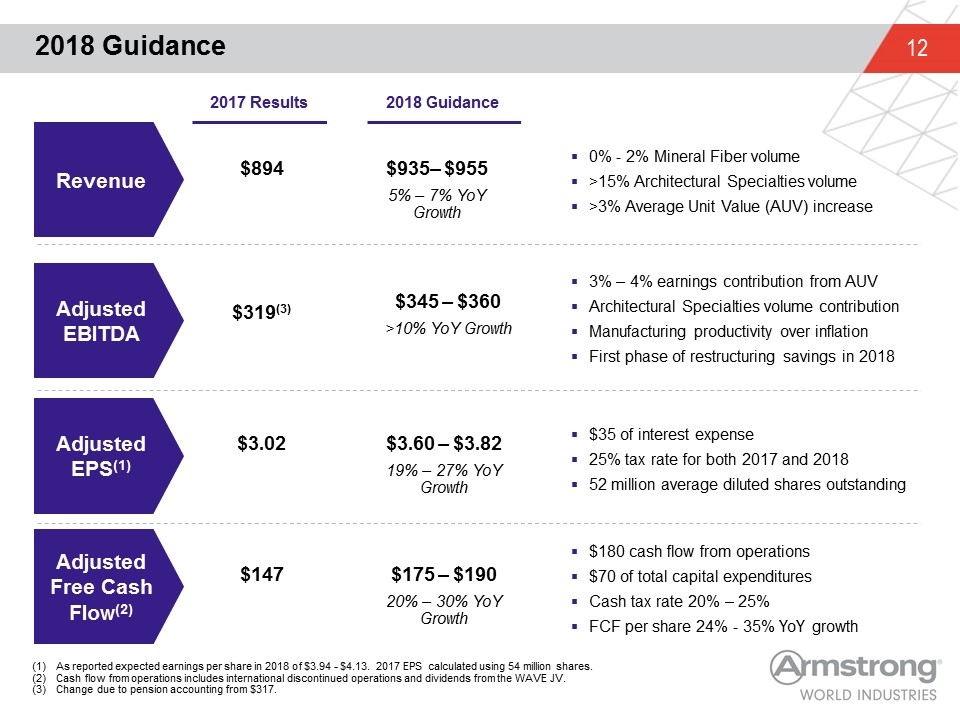

2018 Guidance $3.60 – $3.82 19% – 27% YoY Growth $3.02 Adjusted EBITDA Adjusted EPS(1) Adjusted Free Cash Flow(2) Revenue $894 $319(3) $935– $955 5% – 7% YoY Growth $345 – $360 >10% YoY Growth $175 – $190 20% – 30% YoY Growth $147 As reported expected earnings per share in 2018 of $3.94 - $4.13. 2017 EPS calculated using 54 million shares. Cash flow from operations includes international discontinued operations and dividends from the WAVE JV. Change due to pension accounting from $317. 0% - 2% Mineral Fiber volume >15% Architectural Specialties volume >3% Average Unit Value (AUV) increase 3% – 4% earnings contribution from AUV Architectural Specialties volume contribution Manufacturing productivity over inflation First phase of restructuring savings in 2018 $180 cash flow from operations $70 of total capital expenditures Cash tax rate 20% – 25% FCF per share 24% - 35% YoY growth 2017 Results 2018 Guidance $35 of interest expense 25% tax rate for both 2017 and 2018 52 million average diluted shares outstanding

Appendix

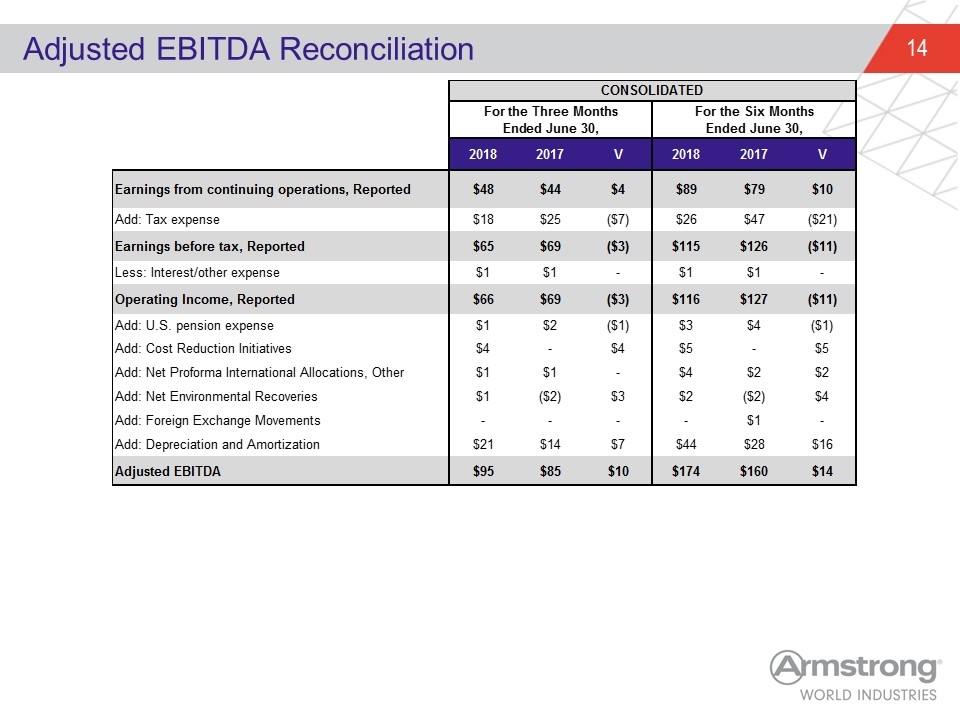

Adjusted EBITDA Reconciliation CONSOLIDATED For the Three MonthsEnded June 30, For the Six MonthsEnded June 30, qtr YTD 2018 2017 V 2018 2017 V Earnings from continuing operations, Reported 47.59999999999998 43.699999999999996 3.8999999999999844 88.799999999999983 79.2 9.5999999999999801 rounding Add: Tax expense 17.7 24.9 -7.1999999999999993 25.9 46.7 -20.800000000000004 Earnings before tax, Reported 65.299999999999983 68.599999999999994 -3.3000000000000114 114.69999999999999 125.9 -11.200000000000017 rounding Less: Interest/other expense 0.70000000000000107 0.59999999999999964 - 0.89999999999999858 0.60000000000000142 - Operating Income, Reported 66 69.199999999999989 -3.1999999999999886 115.6 126.5 -10.900000000000006 Add: U.S. pension expense 1.4346810000000001 2.085121 -0.65043999999999991 2.8690000000000002 4.17 -1.3009999999999997 Add: Cost Reduction Initiatives 4.4171620000000003 0 4.4171620000000003 5.0264439999999997 0 5.0264439999999997 Add: Net Proforma International Allocations, Other 1.0840000000000001 1.2 - 3.9333659999999999 2.4 1.533366 Add: Net Environmental Recoveries 1.08 -2.2164269999999999 3.296427 2.4350000000000001 -1.524 3.9590000000000001 Add: Foreign Exchange Movements - - - - 0.59399999999999997 0 Add: Depreciation and Amortization 21 14.141000000000005 6.8589999999999947 43.830292000000014 27.792000000000002 16.038292000000013 Adjusted EBITDA 95.1 84.741 10.358999999999995 173.69410200000002 159.93199999999999 14.356102000000007 rounding

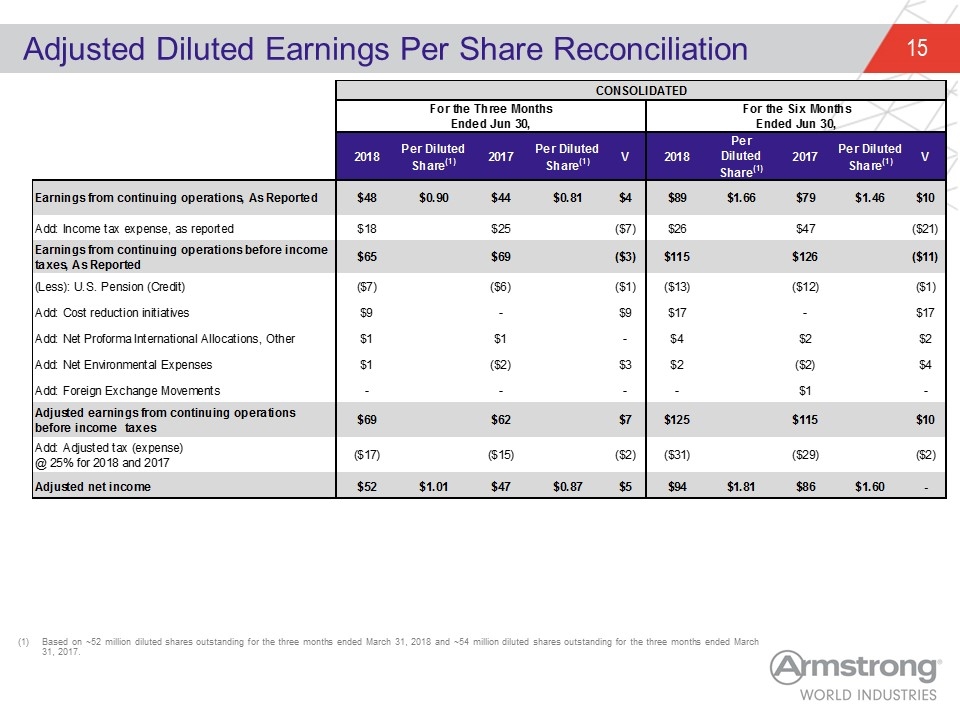

Adjusted Diluted Earnings Per Share Reconciliation Based on ~52 million diluted shares outstanding for the three months ended March 31, 2018 and ~54 million diluted shares outstanding for the three months ended March 31, 2017. CONSOLIDATED For the Three MonthsEnded Jun 30, For the Six MonthsEnded Jun 30, 2018 Per DilutedShare(1) 2017 Per DilutedShare(1) V 2018 Per DilutedShare(1) 2017 Per DilutedShare(1) V Qtr YTD Earnings from continuing operations, As Reported 47.59999999999998 $0.9 43.699999999999996 $0.81 3.8999999999999844 88.799999999999983 $1.66 79.2 $1.46 9.5999999999999801 rounding Add: Income tax expense, as reported 17.7 24.9 -7.1999999999999993 25.9 46.7 -20.800000000000004 Earnings from continuing operations before income taxes, As Reported 65.299999999999983 68.599999999999994 -3.3000000000000114 114.69999999999999 125.9 -11.200000000000017 rounding rounding (Less): U.S. Pension (Credit) -7 -6 -1 -13 -12 -1 Add: Cost reduction initiatives 8.7171620000000001 0 8.7171620000000001 17.026443999999998 0 17.026443999999998 Add: Net Proforma International Allocations, Other 1.0840000000000001 1.2 0 3.9333659999999999 2.4 1.533366 Add: Net Environmental Expenses 1.08 -2.2164269999999999 3.296427 2.4350000000000001 -1.524 3.9590000000000001 Add: Foreign Exchange Movements - - - - 0.59399999999999997 - Adjusted earnings from continuing operations before income taxes 69.281161999999981 61.880636999999993 7.4005249999999876 125.29481 115.37 9.9248099999999937 Add: Adjusted tax (expense) @ 25% for 2018 and 2017 -17 -15 -2 -31 -29 -2 Adjusted net income 52.281161999999981 $1.0054069615384611 46.880636999999993 $0.86815994444444433 5.4005249999999876 94.294809999999998 $1.81 86.37 $1.6 -

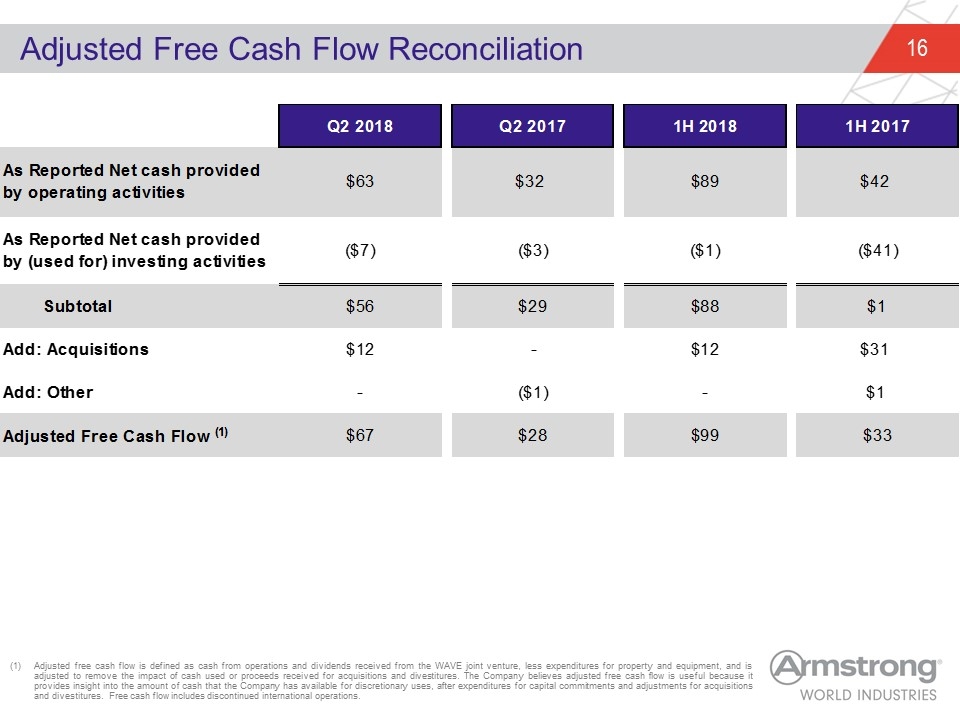

Adjusted Free Cash Flow Reconciliation Adjusted free cash flow is defined as cash from operations and dividends received from the WAVE joint venture, less expenditures for property and equipment, and is adjusted to remove the impact of cash used or proceeds received for acquisitions and divestitures. The Company believes adjusted free cash flow is useful because it provides insight into the amount of cash that the Company has available for discretionary uses, after expenditures for capital commitments and adjustments for acquisitions and divestitures. Free cash flow includes discontinued international operations. Q2 2018 Q2 2017 1H 2018 1H 2017 As Reported Net cash provided by operating activities $63 $32 $89 $42 As Reported Net cash provided by (used for) investing activities $-7 $-3 $-1 $-41 Subtotal $56 $29 $88 $1 Add: Acquisitions $12 - $11.6 $31.4 Add: Other - $-1 - $1 Adjusted Free Cash Flow (1) $67 $28 $99 $33

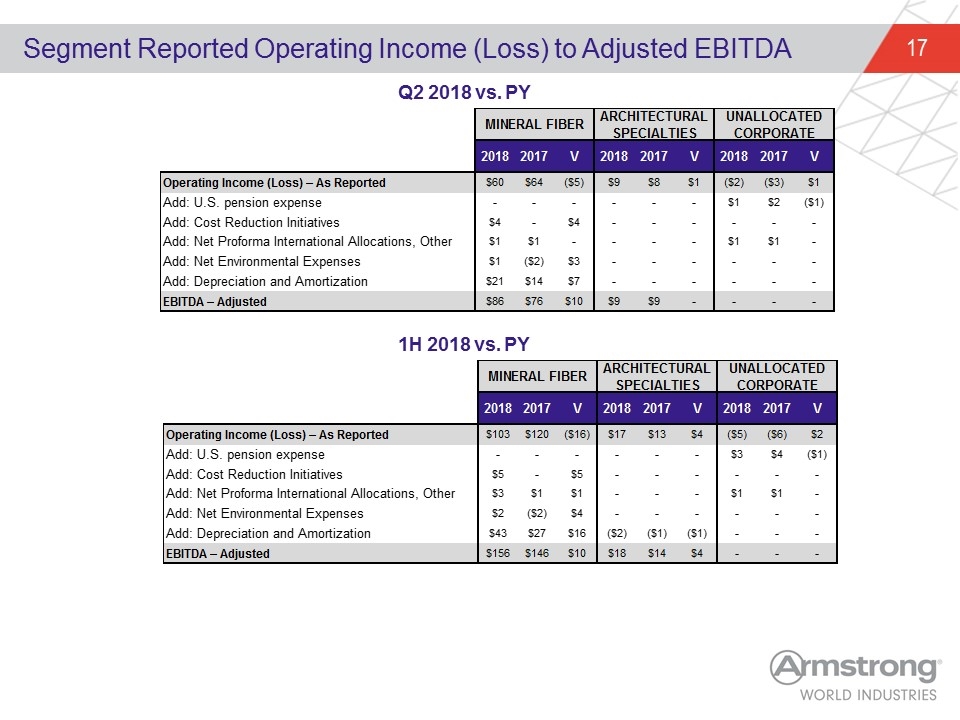

Segment Reported Operating Income (Loss) to Adjusted EBITDA Q2 2018 vs. PY 1H 2018 vs. PY MINERAL FIBER ARCHITECTURAL SPECIALTIES UNALLOCATED CORPORATE rounding factor 2016 V 2018 2017 V 2018 2017 V 2018 2017 V Operating Income (Loss) – As Reported 59.5 64.099999999999994 -4.5999999999999943 8.6 8.1 0.5 -2.4 -3 0.60000000000000009 Add: U.S. pension expense 0 0 0 0 0 0 1.4346810000000001 2.085121 -0.65043999999999991 Add: Cost Reduction Initiatives 4.4171620000000003 0 4.4171620000000003 - 0 - 0 0 0 Add: Net Proforma International Allocations, Other 0.5 0.52500000000000002 - 0 0 0 0.84891499999999986 0.67500000000000004 - check cell n12, was not working properly Add: Net Environmental Expenses 1.08 -2.2164269999999999 3.296427 0 0 0 0 0 0 Add: Depreciation and Amortization 20.612610000000004 13.555 7.0576100000000039 - - - - - - EBITDA – Adjusted 86.049610000000001 76.155000000000001 9.8946100000000001 9.0109999999999992 8.5640000000000001 0 0 0 0 MINERAL FIBER ARCHITECTURAL SPECIALTIES UNALLOCATED CORPORATE rounding factor 2016 V 2018 2017 V 2018 2017 V 2018 2017 V Operating Income (Loss) – As Reported 103.2 119.6 -16.399999999999991 16.899999999999999 12.9 3.9999999999999982 -4.5 -6 1.5 Add: U.S. pension expense 0 0 0 0 0 0 2.8690000000000002 4.17 -1.3009999999999997 Add: Cost Reduction Initiatives 4.9851929999999998 0 4.9851929999999998 - 0 - 0 0 0 Add: Net Proforma International Allocations, Other 2.5 1.05 1.45 0 0 0 1.4333659999999999 1.35 - check cell n12, was not working properly Add: Net Environmental Expenses 2.4350000000000001 -1.524 3.9590000000000001 0 0 0 0 0 0 Add: Depreciation and Amortization 42.919806999999992 26.734999999999999 16.184806999999992 -1.8999999999999986 -1 -0.89999999999999858 - - - EBITDA – Adjusted 156.04 146.261 9.7789999999999964 17.889408 13.766999999999999 4.1224080000000001 0 0 0

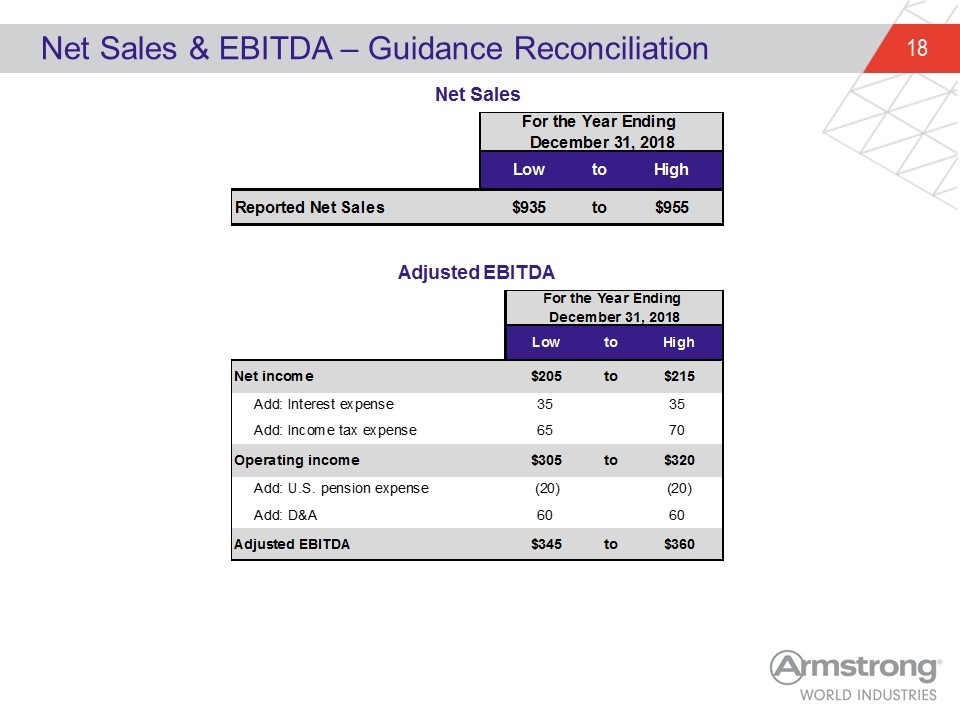

Net Sales & EBITDA – Guidance Reconciliation Net Sales Adjusted EBITDA For the Year Ending December 31, 2018 Low to High Reported Net Sales $935 to $955 For the Year Ending December 31, 2018 Low to High Net income $205 to $215 Add: Interest expense 35 35 Add: Income tax expense 65 70 Operating income $305 to $320 Add: U.S. pension expense -20 -20 Add: D&A 60 60 Adjusted EBITDA $345 to $360

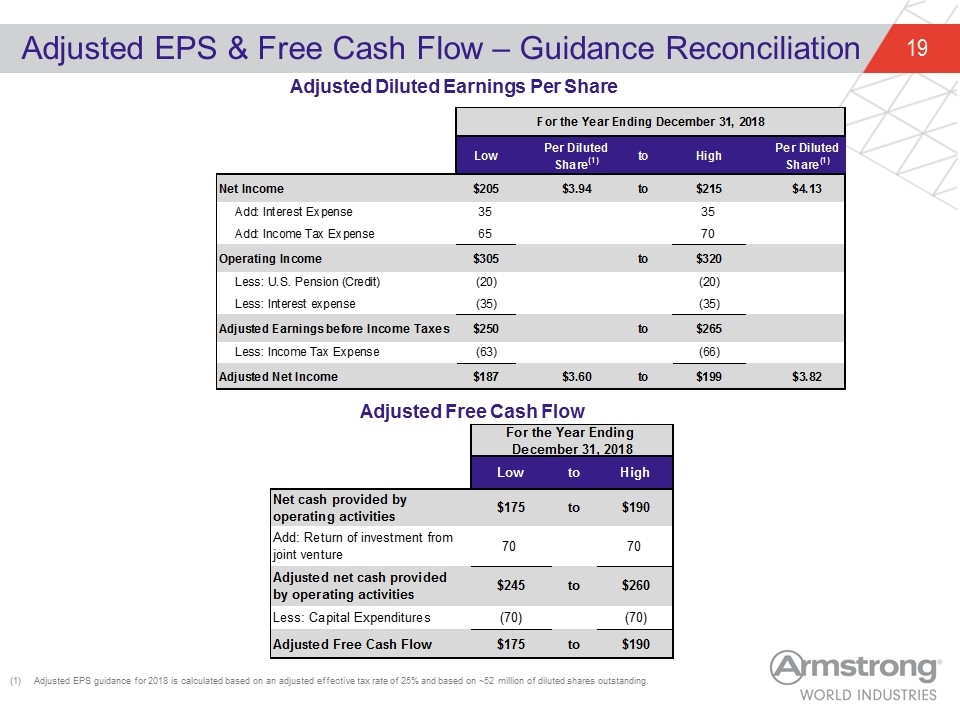

Adjusted EPS & Free Cash Flow – Guidance Reconciliation Adjusted Diluted Earnings Per Share Adjusted Free Cash Flow Adjusted EPS guidance for 2018 is calculated based on an adjusted effective tax rate of 25% and based on ~52 million of diluted shares outstanding. For the Year Ending December 31, 2018 Low to High Net cash provided by operating activities $175 to $190 Add: Return of investment from joint venture 70 70 Adjusted net cash provided by operating activities $245 to $260 Less: Capital Expenditures -70 -70 Adjusted Free Cash Flow $175 to $190 For the Year Ending December 31, 2018 Low Per DilutedShare(1) to High Per DilutedShare(1) Net Income $205 $3.94 to $215 $4.13 Add: Interest Expense 35 35 Add: Income Tax Expense 65 70 Operating Income $305 to $320 Less: U.S. Pension (Credit) -20 -20 Less: Interest expense -35 -35 Adjusted Earnings before Income Taxes $250 to $265 Less: Income Tax Expense -63 -66.25 Adjusted Net Income $187 $3.6 to $198.75 $3.82