Press Information

FOR IMMEDIATE RELEASE

NASDAQ SYMBOL MXIM

Contact: John F. Gifford, Chairman,

President and Chief Executive Officer

(408) 737-7600

MAXIM REPORTS RECORD REVENUES FOR ITS THIRD

QUARTER OF FISCAL 2006

SUNNYVALE, CA-April 26, 2006-Maxim Integrated Products, Inc., (MXIM) reported a record for net revenues of $478.1 million for its third quarter ending March 25, 2006, a 7.2% increase over the $445.9 million reported for the second quarter of fiscal 2006. Net income was $120.3 million including total stock based compensation or $0.36 diluted earnings per share. This compares to $112.6 million or $0.33 diluted earnings per share for the second quarter of fiscal 2006. Non-GAAP net income, which excludes the impact of total stock based compensation expense, for the third quarter was $148.6 million or $0.45 per diluted share compared to non-GAAP net income of $140.0 million or $0.42 per diluted share for the second quarter of fiscal 2006. The total amount of stock based compensation recorded during the third quarter was $42.1 million on a pre-tax basis as compared to $40.8 million for the second quarter of fiscal 2006.

Gross bookings for the third quarter were approximately $537 million, a 6% increase from the second quarter level of $506 million. Gross turns orders received in the third quarter were approximately $245 million, a 7% increase from

– more –

the $230 million received in the prior quarter. Bookings increased in the U.S. and Europe, decreased slightly in the Pac Rim and were unchanged in Japan. Third quarter ending backlog shippable within the next 12 months was approximately $401 million, including approximately $346 million requested for shipment in the fourth quarter of fiscal 2006. The Company's second quarter ending backlog shippable within the next 12 months was approximately $370 million, including approximately $329 million that was requested for shipment in the third quarter of fiscal 2006.

Gross margin was 67.2% for the third quarter. Non-GAAP gross margin percentage, which excludes $8.5 million of stock based compensation, was 69.0% for the third quarter.

Research and development expense, was $119.9 million or 25.1% of net revenue. Non-GAAP research and development expense, which excludes $26.1 million of stock based compensation, was $93.7 million or 19.6% of net revenue. Selling, general and administrative expense was $33.0 million or 6.9% of net revenue. Non-GAAP selling, general and administrative expense, which excludes $7.5 million of stock based compensation, was $25.5 million or 5.3% of net revenue. Total operating expenses for the third quarter were $152.9 million or 32.0% of net revenues, down 1.2 percentage points from the second quarter of fiscal 2006. Total non-GAAP operating expenses also decreased 1.2 percentage points from 26.1% of net revenues in the second quarter to 24.9% of net revenues in the third quarter of fiscal 2006.

During the quarter, the Company repurchased 2.2 million shares of its common stock for $87.8 million, paid dividends of $40.0 million, and acquired $63.9 million in capital equipment. Accounts receivable increased $38.9 million in the third quarter to $259.9 million due to the increase in net revenues. Inventories for the third quarter increased $6.8 million to $204.6 million and includes $11.4 million of stock based compensation.

– more –

In the third quarter, the Company completed a program which allowed its employees, excluding officers, holding vested stock options with an exercise price of at least $35 to exchange them for Restricted Stock Units (RSUs) at a specified exchange rate derived using the Black-Scholes model. These RSUs vest quarterly over the next 12 months subject to the employee's continued service to the Company. In some cases, employees elected to exchange their vested options for RSUs at a specified exchange rate that was greater than that derived using the Black-Scholes model. These RSUs will vest quarterly over the next 18 months subject to the employee's continued service to the Company. A total of approximately 11.8 million vested options were exchanged for approximately 2.4 million RSUs. Included in total stock based compensation for the third quarter is approximately $0.4 million related to this program. Maxim continues to believe that equity-based forms of compensation are most effective in motivating employees and aligning their goals with shareholders' interests.

In addition to the above exchange program, in April 2006 the Company granted 2.1 million RSUs, including 119,000 to officers. These RSUs were granted for retention purposes and will vest over a nine quarter period subject to continued service to the Company. The Company anticipates that this grant will increase total stock based compensation by approximately $8.3 million per quarter over the service period.

Mr. Gifford commented: "The Company's Board of Directors has declared a cash dividend for the fourth quarter of fiscal 2006 of $0.125 per share. Payment will be made on May 31, 2006 to stockholders of record on May 15, 2006."

To supplement its financial results prepared under GAAP, the Company uses certain non-GAAP measures, including non-GAAP net income, non-GAAP earnings per share, non-GAAP gross margin, non-GAAP research and development expense and non-GAAP selling, general and administrative expenses, to exclude all stock-based compensation expense. These non-GAAP measures should be considered in addition to, and

– more –

not as a substitute for, the results prepared in accordance with GAAP. Pursuant to the requirements of Regulation G, the Company has provided a reconciliation of these non-GAAP measures to the most directly comparable GAAP measures included in the financial statements portion of this release. Maxim's management believes the non-GAAP information is useful because it can enhance the understanding of the Company's ongoing financial performance. Maxim uses these non-GAAP measures internally to evaluate and manage the Company's operations and to make strategic decisions. Maxim has chosen to provide this information to investors to enable them to perform comparisons of operating results in a manner similar to how the Company analyzes its operating results.

The following table reconciles free cash flow to net income, and depicts the Company's free cash flow for the three and nine months ended March 25, 2006 and March 26, 2005.

– more –

RECONCILIATION OF FREE CASH FLOW TO NET INCOME

| (Amounts in millions, except per share data) | | Three months ended

| | Nine months ended

|

| | | Mar. 25, 2006

| | Mar. 26, 2005

| | Mar. 25, 2006

| | Mar. 26, 2005

|

| Net income as reported | | $ 120.3

| | $ 125.5

| | $ 338.2

| | $ 414.7

|

| Add adjustments to reconcile | | | | | | | | |

| net income to net cash | | | | | | | | |

| provided by operating activities: | | | | | | | | |

| Stock based compensation | | 42.1 | | - | | 124.4 | | - |

| Depreciation, amortization & other | | 21.5 | | 19.3 | | 62.9 | | 57.1 |

| Tax benefit related to stock plans | | 5.7 | | 29.4 | | 14.0 | | 87.3 |

| Accounts receivable | | (38.9) | | (12.7) | | (67.6) | | 4.8 |

| Inventories | | (6.7) | | (12.9) | | (25.4) | | (41.7) |

| Accounts payable | | 5.5 | | (11.6) | | 26.3 | | (43.7) |

| Income taxes payable | | (8.9) | | (7.2) | | 10.6 | | (3.2) |

| Other assets and liabilities | | 3.1

| | 40.4

| | (27.4)

| | 56.2

|

| Total of adjustments | | 23.4

| | 44.7

| | 117.8

| | 116.8

|

| Cash generated by operating | | | | | | | | |

| activities, as reported | | 143.7 | | 170.2 | | 456.0 | | 531.5 |

| Adjustments: | | | | | | | | |

| Capital expenditures | | (63.9) | | (13.8) | | (121.1) | | (111.6) |

| Additional tax benefit related to stock plans | | 8.7

| | -

| | 30.0

| | -

|

| Free Cash Flow | | $ 88.5

| | $ 156.4

| | $ 364.9

| | $ 419.9

|

| | | | | | | | | |

| Fully diluted shares, as reported | | 334 | | 343 | | 338 | | 344 |

| Free cash flow per fully diluted share | | $ 0.26

| | $ 0.46

| | $ 1.08

| | $ 1.22

|

| Fully diluted earnings per share, as reported | | $ 0.36

| | $ 0.37

| | $ 1.00

| | $ 1.21

|

| | | | | | | | | |

| Non-GAAP fully diluted shares | | 332 | | 343 | | 336 | | 344 |

| Free cash flow per non-GAAP diluted share | | $ 0.27

| | $ 0.46

| | $ 1.09

| | $ 1.22

|

| Non-GAAP fully diluted earnings per share | | $ 0.45

| | $ 0.37

| | $ 1.25

| | $ 1.21

|

Free cash flow is a non-GAAP measure that represents cash that the Company generates after certain adjustments. Free cash flow is used by management to make fundamental decisions with regard to the operation of the Company's business, including working capital requirements, share repurchases and dividend payments. In addition, free cash flow is used by management to evaluate and assess the Company's operating results and for budget and planning purposes. The Company believes that free cash flow is relevant and useful information that is widely used by analysts, investors, and other interested parties in the semiconductor industry to measure financial performance. Accordingly, the Company is disclosing this information to permit a comprehensive and objective analysis of the Company's operating performance, to provide an additional measure of performance and

– more –

liquidity, and to provide additional information with respect to the Company's ability to make future share repurchases and dividend payments and to meet future working capital requirements.

Free cash flow should not be construed as a substitute for net income or as a better measure of liquidity than cash flow from operating activities, both of which are determined in accordance with GAAP. Free cash flow excludes components that are significant in understanding and assessing the Company's results of operations and cash flows. In addition, some of the limitations associated with the use of free cash flow are that it is not a term defined by GAAP, and the Company's measure of free cash flow might not be comparable to similarly titled measures used by other companies. In addition, the Company's measure of free cash flow omits certain actual cash expenditures, such as dividends paid, cash used for share repurchases and cash generated from employee stock option exercises. Management compensates for these limitations by considering net income derived in accordance with GAAP.

****

Certain statements in this press release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risk and uncertainty. Actual results could differ materially from those forecasted based upon, among other things, general market conditions and market developments that could adversely affect the growth of the mixed-signal analog market, such as declines in customer forecasts or greater than expected cyclical downturns within the mixed-signal analog segment of the semiconductor market, as well as other risks described in the Company's Annual Report on Form 10-K for the fiscal year ended June 25, 2005.

All forward-looking statements included in this news release are made as of the date hereof, based on the information available to the Company as of the date hereof, and the Company assumes no obligation to update any forward-looking statement.

Maxim Integrated Products is a leading international supplier of quality analog and mixed-signal products for applications that require real world signal processing.

# # #

Consolidated Balance Sheets

| (In thousands) | 3/25/2006 | | 6/25/2005 |

| | | (unaudited)

| | (unaudited)

|

| Assets | | | |

| | Current assets: | | | |

| | Cash and cash equivalents | $ 243,310 | | $ 185,551 |

| | Short-term investments | 1,092,791

| | 1,289,141

|

| | Total cash, cash equivalents and short-term investments | 1,336,101

| | 1,474,692

|

| | Accounts receivable, net | 259,921 | | 192,345 |

| | Inventories | 204,598 | | 167,779 |

| | Deferred tax assets and other current assets | 140,623

| | 138,950

|

| | Total current assets | 1,941,243 | | 1,973,766 |

| | Property, plant and equipment, at cost, less accumulated depreciation | 1,060,854 | | 1,001,465 |

| | Other assets | 39,459

| | 28,840

|

| | Total assets | $ 3,041,556

| | $ 3,004,071

|

| Liabilities and Stockholders' Equity | | | |

| | Current liabilities: | | | |

| | Accounts payable | $ 82,516 | | $ 56,266 |

| | Accrued expenses | 174,518 | | 175,539 |

| | Deferred income on shipments to distributors | 22,433 | | 20,225 |

| | Income taxes payable | 43,820

| | 33,173

|

| | Total current liabilities | 323,287 | | 285,203 |

| | Deferred tax liabilities | 110,259

| | 134,686

|

| | Total liabilities | 433,546

| | 419,889

|

| | Stockholders' equity: | | | |

| | Common stock | 99,511 | | 134,998 |

| | Retained earnings | 2,517,406 | | 2,455,714 |

| | Accumulated other comprehensive loss | (8,907)

| | (6,530)

|

| | Total stockholders' equity | 2,608,010

| | 2,584,182

|

| | Total liabilities and stockholders' equity | $ 3,041,556

| | $ 3,004,071

|

Consolidated Statements of Income

| (In thousands except per share data) | Three Months Ended

| | Nine Months Ended

|

| | 3/25/2006 | 3/26/2005 | | 3/25/2006 | 3/26/2005 |

| | (unaudited)

| | (unaudited)

| | (unaudited)

| | (unaudited)

|

| Net revenues | $ 478,120 | | $ 400,188 | | $ 1,348,365 | | $ 1,271,316 |

| Cost of goods sold (1) | 156,901

| | 111,896

| | 431,453

| | 351,585

|

| Gross margin | 321,219 | | 288,292 | | 916,912 | | 919,731 |

| | 67.2%

| | 72.0%

| | 68.0%

| | 72.3%

|

| Operating expenses: | | | | | | | |

| Research and development (1) | 119,862 | | 83,141 | | 353,793 | | 243,273 |

| Selling, general and administrative (1) | 33,036

| | 24,713

| | 92,954

| | 75,099

|

| Operating income | 168,321 | | 180,438 | | 470,165 | | 601,359 |

| | 35.2% | | 45.1% | | 34.9% | | 47.3% |

| Interest income, net | 10,444

| | 7,492

| | 32,647

| | 19,446

|

| Income before provision for income taxes | 178,765 | | 187,930 | | 502,812 | | 620,805 |

| Provision for income taxes | 58,456

| | 62,393

| | 164,577

| | 206,108

|

| Net income | $ 120,309

| | $ 125,537

| | $ 338,235

| | $ 414,697

|

| Basic earnings per share | $ 0.38

| | $ 0.38

| | $ 1.04

| | $ 1.27

|

| Shares used in the calculation of basic earnings per share | 320,686

| | 326,945

| | 324,117

| | 325,758

|

| Diluted earnings per share | $ 0.36

| | $ 0.37

| | $ 1.00

| | $ 1.21

|

| Shares used in the calculation of diluted earnings per share | 334,036

| | 342,720

| | 338,385

| | 343,607

|

| Dividends declared per share | $ 0.125

| | $ 0.100

| | $ 0.350

| | $ 0.280

|

| | | | | | | | |

| (1) Includes stock-based compensation charges as follows: | | | | | | | |

| | | | | | | | |

| Cost of goods sold | $ 8,452 | | $ - | | $ 28,128 | | $ - |

| Research and development | 26,146 | | - | | 76,948 | | - |

| Selling, general and administrative | 7,504 | | - | | 19,279 | | - |

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

(amounts in thousands, except for per share amounts and percentages)

|

| | | | | | | | | | | |

| RECONCILIATION OF GROSS MARGIN TO NON-GAAP GROSS MARGIN |

| | | | | Three Months Ended

| | Nine Months Ended

|

| | | | | Mar. 25, 2006

| | Mar. 26, 2005

| | Mar. 25, 2006

| | Mar. 26, 2005

|

| Gross margin, as reported | | | | $ 321,219 | | $ 288,292 | | $ 916,912 | | $ 919,731 |

| Stock-based compensation | | | | 8,452

| | -

| | 28,128

| | -

|

| Non-GAAP gross margin | | | | $ 329,671

| | $ 288,292

| | $ 945,040

| | $ 919,731

|

| Non-GAAP gross margin percentage | | | | 69.0% | | 72.0% | | 70.1% | | 72.3% |

|

|

|

|

|

|

|

|

|

|

|

| RECONCILIATION OF RESEARCH AND DEVELOPMENT EXPENSES TO NON-GAAP RESEARCH AND DEVELOPMENT EXPENSES |

| | | | | Three Months Ended

| | Nine Months Ended

|

| | | | | Mar. 25, 2006

| | Mar. 26, 2005

| | Mar. 25, 2006

| | Mar. 26, 2005

|

| Research and development expenses, as reported | | | | $ 119,862 | | $ 83,141 | | $ 353,793 | | $ 243,273 |

| Stock-based compensation | | | | (26,146)

| | -

| | (76,948)

| | -

|

| Non-GAAP research and development expenses | | | | $ 93,716

| | $ 83,141

| | $ 276,845

| | $ 243,273

|

| Non-GAAP research and development expenses | | | | | | | |

| as a percentage of revenue | 19.6% | | 20.8% | | 20.5% | | 19.1% |

|

|

|

|

|

|

|

|

|

|

|

| RECONCILIATION OF SELLING, GENERAL AND ADMINISTRATIVE EXPENSES TO NON-GAAP SELLING, GENERAL AND ADMINISTRATIVE EXPENSES |

| | | | | Three Months Ended

| | Nine Months Ended

|

| | | | | Mar. 25, 2006

| | Mar. 26, 2005

| | Mar. 25, 2006

| | Mar. 26, 2005

|

| Selling, general and administrative expenses, as reported | | | | $ 33,036 | | $ 24,713 | | $ 92,954 | | $ 75,099 |

| Stock-based compensation | | | | (7,504)

| | -

| | (19,279)

| | -

|

| Non-GAAP selling, general and administrative expenses | | | | $ 25,532

| | $ 24,713

| | $ 73,675

| | $ 75,099

|

| Non-GAAP selling, general and administrative expenses | | | | | | | |

| as a percentage of revenue | 5.3% | | 6.2% | | 5.5% | | 5.9% |

|

|

|

|

|

|

|

|

|

|

|

| RECONCILIATION OF NET INCOME AND FULLY DILUTED EARNINGS PER SHARE TO NON-GAAP NET INCOME AND NON-GAAP FULLY DILUTED EARNINGS PER SHARE |

| | | | | | | Three Months Ended

| | |

| | | | | | | Mar. 25, 2006

| | Dec. 24, 2005

| | |

| Net income, as reported | | | | | | $ 120,309 | | $ 112,558 | | |

| Adjustments to reconcile net income to non-GAAP net income: | | | | | | | | | | |

| Stock based compensation | | | | | | 42,102 | | 40,794 | | |

| Tax effect | | | | | | (13,767)

| | (13,340)

| | |

| Non-GAAP net income | | | | | | $ 148,644

| | $ 140,012

| | |

| | | | | | | | | | | |

| Fully diluted earnings per share, as reported | | | | | | $ 0.36 | | $ 0.33 | | |

| Adjustment to reconcile fully diluted earnings per share | | | | | | | | | | |

| to non-GAAP fully diluted earnings per share | | | | | | | | | | |

| Impact of stock based compensation, net of tax effect | | | | | | 0.09 | | 0.08 | | |

| Impact of rounding | | | | | | -

| | 0.01

| | |

| Non-GAAP fully diluted earnings per share | | | | | | $ 0.45

| | $ 0.42

| | |

|

|

|

|

|

|

|

|

|

|

|

SFAS 123(R) requires the Company to estimate the cost of all forms of stock-based compensation, including employee stock options, restricted stock units and awards under our Employee Stock Participation (ESP Plan), and to record a commensurate expense (which is subjective in nature) in the income statement. The Company is showing non-GAAP gross margin, non-GAAP research and development expenses, non-GAAP selling, general and administrative expenses, non-GAAP net income, and non-GAAP fully diluted earnings per share all of which excludes all stock-based compensation expense, to permit additional analysis of the Company's performance. Management believes these non-GAAP measures are useful to investors because they enhance the understanding of the Company's historical financial performance and comparability between periods with other companies that have not adopted SFAS 123(R), which the Company believes is useful to investors. Many of the Company's investors have requested that the Company disclose this non-GAAP information because they believe it is useful in understanding the Company's performance as it excludes a non-cash charge that many investors feel may obscure the Company's true operating costs. Management uses these non-GAAP measures to manage and assess the profitability of its business and does not consider stock- based compensation expense, a non-cash charge, in the management of its business. Specifically, the Company does not consider stock-based compensation expense when developing and monitoring budgets and spending. The Company's measure of the above non-GAAP measures might not be the same as similarly titled measures used by other companies, and it should not be construed as a substitute for gross margin, research and development expenses, selling, general and administrative expenses, net income and fully diluted earnings per share. There are limitations associated with using non-GAAP measures, including that they exclude financial information that some may consider important in evaluating the Company's performance.

Maxim Integrated Products, Incorporated

Company Profile

| | | | | | | | |

| NASDAQ Symbol: MXI | | • | | Founded 1983 | | • | | Public since: February 29, 1988 |

OPERATIONS

| | |

Corporate Offices: | | 120 San Gabriel Drive, Sunnyvale, California 94086 |

U.S. Sales Offices: | | Sunnyvale and Costa Mesa, CA; Wheeling, IL; Roswell, GA; Chelmsford, MA; Austin and Dallas, TX; Beaverton, OR |

Foreign Offices: | | Munich, Germany; Tokyo, Japan; London, UK; Paris, France; Taipei, Taiwan; Seoul, South Korea; Singapore; Milan, Italy; Beijing, China; Stockholm, Sweden; Zurich, Switzerland; Viborg, Denmark; Helsinki, Finland |

PRODUCTS

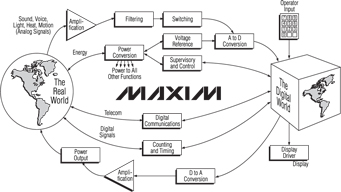

Maxim designs, develops, manufactures and markets a broad range of linear and mixed-signal integrated circuits for use in a variety of electronic products. Maxim circuits “connect” the real world and the digital world by detecting, measuring, amplifying, and converting real world and communication signals, such as temperature, pressure, sound, voice, or light into the digital signals necessary for computer and DSP processing.

| | • | | Maxim serves approximately 35,000 customers worldwide. |

| | • | | Maxim believes it has developed more products than any other analog company in the past 22 years. |

| | • | | Maxim is recognized as the leader in CMOS analog and bipolar high-frequency technologies. |

| | • | | 79% international sales for Q3 FY06. |

FINANCIAL HIGHLIGHTS (In thousands, except EPS)

| | | | | | | | | | | | | | | | | | | | |

| | | FY2002

| | | FY2003

| | | FY2004

| | | FY2005

| | | Q3 FY2006

| |

Net Revenues | | $ | 1,025,104 | | | $ | 1,153,219 | | | $ | 1,439,263 | | | $ | 1,671,713 | | | $ | 478,120 | |

Net Income | | $ | 259,183 | | | $ | 309,601 | | | $ | 419,752 | | | $ | 540,837 | | | $ | 120,309 | |

Shares | | | 355,821 | | | | 341,253 | | | | 350,575 | | | | 342,843 | | | | 334,036 | |

Diluted EPS | | $ | 0.73 | | | $ | 0.91 | | | $ | 1.20 | | | $ | 1.58 | | | $ | 0.36 | |

Cash and Short-Term Investments | | $ | 765,501 | | | $ | 1,164,007 | | | $ | 1,096,613 | | | $ | 1,474,692 | | | $ | 1,336,101 | |

Total Assets | | $ | 2,010,812 | | | $ | 2,367,962 | | | $ | 2,549,462 | | | $ | 3,004,071 | | | $ | 3,041,556 | |

Stockholders’ Equity | | $ | 1,741,151 | | | $ | 2,070,412 | | | $ | 2,112,318 | | | $ | 2,584,182 | | | $ | 2,608,010 | |

ROE | | | 13.5 | % | | | 16.2 | % | | | 20.1 | % | | | 23.0 | % | | | 18.8 | % |

Market Cap | | $ | 13,391,992 | | | $ | 11,870,840 | | | $ | 18,240,400 | | | $ | 13,319,468 | | | $ | 12,148,878 | |

RESEARCH COVERAGE

Amtech Research, Doug Freedman (415) 490-3921 | Morgan Stanley, Louis Gerhardy (415) 576-2391 |

Banc of America, Sumit Dhanda (415) 913-5481 | Morningstar, Brian Lee (312) 696-6221 |

C.E. Unterberg, Towbin, Ramesh Misra (415) 659-2289 | Pacific Crest Securities, Michael McConnell (503) 790-7788 |

CIBC, Richard Schafer (720) 554-1119 | Pacific Growth Equities, Jim Liang (415) 274-6889 |

Credit Suisse First Boston, Michael Masdea (415) 836-7779 | Prudential Securities, Mark Lipakis (415) 395-2063 |

Deutsche Bank, Ross Seymore (415) 617-3268 | Raymond James, Steve Smigle (727) 567-2557 |

FBR, Christopher Caso (212) 381-9217 | RBC Capital, Apjit Walia (212) 428-6406 |

Global Crown Capital, David Wu (415) 402-0518 | Sanford C. Bernstein, Adam Parker (212) 756-4658 |

Goldman Sachs, Simona Jankowski (415) 249-7437 | Smith Barney, Craig Ellis (415) 951-1887 |

Investec, Bobby Burleson, (212) 898-7716 | Thomas Weisel, Eric Gromberg (212) 271-3765 |

Jeffries & Co., John Lau, (212) 284-2127 | U.S. Bancorp Piper Jaffray, Tore Svanberg (650) 838-1411 |

JP Morgan, William Lewis (415) 315-6780 | UBS, Tom Thornhill (415) 352-5667 |

Lehman Brothers, Romit Shah (212) 526-786 | Wachovia Securities, Craig Hettenbach (212) 451-2663 |

Merrill Lynch, Joseph Osha (415) 676-3510 | William Blair & Company LLC, Jeff Rosenberg (312) 364-8342 |

| | |

| | |