Exhibit 99.1

Press Information |

|

FOR IMMEDIATE RELEASE |

NASDAQ SYMBOL MXIM |

Contact: | John F. Gifford, Chairman, |

| President and Chief Executive Officer |

| (408) 737-7600 |

MAXIM REPORTS 50% EPS INCREASE

YEAR-OVER-YEAR FOR THE

SECOND QUARTER OF FISCAL YEAR 2005

AND DECLARES QUARTERLY DIVIDEND

SUNNYVALE, CA–February 1, 2005–Maxim Integrated Products, Inc., (MXIM) reported net revenues of $436.1 million for its fiscal second quarter ending December 25, 2004, a 29.0% increase over the $338.1 million reported for the second quarter of fiscal year 2004. Diluted earnings per share were $0.42 for the second quarter, a 50.0% increase over the $0.28 reported for the same period a year ago. Net income for the second quarter was $144.6 million, a 46.8% increase over the $98.5 million reported for the second quarter of last year. Net revenues, net income, and diluted earnings per share for the second quarter were similar to those reported for the first quarter of fiscal year 2005. The Company’s free cash flow was $122 million, or $0.36 per diluted share, for the second quarter, compared to $102 million, or $0.29 per diluted share, for the second quarter of fiscal year 2004. Free cash flow is defined as cash from operating activities less additions to property, plant and equipment as reported in the Company’s statements of cash flows.

– more –

During the quarter, cash and short-term investments increased $101.1 million after the Company repurchased 317,816 shares of its common stock for $13.8 million, paid dividends of $32.6 million, and acquired $31.4 million in capital equipment. Accounts receivable decreased $20.8 million to $179.7 million, accounts payable decreased $28.3 million to $61.7 million, and inventories increased $10.8 million to $146.6 million in the second quarter.

Gross margin for the second quarter was 72.6%, an increase over the 72.4% reported for the first quarter of fiscal year 2005. The gross margin increase was the result of continued improvement in manufacturing efficiencies. Research and development expense was $81.0 million or 18.6% of net revenues in the second quarter, compared to $79.1 million or 18.2% of net revenues in the first quarter of fiscal year 2005. Selling, general and administrative expenses increased slightly from $25.1 million in the first quarter to $25.3 million in the second quarter and were 5.8% of net revenues for both quarters. Below-the-line spending for the second quarter was 24.4% of net revenues.

Second quarter bookings were approximately $353 million, a 6% decrease from the first quarter’s level of $377 million. Turns orders received in the quarter were approximately $122 million or 35% of net bookings, a 4% increase over the $117 million or 31% of net bookings received in the prior quarter (turns orders are customer orders that are for delivery within the same quarter and may result in revenue within the same quarter if the Company has available inventory that matches those orders). Bookings decreased in all geographic locations except Europe, where bookings improved modestly. Second quarter ending backlog shippable within the next 12 months was approximately $370 million, including approximately $300 million requested for shipment in the third quarter of fiscal year 2005. The Company’s first quarter ending backlog shippable within the next 12 months was approximately $458 million, including approximately $377 million that was requested for shipment in the second quarter of fiscal year 2005.

– more –

The following reconciles free cash flow to net income, and it depicts the Company’s free cash flow for the three and six months ended December 25, 2004 and December 27, 2003, respectively.

RECONCILIATION OF FREE CASH FLOW TO NET INCOME

(in millions, except per share data) | | For the three

months ended

12/25/04 | | For the three

months ended

12/27/03 | | For the six

months ended

12/25/04 | | For the six

months ended

12/27/03 | |

| |

| |

| |

| |

| |

Net income, as reported | | $ | 145 | | $ | 99 | | $ | 289 | | $ | 186 | |

Add adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | | |

Depreciation, amortization, and other | | | 19 | | | 14 | | | 38 | | | 29 | |

Tax benefit related to stock plans | | | 34 | | | 42 | | | 58 | | | 76 | |

Accounts receivable | | | 21 | | | (2 | ) | | 17 | | | (7 | ) |

Accounts payable | | | (28 | ) | | 8 | | | (32 | ) | | 15 | |

Inventories | | | (11 | ) | | 7 | | | (29 | ) | | 13 | |

Income taxes payable | | | (21 | ) | | (3 | ) | | 4 | | | (4 | ) |

Other assets and liabilities | | | (6 | ) | | 7 | | | 16 | | | 20 | |

| |

|

| |

|

| |

|

| |

|

| |

Total of adjustments | | | 8 | | | 73 | | | 72 | | | 142 | |

| |

|

| |

|

| |

|

| |

|

| |

Cash generated by operating activities, as reported | | | 153 | | | 172 | | | 361 | | | 328 | |

Deduct: | | | | | | | | | | | | | |

Capital expenditures | | | (31 | ) | | (70 | ) | | (98 | ) | | (93 | ) |

| |

|

| |

|

| |

|

| |

|

| |

Free cash flow | | $ | 122 | | $ | 102 | | $ | 263 | | $ | 235 | |

Fully diluted shares, as reported | | | 343 | | | 354 | | | 344 | | | 351 | |

| |

|

| |

|

| |

|

| |

|

| |

Free cash flow per fully diluted share | | $ | 0.36 | | $ | 0.29 | | $ | 0.76 | | $ | 0.67 | |

| |

|

| |

|

| |

|

| |

|

| |

Fully diluted earnings per share, as reported | | $ | 0.42 | | $ | 0.28 | | $ | 0.84 | | $ | 0.53 | |

| |

|

| |

|

| |

|

| |

|

| |

Free cash flow should not be construed as a substitute for net income or as a better measure of liquidity than cash flow from operating activities, both of which are determined in accordance with GAAP. Free cash flow excludes components that are significant in understanding and assessing the Company’s results of operations and cash flows. In addition, free cash flow is not a term defined by GAAP and as a result the Company’s measure of free cash flow might not be comparable to similarly titled measures used by other companies.

Free cash flow is used by management to evaluate, assess, and benchmark the Company’s operating results, and the Company believes that free cash flow is relevant and useful information that is often widely used by analysts, investors, and other interested parties in the semiconductor industry. Accordingly, the Company is disclosing this information to permit a more comprehensive and objective analysis of the Company’s operating performance, to provide an additional measure of performance and liquidity, and to provide additional information with respect to the Company’s ability to meet future share repurchases, dividend payments, and working capital requirements.

– more –

Jack Gifford, Chairman, President, and Chief Executive Officer, commented: “As expected, second quarter bookings were below our estimate of consumption of our products as a result of IC inventories accumulated over the past three quarters. We believe that this inventory should be consumed in the next one or two quarters. While some customers have moderated their forecasts for the first half of calendar year 2005, they continue to project growth for the calendar year. We believe that some of our fourth quarter fiscal year 2004 growth was the result of inventory accumulation at our customers. We expect solid income growth in fiscal year 2005 but below fiscal year 2004’s growth rate of over 35%.”

Mr. Gifford continued: “Maxim’s proprietary products continue to be well accepted in the marketplace, and we are encouraged by the rate of design-in activities in both existing and emerging markets.”

Mr. Gifford concluded: “The Company’s Board of Directors has declared a quarterly cash dividend of $0.10 per share. Payment will be made on March 1, 2005 to stockholders of record on February 14, 2005.”

****

Certain statements in this press release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risk and uncertainty. They include statements regarding the Company’s profitability and business outlook, the Company’s belief that customers will consume their inventories of the Company’s products in the next one or two quarters, the Company’s belief that customers are projecting growth for the calendar year, the Company’s belief that it will have solid income growth in fiscal year 2005 over the income reported for fiscal year 2004, and the Company’s belief that the Company’s proprietary products will continue to be well accepted in the marketplace. Actual results could differ materially from those forecasted based upon, among other things, general market conditions and market developments that could adversely affect the growth of the mixed-signal analog

– more –

market, including, without limitation, declines in customer forecasts or greater than expected cyclical downturns within the mixed-signal analog segment of the semiconductor market; the inability of the Company’s customers to consume their inventory of Maxim products in the next one or two quarters; an unexpected decrease in revenue or increase in expenses; and the Company’s success in the markets its products are introduced in and the Company’s ability to effectively and successfully manage manufacturing operations, as well as other risks described in the Company’s Annual Report on Form 10K filed with the SEC for the fiscal year ended June 26, 2004.

All forward-looking statements included in this news release are made as of the date hereof, based on the information available to the Company as of the date hereof, and the Company assumes no obligation to update any forward-looking statement.

Maxim Integrated Products is a leading international supplier of quality analog and mixed-signal products for applications that require real world signal processing.

# # #

Consolidated Balance Sheets

(In thousands) | | 12/25/04 | | 6/26/04 | |

| |

|

| |

|

| |

| | (unaudited) | | (audited) | |

Assets | | | | | | | |

Current assets: | | | | | | | |

Cash and cash equivalents | | $ | 164,414 | | $ | 147,734 | |

Short-term investments | | | 1,122,270 | | | 948,879 | |

| |

|

| |

|

| |

Total cash, cash equivalents and short-term investments | | | 1,286,684 | | | 1,096,613 | |

| |

|

| |

|

| |

Accounts receivable, net | | | 179,682 | | | 197,158 | |

Inventories | | | 146,582 | | | 117,785 | |

Deferred tax assets and other current assets | | | 164,247 | | | 166,558 | |

| |

|

| |

|

| |

Total current assets | | | 1,777,195 | | | 1,578,114 | |

| |

|

| |

|

| |

Property, plant and equipment, at cost, less accumulated depreciation | | | 1,003,965 | | | 942,186 | |

Other assets | | | 27,694 | | | 29,162 | |

| |

|

| |

|

| |

Total assets | | $ | 2,808,854 | | $ | 2,549,462 | |

| |

|

| |

|

| |

Liabilities and Stockholders’ Equity | | | | | | | |

Current liabilities: | | | | | | | |

Accounts payable | | $ | 61,740 | | $ | 93,856 | |

Accrued expenses | | | 191,122 | | | 182,692 | |

Deferred income on shipments to distributors | | | 21,351 | | | 22,858 | |

Income taxes payable | | | 23,384 | | | 19,339 | |

| |

|

| |

|

| |

Total current liabilities | | | 297,597 | | | 318,745 | |

| |

|

| |

|

| |

Deferred tax liabilities | | | 122,569 | | | 114,399 | |

Other liabilities | | | 4,000 | | | 4,000 | |

| |

|

| |

|

| |

Total liabilities | | | 424,166 | | | 437,144 | |

| |

|

| |

|

| |

Stockholders’ equity: | | | | | | | |

Common stock | | | 121,011 | | | 80,462 | |

Retained earnings | | | 2,269,462 | | | 2,038,820 | |

Accumulated other comprehensive loss | | | (5,785 | ) | | (6,964 | ) |

| |

|

| |

|

| |

Total stockholders’ equity | | | 2,384,688 | | | 2,112,318 | |

| |

|

| |

|

| |

Total liabilities and stockholders’ equity | | $ | 2,808,854 | | $ | 2,549,462 | |

| |

|

| |

|

| |

Consolidated Statements of Income

| | Three Months Ending | | Six Months Ending | |

| |

| |

| |

(In thousands except per share data) | | 12/25/04 | | 12/27/03 | | 12/25/04 | | 12/27/03 | |

| |

|

| |

|

| |

|

| |

|

| |

| | | (unaudited) | | | (unaudited) | | | (unaudited) | | | (unaudited) | |

Net revenues | | $ | 436,061 | | $ | 338,108 | | $ | 871,128 | | $ | 648,277 | |

Cost of goods sold | | | 119,437 | | | 103,029 | | | 239,689 | | | 196,057 | |

| |

|

| |

|

| |

|

| |

|

| |

Gross margin | | | 316,624 | | | 235,079 | | | 631,439 | | | 452,220 | |

| | | 72.6 | % | | 69.5 | % | | 72.5 | % | | 69.8 | % |

| |

|

| |

|

| |

|

| |

|

| |

Operating expenses: | | | | | | | | | | | | | |

Research and development | | | 81,035 | | | 71,211 | | | 160,132 | | | 141,307 | |

Selling, general and administrative | | | 25,324 | | | 22,193 | | | 50,386 | | | 43,582 | |

| |

|

| |

|

| |

|

| |

|

| |

Operating income | | | 210,265 | | | 141,675 | | | 420,921 | | | 267,331 | |

| | | 48.2 | % | | 41.9 | % | | 48.3 | % | | 41.2 | % |

Interest income, net | | | 6,225 | | | 5,369 | | | 11,954 | | | 10,120 | |

| |

|

| |

|

| |

|

| |

|

| |

Income before provision for income taxes | | | 216,490 | | | 147,044 | | | 432,875 | | | 277,451 | |

Provision for income taxes | | | 71,875 | | | 48,525 | | | 143,715 | | | 91,559 | |

| |

|

| |

|

| |

|

| |

|

| |

Net income | | $ | 144,615 | | $ | 98,519 | | $ | 289,160 | | $ | 185,892 | |

| |

|

| |

|

| |

|

| |

|

| |

Basic earnings per share | | $ | 0.44 | | $ | 0.30 | | $ | 0.89 | | $ | 0.57 | |

| |

|

| |

|

| |

|

| |

|

| |

Shares used in the calculation of basic earnings per share | | | 325,660 | | | 329,188 | | | 325,164 | | | 327,718 | |

| |

|

| |

|

| |

|

| |

|

| |

Diluted earnings per share | | $ | 0.42 | | $ | 0.28 | | $ | 0.84 | | $ | 0.53 | |

| |

|

| |

|

| |

|

| |

|

| |

Shares used in the calculation of diluted earnings per share | | | 343,226 | | | 353,888 | | | 344,051 | | | 350,611 | |

| |

|

| |

|

| |

|

| |

|

| |

Dividends declared per share | | $ | 0.10 | | $ | 0.08 | | $ | 0.18 | | $ | 0.16 | |

| |

|

| |

|

| |

|

| |

|

| |

Maxim Integrated Products, Incorporated

Company Profile

NASDAQ Symbol: MXIM | • | Founded 1983 | • | Public since: February 29, 1988 |

OPERATIONS | |

Corporate Offices: | 120 San Gabriel Drive, Sunnyvale, California 94086 |

U.S. Sales Offices: | Sunnyvale and Costa Mesa, CA; Wheeling, IL; Roswell, GA; Chelmsford, MA; Austin and Dallas, TX; |

| Beaverton, OR; Horsham, PA |

Foreign Offices: | Munich, Germany; Tokyo, Japan; London, UK; Paris, France; Taipei, Taiwan; Seoul, South Korea; |

| Hong Kong; Singapore; Milan, Italy; Beijing, China; Stockholm, Sweden; Zurich, Switzerland; |

| Viborg, Denmark; Helsinki, Finland |

PRODUCTS

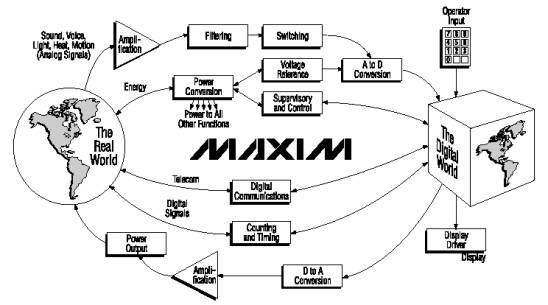

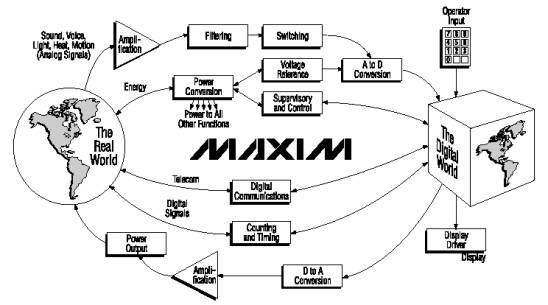

Maxim designs, develops, manufactures and markets a broad range of linear and mixed-signal integrated circuits for use in a variety of electronic products. Maxim circuits “connect” the real world and the digital world by detecting, measuring, amplifying, and converting real world and communication signals, such as temperature, pressure, sound, voice, or light into the digital signals necessary for computer and DSP processing.

| • | Maxim serves

approximately 35,000

customers worldwide. |

| |

• | Maxim has developed

more products than any

other analog company

in the past 21 years. |

| |

• | Maxim is recognized

as the leader in CMOS

analog and bipolar

high-frequency

technologies. |

| |

• | 73% international

sales for Q2 FY05. |

|

|

| |

| |

| |

| |

|

|

|

|

| |

FINANCIAL HIGHLIGHTS (In thousands, except EPS)

| | FY2001 | | FY2002 | | FY2003 | | FY2004 | | Q2 FY2005 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net Revenues | | $ | 1,576,613 | | $ | 1,025,104 | | $ | 1,153,219 | | $ | 1,439,263 | | $ | 436,061 | |

Net Income | | $ | 334,939 | | $ | 259,183 | | $ | 309,601 | | $ | 419,752 | | $ | 144,615 | |

Shares | | | 361,620 | | | 355,821 | | | 341,253 | | | 350,575 | | | 343,226 | |

Diluted EPS | | $ | 0.93 | | $ | 0.73 | | $ | 0.91 | | $ | 1.20 | | $ | 0.42 | |

Cash and Short-Term Investments | | $ | 1,220,352 | | $ | 765,501 | | $ | 1,164,007 | | $ | 1,096,613 | | $ | 1,286,684 | |

Total Assets | | $ | 2,430,531 | | $ | 2,010,812 | | $ | 2,367,962 | | $ | 2,549,462 | | $ | 2,808,854 | |

Stockholders’ Equity | | $ | 2,101,154 | | $ | 1,741,151 | | $ | 2,070,412 | | $ | 2,112,318 | | $ | 2,384,688 | |

ROE | | | 17.5 | % | | 13.5 | % | | 16.2 | % | | 20.1 | % | | 25.1 | % |

Market Cap | | $ | 14,535,766 | | $ | 13,391,992 | | $ | 11,870,840 | | $ | 18,240,400 | | $ | 14,175,243 | |

RESEARCH COVERAGE | |

| |

A.G. Edwards, Brett Miller (314) 955-2620 | Merrill Lynch, Joseph Osha (415) 676-3510 |

Amtech Research, Doug Freedman (415) 490-3921 | Morgan Stanley, Louis Gerhardy (415) 576-2391 |

CIBC, Richard Schafer (720) 554-1119 | Pacific Crest Securities, Michael McConnell (503) 790-7788 |

Credit Suisse First Boston, Michael Masdea (415) 836-7779 | Pacific Growth Equities, Jim Liang (415) 274-6889 |

Deutsche Bank, Ross Seymore (415) 617-3268 | RBC Capital, Apjit Walia (212) 428-6406 |

Global Crown Capital, David Wu (415) 402-0518 | SG Cowen, Jack Romaine (212) 278-4230 |

Goldman Sachs, Andrew Root (212) 902-2550 | Sanford C. Bernstein, Adam Parker (212) 756-4658 |

Investec, Bobby Burleson, (212) 898-7716 | Smith Barney, Craig Ellis (415) 951-1887 |

JMP Securities, Krishna Shankar (415) 835-8971 | U.S. Bancorp Piper Jaffray, Tore Svanberg (650) 838-1411 |

JP Morgan, William Lewis (415) 315-6780 | UBS, Tom Thornhill (415) 352-5667 |

Lehman Brothers, Romit Shah (212) 526-7865 | William Blair & Company LLC, Jeff Rosenberg (312) 364-8342 |