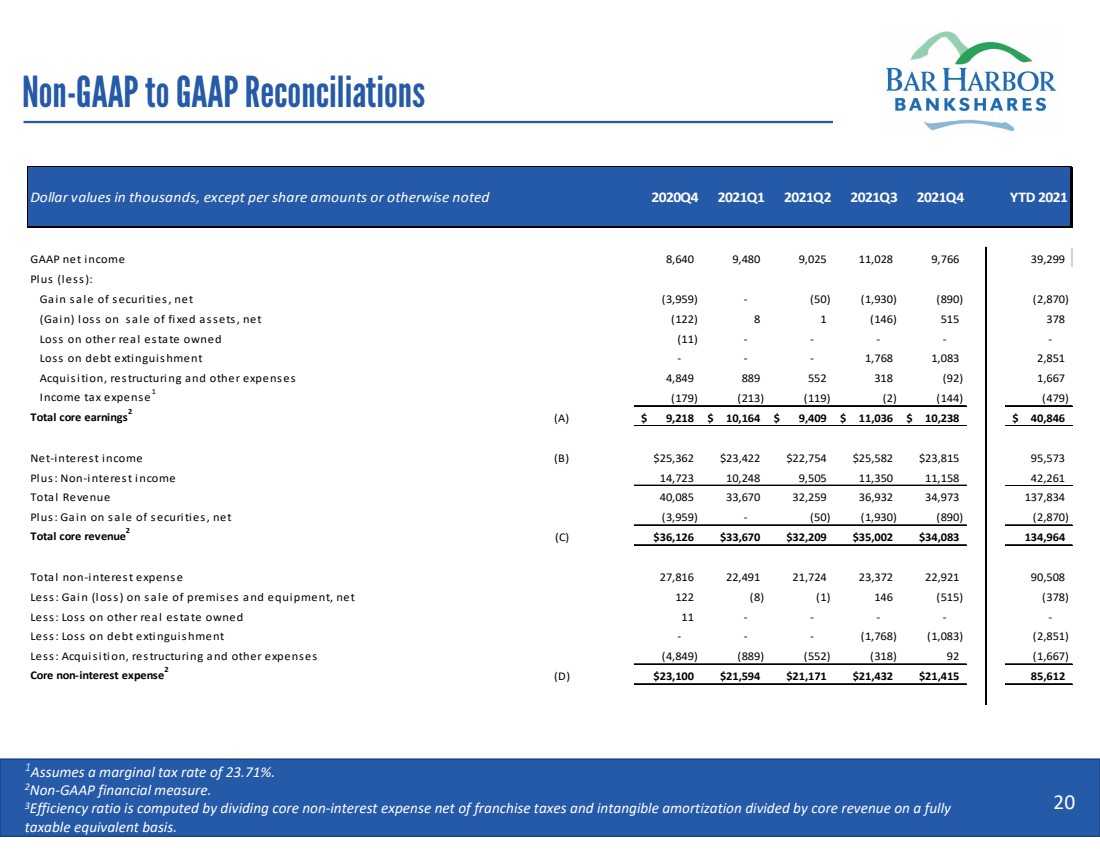

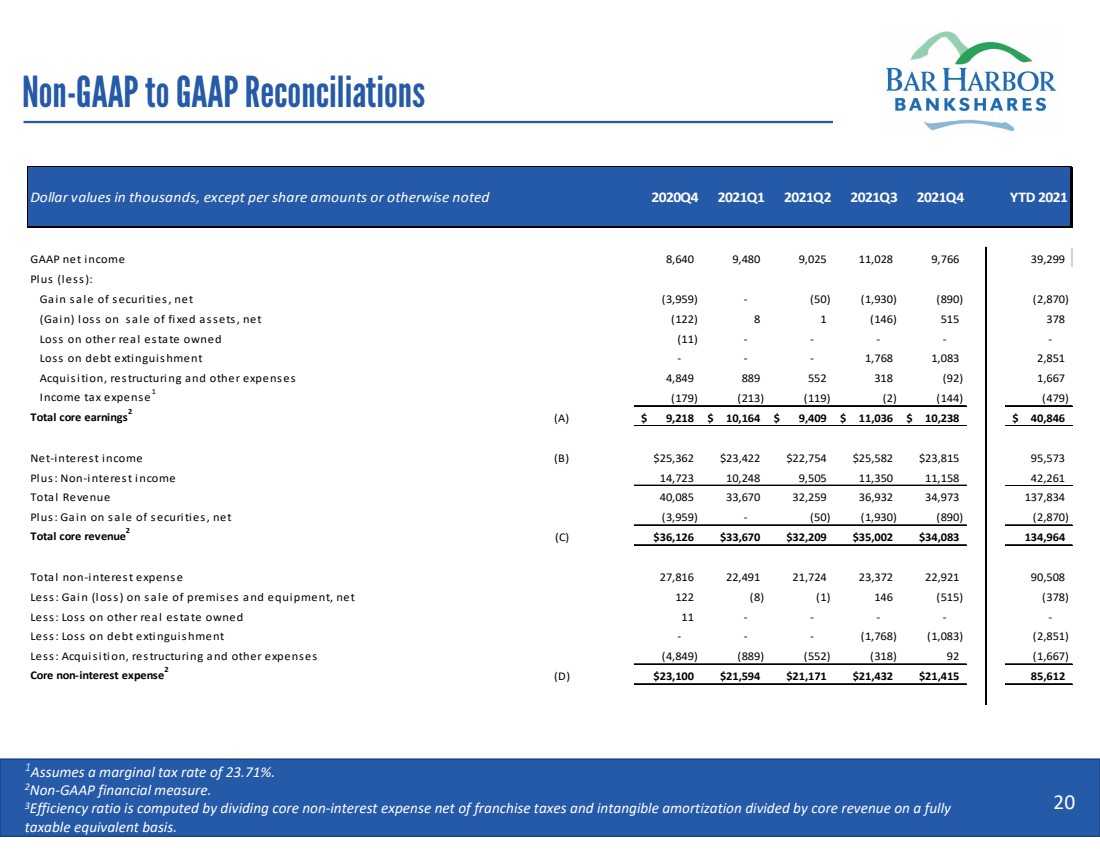

| Non-GAAP to GAAP Reconciliations201Assumes a marginal tax rate of 23.71%.2Non-GAAP financial measure.3Efficiency ratio is computed by dividing core non-interest expense net of franchise taxes and intangible amortization divided bycore revenue on a fully taxable equivalent basis. GAAP net income8,640 9,480 9,025 11,028 9,766 39,299 Plus (less):Gain sale of securities, net(3,959) - (50) (1,930) (890) (2,870) (Gain) loss on sale of fixed assets, net(122) 8 1 (146) 515 378 Loss on other real estate owned(11) - - - - - Loss on debt extinguishment- - - 1,768 1,083 2,851 Acquisition, restructuring and other expenses4,849 889 552 318 (92) 1,667 Income tax expense1(179) (213) (119) (2) (144) (479) Total core earnings2 (A)9,218$ 10,164$ 9,409$ 11,036$ 10,238$ 40,846$ Net-interest income(B)$25,362$23,422$22,754$25,582$23,81595,573 Plus: Non-interest income 14,723 10,248 9,505 11,350 11,158 42,261 Total Revenue 40,085 33,670 32,259 36,932 34,973 137,834 Plus: Gain on sale of securities, net (3,959) - (50) (1,930) (890) (2,870) Total core revenue2 (C)$36,126$33,670$32,209$35,002$34,083134,964 Total non-interest expense 27,816 22,491 21,724 23,372 22,921 90,508 Less: Gain (loss) on sale of premises and equipment, net122 (8) (1) 146 (515) (378) Less: Loss on other real estate owned11 - - - - - Less: Loss on debt extinguishment- - - (1,768) (1,083) (2,851) Less: Acquisition, restructuring and other expenses (4,849) (889) (552) (318) 92 (1,667) Core non-interest expense2 (D)$23,100$21,594$21,171$21,432$21,41585,612 YTD 2021Dollar values in thousands, except per share amounts or otherwise noted2020Q42021Q12021Q22021Q32021Q4 |