QUARTERLY PERFORMANCE SUMMARY

Earnings (third quarter of 2022 compared to the same quarter of 2021)

●Net income was $11.4 million, an increase of 4%, or 27% on a non-GAAP basis when excluding the accretion from PPP loan fees in 2021.

●Diluted earnings per share was $0.76, an increase of $0.03 or 4%. Diluted earnings per share in the third quarter of 2021 included a $0.14 benefit from PPP loan fees.

●Return on assets increased to 1.20% from 1.16% or 0.95% on a non-GAAP basis when excluding PPP loan fees. Return on equity was 11.55% compared to 10.38%. Both ratios include the benefit of higher net income and lower average balances related to unrealized losses on securities as noted below under the Financial Position section.

●Net interest income was $29.9 million, an increase of 17%. Net interest margin (NIM) was 3.47% in the third quarter of 2022, an increase of 45 basis points from the same period in 2021. The increase is primarily due to the repricing of variable rate assets, continued loan growth and a lower percentage of wholesale borrowings to total debt.

●The provision for credit losses was an expense of $1.3 million mainly due to loan growth compared to a net benefit of $174 thousand reflecting improved economic forecasts.

●Non-interest income was $8.8 million, down $2.5 million. Customer service fee income was up 9%, trust and wealth management income was down 8%, and prior year included $1.9 million of net securities gains.

●Non-interest expense was $23.0 million versus $23.4 million. Prior year includes a $1.8 million loss on extinguishment of debt.

●Efficiency ratio improved to 58% from 59%, or 63% on a non-GAAP basis that excludes PPP loan fees.

Financial Position (As of September 30, 2022, compared to June 30, 2022)

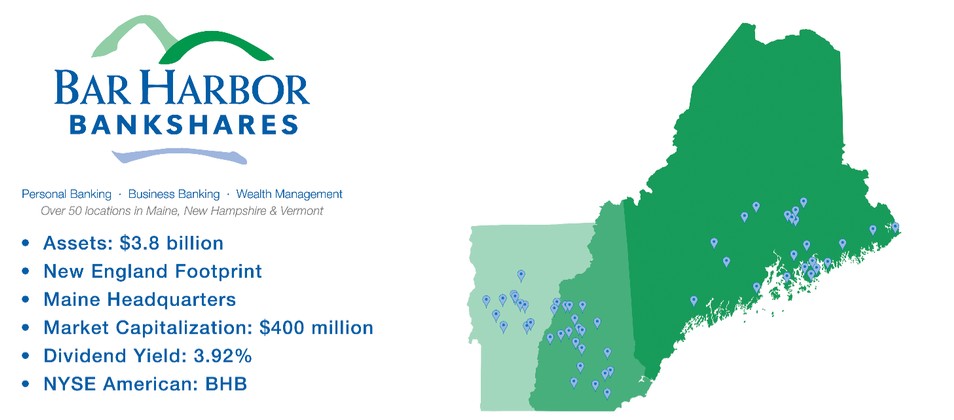

●Total assets increased $124.5 million to $3.8 billion mainly due to loan growth supported by growth in total deposits.

●Cash and cash equivalents were $82.1 million, compared to $67.1 million. The increase is a principally a timing difference between loan activity and short-term borrowings at the end of the quarter.

●Securities were $565.8 million, or 15% of total assets, compared to $592.7 million, or 16% of total assets. Net unrealized losses were $76.6 million, or 12% of gross securities, compared with $49.7 million, or 8% of gross securities as fixed rate securities continued to price reflecting higher interest rates.

●Total loans grew 18% on annualized basis during the quarter as commercial loans and residential loans increased 25% and 9%, respectively. Loan growth was generated across all of our footprint and among many industry sectors and business lines. We believe that the economy in Northern New England continues to be strong despite pressures from the broader economy.

●The ratio of the allowance for credit losses to total loans was 0.88%, increasing from 0.87%, which reflects more conservative economic forecasting. Net charge-offs continue to be insignificant and each credit metric improved during the quarter.

●Total deposits grew 7% on annualized basis during the quarter on an increasing number of customer accounts and gain in market share.