S&P 500 Index is not included in the Reorganization SAI because the net assets of Calvert SRI Equity constitute less than 10% of the net assets of Calvert S&P 500 Index.

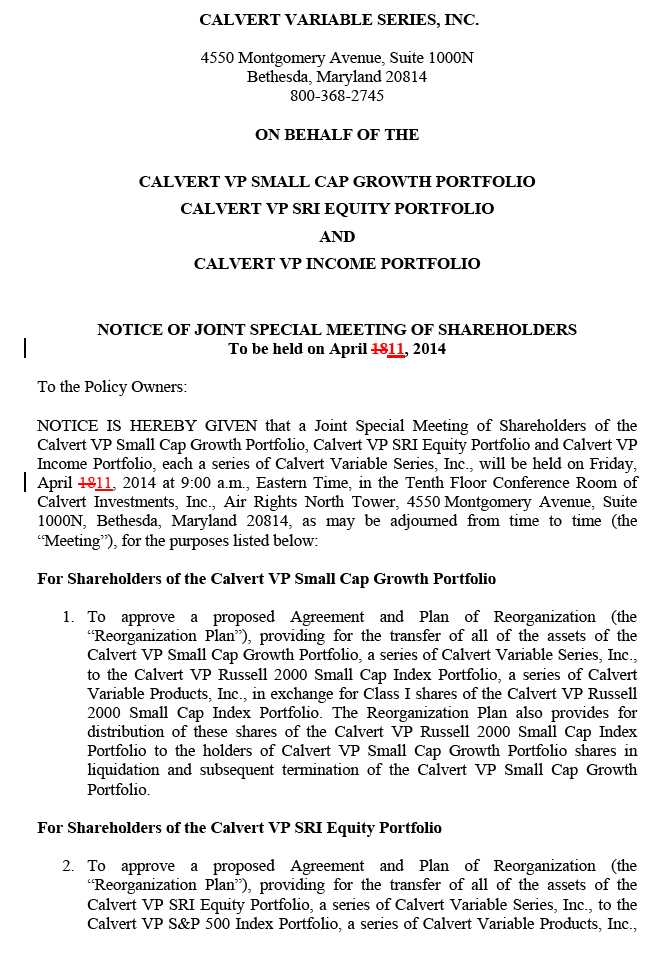

The approximate date on which this Prospectus/Proxy Statement, the Joint Notice of Special Meeting of Shareholders, and Form of Proxy are first being mailed to shareholders is on or aboutFebruary 13, 2014.

These securities have not been approved or disapproved by the SEC or any state securities commission, nor has the SEC or any state securities commission passed on the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The shares offered by this Prospectus/Proxy Statement are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. An investment in Calvert Russell 2000 Index, Calvert S&P 500 Index or Calvert Bond Index through a Policy involves investment risk, including possible loss of the purchase payment of your original investment.

- 6 -

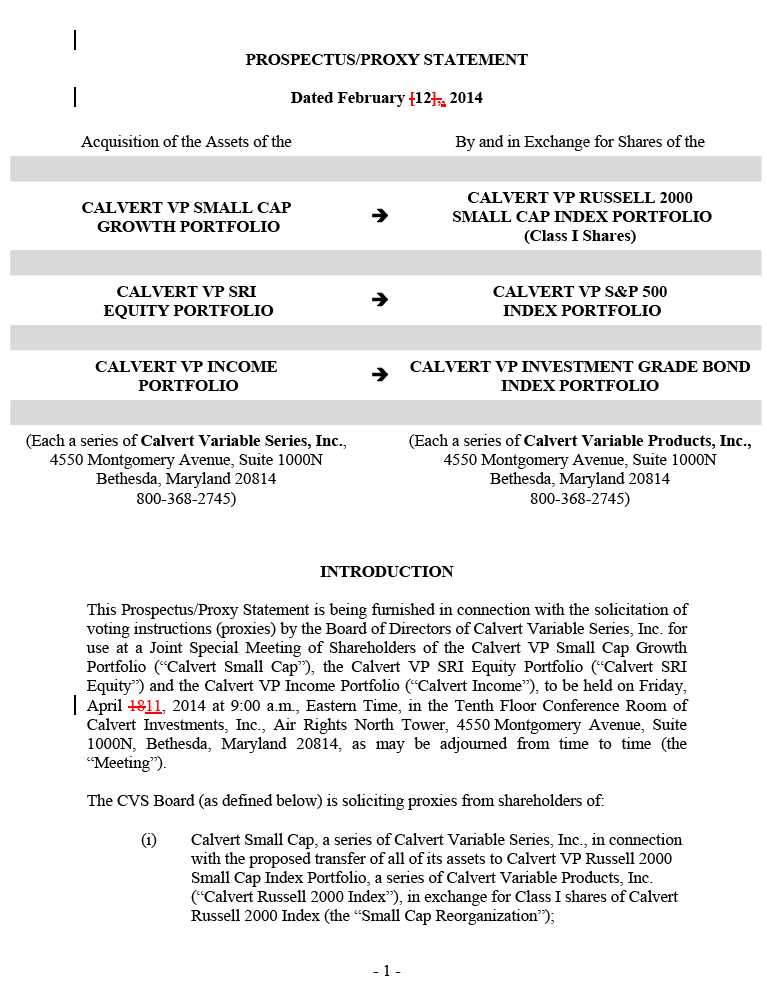

SYNOPSIS

This section summarizes the primary features and consequences of the Reorganizations. It may not contain all of the information that is important to you. To understand each Reorganization, you should read this entire Prospectus/Proxy Statement and the related Exhibit.

This Synopsis is qualified in its entirety by reference to the additional information contained elsewhere in this Prospectus/Proxy Statement, the respective Prospectuses and Statements of Additional Information relating to the Portfolios, and the form of the Agreements and Plans of Reorganization (each a “Reorganization Plan”), which are attached to this Prospectus/Proxy Statement as EXHIBIT A, EXHIBIT B, and EXHIBIT C.

Reasons for the Reorganizations.The Board believes that each proposed Reorganization would be in the best interest of the shareholders of the applicable Merging Portfolio. In reaching this decision, the Board considered the terms and conditions of each Reorganization Plan and the following factors, among others:

1. The relatively small size of each Merging Portfolio and the likelihood that it will not increase substantially in size in the foreseeable future;

2. Following each Reorganization, the shareholders of each Merging Portfolio will remain invested in an open-end portfolio with a substantially larger asset base;

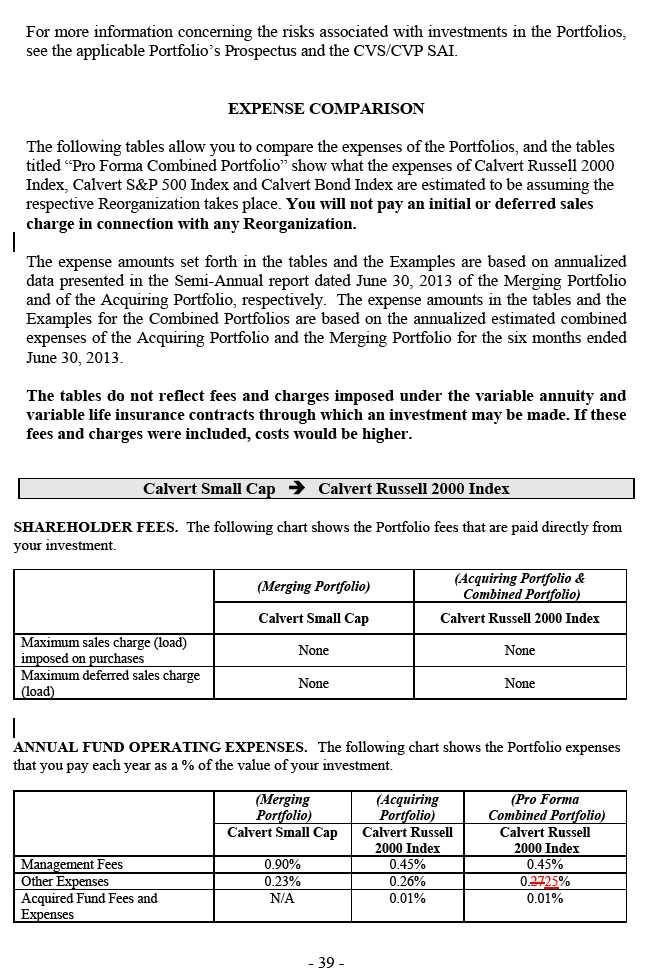

3. With respect to each Reorganization, the Pro Forma Combined Portfolio (as shown in the section entitled “Expense Comparison”) has a lower expense ratio than the current expense ratio of the Merging Portfolio;

4. The likelihood that shareholders of each Merging Portfolio, as part of a larger portfolio, may benefit over time from further reductions in overall operating expenses per share on a pro forma basis as a result of certain economies of scale expected after the Reorganizations;

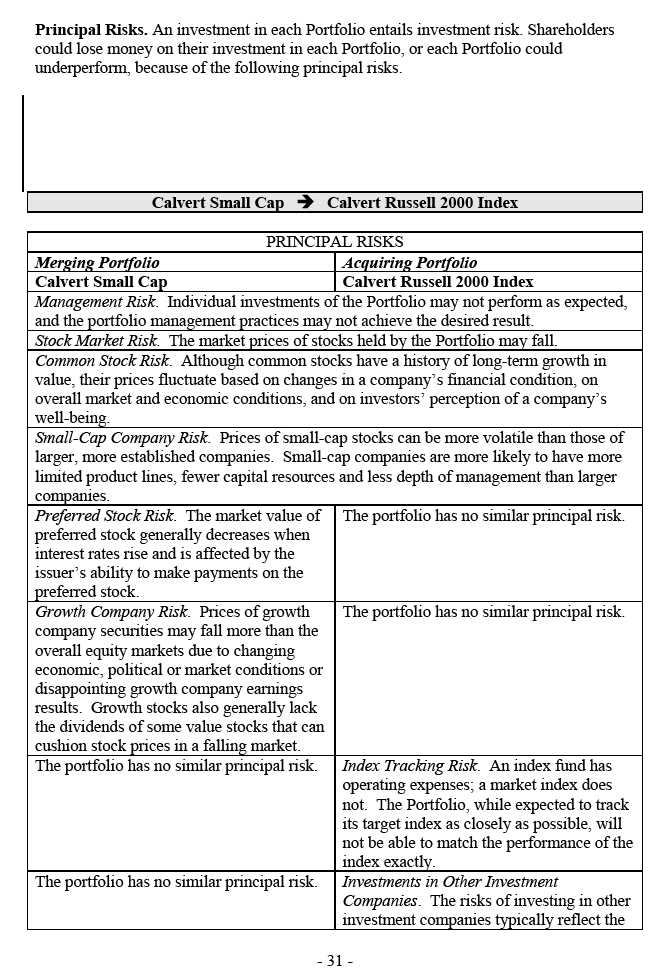

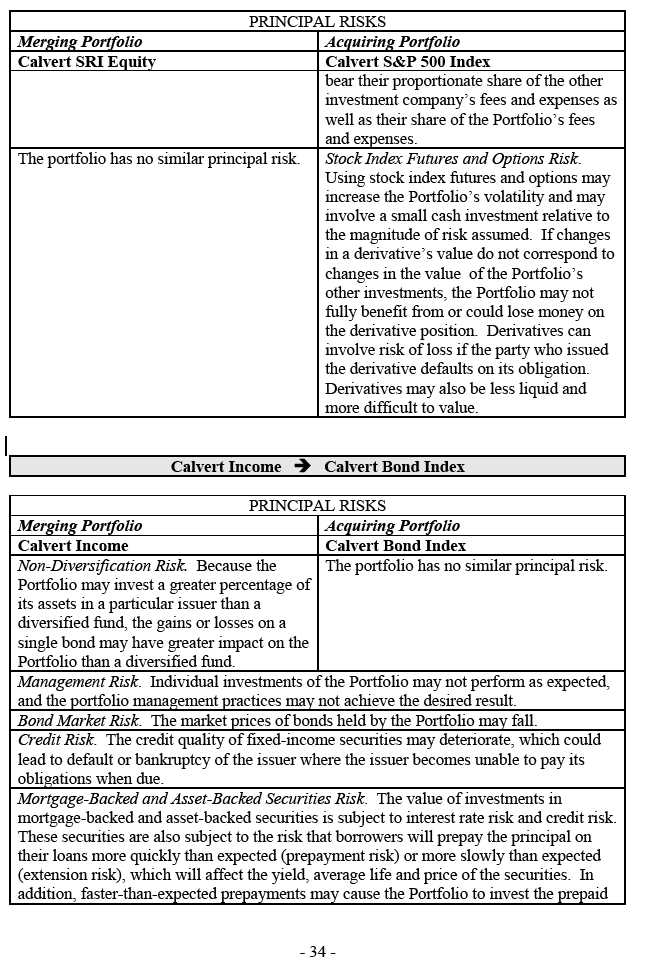

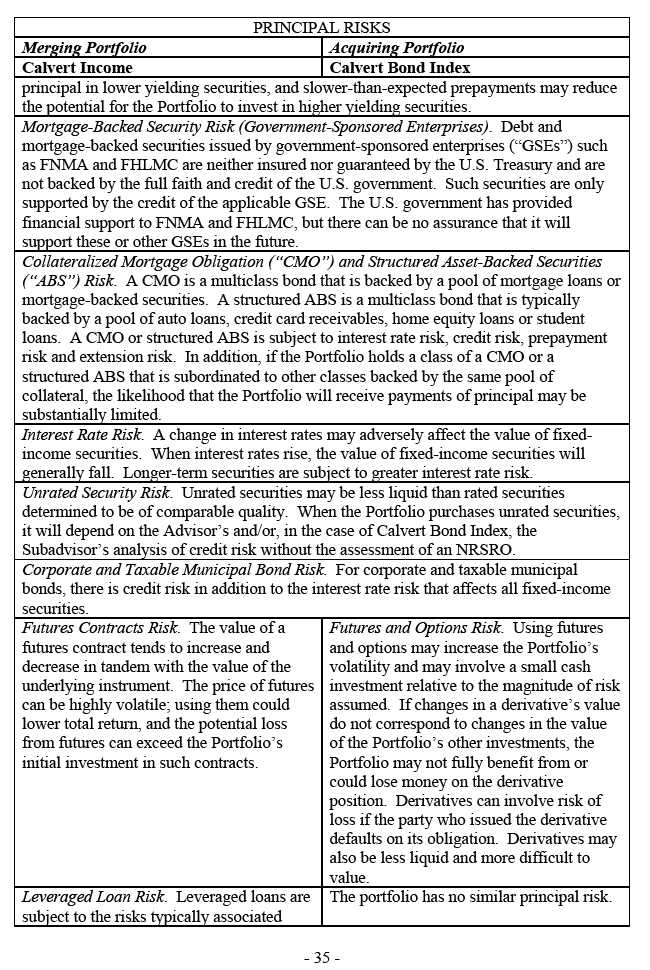

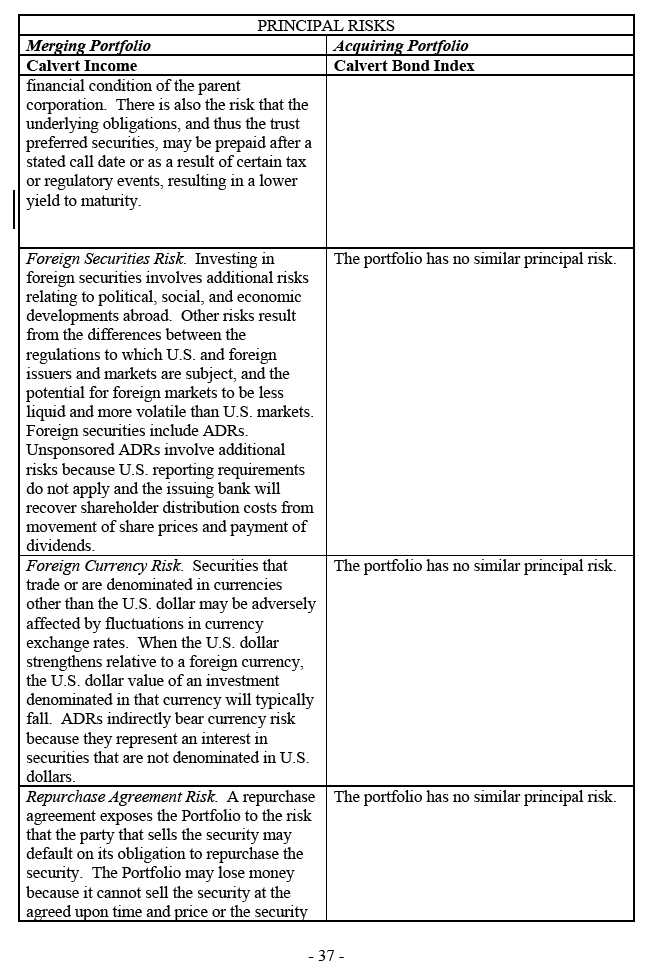

5. With respect to each Reorganization, the investment objective, principal investment policies and principal risks of the Acquiring Portfolio and the Merging Portfolio are similar;

6. With respect to each Reorganization, the Merging Portfolio and the Acquiring Portfolio are situated in the same or a comparable Morningstar style box;

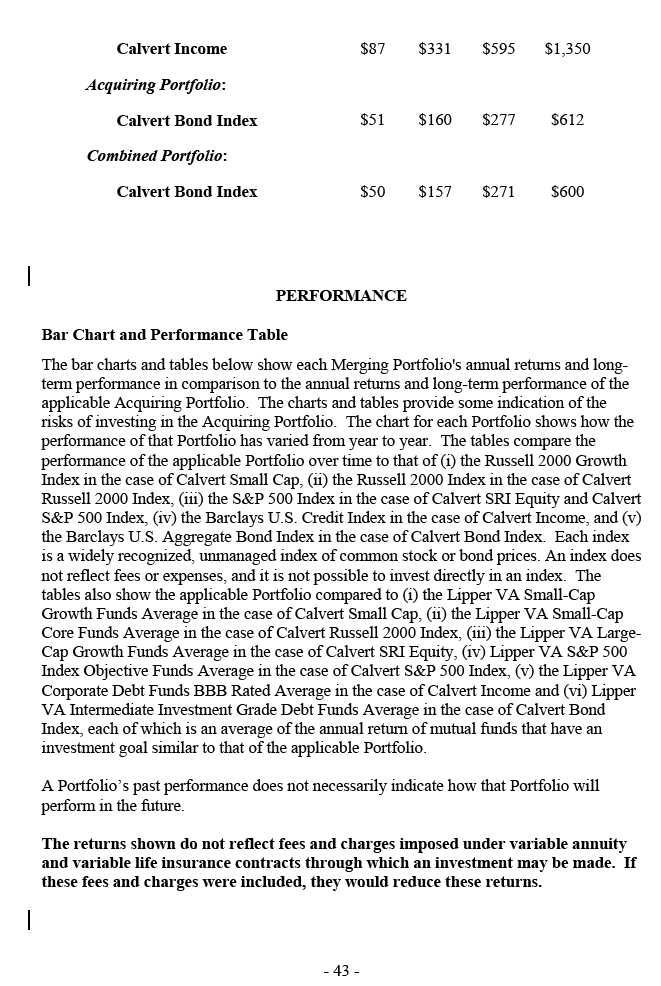

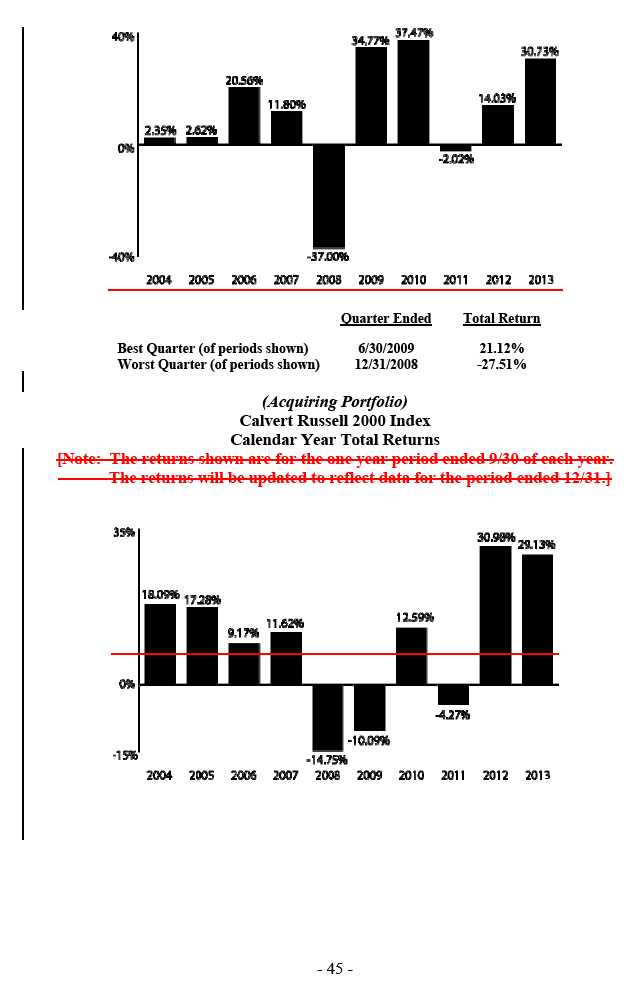

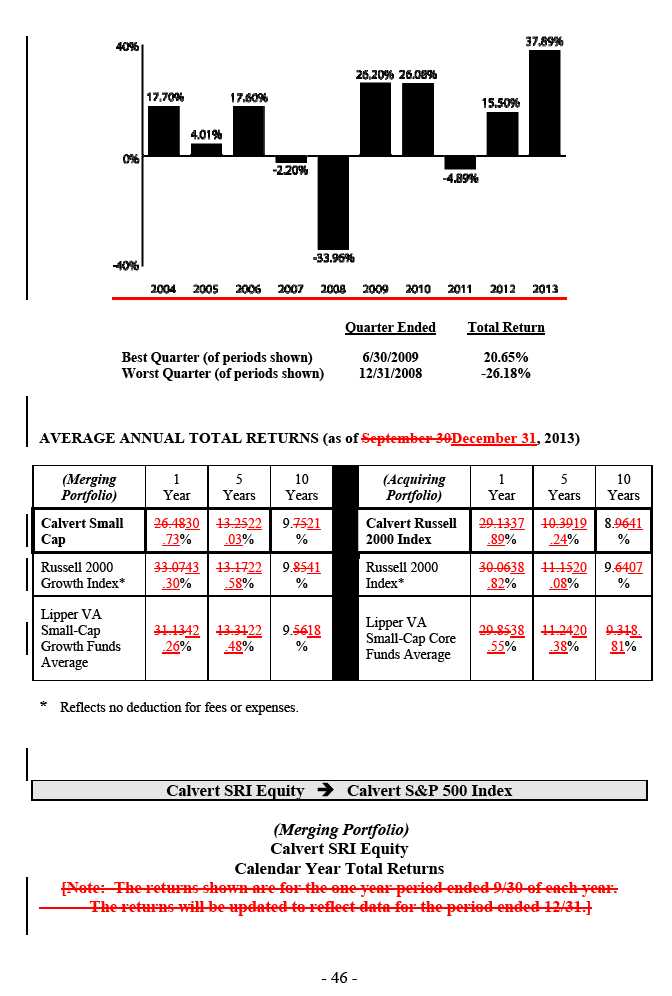

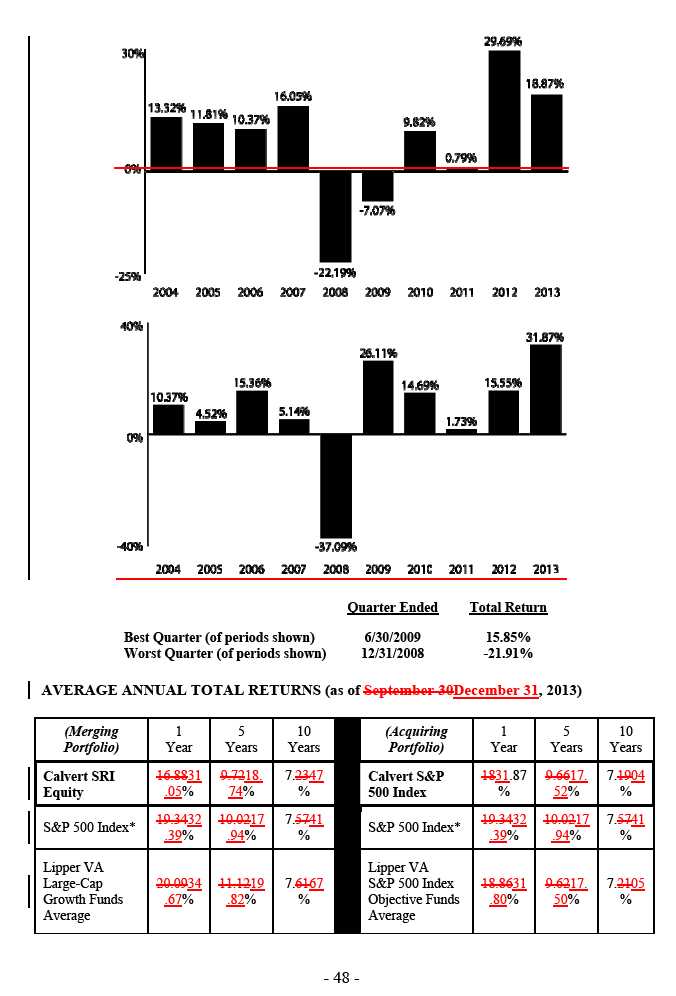

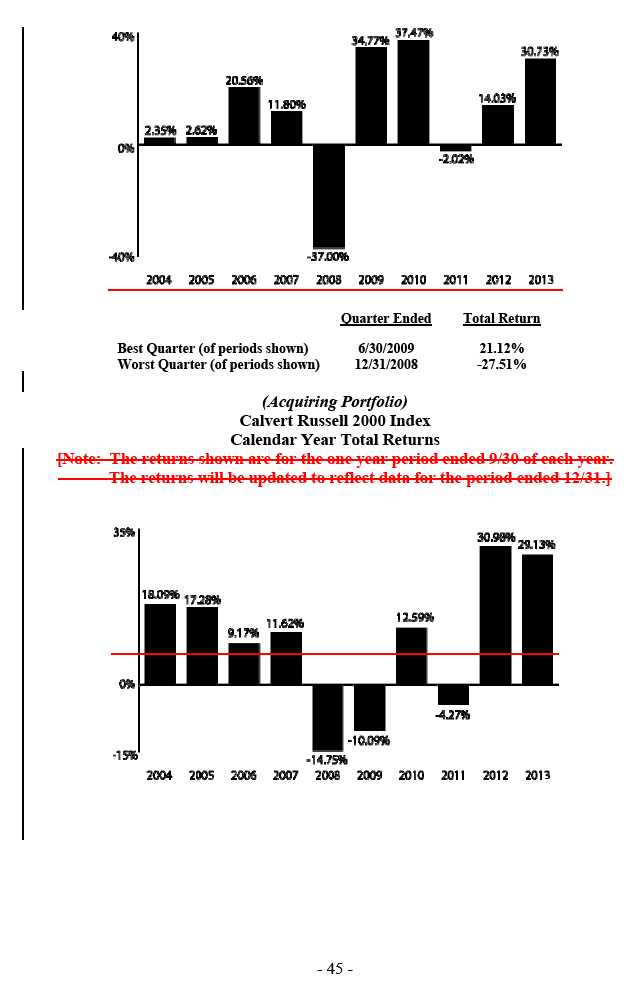

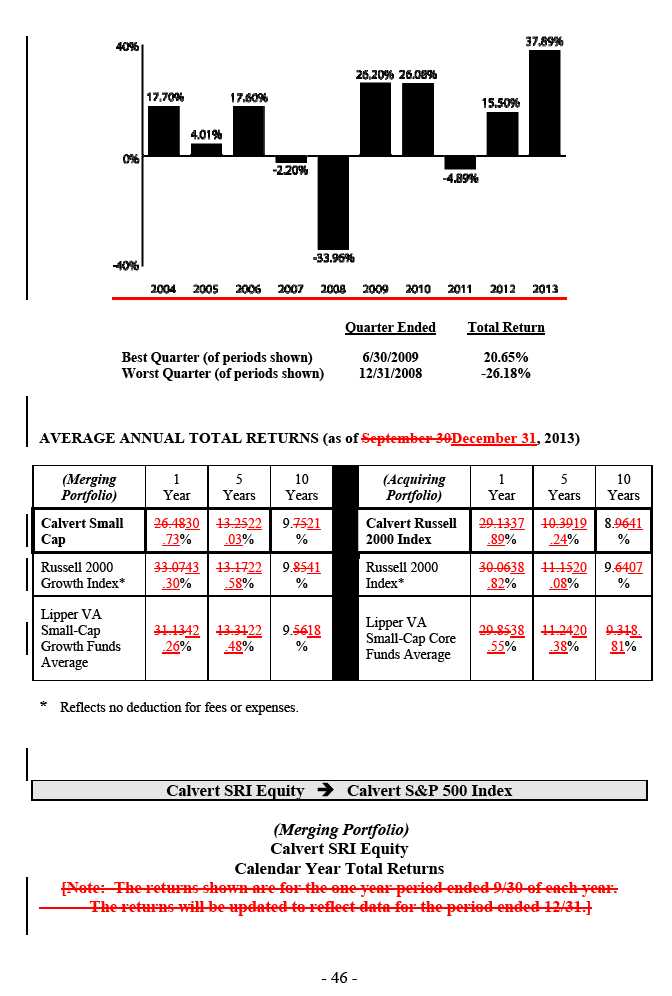

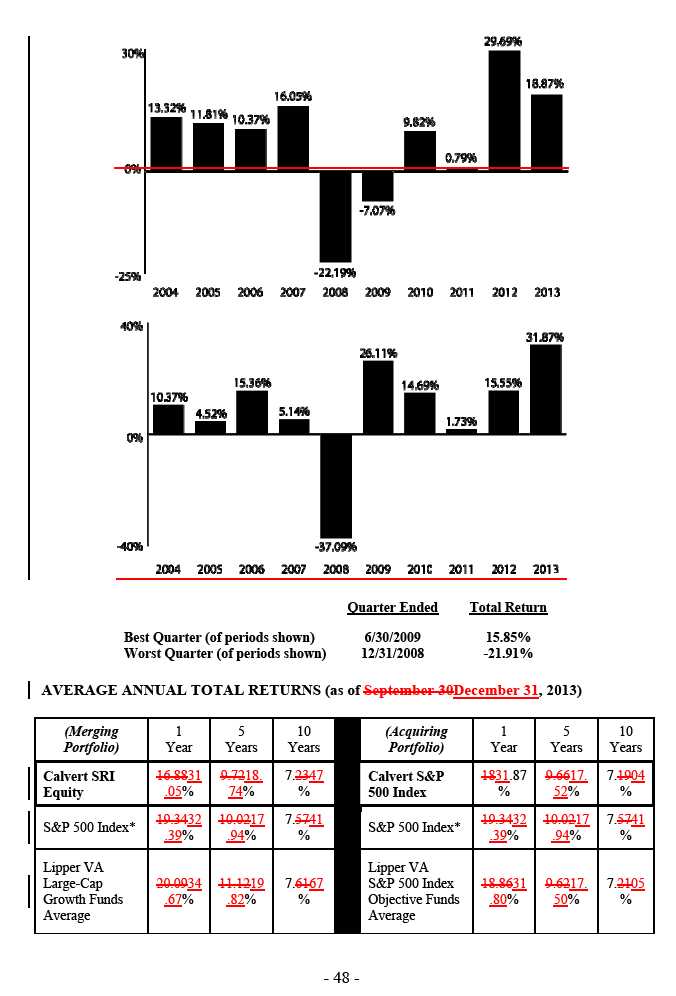

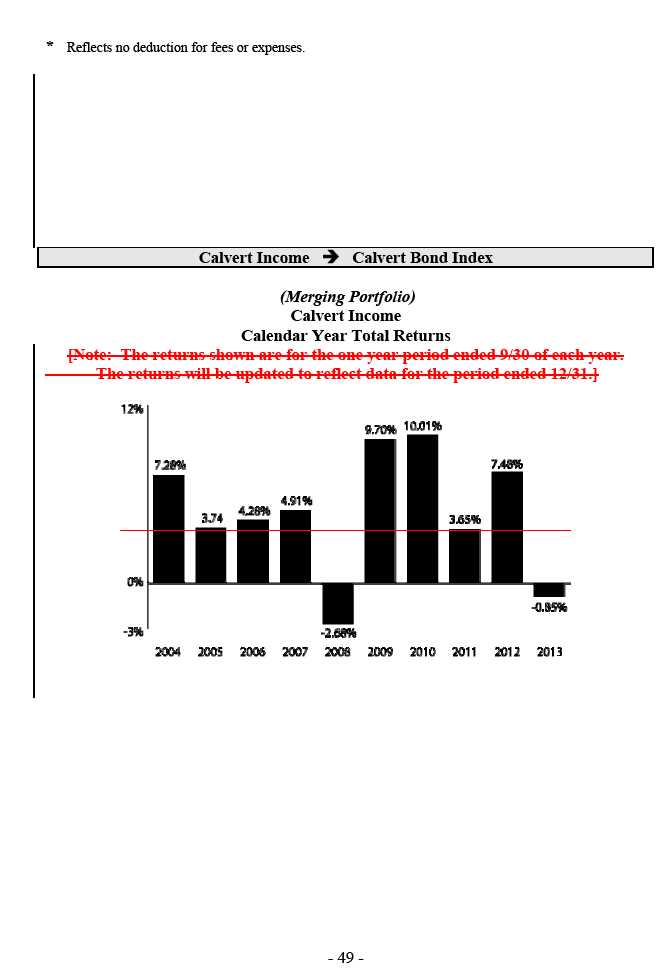

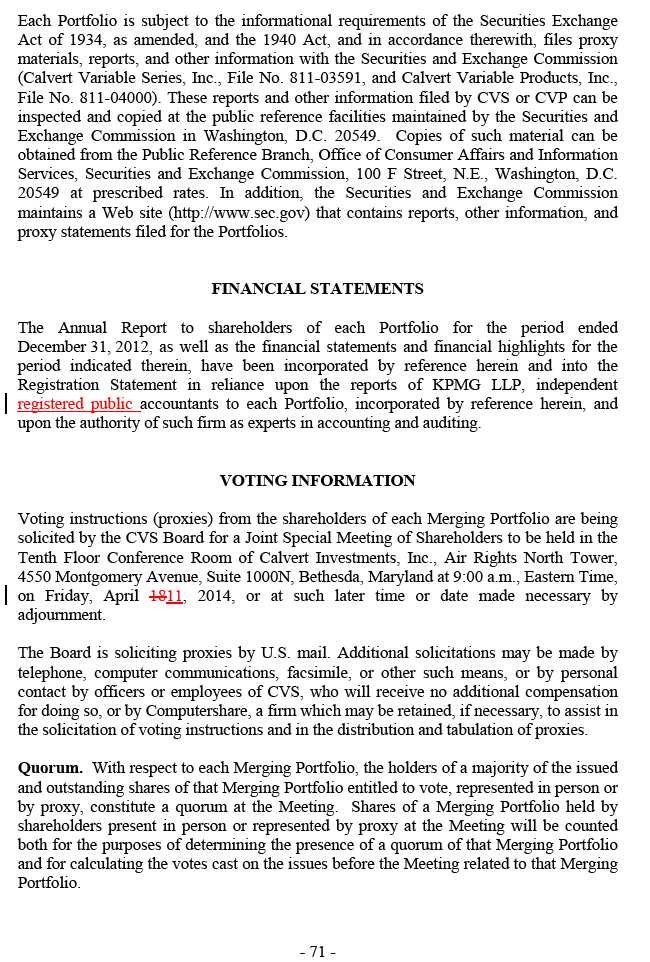

7. With respect to each Reorganization, the performance history of the Acquiring Portfolio is comparable to the performance of the related Merging Portfolio for the standardized reporting periods ended September 30, 2013;

8. With respect to each Reorganization, both the Merging Portfolio and the Acquiring Portfolio are managed by the same investment advisor;

- 8 -

stocks. The Subadvisor selects investments for Calvert SRI Equity that are consistent with its investment criteria, including financial, sustainability and social responsibility factors. Calvert S&P 500 Index invests at least 80% of its assets in investments with economic characteristics similar to large cap stocks as represented in the S&P 500 Index, which may include other investment companies, and index futures and options. The material differences between the principal investment strategies of Calvert SRI Equity and Calvert S&P 500 Index are as follows:

(i)Active versus Passive Management. Calvert SRI Equity is an actively managed portfolio. The Subadvisor looks for established companies with a history of steady earnings growth and selects companies based on its opinion that (i) the company has the ability to sustain growth through high profitability and (ii) the stock is favorably priced with respect to those growth expectations. The Subadvisor of Calvert SRI Equity seeks to invest in portfolio securities that over time have the potential to outperform the Portfolio’s benchmark, the S&P 500 Index Index.

Calvert S&P 500 Index is a passively managed portfolio. The Subadvisor of Calvert S&P 500 Index seeks to substantially replicate the total return of the securities comprising the S&P 500 Index, taking into consideration redemptions, sales of additional shares and certain other adjustments. Under normal market conditions, as much of the Portfolio’s assets as is practical will be invested in stocks included among the S&P 500 Index and futures contracts and options relating thereto. While not required, the Portfolio will generally sell securities that the Index manager removes from the Index. The Portfolio may also invest in Standard & Poor’s Depositary Receipts® (“SPDRs®”) or other investment companies that provide exposure to the S&P 500 Index. SPDRs® are units of beneficial interest in a unit investment trust, representing proportionate undivided interests in a portfolio of securities in substantially the same weighting as the common stocks that comprise the S&P 500 Index.

(ii)Sustainable and Socially Responsible Investing. Calvert SRI Equity utilizes a sustainable and socially responsible investment strategy and Calvert S&P 500 Index does not.

Calvert SRI Equity seeks to invest in companies and other enterprises that demonstrate positive environmental, social and governance performance as they address corporate responsibility and sustainability challenges. The Advisor believes that there are long-term benefits in an investment philosophy that attaches material weight to the environment, workplace relations, human rights, Indigenous Peoples’ rights, community relations, product safety and impact, and corporate governance and business ethics. The Advisor also believes that managing risks and opportunities related to these issues can contribute positively to company performance as well as to investment performance over time. Calvert SRI Equity has sustainable and socially responsible investment criteria that reflect specific types of

- 15 -

the Merging Portfolios. These challenges include, with respect to each Merging Portfolio: (i) stagnant or declining assets over the last three years, (ii) the failure of the Merging Portfolio to achieve scale despite having been in existence for ten or more years, (iii) the fact that a substantial portion of the Merging Portfolio’s assets are invested through variable annuity and variable life insurance products that are closed to new sales, (iv) the Merging Portfolio’s diminished ability to grow assets because it is not an available investment option in the model portfolios of the insurance companies affiliated with Ameritas, (v) very limited opportunities to offer the Merging Portfolio through variable annuity and variable life insurance products of competing insurance companies, and (vi) increased competition from other investment options as variable product providers have shifted towards alternative investment options, especially passively managed funds or volatility managed funds. CIM accordingly recommended the reorganization of each Merging Portfolio into the respective Acquiring Portfolio. In connection with its consideration of these matters, the Board was also advised by counsel to the Independent Directors of its fiduciary responsibilities to the shareholders of each Merging Portfolio and the legal issues involved.

In addition, the Board considered a number of additional factors, including, but not limited to: (i) the capabilities, investment experience, and resources of AIP; (ii) the expenses and advisory fees applicable to each Merging Portfolio before the applicable Reorganization and the pro forma expense ratios for shareholders in the respective Acquiring Portfolio following the Reorganization; (iii) the terms and conditions of each Reorganization Plan and the expectation that each Reorganization would not result in a dilution of the interests of the shareholders in the applicable Merging Portfolio; (iv) the economies of scale expected to be realizable as a result of each Reorganization; (v) the costs estimated to be incurred to complete each Reorganization; (vi) the current size and future growth prospects of each Merging Portfolio in comparison to the anticipated future growth prospects of each Acquiring Portfolio; (vii) the similarity of the investment objective, principal investment strategies, fundamental investment restrictions and principal risks of each Merging Portfolio and the respective Acquiring Portfolio; (viii) the performance of each Acquiring Portfolio in comparison to the related Merging Portfolio; and (ix) the anticipated non-taxable treatment of each Reorganization for federal income tax purposes. Thus, when considering all of the above factors, the Board determined that the Reorganization of each Merging Portfolio into the respective Acquiring Portfolio would be in the best interest of each Merging Portfolio and its shareholders.

After this discussion, and following a further review of the materials and the terms of each proposed Reorganization Plan, the Board, including the Independent Directors, approved each Reorganization and recommended its approval by the shareholders of the applicable Merging Portfolio. In connection with the approval of each Reorganization, the Board noted that (i) since the value of Calvert Russell 2000 Index, Calvert S&P 500 Index or Calvert Bond Index shares, as applicable, to be received by Merging Portfolio shareholders will be equal to the value of the Merging Portfolio shares surrendered in exchange therefor, shareholders of each Merging Portfolio will not experience any dilution in the value of their investment as a result of the Reorganization, and (ii) each Merging Portfolio will receive an opinion of counsel that the exchanges contemplated by the applicable Reorganization Plan are tax-free for federal income tax purposes.

- 55 -

under the 1940 Act by the SEC’s Division of Investment Management. Such liquidation and distribution will be accomplished by the establishment of accounts on the share records of each Acquiring Portfolio, representing the respective pro rata number of full and fractional shares of that Acquiring Portfolio due Record Holders of the respective Merging Portfolio. Share certificates will not be issued in connection with the Reorganizations.

The consummation of each Reorganization Plan is subject to the conditions set forth therein, including the approval of each Reorganization Plan by the lesser of (i) 67% or more of the shares of the applicable Merging Portfolio entitled to vote and present at the Meeting, if the holders of more than 50% of the outstanding shares entitled to vote are present in person or represented by proxy, or (ii) more than 50% of the outstanding shares of the applicable Merging Portfolio entitled to vote. The votes of the shareholders of each applicable Acquiring Portfolio are not being solicited because their approval or consent is not necessary for the Reorganization.

Representations, Warranties and Agreements.Both parties to each Reorganization shall have complied with their respective responsibilities under the applicable Reorganization Plan, the respective representations and warranties contained in that Reorganization Plan shall be true in all material respects as of the Closing Date, and there shall have been no material adverse change in the financial condition, results of operations, business, properties, or assets of either Portfolio which is a party to that Reorganization Plan since December 31, 2013. Both parties to each Reorganization shall produce certificates satisfactory in form and substance indicating that they have met the terms of that Reorganization Plan.

Tax Opinions.Assuming each shareholder’s policy or contract is treated as a variable annuity for federal income tax purposes, each shareholder will not recognize taxable income as a result of the applicable Reorganization.

Both Portfolios involved in a Reorganization shall have received an opinion of counsel, addressed to the applicable Portfolios and in form and substance satisfactory to each Portfolio, as to certain of the federal income tax consequences of the Reorganization under the Internal Revenue Code (the “Code”) to the applicable Merging Portfolio and Acquiring Portfolio, and the separate accounts through which the Insurance Companies own shares of the Merging Portfolios’ stock.For purposes of rendering its opinion, counsel may rely exclusively and without independent verification, as to factual matters, on the statements made in the applicable Reorganization Plan, this Prospectus/Proxy Statement, and on other written representations of the applicable Merging Portfolio and Acquiring Portfolio. With respect to each Reorganization, counsel will opine, based on the facts and assumptions stated in the applicable legal opinion, that for federal income tax purposes:

1. The transfer of all of the assets of the Merging Portfolio in exchange for shares of the Acquiring Portfolio followed by the distribution of those shares pro rata to the separate accounts as shareholders of the Merging Portfolio in liquidation thereof will constitute a “reorganization” within the meaning of §368(a) of the Internal

- 57 -

Revenue Code of 1986, as amended (the “Code”), and the Acquiring Portfolio and the Merging Portfolio will each be “a party to the Reorganization” within the meaning of §368(b) of the Code.

2. No gain or loss will be recognized by the Acquiring Portfolio upon the receipt of the assets of the Merging Portfolio solely in exchange for Acquiring Portfolio shares.

3. No gain or loss will be recognized by the Merging Portfolio upon the transfer of its assets to the Acquiring Portfolio in exchange for Acquiring Portfolio shares, or upon the distribution (whether actual or constructive) of such shares to the separate accounts as shareholders of the Merging Portfolio in exchange for their Merging Portfolio shares.

4. No gain or loss will be recognized by the separate accounts as shareholders of the Merging Portfolio upon the exchange of their Merging Portfolio shares for Acquiring Portfolio shares in liquidation of the Merging Portfolio.

5. The aggregate tax basis of the Acquiring Portfolio shares received by each separate account as a shareholder of the Merging Portfolio pursuant to the Reorganization will be the same as the aggregate tax basis of the Merging Portfolio shares held by such separate account shareholder immediately prior to the Reorganization, and the holding period of the Acquiring Portfolio shares received by each separate account as a shareholder of the Merging Portfolio will include the period during which the shares of the Merging Portfolio exchanged therefor were held by such separate account shareholder (provided the shares of the Merging Portfolio were held as a capital asset on the date of the Reorganization).

6. The tax basis of the assets of the Merging Portfolio acquired by the Acquiring Portfolio will be the same as the tax basis of those assets to the Merging Portfolio immediately prior to the Reorganization, and the holding period of the assets of the Merging Portfolio in the hands of the Acquiring Portfolio will include the period during which those assets were held by the Merging Portfolio.

7. The Acquiring Portfolio will succeed to and take into account the capital loss carryovers of the Merging Portfolio described in section 381(c) of the Code. The Acquiring Portfolio will take any such capital loss carryovers into account subject to the conditions and limitations specified in sections 381, 382, 383 and 384 of the Code and regulations thereunder.

Amendment and Termination.Each Reorganization Plan may be amended by mutual written consent of the parties to that Reorganization Plan authorized by the Board of each party. Each Reorganization Plan may be amended before or after it has been approved by shareholders of the applicable Merging Portfolio, but following its approval by shareholders, no amendment may be made that substantially changes the terms of that Reorganization Plan. Each Reorganization Plan may be terminated, and the respective

- 58 -

If a Reorganization is not consummated, the capital loss carryforwards of each related Portfolio should be available to offset any net realized capital gains of that Portfolio through the expiration date shown in the applicable table above. For the capital loss carryforwards acquired in a previous reorganization by Calvert S&P 500 Index and Calvert Income, the use of these capital losses may be subject to limitations. It is anticipated that no distributions of net realized capital gains would be made by any Portfolio that has a capital loss carryforward until the capital loss carryforwards expire or are offset by net realized capital gains.

If a Reorganization is consummated, the applicable Acquiring Portfolio will be constrained in the extent to which it can use the capital loss carryforwards of the related Merging Portfolio because of limitations imposed by the Code, on the occurrence of an ownership change. Each Acquiring Portfolio should be able to use each calendar year a capital loss carryforward in an amount equal to the net asset value of the related Merging Portfolio on the Closing Date multiplied by a long-term tax-exempt rate calculated by the Internal Revenue Service. If the amount of such a loss is not used in one year, it may be added to the amount available for use in the next year. For 2014, the amount of capital loss carryforwards that may be used under the formula will be further reduced to reflect the number of days remaining in the year following the Closing Date, which is currently anticipated to be on or about April 30, 2014.

CIM believes that the anticipated benefits outweigh the uncertain potential detriment resulting from the partial loss of capital loss carryforwards, since the Record Holders, as separate accounts of the Insurance Companies, pay no tax on their income.

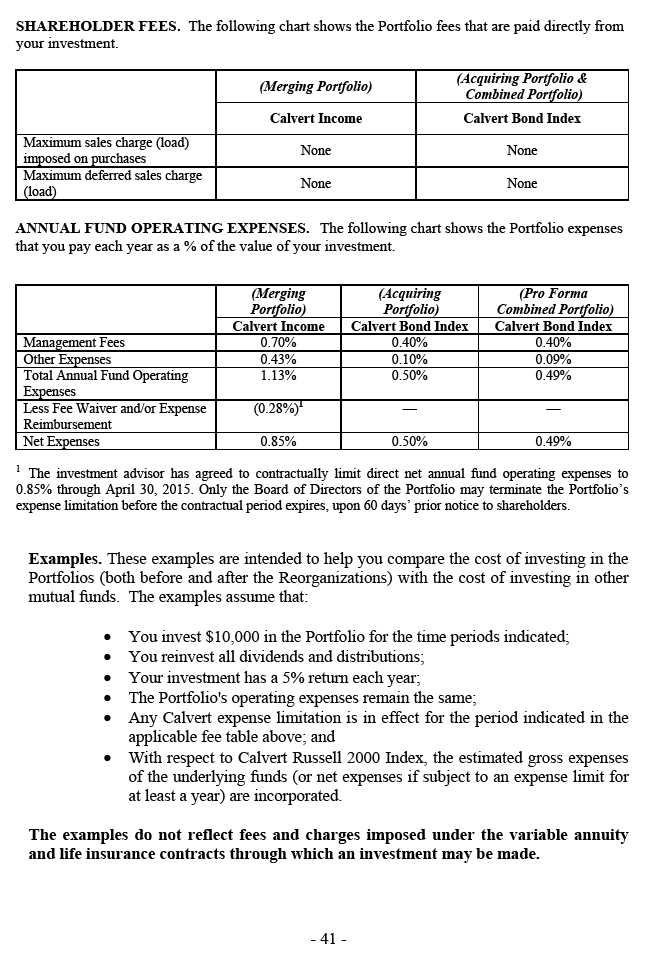

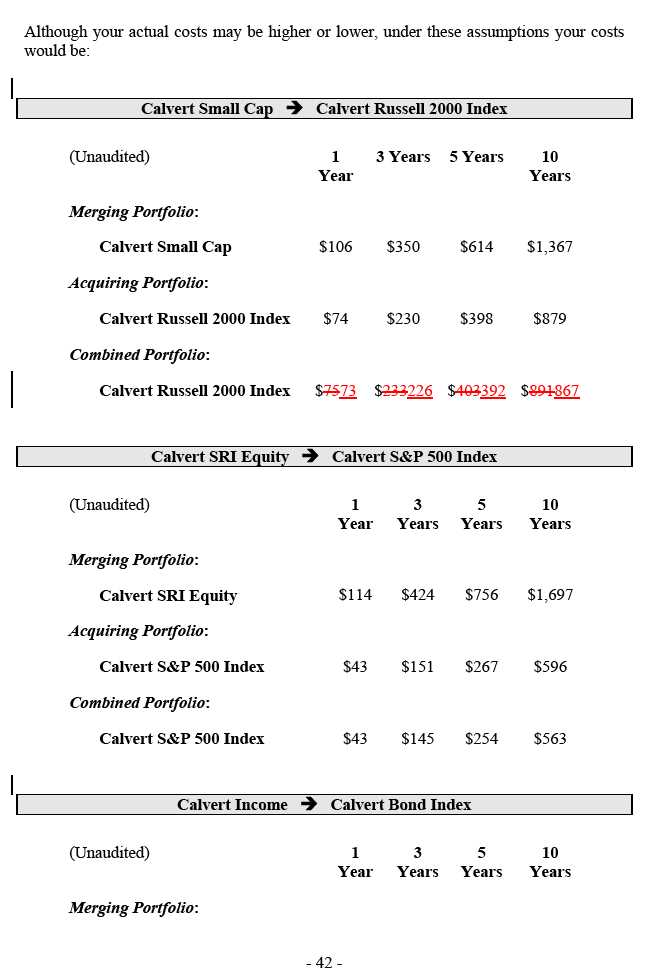

Expenses.After the consummation of each Reorganization, the total operating expenses of each Acquiring Portfolio, as a percent of net assets, are estimated to be less than the current operating expenses of the related Merging Portfolio. Certain administrative and fixed costs, such as set up fees for printing prospectuses, semi-annual and annual reports and proxy statements, legal expenses, audit fees, registration fees, and other similar expenses would be spread across a larger asset base, thereby reducing the expense ratio borne by each Acquiring Portfolio. These efficiencies are not reflected in the Pro Forma Combined Portfolio expenses shown in the tables under “Expense Comparison”. In addition, in each case, the advisory fees for the Acquiring Portfolio are lower than the advisory fees for the related Merging Portfolio because the Acquiring Portfolio is a passively managed portfolio whereas the Merging Portfolio is an actively managed portfolio.

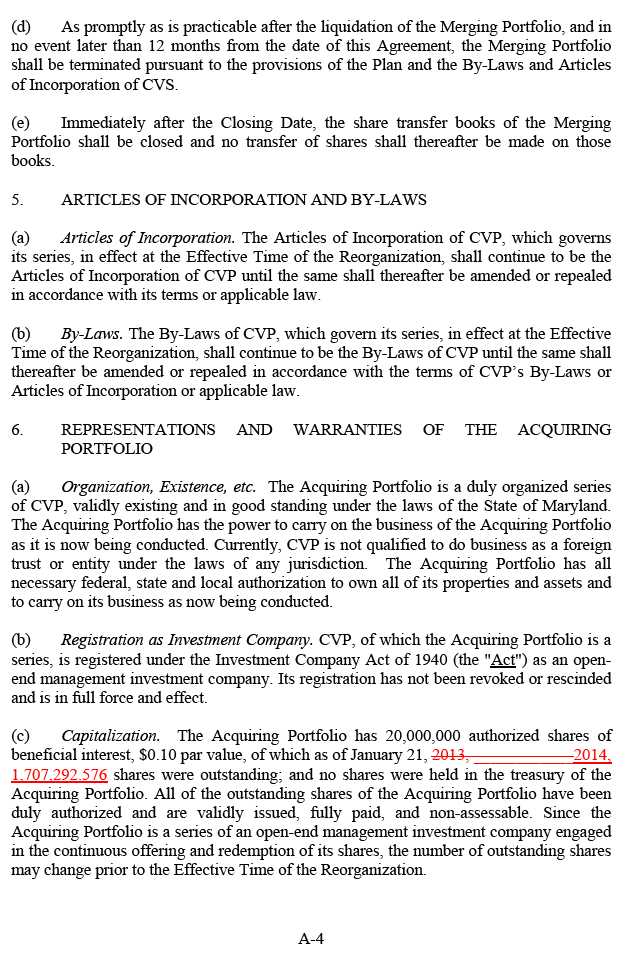

Capitalization. The beneficial interests in CVS are represented by 32,500,000,000 authorized transferable shares of common stock, par value $0.01 per share. The beneficial interests in CVP are represented by 1,130,000,000 authorized transferable shares of common stock, par value $0.10 per share. The Articles of Incorporation of each Fund permit the Board to allocate shares into classes or series, with rights determined by the Board, without shareholder approval.

The following tables show the capitalization of each Merging Portfolio and the respective Acquiring Portfolio as of June 30, 2013, and on a pro forma basis the capitalization of the

- 61 -

Payment for redeemed shares will be made promptly, but in no event later than seven days after receiving a redemption request. Each Portfolio reserves the right to suspend or postpone redemptions during any period when: (a) trading on the NYSE is restricted, as determined by the SEC, or the NYSE is closed all day for other than customary weekend and holiday closings; (b) the SEC has granted an order to the Fund permitting such suspension; or (c) an emergency, as determined by the SEC, exists, making disposal of portfolio securities or valuation of net assets of the Portfolio not reasonably practicable. The amount received upon redemption of the shares of a Portfolio may be more or less than the amount paid for the shares, depending upon the fluctuations in the market value of the assets owned by that Portfolio. Each Portfolio has the right to redeem shares in assets other than cash for redemption amounts exceeding, in any 90-day period, $250,000 or 1% of the NAV of that Portfolio, whichever is less, by making redemptions-in-kind (distributions of a pro rata share of the portfolio securities, rather than cash). A redemption-in-kind transfers the transaction costs associated with redeeming the security from the Portfolio to the investor. The investor will also bear any market risks associated with the portfolio security until the security can be sold.

The Funds reserve the right to terminate or modify the exchange privilege with 60 days’ written notice. The Policy prospectus indicates whether an insurance company charges any fees for moving a shareholder’s assets from one investment option to another. No fees for exchanges are charged by the Portfolios.

How Shares are Priced.The price of shares is based on the applicable Portfolio’s NAV. The NAV is computed by adding the value of the Portfolio’s securities holdings plus other assets, subtracting liabilities, and then dividing the result by the number of shares outstanding.

Each Portfolio’s NAV is calculated as of the close of each business day, which coincides with the closing of the regular session of the NYSE (generally 4 p.m. ET). Each Portfolio is open for business each day the NYSE is open.

If a Portfolio holds securities that are primarily listed on foreign exchanges that trade on days when the NYSE is closed, it does not price shares on days when the NYSE is closed, even if foreign markets may be open. As a result, the value of the Portfolio’s shares may change on days when you will not be able to buy or sell shares.

Generally, portfolio securities and other assets are valued based on market quotations. Debt securities are valued utilizing the average bid prices or at bid prices based on a matrix system (which considers such factors as security prices, yields, maturities and ratings) furnished by dealers through an independent pricing service.

Under the oversight of the Board and pursuant to each Portfolio’s valuation procedures adopted by the Board, CIM determines when a market quotation is not readily available or reliable for a particular security. Investments for which market quotations are not readily available or reliable are fair valued by a fair value team consisting of officers of the Fund and of CIM, as determined in good faith under consistently applied procedures under the general supervision of the Board. No single standard exists for determining fair

- 64 -

value, which depends on the circumstances of each investment, but in general fair value is deemed to be the amount an owner might reasonably expect to receive for a security upon its current sale.

In making a fair value determination, under the ultimate supervision of the Board, CIM, pursuant to the Funds’ valuation procedures, generally considers a variety of qualitative and quantitative factors relevant to the particular security or type of security. These factors are subject to change over time and are reviewed periodically to ascertain whether there are changes in the particular circumstances affecting an investment which may warrant a change in either the valuation methodology for the investment, or the fair value derived from that methodology, or both. The general factors considered typically include, for example, fundamental analytical data relating to the investment, the nature and duration of restrictions, if any, on the security, and the forces that influence the market in which the security is purchased and sold, as well as the type of security, the size of the holding and numerous other specific factors. Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If events occur after the close of the principal market in which securities are traded, and before the close of business of the Portfolio, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. In addition, fair value pricing may be used for high-yield debt securities or in other instances where a portfolio security is not traded in significant volume for a substantial period.

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, because of the inherent uncertainty of valuation, the fair values may differ significantly from the value that would have been used had a ready market for the investment existed, and these differences could be material.

Revenue Sharing.CIM, Calvert Investment Distributors, Inc. (the Portfolios’ distributor), and/or their affiliates make payments, out of their own assets and not as an additional charge to the Portfolio, to financial intermediaries in connection with the sale and/or distribution of Portfolio shares or the retention and/or servicing of portfolio investors and portfolio shares (“revenue sharing”). These payments are not reflected as additional expenses in the fee table contained in this Prospectus/Proxy Statement. The recipients of these payments may include the Portfolios’ distributor and other affiliates of CIM, as well as non-affiliated broker-dealers, financial institutions and other financial intermediaries through which investors may purchase shares of the Portfolio, including your financial intermediary. The total amount of these payments may be substantial to any given recipient and may exceed the costs and expenses incurred by the recipient for any Portfolio-related marketing or shareholder servicing activities.

Revenue sharing payments may create an incentive for an intermediary or its employees or associated persons to recommend or sell shares of the Portfolio to you. You may contact your financial intermediary for details about revenue sharing payments it receives or may receive. Revenue sharing payments also benefit CIM, the Portfolios’ distributor

- 65 -

and their affiliates to the extent the payments result in more assets being invested in the Portfolio on which fees are being charged.

Market Timing Policy. In general, each Portfolio is designed for long-term investment and not as a frequent or short-term trading (“market timing”) vehicle. The Portfolios do not accommodate frequent purchases and redemptions of its shares. Accordingly, the Board has adopted policies and procedures in an effort to detect and prevent market timing in each Portfolio. The Board believes that market timing activity is not in the best interest of shareholders. Market timing can be disruptive to the portfolio management process and may adversely impact the ability of CIM and the applicable Subadvisor to implement a Portfolio’s investment strategies. In addition, market timing can disrupt the management of a Portfolio and raise its expenses through: increased trading and transaction costs; forced and unplanned portfolio turnover; time-zone arbitrage for securities traded on foreign markets; and large asset swings that decrease a Portfolio’s ability to provide maximum investment return to all shareholders. This in turn can have an adverse effect on performance. Each Portfolio or the distributor at its discretion may reject any purchase or exchange request (purchase side only) it believes to be market timing. However, there is no guarantee that any Portfolio or the Portfolios’ distributor will detect or prevent market timing activity.

Shareholders may hold the shares of a Portfolio through a financial intermediary which has adopted market timing policies that differ from the market timing policies adopted by the Board. In formulating their market timing policies, these financial intermediaries may or may not seek input from the Portfolios’ distributor regarding certain aspects of their market timing policies, such as the minimum holding period or the applicability of trading blocks. Accordingly, the market timing policies adopted by a financial intermediary may be quite dissimilar from the policies adopted by the Board. The Board has authorized Fund management to defer to the market timing policies of any financial intermediary that distributes shares of a Portfolio through an omnibus account if the financial intermediary’s policies, in Fund management’s judgment, are reasonably designed to detect and deter market timing transactions. Shareholders may contact the Portfolios’ distributor to determine if the financial intermediary through which the shareholder holds shares of the Portfolio has been authorized by Fund management to apply its own market timing policies in lieu of the policies adopted by the Board. In the event of any such authorization, shareholders should contact the financial intermediary through which the shares of a Portfolio are held for more information on the market timing policies that apply to those shares.

Shares of each Portfolio are generally held through Variable Accounts. Each Portfolio is available as an investment option under a number of different variable insurance products. Calvert monitors cashflows of each Portfolio to help detect market timing.

Owners of these variable insurance products transfer value among subaccounts of the insurance company separate accounts by contacting the Insurance Companies. The resulting purchases and redemptions of Portfolio shares are made through omnibus accounts of the Insurance Companies. The right of an owner of such a variable insurance product to transfer among subaccounts is governed by a contract between the Insurance

- 66 -

Company and such owner. Many of the Policies do not limit the number of transfers among the available underlying funds that a Policy owner may make. The terms of these contracts, the presence of financial intermediaries (including the Insurance Companies) between the Portfolio and Policy owners, the utilization of omnibus accounts by these intermediaries and other factors such as state insurance laws may limit the Portfolio’s ability to detect and deter market timing. Although the Fund has adopted policies and procedures to detect and prevent market timing in each Portfolio, because of the unlimited number of transfers permitted under some Policies, some Policy owners could engage in more frequent trading than others.

Calvert expects all financial intermediaries that maintain omnibus accounts to make reasonable efforts to identify and restrict the short-term trading activities of underlying participants in the Portfolio. Calvert will seek full cooperation from the financial intermediary maintaining the account to identify any underlying participant suspected of market timing. Calvert expects such intermediary to take immediate action to stop any further market timing activity in the Portfolio by such participant(s) or plan, or else the Portfolio will be withdrawn as an investment option for that account.

Each Portfolio and the distributor reserve the right at any time to reject or cancel any part of any purchase or exchange order (purchase side only), including any purchase or exchange order accepted by any Policy owner’s financial intermediary. In such case, orders are canceled within one business day, and the purchase price is returned to the investor. Each Portfolio and the Portfolios’ distributor also may modify any terms or conditions of purchase of shares of the Portfolio (upon prior notice), or withdraw all or any part of the offering of shares of the Portfolio.

Dividends and Distributions.It is the intention of each Portfolio to distribute substantially all of its net investment income, if any on an annual basis. For dividend purposes, net investment income of the Portfolio consists of all interest income and dividends declared on investments, less expenses. All net realized capital gains, if any, of the Portfolio are declared and distributed periodically, no less frequently than annually. All dividends and distributions are made to the Insurance Companies, not Policy owners, and are reinvested in additional shares of the Portfolio at NAV rather than cash.

Taxes.As a "regulated investment company" under the provisions of Subchapter M of the Internal Revenue Code, as amended, the Fund is not subject to federal income tax, nor to the federal excise tax imposed by the Tax Reform Act of 1986, to the extent that it distributes its net investment income and realized capital gains. Each Portfolio intends to distribute its net investment income and realized capital gains to the extent necessary to remain qualified as a regulated investment company. Since the only shareholders of the Portfolio are the Insurance Companies, no discussion is included herein as to the federal income tax consequences at the shareholder level. For information concerning the federal tax consequences to purchasers of the annuity or life insurance Policies, see the prospectuses for the Policies.

- 67 -

Each Portfolio also intends to comply with the diversification requirements of section 817 of the Code relating to the tax-deferred status of variable accounts that are based on insurance company separate accounts.

Disclaimers.

Frank Russell

The Russell 2000 Growth Index and the Russell 2000 Index is a trademark/service mark of the Frank Russell Company. Russell is a trademark of the Frank Russell Company. The Acquiring Portfolios are not promoted, sponsored or endorsed by, nor in any way affiliated with the Frank Russell Company. Frank Russell is not responsible for and has not reviewed this Prospectus/Proxy Statement, and Frank Russell makes no representation or warranty, express or implied, as to its accuracy, or completeness, or otherwise.

Frank Russell Company reserves the right, at any time and without notice, to alter, amend, terminate or in any way change its Index. Frank Russell has no obligation to take the needs of any particular fund or its participants or any other product or person into consideration in determining, composing or calculating the Index.

Frank Russell Company's publication of the Index in no way suggests or implies an opinion by Frank Russell Company as to the attractiveness or appropriateness of the investment in any or all securities upon which the Index is based. FRANK RUSSELL COMPANY MAKES NO REPRESENTATION, WARRANTY, OR GUARANTEE AS TO THE ACCURACY, COMPLETENESS, RELIABILITY, OR OTHERWISE OF THE INDEX OR DATA INCLUDED IN THE INDEX. FRANK RUSSELL COMPANY MAKES NO REPRESENTATION OR WARRANTY REGARDING THE USE, OR THE RESULTS OF USE, OF THE INDEX OR ANY DATA INCLUDED THEREIN, OR ANY SECURITY (OR COMBINATION THEREOF) COMPRISING THE INDEX. FRANK RUSSELL COMPANY MAKES NO OTHER EXPRESS OR IMPLIED WARRANTY, AND EXPRESSLY DISCLAIMS ANY WARRANTY OF ANY KIND, INCLUDING, WITHOUT MEANS OF LIMITATION, ANY WARRANTY OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE INDEX OR ANY DATA OR ANY SECURITY (OR COMBINATION THEREOF) INCLUDED THEREIN.

S&P

"Standard & Poor's®", "S&P®", "S&P 500®", "Standard & Poor's 500", "500", "S&P 500 Index", and "Standard & Poor's MidCap 400 Index" are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use by the Acquiring Portfolios. The Acquiring Portfolios are not sponsored, endorsed, sold or promoted by Standard & Poor's ("S&P"). S&P makes no representation or warranty, express or implied, to the beneficial owners of the Acquiring Portfolios or any member of the public regarding the advisability of investing in securities generally or in the Acquiring Portfolios particularly

- 68 -

or the ability of the S&P 500 Index or the S&P MidCap 400 Index to track general stock market performance. S&P's only relationship to the Acquiring Portfolios is the licensing of certain trademarks and trade names of S&P and of the S&P 500 Index and the S&P MidCap 400 Index which is determined, composed and calculated by S&P without regard to the Acquiring Portfolios. S&P has no obligation to take the needs of the Acquiring Portfolios or the beneficial owners of the Acquiring Portfolios into consideration in determining, composing or calculating the S&P 500 Index and the S&P MidCap 400 Index. S&P is not responsible for and has not participated in the determination of the prices and amount of the Acquiring Portfolios or the timing of the issuance or sale of the Acquiring Portfolios or in the determination or calculation of the equation by which the Acquiring Portfolios are to be converted into cash. S&P has no obligation or liability in connection with the administration, marketing or trading of the Acquiring Portfolios.

INFORMATION ON SHAREHOLDER RIGHTS

Each Merging Portfolio is a separate series of CVS, an open-end management investment company registered with the SEC under the 1940 Act that is organized as a Maryland corporation. Each Acquiring Portfolio is a series of CVP, an open-end management investment company registered with the SEC under the 1940 Act that is organized as a Maryland corporation. Based upon a comparison of the respective organizational documents (i.e., the Articles of Incorporation and By-Laws) of the Funds, there are no material differences with respect to shareholder rights.

The following provides a brief summary of certain aspects of the organizational documents of each Fund and is not a complete description of those documents or applicable law. For more complete information, shareholders should refer directly to the provisions of the Articles of Incorporation and By-Laws of the applicable Fund and Maryland and federal law.

Shareholder Liability.Under Maryland law, shareholders of each Portfolio have no personal liability for the acts or obligations of that Portfolio or of the applicable Fund.

Shareholder Meetings and Voting Rights.meetings of shareholders.

Neither Fund is required to hold annual

With respect to each Fund, a shareholder meeting may be called by the Chairman of the Board at any time at the direction of the Board, or by the Secretary of the Fund upon written request of the holders of not less than 25% of the outstanding shares entitled to vote at the meeting, or as required by law or regulation. A majority of the outstanding shares of each Merging Portfolio or Acquiring Portfolio entitled to vote, present in person or represented at the meeting by proxy, constitutes a quorum for consideration of a matter at a shareholders’ meeting. When a quorum is present at a meeting, a majority of the shares represented (greater than 50%) of each Merging Portfolio or Acquiring Portfolio, as applicable, is sufficient to act on a matter, unless a larger or different vote is required by law, including the 1940 Act. Shareholders of each Acquiring Portfolio or Merging Portfolio vote separately, by Portfolio, as to matters that affect only their particular

- 69 -

Portfolio. Each share of a Portfolio is entitled to one vote and each fractional share amount is entitled to a proportional fractional vote. Shares of each Portfolio have non-cumulative voting rights.

Liquidation.In the event of liquidation or dissolution, the shareholders of a Portfolio being liquidated are entitled to receive, when and as declared by the Board, the excess of the assets belonging to that Portfolio over the liabilities incurred by that Portfolio, distributed among the shareholders in proportion to the number of shares of such Portfolio held by them on the date of distribution.

Liability and Indemnification of Directors.A current or former member of the Board who is a party, or threatened to be made a party, to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of his or her service as a Board member may be indemnified against expenses, judgments, penalties, fines and amounts paid in settlement incurred in connection with such action, suit or proceeding if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the applicable Fund, and with respect to a criminal action or proceeding, had no reasonable cause to believe the conduct was unlawful. A Board member may not be indemnified against any liabilities to a Fund or its shareholders if he or she has been adjudged to have engaged in willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his or her office unless a court determines that indemnification is proper in view of the circumstances of the case. Indemnification, unless ordered by a court, may be made only after a determination that the Board member has met the applicable standard of conduct by: (i) a majority vote of a quorum of the Board members who are not parties to the action; (ii) a majority vote of a committee of the Board comprised of individuals who are not parties to the action; (iii) a special counsel selected by (a) a majority vote of a quorum of the Board members who are not parties to the action, (b) a majority vote of a committee of the Board comprised of individuals who are not parties to the action or (c) if there are fewer than two Board members who are not parties to the action, by the Board; or (iv) by the shareholders (without giving effect to any shares owned by or voted under the control of a Board member who is a party to the action).

GENERAL INFORMATION ABOUT THE PORTFOLIOS

Information about each Portfolio is included in a prospectus. Further information is included in each Portfolio’s Statement of Additional Information. The Prospectus and SAI for each Portfolio are dated April 30, 2013. The CVS/CVP SAI was revised on November 26, 2013. You may obtain additional copies of the Prospectus and SAI for a Portfolio, or copies of this Prospectus/Proxy Statement and the Reorganization SAI, by calling or writing the applicable Portfolio at the address and phone number appearing below. Semi-Annual and Annual Reports of each Portfolio are also available by writing the applicable Portfolio at 4550 Montgomery Avenue, Suite 1000N, Bethesda, Maryland 20814, or by calling 800-368-2745.

- 70 -

Adjournment.In the event that a quorum is not present at the Meeting with respect to any Merging Portfolio, the shareholders of that Merging Portfolio present or represented by proxy at the Meeting may adjourn the Meeting from time to time until a quorum is present. Any such adjournment will require the affirmative vote of a majority of those shares of the applicable Merging Portfolio represented at the Meeting in person or by proxy. In the event that a quorum is present but sufficient votes to approve the respective proposal described in this Prospectus/Proxy Statement are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies or to obtain the vote required for approval of the proxy proposal. If a quorum is present, and an adjournment is proposed, the persons named as proxies will vote those proxies which they are entitled to vote FOR the proxy proposal in favor of such an adjournment and will vote those proxies required to be voted AGAINST the proxy proposal against any such adjournment. A shareholder vote may be taken prior to adjournment of the Meeting on the applicable proxy proposal in this Prospectus/Proxy Statement if sufficient votes have been received and it is otherwise appropriate.

Vote Required.If a quorum is present at the Meeting, the affirmative vote of “a majority of the outstanding voting securities”, as defined in the 1940 Act, of each Merging Portfolio who are eligible to vote on the proxy proposal is required for approval of the applicable Reorganization Plan. This means that the proxy proposal must be approved by the lesser of:

1. 67% or more of the shares of that Merging Portfolio entitled to vote and present at the Meeting, if the holders of more than 50% of the outstanding shares entitled to vote are present in person or represented by proxy, or

2. more than 50% of the outstanding shares of that Merging Portfolio entitled to vote.

Method of Voting.In addition to voting in person at the Meeting, shareholders may also vote via the internet atwww.proxy-direct.com, via telephone by calling 1-866-298-8476 or by marking, signing, dating and mailing the proxy card received with this Prospectus/Proxy Statement. Timely, properly executed proxies will be voted as instructed by shareholders, and will be voted “FOR” the applicable proposal if the proxy contains no voting instructions.

Revocation.A shareholder may revoke his or her proxy at any time before it is exercised by: (1) delivering written notice of revocation addressed to the Secretary of CVS prior to the Meeting, (2) submitting, prior to the Meeting, a properly-executed proxy bearing a later date, or (3) attending and voting in person at the Meeting and giving oral notice of revocation to the Chairman of the Meeting. However, attendance in person at the Meeting, by itself, will not revoke a previously tendered proxy.

Abstentions and Broker Non-Votes.Proxies that reflect abstentions and “broker non-votes” will be counted as shares of the applicable Merging Portfolio that are present and entitled to vote for purposes of determining the presence of a quorum but do not represent votes cast with respect to a proposal. “Broker non-votes” are shares held by brokers or

- 72 -

EXHIBIT A

AGREEMENT AND PLAN OF REORGANIZATION

This AGREEMENT AND PLAN OF REORGANIZATION, dated as of January 29, 2014, is between Calvert Variable Series, Inc. (“CVS”), on behalf of Calvert VP Small Cap Growth Portfolio (the “Merging Portfolio”), and Calvert Variable Products, Inc. (“CVP”), on behalf of Calvert VP Russell 2000 Small Cap Index Portfolio (the “Acquiring Portfolio”).

This Agreement and Plan of Reorganization (the "Agreement" or "Plan") is intended to be and is adopted as a plan of reorganization and liquidation within the meaning of Section 368(a)(1) of the United States Internal Revenue Code of 1986, as amended (the “Code”). The reorganization and liquidation will consist of the transfer of all of the assets of the Merging Portfolio to the Acquiring Portfolio in exchange for common stock of the Acquiring Portfolio, and the distribution of the Acquiring Portfolio’s shares to the shareholders of the Merging Portfolio in complete liquidation of the Merging Portfolio, as provided herein, all upon the terms and conditions hereinafter set forth in this Agreement (the “Reorganization”).

In consideration of the mutual promises contained in this Agreement, the parties agree as follows:

1. SHAREHOLDER APPROVAL

Approval by Shareholders.A meeting of the Merging Portfolio shareholders shall be called and held for the purpose of acting on and authorizing the transactions contemplated in this Agreement. The Acquiring Portfolio shall furnish to the Merging Portfolio such data and information as shall be reasonably requested by the Merging Portfolio for inclusion in the information to be furnished to its shareholders in connection with the meeting.

2. REORGANIZATION

(a)Plan of Reorganization.The Merging Portfolio will convey, transfer, and deliver to the Acquiring Portfolio all of the then-existing assets and property of the Merging Portfolio including without limitation, all cash, securities, commodities and futures interests and dividends or interests receivable that are owned by the Merging Portfolio and any deferred or prepaid expenses shown as an asset on the books of the Merging Portfolio at the closing provided for in Section 2(b) of this Agreement (the "Closing"). In consideration thereof, the Acquiring Portfolio agrees at the Closing to deliver to the Merging Portfolio, in exchange for the assets, the number of full and fractional shares of Class I common stock of the Acquiring Portfolio (the “Acquiring Portfolio Shares") to be determined as follows:

A-1

In accordance with Section 3 of this Agreement, the number of the Acquiring Portfolio Shares to be issued shall be determined by dividing the per share net asset value of the Merging Portfolio shares (rounded to the nearest millionth) by the net asset value per share of the Acquiring Portfolio (rounded to the nearest millionth) and multiplying the quotient by the number of outstanding shares of the Merging Portfolio as of the close of business on the Closing date (the “Closing Date”). It is expressly agreed that there will be no sales charge to the Merging Portfolio, or to any of the shareholders of the Merging Portfolio upon distribution of the Acquiring Portfolio Shares to them.

(b)Closing and Effective Time of the Reorganization.The Closing shall occur at the Effective Time of the Reorganization, which shall be either:

(i) the latest of (x) the satisfaction of all representations and warranties contained herein, (y) receipt of all necessary regulatory approvals, and (z) the final adjournment of the meeting of shareholders of the Merging Portfolio at which the Plan will be considered, or

(ii) such later date as the parties may mutually agree.

(c) On or as soon as practicable prior to the Closing Date, the Merging Portfolio will declare and pay to its shareholders of record one or more dividends and/or other distributions so that it will have distributed substantially all (and in no event less than 98%) of its investment company taxable income (computed without regard to any deduction for dividends paid) and realized net capital gain, if any, for the current taxable year through the Closing Date.

3. VALUATION OF NET ASSETS

(a) The value of the Merging Portfolio’s assets to be transferred to the Acquiring Portfolio under this Agreement shall be computed as of the close of business (coinciding with the closing of the regular session of the New York Stock Exchange (“NYSE”) (normally 4:00 p.m. ET)) on the business day immediately preceding the Closing Date (hereinafter the "Valuation Date") using the valuation procedures as set forth in the Merging Portfolio's prospectus.

(b) The net asset value per share of the Acquiring Portfolio Shares for purposes of Section 2 of this Agreement shall be determined as of the close of business on the Valuation Date by the Acquiring Portfolio’s Controller using the same valuation procedures as set forth in the Acquiring Portfolio’s prospectus.

(c) A copy of the computation showing in reasonable detail the valuation of the Merging Portfolio’s net assets, using the valuation procedures as set forth in the Merging Portfolio's prospectus, to be transferred to the Acquiring Portfolio pursuant to Section 2 of this Agreement, certified by the Controller of the Merging Portfolio, shall be furnished by the Merging Portfolio to the Acquiring Portfolio at the Closing. A copy of the

A-2

computation showing in reasonable detail the determination of the net asset value per share of the Acquiring Portfolio Shares pursuant to Section 2 of this Agreement, certified by the Controller of the Acquiring Portfolio, shall be furnished by the Acquiring Portfolio to the Merging Portfolio at the Closing.

In the event that on the Valuation Date: (a) the NYSE or another primary trading market for portfolio securities of the Acquiring Portfolio or the Merging Portfolio (each, an “Exchange”) shall be closed to trading or trading thereupon shall be restricted, or (b) trading or the reporting of trading on such Exchange or elsewhere shall be disrupted so that, in the judgment of an officer of CVS and an officer of CVP, accurate appraisal of the value of the net assets of the Acquiring Portfolio or the Merging Portfolio is impracticable, the Closing Date shall be postponed until the first business day after the day when trading shall have been fully resumed and reporting shall have been restored.

CVP, on behalf of the Acquiring Portfolio, and CVS, on behalf of the Merging Portfolio, agree to use commercially reasonable efforts to resolve, prior to the Valuation Date, any material pricing differences between the prices of portfolio securities determined in accordance with the pricing policies and procedures of the Acquiring Portfolio and the Merging Portfolio.

4. LIQUIDATION AND DISSOLUTION

(a) As soon as practicable after the Closing Date, the Merging Portfolio will distribute pro rata to Merging Portfolio shareholders of record as of the close of business on the Closing Date the Acquiring Portfolio Shares received by the Merging Portfolio pursuant to Section 2(a) of this Agreement. Such liquidation and distribution will be accompanied by the establishment of shareholder accounts on the share records of the Acquiring Portfolio in the names of each such shareholder of the Merging Portfolio, representing the respective pro rata number of full and fractional Acquiring Portfolio Shares due to each. No such shareholder accounts shall be established by the Acquiring Portfolio or the transfer agent for the Acquiring Portfolio except pursuant to written instructions from the Merging Portfolio, and the Merging Portfolio agrees to provide on the Closing Date instructions to transfer to a shareholder account for each former Merging Portfolio shareholder a pro rata share of the number of the Acquiring Portfolio Shares received pursuant to Section 2(a) of this Agreement.

(b) Promptly after the distribution described in Section 4(a) above, appropriate notification will be mailed by the Acquiring Portfolio or its transfer agent to each shareholder of the Merging Portfolio receiving such distribution of the Acquiring Portfolio Shares informing such shareholder of the number of the Acquiring Portfolio Shares distributed to such shareholder and confirming the registration thereof in such shareholder's name.

(c) Share certificates representing the Acquiring Portfolio Shares shall not be issued in connection with the Reorganization. Ownership of the Acquiring Portfolio Shares will be shown on the books of the Acquiring Portfolio’s transfer agent.

A-3

(d)Shares to be Issued Upon Reorganization.The Acquiring Portfolio Shares to be issued in connection with the Reorganization have been duly authorized and upon consummation of the Reorganization will be validly issued, fully paid and non-assessable.

(e)Authority Relative to this Agreement.CVP has the power to enter into the Plan on behalf of the Acquiring Portfolio and to carry out its obligations under this Agreement. The execution and delivery of the Plan and the consummation of the transactions contemplated by this Plan have been duly authorized by the Board of Directors of CVP and no other proceedings by CVP are necessary to authorize its officers to effectuate the Plan and the transactions contemplated herein. The Acquiring Portfolio is not a party to or obligated under any charter, by-law, indenture, or contract provision or any other commitment or obligation, or subject to any order or decree, which would be violated by the execution and carrying out of the Plan.

(f)Liabilities.There are no liabilities of the Acquiring Portfolio, whether or not determined or determinable, other than the liabilities that will be disclosed or provided for in the Acquiring Portfolio’s financial statements for the period ended December 31, 2013 (the “Acquiring Portfolio Financial Statements”) and liabilities incurred in the ordinary course of business subsequent to December 31, 2013, or otherwise previously disclosed to the Merging Portfolio, none of which has been materially adverse to the business, assets or results of operations of the Acquiring Portfolio.

(g)Litigation.To the knowledge of the officers of CVP and the CVP Board of Directors there are no claims, actions, suits, or proceedings, pending or threatened, which would adversely affect the Acquiring Portfolio or its assets or business, or which would prevent or hinder consummation of the transactions contemplated by this Agreement.

(h)Contracts.Except for contracts and agreements previously disclosed to the Merging Portfolio under which no default exists, CVP on behalf of the Acquiring Portfolio is not a party to or subject to any material contract, debt instrument, plan, lease, franchise, license, or permit of any kind or nature whatsoever.

(i)Taxes.The federal income tax returns of the Acquiring Portfolio have been filed for all taxable years ending on or prior to the Closing Date, and all taxes payable pursuant to such returns have been paid. Since commencement of operations, the Acquiring Portfolio has qualified as a regulated investment company under the Code with respect to each taxable year of the Acquiring Portfolio ending on or prior to the Closing Date.

(j)Registration Statement.The Acquiring Portfolio shall have filed with the Securities and Exchange Commission (the "Commission") a Registration Statement under the Securities Act of 1933 ("Securities Act") relating to the Acquiring Portfolio Shares issuable under this Agreement. At the time the Registration Statement becomes effective, the Registration Statement:

A-5

(h)Contracts.Except for contracts and agreements previously disclosed to the Acquiring Portfolio under which no default exists, CVS, on behalf of the Merging Portfolio, is not a party to or subject to any material contract, debt instrument, plan, lease, franchise, license, or permit of any kind or nature whatsoever.

(i)Taxes.The federal income tax returns of the Merging Portfolio have been filed for all taxable years ending on or prior to the Closing Date, and all taxes payable pursuant to such returns have been paid. Since commencement of operations, the Merging Portfolio has qualified as a regulated investment company under the Code with respect to each taxable year of the Merging Portfolio ending on or prior to the Closing Date.

(j)Portfolio Securities.All securities to be listed in the schedule of investments of the Merging Portfolio as of the Effective Time of the Reorganization will be owned by CVS on behalf of the Merging Portfolio free and clear of any liens, claims, charges, options, and encumbrances, except as indicated in the schedule. Except as so indicated, none of the securities is, or after the Reorganization as contemplated by this Plan will be, subject to any legal or contractual restrictions on disposition (including restrictions as to the public offering or sale of the securities under the Securities Act), and all the securities are or will be readily marketable.

(k)Registration Statement.The Merging Portfolio will cooperate with the Acquiring Portfolio in connection with the Registration Statement referred to in Section 6(j) of this Agreement, and will furnish to the Acquiring Portfolio the information relating to the Merging Portfolio required by the Securities Act and the regulations promulgated thereunder to be set forth in the Registration Statement (including the Prospectus and Statement of Additional Information). At the time the Registration Statement becomes effective, the Registration Statement, insofar as it relates to the Merging Portfolio:

(i) will comply in all material respects with the provisions of the Securities Act and the Regulations, and

(ii) will not contain an untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading.

Further, at the time the Registration Statement becomes effective, at the time of the shareholders' meeting referred to in Section 1 and at the Effective Time of the Reorganization, the Prospectus and Statement of Additional Information included therein, as amended or supplemented by any amendments or supplements filed by the Acquiring Portfolio, insofar as it relates to the Merging Portfolio, will not contain any untrue statement of a material fact or omit to state any material fact necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading; provided, however, that the representations and warranties in this subsection shall apply only to statements in or omissions from the Registration Statement or

A-8

shareholders of the Merging Portfolio in liquidation of the Merging Portfolio will constitute a “reorganization” within the meaning of §368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and the Acquiring Portfolio and the Merging Portfolio will each be “a party to the Reorganization” within the meaning of §368(b) of the Code.

(ii) No gain or loss will be recognized by the Acquiring Portfolio upon the receipt of the assets of the Merging Portfolio solely in exchange for Acquiring Portfolio shares.

(iii) No gain or loss will be recognized by the Merging Portfolio upon the transfer of its assets to the Acquiring Portfolio in exchange for Acquiring Portfolio shares, or upon the distribution (whether actual or constructive) of such Acquiring Portfolio shares to the separate accounts as shareholders of the Merging Portfolio in exchange for their Merging Portfolio shares.

(iv) No gain or loss will be recognized by the separate accounts as shareholders of the Merging Portfolio upon the exchange of their Merging Portfolio shares for Acquiring Portfolio shares in liquidation of the Merging Portfolio.

(v) The aggregate tax basis of Acquiring Portfolio shares received by each separate account as a shareholder of the Merging Portfolio pursuant to the Reorganization will be the same as the aggregate tax basis of the Merging Portfolio shares held by such separate account shareholder immediately prior to the Reorganization, and the holding period of the Acquiring Portfolio shares received by each separate account as a shareholder of the Merging Portfolio will include the period during which the Merging Portfolio shares exchanged therefor were held by such separate account shareholder (provided the Merging Portfolio shares were held as a capital asset on the date of the Reorganization).

(vi) The tax basis of the assets of the Merging Portfolio acquired by the Acquiring Portfolio will be the same as the tax basis of those assets to the Merging Portfolio immediately prior to the Reorganization, and the holding period of the assets of the Merging Portfolio in the hands of the Acquiring Portfolio will include the period during which those assets were held by the Merging Portfolio.

(vii) The Acquiring Portfolio will succeed to and take into account the capital loss carryovers of the Merging Portfolio described in section 381(c) of the Code. The Acquiring Portfolio will take any such capital loss carryovers into account subject to the conditions and limitations

A-10

specified in sections 381, 382, 383 and 384 of the Code and regulations thereunder.

(d)Opinion of Counsel.The Acquiring Portfolio shall have received the opinion of counsel for the Merging Portfolio, dated as of the Effective Time of the Reorganization, addressed to and in form and substance satisfactory to the Acquiring Portfolio, to the effect that:

(i) CVS is an open-end management company registered under the Securities Act of 1933 and the Investment Company Act of 1940, and is duly organized and validly existing in good standing under the laws of the State of Maryland;

(ii) The Merging Portfolio is a series of CVS; and

(iii) The Plan and the execution and filing of the Plan have been duly authorized and approved by all requisite action by the Board of Directors of CVS, and the Plan has been duly executed and delivered by CVS on behalf of the Merging Portfolio and, assuming due authorization, execution, and delivery of the Plan by CVP on behalf of the Acquiring Portfolio, is a valid and binding obligation of CVS and its series, the Merging Portfolio.

9. CONDITIONS TO OBLIGATIONS OF THE MERGING PORTFOLIO

The obligations of the Merging Portfolio under this Agreement with respect to the consummation of the Reorganization are subject to the satisfaction of the following conditions:

(a)Shareholder Approval.The Plan shall have been approved by the affirmative vote of a majority of the outstanding voting securities of the Merging Portfolio as required by the Act. This means that the Plan must be approved by the lesser of: (i) 67% of the shares of the Merging Portfolio entitled to vote and present at a meeting if the holders of more than 50% of the outstanding shares entitled to vote are present in person or by proxy; or (ii) more than 50% of the outstanding shares of the Merging Portfolio entitled to vote.

(b)Representations, Warranties and, Agreements.As of the Effective Time of the Reorganization, the Acquiring Portfolio shall have complied with each of its responsibilities under this Agreement, the representations and warranties contained in this Agreement shall be true in all material respects, and there shall have been no material adverse change in the financial condition, results of operations, business, properties, or assets of the Acquiring Portfolio since December 31, 2013. As of the Effective Time of the Reorganization, the Merging Portfolio shall have received a certificate from the Acquiring Portfolio satisfactory in form and substance to the Merging Portfolio indicating that the Acquiring Portfolio has met the terms stated in this Section.

(c)Regulatory Approval.The Registration Statement referred to in Section 6(j) shall have been declared effective by the Commission and no stop orders under the Securities

A-11

Act pertaining thereto shall have been issued; all necessary orders of exemption under the Act with respect to the transactions contemplated by this Agreement shall have been granted by the Commission; and all approvals, registrations, and exemptions under federal and state securities laws considered to be necessary shall have been obtained.

(d)Tax Opinion.The Merging Portfolio shall have received the opinion of counsel, addressed to and in form and substance satisfactory to the Merging Portfolio, as to certain of the federal income tax consequences of the Reorganization under the Internal Revenue Code to the Merging Portfolio and its shareholders. For purposes of rendering its opinion, counsel may rely exclusively and without independent verification, as to factual matters, on the statements made in the Plan, the proxy statement which will be distributed to the shareholders of the Merging Portfolio in connection with the Reorganization, and on such other written representations as the Merging Portfolio and the Acquiring Portfolio will have verified as of the date of issuance of the tax opinion. The opinion of counsel will be to the effect that, based on the facts and assumptions stated therein, for federal income tax purposes, and while the matter is not entirely free from doubt:

(i) The transfer of all of the assets of the Merging Portfolio in exchange for shares of the Acquiring Portfolio followed by the distribution of said Acquiring Portfolio shares pro rata to the separate accounts as shareholders of the Merging Portfolio in liquidation of the Merging Portfolio will constitute a “reorganization” within the meaning of §368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and the Acquiring Portfolio and the Merging Portfolio will each be “a party to the Reorganization” within the meaning of §368(b) of the Code.

(ii) No gain or loss will be recognized by the Acquiring Portfolio upon the receipt of the assets of the Merging Portfolio solely in exchange for Acquiring Portfolio shares.

(iii) No gain or loss will be recognized by the Merging Portfolio upon the transfer of its assets to the Acquiring Portfolio in exchange for Acquiring Portfolio shares, or upon the distribution (whether actual or constructive) of such Acquiring Portfolio shares to the separate accounts as shareholders of the Merging Portfolio in exchange for their Merging Portfolio shares.

(iv) No gain or loss will be recognized by the separate accounts as shareholders of the Merging Portfolio upon the exchange of their Merging Portfolio shares for Acquiring Portfolio shares in liquidation of the Merging Portfolio.

(v) The aggregate tax basis of Acquiring Portfolio shares received by each separate account as a shareholder of the Merging Portfolio pursuant to the Reorganization will be the same as the aggregate tax basis of the

A-12

Merging Portfolio shares held by such separate account shareholder immediately prior to the Reorganization, and the holding period of the Acquiring Portfolio shares received by each separate account as a shareholder of the Merging Portfolio will include the period during which the Merging Portfolio shares exchanged therefor were held by such separate account shareholder (provided the Merging Portfolio shares were held as a capital asset on the date of the Reorganization).

(vi) The tax basis of the assets of the Merging Portfolio acquired by the Acquiring Portfolio will be the same as the tax basis of those assets to the Merging Portfolio immediately prior to the Reorganization, and the holding period of the assets of the Merging Portfolio in the hands of the Acquiring Portfolio will include the period during which those assets were held by the Merging Portfolio.

(vii) The Acquiring Portfolio will succeed to and take into account the capital loss carryovers of the Merging Portfolio described in section 381(c) of the Code. The Acquiring Portfolio will take any such capital loss carryovers into account subject to the conditions and limitations specified in sections 381, 382, 383 and 384 of the Code and regulations thereunder.

(e)Opinion of Counsel.The Merging Portfolio shall have received the opinion of counsel for the Acquiring Portfolio, dated as of the Effective Time of the Reorganization, addressed to and in form and substance satisfactory to the Merging Portfolio, to the effect that:

(i) CVP is an open-end management company registered under the Securities Act of 1933 and the Investment Company Act of 1940, and is duly organized and validly existing in good standing under the laws of the State of Maryland;

(ii) The Acquiring Portfolio is a series of CVP;

(iii) The Plan and the execution and filing of the Plan have been duly authorized and approved by all requisite action by the Board of Directors of CVP, and the Plan has been duly executed and delivered by CVP on behalf of the Acquiring Portfolio and, assuming due authorization, execution, and delivery of the Plan by CVS on behalf of the Merging Portfolio, is a valid and binding obligation of CVP and its series, the Acquiring Portfolio; and

(iv) the Acquiring Portfolio Shares to be issued pursuant to the Reorganization have been duly authorized and upon issuance thereof in accordance with the Plan and CVP’s Articles of Incorporation and By-Laws will be legally issued, fully paid and non-assessable shares of beneficial interest of the Acquiring Portfolio.

A-13

10. AMENDMENTS, TERMINATIONS, NON-SURVIVAL OF COVENANTS, WARRANTIES AND REPRESENTATIONS

(a) The parties hereto may, by agreement in writing authorized by the Board of Directors of each party, amend the Plan at any time before or after approval of the Plan by shareholders of the Merging Portfolio, but after such approval, no amendment shall be made that materially changes the terms of this Agreement.

(b) At any time prior to the Effective Time of the Reorganization, any of the parties may by written instrument signed by it: (i) waive any inaccuracies in the representations and warranties made pursuant to this Agreement, and (ii) waive compliance with any of the covenants or conditions made for its benefit pursuant to this Agreement.

(c) The Merging Portfolio may terminate the Plan at any time prior to the Effective Time of the Reorganization by notice to the Acquiring Portfolio if: (i) a material condition to its performance under this Agreement or a material covenant of the Acquiring Portfolio contained in this Agreement is not fulfilled on or before the date specified for the fulfillment thereof, or (ii) a material default or material breach of the Plan is made by the Acquiring Portfolio.

(d) the Acquiring Portfolio may terminate the Plan at any time prior to the Effective Time of the Reorganization by notice to the Merging Portfolio if: (i) a material condition to its performance under this Agreement or a material covenant of the Merging Portfolio contained in this Agreement is not fulfilled on or before the date specified for the fulfillment thereof, or (ii) a material default or material breach of the Plan is made by the Merging Portfolio.

(e) The Plan may be terminated by either party at any time prior to the Effective Time of the Reorganization upon notice to the other party, whether before or after approval by the shareholders of the Merging Portfolio, without liability on the part of either party hereto or its respective Directors, officers, or shareholders, and shall be terminated without liability as of the close of business on December 31, 2014, if the Effective Time of the Reorganization is not on or prior to such date.

(f) No representations, warranties, or covenants in or pursuant to the Plan shall survive the Reorganization.

11. EXPENSES

Each Portfolio will bear its own expenses incurred in connection with this Reorganization.

12. GENERAL

This Plan supersedes all prior agreements between the parties (written or oral), is intended as a complete and exclusive statement of the terms of the Plan between the

A-14

parties and may not be changed or terminated orally. The Plan may be executed in one or more counterparts, all of which shall be considered one and the same agreement, and shall become effective when one or more counterparts have been executed by each party and delivered to the parties hereto. The headings contained in the Plan are for reference purposes only and shall not affect in any way the meaning or interpretation of the Plan. Nothing in the Plan, expressed or implied, is intended to confer upon any other person any rights or remedies by reason of the Plan.

A-15

A-16

EXHIBIT B

AGREEMENT AND PLAN OF REORGANIZATION

This AGREEMENT AND PLAN OF REORGANIZATION, dated as of January 29, 2014, is between Calvert Variable Series, Inc. (“CVS”), on behalf of Calvert VP SRI Equity Portfolio (the “Merging Portfolio”), and Calvert Variable Products, Inc. (“CVP”), on behalf of Calvert VP S&P 500 Index Portfolio (the “Acquiring Portfolio”).

This Agreement and Plan of Reorganization (the "Agreement" or "Plan") is intended to be and is adopted as a plan of reorganization and liquidation within the meaning of Section 368(a)(1) of the United States Internal Revenue Code of 1986, as amended (the “Code”). The reorganization and liquidation will consist of the transfer of all of the assets of the Merging Portfolio to the Acquiring Portfolio in exchange for common stock of the Acquiring Portfolio, and the distribution of the Acquiring Portfolio’s shares to the shareholders of the Merging Portfolio in complete liquidation of the Merging Portfolio, as provided herein, all upon the terms and conditions hereinafter set forth in this Agreement (the “Reorganization”).

In consideration of the mutual promises contained in this Agreement, the parties agree as follows:

1. SHAREHOLDER APPROVAL

Approval by Shareholders.A meeting of the Merging Portfolio shareholders shall be called and held for the purpose of acting on and authorizing the transactions contemplated in this Agreement. The Acquiring Portfolio shall furnish to the Merging Portfolio such data and information as shall be reasonably requested by the Merging Portfolio for inclusion in the information to be furnished to its shareholders in connection with the meeting.

2. REORGANIZATION

(a)Plan of Reorganization.The Merging Portfolio will convey, transfer, and deliver to the Acquiring Portfolio all of the then-existing assets and property of the Merging Portfolio including without limitation, all cash, securities, commodities and futures interests and dividends or interests receivable that are owned by the Merging Portfolio and any deferred or prepaid expenses shown as an asset on the books of the Merging Portfolio at the closing provided for in Section 2(b) of this Agreement (the "Closing"). In consideration thereof, the Acquiring Portfolio agrees at the Closing to deliver to the Merging Portfolio, in exchange for the assets, the number of full and fractional shares of common stock of the Acquiring Portfolio (the “Acquiring Portfolio Shares") to be determined as follows:

B-1

In accordance with Section 3 of this Agreement, the number of the Acquiring Portfolio Shares to be issued shall be determined by dividing the per share net asset value of the Merging Portfolio shares (rounded to the nearest millionth) by the net asset value per share of the Acquiring Portfolio (rounded to the nearest millionth) and multiplying the quotient by the number of outstanding shares of the Merging Portfolio as of the close of business on the Closing date (the “Closing Date”). It is expressly agreed that there will be no sales charge to the Merging Portfolio, or to any of the shareholders of the Merging Portfolio upon distribution of the Acquiring Portfolio Shares to them.

(b)Closing and Effective Time of the Reorganization.The Closing shall occur at the Effective Time of the Reorganization, which shall be either:

(i) the latest of (x) the satisfaction of all representations and warranties contained herein, (y) receipt of all necessary regulatory approvals, and (z) the final adjournment of the meeting of shareholders of the Merging Portfolio at which the Plan will be considered, or

(ii) such later date as the parties may mutually agree.