Fund Performance as of October 31, 2005 (excluding sales charges) (unaudited)

| | | | | Since Inception on |

| | | 6 Months | 1/5/05-10/31/05 |

|

| Emerging Markets Equity Fund-Class A Shares | | 13.70 | % | | 15.00 | % |

|

| MSCI Emerging Markets Index | | 17.96 | % | | 20.58 | % |

|

| | | 6 Months | 12/31/04-10/31/05 |

|

| Lipper Emerging Markets Funds Category Average | | 17.42 | % | | 16.33 | % |

|

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.citigroupam.com.

Current reimbursements and/or fee waivers are voluntary, and may be reduced or terminated at any time. Absent these reimbursements or waivers, the performance would have been lower.

All share class returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply when shares are purchased or the deduction of taxes that a shareholder would pay on Fund distributions. Excluding sales charges, Class B shares returned –0.88% since inception on 8/11/05-10/31/05, Class C shares returned –1.75% since inception on 9/7/05-10/31/05 and Class Y shares returned 14.06% over the six months ended October 31, 2005. Excluding sales charges, Class Y shares returned 15.26% since inception on 1/3/05-10/31/05.

Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the period ended October 31, 2005, including the reinvestment of distributions, including returns of capital, if any, calculated among the 192 funds for the six-month period and among the 188 funds in the Fund’s Lipper category and excluding sales charges for the period from 12/31/04-10/31/05.

Q. What were the most significant factors affecting Fund performance? What were the leading contributors to performance?

A. In terms of country allocations, our overweights in Brazil, Russia, and Korea contributed positively to performance as these markets outperformed the Index. Our underweight position in Indonesia also helped relative performance as its market fell over the period.

Stock selection in Turkey, South Africa, Poland, and Indonesia outperformed their respective local markets and, therefore, contributed positively to returns. Within Turkey, the largest contributors were Yapi ve Kredi Bankasi, Turkiye Garanti Bankasi, and Dogan Yayin Holding. Within South Africa, underweights in Sanlam and Old Mutual enhanced results and our Indonesian holding Hanjaya Mandala Sampoerna was another noteworthy contributor to performance. All of the above securities were eliminated from the portfolio over the period.

Other stocks that significantly benefited the Fund were Petroleo Brasileiro and TAM from Brazil, which rose 62.3% and 103.7%, respectively over the reporting period. In Korea, Shinhan Financial Group, KT&G Corp., and Korea Electric Power rose 48.0%, 37.3%, and 25.8%, respectively. Having no exposure to Taiwanese stocks China Steel and China Development Financial Holding helped relative performance as well, as these stocks fell 17.0% and 35.2%, respectively.

What were the leading detractors from performance?

A. From a country perspective, overweights in Taiwan and Thailand were negative contrib utors to performance as they both lagged the Index during the period. In addition, our underweight positions in Mexico, Egypt, Argentina, and Jordan hurt results as these markets outperformed the Index over the same period.

4 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

Stock selection in Brazil, Russia, Korea, Mexico, and China underperformed their respective local indices and, therefore, were negative contributors to relative performance. Not owning Banco Bradesco in Brazil was the largest negative stock contributor. Within Korea, the largest stock detractors were our overweight in SK Telecom and underweight in Hyundai Motor. Our underweight positions in strongly performing Mexican stocks Cemex and America Movil also hurt returns. In China, overweights in Yanzhou Coal Mining and Huaneng Power International, and an underweight in PetroChina detracted from relative performance. PetroChina was eliminated from the portfolio over the period.

Other holdings that negatively impacted results were our overweights in Taiwan-based Quanta Computer Inc., United Microelectronics, Far Eastern Textile, and Cathay Financial Holding. Not owning Orascom Holding (Egypt) and Tenaris (Argentina) also hurt performance as these stocks rose sharply over the period.

Q. Were there any significant changes to the Fund during the reporting period?

A. There were no significant changes to the Fund during the period.

Thank you for your investment in the Smith Barney Emerging Markets Equity Fund. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Acquico Wen

Portfolio Manager

December 1, 2005

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

Portfolio holdings and breakdowns are as of October 31, 2005 and are subject to change and may not be representative of the portfolio manager’s current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of October 31, 2005 were: Samsung Electronics Co., Ltd. (6.0%), Petroleo Brasileiro SA, Sponsored ADR (5.1%), Taiwan Semiconductor Manufacturing Co., Ltd. (3.1%), Standard Bank Group Ltd. (2.5%), Shinhan Financial Group Co., Ltd. (2.5%), Cathay Financial Holding Co., Ltd. (2.3%), Kookmin Bank (2.0%), Companhia Vale do Rio Doce, Sponsored ADR (1.9%), Hon Hai Precision Industry Co., Ltd. (1.8%) and Chinatrust Financial Holdings Co. Ltd. (1.7%) . Please refer to pages 11 through 15 for a list and percentage breakdown of the Fund’s holdings.

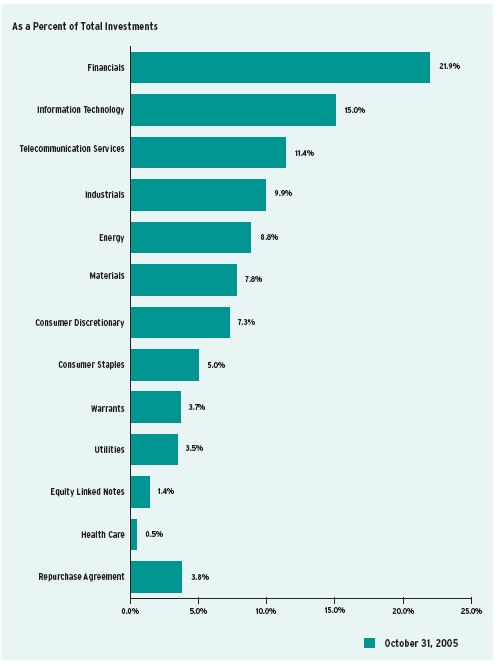

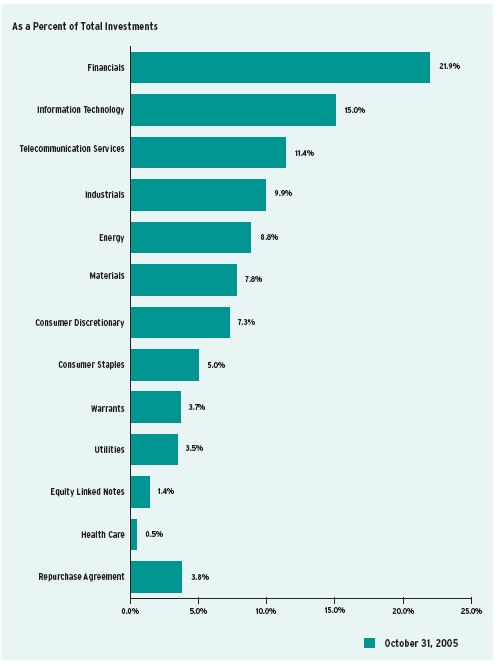

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the portfolio manager’s current or future investments. The Fund’s top five sector holdings (as a percentage of net assets) as of October 31, 2005 were: Financials (21.9%), Information Technology (15.1%), Telecommunication Services (11.4%), Industrials (10.0%) and Energy (8.8%) . The Fund’s portfolio composition is subject to change at any time.

RISKS: The Fund may invest in foreign securities. Investing in foreign securities is subject to certain risks not associated with domestic investing, such as currency fluctuations, and changes in political and economic conditions. These risks are magnified in emerging or developing markets. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact of fund performance. Please see the Fund’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an index.

| i | The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The index measures the performance of emerging markets in Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela. |

| |

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 5

Fund at a Glance (unaudited)

Investment Breakdown

6 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

Fund Expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments, reinvested distributions, including returns of capital, if any; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on May 1, 2005 and held for the period ended October 31, 2005.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| Based on Actual Total Return(1) |

| | | Actual | | | | | | | | | |

| | | Total Return | | Beginning | | Ending | | Annualized | | Expenses |

| | | Without | | Account | | Account | | Expense | | Paid During |

| | | Sales Charges(2) | | Value | | Value | | Ratio | | the Period(3) |

|

| Class A | | 13.70 | % | | $1,000.00 | | $1,137.00 | | 2.00 | % | | $10.77 |

|

| Class B | | (0.88 | ) | | 1,000.00 | | 991.20 | | 2.75 | | | 6.08 |

|

| Class C | | (1.75 | ) | | 1,000.00 | | 982.50 | | 2.75 | | | 4.03 |

|

| Class Y | | 14.06 | | | 1,000.00 | | 1,140.60 | | 1.34 | | | 7.23 |

| |

| (1) | For the six months ended October 31, 2005 for Class A and Y shares and for the period August 11, 2005, and September 7, 2005 (inception dates) for Class B and C shares, respectively, through October 31, 2005. |

| |

| (2) | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class B and C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| |

| (3) | Expenses (net of voluntary fee waiver and/or expense reimbursements) are equal to each class’ respective annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the period, then divided by 365. |

| |

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 7

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| Based on Hypothetical Total Return(1) |

| | | Hypothetical | | Beginning | | Ending | | Annualized | | Expenses |

| | | Annualized | | Account | | Account | | Expense | | Paid During |

| | | Total Return | | Value | | Value | | Ratio | | the Period(2) |

|

| Class A | | 5.00 | % | | $1,000.00 | | $1,015.12 | | 2.00 | % | | $10.16 |

|

| Class B | | 5.00 | | | 1,000.00 | | 1,004.99 | | 2.75 | | | 6.12 |

|

| Class C | | 5.00 | | | 1,000.00 | | 1,003.33 | | 2.75 | | | 4.08 |

|

| Class Y | | 5.00 | | | 1,000.00 | | 1,018.45 | | 1.34 | | | 6.82 |

|

| (1) | For the six months ended October 31, 2005 for Class A and Y shares and for the period August 11, 2005, and September 7, 2005 (inception dates) for Class B and C shares, respectively, through October 31, 2005. |

| |

| (2) | Expenses (net of voluntary waiver and/or expense reimbursements) are equal to each class’ respective annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the period, then divided by 365. |

| |

8 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

| Fund Performance |

|

| Average Annual Total Returns† (unaudited) |

| | | Without Sales Charges(1) |

| |

|

| | | Class A | | Class B | | Class C | | Class Y |

|

| Inception* through 10/31/05 | | 15.00 | % | | (0.88 | )% | | (1.75 | )% | | 15.26 | % |

|

| |

| | | With Sales Charges(2) |

| |

|

| | | Class A | | Class B | | Class C | | Class Y |

|

| Inception* through 10/31/05 | | 9.25 | % | | (5.83 | )% | | (2.74 | )% | | 15.26 | % |

|

|

| Cumulative Total Returns† (unaudited) |

|

| | Without Sales Charges(1) |

|

| Class A (Inception* through 10/31/05) | 15.00 | % |

|

| Class B (Inception* through 10/31/05) | (0.88 | ) |

|

| Class C (Inception* through 10/31/05) | (1.75 | ) |

|

| Class Y (Inception* through 10/31/05) | 15.26 | |

|

| † | All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| | |

| (1) | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect deduction of all applicable sales charges with respect to Class A shares or the applicable contingent deferred sales charge (“CDSC”) with respect to Class B and C shares. |

| |

| (2) | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. In addition, Class A shares reflect the deduction of the maximum sales charges of 5.00%; Class B shares reflect the deduction of a 5.00% CDSC, which applies if shares are redeemed within one year from purchase payment and declines thereafter by 1.00% per year until no CDSC is incurred. Class C shares also reflect the deduction of 1.00% CDSC, which applies if shares are redeemed within one year of purchase payment. |

| | |

| * | Inception dates for Class A, B, C and Y shares are January 5, 2005, August 11, 2005, September 7, 2005 and January 3, 2005, respectively. |

| |

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 9

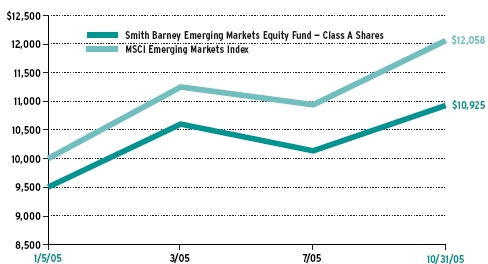

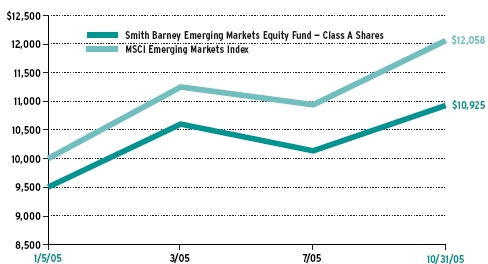

Historical Performance (unaudited)

Value of $10,000 Invested in Class A Shares of the Smith Barney

Emerging Markets Equity Fund vs. MSCI Emerging Markets Index†

(January 5, 2005 – October 31, 2005)

| † | Hypothetical illustration of $10,000 invested in Class A shares at inception on January 5, 2005, assuming deduction of the maximum 5.00% sales charge at the time of investment and reinvestment of all distributions, including returns of capital, if any, through October 31, 2005. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The index is unmanaged and is not subject to the same management and trading expenses as a mutual fund. The performance of the Fund’s other classes may be greater or less than the performance of Class A shares indicated on this chart, depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in other classes. All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

10 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

|

| Schedule of Investments (October 31, 2005) |

|

| SMITH BARNEY EMERGING MARKETS EQUITY FUND |

|

| Shares | | Security | | Value |

|

| COMMON STOCKS — 89.0% | | |

| Brazil — 12.6% | | |

| 4,500 | | Banco do Brasil SA | $ | 82,864 |

| 3,900 | | Banco Nossa Caixa SA* | | 64,704 |

| 4,500 | | Brasil Telecom Participacoes SA, Sponsored ADR | | 187,245 |

| 11,957 | | Companhia Brasileira de Distribuicao Grupo | | |

| | | Pao de Acucar, Sponsored ADR | | 329,535 |

| 12,800 | | Companhia Vale do Rio Doce, Sponsored ADR | | 472,320 |

| 9,700 | | Cyrela Brazil Realty SA | | 76,366 |

| 900 | | EDP — Energias do Brasil SA* | | 8,967 |

| 18,000 | | Grendene SA | | 141,790 |

| 22,318 | | Petroleo Brasileiro SA, Sponsored ADR | | 1,280,384 |

| 10,400 | | Tele Centro Oeste Celular Participacoes SA, Sponsored ADR | | 94,120 |

| 4,216 | | Tele Norte Leste Participacoes SA, Sponsored ADR | | 74,623 |

| 39,900 | | Telesp Celular Participacoes SA, Sponsored ADR | | 145,635 |

| 4,058 | | Tim Participacoes SA, ADR | | 82,256 |

| 500 | | Ultrapar Participacoes SA, Sponsored ADR | | 7,830 |

| 9,400 | | Votorantim Celulose e Papel SA, Sponsored ADR | | 112,518 |

|

| | | Total Brazil | | 3,161,157 |

|

| Cayman Islands — 0.5% | | |

| 1,700 | | Netease.com Inc. ADR* | | 129,659 |

|

| Chile — 0.6% | | |

| 25,108,195 | | CorpBanca SA | | 139,785 |

|

| China — 2.4% | | |

| 201,500 | | China Shenhua Energy Co., Ltd, Class H Shares* (a) | | 221,338 |

| 382,000 | | Huaneng Power International, Inc., Class H Shares (a) | | 255,784 |

| 59,500 | | Weiqiao Textile Co., Ltd., Class H Shares (a) | | 72,185 |

| 98,800 | | Yanzhou Coal Mining Co., Ltd., Class H Shares (a) | | 63,470 |

|

| | | Total China | | 612,777 |

|

| Colombia — 0.6% | | |

| 6,200 | | BanColombia SA, Sponsored ADR | | 146,940 |

|

| Czech Republic — 1.3% | | |

| 6,900 | | Komercni Banka AS, Sponsored GDR | | 321,747 |

|

| Hong Kong — 4.3% | | |

| 66,000 | | China Merchants Holdings International Co., Ltd. (a) | | 127,993 |

| 45,000 | | China Mobile (Hong Kong) Ltd. (a) | | 201,355 |

| 18,000 | | China Netcom Group Corp. (Hong Kong), Ltd. (a) | | 28,463 |

| 412,000 | | China Overseas Land & Investment Ltd. (a) | | 126,550 |

| 162,000 | | China Resources Enterprise Ltd. (a) | | 240,223 |

| 524,400 | | CNOOC Ltd. (a) | | 340,544 |

|

| | | Total Hong Kong | | 1,065,128 |

|

See Notes to Financial Statements.

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 11

|

| Schedule of Investments (October 31, 2005) (continued) | | |

|

| Shares | | Security | | Value |

|

| Indonesia — 0.5% | | |

| 52,000 | | PT Gudang Garam Tbk (a) | $ | 52,455 |

| 128,000 | | PT Indonesian Satellite Corp. Tbk. (a) | | 61,640 |

|

| | | Total Indonesia | | 114,095 |

|

| Israel — 2.6% | | |

| 87,262 | | Bank Hapoalim Ltd. (a) | | 334,130 |

| 100,606 | | Bank Leumi Le-Israel (a) | | 328,398 |

|

| | | Total Israel | | 662,528 |

|

| Malaysia — 4.3% | | |

| 200 | | British American Tobacco (Malaysia) Berhad (a) | | 1,988 |

| 97,100 | | Gamuda Berhad (a) | | 98,321 |

| 32,100 | | Genting Berhad (a) | | 175,274 |

| 29,481 | | IJM Corp. Berhad (a) | | 37,498 |

| 156,500 | | Magnum Corp. Berhad (a) | | 81,668 |

| 94,200 | | PLUS (Projek Lebuhraya Utara Selatan) Expressways Berhad (a) | | 76,318 |

| 128,000 | | Telekom Malaysia Berhad (a) | | 333,762 |

| 99,100 | | Tenaga Nasional Berhad (a) | | 262,107 |

|

| | | Total Malaysia | | 1,066,936 |

|

| Mexico — 3.6% | | |

| 37,100 | | Consorcio ARA SA de CV | | 136,881 |

| 52,500 | | Grupo Bimbo SA de CV, Series A Shares | | 173,946 |

| 21,269 | | Grupo Financiero Banorte SA de CV, Series O Shares | | 181,250 |

| 49,300 | | Grupo Modelo SA de CV, Series C Shares | | 151,281 |

| 12,900 | | Telefonos de Mexico SA de CV, Series L Shares, Sponsored ADR | | 260,322 |

|

| | | Total Mexico | | 903,680 |

|

| Netherlands — 0.5% | | |

| 2,870 | | Zentiva NV, GDR (a) | | 125,562 |

|

| Russia — 5.8% | | |

| 16,511 | | AFK Sistema, Registered Shares, Sponsored GDR (a) | | 369,553 |

| 1,999 | | AO VimpelCom, Sponsored ADR* | | 79,960 |

| 830 | | Gazprom, Registered Shares, Sponsored GDR | | 49,053 |

| 5,345 | | LUKOIL, Sponsored ADR | | 293,975 |

| 11,500 | | Mobile TeleSystems, Sponsored ADR | | 425,385 |

| 5,022 | | Surgutneftegaz, Sponsored ADR | | 236,034 |

|

| | | Total Russia | | 1,453,960 |

|

| South Africa — 6.0% | | |

| 12,188 | | Barloworld Ltd. (a) | | 190,806 |

| 768 | | Impala Platinum Holdings Ltd. (a) | | 83,808 |

| 13,536 | | Massmart Holdings Ltd. (a) | | 104,442 |

| 45,487 | | MTN Group Ltd. (a) | | 338,694 |

| 17,000 | | Sappi Ltd. (a) | | 164,887 |

| 60,481 | | Standard Bank Group Ltd. (a) | | 623,301 |

|

| | | Total South Africa | | 1,505,938 |

|

See Notes to Financial Statements.

12 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

|

| Schedule of Investments (October 31, 2005) (continued) | | |

|

| Shares | | Security | | Value |

|

| South Korea — 21.3% | | |

| 510 | | Cheil Communications, Inc. (a) | $ | 94,038 |

| 2,530 | | Hyundai Mobis (a) | | 201,975 |

| 5,320 | | Hyundai Motor Co. (a) | | 392,435 |

| 8,930 | | Kookmin Bank (a) | | 512,369 |

| 10,640 | | Korea Electric Power Corp. (a) | | 347,057 |

| 10,850 | | KT Corp., Sponsored ADR | | 233,818 |

| 9,430 | | KT&G Corp. (a) | | 386,115 |

| 3,840 | | LG Electronics, Inc. (a) | | 251,081 |

| 1,419 | | POSCO (a) | | 289,254 |

| 2,814 | | Samsung Electronics Co., Ltd. (a) | | 1,500,327 |

| 18,420 | | Shinhan Financial Group Co., Ltd. (a) | | 617,588 |

| 560 | | Shinsegae Co., Ltd. (a) | | 201,115 |

| 15,518 | | SK Telecom Co., Ltd., Sponsored ADR | | 313,619 |

|

| | | Total South Korea | | 5,340,791 |

|

| Taiwan — 15.5% | | |

| 108,881 | | Advanced Semiconductor Engineering, Inc. (a) | | 66,770 |

| 323,000 | | Cathay Financial Holding Co., Ltd. (a) | | 568,755 |

| 558,027 | | Chinatrust Financial Holding Co., Ltd. (a) | | 434,278 |

| 248,412 | | EVA Airways Corp. (a) | | 96,388 |

| 319,680 | | Far Eastern Textile Co., Ltd. (a) | | 186,720 |

| 113,000 | | Formosa Chemicals & Fibre Corp. (a) | | 181,142 |

| 148,240 | | Formosa Plastics Corp. (a) | | 223,664 |

| 101,291 | | Hon Hai Precision Industry Co., Ltd. (a) | | 439,494 |

| 27,000 | | President Chain Store Corp. (a) | | 49,493 |

| 182,700 | | Quanta Computer, Inc. (a) | | 253,382 |

| 26,000 | | Siliconware Precision Industries Co. (a) | | 23,635 |

| 490,498 | | Taiwan Semiconductor Manufacturing Co., Ltd. (a) | | 767,185 |

| 173,583 | | Unimicron Technology Corp. (a) | | 132,271 |

| 700,507 | | United Microelectronics Corp. (a) | | 377,702 |

| 277,000 | | Yageo Corp.* (a) | | 84,622 |

|

| | | Total Taiwan | | 3,885,501 |

|

| Thailand — 6.2% | | |

| 1,051,700 | | Asian Property Development PCL (a) | | 87,180 |

| 97,100 | | Bangkok Bank Public Co., Ltd., NVDR | | 233,373 |

| 760,800 | | Italian-Thai Development PCL | | 164,774 |

| 198,200 | | Kasikornbank PCL (a) | | 306,799 |

| 151,000 | | Kasikornbank PCL, NVDR | | 224,047 |

| 758,800 | | Krung Thai Bank PCL | | 185,164 |

| 1,079,600 | | Land & Houses PCL, NVDR | | 210,492 |

| 166,600 | | Thai Airways International PCL (a) | | 151,176 |

|

| | | Total Thailand | | 1,563,005 |

|

| |

| Turkey — 0.4% | | |

| 17,369 | | Arcelik AS (a) | | 103,537 |

|

| | | TOTAL COMMON STOCKS | | |

| | | (Cost — $20,645,460) | | 22,302,726 |

|

See Notes to Financial Statements.

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 13

|

| Schedule of Investments (October 31, 2005) (continued) | | |

|

| Shares | | Security | | Value |

|

| PREFERRED STOCK — 2.4% | | |

| Brazil — 2.4% | | |

| 3,300 | | Bradespar SA | $ | 86,601 |

| 700 | | Cia Vale do Rio Doce | | 25,808 |

| 16,700 | | Tam SA* | | 211,698 |

| 5,300 | | Telemar Norte Leste SA, Series A Shares | | 143,801 |

| 8,188 | | Ultrapar Participacoes SA | | 127,832 |

|

| | | TOTAL PREFERRED STOCK | | |

| | | (Cost — $449,142) | | 595,740 |

|

| Warrants | | |

|

| WARRANTS (b) — 3.7% | | |

| 600 | | MSDW Asia Securities Products LLC, Each warrant exercisable for 4 shares | | |

| | | of Infosys Technologies Ltd. common stock, Expires 3/30/07 | | 134,303 |

| 19,323 | | MSDW Asia Securities Products LLC, Each warrant exercisable | | |

| | | for 1 share of Hindustan Petroleum Corp., common stock, | | |

| | | Expires 8/13/07 | | 127,455 |

| 17,685 | | MSDW Asia Securities Products LLC, Each warrant exercisable | | |

| | | for 1 share of Oil & Natural Gas Corp., Ltd. common stock, | | |

| | | Expires 3/14/07 | | 364,170 |

| 22,741 | | MSDW Asia Securities Products LLC, Each warrant exercisable | | |

| | | for 1 share of Satyam Computer Services, Ltd., common stock, | | |

| | | Expires 3/21/07 | | 305,616 |

|

| | | TOTAL WARRANTS | | |

| | | (Cost — $876,010) | | 931,544 |

|

| Shares | | |

|

| EQUITY LINKED NOTES (b)(c) — 1.4% | | |

| India — 1.4% | | |

| 33,000 | | UBS Hindalco Industry Ltd., 0.000% due 1/17/06 | | 83,490 |

| 4,857 | | UBS Infosys Technology Ltd., 0.000% due 1/17/06 | | 271,992 |

|

| | | TOTAL EQUITY LINKED NOTES | | |

| | | (Cost — $312,163) | | 355,482 |

|

| | | TOTAL INVESTMENTS BEFORE SHORT-TERM | | |

| | | INVESTMENT | | |

| | | (Cost — $22,282,775) | | 24,185,492 |

|

See Notes to Financial Statements.

14 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

|

| Schedule of Investments (October 31, 2005) (continued) | | | |

|

| |

| Face | | | | | |

| Amount | | Security | | Value | |

|

| SHORT-TERM INVESTMENT — 3.8% | | | |

| Repurchase Agreement — 3.8% | | | |

| $954,000 | | State Street Bank & Trust Co., dated 10/31/05, 3.520% due 11/1/05; | | | |

| | | Proceeds due at maturity — $954,093; (Fully collateralized by U.S. | | | |

| | | Treasury Bond, 6.250% due 8/15/23; Market value — $978,841) | | | |

| | | (Cost — $954,000) | $ | 954,000 | |

|

| | | TOTAL INVESTMENTS — 100.3% | | | |

| | | (Cost — $23,236,775#) | | 25,139,492 | |

| | | Liabilities in Excess of Other Assets — (0.3)% | | (72,877 | ) |

|

| | | TOTAL NET ASSETS — 100.0% | $ | 25,066,615 | |

|

| * | Non-income producing security. |

| | |

| (a) | Securities are fair valued at October 31, 2005 in accordance with the policies adopted by the Board of Trustees (see Note 1a). |

| |

| (b) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Trustees unless otherwise noted. |

| |

| (c) | Equity-linked security whereby the coupon, dividend and or redemption amount is linked to the price of an underlying equity security. |

| | |

| # | Aggregate cost for federal income tax purposes is $23,264,326. |

| |

| |

| | Abbreviations used in this schedule: |

| | ADR — American Depositary Receipt

GDR — Global Depositary Receipt

NVDR — Non-Voting Depositary Receipt |

| |

|

|

|

| Summary of Investments by Sector* | | |

|

| Financials | 21.9 | % |

| Information Technology | 15.0 | |

| Telecommunication Services | 11.4 | |

| Industrials | 9.9 | |

| Energy | 8.8 | |

| Materials | 7.8 | |

| Consumer Discretionary | 7.3 | |

| Consumer Staples | 5.0 | |

| Warrants | 3.7 | |

| Utilities | 3.5 | |

| Equity Linked Notes | 1.4 | |

| Health Care | 0.5 | |

| Repurchase Agreement | 3.8 | |

|

|

|

| | 100.0 | % |

|

|

|

* As a percentage of total investments. Please note that Fund holdings are as of October 31, 2005 and are subject to change.

See Notes to Financial Statements.

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 15

|

| Statement of Assets and Liabilities (October 31, 2005) | | | |

|

| ASSETS: | | | |

| Investments, at value (Cost — $23,236,775) | $ | 25,139,492 | |

| Foreign currency, at value (Cost — $107,942) | | 108,275 | |

| Cash | | 171 | |

| Receivable for securities sold | | 135,354 | |

| Dividends and interest receivable | | 45,351 | |

| Receivable for Fund shares sold | | 5,505 | |

| Prepaid expenses | | 4,105 | |

|

| Total Assets | | 25,438,253 | |

|

| LIABILITIES: | | | |

| Payable for securities purchased | | 215,735 | |

| Management fee payable | | 15,507 | |

| Payable for foreign capital gains tax | | 4,847 | |

| Payable for Fund shares repurchased | | 3,049 | |

| Distribution fees payable | | 2,834 | |

| Unrealized depreciation on foreign currency contracts (Notes 1 and 3) | | 881 | |

| Trustees’ fees payable | | 823 | |

| Transfer agent fees payable | | 433 | |

| Accrued expenses | | 127,529 | |

|

| Total Liabilities | | 371,638 | |

|

| Total Net Assets | $ | 25,066,615 | |

|

| NET ASSETS: | | | |

| Par value (Note 5) | $ | 19 | |

| Paid-in capital in excess of par value | | 22,010,156 | |

| Undistributed net investment income | | 126,446 | |

| Accumulated net realized gain on investments and foreign | | | |

| currency transactions | | 1,032,067 | |

| Net unrealized appreciation on investments and foreign | | | |

| currency transactions | | 1,897,927 | |

|

| Total Net Assets | $ | 25,066,615 | |

|

| Shares Outstanding: | | | |

| Class A | | 997,013 | |

|

| Class B | | 2,415 | |

|

| Class C | | 5,742 | |

|

| Class Y | | 905,524 | |

|

| Net Asset Value: | | | |

| Class A (and redemption price) | $ | 13.11 | |

|

| Class B* | $ | 11.30 | |

|

| Class C* | $ | 11.20 | |

|

| Class Y (and redemption price) | $ | 13.14 | |

|

| Maximum Public Offering Price Per Share: | | | |

| Class A (based on maximum sales charge of 5.00%) | $ | 13.80 | ** |

|

| * | Redemption price is NAV of Class B and C shares reduced by a 5.00% and 1.00% CDSC, respectively, if shares are redeemed within one year from purchase payment (See Note 2). |

| |

| ** | Based upon a single purchase of less than $25,000. |

| |

See Notes to Financial Statements.

16 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

|

| Statement of Operations (For the period January 3, 2005* through October 31, 2005) | | | |

|

| INVESTMENT INCOME: | | | |

| Dividends | $ | 491,756 | |

| Interest | | 22,549 | |

| Less: Foreign taxes withheld | | (67,977 | ) |

|

| Total Investment Income | | 446,328 | |

|

| EXPENSES: | | | |

| Custody fees | | 163,158 | |

| Management fee (Note 2) | | 155,295 | |

| Organization and offering costs (Note 1k) | | 92,803 | |

| Shareholder reports (Note 4) | | 44,209 | |

| Audit and tax | | 30,032 | |

| Distribution fees (Notes 2 and 4) | | 24,354 | |

| Legal fees | | 21,660 | |

| Trustees’ fees (Note 2) | | 9,665 | |

| Registration fees | | 6,183 | |

| Transfer agent fees (Notes 2 and 4) | | 1,612 | |

| Miscellaneous expenses | | 4,886 | |

|

| Total Expenses | | 553,857 | |

| Less: Management fee waiver and expense reimbursement (Note 2) | | (267,404 | ) |

|

| Net Expenses | | 286,453 | |

|

| Net Investment Income | | 159,875 | |

|

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND | | | |

| FOREIGN CURRENCY TRANSACTIONS (NOTES 1 AND 3): | | | |

| Net Realized Gain (Loss) From: | | | |

| Investments | | 1,032,068 | |

| Foreign currency transactions | | (92,014 | ) |

|

| Net Realized Gain | | 940,054 | |

|

| Change in Net Unrealized Appreciation/Depreciation From: | | | |

| Investments | | 1,902,717 | |

| Foreign currency transactions | | (4,790 | ) |

|

| Change in Net Unrealized Appreciation/Depreciation | | 1,897,927 | |

|

| Net Gain on Investments and Foreign Currency Transactions | | 2,837,981 | |

|

| Increase in Net Assets From Operations | $ | 2,997,856 | |

|

| * Commencement of Operations. | | | |

See Notes to Financial Statements.

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 17

|

| Statement of Changes in Net Assets | | | |

| (For the period January 3, 2005† through October 31, 2005) | | | |

|

| | 2005 |

|

| OPERATIONS: | | | |

| Net investment income | $ | 159,875 | |

| Net realized gain | | 940,054 | |

| Change in net unrealized appreciation/depreciation | | 1,897,927 | |

|

| Increase in Net Assets From Operations | | 2,997,856 | |

|

| FUND SHARE TRANSACTIONS (NOTE 5): | | | |

| Net proceeds from sale of shares | | 31,638,198 | |

| Cost of shares repurchased | | (9,569,439 | ) |

|

| Increase in Net Assets From Fund Share Transactions | | 22,068,759 | |

|

| Increase in Net Assets | | 25,066,615 | |

| NET ASSETS: | | | |

| Beginning of period | | — | |

|

| End of period* | $ | 25,066,615 | |

|

| * Includes undistributed net investment income of:` | $ | 126,446 | |

|

| † Commencement of Operations. | | | |

See Notes to Financial Statements.

18 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

Financial Highlights

For a share of each class of beneficial interest outstanding throughout the period ended

October 31:

| | | | |

| Class A Shares(1) | | 2005 | (2) |

|

| Net Asset Value, Beginning of Period | $ | 11.40 | |

|

| Income From Operations: | | | |

| Net investment income | | 0.07 | |

| Net realized and unrealized gain | | 1.64 | |

|

| Total Income From Operations | | 1.71 | |

|

| Net Asset Value, End of Period | $ | 13.11 | |

|

| Total Return(3) | | 15.00 | % |

|

| Net Assets, End of Period (000s) | $ | 13,074 | |

|

| Ratios to Average Net Assets: | | | |

| Gross expenses(4) | | 3.77 | % |

| Net expenses(4)(5)(6) | | 2.00 | |

| Net investment income(4)(5) | | 0.66 | |

|

| Portfolio Turnover Rate | | 66 | % |

|

| (1) | Per share amounts have been calculated using the average shares method. |

| |

| (2) | For the period January 5, 2005 (inception date) to October 31, 2005. |

| |

| (3) | Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| |

| | Total returns for periods of less than one year are not annualized. |

| |

| (4) | Annualized. |

| |

| (5) | The investment manager voluntarily waived all of its fees and reimbursed expenses. Such waivers and expense reimbursements are voluntary and may be reduced or terminated at any time. |

| |

| (6) | As a result of a voluntary expense limitation, the ratio of expenses to average net assets will not exceed 2.00%. |

| |

See Notes to Financial Statements.

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 19

|

| Financial Highlights | | | |

| For a share of each class of beneficial interest outstanding throughout the period ended | | | |

| October 31: | | | |

|

| |

| Class B Shares(1) | | 2005 | (2) |

|

| Net Asset Value, Beginning of Period | $ | 11.40 | |

|

| Loss From Operations: | | | |

| Net investment loss | | (0.02 | ) |

| Net realized and unrealized loss | | (0.08 | ) |

|

| Total Loss From Operations | | (0.10 | ) |

|

| Net Asset Value, End of Period | $ | 11.30 | |

|

| Total Return(3) | | (0.88 | )% |

|

| Net Assets, End of Period (000s) | $ | 27 | |

|

| Ratios to Average Net Assets: | | | |

| Gross expenses(4) | | 4.52 | % |

| Net expenses(4)(5)(6) | | 2.75 | |

| Net investment loss(4)(5) | | (0.93 | ) |

|

| Portfolio Turnover Rate | | 66 | % |

|

| (1) | Per share amounts have been calculated using the average shares method. |

| |

| (2) | For the period August 11, 2005 (inception date) to October 31, 2005. |

| |

| (3) | Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| |

| | Total returns for periods of less than one year are not annualized. |

| |

| (4) | Annualized. |

| |

| (5) | The investment manager voluntarily waived all of its fees and reimbursed expenses. Such waivers and expense reimbursments are voluntary and may be reduced or terminated at any time. |

| |

| (6) | As a result of a voluntary expense limitation, the ratio of expenses to average net assets will not exceed 2.75%. |

| |

See Notes to Financial Statements.

20 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

|

| Financial Highlights | | | |

| For a share of each class of beneficial interest outstanding throughout the period ended | | | |

| October 31: | | | |

|

| |

| Class C Shares(1) | | 2005 | (2) |

|

| Net Asset Value, Beginning of Period | $ | 11.40 | |

|

| Loss From Operations: | | | |

| Net investment loss | | (0.02 | ) |

| Net realized and unrealized loss | | (0.18 | ) |

|

| Total Loss From Operations | | (0.20 | ) |

|

| Net Asset Value, End of Period | $ | 11.20 | |

|

| Total Return(3) | | (1.75 | )% |

|

| Net Assets, End of Period (000s) | $ | 64 | |

|

| Ratios to Average Net Assets: | | | |

| Gross expenses(4) | | 4.53 | % |

| Net expenses(4)(5)(6) | | 2.75 | |

| Net investment loss(4)(5) | | (1.37 | ) |

|

| Portfolio Turnover Rate | | 66 | % |

|

| (1) | Per share amounts have been calculated using the average shares method. |

| |

| (2) | For the period September 7, 2005 (inception date) to October 31, 2005. |

| |

| (3) | Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| |

| | Total returns for periods of less than one year are not annualized. |

| |

| (4) | Annualized. |

| |

| (5) | The investment manager voluntarily waived all of its fees and reimbursed expenses. Such waivers and expense reimbursements are voluntary and may be reduced or terminated at any time. |

| |

| (6) | As a result of a voluntary expense limitation, the ratio of expenses to average net assets will not exceed 2.75%. |

| |

See Notes to Financial Statements.

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 21

|

| Financial Highlights | | | |

| For a share of each class of beneficial interest outstanding throughout the period ended October 31: | | | |

|

| | | | |

| Class Y Shares(1) | | 2005 | (2) |

|

| Net Asset Value, Beginning of Period | $ | 11.40 | |

|

| Income From Operations: | | | |

| Net investment income | | 0.14 | |

| Net realized and unrealized gain | | 1.60 | |

|

| Total Income From Operations | | 1.74 | |

|

| Net Asset Value, End of Period | $ | 13.14 | |

|

| Total Return(3) | | 15.26 | % |

|

| Net Assets, End of Period (000s) | $ | 11,902 | |

|

| Ratios to Average Net Assets: | | | |

| Gross expenses(4) | | 2.73 | % |

| Net expenses(4)(5)(6) | | 1.35 | |

| Net investment income(4)(5) | | 1.39 | |

|

| Portfolio Turnover Rate | | 66 | % |

|

| (1) | Per share amounts have been calculated using the average shares method. |

| |

| (2) | For the period January 3, 2005 (inception date) to October 31, 2005. |

| |

| (3) | Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| |

| | Total returns for periods of less than one year are not annualized. |

| |

| (4) | Annualized. |

| |

| (5) | The investment manager voluntarily waived all of its fees and reimbursed expenses. Such waivers and expense reimbursements are voluntary and may be reduced or terminated at any time. |

| |

| (6) | As a result of a voluntary expense limitation, the ratio of expenses to average net assets will not exceed 1.35%. |

| |

See Notes to Financial Statements.

22 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

Notes to Financial Statements

1. Organization and Significant Accounting Policies

The Smith Barney Emerging Markets Equity Fund (“Fund”), is a separate diversified investment fund of CitiFunds Trust I (“Trust”), a Massachusetts business trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (“1940 Act”).

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment Valuation. Equity securities for which market quotations are available are valued at the last sale price or official closing price on the primary market or exchange on which they trade. Debt securities are valued at the mean between the bid and asked prices provided by an independent pricing service that are based on transactions in debt obligations, quotations from bond dealers, market transactions in comparable securities and various relationships between securities. When prices are not readily available, or are determined not to reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund may value these investments at fair value as determined in accordance with the procedures approved by the Fund’s Board of Trustees. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures contracts. Short-term obligations maturing within 60 days are valued at amortized cost, which approximates market value.

(b) Repurchase Agreements. When entering into repurchase agreements, it is the Fund’s policy that its custodian or a third party custodian takes possession of the underlying collateral securities, the market value of which at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market to ensure the adequacy of the collateral. If the seller defaults, and the market value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

(c) Equity Linked Notes. Equity-linked notes, or ELNs, are debt securities that pay interest based upon the performance of one or more equity securities, such as a stock index, a group of stocks or a single stock. ELNs offer investors the opportunity to participate in the appreciation of the underlying equity securities, often subject to a cap on the interest payable. ELNs are typically considered more conservative investments than investments in the equity securities to which they are linked, as ELNs generally provide for the repayment at maturity of the principal amount invested, plus interest (if any). However, in addition to the credit and market risks applicable to debt securities, ELNs are subject to the risk that an investor will receive less than the prevailing rate of interest if the value of the relevant equity securities decline or fail to increase sufficiently.

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 23

Notes to Financial Statements (continued)

(d) Concentration Risk. The Fund’s investments in foreign securities may involve risks not present in domestic investments. Since securities may be denominated in foreign currencies and may require settlement in foreign currencies and pay interest or dividends in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Fund. Foreign investments may also subject the Fund to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, all of which affect the market and/or credit risk of the investments.

(e) Security Transactions and Investment Income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as practical after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults on an expected interest payment, the Fund’s policy is to generally halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default.

(f ) Expenses. The Fund bears all costs of its operations other than expenses specifically assumed by the Manager. Expenses incurred by the Trust with respect to any two or more funds in the series are allocated in proportion to the average net assets of each fund, except when allocations of direct expenses to each fund can otherwise be made fairly. Expenses directly attributable to a fund are charged to that fund.

(g) Foreign Currency Translation. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities, at the date of valuation, resulting from changes in exchange rates.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of,

24 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

Notes to Financial Statements (continued)

among other factors, the possibility of lower levels of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

(h) Distributions to Shareholders. Distributions from net investment income and distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(i) Class Accounting. Investment income, common expenses and realized/unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Fees relating to a specific class are charged directly to that class.

(j) Federal and Other Taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute substantially all of its taxable income and net realized gains on investments, if any, to shareholders each year. Therefore, no federal income tax provision is required in the Fund’s financial statements. Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

(k) Organization and Offering Costs. It is the Fund’s policy to expense all costs related to the organization and offering of the Fund as they are incurred. For the period ended October 31, 2005, the Fund paid $92,803 for legal and shareholder fees related to the initial registration of the Fund and related activities.

(l) Reclassification. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. During the current year, the following reclassifications have been made:

| | | (Over)/ | | | | |

| | | Undistributed Net | | | | |

| | | Investment | Accumulated Net | | | |

| | | Income | Realized Gain | | Paid-in Capital |

|

| (a) | | $ | 58,584 | | — | | $(58,584 | ) |

|

| (b) | | | (92,013 | ) | $92,013 | | — | |

|

| (a) | Reclassifications are primarily due to non-deductible 12b-1 fees and non-deductible offering costs. |

| |

| (b) | Reclassifications are primarily due to foreign currency transactions treated as ordinary income for tax purposes. |

| |

2. Management Agreement and Other Transactions with Affiliates

Smith Barney Fund Management LLC (“SBFM”), which for the period of this report was an indirect wholly-owned subsidiary of Citigroup Inc. (“Citigroup”), acts as investment manager to the Fund. SBFM delegates the daily management of the investments of the Fund to its affiliate, Citigroup Asset Management, Ltd., as sub-advisor. Effective October 1, 2005, the Fund’s investment management fee, which is calculated daily and payable monthly, was reduced from 0.95% of the Fund’s average daily net assets to a fee calculated in accordance with the following breakpoint schedule:

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 25

Notes to Financial Statements (continued)

| | | Investment Management |

| Average Daily Net Assets | | Fee Rate |

|

| First $1 billion | | 0.850 | % |

|

| Next $1 billion | | 0.825 | % |

|

| Next $3 billion | | 0.800 | % |

|

| Next $5 billion | | 0.775 | % |

|

| Over $10 billion | | 0.750 | % |

|

During the period ended October 31, 2005, the Fund’s Class A, B, C and Y shares had voluntary expense limitations in place of 2.00%, 2.75%, 2.75% and 1.35%, respectively, of each class’ respective average daily net assets, resulting in waived management fees of $155,295 and expense reimbursements of $112,109. These expense limitations can be terminated at any time by SBFM.

Citicorp Trust Bank, fsb. (“CTB”), another subsidiary of Citigroup, acts as the Fund’s transfer agent. PFPC Inc. (“PFPC”) acts as the Fund’s sub-transfer agent. CTB receives account fees and asset-based fees that vary according to the size and type of account. PFPC is responsible for shareholder recordkeeping and financial processing for all shareholder accounts and is paid by CTB. For the period ended October 31, 2005, the Fund paid transfer agent fees of $711 to CTB.

Citigroup Global Markets Inc. (“CGM”), another indirect wholly-owned subsidiary of Citigroup, acts as the Fund’s distributor.

There is a maximum initial sales charge of 5.00% for Class A shares. There is a contingent deferred sales charge (“CDSC”) of 5.00% on Class B shares, which applies if redemption occurs within one year from purchase payment and declines thereafter by 1.00% a year until no CDSC is incurred. Class C shares have a 1.00% CDSC, which applies if redemption occurs within one year from purchase payment. In certain cases, Class A shares have a 1.00% CDSC, which applies if redemption occurs within one year from purchase payment. This CDSC only applies to those purchases of Class A shares, which, when combined with current holdings of Class A shares, equal or exceed $1,000,000 in the aggregate. These purchases do not incur an initial sales charge.

For the period ended October 31, 2005, CGM received sales charges of approximately $1,000 on sales of the Fund’s Class A shares.

Certain officers and one Trustee of the Trust are employees of SBFM or its affiliates and do not receive compensation from the Fund.

The Trustees of the Fund have adopted a Retirement Plan (the “Plan”) for all Trustees who are not “interested persons” of the Fund, within the meaning of the 1940 Act. Under the Plan, all Trustees are required to retire from the Board as of the last day of the calendar year in which the applicable Trustee attains age 75. Trustees may retire under the Plan before attaining the mandatory retirement age. Trustees who have served as Trustee of the Trust or any of the investment companies associated with the manager for at least ten years when they retire are eligible to receive the maximum retirement benefit under the Plan. The maximum retirement benefit is an amount equal to five times the amount of retainer and regular meeting fees payable to a Trustee during the entirety of the calendar year of the

26 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

Notes to Financial Statements (continued)

Trustee’s retirement. Amounts under the Plan may be paid in installments or in a lump sum (discounted to present value). Benefits under the Plan are unfunded. Three former Trustees are currently receiving payments under the Plan. In addition, two other Trustees previously elected to receive a lump sum payment under the Plan. The Fund’s allocable share of the liability at October 31, 2005 was $477.

3. Investments

During the year ended October 31, 2005, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows:

|

| Purchases | $34,236,362 | |

|

| Sales | 12,985,677 | |

|

At October 31, 2005, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

|

| Gross unrealized appreciation | $2,603,412 | |

| Gross unrealized depreciation | (728,246 | ) |

|

| Net unrealized appreciation | $1,875,166 | |

|

At October 31, 2005, the Fund had the following open foreign currency contracts as described below. The unrealized loss on the contracts reflected in the accompanying financial statements were as follows:

| | | Local | | Market | | Settlement | | Unrealized |

| Foreign Currency | | Currency | | Value | | Date | | Gain (Loss) |

|

| Contracts to Buy: | | | | | | | | | | |

| Brazilian Real (BRL) | | 120,900 | | | $53,775 | | 11/1/05 | | $ 327 | |

| Indonesian Rupiah (IDR) | | 144,666,214 | | | 14,292 | | 11/1/05 | | (230 | ) |

| Indonesian Rupiah (IDR) | | 201,890,437 | | | 19,945 | | 11/9/05 | | (114 | ) |

| Mexican Peso (MXN) | | 39,694 | | | 3,679 | | 11/1/05 | | (5 | ) |

| South African Rand (ZAR) | | 412,100 | | | 61,412 | | 11/2/05 | | (600 | ) |

| Contracts to Sell: | | | | | | | | | | |

| Brazilian Real (BRL) | | 8,826 | | | 3,926 | | 11/3/05 | | (13 | ) |

| Hong Kong Dollar (HKD) | | 40,331 | | | 5,203 | | 11/1/05 | | (1 | ) |

| Malaysian Ringgit (MYR) | | 52,136 | | | 13,811 | | 11/2/05 | | (9 | ) |

| Malaysian Ringgit (MYR) | | 22,401 | | | 5,934 | | 11/7/05 | | (4 | ) |

| South African Rand (ZAR) | | 402,259 | | | 59,945 | | 11/3/05 | | (186 | ) |

| South African Rand (ZAR) | | 99,059 | | | 14,762 | | 11/4/05 | | (46 | ) |

|

| |

| Net unrealized loss on open | | | | | | | | | | |

| foreign currency contracts | | | | | | | | | $ (881 | ) |

|

4. Class Specific Expenses

Pursuant to a Distribution Plan, the Fund pays a service fee with respect to its Class A, B and C shares calculated at the annual rate of 0.25%, 1.00% and 1.00% of the average daily net assets of each respective class. For the period ended October 31, 2005, total

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 27

Notes to Financial Statements (continued)

Distribution fees, which are accrued daily and paid monthly, were as follows:

| | | Class A | | Class B | | Class C |

|

| Distribution Fees | | | $24,231 | | | $57 | | | $66 |

|

For the period ended October 31, 2005, total Transfer Agent fees were as follows:

| | Class A | Class B | Class C | Class Y |

|

| Transfer Agent Fees | $1,504 | $24 | $35 | $49 |

|

For the period ended October 31, 2005, total Shareholder Reports expenses were as follows:

| | Class A | Class B | Class C | Class Y |

|

| Shareholder Reports Expenses | $41,590 | $22 | $63 | $2,534 |

|

5. Shares of Beneficial Interest

At October 31, 2005, the Trust’s Declaration of Trust permits the Trust to issue unlimited number of full and fractional shares of beneficial interest (par value of $0.00001 per share) of each series and to divide or combine the shares of any series into a greater or lesser number of shares of that series without thereby changing the proportionate beneficial interests in that series and to divide such shares into classes. The Trust has reserved the right to create and issue additional series and classes of shares. Each share of a class represents an identical interest in the Fund and has the same rights, except that each class bears certain expenses specifically related to the distribution of its shares.

Transactions in shares if each class were as follows:

| | Period Ended |

| | October 31, 2005(1) |

|

|

| | Shares | Amount |

|

| Class A | | | | | |

| Shares sold | 1,287,970 | | $ | 15,058,191 | |

| Shares repurchased | (290,957 | ) | | (3,553,273 | ) |

|

| Net Increase | 997,013 | | $ | 11,504,918 | |

|

| Class B | | | | | |

| Shares sold | 2,415 | | $ | 27,560 | |

|

| Net Increase | 2,415 | | $ | 27,560 | |

|

| Class C | | | | | |

| Shares sold | 5,966 | | $ | 69,404 | |

| Shares repurchased | (224 | ) | | (2,510 | ) |

|

| Net Increase | 5,742 | | $ | 66,894 | |

|

| Class Y | | | | | |

| Shares sold | 1,412,497 | | $ | 16,483,043 | |

| Shares repurchased | (506,973 | ) | | (6,013,656 | ) |

|

| Net Increase | 905,524 | | $ | 10,469,387 | |

|

| (1) | For the periods January 5, 2005, August 11, 2005, September 7, 2005, and January 3, 2005 through October 31, 2005 for Class A, B, C and Y, respectively. |

| |

28 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

Notes to Financial Statements (continued)

6. Income Tax Information and Distributions to Shareholders

Subsequent to the fiscal year end, the Fund has made the following distributions:

| Record Date | | | | |

| Payable Date | Class A | Class B | Class C | Class Y |

|

| Short-Term Capital Gains | | | | |

| 12/8/2005 | | | | |

| 12/9/2005 | $0.544762 | $0.544762 | $0.544762 | $0.544762 |

|

During the fiscal year ended October 31, 2005, the Fund did not make any distributions. As of October 31, 2005, the components of accumulated earnings on a tax basis were as follows:

|

| Undistributed ordinary income — net | | $1,185,541 |

|

| Other book/tax temporary differences (a) | | 523 |

| Unrealized appreciation (b) | | 1,870,376 |

|

| Total Accumulated Earnings/(losses) — net | | $3,056,440 |

|

| (a) | Other book/tax temporary differences are attributable primarily to realization for tax purposes of unrealized gains/(losses) on certain foreign currency contracts. |

| |

| (b) | The difference between book-basis and tax-basis unrealized appreciation is attributable primarily to the tax deferral of losses on wash sales. |

| |

7. Regulatory Matters

On May 31, 2005, the U.S. Securities and Exchange Commission (“SEC”) issued an order in connection with the settlement of an administrative proceeding against SBFM and CGM relating to the appointment of an affiliated transfer agent for the Smith Barney family of mutual funds (the “Funds”).

The SEC order finds that SBFM and CGM willfully violated Section 206(1) of the Investment Advisers Act of 1940 (“Advisers Act”). Specifically, the order finds that SBFM and CGM knowingly or recklessly failed to disclose to the boards of the Funds in 1999 when proposing a new transfer agent arrangement with an affiliated transfer agent that: First Data Investors Services Group (“First Data”), the Funds’ then-existing transfer agent, had offered to continue as transfer agent and do the same work for substantially less money than before; and that Citigroup Asset Management (“CAM”), the Citigroup business unit that, at the time, included the fund’s investment manager and other investment advisory companies, had entered into a side letter with First Data under which CAM agreed to recommend the appointment of First Data as sub-transfer agent to the affiliated transfer agent in exchange for, among other things, a guarantee by First Data of specified amounts of asset management and investment banking fees to CAM and CGM. The order also finds that SBFM and CGM willfully violated Section 206(2) of the Advisers Act by virtue of the omissions discussed above and other misrepresentations and omissions in the materials pro vided to the Funds’ boards, including the failure to make clear that the affiliated transfer agent would earn a high profit for performing limited functions while First Data continued to perform almost all of the transfer agent functions, and the suggestion that the proposed arrangement was in the Funds’ best interests and that no viable alternatives existed. SBFM and CGM do not admit or deny any wrongdoing or liability. The settlement does not establish wrongdoing or liability for purposes of any other proceeding.

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 29

Notes to Financial Statements (continued)

The SEC censured SBFM and CGM and ordered them to cease and desist from violations of Sections 206(1) and 206(2) of the Advisers Act. The order requires Citigroup to pay $208.1 million, including $109 million in disgorgement of profits, $19.1 million in interest, and a civil money penalty of $80 million. Approximately $24.4 million has already been paid to the Funds, primarily through fee waivers. The remaining $183.7 million, including the penalty, has been paid to the U.S. Treasury and will be distributed pursuant to a plan prepared and submitted for approval by the SEC. The order also requires that transfer agency fees received from the Funds since December 1, 2004 less certain expenses be placed in escrow and provides that a portion of such fees may be subsequently distributed in accordance with the terms of the order.

The order required SBFM to recommend a new transfer agent contract to the Fund boards within 180 days of the entry of the order; if a Citigroup affiliate submitted a proposal to serve as transfer agent or sub-transfer agent, SBFM and CGM would have been required, at their expense, to engage an independent monitor to oversee a competitive bidding process. On November 21, 2005, and within the specified timeframe, the Fund’s Board selected a new transfer agent for the Fund. No Citigroup affiliate submitted a proposal to serve as transfer agent. Under the order, SBFM also must comply with an amended version of a vendor policy that Citigroup instituted in August 2004. At this time, there is no certainty as to how the proceeds of the settlement will be distributed, to whom such distributions will be made, the methodology by which such distributions will be allocated, and when such distributions will be made. Although there can be no assurance, SBFM does not believe that this matter will have a material adverse effect on the Funds.

On December 1, 2005, Citigroup completed the sale of substantially all of its global asset management business, including SBFM, to Legg Mason Inc.

8. Legal Matters

Beginning in August 2005, five class action lawsuits alleging violations of federal securities laws and state law were filed against CGM and SBFM, (collectively, the “Defendants”) based on the May 31, 2005 settlement order issued against the Defendants by the SEC based in Note 7. The complaints seek injunctive relief and compensatory and punitive damages, removal of SBFM as the advisor for the Smith Barney family of funds, rescission of the Funds’ management and other contracts with SBFM, recovery of all fees paid to SBFM pursuant to such contracts, and an award of attorneys’ fees and litigation expenses.

On October 5, 2005, a motion to consolidate the five actions and any subsequently-filed, related action was filed. That motion contemplates that a consolidated amended complaint alleging substantially similar causes of action will be filed in the future.

As of the date of this report, the Fund’s investment manager believes that resolution of the pending lawsuit will not have a material effect on the financial position or results of operations of the Funds or the ability of the Fund’s investment manager and its affiliates to continue to render services to the Funds under their respective contracts.

* * *

30 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

Notes to Financial Statements (continued)

Beginning in June 2004, class action lawsuits alleging violations of the federal securities laws were filed against Citigroup Global Markets Inc. (the “Distributor”) and a number of its affiliates, including SBFM and Salomon Brothers Asset Management Inc (the “Advisers”), substantially all of the mutual funds managed by the Advisers, including the Fund (the “Funds”), and directors or trustees of the Funds (collectively, the “Defendants”). The complaints alleged, among other things, that CGM created various undisclosed incentives for its brokers to sell Smith Barney and Salomon Brothers funds. In addition, according to the complaints, the Advisers caused the Funds to pay excessive brokerage commissions to CGM for steering clients towards proprietary funds. The complaints also alleged that the defendants breached their fiduciary duty to the Funds by improperly charging Rule l2b-1 fees and by drawing on fund assets to make undisclosed payments of soft dollars and excessive brokerage commissions. The complaints also alleged that the Funds failed to adequately disclose certain of the allegedly wrongful conduct. The complaints sought injunctive relief and compensatory and punitive damages, rescission of the Funds’ contracts with the Advisers, recovery of all fees paid to the Advisers pursuant to such contracts and an award of attorneys’ fees and litigation expenses.

On December 15, 2004, a consolidated amended complaint (the “Complaint”) was filed alleging substantially similar causes of action. While the lawsuit is in its earliest stages, to the extent that the Complaint purports to state causes of action against the Funds, the Fund’s investment manager believes the Funds have significant defenses to such allegations, which the Funds intend to vigorously assert in responding to the Complaint.

Additional lawsuits arising out of theses circumstances and presenting similar allegations and requests for relief may be filed against the Defendants in the future.

As of the date of this report, the Fund’s investment manager and the Funds believe that the resolution of the pending lawsuit will not have a material effect on the financial position or results of operations of the Funds or the ability of the Advisers and their affiliates to continue to render services to the Funds under their respective contracts.

The Defendants have moved to dismiss the Complaint. Those motions are pending before the court.

9. Other Matters

The Fund has received information concerning SBFM as follows:

On September 16, 2005, the staff of the Securities and Exchange Commission (the “Commission”) informed SBFM that the staff is considering recommending that the Commission institute administrative proceedings against SBFM for alleged violations of Sections 19(a) and 34(b) of the Investment Company Act (and related Rule 19a-1). The notification is a result of an industry wide inspection undertaken by the Commission and is based upon alleged deficiencies in disclosures regarding dividends and distributions paid to shareholders of certain funds. In connection with the contemplated proceedings, the staff may seek a cease and desist order and/or monetary damages from SBFM.

Although there can be no assurance, SBFM believes that this matter is not likely to have a material adverse effect on the Fund or SBFM’s ability to perform investment advisory services relating to the Fund.

Smith Barney Emerging Markets Equity Fund 2005 Annual Report 31

Notes to Financial Statements (continued)

10. Subsequent Events

On December 1, 2005, Citigroup Inc. (“Citigroup”) completed the sale of substantially all of its asset management business, Citigroup Asset Management (“CAM”), to Legg Mason, Inc. (“Legg Mason”). As a result, the fund’s investment adviser (the “Manager”), previously an indirect wholly-owned subsidiary of Citigroup, has become a wholly-owned subsidiary of Legg Mason. Completion of the sale caused the Fund’s existing investment management contract (and sub-advisory contract(s), if applicable) to terminate. The fund’s shareholders previously approved a new investment management contract between the Fund and the Manager (and new sub-advisory contract(s), if applicable) which became effective on December 1, 2005.

Legg Mason, whose principal executive offices are at 100 Light Street, Baltimore, Maryland 21202, is a financial services holding company. As of December 2, 2005, Legg Mason’s asset management operation had aggregate assets under management of approximately $830 billion.

�� The Fund’s Board has appointed the Fund’s current distributor, Citigroup Global Markets Inc. (“CGM”) and Legg Mason Investor Services, LLC (“LMIS”), a wholly-owned broker-dealer subsidiary of Legg Mason, as co-distributors of the Fund. The Fund’s Board has also approved amended and restated Rule 12b-1 Plans. CGM and other broker-dealers, financial intermediaries and financial institutions (each called a “Service Agent”) that currently offer Fund shares will continue to make the Fund’s shares available to their clients. Additional Service Agents may offer fund shares in the future.

Effective December 1, 2005, with respect to those Fund classes subject to a 12b-1 Plan, the Fund pays service and distribution fees to each of LMIS and CGM for the services they provide and expenses they bear under the Distribution Agreements. The expenses intended to be covered by the distribution fees include those of each co-distributor. The co-distributors will provide the Fund’s Board with periodic reports of amounts expended under the Fund’s Rule 12b-1 Plans and the purposes for which such expenditures were made.

Effective December 1, 2005, CGM will no longer be an affiliated person of the Fund under the 1940 Act. As a result, the Fund will be permitted to execute transactions with CGM or an affiliate of CGM as agent (but not as principal) without the restrictions applicable to transactions with affiliated persons. Similarly, the Fund generally will be permitted to purchase securities in underwritings in which CGM or an affiliate of CGM is a member without the restrictions imposed by certain rules of the Securities and Exchange Commission. The Manager’s use of CGM or affiliates of CGM as agent in portfolio transactions with the Fund will be governed by the Fund’s policy of seeking the best overall terms available.

Certain officers and one Trustee of the Fund are employees of Legg Mason or its affiliates and do not receive compensation from the Fund.

The Fund’s Board has approved PFPC Inc. (“PFPC”) to serve as transfer agent for the Fund. The principal business office of PFPC is located at P.O. Box 9699, Providence, RI 02940-9699.

32 Smith Barney Emerging Markets Equity Fund 2005 Annual Report

Report of Independent Registered Public Accounting Firm

The Shareholders and Board of Trustees CitiFunds Trust I:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Smith Barney Emerging Markets Equity Fund, a series of CitiFunds Trust I, as of October 31, 2005, and the related statement of operations, changes in net assets, and the financial highlights for the period from January 3, 2005 (commencement of operations) to October 31, 2005. These financial statements and financial highlights are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.