Exhibit 99.1

A Next Generation Platform for Genetic Medicine Manufacturing Nasdaq: APDN

The statements made by Applied DNA in this presentation may be “forward - looking” in nature within the meaning of Section 27 A of the Securities Act of 1933 , Section 21 E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 . Forward - looking statements describe Applied DNA’s future plans, projections, strategies, and expectations, and are based on assumptions and involve a number of risks and uncertainties, many of which are beyond the control of Applied DNA . Actual results could differ materially from those projected due to its history of net losses, limited financial resources, unknown future demand for its biotherapeutics products and services, the unknown amount of revenues and profits that will result from the Linea DNA and/or Linea IVT platforms, limited market acceptance for its supply chain security products and services, our unknown ability to procure additional financing to build our GMP manufacturing facility, the declining demand for Applied DNA’s COVID - 19 testing services, the fact that there has never been a commercial drug product utilizing PCR - produced DNA technology and/or the Linea DNA or Linea IVT platforms approved for therapeutic use, and various other factors detailed from time to time in Applied DNA’s SEC reports and filings, including its Annual Report on Form 10 - K filed on December 7 , 2023 , and other reports it files with the SEC, which are available at www . sec . gov . Applied DNA undertakes no obligation to update publicly any forward - looking statements to reflect new information, events, or circumstances after the date hereof or to reflect the occurrence of unanticipated events, unless otherwise required by law . 2 ©2024 Applied DNA Sciences, Inc. Safe Harbor Statement

Company Overview • 3 interrelated business segments all leveraging the polymerase chain reaction (PCR) to enable manufacture and analysis of DNA - Therapeutic DNA Production - MDx and Genetic Testing - DNA Tagging and Authentication • 15 years of experience in enzymatic DNA production • Growth in genetic medicine development pipelines accelerated pivot to therapeutic DNA production • 55 employees located in 30,000 sq. ft. facility in Stony Brook, New York ©2024 Applied DNA Sciences, Inc. 3 ©2024 Applied DNA Sciences, Inc.

I n v es t m e nt Highlights • Pioneering enzymatic therapeutic DNA production for next generation genetic medicines as a direct replacement for plasmid DNA (pDNA) • Patented and patent - pending expertise in the production of DNA via PCR at very large scale • The largest enzymatic DNA manufacturing company in North America • Initial opportunity: critical starting material for mRNA therapeutics • Proprietary platform combining two mRNA critical starting materials outclasses conventional production methods • Marquee RUO - scale customer base: from Big Pharma to CDMOs • Imminent, Potential Near - Term Catalysts (CY2024) 4 ©2024 Applied DNA Sciences, Inc.

Q1’CY24 Q2’CY24 Q3’CY24 Q4’CY24 Initiate pursuit of FDA Advanced Manufacturing Technology Designation 1 Launch GMP manufacturing capacity for mRNA critical starting materials 2 Anticipate signing supply agreements for Linea DNA IVT templates/Linea IVT platform Anticipate PGx test approval 3 ; launch of testing service Anticipate initiation of new cotton supply chain 1 Proposed designation announced by FDA in December 2023. Pursuit contingent upon final approval of program by FDA 2 Subject to future ability to raise necessary capital 3 Approval contingent on length of New York State Department of Health review that is outside of the control of the Company Multiple Potential Near - Term Catalysts (CY24) 5 ©2024 Applied DNA Sciences, Inc.

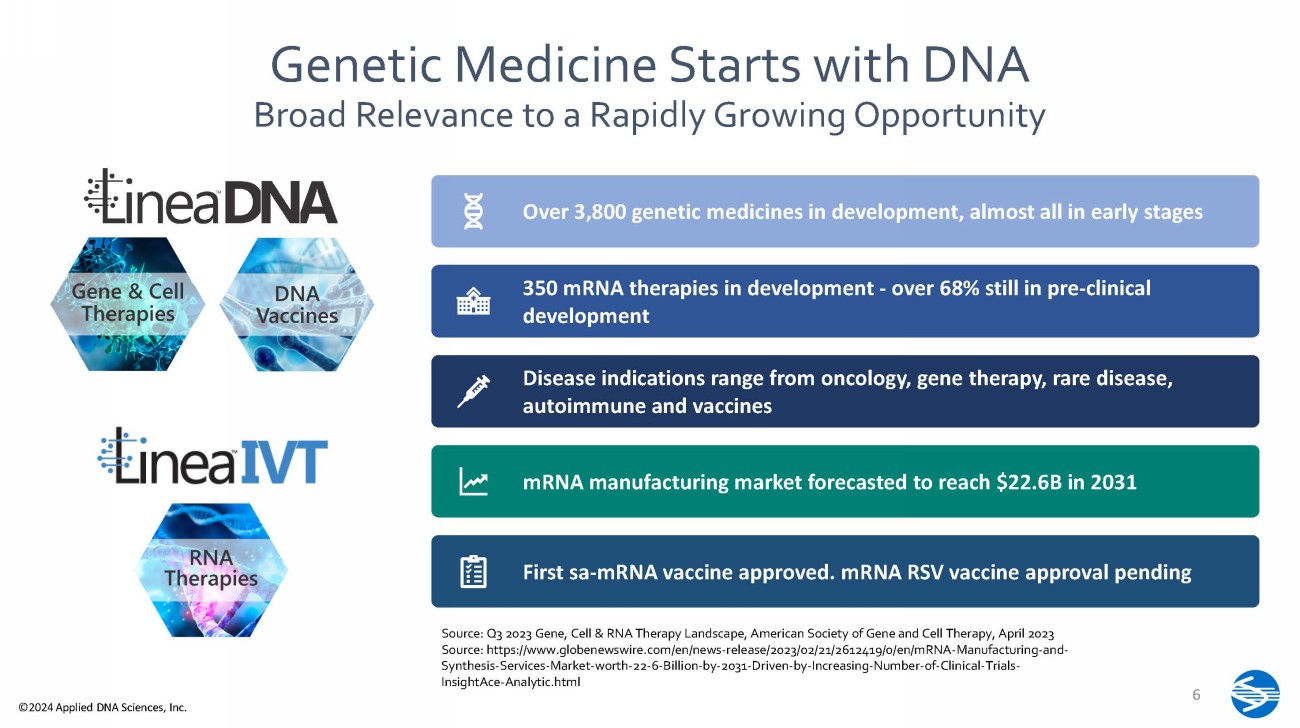

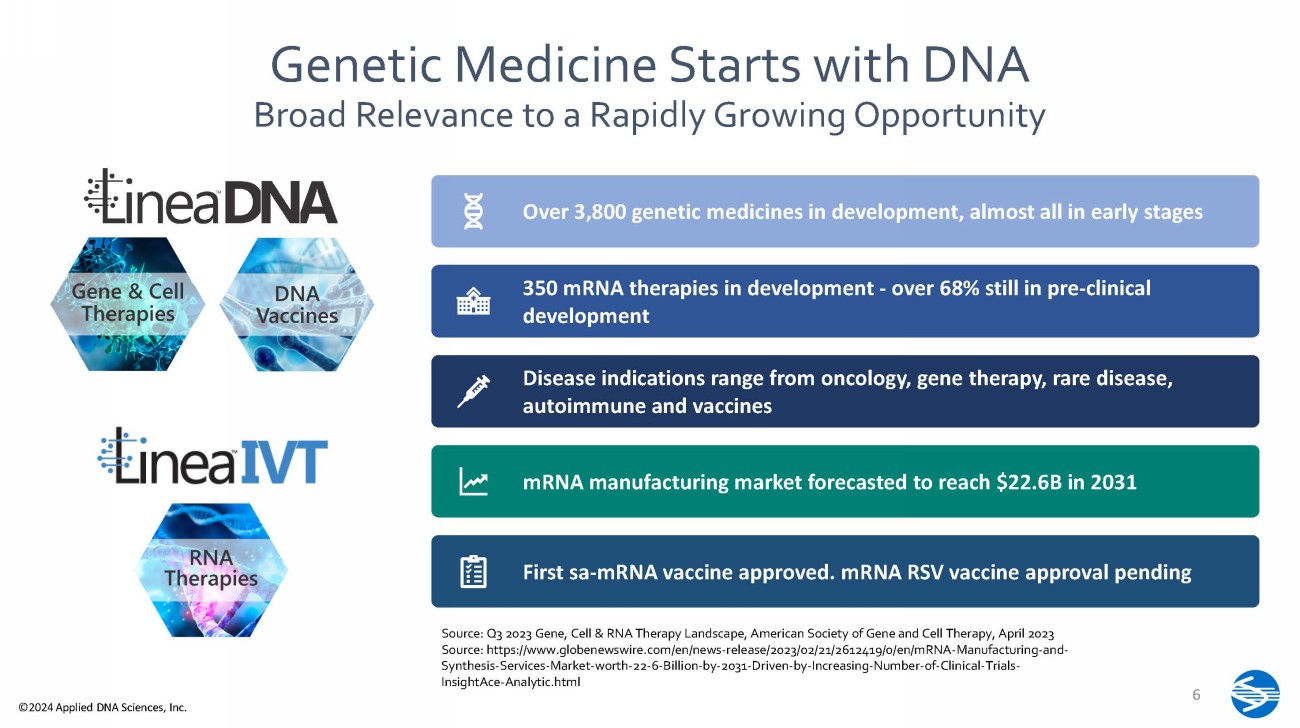

Genetic Medicine Starts with DNA Broad Relevance to a Rapidly Growing Opportunity Over 3,800 genetic medicines in development, almost all in early stages 350 mRNA therapies in development - over 68% still in pre - clinical development Disease indications range from oncology, gene therapy, rare disease, autoimmune and vaccines mRNA manufacturing market forecasted to reach $22.6B in 2031 First sa - mRNA vaccine approved. mRNA RSV vaccine approval pending Source: Q3 2023 Gene, Cell & RNA Therapy Landscape, American Society of Gene and Cell Therapy, April 2023 Source: https:// www.globenewswire.com/en/news - release/2023/02/21/2612419/0/en/mRNA - Manufacturing - and - Synthesis - Services - Market - worth - 22 - 6 - Billion - by - 2031 - Driven - by - Increasing - Number - of - Clinical - Trials - InsightAce - Analytic.html 6 ©2024 Applied DNA Sciences, Inc.

Platform An Adaptable, Enabling Manufacturing Technology 7 ©2024 Applied DNA Sciences, Inc.

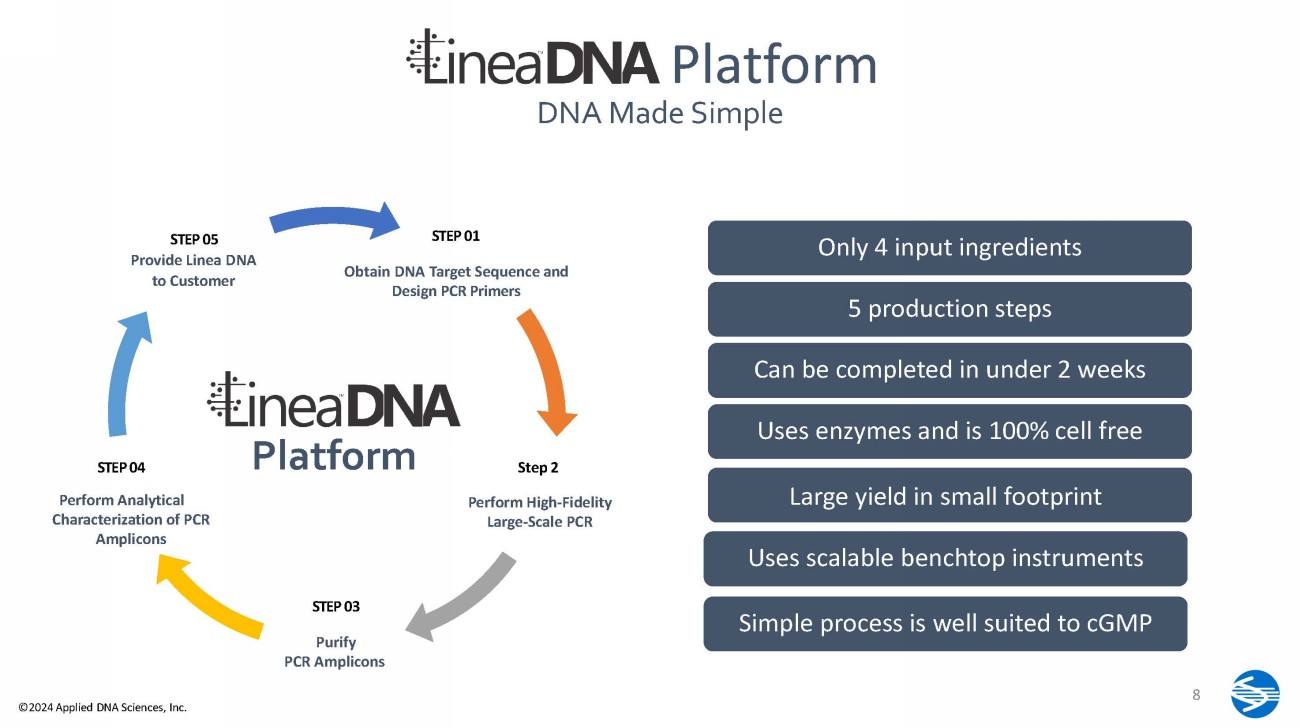

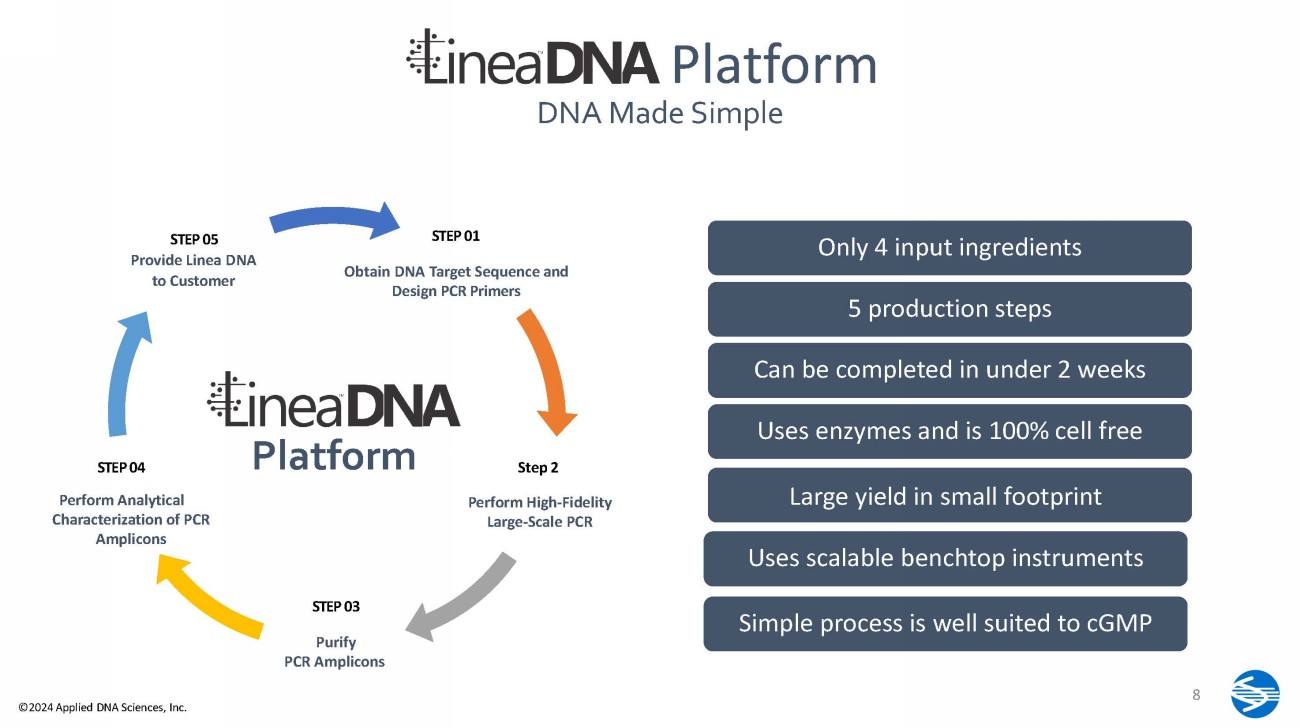

STEP 01 Obtain DNA Target Sequence and Design PCR Primers STEP 05 Provide Linea DNA to Customer STEP 04 Step 2 Perform High - Fidelity Large - Scale PCR STEP 03 Purify PCR Amplicons Pl a t fo r m Perform Analytical Characterization of PCR Amplicons Only 4 input ingredients 5 production steps Can be completed in under 2 weeks Uses enzymes and is 100% cell free Large yield in small footprint Uses scalable benchtop instruments Simple process is well suited to cGMP Platform DNA Made Simple 8 ©2024 Applied DNA Sciences, Inc.

Advantages over plasmid DNA (pDNA) Simplicity Simplify Genetic Medicine Manufacturing Purity Produce Only the DNA You Want Speed Milligrams in 14 days Grams in ≈ 30 days Flexibility Chemical Modifications Various templates Scalability Milligrams to Multi - Grams 9 ©2024 Applied DNA Sciences, Inc.

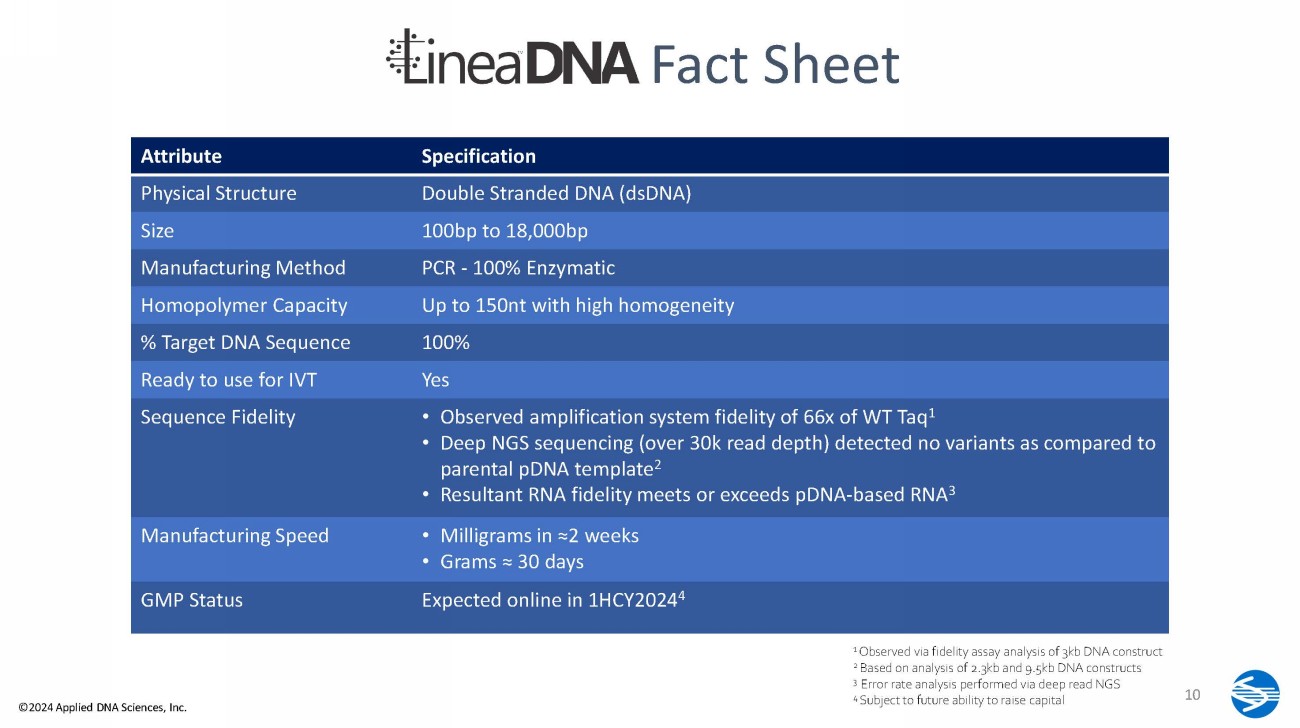

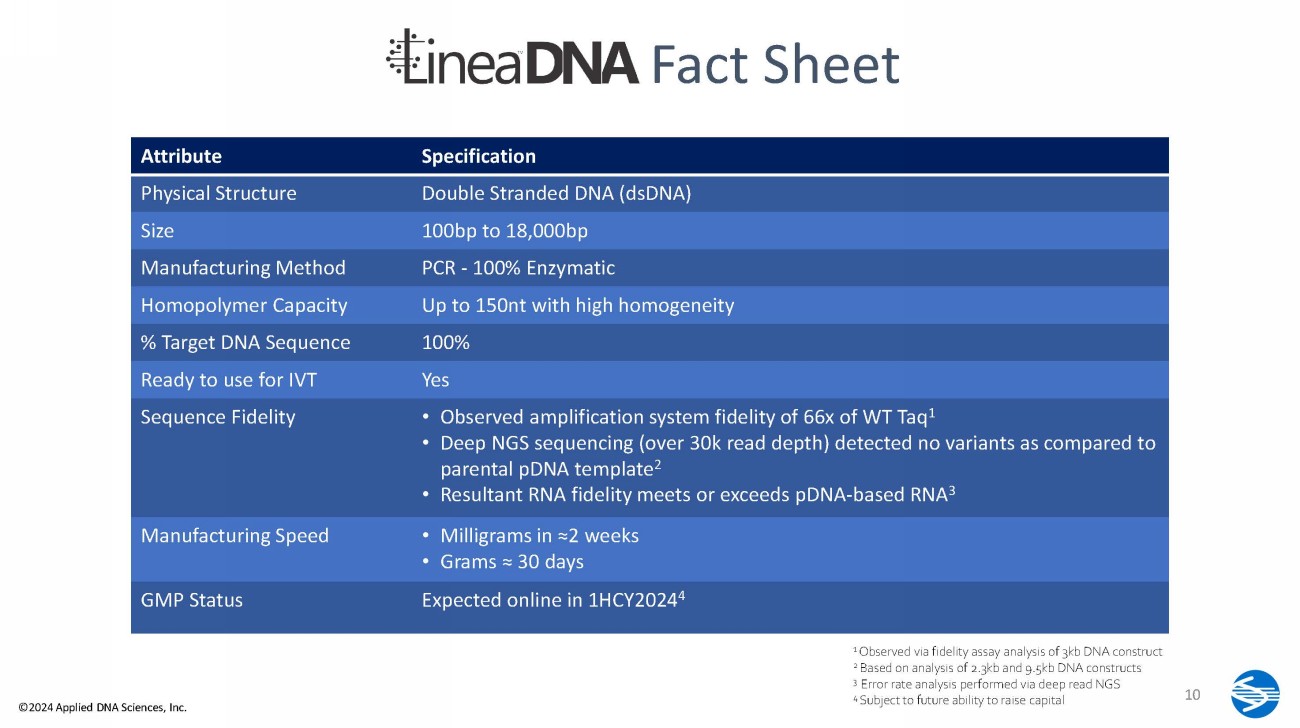

1 Observed via fidelity assay analysis of 3kb DNA construct 2 Based on analysis of 2.3kb and 9.5kb DNA constructs 3 Error rate analysis performed via deep read NGS Attribute Specification Physical Structure Double Stranded DNA (dsDNA) Size 100bp to 18,000bp Manufacturing Method PCR - 100% Enzymatic Homopolymer Capacity Up to 150nt with high homogeneity % Target DNA Sequence 100% Ready to use for IVT Yes Sequence Fidelity • Observed amplification system fidelity of 66x of WT Taq 1 • Deep NGS sequencing (over 30k read depth) detected no variants as compared to parental pDNA template 2 • Resultant RNA fidelity meets or exceeds pDNA - based RNA 3 Manufacturing Speed • Milligrams in ≈2 weeks • Grams ≈ 30 days GMP Status Expected online in 1HCY2024 4 Fact Sheet 10 4 Subject to future ability to raise capital ©2024 Applied DNA Sciences, Inc.

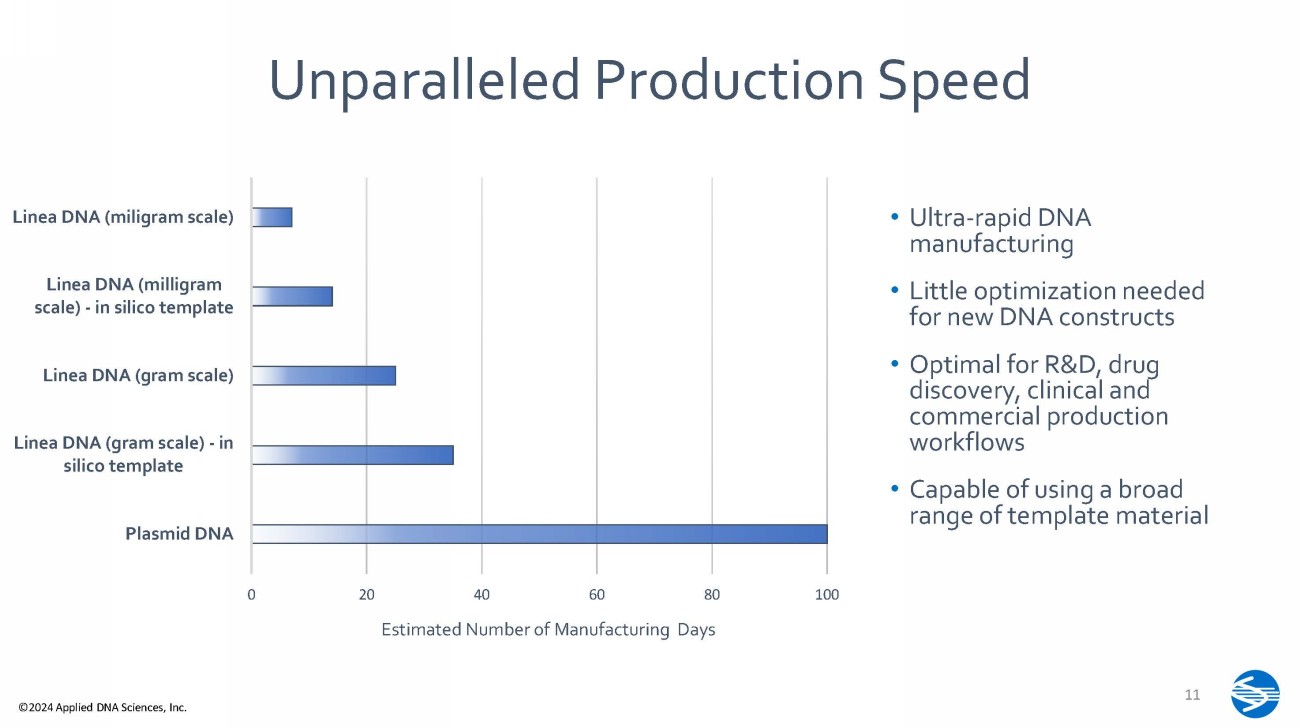

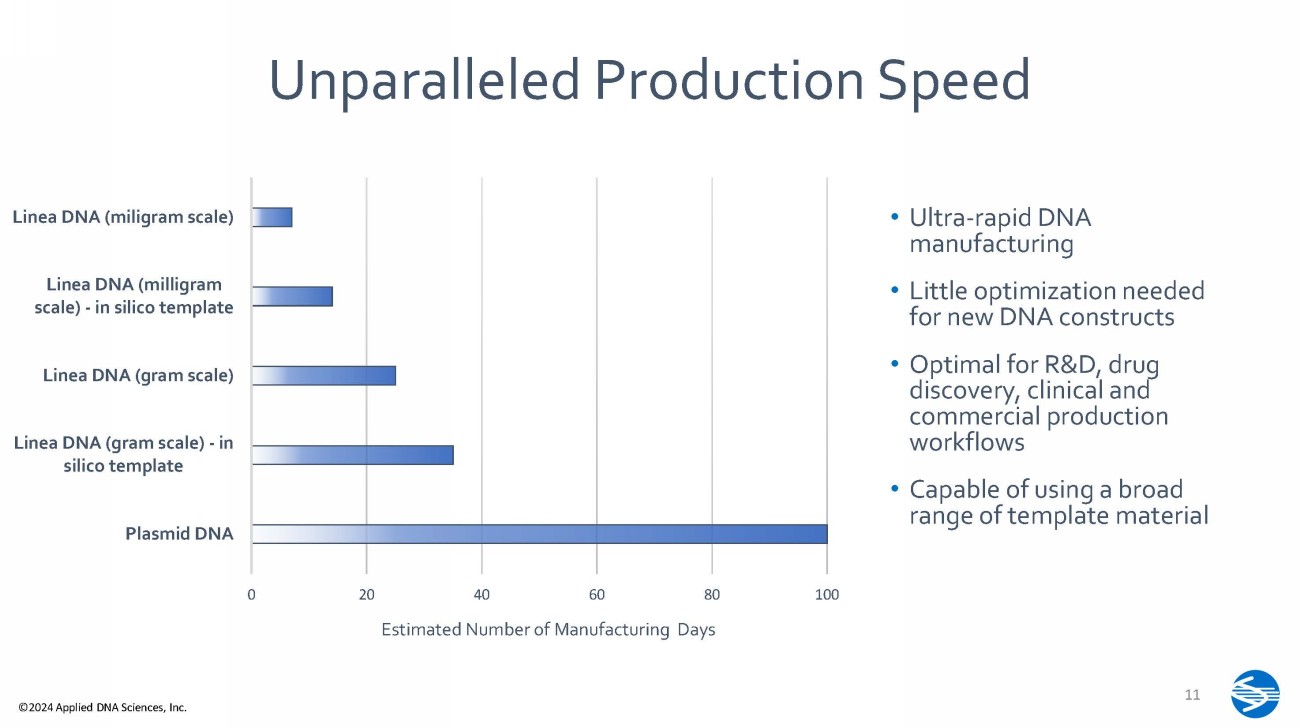

Unparalleled Production Speed • Ultra - rapid DNA manufacturing • Little optimization needed for new DNA constructs • Optimal for R&D, drug discovery, clinical and commercial production workflows • Capable of using a broad range of template material 0 11 ©2024 Applied DNA Sciences, Inc. 20 40 60 80 Estimated Number of Manufacturing Days 1 00 Plasmid DNA Linea DNA (gram scale) - in silico template Linea DNA (gram scale) Linea DNA (milligram scale) - in silico template Linea DNA (miligram scale)

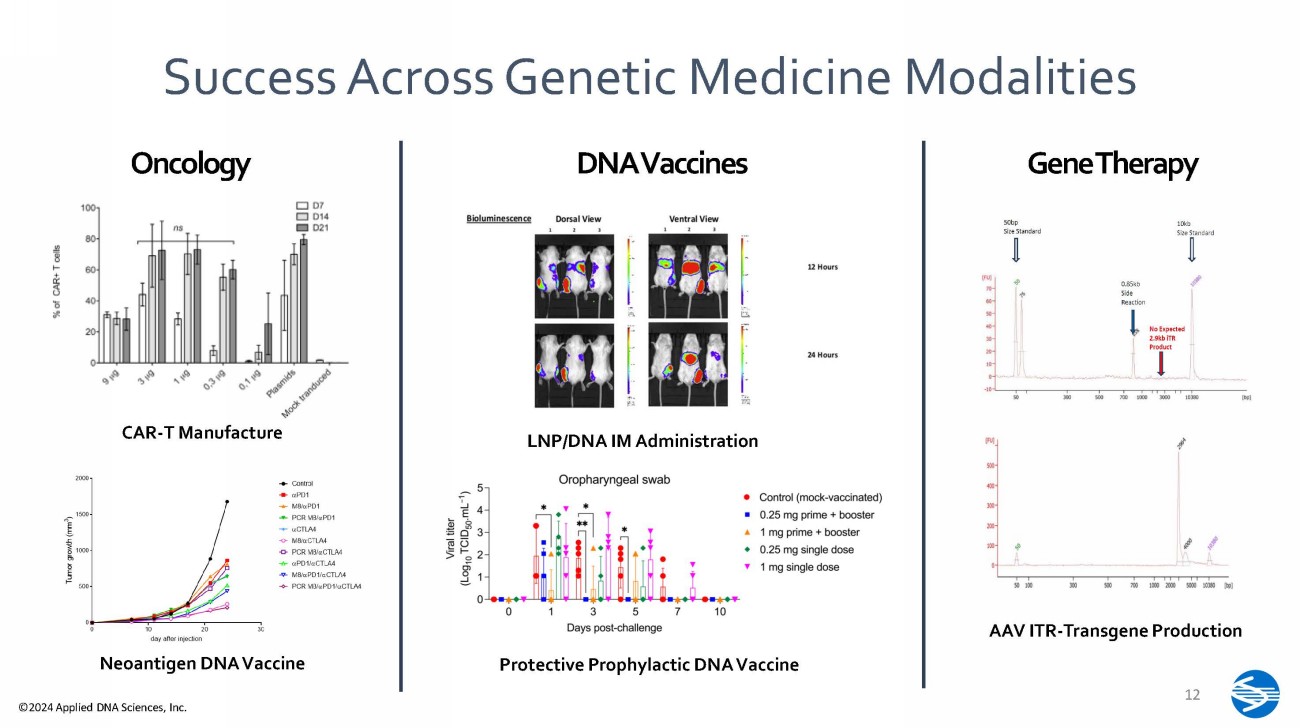

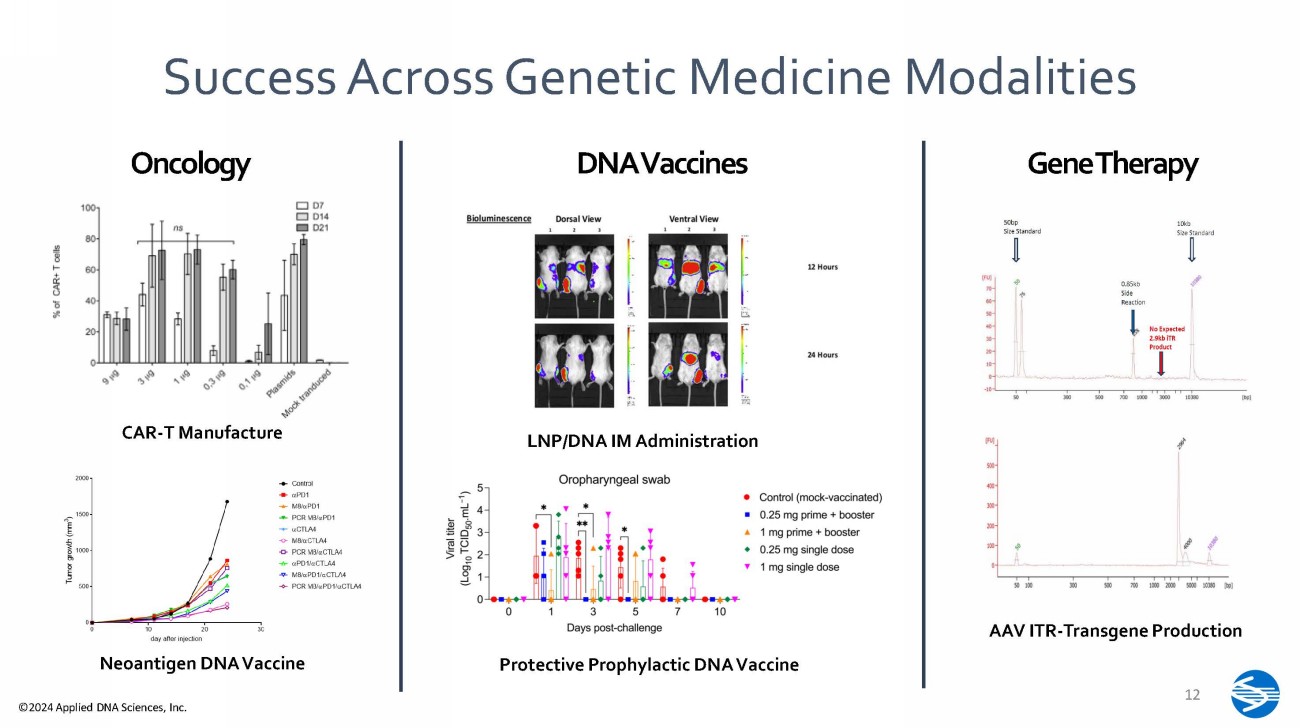

Success Across Genetic Medicine Modalities Oncology DNAVaccines GeneTherapy 12 ©2024 Applied DNA Sciences, Inc. CAR - T Manufacture Neoantigen DNA Vaccine LNP/DNA IM Administration Protective Prophylactic DNA Vaccine AAV ITR - Transgene Production

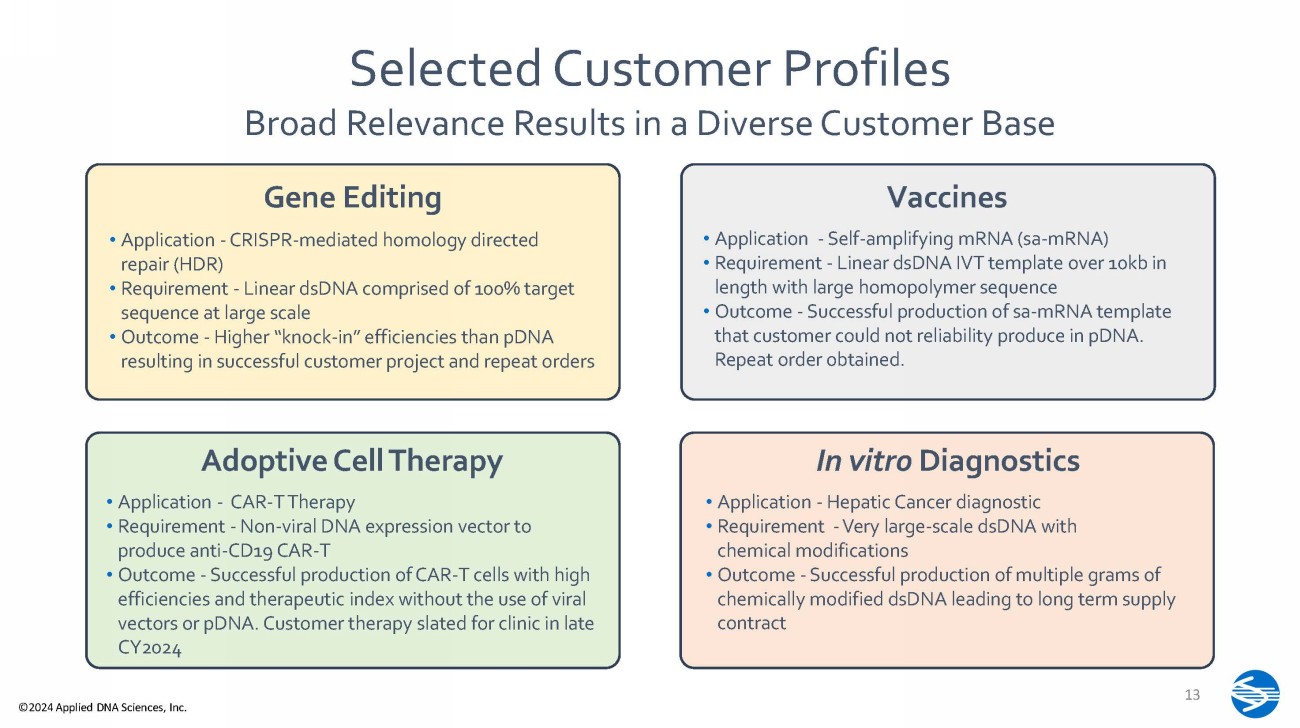

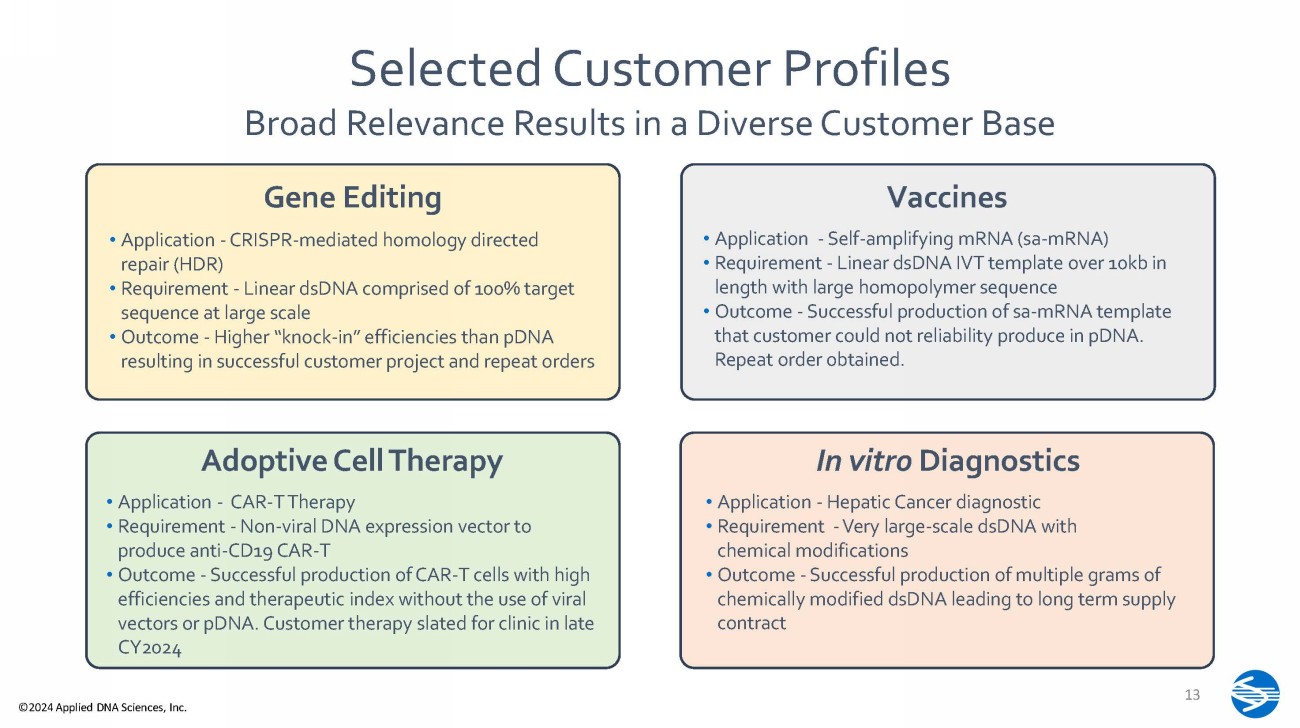

Selected Customer Profiles Broad Relevance Results in a Diverse Customer Base Gene Editing • Application - CRISPR - mediated homology directed repair (HDR) • Requirement - Linear dsDNA comprised of 100% target sequence at large scale • Outcome - Higher “knock - in” efficiencies than pDNA resulting in successful customer project and repeat orders Vaccines • Application - Self - amplifying mRNA (sa - mRNA) • Requirement - Linear dsDNA IVT template over 10kb in length with large homopolymer sequence • Outcome - Successful production of sa - mRNA template that customer could not reliability produce in pDNA. Repeat order obtained. In vitro Diagnostics • Application - Hepatic Cancer diagnostic • Requirement - Very large - scale dsDNA with chemical modifications • Outcome - Successful production of multiple grams of chemically modified dsDNA leading to long term supply contract Adoptive Cell Therapy • Application - CAR - T Therapy • Requirement - Non - viral DNA expression vector to produce anti - CD 19 CAR - T • Outcome - Successful production of CAR - T cells with high efficiencies and therapeutic index without the use of viral vectors or pDNA . Customer therapy slated for clinic in late CY 2024 13 ©2024 Applied DNA Sciences, Inc.

Better RNA…Faster 14 ©2024 Applied DNA Sciences, Inc.

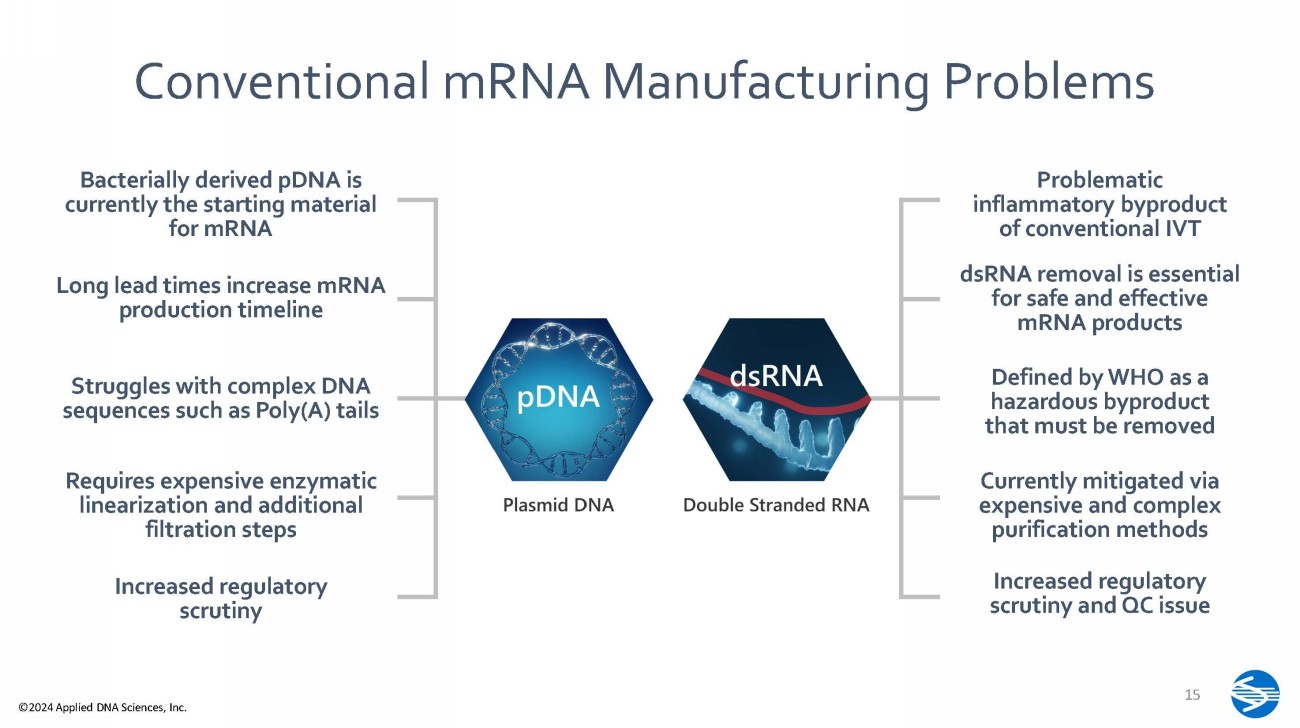

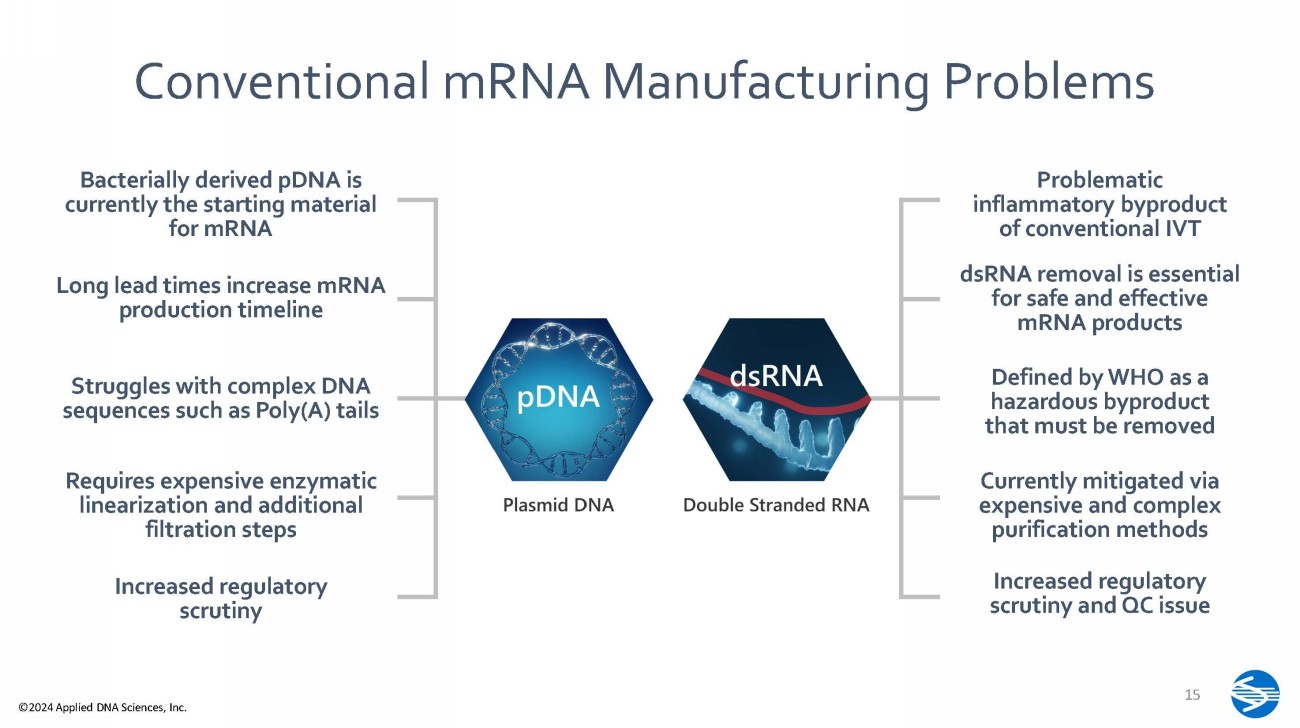

Conventional mRNA Manufacturing Problems Long lead times increase mRNA production timeline 15 ©2024 Applied DNA Sciences, Inc. Struggles with complex DNA sequences such as Poly(A) tails Requires expensive enzymatic linearization and additional filtration steps Problematic inflammatory byproduct of conventional IVT dsRNA removal is essential for safe and effective mRNA products Increased regulatory scrutiny Currently mitigated via expensive and complex purification methods Defined by WHO as a hazardous byproduct that must be removed Increased regulatory scrutiny and QC issue Bacterially derived pDNA is currently the starting material for mRNA

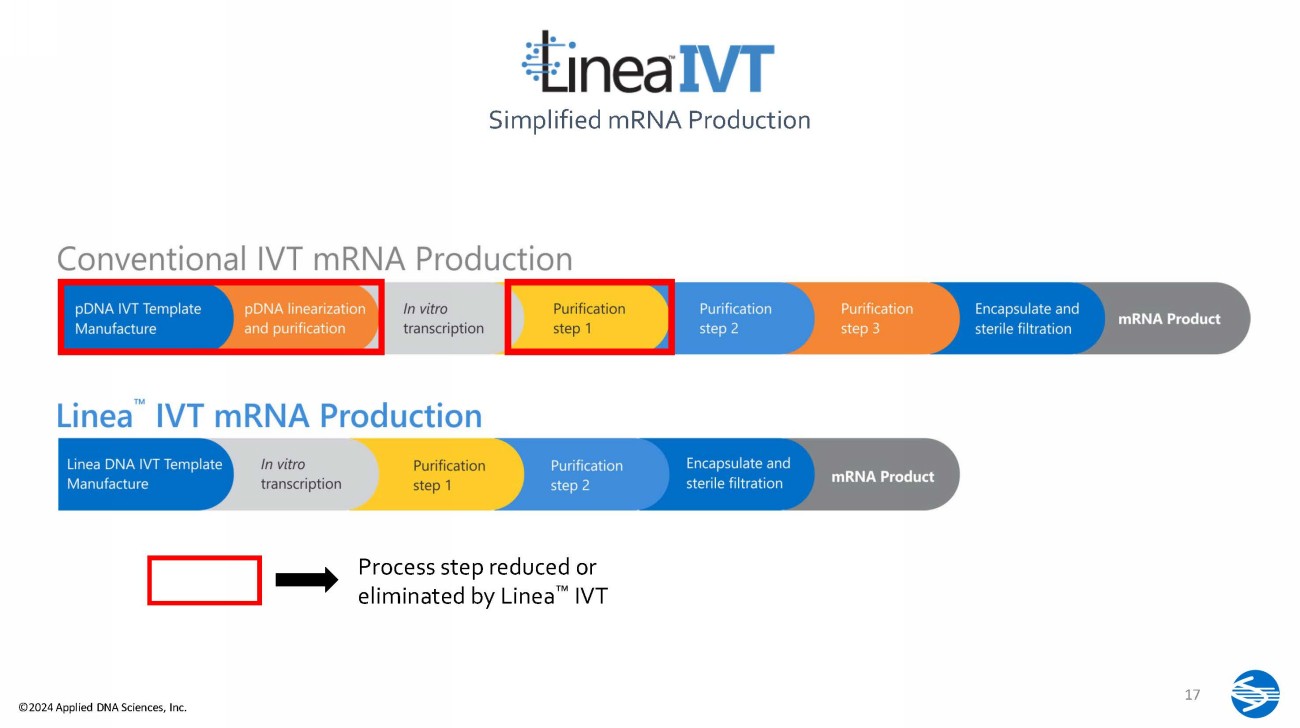

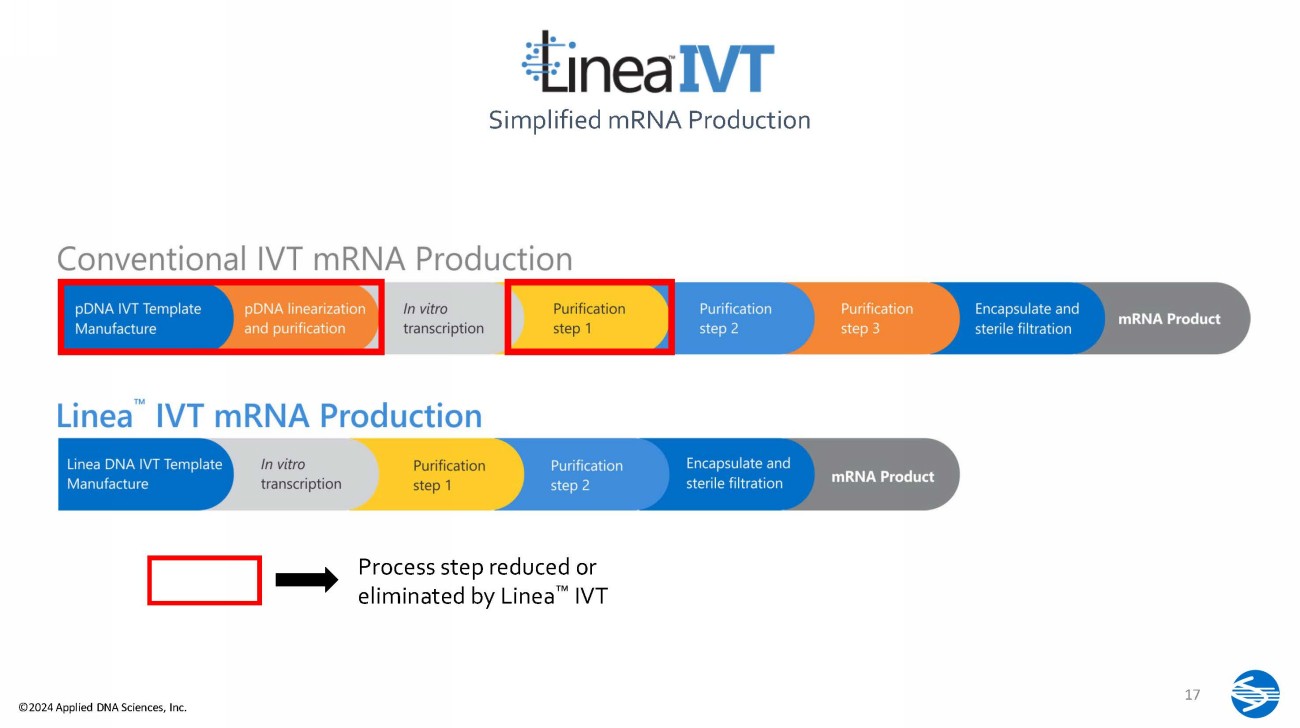

Two Next Generation Technologies for Better mRNA • Secured via acquisition of Spindle Bio Inc. in July 2023 • Proprietary fusion enzyme comprised of a high fidelity RNAP and DNA binding domain • Chemically binds to Linea DNA IVT templates allowing unique IVT conditions that reduce or mitigate dsRNA • No impact on RNA fidelity • Pending IP in over 15 countries IVT Templates • Leverages platform advantages for 100% enzymatic production of IVT templates • Reduces up to 40% of the IVT steps used to manufacture mRNA • Homopolymers are added enzymatically providing homogeneous poly(a) sequence in mRNA • Chemical modification needed to enable Linea RNAP easily added 16 ©2024 Applied DNA Sciences, Inc.

Process step reduced or eli m i n a t ed b y L i n ea I V T Simplified mRNA Production 17 ©2024 Applied DNA Sciences, Inc.

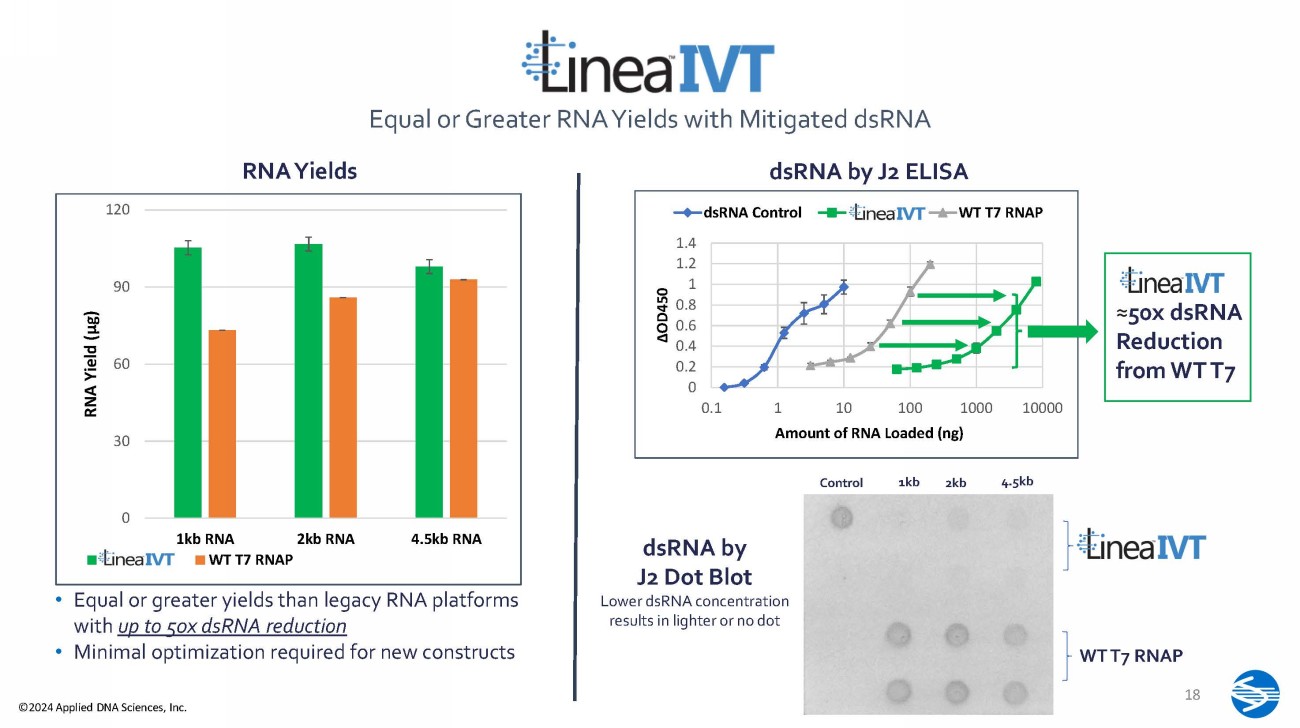

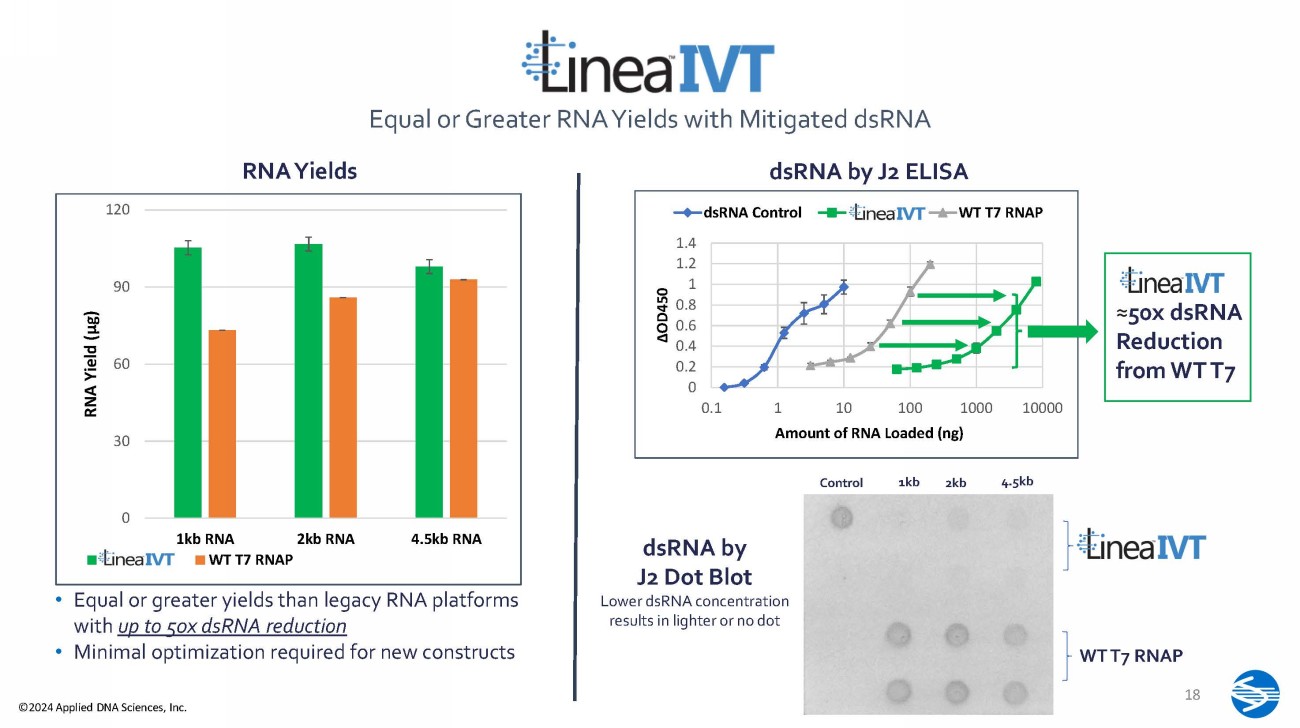

0 30 60 90 1 20 2kb RNA 4.5kb RNA RNA Yield (µg) Linea IVT…. 1kb RNA WT T7 RNAP 1 kb 2 kb 4 . 5kb C o n t r ol 1 .4 1 .2 1 0 .8 0 .6 0 .4 0 .2 0 0 .1 ΔOD450 1 10 1 0 0 1 0 00 1 0 0 00 Amount of RNA Loaded (ng) Linea IVT dsRNA by J2 ELISA dsRNA Control WT T7 RNAP WT T7 RNAP ≈ 50x dsRNA Reduction from WT T7 dsRNA by J2 Dot Blot Lower dsRNA concentration results in lighter or no dot RNA Yields • Equal or greater yields than legacy RNA platforms with up to 50x dsRNA reduction • Minimal optimization required for new constructs Equal or Greater RNAYields with Mitigated dsRNA 18 ©2024 Applied DNA Sciences, Inc.

0 0.05 0.1 0.15 0.2 0.25 Control Linea IVT WT Linea IVT WT Linea IVT WT N e g a ti ve Control 1kb RNA 2kb RNA 4.5kb RNA NF - kB signaling (OD640) RNA Constructs (500ng) 4000 3500 3000 2500 2000 1500 1000 500 0 Control Linea IVT WT Linea IVT WT Linea IVT WT N e g a ti ve Control 1kb RNA 2kb RNA 4.5kb RNA IL - 8 signal (RLU) RNA Constructs (500ng) • dsRNA mitigated mRNA produced with Linea IVT reduced unwanted cellular immune stimulation in vitro to near negative control levels • mRNA produced with legacy platform showed significant unwanted cellular immune stimulation in vitro hTLR3 - SEAP reporter in HEK293 hTLR3 - Luc reporter in HEK293 Reduced Unwanted Cellular Immune Stimulation 19 ©2024 Applied DNA Sciences, Inc.

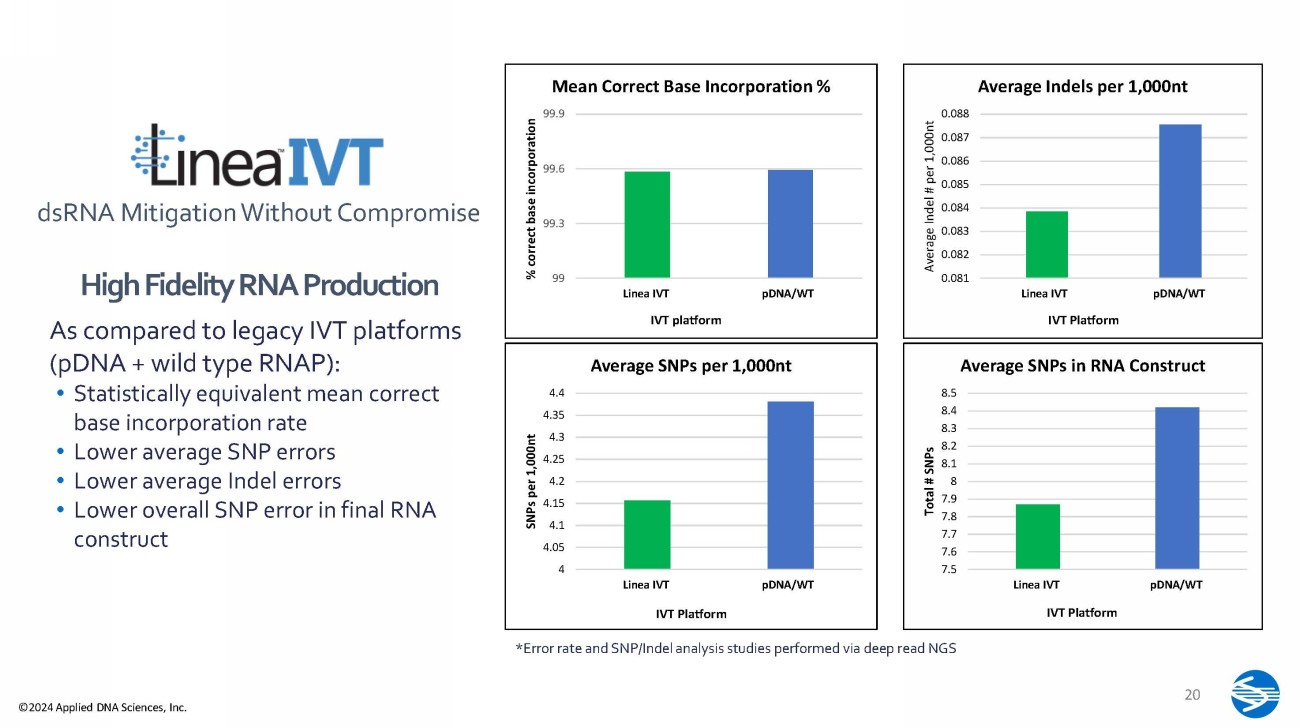

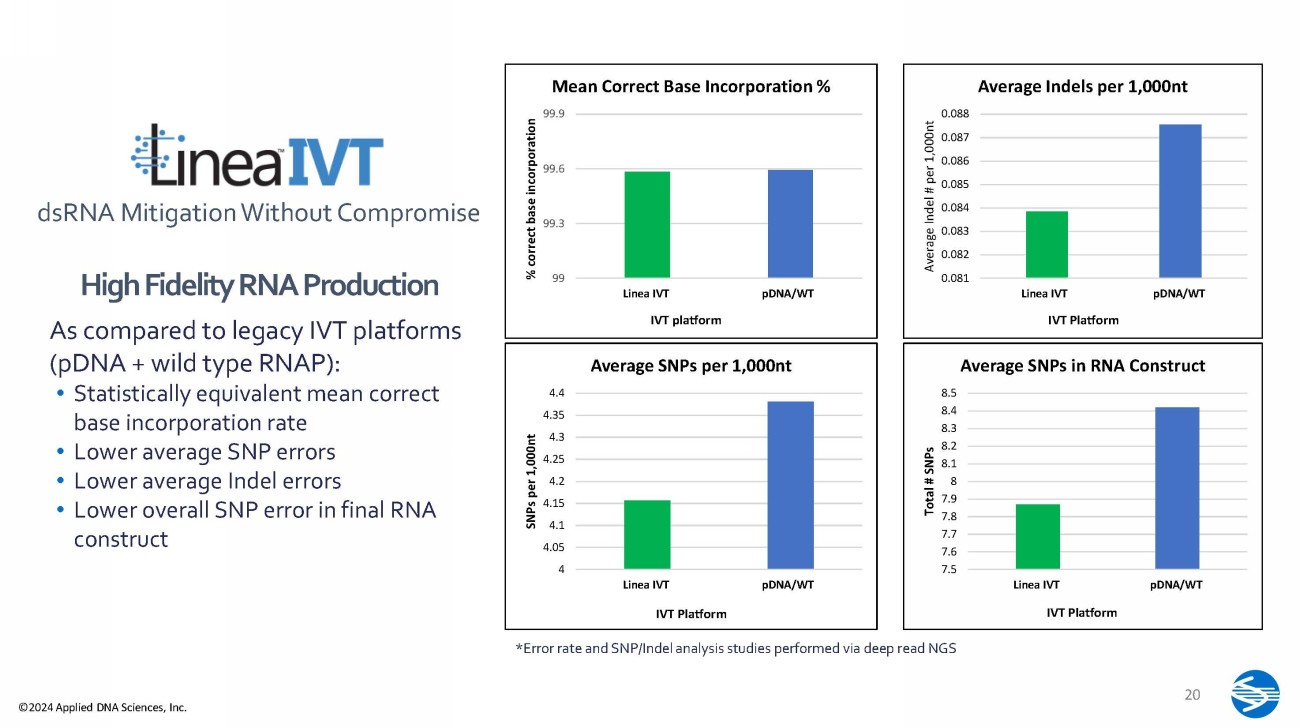

8.5 8.4 8.3 8.2 8.1 8 7.9 7.8 7.7 7.6 7.5 Linea IVT pDNA/WT Total # SNPs IVT Platform Average SNPs in RNA Construct 0.088 0.087 0.086 0.085 0.084 0.083 0.082 0.081 Linea IVT pDNA/WT Average Indel # per 1,000nt IVT Platform Average Indels per 1,000nt 4.4 4.35 4.3 4.25 4.2 4.15 4.1 4.05 4 Linea IVT pDNA/WT SNPs per 1,000nt IVT Platform Average SNPs per 1,000nt 99 99.3 99.6 99.9 Linea IVT pDNA/WT % correct base incorporation IVT platform Mean Correct Base Incorporation % High Fidelity RNA Production As compared to legacy IVT platforms (pDNA + wild type RNAP): • Statistically equivalent mean correct base incorporation rate • Lower average SNP errors • Lower average Indel errors • Lower overall SNP error in final RNA construct *Error rate and SNP/Indel analysis studies performed via deep read NGS dsRNA Mitigation Without Compromise 20 ©2024 Applied DNA Sciences, Inc.

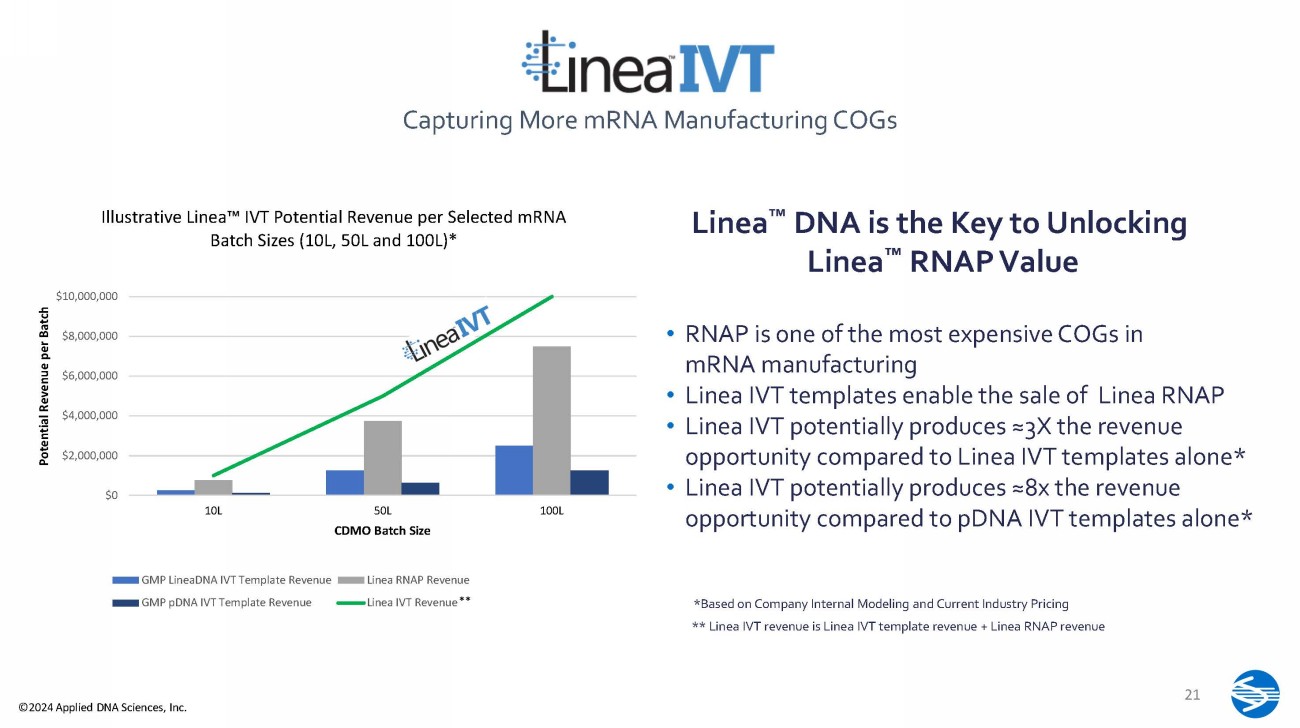

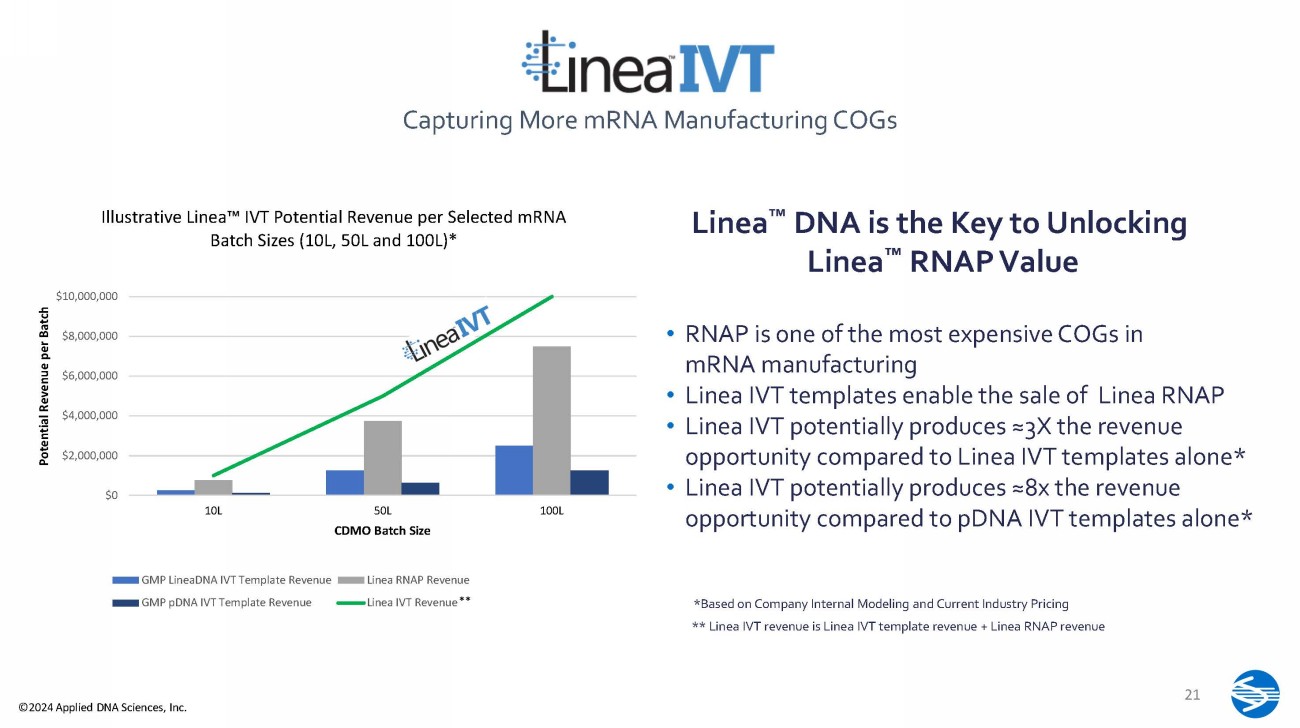

$0 $2,000,000 $4,000,000 $6,000,000 $8,000,000 $10,000,000 10L 50L CDMO Batch Size 100L Potential Revenue per Batch Illustrative Linea IVT Potential Revenue per Selected mRNA Batch Sizes (10L, 50L and 100L)* GMP LineaDNA IVT Template Revenue GMP pDNA IVT Template Revenue Linea RNAP Revenue Linea IVT Revenue ** *Based on Company Internal Modeling and Current Industry Pricing ** Linea IVT revenue is Linea IVT template revenue + Linea RNAP revenue • RNAP is one of the most expensive COGs in mRNA manufacturing • Linea IVT templates enable the sale of Linea RNAP • Linea IVT potentially produces ≈3X the revenue opportunity compared to Linea IVT templates alone* • Linea IVT potentially produces ≈8x the revenue opportunity compared to pDNA IVT templates alone* Linea DNA is the Key to Unlocking Linea RNAP Value Capturing More mRNA Manufacturing COGs 21 ©2024 Applied DNA Sciences, Inc.

Financial Snapshot * $8.7 Million Market Cap 64,125 Average 3 - month daily share volume $7.2 Million C a s h /e q u i v a le n ts 13.7 Million Common shares outstanding 21.4 Million Fully diluted shares Capital Stock Series A Preferred: 10M authorized; 0 issued and outstanding Series B Preferred: 10M authorized; 0 issued and outstanding *As of closing price on 01.03.24 and Form 10 - K filed on 12/7/23 22 ©2024 Applied DNA Sciences, Inc.

Thank you! Nasdaq: APDN