- APDN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Applied DNA Sciences (APDN) PRE 14APreliminary proxy

Filed: 26 Sep 19, 5:22pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

APPLIED DNA SCIENCES, INC.

(Name of Registrant as Specified in Its Charter)

Not applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

APPLIED DNA SCIENCES, INC.

50 HEALTH SCIENCES DRIVE

STONY BROOK, NEW YORK 11790

(631) 240-8800

October 10, 2019

Dear Fellow Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders (the “Special Meeting”) of Applied DNA Sciences, Inc. (“Applied DNA Sciences,” the “Company,” “we” or “us”) to be held at9:00 a.m., local time, on October 31, 2019, at the Long Island High Technology Incubator located at 25 Health Sciences Drive, Stony Brook, New York 11790.

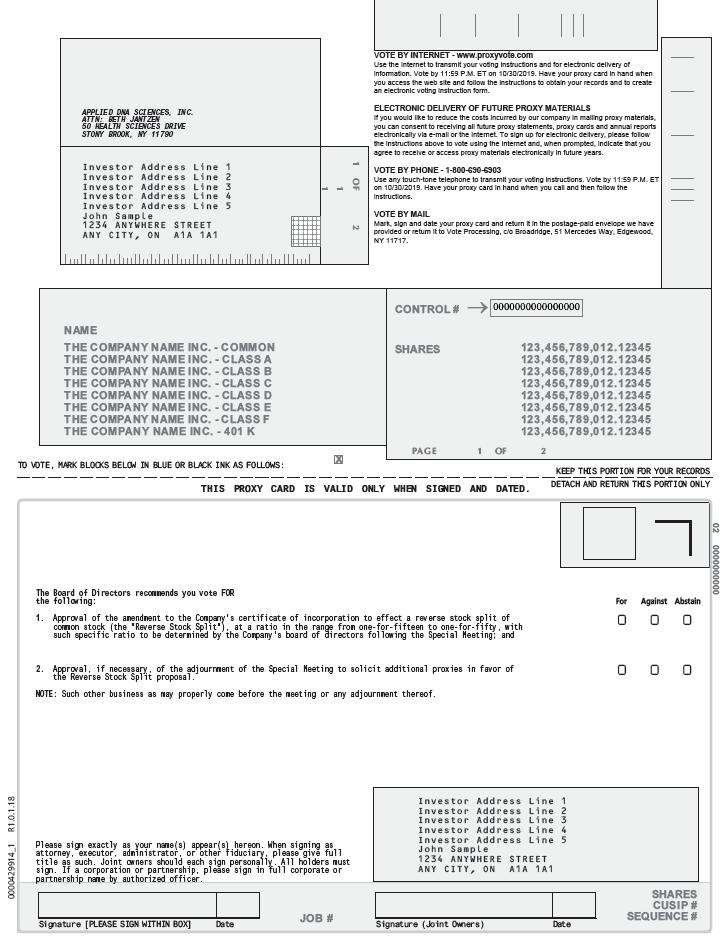

At the meeting, you will be asked (i) to approve an amendment to the Company’s certificate of incorporation to effect a reverse stock split of common stock, at a ratio in the range from one-for-fifteen to one-for-fifty, with such specific ratio to be determined by the Company’s board of directors following the Special Meeting; and (ii) if necessary, to adjourn the Special Meeting to permit the Company to solicit additional proxies if there are insufficient proxies at the Special Meeting to approve the reverse stock split proposal. Detailed information with respect to these matters is set forth in the accompanying proxy statement (the “Proxy Statement”), which we encourage you to carefully read in its entirety.

We look forward to greeting personally those stockholders who are able to attend the meeting in person. Please note that each stockholder who wishes to attend the Special Meeting will be required to present valid government-issued photo identification to be admitted to the Special Meeting. However, whether or not you plan to be with us at the meeting, it is important that your shares be represented. Stockholders of record at the close of business on October 4, 2019 are entitled to notice of and to vote at the meeting. Please read the Proxy Statement and then, regardless of whether you plan to attend the Special Meeting, vote your shares as promptly as possible. Please see page4 for information about voting by Internet, telephone, mail or in person at the Special Meeting. Please note that voting in advance in any of the ways described will not prevent you from attending the Special Meeting should you choose to do so. You may revoke your proxy at any time before the vote is taken by delivering to the Company’s Corporate Secretary a written revocation, submitting a proxy with a later date or by voting your shares in person at the Special Meeting, in which case your prior proxy will be disregarded. I hope that you will attend the Special Meeting, but even if you cannot, please vote your shares as promptly as possible.

Thank you for your ongoing support of Applied DNA Sciences.

| Very truly yours, | |

| /s/ James A. Hayward | |

| James A. Hayward Chairman, President and Chief Executive Officer |

APPLIED DNA SCIENCES, INC.

NOTICE OF Special MEETING OF STOCKHOLDERS

Notice is hereby given that a Special Meeting of Stockholders (the “Special Meeting”) of Applied DNA Sciences, Inc. (“Applied DNA Sciences” or the “Company”), will be held on October 31, 2019 at 9:00 a.m., local time, at the Long Island High Technology Incubator, located at 25 Health Sciences Drive, Stony Brook, New York 11790 for the following purposes:

| · | to approve an amendment to the Company’s certificate of incorporation to effect a reverse stock split of common stock (the “Reverse Stock Split”), at a ratio in the range from one-for-fifteen to one-for-fifty, with such specific ratio to be determined by the Company’s board of directors following the Special Meeting; and |

| · | if necessary, the adjournment of the Special Meeting to solicit additional proxies in favor of the Reverse Stock Split proposal. |

These matters are more fully described in the accompanying proxy statement.

Only stockholders of record at the close of business on October 4, 2019 are entitled to notice of and to vote at the meeting or any postponements or adjournments of the meeting. A list of stockholders eligible to vote at the meeting will be available for inspection at the meeting and for a period of ten days prior to the meeting during regular business hours at our corporate headquarters at Applied DNA Sciences, 50 Health Sciences Drive, Stony Brook, New York 11790.

You are cordially invited to attend the Special Meeting in person. Whether or not you expect to attend the Special Meeting, please vote online or by telephone or please complete, sign and date the proxy provided to you and return it promptly in the envelope provided to you, which does not require any postage if mailed in the United States, in order to ensure your representation at the Special Meeting. Even if you have voted by proxy, you may still vote in person if you attend the Special Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder in order to vote in person.

Ms. Judith Murrah Secretary |

| |

| Stony Brook, New York October 10, 2019 | ||

You can help avoid the necessity and expense of sending follow-up letters to ensure a quorum by promptly returning the enclosed proxy card. Please fill in, sign and return the enclosed proxy card in order that the necessary quorum may be represented at the Special Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders To Be Held on October 31, 2019

The proxy statement is available free of charge at the following website:www.proxyvote.com.

TABLE OF CONTENTS

Page

APPLIED DNA SCIENCES, INC.

50 HEALTH SCIENCES DRIVE

STONY BROOK, NEW YORK 11790

Proxies are being solicited on behalf of the board of directors (the “Board”)for use at a Special Meeting of Stockholders (the “Special Meeting”) of Applied DNA Sciences, Inc. (“Applied DNA Sciences,” the “Company,” “we” or “us”) to be held on October 31, 2019, beginning at 9:00 a.m., local time, at the Long Island High Technology Incubator, 25 Health Sciences Drive, Stony Brook, New York 11790, and at any postponements or adjournments of the Special Meeting. As a stockholder, you are invited to attend the Special Meeting and are requested to vote on the items of business described in this proxy statement (the “Proxy Statement”).

Applied DNA Sciences is using the Securities and Exchange Commission (the “SEC”) rule that allows us to deliver a “full set” of our proxy materials by mail to all of our stockholders of record as of October 4, 2019 (the “Record Date”). Our proxy materials include the Notice of Special Meeting (the “Notice”), this Proxy Statement and a proxy card (collectively, the “Proxy Materials”), and we will mail our Proxy Materials on or about October 10, 2019. In addition to mailing our Proxy Materials, we will also provide access to our Proxy Materials over the Internet, by October 10, 2019. The Notice and the Proxy Statement instruct you on how to access and review all of the important information contained in the Proxy Materials via the Internet. The Notice and the Proxy Statement also instruct you on how you may submit your vote by mail, the Internet, toll-free number, or in person at the Special Meeting.

Why am I receiving these materials?

We have sent you these Proxy Materials because the Board is soliciting your proxy to vote at the Special Meeting, including at any adjournments or postponements of the meeting. You are invited to attend the Special Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or through the Internet. The mailing of our Proxy Materials to our stockholders is scheduled to begin on or about October 10, 2019.

What is the purpose of the Special Meeting?

At our Special Meeting, stockholders will act upon the matters outlined in the Notice accompanying this Proxy Statement, consisting of:

Proposal 1 -to approve an amendment to the Company’s certificate of incorporation, as amended, (the “Certificate of Incorporation”) to effect a reverse stock split of common stock (the “Reverse Stock Split”), at a ratio in the range from one-for-fifteen to one-for-fifty, with such specific ratio to be determined by the Board following the Special Meeting. The purpose of this proposal is to enable the Company to regain compliance with the minimum per share bid price requirement of The Nasdaq Capital Market (“Nasdaq”) so that we may continue our listing on Nasdaq; and

Proposal 2 -if necessary, the adjournment of the Special Meeting to solicit additional proxies in favor of the Reverse Stock Split proposal.

Our Board is not currently aware of any other matters which will come before the Special Meeting.

If Proposal 1 is approved by the Company’s stockholders at the Special Meeting, the Reverse Stock Split will be effected, if at all, only upon a subsequent determination by the Board of Directors that the Reverse Stock Split is in the best interests of the Company and our stockholders. The Board may make this determination as soon as immediately following the conclusion of the Special Meeting, and the Reverse Stock Split could become effective as soon as the business day immediately following the Special Meeting.

-2-

Notwithstanding approval of the Reverse Stock Split proposal by our stockholders, the Board reserves its right to elect not to proceed with implementing the Reverse Stock Split proposal at any time prior to the date on which the amendment to our Certificate of Incorporation becomes effective under Delaware law, if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of the Company or its stockholders.

Each of these proposals is described in further detail below.

Why does the Company need stockholders to vote on the Reverse Stock Split?

Our common stock and publicly traded warrants are listed on Nasdaq under the symbols “APDN” and “APDNW,” respectively. For our common stock and publicly traded warrants to continue to be listed on Nasdaq, we must meet the current continued listing requirements, including the requirements that (1) our common stock must maintain a minimum closing bid price of $1.00 pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”); and (2) we must maintain net income from continuing operations (in the latest fiscal year or two of the three last fiscal years) of at least $500,000, a market value of listed securities of at least $35 million (the “Minimum Value of Listed Securities Requirement”), or stockholders’ equity of at least $2.5 million, pursuant to Nasdaq Listing Rule 5550(b).

On January 29, 2019 and January 30, 2019, we received written notices from the Listing Qualifications Department of Nasdaq notifying us that we are not in compliance with the Minimum Bid Price Requirement as well as the Minimum Value of Listed Securities Requirement, or the alternative standards of Nasdaq Listing Rule 5550(b)(1) or 5550(b)(3) which require a company to have minimum stockholders equity of at least $2.5 million or for it to have had net income from continuing operations of at least $500,000 in the latest fiscal year or in two of the last three fiscal years, respectively.

On July 30, 2019, we received written notice from Nasdaq indicating that, based upon our continued non-compliance with the Minimum Bid Price Requirement and Minimum Value of Listed Securities Requirement, the staff of Nasdaq (the “Staff”) had determined to delist our securities (including our common stock and publicly traded warrants) from Nasdaq unless we timely requested a hearing before the Nasdaq Hearings Panel (the “Panel”). We requested a hearing before the Panel and the hearing was held on September 19, 2019. The hearing stayed any further action by the Staff pending the ultimate conclusion of the hearing process and during the pendency of the hearing before the Panel, our listed securities remain listed on Nasdaq. As of September 26, 2019, the Panel had not made its ruling. There can be no assurance that the Panel will grant our request for continued listing on Nasdaq or that we will be able to regain compliance with the applicable listing criteria within the period of time that may be granted by the Panel. If the Panel does not grant our request for continued listing, the Board, in its discretion, may not effect the Reverse Stock Split, and the Reverse Stock Split, if it occurs, will not be sufficient to maintain our listing on Nasdaq.

The Board has determined that an amendment to our Certificate of Incorporation to effect the Reverse Stock Split is necessary to the continued listing of our common stock on Nasdaq and is in the best interests of our stockholders.

In addition to bringing the per share trading price of our common stock above $1.00, we also believe that the Reverse Stock Split will make our common stock more attractive to a broader range of institutional and other investors, as we have been advised that the current per share trading price of our common stock may affect its acceptability to certain institutional investors, professional investors and other members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers.

How do proxies work and how are votes counted?

The Board is asking for your proxy. Giving us your proxy means that you authorize us to vote your shares at the Special Meeting in the manner you direct. You may vote for or against, or abstain from voting on the approval of Proposals 1 and 2. If a stockholder of record does not indicate instructions with respect to one or more matters on his, her or its proxy, the shares represented by that proxy will be voted as recommended by the Board (for more information, see “- How does the Board recommend that I vote?”). If a beneficial owner of shares held in street name does not provide instructions to the bank, broker, or other nominee holding those shares, please see the information below under the caption“- What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?”

-3-

Who is entitled to vote at the Special Meeting?

Only stockholders of record at the close of business on October 4, 2019, the Record Date, are entitled to receive notice of and to participate in the Special Meeting, or any postponements and adjournments of the meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares you held on that date at the meeting, or any postponements or adjournments of the meeting.

As of September 25, 2019, there were 48,015,938 shares of common stock outstanding. On the Record Date, there were shares of common stock outstanding. Each outstanding share of common stock is entitled to one vote on each of the matters presented at the Special Meeting or postponements and adjournments of the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the outstanding shares of common stock as of the Record Date will constitute a quorum, permitting the Special Meeting to conduct its business. As of the Record Date, , shares of common stock, representing the same number of votes, were outstanding. Thus, the presence of holders representing at least shares will be required to establish a quorum.

If a stockholder abstains from voting as to any matter or matters, the shares held by such stockholder shall be deemed present at the Special Meeting for purposes of determining a quorum. If a bank, broker, or other nominee returns a “broker non-vote” proxy, indicating a lack of voting instructions by the beneficial holder of the shares and a lack of discretionary authority on the part of the bank, broker, or other nominee to vote on a particular matter, then the shares covered by such broker non-vote proxy shall be deemed present at the Special Meeting for purposes of determining a quorum, but otherwise shall have no effect. For more information on broker non-votes, see“- What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?”

How do I attend the Special Meeting?

The meeting will be held on October 31, 2019 beginning at 9:00 a.m., local time, at the Long Island High Technology Incubator, 25 Health Sciences Drive, Stony Brook, New York 11790. Directions to the Long Island High Technology Incubator can be found on our website atwww.adnas.com. The information found on, or accessible through, our website is not incorporated into, and does not form a part of, this Proxy Statement or any other report or document we file with or furnish to the SEC due to the inclusion of our website address above or elsewhere in this Proxy Statement. Information on how to vote in person at the Special Meeting is discussed below under the caption “- How can I vote my shares?” Each stockholder who wishes to attend the Special Meeting will be required to present valid government-issued photo identification to be admitted to the Special Meeting.

How can I vote my shares?

In person:

| · | Record stockholders:Shares held in your name as the stockholder of record may be voted by you in person at the Special Meeting. |

| · | Owners of shares held beneficially in street name:Shares held beneficially in street name may be voted by you in person at the Special Meeting only if you obtain a legal proxy from the broker, bank, or other nominee that holds your shares giving you the right to vote the shares and you bring that legal proxy with you to the Special Meeting. |

Even if you plan to attend the Special Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the meeting.

-4-

By proxy:

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Special Meeting.

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote:

By Internet or by telephone: Follow the instructions included in the proxy card to vote by Internet or telephone.

By mail: You can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the Board’s recommendations as noted below.

In person at the meeting: If you attend the Special Meeting, you may deliver a completed proxy card in person or you may vote by completing a ballot, which will be available at the meeting.

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on October 30, 2019.

If you return your signed proxy card to us before the Special Meeting, we will vote your shares as you direct. Whether or not you plan to attend the Special Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Special Meeting and vote in person if you have already voted by proxy.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, you should have received a proxy card and voting instructions with these Proxy Materials from that organization rather than from us. Simply complete and mail the proxy card to ensure that your vote is counted. To vote in person at the Special Meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these Proxy Materials, or contact your broker or bank to request a proxy card.

Stockholders who submit a proxy through the Internet or telephone should be aware that they may incur costs to access the Internet or telephone, such as usage charges from telephone companies or Internet service providers, and that these costs will not be reimbursed by the Company.

What happens if additional matters are presented at the Special Meeting?

Other than the items of business described in this Proxy Statement, we are not currently aware of any other business to be acted upon at the Special Meeting. If you grant a proxy, the persons named as proxy holders, Ms. Beth Jantzen and Ms. Judith Murrah, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting.

How does the Board recommend that I vote?

As to the proposals to be voted on at the Special Meeting, the Board unanimously recommends that you vote:

| · | FOR Proposal 1, for the approval of an amendment to our Certificate of Incorporation and authorization of the Board to effect the Reverse Stock Split; and |

| · | FOR Proposal 2, for approval of a proposal for the adjournment of the Special Meeting to permit the Company to solicit additional proxies if there are insufficient proxies at the Special Meeting to approve Proposal 1. |

-5-

What if I am a stockholder of record and do not indicate voting instructions on my proxy?

If you are a stockholder of record and provide specific instructions on your proxy with regard to certain items, your shares will be voted as you instruct on such items.If no instructions are indicated on your proxy for one or more of the proposals to be voted on, the shares will be voted as recommended by the Board: (i) for Proposal 1, for the approval of an amendment to our Certificate of Incorporation and authorization of the Board to effect the Reverse Stock Split; and (ii) for Proposal 2, for approval of a proposal for the adjournment of the Special Meeting to permit the Company to solicit additional proxies if there are insufficient proxies at the Special Meeting to approve Proposal 1. If any other matters are properly presented for consideration at the meeting, the individuals named as proxy holders, Ms. Beth Jantzen and Ms. Judith Murrah, will vote the shares that they represent on those matters as recommended by the Board. If the Board does not make a recommendation, then they will vote in accordance with their best judgment.

What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?

As a beneficial owner, in order to ensure your shares are voted in the way you would like, you must provide voting instructions to your bank, broker, or other nominee by the deadline provided in the materials you receive from your bank, broker, or other nominee or vote by mail, telephone or Internet according to instructions provided by your bank, broker, or other nominee.

The approval of Proposal 1, an amendment to our Certificate of Incorporation and authorization of the Board to effect the Reverse Stock Split, and the approval of Proposal 2, the adjournment of the Special Meeting to permit the Company to solicit additional proxies if there are insufficient proxies at the Special Meeting to approve Proposal 1, are each non-discretionary items and may not be voted on by brokers, banks or other nominees who have not received specific voting instructions from beneficial owners. A broker non-vote occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting authority and has not received voting instructions from the beneficial owner. Therefore, broker non-votes may exist in connection with Proposals 1 and 2. For Proposal 1, regarding the Reverse Stock Split, broker non-votes will be excluded entirely from the vote and will, therefore, have the same effect as a vote “AGAINST” such proposal. Broker non-votes will not be considered votes cast by the holders of all of the shares of common stock present in person or by proxy at the Special Meeting and voting affirmatively or negatively and will therefore not have any effect with respect to Proposal 2.

We encourage you to provide instructions to your broker regarding the voting of your shares.

Can I change my vote or revoke my proxy?

Yes. (1) If you are a stockholder of record, you may revoke your proxy by (i) following the instructions on the proxy card and entering a new vote by telephone or over the Internet up until 11:59 p.m. Eastern Time on October 30, 2019, (ii) attending the Special Meeting and voting in person (although attendance at the Special Meeting will not in and of itself revoke a proxy) or (iii) entering a new vote by mail. Any written notice of revocation or subsequent proxy card must be received by the Secretary of the Company prior to the holding of the vote at the Special Meeting at 9:00 a.m., Eastern Time, on October 31, 2019. Such written notice of revocation or subsequent proxy card should be hand delivered to the Secretary of the Company or sent to the Company’s principal executive offices at 50 Health Sciences Drive, Stony Brook, New York 11790, Attention: Corporate Secretary. (2) If a broker, bank, or other nominee holds your shares, you must contact them in order to find out how to change your vote.

The last proxy or vote that we receive from you will be the vote that is counted.

-6-

Who will bear the cost of soliciting votes for the Special Meeting?

We will pay the entire cost of preparing, assembling, printing, mailing, and distributing these Proxy Materials and soliciting votes. If you choose to access the Proxy Materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these Proxy Materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors, officers, and employees, who will not receive any additional compensation for such solicitation activities. We have engaged Kingsdale Advisors to assist in soliciting proxies on our behalf. Kingsdale Advisors may solicit proxies personally, electronically or by telephone. We have agreed to pay Kingsdale Advisors a fee of $9,000 for its services. We have also agreed to reimburse Kingsdale Advisors for its reasonable out-of-pocket expenses and to indemnify Kingsdale Advisors and its employees against certain liabilities arising from or in connection with the engagement.

What is “householding” and where can I get additional copies of Proxy Materials?

For information about householding and how to request additional copies of Proxy Materials, please see the section captioned “Householding of Proxy Materials.”

Whom may I contact if I have other questions about the Special Meeting or voting?

You may contact the Company at 50 Health Sciences Drive, Stony Brook, New York 11790, Attention: Beth Jantzen, or by telephone at 631-240-8800 or you may contact Kingsdale Advisors by telephone at 1-855-682-9644.

Where can I find the voting results of the Special Meeting?

We will announce preliminary voting results at the Special Meeting. Voting results will be disclosed on a Form 8-K filed with the SEC within four business days after the Special Meeting, which will also be available on our website.

The Notice and the Proxy Statement instruct you on how you may submit your vote by mail, the Internet, toll-free number, or in person at the Special Meeting.

-7-

PROPOSAL 1

To APPROVE THE AMENDMENT TO THE COMPANY’S CERTIFICATE OF INCORPORATION EFFECTING THE REVERSE STOCK SPLIT IN THE RANGE FROM ONE-FOR-FIFTEEN TO ONE-FOR-FIFTY

Introduction

At the Special Meeting, stockholders will be asked to approve an amendment (the “Amendment”) to the Company’s Certificate of Incorporation that will effect the Reverse Stock Split at a ratio in the range from one-for-fifteen to one-for-fifty, with such specific ratio to be determined by the Company’s Board following the Special Meeting(the “Reverse Stock Split Ratio”). Upon the effectiveness of the Amendment (the “Split Effective Time”), the issued shares of common stock outstanding immediately prior to the Split Effective Time will be reclassified into a smaller number of shares. The ultimate Reverse Stock Split Ratio will be based on a number of factors, including market conditions, existing and expected trading prices for the common stock and the listing requirements of Nasdaq.

The proposed Amendment to effect the Reverse Stock Split is attached as theAppendix to this Proxy Statement. The form of the Amendment, as more fully described below, will effect the reverse stock split but will not change the number of authorized shares of common stock or preferred stock, or the par value of the common stock or preferred stock. The following discussion is qualified in its entirety by the full text of the Amendment, which is incorporated herein by reference.

Purpose

The Board approved the proposal approving the Amendment for the following reasons:

| ● | the Board believes that the Reverse Stock Split is the best option available to the Company to increase its stock price as required for continued listing on Nasdaq; | |

| ● | the Board believes a higher stock price may help generate investor interest in the Company and help the Company attract and retain employees; and | |

| ● | if the Reverse Stock Split successfully increases the per share price of the common stock, the Board believes this increase may increase trading volume in the common stock and facilitate future financings by the Company. |

Reasons for the Reverse Stock Split and Nasdaq Listing Requirements

Our common stock and publicly traded warrants are listed on Nasdaq under the symbols “APDN” and “APDNW,” respectively. For our common stock and publicly traded warrants to continue to be listed on Nasdaq, we must meet the current continued listing requirements, including the requirements that (1) our common stock must maintain the Minimum Bid Price Requirement; and (2) we must maintain net income from continuing operations (in the latest fiscal year or two of the three last fiscal years) of at least $500,000, the Minimum Value of Listed Securities Requirement, or stockholders’ equity of at least $2.5 million, pursuant to Nasdaq Listing Rule 5550(b).

On January 29, 2019 and January 30, 2019, we received written notices from the Listing Qualifications Department of Nasdaq notifying us that we are not in compliance with the Minimum Bid Price Requirement as well as the Minimum Value of Listed Securities Requirement, or the alternative standards of Nasdaq Listing Rule 5550(b)(1) or 5550(b)(3) which require a company to have minimum stockholders equity of at least $2.5 million or for it to have had net income from continuing operations of at least $500,000 in the latest fiscal year or in two of the last three fiscal years.

On July 30, 2019, we received written notice from Nasdaq indicating that, based upon our continued non-compliance with the Minimum Bid Price Requirement and Minimum Value of Listed Securities Requirement, the staff of Nasdaq (the “Staff”) had determined to delist our securities (including our common stock and publicly traded warrants) from Nasdaq unless we timely requested a hearing before the Nasdaq Hearings Panel (the “Panel”). We requested a hearing before the Panel and the hearing was held on September 19, 2019. The hearing stayed any further action by the Staff pending the ultimate conclusion of the hearing process and during the pendency of the hearing before the Panel, our listed securities remain listed on Nasdaq. As of September 26, 2019, the Panel had not made its ruling. There can be no assurance that the Panel will grant our request for continued listing on Nasdaq or that we will be able to regain compliance with the applicable listing criteria within the period of time that may be granted by the Panel. To regain compliance with the Minimum Bid Price Requirement, the bid price of the common stock must have a closing bid price of at least $1.00 per share for a minimum of 10 consecutive trading days. If the Panel does not grant our request for continued listing, the Board, in its discretion, may not effect the Reverse Stock Split, and the Reverse Stock Split, if it occurs, will not be sufficient to maintain our listing on Nasdaq.

-8-

The Board has determined that the Amendment to effect the Reverse Stock Split is necessary to the continued listing of our common stock on Nasdaq and is in the best interests of our stockholders.

In addition to bringing the per share trading price and closing bid price of our common stock back above $1.00, we also believe that the Reverse Stock Split will make our common stock more attractive to a broader range of institutional and other investors, as we have been advised that the current per share trading price of our common stock may affect its acceptability to certain institutional investors, professional investors and other members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers.

If we were unable to maintain compliance with the Minimum Bid Price Requirement and our common stock were delisted from Nasdaq, trading of our common stock would most likely take place on an over-the-counter market established for unlisted securities, such as the OTCQX, the OTCQB or the OTC Pink markets maintained by OTC Markets Group Inc. An investor would likely find it less convenient to sell, or to obtain accurate quotations in seeking to buy, our common stock on an over-the-counter market, and many investors would likely not buy or sell our common stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange or other reasons. In addition, as a delisted security, our common stock would be subject to SEC rules as a “penny stock,” which impose additional disclosure requirements on broker-dealers. The regulations relating to penny stocks, coupled with the typically higher cost per trade to the investor of penny stocks due to factors such as broker commissions generally representing a higher percentage of the price of a penny stock than of a higher-priced stock, would further limit the ability of investors to trade in our common stock. For these reasons and others, delisting would adversely affect the liquidity, trading volume and price of our common stock, causing the value of an investment in us to decrease and having an adverse effect on our business, financial condition and results of operations, including our ability to attract and retain qualified employees and to raise capital.

Reverse Stock Split Ratio

If approved by stockholders, this Reverse Stock Split proposal would permit (but not require) the Board to effect a Reverse Stock Split of our common stock at any time beforeDecember 31, 2019by theReverse Stock Split Ratio, with the specific ratio to be fixed within this range by the Board in its sole discretion without further stockholder approval. We believe that enabling the Board to fix the specificReverse Stock Split Ratiowithin the stated range will provide us with the flexibility to implement it in a manner designed to maximize the anticipated benefits for our stockholders. In fixing theReverse Stock Split Ratio, the Board may consider, among other things, factors such as:

| · | the total number of shares of common stock outstanding; |

| · | Nasdaq requirements for the continued listing of common stock; |

| · | the historical trading price and trading volume of common stock; |

| · | the then prevailing trading price and trading volume for common stock; |

| · | the anticipated impact of the Reverse Stock Split on the trading price of and market for common stock; |

| · | the administrative and transaction costs associated with potential exchange ratios; |

| · | potential financing opportunities; and |

| · | prevailing general market and economic conditions. |

-9-

The Board will have sole discretion as to any implementation of, and the exact timing and actual Reverse Stock Split Ratio of, the Reverse Stock Split within the range of Reverse Stock Split Ratios specified in this proposal and before December 31, 2019. The Board may also determine that the Reverse Stock Split is no longer in the best interests of the Company and its stockholders and decide to abandon the Reverse Stock Split at any time before, during or after the Special Meeting and prior to its effectiveness, without further action by the stockholders.

Effectiveness of the Reverse Stock Split

If approved by our stockholders, the Reverse Stock Split would become effective upon the filing of the Amendment with the Secretary of State of the State of Delaware, or at the later time set forth in the Amendment, which will constitute the Split Effective Time.The exact timing of the Amendment will be determined by the Board based on its evaluation as to when such action will be the most advantageous to the Company and its stockholders. In addition, the Board reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to abandon the Amendment and the Reverse Stock Split if, at any time prior to the effectiveness of the filing of the Amendment with the Secretary of State of the State of Delaware, the Board, in its sole discretion, determines that it is no longer in our best interest and the best interests of our stockholders to proceed.

The proposed form of Amendment to effect the Reverse Stock Split is attached as theAppendix to this Proxy Statement. Any Amendment to effect the Reverse Stock Split will include the Reverse Stock Split Ratio fixed by the Board, within the range approved by the stockholders.

Potential Market Effects of the Reverse Stock Split

The Reverse Stock Split proposal is intended primarily to increase the Company’s per share bid price and satisfy the Minimum Bid Price Requirement. Reducing the number of outstanding shares of common stock should, absent other factors, increase the per share market price of the common stock, although the Company cannot provide any assurance that it will be able to meet or maintain a bid price over the Minimum Bid Price Requirement for continued listing on Nasdaq or any other exchange. The delisting of the common stock from Nasdaq may result in decreased liquidity, increased volatility in the price and trading volume of our common stock, a loss of current or future coverage by certain sell-side analysts, a diminution of institutional investor interest and/or the impairment of the Company’s ability to raise capital. Delisting could also cause a loss of confidence of the Company’s customers, collaborators, vendors, suppliers and employees, which could harm its business and future prospects.

Reducing the number of outstanding shares of common stock through a Reverse Stock Split is intended, absent other factors, to increase the per share market price of our common stock. The market price of our common stock will also be based on and may be adversely affected by our performance, financial results market conditions, the market’s perception of our business and other factors which are unrelated to the number of shares outstanding. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Stock Split or that the market price of the common stock will not decrease in the future. Additionally, Applied DNA Sciences cannot assure you that the market price per share of common stock after a Reverse Stock Split will increase in proportion to the reduction in the number of shares of common stock outstanding before the Reverse Stock Split. In addition, the Reverse Stock Split may not result in a market price per share that will attract certain segments of the institutional investor community and the investing public that previously refrained from investing in Applied DNA Sciences because of the low market price of common stock, especially if we are listed on the OTCQB or OTC Pink markets. If the Reverse Stock Split is effected and the market price of common stock declines, the percentage decline as an absolute number and as a percentage of the overall market capitalization of Applied DNA Sciences may be greater than would occur in the absence of a Reverse Stock Split. Furthermore, the liquidity of common stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split.

-10-

In evaluating the Reverse Stock Split proposal, in addition to the considerations described above, the Board also took into account various negative factors associated with Reverse Stock Splits generally. These factors include: the negative perception of Reverse Stock Splits held by some investors, analysts and other stock market participants; the fact that the stock price of some companies that have effected Reverse Stock Splits has subsequently declined in share price and corresponding market capitalization; the adverse effect on liquidity that might be caused by a reduced number of shares outstanding; and the costs associated with implementing a Reverse Stock Split.

Potential Increased Investor Interest

On September 25, 2019, the Company’s common stock closed at $0.24 per share. On October 4, 2019, the Company’s common stock closed at $ per share. An investment in the common stock may not appeal to brokerage firms that are reluctant to recommend lower priced securities to their clients. Investors may also be dissuaded from purchasing lower priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. Also, the Board believes that most investment funds are reluctant to invest in lower priced stocks. The Board believes that the anticipated higher market price expected to result from a Reverse Stock Split will reduce, to some extent, the negative effects of the practices of brokerage houses and investors described above on the liquidity and marketability of the common stock.

There are risks associated with the Reverse Stock Split, including that the Reverse Stock Split may not result in an increase in the per share price of the common stock. The Company cannot predict whether the Reverse Stock Split will increase the market price for the common stock. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

| ● | the market price per share of the common stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares of the common stock outstanding before the Reverse Stock Split; | |

| ● | the Reverse Stock Split will result in a per share price that will attract brokers and investors who do not trade in lower priced stocks; | |

| ● | the Reverse Stock Split will result in a per share price that will increase the ability of the Company to attract and retain employees; | |

| ● | the market price per share will either exceed or remain in excess of $1.00, the Minimum Bid Price Requirement by Nasdaq for continued listing; or | |

| ● | the Company would otherwise meet the Nasdaq listing requirements even if the per share market price of the common stock after the Reverse Stock Split meets the Minimum Bid Price Requirement. |

The market price of the common stock will also be based on the Company’s performance and other factors, some of which are unrelated to the number of shares outstanding. If the Reverse Stock Split is effected and the market price of the common stock declines, the percentage decline as an absolute number and as a percentage of the overall market capitalization of the Company may be greater than would occur in the absence of a Reverse Stock Split. Furthermore, the liquidity of the common stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split.

Potential Effects of Proposed Amendment

If our stockholders approve the Reverse Stock Split and the Board effects it, the number of shares of common stock issued and outstanding will be reduced, depending upon the Reverse Stock Split Ratio determined by the Board. The Reverse Stock Split will affect all holders of our common stock uniformly and will not affect any stockholder’s percentage ownership interest in the Company, except that, as described below in “Fractional Shares,” holders of our common stock otherwise entitled to a fractional share as a result of the Reverse Stock Split because they hold a number of shares not evenly divisible by the Reverse Stock Split Ratio will, in lieu of a fractional share, receive one whole share of common stock. In addition, the Reverse Stock Split will not affect any stockholder’s proportionate voting power (subject to the treatment of fractional shares).

-11-

The Reverse Stock Split alone would have no effect on our authorized capital stock, and the total number of authorized shares would remain the same as before the Reverse Stock Split. This would have the effect of increasing the number of shares of our common stock available for issuance. The additional available shares would be available for issuance from time to time at the discretion of the Board when opportunities arise, without further stockholder action or the related delays and expenses, except as may be required for a particular transaction by law, the rules of any exchange on which our securities may then be listed, or other agreements or restrictions (including rights of first refusal, pursuant to the terms of certain of our outstanding secured convertible notes). Any issuance of additional shares of our common stock would increase the number of outstanding shares of our common stock and (unless such issuance was pro-rata among existing stockholders) the percentage ownership of existing stockholders would be diluted accordingly. In addition, any such issuance of additional shares of our common stock could have the effect of diluting the earnings per share and book value per share of outstanding shares of our common stock.

In addition to sales of our common stock, if our stockholders approve the Reverse Stock Split and the Board effects it, the additional available shares of our common stock would also be available for conversions of convertible securities that we may issue, acquisition transactions, strategic relationships with corporate and other partners, stock splits, stock dividends and other transactions that may contribute to the growth of our business. Any decision to issue equity will depend on, among other things, our evaluation of funding needs, developments in business and technologies, current and expected future market conditions and other factors. There can be no assurance, however, even if the Reverse Stock Split is approved and implemented, that any financing transaction or other transaction would be undertaken or completed.

The Reverse Stock Split will not change the terms of our common stock. After the Reverse Stock Split, the shares of common stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to common stock now authorized.

The Reverse Stock Split may result in some stockholders owning “odd-lots” of less than 100 shares of common stock. Brokerage commissions and other costs of transactions in odd-lots are generally higher than the costs of transactions in “round-lots” of even multiples of 100 shares.

After the Split Effective Time, the Company will continue to be subject to the periodic reporting and other requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Subject to compliance with applicable continued listing requirements, our common stock will continue to be listed on Nasdaq and traded under the symbol “APDN,” although the exchange will add the letter “D” to the end of the trading symbol for a period of 20 trading days after the Split Effective Time to indicate that a Reverse Stock Split has occurred. After the Split Effective Time, it is expected that our common stock will have a new CUSIP number. The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” as described by Rule 13e-3 under the Exchange Act.

After the Split Effective Time, the post-split market price of our common stock may be less than the pre-split price multiplied by the Reverse Stock Split Ratio. In addition, a reduction in the number of shares outstanding may impair the liquidity for our common stock, which may reduce the value of the common stock.

Beneficial Holders of Common Stock

Upon the implementation of the Reverse Stock Split, Applied DNA Sciences intends to treat shares held by stockholders through a stockbroker, bank or other nominee in the same manner as registered stockholders whose shares are registered in their names. Stockbrokers, banks or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding common stock in street name. However, these stockbrokers, banks or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. Stockholders who hold shares of common stock with a stockbroker, bank or other nominee and who have any questions in this regard are encouraged to contact their stockbrokers, banks or other nominees.

-12-

Registered “Book-Entry” Holders of Common Stock

Certain registered holders of common stock may hold some or all of their shares electronically in book-entry form with our transfer agent. These stockholders do not have stock certificates evidencing their ownership of the common stock. They are, however, provided with statements reflecting the number of shares registered in their accounts. Stockholders who hold shares electronically in book-entry form with our transfer agent will not need to take action to receive evidence of their shares of post-Reverse Stock Split common stock.

Holders of Certificated Shares of Common Stock

Stockholders holding shares of our common stock in certificated form will be sent a transmittal letter by our transfer agent after the effective time of the Reverse Stock Split. The letter of transmittal will contain instructions on how a stockholder should surrender his, her or its certificate(s) representing shares of our Common Stock (the “Old Certificates”) to the transfer agent. Unless a stockholder specifically requests a new paper certificate or holds restricted shares, upon the stockholder’s surrender of all of the stockholder’s Old Certificates to the transfer agent, together with a properly completed and executed letter of transmittal, the transfer agent will register the appropriate number of shares of post-Reverse Stock Split common stock electronically in book-entry form and provide the stockholder with a statement reflecting the number of shares of common stock registered in the stockholder’s account. No stockholder will be required to pay a transfer or other fee to exchange his, her or its Old Certificates. Until surrendered, we will deem outstanding Old Certificates held by stockholders to be cancelled and only to represent the number of shares of post-Reverse Stock Split common stock to which these stockholders are entitled. Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of stock, will automatically be exchanged for the appropriate number of shares of post-Reverse Stock Split common stock. If an Old Certificate has a restrictive legend on its reverse side, then a new certificate will be issued with the same restrictive legend on its reverse side.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Fractional Shares

Applied DNA Sciences will not issue fractional shares in connection with the Reverse Stock Split. Instead stockholders who would otherwise be entitled to receive a fractional share as a result of the Reverse Stock Split will receive one whole share of our common stock in lieu of such fractional share.

Effect of the Reverse Stock Split on Stock Option Awards and Equity Incentive Plans

Based upon the Reverse Stock Split Ratio, proportionate adjustments are generally required to be made to the per share exercise price or the per share base price and the number of shares issuable upon the exercise of all outstanding options and to the per share exercise price of all outstanding options. This would result in approximately the same aggregate price being required to be paid under such options upon exercise, and approximately the same value of shares of our common stock being delivered upon such exercise immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. However, to comply with certain regulations under the Internal Revenue Code of 1986, as amended (the “Code”), the per share exercise price of each outstanding option would be rounded up to the nearest whole cent and the number of shares of our common stock that could be acquired upon the exercise of each option would be rounded down to the nearest whole share. The number of shares of our common stock reserved for issuance pursuant to the 2005 Incentive Stock Plan, as amended, (the “2005 Plan”) will be reduced proportionately based upon the Reverse Stock Split Ratio.

Effect of the Reverse Stock Split on Warrants and Convertible Notes

In addition to adjusting the number of shares of our common stock, we would adjust all shares underlying any of our outstanding warrants and secured convertible notes as a result of the Reverse Stock Split, as required by the terms of these securities. In particular, we would reduce the conversion ratio for each instrument, and would increase the applicable exercise price or conversion price in accordance with the terms of each instrument and based on the Reverse Stock Split Ratio.

-13-

Accounting Matters

The proposed Amendment will not affect the par value of $0.001 of our common stock. As a result, at the Split Effective Time, the stated capital on our balance sheet attributable to the common stock will be reduced in the same proportion as the Reverse Stock Split Ratio, and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. The per share net income or loss and net book value of the common stock will be reclassified for prior periods to conform to the post-Reverse Stock Split presentation.

Pro Forma Capitalization of Common Stock

The table below summarizes the Company’s pro forma capitalization of common stock, as of September 25, 2019, before and after giving effect to a hypothetical reverse stock split of one-for-fifteen (1-for-15), one-for-twenty (1-for-20), one-for-twenty-five (1-for-25), one-for-thirty (1-for-30), one-for-thirty-five (1-for-35), one-for-forty (1-for-40), one-for-forty-five (1-for-45) and one-for-fifty (1-for-50). The table below does not include the 10,000,000 shares of preferred stock authorized under the Certificate of Incorporation, none of which is currently outstanding. The Reverse Stock Split alone would have no effect on our authorized capital stock, including our authorized preferred stock. For purposes of the figures below, share numbers have been rounded down to the nearest whole share.

| Prior to Reverse | After Reverse Stock Split | ||||||||||||||||||

Stock Split | 1-for-15 | 1-for-20 | 1-for-25 | 1-for-30 | 1-for-35 | 1-for-40 | 1-for-45 | 1-for-50 | |||||||||||

| Authorized Shares of Common Stock | 500,000,000 | 500,000,000 | 500,000,000 | 500,000,000 | 500,000,000 | 500,000,000 | 500,000,000 | 500,000,000 | 500,000,000 | ||||||||||

| Shares of Common Stock Issued and Outstanding(1) | 48,015,938 | 3,201,063 | 2,400,797 | 1,920,638 | 1,600,531 | 1,371,884 | 1,200,398 | 1,067,021 | 960,319 | ||||||||||

| Shares of Common Stock Reserved for Future Issuance but not Issued and Outstanding(1)(2) | 27,078,384 | 1,805,226 | 1,353,919 | 1,083,135 | 902,613 | 773,668 | 676,960 | 601,742 | 541,568 | ||||||||||

| Shares of Common Stock Available for Future Issuance(1) | 424,905,678 | 494,993,711 | 496,245,284 | 496,996,227 | 497,496,856 | 497,854,448 | 498,122,642 | 498,331,237 | 498,498,113 | ||||||||||

(1) These estimates do not reflect the potential effects of rounding up of fractional shares that may result from the Reverse Stock Split.

(2) Includes, as of September 25, 2019, (i) 10,543,527 shares issuable upon the exercise of outstanding warrants at a weighted average exercise price of $3.28; (ii) 7,972,504 shares issuable upon the exercise of outstanding stock options, at a weighted average exercise price of $2.49; (iii) 5,563,759 shares reserved for future issuance under the 2005 Plan; and (iv) 2,998,594 shares reserved for the conversion of secured convertible notes. Does not include any shares of common stock issuable upon the exercise or conversion of securities that may have been issued since September 26, 2019.

Material U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following discussion is a summary of the material U.S. federal income tax consequences of the proposed Reverse Stock Split to U.S. Holders (as defined below) of common stock. This discussion is based on the Code, U.S. Treasury Regulations promulgated thereunder, judicial decisions, and published rulings and administrative pronouncements of the Internal Revenue Service (“IRS”), in each case in effect as of the date hereof. These authorities may change or be subject to differing interpretations. Any such change or differing interpretation may be applied retroactively in a manner that could adversely affect a holder of common stock. Applied DNA Sciences has not sought and will not seek any rulings from the IRS regarding the matters discussed below. There can be no assurance the IRS or a court will not take a contrary position to that discussed below regarding the tax consequences of the proposed Reverse Stock Split.

-14-

For purposes of this discussion, a “U.S. Holder” is a beneficial owner of common stock that, for U.S. federal income tax purposes, is or is treated as:

| · | an individual who is a citizen or resident of the United States; |

| · | a corporation (or any other entity or arrangement treated as a corporation for U.S. federal income tax purposes) created or organized under the laws of the United States, any state thereof or the District of Columbia; |

| · | an estate, the income of which is subject to U.S. federal income tax regardless of its source; or |

| · | a trust that (1) is subject to the primary supervision of a U.S. court and all substantial decisions of which are subject to the control of one or more “United States persons” (within the meaning of Section 7701(a)(30) of the Code) or (2) has a valid election in effect under applicable U.S. Treasury Regulations to be treated as a United States person for U.S. federal income tax purposes. |

This discussion is limited to U.S. Holders who hold their common stock as a “capital asset” within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all U.S. federal income tax consequences relevant to the particular circumstances of a U.S. Holder, including the impact of the alternative minimum tax or the Medicare contribution tax on net investment income or the application of the constructive sale provisions of the Code, the “qualified small business stock” provisions of Section 1202 of the Code, the “Section 1244 stock” provisions of Section 1244 of the Code, or special rules relevant to tax-qualified retirement plans. In addition, it does not address consequences relevant to U.S. Holders that are subject to special rules, including, without limitation:

| · | persons who are not U.S. Holders; |

| · | U.S. Holders whose functional currency is not the U.S. dollar; |

| · | persons holding our common stock as part of a hedge, straddle or other risk reduction strategy or as part of a conversion transaction or other integrated investment; |

| · | banks, insurance companies and other financial institutions; |

| · | real estate investment trusts or regulated investment companies; |

| · | brokers, dealers or traders in securities; |

| · | tax-exempt organizations or governmental organizations; and |

| · | persons who actually or constructively own 10% or more of our voting stock. |

If a partnership (or other entity treated as a partnership for U.S. federal income tax purposes) is the beneficial owner of common stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner, the activities of the partnership and certain determinations made at the partner level. Accordingly, partnerships (and other entities treated as partnerships for U.S. federal income tax purposes) holding common stock and the partners in such entities should consult their tax advisors regarding the U.S. federal income tax consequences of the proposed Reverse Stock Split to them.

In addition, the following discussion does not address the U.S. federal estate and gift tax laws or any applicable state, local or non-U.S. tax law consequences of the proposed Reverse Stock Split. Furthermore, the following discussion does not address any tax consequences of transactions effected before, after or at the same time as the proposed Reverse Stock Split, whether or not they are in connection with the proposed Reverse Stock Split.

HOLDERSOF OUR COMMON STOCK SHOULD CONSULT THEIR TAX ADVISORS WITH RESPECT TO THE APPLICATION OF THE U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS AS WELL AS ANY TAX CONSEQUENCES OF THE PROPOSED REVERSE STOCK SPLIT ARISING UNDER OTHER U.S. FEDERAL TAX LAWS (INCLUDING ESTATE AND GIFT TAX LAWS), UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION OR UNDER ANY APPLICABLE INCOME TAX TREATY.

-15-

Tax Consequences of the Reverse Stock Split

The proposed Reverse Stock Split is expected to constitute a “recapitalization” for U.S. federal income tax purposes pursuant to Section 368(a)(1)(E) of the Code. As a result, a U.S. Holder generally should not recognize gain or loss upon the proposed Reverse Stock Split. A U.S. Holder’s aggregate adjusted tax basis in the shares of our common stock received pursuant to the proposed Reverse Stock Split should equal the aggregate adjusted tax basis of the shares of the common stock surrendered (excluding any portion of such basis that is allocated to any fractional share of common stock), and such U.S. Holder’s holding period in the shares of common stock received should include the holding period in the shares of common stock surrendered. U.S. Treasury Regulations provide detailed rules for allocating the tax basis and holding period of the shares of common stock surrendered to the shares of common stock received in a recapitalization pursuant to the proposed Reverse Stock Split. U.S. Holders of shares of common stock acquired on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

As noted above, we will not issue fractional shares in connection with the Reverse Stock Split. Instead, stockholders who otherwise would be entitled to receive fractional shares will be automatically entitled to receive an additional fraction of a share of our common stock to round up to the next whole post-split share. The U.S. federal income tax treatment of the receipt of such a fractional share in a reverse stock split is not clear. It is possible that the receipt of such an additional fraction of a share of common stock may be treated as a distribution taxable as a dividend or as an amount received in exchange for common stock. We intend to treat the issuance of such an additional fraction of a share of our common stock in the Reverse Stock Split as a non-recognition event, but there can be no assurance that the IRS or a court would not successfully assert otherwise.

Appraisal Rights

Under the General Corporation Law of the State of Delaware, our stockholders will not be entitled to dissenter’s rights with respect to the proposed Amendment to effect the Reverse Stock Split, and Applied DNA Sciences does not intend to independently provide stockholders with such rights.

Proposal 1, the approval of the Amendment effecting the Reverse Stock Split, requires the affirmative vote of a majority of the shares of our common stock outstanding on the Record Date and entitled to vote. Abstentions and broker non-votes will be excluded entirely from the vote and will, therefore, have the same effect as a vote “AGAINST” such proposal.

The Board Recommends a VoteTo Approve the Amendment to the Company’s Certificate of Incorporation Effecting the Reverse Stock Split in the Range from One-for-Fifteen to One-for-Fifty.Proxies that are Returned will be so Voted Unless Otherwise Instructed.

-16-

PROPOSAL 2

APPROVAL OF THE ADJOURNMENT OF THE SPECIAL MEETING TO SOLICIT ADDITIONAL PROXIES

Adjournment of the Special Meeting

In the event that the number of shares of our common stock present in person or represented by proxy at the Special Meeting and voting “FOR” the adoption of the Reverse Stock Split is insufficient to adopt the Reverse Stock Split, we may move to adjourn the Special Meeting in order to enable the Board to solicit additional proxies in favor of the adoption of the Reverse Stock Split. In that event, we will ask stockholders to vote only upon this Proposal 2 and not on Proposal 1. If the adjournment is for more than thirty (30) days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting.

If a quorum is present, Proposal 2, approval of the proposal to adjourn the Special Meeting to a later date, requires the affirmative vote of the majority of the votes cast on the proposal. Abstentions and broker non-votes will not be considered votes cast on Proposal 2 and will therefore not have any effect with respect to Proposal 2.

The Board Recommends a Vote FOR the Adjournment of the Special Meeting to Solicit Additional Proxies if there Are Insufficient Proxies at the Special Meeting to Approve the Reverse Stock Split. Proxies that Are Returned Will Be so Voted Unless Otherwise Instructed.

-17-

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth certain information regarding the shares of our common stock beneficially owned as of September 25, 2019, (i) by each person who is known to us to beneficially own 5% or more of the outstanding common stock, (ii) by each of our principal executive officer, our principal financial officer and our other executive officers and by each of our directors and (iii) by all executive officers and directors as a group.

Unless otherwise indicated below, each person or entity has an address in care of our principal executive offices at 50 Health Sciences Drive, Stony Brook, New York 11790.

| Name and Address of Beneficial Owner | Title of Class | Number of Shares Owned(1)(2) | Percentage of Class(3) | ||||||

| Executive Officers and Directors: | | | | ||||||

| James A. Hayward | Common Stock | 8,038,697 | (4) | 15.86% | |||||

| Yacov A. Shamash | Common Stock | 321,137 | (5) | * | |||||

| John Bitzer, III | Common Stock | 1,699,483 | (6)(7) | 3.52% | |||||

| Robert C. Catell | Common Stock | 230,405 | (11) | * | |||||

| Joseph D. Ceccoli | Common Stock | 210,652 | (8) | * | |||||

| Beth M. Jantzen | Common Stock | 282,842 | (12) | * | |||||

| Judith Murrah | Common Stock | 461,864 | (13) | * | |||||

| Charles S. Ryan | Common Stock | 227,382 | (6) | * | |||||

| Sanford R. Simon | Common Stock | 212,149 | (9) | * | |||||

| Elizabeth Schmalz Ferguson | Common Stock | 142,888 | (10) | * | |||||

| All directors and officers as a group (10 persons) | Common Stock | 11,827,499 | (14) | 22.42% | |||||

| 5% Stockholders: | | | | ||||||

| William W. Montgomery | Common Stock | 6,030,900 | (15) | 12.56% | |||||

| Dillon Hill | Common Stock | 2,777,777 | (16) | 5.47% | |||||

* indicates less than one percent

(1) Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to the shares shown. Except as indicated by footnote and subject to community property laws where applicable, to our knowledge, the stockholders named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. A person is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days upon the exercise of options, warrants or convertible securities (in any case, the “Currently Exercisable Options”).

(2) Does not include the remaining unvested shares subject to options granted on December 21, 2015 pursuant to the 2005 Incentive Stock Plan, which vest 25% of the underlying shares ratably on each anniversary date thereafter until fully vested on the fourth anniversary date of grant, including 12,500 for each of Dr. Hayward, Ms. Jantzen and Ms. Murrah.

(3) Based upon 48,015,938 shares of common stock outstanding as of September 25, 2019. Each beneficial owner’s percentage ownership is determined by assuming that the Currently Exercisable Options that are beneficially held by such person (but not those held by any other person) have been exercised and converted.

(4) Includes 2,671,262 shares underlying currently exercisable options and warrants.

(5) Includes 257,767 shares underlying currently exercisable options and warrants.

(6) Includes 213,177 shares underlying currently exercisable options for Messrs. Bitzer and Ryan.

-18-

(7) Includes 1,185,855 shares of common stock and 76,923 currently exercisable warrants to purchase our common stock owned by Delabarta, Inc. (“Delabarta”), a wholly-owned subsidiary of ABARTA, Inc. (“ABARTA”). Mr. Bitzer is President and a member of the boards of directors of each of Delabarta and ABARTA. Mr. Bitzer disclaims beneficial ownership of the shares held by Delabarta except to the extent of his pecuniary interest therein.

(8) Includes 187,924 shares underlying currently exercisable options.

(9) Includes 209,308 shares underlying currently exercisable options.

(10) Includes 111,858 shares underlying currently exercisable options.

(11) Includes 152,830 shares underlying currently exercisable options.

(12) Includes 280,001 shares underlying currently exercisable options.

(13) Includes 360,001 shares underlying currently exercisable options.

(14) Includes 4,734,228 shares underlying currently exercisable options and warrants.

(15) This information is based on a Form 4 filed with the SEC on September 16, 2019 by William W. Montgomery. William W. Montgomery reported sole voting and sole dispositive power of 6,030,900 shares of common stock. The address of William W. Montgomery is 34211 Seavey Loop Road, Eugene, Oregon 97405.

(16) This information is based on a Schedule 13G filed with the SEC on July 24, 2019 by Bruce Grossman, the sole member of Dillon Hill Capital, LLC (“Dillon Hill”). Bruce Grossman reported indirect beneficial ownership, and sole voting and sole dispositive power, of 2,777,777 shares of common stock, issuable upon conversion of secured convertible notes payable.Until October 13, 2019, Dillon Hill has the right to purchase up to an additional $500,000 principal amount of such secured convertible notes, which would be convertible into an additional 925,925 shares of common stock of the Company. Such secured convertible notes include a provision limiting conversion of such notes to the extent that conversion would result in the holder beneficially owning more than 9.99% of the Company’s common stock.The address of Bruce Grossman is c/o Dillon Hill Capital LLC, 200 Business Park Drive, Suite 306, Armonk, NY 10504.

-19-

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy materials with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. The Company, as well as some brokers (or other nominees), household the Company’s Proxy Materials, which means that we or they deliver a single Proxy Statement to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker (or other nominee) or from or us that they or we will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate Proxy Statement in the future, or if you are receiving multiple copies of the Proxy Statement and wish for only one copy to be delivered to your household in the future, please notify (i) your broker (or other nominee) if your shares are held in a brokerage or similar account or (ii) the Company if you hold registered shares in your own name. We will promptly deliver a separate Proxy Statement to record stockholders upon written or oral request. You can notify us of your instructions by telephone at 631-240-8800 or by sending a written request to:

Corporate Secretary

Applied DNA Sciences, Inc.

50 Health Sciences Drive

Stony Brook, New York 11790

-20-

STOCKHOLDER PROPOSALS AND NOMINATIONS

In order for a stockholder proposal to be considered for inclusion in the proxy statement for the 2020 annual meeting of stockholders, the written proposal must have been received by the Corporate Secretary at the address below no later thanDecember 6, 2019. In the event that the annual meeting of stockholders is called for a date that is not within 30 days before or after the first anniversary of the date of this year’s annual meeting, which was held on May 16, 2019, the proposal must be received no later than a reasonable time before the Company begins to print and mail its proxy materials. The proposal will also need to comply with the SEC’s regulations under Rule 14a-8 under the Exchange Act regarding the inclusion of stockholder proposals in company sponsored proxy materials. Proposals should be addressed to:

Corporate Secretary

Applied DNA Sciences, Inc.

50 Health Sciences Drive

Stony Brook, New York 11790